Attached files

| file | filename |

|---|---|

| 8-K - 8-K - KNOLL INC | investorpresentation8k.htm |

Knoll, Inc. Third Quarter 2014 Investor Presentation Andrew Cogan, CEO Craig Spray, SVP & CFO July 22, 2014

Forward-Looking Statements 2 The following information includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements discuss goals, intentions and expectations as to future trends, plans, events, results of operations or financial condition, or state other information relating to us, based on our current beliefs as well as assumptions made by us and information currently available to us. Forward-looking statements generally will be accompanied by words such as "anticipate," "believe," "could," "estimate," "expect," "forecast," "intend," "may," "possible," "potential," "predict," "project," or other similar words, phrases or expressions. This includes, without limitation, our statements and expectations regarding any current or future recovery in our industry and publicly announced plans for increased capital and investment spending to achieve our long-term revenue and profitability growth goals, and our expectations with respect to leverage. Although we believe these forward-looking statements are reasonable, they are based upon a number of assumptions concerning future conditions, any or all of which may ultimately prove to be inaccurate. Important factors that could cause actual results to differ materially from the forward-looking statements include, without limitation: the risks identified in Knoll’s annual report on Form 10-K, and other filings with the Securities and Exchange Commission; changes in the financial stability of our clients or the overall economic environment, resulting in decreased corporate spending and service sector employment; changes in relationships with clients; the mix of products sold and of clients purchasing our products; the success of new technology initiatives; changes in business strategies and decisions; competition from our competitors; our ability to recruit and retain an experienced management team; changes in raw material prices and availability; restrictions on government spending resulting in fewer sales to the U.S. government, one of our largest customers; our debt restrictions on spending; our ability to protect our patents, copyrights and trademarks; our reliance on furniture dealers to produce sales; lawsuits arising from patents, copyrights and trademark infringements; violations of environmental laws and regulations; potential labor disruptions; adequacy of our insurance policies; the availability of future capital and the cost of borrowing; the overall strength and stability of our dealers, suppliers, and customers; access to necessary capital; our ability to successfully integrate acquired businesses; the success of our design and implementation of a new enterprise resource planning system; and currency rate fluctuations. The factors identified above are believed to be important factors (but not necessarily all of the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement. Unpredictable or unknown factors could also have material adverse effects on us.

For 75 Years, Clients Have Come to Knoll for the Help, Knowledge, and Products to Create Inspired Interiors. 3 “If you are not going to do it the best, why do it?” — Holly Hunt “No compromise. I wanted simply the best.” — Florence Knoll 3

60s 60s 90s 90s 00s 00s 10s 10s 10s History and Reputation for Design Leadership, Quality, and Innovation in Both the Contract and Residential Markets 60s 4

1955 2014 Knoll has Always Focused on Both Commercial and Residential Interiors as the Boundaries between Work and Home Continue to Blur. Proforma estimate * * 5

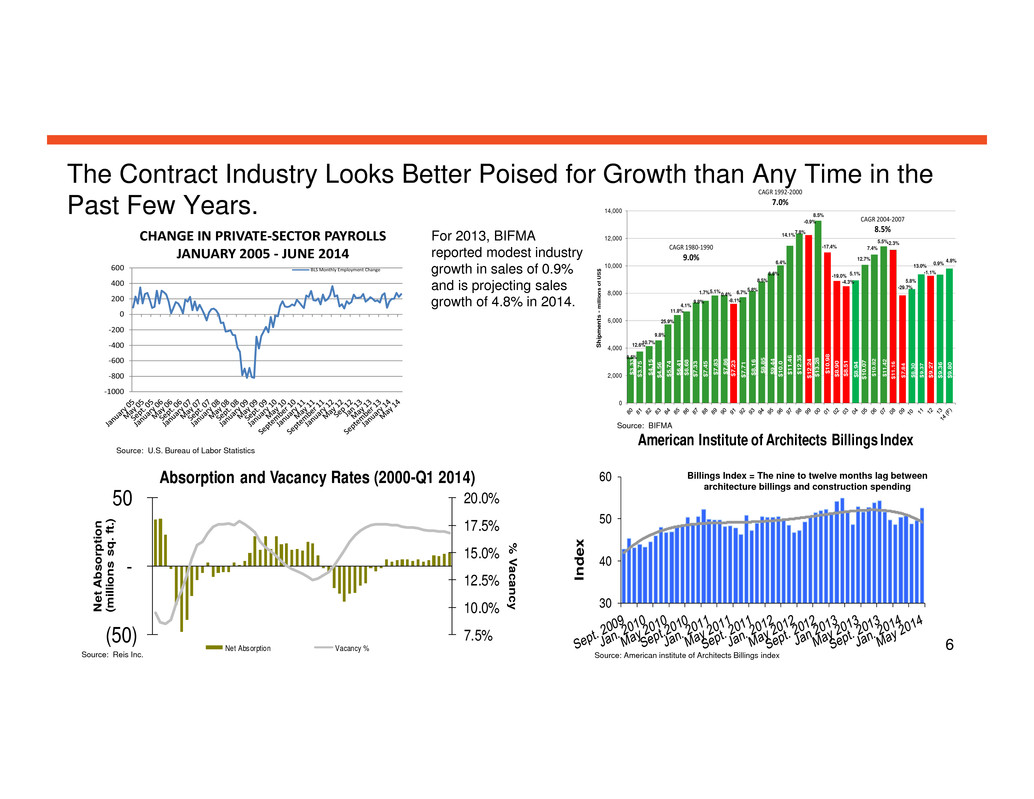

For 2013, BIFMA reported modest industry growth in sales of 0.9% and is projecting sales growth of 4.8% in 2014. The Contract Industry Looks Better Poised for Growth than Any Time in the Past Few Years. Billings Index = The nine to twelve months lag between architecture billings and construction spending Source: American institute of Architects Billings indexSource: Reis Inc. Source: BIFMA 6 Source: U.S. Bureau of Labor Statistics ‐1000 ‐800 ‐600 ‐400 ‐200 0 200 400 600 CHANGE IN PRIVATE‐SECTOR PAYROLLS JANUARY 2005 ‐ JUNE 2014 BLS Monthly Employment Change 0 2,000 4,000 6,000 8,000 10,000 12,000 14,000 S h i p m e n t s - m i l l i o n s o f U S $ x $ 8 . 9 0 $ 1 0 . 9 8 $ 8 . 5 1 $ 3 . 3 3 $ 3 . 7 5 $ 4 . 1 5 $ 4 . 5 6 $ 5 . 7 4 $ 6 . 4 1 $ 6 . 6 8 $ 7 . 3 3 $ 7 . 4 5 $ 7 . 8 3 $ 7 . 8 6 $ 7 . 7 1 $ 8 . 1 6 $ 8 . 8 5 $ 9 . 4 4 $ 1 0 . 0 $ 1 1 . 4 6 $ 1 2 . 3 58.5% 12.6%10.7% 9.8% 25.9% 11.8% 4.1% 9.8% 1.7% 13.0% 0.4% -8.1% 6.7%5.8% 8.5% 6.6% 6.4% 14.1%7.8% -0.9% 8.5% -17.4% -19.0% -4.3% $ 7 . 2 3 $ 1 2 . 2 4 $ 1 3 . 2 8 $ 8 . 9 4 5.1% 12.7% $ 1 0 . 0 7 7.4% $ 1 0 . 8 2 5.5% $ 1 1 . 4 2 -2.3% $ 1 1 . 1 6 -29.7% $ 7 . 8 4 $ 9 . 3 7 $ 8 . 3 0 5.1% 5.8% CAGR 1980‐1990 9.0% CAGR 2004‐2007 8.5% CAGR 1992‐2000 7.0% $ 9 . 2 7 -1.1% 4.8% $ 9 . 3 6 $ 9 . 8 0 0.9% 7.5% 10.0% 12.5% 15.0% 17.5% 20.0% (50) - 50 % V a c a n c y Absorption and Vacancy Rates (2000-Q1 2014) Net Absorption Vacancy % N e t A b s o r p t i o n ( m i l l i o n s s q . f t . ) 30 40 50 60 I n d e x American Institute of Architects Billings Index

Absent a major cyclical driver, secular changes in the workplace have pressured industry demand. $0 $10 $20 $30 $40 $50 $60 $70 $80 1 9 7 1 1 9 7 2 1 9 7 3 1 9 7 4 1 9 7 5 1 9 7 6 1 9 7 7 1 9 7 8 1 9 7 9 1 9 8 0 1 9 8 1 1 9 8 2 1 9 8 3 1 9 8 4 1 9 8 5 1 9 8 6 1 9 8 7 1 9 8 8 1 9 8 9 1 9 9 0 1 9 9 1 1 9 9 2 1 9 9 3 1 9 9 4 1 9 9 5 1 9 9 6 1 9 9 7 1 9 9 8 1 9 9 9 2 0 0 0 2 0 0 1 2 0 0 2 2 0 0 3 2 0 0 4 2 0 0 5 2 0 0 6 2 0 0 7 2 0 0 8 2 0 0 9 2 0 1 0 2 0 1 1 2 0 1 2 2 0 1 3 2 0 1 4 S h i p m e n t s / E m p l o y e e ( $ , 3 M M A ) BIFMA Shipments per Service Sector Employee Median = $50 + 1 st. dev. ‐1 st. dev. Trough to Peak of Non‐res Construction Cycle Source: BB&T Capital Markets, BIFMA, and U.S. Bureau of Labor StatisticsSource: Raymond James Research, BIFMA $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 Office Furniture Trailing 12 Month Orders and Shipments 1978 Forward Orders ($mil) Shipments ($mil) 5% CAGR Line $(Mil) CAGR 1980‐1990 = 9% CAGR 1992 ‐ 2000 = 7% CAGR 5/2003‐5/2008 = 6.3%White Collar Employment Boom PC on Every Desktop Boom Internet, Wireless, Ergonomics, Green, Hoteling, Groupwork 7

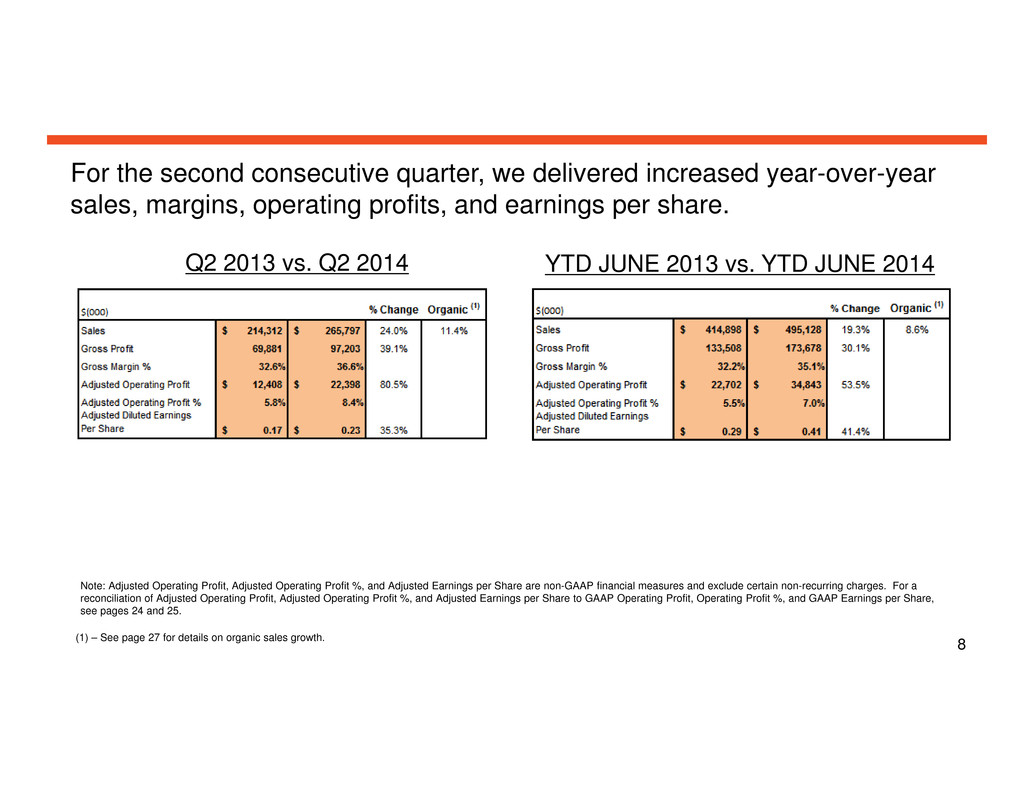

For the second consecutive quarter, we delivered increased year-over-year sales, margins, operating profits, and earnings per share. Note: Adjusted Operating Profit, Adjusted Operating Profit %, and Adjusted Earnings per Share are non-GAAP financial measures and exclude certain non-recurring charges. For a reconciliation of Adjusted Operating Profit, Adjusted Operating Profit %, and Adjusted Earnings per Share to GAAP Operating Profit, Operating Profit %, and GAAP Earnings per Share, see pages 24 and 25. 8 Q2 2013 vs. Q2 2014 YTD JUNE 2013 vs. YTD JUNE 2014 (1) – See page 27 for details on organic sales growth.

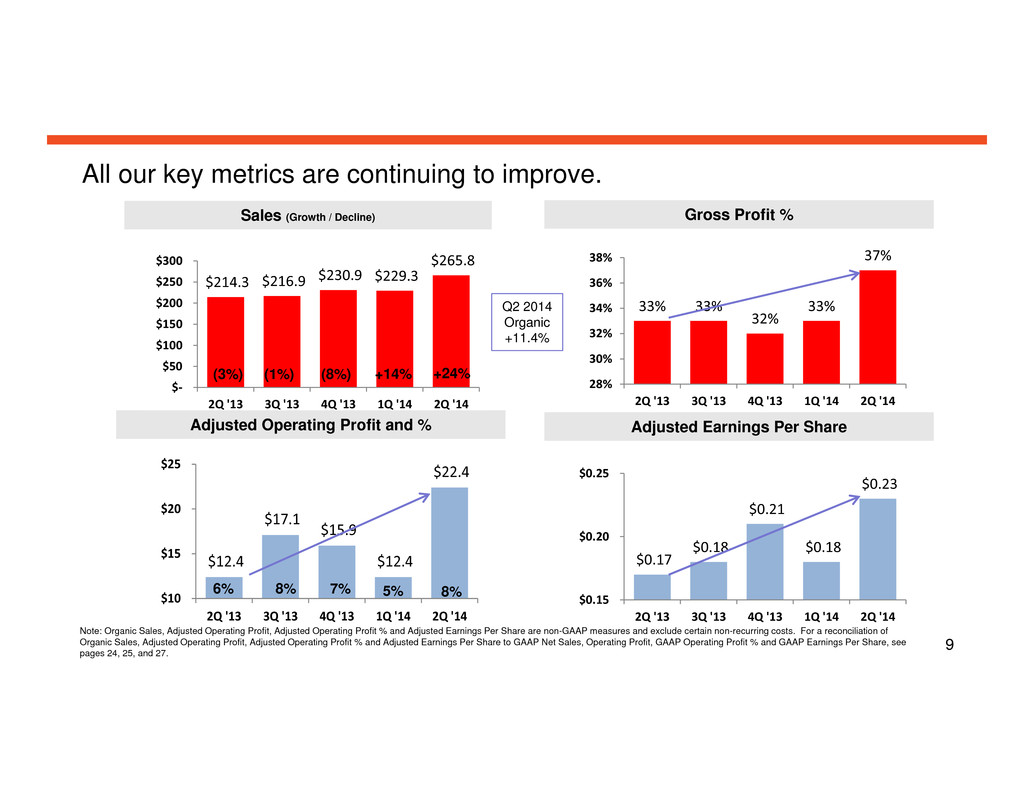

All our key metrics are continuing to improve. 9 Gross Profit % Adjusted Operating Profit and % Adjusted Earnings Per Share Note: Organic Sales, Adjusted Operating Profit, Adjusted Operating Profit % and Adjusted Earnings Per Share are non-GAAP measures and exclude certain non-recurring costs. For a reconciliation of Organic Sales, Adjusted Operating Profit, Adjusted Operating Profit % and Adjusted Earnings Per Share to GAAP Net Sales, Operating Profit, GAAP Operating Profit % and GAAP Earnings Per Share, see pages 24, 25, and 27. Sales (Growth / Decline) Q2 2014 Organic +11.4% 33% 33% 32% 33% 37% 28% 30% 32% 34% 36% 38% 2Q '13 3Q '13 4Q '13 1Q '14 2Q '14 $0.17 $0.18 $0.21 $0.18 $0.23 $0.15 $0.20 $0.25 2Q '13 3Q '13 4Q '13 1Q '14 2Q '14 $214.3 $216.9 $230.9 $229.3 $265.8 $‐ $50 $100 $150 $200 $250 $300 2Q '13 3Q '13 4Q '13 1Q '14 2Q '14 (3%) (1%) (8%) +14% +24% $12.4 $17.1 $15.9 $12.4 $22.4 $10 $15 $20 $25 2Q '13 3Q '13 4Q '13 1Q '14 2Q '14 6% 8% 7% 5% 8%

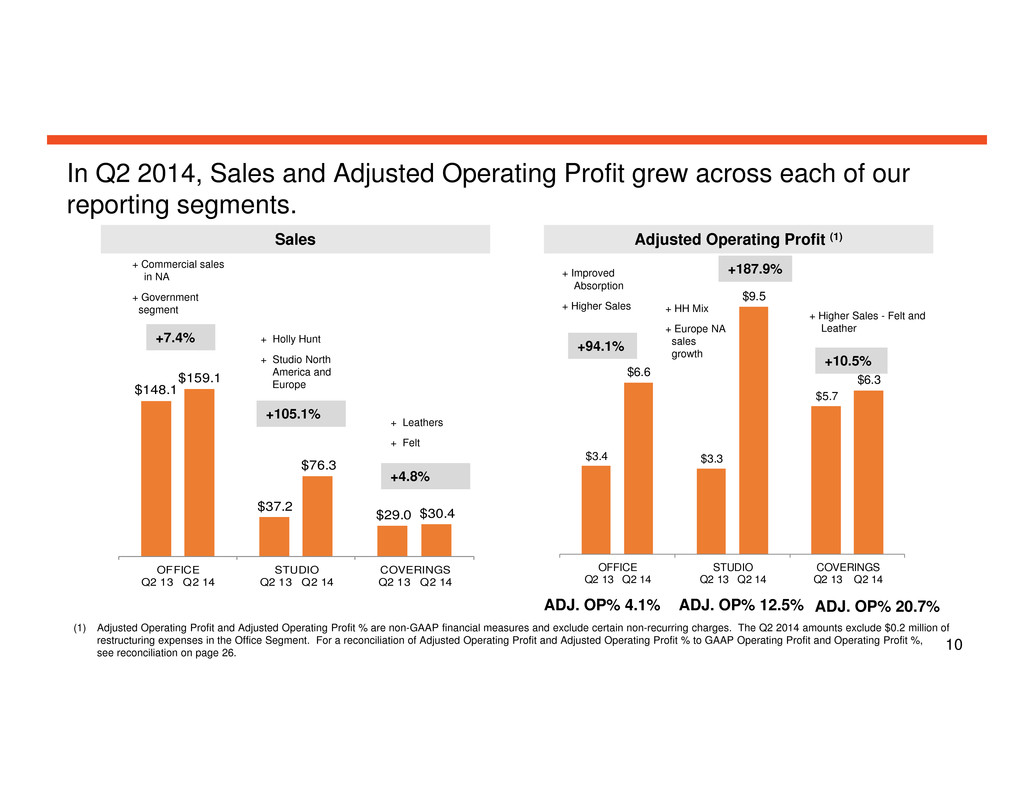

In Q2 2014, Sales and Adjusted Operating Profit grew across each of our reporting segments. 10 Sales Adjusted Operating Profit (1) + Commercial sales in NA + Government segment (1) Adjusted Operating Profit and Adjusted Operating Profit % are non-GAAP financial measures and exclude certain non-recurring charges. The Q2 2014 amounts exclude $0.2 million of restructuring expenses in the Office Segment. For a reconciliation of Adjusted Operating Profit and Adjusted Operating Profit % to GAAP Operating Profit and Operating Profit %, see reconciliation on page 26. $148.1 $37.2 $29.0 $159.1 $76.3 $30.4 OFFICE Q2 13 Q2 14 STUDIO Q2 13 Q2 14 COVERINGS Q2 13 Q2 14 +7.4% + Holly Hunt + Studio North America and Europe + Leathers + Felt +105.1% +4.8% $3.4 $3.3 $5.7 $6.6 $9.5 $6.3 OFFICE Q2 13 Q2 14 STUDIO Q2 13 Q2 14 COVERINGS Q2 13 Q2 14 +94.1% +187.9% +10.5% ADJ. OP% 4.1% ADJ. OP% 12.5% ADJ. OP% 20.7% + Improved Absorption + Higher Sales + HH Mix + Europe NA sales growth + Higher Sales - Felt and Leather

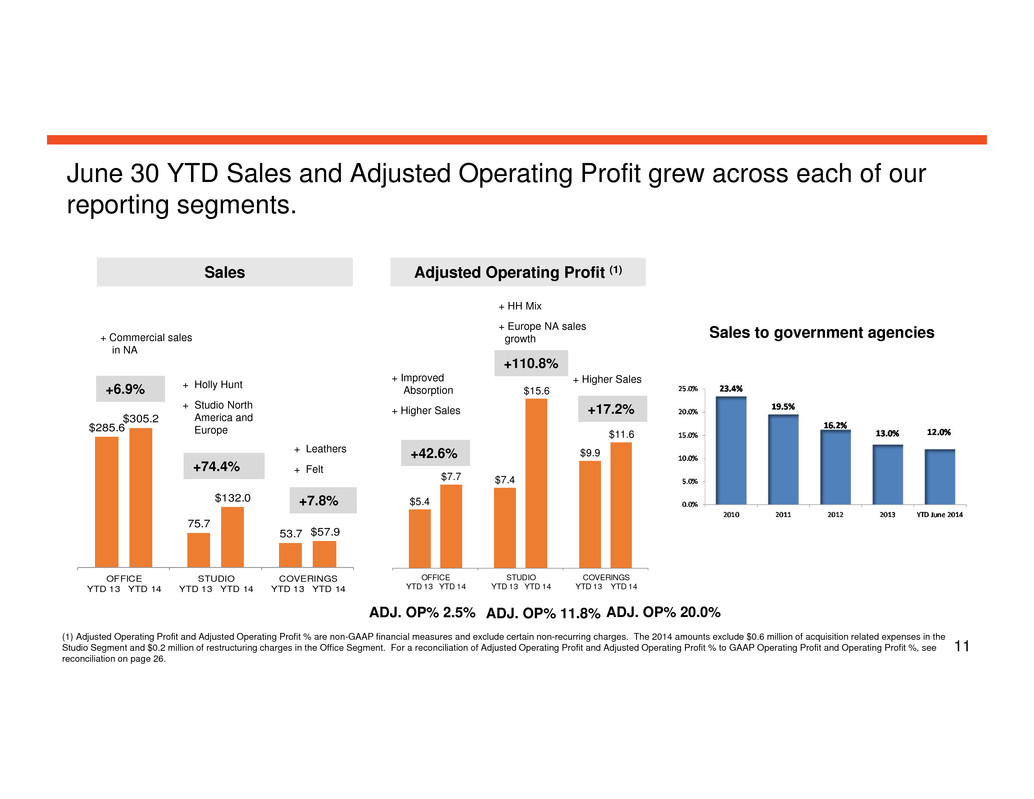

June 30 YTD Sales and Adjusted Operating Profit grew across each of our reporting segments. 11 Sales Adjusted Operating Profit (1) + Commercial sales in NA (1) Adjusted Operating Profit and Adjusted Operating Profit % are non-GAAP financial measures and exclude certain non-recurring charges. The 2014 amounts exclude $0.6 million of acquisition related expenses in the Studio Segment and $0.2 million of restructuring charges in the Office Segment. For a reconciliation of Adjusted Operating Profit and Adjusted Operating Profit % to GAAP Operating Profit and Operating Profit %, see reconciliation on page 26. $285.6 75.7 53.7 $305.2 $132.0 $57.9 OFFICE YTD 13 YTD 14 STUDIO YTD 13 YTD 14 COVERINGS YTD 13 YTD 14 +6.9% + Holly Hunt + Studio North America and Europe + Leathers + Felt+74.4% +7.8% $5.4 $7.4 $9.9 $7.7 $15.6 $11.6 OFFICE YTD 13 YTD 14 STUDIO YTD 13 YTD 14 COVERINGS YTD 13 YTD 14 +42.6% +110.8% +17.2% ADJ. OP% 2.5% ADJ. OP% 11.8% ADJ. OP% 20.0% Sales to government agencies + Improved Absorption + Higher Sales + HH Mix + Europe NA sales growth + Higher Sales

22% 45% 33% Our Office profitability troughed in Q1 and increased during the second quarter of 2014. Sales Adjusted Operating Profit(1) 2001 YTD JUNE 2014 17% 16% Office Studio Coverings 38% 78% 62%27% 11% 11% 6% 83% 8% 8% 84% 2001 YTD JUNE 2014 (1) Adjusted Operating Profit is a non-GAAP financial measure and excludes certain non-recurring charges. The YTD June 2014 amounts exclude $0.6 million of acquisition related expenses in the Studio Segment and $0.2 million of restructuring charges in the Office Segment.. For a reconciliation of Adjusted Operating Profit to GAAP Operating Profit, see reconciliation on page 26. 12

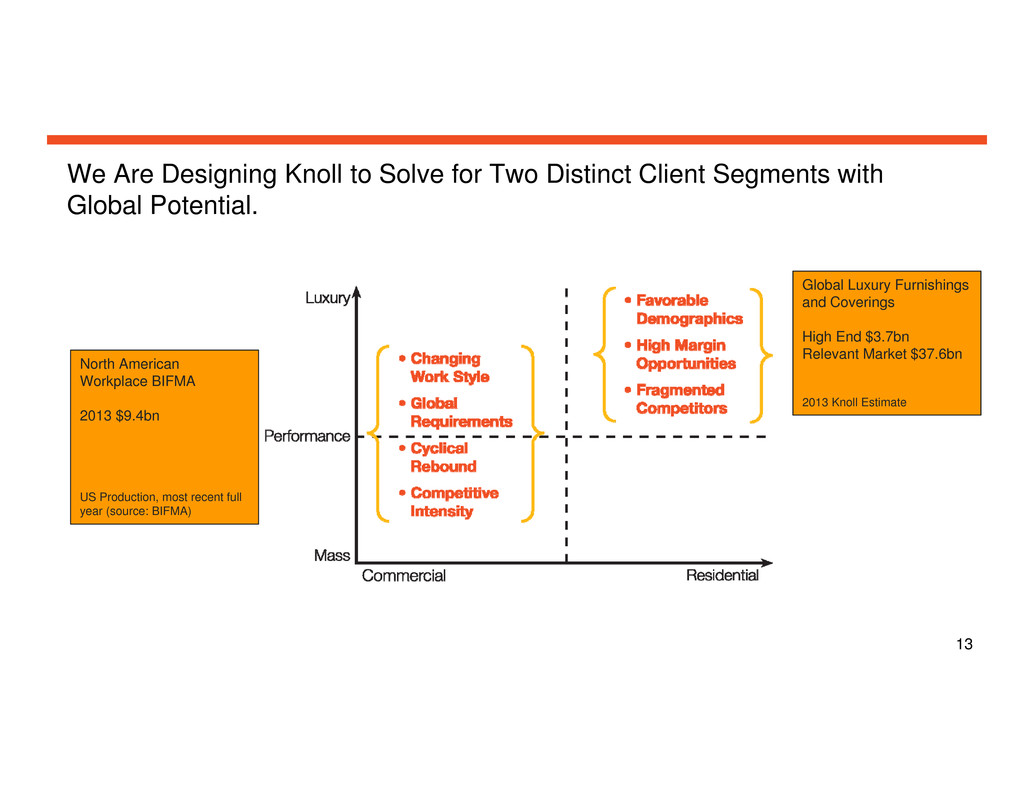

We Are Designing Knoll to Solve for Two Distinct Client Segments with Global Potential. North American Workplace BIFMA 2013 $9.4bn US Production, most recent full year (source: BIFMA) Global Luxury Furnishings and Coverings High End $3.7bn Relevant Market $37.6bn 2013 Knoll Estimate 13

Digital Outreach Strategic Sales Efforts Technology Partnerships Product Development Mergers + Acquisitions E-Commerce New Distribution Channels Product Development Architectural Products Product Dev. Architectural products Transportation + Hospitality Decorator+ Residential Dist. Workplace Solutions Furnishings For Activity + High Design Residential Spaces Materials that Complete and Enrich Commercial and Domestic Interiors …and Now Adding a Luxury Residential Platform 14

Headline Attributes of the Holly Hunt Acquisition Strategic Alignment + Scale + A major platform for the residential “to-the-trade” market + Significant size + Margin enhancing Culturally Parallel, with Minimal Risk + A close fit with Knoll + Diversified sales base + Knoll specialty expertise Potential for Growth + Scalable distribution model + Potential for industry consolidation + Significant market penetration opportunities The Acquisition of Holly Hunt Enterprises Accelerates Knoll’s Multi-Channel Residential Strategy. 15

The Most Powerful Collection of Design Brands, Products, and Sales Capabilities in the Interior Space. 16

Remix™ Best of NeoCon, Gold Washington Skeleton™ Best of NeoCon, Gold Antenna® Telescope™ Best of NeoCon, Silver Spirit & Archival Collections Best of NeoCon, Gold & Silver We had a very strong NeoCon®, with 5 Best of NeoCon Awards. 17

Antenna® Telescope™ Antenna® Telescope™ Dividends Horizon® Antenna® Telescope™ NeoCon® 2014 Open Plan Introductions 18

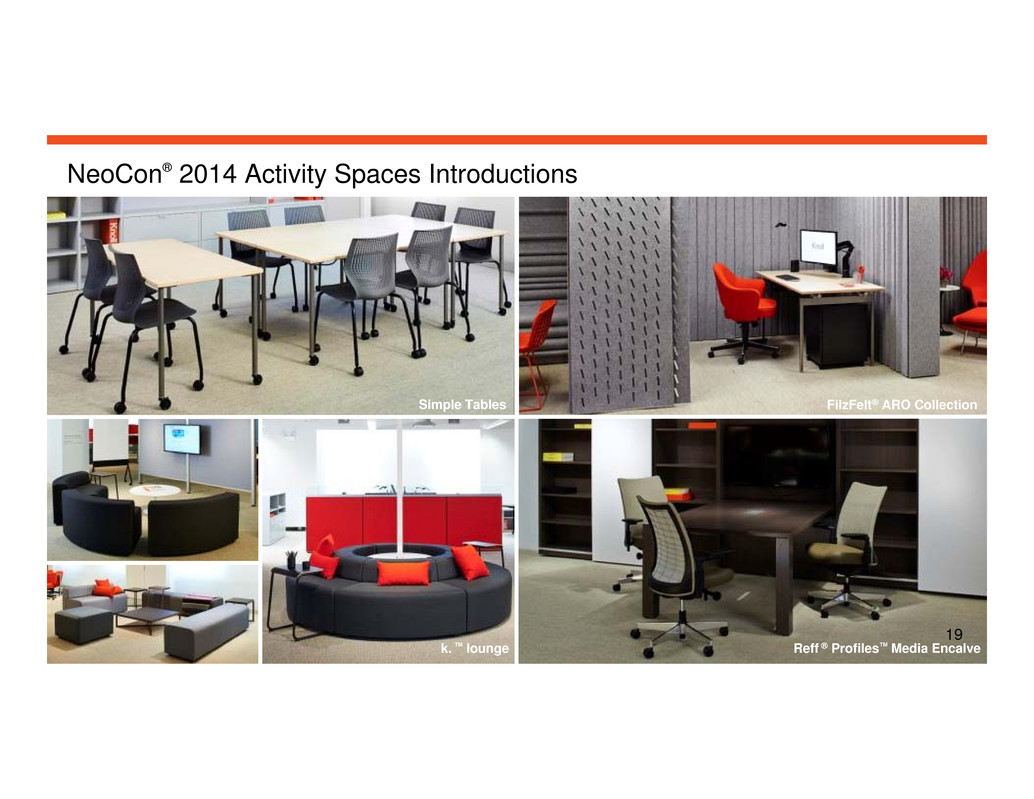

Reff ® Profiles™ Media Encalve FilzFelt® ARO Collection k. ™ lounge Simple Tables NeoCon® 2014 Activity Spaces Introductions 19

+ Maximize office segment growth & profitability + Target underpenetrated and emerging categories and markets for growth + Expand reach into consumer and decorator channels around the world + Build a responsive and efficient technology infrastructure across our businesses Four Strategic Imperatives 20

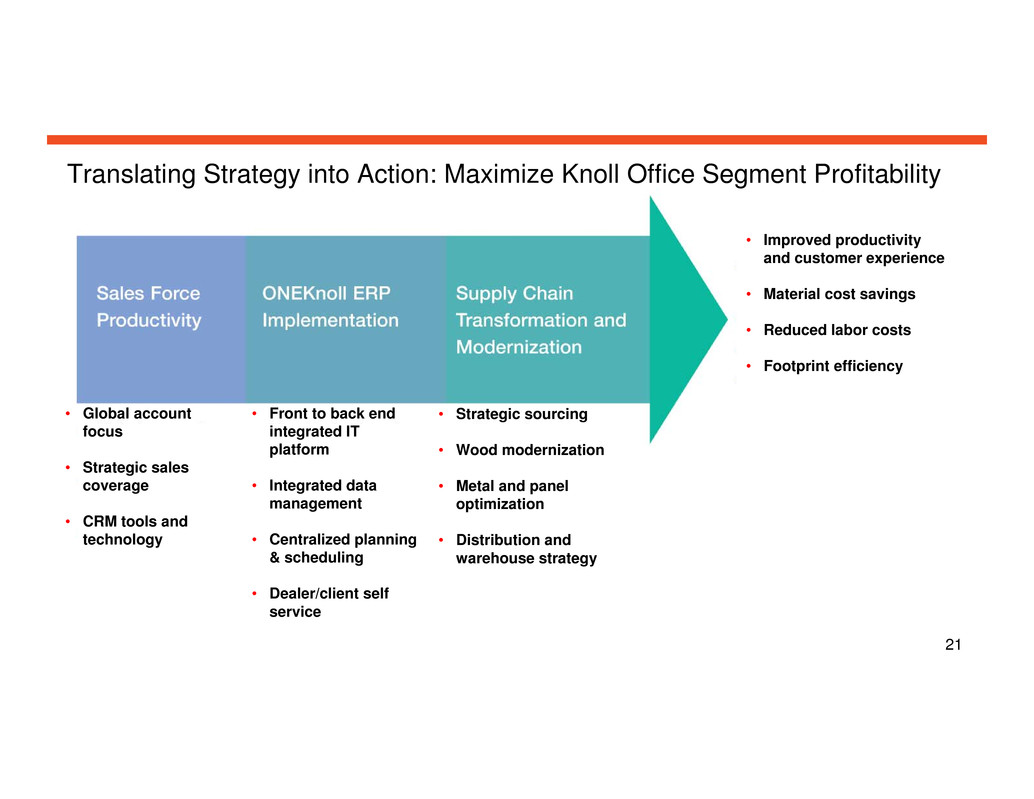

Translating Strategy into Action: Maximize Knoll Office Segment Profitability 21 • Global account focus • Strategic sales coverage • CRM tools and technology • Front to back end integrated IT platform • Integrated data management • Centralized planning & scheduling • Dealer/client self service • Strategic sourcing • Wood modernization • Metal and panel optimization • Distribution and warehouse strategy • Improved productivity and customer experience • Material cost savings • Reduced labor costs • Footprint efficiency

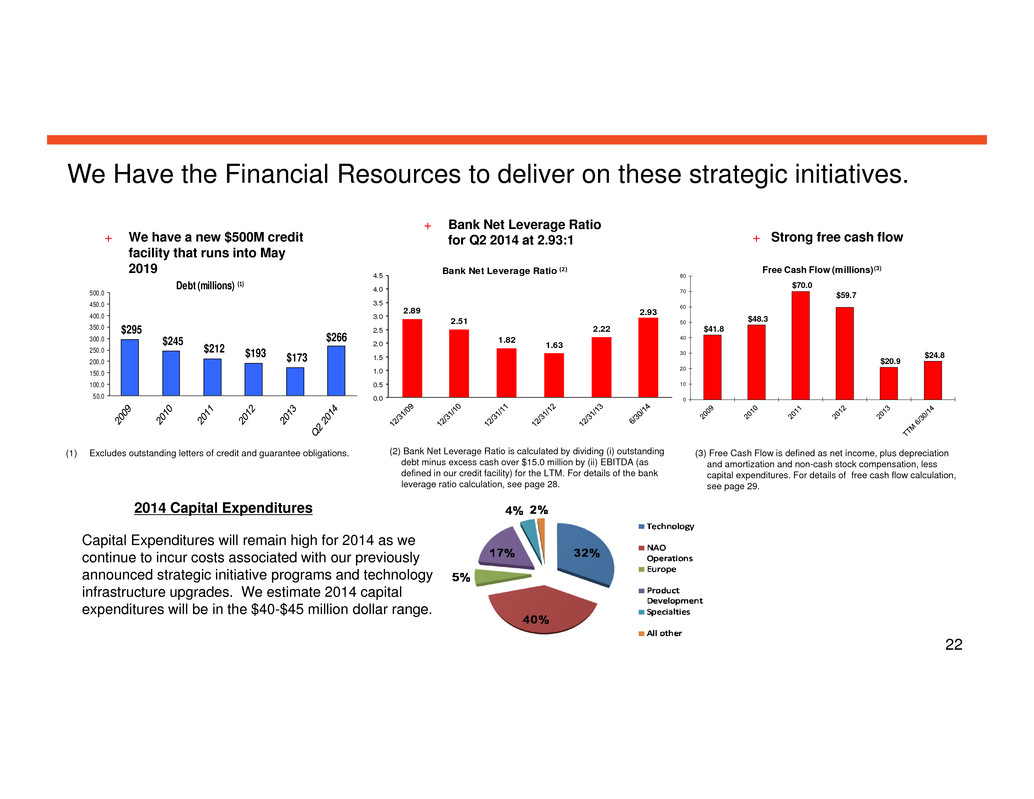

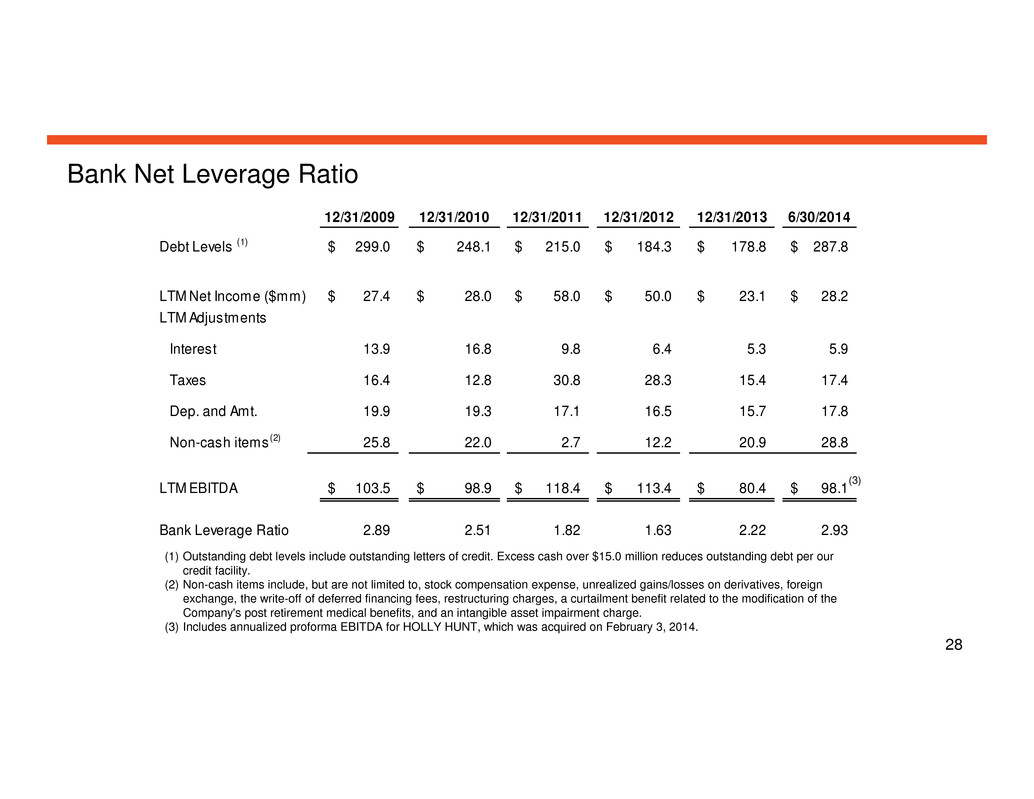

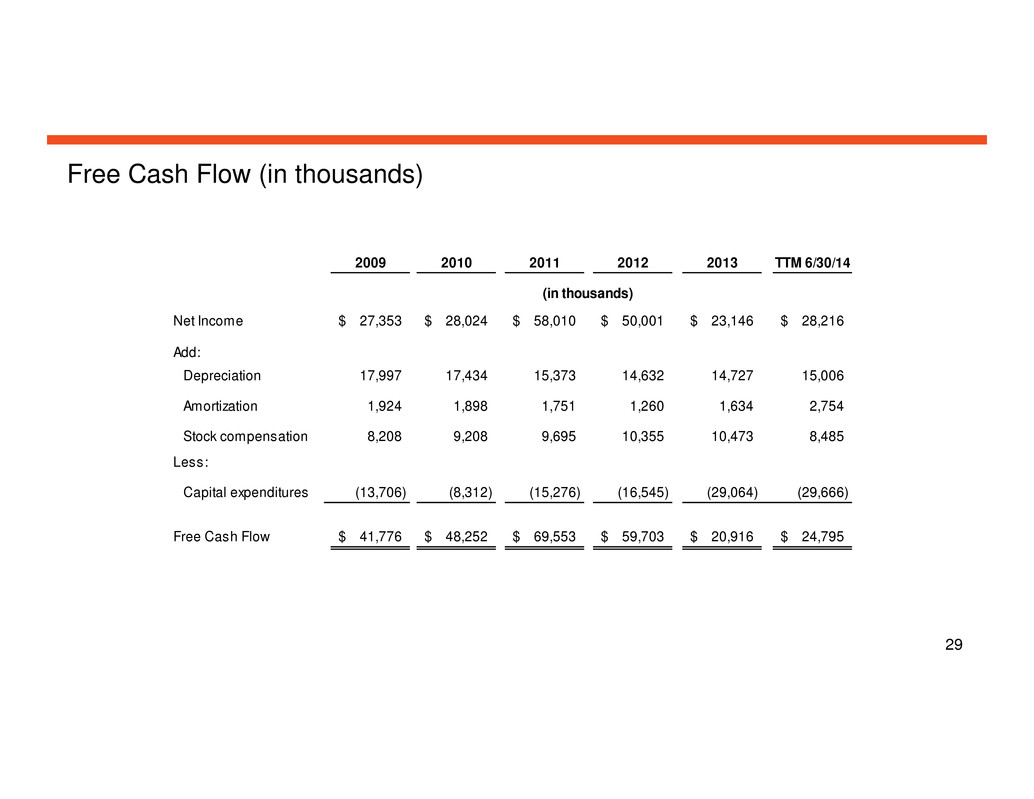

We Have the Financial Resources to deliver on these strategic initiatives. + We have a new $500M credit facility that runs into May 2019 + Bank Net Leverage Ratio for Q2 2014 at 2.93:1 $295 $245 $212 $193 $173 $266 50.0 100.0 150.0 200.0 250.0 300.0 350.0 400.0 450.0 500.0 Debt (millions) (1) $41.8 $48.3 $70.0 $59.7 $20.9 $24.8 0 10 20 30 40 50 60 70 80 Free Cash Flow (millions)(3) Capital Expenditures will remain high for 2014 as we continue to incur costs associated with our previously announced strategic initiative programs and technology infrastructure upgrades. We estimate 2014 capital expenditures will be in the $40-$45 million dollar range. 2.89 2.51 1.82 1.63 2.22 2.93 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 Bank Net Leverage Ratio (2) + Strong free cash flow (1) Excludes outstanding letters of credit and guarantee obligations. (2) Bank Net Leverage Ratio is calculated by dividing (i) outstanding debt minus excess cash over $15.0 million by (ii) EBITDA (as defined in our credit facility) for the LTM. For details of the bank leverage ratio calculation, see page 28. (3) Free Cash Flow is defined as net income, plus depreciation and amortization and non-cash stock compensation, less capital expenditures. For details of free cash flow calculation, see page 29. 2014 Capital Expenditures 22

For more information visit www.knoll.com

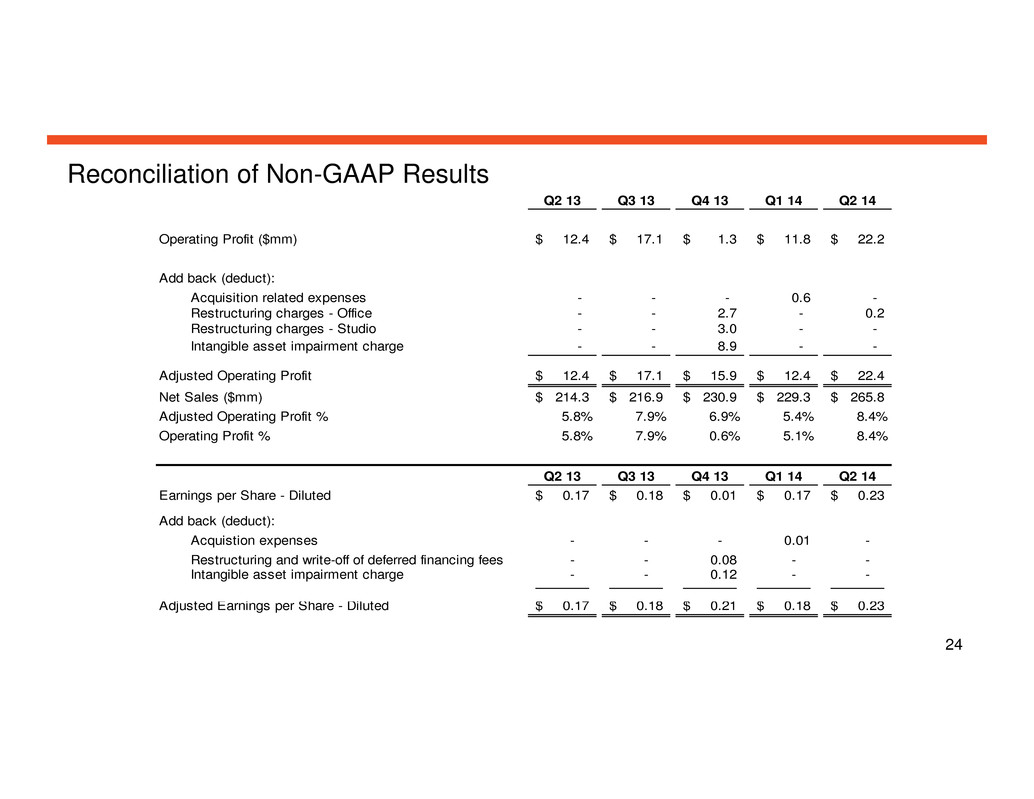

Reconciliation of Non-GAAP Results 24 Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Operating Profit ($mm) 12.4$ 17.1$ 1.3$ 11.8$ 22.2$ Add back (deduct): Acquisition related expenses - - - 0.6 - Restructuring charges - Office - - 2.7 - 0.2 Restructuring charges - Studio - - 3.0 - - Intangible asset impairment charge - - 8.9 - - Adjusted Operating Profit 12.4$ 17.1$ 15.9$ 12.4$ 22.4$ Net Sales ($mm) 214.3$ 216.9$ 230.9$ 229.3$ 265.8$ Adjusted Operating Profit % 5.8% 7.9% 6.9% 5.4% 8.4% Operating Profit % 5.8% 7.9% 0.6% 5.1% 8.4% Q2 13 Q3 13 Q4 13 Q1 14 Q2 14 Earnings per Share - Diluted 0.17$ 0.18$ 0.01$ 0.17$ 0.23$ Add back (deduct): Acquistion expenses - - - 0.01 - Restructuring and write-off of deferred financing fees - - 0.08 - - Intangible asset impairment charge - - 0.12 - - Adjusted Earnings per Share - Diluted 0.17$ 0.18$ 0.21$ 0.18$ 0.23$

YTD June 2013 YTD June 2014 Operating Profit ($mm) 22.7$ 34.0$ Add back (deduct): Acquisition related expenses - 0.6 Restructuring charges - Office - 0.2 Adjusted Operating Profit 22.7$ 34.8$ Net Sales ($mm) 414.9$ 495.1$ Adjusted Operating Profit % 5.5% 7.0% Operating Profit % 5.5% 6.9% YTD June 2013 YTD June 2014 Earnings per Share - Diluted 0.29$ 0.40$ Add back (deduct): Acquistion expenses - 0.01 Adjusted Earnings per Share - Diluted 0.29$ 0.41$ Reconciliation of Non-GAAP Results 25

Reconciliation of Non-GAAP Results 26

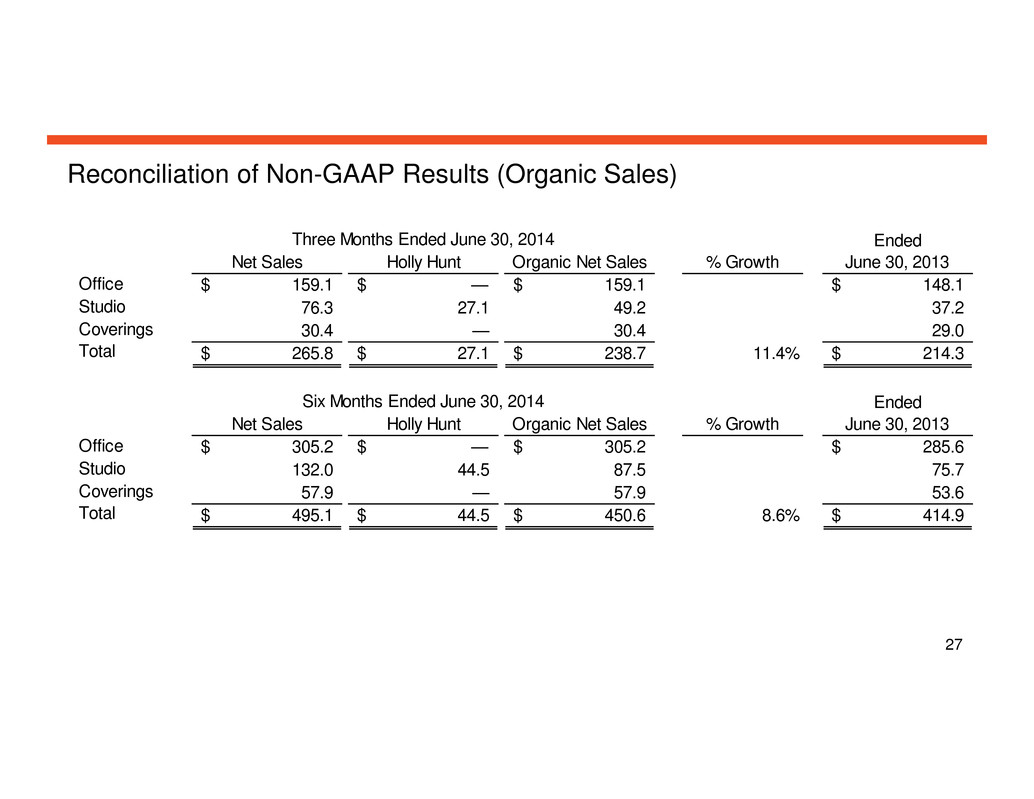

Reconciliation of Non-GAAP Results (Organic Sales) Net Sales Holly Hunt Organic Net Sales % Growth Office 159.1$ $ — 159.1$ 148.1$ Studio 76.3 27.1 49.2 37.2 Coverings 30.4 — 30.4 29.0 Total 265.8$ 27.1$ 238.7$ 11.4% 214.3$ Net Sales Holly Hunt Organic Net Sales % Growth Office 305.2$ $ — 305.2$ 285.6$ Studio 132.0 44.5 87.5 75.7 Coverings 57.9 — 57.9 53.6 Total 495.1$ 44.5$ 450.6$ 8.6% 414.9$ Three Months Ended June 30, 2014 Ended June 30, 2013 Six Months Ended June 30, 2014 Ended June 30, 2013 27

(1) Outstanding debt levels include outstanding letters of credit. Excess cash over $15.0 million reduces outstanding debt per our credit facility. (2) Non-cash items include, but are not limited to, stock compensation expense, unrealized gains/losses on derivatives, foreign exchange, the write-off of deferred financing fees, restructuring charges, a curtailment benefit related to the modification of the Company's post retirement medical benefits, and an intangible asset impairment charge. (3) Includes annualized proforma EBITDA for HOLLY HUNT, which was acquired on February 3, 2014. Bank Net Leverage Ratio 12/31/2009 12/31/2010 12/31/2011 12/31/2012 12/31/2013 6/30/2014 Debt Levels (1) 299.0$ 248.1$ 215.0$ 184.3$ 178.8$ 287.8$ LTM Net Income ($mm) 27.4$ 28.0$ 58.0$ 50.0$ 23.1$ 28.2$ LTM Adjustments Interest 13.9 16.8 9.8 6.4 5.3 5.9 Taxes 16.4 12.8 30.8 28.3 15.4 17.4 Dep. and Amt. 19.9 19.3 17.1 16.5 15.7 17.8 Non-cash items(2) 25.8 22.0 2.7 12.2 20.9 28.8 LTM EBITDA 103.5$ 98.9$ 118.4$ 113.4$ 80.4$ 98.1$ Bank Leverage Ratio 2.89 2.51 1.82 1.63 2.22 2.93 28 (3)

Free Cash Flow (in thousands) 2009 2010 2011 2012 2013 TTM 6/30/14 Net Income 27,353$ 28,024$ 58,010$ 50,001$ 23,146$ 28,216$ Add: Depreciation 17,997 17,434 15,373 14,632 14,727 15,006 Amortization 1,924 1,898 1,751 1,260 1,634 2,754 Stock compensation 8,208 9,208 9,695 10,355 10,473 8,485 Less: Capital expenditures (13,706) (8,312) (15,276) (16,545) (29,064) (29,666) Free Cash Flow 41,776$ 48,252$ 69,553$ 59,703$ 20,916$ 24,795$ (in thousands) 29