Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PAR PACIFIC HOLDINGS, INC. | d765325d8k.htm |

Mid-Pac

Acquisition and Rights Offering Presentation

July 2014

Exhibit 99.1 |

2

The company filed a prospectus supplement with the SEC on July 22, 2014, which prospectus

supplement provides the terms of the rights offering and supplements the accompanying

prospectus, dated July 7, 2014, which is part of the Company’s registration

statement on Form S-3, File No. 333-195662. This communication is being

used in connection with the rights offering. Before you invest, you should read the prospectus

supplement, the prospectus in the registration statement and other documents that the Company

has filed with

the

SEC

for

more

complete

information

about

the

Company

and

this

rights

offering.

You

may

get

these

documents

for

free

by

visiting

EDGAR

on

the

SEC

website

at

www.sec.gov.

Alternatively,

you

may

obtain

a

prospectus supplement and prospectus from the information agent for the rights offering at the

following address and telephone number: D.F. King & Co., Inc., 48 Wall Street, New

York, NY 10005. Banks and Brokers call collect: (212) 269-5550.

All others call Toll Free: (800) 967-4607. |

3

Forward Looking Disclaimer

Certain

statements

in

this

presentation

may

constitute

“forward-looking”

statements

as

defined

in

various

provisions of the federal securities law or in releases made by the SEC, all as may be amended

from time to time. Such forward-looking statements involve known and unknown

risks, uncertainties and other important factors that could cause our actual results,

performance or achievements to differ materially from any future results, performance

or achievements expressed or implied by such forward-looking statements. Statements

that are not historical fact are forward-looking statements.

The forward-looking statements contained in this presentation are largely based on our

expectations, which reflect estimates and assumptions made by our management. These

estimates and assumptions reflect our best judgment based on currently known market

conditions and other factors. Although we believe such estimates and assumptions to be

reasonable, they are inherently uncertain and involve a number of risks and

uncertainties that are beyond our control, including: our ability to successfully

complete the pending Mid Pac acquisition, integrate it with our operations and realize

the anticipated benefits from the acquisition; our ability to identify all potential

risks and liabilities in our due diligence of Mid Pac and its business; any unexpected

costs or delays, including modifications to the terms of the transaction which may be

required by HSR, in connection with the pending Mid Pac acquisition; the continued

availability of our net operating loss tax carryforwards; our ability to maintain

adequate liquidity; compliance with legal and/or regulatory requirements; a liquid

market for our common stock may not develop; the concentrated ownership of our common

stock may depress its liquidity; our ability to generate cash flow may be limited; effectiveness of our

disclosure controls and procedures and our internal controls over financial reporting; the

potential for spills, discharges or other releases of petroleum products or hazardous

substances; our level of indebtedness may prove excessive; and the other risks

identified in our Prospectus Supplement filed with the SEC on July 22, 2014, and in our

most recent periodic and current reports filed with the SEC. In addition,

management’s assumptions about future events may prove to be inaccurate. All readers are

cautioned that the forward-looking statements contained in this presentation are not

guarantees of future performance, and we cannot assure any reader that such statements

will be realized or that the forward- looking events and circumstances will occur.

Actual results may differ materially from those anticipated or implied in the

forward-looking statements. All forward-looking statements speak only as of the date they are

made. We do not intend to update or revise any forward-looking statements as a result of

new information, future events or otherwise. These cautionary statements qualify all

forward-looking statements attributable to us or persons acting on our

behalf. |

4

Agenda

I.

Participants

II.

Par Fundamentals

III.

Mid-Pac Overview and Island Strategy

IV.

Rights Offering Details

V.

Par Overview |

5

Participants

Melvyn Klein, Chairman of the Board

Will Monteleone, President & Chief Executive Officer

Curt Anastasio, Member of Board of Directors & Chairman of the

Operations and Technology Committee |

6

Par Petroleum –

Key Statistics

Key Statistics

(1)

Share price and current balances as of July 24, 2014 other than cash and Term Loan; see

note (4) below

(2)

Pro forma for rights offering of $100 million at $16.00 / share.

(3)

Total common shares outstanding as of the record date, July 21, 2014.

(4)

Includes upsized facility as of July 28, 2014; $35 MM to be repaid from proceeds of rights

offering

(5)

Includes current maturities

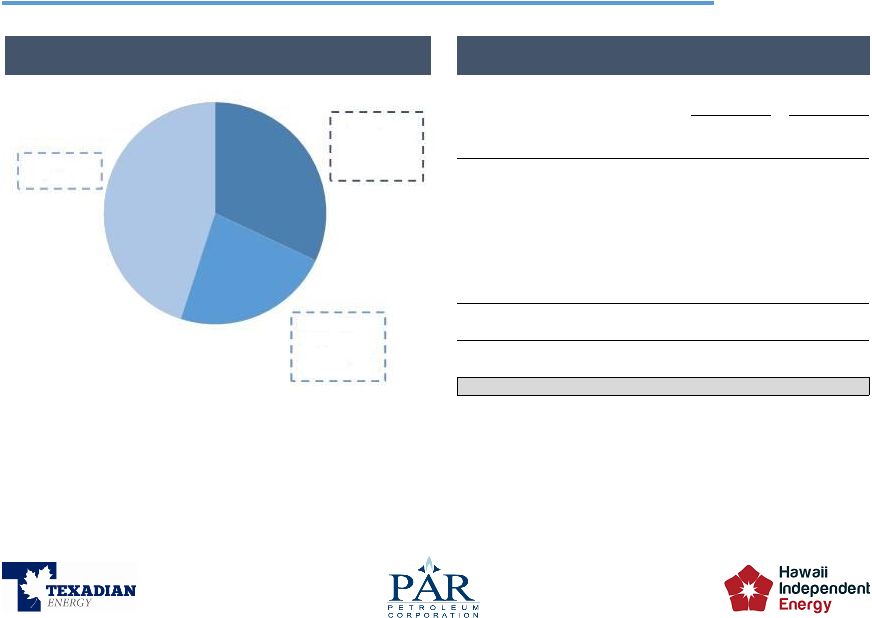

Shareholder Base Overview

($ in millions, except share price)

Current

(1)

Pro forma

(2)

Total

Shares

Outstanding

(3)

30.3

36.7

Share Price

20.12

20.12

Market Capitilization

$609.8

$737.8

Term Loan

(4)

85.00

50.00

Committed Bridge Facility ($75 MM)

0.00

0.00

ABL Facility

45.0

45.0

Retail

Credit

Agreement

(5)

29.1

29.1

Total Debt Outstanding

$159.1

$124.1

(-) Cash and Cash Equivalents

(62)

(127)

Net Debt

$97.1

($2.9)

Total Enterprise Value

$706.9

$734.9

Zell Credit

Opportunities

Master Fund LP

32%

Funds Managed

by Whitebox

Advisors LLC

24%

Other Holders

45% |

Mid-Pac

Overview |

8

Mid-Pac Business Overview

Over 80 retail locations across 4 islands

Annualized refined product sales of approximately 74 million gallons of fuel (based

on the 6 months ended 3/31/14)

Exclusive right to 76 brand for Hawaii through 2024

Fee owned real estate locations provides competitive advantage

4 refined product terminals with throughput rights to an additional site

–

Throughput rights for Barbers Point Aloha

–

Leased & operated terminal on Kauai

–

Leased & operated terminal on Kona

–

Owned terminal leased to HIE in Hilo

–

Owned & operated terminal on Molokai (only terminal on island)

|

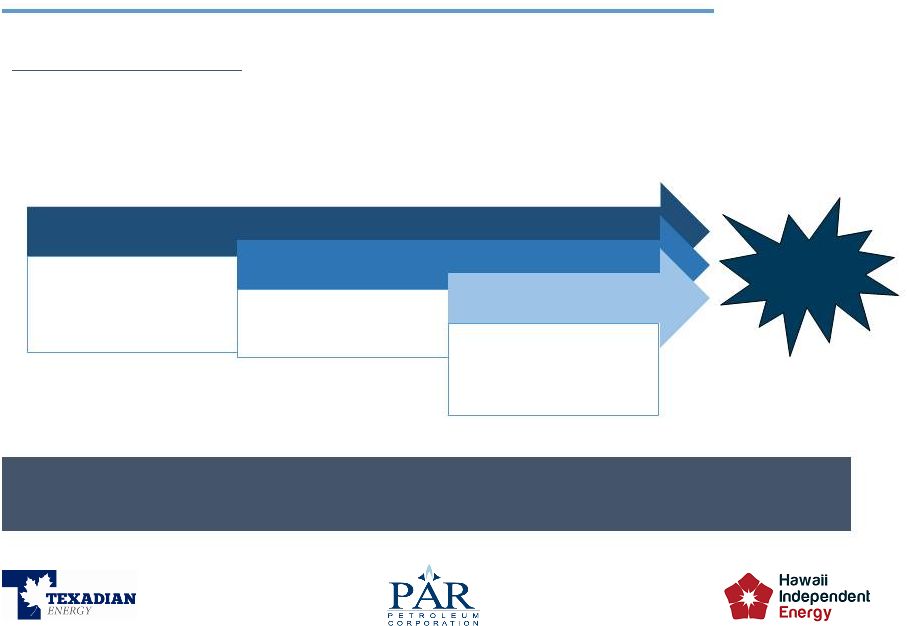

Mid-Pac

Fits

into

Our

Operating

Strategy

(1)

Core Strategic Element:

Hawaii

is

highly

contractual

market….optimal

sales

slate

must

be

developed

over

time

Maximizing

product

slate

value

requires

optimizing

our

jet

sales

which

creates incremental gasoline range molecules

Optimal

Slate

(1)

Hawaii aggregate markets based on Company estimates

9

Commercial Jet Demand

Military Jet / Diesel

Major Gasoline

~35mbpd

20% Effective 4/1

80% Effective 7/1

~6.5mbpd

100% Effective 10/1

~30,000 mbpd

100% Effective 1/1 |

10

Acquisition Summary

Investment in Mid-Pac provides significant cost savings opportunity by internalizing

consumption and keeping product on-island

–

Keeping product on-island vs. exporting is expected to improve margin by

~$6-10/barrel –

Mid-Pac sells ~4,200 bpd of gasoline and 1,000 bpd of diesel

Motor fuels

–

Management believes Mid-Pac footprint is highly complementary

–

Consolidation allows increased logistics efficiency and access to localized markets

Market access

–

Mid-Pac adds access to Kauai motor fuel market

–

Mid-Pac’s terminaling capability on Kona-side of Hawaii reduces trucking

cost –

Mid-Pac owns in fee many retail locations

Other benefits

–

Mid-Pac has full back office and creates immediate staff augmentation

–

Long-term license of major brand name (76 brand)

Mid-Pac synergies

–

In addition to the margin enhancing synergies relating to minimizing gasoline exports,

Mid-Pac provides material cost savings at the retail and logistics level

–

Mid-Pac is expected to provide approximately $5mm of annual cost savings

|

11

Rights Offering

The Company expects its two largest shareholders will subscribe to their pro rata portion of

the offering

Par intends to raise $100 million of gross proceeds from the rights offering based upon the

following terms:

Record date

7/21/2014

Shares/ right

0.21

Shares issued in offering

6,364,512

Pro forma shares outstanding

36,671,712

Exercise price/ share

$16.00

Discount to market (7/21/14)

21%

Expiration date

8/13/2014 5:00 PM ET |

Par

Overview |

13

Current Hawaii Operations

Refinery

Integrated Logistics

Retail

94,000 BPD Capacity

5.7x Nelson Complexity

2.4 MMBls crude oil and

feedstock storage

2.5 MMBls refined product

storage

Five refined product

terminals with

approximately 247,000 Bbls

of working capacity

Total of 290,000 Bbls of

shell capacity

27 miles of distribution

pipelines

Proprietary product lines to

Kalaeloa Barbers Point

Harbor from the Refinery

Single Point Mooring (SPM)

and associated subsea

crude oil and refined

product pipelines

Two dedicated time

chartered tug/barge units

One assist Tug

31 retail locations on Maui,

Hawaii and Oahi islands

27 company operated

retail outlets

One company controlled,

unattended cardlock

location

One company controlled,

dealer operated outlet

One dealer owned,

dealer operated outlet

Refining Unit

Capacity

(MBPD)

Crude Unit

94

Vacuum Distillation Unit

36

Hydrocracker

18

Catalytic Reformer

13

Visbreaker

11

Hydrogen Plant (MMCFD)

18

Naphtha Hydrotreater

13

Two

company

controlled,

commission agent

outlets |

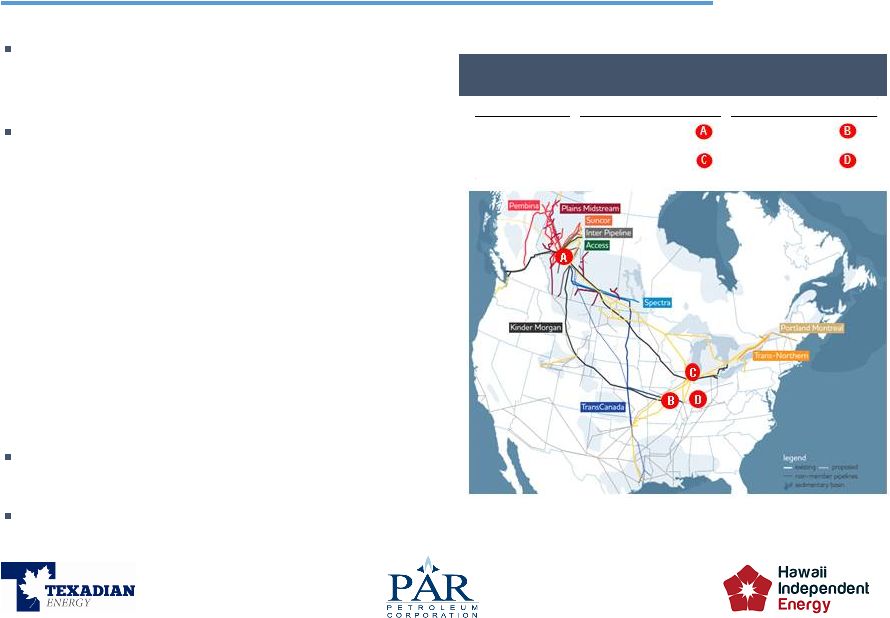

14

Texadian acquired from SEACOR Holdings on

December 31, 2012 for $13 million + working

capital

Primary assets consist of the following as of

December 31, 2013:

–

Historical pipeline positions on attractive

lines moving Canadian barrels from north

to south

–

178 leased railcars

–

Leased tow and barge equipment

–

Favorable relationships with major inland

marine providers

–

Significant marine expertise in moving

Canadian barrels via barge from St. Louis

to the lower Mississippi river

Financed separately with access to $50 million

trade credit facility

Access to terminal and dock facility in Wood

River, IL

Pipeline Positions

Texadian Energy

Pipeline

Origin

Destination

Platte / Express

Hardisty, Alberta

Wood River, IL

Mustang

Chicago, IL

Patoka, IL |

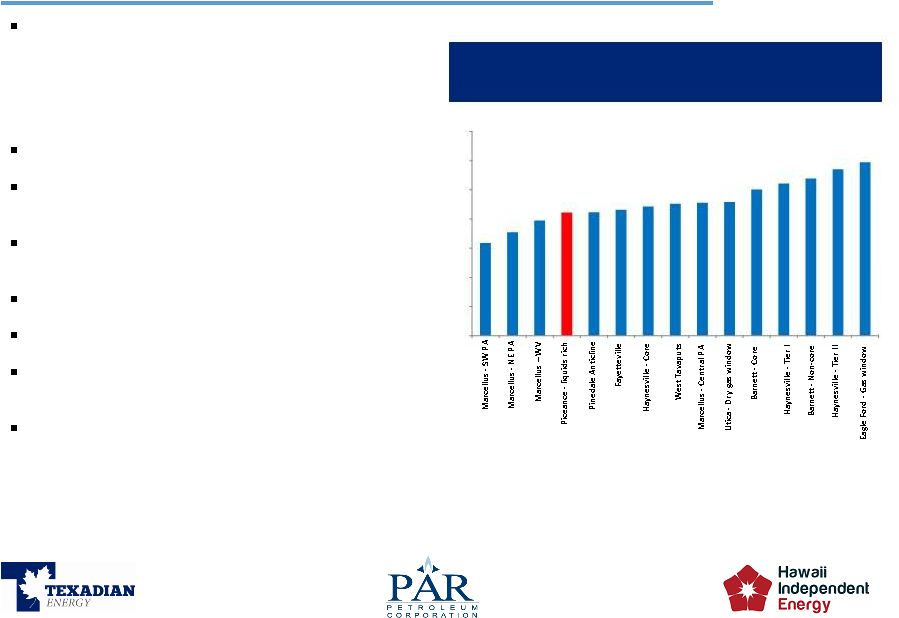

15

Piceance Energy Overview

Concentrated acreage footprint in the historically

prolific Piceance basin

–

Underlying geology characterized by consistent

Williams Fork sand with deeper Mancos / Niobrara

potential

Over 304 producing Williams Fork wells

Among the lowest cost gas weighted basins in the

continental U.S.

Liquids production of 19% on a volume basis in

the form of NGLs / Condensate

Over 3,500 undeveloped Williams Fork locations

Almost all leasehold interests held by production

Significant undeveloped resource base from the

Mancos / Niobrara shale

Piceance is commencing a one rig pad drilling

program in Q3’14, which is expected to grow

production and generate borrowing base

expansion to pursue future development

Required Henry Hub ($ / MCF )Price to Generate 11%

IRR

(1)

(1)

Source: Goldman Sachs Global Investment Research

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

$7.00 |

16

Building a foundation for 2015 and beyond

2014 is a transition year for Par highlighted by the pending Mid-Pac acquisition

Increasing on-island sales volumes is a core strategic initiative and there are

several ongoing bidding processes with new customers

Crude purchasing strategy has improved feedstock differentials to Brent relative to

what the refinery experienced in 2013 and Q1 2014

Anticipated immediate staff augmentation from the existing Mid-Pac personnel

|

17

Strategy & Conclusions

Investment in Mid-Pac provides significant value creation by internalizing

consumption, keeping product on-island, and allowing the company to optimize its

product and crude slate to the local economy

The acquired assets of Mid-Pac unlock value inside Par’s existing footprint

The current Hawaii operations, combined with this years’

transition/repositioning

costs and Mid-Pac acquisition, offers potential for an attractive return on total

invested capital

Strategy is to create ongoing, stable earnings capable of predictable monetization

of NOLs

Serious commitment by a professional and experienced Board of Directors and

two major shareholders

Early stages of evolutionary process and value creation present challenges, but

high level of focus on a sound strategy translates into success |