Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT - NGA Holdco, LLC | a2281410-kexhibit311.htm |

| EX-31.2 - EXHIBIT - NGA Holdco, LLC | a2281410-kexhibit312.htm |

| EXCEL - IDEA: XBRL DOCUMENT - NGA Holdco, LLC | Financial_Report.xls |

| EX-32.2 - EXHIBIT - NGA Holdco, LLC | a2281410-kexhibit322.htm |

| EX-32.1 - EXHIBIT - NGA Holdco, LLC | a2281410-kexhibit321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 28, 2014

¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT |

For the transition period from to

Commission file number 0-52734

NGA HOLDCO, LLC

(Exact Name of Small Business Issuer as Specified in its Charter)

Nevada | 20-8349236 |

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

21 Waterway Avenue, Suite 150, The Woodlands, TX 77380

(Address of Principal Executive Offices)

713-559-7400

(Registrant’s Telephone Number, Including Area Code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act: Class A Units

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporate by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | ¨ | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if smaller reporting company) | Smaller reporting company | ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act. Yes ¨ No ý

State the aggregate market value of the voting and non-voting common equity held by non-affiliates. None.

DOCUMENTS INCORPORATED BY REFERENCE

None

NGA Holdco, LLC | ||||

TABLE OF CONTENTS | ||||

Page | ||||

Part 1

ITEM 1. | BUSINESS. |

THE COMPANY

Overview of the Company

NGA Holdco, LLC, a Nevada limited liability company ("NGA"), was formed on January 8, 2007 at the direction of Newport Global Opportunities Fund LP, a Delaware limited partnership (“NGOF”) and an affiliate of Newport Global Advisors LP, a Delaware limited partnership (“Newport”). NGA was formed for the primary purpose of holding equity, directly or indirectly through its subsidiaries, in one or more entities related to the gaming industry. NGA has two wholly-owned subsidiaries, NGA Blocker, LLC, a Nevada limited liability company (“Blocker”), and AcquisitionCo, LLC, a Nevada limited liability company (“AcquisitionCo”), each of which was formed on January 8, 2007. References to the "Company" are to NGA and, unless the context otherwise requires, its subsidiaries.

The Company has had no revenue generating business since inception. Its current business plan consists primarily of its holding, through AcquisitionCo, of a 17.0359% equity interest in Eldorado Holdco LLC (the "Eldorado Interest"), a Nevada limited liability company ("Eldorado"), and a 40% equity interest in Mesquite Gaming LLC (the “Mesquite Interest”), a Nevada limited liability company (“Mesquite”). The Eldorado Interest was effectively acquired December 14, 2007 (the

“Eldorado Acquisition”), in exchange for certain first mortgage bonds and preferred equity interests (the “Eldorado-Shreveport Investments”) valued at $38,314,863. The Mesquite Interest was acquired August 1, 2011 (the “Mesquite Acquisition”), in exchange for $8,222,222 in cash, of which $7,222,222 and $1,000,000 were contributed to the Company by NGOF and Newport Global Credit Fund (“NGCF,” and collectively with NGOF, the “Newport Funds”), respectively.

Eldorado owns entities that own and operate the Eldorado Hotel & Casino located in Reno, Nevada ("Eldorado-Reno")and the Eldorado Resort Casino Shreveport located in Shreveport, Louisiana ("Eldorado-Shreveport"). One of the entities owned by Eldorado also owns an approximate 21% interest in a joint venture that owns and operates Tamarack Junction Casino & Restaurant, a small casino located in Reno, Nevada. In addition, an approximately 96% owned subsidiary of Eldorado owns a 50% interest in a joint venture that owns and operates the Silver Legacy Resort Casino, which is located in Reno, Nevada and is seamlessly connected to the Eldorado-Reno.

Mesquite is engaged in the casino resort industry in Mesquite, Nevada through wholly-owned subsidiaries that own and operate the CasaBlanca Resort/Golf/Spa, the Virgin River Hotel/Casino/Bingo, two championship golf courses, a full-service spa, a bowling center, restaurants, and banquet and conference facilities. Mesquite also owns real estate on which the Oasis Resort & Casino was located prior to its demolition.

The Company holds no equity interests other than its equity interests in Eldorado and Mesquite, along with any indirect interests it holds in other entities by virtue of its equity interests in Eldorado and Mesquite, and has no current plans to acquire any interest in another entity.

Formed in 2005, Newport is a Texas-based investment management firm focused on alternative fixed income strategies. The firm concentrates primarily on the stressed and distressed opportunities within the high yield debt and bank loan markets but may also include the acquisition and disposition of other types of corporate securities and claims. Newport has 11 employees, with its primary office in The Woodlands, TX. Newport’s principals include Timothy T. Janszen, CEO, Ryan Langdon, Senior Managing Director, and Roger A. May, Senior Managing Director. Collectively, the principals have over 35 years of experience investing in the high yield and distressed debt markets. Newport is registered with the Securities and Exchange Commission (the "Commission") as an investment adviser under the Investment Advisers Act of 1940, as amended. Newport is investment manager of the Newport Funds, private investment funds which seek attractive long-term risk adjusted returns by capitalizing on investments in the distressed debt markets and possibly control-oriented investments. The Newport Funds began investing in 2006.

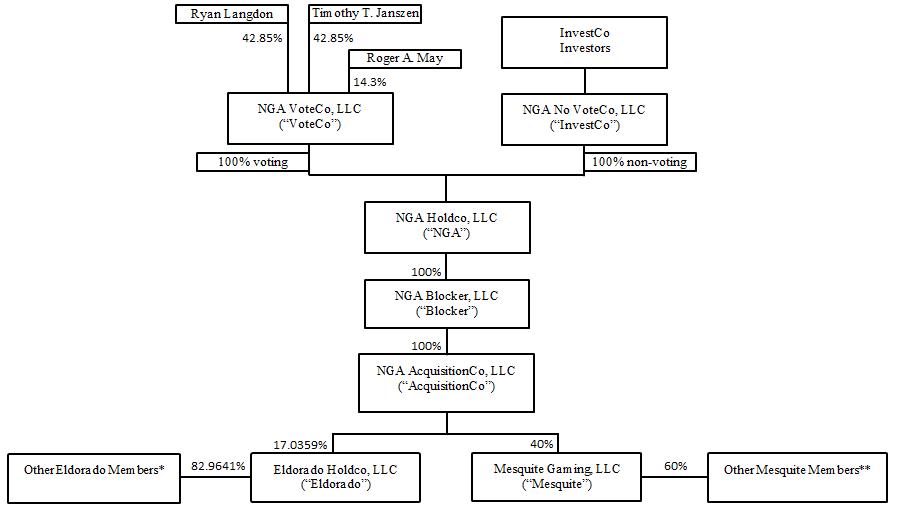

Ownership of the Company

NGA's one issued and outstanding Class A Unit, representing all of its voting equity, is held by NGA VoteCo, LLC, a Nevada limited liability company (“VoteCo”). All of NGA's issued and outstanding Class B Units, representing all of its non-voting equity, are held by NGA No VoteCo, LLC, a Nevada limited liability company (“InvestCo”). At present, NGA has no plans to issue any additional Class A or Class B Units.

VoteCo is owned by Timothy T. Janszen and Ryan L. Langdon, each of whom owns a 42.85% interest, and Roger A. May, who owns a 14.3% interest. Messrs. Janszen, Langdon and May collectively are referred to as the “VoteCo Equityholders." InvestCo is owned by the Newport Funds, which hold all of InvestCo’s issued and outstanding voting securities.

The VoteCo Equityholders, through VoteCo, control all matters of the Company that are subject to the vote of members, including the appointment and removal of managers. Each of the VoteCo Equityholders is a member of NGA's board of managers, and Mr. Janszen is NGA's operating manager who has responsibility for the day-to-day management of the Company. The Class B Units issued to InvestCo allow it and its investors to invest in the Company without having any voting power or power to control the operations or affairs of the Company, except as otherwise required by law. If InvestCo and its investors had any of the power to control the operations or affairs of the Company afforded to holders of the Class A Units, they and their respective constituent equityholders would generally be required to be licensed or found suitable under applicable gaming laws and regulations, including those of the States of Nevada and Louisiana.

Management of the Company

A majority of NGA's managers may remove the operating manager from such position. The approval of a majority of the managers is required to elect a new operating manager, who must be selected from among the members of NGA's board of managers. Neither NGA's board of managers nor the operating manager may take, or cause NGA to take, the following actions without the approval of VoteCo:

• | Materially change the business purpose of NGA or the nature of the business, |

3

• | Act to render it impossible to carry on the ordinary business of NGA, |

• | Remove or appoint any manager, |

• | Allow any voluntary withdrawal of any member from NGA, |

• | Make any assignment for the benefit of creditors, any voluntary bankruptcy of NGA, or any transaction to dissolve, wind up or liquidate NGA, or |

• | Make any transaction between NGA and any member or manager of NGA, or any affiliate or direct family member of any member or manager of NGA, that is not made on an arm’s-length basis. |

Generally, in all other respects, VoteCo has no power or authority to participate in the management of NGA or to bind or act on behalf of NGA in any way or to render it liable for any purpose. Except as otherwise expressly required by applicable law, InvestCo has neither any right to vote on any matters to be voted on by the members of NGA, nor any power or authority to participate in the management of NGA or bind or act on behalf of NGA in any way or render it liable for any purpose.

Neither the operating manager nor any other manager has the authority to do any of the following acts on behalf of NGA without the approval of a majority of NGA's managers:

• | Acquire, by purchase, lease, or otherwise, any real property on behalf of NGA; |

• | Give or grant any options, rights of first refusal, deeds of trust, mortgages, pledges, ground leases, security interests, or otherwise encumbering any stock, interest in a business entity, promissory note issued to NGA, or any other asset owned by NGA; |

• | Sell, convey, or refinance any interest, direct or indirect, in NGA’s unconsolidated investees; |

• | Cause or permit NGA to extend credit to or make any loans or become a surety, guarantor, endorser, or accommodation endorser for any person or enter into any contracts with respect to the operation or management of the business of NGA; |

• | Release, compromise, assign, or transfer any claims, rights, or benefits of NGA; |

• | Confess a judgment against NGA or submit an NGA claim to arbitration; |

• | File any petition for bankruptcy of NGA; |

• | Distribute any cash or property of NGA, other than as provided in NGA’s operating agreement; |

• | Admit a new member to NGA; or |

• | Do any act in contravention of NGA’s operating agreement or do any act which would make it impossible or unreasonably burdensome to carry on the business of NGA. |

Notwithstanding the foregoing provisions, the operating manager has the authority under NGA’s operating agreement to take such actions as he, in his reasonable judgment, deems necessary for the protection and preservation of NGA assets if, under the circumstances, in his good faith estimation, there is insufficient time to obtain the approval of NGA’s board of managers and any delay would materially increase the risk to preservation of NGA’s assets.

Restrictions on Transfer

Unless approved in advance by the operating manager and by applicable gaming authorities, no member of the Company may transfer all or any portion of its membership units.

Member and Manager Compensation

No member or manager of NGA or either of its subsidiaries is entitled to receive any compensation from the Company for any services rendered to or on behalf of the Company, or otherwise, in his, her or its capacity as a member or manager of NGA or either of its subsidiaries. A manager of NGA is entitled to reimbursement from the first available funds for direct out-of-pocket costs and expenses incurred by the manager on behalf of the Company that directly relate to the business and affairs of the Company.

Dissolution and Termination

NGA will be dissolved upon the happening of any of the following events:

• | Sale or other disposition of all or substantially all of NGA’s assets and receipt of all consideration therefore, |

4

• | Determination that an event has occurred that makes it unlawful, impossible or impracticable for NGA to carry on the business, or |

• | VoteCo decides NGA will be dissolved. |

Following such an event or the determination by a court of competent jurisdiction that NGA has dissolved prior to the occurrence of such an event, the property of NGA, or the proceeds from the sale thereof, will be applied and distributed first to the payment and discharge of all of NGA’s debts and other liabilities to creditors (including members that are creditors), second to establishing any reserves that the managers of NGA determine, in their sole and absolute discretion, are necessary for any contingent, conditional or unmatured liabilities or obligations of NGA, and third to the members of NGA in proportion to their respective percentage interest in NGA.

Eldorado Acquisition

On December 14, 2007, the Company effectively acquired its Eldorado Interest by transferring the Eldorado-Shreveport Investments in part to Eldorado Resorts, LLC (“Resorts”) and in part to Donald L. Carano (“Carano”), free and clear of any liens, in exchange for a 17.0359% interest in Resorts (the “Resorts Interest”), of which 14.47% was acquired directly from Resorts and the balance from Carano. The Eldorado-Shreveport Investments included first mortgage bonds due 2012 (the “Mortgage Bonds”) and 11,000 preferred shares of a partner of the co-issuer of the Mortgage Bonds. The Mortgage Bonds were co-issued by Eldorado Casino Shreveport Joint Venture (the “Louisiana Partnership”) and Shreveport Capital Corporation, a wholly-owned subsidiary of the Louisiana Partnership (the “New Shreveport Notes”). The original principal amount of the Mortgage Bonds was $38,045,363. The 11,000 preferred shares were issued by Shreveport Gaming Holdings, Inc. (“SGH”), then a partner of the Louisiana Partnership, that is not affiliated with Resorts or the Company. In May 2007, NGOF had contributed the Eldorado-Shreveport Investments to the Company at the estimated fair value of such investments as of that date. Effective April 1, 2009, Resorts became a wholly-owned subsidiary of Eldorado and the Resorts Interest was exchanged for the Eldorado Interest when all of the members of Resorts, including AcquisitionCo, exchanged their interests in Resorts for identical interests in Eldorado.

The Eldorado Acquisition occurred pursuant to the terms and conditions of a purchase agreement, dated July 20, 2007 (the “Purchase Agreement”). The parties to the Purchase Agreement were Resorts, AcquisitionCo, and Carano, now the presiding member of Eldorado’s Board of Managers and the Chief Executive Officer of Eldorado who then held the same positions with Resorts. The closing of this transaction occurred after necessary gaming licenses and approvals were obtained from Nevada and Louisiana. Carano or members of his family continue to own directly or indirectly approximately 51% of Eldorado. Some other provisions of the Purchase Agreement included:

• | At closing, Resorts and Carano paid Newport in cash the respective amounts owed to AcquisitionCo for interest on the respective amounts of New Shreveport Notes received at closing that were accrued and unpaid through the date of closing. |

• | Members of Resorts other than AcquisitionCo received distributions totaling $10 million, funded through borrowings under Resorts’ credit facility. |

Put and Call Rights

At the time of closing under the Purchase Agreement, AcquisitionCo and the members of Resorts entered into an amendment and restatement of Resorts’ operating agreement (the “Resorts Operating Agreement”) and, when the equity interests in Resorts were exchanged for equivalent equity interests in Eldorado, the members of Eldorado entered into an operating agreement with substantially the same provisions included in the Resorts Operating Agreement (the “Eldorado Operating Agreement”). Under the terms of the Eldorado Operating Agreement, at any time after the occurrence of a “Material Event” (as defined) or at any time after June 14, 2015 (the “Trigger Date”) AcquisitionCo or its permitted assignee(s) (the “Interest Holder”) will have the right to sell (“Put”) 14.47% of its 17.0359% Eldorado Interest but not less, and Eldorado will have the right to purchase (“Call”) all but not less than all of the entire 17.0359% Eldorado Interest at a price equal to the estimated fair market value of such interest, without discounts for minority ownership and lack of marketability, as determined by mutual agreement of the Interest Holder and Eldorado. In the event that after 30 days the Interest Holder and Eldorado have not mutually agreed on a purchase price, the purchase price will be determined by the average of two appraisals by nationally recognized appraisers of private companies, provided the two appraisals are within a 5% range of value based upon the lowest of the two appraisals. If the two appraisals are not within the 5% range, the purchase price will be determined by the average of a third mutually acceptable, independent, nationally recognized appraiser of private companies and the next nearest of the first two appraisals unless the third appraisal is at the mid-point of the first two appraisals, in which event the third appraisal will be used to established the fair market value. So long as a Material Event that entitles the Interest Holder to exercise its Put right has not occurred, AcquisitionCo will have the right to unilaterally extend the Trigger Date for up to two one-year extension periods. Upon exercise of either the Call or the Put, the Eldorado Operating Agreement provides that the transaction close within one year of the exercise of the right unless delayed for necessary approvals from applicable gaming authorities.

5

As defined in the Eldorado Operating Agreement, a “Material Event” for the purpose of allowing Eldorado to exercise the right to Call the 17.0359% interest means the loss, forfeiture, surrender or termination of a material license or finding of unsuitability issued by one or more of the applicable gaming authorities with respect to AcquisitionCo or any transferee of AcquisitionCo or any affiliate of AcquisitionCo. If a Material Event occurs that permits Eldorado to exercise its Call right prior to the Trigger Date, the Interest Holder will be obligated to provide carry back financing to Eldorado on terms and conditions reasonably acceptable to Eldorado. If a Call is required or ordered by any applicable gaming authority, the Call will be on the terms provided for in the Eldorado Operating Agreement, unless other terms are required by any of the applicable gaming authorities, in which event the Call will be on those terms.

As defined in the Eldorado Operating Agreement, a “Material Event” for the purpose of allowing the Interest Holder to exercise the right to Put the 14.47% interest to Eldorado means the loss, forfeiture, surrender or termination of a material license or finding of unsuitability by any applicable gaming authority with respect to Eldorado, any affiliate of Eldorado (other than AcquisitionCo or its affiliates), including, but not limited to, the Eldorado-Reno, the Eldorado-Shreveport and Silver Legacy.

At the time of closing under the Purchase Agreement, Resorts, AcquisitionCo and Carano entered into a separate put-call agreement (as subsequently amended, the “Put-Call Agreement”). Under the terms of the Put-Call Agreement, the Interest Holder is entitled, if it exercises its Put rights under the Eldorado Operating Agreement as then in effect, to require Carano to purchase from it the portion of the 17.0359% interest acquired from Carano. In that event, the purchase price payable by Carano will be based on a fractional relationship of the purchase price payable to the Interest Holder for the 14.47% interest relative to the percentage interests being purchased by Carano. However, as a practical matter, restrictive covenants of Eldorado’s 2011 debt financing, discussed in the following paragraph may prevent the purchase of the 14.47% interest or the 17.0359% interest unless the transaction, at the time it occurs, can be funded within the covenants’ provisions. In the event of an initial public offering by Eldorado of any of its equity securities, the Put and Call provisions described above will terminate and be of no further force and effect.

On June 1, 2011, Resorts and Eldorado Capital Corp., a Nevada Corporation that is a wholly-owned subsidiary of Resorts, completed the issuance of $180 million of 8.625% Senior Secured Notes due June 15, 2019 (the “Resorts Senior Notes”). Also, on June 1, 2011, Resorts entered into a new $30 million senior secured revolving credit facility available until May 30, 2014 (the “Resorts New Credit Facility”), which consists of a $15 million term loan requiring principal payments of $1.25 million each quarter beginning September 30, 2011, and a $15 million revolving credit facility. Resorts does not intend to renew the Resorts New Credit Facility when it matures on May 30, 2014. Proceeds from the issuance of the Resorts Senior Notes, together with borrowings under the Resorts New Credit Facility, were used to redeem or otherwise retire approximately $ 230 million of previously outstanding debt owed by Resorts and its subsidiaries, of which approximately $31 million was held by Resorts. The remaining previously outstanding debt was called and redeemed on August 1, 2011 utilizing $9.7 million of restricted cash which was set aside on June 1, 2011 for the purpose of redeeming the notes that were called. Interest on the Resorts Senior Notes is payable semiannually each June 15 and December 15 (commencing on December 15, 2011) to holders of record on the preceding June 1 or December 1, respectively. Interest on the credit facility is payable on the last day of the loan in the case of a Eurodollar Rate loan, provided, however, that if the period exceeds three months the interest will be payable on the respective dates that fall every three months after the beginning of the loan period. For each Base Rate loan, interest is payable as of the end of the respective quarter. The interest period cannot exceed the maturity date of the credit facility for either a Eurodollar Rate loan or Base Rate loan.

The indenture relating to the Resorts Senior Notes contains various restrictive covenants including covenants relating to restricted payments and investments, additional liens, transactions with affiliates, covenants imposing limitations on additional debt, dispositions of property, mergers and similar transactions. As of December 31, 2013, Resorts was in compliance with all of the covenants under the indenture relating to the Resorts Senior Notes. So long as these covenants are in effect, they may limit or restrict entirely the ability of Eldorado to fund the purchase by Eldorado of the 14.47% interest in the event the Interest Holder exercises its Put right under the Eldorado Operating Agreement as well as the purchase of the 17.0359% interest in the event Eldorado exercises its Call right under the Eldorado Operating Agreement. Accordingly, there can be no assurance that the covenants then in effect will not preclude Eldorado from being able to conclude a Put or Call transaction, and, if so, that any waivers that may then be required to consummate the transaction can be obtained or that Resorts will be able to eliminate the covenant restrictions by the repayment of any indebtedness then owed to the creditors whom the covenants are intended to benefit or otherwise.

Registration Rights

In the event of a public offering by Eldorado of its equity securities in which any member of Eldorado is allowed to participate, the Interest Holder will have rights under the Eldorado Operating Agreement equivalent to other members of Eldorado to sell the equity securities of Eldorado held by the Interest Holder on a pro rata basis with the other members. At the

6

time of closing under the Purchase Agreement, AcquisitionCo and Resorts entered into a registration rights agreement (the “Registration Rights Agreement”). By an assignment and assumption of the Registration Rights Agreement, with the consent of AcquisitionCo, the rights and obligations of Resorts under the agreement were assigned to, and assumed by, Eldorado. Under the Registration Rights Agreement, AcquisitionCo and its permitted assigns have certain registration rights to conduct a secondary offering subsequent to any initial public offering of the equity securities of Eldorado.

Mesquite Acquisition

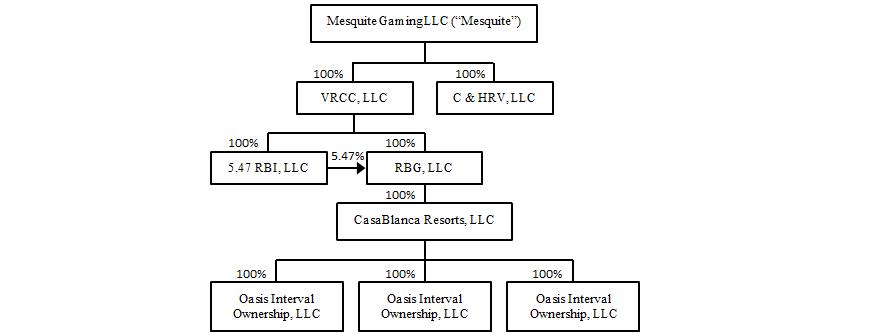

Mesquite is engaged in the hotel casino industry in Mesquite, Nevada through its wholly-owned subsidiaries, C & HRV, LLC (doing business as Virgin River Hotel/Casino/Bingo) and VRCC, LLC and its wholly-owned subsidiaries, 5.47 RBI, LLC and RBG, LLC (doing business as CasaBlanca Resort/Golf/Spa) and its wholly-owned subsidiary CasaBlanca Resorts, LLC (doing business as the Oasis Resort and Casino prior to its demolition which was substantially completed by August 31, 2013) and its wholly-owned subsidiaries Oasis Interval Ownership, LLC, Oasis Interval Management, LLC and Oasis Recreational Properties, Inc.

On August 1, 2011, the Company acquired its 40% Mesquite Interest in exchange for $8,222,222 in cash that was contributed to the Company by the Newport Funds in July 2011. The Mesquite Acquisition was completed upon the transfer to Mesquite of all of the assets of Black Gaming, LLC (“Black Gaming”), including Black Gaming’s direct and indirect ownership interests in its subsidiaries. The transfer of the Black Gaming assets to Mesquite and the acquisition by AcquisitionCo of the Mesquite Interest were pursuant to a joint plan of reorganization filed by Black Gaming and its subsidiaries with the United States Bankruptcy Court for the District of Nevada on March 1, 2010, and approved by the Court on June 28, 2010.

On August 1, 2011, Mesquite completed the issuance of $62.5 million of Senior Secured Notes under Mesquite’s New Loan Facility that provided for interest at an annual rate of LIBOR (1.5% floor and 4.5% ceiling) plus 700 basis points and were due and payable August 1, 2016 (the “Mesquite Senior Notes”), and entered into a new $10 million senior secured credit facility. Interest and principal on the Mesquite Senior Notes and interest on the Mesquite Credit Facility were payable quarterly.

On August 22, 2013, Mesquite completed its refinancing of the indebtedness then outstanding under the Mesquite Senior Notes and the Mesquite Credit Facility utilizing the following: (a) $20 million of First Lien Notes held by Nevada State Bank, due and payable August 21, 2019, that provide for interest at a 30 day LIBOR rate effective on the first day of each month plus an applicable margin which is determined by reference to Mesquite's senior leverage ratio (5.25% for a ratio greater than 2:1 and 4.75% for a ratio less than or equal to 2:1), (b) a three-year term, $6 million First Lien Revolver with Nevada State Bank, which is subject to the same interest terms as the First Lien Notes plus 0.25% quarterly on the unused principal portion of the First Lien Revolver, and (c) $35 million of Second Lien Notes held by Wilmington Trust, due and payable February 21, 2020, that provide for no principal amortization and payment of interest on the unpaid principal amount at the rate of 7% per annum over the period from August 22, 2013 to August 22, 2014, and at the rate of 8% per annum thereafter.

7

Organizational Diagrams

The Company

The diagram below depicts the general ownership of the entities related to the Company and its subsidiaries, as well as the Company’s ownership interests in Eldorado and Mesquite.

* | Includes Recreational Enterprises, Inc. (47.0415%), Hotel Casino Realty Investments, Inc. (5.1318%), Hotel Casino Management, Inc. (24.8037%), Ludwig J. Corrao (4.2765%), Gary Carano S Corp Trust (0.3421%), Glenn Carano S Corp Trust (0.3421%), Gene Carano S Corp Trust (0.3421%), Gregg Carano S Corp Trust (0.3421%) and Cindy Carano S Corp Trust (0.3421%). |

** | Includes Anthony Toti (25%), Michael J. Gaughan Family, LLC (25%) and Robert R. Black, Sr. (10%). |

8

Eldorado

The diagram below depicts the current organizational structure of Eldorado, as well as Eldorado's ownership interest in other entities.

Mesquite

The diagram below depicts the current organizational structure of Mesquite and its subsidiaries.

ELDORADO

Introduction

Effective April 1, 2009, all of the equity interests of Resorts (including the 17.0359% interest then indirectly held by the Company through AcquisitionCo) were exchanged for equivalent equity interests of Eldorado and Resorts thus became a wholly- owned subsidiary of Eldorado. Eldorado conducts no operations other than those conducted indirectly through Resorts and its subsidiaries and investees.

In 1996, Resorts was formed and became the successor to a predecessor partnership in a reorganization in which all of the interests in the predecessor partnership were exchanged for membership interests in Resorts. Insofar as they relate to periods prior to July 1, 1996, the effective date of the reorganization, references to Resorts are to its predecessor partnership except to the extent the context requires otherwise. Eldorado Capital Corp., a Nevada corporation wholly owned by Resorts (“Eldorado Capital”), was incorporated with the sole purpose of serving as co-issuer of debt co-issued by Resorts and Eldorado Capital. Eldorado Capital holds no significant assets and conducts no business activity. Resorts’ other subsidiaries include Eldorado-

9

Shreveport #l, LLC (“ES#1”) and Eldorado-Shreveport #2, LLC (“ES#2”), Nevada limited liability companies wholly-owned by Resorts, and Eldorado Limited Liability Company, a Nevada limited liability company approximately 96% owned by Resorts (“ELLC”).

Eldorado, through Resorts, owns and operates Eldorado-Reno, a premier hotel/casino and entertainment facility in Reno, Nevada. The Eldorado-Reno is easily accessible both to vehicular traffic from Interstate 80, the principal highway linking Reno to its primary visitor markets in northern California, and to pedestrian traffic from nearby casinos.

Resorts indirectly owns 100% of the partnership interests of Eldorado Casino Shreveport Joint Venture, a Louisiana general partnership (the “Louisiana Partnership”). The Louisiana Partnership owns and Resorts manages the Eldorado Resort Casino Shreveport (the “Eldorado-Shreveport”), a 403-room all suite art deco-style hotel and a tri-level riverboat dockside casino complex situated on the Red River in Shreveport, Louisiana, which commenced operations under its previous owners in December 2000. Resorts acquired a majority ownership interest in the hotel and riverboat casino complex in July 2005, and acquired the remaining minority interest in March 2008. Resorts’ ownership interest in the Louisiana Partnership is held through ES#1 and ES#2.

ELLC, which is approximately 96%-owned by Resorts, is a 50% joint venture partner in a general partnership (the “Silver Legacy Joint Venture”) that owns Silver Legacy, a major themed hotel/casino which is situated between, and seamlessly connected at the casino level to, Eldorado-Reno and Circus Circus-Reno, a hotel casino owned and operated by the other partner in the Silver Legacy Joint Venture, Galleon, Inc., an indirect, wholly-owned subsidiary of MGM Resorts International (“MGM”).

Resorts also owns an approximate 21% interest in Tamarack Crossing, LLC, a Nevada limited liability company that owns and operates Tamarack Junction, a small casino in south Reno which commenced operations September 4, 2001. Tamarack Junction is situated on approximately 62,000 square feet of land with 13,230 square feet of gaming space and 460 slot machines as of December 31, 2013.

Management of Eldorado

Eldorado’s board of managers (the “Eldorado Board”) is currently composed of individuals designated by Eldorado's three managers, including Timothy T. Janszen designated by AcquisitionCo, Donald L. Carano, Gary L. Carano and Thomas R. Reeg designated by Recreational Enterprises, Inc. (“REI”), and Raymond J. Poncia, Jr. designated by Hotel-Casino Management, Inc. (“HCM”). AcquisitionCo, REI and HCM may change their respective representatives on the Eldorado Board from time to time by notice to Eldorado so long as they remain managers of Eldorado. Generally, any member of the Eldorado board may be removed from office with cause upon a vote of more than 50% of Eldorado’s membership interests.

Subject to the limitations described below, and except as otherwise delegated to Eldorado’s Chief Executive Officer (the “Eldorado CEO”), the Eldorado Board has control over the management of the business and affairs of Eldorado. Each board member has one vote and actions of the Eldorado Board generally require a majority vote of the board members. The members of the Eldorado Board are required to be licensed or found suitable by the relevant Nevada and Louisiana gaming authorities in order to engage in the management of Eldorado. For further information about these licensing and suitability requirements, see “Laws and Regulations,” below.

Under the Eldorado Operating Agreement, the Eldorado CEO is given the general powers and duties of management usually vested in the chief executive officer of a corporation along with such other powers and duties as may be prescribed by the Eldorado Board or the Eldorado Operating Agreement, including the supervision, direction and control of the day-to-day business and affairs of Eldorado. In addition to this general authority, the Eldorado CEO has the following specific rights which may be exercised on behalf of Eldorado:

• | Develop, improve, maintain, operate and lease Eldorado’s property; |

• | In any single transaction or series of related transactions having a value of under $5,000,000, on behalf of Eldorado, contract to sell, lease, exchange, grant any option on, convert to condominiums or otherwise transfer or dispose of any of the real or personal property of Eldorado; |

• | Select and remove such officers, agents and employees of Eldorado to assist with the management or operation of Eldorado; |

• | Employ and terminate the services of such persons, firms, corporations or other entities, including any one or more of Eldorado’s members, for or in connection with the business of Eldorado or the acquisition, development, improvement, operation, maintenance, management, leasing, financing, refinancing, sale, exchange or other disposition of the property of Eldorado and perform Eldorado’s administrative services, accounting services, independent auditing services, legal and other services; |

10

• | Institute, prosecute, defend and settle any legal or administrative proceedings having an actual or potential value of under $5,000,000; |

• | In any single transaction or series of related transactions having a value of under $5,000,000, acquire real or tangible personal property to carry on the business of Eldorado, and sell, exchange or otherwise dispose of the same; and |

• | In any single transaction or series of related transactions having a value of under $5,000,000, enter into loans, mortgages and other financing arrangements or rearrangements, and grant such security interests in the assets of Eldorado, as may be necessary or desirable to carry on the business. |

Without the affirmative vote or written consent of all of Eldorado’s members, neither the Eldorado Board nor the Eldorado CEO may directly or indirectly:

• | Act in contravention of the Eldorado Operating Agreement; |

• | Act to make it impossible to carry on Eldorado’s ordinary business, provided that actions of the managers in accordance with Eldorado’s purposes or the rights and powers granted under the Eldorado Operating Agreement will not be considered to breach this provision; or |

• | Commingle funds of Eldorado with funds of any other person. |

Without the affirmative vote or written consent of members holding 65% of Eldorado’s outstanding membership interests, neither the Eldorado Board nor the Eldorado CEO may directly or indirectly:

• | Amend the number of Eldorado’s authorized managers; |

• | Cause Eldorado to merge or otherwise engage in any kind of business combination or reorganization with another entity or other person; |

• | Approve, adopt and implement such new or additional incentive compensation policies and plans for the benefit of the managers, officers, agents and/or employees of Eldorado that contemplate the issuance of any form of equity interest in Eldorado; |

• | Cause Eldorado to enter into any joint venture or partnership or limited liability company agreement; |

• | Cause Eldorado to enter into any loan that results in assets of Eldorado being hypothecated in excess of 80% of the fair market value of all assets of Eldorado; |

• | Cause or permit any new issuance and sale of membership interests of Eldorado other than in connection with subsequent capital contributions in accordance with the Eldorado Operating Agreement; |

• | Cause or permit any person or entity to which a new issuance and sale of membership interests has been made by Eldorado other than in connection with subsequent capital contributions in accordance with the Eldorado Operating Agreement to become a member by reason of or in connection therewith; |

• | Possess Eldorado property, or assign rights in specific Eldorado property, for other than an Eldorado purpose; |

• | Purchase or lease Eldorado property from Eldorado or sell or lease property to Eldorado; |

• | Cause Eldorado to guarantee the indebtedness of any person or cause or suffer or permit any Eldorado property to secure or become collateral for any indebtedness of any person other than Eldorado; |

• | Cause or permit Eldorado at any time to have more than 100 members and/or interest holders; or |

• | Designate a new “Tax Matters Partner” as described in the Eldorado Operating Agreement. |

Without the affirmative vote or written consent of members holding 75% of Eldorado’s outstanding membership interests, neither the Eldorado Board nor the Eldorado CEO may directly or indirectly request subsequent capital contributions from the members and interest holders of Eldorado.

Members of Eldorado and AcquisitionCo do not have the right to take part in the management or control of Eldorado. The members of Eldorado have voting rights generally limited to those required by law.

Proposed Eldorado Transaction

On September 9, 2013, Eldorado and MTR Gaming Group, Inc. (“MTR”), a publicly traded company, announced that they had entered into a definitive agreement (the “Merger Agreement”), which provides for the combination of MTR and Eldorado in a stock merger with a cash election option offered to MTR’s current stockholders. On November 18, 2013, Eldorado and MTR entered into Amendment No. 1 to the Merger Agreement, which increased the cash election option per share amount from $5.15 to $6.05 and increased the aggregate amount available for the purchase of shares pursuant to the cash

11

option from $30 million to $35 million, with the $5 million increase to be funded by Eldorado utilizing its cash on hand. MTR’s remaining common shares will be exchanged for shares in the combined new company, which is to be publicly traded under the name Eldorado Resorts, Inc. (“NewCo”).

On February 13, 2014, Eldorado and MTR entered into Amendment No. 2 to the Merger Agreement, which allows for the minority investors who own 3.8142% of ELLC (the "Minority Investors") to enter into agreements with Eldorado and MTR to transfer all of their interests in ELLC to Eldorado following closing of the merger for a portion (the "Retained Consideration") of the aggregate number of shares of NewCo to be delivered, as merger consideration, at closing to all members of Eldorado (collectively, the "Retained Interest Agreements"). Prior to its second amendment, the Merger Agreement required Minority Investors to transfer their respective interests in ELLC to a wholly-owned subsidiary of Eldorado on or prior to the closing date. Pursuant to the Retained Interest Agreements, the Minority Investors will grant a wholly-owned subsidiary of Eldorado a right, exercisable for three months commencing on the first business day after the first anniversary of the closing date of the mergers, to acquire all of their interests in ELLC in exchange for payment of the Retained Consideration. This wholly-owned subsidiary of Eldorado will grant a right, pursuant to the Retained Interest Agreements, to the Minority Investors, exercisable for three months commencing on the first business day after the second anniversary of the closing date of the mergers, to put to it all of the Minority Investors’ interests in ELLC in exchange for payment of the Retained Consideration. The Retained Consideration shall mean the number of shares of NewCo common stock equal to the estimated value of ELLC’s interest in Silver Legacy (as calculated in accordance with the provisions of the Merger Agreement), multiplied by the portion of the outstanding interests in ELLC (expressed as a percentage) represented by the interests in ELLC held by the Minority Investors. The number of shares of NewCo common stock issuable at closing to all members of Eldorado shall be reduced by the number of shares of NewCo common stock equal to the Retained Consideration.

On May 13, 2014, Eldorado and MTR entered into Amendment No. 3 to the Merger Agreement, which expands the circumstances under which either Eldorado or MTR may unilaterally extend the termination date from June 9, 2014 for 180 days to include a scenario in which MTR will not have obtained the requisite stockholder approval of the Merger Agreement by June 9, 2014. The parties entered into the amendment in order to allow for additional time for the registration statement on Form S-4 initially filed by NewCo on November 4, 2013 to be declared effective by the Securities and Exchange Commission and for MTR to obtain the requisite stockholder approval following such effectiveness.

Under the terms of the Merger Agreement, as amended, the transaction value of Eldorado will be determined by Eldorado’s adjusted EBITDA for the twelve-month period specified in the Merger Agreement multiplied by 6.81, less net debt and other adjustments. Based on Eldorado’s adjusted EBITDA for the twelve-month period ending on the most recent month end preceding the closing date by at least twenty days (including its interest in Silver Legacy), Eldorado’s owners, including the Company, would receive in exchange for their current interests in Eldorado, an aggregate of approximately 35.6 million shares, or approximately 55% of the total shares, in NewCo valued at $6.05 per share. These valuation metrics and the Company’s percentage ownership interest in Eldorado would yield a value to the Company that exceeds the Company’s current carrying value of its investment in Eldorado. Based upon this calculation, the Company would at closing acquire ownership of between 9% and 10% of NewCo, depending on the number of shares purchased pursuant to the cash option. The closing of the proposed transaction is subject to a number of conditions. The foregoing discussion is qualified in its entirety by reference to the Merger Agreement and to Amendments No. 1, No. 2 and No. 3 to the Merger Agreement, copies of which are included as exhibits to this report.

Upon closing of the aforementioned Merger Agreement, which is not assured, the Company may distribute the shares of NewCo common stock received at closing to NGOF. Should that occur, the Company's operations will, subsequent to such date, reflect only the Company's ownership of Mesquite and will no longer reflect the Company's current ownership of the Eldorado Interest. The Company is unable to determine at this time the impact on the Company if the transactions contemplated by the Merger Agreement are consummated and the Company ultimately does not distribute the shares of NewCo to NGOF.

Entry into a Material Definitive Agreement

As discussed under "Proposed Eldorado Transaction" above, on September 9, 2013, Eldorado, MTR Gaming Group, Inc., and Thomas Reeg, Robert Jones, and Gary Carano, as the representative of the members of Eldorado, entered into a Merger Agreement that if consummated would result in shares of NewCo being listed on The Nasdaq Stock Market (the "Nasdaq"). Consummation of the Mergers is subject to numerous conditions including, among others, MTR receiving a superior proposal. In addition, Eldorado has been advised by MTR that it has received proposals that may lead to a superior proposal that would entitle it to terminate the Merger Agreement by paying Eldorado a $5.0 million termination fee plus reimbursement for out-of-pocket costs not to exceed $500,000. Under certain circumstances of non-performance by MTR, Eldorado Holdco may terminate the Merger Agreement and receive a $6.0 million termination fee plus reimbursement of out-of-pocket costs not to exceed $1.0 million.

12

Accordingly, there can be no assurances that the transactions contemplated by the Merger Agreement will be consummated on the terms described herein or at all.

The Merger Agreement, as amended, provides that, upon completion of the Mergers, MTR stockholders will have the right to receive, at their election (but subject to customary procedures applicable to over subscription for cash consideration), either (i) one share of NewCo common stock, or (ii) $6.05 in cash in exchange for each share of MTR common stock they own immediately prior to completion of the Mergers (the "MTR Exchange Ratio"); provided that the total amount of cash consideration is limited to $35.0 million, and if the cash election is oversubscribed, the cash consideration will be payable to the MTR stockholders making the cash election only with respect to a portion of their shares selected by an equitable, pro rata procedure determined by NewCo. The members of Eldorado will collectively receive, in the aggregate, an amount of merger consideration (the "Eldorado Valuation") equal to the product of (a) Eldorado’s adjusted EBITDA for the twelve months ending on the most recent month end preceding the closing date by at least twenty days (the Report Date) and (b) 6.81, with such amount being adjusted for Eldorado’s excess cash, outstanding debt, and working capital based upon an agreed upon working capital target for Eldorado, an amount equal to certain transaction expenses of MTR which is capped at $7.0 million, the value of Eldorado’s interest in the Silver Legacy Joint Venture, and the amount of restricted cash on Eldorado’s balance sheet (if any) relating to the credit support required in connection with the Silver Legacy Joint Venture’s credit facility. The value of Eldorado’s interest in the Silver Legacy Joint Venture is equal to the product of (x) ELLC’s proportionate ownership interest in the Silver Legacy Joint Venture, which is currently 50%, and (y) the product of (A) the Silver Legacy Joint Venture’s adjusted EBITDA for the twelve months ending on the Report Date and (B) 6.81, with such amount being adjusted for the Silver Legacy Joint Venture’s excess cash, outstanding debt, and working capital based upon an agreed upon working capital target for the Silver Legacy Joint Venture (each such adjustment in proportion to Eldorado’s ownership interest), the amount of the subordinated notes made by Eldorado to the Silver Legacy Joint Venture, and Eldorado’s portion of the difference between the capital accounts of the members of the Silver Legacy Joint Venture. As a result, the members of Eldorado will receive, in the aggregate, the number of shares of NewCo common stock equal to the quotient obtained by dividing the merger consideration as calculated in the two preceding sentences by an implied price per share of $6.05 for NewCo common stock (the "Eldorado Merger Shares"). The number of Eldorado Merger Shares issued to Eldorado members is subject to a post-closing adjustment based on a final calculation of the components of the Eldorado Valuation as of the closing date. The MTR Exchange Ratio and the number of Eldorado Merger Shares are subject to customary anti-dilution adjustments in the event of stock splits, stock dividends and similar transactions involving MTR common stock. For federal income tax purposes, MTR common stockholders and Eldorado members are not expected to realize gain or loss with respect to the exchange of MTR common stock or Eldorado membership interests for ERI common stock, but gain or loss might be realized with respect to any merger consideration receive in the form of cash.

In accordance with the Merger Agreement, Eldorado (through its subsidiaries) will be permitted to participate in any buy-sell procedure initiated with respect to the Silver Legacy Joint Venture in accordance with the Silver Legacy Joint Venture’s operating agreement. Additionally, Eldorado shall, at its own expense, dispose of, or sell or assign to a third party, all of its interests in Tamarack.

NewCo filed a proxy statement and prospectus on Form S-4 (the "Registration Statement") with the Securities and Exchange Commission (the "SEC") to solicit proxies from MTR stockholders in connection with the MTR stockholder vote necessary to approve the MTR Merger and to register the shares of NewCo common stock to be issued in connection with the Mergers. Within forty days after the Registration Statement is declared effective by the SEC, the Merger Agreement provides that MTR shall take all action necessary to call and hold a meeting of its stockholders to approve the Merger Agreement. Eldorado members have unanimously approved the Merger Agreement.

At the request of Eldorado, MTR commenced an initial consent solicitation with respect to obtaining certain amendments and waivers of the indenture underlying MTR’s 11.5% Senior Secured Second Lien Notes due August 1, 2019 on terms and conditions agreed upon between Eldorado and MTR. Additionally, Eldorado agreed that each of the members of Eldorado and certain officer and senior managers of Eldorado will enter into non-competition agreements with NewCo that will become effective as of the closing of the Mergers.

The Merger, if consummated, will be accounted for as a reverse acquisition of MTR by Eldorado under accounting principles generally accepted in the United States. As a result, Eldorado will be considered the acquirer of MTR for accounting purposes. Additional information regarding MTR, Eldorado, NewCo, and the merger plans are included in the Registration Statement.

13

Silver Legacy Joint Venture

Background. The Silver Legacy Resort Casino was developed by the Silver Legacy Joint Venture, an unconsolidated investee of Resorts, which was formed pursuant to the Agreement of Joint Venture of Circus and Eldorado Joint Venture dated as of March 1, 1994 (as amended to date, the “Original Joint Venture Agreement”), between ELLC and Galleon, Inc. (“Galleon”). Under the terms of the Original Joint Venture Agreement, ELLC, which is approximately 96% owned by Resorts, and Galleon (each a “Partner” and, together, the “Partners”) each acquired a 50% interest in the Silver Legacy Joint Venture (each Partner’s “Percentage Interest”).

On March 5, 2002, the Silver Legacy Joint Venture and its wholly owned finance subsidiary, Silver Legacy Capital Corp., issued $160 million principal amount of 10⅛% mortgage notes due March 1, 2012 (the “Silver Legacy Notes”). The Silver Legacy Notes matured on March 1, 2012 and the Silver Legacy Joint Venture did not make the principal and interest payment due on such date. On May 17, 2012, the Silver Legacy Joint Venture and Silver Legacy Capital Corp. (the “Silver Legacy Debtors”) filed voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code and on June 1, 2012 the Silver Legacy Debtors filed a joint plan of reorganization, which was subsequently amended on June 29, 2012 and August 8, 2012 (the “Plan of Reorganization”). On October 23, 2012, an order of confirmation relating to the Plan of Reorganization was entered by the bankruptcy court. On November 16, 2012, the effective date, as defined in the Plan of Reorganization, occurred. Concurrently, the Silver Legacy Joint Venture entered into a new $70 million credit facility (the “Silver Legacy Credit Facility”, issued $27.5 million in second lien notes (the “Silver Legacy Second Lien Notes”) and, in consideration of a $7.5 million contribution made by each of the Partners, issued $15 million in subordinated notes to the Partners (the “Partner Notes”). All creditors were paid under the terms of the Plan of Reorganization (with the exception of the quarterly installment payments to certain general unsecured creditors which are to be paid in full by November 16, 2013), the obligations under the Silver Legacy Notes were extinguished and the Silver Legacy Joint Venture emerged from bankruptcy. A final hearing was held and the Chapter 11 Case closed on March 20, 2013.

Under the Plan of Reorganization, each of ELLC and Galleon retained its 50% interest in the Silver Legacy Joint Venture, but was required to advance $7.5 million to the Silver Legacy Joint Venture in exchange for the Partner Notes and provide credit support by depositing $5.0 million of cash into bank accounts that are subject to a security interest in favor of the lender under the Silver Legacy Joint Venture Credit Facility. The $7.5 million Partner Note from ELLC to the Silver Legacy Joint Venture was issued on November 16, 2012 with a stated interest rate of 5% per annum and a maturity date of May 16, 2018. Payment of any interest or principal under the loan is subordinate to the senior indebtedness of the Silver Legacy Joint Venture, including the Silver Legacy Credit Facility and the Silver Legacy Second Lien Notes. Accrued interest under the Partner Notes will be added to the principal amount and may not be paid unless principal of the loan may be made in compliance with the terms of the senior indebtedness of the Silver Legacy Joint Venture, including the Silver Legacy Credit Facility or the Silver Legacy Second Lien Notes, or at maturity.

As a result of the identification of triggering events by Eldorado's management, Eldorado recognized non-cash impairment charges of $33.1 million in 2011 for its investment in the Silver Legacy Joint Venture. Such impairment charges eliminated Eldorado’s remaining investment in the Silver Legacy Joint Venture. Non-controlling interests in the Silver Legacy Joint Venture were allocated $4.8 million of the non-cash impairments, eliminating the remaining non-controlling interest. Assumptions used in such analyses were impacted by the default in the payment of principal and interest on the Silver Legacy Joint Venture’s debt obligations on March 1, 2012, the current cash flow forecasts and market conditions for the Silver Legacy Joint Venture. As a result of the elimination of Eldorado's remaining investment in the Silver Legacy Joint Venture, Eldorado discontinued the equity method of accounting for its investment in the Silver Legacy Joint Venture until the fourth quarter of 2012 when additional investments in the Silver Legacy Joint Venture were made by Eldorado. At such time, Eldorado recognized its share of the Silver Legacy Joint Venture's net losses not recognized during the period the equity method of accounting was suspended and resumed the equity method of accounting for its investment.

Eldorado's equity in income (losses) related to the Silver Legacy for the years ended December 31, 2013, 2012 and 2011 amounted to $2.3 million, ($9.7) million, and ($4.6) million, respectively. In addition, Eldorado recognized $12.0 million of gain from early extinguishment of debt of unconsolidated affiliate in connection with its investment in the Silver Legacy Joint Venture.

As a further consequence of the reorganization of the Silver Legacy Joint Venture through the bankruptcy process, on July 1, 2013, the Silver Legacy Joint Venture was converted into a Nevada limited liability company, Circus and Eldorado Joint Venture, LLC. Ownership interests held by ELLC and Galleon in the new entity are equal to the ownership interests held by each former partner in the joint venture, and the operating agreement of the limited liability company (the "Joint Venture Agreement") includes all of the material provisions of the Original Joint Venture Agreement with regard to management and operation of the Silver Legacy.

14

The Joint Venture Agreement provides equal voting rights for ELLC and Galleon (and procedures for resolving deadlocks) with respect to approval of the Silver Legacy Joint Venture’s annual business plan and the appointment and compensation of the general manager and gives each partner the right to terminate the general manager.

Silver Legacy Joint Venture Agreement. The following is a summary of certain provisions of the Joint Venture Agreement. The summary is qualified in its entirety by reference to the Joint Venture Agreement, which is incorporated by reference as an exhibit to this annual report.

Additional Capital Contributions. The Joint Venture Agreement provides that the Partners shall not be permitted or required to contribute additional capital to the Silver Legacy Joint Venture without the consent of the Partners, which consent may be given or withheld in each Partner’s sole and absolute discretion.

Partnership Distributions. In addition to distributions agreed to by the Partners and subject to any contractual restrictions, including the indenture relating to the Silver Legacy Second Lien Notes, prior to the occurrence of a “Liquidating Event” the Silver Legacy Joint Venture is required by the Joint Venture Agreement to make distributions to its Partners as follows:

(a) An amount equal to the estimated taxable income of the Silver Legacy Joint Venture allocable to each Partner multiplied by the greater of the maximum marginal income tax rate applicable to individuals for such period or the maximum marginal federal income tax rate applicable to corporations for such period; provided, however, that if the State of Nevada enacts an income tax (including any franchise tax based on income), the applicable tax rate for any tax distributions subsequent to the effective date of such income tax shall be increased by the higher of the maximum marginal individual tax rate or corporate income tax rate imposed by such tax (after reduction for the federal tax benefit for the deduction of state taxes, using the maximum marginal federal, individual or corporate rate, respectively).

(b) Annual distributions of remaining “Net Cash From Operations” as defined in the Joint Venture Agreement in proportion to the Percentage Interests of the Partners.

(c) Distributions of “Net Cash From Operations” in amounts or at times that differ from those described in (a) and (b) above, provided in each case that both Partners agree in writing to the distribution in advance thereof.

As defined in the Joint Venture Agreement, the term “Net Cash From Operations” means the gross cash proceeds received by the Silver Legacy Joint Venture, less the following amounts: (i) cash operating expenses and payments of other expenses and obligations of the Silver Legacy Joint Venture, including interest and scheduled principal payments on Silver Legacy Joint Venture indebtedness, including indebtedness owed to the Partners, if any, (ii) all capital expenditures made by the Silver Legacy Joint Venture, and (iii) such reasonable reserves as the Partners deem necessary in good faith and in the best interests of the Silver Legacy Joint Venture to meet anticipated future obligations and liabilities of the Silver Legacy Joint Venture (less any release of reserves previously established, as similarly determined).

The Managing Partner. The Joint Venture Agreement designates Galleon as the Silver Legacy Joint Venture’s managing partner with responsibility and authority for the day-to-day management of the business affairs of the Silver Legacy Joint Venture, including overseeing the day-to-day operations of Silver Legacy and other Silver Legacy Joint Venture business, preparation of the Silver Legacy Joint Venture’s budgets and implementation of the decisions made by the Partners. In the event Galleon resigns as managing partner, ELLC will have the right and option to become the managing partner. The managing partner is also responsible for the preparation and submission of the Silver Legacy Joint Venture’s annual business plan for review and approval by the Silver Legacy Joint Venture’s executive committee. The executive committee consists of five members, with three members appointed by the managing partner and two members appointed by the other Partner. However, some actions require unanimous approval of the Partners and the Joint Venture Agreement contains certain deadlock breaking protocols.

The Joint Venture Agreement provides that the managing partner shall appoint the general manager, subject to approval of the appointment by the executive committee. Under the terms of the Joint Venture Agreement, the general manager may be removed by ELLC or Galleon upon 30 days written notice. The Joint Venture Agreement also provides that the managing partner shall appoint the other principal senior management of the Silver Legacy Joint Venture and Silver Legacy, subject to approval of such appointments by the executive committee in the case of the general manager, who is the Partnership’s chief executive officer, and the controller, who is the Silver Legacy Joint Venture’s chief financial officer and accounting officer. The Silver Legacy Joint Venture’s senior management performs such functions, duties, and responsibilities as the managing partner may assign, and serves at the direction and pleasure of the managing partner.

The Joint Venture Agreement provides that the unanimous approval of both Partners is required for certain actions, including the admission of an additional partner, the purchase of additional real property, encumbrances on Silver Legacy, sales or other dispositions of all or substantially all of the assets of the Silver Legacy Joint Venture, refinancing or incurrence of

15

indebtedness involving in excess of $250,000 other than in the ordinary course of business, capital improvements involving more than $250,000 that are not included in an approved annual business plan, and any obligation, contract, agreement, or commitment with a partner or an affiliate of a partner which is not specifically permitted by the Joint Venture Agreement.

Replacement of the Managing Partner. If the actual net operating results of the business of the Silver Legacy Joint Venture for any four consecutive quarters are less than 80% of the projected amount as set forth in the Silver Legacy Joint Venture’s annual business plan, after appropriate adjustments for factors affecting similar business in the vicinity of the Silver Legacy, ELLC may require Galleon to resign from its position as managing partner.

In addition, in the event Galleon resigns as managing partner, ELLC will have the right and option to become the managing partner of the Silver Legacy Joint Venture and assume all the obligations of the managing partner under the Joint Venture Agreement, or the Partners are required to attempt to appoint a third party to manage the day-to-day business affairs of the Silver Legacy Joint Venture. In that event, if the Partners are unable to agree on a manager, then the Silver Legacy Joint Venture shall be dissolved and liquidated in accordance with the provisions of the Joint Venture Agreement.

The Executive Committee. An executive committee of the Silver Legacy Joint Venture is authorized to review, monitor and oversee the performance of the management of the Silver Legacy. The executive committee of the Silver Legacy Joint Venture shall consist of five members, with three members appointed by the managing partner and two members appointed by the other Partner. In the event that neither of the Partners is the managing partner, then the executive committee shall consist of five members, with two members appointed by each Partner and a fifth member appointed by a third party manager selected by the Partners. Each Partner may, at any time, appoint alternate members to the executive committee and the alternates will have all the powers of a regular committee member in the event of the absence or inability of a regular committee member to serve. With the exception of the special voting procedures described below, each member of the executive committee is entitled to one vote on each matter decided by the executive committee and each action of the executive committee must be approved by a majority of all of the members of the executive committee, who may be present or voting by proxy. The current members of the executive committee are James J. Murren, Corey I. Sanders and Donald D. Thrasher, each of whom was appointed by Galleon, and Robert M. Jones and Gene R. Carano, each of whom was appointed by ELLC.

Subject to the requirement of unanimous approval of the Partners for certain actions, the duties of the executive committee include, but are not limited to, (i) reviewing, adjusting, approving, developing, and supervising the Silver Legacy Joint Venture’s annual business plan, (ii) reviewing and approving the terms of any loans made to the Silver Legacy Joint Venture, (iii) approving all material purchases, sales, leases or other dispositions of Silver Legacy Joint Venture property, other than in the ordinary course of business, and (iv) approving the appointment of the General Manager, who is the Silver Legacy Joint Venture’s Chief Executive Officer, and the Controller, who is the Silver Legacy Joint Venture’s Chief Financial Officer and Accounting Officer, and determining the compensation of the General Manager and the Controller.

The Joint Venture Agreement provides special voting procedures for (i) the executive committee’s approval of the annual business plan, (ii) the appointment of the general manager and (iii) the determination of the general manager’s compensation. In voting on these matters, the members of the executive committee appointed by the managing partner shall have a total of two votes and the members of the executive committee appointed by the other Partner shall have a total of two votes. The managing partner shall designate which two of the three members of the executive committee appointed by the managing partner are to exercise the two votes. If the executive committee is deadlocked in deciding any matter which is subject to the special voting procedures, then the meeting may be adjourned to another meeting date. If the executive committee remains deadlocked with respect to its approval of an annual business plan until the end of the second month of the fiscal year described in the annual business plan, then either Partner may by written notice cause the approval of the annual business plan to be submitted to a nationally recognized accounting firm mutually agreeable to the Partners (the “Accountant”) for resolution. The Accountant shall consider the positions of the members of the executive committee and the Partners, and shall decide whether to approve the annual business plan, or to modify the annual business plan and approve it with such modifications. The decision of the Accountant on these matters shall have the same effect as the approval of the annual business plan by the executive committee. If the executive committee remains deadlocked with respect to its approval of the appointment of a general manager for a period of one month following the effective date of the resignation or removal of the previous general manager, then the executive committee shall assume the duties of the general manager until such time as the executive committee can reach a decision on the appointment and compensation of a new general manager. In exercising the duties of the general manager, the executive committee shall act and vote in accordance with the special voting procedures described above. If the executive committee remains deadlocked on the determination of the compensation of the general manager for a period of one month following the first meeting on the proposed compensation, then either Partner may by written notice cause the determination of such compensation to be submitted to the Accountant for resolution. In that event, the Accountant shall consider the positions of the executive committee, and shall adopt a compensation arrangement consistent with the position advocated by at least one member of the executive committee. The decision of the Accountant on any matter which is subject to the special voting procedures shall be final and binding on the executive committee and the Partners.

16

Transfer of Partnership Interests. Except as expressly permitted by the Joint Venture Agreement, neither Partner may transfer all or any portion of its interest in the Silver Legacy Joint Venture or any rights therein without the unanimous consent of both Partners. The Joint Venture Agreement provides that a Partner may transfer or convey all or any portion of its interest in the Silver Legacy Joint Venture to an affiliate of such Partner (subject to certain limitations), members of the Partner’s family (which includes the Partner’s spouse, natural or adoptive lineal descendants, and trusts for their benefit), another Partner, a personal representative of the Partner or any person or entity approved by the unanimous consent of the Partners.

Unless otherwise agreed by Galleon, Carano or a member of his immediate family acceptable to Galleon, which acceptance may not be unreasonably withheld, or an affiliate controlled by Carano or a member of his immediate family acceptable to Galleon, which acceptance may not be unreasonably withheld, is required to be the manager of and control ELLC (or, if applicable, any entity that is a permitted transferee and to which ELLC has transferred its interest in the Silver Legacy Joint Venture). Unless otherwise agreed by ELLC, which may not be unreasonably withheld, Galleon (or, if applicable, any entity that is a permitted transferee and to which Galleon has transferred its interest in the Silver Legacy Joint Venture) is required to be controlled by Mandalay Resort Group. In the event the limitation in this paragraph with respect to either Partner is breached, the other Partner will have the right (but not be required) to exercise the buy-sell provisions described below.

Limitation on Partners’ Actions. The Joint Venture Agreement includes each Partner’s covenant and agreement not to (i) take any action to require partition or to compel any sale with respect to its Silver Legacy Joint Venture interest, (ii) take any action to file a certificate of dissolution or its equivalent with respect to itself, (iii) take any action that would cause a bankruptcy of such Partner, (iv) withdraw or attempt to withdraw from the Silver Legacy Joint Venture, (v) exercise any power under the Nevada Uniform Partnership Act to dissolve the Silver Legacy Joint Venture, (vi) transfer all or any portion of its interest in the Silver Legacy Joint Venture (other than as permitted thereunder), (vii) petition for judicial dissolution of the Silver Legacy Joint Venture, or (viii) demand a return of such Partner’s contributions or profits (or a bond or other security for the return of such contributions or profits) without the unanimous consent of the Partners. The Joint Venture Agreement also provides that if a Partner attempts to (A) cause a partition or (B) withdraw from the Silver Legacy Joint Venture or dissolve the Silver Legacy Joint Venture, or otherwise take any action in breach of its aforementioned agreements, the Silver Legacy Joint Venture shall continue and (1) the breaching Partner shall immediately cease to have the authority to act as a Partner, (2) the other Partner shall have the right (but shall not be obligated unless it was so obligated prior to such breach) to manage the affairs of the Silver Legacy Joint Venture, (3) the breaching Partner shall be liable in damages, without requirement of a prior accounting, to the Silver Legacy Joint Venture for all costs and liabilities that the Silver Legacy Joint Venture or any Partner may incur as a result of such breach, (4) distributions to the breaching Partner shall be reduced to 75% of the distributions otherwise payable to the breaching Partner and (5) the breaching Partner shall continue to be liable to the Silver Legacy Joint Venture for any obligations of the Silver Legacy Joint Venture pursuant to the Joint Venture Agreement, and to be jointly and severally liable with the other Partner(s) for any debts and liabilities (whether actual or contingent, known or unknown) of the Silver Legacy Joint Venture existing at the time the breaching Partner withdraws or dissolves.

Buy-Sell Provision. Either Partner (provided such Partner is not in default of any of the provisions of the Joint Venture Agreement) may make an offer to purchase (“Offer”) the interest of the other Partner, which will constitute an irrevocable offer by the Partner giving the Offer either to (i) purchase all, but not less than all, of the interest in the Silver Legacy Joint Venture of the other Partner free of liens and encumbrances for the amount specified in the Offer (the “Sales Price”), or (ii) sell all, but not less than all, of its interest in the Silver Legacy Joint Venture free of liens and encumbrances to the other Partner for the amount specified in the Offer (the “Purchase Price”). The Partner receiving an Offer will have a period of two months to accept the Offer to sell at the Sales Price or, in the alternative, to require that the offering Partner sell its interest to the other Partner at the Purchase Price. The closing of the transaction for the sale or purchase of the Silver Legacy Joint Venture interest shall occur not later than six months after the notice of election or at such other time as may be required by the Nevada Gaming Authorities. Subject to any agreements to which the Silver Legacy Joint Venture is a party, the Partner purchasing the Silver Legacy Joint Venture interest (the “Purchasing Partner”) shall be entitled to encumber the Silver Legacy Joint Venture property in order to finance the purchase, provided that the other Partner (the “Selling Partner”) will have no liability, contingent or otherwise, under such financing. The Purchasing Partner may assign all or part of its right to purchase the Silver Legacy Joint Venture interest of the Selling Partner to an affiliate of the Purchasing Partner, provided that no such assignment relieves the Purchasing Partner of its obligations in the event of a default by the affiliate.

Dissolution, Winding Up and Liquidation. The Joint Venture Agreement provides that the Silver Legacy Joint Venture shall dissolve and commence winding up and liquidating upon the first to occur of any of (i) January 1, 2053, (ii) the sale of all or substantially all of the Silver Legacy Joint Venture property, (iii) the unanimous vote of the Partners to dissolve, wind up, and liquidate the Silver Legacy Joint Venture, (iv) the happening of any other event that makes it unlawful or impossible to carry on the business of the Silver Legacy Joint Venture, (v) the occurrence of an Event of Bankruptcy (as defined the Joint Venture Agreement) of a Partner, or (vi) the Partners are unable to agree upon a replacement managing partner as provided in the Joint Venture Agreement (each, a “Liquidating Event”).

17

The Joint Venture Agreement also includes the Partners’ agreement that the Silver Legacy Joint Venture shall not dissolve prior to the occurrence of a Liquidating Event, notwithstanding any provision of the Nevada Uniform Silver Legacy Joint Venture Act to the contrary. If it is determined by a court of competent jurisdiction that the Silver Legacy Joint Venture has dissolved prior to the occurrence of a Liquidating Event, the Partners have agreed to continue the business of the Silver Legacy Joint Venture without a winding up or liquidation.