Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BMC STOCK HOLDINGS, INC. | sbs_8-kxaug2014investorpre.htm |

STOCK Building Supply Investor Presentation August 2014

2 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Disclaimer Forward-Looking Statements This presentation contains forward-looking statements, which are subject to substantial risks, uncertainties and assumptions. You should not place reliance on these statements. These statements often include words such as “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “seek,” “will,” “may” or similar expressions. These risks include, but are not limited to, the following: (i) the state of the homebuilding industry and repair and remodel activity; (ii) seasonality and cyclicality of the building products supply and services industry; (iii) competitive industry pressures and competitive pricing pressure from our customers; (iv) inflation or deflation of commodity prices; (v) litigation or claims relating to our products and services; (vi) our ability to maintain profitability; (vii) our ability to attract and retain key employees and (viii) product shortages and relationships with key suppliers. Further information regarding factors that could impact our financial and other results can be found in the Risk Factors section of our Annual Report on Form 10-K, filed with the Securities and Exchange Commission (“SEC”) on March 4, 2014, and subsequent filings with the SEC. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of expected future developments and other factors we believe are appropriate in these circumstances. As you read and consider this presentation, you should understand that these statements are not guarantees of performance or results. Many factors could affect our actual performance and results and could cause actual results to differ materially from those expressed in the forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Non-GAAP Financial Measures Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in accordance with generally accepted accounting principles in the United States of America because management believes such measures are useful to investors. Because the Company’s calculations of these measures may differ from similar measures used by other companies, you should be careful when comparing the Company’s non-GAAP financial measures to those of other companies. A reconciliation of non-GAAP financial measures to GAAP financial measures is included in an appendix to this presentation.

3 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK Building Supply A Leading Provider of LBM Products and Services A Leading U.S. Lumber and Building Materials Distributor Operations in 21 Markets Across 14 States Served ~12,000 Unique Customers in 2013 … Delivered to ~86,000 Job Sites Offers a Broad Range of SKUs and Customized Products Provides Full Complement of Homebuilder Services: Product Selection Inventory Management Job Site Delivery Design Support Custom Component and Millwork Manufacturing Installation Management Distribution and Retail LBM Services • 48 locations Design & Manufacturing Services Structural Components • 15 locations Millwork Manufacturing • 20 locations Installed Services • Offered in most Markets including 15 flooring locations S T O C K

4 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK is a Leader in the Highly Fragmented U.S. Building Materials Industry STOCK Building Supply is Well-Positioned in a Fragmented Segment 1 Estimates; Source: 2007 U.S. Census NAICS Survey • ~$300B Industry • STOCK is a Top 5 LBM distributor • Top 20 have ~35% share • Top 100 have ~45% share 2013 Levels2 Building Materials Sales by Distribution Channel¹ 2 Estimates; Sources: 2013 U.S. NAICS Annual Retail Trade Report and 2014 ProSales 100 Rankings LBM Dist. 13% Home Centers 42% Roofing and Other Building Materials 23% All Other 22% Multi-Regional Players Two-Step Players Regional / Local Players

5 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK Building Supply Key Highlights Low Cost, High Service Integrated Supply Chain A Leading U.S. Builder/Contractor- focused LBM Distributor Leadership Positions in Attractive Geographies Extensive Product and Service Offering Experienced Management Team Focused Growth Strategy

6 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 TX 32% NC 15% GA 10% CA 10% UT 10% Other 23% Operating in 21 MSAs across 14 States Employment growth above U.S. average ~3,000 non-union employees as of January 2014 Main branch (headquarters) located in Raleigh, NC Strong U.S. LBM Footprint with Significant Room to Grow 2013 Sales by State National Footprint in Attractive Growth Markets Stock Building Supply Locations LA NC SC PA VA GA AR TX UT CA ID WA NM NJ MD DC AL AZ CO CT DE FL IL IN IA KS KY ME MA MI MN MS MO MT NE NV NH NY ND OH OK OR RI SD TN VT WV WI WY

7 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK’s Products and Services Represent ~50% of the Cost of a Typical New Home STOCK Provides an Extensive Product and Service Offering Source: 2013 NAHB Cost of Construction Survey Average Cost Share of Cost Building Permit Fees $3,647 1.5% Impact Fee $3,312 1.4% Water & Sewer Fees Inspections $4,346 1.8% Architecture, Engineering $3,721 1.5% Excavation, Foundation & Backfill $23,028 9.3% Framing & Trusses $41,899 17.0% Sheathings $2,332 1.0% Siding $16,867 6.8% Roofing $7,932 3.2% Windows & Doors $10,117 4.1% Plumbing $11,823 4.8% Electrical $9,967 4.0% HVAC $10,980 4.5% Insulation $4,786 1.9% Drywall $9,376 3.8% Interior Trim, Doors & Hardware $10,536 4.3% Painting $8,355 3.4% Lighting $3,008 1.2% Cabinets & Countertops $12,785 5.2% Appliances $4,189 1.7% Flooring $12,378 5.0% Plumbing Fixtures $4,265 1.7% Outdoor Structures (deck, patio) $2,891 1.2% Landscaping $5,744 2.3% Driveway $3,741 1.5% Other $14,428 5.9% Total $246,453 100%

8 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK Supplies LBM Products and Value-added Services to U.S. Homebuilders & Contractors 2013 Product and Service Sales 2013 Sales by Customer Type STCK Supports Builder Projects with Materials and Services from Framing to Finish STCK Serves a Full Spectrum of Builders … Remodel Projects to Custom Luxury Homes Structural Components 13% Millwork & Other Interior Products 18% Lumber & Lumber Sheet Goods 36% Windows & Other Exterior Products 21% Other Building Products & Services 12% Production Builder 37% Custom Builder 37% Remodeling Contractor 17% Multi- Family 3% Light Commercial 3% Other 3% 74% new single-family construction

9 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK is a Low Cost, High Service Integrated Supply Chain Partner Supplier Benefits Customer Benefits Integral Channel Partner for Suppliers and Customers Access to thousands of customers Scale and breadth efficiencies Value-added services partner Utilize STOCK’s technical sales force Access to over 1,000 suppliers Access to a broad product knowledge Integrated supply chain efficiencies Partnership w/ leading service provider Low Cost Supply Chain Partner Efficient Asset Manager Leading Customer Service and Solutions Provider at the Job Site! Partnership with a leading LBM Support of national LBM supplier

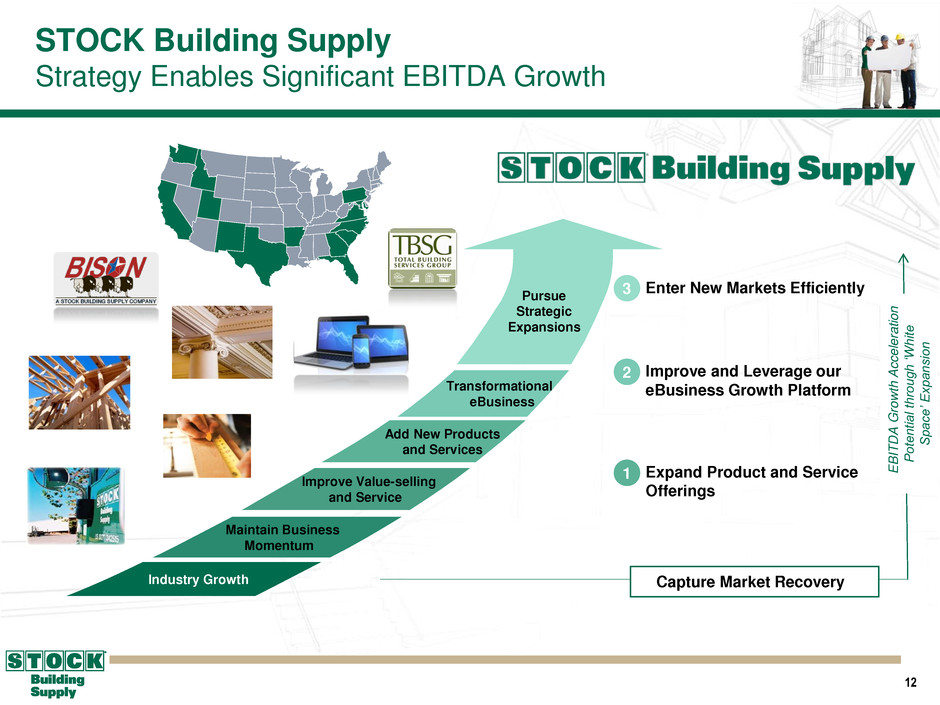

10 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Focused Growth Strategy

11 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 79% 93% >99% 0.0 400.0 800.0 1,200.0 1,600.0 2,000.0 1959 1965 1971 1977 1983 1989 1995 2001 2007 2013 U.S. Single-Family Starts Capture Market Recovery in Core Markets While Positioning Company to Expand Profitably 1 Source: United States Census Bureau Single-Family Housing Starts 2 2013 STCK sales to S-F builders as percent of 2013 purchases by S-F builders in STCK markets of products that STCK sells; Source: Management estimates, NAHB and McGraw-Hill 3 2013 STCK sales to remodeling contractors as percent of 2013 U.S. professional home improvement market; Source: Management estimates, HIRI Significant White Space for Profitable Growth Single-Family Housing Starts over the Last 50+ Years1 R&R Share3 Wallet Share2 Significant Room to Recover from Today’s Levels Macro Conditions Support Growth Geography1 White Space 618k 40% below 50-yr avg. S-F New Construction 1959-2013 avg. ~1.0M S-F starts / yr Demographics favorable Aging housing stock Recoveries typically exceed average 22% <10% 78% >90% <1%

12 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK Building Supply Strategy Enables Significant EBITDA Growth Industry Growth Maintain Business Momentum Improve Value-selling and Service Add New Products and Services Pursue Strategic Expansions Enter New Markets Efficiently E B IT D A G rowt h A c c e lerat io n P ote nti al throug h ‘W hi te S pa c e’ E x pa ns ion Capture Market Recovery Expand Product and Service Offerings Improve and Leverage our eBusiness Growth Platform 2 1 3 Transformational eBusiness

13 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Capitalize on Superior Logistics Capabilities to Grow Share Increasing Whole-House Selling Capability Expanding Product and Service Offerings Increase Share as Professional Service Capabilities Expand Growing Sales per Start >5% Annually Expand Product and Service Offerings Increasing Wallet Share of ‘New Construction’ and ‘R&R’ STOCK single-family revenue / U.S. S-F start Source: Management estimates; U.S. Census Bureau; 2013 subject to revision in S-F starts by U.S. Census Bureau 1 • Increase Structures Capacity • Increase Millwork Capability • Improve Service Offerings • Enhance Sales Capacity $1,094 $1,204 $1,270 $1,441 2010 2011 2012 2013

14 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Adding Millwork Facilities and Expanding Sales Capabilities Atlanta custom millwork S. Carolina / Charlotte production millwork Houston millwork expansion Expanding sales resources / showrooms and product offerings Mix to High Margin Product Growth as Market Recovers Lumber & Lumber Sheet Goods Structural Components Millwork / Interior Windows / Exterior Other Bldg Prod Expand Product and Service Offerings Drive Growth of High Value Products and Services Medium Medium High High Low Relative GM % Atlanta plant (TBSG acquisition) Virginia plant (Chesapeake acquisition) Salt Lake City and N. Carolina expansions LEAN eBusiness project to improve customer support Increasing Structures Facilities and Technical Selling Capabilities Sources: Management estimates, NAHB, McGraw-Hill 1 % of 2013 Net Sales 2013 Growth % 28% 36% 18% 13% 21% 48% 12% 23% 23% 17%

15 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 $752 13.0% 10.2% 2010 2013 Leverage Our eBusiness Growth Platform LEAN eBusiness Implementation Underway Suppliers (>1000) Customers (>100,000) STOCK’s Integrated and Proprietary LEAN eBusiness Processes: P ro ject S p ec if ica ti o n S ales S u p p o rt LEAN eBusiness Driving Improved Operating Performance S e rv ic e T ra ns a c t Driving a Low Cost Distribution Platform STOCK Logistics Solutions (SLS) eCFO Performance Suite (entrepreneurial leaders digital execution platform) STOCK Installation Solutions (SIS) Many other customer-centric services planned Technology & LEAN Enabling Leading Service and Efficiency 6.6% 5.2% 2010 2013 Delivering Efficient Growth Leading Customer Service (>92% OTIF in 2012 and 2013) Working Capital (% of Sales) Sales ($M) Shipping & Handling Costs (% of Sales) 2 $1,197

16 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Enter New Markets Efficiently Expand in Adjacent and New Markets Since 2010, STOCK has acquired four businesses • Many attractive targets exist in highly fragmented market Strategic Growth Accelerators in place • Low-cost / national operating platform • Access to capital Brownfield / Greenfield Expansions in process Bison Building Materials Acquired in 2010; Located in Houston, TX Made STOCK the leading distributor in Houston, with strong value-add capabilities National Home Centers Acquired in 2010; Located in Northwest Arkansas Established position in Arkansas market Total Building Services Group Acquired Dec 2012; Located in Marietta, GA Provided critical Structures and Millwork capability in Atlanta market Chesapeake Acquired in April 2013; Located outside Richmond, VA Provided component manufacturing capabilities in southern / central VA market Proven Acquisition Capability to Augment Strategic Growth 3

17 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Financial Overview

18 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 $ 760.0 $ 942.4 $ 1,197.0 2011 2012 2013 Review of Historical Financial Performance Net Sales ¹ Adjusted EBITDA is calculated as net loss before interest, taxes, depreciation and amortization and certain items. See Appendix for a reconciliation of net income / (loss) to adjusted EBITDA. Gross Profit Adjusted EBITDA1 New construction recovery beginning GM% expansion despite challenging environment Revenue pull-through drove $58.6M gain in Adjusted EBITDA over past eight quarters from 2011 to 2013 Current STCK footprint generated ~$1.8B revenue in 2006 ($ in millions) Significant Capacity for Growth in Revenue and EBITDA $(30.8) $ 2.0 $ 27.8 2011 2012 2013 $ 169.0 $ 214.7 $ 274.4 2011 2012 2013

19 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Quarterly Financial Results Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 LTM Jun 2014 Revenue $314.7 $328.5 $305.2 $280.0 $344.6 $1,258.2 YOY chg 27.7% 28.4% 21.0% 12.6% 9.5% 17.4% Gross profit $71.5 $75.4 $73.7 $65.2 $82.2 $296.6 GM% 22.7% 22.9% 24.2% 23.3% 23.9% 23.6% Adjusted EBITDA1 $9.0 $10.4 $9.6 $0.1 $12.9 $33.0 Adj. EBITDA Margin 2.9% 3.2% 3.1% 0.0% 3.8% 2.6% ($ in millions) Adjusted EBITDA (1) and Margin Improvements Build Momentum Quarterly financial results are unaudited. ¹ Adjusted EBITDA is calculated as net loss before interest, taxes, depreciation and amortization and certain items. See Appendix for a reconciliation of net income / (loss) to adjusted EBITDA.

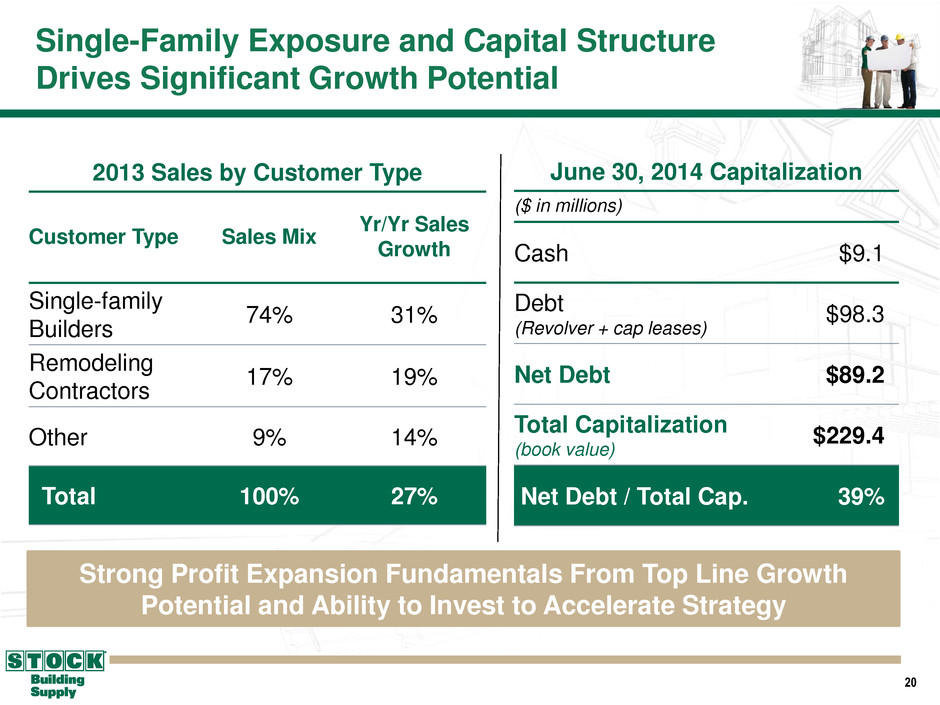

20 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Single-Family Exposure and Capital Structure Drives Significant Growth Potential 2013 Sales by Customer Type Customer Type Sales Mix Yr/Yr Sales Growth Single-family Builders 74% 31% Remodeling Contractors 17% 19% Other 9% 14% Total 100% 27% Strong Profit Expansion Fundamentals From Top Line Growth Potential and Ability to Invest to Accelerate Strategy June 30, 2014 Capitalization ($ in millions) Cash $9.1 Debt (Revolver + cap leases) $98.3 Net Debt $89.2 Total Capitalization (book value) $229.4 Net Debt / Total Cap. 39%

21 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 STOCK Building Supply Positioned for Profitable Growth Continued U.S. Housing Recovery Provides for Strong End- market Demand Growth Initiatives Capitalize on Fragmented Market and Significant “White Space” Expansion Opportunities Improving on our Established Operating Platform: Strong Earnings Momentum … LEAN eBusiness Differentiates Flexible Balance Sheet and Attractive Mid / Long-term Growth and Cash-flow Dynamics Proven Team to Execute our Growth Plan

22 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Appendix

23 0 108 78 144 156 172 198 179 146 89 137 209 210 211 231 95 95 95 Reconciliation of Non-GAAP Items Year Ended December 31, ($ in thousands) 2011 2012 2013 2Q 13 3Q 13 Q4 13 Q1 14 Q2 14 LTM Jun 14 Net Income (loss) $(42,133) $(14,533) $(4,635) $1,978 $(5,513) $2,957 $(3,288) $5,627 $(217) Interest expense 2,842 4,037 3,793 1,233 892 643 631 668 2,834 Income tax expense (benefit) (22,332) (8,084) 2,874 966 1,989 1,798 (1,498) 2,943 5,232 Depreciation and amortization 16,188 11,718 12,060 3,067 3,032 3,002 3,036 3,410 12,480 EBITDA $(45,435) $(6,862) $14,092 $7,244 $400 $8,400 $(1,119) $12,648 $20,329 Impairment of assets held for sale 580 361 432 – – 432 48 – 480 Restructuring, severance, other items related to store closures and business optimization 8,110 5,228 1,254 358 260 403 192 (68) 787 Discontinued operations, net of taxes 202 (49) (401) (94) (90) (60) (21) (147) (318) Management fees 2,406 1,379 1,307 560 239 102 77 12 430 Non-cash compensation expense 384 1,305 1,049 118 309 476 485 495 1,765 Acquisition costs 1,017 284 257 154 – – – – – Public offering transaction-related costs – – 10,008 686 9,322 – 448 – 9,770 Reduction of tax indemnification asset 1,937 347 – – – – – – – Other Items – – (195) – – (195) – – (195) Adjusted EBITDA $(30,799) $1,993 $27,803 $9,026 $10,440 $9,558 $110 $12,940 $33,048 Quarterly financial results are unaudited.