Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Viabuilt Ventures Inc. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - Viabuilt Ventures Inc. | mdsv_ex311.htm |

| EX-32.1 - CERTIFICATION - Viabuilt Ventures Inc. | mdsv_ex321.htm |

| EX-31.2 - CERTIFICATION - Viabuilt Ventures Inc. | mdsv_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2014

Commission File No. 333-188753

|

MADISON VENTURES INC.

|

(Exact name of registrant as specified in its charter)

|

Nevada

|

None

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

1208 Tamarind Road

Dasmarinas Village, Makati City

Metro Manila, Philippines 1222

(Address of principal executive offices, zip code)

+52 (442) 388-2645

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes x No ¨

At September 30, 2013, the last business day of the Registrant’s most recently completed second fiscal quarter, the aggregate market value of the voting common stock held by non-affiliates of the Registrant (without admitting that any person whose shares are not included in such calculation is an affiliate) was $0. At July 10, 2014, there were 6,850,000 shares of the Registrant’s common stock, par value $0.001 per share, outstanding. At March 31, 2014, the end of the Registrant’s most recently completed fiscal year there were 6,850,000 shares of the Registrant’s common stock, par value $0.001 per share, outstanding.

MADISON VENTURES INC.

TABLE OF CONTENTS

|

Page No.

|

|||||

|

PART I

|

|||||

|

Item 1.

|

Business

|

4

|

|||

|

Item 1A.

|

Risk Factors

|

17

|

|||

|

Item 1B.

|

Unresolved Staff Comments

|

17

|

|||

|

Item 2.

|

Properties

|

17

|

|||

|

Item 3.

|

Legal Proceedings

|

17

|

|||

|

Item 4.

|

Mine Safety Disclosures

|

17

|

|||

|

PART II

|

|||||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

18

|

|||

|

Item 6.

|

Selected Financial Data

|

19

|

|||

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

19

|

|||

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|||

|

Item 8.

|

Financial Statements and Supplementary Data

|

22

|

|||

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

23

|

|||

|

Item 9A.

|

Controls and Procedures

|

23

|

|||

|

Item 9B.

|

Other Information

|

24

|

|||

|

PART III

|

|||||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

25

|

|||

|

Item 11.

|

Executive Compensation

|

27

|

|||

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

29

|

|||

|

Certain Relationships and Related Transactions, and Director Independence

|

29

|

||||

|

Item 14.

|

Principal Accounting Fees and Services

|

29

|

|||

|

PART IV

|

|||||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

30

|

|||

|

Signatures

|

31

|

||||

2

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K of Madison Ventures Inc., a Nevada corporation, contains “forward-looking statements,” as defined in the United States Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terminology such as “may”, “will”, “should”, “could”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of such terms and other comparable terminology. These forward-looking statements include, without limitation, statements about our market opportunity, our strategies, competition, expected activities and expenditures as we pursue our business plan, and the adequacy of our available cash resources. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Actual results may differ materially from the predictions discussed in these forward-looking statements. The economic environment within which we operate could materially affect our actual results.

Our management has included projections and estimates in this Form 10-K, which are based primarily on management’s experience in the industry, assessments of our results of operations, discussions and negotiations with third parties and a review of information filed by our competitors with the SEC or otherwise publicly available. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

All references in this Form 10-K to the “Company”, “Madison Ventures”, “we”, “us,” or “our” are to Madison Ventures Inc.

3

ORGANIZATION WITHIN THE LAST FIVE YEARS

On September 14, 2009, the Company was incorporated under the laws of the State of Nevada. We are engaged in the business of acquisition, exploration and development of natural resource properties.

Gene Gregorio has served as our President, Secretary and Treasurer, and a director from April 2, 2014 until the present time. From September 14, 2009, until April 2, 2014, Art Kerry served as our President, Secretary and Treasurer and a director. From September 14, 2009, until April 2, 2014 Ivan Arredondo served as a director. Our board of directors is comprised of one person: Gene Grgorio.

We are authorized to issue 75,000,000 shares of common stock, par value $.001 per share. We currently have 6,850,000 shares of common stock, par value $0.001 per share, outstanding.

On March 3, 2012 we entered into a Mineral Property Option Agreement (the “Option Agreement”) with Brian Fowler, William Roberts and Jason Shaver (collectively, “Optionors”), whereby we have the right to acquire a 100% interest in three mining claims, claims numbers 4263523, 4263524 and 4266933 (collectively, the “Johnny Lake Property”), located in the Thunder Bay Mining District of the Province of Ontario, Canada. In order exercise our option to acquire 100% of the claims underlying the Johnny Lake Property, the Option Agreement requires us to make a total of $30,000 in payments to the Optionors, in four payments, as follows: (i) an initial cash payment of $15,000 (the obligation of which to pay was deferred by the Optionors for eight months, but was paid by us prior to the expiration of the eight-month period), (ii) $5,000 on or before March 3, 2013, which $5,000 we paid on March 3, 2013, (iii) $5,000 on or before March 3, 2014, which $5,000 we paid on February 25, 2014 and (iv) $5,000 on or before March 3, 2015. A net smelter royalty (“NSR”) of 2% is carried by the Optionors through the life of mine on the property. The Company has the right to purchase at any time 1% of the NSR from the Optionors for $1,000,000, and the option expires March 3, 2015. The remaining payment under the Mineral Property Option Agreement is $5,000. We plan to pay for the $5,000 with funds we raise from equity or debt financing. If we fail to pay the exercise price, we will not have the right to conduct exploration activities at all. Currently, we do not have sufficient funds to pay the exercise price. We cannot provide investors with any assurance that we will be able to raise sufficient funds pay the exercise price, and we have no current plans on how to raise the additional funding.

The Optionors have the right to terminate the Option Agreement if we fail to make any payment due to Optionors, on written notice to us and after 90 days we have failed to make the payment(s) due. We have the right to terminate the Option Agreement at any time.

We retained a consulting geologist, Caitlin Jeffs, P.Geo., to prepare an evaluation report on the Johnny Lake Property. We intend to conduct exploratory activities on the Johnny Lake Property and if feasible, develop the prospects.

IN GENERAL

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We currently hold an option, under the Option Agreement, to acquire a 100% undivided interest the Johnny Lake Property located in the Thunder Bay Mining District of the Province of Ontario, Canada. We are currently conducting mineral exploration activities on the Johnny Lake Property in order to assess whether it contains any commercially exploitable mineral reserves. Currently there are no known mineral reserves on the Johnny Lake Property.

4

Since our inception, we have not earned any revenues to date and our net losses are $39,213 at March 31, 2014. Our independent auditor has issued an audit opinion which includes a statement expressing substantial doubt as to our ability to continue as a going concern. The source of information contained in this discussion is our geology report prepared by Caitlin Jeffs, P.Geo., dated March 18, 2013.

While we intend to test for commercially viable reserves of gold, sulphur and pyrite occurrence with secondary silver, there is the likelihood of our mineral claim containing little or no economic mineralization or reserves of gold and other minerals. We are presently in the exploration stage of our business and we can provide no assurance that any commercially viable mineral deposits exist on our mineral claims, that we will discover commercially exploitable levels of mineral resources on our property, or, if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final determination can be made as to whether our mineral claims possess commercially exploitable mineral deposits. If our claim does not contain any reserves all funds that we spend on exploration will be lost.

We have no current plans, proposals or arrangements, written or otherwise, to seek a business combination with another entity in the near future.

POTENTIAL ACQUISITION OF THE JOHNNY LAKE PROPERTY

On March 3, 2012, we purchased an option to acquire a 100% undivided interest in three mineral claims, known as the Johnny Lake Property, located in the Thunder Bay Mining District of the Province of Ontario, Canada, under the terms of the Option Agreement. The mineral claims underlying the option were granted by the Ministry of Northern development and Mines, Province of Ontario, Canada, on March 5, 2012.

We engaged Fladgate Exploration Consulting Corporation to prepare a geological evaluation report on the Johnny Lake Property. Caitlin Jeffs, HBSc, P.Geo. is the professional geologist who authored the report. Ms. Jeffs graduated from the University of British Columbia in 2002 with an honors bachelor of science in geology. She is a professional geologist on the register of the Association of Professional Geoscientists of Ontario.

The work completed by Ms. Jeffs in preparing the geological report consisted of a review of geological data from previous exploration within the region. The acquisition of this data involved the research and investigation of historical files to locate and retrieve data information acquired by previous exploration companies in the area of the mineral claims.

We received the geological evaluation report on the Johnny Lake Property entitled “Johnny Lake Property; Property Review Report” prepared by Ms. Jeffs on March 18, 2013. The geological report summarizes the results of the history of the exploration of the mineral claims, the regional and local geology of the mineral claims and the mineralization and the geological formations identified as a result of the prior exploration. The geological report also gives conclusions regarding potential mineralization of the mineral claims and recommends a further geological exploration program on the mineral claims. The description of the Johnny Lake Property provided below is based on Ms. Jeffs’s report.

DESCRIPTION OF PROPERTY

The Johnny Lake Property is located in the Thunder Bay South District of the Thunder Bay Mining Division and the Thunder Bay Ministry of Natural Resources District, Ontario, Canada, approximately 55 km west of Marathon, Ontario and 28 km east of Terrace Bay, Ontario. The Johnny Lake Property is accessible via a trappers trail from the Trans-Canada Highway, then by boat to the north end of Johnny Lake. The Johnny Lake Property has was water from a river which flows through the property, and the source of power is from a transmission cable approximately 1 mile north of the property.

5

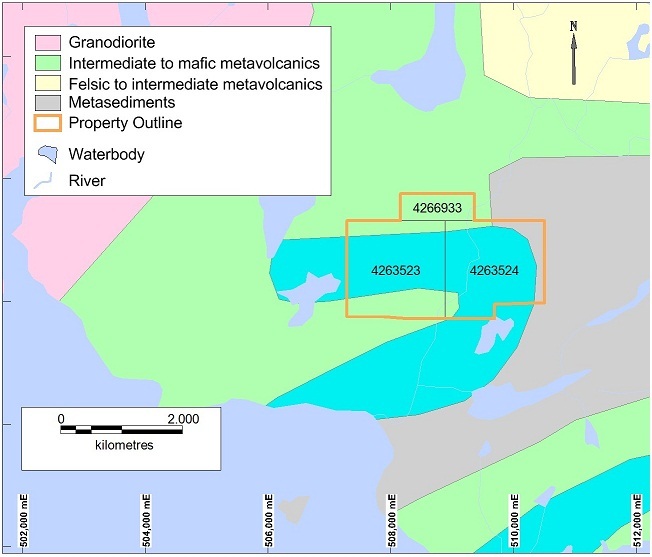

The Johnny Lake Property consists of 3 contiguous claims blocks known as the Johnny Lake Property. The claims are comprised of 3 mining claims totaling 34 units and covering 543.9 hectares. It is approximately 3.2 km long by 2.0 km wide in an irregular shape. The Johnny Lake Property is covered by National Topographic System (NTS) map sheet 42D/15SW. The center of the Johnny Lake Property has approximate geographic coordinates of Latitude 48 o 47’43” North, Longitude 86 o 52’44” West, UTM NAD 83, Zone 16, 508894.6 mE, 5404705.3 mN.

Mineral rights at the Johnny Lake Property are acquired from the Province of Ontario, Canada. By way of the Mineral Property Option Agreement, we have right to a lode claim and annual work expenditures of $13,600, on an annual basis, must be made on the Johnny Lake Property in order to maintain rights to the claim. Each year, a work report by the Company’s consulting geologist has to be filed with the Province on Ontario, detailing the work expenditures of the prior year.

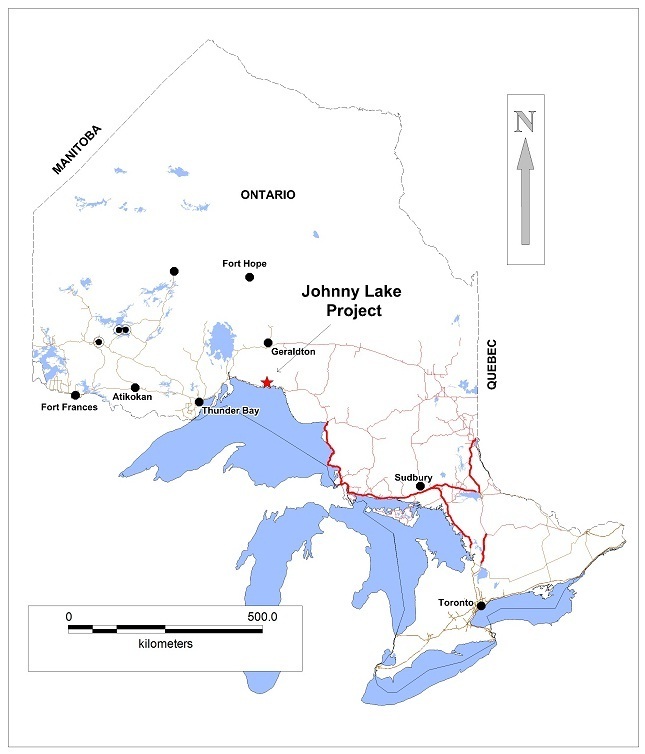

ACCESSIBILITY

The Johnny Lake Property is located in the Thunder Bay South District of the Thunder Bay Mining Division and the Thunder Bay Ministry of Natural Resources District, Ontario, Canada, approximately 55 km west of Marathon, Ontario and 28 km east of Terrace Bay, Ontario (Figure 1). The property is accessible from the north shore of Johnny Lake and the northeast shore of Foxxe Lake, both lakes are located on the north side of Highway 11/17.

[remainder of page intentionally left blank]

6

Figure 1 – Johnny Lake Johnny Lake Property Location Map

7

PHYSIOGRAPHY, CLIMATE, VEGETATION & INFRASTRUCTURE

The Property lies on the northern shore of Lake Superior. Relief around the area of the properties varies from approximately 200 m (Lake Superior mean level at 180 m ASL) to 400 m above sea level. Topography in the region is highly variable, generally rising from Lake Superior in the south to a rugged Precambrian shield terrain characterized by large hills and rapid elevation changes.

The area is characterized by generally cooler spring and summer temperatures with relatively warmer fall and winter temperatures. Average spring and summer daily temperatures range from 1.7oC in April to 15.9oC in July. Fall and winter temperatures range from highs of 4.9oC in October to lows of -15.1oC in January. The moderate temperatures are a function of proximity to Lake Superior; the degree of moderation diminishes relative to the distance inland from the lake. Despite the moderating effect of the lake, temperatures of 33oC in July and -38oC in January have been recorded. The total annual precipitation is 892 mm of which 468 mm is in the form of rain, and the remaining 424 mm as snowfall. There are no guaranteed frost-free days, meaning that frost can occur at any time, even during the summer season.

The region is characterized by mid boreal forest which typically includes aspen, white birch, white spruce and balsam fir stands with abundant jack, red and white pine, particularly on rocky, topographic highs. Black spruce, balsam fir and alder are common in marshy areas and along drainage arteries. The forest also contains hundreds of plant species such as ferns, moss, fungi, shrubs and herbs.

Larger mammals in the area include moose, black bear and grey wolf. Smaller mammals include red fox, snowshoe hare, rabbits, beavers, otter, pine martins, porcupine and squirrels. Prominent Caribou herds exist on Slate Island, approximately 12 km south of the property with few Caribou documented on the mainland. Other wildlife of note include an increasing number of sandhill cranes, bald eagles (endangered in Ontario), loons, Ruffed and Spruce Grouse, a variety of ducks and smaller song birds.

Infrastructure proximal to the Property includes all season access roads and trails which connect to the Trans-Canada Highway. Skilled labor forces are available from both the community of Marathon and Terrace Bay. Access to hydro-electrical grid is also readily available. The city of Thunder Bay, Ontario, approximately 244 km west of the Johnny Lake Property, provides logistical and industrial support in addition to skilled labor. It is also the closest port to the property and provides seaboard access via Lake Superior.

[remainder of page intentionally left blank]

8

Figure 2 – Johnny Lake Property Contiguous Land Tenure

PROPERTY HISTORY

The quality assurance program associated with the sampling data presented in this “Property History” section is the Canadian “National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101).”

The Johnny Lake Property is composed of three contiguous claims which contain two historic Mineral Deposit Inventory (“MDI”) occurrences. Occurrences in the Johnny Lake Property area include:

|

·

|

MDI42D15SW00034 – Kingdom Occurrence. Described as a gold, sulphur and pyrite occurrence with secondary silver. The occurrence is located at NAD 83, Z 16, 507901 mE, 5405104 mN. Occurs in an Algoman-type sulphide facies iron formation which strikes northeast, dips sub-vertically and is up to 10 metres wide.

|

|

·

|

MDI42D15SW00018 – Steel Mountain Occurrence. Described as a sulphur and pyrite occurrence. Located at NAD 83, Z 16, 509140 mE, 5405668 mN. No description provided however probably represents Algoman-type sulphide facies iron formation, a potential target for economic gold mineralization.

|

9

The Johnny Lake Property has been explored for precious and base metals since the first discoveries in the area ca. 1950. Initial exploration efforts were for base metal deposits in light of the discovery of the Geco mine in Manitouwadge, Ontario. After Hemlo was discovered in the 1980’s, exploration focused on gold mineralization. Due to the numerous discoveries in the Steel Mountain area, the Ontario Geological Survey (“OGS”) commenced “Operation Treasure Hunt”, a lake sediment sampling program published in 1997 by Dyer in OGS Open File Report 5964.

Results of the high density regional lake sediment and water survey were plotted, outlining high, moderate and low priority target areas. In the Steel River area, target 17 was identified as a high priority target with anomalous Ni, Cr, Sb and Ag values indicating a magmatic sulphide signature on the Johnny Lake Property. North of the Johnny Lake Property in the Spider Lake area, target 21 outlined a medium priority target with anomalous Cu, Zn and Mo values indicating a base metal signature.

Though the OGS work did not highlight potential gold targets, the two historical MDI occurrences are described as gold in iron formation. The gold model suggests targeting dilatant zones where they intersect chemical traps such as at the Kingdom occurrence, where sulphide facies iron formation hosts gold mineralization. Base metal targets include magmatic Ni-Cu-Cr associated with mafic intrusions and Pb-Zn-Ag associated with meta-sedimentary and meta-volcanic rocks on the property. In general, the lithologic variability on the property should be explored for dilatant shear zone development along lithologic contacts as possible sites for Au and poly-metallic mineralization.

Historical assessment work on the property has been documented by the government since 1983 and includes a number of geophysical airborne magnetic and electromagnetic surveys between 1983 and 1985 followed by geological mapping and prospecting between 1995 and as recently as 2008. This work has yielded gold values up to 0.10 oz/t (3.1 g/t) Au at the Kingdom occurrence but no major discoveries have yet been made in the area. Table 2 lists the Johnny Lake Property’s exploration history since 1983.

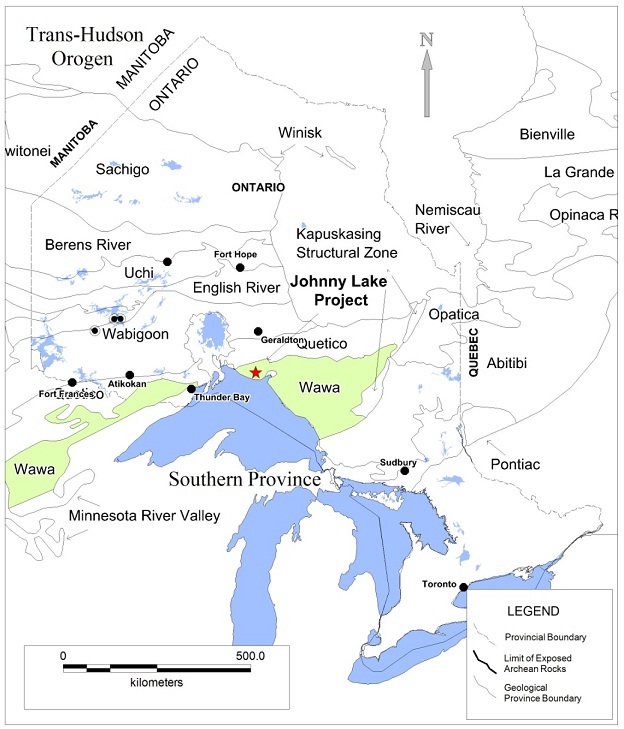

REGIONAL GEOLOGY

The Johnny Lake Property is underlain by Archaen supracrustal and plutonic rocks of the Wawa-Abitibi Sub-Province of the Superior Province (Figure 3).

[remainder of page intentionally left blank]

10

Figure 3 – Geologic Sub-Provinces of the Superior Province

11

PROPERTY GEOLOGY

The felsic volcanic sequences in the Steel River area form the core of an anticlinal sequence of rhyolite domes, coarse epiclastic breccias and thin, laterally discontinuous tuffaceous horizons that are intruded by felsic to mafic dykes. The southern portion of the belt is characterized by mafic volcanic rocks with intercalated sedimentary units, including Algoma-type iron formation, which have all been intruded by mafic to ultramafic intrusive bodies (Figure 4). The geology of the Kingdom occurrence is described as Algoma-type sulphide facies ironstone that strikes northeast, has a near vertical dip, and varies up to 10 m in width. The ironstone consists of interlaminated pyrite, graphitic slate, and minor chert. It is situated between graded turbidite sequences (and a possible tuffaceous unit) to the northwest and pillowed metavolcanics to the southeast. The metasediments have been folded and have a well-developed axial planar cleavage, especially in the graphitic slates. Late diabase dikes and a felsic porphyry intrude the sequence in the vicinity of the ironstone. Narrow quartz veins parallel to the cleavage are present (Patterson, 1984).

MINERALIZATION

A complex structural history exists in the belt that has never been adequately documented. A major antiform/synform exists north of the property, the axial plane trending east-west with felsic and meta-sedimentary horizons at the core and mafic volcanic horizons on the periphery. Numerous minor north-south trending faults are interpreted to offset felsic tuff and meta-sedimentary horizons. Late Riedel shears appear to develop locally along lithologic contacts and within chemical precipitate horizons creating en-echelon quartz veining and depositing gold.

[remainder of page intentionally left blank]

12

Figure 4 – Geology of the Schreiber-Hemlo Greenstone Belt, Johnny Lake Project Area

EXPLORATION POTENTIAL

The Johnny Lake Property lies in a rugged and underexplored portion of the Schreiber-Hemlo greenstone belt. Based on historic work completed in the Johnny Lake Property area, Fladgate recommends a two phase exploration program designed to further examine the potential for economically viable gold or magmatic Ni-Cu-Co mineralization that may exist on the property. Phase one would consist of line-cutting and soil sampling followed by a phase two program of geological mapping, prospecting and litho-geochemical sampling. Fladgate suggests a total budget of approximately $115,459.00 to complete the work programs.

Phase 1 Line-cutting & Soil Sampling

The phase one soil sampling program would include cutting a 200m spaced grid across high priority portions of the Property. Soil geochemical samples would be taken every 25m to evaluate targets obscured by areas of thick overburden. The Johnny Lake Property would require approximately 17 line kilometres in two separate grids and 300 soil samples. Fladgate suggests $40,422 to complete this work. Phase 1 would take approximately 15 days to complete.

13

Table 3 – Phase One Budget Recommendations – Johnny Lake Property

|

Item

|

Units

|

Unit Cost ($/unit)

|

Units

|

Cost

|

|

Line-cutting

|

Ln-km

|

$700

|

17

|

$11,900

|

|

Soil Geochemical Assays

|

Sample

|

$20

|

600

|

$12,000

|

|

Transportation

|

Month

|

$2,000

|

1/2

|

$1,000

|

|

Accommodation & Meals

|

Month

|

$4,500

|

1/2

|

$2,250

|

|

Soil Sampling Labor

|

Day

|

$800

|

5

|

$4,000

|

|

Compilation & Reporting

|

Day

|

$800

|

5

|

$4,000

|

|

Sub-Total

|

|

|

|

$35,150

|

|

15% Contingency

|

|

|

|

$5,272

|

|

Total

|

|

|

|

$40,422

|

The basis of the foregoing cost estimates are from the geological exploration advice of Caitlin Jeffs, our professional consulting geologist.

Phase 2 Geological Mapping, Litho-geochemical Sampling & Prospecting

The phase two program would include geological mapping and litho-geochemical sampling of the grid to outline high priority exploration targets. Property wide prospecting will also be useful to generate targets and develop current targets. The Johnny Lake Property would require two field mapping crews and one prospecting crew for approximately 15 days to map and prospect the Property. Fladgate suggests $75,037 to complete this work. Phase 2 would take approximately 15 days to complete.

Table 4 – Phase Two Budget Recommendations – Johnny Lake Property

|

Item

|

Units

|

Unit Cost ($/unit)

|

Units

|

Cost

|

|

Prospecting Samples

|

Sample

|

$30

|

300

|

$9,000

|

|

Litho-Geochemical Assays

|

Sample

|

$80

|

50

|

$4,000

|

|

Transportation

|

Month

|

$2,000

|

1/2

|

$1,000

|

|

Accommodation & Meals

|

Month

|

$4,500

|

1/2

|

$2,250

|

|

Prospecting Labor

|

Day

|

$400

|

60

|

$24,000

|

|

Geological Mapping

|

Day

|

$700

|

30

|

$21,000

|

|

Compilation & Reporting

|

Day

|

$800

|

5

|

$4,000

|

|

Sub-Total

|

|

|

|

$65,250

|

|

15% Contingency

|

|

|

|

$9,787

|

|

Total

|

|

|

|

$75,037

|

The basis of the foregoing cost estimates are from the geological exploration advice of Caitlin Jeffs, our professional consulting geologist. Such costs will not differ depending on the minerals we find in Phase I.

14

CONDITIONS TO RETAIN TITLE TO THE CLAIM

Under the laws and regulations of the Province of Ontario, Canada, the mining claims underlying the Property are subject to annual exploration expenditures. Minimum annual exploration expenditures for the 3 claims in the Johnny Lake Property are $13,600.

No permits are required at the present time because of the early stage of exploration by the Company. Mineral rights are government-owned and cannot be purchased, but only leased, by individuals or companies. Under the Canadian Constitution, the regulation of mining activities on publicly owned mineral leases falls under provincial/territorial government jurisdiction. Thus, there is separate mining rights legislation for each of the thirteen Canadian jurisdictions except Nunavut (the northern and eastern portions of the former Northwest Territories that became a separate territory on April 1, 1999). In the Province of Ontario, where the Johnny Lake Property is situated, companies must obtain a prospector's license before engaging in exploration for minerals. Holders of claims in good standing must obtain a mining lease from the Province of Ontario in order to proceed with the development of a property into a mine. Mining leases require that claim boundaries be surveyed by a Registered Land Surveyor.

COMPETITIVE CONDITIONS

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are a very early stage mineral exploration company and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies. We have no competitive position or advantage in the mining industry.

Methods of competition in the mining industry are to discover, acquire and finance the development of mineral properties considered to have commercial potential before other competitors do. In addition, mining companies compete with each other by acquiring and utilizing mineral exploration equipment and hiring qualified mineral exploration and development personnel before competitors do.

GOVERNMENT APPROVALS AND RECOMMENDATIONS

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in Canada and the Province of Ontario.

COSTS AND EFFECTS OF COMPLIANCE WITH ENVIRONMENTAL LAWS

We currently have no costs to comply with environmental laws concerning our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all work undertaken which causes sufficient surface disturbance to necessitate reclamation work. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to a natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused, i.e. refilling trenches after sampling or cleaning up fuel spills. Our initial programs do not require any reclamation or remediation other than minor clean up and removal of supplies because of minimal disturbance to the ground. The amount of these costs is not known at this time as we do not know the extent of the exploration program we will undertake, beyond completion of the recommended three phases described in the chart below. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on our earnings or competitive position in the event a potentially economic deposit is discovered.

15

EMPLOYEES

We currently have no employees other than our directors and officers. We intend to retain the services of geologists, prospectors and consultants on a contract basis to conduct the exploration programs on our mineral claims and to assist with regulatory compliance and preparation of financial statements.

OUR EXECUTIVE OFFICES

Our executive offices are located at 1208 Tamarind Road, Dasmarinas Village, Makati City, Metro Manila, Philippines 1222.

GOVERNMENT REGULATION

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies in any jurisdiction which we would conduct activities in the future. As of now there are no required government approvals present that we need approval from or any existing government regulation on our business.

RESEARCH AND DEVELOPMENT EXPENDITURES

We have not incurred any research expenditures since our incorporation.

BANKRUPTCY OR SIMILAR PROCEEDINGS

There has been no bankruptcy, receivership or similar proceeding.

REORGANIZATIONS, PURCHASE OR SALE OF ASSETS

There have been no material reclassifications, mergers, consolidations, or purchase or sale of a significant amount of assets not in the ordinary course of business.

PATENT, TRADEMARK, LICENSE & FRANCHISE RESTRICTIONS AND CONTRACTUAL OBLIGATIONS & CONCESSIONS

We currently do not own any intellectual property have not obtained any copyrights, patents or trademarks in respect of any intellectual property. Interactive entertainment software is susceptible to piracy and unauthorized copying. Our primary protection against unauthorized use, duplication and distribution of our services is copyright and trademark protection of our business consulting services and any related elements and enforcement to protect these interests. We do not anticipate filing any copyright or trademark applications related to any assets over the next 12 months.

We have not entered into any franchise agreements or other contracts that have given, or could give rise to obligations or concessions.

RESEARCH AND DEVELOPMENT ACTIVITIES AND COSTS

We have no research or development activities costs.

16

LEGAL PROCEEDINGS

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or stockholder is a party adverse to the Company or has a material interest adverse to the Company.

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

None.

ITEM 2. PROPERTIES

The Company’s principal offices are located at 1208 Tamarind Road, Dasmarinas Village, Makati City, Metro Manila, Philippines 1222.

ITEM 3. LEGAL PROCEEDINGS

We are not currently involved in any legal proceedings and we are not aware of any pending or potential legal actions.

ITEM 4. MINE SAFETY DISCLOSURES.

None.

17

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS MARKET INFORMATION

Since October 30, 2013 our shares of common stock have been quoted on the OTC Bulletin Board and the OTCPink tier of OTC Markets Group Inc., under the stock symbol “MAVT”. The following table shows the reported high and low closing bid prices per share for our common stock based on information provided by the OTCQB. The over-the-counter market quotations set forth for our common stock reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

|

BID PRICE PER SHARE

|

||||||||

|

HIGH

|

LOW

|

|||||||

|

Three Months Ended December 31, 2013

|

$

|

0.00

|

$

|

0.00

|

||||

|

Three Months Ended March 31, 2014

|

$

|

0.00

|

$

|

0.00

|

||||

|

Three Months Ended June 30, 2014

|

$

|

0.00

|

$

|

0.00

|

||||

TRANSFER AGENT

Our transfer agent is Globex Transfer, LLC, whose address is 780 Deltona Blvd., Suite 202, Deltona, Florida 32725, and whose telephone number is (813) 344-4490.

HOLDERS

As of March 31, 2014, the Company had 6,850,000 shares of our common stock issued and outstanding held by approximately 30 holders of record.

Historically, we have not paid any dividends to the holders of our common stock and we do not expect to pay any such dividends in the foreseeable future as we expect to retain our future earnings for use in the operation and expansion of our business.

RECENT SALES OF UNREGISTERED SECURITIES

None.

18

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

We have not established any compensation plans under which equity securities are authorized for issuance.

PURCHASES OF EQUITY SECURITIES BY THE REGISTRANT AND AFFILIATED PURCHASERS

We did not purchase any of our shares of common stock or other securities during the year ended March 31, 2014.

As a “smaller reporting company,” as defined in Rule 12b-2 of the Exchange Act, we are not required to provide the information called for by this Item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

RESULTS OF OPERATIONS

We have generated no revenues since inception and have incurred $39,213 in operating expenses from inception through March 31, 2014.

For the year ended March 31, 2014, we incurred $57,382 in operating expenses, comprised of $55,006 in professional fees, $1,975 in exploration costs, and $401 in general and administrative expenses. For the year ended March 31, 2013, we incurred $4,932 in operating expenses, consisting of $4,867 in exploration costs and $65 in general and administrative expenses.

Our net loss since inception (September 14, 2009) through March 31, 2014 was $39,213.

The following table provides selected financial data about our company for the years ended March 31, 2014 and 2013.

|

Balance Sheet Data

|

March 31, 2014

|

March 31, 2013

|

||||||

|

Cash and Cash Equivalents

|

$

|

106

|

$

|

32,164

|

||||

|

Total Assets

|

$

|

106

|

$

|

32,164

|

||||

|

Total Liabilities

|

$

|

6,803

|

$

|

-

|

||||

|

Shareholders’ Equity

|

$

|

18,287

|

$

|

52,148

|

||||

GOING CONCERN

Madison Ventures Inc. is an exploration stage company and currently has no operations. Our independent auditor has issued an audit opinion for Madison Ventures which includes a statement raising substantial doubt as to our ability to continue as a going concern.

19

LIQUIDITY AND CAPITAL RESOURCES

Our cash balance at March 31, 2014 was $106 with $6,803 in outstanding liabilities. Total expenditures over the next 12 months are expected to be approximately $152,984. If we experience a shortage of funds prior to generating revenues from operations we may utilize funds from our directors, who have informally agreed to advance funds to allow us to pay for operating costs, however they have no formal commitment, arrangement or legal obligation to advance or loan funds to us. Management believes our current cash balance will not be sufficient to fund our operations for the next twelve months.

PLAN OF OPERATION

Our plan of operation for the twelve months following the date of this Form 10-K is to complete the first and second phases of the exploration program on our prospects. In addition to the $115,459 we anticipate spending for the first two phases of the exploration program as outlined below, we anticipate spending an additional $12,525 on general and administration expenses and $25,000 complying with reporting obligations, and general administrative costs as a reporting issuer. Total expenditures over the next 12 months are therefore expected to be approximately $152,984. We will experience a shortage of funds prior to funding and we may utilize funds from our president, however he has no formal commitment, arrangement or legal obligation to advance or loan funds to the company.

PHASE 1

|

Item

|

Units

|

Unit Cost ($/unit)

|

Units

|

Cost

|

|

Line-cutting

|

Ln-km

|

$700

|

17

|

$11,900

|

|

Soil Geochemical Assays

|

Sample

|

$20

|

600

|

$12,000

|

|

Transportation

|

Month

|

$2,000

|

1/2

|

$1,000

|

|

Accommodation & Meals

|

Month

|

$4,500

|

1/2

|

$2,250

|

|

Soil Sampling Labor

|

Day

|

$800

|

5

|

$4,000

|

|

Compilation & Reporting

|

Day

|

$800

|

5

|

$4,000

|

|

Sub-Total

|

|

|

|

$35,150

|

|

15% Contingency

|

|

|

|

$5,272

|

|

Total

|

|

|

|

$40,422

|

|

Item

|

Units

|

Unit Cost ($/unit)

|

Units

|

Cost

|

|

Prospecting Samples

|

Sample

|

$30

|

300

|

$9,000

|

|

Litho-Geochemical Assays

|

Sample

|

$80

|

50

|

$4,000

|

|

Transportation

|

Month

|

$2,000

|

1/2

|

$1,000

|

|

Accommodation & Meals

|

Month

|

$4,500

|

1/2

|

$2,250

|

|

Prospecting Labor

|

Day

|

$400

|

60

|

$24,000

|

|

Geological Mapping

|

Day

|

$700

|

30

|

$21,000

|

|

Compilation & Reporting

|

Day

|

$800

|

5

|

$4,000

|

|

Sub-Total

|

|

|

|

$65,250

|

|

15% Contingency

|

|

|

|

$9,787

|

|

Total

|

|

|

|

$75,037

|

20

We plan to commence Phase 1 of the exploration program on the prospects in the fall of 2014. We expect this phase to take 15 days to complete and an additional one to two months for the geologist to prepare her report.

The above program costs are management’s estimates based upon the recommendations of the consulting geologist’s report and the actual project costs may exceed our estimates. To date, we have not commenced exploration.

Following Phase 1 of the exploration program, if it proves successful in identifying mineral deposits, we intend to proceed with Phase 2 of our exploration program. Management will rely on the consulting geologist’s recommendations in making a decision to proceed with Phase 2. Subject to the results of Phase 1, we anticipate commencing with Phase 2 in the winter of 2014. We will require additional funding to commence with Phase 1 work on the prospects; we have no current plans on how to raise the additional funding. We cannot provide any assurance that we will be able to raise sufficient funds to proceed with any work after the first phase of the exploration program.

On March 3, 2012 we entered into a Mineral Property Option Agreement (the “Option Agreement”) with Brian Fowler, William Roberts and Jason Shaver (collectively, “Optionors”), whereby we have the right to acquire a 100% interest in three mining claims, claims numbers 4263523, 4263524 and 4266933 (collectively, the “Johnny Lake Property”), located in the Thunder Bay Mining District of the Province of Ontario, Canada. In order exercise our option to acquire 100% of the claims underlying the Johnny Lake Property, the Option Agreement requires us to make a total of $30,000 in payments to the Optionors, in four payments, as follows: (i) an initial cash payment of $15,000 (the obligation of which to pay was deferred by the Optionors for eight months, but was paid by us prior to the expiration of the eight-month period), (ii) $5,000 on or before March 3, 2013, which $5,000 we paid on March 3, 2013, (iii) $5,000 on or before March 3, 2014, which $5,000 we paid on February 25, 2014 and (iv) $5,000 on or before March 3, 2015. A net smelter royalty (“NSR”) of 2% is carried by the Optionors through the life of mine on the property. The Company has the right to purchase at any time 1% of the NSR from the Optionors for $1,000,000, and the option expires March 3, 2015.

If we fail to pay the exercise price, we will not have the right to conduct exploration activities at all. Currently, we do not have sufficient funds to pay the exercise price. We cannot provide investors with any assurance that we will be able to raise sufficient funds pay the exercise price, and we have no current plans on how to raise the additional funding. In terms of exploratory work we will be able to conduct before we exercise the option, we anticipate completing Phases 1 and 2 of our Plan of Operation, subject to our ability to raise sufficient funds to complete Phases 1 and 2, and depending on the results of Phases 1 and 2, commencement of drilling of any significant targets generated during Phase 2 work.

BUDGET

ACCOUNTING AND AUDIT PLAN

We intend to continue to have our President prepare our quarterly and annual financial statements and have these financial statements reviewed or audited by our independent auditor. Our independent auditor is expected to charge us approximately $2,000 to review our quarterly financial statements and approximately $4,000 to audit our annual financial statements. In the next twelve months, we anticipate spending approximately $13,500 to pay for our accounting and audit requirements.

SEC FILING PLAN

We expect to incur filing costs of approximately $1,000 per quarter to support our quarterly and annual filings with the SEC. In the next twelve months, we anticipate spending approximately $10,000 for legal costs in connection with our three quarterly filings, annual filing, and other filings.

OFF-BALANCE SHEET ARRANGEMENTS

We have no off-balance sheet arrangements.

21

ITEM 8. FINANCIAL STATEMENTS

MADISON VENTURES INC.

(An Exploration Stage Company)

INDEX TO FINANCIAL STATEMENTS

Index To Financial Statements

|

Page

|

||||

|

Audited Financial Statements

|

||||

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|||

|

Balance Sheets as of March 31, 2014 and 2013

|

F-2

|

|||

|

Statements of Operations for the Years ended March 31, 2014 and 2013 and from Inception on September 14, 2009 through March 31, 2014

|

F-3

|

|||

|

Statements of Changes in Stockholders Equity from Inception on September 14, 2009 through March 31, 2014

|

F-4

|

|||

|

Statements of Cash Flows for the Years ended March 31, 2014 and 2013 and from Inception on September 14, 2009 through March 31, 2014

|

F-5

|

|||

|

Notes to the Financial Statements

|

F-6

|

|||

22

PLS CPA, A Professional Corp.

t 4725 MERCURY STREET SUITE 210 t SAN DIEGO t CALIFORNIA 92111 t

t TELEPHONE (858)722-5953 t FAX (858) 761-0341 t FAX (858) 764-5480

t E-MAIL changgpark@gmail.comt

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Stockholders

Madison Venture Inc.

(An Exploration Stage Company)

We have audited the accompanying balance sheet of Madison Venture Inc. (An Exploration Stage “Company”) as of March 31, 2014 and the related financial statements of operations, changes in shareholder’s equity and cash flows for the year ended March 31, 2014 and the period September 14, 2009 (inception) to March 31, 2014. These financial statements are the responsibility of the Company’s management.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Madison Venture Inc. as of March 31, 2014, and the results of its operation and its cash flows for the period from September 14, 2009 (inception) to March 31, 2014 in conformity with U.S. generally accepted accounting principles.

The financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 7 to the financial statements, the Company’s losses from operations raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ PLS CPA

PLS CPA, A Professional Corp.

July 14, 2014

San Diego, CA. 92111

Registered with the Public Company Accounting Oversight Board

F-1

MADISON VENTURES INC.

(An Exploration Stage Company)

Balance Sheets

|

March 31,

|

March 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$ | 106 | $ | 32,164 | ||||

|

Total current assets

|

106 | 32,164 | ||||||

|

Mineral Claim

|

24,984 | 19,984 | ||||||

|

Total assets

|

$ | 25,090 | $ | 52,148 | ||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$ | 5,978 | $ | - | ||||

|

Accrued liabilities

|

825 | - | ||||||

|

Due to related party

|

- | - | ||||||

|

Total current liabilities

|

6,803 | - | ||||||

|

Total Liabilities

|

6,803 | - | ||||||

|

Commitments and Contingencies

|

||||||||

|

Shareholders' equity:

|

||||||||

|

Common stock: 75,000,000 shares authorized of $0.001 par value;

|

||||||||

|

6,850,000 and 6,850,000 shares issued and outstanding as of

|

||||||||

|

March 31, 2014 and 2013

|

6,850 | 6,850 | ||||||

|

Additional paid-in capital

|

50,650 | 50,650 | ||||||

|

Accumulated deficit during exploration stage

|

(39,213 | ) | (5,352 | ) | ||||

|

Total shareholders' equity

|

18,287 | 52,148 | ||||||

|

Total liabilities and shareholders' equity

|

$ | 25,090 | $ | 52,148 | ||||

The accompanying notes are an integral part of these financial statements

F-2

MADISON VENTURES INC.

(An Exploration Stage Company)

Statements of Operations

|

Years Ended March 31,

|

Period from September

14, 2009

(Inception)

to March 31,

|

|||||||||||

|

2014

|

2013

|

2014 | ||||||||||

|

Operating costs:

|

||||||||||||

|

Mineral property exploration costs

|

$ | 1,975 | $ | 4,867 | $ | 6,842 | ||||||

|

Consulting and professional fees

|

55,006 | - | 55,006 | |||||||||

|

Other general & administrative expenses

|

401 | 65 | 965 | |||||||||

|

Total operating costs

|

57,382 | 4,932 | 62,813 | |||||||||

|

Other income (expenses)

|

||||||||||||

|

Interest income

|

- | 26 | 95 | |||||||||

|

Related party debt forgiveness

|

23,521 | - | 23,521 | |||||||||

|

Interest (expense)

|

- | (14 | ) | (16 | ) | |||||||

|

Total other income (expenses)

|

23,521 | 12 | 23,600 | |||||||||

|

Net (loss) income

|

$ | (33,861 | ) | $ | (4,920 | ) | $ | (39,213 | ) | |||

|

Loss per common share:

|

||||||||||||

|

Basic and diluted

|

$ | (0.00 | ) | $ | (0.00 | ) | ||||||

|

Weighted average common shares outstanding:

|

||||||||||||

|

Basic and diluted

|

6,850,000 | 6,661,096 | ||||||||||

The accompanying notes are an integral part of these financial statements

F-3

MADISON VENTURES INC.

(An Exploration Stage Company)

Statements of Changes in Stockholders' Equity

|

Accumulated

|

||||||||||||||||||||

|

deficit

|

||||||||||||||||||||

|

Common

|

Additional

|

during

|

||||||||||||||||||

|

Common

|

stock

|

paid-in

|

exploration

|

|||||||||||||||||

|

stock

|

amount

|

capital

|

stage

|

Total

|

||||||||||||||||

|

Balance, September 14, 2009 (inception)

|

- | $ | - | $ | - | $ | - | $ | - | |||||||||||

|

Shares issued to founders for cash

|

5,000,000 | 5,000 | - | - | 5,000 | |||||||||||||||

|

Shares issued for cash

|

1,250,000 | 1,250 | 11,250 | - | 12,500 | |||||||||||||||

|

Net loss, March 31, 2010

|

- | - | - | (14 | ) | (14 | ) | |||||||||||||

|

Balance, March 31, 2010

|

6,250,000 | 6,250 | 11,250 | (14 | ) | 17,486 | ||||||||||||||

|

Shares issued for cash

|

400,000 | 400 | 19,600 | - | 20,000 | |||||||||||||||

|

Net loss, March 31, 2011

|

- | - | - | (429 | ) | (429 | ) | |||||||||||||

|

Balance, March 31, 2011

|

6,650,000 | 6,650 | 30,850 | (443 | ) | 37,057 | ||||||||||||||

|

Net income, March 31, 2012

|

- | - | - | 11 | 11 | |||||||||||||||

|

Balance, March 31, 2012

|

6,650,000 | 6,650 | 30,850 | (432 | ) | 37,068 | ||||||||||||||

|

Shares issued for cash

|

200,000 | 200 | 19,800 | - | 20,000 | |||||||||||||||

|

Net loss, March 31, 2013

|

- | - | - | (4,920 | ) | (4,920 | ) | |||||||||||||

|

Balance, March 31, 2013

|

6,850,000 | $ | 6,850 | $ | 50,650 | $ | (5,352 | ) | $ | 52,148 | ||||||||||

|

Net loss, March 31, 2014

|

- | - | - | (33,861 | ) | (33,861 | ) | |||||||||||||

|

Balance, March 31, 2014

|

6,850,000 | $ | 6,850 | $ | 50,650 | $ | (39,213 | ) | $ | 18,287 | ||||||||||

The accompanying notes are an integral part of these financial statements

F-4

MADISON VENTURES INC.

(An Exploration Stage Company)

Statements of Cash Flows

|

For the Years Ended March 31,

|

Period from September

14, 2009

(Inception)

to March 31,

|

|||||||||||

|

2014

|

2013

|

2014 | ||||||||||

|

Cash flows from operating activities:

|

||||||||||||

|

Net (loss) income

|

$ | (33,861 | ) | $ | (4,920 | ) | $ | (39,213 | ) | |||

|

Adjustments to reconcile net loss to net cash (used in) provided by operating activities:

|

||||||||||||

|

Forgiveness of related party debt

|

(23,521 | ) | - | (23,521 | ) | |||||||

|

Changes in operating assets and liabilities:

|

||||||||||||

|

Accounts payable

|

5,978 | - | 5,978 | |||||||||

|

Accrued liabilities

|

825 | - | 825 | |||||||||

|

Deferred mineral option

|

- | (14,986 | ) | - | ||||||||

|

Net cash (used in) provided by operating activities

|

(50,579 | ) | (19,906 | ) | (55,931 | ) | ||||||

|

Cash flows from investing activities:

|

||||||||||||

|

Acquisition of mineral claim

|

(5,000 | ) | (5,000 | ) | (24,984 | ) | ||||||

|

Net cash (used in) investing activities

|

(5,000 | ) | (5,000 | ) | (24,984 | ) | ||||||

|

Cash flows from financing activities:

|

||||||||||||

|

Proceeds from related parties

|

23,521 | - | 23,521 | |||||||||

|

Proceeds from stock issuances

|

- | 20,000 | 57,500 | |||||||||

|

Net cash provided by financing activities

|

23,521 | 20,000 | 81,021 | |||||||||

|

Net (decrease) increase in cash

|

(32,058 | ) | (4,906 | ) | 106 | |||||||

|

Cash, beginning of the period

|

32,164 | 37,070 | - | |||||||||

|

Cash, end of the period

|

$ | 106 | $ | 32,164 | $ | 106 | ||||||

|

Non-cash investing and financing activities

|

$ | - | $ | - | $ | - | ||||||

|

Supplement cash flow disclosure:

|

||||||||||||

|

Interest paid

|

$ | - | $ | 16 | $ | 16 | ||||||

|

Income tax paid

|

$ | - | $ | - | $ | - | ||||||

The accompanying notes are an integral part of these financial statements

F-5

MADISON VENTURES INC.

(An Exploration Stage Company)

Notes to Financial Statements

As of March 31, 2014

1. Nature of operations

Madison Ventures Inc. (“Company”) was incorporated in the State of Nevada as a for-profit company on September 14, 2009 and established a fiscal year end of March 31. The Company is an Exploration Stage Company, as defined by the Financial Accounting Standards Board (“FASB”) Accounting Standards CodificationTM (the “Codification”) topic 915 “Development Stage Entities”. The Company is engaged in the acquisition, exploration and development of natural resource properties. The Company has no revenues and limited operating history.

The Company is in the process of evaluating its properties and has not yet determined whether these properties contain reserves that are economically recoverable. The success of the Company and the recoverability of the amounts shown for mineral properties are dependent upon the existence of economically recoverable reserves, the ability of the Company to obtain the necessary financing to complete exploration and development of the reserves, and upon future profitable production or proceeds from disposition of the properties.

2. Summary of significant accounting policies

Basis of Presentation

The Company's financial statements are presented in United States dollars and are prepared using the accrual method of accounting which conforms to generally accepted accounting principles in the United States of America (“US GAAP”).

Going Concern

These financial statements have been prepared on a going concern basis which assumes the Company will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Company anticipates future losses in the development of its business raising substantial doubt about the Company’s ability to continue as a going concern. The ability to continue as a going concern is dependent upon the Company generating profitable operations in the future and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. The Company’s operating expenditure plan for the following twelve months will require cash of approximately $65,000. Management intends to finance operating costs over the next twelve months with existing cash on hand and from the issuance of common shares.

Use of Estimates and Assumptions

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods presented. The Company is required to make judgments and estimates about the effect of matters that are inherently uncertain. The Company regularly evaluates estimates and assumptions related to the useful life and recoverability of long-lived assets, deferred income tax asset valuations and loss contingences. The Company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. Although, we believe our judgments and estimates are appropriate, actual future results may be different; if different assumptions or conditions were to prevail, the results could be materially different from our reported results.

Fair Value of Financial Instruments

Codification topic 825, “Financial Instruments”, requires disclosure of fair value information about financial instruments when it is practicable to estimate that value. The carrying amounts of the Company’s financial instruments as of March 31, 2014 and 2013 approximate their respective fair values because of the short-term nature of these instruments.

F-6

MADISON VENTURES INC.

(An Exploration Stage Company)

Notes to Financial Statements

As of March 31, 2014

2. Summary of significant accounting policies (continued)

Mineral Properties

Mineral property acquisition costs are capitalized in accordance with Codification topic 930 “Extractive Activities - Mining”. Mineral property pre-exploration and exploration costs are expensed as incurred. When it has been determined that a mineral property can be economically developed as a result of establishing proven and probable reserves, the costs incurred to develop such property are capitalized. To date the Company has not established any reserves on its mineral properties.

Long-Lived Assets

Long-Lived assets, such as property and equipment, mineral properties, and purchased intangibles with finite lives (subject to amortization), are evaluated for impairment whenever events or changes in circumstances indicate that the carrying amount of the asset may not be recoverable in accordance with Codification topic 360 “Property, Plant, and Equipment”. Circumstances which could trigger a review include, but are not limited to: significant decreases in the market price of the asset; significant adverse changes in the business climate or legal factors; accumulation of costs significantly in excess of the amount originally expected for the acquisition or construction of the asset; current period cash flow or operating losses combined with a history of losses or a forecast of continuing losses associated with the use of the asset; and current expectation that the asset will more likely than not be sold or disposed significantly before the end of its estimated useful life.

Recoverability of assets is measured by a comparison of the carrying amount of an asset to estimated undiscounted future cash flows expected to be generated by an asset. If the carrying amount of an asset exceeds its estimated future cash flows, an impairment charge is recognized as the amount by which the carrying amount exceeds the estimated fair value of the asset. The estimated fair value is determined using a discounted cash flow analysis. Any impairment in value is recognized as an expense in the period when the impairment occurs. The Company’s management has considered the conditions outlined in Codification topic 360 and has concluded no impairment of the $24,984 mineral claim acquisition costs has taken place for the year ended March 31, 2014.

Rehabilitation Provisions

The Company is subject to various government laws and regulations relating to environmental disturbances which are caused by exploration and evaluation activities. The Company will record the present value for the estimated costs of legal and constructive obligations required to restore the exploration sites in the period in which the obligation is incurred. The nature of the rehabilitation activities includes restoration, reclamation and re-vegetation of the affected exploration sites. The Company has determined that there are no rehabilitation provisions at March 31, 2014.

Income Taxes

Income taxes are provided in accordance with Codification topic 740, “Income Taxes”, which requires an asset and liability approach for the financial accounting and reporting of income taxes. Current income tax expense (benefit) is the amount of income taxes expected to be payable (receivable) for the current year. A deferred tax asset and/or liability is computed for both the expected future impact of differences between the financial statement and tax bases of assets and liabilities and for the expected future tax benefit to be derived from tax loss and tax credit carry forwards. Deferred income tax expense is generally the net change during the year in the deferred income tax asset and liability. Valuation allowances are established when necessary to reduce deferred tax assets to the amount expected to be “more likely than not” realized in future tax returns. Tax rate changes and changes in tax laws are reflected in income in the period such changes are enacted.

F-7

MADISON VENTURES INC.

(An Exploration Stage Company)

Notes to Financial Statements

As of March 31, 2014

2. Summary of significant accounting policies (continued)

Uncertain Tax Positions

Codification topic 740 addresses the determination of whether tax benefits claimed or expected to be claimed on a tax return should be recorded in the financial statements. Accounting for uncertainty in income taxes is addressed by a two-step method of first evaluating whether a tax position has met a more-likely-than-not recognition threshold and second, measuring that tax position to determine the amount of benefit to be recognized in the financial statements.

Basic and Diluted Net Loss Per Share

Net loss per share is calculated in accordance with Codification topic 260, “Earnings Per Share” for the periods presented. Basic net loss per share is computed using the weighted average number of common shares outstanding. Diluted loss per share has not been presented because there are no dilutive items. Diluted earnings loss per share is based on the assumption that all dilutive stock options, warrants, and convertible debt are converted or exercised by applying the treasury stock method. Under this method, options and warrants are assumed exercised at the beginning of the period (or at the time of issuance, if later), and as if funds obtained thereby were used to purchase common stock at the average market price during the period. Options, warrants and/or convertible debt will have a dilutive effect, during periods of net profit, only when the average market price of the common stock during the period exceeds the exercise or conversion price of the items.

Share-based Compensation

Codification topic 718 “Stock Compensation” requires that the cost resulting from all share-based transactions be recorded in the financial statements and establishes fair value as the measurement objective for share-based payment transactions with employees and acquired goods or services from non-employees. The codification also provides guidance on valuing and expensing these awards, as well as disclosure requirements of these equity arrangements. The Company adopted the codification upon creation of the company and will expense share based costs in the period incurred. The Company has not adopted a stock option plan or completed a share-based transaction; accordingly no stock-based compensation has been recorded to date.

Recent Accounting Pronouncements

The Company’s management has evaluated all the recently issued, but not yet effective, accounting standards that have been issued or proposed by the FASB or other standards-setting bodies through the filing date of these financial statements and does not believe the future adoption of any such pronouncements will have a material effect on the Company’s financial position and results of operations.

3. Mineral claim

On March 3, 2012, the Company entered into a Revised and Restated Mineral Property Option Agreement with 3 individuals (the “Optionors”) for an exclusive and irrevocable three year option to acquire a 100% undivided interest in three contiguous unpatented mining claims comprising 34 units (the “Claim” or the “Property”) situated in the Thunder Bay Mining Division in the province on Ontario, Canada (the “Agreement”). The option payments aggregating $30,000 (U.S. Dollars) (the “Option Price”) are due: i) $15,000 upon signing but deferred for eight months, ii) $5,000 on or before March 3, 2013, iii) $5,000 on or before March 3, 2014, and iv) $5,000 on or before March 3, 2015 (the “Option Payments”). During the term of the Agreement the Company is granted free and unrestricted access and use of the Property to act as the operator of the Property with the right to bring buildings, plant, equipment, machinery, tools, appliances and supplies onto the Property. The Optionors hold title to the Property until the full payment of the Option Price. Upon full payment of the Option Price the Optionors will deliver a duly executed transfer of mining claims in respect of the Property to transfer a 100% undivided interest in the Property to the Company free and clear of all encumbrances except for a retained net smelter return royalty (the “NSR”). The NSR is a 2% royalty paid within 30 days of each calendar month calculated, as defined, from gross Property revenues less permissible deductions. The Company has the right, at any time, to reduce the NSR to a 1% royalty by a One Million Dollar payment to the Optionors.

F-8

MADISON VENTURES INC.

(An Exploration Stage Company)

Notes to Financial Statements

As of March 31, 2014

3. Mineral claim (continued)

If the Company terminates the Agreement it is responsible to remove all buildings, plant, equipment, machinery, tools, appliances and supplies that it brought onto the Property not later than twelve months after termination of the Agreement unless arrangements are made with the Optionors to retain some or all of the items brought onto the Property.

The Company deferred the first option payment for an eight month term and made the $15,000 payment on October 27, 2012. Upon execution of the Agreement, the Company recorded the first option payment net of imputed interest as $14,984 and accrued the imputed interest ratably over the deferral period. Annually the Company has the option to retain the mineral claim and make the next contractual Option Payment or to terminate the Agreement. The Company made the March 3, 2013 Option Payment on March 1, 2013. The Company made the March 3, 2014 Option Payment on February 25, 2014. The aggregate total of $24,984 is included in the mineral claim as of March 31, 2014.

In response to the new GPS standards for unpatented claims issued recently by the Ontario Ministry of Northern Development and Mines, the Company expended $1,975 to provide upgraded geo-referenced location information on its Claim during the quarter ended September 30, 2013. An aggregate total of $1,975, $4,067, and $6,842 have been expensed for exploration and evaluation of the Company’s Claim as of March 31, 2014, March 31, 2013 and from inception on September 14, 2009 through March 31, 2014, respectively. An aggregate total of zero, zero, and $800 have been expensed for evaluation of other mineral property prior to acquisition as of March 31, 2014 and March 31, 2013 and from inception on September 14, 2009 through March 31, 2014, respectively.

4. Due to related party

Due to related parties at March 31, 2014 and 2013 consisted of the following:

|

March 31,

|

March 31,

|

|||||||

|

2014

|

2013

|

|||||||

|

|

|

|

|

|

||||

|

Balance at beginning of period

|

$

|

-

|

$

|

-

|

||||

|

Funds advanced

|

23,521

|

-

|

||||||

|

Funds repaid

|

-

|

-

|

||||||

|

Funds forgiven

|

23,521

|

-

|

||||||

|

Balance at end of period

|

$

|

-

|

$

|

-

|

||||

On October 31, 2013 November 4, 2013, January 7, 2014 and February 25, 2014 Mr. Art Kerry, the Company’s then President, Secretary, Treasurer and a Director, advanced the Company $2,301, $12,000, $4,220 and $5,000, respectively, as an unsecured obligation. The funds were used to pay operating expenses of the Company. The obligation bears no interest, has no fixed term and is not evidenced by any written agreement. On March 28, 2014, Mr. Kerry forgave the $23,521 aggregate amount previously advanced to the Company. On April 2, 2014, Mr. Kerry resigned as the Company’s President, Secretary, Treasurer and a Director. On May 22, 2014 Mr. Kerry was directed to close the Company’s Canadian bank account which had a balance of $11; Mr. Kerry received the $11 upon its closing. Additionally on June 11, 2014, Mr. Kerry advanced the Company $3,960 to pay prior operating expenses of the Company as an unsecured obligation. Also on June 11, 2014, Mr. Kerry forgave the $3,949 aggregate amount received from and advanced to the Company subsequent to balance forgiven on March 28, 2014. Mr. Kerry is under no obligation to advance funds in the future.

F-9

MADISON VENTURES INC.

(An Exploration Stage Company)

Notes to Financial Statements

As of March 31, 2014

4. Due to related party (continued)