Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Islet Sciences, Inc. | Financial_Report.xls |

| EX-14.1 - CODE OF ETHICS - Islet Sciences, Inc. | once_ex141.htm |

| EX-31.2 - CERTIFICATION - Islet Sciences, Inc. | once_ex312.htm |

| EX-31.1 - CERTIFICATION - Islet Sciences, Inc. | once_ex311.htm |

| EX-32.1 - CERTIFICATION - Islet Sciences, Inc. | once_ex321.htm |

| EX-21.1 - SUBSIDIARIES OF THE REGISTRANT - Islet Sciences, Inc. | once_ex211.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

þ

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the Fiscal Year Ended April 30, 2014

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ________________ to ________________

Commission File Number 001-34048

Islet Sciences, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

87-0531751

|

|

|

(State or other jurisdiction of

|

(IRS Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

8601 Six Forks Rd, Suite 400

Raleigh, NC 27615

(Address of principal executive offices)

Issuer’s telephone number, including area code: 919.480.1518

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $0.001 Par Value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was Required to submit and post such files). þ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. (as defined in Rule 12b-2 of the Exchange Act). Check one:

|

Large accelerated filer

|

¨

|

Non-accelerated filer

|

¨

|

|

Accelerated Filer

|

¨

|

Smaller reporting company

|

þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes¨ No þ

As of October 31, 2013, the last day of the Registrant’s most recently completed second fiscal quarter; the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates (based upon the closing stock price of $0.25 as reported on the Over-the-Counter Bulletin Board) was approximately $9,107,409. Shares of the Registrant’s common stock held by each executive officer and director and by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of July 22, 2014, there were 68,273,253 outstanding shares of the registrant’s common stock, $0.001 par value.

Documents incorporated by reference: None.

Islet Sciences, Inc.

Form 10-K

Table of Contents

|

Page

|

||||

|

PART I

|

||||

|

Item 1.

|

Business

|

3

|

||

|

Item 1A.

|

Risk Factors

|

15

|

||

|

Item 2.

|

Properties

|

22

|

||

|

Item 3.

|

Legal Proceedings

|

22

|

||

|

PART II

|

||||

|

Item 5.

|

Market for Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

23

|

||

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

23

|

||

|

Item 8.

|

Financial Statements and Supplementary Data

|

27

|

||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

27

|

||

|

Item 9A

|

Controls and Procedures

|

27

|

||

|

Item 9B.

|

Other Information

|

29

|

||

|

PART III

|

||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

29

|

||

|

Item 11.

|

Executive Compensation

|

34

|

||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

36

|

||

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

38

|

||

|

Item 14.

|

Principal Accountant Fees and Services

|

39

|

||

|

PART IV

|

||||

|

Item 15.

|

Exhibits

|

40

|

||

|

Signatures

|

41

|

|||

|

Financial Statements

|

F-1

|

|||

2

PART I

Corporate History

Islet Sciences, Inc. (the “Company”, “we”, or “our”) was incorporated under the name One E-Commerce Corporation on September 14, 1994 in the State of Nevada. Effective February 23, 2012, the Company changed its name to Islet Sciences, Inc.

On December 30, 2011, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with ONCE, Inc., a Delaware corporation which was wholly-owned by the Company (“Merger Sub”), and Islet Sciences, Inc., a Delaware corporation (“ISI”). Pursuant to the Merger Agreement, on December 30, 2011, Merger Sub was merged with and into ISI, the holders of common stock of ISI received an aggregate of 38,005.87 shares of the Company’s Series B preferred stock, $.001 par value per share (“Series B Preferred”) in exchange for the cancellation of all of the shares of common stock of ISI formerly owned by them, and the holders of Series A preferred stock of ISI received an aggregate of 1,173 shares of the Company’s Series A preferred stock, $.001 par value per share (“Series A Preferred”) in exchange for the cancellation of all of the shares of Series A preferred stock of ISI formerly owned by them (the “Merger”).

Effective February 23, 2012, the Company completed a 1-for-45 reverse stock split (the “Reverse Split”) of shares of its common stock. Upon effectiveness of the Reverse Split, shares of Series A Preferred were automatically converted into an aggregate of 1,173,000 shares of common stock at a conversion ratio of one share of Series A Preferred for one thousand shares of common stock, and shares of Series B Preferred were automatically converted into an aggregate of 38,005,870 shares of common stock, at a conversion ratio of one share of Series B Preferred for one thousand shares of common stock. Upon conversion of Series A Preferred, the holders received the Company’s warrants to purchase an aggregate of 586,500 shares of Common Stock at an exercise price of $1.00 per share.

Merger with BHV Pharma

In March 2014 the Company announced it had signed a binding letter of intent to enter into a merger agreement with and acquire Brighthaven Ventures, LLC, a North Carolina limited liability company, d/b/a BHV Pharma (“BHV”) a privately held pharmaceutical company developing the SGLT2 inhibitor remogliflozin etabonate (“remogliflozin”) for type 2 diabetes and non-alcoholic steatohepatitis (“NASH”). Remogliflozin is currently in phase II clinical development. In exchange for 100% ownership of BHV, the Company will issue 30 million shares of its common stock to the holders of BHV units. Additional shares of common stock will be issued upon successful completion of development, regulatory and commercial milestones associated with the remogliflozin program. James Green and William Wilkison, the current members of BHV, are the Chief Executive Officer and the Chief Operating Officer of the Company, respectively, and are the sole members of BHV. The Company anticipates it will sign the merger agreement within the next 30 days and complete the merger upon successful completion of regulatory review.

Acquisition of DiaKine Therapeutics, Inc.

On March 14, 2012, the Company completed its acquisition of DiaKine Therapeutics, Inc., a Delaware corporation (“DTI”), and shareholders of DTI, whereby the Company issued to the DTI shareholders an aggregate of 200,000 shares of its newly designated shares of Series C convertible preferred stock, par value $0.001 per share (“Series C Preferred”) in exchange for all issued and outstanding shares of DTI. The Company also issued to DTI 100,000 shares of its common stock for no additional consideration in satisfaction of DTI’s liabilities outstanding at the closing under the agreement. As a result, DTI became a wholly-owned subsidiary of the Company. Subsequent to the closing of the DTI acquisition, the preferred stock was converted into 2,000,000 shares of common stock.

DTI’s compounds are small-molecule drugs that block the destructive, inflammatory actions of immune agents called cytokines. Cytokines have been shown in numerous studies to be components in the inflammation pathway that destroy insulin producing beta cells found in the pancreatic islets – a hallmark of type 1 diabetes and Latent Autoimmune Diabetes of Adults (LADA). Additionally, there is evidence that lipotoxicity, glucotoxicity, and other inflammatory factors induces progressive beta cell drop out in type 2 diabetes.

3

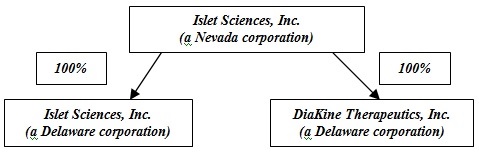

Company’s Corporate Structure

Below is the Company’s current corporate structure:

Our Business

Overview

We are a biotechnology company engaged in the research, development, and commercialization of new medicines and technologies for the treatment of metabolic diseases and related indications where there is a significant measurable unmet medical need. The rising incidence of obesity is associated with many obesity-related health complications, including cardiovascular disease, diabetes, hyperlipidemia, hypertension, nonalcoholic fatty liver disease/steatohepatitis (NAFLD/NASH). This constellation is also recognized as the metabolic syndrome and is characterized by underlying insulin resistance. These various diseases have interrelated risk factors and markers, such that often treatment of one disease may allow new therapies and opportunities for treatment in one of these related indications. Our focused effort to develop new therapies and related diagnostics for metabolic related diseases establishes us as a recognized leader in a large and growing market.

Metabolism is the ability of your body and its organs to process energy derived from the intake of nutrition. Metabolic diseases typically involve a derangement or malfunction of the normal processing of such metabolism. Some of the more prevalent metabolic diseases include obesity (excessive storage of nutrients); diabetes (loss of storage capability); NAFLD/NASH (excessive storage of lipids and fibrotic accumulation in the liver); dyslipidemia (inability to process fat from the blood); hypertension (excessive elevation of blood pressure).

We are developing the following therapeutic product candidates, which will include BHV’s SGLT2 inhibitor remogliflozin etabonate once the BHV merger is completed, to address the needs of patients suffering from metabolic disease:

|

●

|

Remogliflozin, a selective SGLT2 inhibitor in phase II clinical development for type 2 diabetes and NASH (BHV Pharma);

|

|

●

|

ISLT-P, an implantable suspension of encapsulated insulin-producing porcine islet cells, for the treatment of insulin-dependent diabetes;

|

|

●

|

ISLT-2669, a novel lead IL-12 small molecule inhibitor selected for preclinical development for treatment of type 2 diabetes. This IL12 inhibitor blocks the auto-immune and inflammatory cascade initiated by IL-12 receptor activation; and

|

|

●

|

ISLT-LSF Analogs, a library of small molecule lisofylline analogs that block inflammatory actions of cytokines that destroy insulin-producing beta cells, for diabetes and diabetes-related complications.

|

We are also developing the following diagnostic product candidate to better enable patients and their physicians to understand disease diagnosis and progression.

|

●

|

ISLT-Bdx, a PCR based molecular diagnostic measuring hypomethylated beta cell-derived DNA as a biomarker of beta cell loss for the early detection of type 1 diabetes or onset of insulin dependent type 2 diabetes;

|

4

Remogliflozin etabonate (“Remo”) is a selective O-linked glycoside SGLT2 inhibitor. In the kidney, glucose is filtered in the glomerulus and is reabsorbed through active transport mechanisms in the proximal tubule. Both sodium-glucose co-transporters, SGLT1 and SGLT2, are responsible for glucose reabsorption. SGLT2 is expressed exclusively in the proximal tubule and accounts for approximately 90% of glucose reabsorption. SGLT1, which is also expressed in GI and cardiac tissues, among others, accounts for the remaining approximate 10% of reabsorption. SGLT1 inhibition is known to cause significant GI distress; its effect on cardiac tissue is not completely known but it has been demonstrated that SGLT1 plays an active metabolic role in cardiac tissue.

Treating hyperglycemia with drugs that block renal glucose reabsorption through the SGLT2 transporter represents a validated approach to the treatment of type 2 diabetes. In non-diabetics, plasma glucose is filtered by the kidneys, but virtually all of it is reabsorbed. Inhibiting functional SGLT2 in the kidney reduces glucose reabsorption and therefore, more excess blood glucose is excreted into the urine which results in reduced circulating glucose, weight loss and increased insulin sensitivity via a beta-cell sparing insulin independent mechanism of action.

Pre-Clinical Summary: The Drug Metabolism and Pharmacokinetics (“DPMK”) package, as well as long term safety studies in rodents and dog, including two-year oncology studies, are complete. Toxicology studies in dog (52 week), rat (26 week) and mouse (13 week) demonstrate a very wide therapeutic window. Multiple diabetic rodent models also demonstrated significant plasma glucose, as well as reduction of fatty liver disease and weight loss.

Clinical Summary: Remo has been administered in sixteen phase I, three phase IIa, and two phase IIb clinical studies. Approximately 850 subjects, have been dosed with Remo. Remo has demonstrated dose-related glycosuria consistent with SGLT2 inhibition with best in class lowering of HbA1c, plasma glucose, and body weight observed in subjects with T2DM over 12 weeks of treatment. Remo has also proven to be well tolerated with low incidences of urogenital infections over 12 weeks of treatment in subjects with T2DM.

Phase I Clinical Studies: Remo has proven to be safe and well tolerated. Sixteen phase I studies, with doses ranging up to 4000 mg/day, have been performed in order to measure the PK, safety and drug-drug interaction of Remo. Remogliflozin etabonate (prodrug) was rapidly absorbed and extensively converted to its active entity, remogliflozin. Drug exposures were proportional to the dose administered and there were no apparent age or sex effect on the PK. There were no clinically significant changes in vital signs or ECGs and a thorough QtC study showed no effects of the drug on cardiac function. Subjects with mild and moderate renal impairment did not demonstrate any decrease in pharmacodynamic efficacy (as measured by UGE) or alteration in plasma PK. Drug-drug interaction studies with ketaconazole, bupropion, and metformin demonstrated no adverse effects of Remo on these compounds or vice versa. Formulation studies evaluated a number of formulations, with the biphasic formulation demonstrating the ideal characteristics for delivering remogliflozin primarily during the waking hours and minimizing remogliflozin exposure during the sleep period. The biphasic formulation was validated in healthy volunteers and demonstrated significant inhibition of SGLT2 during the waking hours while minimizing remogliflozin exposure during the sleep period.

Phase IIa Clinical Studies: Three phase IIa studies were conducted in subjects with T2DM. One study (KG219017) demonstrated that Remo caused FPG lowering in type II diabetics. All patients taking Remo also had clinically significant increases in urinary glucose excretion. Another study (KGW108201) utilizing echo MRI demonstrated that the weight loss observed with patients taking Remo was due to adipose (fat) loss and not fluid or lean mass loss. A third study (KG2110243) demonstrated that Remo was safe and effective when co-dosed with metformin. Fifty poorly controlled T2DM subjects taking metformin were treated with Remo for 13 days. The weighted mean glucose and insulin values following an oral glucose tolerance test (75 g glucose) were decreased in all treatment groups.

Phase IIb Clinical Studies: Two 12-week phase IIb studies of Remo were completed. The studies were multi-center, randomized, double blind, placebo-controlled, parallel-group, and dose-ranging with pioglitazone as an active comparator. The primary objective of both studies was to determine the dose response and efficacy of a range of doses of Remo versus placebo on the change from baseline in HbA1c over 12 weeks. Secondary objectives included additional markers of glycemic control, body weight and waist circumference. In addition, the safety and tolerability of Remo were characterized. Efficacy measurements included HbA1c, fasting plasma glucose, weight change and blood pressure. Safety measurements included clinical chemistry, UTI, GFI, and incidence of hypoglycemia. HbA1c entry criterion for both studies was ≥7.0% to ≤9.5%. In all doses, there were clinically significant reductions in HbA1c compared to placebo. The decreases in HbA1c were rapid, and were seen as early as Week 4 and continuing through to Week 12.

5

Study KG2110375 (“Remo QD”) was conducted to determine the dose response and efficacy of a range of once-daily doses with 252 subjects randomized across 14 countries. Clinically significant decreases from baseline in FPG were observed at Week 12 compared with placebo in all Remo once daily doses but were not as robust as the twice daily doses. Changes in FPG were seen as early as Week 2 and were maintained throughout to Week 12. In addition, the 24-hour UGE level increased from baseline in all remogliflozin etabonate treatment groups. Statistically significant decreases in body weight from baseline compared with placebo were observed at Week 12.

Study KG2105255 (“Remo BID”) was conducted to determine the dose response and efficacy of a range of twice-daily doses with 336 subjects randomized across 18 countries. A clinically significant dose response for the change from baseline in HbA1c at week 12 and significant decreases in HbA1c versus placebo were seen for all Remo doses. The decrease in HbA1c was generally rapid, beginning as early as Week 4. Significant dose-related decreases from baseline in FPG were observed at week 12 in all Remo doses compared with placebo, with changes seen as early as week 2. Similarly, 24-hour urinary glucose excretion (“UGE”) increased from baseline in all Remo treatment groups at week 12. Statistically significant decreases in body weight from baseline compared with placebo were observed at week 12.

Remogliflozin etabonate was efficacious for Hba1c lowering in both twice daily and once daily dosing, although the magnitude of decrease in Hba1c was greater with twice daily dosing. The compound also caused weight loss in both studies. Remogliflozin was well tolerated in both studies, with low incidences of hypoglycemia, urinary tract infection and genital infection.

Phase IIb Safety Profile: In both the Remo QD and Remo BID phase IIb studies, Remo was safe and well tolerated with no drug related SAEs. The overall rate of AEs across the treatment groups was low and the AE’s were all considered mild. The incidence of reported hypoglycemic events was low and were mild to moderate in intensity. There was also a low incidence of renal/urinary AEs. There were no significant differences from baseline in ECG. There were no significant changes in clinical chemistry parameters related to bone metabolism.

ISLT-P is an implantable suspension of encapsulated insulin-producing porcine islet cells, for the treatment of insulin-dependent diabetes. We believe that ISLT-P has significantly more commercial potential than human-to-human (allotransplantation) islet replacement approaches, due to the high cost and inherently limited supply of human islets. These implanted porcine islets are expected to produce insulin in response to increases in blood glucose, replacing the function of the patient’s destroyed pancreatic islets. Our near term development plans include initiation of an IND-enabling second species preclinical safety and efficacy study. After successful filing of an investigational new drug (“IND”) application, we anticipate initiating an open label phase I / II clinical study in patients with type 1 diabetes.

We expect ISLT-Bdx, our PCR based molecular diagnostic measuring beta-cell loss, to be the first commercially available diagnostic capable of recognizing active beta cell loss through measurement of hypomethalated beta-cell DNA circulating in bodily fluids. The diagnostic has been shown to predict the onset of type 1 diabetes as early as 625 days in advance of definitive diagnosis in populations with familial predisposition to type 1 diabetes. Early detection may provide for more effective disease management. We believe the diagnostic may also prove useful in measuring the progression of type 2 diabetics into insulin dependent type 2 diabetics. Our near term development strategy for ISLT-Bdx is the analysis of clinical serum samples from prospective type I diabetics and type II diabetics in clinical trials to confirm the ability of the assay to predict the onset of diabetes. In addition, we are establishing a state-of-the-art laboratory that will be certified under the Clinical Laboratory Improvement Amendments of 1988, or CLIA, to perform diagnostic testing of patient serum samples. We are dedicated to further validating and commercializing our diagnostic capabilities and making our diagnostic services available to all patients who need them through sales and distribution partnerships.

ISLT-2669 is a first-in-class immune-modulating IL-12 inhibitor shown to protect insulin-producing beta-cells from cytokines responsible for cell destruction. IL-12 is a pro-inflammatory cytokine important for immune responses leading to type 1 diabetes and atherosclerosis and involves the JAK/STAT4 signaling system to induce genes linked to chronic inflammatory disorders. It has been demonstrated that hyperglycemia, obesity and diabetes markedly increase IL-12/STAT4 expression in key tissues. We identified this compound from our proprietary library of orally bioavailable immune modulators. These compounds were screened in vitro for their ability to provide beta cell protection against cytokines and preservation of insulin secretion. From this initial screening effort, we identified ISLT-2669 as a potent inhibitor of STAT4 activation. ISLT-2669 had an EC50~10nM for inhibition of cytokine-induced apoptosis of a pancreatic beta cell line and produced insulin secretion responses very similar to LSF in vitro. Importantly, basal insulin secretion was not stimulated by increasing concentrations of ISLT-2669. This compound was also very stable in rat liver microsomes and showed little inhibitory effects on various CYP enzymes. The compound appeared to have good oral bioavailability (F=77%) and a rapid tmax (~30 min). An additional study in a rat model of NASH showed that ISLT-2669 may directly reduce liver fibrosis.

6

We continue to create and screen another series of small molecule analogs of lisofylline (“LSF”). LSF is a novel compound shown to have anti-inflammatory properties and has been the subject of three clinical studies. In these trials, LSF was well tolerated with no subject experiencing a serious adverse event. IL-12 and STAT 4 activation are important pathways linked to inflammatory damage to insulin producing cells. It has been shown that LSF and LSF analogs reduce activation of IL-12/STAT4, leading to preservation of islet function and viability and reduction of insulin resistance. IL-12 is made directly in insulin producing beta cells of the pancreas and can directly lead to reduced insulin secretion and cell death while Stat4 deletion reduces insulin resistance. In the Phase I/II trial, LSF significantly reduced the plasma levels of several major inflammatory cytokines linked to autoimmunity. LSF however has poor pharmaceutical characteristics. Therefore, these next generation compounds have better oral bioavailability and efficacy than LSF, offering the promise of providing a new therapeutic approach to treat type 1 or type 2 diabetes. We are developing a structure/activity relationship assay as well as creating new LSF analogs based on our previously generated data.

We intend to develop and commercialize these product candidates ourselves or in conjunction with appropriate business partners.

Market Opportunity

Diabetes is a chronic disease that occurs when the pancreas does not produce enough insulin or when the body cannot effectively use the insulin it produces. Insulin is a hormone secreted by beta-cells in the pancreas to regulate blood sugar. Hyperglycemia (high blood sugar) is a common effect of uncontrolled diabetes and over time leads to serious damage to many of the body's systems, especially the nerves and blood vessels. According to the World Health Organization, 347 million people worldwide have diabetes with an estimated 3.4 million deaths attributable to the disease in 2010. The American Diabetes Association (“ADA”) estimates that 29 million Americans have diabetes, 9.3% of the population, with another 86 million prediabetics that account for a $176 billion direct medical expenditure. Also according to the ADA, diabetes represents the 7th leading cause of death in the United States. Standard & Poor's has estimated the annual market for diabetes medications will hit $58 billion by 2018, from about $35 billion today (http://www.fiercepharma.com/special-reports/10-top-selling-diabetes-drugs-2012).

Type 1 diabetes (previously known as insulin-dependent or juvenile diabetes) is characterized by an autoimmune attack leading to destruction of insulin producing pancreatic beta-cells. The islets of Langerhans are invaded by mononuclear cells in an inflammatory reaction termed ‘insulitis’, leading to loss of up to 70% -80% of β cells by the time of onset of clinical symptoms (9). The destruction of β cells commences years before diagnosis. The result is an inability by the pancreas to produce insulin thereby requiring daily administration of exogenous insulin. The cause of type 1 diabetes is unknown, it is not preventable and there is currently no cure for the disease. Type 2 diabetes (formerly known as adult-onset diabetes) results from the body’s ineffective use of insulin. Type 2 diabetes comprises 90% of the global diabetic population and is largely the result of excess body weight and reduced physical activity.

Over time, diabetes can lead to complications in heart, blood vessels, eyes, kidneys, and nerves. Diabetes is associated with increased risk of heart disease and stroke. 50% of people with diabetes die of cardiovascular disease (primarily heart disease and stroke) ( Morrish NJ, Wang SL, Stevens LK, Fuller JH, Keen H. Mortality and causes of death in the WHO Multinational Study of Vascular Disease in Diabetes. Diabetologia 2001, 44 Suppl 2:S14–S21.). Combined with diabetic induced reductions in blood flow, neuropathy (nerve damage) in the feet increases incidence rates of foot ulcers, infections and limb amputation. Diabetic retinopathy is a common cause of blindness and is the result of long-term accumulated damage to blood vessels in the retina. Diabetes is among the leading causes of kidney failure (Global status report on noncommunicable diseases 2010. Geneva, World Health Organization, 2011.).

7

The overall risk of dying among people with diabetes is at least double the risk of their peers without diabetes (Roglic G, Unwin N, Bennett PH, Mathers C, Tuomilehto J, Nag S et al. The burden of mortality attributable to diabetes: realistic estimates for the year 2000. Diabetes Care, 2005, 28(9):2130–2135). The overall risk of dying among people with diabetes is at least double the risk of their peers without diabetes (Roglic G, Unwin N, Bennett PH, Mathers C, Tuomilehto J, Nag S et al. The burden of mortality attributable to diabetes: realistic estimates for the year 2000. Diabetes Care, 2005, 28(9):2130–2135).

In parallel with the increasing incidence of obesity and insulin resistance in the general population is the occurrence of fatty liver. Non-Alcoholic Fatty Liver Disease (“NAFLD”) is a chronic hepatic disorder that may affect up to 25% of the general population; including a significant portion of pediatric cases. NAFLD can progress to Nonalcoholic steatohepatitis (“NASH”) which is thought to affect 2%-5% of the U.S. population. Non-alcoholic fatty liver disease (NAFLD) is a condition defined by excessive fat accumulation in the form of triglycerides (steatosis) in the liver. A subgroup of NAFLD patients have liver cell injury and inflammation in addition to excessive fat called non-alcoholic steatohepatitis (NASH). NASH dramatically increases the risks of cirrhosis, liver failure, and hepatocellular carcinoma (HCC). The prevalence of NAFLD (40-90%) and NASH (10-20%) is increasing globally (Nonalcoholic Fatty Liver Disease and Nonalcoholic Steatohepatitis, World Gastroenterology Organization Global Guidelines, June 2012).

NASH is characterized by increased fibrosis, cirrhosis and chronic inflammation which can lead to end-stage liver disease. Current predictions estimate 40% of the population will be obese by 2025, and that NAFLD/NASH will become the leading cause of liver disease and liver transplantation. Even now the demand for livers suitable for transplant and non-transplantable livers for research far exceeds availability, leaving an urgent need for alternative human cell-based models.

NAFLD/NASH is a common, often “silent” liver disease. It resembles alcoholic liver disease, but occurs even in people who drink little or no alcohol. The major feature of NAFLD/NASH is fat in the liver, along with inflammation and damage. Most people with NAFLD/NASH generally feel well and are not aware of their liver problem. Left untreated NAFLD/NASH leads to liver fibrosis and ultimately cirrhosis of the liver, in which the liver is permanently damaged and no longer able to function properly. While the underlying reason for NAFLD/NASH is not known, two key factors thought to be responsible include insulin resistance and oxidative stress inside liver cells.

Although NAFLD/NASH has become more common, its underlying cause is still not clear. It most often occurs in persons who are middle-aged and overweight or obese. Many patients with NAFLD/NASH have elevated blood lipids, such as cholesterol and triglycerides, and many have diabetes or pre-diabetes, but not every obese person or every patient with diabetes has NAFLD/NASH. Furthermore, some patients with NAFLD/NASH are not obese, do not have diabetes, and have normal blood cholesterol and lipids. NAFLD/NASH can occur without any apparent risk factor and can even occur in children. Thus, NAFLD/NASH is not simply obesity that affects the liver. While the underlying reason for the liver injury that causes NASH is not known, several factors are possible candidates:

● insulin resistance

● release of toxic inflammatory proteins by fat cells (cytokines)

● oxidative stress (deterioration of cells) inside liver cells

Currently, no specific therapies for NAFLD/NASH exist. The most important recommendations given to persons with this disease are to reduce their weight (if obese or overweight), follow a balanced and healthy diet, increase physical activity and avoid alcohol. Experimental approaches under evaluation in patients with NAFLD/NASH include antioxidants, such as vitamin E, selenium, and betaine. These medications act by reducing the oxidative stress that appears to increase inside the liver in patients with NAFLD/NASH. Another experimental approach to treating NAFLD/NASH is the use of newer antidiabetic medications—even in persons without diabetes. Most patients with NAFLD/NASH have insulin resistance, meaning that the insulin normally present in the bloodstream is less effective for them in controlling blood glucose and fatty acids in the blood than it is for people who do not have NAFLD/NASH. The newer antidiabetic medications make the body more sensitive to insulin and may help reduce liver injury in patients with NAFLD/NASH.NASH (Non-alcoholic steatohepatitis) is characterized by inflammation and concurrent fat accumulation in the liver when not associated with excessive alcohol intake. Steatohepatitis is the progressive form of non-alcoholic fatty liver disease and can progress to cirrhosis. NASH is a frequent cause of unexplained cirrhosis and is associated with lysosomal acid lipase deficiency. While the underlying reason for the liver injury that causes NASH is not known, several factors are possible candidates including insulin resistance, release of toxic inflammatory proteins by fat cells (cytokines), or oxidative stress (deterioration of cells) inside liver cells.

8

Our Strategy

Our strategy is to transition into a clinical-stage growth company and become a leading innovator, developer and provider of therapeutics and diagnostics for patients suffering from metabolic related disease. As part of that transition we will continue to rebrand the Company to better reflect our broader focus on metabolic related disease. We believe that completion of our announced merger with BHV Pharma will successfully complete our transition into a clinical stage growth company. After the completion of our merger with BHV Pharma, we intend to change the Company’s name. We also intend to seek additional investment in the Company to support the development of our pipeline of therapeutic and diagnostic product candidates. Additionally, the Company intends to develop strategic relationships with other companies in order to accelerate, where possible, product development and to develop distribution channels for our product candidates. The key elements of our strategy are as follows:

|

●

|

Initiate two phase IIb clinical studies for remogliflozin etabonate, one for the type 2 diabetes indication and the other for the NASH indication, to measure safety and efficacy as well as to select doses for the respective phase III development programs.

|

|

●

|

Validate and commercialize ISLT-Bdx for type 1 diabetes using a CLIA certified diagnostic laboratory and a sales and distribution partner. Once the commercial market is established and validation for type 2 diabetes complete, we expect to bring forward a diagnostic product for type 2 diabetes;

|

|

●

|

Continue preclinical development of ISLT-2669 and LSF analogs for diabetes and other autoimmune and/or inflammatory related diseases

|

|

●

|

Advance ISLT-P into a second species IND enabling study targeting T1DM

|

|

●

|

Form development and commercialization partnerships where appropriate; and

|

|

●

|

Selectively acquire rights to and develop complementary product candidates.

|

Intellectual Property

The Company seeks patents and other intellectual property rights to protect and preserve our proprietary technology and our right to capitalize on the results of its research and development activities. The Company is pursuing patents in the US and in foreign countries. The Company may also rely on trade secrets, know-how, continuing technological innovations and licensing opportunities to provide competitive advantages for its eventual products in various markets and to accelerate new product introductions.

Below is a list of the US patent applications held by the Company.

Islet Sciences, Inc.

|

Title

|

Patent Application Number

|

Status

|

||

|

Ex Vivo Maturation of Islet Cells

|

W02103/049693

|

Pending

|

||

| US/14,346,454 | ||||

| PCT/US2012/058087 | ||||

|

Compositions And Methods For Detecting Hypo-Methylated DNA In Body Fluids

|

PCT/US2014/020431

|

Pending

National Phase begins September 2015

|

9

The maturation patent comprises a novel method for isolating islets cells from a porcine animal model in which the pancreas is excised, intact, from the porcine animal model which is then severed into a series of appropriate sizes and volume. The isolated and severed exocrine tissue and islet cells are then treated in-vitro with a non-specific collagenase enzyme exposure for a specific period that results in a partial digestion of the exocrine tissue comprising islets cells that are embedded within and protected by the partial digested exocrine tissue. It is the partial digestion followed by in vitro maturation that allows islets to function and be able to survive long term. In addition, the present invention further comprises a novel method for maturing a plurality of isolated porcine islet cells that are functional and can respond to glucose stimulation early in the maturation process.

The international patent application PCT/US2014/010431 provides for methods of detecting hypomethylated DNA in a process similar to that described for the beta cell loss diagnostic but in bodily fluids such as saliva and urine as opposed to blood/serum. The obvious advantage is the non-invasive nature of this testing.

Patent applications licensed by the Company from Winthrop University Hospital

|

Title

|

Patent Application Number

|

Status

|

||

|

Method For Using Probe Based PCR Detection To Measure The Levels Of Circulating Demethylated Beta Cell-Derived DNA as a Measure Of Beta Cell Loss In Diabetes

|

PCT/US2013/028862

|

Pending

Enters National

Phase September 2014

|

||

|

Method For Using Probe Based PCR Detection To Measure The Levels Of Circulating Demethylated Beta Cell-Derived DNA as a Measure Of Beta Cell Loss In Diabetes

|

US Patent Application 13/279,261

|

Pending

|

Patent Applications that are licensed by Islet Sciences, Inc. from Yale University

|

Title

|

Patent Application Number

|

Status

|

||

|

Compositions and Methods of Diagnosing Diseases and Disorders associated with b cell death

|

EP 2723901

|

Pending

|

||

| US 14/127,906 | ||||

| These applications correspond to WO2012/178007 |

The family of patent applications corresponding to WO2012/178007 and PCT/US2013/028862 relate to compositions and methods for detecting cell death by detecting β-cell insulin gene DNA in a biological sample based on the discovery that the presence of extrapancreatic hypomethylated β-cell DNA is indicative of β-cell death. Thus, in one embodiment, the invention is a method of detecting hypomethylated β-cell insulin DNA in a biological sample of a subject including the steps of: obtaining a biological sample from the subject, where the biological sample is obtained from outside of the subject's pancreas, and where the biological sample contains β-cell insulin DNA; determining the methylation status of at least one of the CpG dinucleotides in the β-cell insulin DNA, where when at least one of the CpG dinucleotides in the β-cell insulin DNA is determined to be unmethylated, the hypomethylated β-cell insulin DNA is detected.

BHV Pharma

|

Title

|

Patent (Application) Number

|

Status

|

||

|

Glucopyranosyloxypyrazole derivatives, medicinal compositions containing the same and intermediates in the production thereof

|

US 6,972,283; 7,056,892; 7,115,575;

|

Patent

|

||

|

Glucopyranosyloxypyrazole Derivates and Use Thereof in Medicines

|

US 7,084,123; 7,393,838; 7,465,713

|

Patent

|

||

|

Progression Inhibitor For Disease Attributed To Abnormal Accumulation Of Liver Fat

|

US 12/511,654

|

Pending

|

||

| WO2006/0091149 | ||||

|

Process For Production Of Glucopyranosyloxypyrazole Derivative

|

US 8,022,192

|

Patent

|

||

| WO2006/098413 | ||||

|

Combination immediate/delayed release delivery system for short half-life pharmaceuticals including remogliflozin

|

PCT/US2011/043143

|

Pending

|

||

| WO2012/006398 |

10

The first two sets of issued patents relate to composition of matter patents for glucopyranosyloxypyrazole derivatives representing remogliflozin (the active circulating species) and remogliflozin etabonate (the prodrug) which have inhibitory activity in human SGLT2 and are useful as agents for the prevention or treatment of diabetes, diabetic complications or obesity, and to pharmaceutical compositions comprising the same and intermediates thereof. The patent application US 12/511,654 and WO2006/0091149 provides a pharmaceutical composition characterized by containing a sodium/glucose cotransporter 2 inhibitor as an active ingredient. This pharmaceutical composition is capable of inhibiting any abnormal accumulation of fat in the liver and is highly suitable for use as a progression inhibitor for not only general fatty liver, but also non-alcoholic fatty liver (NAFL), non-alcoholic steatohepatitis (NASH), hyperalimentation-induced fatty liver, diabetic fatty liver, alcohol-induced fatty liver or toxic fatty liver. US 8,022,192 and WO2006/098413 discloses a process for producing a glucopyranosyloxypyrazole derivative, such as remogliflozin etabonate, which is useful as a prophylactic or therapeutic agent for a disease induced by hyperglycemia, such as diabetes, a diabetes complication and obesity. This process is quite useful as the process for producing a pharmaceutical. The family of patent applications corresponding to WO2012/006398 (as well as South African patent ZA 2013/00877) relate to a combination immediate/delayed release delivery system for compounds which have short half-lives, such as the antidiabetic remogliflozin etabonate. This delivery system provide a dosage form that has two distinct phases of release, a formulation that promotes immediate release of the compound upon ingestion and another formulation which delays the release of the compound so that a once-daily dosing regimen of remogliflozin etabonate may be achieved while providing effective control of plasma glucose and minimizing the nighttime exposure of this compound. Methods for forming the so-described immediate/delayed release delivery system and using such delivery system for treating diabetes are also provided.

DiaKine Therapeutics, Inc.

DiaKine has licensed the rights for next generation small molecule immune modulator-anti-inflammatory drugs from the University of Virginia Patent Foundation.

US Patents licensed by DTI from the University of Virginia Patent Foundation

|

Title

|

Patent Application Number

|

Status

|

||

|

Lisofylline analogs and methods for use

|

US 8,481,580

US 13/928691

|

Patent

Pending

|

||

| Lisofylline analogs and methods for use | US 13/477,613 | Pending |

Foreign Patents and Patent Applications that are licensed by DTI from the University of Virginia Patent Foundation

|

Title

|

Patent Application Number

|

Status

|

||

|

Lysofylline Analogs and Methods for Use

|

WO2007027719A2

|

Pending

|

11

There can be no assurance that the Company will succeed in obtaining any patent protection from its pending patent applications. No assurance can be given that any patent will be issued or that the scope of any patent protection will exclude competitors or that any patent, if issued, will be held valid if subsequently challenged. There can be no assurance that any steps the Company takes in this regard will be adequate to deter misappropriation of its proprietary rights or independent third parties developing functionally equivalent products. Despite precautions, unauthorized parties may attempt to engineer, reverse engineer, copy, or obtain and use the Company’s products or other information. Although management believes that the Company’s products do not infringe on the intellectual property rights of others, there can be no assurance that an infringement claim will not be asserted in the future. The prosecution or defense of any intellectual property litigation can be extremely expensive and would place a material burden upon the Company’s working capital.

License and Supply Agreements

On May 2, 2012, the Company, entered into a license agreement with the Yale University (“Yale”). Under the agreement, the Company received exclusive license to technology directed to compositions and methods for detecting cell death by detecting β-cell insulin gene DNA in a biological sample based on the discovery that the presence of extrapancreatic hypomethylated β-cell DNA is indicative of β-cell death and supports our efforts with the ISLT-BDx which is patented by Yale. In consideration of the license granted under the agreement, the Company paid Yale a license issue royalty of $10,000 (plus a $10,000 annual renewal fee) and issued 20,000 shares of its common stock, and agreed to pay certain milestones royalties by issuing an aggregate of 160,000 shares of common stock. The Company also agreed to pay to Yale a royalty on net sales. The agreement will expire automatically, on a country-by-country basis, on the date on which the last of the claims of the subject patents expires. The agreement can be terminated by Yale if the Company defaults on its obligations under the agreement and fails to cure such default within 60 days of a written notice by the university. The Company can terminate the agreement upon a six month notice subject to payment of all amounts due Yale under the agreement.

On July 23, 2012, the Company entered into a licensing agreement with the Winthrop University Hospital (“Winthrop”) to license certain patents and technology directed to compositions and methods for detecting cell death by detecting β-cell insulin gene DNA in a biological sample based on the discovery that the presence of extrapancreatic hypomethylated β-cell DNA is indicative of β-cell death and supports our efforts with the ISLT-BDx. In consideration of the license granted under the agreement, the Company agreed to pay to Winthrop a license issue royalty of $10,000 (plus a $10,000 annual renewal fee) and issue 20,000 shares of its common stock, and to pay certain milestones royalties by issuing an aggregate of 160,000 shares of common stock. The Company also agreed to pay to Winthrop a royalty on net sales. The agreement will expire automatically, on a country-by-country basis, on the date on which the last of the claims of the subject patents expires. It can be terminated by Winthrop if the Company defaults on its obligations under the agreement and fails to cure such default within 60 days of a written notice by the university. The Company can terminate the agreement upon a six month notice subject to payment of all amounts due Winthrop under the agreement. The Company is currently in default regarding its payment obligations under the foregoing agreements and is in active discussions with Winthrop University Hospital.

On January 10, 2012, the Company entered into a letter agreement with Progenitor Cell Therapy, LLC (“PCT”), a subsidiary of NeoStem, Inc. (“NeoStem”), which was amended by an agreement dated May 15, 2012 by and between the Company and NeoStem, PCT’s parent company. Under the agreement, PCT was to, among other things, generate protocols, develop procedures for testing and quality control and manufacturing to support the development and submission of an investigational new drug application to the FDA for the Company’s encapsulated porcine islet cells for the treatment of diabetes. The Letter Agreement estimated the duration of services to span approximately six months beginning on January 17, 2012. The Letter Agreement required the parties to enter into a mutually agreeable Services Agreement that would more particularly set forth the services to be provided by PCT and include customary representations, warranties, covenants, indemnities and agreements between the parties. The Services Agreement was never entered into by the parties. As compensation for the services of PCT, the Company agreed to pay to PCT a non-refundable monthly fee of $63,000 and a non-refundable monthly charge of between $33,000 and $54,000. NeoStem was entitled to receive shares and warrants of the Company’s common stock, as well as additional shares for no consideration so that NeoStem’s ownership was not less than 1% of outstanding shares on a fully diluted basis. PCT was also given the exclusive right for a period of ten years to manufacturer any product involved in the services to be provided under the agreement. With respect to commercial production of such products, PCT will be entitled to a royalty on gross sales and a percentage of sublicensing fees, royalties, milestone fees or profit sharing payments.

12

On February 7, 2013, the services had not yet been completed and the Company provided to NeoStem Inc. notice of termination of the agreement with PCT dated January 10, 2012, as amended by the agreement dated May 15, 2012 by and between the Company and NeoStem.

On April 25, 2014, LLC, PCT filed a lawsuit against the Company in the United States District Court for the District of New Jersey (Case No. 2:14-cv-02658-SDW-MCA). PCT’s complaint asserts various claims, including breach of contract and unjust enrichment, based on the alleged failure of the Company to pay for services and goods provided by PCT under a January 10, 2012 letter agreement. See Item 3 for legal proceedings.

On July 23, 2012, the Company entered into a long-term supply agreement with Spring Point Project, a source animal facility to purchase pigs for use in the Company’s xenotransplantation research. On August 12, 2013, the Company received from Spring Point Project a notice of termination of the supply agreement, effective November 10, 2013, unless the Company cures the default before that date. The default was not cured and the agreement with Spring Point Project has been terminated.

In August 2012, the Company entered into an agreement with the Regents of the University of California, Los Angles, (“UCLA’), whereby UCLA was provided work dealing with small molecule mediated porcine islet proliferation. Work under this agreement will be performed for a period of six months with an estimated cost of $23,100. The Company had continued to work with UCLA on a month to month basis following the six month period. On February 25, 2014, the Company terminated its licensing agreement with UCLA.

In May 2013, the Company entered into a sales and services agreement with the Regents of the University of California, Irvine (“UCI”) to provide materials consisting of isolated islets to be supplied to the Spring Point Project. The Company terminated this agreement on March 24, 2014 for settlement payments totaling $150,000 on total liabilities of approximately $305,000 for expenses incurred in this and last fiscal year.

In September 2013, the Company entered into a consulting agreement with American Capital Ventures, Inc. to provide consulting services related to investor relations and corporate communications. The Company terminated this agreement on January 23, 2014.

Competition

The biotechnology and pharmaceutical industries are highly competitive and characterized by rapid technological change. We face significant competition in each of the aspects of our business from other pharmaceutical and biotechnology companies. Many of our competitors have substantially greater research and development capabilities and financial, scientific, marketing and human resources than we do. As a result, our competitors may succeed in developing products earlier than we do, obtaining approvals from the Food and Drug Administration or FDA or other regulatory agencies for those products more rapidly than we do, or developing products that are more effective than those we propose to develop. Similarly, our collaborators face similar competition from other competitors who may succeed in developing products more quickly, or developing products that are more effective, than those developed by our collaborators. Any products that we may develop or discover are likely to be in highly competitive markets.

Government Regulation

Overview

The development and commercialization of our products will be subject to extensive regulation in the U.S. by a number of regulatory authorities, including the FDA, and by comparable regulatory authorities in foreign countries. These regulatory authorities and other federal, state and local entities will regulate, among other things, the preclinical and clinical testing, safety, effectiveness, approval, manufacturing, labeling, packaging, export, storage, recordkeeping, adverse event reporting, and promotion and advertising of our products. We will require FDA approval of our products in the United States, including a review of the manufacturing processes and facilities used to produce our products, before we may market the products in the U.S.

13

Remogliflozin etabonate and ISLT-2669 will be subject to approval by CDER (Center for Drug Evaluation and Research), a division in the FDA while ISLT maintains an active IND for remogliflozin etabonate and will plan to file an IND for 2669 after completion of IND-enabling studies. ISLT-P will be classified as combination biological and device products by the CBER (Center for Biologicals Evaluation and Research), another division within the FDA. The islets comprise the biological component and the microencapsulation material comprises the device component. The FDA Center for Biologics (“CBER”) has jurisdiction, meaning the ISLT-P product will be reviewed primarily as a biological product. Finally, ISLTDX will be subject to approval by the Medical Device division of the FDA.

Clinical Trial Process

Remogliflozin etabonate is being developed with a new formulation. The next step in the development process will be to examine the safety and efficacy of multiple doses of remogliflozin etabonate in our biphasic formulation in two phase IIb clinical studies; one for T2DM and the other for NASH. This study will be very similar in design to the studies previously run with remogliflozin etabonate. Pending completion of this study, ISLT will have a formal end of phase II meeting with the FDA to obtain guidance and permission for the phase III studies.

For the ISLT-P and ISLT-2669 and LSF inhibitory analogs, the development of a therapeutic product for human use under applicable laws and regulations is a multi-step process. First, in vitro and/or animal testing must be conducted in a manner consistent with good laboratory practices to establish the potential safety and effectiveness of the experimental product with regard to a given disease. Before human clinical trials may begin for new drugs and biologics, an IND application containing, among other things, preclinical data, chemistry, manufacturing and control information, an investigative plan, must be submitted to the FDA. The Clinical trials following approval of an IND will also require the approval and oversight by an Institutional Review Board (“IRB”) to assure proper patient protection. Clinical trials of certain medical devices generally require the same sort of submission in the form of an application for an investigational device exemption (“IDE”). We believe that the submission of an IND will be adequate for ISLT-P, and that a separate IDE submission will not be required for either product. Once a trial begins, changes to the investigational product or study protocol may require prior approval before implementation. There can be no assurance that submission of an IND application or an IDE will result in the ability to commence clinical trials. In addition, the FDA may place a clinical trial on hold or terminate it at any phase if, among other reasons, it concludes that clinical subjects are being exposed to an unacceptable health risk. Finally, pursuant to the FDA's Bioresearch Monitoring (“BIMO”) program, the FDA conducts on-site inspections and data audits of the conduct and reporting of all FDA-regulated research. The FDA's BIMO compliance programs address inspections of non-clinical testing labs, clinical investigators, clinical trial sponsors/monitors and IRBs.

Clinical trials of pharmaceuticals or biologics typically involve three phases, although those phases can overlap.

● Phase I is conducted to evaluate the basic safety, metabolism, and pharmacology, and pharmacokinetics, and to identify potential side effects with escalating doses, the maximum tolerated dose of the experimental product in humans, and if possible, to begin to evaluate various routes, dosages, and schedules of product administration. These studies are often conducted in healthy subjects. Phase I trials are not intended to find early indications of effectiveness; however, it is not uncommon to evaluate these endpoints.

● Phase I/II clinical trials are conducted to evaluate safety and initial efficacy indications in the patient population afflicted with a specific disease or condition for which the product is intended for use.

● Phase II clinical trials are conducted in groups of patients afflicted with a specific disease or condition for which the product is intended for use in order to further test safety, begin evaluating effectiveness, optimize dosage amounts and determine dose schedules and routes of administration.

● Phase III studies are usually randomized, double blind studies testing for product safety and effectiveness in an expanded patient population in order to evaluate the overall risk/benefit relationship of the product and to provide an adequate basis for product labeling. These studies also may compare the safety and effectiveness of the product with currently available products.

Employees

As of July 22, 2014, the Company had 3 fulltime and 2 part time employees. The Company also utilizes the services of consultants and advisors on an appropriate as needed basis.

14

Emerging Growth Company

The Company is an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404(b) of the Sarbanes-Oxley Act, and exemptions from the requirements of Sections 14A(a) and (b) of the Securities Exchange Act of 1934 to hold a nonbinding advisory vote of shareholders on executive compensation and any golden parachute payments not previously approved.

The Company has elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an “emerging growth company” until the earliest of (1) the last day of the fiscal year during which our revenues exceed $1 billion, (2) the date on which we issue more than $1 billion in non-convertible debt in a three year period, (3) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our common equity securities pursuant to an effective registration statement filed pursuant to the Securities Act of 1933, as amended, or (4) when the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter.

To the extent that we continue to qualify as a “smaller reporting company”, as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (2) scaled executive compensation disclosures; and (3) the requirement to provide only two years of audited financial statements, instead of three years.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

We have a limited operating history and are a development stage company.

We started our operations in 2010 with the formation of ISI. To date, we have had no sales and profits. We cannot assure investors that we will ever become or remain profitable. An investment in our securities is subject to all of the risks involved in a newly established business venture. Potential investors should be aware of the problems, delays, expenses, and difficulties experienced by companies in the early developmental stage, which generally include unanticipated problems and additional costs relating to the commencement of operation and implementation of a business plan.

Future funding requirement

To date, we have not generated any revenue from product sales. We do not know when, or if, we will generate any revenue from product sales. We do not expect to generate any revenue from product sales unless and until we obtain regulatory approval of our product candidates and our companion diagnostic products or any of our other product candidates. At the same time, we expect our expenses to increase in connection with our ongoing development activities, particularly as we continue the research, development and clinical trials of, and seek regulatory approval for, our product candidates and companion diagnostic. In addition, subject to obtaining regulatory approval of any of our product candidates and companion diagnostic, we expect to incur significant commercialization expenses for product sales, marketing, manufacturing and distribution. We anticipate that we will need significant additional funding, which may not be available to us on acceptable terms, or at all, and if not so available, may require us to delay, limit, reduce, or cease our operations.

15

Until such time that we can generate meaningful revenue from product sales, if ever, we expect to finance our operating activities through public or private equity or debt financings, government or other third-party funding, marketing and distribution arrangements, and other collaborations, strategic alliances and licensing arrangements or a combination of these approaches. To the extent that we raise additional capital through the sale of equity or convertible debt securities, the ownership interests of our common stockholders will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the rights of our common stockholders. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through government or other third-party funding, marketing and distribution arrangements or other collaborations, or strategic alliances or licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable to us.

There are risks associated with the Company’s pending merger with BHV.

In March 2014, the Company announced it had signed a binding letter of intent to enter into a merger agreement with and acquire BHV. The Company anticipates it will sign the merger agreement within the next thirty days and complete the merger upon successful regulatory review. The addition of BHV's remogliflozin to our pipeline is a key element of our strategy to transition into a clinical stage company and attract additional funding. If this transaction is not completed or its completion is delayed the Company’s strategy, results of operations and consolidated financial condition may be adversely impacted.

If we cease to continue as an operational entity, due to lack of funding or otherwise, you may lose your entire investment in the Company.

Our current plans indicate that we will need substantial additional capital for research and development, including costs associated with developing our technology and conducting clinical trials of our product candidates, before we have any anticipated revenue generating products.

When we require additional funds, general market conditions or the then-current market price of our common stock may not support capital raising transactions such as additional public or private offerings of our common stock. If we require additional funds and we are unable to obtain them on a timely basis or on terms favorable to us, we may be required to scale back our development of new products, sell or license some or all of our technology or assets, or curtail or cease operations.

You may experience dilution of your ownership interests due to the future issuance of additional shares of our common stock.

We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of our common stockholders. We are currently authorized to issue one hundred million shares of common stock and ten million shares of preferred stock with such designations, preferences and rights as determined by our board of directors. Issuance of additional shares of common stock may substantially dilute the ownership interests of our existing stockholders. We may also issue additional shares of our common stock or other securities that are convertible into or exercisable for common stock in connection with the hiring of personnel, future acquisitions, future public or private placements of our securities for capital raising purposes, or for other business purposes. Any such issuance would further dilute the interests of our existing stockholders.

There has been no active public market for the Company's securities.

There has been no active public market for the Company common stock. An active public market for the Company's common stock may not develop or be sustained. The market price of the common stock may fluctuate significantly in response to factors, some of which are beyond the Company's control, such as product liability claims or other litigation, the announcement of new pharmaceuticals or pharmaceutical enhancements by the Company’s competitors, developments concerning intellectual property rights and regulatory approvals, quarterly variations in competitors' results of operations, changes in earnings estimates or recommendations by securities analysts, developments in our industry, and general market conditions and other factors, including factors unrelated to our operating performance.

16

The Company’s common stock is considered a "penny stock" and may be difficult to sell.

The SEC has adopted regulations which generally define "penny stock" to be an equity security that has a market or exercise price of less than $5.00 per share, subject to specific exemptions. The market price of the Company’s common stock is currently below $5.00 per share and therefore is designated as a "penny stock" according to SEC rules. This designation requires any broker or dealer selling these securities to disclose certain information concerning the transaction, obtain a written agreement from the purchaser and determine that the purchaser is reasonably suitable to purchase the securities. These rules may restrict the ability of brokers or dealers to sell such shares and may affect the ability of investors to sell their shares. In addition, since the Company’s common stock is currently quoted on the OTC Bulletin Board, investors may find it difficult to obtain accurate quotations of the stock and may find few buyers to purchase the stock or a lack of market makers to support the stock price.

No assurance of future successful development.

Prospects for companies in the medical industry generally are uncertain given the nature of the industry and, accordingly, investments in medical companies should be regarded as highly speculative.

Our products may not be successfully developed or commercialized, which would harm us and force us to curtail our operations.

We may not be able to obtain regulatory approvals for product candidates we develop, to enter clinical trials for any of our product candidates, or to commercialize any products, on a timely basis or at all. If we are unable, for technological or other reasons, to complete the development, introduction or scale-up of manufacturing of potential products, or if our products do not achieve a significant level of market acceptance, we would be forced to curtail or cease operations.

Any product candidate we advance into clinical trials may cause undesirable side effects that could delay or prevent its regulatory approval or commercialization.

Undesirable side effects caused by any product candidate we advance into clinical trials could interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities for any or all targeted indications. This, in turn, could prevent us from commercializing these or any other product candidate we advance into clinical trials.

Any one or a combination of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase the costs and expenses of commercializing the product, which in turn could delay or prevent us from generating significant revenues from the sale of the product.

If we receive regulatory approval we will also be subject to ongoing FDA obligations and continued regulatory review such as continued safety reporting requirements, and we may also be subject to additional FDA post-marketing obligations. FDA and corresponding foreign regulatory requirements could adversely affect our ability to generate revenue and require additional expenditures to bring our products to market.

Any regulatory approvals that we receive for our products may also be subject to limitations on the indicated uses for which the product may be marketed or contain requirements for potentially costly post-marketing follow-up studies. In addition we or our third party manufacturers may be required to undergo a pre-approval inspection of manufacturing facilities by the FDA and foreign authorities before obtaining marketing approval and will be subject to periodic inspection by the FDA and corresponding foreign regulatory authorities under reciprocal agreements with the FDA. Such inspections may result in compliance issues that could prevent or delay marketing approval or require the expenditure of money or other resources to correct noncompliance.

17

If a regulatory agency discovers previously unknown problems with a product, such as adverse events of unanticipated severity or frequency, or problems with the facility where the product is manufactured, a regulatory agency may impose restrictions on that product, our collaborators, or us, including requiring withdrawal of the product from the market. Our product candidates will also be subject to ongoing FDA requirements for the labeling, packaging, storage, advertising, promotion, record-keeping, and submission of safety and other post-market information on the drug. If our product candidates fail to comply with applicable regulatory requirements, a regulatory agency may:

- issue warning letters;

- impose civil or criminal penalties;

- withdraw regulatory approval;

- suspend any ongoing clinical trials;

- refuse to approve pending applications or supplements to approved applications filed by us or our collaborators;

- impose restrictions on operations, including costly new manufacturing requirements; or

- seize or detain products or require a product recall.

Moreover, in order to market any products outside of the United States, we and our collaborators must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries may include all of the risks described above regarding FDA approval in the United States. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may negatively impact the regulatory process in others. Failure to obtain regulatory approval in other countries or any delay or setback in obtaining such approval could have the same adverse effects detailed above regarding FDA approval in the United States. As described above, such effects include the risk that our product candidates may not be approved for all indications requested, which could limit the uses of our product candidates and adversely impact potential royalties and product sales, and that such approval may be subject to limitations on the indicated uses for which the product may be marketed or require costly, post-marketing follow-up studies.

If we or our collaborators fail to comply with applicable domestic or foreign regulatory requirements, we and our collaborators may be subject to fines, suspension or withdrawal of regulatory approvals, product recalls, seizure of products, operating restrictions, and criminal prosecution.

The transplantation of animal cells into humans involves risks which have resulted in additional FDA oversight and which in the future may result in additional regulation that may prevent or delay approval of our potential products and require additional expenditures to bring these products to market.

Our business involves the transplantation of animal cells into humans, a process known as xenotransplantation. Xenotransplantation poses a risk that viruses or other animal pathogens may be unintentionally transmitted to a human patient. The FDA will require testing to determine whether infectious agents, including porcine endogenous retroviruses, also known as PERV, are present in patients who have received cells, tissues, or organs from porcine sources. While PERV has not been shown to cause any disease in pigs, it is not known what effect, if any, PERV may have on humans.

Other companies are currently conducting clinical trials involving the transplantation of porcine cells into humans. The FDA requires lifelong monitoring of all recipients of xenotransplantation products. If PERV or any other virus or infectious agent is detected in tests or samples from these transplant recipients, the FDA may require that we not initiate or halt our clinical trials and perform additional tests to assess the risk of infection to potential patients. This could result in additional costs to us and delay in the trials of our products under development.