Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended March 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-14656

REPLIGEN CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 04-2729386 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 41 Seyon Street, Bldg. 1, Suite 100 Waltham, MA |

02453 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (781) 250-0111

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class

Common Stock, $0.01 Par Value Per Share

Series A Junior Participating Preferred Stock Purchase Rights

Name of Each Exchange on Which Registered

The NASDAQ Stock Market LLC

Securities registered pursuant to Section 12(g) of the Act: None

Title of Each Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x.

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of September 30, 2010, the last business day of the registrant’s most recently completed second fiscal quarter, was $104,061,098.

The number of shares of the registrant’s common stock outstanding as of May 20, 2011 was 30,812,257.

Documents Incorporated By Reference

Portions of the Company’s Proxy Statement for the 2011 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

| PAGE | ||||||

| PART I |

||||||

| Item 1. |

1 | |||||

| Item 1A. |

10 | |||||

| Item 1B. |

18 | |||||

| Item 2. |

18 | |||||

| Item 3. |

18 | |||||

| Item 4. |

18 | |||||

| PART II |

||||||

| Item 5. |

19 | |||||

| Item 6. |

21 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

22 | ||||

| Item 7A. |

33 | |||||

| Item 8. |

33 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

33 | ||||

| Item 9A. |

33 | |||||

| Item 9B. |

36 | |||||

| PART III |

||||||

| PART IV |

||||||

| Item 15. |

38 | |||||

| 41 | ||||||

Table of Contents

PART I

| Item 1. | BUSINESS |

The following discussion of our business contains forward-looking statements that involve risks and uncertainties. When used in this report, the words “intend,” “anticipate,” “believe,” “estimate,” “plan” and “expect” and similar expressions as they relate to us are included to identify forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements and are a result of certain factors, including those set forth under “Risk Factors” and elsewhere in this Annual Report on Form 10-K.

Repligen Corporation (“Repligen,” the “Company” or “we”) is an integrated biopharmaceutical company focused on the development and commercialization of innovative therapies that deliver the benefits of protein therapies to patients and clinicians in the fields of neurology and gastroenterology. We are currently conducting a number of drug development programs for diseases such as pancreatitis, Friedreich’s ataxia and spinal muscular atrophy. We also have a bioprocessing business that focuses on the development and commercialization of products that are used in the production of biopharmaceuticals. In addition, we have out-licensed certain biologics intellectual property from which we receive royalties from Bristol-Myers Squibb Company (“Bristol”) on their net sales in the United States of their product Orencia®.

We were incorporated in May 1981, under the laws of the State of Delaware. Our principal executive offices are at 41 Seyon Street, Waltham, Massachusetts 02453 and our telephone number is (781) 250-0111.

Currently Marketed Products

We currently sell a line of commercial bioprocessing products based on Protein A, as well as a line of pre-packed chromatography columns, which are used in the production of monoclonal antibodies and other biopharmaceutical products.

Products for Biologics Manufacturing

Chromatography resins based on Protein A are widely used in the purification of therapeutic monoclonal antibodies. Most therapeutic monoclonal antibodies are manufactured by the fermentation of mammalian cells that express the monoclonal antibody. The monoclonal antibody is typically produced by a process in which an impure fermentation broth containing the desired monoclonal antibody is passed over a solid support to which Protein A has been chemically attached or a “resin.” The immobilized Protein A binds the monoclonal antibody while other impurities are washed away. The monoclonal antibody is then recovered from the support in a substantially purified form.

We manufacture and market several products based on recombinant forms of Protein A. Our primary customers incorporate various forms of Protein A products into their proprietary monoclonal antibody purification products that they sell directly to the biopharmaceutical industry. We primarily supply Protein A products to GE Healthcare (“GEHC”) under a supply agreement which extends through 2015. The majority of our product sales for the last three years have been sales of Protein A products and related detection assays.

We recently introduced a second product line under the tradename OpusTM which is based on a technology for the production of pre-packed, “plug and play” chromatography columns for the purification of biopharmaceuticals and vaccines. In January 2010, we acquired this patented technology from BioFlash Partners, LLC (“BioFlash”) (see Note 13) that enables reliable production of pre-packed chromatography columns in a format that is ready for use in manufacturing. Opus columns have the potential to improve manufacturing efficiencies by reducing time for column packing, set-up and cleaning. We plan to invest in the expansion of this product line this year based on specific customer feedback. We also expect to seek to acquire, license or distribute additional bioprocessing products which we can sell directly to end-users.

1

Table of Contents

Monoclonal antibodies are highly valuable therapeutic agents and were among the best-selling drugs in the world in 2010. Global revenues from monoclonal antibody products will have moved significantly past the $40 billion level in 2010 and are poised to continue growing steadily through 2015. Examples of therapeutic antibodies include Enbrel® and Remicade® for rheumatoid arthritis and other inflammatory disorders, and Rituxan® for rheumatoid arthritis and Non-Hodgkin’s Lymphoma, among others. There are approximately 286 monoclonal antibodies in various stages of clinical development which may lead to additional growth of the biopharmaceuticals market and in turn, increased demand for Protein A and Opus products.

SecreFlo® for Pancreatic Diagnosis

We discontinued distribution of SecreFlo® in the second quarter of fiscal year 2009 due to the expiration of our agreement with ChiRhoClin, Inc. Previously, we recorded sales of SecreFlo®, a synthetic form of porcine (pig-derived) secretin. SecreFlo® is approved by the U.S. Food and Drug Administration (“FDA”) as an aid in the diagnosis of chronic pancreatitis and gastrinoma (a form of cancer) and as an aid during endoscopic retrograde cholangiopancreatography (“ERCP”), a gastrointestinal procedure.

Intellectual Property on CTLA4-Ig

Orencia® (CTLA4-Ig) Royalties

CTLA4 is a key regulator of the activity of the immune system. CTLA4 “turns off” the immune system after it has successfully cleared a bacterial or viral infection by blocking the activation of T-cells, the immune cells responsible for initiating an immune response. In the 1990’s, our collaborators at the University of Michigan and the U.S. Navy demonstrated in animal models that a fusion protein consisting of fragments of CTLA4 and an antibody (“CTLA4-Ig”) could be used to treat certain autoimmune diseases. This research finding resulted in the granting of U.S. patent No. 6,685,941 (“the ‘941 Patent”) covering the treatment of certain autoimmune disorders including rheumatoid arthritis with CTLA4-Ig. CTLA4-Ig’s mechanism of action is different from the current therapies for autoimmune disease or organ transplant rejection, thus it may provide a treatment for patients who are refractory to existing therapies.

In December 2005, the FDA approved Bristol’s application to market CTLA4-Ig, under the brand name Orencia®, for treatment of rheumatoid arthritis. In January 2006, Repligen and the University of Michigan jointly filed a lawsuit against Bristol in the United States District Court for the Eastern District of Texas for infringement of the ‘941 Patent. In April 2008, Repligen and the University of Michigan entered into a settlement agreement with Bristol pursuant to which, Bristol made an initial payment of $5 million to Repligen and agreed to pay us royalties on the U.S. net sales of Orencia® for any clinical indication at a rate of 1.8% for the first $500 million of annual sales, 2.0% for the next $500 million and 4.0% of annual sales in excess of $1 billion for each year from January 1, 2008 until December 31, 2013.

The ‘941 Patent is owned by the University of Michigan and exclusively licensed to Repligen. In consideration of this exclusive license, Repligen agreed to pay the University of Michigan 15% of all royalty income received, after deducting legal expenses. There are no annual or other fees associated with this agreement. Under this agreement, since its inception through fiscal year 2011, Repligen has paid approximately $3,975,000 to the University of Michigan.

Research and Development

For the past three years, we have devoted substantial resources to the research and development of therapeutic product candidates and our commercial products discussed herein. We spent $12,529,000, $14,160,000 and $12,772,000 in fiscal years 2011, 2010 and 2009, respectively, on company-sponsored research and development activities.

2

Table of Contents

Development Stage Products

Secretin for MRI Imaging of the Pancreas

Secretin is a well-known gastrointestinal hormone produced in the small intestine that regulates the function of the pancreas as part of the process of digestion. We recently completed a Phase 3 clinical trial evaluating the sensitivity and specificity of secretin in combination with MRI to improve the detection of structural abnormalities of the pancreas relative to MRI alone. Detailed visual assessment of the pancreatic ducts and identification of structural abnormalities is important in the assessment, diagnosis and treatment of diseases such as acute and chronic pancreatitis. The use of secretin during MRI harnesses the natural biologic properties of secretin, which signals the release of water-rich fluids into the ducts of the pancreas. Improvement in the detection and delineation of normal and abnormal structures with MRI is attractive for patient care as it can obviate the need for more invasive endoscopic procedures.

We initiated a Phase 2 clinical trial in June 2006 to evaluate the use of RG1068, synthetic human secretin, as an agent to improve the detection of structural abnormalities of the pancreatic ducts during MRI imaging of the pancreas. This was a multi-center, baseline controlled, single dose study in which 76 patients with a history of pancreatitis received an RG1068-MRI and an MRI alone of the pancreas. In May 2007, we announced positive results from this Phase 2 clinical trial. The study showed an improvement in sensitivity of detection of structural abnormalities of the pancreatic duct of approximately 20% with no loss in specificity. In addition, the study showed highly significant increases in the following three assessments: physician confidence in their ability to identify structural abnormalities, the number of pancreatic duct segments visualized, and improvement in the overall quality of the MRI images. Our Phase 2 data was reviewed by the FDA and served as the basis for a pivotal, Phase 3 study.

This Phase 3 clinical trial was initiated in March 2008 and completed in December 2009. This was a multi-center, baseline controlled, single dose study in which 258 patients with a history of pancreatitis at 23 clinical sites within the United States and Canada received an MRI of the pancreas with and without RG1068. The primary objectives of the Phase 3 study were to demonstrate that RG1068 increases the sensitivity in detecting structural abnormalities of the pancreas by MRI, with minimal loss of specificity. The predetermined criteria for a successful study included the achievement of a statistically significant improvement in sensitivity with minimal loss in specificity from two of the three central radiologists reading the MRI images. In this study, one radiologist achieved a statistically significant improvement in sensitivity with RG1068, while a second radiologist showed a trend but did not achieve statistical significance. There was minimal loss in specificity for all radiologists. Based on inconsistencies in the analysis of the radiographic images by the three radiologists hired to review the Phase 3 images, we submitted a request to the FDA and the European Medicines Agency (“EMA”) to re-analyze the Phase 3 data set (“Phase 3 re-read”). In May 2010, the FDA and EMA approved our plan for a re-analysis of images obtained from the Phase 3 trial. In March 2011, we announced positive results of the Phase 3 re-read, in which all three independent radiologists achieved a statistically significant improvement in sensitivity (all radiologists p<0.0001) with minimal loss in specificity. In addition, the RG1068-MRI images showed statistically significant improvements on image quality and confidence in the diagnostic findings when compared to MRI alone. We plan to file a New Drug Application (“NDA”) with the FDA in the second quarter of fiscal 2012. We also expect to build a commercial infrastructure to support the launch of RG1068 in the U.S. and to seek to establish one or more partnerships for commercialization of RG1068 outside the U.S., pending regulatory approvals.

We have received an Orphan Drug designation from the FDA covering the use of RG1068 in MRI which, if we are the first company to receive FDA approval for this use of secretin in the United States, will provide seven years of marketing exclusivity in the United States following approval of the NDA. We also have received “fast track” designation from the FDA which may provide the basis for an expedited review of this NDA by the FDA.

We believe that there may be additional uses for RG1068 and we intend to evaluate whether RG1068 has the potential to improve the detection of pancreatic cancer. We will also seek to acquire products that are complementary to RG1068, which we may be able to sell to gastroenterologists or radiologists.

3

Table of Contents

Histone Deacetylase Inhibitors for Friedreich’s Ataxia and Memory Disorders

Friedreich’s ataxia is an inherited neurodegenerative disease caused by a single gene defect that results in inadequate production of the protein frataxin. Low levels of frataxin lead to degeneration of both the nerves controlling muscle movements in the arms and legs and the nerve tissue in the spinal cord. Symptoms of Friedreich’s ataxia typically emerge between the ages of five and fifteen and often progress to severe disability, incapacitation or loss of life in early adulthood. There are approximately 15,000 patients worldwide with Friedreich’s ataxia. There is currently no treatment for Friedreich’s ataxia.

Repligen is currently developing RG2833, a selective class I histone deacetylase 3 inhibitor for the treatment of Friedreich’s ataxia. In May 2010, we filed an Investigational New Drug Application (“IND”) for RG2833 with the FDA and are now completing additional toxicology studies to support that filing. Pending regulatory approval, we plan to initiate a single, ascending dose Phase 1 study of RG2833 in Friedreich’s ataxia patients in Europe. We have developed methods to measure changes in frataxin levels in patient cells for use in our clinical trial which may enable us to gain an early insight into the potential benefit of treating patients with RG2833. We have received an Orphan Drug designation from the FDA for RG2833, which, if we are the first company to obtain market approval for RG2833 for Friedreich’s ataxia in the United States, will provide seven years of marketing exclusivity in the United States following NDA approval. We have received an Orphan Drug designation from the European Commission for RG2833, which, if we are the first company to obtain market approval for RG2833 for Friedreich’s ataxia in Europe, will provide ten years of marketing exclusivity in Europe following the Marketing Authorization Application (“MAA”) approval. The composition of RG2833 is covered by patent applications in the United States and Europe (see Patents, Licenses and Proprietary Rights section below.)

Repligen is also exploring the applicability of histone deacetylase inhibitors in the treatment of memory disorders.

DcpS Inhibitors for Spinal Muscular Atrophy

We are pursuing development of a drug that targets the scavenger mRNA decapping enzyme, DcpS, for treatment of patients with spinal muscular atrophy (“SMA”). Our inhibitors have the potential to be the first in class treatment for this disease. SMA is an inherited neurodegenerative disease in which a defect in the survival motor neuron gene (“SMN”) results in low levels of the protein SMN and leads to progressive damage to motor neurons, loss of muscle function and, in many patients, early death. There are approximately 20,000 people in the U.S. and Europe diagnosed with SMA.

On October 22, 2009, we entered into an exclusive worldwide commercial license agreement (“FSMA License Agreement”) with Families of Spinal Muscular Atrophy (“FSMA”). Pursuant to the FSMA License Agreement, we obtained an exclusive license to develop and commercialize certain patented technology and improvements thereon, owned or licensed by FSMA, relating to compounds which may have utility in treating SMA. If all milestones are achieved, total financial obligations under this agreement, including milestone payments, sublicense fees, and other charges, could total approximately $16,000,000.

Repligen’s compounds, based on RNA processing enzymes to inhibit DcpS, increase the production of the SMN protein in cells derived from patients. RG3039, our lead compound, has been shown to improve survival in a preclinical model of SMA. We filed an IND for RG3039 in the first quarter of fiscal 2012 and plan to initiate a Phase 1 study of RG3039 in healthy volunteers later in fiscal 2012. We have received an Orphan Drug designation from the FDA for RG3039, which, if we are the first company to obtain market approval for RG3039 for SMA in the United States, will provide seven years of marketing exclusivity in the United States following NDA approval. We are also seeking an Orphan Drug designation from the European Commission for RG3039, which, if granted, and if we are the first company to obtain market approval for RG3039 for SMA in Europe, will provide ten years of marketing exclusivity in Europe following MAA approval. The composition of RG3039 is covered by patent applications in the United States and Europe (see Patents, Licenses and Proprietary Rights section below.)

4

Table of Contents

Uridine for Bipolar Depression

Bipolar disorder, also known as manic depression, is a chronic illness marked by extreme changes in mood, thought, energy and behavior. Uridine is a biological compound that is essential for multiple biosynthetic processes including the synthesis of DNA and RNA, the basic hereditary material found in all cells and numerous other factors essential for cell metabolism. Researchers at McLean Hospital previously demonstrated that uridine is active in a well-validated animal model of depression. Literature reports indicate that certain genes that encode for mitochondrial proteins are significantly down-regulated in the brains of bipolar patients. This insight suggested that the symptoms of bipolar disorder may be linked to dysregulation of energy metabolism in the brain.

In March 2006, we initiated a Phase 2a clinical trial of RG2417, an oral formulation of uridine, in patients with bipolar disorder. The study showed a statistically significant improvement in the symptoms of depression in the patients treated with RG2417 when compared to placebo. Our Phase 2a data was reviewed by the FDA and served as the basis for a Phase 2b proof-of-concept clinical trial which we initiated in November 2008. In March 2011, we announced the results from this Phase 2b study which did not demonstrate a statistically significant improvement when compared to placebo in treating the symptoms of depression. At this time, we do not plan to invest additional resources in RG2417.

Sales and Marketing

We sell our bioprocessing products through our direct sales force, partners such as GEHC and distributors in certain foreign markets. Prior to its discontinuation in the second quarter of fiscal year 2009, we marketed SecreFlo® directly to hospital-based gastroenterologists in the United States.

We will file an NDA covering the use of RG1068 in MRI as early as the second quarter of fiscal 2012. We have also received “fast track” designation from the FDA which may provide the basis for an expedited review of this NDA by the FDA. We expect to build a commercial infrastructure to support the launch of RG1068 in the U.S., if approved, and to establish one or more partnerships for commercialization of RG1068 outside the U.S.

Significant Customers and Geographic Reporting

Customers for our bioprocessing products include chromatography companies, diagnostics companies, biopharmaceutical companies and laboratory researchers. In fiscal years 2011, 2010 and 2009, total revenues from sales to customers in the United States were approximately 50%, 57% and 59%, respectively. During the same fiscal periods, total revenues generated though sales to customers in Sweden were 42%, 36% and 36%, respectively. In April 2008, we settled our litigation with Bristol regarding their sales of Orencia® for which we now receive a royalty. For fiscal years 2011, 2010 and 2009, royalty revenue from Bristol represented 38%, 43% and 46% of total revenues, respectively. Our largest bioprocessing customer accounted for 42%, 36% and 36% of total revenues in fiscal years 2011, 2010 and 2009, respectively.

Employees

As of May 31, 2011, we had 66 employees. Of those employees, 46 were engaged in research, development and manufacturing and 20 were in administrative and marketing functions. Thirty-one of our employees hold doctorates or other advanced degrees. Each of our employees has signed a confidentiality agreement. None of our employees are covered by collective bargaining agreements.

Patents, Licenses and Proprietary Rights

Repligen considers patents to be an important element in the protection of our competitive and proprietary position and actively pursues patent protection in the United States and in major countries abroad. Other forms of protection, including trade secrets, orphan drug status and know-how, are also considered important elements of

5

Table of Contents

our proprietary strategy. As further described below, Repligen owns or has exclusive rights to a number of U.S. patents and U.S. pending patent applications as well as corresponding foreign patents and patent applications. The expiration of key patents owned or licensed by us or the failure of patents to issue on pending patent applications could create increased competition, with potential adverse effects on our business prospects. For each of our license agreements where we license the rights to patents or patent applications, the license will terminate on the day that the last to expire patent covered by each such license agreement expires.

We also rely upon trade secret protection for our confidential and proprietary information. Our policy is to require each of our employees, consultants, business partners and significant scientific collaborators to execute confidentiality agreements upon the commencement of an employment, consulting or business relationship with us. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific circumstances. In the case of employees and consultants, the agreements generally provide that all inventions conceived by the individual in the course of rendering services to Repligen shall be our exclusive property.

CTLA4-Ig

The ‘941 patent, covering the use of CTLA4-Ig to treat specific autoimmune disorders including rheumatoid arthritis and multiple sclerosis was issued in February 2004. The patent is assigned to the University of Michigan and the U.S. Navy and is exclusively licensed to Repligen. In April 2008, Repligen granted Bristol an exclusive sublicense to this patent.

Protein A

We own a broad U.S. patent covering recombinant Protein A, which expired in September 2009, as well as proprietary technology, trade secrets, and know-how relating to the manufacture of high-purity Protein A. In fiscal 2010, we were granted U.S. Patent No. 7,691,608 B2, “Nucleic Acids Encoding Recombinant Protein A,” which claims a recombinant gene that encodes a Protein A molecule with an amino acid sequence identical to that of the natural Protein A molecule which has long been commercialized for bioprocessing applications. This U.S. patent, with the term extension that was granted, will remain in effect until 2028. Foreign equivalents of this patent are being prosecuted outside of the United States.

Histone Deacetylase Inhibitors

Repligen has entered into an exclusive license agreement with The Scripps Research Institute for worldwide rights to a patent application claiming compounds and methods for treating Friedreich’s ataxia with inhibitors of histone deacetylase (“HDAC”). We have extended this original work and filed additional patent applications which claim both methods and compositions for treating Friedreich’s ataxia. These patent applications are currently being prosecuted in the United States and abroad.

Spinal Muscular Atrophy

In 2009, Repligen entered into an exclusive license agreement with a non-profit organization, the Families of Spinal Muscular Atrophy (“FSMA”), for worldwide rights to patent applications related to compositions and methods for the treatment of spinal muscular atrophy. FSMA had funded the development of these compounds and identified a novel enzyme target (“DcpS”) that these compounds inhibit. Notices of Allowance have been received from the U.S. Patent and Trademark Office for two of these pending applications. Allowed claims include genus and species claims of the lead clinical candidates. Repligen is prosecuting equivalent patent applications abroad.

6

Table of Contents

Uridine

In 2009, Repligen entered into an exclusive license agreement with McLean Hospital for the worldwide rights to an internationally filed patent application which covers the use of uridine in the treatment of patients with bipolar disorder. On June 15, 2010, we were granted U.S. Patent No. 7,737,128 B2, “Pyrimidines, such as uridine, in treatments for patients with bipolar disorder,” which, with the term extension that was granted, will remain in effect until October 2025. Under the terms of the license agreement, McLean received an upfront payment and is eligible to receive payments upon certain product development milestones and royalties upon successful commercialization of uridine for bipolar disorder.

Competition

Our bioprocessing products compete on the basis of quality, performance, cost effectiveness, and application suitability with numerous established technologies. Additional products using new technologies that may be competitive with our products may also be introduced. Many of the companies selling or developing competitive products have financial, manufacturing and distribution resources significantly greater than ours.

The field of drug development is characterized by rapid technological change. New developments are expected to continue at a rapid pace in both industry and academia. There are many companies, both public and private, including large pharmaceutical companies, chemical companies and specialized biotechnology companies, engaged in developing products competitive with products that we have under development. Many of these companies have greater capital, human resources, research and development, manufacturing and marketing experience than we do. They may succeed in developing products that are more effective or less costly than any that we may develop. These competitors may also prove to be more successful than we are in production and marketing. In addition, academic, government and industry-based research groups compete intensely with us in recruiting qualified research personnel, in submitting patent filings for protection of intellectual property rights and in establishing corporate strategic alliances. We cannot be certain that research, discoveries and commercial developments by others will not render any of our programs or potential products noncompetitive.

Manufacturing

Bioprocessing Products

We manufacture Protein A bioprocessing products from recombinant strains of bacteria. We manufacture Protein A for GEHC under a supply agreement which extends through 2015. We purchase raw materials from more than one commercially established company and believe that the necessary raw materials are currently commercially available in sufficient quantities necessary to meet market demand. We utilize our own facility and third parties to carry out certain fermentation and recovery operations, while the purification, immobilization, packaging and quality control testing of our Protein A bioprocessing products are conducted at our facilities. We are ISO 9001 certified and utilize a formal quality system to maintain process control, traceability, and product conformance. We also practice continuous improvement initiatives based on routine internal audits, customer feedback and audits performed by our partners and customers. In addition, our business continuity management system focuses on key areas such as contingency planning, security stocks and off-site storage of raw materials and finished goods to ensure continuous supply of our products.

We recently introduced a second product line under the tradename Opus which is based on a technology for the production of pre-packed, “plug and play” chromatography columns for the purification of biopharmaceuticals and vaccines. Opus columns have the potential to improve manufacturing efficiencies by reducing time for column packing, set-up and cleaning. We plan to invest in the expansion of this product line this year based on specific customer feedback. We also expect to seek to acquire, license or distribute additional bioprocessing products which we can sell directly to end-users.

7

Table of Contents

Therapeutic Product Candidates

We currently rely, and will continue to rely for at least the next few years, upon contract manufacturers for both the procurement of raw materials and the production of our product candidates for use in our clinical trials. Our product candidates will need to be manufactured in a facility and by processes that comply with the FDA’s good manufacturing practices and other similar regulations. It may take a substantial period of time to begin manufacturing our products in compliance with such regulations. If we are unable to establish and maintain relationships with third parties for manufacturing sufficient quantities of our product candidates and their components that meet our planned time and cost parameters, the development and timing of our clinical trials may be adversely affected.

Government Regulation

The development of drug candidates is subject to regulation in the United States by the FDA and abroad by foreign equivalents. Product development and approval within the FDA regulatory framework usually takes a significant number of years and involves the expenditure of substantial capital resources. Timelines for development are uncertain.

Before clinical testing in the United States of any drug candidate may begin, FDA requirements for preclinical efficacy and safety must be completed. Required toxicity testing typically involves characterization of the drug candidate in several animal species. Safety and efficacy data are submitted to the FDA as part of an Investigational New Drug application and are reviewed by the FDA prior to the commencement of human clinical trials.

Clinical trials involve the administration of the drug to human volunteers or patients under the supervision of a qualified investigator, usually a physician, with an FDA-approved protocol. Human clinical trials are typically conducted in three sequential phases:

| • | Phase 1 clinical trials represent the initial administration of the investigational drug to a small group of human subjects to test for safety (pharmacovigilance), dose tolerability, absorption, biodistribution, metabolism, excretion and clinical pharmacology and, if possible, to gain early evidence regarding efficacy and potential biomarkers. |

| • | Phase 2 clinical trials typically involve a small sample of the actual intended patient population and seek to assess the efficacy of the drug for specific targeted indications, to determine dose tolerance and the optimal dose range, and to gather additional information relating to safety and potential adverse effects. |

| • | Once an investigational drug is found to have some efficacy and an acceptable safety profile in the targeted patient population, Phase 3 clinical trials are initiated to establish further clinical safety and efficacy of the investigational drug in a broader sample of the general patient population at multiple study sites in order to determine the overall risk-benefit ratio of the drug and to provide an adequate basis for product approval. The Phase 3 clinical development program consists of expanded, large-scale studies of patients with the target disease or disorder to obtain definitive statistical evidence of the efficacy and safety of the proposed product. |

All data obtained from a comprehensive development program are submitted in an NDA to the FDA and the corresponding agencies in other countries for review and approval. The NDA includes information pertaining to clinical studies and the manufacture of the new drug. Review of an NDA by the FDA can be a time-consuming process, and the FDA may request that we submit additional data or carry out additional studies.

Available Information

We maintain a website with the address www.repligen.com. We are not including the information contained on our website as a part of, or incorporating it by reference into, this annual report on Form 10-K. We make

8

Table of Contents

available free of charge through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to these reports, as soon as reasonably practicable after we electronically file such materials with, or furnish such materials to, the Securities and Exchange Commission. Our Code of Business Conduct and Ethics is also available free of charge through our website.

In addition, the public may read and copy any materials that we file with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-SEC-0330. Also, our filings with the Securities and Exchange Commission may be accessed through the Securities and Exchange Commission’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) system at www.sec.gov.

9

Table of Contents

| Item 1A. | RISK FACTORS |

Investors should carefully consider the risk factors described below before making an investment decision.

If any of the events described in the following risk factors occur, our business, financial condition or results of operations could be materially harmed. In that case the trading price of our common stock could decline, and investors may lose all or part of their investment. Additional risks and uncertainties that we are unaware of or that we currently deem immaterial may also become important factors that affect Repligen.

This annual report on Form 10-K contains forward looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward looking statements as a result of certain factors, including the risks faced by us described below and elsewhere in this annual report on Form 10-K.

We are dependent on others to develop, conduct clinical trials for, manufacture, market and sell our principal products.

We conduct some of our development activities, and conduct most of our commercialization activities, through collaborations. These collaborations include academic researchers as well as contracts with vendors. Our collaborations are heavily dependent on the efforts and activities of our collaborative partners. Our existing and any future collaborations may not be technically or commercially successful. For example, if any of our collaborative partners were to breach or terminate an agreement with us, reduce its funding or otherwise fail to conduct the collaboration successfully, we may need to devote additional internal resources to the program that is the subject of the collaboration, scale back or terminate the program or seek an alternative partner, any of which could lead to delays in development and/or commercialization of our products.

We depend on, and expect to continue to depend on, a limited number of customers for a high percentage of our revenues.

As a result, the loss of, or a significant reduction in orders from, any of these customers would significantly reduce our revenues and harm our results of operations. If a large customer purchases fewer of our products, defers orders or fails to place additional orders with us, our revenue could decline, and our operating results may not meet market expectations. In addition, if those customers order our products, but fail to pay on time or at all, our liquidity and operating results could be materially and adversely affected.

Royalty revenue from Bristol-Myers Squibb Company for sales of Orencia® could fail to materialize.

Our royalty agreement with Bristol provides for us to receive payments from Bristol based on their net sales of their Orencia® product in the United States through December 31, 2013. We have no control over Bristol’s sales and marketing practices for Orencia®, and Bristol has no obligation to use commercially reasonable efforts to sell Orencia®. Bristol’s sales could be significantly impacted by regulatory and market influences beyond our control, resulting in low or even no royalty revenue for us.

Our research activities may not identify a clinical candidate with appropriate efficacy, safety and pharmacology to support clinical trials in humans.

In order to conduct Phase 1 clinical trials in humans, we must first demonstrate suitable efficacy, safety and pharmacology characteristics of any potential drug candidates. If we are unsuccessful in these efforts, we may be forced to identify alternative drug candidates at substantial cost, or possibly abandon certain pre-clinical research activities.

10

Table of Contents

Our clinical trials may not be successful and we may not be able to develop and commercialize related products.

In order to obtain regulatory approvals for the commercial sale of our future therapeutic products, we and our collaborative partners will be required to complete extensive clinical trials in humans to demonstrate the safety and efficacy of the products. We have limited experience in conducting clinical trials.

The submission of an IND application may not result in FDA authorization to commence clinical trials. If clinical trials begin, we or our collaborative partners may not complete testing successfully within any specific time period, if at all, with respect to any of our products. Furthermore, we, our collaborative partners, or the FDA, may suspend clinical trials at any time on various grounds, including a finding that the subjects or patients are being exposed to unacceptable health risks. Clinical trials, if completed, may not show any potential product to be safe or effective. Thus, the FDA and other regulatory authorities may not approve any of our potential products for any indication.

The rate of completion of clinical trials is dependent in part upon the rate of enrollment of patients. Patient enrollment is a function of many factors, including the size of the patient population, the proximity of patients to clinical sites, the eligibility criteria for the study, and the existence of competitive clinical trials. Delays in planned patient enrollment may result in increased costs and delays in completion of clinical trials.

We may not obtain regulatory approvals; the approval process is costly and lengthy.

We must obtain regulatory approval for our ongoing development activities and before marketing or selling any of our future therapeutic products. We may not receive regulatory approvals to conduct clinical trials of our products or to manufacture or market our products. In addition, regulatory agencies may not grant such approvals on a timely basis or may revoke previously granted approvals.

The process of obtaining FDA and other required regulatory approvals, such as the approval we are seeking with our NDA submission for RG1068, is lengthy and may be expensive. The time required for FDA and other clearances or approvals is uncertain and typically takes a number of years, depending on the complexity and novelty of the product. Our RG1068 NDA submission to the FDA will be based on a single re-read of our Phase 3 trial results. The FDA may not deem this to be sufficient for approval. Our analysis of data obtained from preclinical and clinical activities is subject to confirmation and interpretation by regulatory authorities, which could delay, limit or prevent regulatory approval. Any delay in obtaining or failure to obtain required clearance or approvals could materially adversely affect our ability to generate revenues from the affected product. We have only limited experience in filing and prosecuting applications necessary to gain regulatory approvals.

We are also subject to numerous foreign regulatory requirements governing the design and conduct of the clinical trials and the manufacturing and marketing of our future products. The approval procedure varies among countries. The time required to obtain foreign approvals often differs from that required to obtain FDA approvals. Moreover, approval by the FDA does not ensure approval by regulatory authorities in other countries (or vice versa).

All of the foregoing regulatory risks also are applicable to development, manufacturing and marketing undertaken by our collaborative partners or other third parties.

Even if we obtain marketing approval, our therapeutic products will be subject to ongoing regulatory review, which may be expensive and may affect our ability to successfully commercialize our products.

Even if we or our collaborative partners receive regulatory approval of a product, such approval may be subject to limitations on the indicated uses for which the product may be marketed, which may limit the size of the market for the product or contain requirements for costly post-marketing follow-up studies. The

11

Table of Contents

manufacturers of our products for which we or our collaborative partners have obtained marketing approval will be subject to continued review and periodic inspections by the FDA and other regulatory authorities. The subsequent discovery of previously unknown problems with the product, clinical trial subjects, or with a manufacturer or facility may result in restrictions on the product or manufacturer, including withdrawal of the product from the market.

If we or our collaborative partners fail to comply with applicable regulatory requirements, we may be subject to fines, suspension or withdrawal of regulatory approvals, product recalls, seizure of products, operating restrictions, and criminal prosecution.

If we are unable to obtain, maintain and enforce patents or regulatory exclusivity (orphan drug or new chemical entity exclusivity) for our products, we may not be able to succeed commercially.

We endeavor to obtain and maintain patent and trade secret protection for our products and processes when available in order to protect them from unauthorized use and to produce a financial return consistent with the significant time and expense required to bring our products to market. Our success will depend, in part, on our ability to:

| • | obtain and maintain patent protection for our products and manufacturing processes; |

| • | preserve our trade secrets; |

| • | operate without infringing the proprietary rights of third parties; and |

| • | secure licenses from others on acceptable terms. |

We cannot be sure that any patent applications relating to our products that we will file in the future or that any currently pending applications will issue on a timely basis, if ever. Since patent applications in the United States filed prior to November 2000 are maintained in secrecy until patents issue and since publication of discoveries in the scientific or patent literature often lag behind actual discoveries, we cannot be certain that we were the first to make the inventions covered by each of our pending patent applications or that we were the first to file patent applications for such inventions. Even if patents are issued, the degree of protection afforded by such patents will depend upon the:

| • | scope of the patent claims; |

| • | validity and enforceability of the claims obtained in such patents; and |

| • | our willingness and financial ability to enforce and/or defend them. |

The patent position of biotechnology and pharmaceutical firms is often highly uncertain and usually involves complex legal and scientific questions. Moreover, no consistent policy has emerged in the United States or in many other countries regarding the breadth of claims allowed in biotechnology patents. Patents which may be granted to us in certain foreign countries may be subject to opposition proceedings brought by third parties or result in suits by us, which may be costly and result in adverse consequences for us.

In some cases, litigation or other proceedings may be necessary to assert claims of infringement, to enforce patents issued to us or our licensors, to protect trade secrets, know-how or other intellectual property rights we own or to determine the scope and validity of the proprietary rights of third parties. Such litigation could result in substantial cost to us and diversion of our resources. An adverse outcome in any such litigation or proceeding could have a material adverse effect on our business, financial condition and results of operations.

If our competitors prepare and file patent applications in the United States that claim technology also claimed by us, we may be required to participate in interference proceedings declared by the U.S. Patent and Trademark Office to determine priority of invention, which would result in substantial costs to us.

12

Table of Contents

Since some of our U.S. patents covering recombinant Protein A have expired, we may face increased competition which could harm our results of operations, financial condition, cash flow and future prospects.

Other companies could begin manufacturing and selling recombinant Protein A in the U.S. and may directly compete with us on certain Protein A products. This may induce us to sell Protein A at lower prices and may erode our market share which could adversely affect our results of operations, financial condition, cash flow and future prospects.

Our freedom to develop our product candidates may be challenged by others, and we may have to engage in litigation to determine the scope and validity of competitors’ patents and proprietary rights, which, if we do not prevail, could harm our business, results of operations, financial condition, cash flow and future prospects.

There has been substantial litigation and other proceedings regarding the complex patent and other intellectual property rights in the pharmaceutical and biotechnology industries. We have been a party to, and in the future may become a party to, patent litigation or other proceedings regarding intellectual property rights.

Other types of situations in which we may become involved in patent litigation or other intellectual property proceedings include:

| • | We may initiate litigation or other proceedings against third parties to seek to invalidate the patents held by such third parties or to obtain a judgment that our products or services do not infringe such third parties’ patents. |

| • | We may initiate litigation or other proceedings against third parties to seek to enforce our patents against infringement. |

| • | If our competitors file patent applications that claim technology also claimed by us, we may participate in interference or opposition proceedings to determine the priority of invention. |

| • | If third parties initiate litigation claiming that our processes or products infringe their patent or other intellectual property rights, we will need to defend against such claims. |

The cost to us of any patent litigation or other proceeding, even if resolved in our favor, could be substantial. Some of our competitors may be able to sustain the cost of such litigation or proceedings more effectively than we can because of their substantially greater financial resources. If a patent litigation or other intellectual property proceeding is resolved unfavorably to us, we or our collaborative partners may be enjoined from manufacturing or selling our products and services without a license from the other party and be held liable for significant damages. The failure to obtain any required license on commercially acceptable terms or at all may harm our business, results of operations, financial condition, cash flow and future prospects.

Uncertainties resulting from the initiation and continuation of patent litigation or other proceedings could have a material adverse effect on our ability to compete in the marketplace. Patent litigation and other proceedings may also absorb significant management time, attention and resources.

For more information about the legal proceedings in which we were involved but which have been settled, please see “Legal Proceedings.”

We may become involved in litigation or other proceedings with collaborative partners, which may be time consuming, costly and could result in delays in our development and commercialization efforts.

We conduct some of our development activities, and conduct most of our commercialization activities, through arrangements with third parties. Any disputes with such partners that lead to litigation or similar

13

Table of Contents

proceedings may result in us incurring legal expenses, as well as facing potential legal liability. Such disputes, litigation or other proceedings are also time consuming and may cause delays in our development and commercialization efforts.

We have limited sales and marketing experience and capabilities.

We have limited sales, marketing and distribution experience and capabilities. We may, in some instances, rely significantly on sales, marketing and distribution arrangements with our collaborative partners and other third parties. In these instances, our future revenues will be materially dependent upon the success of the efforts of these third parties.

If in the future we determine to perform sales, marketing and distribution functions ourselves, we would face a number of additional risks, including:

| • | we may not be able to attract and build a significant marketing staff or sales force; |

| • | the cost of establishing a marketing staff or sales force may not be justifiable in light of any product revenues; and |

| • | our direct sales and marketing efforts may not be successful. |

We have limited pharmaceutical manufacturing capabilities and will be dependent on third party manufacturers.

We have limited pharmaceutical manufacturing experience and no commercial or pilot scale manufacturing facilities for the production of pharmaceuticals. In order to continue to develop pharmaceutical products, apply for regulatory approvals and, ultimately, commercialize any products, we may need to develop, contract for, or otherwise arrange for the necessary manufacturing capabilities.

We currently rely upon third parties to produce material for preclinical and clinical testing purposes and expect to continue to do so in the future. We also expect to rely upon third parties, including our collaborative partners, to produce materials required for the commercial production of certain of our products if we succeed in obtaining the necessary regulatory approvals. We believe that there is no proprietary aspect to the manufacture of our product candidates. However, there are only a limited number of manufacturers that operate under the FDA’s regulations for good manufacturing practices which are capable of and/or approved to manufacture our product candidates. Timing for the initiation of new manufacturers is uncertain, and, if we are unable to arrange for third party manufacturing of our product candidates on a timely basis, or to do so on commercially reasonable terms, we may not be able to complete development of our product candidates or market them, if they are approved.

The manufacture of products by us and our collaborative partners and suppliers is subject to regulation by the FDA and comparable agencies in foreign countries. Delay in complying or failure to comply with such manufacturing requirements could materially adversely affect the marketing of our products.

If we are unable to continue to hire and retain skilled personnel, then we will have trouble developing and marketing our products.

Our success depends largely upon the continued service of our management and scientific staff and our ability to attract, retain and motivate highly skilled technical, scientific, management, regulatory, clinical and marketing personnel. Potential employees with an expertise in the field of molecular biology, biochemistry, regulatory affairs and/or clinical development of new drug and biopharmaceutical manufacturing are not generally available in the market and are difficult to attract and retain. We also face significant competition for such personnel from other companies, research and academic institutions, government and other organizations who have superior funding and resources to be able to attract such personnel. The loss of key personnel or our inability to hire and retain personnel who have technical, scientific or regulatory compliance backgrounds could materially adversely affect our product development efforts and our business.

14

Table of Contents

The market may not be receptive to our products upon their introduction.

The commercial success of our therapeutic products that are approved for marketing will depend upon their acceptance by the medical community and third party payors as being clinically useful, cost effective and safe. All of the products that we are developing are based upon new technologies or therapeutic approaches. As a result, it is hard to predict market acceptance of our products or changes in third party payor reimbursement practices in the U.S. and abroad.

Other factors that we believe will materially affect market acceptance of our products and services include:

| • | the timing of receipt of marketing approvals and the countries in which such approvals are obtained; |

| • | the safety, efficacy and ease of administration of our products; |

| • | the success of physician education programs; |

| • | the availability of government and third party payor reimbursement of our products; |

| • | additional data requests from third party payors to support cost effectiveness before reimbursement of our products; and |

| • | competition from products which may offer better safety, efficacy or lower cost. |

Healthcare reform measures could adversely affect our business.

The efforts of governmental and third-party payors to contain or reduce the costs of health care may adversely affect the business and financial condition of pharmaceutical and biotechnology companies. Specifically, in both the United States and some foreign jurisdictions, there have been a number of legislative and regulatory proposals to change the health care system in ways that could affect our ability to sell our products profitably. The U.S. Congress passed the America Affordable Health Choices Act of 2009 and is considering a number of proposals that are intended to reduce or limit the growth of health care costs and which could significantly transform the market for pharmaceuticals products. We expect further federal and state proposals and health care reforms to continue to be proposed by legislators, which could limit the prices that can be charged for the products we develop and may limit our commercial opportunity. In the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, also called the Medicare Modernization Act, or MMA, changed the way Medicare covers and pays for pharmaceutical products. These cost reduction initiatives and other provisions of this legislation could decrease the coverage and price that we receive for any approved products and could seriously harm our business. While the MMA applies only to drug benefits for Medicare beneficiaries, private payors often follow Medicare coverage policy and payment limitations in setting their own reimbursement rates, and any reduction in reimbursement that results from the MMA may result in a similar reduction in payments from private payors. The continuing efforts of government and other third-party payors to contain or reduce the costs of health care through various means may limit our commercial opportunity. In addition, the pendency or approval of such proposals could result in a decrease in the price of Repligen’s common stock or limit our ability to raise capital or to enter into collaborations or license rights to our products.

We compete with pharmaceutical and biotechnology companies who are capable of developing new approaches that could make our products and technology obsolete.

The market for therapeutic and commercial products is intensely competitive, rapidly evolving and subject to rapid technological change. Pharmaceutical and biotechnology companies may have substantially greater financial, manufacturing, marketing, and research and development resources than we have. New approaches by these competitors may make our products and technologies obsolete or noncompetitive.

15

Table of Contents

We have incurred substantial losses, we may continue to incur operating losses and we will not be successful until we reverse this trend.

Although the company had significant net income in fiscal years 2009 and 2008 as a result of the ImClone and Bristol settlements, we have historically incurred operating losses since our founding in 1981. We incurred losses in fiscal years 2011 and 2010, and we expect to incur operating losses for the foreseeable future.

While we generate revenue from bioprocessing product sales and began receiving royalty payments in fiscal year 2009 from Bristol for the net sales of their Orencia® product in the United States, this revenue may not be sufficient to cover the costs of our clinical trials and drug development programs. We plan to continue to invest in key research and development activities. As a result, we will need to generate significant revenues in order to achieve profitability. We cannot be certain whether or when this will occur because of the significant uncertainties that affect our business.

We may need to obtain additional capital resources for our drug development programs, or we may be unable to develop or discover new drugs.

We may need additional long-term financing to develop our drug development programs through the clinical trial process as required by the FDA and to develop our commercial products business. We also may need additional long-term financing to support future operations and capital expenditures, including capital for additional personnel and facilities. If we spend more money than currently expected for our drug development programs and our commercial products business, we may need to raise additional capital by selling debt or equity securities, by entering into strategic relationships or through other arrangements. Debt financing, if available, may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration, strategic alliance and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. We may be unable to raise any additional amounts on reasonable terms or when they are needed due to the volatile nature of the biotechnology marketplace. If we are unable to raise this additional capital, we may have to delay or postpone critical clinical studies or abandon other development programs.

Pursuing and completing potential acquisitions could divert management attention and financial resources and may not produce the desired business results.

While we currently do not have commitments or agreements with respect to any acquisitions, as part of our growth strategy, we may make selected acquisitions of complementary businesses. If we pursue any acquisition, our management, in addition to their operational responsibilities, could spend a significant amount of time and management and financial resources to pursue and integrate any acquired business with our existing business. To fund the purchase price of an acquisition, we might use capital stock, cash or a combination of both. Alternatively, we may borrow money from a bank or other lender. If we use capital stock, our stockholders will experience dilution. If we use cash, our financial liquidity may be reduced. If we take on debt, it may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring additional debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration, strategic alliance and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us. In addition, from an accounting perspective, an acquisition may involve amortization of significant amounts of other intangible assets that could adversely affect our ability to maintain profitability.

Despite the investment of these management and financial resources, an acquisition may not produce the revenue, earnings or business synergies that we anticipated or may produce such synergies less rapidly than anticipated for a variety of reasons, including:

| • | difficulties in the assimilation of the operations, operational systems deployments, technologies, services, products and personnel of the acquired company; |

16

Table of Contents

| • | failure of acquired technologies and services to perform as expected; |

| • | risks of entering markets in which we have no, or limited, prior experience; |

| • | effects of any undisclosed or potential legal or tax liabilities of the acquired company; |

| • | compliance with additional laws, rules or regulations that we may become subject to as a result of an acquisition that might restrict our ability to operate; and |

| • | the loss of key employees of the acquired company. |

We may not be able to successfully address these problems. Our future operating results may depend to a significant degree on our ability to successfully integrate acquisitions and manage operations while controlling expenses and cash outflows.

We may be exposed to liabilities under the Foreign Corrupt Practices Act, and any determination that we violated the Foreign Corrupt Practices Act could have a material adverse effect on our business.

We are subject to the Foreign Corrupt Practice Act (the “FCPA”) and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by U.S. persons and issuers as defined by the statute for the purpose of obtaining or retaining business. We have operations, agreements with third parties and make sales in jurisdictions outside of the U.S., which may experience corruption. Our activities in jurisdictions outside of the U.S. create the risk of unauthorized payments or offers of payments by one of our employees, consultants, sales agents or distributors, because these parties are not always subject to our control. It is our policy to implement safeguards to discourage these practices by our employees. However, our existing safeguards and any future improvements may prove to be less than effective, and the employees, consultants, sales agents or distributors of our Company may engage in conduct for which we might be held responsible. Violations of the FCPA may result in severe criminal or civil sanctions, and we may be subject to other liabilities, which could negatively affect our business, operating results and financial condition. In addition, the government may seek to hold us liable for successor liability FCPA violations committed by any companies in which we invest or that we acquire.

Our stock price could be volatile, which could cause shareholders to lose part or all of their investment.

The market price of our common stock, like that of the common stock of many other development stage biotechnology companies, is highly volatile. In addition, the stock market has experienced extreme price and volume fluctuations. This volatility has significantly affected the market prices of securities of many biotechnology and pharmaceutical companies for reasons frequently unrelated to or disproportionate to the operating performance of the specific companies. These broad market fluctuations may adversely affect the market price of our common stock.

Provisions in our certificate of incorporation and by-laws and of Delaware law may prevent or delay an acquisition of our Company, which could decrease the trading price of our common stock.

Our certificate of incorporation, by-laws and Delaware law contain provisions that are intended to deter coercive takeover practices and inadequate takeover bids by making such practices or bids unacceptably expensive to the raider and to encourage prospective acquirors to negotiate with our Board of Directors rather than to attempt a hostile takeover. These provisions include our Board of Directors’ ability to issue preferred stock without stockholder approval and Delaware law’s various restrictions on mergers and other business combinations between us and any holder of 15% or more of our outstanding common stock. In addition, we maintain a shareholder rights plan which may deter a potential acquiror from pursuing an offer for our company.

We believe these provisions protect our stockholders from coercive or otherwise unfair takeover tactics by requiring potential acquirors to negotiate with our Board of Directors and by providing our Board of Directors

17

Table of Contents

with more time to assess any acquisition proposal. These provisions are not intended to make our company immune from takeovers. However, these provisions apply even if the offer may be considered beneficial by some stockholders and could delay or prevent an acquisition that our Board of Directors determines is not in the best interests of our company and our stockholders.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

None.

| Item 2. | PROPERTIES |

We lease approximately 25,000 square feet of space located in Waltham, Massachusetts which serves as our corporate headquarters. We also conduct manufacturing, research and development, marketing and administrative operations at this facility. In addition, we lease approximately 10,000 square feet of space at a second location in Waltham for expanded manufacturing and administrative operations. Both of these leases expire in 2012. During fiscal 2011, we incurred total rental costs for both facilities of approximately $686,000.

| Item 3. | LEGAL PROCEEDINGS |

From time to time, we may be subject to other legal proceedings and claims in the ordinary course of business. We are not currently aware of any such proceedings or claims that we believe will have, individually or in the aggregate, a material adverse effect on our business, financial condition or results of operations.

| Item 4. | (REMOVED AND RESERVED) |

18

Table of Contents

PART II

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock is traded on the Nasdaq Global Market under the symbol “RGEN.” The quarterly high and low closing prices for our common stock are shown in the following table.

| Fiscal Year 2011 | Fiscal Year 2010 | |||||||||||||||

| High | Low | High | Low | |||||||||||||

| First Quarter |

$ | 3.92 | $ | 3.13 | $ | 5.50 | $ | 3.92 | ||||||||

| Second Quarter |

$ | 3.56 | $ | 3.15 | $ | 5.55 | $ | 4.96 | ||||||||

| Third Quarter |

$ | 4.75 | $ | 3.29 | $ | 5.13 | $ | 3.74 | ||||||||

| Fourth Quarter |

$ | 5.34 | $ | 3.36 | $ | 4.06 | $ | 3.35 | ||||||||

Stockholders and Dividends

As of May 24, 2011, there were approximately 636 stockholders of record of our common stock. We have not paid any dividends since our inception and do not intend to pay any dividends on our common stock in the foreseeable future. We anticipate that we will retain all earnings, if any, to support our operations and our proprietary drug development programs. Any future determination as to the payment of dividends will be at the sole discretion of our Board of Directors and will depend on our financial condition, results of operations, capital requirements and other factors our Board of Directors deems relevant.

Equity Compensation Plan Information

See Part III, Item 12 for information regarding securities authorized for issuance under our equity compensation plans.

Issuer Purchases of Equity Securities

In June 2008, the Board of Directors authorized a program to repurchase up to 1.25 million shares of our common stock to be repurchased at the discretion of management from time to time in the open market or through privately negotiated transactions. The repurchase program has no set expiration date and may be suspended or discontinued at any time. For the twelve-month period ended March 31, 2009, the Company repurchased 492,827 shares of common stock, for an aggregate purchase price of $1,969,240, leaving 757,173 shares remaining under this authorization. Since March 31, 2009, we have made no additional repurchases of shares of common stock.

19

Table of Contents

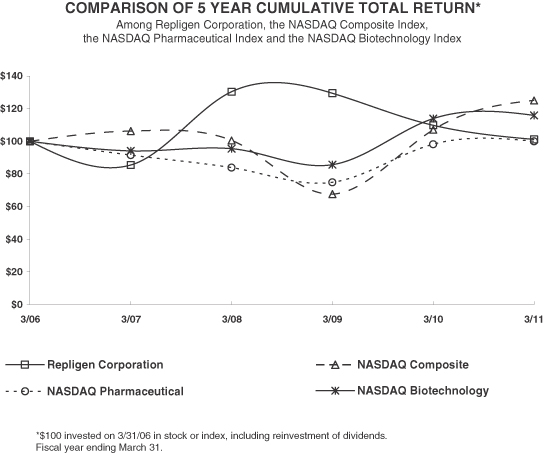

The information contained in the performance graph shall not be deemed to be “soliciting material” or to be “filed” with the Securities and Exchange Commission, and such information shall not be incorporated by reference into any future filing under the Securities Act or Exchange Act, except to the extent that Repligen specifically incorporates it by reference into such filing.

20

Table of Contents

| Item 6. | SELECTED FINANCIAL DATA |

The following selected financial data are derived from the audited financial statements of Repligen. The selected financial data set forth below should be read in conjunction with our financial statements and the related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this report and our Annual Report on Form 10-K for the years ended March 31, 2010, 2009, 2008 and 2007.

| Years ended March 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In thousands except per share amounts) | ||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Product revenue |

$ | 14,961 | $ | 10,305 | $ | 14,529 | $ | 18,587 | $ | 13,074 | ||||||||||

| Royalty and other revenue |

12,330 | 10,666 | 14,833 | 709 | 1,000 | |||||||||||||||

| Total revenue |

27,291 | 20,971 | 29,362 | 19,296 | 14,074 | |||||||||||||||

| Operating expenses: |

||||||||||||||||||||

| Cost of product revenue |

5,580 | 4,159 | 5,686 | 6,160 | 3,615 | |||||||||||||||

| Cost of royalty and other revenue |

1,537 | 1,347 | 1,091 | — | — | |||||||||||||||

| Research and development |

12,529 | 14,160 | 12,772 | 7,241 | 5,924 | |||||||||||||||

| Selling, general and administrative |

8,019 | 7,072 | 5,933 | 10,173 | 6,360 | |||||||||||||||

| Net gain from litigation settlement |

— | — | — | (40,170 | ) | — | ||||||||||||||

| Total operating expenses (income) |

27,665 | 26,738 | 25,482 | (16,596 | ) | 15,899 | ||||||||||||||

| (Loss) income from operations |

(374 | ) | (5,767 | ) | 3,880 | 35,892 | (1,825 | ) | ||||||||||||

| Interest expense |

(26 | ) | (2 | ) | (3 | ) | (9 | ) | (11 | ) | ||||||||||

| Investment income |

357 | 870 | 1,896 | 2,051 | 947 | |||||||||||||||

| Income (loss) before taxes |

(43 | ) | (4,899 | ) | 5,773 | 37,934 | (889 | ) | ||||||||||||

| Income tax (benefit) provision |

— | (835 | ) | 27 | 827 | — | ||||||||||||||

| Net income (loss) |

$ | (43 | ) | $ | (4,064 | ) | $ | 5,746 | $ | 37,107 | $ | (889 | ) | |||||||

| Earnings (loss) per share: |

||||||||||||||||||||

| Basic |

$ | (0.00 | ) | $ | (0.13 | ) | $ | 0.19 | $ | 1.20 | $ | (0.03 | ) | |||||||

| Diluted |

$ | (0.00 | ) | $ | (0.13 | ) | $ | 0.18 | $ | 1.18 | $ | (0.03 | ) | |||||||

| Weighted average shares outstanding: |

||||||||||||||||||||

| Basic |

30,782 | 30,752 | 30,958 | 30,834 | 30,379 | |||||||||||||||

| Diluted |

30,782 | 30,752 | 31,290 | 31,321 | 30,379 | |||||||||||||||

| As of March 31, | ||||||||||||||||||||

| 2011 | 2010 | 2009 | 2008 | 2007 | ||||||||||||||||

| (In thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and marketable securities (1) |

$ | 61,503 | $ | 59,146 | $ | 63,961 | $ | 60,589 | $ | 22,627 | ||||||||||

| Working capital |

51,221 | 55,024 | 50,235 | 49,831 | 22,394 | |||||||||||||||

| Total assets |

72,294 | 71,420 | 73,755 | 68,840 | 29,076 | |||||||||||||||

| Long-term obligations |

584 | 642 | 82 | 143 | 200 | |||||||||||||||

| Accumulated deficit |

(117,965 | ) | (117,921 | ) | (113,857 | ) | (120,577 | ) | (157,683 | ) | ||||||||||

| Stockholders’ equity |