Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GETTY REALTY CORP /MD/ | d735044d8k.htm |

GETTY REALTY CORP. PRESENTATION

REIT Week Presentation

June 2014

Exhibit 99.1 |

Forward Looking Statements

1

Certain statements in this Presentation constitute “forward-looking statements” within

the meaning of the federal securities laws. Forward- looking statements are statements

that relate to management’s expectations or beliefs, future plans and strategies, future financial performance

and similar expressions concerning matters that are not historical facts. In some cases, you can

identify forward-looking statements by the use of forward-looking terminology such as

“may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or

“potential.” Such forward-looking statements reflect current views with respect to the

matters referred to and are based on certain assumptions and involve known and unknown risks,

uncertainties and other important factors, many of which are beyond the Company’s control, that could

cause the actual results, performance, or achievements of the Company to differ materially from any

future results, performance, or achievement implied by such forward-looking statements. While

forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, they are not guarantees of future

performance. The Company does not undertake any obligation to publicly update or revise any

forward-looking statements to reflect changes in underlying assumptions or factors, new

information, data or methods, future events or other changes. For a further discussion of these and

other factors that could cause the Company’s future results to differ materially from any

forward-looking statements, see the Company’s Annual Report on Form 10-K for the

year ended December 31, 2013 and the Company’s Quarterly Report on Form 10-Q for the quarter ended March

31, 2014, including, in particular, the section entitled “Risk Factors” contained therein,

and its other filings with the SEC.

Unless otherwise noted in this Presentation, all reported financial data is presented as of the

quarter ended March 31, 2014, and all portfolio data is as of June 2, 2014. The information

contained herein has been prepared from public and non-public sources believed to be reliable. However, the Company has not

independently verified certain of the information contained herein, and does not make any

representation or warranty as to the accuracy or completeness of the information contained in

this Presentation. |

Investment Highlights

2

1

National portfolio with focus on growing and densely populated,

high barrier to entry markets

2

Stable cash flows supported by long-term, triple-net leases

3

4

Proven platform to pursue internal and external growth

opportunities in a consolidating sector

5

At a positive inflection point in the Company’s evolution

6

Flexible balance sheet with low leverage

Upside opportunities created through rationalization of

transitional properties in existing portfolio |

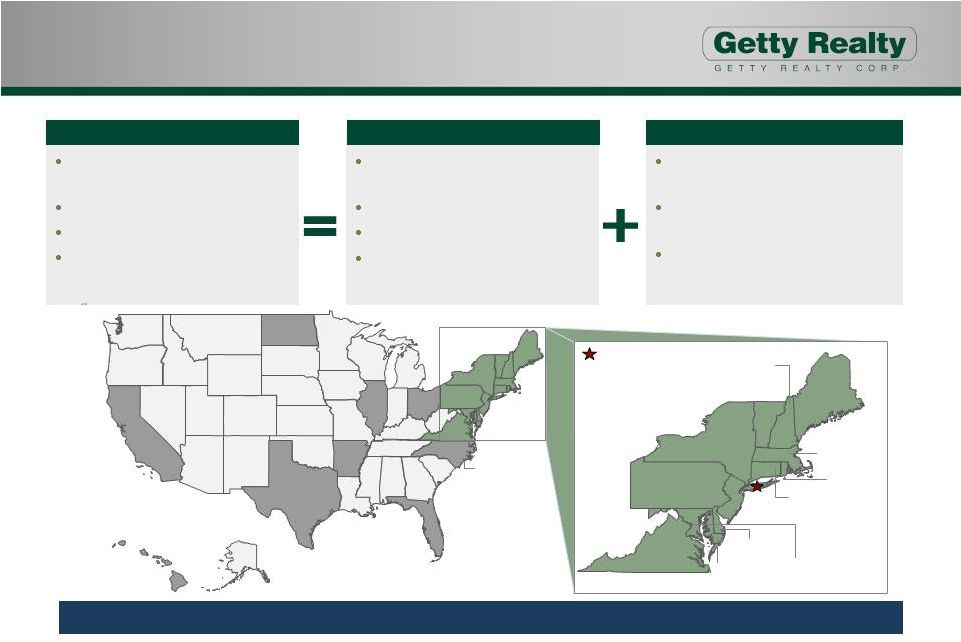

Leading National Portfolio with Future Upside

3

Hawaii

(10)

Florida

(6)

Texas

(17)

North Carolina

(5)

Ohio

(4)

California

(9)

Arkansas

(3)

North Dakota

(1)

Illinois

(1)

Headquarters

New York

(305)

New Hampshire

(50)

Maine

(10)

Massachusetts

(150)

Rhode Island

(13)

Connecticut

(97)

New Jersey

(76)

Delaware

(5)

Pennsylvania

(61)

Maryland

(43)

Virginia

(48)

Washington, DC

(2)

Long-term triple-net lease stability with future upside through transitional

properties 916 retail motor fuel/convenience store

properties

798 owned properties (87%)

118 leased properties (13%)

20 states plus Washington, D.C.

Current Portfolio

20 tenants (685 properties) under long-

term, triple-net leases

85 single tenant triple-net leases

84% of core leases expire after 2022

Sites branded Getty, BP, Exxon, Mobil,

Shell, Chevron, Valero and Aloha

770 Core Properties

Repositioned ~250 properties since

May 2012

Releasing program focused on

attractive long-term, triple-net leases

Proactively recycling capital from

property dispositions into accretive

investments

146 Transitional Properties |

Significant Presence in Markets with

“High Barriers to Entry”

4

Limited Availability

of

Suitable

Land

Prime Locations in

High

Traffic

Areas

Increasingly

Restrictive

Zoning

Regulations

High replacement costs

Limited new development

Unique assets with ability to satisfy increased

demand for non-gas

uses

Mature and densely populated neighborhoods

High daily traffic counts

Optimal corners with high visibility and easy

access

Close proximity to highway entrances or exit

ramps

Lengthy permitting process

Difficult to obtain the necessary permits to

construct a similar use site

Leading national portfolio with concentrations in high barrier to entry markets

in the Northeast and Mid-Atlantic regions |

Sustainable Cash Flows Supported by

Long-Term Leases

5

Only 3% of leases

mature in next 5 years

and 17% in next 10

years

High Quality Tenant Base

Diversified tenant base

Prominent national and regional suppliers

2012 repositioning added more than 10 new

quality tenants to the Company’s portfolio

Compelling unit level economics

Rent

coverage

generally

–

1.75x

to

2.25x

Majority of triple-net leases have 15 year initial terms

Provisions for rent increases during initial term

and renewal periods

Unit level visibility via station and tenant financial

performance

84% of core property leases expire after 2022

Highlights

Stable Long-Term Lease Structure

(1)

(1) Does not include single tenant triple-net leases or transitional properties

as their lease maturities vary. 0.7%

0.0%

0.0%

2.2%

0.0%

5.1%

3.3%

4.6%

0.0%

1.0%

0.0%

1.5%

9.1%

72.3%

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027+ |

Incremental Upside in Transitional Properties

6

Proactive portfolio repositioning presents an opportunity to improve the cash flow

profile Near-Term

Lease

Expirations

Restructuring of original unitary lease entered into in May 2012

Ten locations are entangled in an ongoing eviction action in CT Supreme Court

Expect to enter into a restructuring of the NECG Lease at the conclusion of the

pending litigation NECG

Lease

Sites to

be Leased

Sites to

be Sold

83

25

31

7

Composed primarily of operating gas stations

Properties being re-let to national and regional fuel distributors

Locations

will

be

added

to

existing

leases

or

Company

will

enter

into

new

triple-net

leases

with

regional

distributors

75% of locations either under contract or have accepted offers

Remaining properties in multi-layer disposition process

Sites not leased on a triple-net basis with lease expirations over the next six

to eighteen months |

Poised to Consolidate Fragmented Industry

7

More than 150,000 properties in the sector

(1)

Portfolio

dispositions

–

distributors,

MLP’s,

families

Consolidating

sector

–

approximately

60%

of

U.S.

stations individually owned

(1)

Debt

maturities

–

conduits,

majors,

banks

Little institutional capital

Mature, infill locations

Wide variety of formats

Convenience stores, repair bays, quick serve, quick

lube, etc.

Focus on fuel component to drive customer visits /

visibility

Gasoline, Diesel, Ethanol, CNG, LNG, other

Proven ability to source off-market

transactions not seen by others

Ability to integrate and assimilate

multi-unit portfolios

Capacity to operate in a

highly regulated industry

Established track-record of managing and

remediating environmental concerns

Actively seeking portfolio acquisitions through competitively priced and

innovatively structured capital allocation

Target Investments

Broad Market Opportunity

The Getty Competitive Advantage

(1)

Per NACS 2013 Retail Fuels Report. |

Flexible Balance Sheet with Low Leverage

8

$175 million senior secured credit facility

Matures in 2015 (plus one year option)

L+ 250-300 bps

No amortization requirements

$100 million secured debt private placement

Matures in 2021

Fixed rate: 6%

No amortization requirements

Debt / EBITDA

(2)

Leverage / Total Market Capitalization

(2)

Debt Maturity Schedule

(1)

Debt Refinancing in February 2013

(1)

Low leverage and flexible balance sheet compared to REIT peers

(1)

Amounts outstanding are as of March 31, 2014. For additional information

regarding the Company’s financing agreements, see the Company’s Annual Report on Form 10-K for the year ended

December 31, 2013.

(2)

Source: Wall Street research report dated May 27, 2014.

$43.0

$100.0

2014

2015

2016

2017

2018

2020

2021

7.7x

6.1x

6.0x

5.9x

5.6x

4.8x

4.3x

3.1x

SRC

ARCP

WPC

LXP

O

EPR

NNN

GTY

53.1%

47.5%

44.6%

39.0%

35.0%

33.6%

32.6%

19.6%

ARCP

SRC

LXP

EPR

O

NNN

WPC

GTY |

Investment Highlights

9

1

National portfolio with focus on growing and densely populated,

high barrier to entry markets

2

Stable cash flows supported by long-term, triple-net leases

3

4

Proven platform to pursue internal and external growth

opportunities in a consolidating sector

5

At a positive inflection point in the Company’s evolution

6

Flexible balance sheet with low leverage

Upside opportunities created through rationalization of

transitional properties in existing portfolio |