Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CU Bancorp | d762662d8k.htm |

CU

Bancorp Investor Presentation

as of June 30, 2014

Exhibit 99.1

…

a better banking experience |

2

Forward-Looking Statements

This

press

release

contains

certain

forward-looking

information

about

CU

Bancorp

(the

“Company”),

1

st

Enterprise

Bank

and

the

combined

company

after

the

close

of

the

transaction

that

is

intended

to

be

covered

by

the

safe

harbor for “forward looking statements”

provided by the Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical fact are forward-looking statements. Such statements involve inherent

risks and uncertainties, many of which are difficult to predict and are generally

beyond the control of the Company. Forward-looking statements speak only as of the date they are made and we assume no duty to update such

statements. We caution readers that a number of important factors could

cause actual results to differ materially from those expressed in, implied or projected by, such forward-looking statements. Risks and uncertainties

include,

but

are

not

limited

to:

lower

than

expected

revenues;

credit

quality

deterioration

or

a

reduction

in

real

estate

values

could

cause

an

increase

in

the

allowance

for

credit

losses

and

a

reduction

in

net

earnings;

increased

competitive pressure among depository institutions; the Company’s ability to

complete future acquisitions, successfully integrate such acquired entities, or achieve expected beneficial synergies and/or operating efficiencies

within expected time-frames or at all; the possibility that personnel changes

will not proceed as planned; the cost of additional capital is more than expected; a change in the interest rate environment reduces net interest

margins; asset/liability repricing risks and liquidity risks; legal matters could

be filed against the Company and could take longer or cost more than expected to resolve or may be resolved adversely to the Company; general

economic

conditions,

either

nationally

or

in

the

market

areas

in

which

the

Company

does

or

anticipates

doing

business,

are

less

favorable

than

expected;

environmental

conditions,

including

natural

disasters

and

drought,

may

disrupt our business, impede our operations, negatively impact the values of

collateral securing the Company’s loans and leases or impair the ability of our borrowers to support their debt obligations; the economic and

regulatory

effects

of

the

continuing

war

on

terrorism

and

other

events

of

war,

including

the

conflicts

in

the

Middle

East;

legislative

or

regulatory

requirements

or

changes

adversely

affecting

the

Company’s

business;

changes

in

the securities markets; regulatory approvals for any capital activities cannot be

obtained on the terms expected or on the anticipated schedule; and, other risks that are described in CU Bancorp’s public filings with the U.S.

Securities and Exchange Commission (the “SEC”). Additional risks

and uncertainties relating to the proposed transaction with 1st Enterprise Bank include, but are not limited to: the ability to complete the proposed transaction,

including obtaining regulatory approvals and approvals by the shareholders of CU

Bancorp and 1st Enterprise Bank; the length of time necessary to consummate the proposed transaction; the ability to successfully integrate the

two

institutions

and

achieve

expected

synergies

and

operating

efficiencies

on

the

expected

timeframe;

unexpected

costs

relating

to

the

proposed

transaction;

and

the

potential

impact

on

the

institutions’

respective

businesses

as

a result

of

uncertainty

surrounding

the

proposed

transaction.

If

any

of

these

risks

or

uncertainties

materializes

or

if

any

of

the

assumptions

underlying

such

forward-looking

statements

proves

to

be

incorrect,

CU

Bancorp’s

results

could

differ

materially

from

those

expressed

in,

implied

or

projected

by

such

forward-looking

statements.

CU

Bancorp

assumes

no

obligation

to

update

such

forward-looking

statements.

For

a

more

complete

discussion

of risks and uncertainties, investors and security holders are urged to read CU

Bancorp’s annual report on Form 10-K, quarterly reports on Form 10-Q and other reports filed by CU Bancorp with the SEC. The documents filed by

CU

Bancorp

with

the

SEC

may

be

obtained

at

CU

Bancorp’s

website

at

www.cubancorp.com

or

at

the

SEC’s

website

at

www.sec.gov.

These

documents

may

also

be

obtained

free

of

charge

from

CU

Bancorp

by

directing

a

request

to:

CU

Bancorp

c/o

California

United

Bank,

15821

Ventura

Boulevard,

Suite

100,

Encino,

CA

91436.

Attention:

Investor

Relations.

Telephone

818-257-7700.

CU

BANCORP,

CALIFORNIA

UNITED

BANK

AND

1

ST

ENTERPRISE

BANK

MERGER

ANNOUNCEMENT

On

June

3,

2014,

CU

Bancorp

announced

that

it

had

entered

into

an

Agreement

and

Plan

of

Merger

(the

“Merger

Agreement”)

among

CU

Bancorp,

California

United

and

1st

Enterprise

Bank,

a

California

state-chartered

commercial

bank

(“1st

Enterprise”)

pursuant

to

which

CU

Bancorp

will

acquire

1st

Enterprise

Bank

by

merging

1st

Enterprise

Bank

with

and

into

California

United

Bank

(the

“Merger”).

California

United

Bank

will

survive

the

Merger

and

will

continue

the

commercial

banking

operations

of

the

combined

bank

following

the

Merger.

Under

the

terms

of

the

Merger

Agreement,

holders

of

1st

Enterprise

Bank

common

stock

will

receive

shares

of

CU

Bancorp

common

stock

based

upon

a

fixed

exchange

ratio

of

1.3450

shares

of

CU

Bancorp

common

stock

for

each

share

of

1st

Enterprise

Bank

common

stock.

The

U.S.

Treasury,

as

the

holder

of

all

outstanding

shares

of

1st

Enterprise

Bank

preferred

stock

granted

in

connection

with

1st

Enterprise’s

participation

in

the

Treasury’s

Small

Business

Lending

Fund

program,

will

receive,

in

exchange

for

these

shares,

a

new

series

of

CU

Bancorp

preferred

stock

having

the

same

rights

(including

with

respect

to

dividends),

preferences,

privileges,

voting

powers,

limitations

and

restrictions

as

the

1st

Enterprise

preferred

stock.

The

Merger

is

subject

to

customary

closing

conditions,

including

regulatory

and

shareholder

approvals.

ADDITIONAL

INFORMATION

ABOUT

THE

PROPOSED

TRANSACTION

WITH

1

ST

ENTERPRISE

BANK

AND

WHERE

TO

FIND

IT

Investors

and

security

holders

are

urged

to

carefully

review

and

consider

each

of

CU

Bancorp’s

public

filings

with

the

SEC,

including

but

not

limited

to

its

annual

reports

on

Form

10-K,

proxy

statements,

current

reports

on

Form

8-K

and

quarterly

reports

on

Form

10-Q.

The

documents

filed

by

CU

Bancorp

with

the

SEC

may

be

obtained

free

of

charge

at

CU

Bancorp’s

website

at

www.cubancorp.com

or

at

the

SEC

website

at

www.sec.gov.

These

documents

may also be obtained free of charge from CU Bancorp by directing

a request to: CU Bancorp c/o California United Bank, 15821 Ventura Boulevard,

Suite 100, Encino, CA 91436. Attention: Investor Relations. Telephone 818-257-

7700. The information on CU Bancorp’s website is not, and shall not be

deemed to be, a part of this filing or incorporated into other filings CU Bancorp makes with the SEC.

In

connection

with

the

proposed

merger

of

California

United

Bank

with

1

st

Enterprise

Bank,

CU

Bancorp

intends

to

file

a

registration

statement

on

Form

S-4

with

the

SEC

to

register

the

shares

of

CU

Bancorp

common

stock

to

be

issued

to

shareholders

of

1

st

Enterprise

Bank.

The

registration

statement

will

include

a

joint

proxy

statement

of

CU

Bancorp

and

1

st

Enterprise

and

a

prospectus

of

CU

Bancorp,

and

each

party

will

file

other

documents

regarding

the

proposed

transaction

with

the

SEC.

Before

making

any

voting

or

investment

decision,

investors

and

security

holders

of

CU

Bancorp

and

1

st

Enterprise

Bank

are

urged

to

carefully

read

the

entire

registration

statement

and

joint

proxy

statement/prospectus,

when

they

become

available,

as

well

as

any

amendments

or

supplements

to

these

documents,

because

they

will

contain

important

information

about

the

proposed

transaction.

A

definitive

joint

proxy

statement/prospectus

will

be

sent

to

the

shareholders

of

each

institution

seeking

any

required

stockholder

approvals.

Investors

and

security

holders

will

be

able

to

obtain

the

registration statement and the joint proxy statement/prospectus free of charge

from the SEC’s website or from CU Bancorp by writing to the address provided in the paragraph above.

PARTICIPANTS IN THE SOLICITATION

CU

Bancorp

and

its

directors

and

executive

officers

may

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

the

shareholders

of

CU

Bancorp

and

1

st

Enterprise

Bank

in

connection

with

the

transaction.

Information

about

the

directors

and

executive

officers

of

CU

Bancorp

is

set

forth

in

its

annual

report

on

Form

10-K/A

filed

with

the

SEC

on

April

29,

2014.

1st

Enterprise

Bank

and

its

directors

and

executive

officers

may

also

be

deemed

to

be

participants

in

the

solicitation

of

proxies

from

the

shareholders

of

CU

Bancorp

and

1st

Enterprise

Bank

in

connection

with

the

Merger.

Additional information regarding the interests of these participants and other

persons who may be deemed participants in the Merger may be obtained by reading the proxy statement/prospectus regarding the Merger when it

becomes available.

This communication does not constitute an offer to sell or the solicitation of an

offer to buy any securities or a solicitation of any vote or approval. |

3

Investment Highlights

……….……………….……… 4

Earnings Review

..……………………..………………

14

Appendix

………………………..……………………

24

CUNB & FENB Merger Overview.

..……………………31 |

4

Investment Highlights

Premier community-based business banking

franchise serving large and diverse market

Strong organic loan growth

Attractive low-cost core deposit base

Exceptional credit quality

Growing visibility in the investment community

Announced merger with 1 Enterprise Bank to

create

$2.2

billion

“pure

play”

business

bank

in

attractive Southern California market

st |

5

Premier Business Banking Franchise

$1.4 billion in assets, achieved by experienced management

team* in nine years, through organic growth and two successful

acquisitions

16

th

largest publicly-owned bank by assets in combined Los Angeles, Orange and

Ventura counties

279

th

largest publicly-owned bank by assets in U.S.

Asset CAGR of 39% since inception in 2005 through 12/31/13

Footprint includes eight branches covering L.A., Orange and Ventura counties

*See appendix for management experience |

6

Sophisticated Relationship Management Team offers

Solutions for Small-

and Medium-Sized Businesses

Sophisticated relationship management team offers personalized and

responsive

service

focused

on

small-

and

medium-sized

businesses

in

Los

Angeles, Orange and Ventura counties

Los Angeles County is the largest manufacturing center in the U.S. and would be

9

th

largest state in U.S.

L.A.

County

expected

to

add

more

than

150,000

jobs

over

the

next

two

years;

June

2014

unemployment rate of 8.2% projected to fall to 7.2% by end of 2015*

Orange County would be 31

st

largest state in U.S.

Orange County unemployment rate is 5.2% as of June 2014**

Three-county

area

is

home

to

more

than

532,000

small-

and

middle-market

business** (defined as employing 1 to 499 workers)

*Source: Forecast by Beacon Economics, February 2014; actual unemployment rate from

Bureau of Labor and Statistics (BLS)

**Source: County data from Los Angeles Economic Development Corporation and California

EDD, as of 2012; actual unemployment rate from BLS |

7

Franchise Growth Strategies

Organic Growth

Offer expertise in C&I and commercial real estate lending to small and

middle- market businesses

Provide customers with sophisticated products and solutions

Leverage relationship-based banking approach and superior service

SBA lending platform expertise acquired with Premier Commercial Bank

Continue

recruiting

“in

market”

talent

from

competitors

Growth by Merger/Acquisition

Strong management team experienced with successful, accretive acquisitions

California Oaks State Bank (12/31/10)

Premier Commercial Bank (7/31/12)

1

Enterprise Bank (Announced 6/3/14, expected to close in fourth quarter 2014)

st |

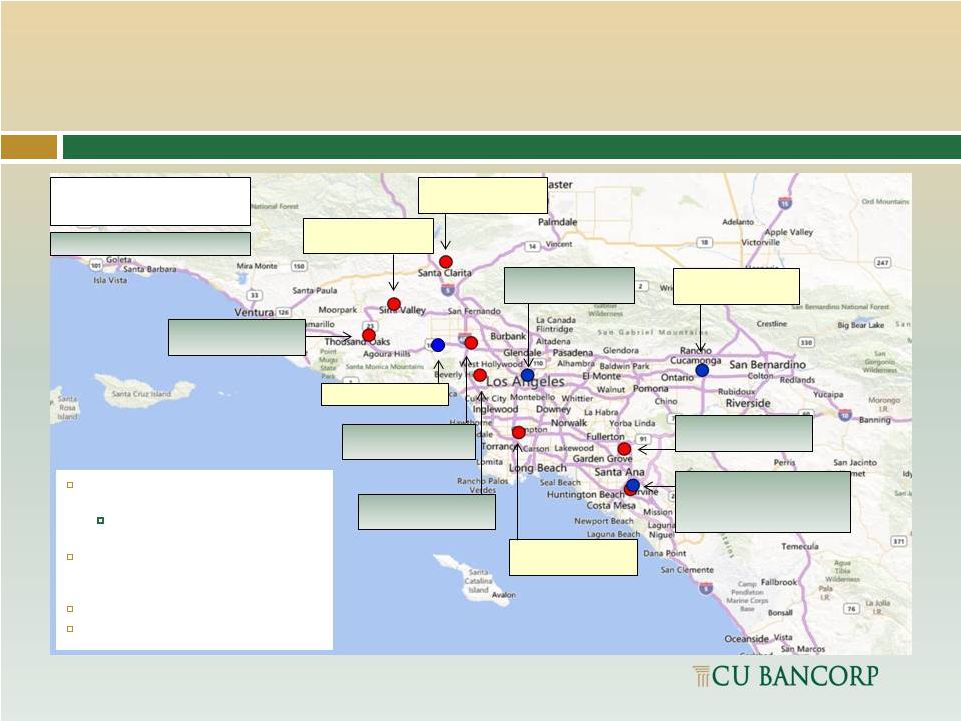

Strategic

Geographic Locations Encino (2005) –

Headquarters

Los Angeles (2006)

Santa Clarita Valley (2007)

South

Bay

(2009)

–

Converted

to

a

branch

in

2010

Orange

County

(2010)

–

Loan

Production

Office*

Simi

Valley

(2010)

–

Acquired

from

California

Oaks

State Bank

Thousand

Oaks

(2010)

–

Acquired

from

California

Oaks

State Bank

Anaheim

(2012)

–

Acquired

from

Premier

Commercial

Bank

Irvine/Newport

Beach

(2012)

–

Acquired

from

Premier

Commercial Bank*

CUB Branch

Former COSB

Branch

Former PCB Branch

*Combined location (August 2013)

Encino

8

California United Bank has a footprint that

spans the most attractive markets in

Southern California:

|

Announced

Merger Has Attractive Footprint and Large Branch Size

CUNB (8 branches)

FENB (3 branches; 1 LPO)

Inland Empire:

FENB: $81 million

Downtown LA:

FENB: $331 million

Irvine/Newport Beach:

CUNB: $148 million

FENB: $240 million

Pro Forma: $388 million

Santa Clarita Valley:

CUNB: $94 million

Simi Valley:

CUNB: $14 million

West LA:

CUNB: $256

million

San Fernando Valley:

CUNB: $207 million

Anaheim:

CUNB: $191 million

$100 Million+ Branches

Woodland Hills LPO

South Bay:

CUNB: $55 million

Conejo Valley:

CUNB: $229 million

Source: CUNB and FENB; branch deposits data as of March 31, 2014

9

6 of 10 pro forma branches with

deposits greater than $100 million

Branch consolidation in Irvine

Woodland Hills LPO to be consolidated

into a CUNB branch

Expands CUNB’s branch presence to

Downtown LA (pro forma headquarters) and

Inland Empire

Pro forma average branch size of approx.

$185 million in deposits |

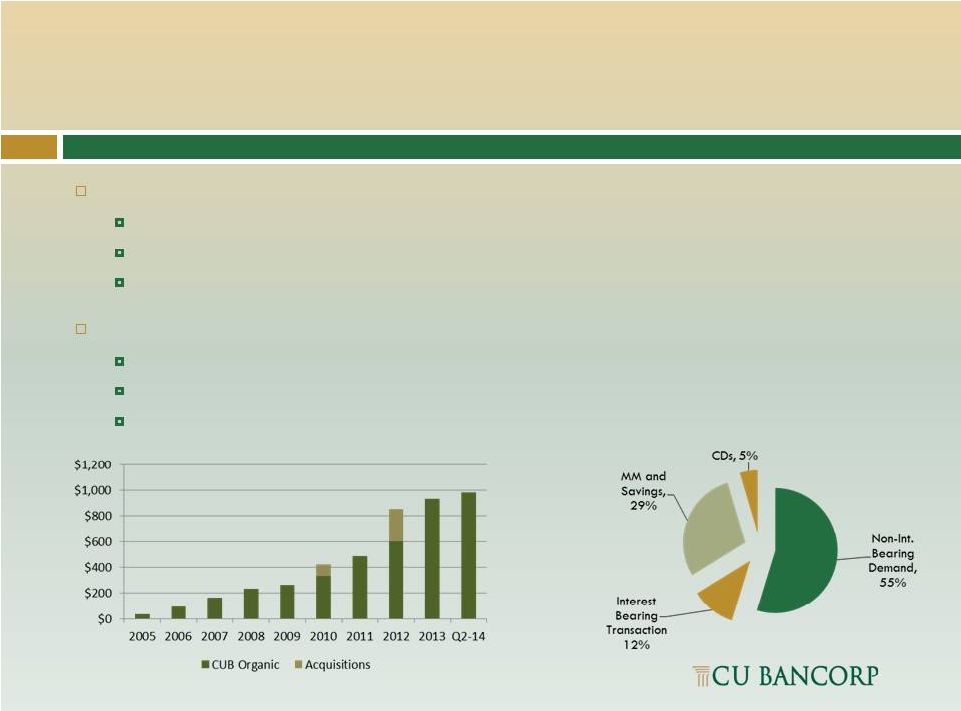

Strong

Organic Loan Growth CUB lenders’

expertise allows the Bank to underwrite complex loans, while providing

better service than larger banks

Total loans grew 10.7% to $980 million from 2Q13 to 2Q14

Total loans grew 3.6% from 1Q14 to 2Q14, a 14.4% annualized rate

52% of total loans are commercial and industrial loans, and owner-occupied

nonresidential properties—relationship-based “sticky”

accounts

Since inception in 2005 loan portfolio has grown to $980 million

$778 million in net organic loan growth, in addition to two acquisitions

Annual Loan Growth ($ in millions)

Portfolio Composition

10 |

Attractive

Low Cost Deposit Base Total deposits of $1.2 billion

Increased $148 million or 13.4% from 2Q13 to 2Q14

Increased $42 million or 3.5% from 1Q14 to 2Q14

Cost of deposits was 0.11% in 2Q14

Non-interest bearing deposits of $682 million

55% of total deposits

Up 19.5% from 2Q13 to 2Q14

Up 4.7% from 1Q14 to 2Q14, an 18.8% annualized rate

Deposit Composition

Total Deposit Growth Since Inception

11 |

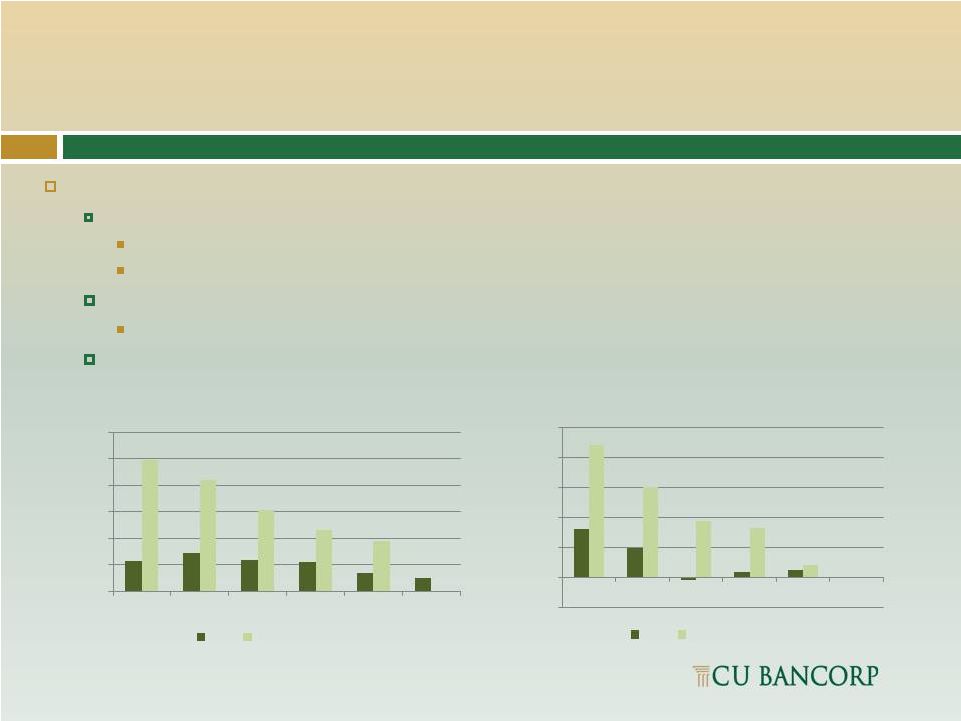

12

Strong Credit Quality Trend Continues

CUB credit quality at June 30, 2014:

Total nonaccrual loans of $7.0 million or 0.72% of total loans

71% of nonaccrual loans were acquired loans marked-to-market at the time of

acquisition Excluding acquired loans, total nonaccrual loans were $2.0 million or

0.29% of total loans NPAs to total assets of 0.51%

One REO in 2Q14 of $219 thousand, sold early in 3Q14 for approximate book value

Net recoveries in 2Q14 of $53 thousand; net recoveries year to date of $198

thousand Peer group includes California banks or bank holding companies with total

assets

between

$1.0-2.0

billion;

source:

SNL.

NPAs to total assets

Net charge-offs

1.12%

1.42%

1.19%

1.09%

0.68%

0.51%

4.94%

4.19%

3.06%

2.31%

1.89%

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

2009

2010

2011

2012

2013

2Q-14

CUB

Peer Group Avg.

0.80%

0.49%

-0.04%

0.08%

0.12%

-0.02%

2.20%

1.50%

0.94%

0.82%

0.21%

0.50%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

2009

2010

2011

2012

2013

CUB

Peer Group Avg.

12

2Q-14 |

Growing

Visibility in the Investment Community Surpassed $1 billion in assets in July

2012 Transferred listing to Nasdaq Capital Market in October 2012 (CUNB)

36.2% institutional ownership per 1Q14 13-f filings

11.2 million shares outstanding at 6/30/14

$211 million market cap at 7/21/14

Added to Russell Indexes in June 2013

Analyst coverage by five Wall Street brokerage firms

Year to date performance vs. KBW Bank Index (BKX), Nasdaq

Composite Index (NASDAQ), ABA Nasdaq Bank Index (ABAQ)

and Russell 2000 Index (RUT)

CUNB has had a strong performance in a

challenging year. Year to date, it’s up

7.0%, compared to the NASDAQ, up

5.9%, the BKX bank index, up 1.8% and

the Russell 2000 and the ABA NASDAQ

Bank Index, which are down (1.5)% and

(3.2)%, respectively, as of 7/21/14.

13 |

14

Earnings Review

Second Quarter 2014 |

15

Second Quarter 2014 Highlights

Net income of $2.4 million, 2.8% increase from $2.3 million in 2Q13

EPS of $0.21, compared to $0.22 in 2Q13

Core net income of $2.9 million, 24% increase from $2.3 million in 2Q13

Core EPS of $0.26, 18.2% increase from $0.22 in 2Q13

Total loans increased $95 million or 10.7% from 2Q13

$151 million in net organic loan growth

Offset by $56 million in loan run-off from acquired portfolios

Total deposits increased $148 million, or 13.4%, from 2Q13

Non-interest

bearing

deposits

increased

$111

million,

or

19.5%,

from

2Q13

Continued strong credit quality

NPAs to total assets of 0.51%, down from 1.06% in 2Q13

Net recoveries of $53 thousand in 2Q14 |

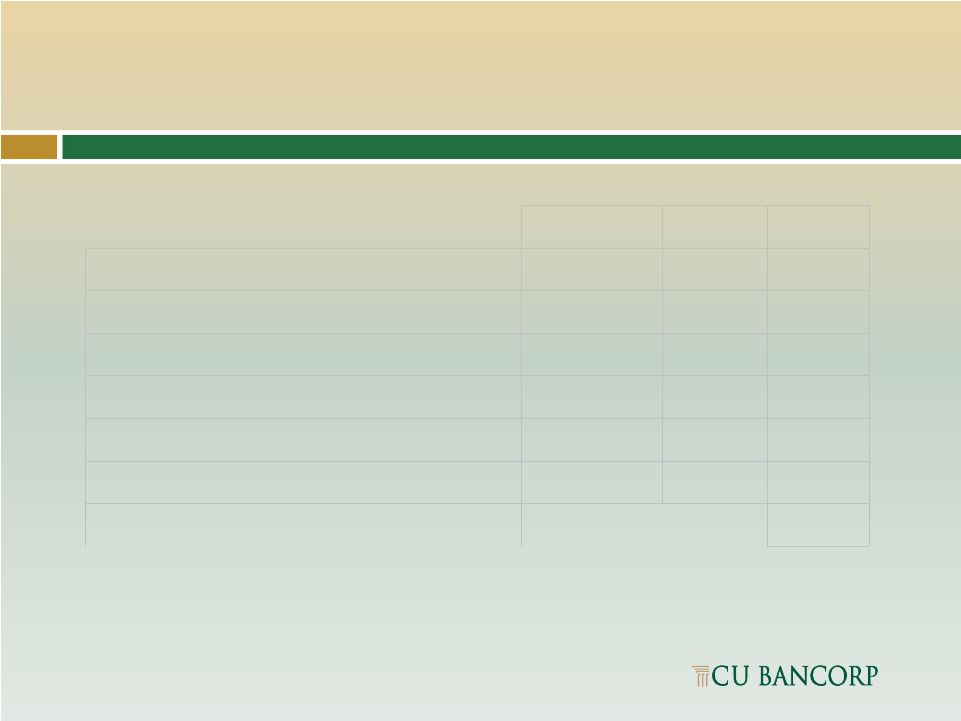

Snapshot

of Income Statement for 2Q14 $ in thousands, except per share data

Core net income increased 24% year over year

Income Statement

2Q 14

2Q 13

% change

EPS -

fully diluted

$0.21

$0.22

-5%

Core EPS

$0.26

$0.22

18%

Net Income

2,386

2,321

3%

Core Net Income

2,883

2,321

24%

Net Interest income

12,578

12,580

0.0%

Non-interest income

1,783

1,690

6%

Gain on sale of SBA loans

167

60

178%

Non-interest expense

9,698

9,281

4%

Core non-interest expense

9,201

9,281

-1%

Provision for loan losses

408

1,153

-65%

16 |

17

Improving Operating Leverage

*3Q12 operating expenses excludes $2.5 million in merger-related expenses; 2Q14

excludes $497 thousand in merger-related expenses $6

$7

$8

$9

$10

$11

$12

$13

$14

$15

Revenue

Operating Expenses |

Snapshot

of Balance Sheet 2Q14 vs. 2Q13

$ in thousands

*Non-interest bearing deposits now account for 55% of total deposits

Year over year: total loans up 11%, non-interest bearing deposits up 19%

Balance Sheet

2Q14

2Q13

% change

Assets

$1,430,313

$1,278,661

12%

Total loans

979,890

885,027

11%

Total deposits

1,245,280

1,097,707

13%

Non-interest bearing demand deposits*

682,300

571,045

19%

Shareholders' equity

145,438

129,567

12%

18 |

Snapshot

of Performance Ratios 2Q14 vs. 2Q13

Performance Ratios

2Q 14

2Q 13

% change

Net interest margin

3.88%

4.25%

-9%

ROAA

0.69%

0.73%

-5%

Core ROAA

0.83%

0.73%

14%

ROAE

6.63%

7.16%

-7%

Core ROAE

8.01%

7.16%

12%

Efficiency ratio

68%

65%

4%

Core efficiency ratio

64%

65%

-1%

19 |

Snapshot

of Income Statement and Balance Sheet 2Q14 vs. 1Q14

$ in thousands, except per share data

Income Statement

2Q 14

1Q 14

% change

EPS

$0.21

$0.24

-13%

Core EPS

$0.26

$0.24

8.3%

Net Income

2,386

2,666

-11%

Core Net Income

2,883

2,666

8%

Net Interest income

12,578

12,173

3%

Non-Interest income

1,783

1,790

0%

Non-Interest expense

9,698

9,549

2%

Core non

-interest expense

9,201

9,549

-4%

Balance Sheet

Assets

1,430,313

1,382,363

3%

Total loans

979,890

945,507

4%

Total deposits

1,245,280

1,203,398

3%

Non-interest bearing demand deposits

682,300

651,645

5%

Shareholders' equity

145,438

142,258

2%

20 |

21

Snapshot of Income Statement and

Balance Sheet for 1H14 & 1H13

For the Six Months Ended

Income Statement

2014

2013

% change

EPS

$0.45

$0.42

7%

Net income

5,052

4,476

13%

Net Interest income

24,751

24,118

3%

Non-Interest income

3,573

3,116

15%

Gain on sale of SBA loans

605

410

48%

Non-Interest expense

19,247

18,590

4%

Provision for loan losses

483

1,287

-62%

Balance Sheet

Assets

1,430,313

1,278,661

12%

Total loans

979,890

885,027

11%

Total deposits

1,245,280

1,097,707

13%

Non-interest bearing DDA

682,300

571,045

19% |

Snapshot

of Shares Outstanding, Market Cap and Tangible Book Value, 2Q14 vs. 2Q13

Shares Outstanding & Market Cap

2Q 14

2Q 13

% change

Share price

$19.07

$15.80

21%

Market cap

$214,008,021

$169,601,150

26%

Diluted average shares outstanding

11,159,000

10,660,000

4%

Common shares issued and outstanding

11,222,235

10,734,250

5%

Tangible book value

$11.66

$10.78

8%

22 |

CU

Bancorp is Well Capitalized by all Regulatory Ratios

CU

Bancorp

is

“well

capitalized”

as

defined

by

federal

regulations,

which

is

the

highest

regulatory classification.

Regulatory Ratios

"Well Capitalized"

2Q 14

2Q 13

Tier 1 Leverage

5.0%

10.38%

9.85%

Tier 1 Risk-

based Capital

6.0%

11.79%

11.69%

Total Risk-based Capital

10.0%

12.75%

12.60%

23 |

Appendix

24 |

Experienced Management Team

*Formerly EVP at Premier Commercial Bank, N.A.

Name

Title

Functional

Banking Exp

CUB Tenure

David Rainer

President

Chief Executive Officer

34 years

9 years

Anne Williams

EVP

Chief Operating Officer and Chief Credit Officer

34 years

9 years

Karen Schoenbaum

EVP

Chief Financial Officer

21 years

5 years

Anita Wolman

EVP

Chief Administrative Officer and General Counsel

37 years

9 years

Sam Kunianski

EVP

Executive Manager –

Commercial and Private Banking

30 years

8 years

William Sloan

EVP

Executive Manager –

Real Estate and Santa Clarita Regional Manager

30 years

9 years

Stephen Pihl

EVP

Executive Manager –

SBA and Orange County Regional Manager

27 years

2 years*

25 |

Asset

Quality & Allowance for Loan Losses $ in thousands

Asset Quality

2Q14

2Q13

% change

Organic loans on non-accrual

$2,046

$3,750

-45%

Acquired loans on non-accrual

4,982

6,719

-26%

Total non-accrual

$7,028

$10,469

-33%

REO

219

3,112

-93%

Total non-accrual loans & REO

$7,247

$13,581

-47%

Net charge offs (recoveries) Qtrly

-53

678

NM

Non-accruals to total loans

0.72%

1.18%

-39%

Non-performing assets to total assets

0.51%

1.06%

-52%

Allowance for loan losses to total loans

1.15%

1.06%

8%

ALL as % of total loans (excluding acquired loans)

1.45%

1.50%

-3%

Net YTD charge-offs as % of avg YTD loans

-0.02%

0.08%

NM

ALL as % of non-accrual organic loans

551.4%

251%

120%

ALL as % of total non-accrual loans (org. & acq.)

160.5%

89.9%

79%

26 |

27

Reconciliation of Non-GAAP Measures

The Company utilizes the term Core Net Income, a non-GAAP financial measure. CU

Bancorp’s management believes Core Net Income is useful because it is a measure utilized by management and market

analysts to understand the effects of merger expenses and provides an alternative view of

the Company’s performance over time and in comparison to the Company’s competitors. Core net income should

not be viewed as a substitute for net income. A reconciliation of CU Bancorp’s

Net Income to Core Net Income, as well as related ratios is presented in the tables below for the periods indicated:

(Dollars in thousands except per share data)

Three Months Ended

30-Jun-14

31-Mar-14

30-Jun-13

Net Income

$

2,386

$

2,666

$

2,321

Add back: Merger related expenses

497

–

–

Core Net Income

$

2,883

$

2,666

$

2,321

Average Assets

$

1,390,257

$

1,385,845

$

1,280,395

ROAA

0.69%

0.78%

0.73%

Core ROAA*

0.83%

0.78%

0.73%

Average Equity

$

144,427

$

140,439

$

130,010

ROAE

6.63%

7.70%

7.16%

Core ROAE**

8.01%

7.70%

7.16%

Diluted Average Shares Outstanding

11,159,000

11,095,000

10,660,000

Diluted Earnings Per Share

$

0.21

$

0.24

$

0.22

Core Diluted Earnings Per Share***

$

0.26

$

0.24

$

0.22

* Core ROAA: Annualized core net income/average assets

** Core ROAE: Annualized core net income/average equity

*** Core Diluted Earnings Per Share: Annualized core net income/diluted average shares

outstanding Three Months Ended

June 30, 2014

March 31, 2014

June 30, 2013

Net Interest Income

$

12,578

$

12,173

$

12,580

Non-Interest Income

1,783

1,790

1,690

Non-Interest Expense

9,698

9,549

9,281

Subtract: Merger related expenses

497

–

–

Core Non-Interest Expense

$

9,201

$

9,549

$

9,281

Efficiency Ratio

68%

68%

65%

Core Efficiency Ratio*

64%

68%

65%

* Core Efficiency Ratio: Core non-interest expense / (non-interest income + net

interest income) |

Loans by

Industry – C&I and Owner-Occupied CRE

28 |

Customer

Profile Our customer base reflects the diversity

of industries in Southern California

Significant percentage of customers involved in the manufacturing, distribution and

services industries

Typical customer has between $10 million and $60 million in annual sales (excluding

SBA borrowers)

Typical loan commitment ranges between $1 million and $5 million

(excluding SBA

loans)

Majority of new customers come from larger banks

Most new business generation results from warm leads provided by

referral sources

29 |

Shareholders of CUB Acquisitions Have

Been Well Rewarded

1

st

Enterprise Bank (FENB) –

Acquisition announced June 3, 2014

California Oaks State Bank (COSB) –

Acquisition announced Aug. 25, 2010; Premier Commercial Bancorp

(PCBP) –

Acquisition announced Dec. 9,

2011

30

$20.00

$20.50

$21.00

$21.50

$22.00

$22.50

$23.00

$23.50

$24.00

$24.50

$25.00

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

$20.00

$0.00

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

$20.00

COSB

8/24/10

$6.00

CUNB

7/21/14

$18.70

PCBP

12/8/11

$9.00

CUNB

7/21/14

$18.70

FENB

6/2//14

$21.75

FENB

7/21/14

$24.65 |

CUNB

& FENB Merger Overview 31 |

Transaction Rationale

Combination

to

create

a

$2.2

billion

“pure

play”

business

bank

in

Southern

California

Both companies have a track record of strong organic growth

Scarcity value for a business banking franchise in Southern California

Southern California offers an unparalleled opportunity for middle market business

banks Cultural similarities

Focused on small to mid-sized businesses as target clients

High quality deposit base (> 50% noninterest bearing deposits and 0.11% cost of

deposits) Conservative credit cultures and similar loan portfolio mix (> 50%

combined C&I and OO CRE) Performance driven business development philosophy

Management team comprised of veteran Southern California business bankers

Complementary strengths provide opportunities for revenue synergies

Partnership approach to create the “best-in-class”

group of banking professionals for the pro forma

company

Pro forma branch network covers the greater Los Angeles market

Leverages capital and increases liquidity

Draws on CUNB’s strong track record of transaction execution

Financially compelling projected pro forma results

Strategic

Partnership

Enhances

Value of Both

Franchises

Source: SNL Financial as of March 31, 2014

32 |

Summary of

Terms 1

Based on CUNB closing price of $18.19 on June 2, 2014

2

Based on FENB closing price of $21.75 on June 2, 2014

3

As of March 31, 2014

Name:

CU Bancorp / California United Bank

Headquarters:

Downtown

Los

Angeles

(Current

FENB

headquarters)

Management:

Chairman

and

CEO,

David

I.

Rainer

(current

Chairman,

President

and

CEO

of

CUNB)

Board

Composition:

8

CUNB

/

4

FENB

Ownership:

68%

CUNB

/

32%

FENB

Consideration:

1.3450

shares

of

CUNB

stock

for

each

FENB

share

100% stock consideration; fixed exchange ratio

Equivalent

to

$24.47

per

FENB

share

13%

premium

to

FENB’s

last

closing

price

Deal

value

of

approximately

$103

million

16.9x 2014 analyst EPS estimate

172%

of

tangible

book

value

per

share

Timing:

Expected

to

close

in

Q4

2014

President, K. Brian Horton (current President of FENB)

Chief Financial Officer, Karen A. Schoenbaum (current CFO of CUNB)

33

3

2

1

1 |

Company

Overviews Headquarters

Encino, CA

Branches

8

Total Assets ($mm)

$1,382

Gross Loans ($mm)

$946

Total Deposits ($mm)

$1,203

Noninterest Bearing Deposits (%)

54%

C&I + Own. Occ. CRE (%)

51%

NPAs / Assets (%)

0.60%

LTM Net Income to Common ($mm)

$10.3

Headquarters

Los Angeles, CA

Branches

3 + 1 LPO

Total Assets ($mm)

$776

Gross Loans ($mm)

$513

Total Deposits ($mm)

$652

Noninterest Bearing Deposits (%)

49%

C&I + Own. Occ. CRE (%)

59%

NPAs / Assets (%)

0.57%

LTM Net Income to Common ($mm)

$5.3

Company Highlights

Company Highlights

Established in 2006

Raised $12.5 million of common equity in 2012

Funded $16.4 million of SBLF preferred equity in

2011

17.8%

insider

ownership

Established in 2005

Completed two accretive transactions

California Oaks State Bank (12/31/10)

Premier Commercial Bancorp (7/31/12)

Raised $22.0 million and $10.3 million of common

equity in 2006 and 2011, respectively

Listed on NASDAQ Capital Market in October 2012

Added to Russell 3000 Index in June 2013

12.1% insider ownership

1

Source: SNL Financial as of June 2, 2014

2

Source: Company information, as of May 15, 2014

34

1

2 |

Combination of Two Growth-Oriented Franchises

Source: SNL Financial

1

Mean analyst estimate as of June 2, 2014

2

Analyst estimate as of June 2, 2014

CUNB Performance

Gross Loans ($mm)

Total Deposits ($mm)

Net Income to Common ($mm)

Gross Loans ($mm)

Total Deposits ($mm)

Net Income to Common ($mm)

2013 represents 1st full year impact of PCB

Noninterest bearing deposits

Interest bearing deposits

Noninterest bearing deposits

Interest bearing deposits

16%

26%

FENB Performance

$489

$855

$933

$946

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2011

2012

2013

Q12014

34%

CAGR

$381

$544

$632

$652

$309

$535

$600

$552

$691

$1,078

$1,232

$1,203

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2011

2012

2013

Q12014

$293

$409

$505

$513

$0

$100

$200

$300

$400

$500

$600

2011

2012

2013

Q12014

28%

CAGR

$9.8

$11.3

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

2013

2014E

$215

$287

$316

$322

$282

$325

$327

$330

$497

$612

$643

$652

$0

$100

$200

$300

$400

$500

$600

$700

2011

2012

2013

Q12014

$4.8

$6.1

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

$8.0

2013

2014E²

35 |

36

Key Merger Assumptions

Cost savings

Approximately 20% of FENB noninterest expense base

Anticipate that 70% of cost savings will be realized in 2015; 100% phased-in by

2016 Consolidation of FENB’s Woodland Hills LPO

Revenue

synergies:

opportunities

identified

but

none

assumed

One-time

charges:

approximately

$7.9

million

pre-tax

Preferred

stock:

$16.4

million

of

FENB

SBLF

preferred

stock

to

remain

outstanding

1% preferred dividend thru March 1, 2016; 9% thereafter

$0.5 million initial write-down; 4 year impact using constant yield method

(7.3%) Core

deposit

intangible:

1.1%

($7.4

million);

amortized

over

10

years

(sum-of-the-years

digits

methodology)

Loan mark:

Credit mark write-down of 1.9% of gross loans ($10.0 million)

Rate mark write-down of 0.8% of gross loans ($4.3 million)

|

Financially Compelling Combination

High

single

digits

in

2015

>10% in 2016 with fully-phased in cost savings

~ 7% TBVPS dilution at close

~ 3.5 year TBVPS earn back

Pro forma capital ratios at close

TCE: 8.1%

Tier I Leverage: 9.6%

Total Risk-Based Capital: 11.5%

While there are no near term plans to redeem FENB’s preferred stock, CUNB

will continually evaluate the cost and amount of capital required to support

the pro forma balance sheet

37

2

1 |