Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REPLIGEN CORP | d737337d8k.htm |

| EX-99.1 - EX-99.1 - REPLIGEN CORP | d737337dex991.htm |

Repligen Acquires Bioprocessing

Business of Refine Technology

June 3, 2014

Exhibit 99.2 |

Participants

•

Walter Herlihy, President and CEO

•

Howard Benjamin, VP Business Development

•

Sondra Newman, Director Investor Relations

Safe Harbor Statement.

This presentation contains forward looking statements. These statements are

subject to risks and 2

uncertainties which may cause our plans to change or results to vary. In particular, unforeseen

events outside of our control may adversely impact future results. Additional information

concerning these factors is discussed in our reports filed with the Securities and Exchange

Commission including recent Form 8-Ks, our most recent Annual Report on Form 10-K and our most

recent Quarterly report on Form 10-Q. The forward looking statements in this presentation reflect

management’s current views and may become obsolete as a result of new information, future

events or otherwise. We do not undertake any duty to update such forward looking

statements, except as required by law. The industry and market data contained in this presentation are

based on management’s own estimates, independent publications, government publications, reports

by market research firms or other published independent sources, and, in each case, are

believed by management to be reasonable estimates. Although we believe these sources are

reliable, we have not independently verified the information. |

Building a Best-in-Class Bioprocessing Company

•

Repligen is a leading provider of innovative products that

increase efficiency in the manufacture of biologic drugs

•

Strong organic growth supplemented by timely strategic

acquisitions has substantially increased revenues

•

Refine Technology acquisition provides:

•

Profitable, complementary product line

•

15% increase in revenues

•

Significant customer overlap and direct sales synergy

•

Plans for continued revenue growth includes significant

commercial expansion to support enhanced product lines

3 |

Refine Technology Profile

•

Refine manufactures and sells the ATF System, a filtration

device that significantly increases biologic product yields in

fermentation by continuously removing waste materials,

enabling cells to grow to high density

•

The ATF System is the market-leading device for this

application; incorporated into several FDA-approved

manufacturing processes

•

ATF products are sold to leading biopharmaceutical

manufacturers worldwide through distributors and direct

sales to several key customers

•

Refine is profitable with gross margins >50%

4 |

Refine Acquisition: Financial Terms

•

Definitive agreement to acquire the business of Refine

Technology for $20.5 million cash and 215,285 shares of

Repligen stock; total upfront = $24.5 million

•

Deal includes future contingent payments of up to $8.75

million based on defined revenue targets

•

Integration

expected

to

be

completed

by

Q1

2015

5 |

Benefits of the Transaction

•

Increases annual product revenue by approximately 15%

•

ATF System strengthens our brand and technology base

•

Increases our presence in fermentation

•

Multiple opportunities to drive growth:

•

Increase direct sales to overlapping customer base

•

Develop applications data to support product adoption

•

Integrate with Repligen’s quality system

•

Develop a single-use, consumable ATF product for use in

facilities designed around disposables

6 |

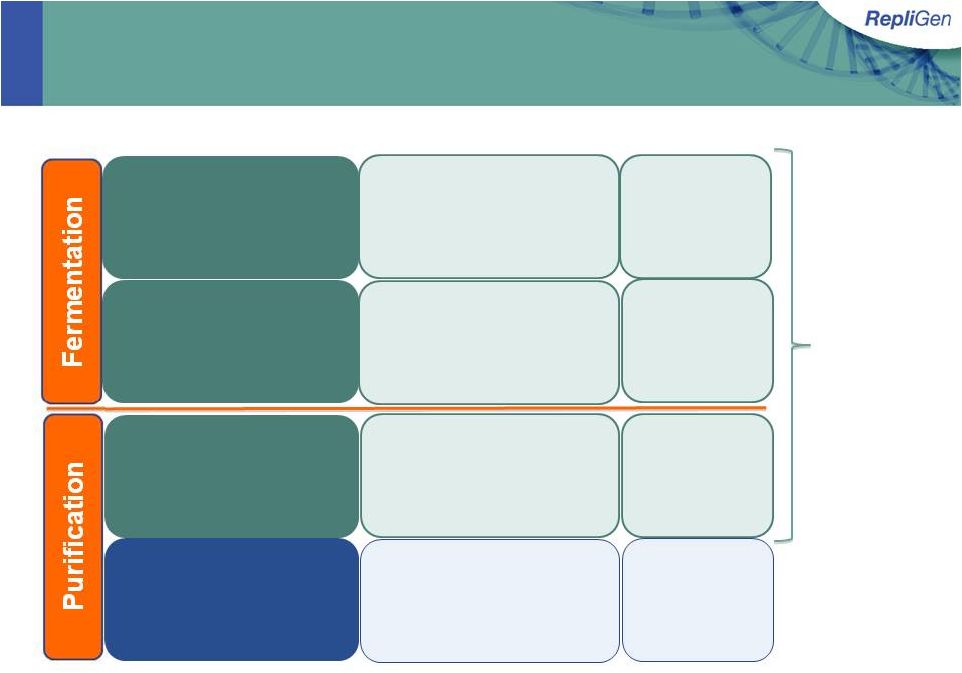

Used to improve cell growth

and productivity during

fermentation

Growth Factors

LONG

®

R3 IGF-1

Distributor

co-promote

to end users

Expanded

portfolio to

support

expansion of

commercial

organization

Expanded Product Portfolio

Protein A

Affinity Ligands

Affinity ligands used to

make media for monoclonal

antibody purification

Sell through

partners

Chromatography

OPUS

®

Pre-packed columns and

media used for biologic

drug purification

Sell directly

to end users

7

Filtration devices that

enable high density cell

growth during fermentation

ATF Systems

Sell directly

to end users*

* Supplemented by distributors in specific geographies

|

Expansion of Commercial

Organization •

Tony Hunt, COO

•

Former

President

of

the

Bioproduction

business

at

Life

Technologies; $300M+ business

•

Product lines: Gibco (fermentation) and Poros (purification)

•

Increasing size of commercial organization

•

Sales managers in more geographies: U.S., EU, Asia

•

Technical applications and customer support

•

John Bonham-Carter, Head of Sales at Refine Technology

•

Increased marketing and promotion of all product lines

•

Expansion to be completed by the end of 2014

8 |

Financial Guidance for 2014

9

2014

Previous

2014

Revised

Comment

Product Sales

$52-$55M

$56-$59M

ATF ~$3.5-4M in H2 2014

Product Gross Margin

~53%

51%-53%

Inventory revaluation,

relocation expenses

R&D

~$5.0M

~$5.5M

ATF Single Use +$500K

SG&A

$14-$15M

$15-$16M

Sales expansion,

Deal expenses

Operating Profit

$11-$13M

$10-$12M

Includes $2M for licensing

Q1 2014

Net Income

$8-$10M

$8-$10M

Includes $2M for licensing

Q1 2014

CAPEX

$4.5M

$6M

Expand manufacturing

EOY Cash

$84-$87M

$62-$66M

No debt |

•

Favorable acquisition of Refine Technology supports

corporate strategy and expanded market presence

•

Next

steps:

•

Q4 2014 –

Complete expansion of commercial organization

•

Q1 2015 –

Complete integration of Refine’s operations

•

H1 2015 –

Launch single-use ATF product line

•

We are positioned for sustained growth within the

worldwide biologics market, particularly monoclonal

antibodies

Summary

10 |