Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IDEX CORP /DE/ | iex-20140728x8k.htm |

| EX-99.2 - EX99.2 - IDEX CORP /DE/ | iex-20140728xex992.htm |

Second Quarter Earnings JULY 23, 2014

AGENDA IDEX Strategic Priorities Q2 2014 Financial Performance Q2 2014 Segment Performance • Fluid & Metering • Health & Science • Fire & Safety / Diversified Guidance Update Q&A 1

REPLAY INFORMATION Dial toll–free: 877.660.6853 International: 201.612.7415 Conference ID: #13583593 Log on to: www.idexcorp.com 2

Cautionary Statement Under the Private Securities Litigation Reform Act This presentation and discussion will include forward-looking statements. Our actual performance may differ materially from that indicated or suggested by any such statements. There are a number of factors that could cause those differences, including those presented in our most recent annual report and other company filings with the SEC. 3

Revenue Organic: 4% growth 130 bps expansion EPS Operating Margin Free Cash Flow Solid organic growth and margin expansion deliver 16 percent EPS growth 16% growth 22% decrease IDEX Q2 Financial Performance 4 $0 $200 $400 $600 Q2 $518 $547 2013 2014 $0.00 $0.50 $1.00 Q2 $0.76 $0.88 2013 2014 15.0% 20.0% 25.0% Q2 19.2% 20.5% 2013 2014 $0 $40 $80 $120 Q2 $103 $80 2013 2014

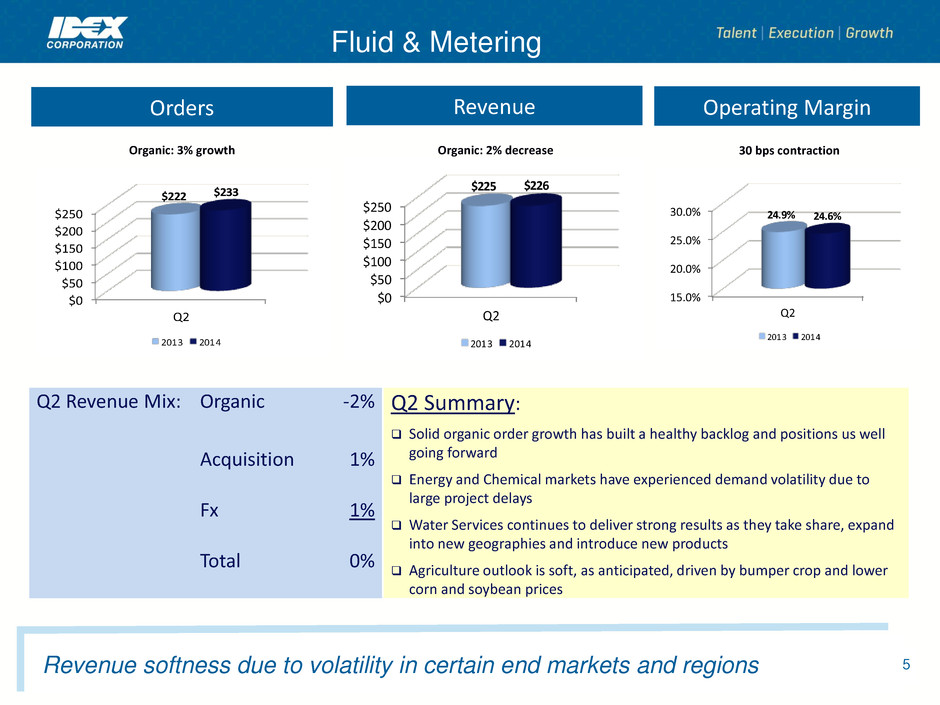

Orders Revenue Q2 Revenue Mix: Organic -2% Acquisition 1% Fx 1% Total 0% Q2 Summary: Solid organic order growth has built a healthy backlog and positions us well going forward Energy and Chemical markets have experienced demand volatility due to large project delays Water Services continues to deliver strong results as they take share, expand into new geographies and introduce new products Agriculture outlook is soft, as anticipated, driven by bumper crop and lower corn and soybean prices 30 bps contraction Operating Margin Organic: 3% growth Organic: 2% decrease Fluid & Metering 5 Revenue softness due to volatility in certain end markets and regions $0 $50 $100 $150 $200 $250 Q2 $222 $233 2013 2014 $0 $50 $100 $150 $200 $250 Q2 $225 $226 2013 2014 15.0% 20.0% 25.0% 30.0% Q2 24.9% 24.6% 2013 2014

Health & Science Orders Revenue Operating Margin Q2 Revenue Mix: Organic 1% Acquisition 0% Fx 2% Total 3% Q2 Summary: IOP orders rebounded in the second quarter on the strength of the life sciences, industrial and semiconductor markets MPT continues to see increased orders in Asia for industrial and pharmaceutical applications Scientific Fluidics paused after 18 months of growth, but our strong position in the product cycle and development platforms should deliver future results Industrial business growth is driven by the success of new products and entrance into new markets Organic: 5% growth Organic: 1% growth 40 bps expansion 6 Continued organic order growth provides confidence for the second half of 2014 $0 $50 $100 $150 $200 Q2 $181 $194 2013 2014 $0 $50 $100 $150 $200 Q2 $181 $186 2013 2014 10.0% 15.0% 20.0% 25.0% Q2 19.1% 19.5% 2013 2014

Orders Revenue 570 bps expansion Organic: 17% growth Operating Margin Q2 Revenue Mix: Organic 17% Acquisition 0% Fx 2% Total 19% Q2 Summary: Across the segment, outstanding operating margin improvement is due to volume leverage, productivity and a prior year charge from a facility disposal Dispensing growth realized from mature markets of North America and Europe, with greater penetration of X-Smart product across Asia Rescue has a positive outlook for the second half of the year based on large project orders, combined with new product introductions Band-It is seeing growth in all primary markets Organic: 17% growth Fire & Safety Diversified 7 Strong organic order and sales growth combined with exceptional margin expansion $0 $50 $100 $150 Q2 $114 $136 2013 2014 15.0% 20.0% 25.0% 30.0% Q2 20.7% 26.4% 2013 2014

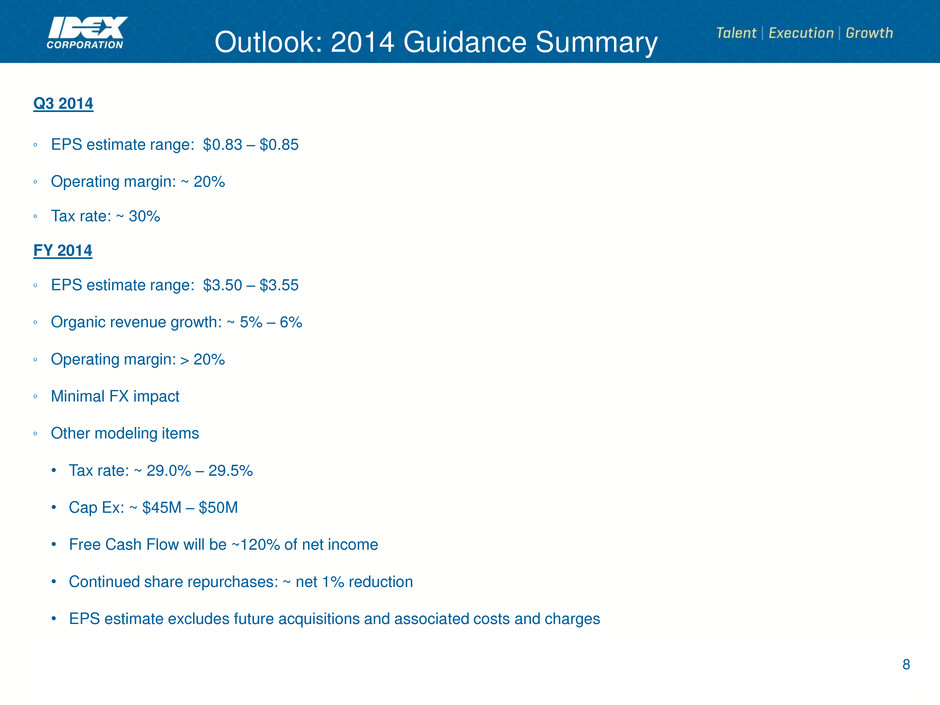

Q3 2014 EPS estimate range: $0.83 – $0.85 Operating margin: ~ 20% Tax rate: ~ 30% FY 2014 EPS estimate range: $3.50 – $3.55 Organic revenue growth: ~ 5% – 6% Operating margin: > 20% Minimal FX impact Other modeling items • Tax rate: ~ 29.0% – 29.5% • Cap Ex: ~ $45M – $50M • Free Cash Flow will be ~120% of net income • Continued share repurchases: ~ net 1% reduction • EPS estimate excludes future acquisitions and associated costs and charges 8 Outlook: 2014 Guidance Summary

Q&A 9