Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Approach Resources Inc | d729623d8k.htm |

DUG PERMIAN BASIN

J. ROSS CRAFT

PRESIDENT & CHIEF EXECUTIVE OFFICER

Building Momentum: Multi-Bench and Pad

Development in the Southern Midland Basin

Exhibit 99.1 |

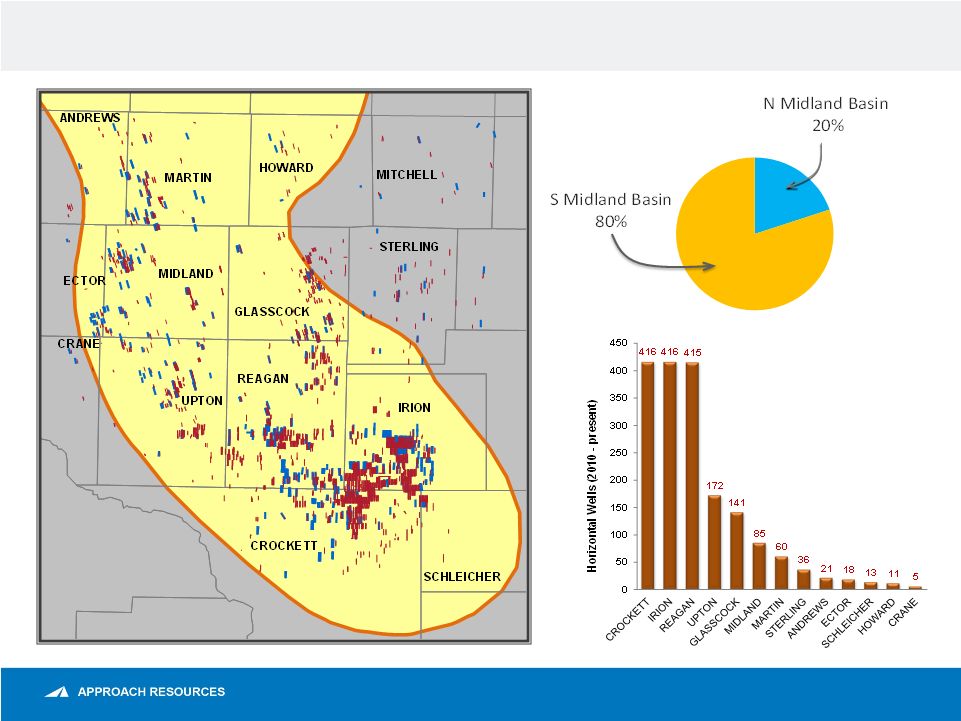

Wolfcamp oil shale play –

activity overview

2

N = 1,809

Note:

Data

sourced

from

company

news

releases/IR

presentations,

public

databases,

DrillingInfo

and

IHS. |

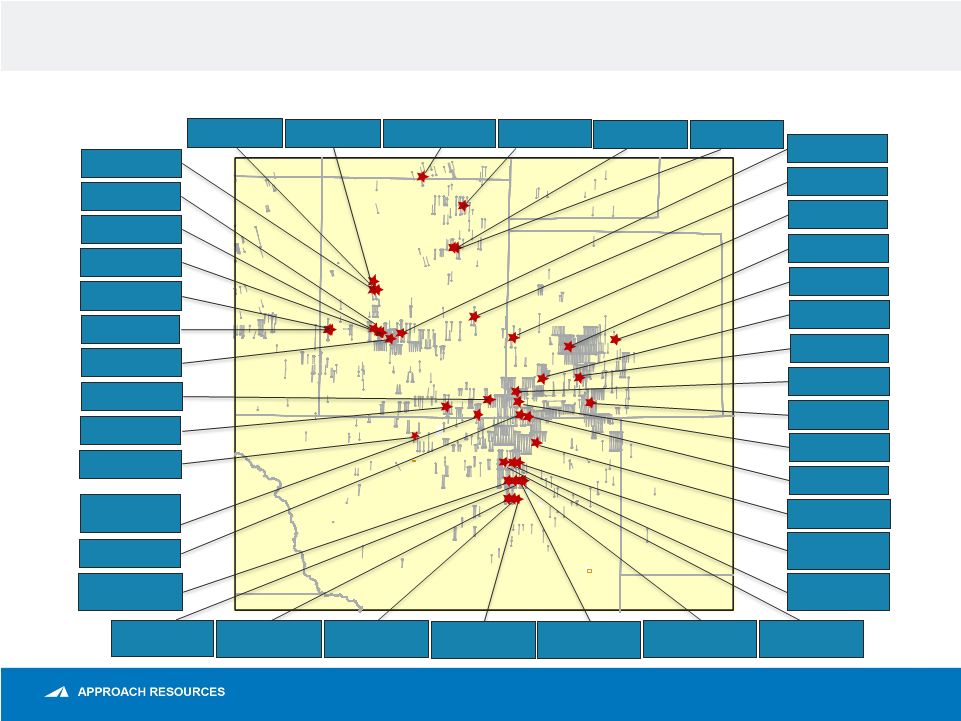

Wolfcamp oil shale play –

S Midland Basin

3

Ham 1801H

1,202 Boe/d (B)

Rocker B-N 74H

1,338 Boe/d (B)

University 2-20 12

3,176 Boe/d (B)

University 901H

1,561 Boe/d (B)

Rocker B 9H

1,022 Boe/d (B)

University 2-20 14

1,852 Boe/d (C)

University 1804H

1,803 Boe/d (C)

University 905H

1,302 Boe/d (B)

University 10-1 2H

1,311 Boe/d (B)

University 906H

1,277 Boe/d (A)

Scott Sugg 5051 1H

1,255 Boe/d (B)

Halcomb 3304H

1,037 Boe/d (B)

Munson 1005H

1,295 Boe/d (B)

Bennie 4342 2H

1,260 Boe/d (B)

Linthicum M 2H

1,294 Boe/d (B)

University 48-7 1H

1,448 Boe/d (C)

University 43 902H

1,256 Boe/d (B)

University 40-1309H

2,005 Boe/d (B)

University E 4108CH

1,021 Boe/d (B)

University 49 1H

1,561 Boe/d (B)

University 47-48

2301H

1,398 Boe/d (B)

Pangea West 6533HA

843 Boe/d (A)

University 45 803HB

1,044 Boe/d (B)

University 45 2216HB

1,042 Boe/d (B)

Baker B 207HB

1,003 Boe/d (B)

University 45 2304HB

1,111 Boe/d (B)

University 45 2302HB

1,136 Boe/d (B)

University 45 2301HB

1, 310 Boe/d (B)

University 45 905HA 1,027

Boe/d (A)

Baker B 256HB

1,334 Boe/d (B)

Clinch 4238 1H

1,260 Boe/d (A)

Lane Trust C/E 42 2HL

2,147 Boe/d (C)

Sugg C 271HU

1,112 Boe/d (C)

Sugg C 273HU

1,221 Boe/d (A)

Sugg A 143 4HU

1,904 Boe/d (A)

Ham 1825H

1,780 Boe/d (C)

Ham 1802H

1,338 Boe/d (B)

Wolfcamp HZ Oil Shale Play was discovered in the S Midland Basin

Well

IPs

range

from

several

hundred

Boe

to

>3,000

Boe/d

and

EURs

range

from

350

to

>750

MBoe

Note:

Data

sourced

from

company

news

releases/IR

presentations,

public

databases,

DrillingInfo

and

IHS.

Baker B 234 HC

970 Boe/d (C)

University 45 713HC

879 Boe/d (B)

University 43-22 H

1,192 Boe/d (B)

Reagan

Upton

Crockett

Sutton

Schleicher

Tom

Green

Sterling

Irion |

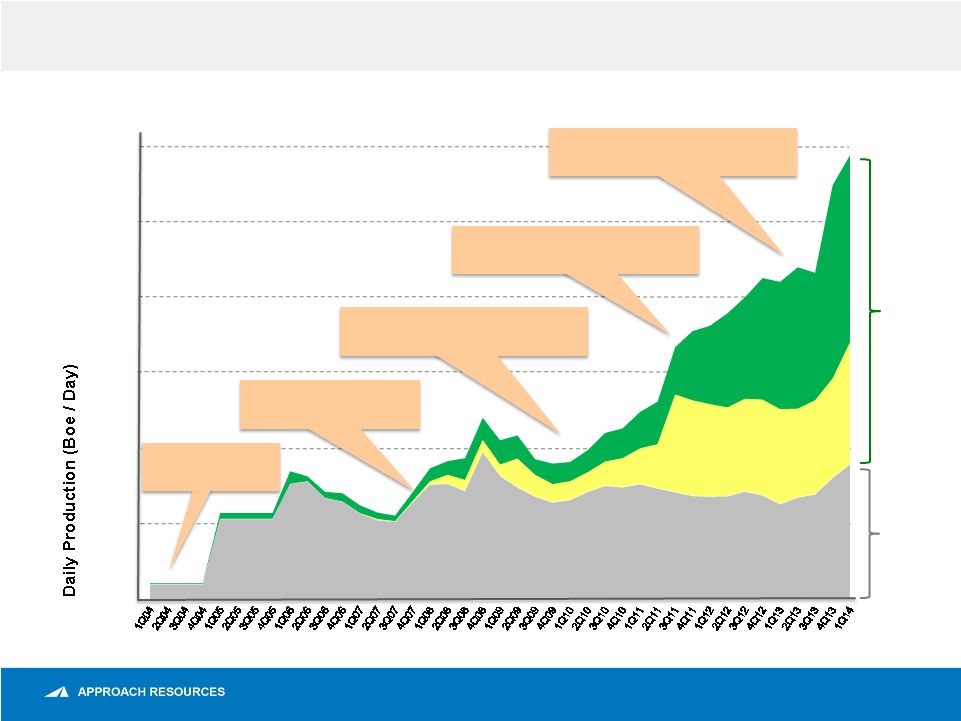

1

st

Producing

Asset

Beginning Large Scale Development of

Wolfcamp Oil Shale Play

Launching IPO

Announcing

Wolfcamp Oil Shale Discovery

Commercializing

Wolfcamp Oil Shale Discovery

Successful transition to an oil and liquids-rich Permian producer –

Approach’s story

4

Oil

NGL

Gas

0

2,000

4,000

6,000

8,000

10,000

12,000

30

%

70

% |

Company overview

AREX OVERVIEW

ASSET OVERVIEW

Enterprise value $1.1 BN

High-quality reserve base

115 MMBoe proved reserves

$1.1 BN proved PV-10

99% Permian Basin

Permian core operating area

162,000 gross (144,000 net) acres

~1+ BnBoe gross, unrisked resource potential

~2,000+ Identified HZ drilling locations targeting

Wolfcamp A/B/C

2014 Capital program of $400 MM

Running 3 HZ rigs in the Wolfcamp shale play to drill

70 wells during 2014

Notes:

Proved

reserves

and

acreage

as

of

12/31/2013

and

3/31/2014,

respectively.

All

Boe

and

Mcfe

calculations

are

based

on

a

6

to

1

conversion

ratio.

Enterprise

value

is

equal

to

market

capitalization

using

the

closing

share

price

of

$20.70

per

share

on

5/2/2014,

plus

net

debt

as

of

3/31/2014.

See

“PV-10

(unaudited)”

slide.

5 |

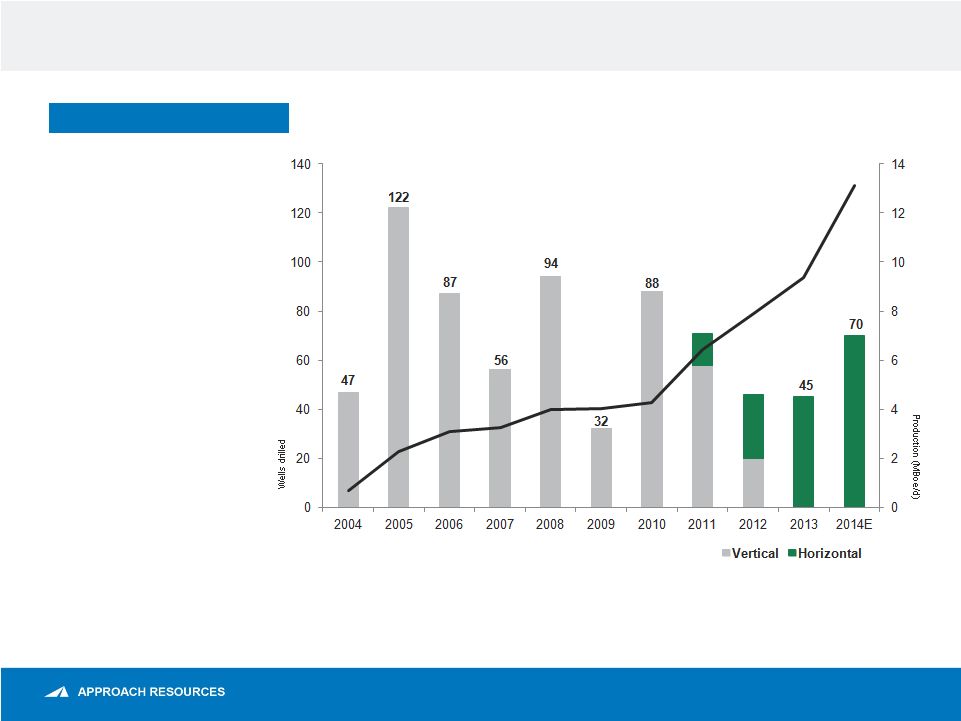

Long history of operating in Midland Basin

6

WELLS DRILLED TO DATE

•

Drilled more than 750 wells

in Midland Basin since

2004

•

One of the first-movers in

the HZ Wolfcamp play with

longest production history

and track record of full-

scale development

•

Well data, core data, 3-D

seismic and micro-seismic

reduces future

development risk

69

46 |

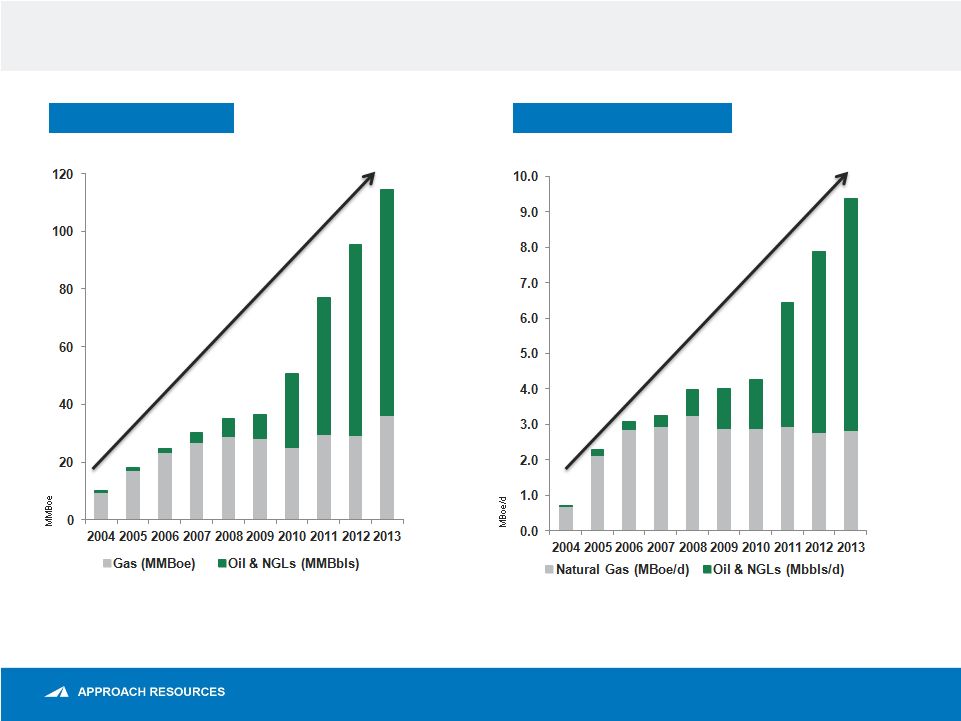

Strong track record of reserve and production growth

7

RESERVE GROWTH

CAGR 31%

PRODUCTION GROWTH

CAGR 34% |

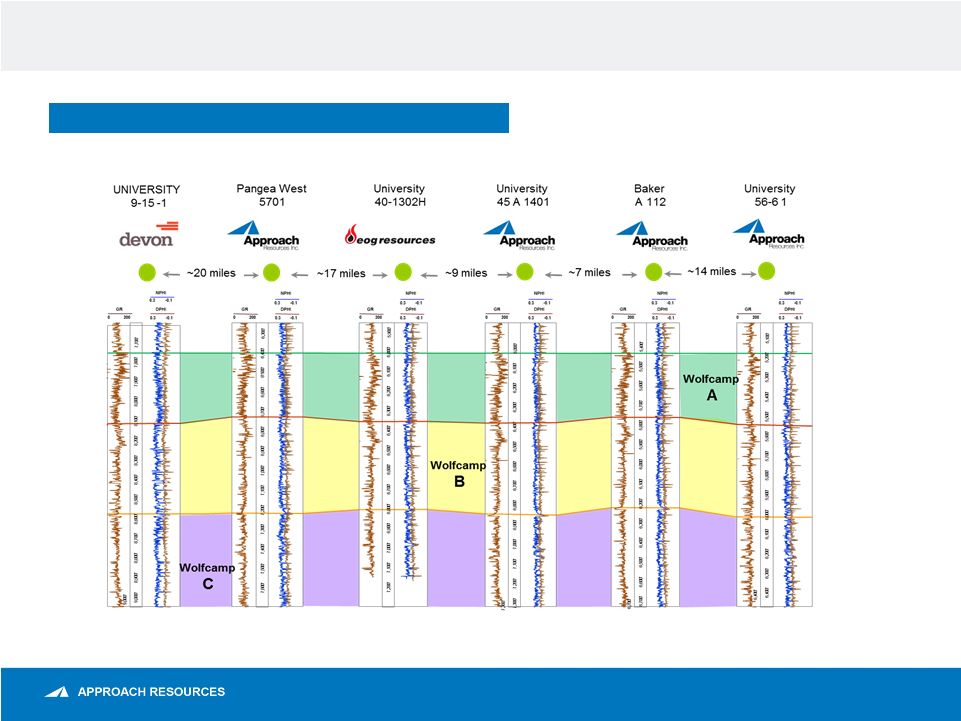

Wolfcamp shale oil play

8

WIDESPREAD, THICK, CONSISTENT & REPEATABLE |

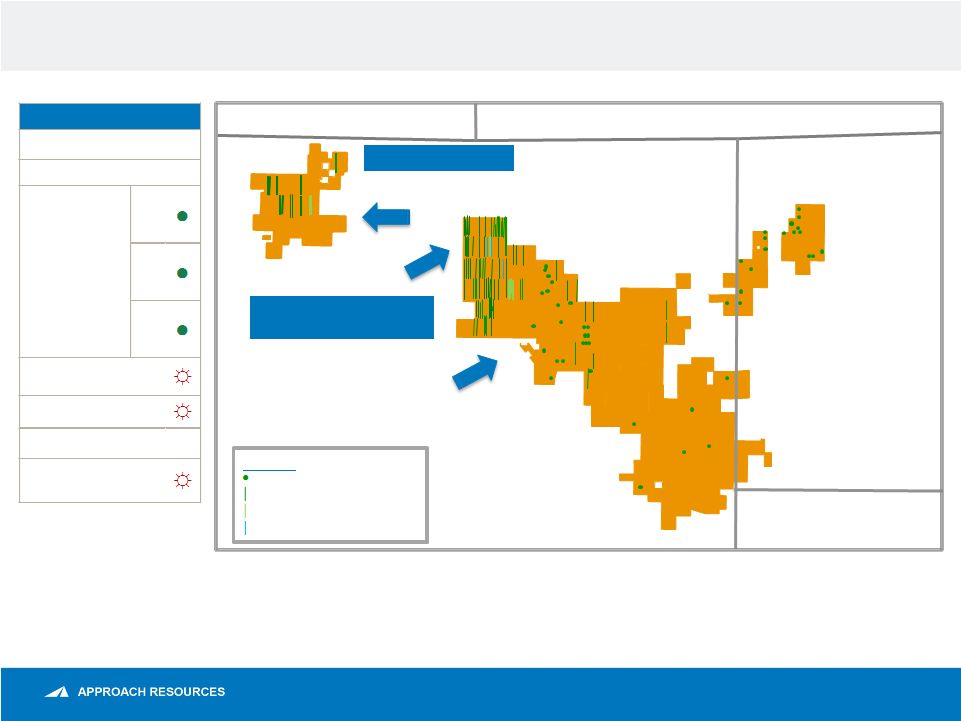

AREX Wolfcamp activity

9

Note: Acreage as of 3/31/2014.

STRATIGRAPHIC UNIT

Clearfork/Spraberry

Dean

Wolfcamp

A

B

C

Canyon

Strawn

Ellenburger

NORTH &

CENTRAL PANGEA

PANGEA WEST

•

1Q14 Activity included:

Stacked A/C completion

Schleicher

Crockett

Irion

Reagan

Sutton

•

1Q14 Activity included:

Stand-alone B-zone

completions and stacked B/C

completions in North &

Central Pangea

Legend

Vertical Producer

HZ Producer

HZ –

Waiting on Completion

HZ –

Drilling |

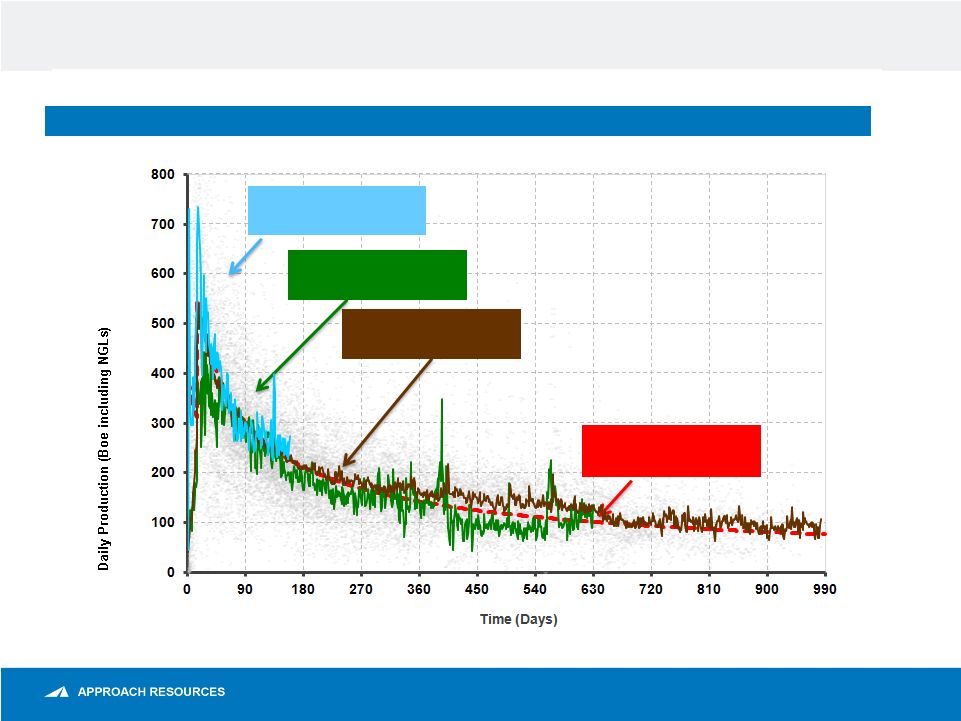

AREX HZ Wolfcamp well performance

10

AREX HZ WOLFCAMP (BOE/D)

Note: Daily production normalized for operational downtime.

Production Data from

AREX C Bench Wells (4)

Production Data from

AREX A Bench Wells (8)

Production Data from

AREX B Bench Wells (63)

450 MBoe Type Curve

Wolfcamp Shale Oil |

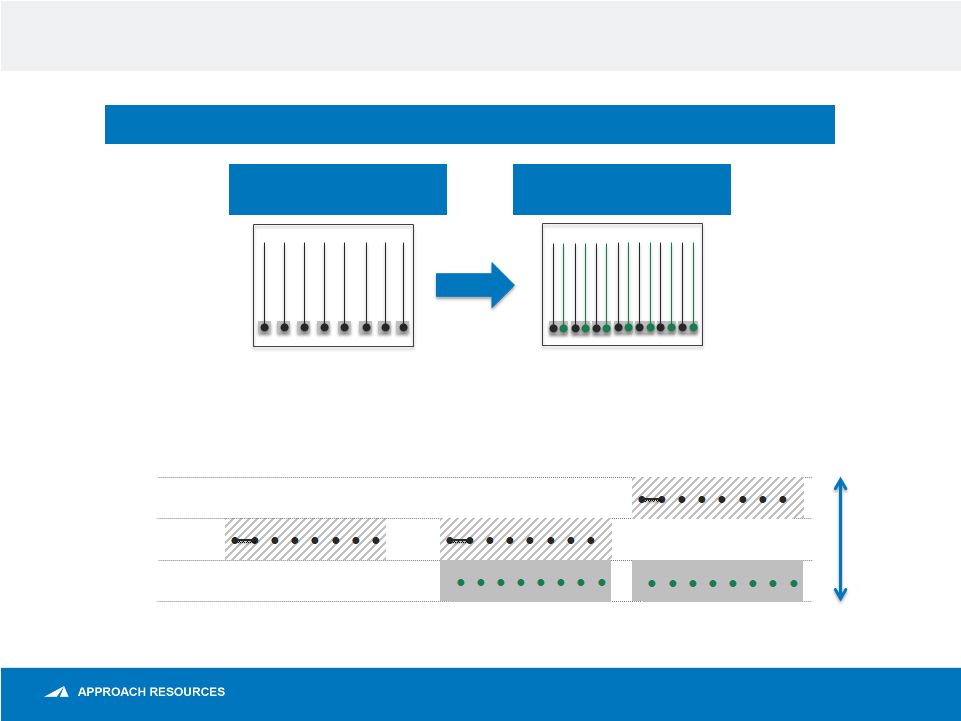

Efficiency-driven transition to two-bench pad development

11

•

Reduces time between spud to

first sales

•

7 to 8 wells per section

•

Reduces surface footprint

•

Reduces rig mobilization costs

•

Completion optimization from

zipper fracs and frac cost savings

•

14 to 16 wells per section

2011 –

2013: SINGLE-BENCH

DEVELOPMENT

CURRENT: TWO-BENCH

DEVELOPMENT

TRANSITION FROM SINGLE-BENCH TO TWO-BENCH DEVELOPMENT

660’

A

B

C

Map view

X-Section

view

~1200’

thick

660’

Note: Target zones in X-Section view are illustrative.

660’

OR |

Evaluating water infrastructure

12

Key factors for Approach in determining to install large-scale water

infrastructure system:

Large, primarily contiguous acreage position

Delineation of Wolfcamp shale across acreage position and

transition to large-scale development phase

How efficiently can we source and transport water from A to B?

Responsible operatorship

Water infrastructure and equipment projects are key to large-scale

field development and to reducing D&C and LOE costs

|

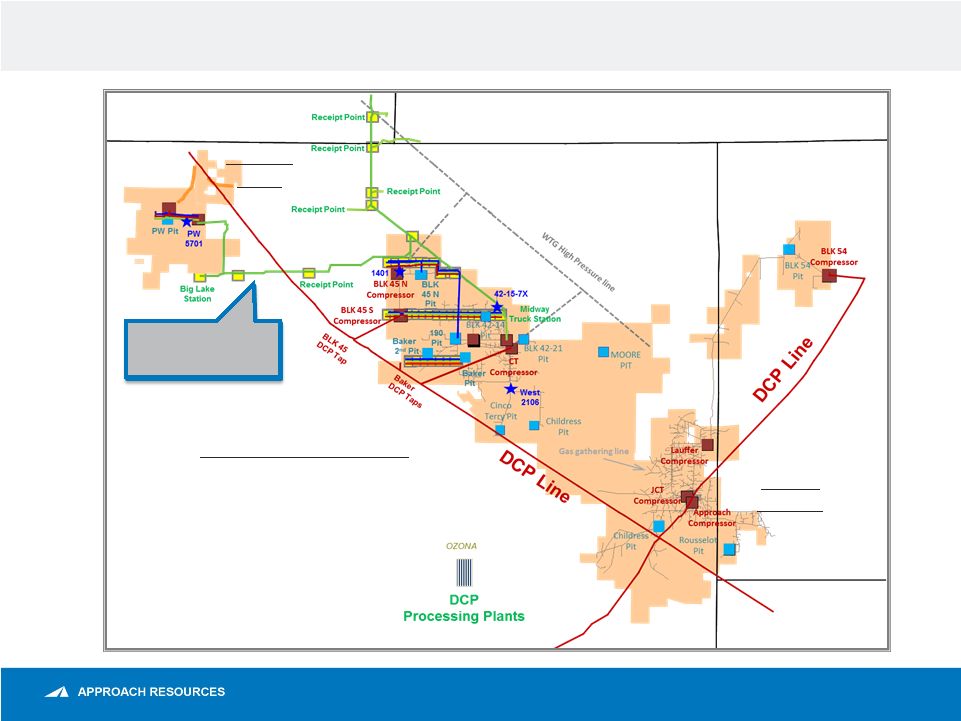

Infrastructure for large-scale development

13

•

Reducing D&C cost

•

Reducing LOE

•

Increasing project profit margin

•

Minimizing truck traffic and surface

disturbance

Pangea

West

North

&

Central

Pangea

South

Pangea

Schleicher

Crockett

Irion

Reagan

Sutton

50-Mile Oil Pipeline

100,000 Bbls/d

Capacity |

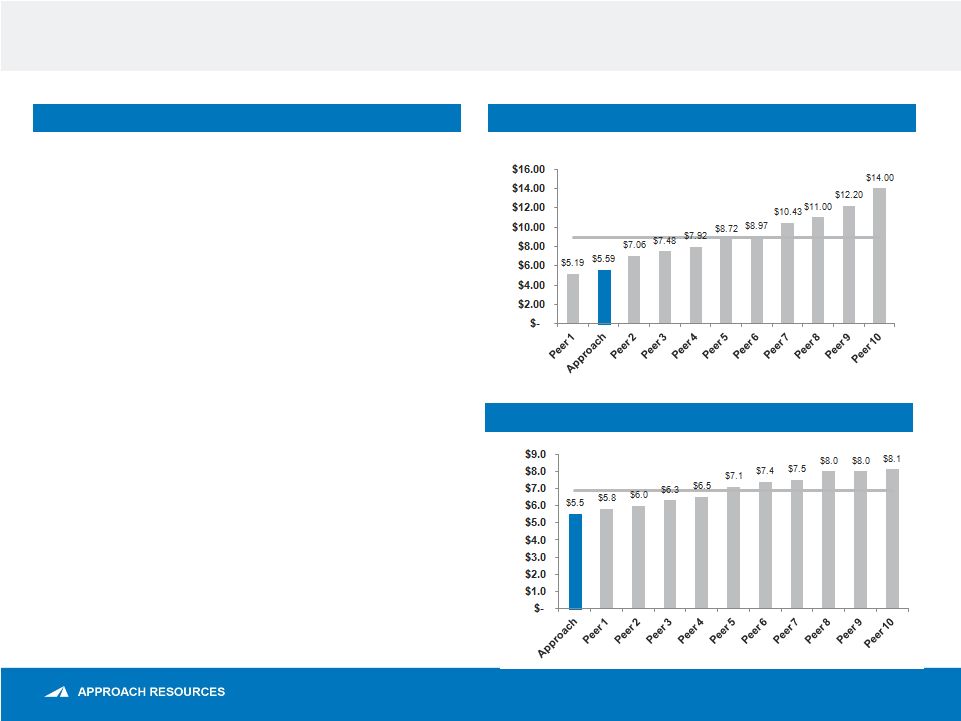

Low cost operator

14

Expect to drill ~20 to 24 HZ wells per rig in

2014 vs. prior estimate of 10 to 12 HZ

wells per rig

3 HZ rigs currently running in Project

Pangea / Pangea West

Recently drilled wells in 10 to 11 days

(~7,500’

lateral)

Compressing spud-to-sales times

Focusing activity around field infrastructure systems

COMPETITIVE LOE (FY13 LOE/Boe)

OPERATIONAL EFFICIENCY

BEST-IN-CLASS HZ D&C ($MM/Well)

Avg. $6.9 MM

Avg. $8.96/Boe

Note: Peers include APA, ATHL, CPE, DVN, FANG, EGN, EPE, LPI, PXD and RSPP.

Data sourced from SEC filings and company news releases/IR

presentations. |

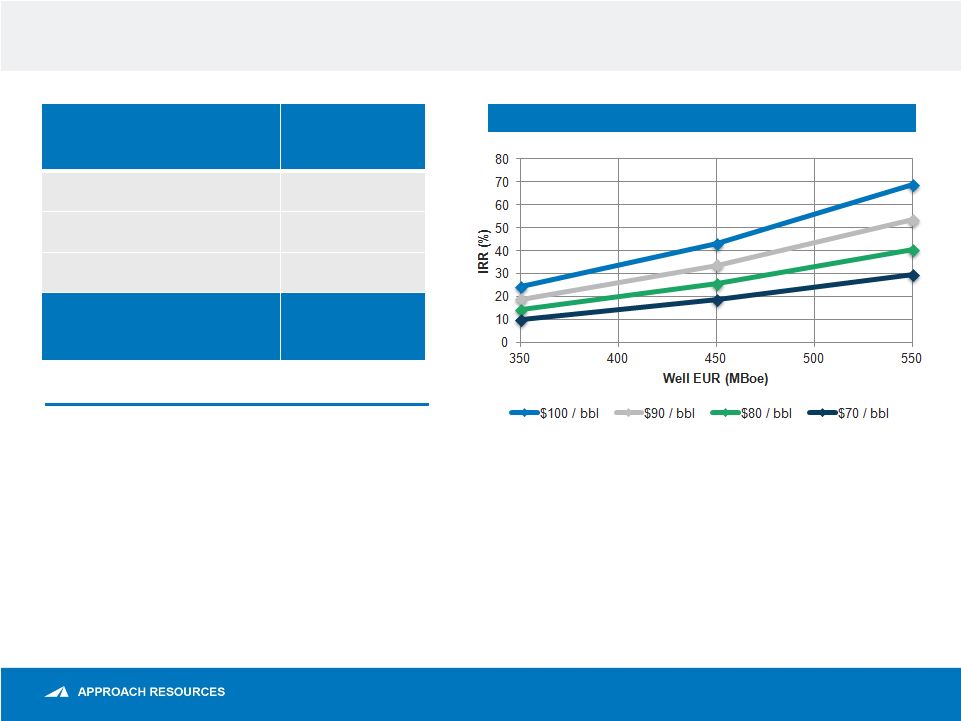

AREX HZ Wolfcamp economics

15

Notes: Identified locations based on multi-bench development and 120-acre

spacing for HZ Wolfcamp. No locations assigned to south

Project

Pangea.

HZ

Wolfcamp

economics

assume

NYMEX

–

Henry

Hub

strip

and

NGL

price

based

on

40%

of

WTI.

Play Type

Horizontal

Wolfcamp

Avg. EUR (gross)

450 MBoe

Targeted Well Cost

$5.5 MM

Potential Locations

~2,000

Gross Resource

Potential

~1 Bn

Boe

BTAX IRR SENSITIVITIES

•

Horizontal drilling improves recoveries and

returns

•

Targeting Wolfcamp A / B / C

•

7,000’+ lateral length

•

~80% of EUR made up of oil and NGLs |

Key takeaways

•

Wolfcamp HZ oil shale play has expanded to more than 10 counties

since discovered in Crockett and Irion Counties in 2010

•

More than 1,800 HZ Wolfcamp wells have been drilled across the

Midland Basin

•

Nearly 80% of the horizontal wells have been drilled in S Midland Basin

•

Crockett, Irion and Reagan Counties account for most activity

•

S Midland Basin is shallower–

lower cost of drilling

•

N Midland Basin is deeper –

higher cost of drilling

•

Contiguous acreage, infrastructure and operational efficiency –

lower

cost of completion and operations

16 |

Appendix |

PV-10 (unaudited)

18

PV-10 (UNAUDITED)

(in millions)

December 31, 2013

PV-10

$

1,132

Less income taxes:

Undiscounted future income taxes

(919)

10% discount factor

463

Future discounted income taxes

(456)

Standardized measure of discounted future net cash flows

$

676

The

present

value

of

our

proved

reserves,

discounted

at

10%

(“PV-10”),

was

estimated

at

$1.1

billion

at

December

31,

2013,

and

was

calculated

based

on

the

first-of-the-month,

twelve-month

average

prices

for

oil,

NGLs

and

gas,

of

$97.28

per

Bbl

of

oil,

$30.16

per

Bbl

of

NGLs

and

$3.66

per

MMBtu

of

natural

gas.

PV-10

is

our

estimate

of

the

present

value

of

future

net

revenues

from

proved

oil

and

gas

reserves

after

deducting

estimated

production

and

ad

valorem

taxes,

future

capital

costs

and

operating

expenses,

but

before

deducting

any

estimates

of

future

income

taxes.

The

estimated

future

net

revenues

are

discounted

at

an

annual

rate

of

10%

to

determine

their

“present

value.”

We

believe

PV-10

to

be

an

important

measure

for

evaluating

the

relative

significance

of

our

oil

and

gas

properties

and

that

the

presentation

of

the

non-GAAP

financial

measure

of

PV-10

provides

useful

information

to

investors

because

it

is

widely

used

by

professional

analysts

and

investors

in

evaluating

oil

and

gas

companies.

Because

there

are

many

unique

factors

that

can

impact

an

individual

company

when

estimating

the

amount

of

future

income

taxes

to

be

paid,

we

believe

the

use

of

a

pre-tax

measure

is

valuable

for

evaluating

the

Company.

We

believe

that

PV-10

is

a

financial

measure

routinely

used

and

calculated

similarly

by

other

companies

in

the

oil

and

gas

industry.

The

following

table

reconciles

PV-10

to

our

standardized

measure

of

discounted

future

net

cash

flows,

the

most

directly

comparable

measure

calculated

and

presented

in

accordance

with

GAAP.

PV-10

should

not

be

considered

as

an

alternative

to

the

standardized

measure

as

computed

under

GAAP. |

Forward-looking statements

19

The

Securities

and

Exchange

Commission

(“SEC”)

permits

oil

and

gas

companies,

in

their

filings

with

the

SEC,

to

disclose

only

proved,

probable

and

possible

reserves

that

meet

the

SEC’s

definitions

for

such

terms,

and

price

and

cost

sensitivities

for

such

reserves,

and

prohibits

disclosure

of

resources

that

do

not

constitute

such

reserves.

The

Company

uses

the

terms

“estimated

ultimate

recovery”

or

“EUR,”

reserve

or

resource

“potential,”

and

other

descriptions

of

volumes

of

reserves

potentially

recoverable

through

additional

drilling

or

recovery

techniques

that

the

SEC’s

rules

may

prohibit

the

Company

from

including

in

filings

with

the

SEC.

These

estimates

are

by

their

nature

more

speculative

than

estimates

of

proved,

probable

and

possible

reserves

and

accordingly

are

subject

to

substantially

greater

risk

of

being

actually

realized

by

the

Company.

EUR

estimates,

identified

drilling

locations

and

resource

potential

estimates

have

not

been

risked

by

the

Company.

Actual

locations

drilled

and

quantities

that

may

be

ultimately

recovered

from

the

Company’s

interest

may

differ

substantially

from

the

Company’s

estimates.

There

is

no

commitment

by

the

Company

to

drill

all

of

the

drilling

locations

that

have

been

attributed

these

quantities.

Factors

affecting

ultimate

recovery

include

the

scope

of

the

Company’s

ongoing

drilling

program,

which

will

be

directly

affected

by

the

availability

of

capital,

drilling

and

production

costs,

availability

of

drilling

and

completion

services

and

equipment,

drilling

results,

lease

expirations,

regulatory

approval

and

actual

drilling

results,

as

well

as

geological

and

mechanical

factors

Estimates

of

unproved

reserves,

type/decline

curves,

per

well

EUR

and

resource

potential

may

change

significantly

as

development

of

the

Company’s

oil

and

gas

assets

provides

additional

data.

Type/decline

curves,

estimated

EURs,

resource

potential,

recovery

factors

and

well

costs

represent

Company

estimates

based

on

evaluation

of

petrophysical

analysis,

core

data

and

well

logs,

well

performance

from

limited

drilling

and

recompletion

results

and

seismic

data,

and

have

not

been

reviewed

by

independent

engineers.

These

are

presented

as

hypothetical

recoveries

if

assumptions

and

estimates

regarding

recoverable

hydrocarbons,

recovery

factors

and

costs

prove

correct.

The

Company

has

very

limited

production

experience

with

these

projects,

and

accordingly,

such

estimates

may

change

significantly

as

results

from

more

wells

are

evaluated.

Estimates

of

resource

potential

and

EURs

do

not

constitute

reserves,

but

constitute

estimates

of

contingent

resources

which

the

SEC

has

determined

are

too

speculative

to

include

in

SEC

filings.

Unless

otherwise

noted,

IRR

estimates

are

before

taxes

and

assume

NYMEX

forward-curve

oil

and

gas

pricing

and

Company-generated

EUR

and

decline

curve

estimates

based

on

Company

drilling

and

completion

cost

estimates

that

do

not

include

land,

seismic

or

G&A

costs.

Cautionary statements regarding oil & gas quantities

This

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.

All

statements,

other

than

statements

of

historical

facts,

included

in

this

presentation

that

address

activities,

events

or

developments

that

the

Company

expects,

believes

or

anticipates

will

or

may

occur

in

the

future

are

forward-looking

statements.

Without

limiting

the

generality

of

the

foregoing,

forward-looking

statements

contained

in

this

presentation

specifically

include

the

expectations

of

management

regarding

plans,

strategies,

objectives,

anticipated

financial

and

operating

results

of

the

Company,

including

as

to

the

Company’s

Wolfcamp

shale

resource

play,

estimated

resource

potential

and

recoverability

of

the

oil

and

gas,

estimated

reserves

and

drilling

locations,

capital

expenditures,

typical

well

results

and

well

profiles,

type

curve,

and

production

and

operating

expenses

guidance

included

in

the

presentation.

These

statements

are

based

on

certain

assumptions

made

by

the

Company

based

on

management's

experience

and

technical

analyses,

current

conditions,

anticipated

future

developments

and

other

factors

believed

to

be

appropriate

and

believed

to

be

reasonable

by

management.

When

used

in

this

presentation,

the

words

“will,”

“potential,”

“believe,”

“intend,”

“expect,”

“may,”

“should,”

“anticipate,”

“could,”

“estimate,”

“plan,”

“predict,”

“project,”

“target,”

“profile,”

“model”

or

their

negatives,

other

similar

expressions

or

the

statements

that

include

those

words,

are

intended

to

identify

forward-looking

statements,

although

not

all

forward-looking

statements

contain

such

identifying

words.

Such

statements

are

subject

to

a

number

of

assumptions,

risks

and

uncertainties,

many

of

which

are

beyond

the

control

of

the

Company,

which

may

cause

actual

results

to

differ

materially

from

those

implied

or

expressed

by

the

forward-looking

statements.

In

particular,

careful

consideration

should

be

given

to

the

cautionary

statements

and

risk

factors

described

in

the

Company's

most

recent

Annual

Report

on

Form

10-K

and

Quarterly

Reports

on

Form

10-Q.

Any

forward-looking

statement

speaks

only

as

of

the

date

on

which

such

statement

is

made

and

the

Company

undertakes

no

obligation

to

correct

or

update

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

events

or

otherwise,

except

as

required

by

applicable

law. |

Thank you |