Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL SIGNAL CORP /DE/ | may2014investorpresentation.htm |

Disciplined Growth Investor Presentation May 2014

This presentation contains unaudited financial information and forward-looking statements. Statements that are not historical are forward- looking statements and may contain words such as “may,” “will,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “project,” “estimate”, and “objective” or similar terminology, concerning the company’s future financial performance, business strategy, plans, goals and objectives. These expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future performance or results of operations and are not guarantees. While these statements are based on assumptions and judgments that management has made in light of industry experience as well as perceptions of historical trends, current conditions, expected future developments and other factors believed to be appropriate under the circumstances, they are subject to risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements to be materially different. Such risks and uncertainties include, but are not limited to, economic conditions, product and price competition, supplier and raw material prices, foreign currency exchange rate changes, interest rate changes, increased legal expenses and litigation results, legal and regulatory developments and other risks and uncertainties described under Item 1A, Risk Factors, in the Company’s Annual Report on Form 10-K and in other filings with the Securities and Exchange Commission. Such forward-looking statements are made as of the date hereof and we undertake no obligation to update these forward-looking statements regardless of new developments or otherwise. This presentation also contains certain measures that are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations, and to provide an additional measure of performance which management considers in operating the business. A reconciliation of these items to the most comparable GAAP measures is provided in our filings with the SEC and in the Appendix to this presentation. 2 Safe Harbor Statement

3 Agenda Management Company overview Investment case Performance trends Growth strategy Segments and products Corporate focus, goals and initiatives Financial results and outlook

Experienced Management Team Dennis Martin, President and Chief Executive Officer President and Chief Executive Officer since October 2010 Previously served as Chairman, President and CEO of General Binding Corporation 35+ years operational and leadership experience, primarily at Illinois Tool Works and Ingersoll-Rand 4 Brian Cooper, SVP and Chief Financial Officer Appointed Chief Financial Officer May 28, 2013 Chief Financial Officer of Westell Technologies, Inc. from 2009-2013 Previously with Fellowes, Inc. (CFO), United Stationers, Borg-Warner Security and Amoco Strong treasury, financial, M&A and strategic background Jennifer Sherman, SVP and Chief Operating Officer Appointed Chief Operating Officer April 29, 2014 Previously Chief Administrative Officer, Secretary and General Counsel, with operating responsibilities for the Company’s Safety and Security Systems Group Joined Federal Signal in 1994 as Corporate Counsel

5 Federal Signal Overview Founded in 1901, joined NYSE in 1969 (“FSS”) Safety, security and environmental products and services that protect people and our planet Environmental Solutions Group (ESG) Safety & Security Systems Group (SSG) Fire Rescue Group (FRG) Restructured for growth and profitability $852 million TTM revenue, $71 million TTM operating income $937 million market capitalization (3/31/14) Increasing global presence and customer base Leading brands serving municipal, governmental, industrial and commercial markets Diversified manufacturing, 11 facilities in 6 countries Over 3,000 customers in more than 100 countries Employees: ≈2,600 worldwide Company Overview TTM Net Sales by Segment, $ Millions Valuable Brands $483 $235 $134 Environmental Solutions Group 57% Safety & Security Systems Group 27% Fire Rescue Group 16% (As of 3/31/14)

Leading positions in niche governmental and industrial markets Valuable brands, high quality products, well-established distribution Flexible manufacturing capacity to leverage profits Favorable market dynamics • Improving municipal spend • Growing higher-margin industrial markets • Multiple product categories serving a robust oil & gas sector • Security solutions addressing man-made and natural disasters Solid execution, results and outlook • Company culture steadfastly focused on “80/20” and continuous improvement • Management depth in sales, marketing, engineering, operations and M&A • Organic and inorganic opportunities to grow shareholder value • Strengthening balance sheet, profitability and free cash flow 6 Investment Case

7 Performance Levers and Progress 2010: Introduced “80/20” education and initiatives 2011-14: Driving continuous improvement in all businesses • Prioritizing customers and suppliers • Tackling proactive pricing improvements • Streamlining product offerings • Streamlining management structure • Creating lean manufacturing efficiencies 2012: Major repositioning with sale of FSTech 2013: Debt refinancing to reduce interest costs 2012-14: Investments to promote growth and innovation • Additional space and engineering resources at Jetstream • Paint and cutting systems and new lines at Vactor • New plant layouts and other lean improvements at Bronto and Elgin • Innovations and product development initiative Significant turnaround in financial performance

2.7% 4.8% 6.6% 8.4% 8.4% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 2010 2011 2012 2013 TTM Q1 2014 Op era tin g M arg in To tal FS C C on tin uin g O pe rat ion s Margin Expansion and Debt Reduction 8 Business Segment FY 2011 Operat ng Margin FY 2012 Operating Margin FY 2013 Operating Margin TTM Q1 2014 Operating Margin Margin Targets ESG 6.8% 9.8% 12.3% 12.6% 11% - 13% SSG 9.7% 12.0% 11.3% 10.9% 14% - 16% FRG 6.0% 6.6% 6.5% 5.6% 10% - 12% *Operating margin excludes the impact of restructuring charges in all periods 11.0 4.8 2.4 1.1 1.0 - 2.0 4.0 6.0 8.0 10 0 12.0 2010 2011 2012 2013 Q1 TTM 2014 Tot al D eb t/A dju ste d E BIT DA Margins improving and targeted higher…. … complemented by declining leverage.

9 Growth Strategy Geographic Expansion • Jetstream and Industrial Systems in the Asia Pacific and Middle East • Export markets from U.S. • Bronto in North America New Markets for Existing Products • Waterblasting • Hydro-excavation • Security systems New Product Development and Acquisitions • Innovation program • Leverage use of established platforms

10 Growth Markets and Opportunities Developing growth product areas • Vactor (hydro-excavation and sewer cleaning) • Jetstream (waterblasting) • Global Systems (integrated communication safety systems) These predominantly industrial areas aggregate to ≈50% of total revenue* Growth opportunities • U.S. and other industrial uses for high-reach lifts (Bronto) • Recovering U.S. municipal spending (Elgin, among others) • Recovering government spending in Europe (Bronto, Vama) • Expanding industrial energy and utility use (Jetstream, Vactor) • International waterblasting market share (Jetstream) • Oil-field environmental protection and clean-up (Vactor) • Price-competitive product introductions in police, fire, ambulance and other safety markets (Safety and Security Systems Group) * (as of 12/31/13)

11 Federal Signal Segments Environmental Systems (ESG) Products Geographic Mix Q1 TTM 2014 Revenue Elgin street sweepers Vactor truck-mounted sewer cleaners, hydro-excavators, and industrial vacuum trucks Jetstream waterblasters FS Depot and FS Solutions – parts and service deliveries and rental centers $483M (57% of sales) $235M (27% of sales) $134M (16% of sales) Fire Rescue (FRG) High-reach aerial lift access platforms for fire rescue and wind turbine maintenance, utilities and other industrial applications Safety and Security (SSG) Vehicle lights and sirens (U.S. and Vama) Indoor and outdoor mass warning and notification systems (Industrial Systems and Alerting & Notification Systems) Victor mining and electrical safety equipment Non-US 20% ≈30-50% U.S. Average ≈30% U.S. ≈50% Globally Representative Market Share Non-U.S. 17% U.S. 83% Non-U.S. 41% U.S. 59% Non-U.S. 90% U.S. 10%

Environmental Solutions Group 12

Safety and Security Group 13

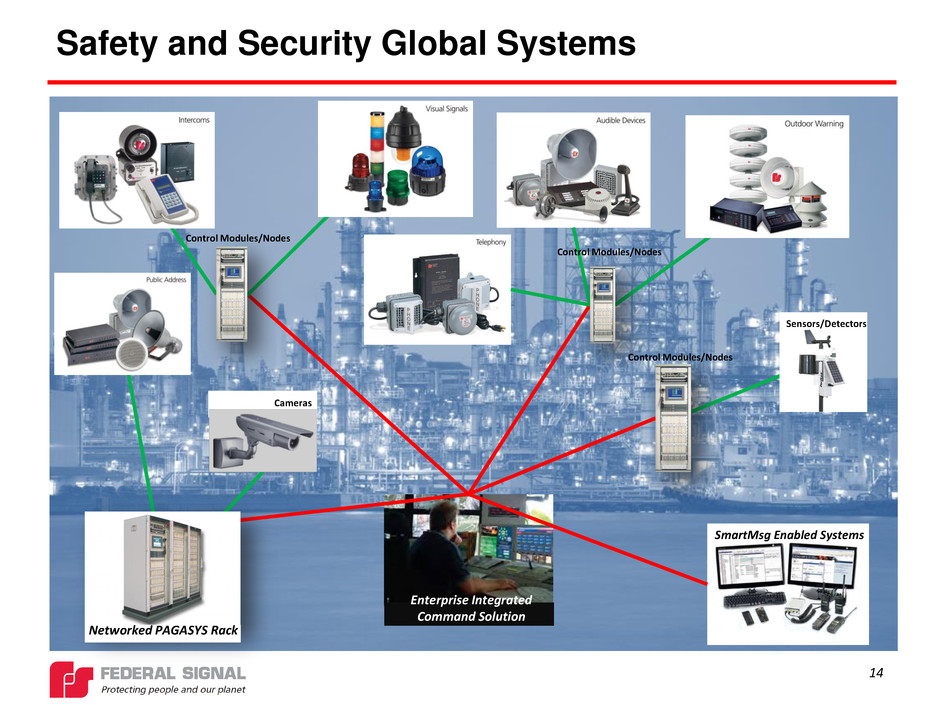

Safety and Security Global Systems SmartMsg Enabled Systems Enterprise Integrated Command Solution Sensors/Detectors Cameras Networked PAGASYS Rack Control Modules/Nodes Control Modules/Nodes Control Modules/Nodes 14

Fire Rescue Group 15

Focus and Goals 16 Create Disciplined Growth Organic and Acquisitions Diversify Customer Base Leverage Invested Capital Improve Manufacturing Efficiencies and Costs High single-digit % EPS growth Operating margin targets Consolidated ‒ 10% ESG ‒ 11-13% SSG ‒ 14-16% FRG ‒ 10-12% Accelerate industrial revenue growth Sequential improvement in ROIC Grow Shareholder Value

Optimize ERP System Organic and M&A growth in industrial markets Freight cost savings Jetstream expansion Bronto U.S. industrial opportunities Flexible ESG manufacturing Up-fitting police cars New Navigator “Fire” light bar Specific Initiatives 17 Create Disciplined Growth Organic and Acquisitions Diversify Customer Base Leverage Invested Capital New innovation teams and focus New line at Vactor New line at Elgin Leverage core competencies ROIC-based compensation Streamlined Global Systems leadership Engineering refocus IT cost savings SSG productivity measures from ERP New industrial products Improve Manufacturing Efficiencies and Costs Continued 80/20 and lean focus Core “tuck-in” acquisitions Paint system investments

Consolidated Historical Financial Performance 18 ($ in millions) 2011 2012 2013 Q1 2014 Net sales $ 688.7 $ 803.2 $ 851.3 $ 200.2 % Growth 8.8% 16.6% 6.0% Cost of sales 533.3 613.4 646.2 153.4 Gross profit $ 155.4 $ 189.8 $ 205.1 $ 46.8 % Margin 22.6% 23.6% 24.1% 23.4% Operating expenses 122.2 138.3 134.5 34.0 Operating income $ 33.2 $ 51.5 $ 70.6 $ 12.8 % Margin 4.8% 6.4% 8.3% 6.4% Interest expense 16.4 21.4 8.8 1.0 Debt settlement charges 3.5 8.7 - Other expense 0.2 0.7 0.1 - Pretax income $ 16.6 $ 25.9 $ 53.0 $ 11.8 * Consolidated financial results reflect only continuing operations of the Company.

0.19 0.35 0.67 0.12 0.00 0.10 0.20 0.30 0.40 0.50 0.60 0.70 0.80 0.90 YR 2011 YR 2012 YR 2013 YR 2014 $ per share 0.79 or more EPS Trends 19 Adjusted Earnings Per Share * * To facilitate comparisons to 2014, adjusted earnings for 2013 are $0.67 per share, which is computed by excluding special tax items, the impacts of restructuring and debt settlement charges and applying a 32% income tax rate. Our effective book tax rate before special items is expected to increase to approximately 32-34% in 2014 as a result of the Company no longer being in a full deferred tax valuation allowance position in the U.S. after 2013. The Company's cash tax payment obligations are not impacted by this change. A reconciliation of adjusted earnings per share is included in Appendix 1. Full Year Q1

2014 Outlook 20 EPS target of at least $0.79 Improvement of 18% or more over 2013 normalized EPS Upside based on market conditions Quarterly Dividend Reinstated quarterly dividend in April 2014 (payable 6/3/2014) $0.03 per share Share Repurchase Program Recently announced authorization to repurchase up to $15 million of company stock Primarily intended to reduce the allocation of investment of company stock within the U.S. pension plan and to offset dilution resulting from employee equity incentive programs.

Building Equity in Our Brands 21

Appendix 1: Adjusted Earnings per Share * 22 * The adjusted financial measures presented above are unaudited and are not in accordance with U.S. generally accepted accounting principles (“GAAP”). The non-GAAP financial information presented herein should be considered supplemental to, and not a substitute for, or superior to, financial measures calculated in accordance with GAAP. The Company has provided this supplemental information to investors, analysts, and other interested parties to enable them to perform additional analyses of operating results, to illustrate the results of operations giving effect to the non-GAAP adjustments shown in the reconciliations below, and to provide an additional measure of performance which management considers in operating the business. ($ in millions) 2011 2012 2013 Q1 2014 Income (loss) from continuing operations 13.1$ 22.0$ 160.2$ 7.6$ Add (less): Income tax expense (benefit) 3.5 3.9 (107.2) 4.2 Income (loss) before income taxes 16.6 25.9 53.0 11.8 Add (less): Restructuring - 1.4 0.7 (0.2) Debt settlement charges - 3.5 8.7 - Adjusted income before income taxes 16.6 30.8 62.4 11.6 Adjusted income tax expense (1) (4.6) (8.6) (20.1) (4.1) Adjusted net income from continuing operations 12.0$ 22.2$ 42.3$ 7.5$ Diluted EPS impact 2011 2012 2013 Q1 2014 Diluted earnings (loss) per share from continuing operations 0.21$ 0.35$ 2.53$ 0.12$ Add (less): Income tax expense (benefit) 0.06 0.06 (1.69) 0.06 Income (loss) before income taxes 0.27 0.41 0.84 0.18 Add (less): Restructuring - 0.02 0.01 - Debt settlement charges - 0.06 0.14 - Adjusted income before income taxes 0.27 0.49 0.99 0.18 Adjusted income tax expense (1) (0.07) (0.14) (0.32) (0.06) Adjusted EPS from continuing operations 0.19$ 0.35$ 0.67$ 0.12$ (1) Adjusted income tax expense for f iscal years 2011-2013 w as computed by applying the Company's normalized effective tax rate of approximately 28%, 28% and 32% for 2011, 2012 and 2013, respectively. The normalized tax rate excludes the impacts of the valuation allow ance release and other special tax items in these periods. Adjusted income tax expense for the three months ended March 31, 2014 w as recomputed after excluding the impact of restructuring activity.