Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CyrusOne Inc. | a2ndqtr2014er8-k.htm |

| EX-99.1 - EXHIBIT 99.1 - CyrusOne Inc. | exhibit991-earningsrelease.htm |

Second Quarter 2014 Earnings Presentation August 6, 2014

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 2 Forward-looking statements Safe Harbor This presentation contains forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward- looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including CyrusOne’s Form 10-K and Form 8-Ks. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 3 Second Quarter 2014 Highlights Second quarter revenue of $81.7 million increased 28% over the second quarter of 2013 Second quarter Normalized FFO of $25.6 million and AFFO of $25.3 million increased 60% and 71%, respectively, over the second quarter of 2013 Second quarter Adjusted EBITDA of $40.8 million increased 32% over the second quarter of 2013 Leased 59,000 colocation square feet(1) in the second quarter, with utilization remaining high at 86%, and also leased an additional 17,000 square feet of office space Added four Fortune 1000(2) companies as new customers, increasing total number of Fortune 1000 customers to 139 Note: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represents the total square feet of a building currently leased or available for lease, based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size.

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 4 Keys to delivering shareholder value Organic Growth Drivers Portfolio Expansion Existing Customer Base New Logos Sales Efficiency, New Channels and Products Focus on high yielding organic growth

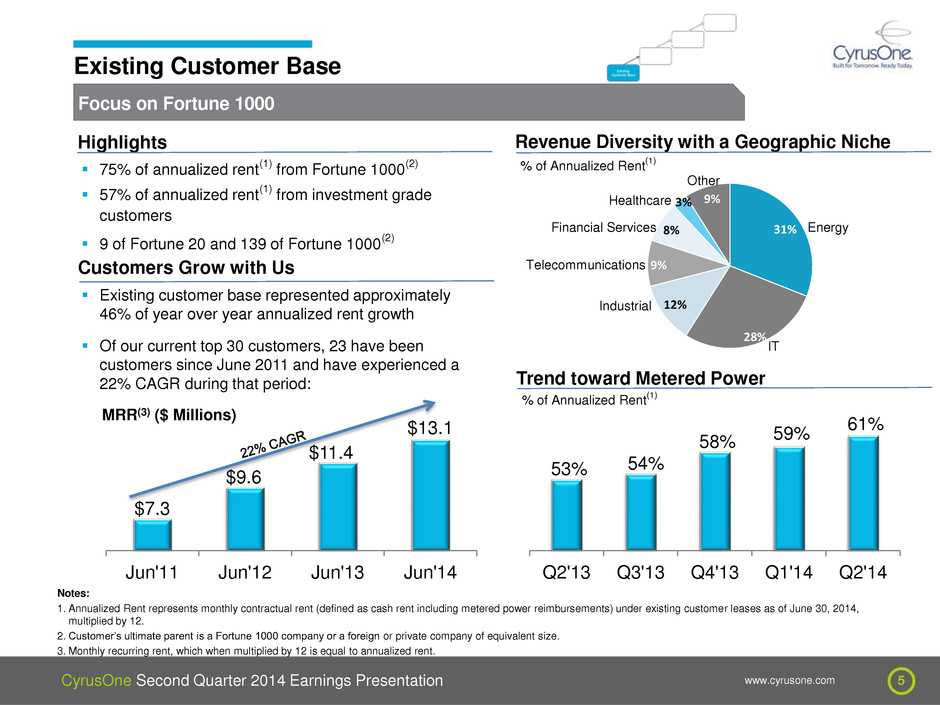

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 5 Focus on Fortune 1000 Existing Customer Base 75% of annualized rent(1) from Fortune 1000(2) 57% of annualized rent(1) from investment grade customers 9 of Fortune 20 and 139 of Fortune 1000(2) Highlights Notes: 1. Annualized Rent represents monthly contractual rent (defined as cash rent including metered power reimbursements) under existing customer leases as of June 30, 2014, multiplied by 12. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. 3. Monthly recurring rent, which when multiplied by 12 is equal to annualized rent. 31% 28% 12% 9% 8% 3% 9% Revenue Diversity with a Geographic Niche Energy Other Telecommunications Financial Services Healthcare IT % of Annualized Rent (1) Trend toward Metered Power % of Annualized Rent (1) Industrial Customers Grow with Us Existing customer base represented approximately 46% of year over year annualized rent growth Of our current top 30 customers, 23 have been customers since June 2011 and have experienced a 22% CAGR during that period: 53% 54% 58% 59% 61% Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 $7.3 $9.6 $11.4 $13.1 Jun'11 Jun'12 Jun'13 Jun'14 MRR(3) ($ Millions)

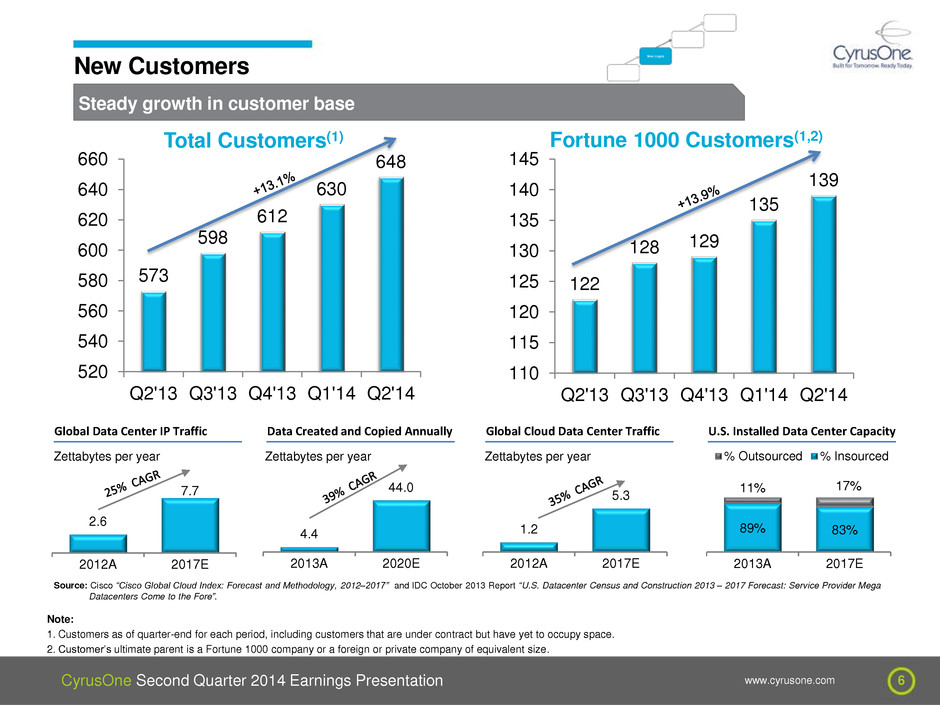

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 6 Steady growth in customer base New Customers 573 598 612 630 648 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 520 540 560 580 600 620 640 660 122 128 129 135 139 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 110 115 120 125 130 135 140 145 Total Customers(1) Note: 1. Customers as of quarter-end for each period, including customers that are under contract but have yet to occupy space. 2. Customer’s ultimate parent is a Fortune 1000 company or a foreign or private company of equivalent size. Fortune 1000 Customers(1,2) Source: Cisco “Cisco Global Cloud Index: Forecast and Methodology, 2012–2017” and IDC October 2013 Report “U.S. Datacenter Census and Construction 2013 – 2017 Forecast: Service Provider Mega Datacenters Come to the Fore”. Global Data Center IP Traffic Data Created and Copied Annually 2.6 7.7 2012A 2017E Zettabytes per year 4.4 44.0 2013A 2020E Zettabytes per year U.S. Installed Data Center Capacity 89% 83% 11% 17% 2013A 2017E % Outsourced % Insourced Global Cloud Data Center Traffic 1.2 5.3 2012A 2017E Zettabytes per year

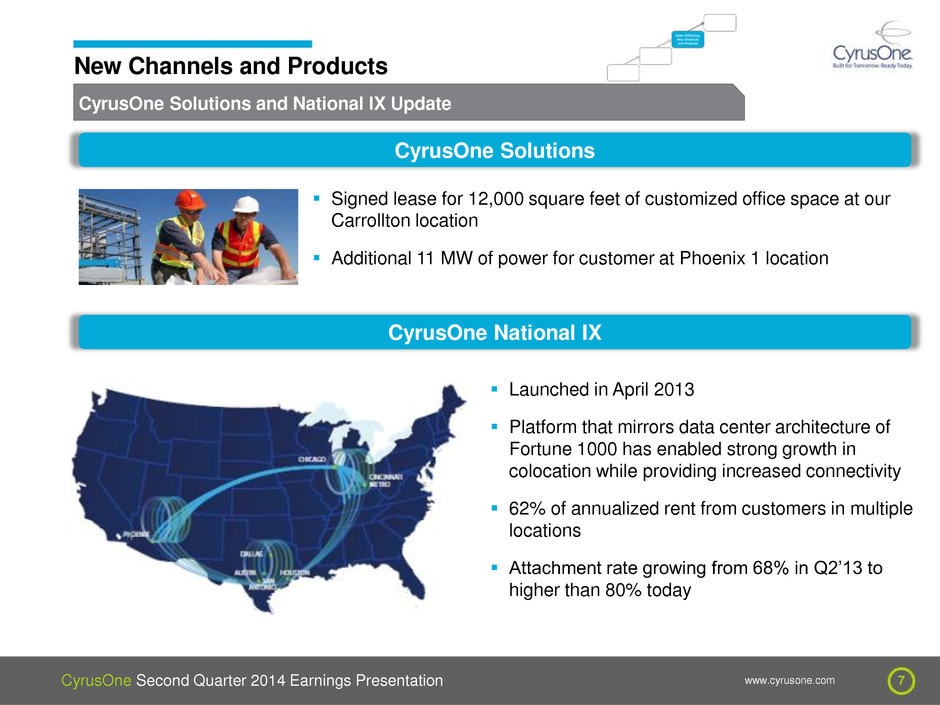

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 7 CyrusOne Solutions and National IX Update New Channels and Products CyrusOne National IX CyrusOne Solutions Signed lease for 12,000 square feet of customized office space at our Carrollton location Additional 11 MW of power for customer at Phoenix 1 location Launched in April 2013 Platform that mirrors data center architecture of Fortune 1000 has enabled strong growth in colocation while providing increased connectivity 62% of annualized rent from customers in multiple locations Attachment rate growing from 68% in Q2’13 to higher than 80% today

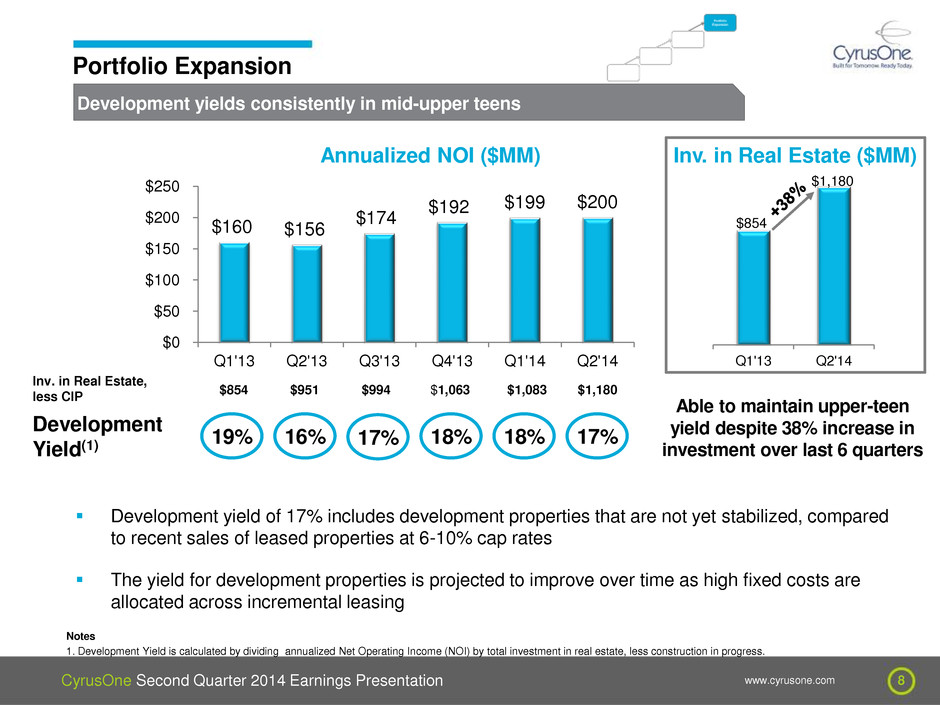

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 8 17% Development yields consistently in mid-upper teens Portfolio Expansion $160 $156 $174 $192 $199 $200 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 $0 $50 $100 $150 $200 $250 Annualized NOI ($MM) Development Yield(1) Inv. in Real Estate, less CIP $951 $994 $1,063 18% 18% 17% $1,083 Development yield of 17% includes development properties that are not yet stabilized, compared to recent sales of leased properties at 6-10% cap rates The yield for development properties is projected to improve over time as high fixed costs are allocated across incremental leasing Notes 1. Development Yield is calculated by dividing annualized Net Operating Income (NOI) by total investment in real estate, less construction in progress. $854 16% 19% Q1'13 Q2'14 $1,180 $854 Able to maintain upper-teen yield despite 38% increase in investment over last 6 quarters Inv. in Real Estate ($MM) $1,180

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 9 Pre-lease at new Phoenix 2 facility Portfolio Expansion Pre-leased 30,000 colocation square feet(1) at Phoenix 2 facility currently under development The facility is expected to be commissioned by Q4’14 Note: 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represents the total square feet of a building currently leased or available for lease, based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne.

Second Quarter 2014 Financial Review

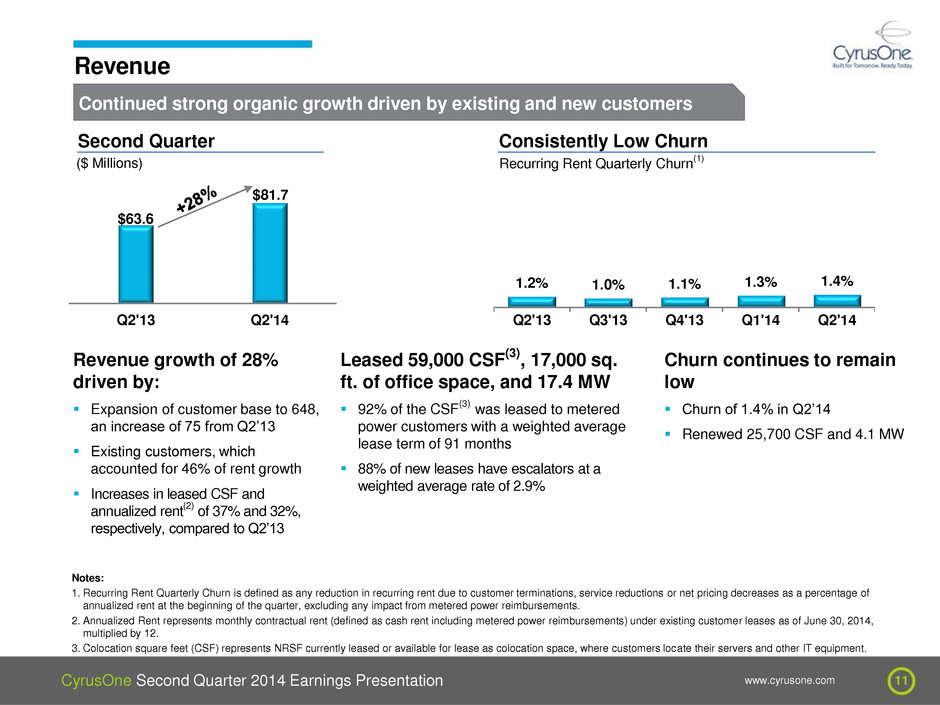

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 11 $63.6 $81.7 Q2'13 Q2'14 1.2% 1.0% 1.1% 1.3% 1.4% Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Continued strong organic growth driven by existing and new customers Revenue Second Quarter ($ Millions) Consistently Low Churn Recurring Rent Quarterly Churn (1) Revenue growth of 28% driven by: Expansion of customer base to 648, an increase of 75 from Q2’13 Existing customers, which accounted for 46% of rent growth Increases in leased CSF and annualized rent (2) of 37% and 32%, respectively, compared to Q2’13 Leased 59,000 CSF (3) , 17,000 sq. ft. of office space, and 17.4 MW 92% of the CSF(3) was leased to metered power customers with a weighted average lease term of 91 months 88% of new leases have escalators at a weighted average rate of 2.9% Notes: 1. Recurring Rent Quarterly Churn is defined as any reduction in recurring rent due to customer terminations, service reductions or net pricing decreases as a percentage of annualized rent at the beginning of the quarter, excluding any impact from metered power reimbursements. 2. Annualized Rent represents monthly contractual rent (defined as cash rent including metered power reimbursements) under existing customer leases as of June 30, 2014, multiplied by 12. 3. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Churn continues to remain low Churn of 1.4% in Q2’14 Renewed 25,700 CSF and 4.1 MW

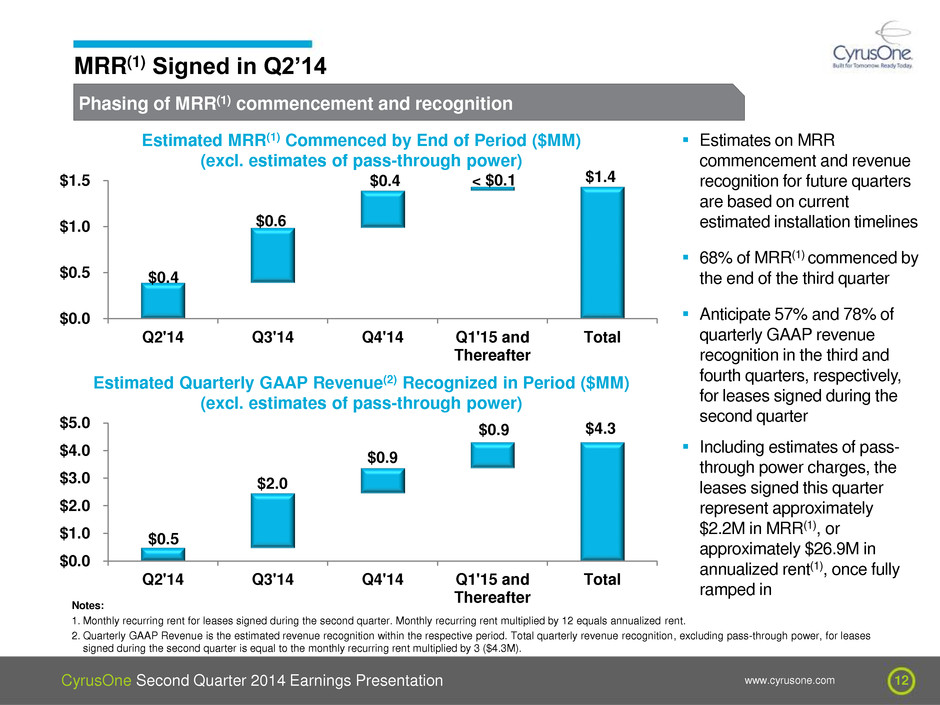

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 12 Phasing of MRR(1) commencement and recognition MRR(1) Signed in Q2’14 Notes: 1. Monthly recurring rent for leases signed during the second quarter. Monthly recurring rent multiplied by 12 equals annualized rent. 2. Quarterly GAAP Revenue is the estimated revenue recognition within the respective period. Total quarterly revenue recognition, excluding pass-through power, for leases signed during the second quarter is equal to the monthly recurring rent multiplied by 3 ($4.3M). $0.4 $1.4 $0.6 $0.4 < $0.1 Q2'14 Q3'14 Q4'14 Q1'15 and Thereafter Total $0.0 $0.5 $1.0 $1.5 Estimated MRR(1) Commenced by End of Period ($MM) (excl. estimates of pass-through power) $0.5 $4.3 $2.0 $0.9 $0.9 Q2'14 Q3'14 Q4'14 Q1'15 and Thereafter Total $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 Estimated Quarterly GAAP Revenue(2) Recognized in Period ($MM) (excl. estimates of pass-through power) Estimates on MRR commencement and revenue recognition for future quarters are based on current estimated installation timelines 68% of MRR(1) commenced by the end of the third quarter Anticipate 57% and 78% of quarterly GAAP revenue recognition in the third and fourth quarters, respectively, for leases signed during the second quarter Including estimates of pass- through power charges, the leases signed this quarter represent approximately $2.2M in MRR(1), or approximately $26.9M in annualized rent(1), once fully ramped in

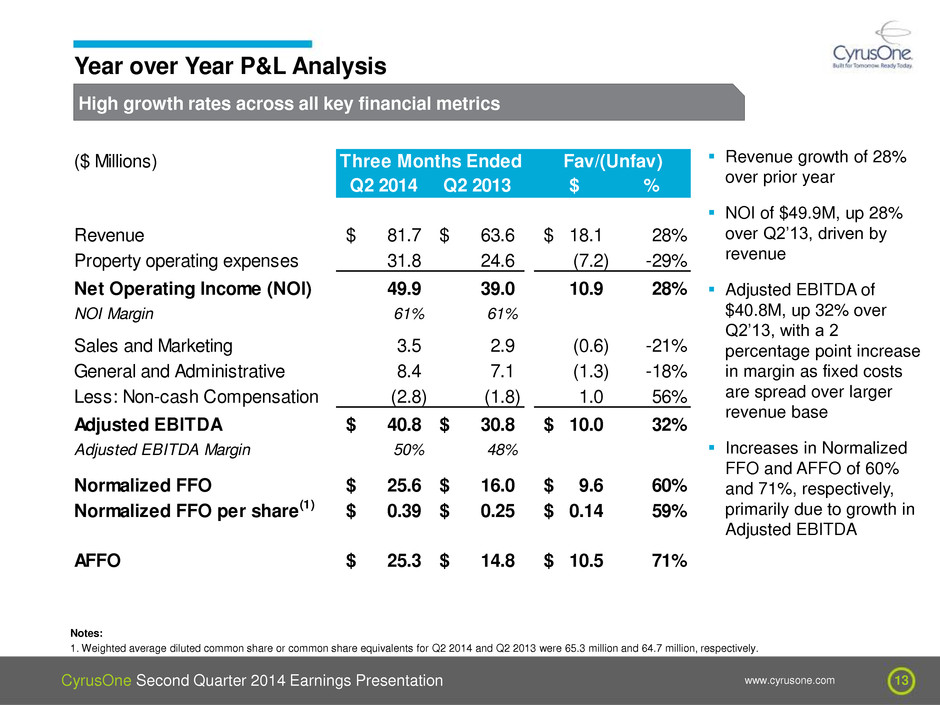

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 13 High growth rates across all key financial metrics Year over Year P&L Analysis Notes: 1. Weighted average diluted common share or common share equivalents for Q2 2014 and Q2 2013 were 65.3 million and 64.7 million, respectively. Revenue growth of 28% over prior year NOI of $49.9M, up 28% over Q2’13, driven by revenue Adjusted EBITDA of $40.8M, up 32% over Q2’13, with a 2 percentage point increase in margin as fixed costs are spread over larger revenue base Increases in Normalized FFO and AFFO of 60% and 71%, respectively, primarily due to growth in Adjusted EBITDA ($ Millions) Q2 2014 Q2 2013 $ % Revenue 81.7$ 63.6$ 18.1$ 28% Property operating expenses 31.8 24.6 (7.2) -29% Net Operating Income (NOI) 49.9 39.0 10.9 28% NOI Margin 61% 61% Sales and Marketing 3.5 2.9 (0.6) -21% General and Administrative 8.4 7.1 (1.3) -18% Less: Non-cash Compensation (2.8) (1.8) 1.0 56% Adjusted EBITDA 40.8$ 30.8$ 10.0$ 32% Adjusted EBITDA Margin 50% 48% Normalized FFO 25.6$ 16.0$ 9.6$ 60% Normalized FFO per share(1) 0.39$ 0.25$ 0.14$ 59% AFFO 25.3$ 14.8$ 10.5$ 71% Three Months Ended Fav/(Unfav)

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 14 Continued strong sequential revenue growth Sequential P&L Analysis Notes: 1. Weighted average diluted common share or common share equivalents for Q2 2014 and Q1 2014 were 65.3 million and 65.0 million, respectively. Sequential revenue growth of 5% driven by strong leasing in prior quarters as well as pass- through power Higher property operating expenses due to higher electricity usage, and increased maintenance and circuits expense FFO decrease primarily driven by lower Adjusted EBITDA and higher non- cash compensation AFFO decrease primarily driven by lower Adjusted EBITDA and higher leasing commissions and straight line rent adjustments ($ Millions) Q2 2014 Q1 2014 $ % Revenue 81.7$ 77.5$ 4.2$ 5% Property operating expenses 31.8 27.7 (4.1) -15% Net Operating Income (NOI) 49.9 49.8 0.1 0% NOI Margin 61% 64% Sales and Marketing 3.5 3.0 (0.5) -17% General and Administrative 8.4 7.3 (1.1) -15% Less: Non-cash Compensation (2.8) (2.2) 0.6 27% Adjusted EBITDA 40.8$ 41.7$ (0.9)$ -2% Adjusted EBITDA Margin 50% 54% Normalized FFO 25.6$ 27.2$ (1.6)$ -6% Normalized FFO per share(1) 0.39$ 0.42$ (0.03)$ -6% AFFO 25.3$ 27.5$ (2.2)$ -8% Three Months Ended Fav/(Unfav)

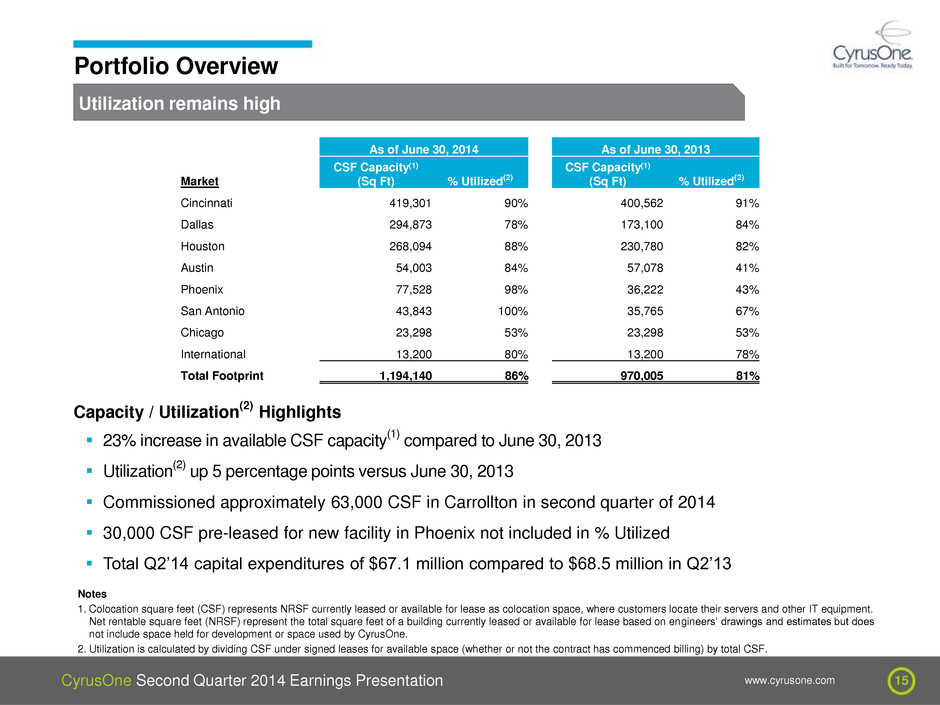

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 15 Utilization remains high Portfolio Overview As of June 30, 2014 As of June 30, 2013 Market CSF Capacity(1) (Sq Ft) % Utilized(2) CSF Capacity(1) (Sq Ft) % Utilized(2) Cincinnati 419,301 90% 400,562 91% Dallas 294,873 78% 173,100 84% Houston 268,094 88% 230,780 82% Austin 54,003 84% 57,078 41% Phoenix 77,528 98% 36,222 43% San Antonio 43,843 100% 35,765 67% Chicago 23,298 53% 23,298 53% International 13,200 80% 13,200 78% Total Footprint 1,194,140 86% 970,005 81% Capacity / Utilization (2) Highlights 23% increase in available CSF capacity(1) compared to June 30, 2013 Utilization(2) up 5 percentage points versus June 30, 2013 Commissioned approximately 63,000 CSF in Carrollton in second quarter of 2014 30,000 CSF pre-leased for new facility in Phoenix not included in % Utilized Total Q2’14 capital expenditures of $67.1 million compared to $68.5 million in Q2’13 Notes 1. Colocation square feet (CSF) represents NRSF currently leased or available for lease as colocation space, where customers locate their servers and other IT equipment. Net rentable square feet (NRSF) represent the total square feet of a building currently leased or available for lease based on engineers’ drawings and estimates but does not include space held for development or space used by CyrusOne. 2. Utilization is calculated by dividing CSF under signed leases for available space (whether or not the contract has commenced billing) by total CSF.

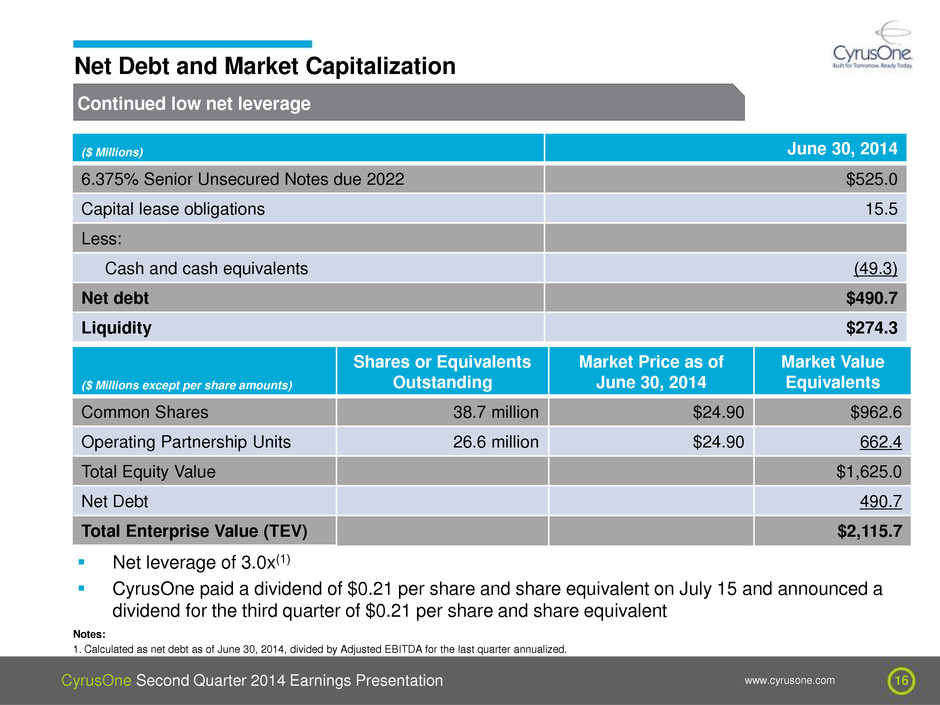

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 16 Continued low net leverage Net Debt and Market Capitalization ($ Millions except per share amounts) Shares or Equivalents Outstanding Market Price as of June 30, 2014 Market Value Equivalents Common Shares 38.7 million $24.90 $962.6 Operating Partnership Units 26.6 million $24.90 662.4 Total Equity Value $1,625.0 Net Debt 490.7 Total Enterprise Value (TEV) $2,115.7 ($ Millions) June 30, 2014 6.375% Senior Unsecured Notes due 2022 $525.0 Capital lease obligations 15.5 Less: Cash and cash equivalents (49.3) Net debt $490.7 Liquidity $274.3 Net leverage of 3.0x(1) CyrusOne paid a dividend of $0.21 per share and share equivalent on July 15 and announced a dividend for the third quarter of $0.21 per share and share equivalent Notes: 1. Calculated as net debt as of June 30, 2014, divided by Adjusted EBITDA for the last quarter annualized.

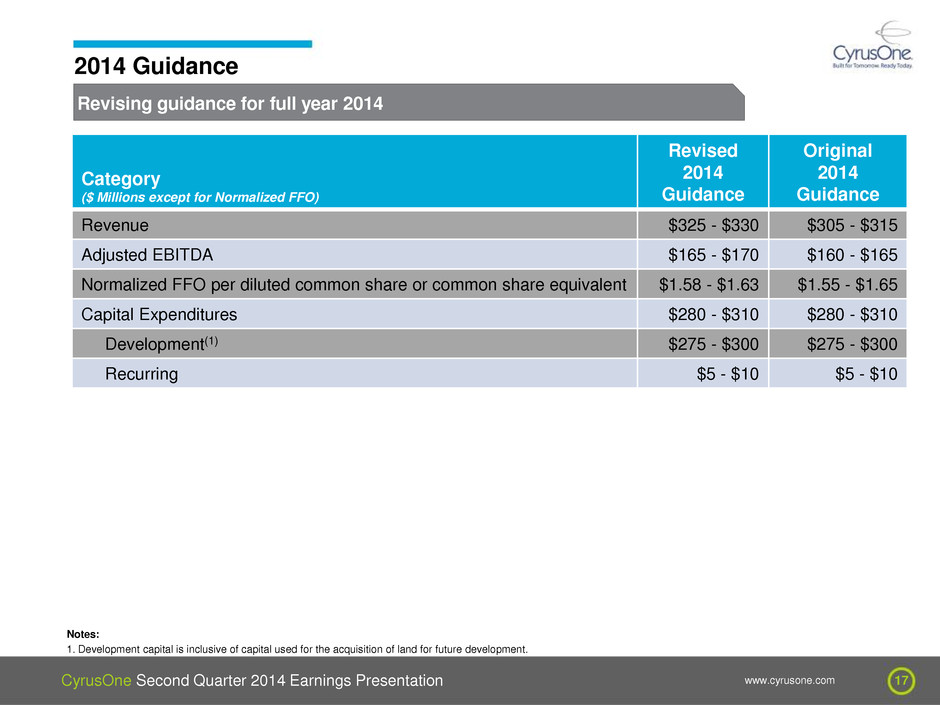

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 17 Revising guidance for full year 2014 2014 Guidance Category ($ Millions except for Normalized FFO) Revised 2014 Guidance Original 2014 Guidance Revenue $325 - $330 $305 - $315 Adjusted EBITDA $165 - $170 $160 - $165 Normalized FFO per diluted common share or common share equivalent $1.58 - $1.63 $1.55 - $1.65 Capital Expenditures $280 - $310 $280 - $310 Development(1) $275 - $300 $275 - $300 Recurring $5 - $10 $5 - $10 Notes: 1. Development capital is inclusive of capital used for the acquisition of land for future development.

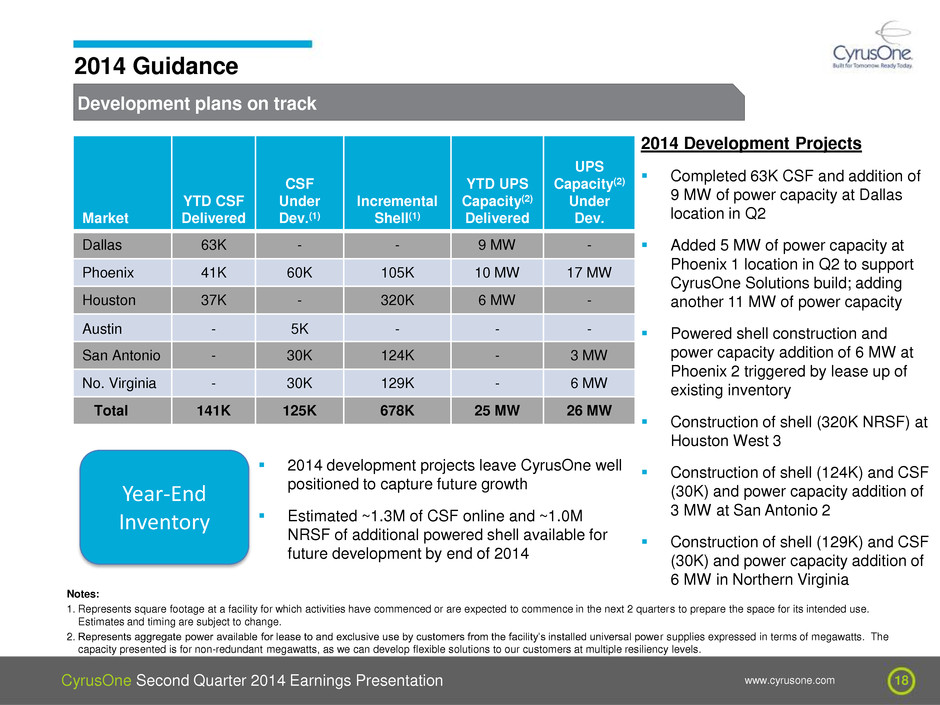

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 18 Development plans on track 2014 Guidance Market YTD CSF Delivered CSF Under Dev.(1) Incremental Shell(1) YTD UPS Capacity(2) Delivered UPS Capacity(2) Under Dev. Dallas 63K - - 9 MW - Phoenix 41K 60K 105K 10 MW 17 MW Houston 37K - 320K 6 MW - Austin - 5K - - - San Antonio - 30K 124K - 3 MW No. Virginia - 30K 129K - 6 MW Total 141K 125K 678K 25 MW 26 MW Notes: 1. Represents square footage at a facility for which activities have commenced or are expected to commence in the next 2 quarters to prepare the space for its intended use. Estimates and timing are subject to change. 2. Represents aggregate power available for lease to and exclusive use by customers from the facility’s installed universal power supplies expressed in terms of megawatts. The capacity presented is for non-redundant megawatts, as we can develop flexible solutions to our customers at multiple resiliency levels. 2014 Development Projects Completed 63K CSF and addition of 9 MW of power capacity at Dallas location in Q2 Added 5 MW of power capacity at Phoenix 1 location in Q2 to support CyrusOne Solutions build; adding another 11 MW of power capacity Powered shell construction and power capacity addition of 6 MW at Phoenix 2 triggered by lease up of existing inventory Construction of shell (320K NRSF) at Houston West 3 Construction of shell (124K) and CSF (30K) and power capacity addition of 3 MW at San Antonio 2 Construction of shell (129K) and CSF (30K) and power capacity addition of 6 MW in Northern Virginia Year-End Inventory 2014 development projects leave CyrusOne well positioned to capture future growth Estimated ~1.3M of CSF online and ~1.0M NRSF of additional powered shell available for future development by end of 2014

Appendix Non-GAAP Reconciliations

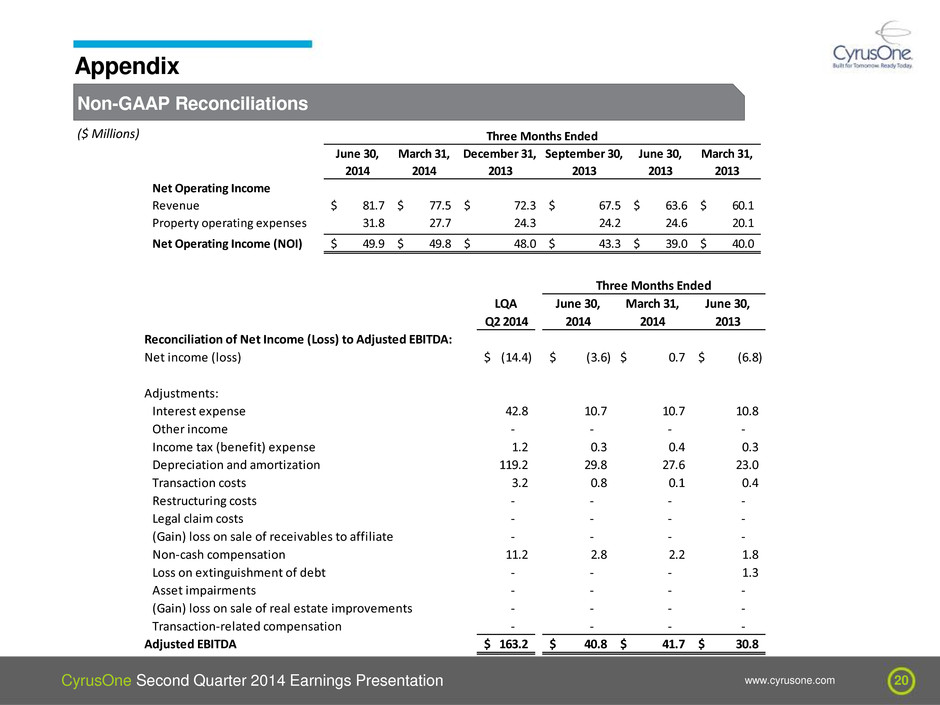

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 20 Non-GAAP Reconciliations Appendix ($ Millions) Net Operating Income Revenue 81.7$ 77.5$ 72.3$ 67.5$ 63.6$ 60.1$ Property operating expenses 31.8 27.7 24.3 24.2 24.6 20.1 Net Operating Income (NOI) 49.9$ 49.8$ 48.0$ 43.3$ 39.0$ 40.0$ Three Months Ended June 30, 2014 March 31, 2014 June 30, 2013 March 31, 2013 September 30, 2013 December 31, 2013 LQA Q2 2014 Reconciliation of Net Income (Loss) to Adjusted EBITDA: Net income (loss) (14.4)$ (3.6)$ 0.7$ (6.8)$ Adjustments: Interest expense 42.8 10.7 10.7 10.8 Other income - - - - Income tax (benefit) expense 1.2 0.3 0.4 0.3 Depreciation and amortization 119.2 29.8 27.6 23.0 Transaction costs 3.2 0.8 0.1 0.4 Restructuring costs - - - - Legal claim costs - - - - (Gain) loss on sale of receivables to affiliate - - - - Non-cash compensatio 11.2 2.8 2.2 1.8 Loss on extinguishment of debt - - - 1.3 Asset impairments - - - - (Gain) loss on sale of real estate improvements - - - - Transaction-related compensation - - - - Adjusted EBITDA 163.2$ 40.8$ 41.7$ 30.8$ June 30, 2013 Three Months Ended March 31, 2014 June 30, 2014

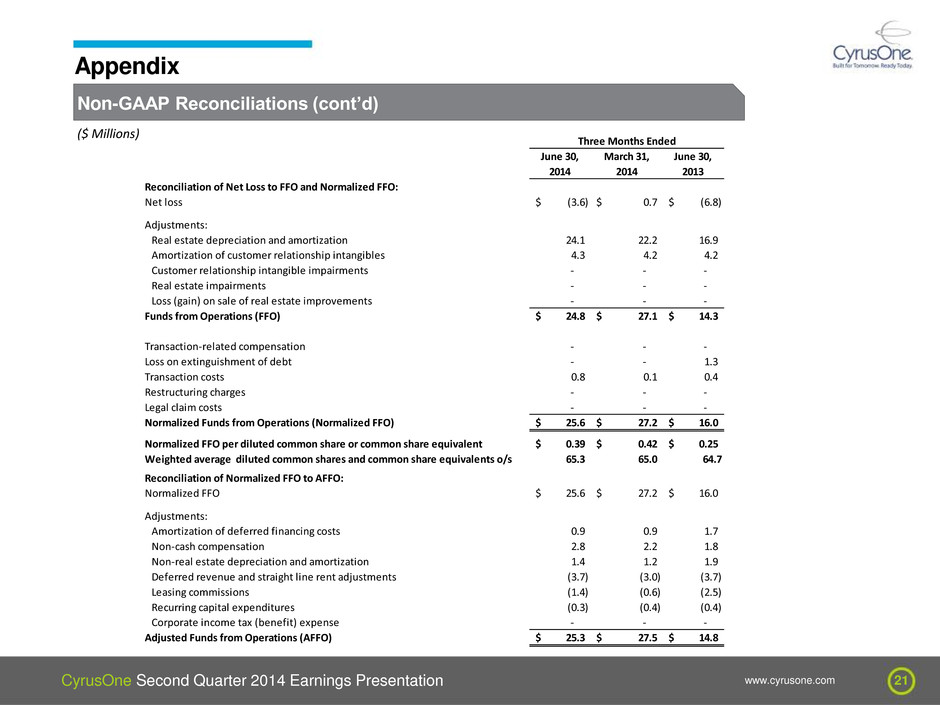

CyrusOne Second Quarter 2014 Earnings Presentation www.cyrusone.com 21 Non-GAAP Reconciliations (cont’d) Appendix ($ Millions) Reconciliation of Net Loss to FFO and Normalized FFO: Net loss (3.6)$ 0.7$ (6.8)$ Adjustments: Real estate depreciation and amortization 24.1 22.2 16.9 Amortization of customer relationship intangibles 4.3 4.2 4.2 Customer relationship intangible impairments - - - Real estate impairments - - - Loss (gain) on sale of real estate improvements - - - Funds from Operations (FFO) 24.8$ 27.1$ 14.3$ Transaction-related compensation - - - Loss on extinguishment of debt - - 1.3 Transaction costs 0.8 0.1 0.4 Restructuring charges - - - Legal claim costs - - - Normalized Funds from Operations (Normalized FFO) 25.6$ 27.2$ 16.0$ Normalized FFO per diluted common share or common share equivalent 0.39$ 0.42$ 0.25$ Weighted average diluted common shares and common share equivalents o/s 65.3 65.0 64.7 Reconciliation of Normalized FFO to AFFO: Normalized FFO 25.6$ 27.2$ 16.0$ Adjustments: Amortization of deferred financing costs 0.9 0.9 1.7 Non-cash compensation 2.8 2.2 1.8 Non-real estate depreciation and amortization 1.4 1.2 1.9 Deferred revenue and straight line rent adjustments (3.7) (3.0) (3.7) Leasing commissions (1.4) (0.6) (2.5) Recurring capital expenditures (0.3) (0.4) (0.4) Corporate income tax (benefit) expense - - - Adjusted Funds from Operations (AFFO) 25.3$ 27.5$ 14.8$ Three Months Ended June 30, 2014 June 30, 2013 March 31, 2014