Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION - UAN CULTURAL & CREATIVE CO., LTD. | ex31-1.htm |

| EXCEL - IDEA: XBRL DOCUMENT - UAN CULTURAL & CREATIVE CO., LTD. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - UAN CULTURAL & CREATIVE CO., LTD. | ex32-1.htm |

| EX-32.2 - CERTIFICATION - UAN CULTURAL & CREATIVE CO., LTD. | ex32-2.htm |

| EX-31.2 - CERTIFICATION - UAN CULTURAL & CREATIVE CO., LTD. | ex31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

(Mark One)

| [X] | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||||||||||

| For the quarterly period ended | March 31, 2014 | |||||||||||||||||||

| or | ||||||||||||||||||||

| [ ] | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||||||||||||||||

| For the transition period from | to | |||||||||||||||||||

| Commission File Number | 000-51693 | |||||||||||||||||||

| UAN Cultural & Creative Co., Ltd. | ||||||||||||||||||||

| (Exact name of registrant as specified in its charter) | ||||||||||||||||||||

| Delaware | 20-3303304 | |||||||||||||||||||

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |||||||||||||||||||

| 102 North Avenue, Mt. Clemens, Michigan | 48043 | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| (586) 530-5605 | ||||||||||||||||||||

| (Registrant’s telephone number, including area code) | ||||||||||||||||||||

| N/A | ||||||||||||||||||||

| (Former name, former address and former fiscal year, if changed since last report) | ||||||||||||||||||||

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ||||||||||||||||||||

| [X] | YES | [ ] | NO | |||||||||||||||||

| Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | ||||||||||||||||||||

| [X] | YES | [ ] | NO | |||||||||||||||||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. | ||||||||||||||||||||

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |||||||||||||||||

| Non-accelerated filer | [ ] | (Do not check if a smaller reporting company) | Smaller reporting company | [X] | ||||||||||||||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) | ||||||||||||||||||||

| [X] | YES | [ ] | NO | |||||||||||||||||

APPLICABLE

ONLY TO ISSUERS INVOLVED IN BANKRUPTCY Check whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act after the distribution of securities under a plan confirmed by a court. | ||||||||||||||||||||

| [ ] | YES | [ ] | NO | |||||||||||||||||

| APPLICABLE ONLY TO CORPORATE ISSUERS | ||||||||||||||||||||

| Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. | ||||||||||||||||||||

| 53,668,778 common shares issued and outstanding as of May 15, 2014. | ||||||||||||||||||||

TABLE OF CONTENTS

| PART I – FINANCIAL INFORMATION | 3 | ||

| Item 1. | Financial Statements | 3 | |

| Item 2. | Management's Discussion and Analysis of Financial Condition and Result of Operations | 15 | |

| Item 3. | Quantitative and Qualitative Disclosure About Market Risks | 23 | |

| Item 4. | Controls and Procedures | 23 | |

| PART II - OTHER INFORMATION | 24 | ||

| Item 1. | Legal Proceedings | 24 | |

| Item 1A. | Risk Factors | 24 | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | 24 | |

| Item 3. | Defaults Upon Senior Securities | 24 | |

| Item 4. | Mine Safety Disclosures | 24 | |

| Item 5. | Other Information | 24 | |

| Item 6. | Exhibits | 25 | |

| SIGNATURES | 27 | ||

| 2 |

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements

Our unaudited interim consolidated financial statements for the three month period ended March 31, 2014 form part of this quarterly report. They are stated in United States Dollars (US$) and are prepared in accordance with United States generally accepted accounting principles.

UAN Cultural & Creative Co., Ltd. and Subsidiaries

(A Development Stage Company)

Consolidated Balance Sheets

| March

31, 2014 | December

31, 2013 | |||||||||||

| (Unaudited) | ||||||||||||

| ASSETS | ||||||||||||

| Current Assets: | ||||||||||||

| Cash and cash equivalents | $ | 600 | $ | 4,117 | ||||||||

| Current assets from discontinued operations (Note 4) | — | 2,264 | ||||||||||

| Total current assets | 600 | 6,381 | ||||||||||

| Other assets from discontinued operations (Note 4) | — | 19,889 | ||||||||||

| Total assets | $ | 600 | $ | 26,270 | ||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||

| Current Liabilities: | ||||||||||||

| Accounts payable | $ | 26,501 | $ | 27,274 | ||||||||

| Accrued expenses | 35,832 | 40,732 | ||||||||||

| Due to officer & shareholder (Note 8) | 201,842 | 165,522 | ||||||||||

| Current liabilities from discontinued operations (Note 4) | — | — | ||||||||||

| Total current liabilities | 264,175 | 233,528 | ||||||||||

| Other liabilities from discontinued operations (Note 4) | — | — | ||||||||||

| Total liabilities | 264,175 | 233,528 | ||||||||||

| Commitments & Contingencies (Note 6) | — | — | ||||||||||

| Stockholders' Deficit (Note 7): | ||||||||||||

| Preferred stock, $.0001 par value, 5,000 shares authorized, 0 shares issued | — | — | ||||||||||

| Common stock, $.0001 par value, 100,000,000 shares authorized, 53,672,708 shares issued and outstanding on March 31, 2014 and December 31, 2013 | 5,367 | 5,367 | ||||||||||

| Common stock, Class B, $.0001 par value, 12,000,000 shares authorized, 0 shares issued and outstanding | — | — | ||||||||||

| Additional paid-in-capital | 3,048,134 | 3,048,134 | ||||||||||

| Accumulated deficit | (2,977,102 | ) | (2,977,102 | ) | ||||||||

| Accumulated deficit under development stage | (354,824 | ) | (281,495 | ) | ||||||||

| Accumulated other comprehensive income (loss) | 14,850 | (2,162 | ) | |||||||||

| Total stockholders' deficit | (263,575 | ) | (207,258 | ) | ||||||||

| Total liabilities and stockholders' deficit | $ | 600 | $ | 26,270 | ||||||||

See accompanying notes to financial statements.

| 3 |

UAN Cultural & Creative Co., Ltd. and Subsidiaries

(A Development Stage Company)

Consolidated Statements of Operations and Comprehensive (Loss)

(Unaudited)

| From Inception | ||||||||||||

| For the Three Months Ended | December 1, 2012 to | |||||||||||

| March

31, 2014 | March

31, 2013 | March

31, 2014 | ||||||||||

| Revenue | $ | — | $ | — | $ | — | ||||||

| Cost of Sales | — | — | — | |||||||||

| Gross Profit | — | — | — | |||||||||

| Operating expenses: | ||||||||||||

| Selling, general & administrative expenses | 34,165 | 29,683 | 271,722 | |||||||||

| Total operating expenses | 34,165 | 29,683 | 271,722 | |||||||||

| Loss from operations | (34,165 | ) | (29,683 | ) | (271,722 | ) | ||||||

| Other income/(expenses) | ||||||||||||

| Interest income, net | 20 | 22 | ||||||||||

| Total other income | 20 | 22 | ||||||||||

| Loss from continuing operations before provision for income taxes | (34,165 | ) | (29,663 | ) | (271,700 | ) | ||||||

| Provision for income taxes (Note 5) | — | — | — | |||||||||

| Loss from continuing operations | (34,165 | ) | (29,663 | ) | (271,700 | ) | ||||||

| Loss from discontinued operations, net of tax | (34,164 | ) | — | (83,124 | ) | |||||||

| Net Loss | $ | (73,329 | ) | $ | (29,663 | ) | $ | (354,824 | ) | |||

| Weighted average number of common shares outstanding, basic | 53,672,708 | 53,672,708 | ||||||||||

| Net Loss per share, basic | ||||||||||||

| Continuing operations | $ | (0.001 | ) | $ | (0.001 | ) | ||||||

| Discontinued operations | $ | (0.001 | ) | $ | — | |||||||

| Weighted average number of common shares outstanding, diluted | 53,672,708 | 53,672,708 | ||||||||||

| Net Loss per share, diluted | ||||||||||||

| Continuing operations | $ | (0.001 | ) | $ | (0.001 | ) | ||||||

| Discontinued operations | $ | (0.001 | ) | $ | — | |||||||

| Comprehensive Loss | ||||||||||||

| Net loss | $ | (73,329 | ) | $ | (29,663 | ) | ||||||

| Foreign currency translation gain (loss) | 17,012 | (48 | ) | |||||||||

| Comprehensive loss | $ | (55,317 | ) | $ | (29,711 | ) | ||||||

See accompanying notes to financial statements.

| 4 |

UAN Cultural & Creative Co., Ltd. and Subsidiaries

(A Development Stage Company)

Consolidated Statement of Cash Flows

(Unaudited)

| From | ||||||||||||

| For the Three Months Ended | December 1, 2012 to | |||||||||||

| March 31, 2014 | March 31, 2013 | March 31, 2014 | ||||||||||

| Cash Flows from Operating Activities | ||||||||||||

| Net loss | $ | (73,329 | ) | $ | (29,663 | ) | $ | (354,824 | ) | |||

| Less: Loss from discontinued operations | (39,164 | ) | — | (83,124 | ) | |||||||

| Loss from continuing operations | (34,165 | ) | (29,663 | ) | (271,700 | ) | ||||||

| Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Increase in other current assets | — | — | 5,802 | |||||||||

| Increase (Decrease) in accounts payable & accrued expenses | (5,673 | ) | 15,271 | 9,143 | ||||||||

| Net cash used in operating activities of continuing operations | (39,838 | ) | (14,392 | ) | (256,755 | ) | ||||||

| Net cash provided by (used in) operating activities of discontinued operations | (17,080 | ) | 57,785 | 29,880 | ||||||||

| Net cash provided by (used in) operating activities | (56,918 | ) | 43,393 | (226,875 | ) | |||||||

| Cash Flows from Investing Activities | ||||||||||||

| Net cash provided by investing activities of continuing operations | — | — | — | |||||||||

| Net cash used in investing activities of discontinued operations | — | (24,972 | ) | (20,052 | ) | |||||||

| Net cash used in investing activities | — | (24,972 | ) | (20,052 | ) | |||||||

| Cash Flows from Financing Activities | ||||||||||||

| (Repayment)/Proceeds of advances from shareholders & officers | 36,320 | 9,067 | 210,802 | |||||||||

| Net cash provided by financing activities of continuing operations | 36,320 | 9,067 | 210,802 | |||||||||

| Net cash used in financing activities of discontinued operations | — | (32,744 | ) | (7,224 | ) | |||||||

| Net cash provided by (used in) financing activities | 36,320 | (23,677 | ) | 203,578 | ||||||||

| Effect of exchange rate change on cash | 17,081 | (48 | ) | 17,378 | ||||||||

| Net decrease in cash and cash equivalents | (3,517 | ) | (5,304 | ) | (25,971 | ) | ||||||

| Cash and cash equivalents | ||||||||||||

| Beginning of period | 4,117 | 15,131 | 26,592 | |||||||||

| End of period | 600 | 9,827 | 621 | |||||||||

| Less: cash and cash equivalents of discontinued operations at end of year | 21 | 21 | ||||||||||

| Cash and cash equivalents of continuing operations at end of year | $ | 600 | $ | 9,806 | $ | 600 | ||||||

| Supplemental disclosure of cash flow information: | ||||||||||||

| Interest paid | $ | — | $ | 27,317 | $ | — | ||||||

| Income taxes paid | $ | — | $ | — | $ | — | ||||||

See accompanying notes to financial statements.

| 5 |

UAN CULTURAL & CREATIVE CO., LTD. AND SUBSIDIARIES

(A DEVELOPMENT STAGE COMPANY)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—ORGANIZATION AND BUSINESS OPERATIONS

UAN Cultural & Creative Co., Ltd. (formerly named Good Harbor Partners Acquisition Corp.) (“UAN CCC”) was incorporated in Delaware on August 10, 2005.

On June 30, 2010, a change of control of UAN CCC occurred when eight purchasers acquired an aggregate of approximately 95.6% of the outstanding voting Common Stock of UAN CCC. In connection with these transactions, UAN CCC’s Board of Directors was reconstituted, and UAN CCC initiated a new business plan involving the sale and appraisal of authentic and high quality works of art, primarily paintings, initially in Taiwan.

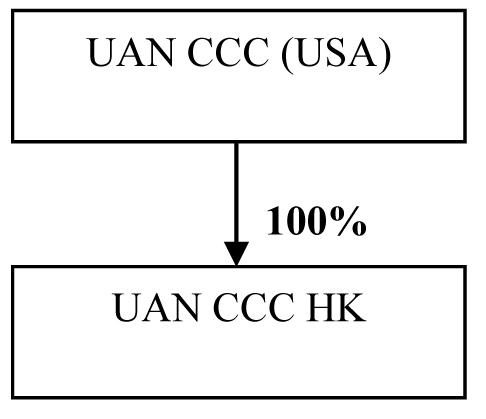

On February 14, 2012, UAN CCC, through its director, established UAN Cultural and Creative Company Limited (“UAN HK”) in Hong Kong to take advantage of tax benefits.

On August 9, 2012, UAN CCC though its director and UAN HK, established UAN Yeh Cultural and Creative Company Limited Taiwan Branch (“UAN Yeh”) in Taiwan.

As at August 12, 2012, UAN HK became wholly owned subsidiary of UAN CCC with 10,000 capital shares authorized at HKD1.00 par value and 10,000 shares issued and outstanding.

The operation of the Old Taiwan Branch was ceased and subsequently transferred to UAN Yeh.

On December 1, 2012, the board has decided to abandon the art gallery business in Taiwan as it was not able to generate sufficient revenue or financing interest to continue the business. Consequently, UAN CCC became a development stage company to serve as a vehicle to effect a merger, capital stock exchange, asset acquisition or other similar business combination with an operating business.

UAN CCC and its subsidiaries – UAN HK shall be collectively referred throughout as the “Company”.

To summarize the paragraphs above, the organization and ownership structure of the Company is currently as follows:

| 6 |

NOTE 2—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

INTERIM FINANCIAL STATEMENTS

The accompanying unaudited consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission and should be read in conjunction with the Company’s audited financial statements and footnotes thereto for the year ended December 31, 2013, included in the Company’s Form 10-K filed on April 15, 2014. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to such rules and regulations. However, the Company believes that the disclosures are adequate to make the information presented not misleading. The financial statements reflect all adjustments (consisting primarily of normal recurring adjustments) that are, in the opinion of management necessary for a fair presentation of the Company’s financial position and results of operations. The operating results for the three months ended March 31, 2014 are not necessarily indicative of the results to be expected for any other interim period of a future year.

BASIS OF PRESENTATION

The Company has prepared the accompanying consolidated financial statements in conformity with accounting principles generally accepted in the United States of America. All significant intercompany accounts and transactions between the Company and its subsidiaries have been eliminated in consolidation.

RECLASSIFICATION

Certain amounts in the prior period financial statements have been reclassified to conform to the current period presentation. These reclassifications had no effect on reported losses.

DISCONTINUED OPERATIONS

On December 1, 2012, the Company ceased its Taiwan’s business operations. The Consolidated Financial Statements have been recast to present the Taiwan’s business operation as discontinued operations as described in “Note 4 - Discontinued Operations.” Unless noted otherwise, discussion in the Notes to Consolidated Financial Statements pertain to continuing operations.

USE OF ESTIMATES

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

CASH AND CASH EQUIVALENTS

Cash and cash equivalents are deposits in financial institutions as well as short-term money market instruments with maturities of three months or less when purchased.

CONCENTRATION OF CREDIT RISK

Financial instruments that potentially subject the Company to a significant concentration of credit risk consist primarily of cash and cash equivalents. The Company maintains deposits in federally insured financial institutions in excess of federally insured limits. However, management believes the Company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held.

| 7 |

COMPREHENSIVE INCOME

The Company adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 220, “Comprehensive Income,” which establishes standards for reporting and presentation of comprehensive income (loss) and its components in a full set of general-purpose financial statements. The Company has chosen to report comprehensive income (loss) in the statements of income and comprehensive income. Comprehensive income (loss) is comprised of net income and all changes to stockholders’ equity except those due to investments by owners and distributions to owners.

EARNINGS (LOSS) PER SHARE

Basic earnings (loss) per share is computed by dividing income (loss) available to common stockholders by the weighted average common shares outstanding for the period and Class B common stock outstanding prior to its redemption. Diluted earnings per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the earnings of the entity. The average market price of the common shares is below the exercise price of the outstanding warrants therefore not included in the calculation for dilutive share.

The computation of basic and diluted earnings (loss) per share for the three months ended March 31, 2014 and 2013 as follows:

| For the Three Months Ended | ||||||||

| March 31, 2014 | March 31, 2013 | |||||||

| Numerator: | ||||||||

| Net Income/(Loss) from continuing operation | $ | (34,165 | ) | $ | (29,663 | ) | ||

| Net income/(loss) from discontinued operation | $ | (39,164 | ) | $ | — | |||

| Denominator | ||||||||

| Weighted average common shares outstanding – basic | 53,672,708 | 53,672,708 | ||||||

| Dilution associated with W and Z warrants | — | — | ||||||

| Weighted average common share outstanding – diluted | 53,672,708 | 53,672,708 | ||||||

| Basic earnings (loss) per share | ||||||||

| Continuing operations | $ | (0.001 | ) | $ | (0.001 | ) | ||

| Discontinuing operations | $ | (0.001 | ) | $ | — | |||

| Diluted earnings (loss) per share | ||||||||

| Continuing operations | $ | (0.001 | ) | $ | (0.001 | ) | ||

| Discontinuing operations | $ | (0.001 | ) | $ | — | |||

| 8 |

FAIR VALUE OF FINANCIAL INSTRUMENTS

FASB ASC Topic 820, “Fair Value measurement and Disclosures”, an Accounting Standard Update. In September 2009, the FASB issued this Update to amendments to Subtopic 820-10, “Fair Value Measurements and Disclosures”. Overall, for the fair value measurement of investments in certain entities that calculates net asset value per share (or its equivalent). The amendments in this Update permit, as a practical expedient, a reporting entity to measure the fair value of an investment that is within the scope of the amendments in this Update on the basis of the net asset value per share of the investment (or its equivalent) if the net asset value of the investment (or its equivalent) is calculated in a manner consistent with the measurement principles of Topic 946 as of the reporting entity’s measurement date, including measurement of all or substantially all of the underlying investments of the investee in accordance with Topic 820. The amendments in this Update also require disclosures by major category of investment about the attributes of investments within the scope of the amendments in this Update, such as the nature of any restrictions on the investor’s ability to redeem its investments at the measurement date, any unfunded commitments (for example, a contractual commitment by the investor to invest a specified amount of additional capital at a future date to fund investments that will be made by the investee), and the investment strategies of the investees. The major category of investment is required to be determined on the basis of the nature and risks of the investment in a manner consistent with the guidance for major security types in GAAP on investments in debt and equity securities in paragraph 320-10-50-lB. The disclosures are required for all investments within the scope of the amendments in this Update regardless of whether the fair value of the investment is measured using the practical expedient. The amendments in this Update apply to all reporting entities that hold an investment that is required or permitted to be measured or disclosed at fair value on a recurring or non-recurring basis and, as of the reporting entity’s measurement date, if the investment meets certain criteria The amendments in this Update are effective for the interim and annual periods ending after December 15, 2009. Early application is permitted in financial statements for earlier interim and annual periods that have not been issued.

REVENUES

The Company is a development stage company as such has not realized any revenues or directly related expenses.

ADVERTISING COSTS

Advertising costs are expensed as incurred and included in selling, general and administrative expenses. The Company has not incurred any advertising expense for the three months ended March 31, 2014 and 2013.

FOREIGN CURRENCY TRANSLATIONS

The functional currency of UAN CCC is U.S. Dollar (“USD”).

The functional currency of UAN CCC HK is Hong Kong Dollar (“HKD”).

The functional currency of UAN CCC’s branch in Taiwan (discontinued operations) and UAN Yeh CCC (discontinued operations) is New Taiwan Dollar (“TWD”).

Transactions denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the date of the transactions. Exchange gains or losses on transactions are included in earnings.

The consolidated financial statements of the Company are translated into U.S. dollars in accordance with the standard, “Foreign Currency Translation,” codified in ASC 830, using rates of exchange at the end of the period for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for equity. Translation adjustments resulting from the process of translating the local currency combining financial statements into U.S. dollars are included in determining comprehensive income.

At March 31, 2014, the cumulative translation adjustments of $14,850, were classified as items of accumulated other comprehensive income in the stockholders’ equity section of the balance sheet. Other comprehensive income (loss) was $17,012 and $(48) for the three months ended March 31, 2014 and 2013, respectively.

| 9 |

The exchange rates used to translate TWD amounts into USD at (1USD=TWD) as follows:

| Balance Sheet Rate |

Average Rate | |||

| March 31, 2014 | 30.44 | 30.32 | ||

| December 31, 2013 | 30.00 | 29.70 | ||

| March 31, 2013 | 29.08 | 29.48 |

The exchange rates used to translate HKD amounts into USD at (1USD=HKD) as follows:

| Balance Sheet Rate |

Average Rate | |||

| March 31, 2014 | 7.76 | 7.76 | ||

| December 31, 2013 | 7.75 | 7.76 | ||

| March 31, 2013 | 7.76 | 7.76 |

INCOME TAXES

The Company accounts for income taxes following the liability method pursuant to FASB ASC 740 “Income Taxes”. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the period in which the differences are expected to reverse. The Company records a valuation allowance to offset deferred tax assets if, based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rate is recognized in income in the period that includes the enactment date.

The Company accounts for uncertainty in income taxes in accordance with FASB ASC 740-10 “Income Taxes-Overall”. The Company has elected to classify interest and penalties related to an uncertain position, if and when required, as part of interest expenses and other expenses, respectively, in the consolidated statements of income and comprehensive income.

NEW ACCOUNTING PRONOUNCEMENTS

In April 2014, the FASB issued ASU No. 2014-08, Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity, which changes the criteria for determining which disposals can be presented as discontinued operations and modifies related disclosure requirements. This standard will have the impact of reducing the frequency of disposals reported as discontinued operations, by requiring such a disposal to represent a strategic shift that has or will have a major effect on an entity’s operations and financial results. However, existing provisions that prohibit an entity from reporting a discontinued operation if it has certain continuing cash flows or involvement with the component after disposal are eliminated by this standard. The ASU also expands the disclosures for discontinued operations and requires new disclosures related to individually significant disposals that do not qualify as discontinued operations. The ASU is effective prospectively beginning January 1, 2015. Early adoption is, however, permitted. This ASU would impact the Company’s consolidated results of operations and financial condition only in the instance of a disposal as described above.

In July 2013, the FASB issued ASU 2013-11, “Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists.” This standard requires that an unrecognized tax benefits, or a portion of an unrecognized tax benefit be presented on a reduction to a deferred tax asset for an NOL carryforward, a similar tax loss, or a tax credit carryforward with certain exceptions to this rule. If certain exception conditions exist, an entity should present an unrecognized tax benefit in the financial statements as a liability and should not net the unrecognized tax benefit with a deferred tax asset. This standard is effective for fiscal years and interim periods within those years beginning after December 15, 2013. The Company does not expect the adoption of the new provisions to have a material impact on our financial condition or results of operations.

| 10 |

In March 2013, the FASB issued ASU No. 2013-05, Foreign Currency Matters. This standard provides additional guidance with respect to the reclassification into income of the cumulative translation adjustment (CTA) recorded in accumulated other comprehensive income associated with a foreign entity of a parent company. The ASU differentiates between transactions occurring within a foreign entity and transactions/events affecting an investment in a foreign entity. For transactions within a foreign entity, the full CTA associated with the foreign entity would be reclassified into income only when the sale of a subsidiary or group of net assets within the foreign entity represents the substantially complete liquidation of that foreign entity. For transactions/events affecting an investment in a foreign entity (for example, control or ownership of shares in a foreign entity), the full CTA associated with the foreign entity would be reclassified into income only if the parent no longer has a controlling interest in that foreign entity as a result of the transaction/event. In addition, acquisitions of a foreign entity completed in stages will trigger release of the CTA associated with an equity method investment in that entity at the point a controlling interest in the foreign entity is obtained. This ASU is effective prospectively beginning January 1, 2014, with early adoption permitted. This ASU would impact the Company’s consolidated results of operations and financial condition only in the instance of an event/transaction as described above.

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified out of Accumulated Other Comprehensive Income. Under this standard, an entity is required to provide information about the amounts reclassified out of accumulated other comprehensive income (“AOCI”) by component. In addition, an entity is required to present, either on the face of the financial statements or in the notes, significant amounts reclassified out of AOCI by the respective line items of net income, but only if the amount reclassified is required to be reclassified in its entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety to net income, an entity is required to cross-reference to other disclosures that provide additional details about those amounts. ASU 2013-02 does not change the current requirements for reporting net income or other comprehensive income in the financial statements. For the Company, this ASU is effective beginning January 1, 2013, and interim periods within those annual periods. The adoption of this standard is not expected to have an impact on the Company’s financial results or disclosures.

The Company believes that there were no other accounting standards recently issued that had or are expected to have a material impact on our financial position or results of operations.

NOTE 3 — GOING CONCERN

As of March 31, 2014, the Company had incurred accumulated losses of $3,331,926 that include a net loss of $73,329 for the three months ended March 31, 2014, respectively. The Company is actively pursuing additional funding and a potential merger or acquisition candidate and strategic partners, which would enhance owners’ investment. There can be no assurance the Company will be successful in its effort to secure additional equity financing. The Company’s ability to continue as a going concern is contingent upon its ability to secure financing and attain profitable operations.

NOTE 4 — DISCONTINUED OPERATIONS

On December 1, 2012, the Company ceased its art gallery business in Taiwan as it was not able to generate sufficient revenue or financing interest to continue the business. In accordance with the applicable accounting guidance for the ceased operations, the results of the Taiwan Business are presented as discontinued operations and, as such, have been excluded from both continuing operations and segment results for all periods presented.

The Company recognized $39,164 loss on the impairment of discontinued operations for the three months ended March 31, 2014,

| 11 |

Summarized financial information for discontinued operations is as follows:

| March 31, 2014 | December 31, 2013 | |||||||

| Assets | ||||||||

| Cash and equivalents | $ | — | $ | 21 | ||||

| Accounts receivables, net | — | — | ||||||

| Inventories | — | — | ||||||

| Other current assets | — | 2,243 | ||||||

| Restricted cash | 491 | |||||||

| Fixed assets, net | — | — | ||||||

| Due from affiliated companies | — | 19,398 | ||||||

| Other assets | — | — | ||||||

| Total assets of discontinued operations | $ | — | $ | 22,153 | ||||

| Liabilities | ||||||||

| Accounts payables and accrued expenses | $ | — | $ | — | ||||

| Notes payable | — | — | ||||||

| Advances from related parties | — | — | ||||||

| Other current liabilities | — | — | ||||||

| Long term notes payable | — | — | ||||||

| Total liabilities of discontinued operations | $ | — | $ | — | ||||

| For the Three Months Ended | ||||||||

| March 31, 2014 | March 31, 2013 | |||||||

| Discontinued Operations | ||||||||

| Revenues, net | $ | — | $ | — | ||||

| Loss from operations of discontinued components | $ | (39,164 | ) | $ | — | |||

| Benefit (provision) for income taxes | — | |||||||

| Loss from operations of discontinued components, net of tax | $ | (39,164 | ) | $ | — | |||

| Disposal | ||||||||

| Loss on disposal in discontinued components | $ | — | $ | — | ||||

| Benefit (provision) for income taxes | — | — | ||||||

| Loss on disposal in discontinued components, net of tax | $ | — | $ | — | ||||

| Loss from discontinued operations, net of tax | $ | (39,164 | ) | $ | — | |||

NOTE 5 — INCOME TAXES

UAN CCC was established under the laws of the State of Delaware and is subject to U.S. federal income tax and Delaware state income tax.

The Company has not made a provision for U.S. income taxes on undistributed earnings of oversea subsidiaries (UAN CCC HK) with which the Company intends to continue to reinvest. It is not practicable to estimate the amount of additional tax that might be payable on the foreign earnings if they were remitted as dividends, or lent to the Company, or if the Company should sell its stock in these subsidiaries.

| 12 |

UAN CCC HK was established in Hong Kong and is subject to Hong Kong tax laws. However, there is no Hong Kong based income; therefore, there is no income tax impact from Hong Kong.

UAN CCC has cumulative net operating tax loss carryover (the “NOL”) of approximately $3.3 million at March 31, 2014, which are not likely to be fully realized and consequently a full valuation allowance has been established relating to this deferred tax assets. The final portion of the NOL will expires in 20 years.

UAN CCC has foreign tax credit carryover of approximately (the “FTC”) $37,000 at March 31, 2014. The final portion of the FTC will expire in 10 years.

Deferred income tax assets and liabilities are computed for differences between the financial statement and tax bases of assets and liabilities that will result in future taxable or deductible amounts and are based on enacted tax laws and rates applicable to the periods in which the differences are expected to affect taxable income. Valuation allowances are established when necessary to reduce deferred income tax assets to the amount expected to be realized. The deferred income tax asset related to the abovse noted NOL in the amount of approximately $3.2 million and FTC in the amount of $37,000 has been reduced by a related allowance of equal amount at March 31, 2014.

Income/(Loss) before Income Taxes from continuing operations for the three months ended March 31, 2014 and 2013 were as follows:

| For the Three Months Ended | ||||||||

| March 31, 2014 | March 31, 2013 | |||||||

| United States | $ | (34,165 | ) | $ | (29,624 | ) | ||

| Hong Kong | — | (39 | ) | |||||

| Total Income (Loss) before Tax | $ | (34,165 | ) | $ | (29,663 | ) | ||

Provisions for Income from continuing operations for the three months ended March 31, 2014 and 2013 were as follows:

| For the Three Months Ended | ||||||||

| March 31, 2014 | March 31, 2013 | |||||||

| United States | $ | — | $ | — | ||||

| Hong Kong | — | — | ||||||

| Total Tax Expense | $ | — | $ | — | ||||

Reconciliations of statutory rates to effective tax rates from continuing operations for the three months ended March 31, 2014 and 2013 were as follows:

| For the Three Months Ended | ||||

| March 31, 2014 |

March 31, 2013 | |||

| US Federal Statutory Tax Rate | 39.0% | 39.0% | ||

| Hong Kong Foreign Tax Rate | 0.0% | 0.0% | ||

| US State Income Tax Rate Effected | 0.0% | 0.0% | ||

| Foreign Tax Credit | 0.0% | 0.0% | ||

| Tax Exemption Allowance | 0.0% | 0.0% | ||

| Net Operating Loss Carryforward | -39.0% | -39.0% | ||

| Effective Worldwide Tax Rate | 0.0% | 0.0% | ||

| 13 |

NOTE 6 — COMMITMENTS & CONTINGENCIES

Office Space Lease

The Company entered into a month to month office space lease of the Company's office space in Michigan State for $200 a month starting December 2012. The rent expense for the three months ended March 31, 2014 were $600, respectively.

Litigation

In November 2012, the Company’s prior president, chairman and director is subject to lawsuit for marketing manners used in sales of artwork in Taiwan. In accordance with Taiwan’s Law, the Company’s bank accounts in Taiwan are accordingly frozen during the litigation period. The amount of $21 held in the bank was written off for the three months ended March 31, 2014.

NOTE 7 — CAPITAL STOCK

Preferred Stock

The Company is authorized to issue up to 5,000 shares of Preferred Stock with such designations, voting, and other rights and preferences as may be determined from time to time by the Board of Directors.

Common Stock and Class B Common Stock

The Company’s certificate of incorporation was amended to increase the authorization to issue shares of common stock from 80,000,000 to 100,000,000 on August 27, 2010. This amendment also effected a one-for-ten reverse split of the Company’s Common Stock.

NOTE 8 — RELATED PARTY TRANSACTIONS

At March 31, 2014, the Company has an outstanding payable of $10,119 to Yuan-Hao Chang (shareholder and consultant to the Company) for which the Company has advanced to Mr. Chang for expenses to be incurred on behalf of the Company.

Mr. Chang also provides various consulting and professional services to the Company for which he is compensated. Consulting and professional expense for Mr. Chang were $7,500 and $7,500 for the three months ended March 31, 2014 and 2013, respectively. At March 31, 2014, the outstanding consulting fee payable to Mr. Chang was $35,500.

At March 31, 2014, the Company has an outstanding payable of $2,845 to Parashar Patel (shareholder and CEO of the Company) for which Mr. Patel has paid expenses on behalf of the Company and certain unpaid consulting expenses compensation.

At March 31, 2014, the Company has an outstanding payable of $9,978 to Chung-Hua Yang (former CFO of the Company) for which Mr. Yang has advanced to the Company as working capital.

At March 31, 2014, the Company has an outstanding payable of $114,500 to Chih-Hung Cheng (former Director of the Company) for which Mr. Cheng has advanced to the Company as working capital.

The above related parties’ amounts are due upon demand and non-interest bearing.

In July 2010, Mr. David Chen-Te Yen (Chairman, director, and shareholder of the Company) loaned the Company $300,000 in demand notes bearing interest at 8%. This demand note was repaid on December 3, 2010. The related accrued interest of $8,482 remains unpaid at March 31, 2014.

| 14 |

Item 2. Management's Discussion and Analysis of Financial Condition and Result of Operations

FORWARD-LOOKING STATEMENTS

This quarterly report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "could", "may", "will", "should", "expect", "plan", "anticipate", "believe", "estimate", "predict", "potential" or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this quarterly report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this quarterly report and unless otherwise indicated, the terms "we", "us" and "our" mean UAN Cultural & Creative Co., Ltd., and our wholly owned subsidiary, UAN Cultural and Creative Company Limited, a Hong Kong corporation, unless otherwise indicated.

General Overview

We were incorporated on August 10, 2005 under the laws of the State of Delaware to serve as a vehicle to effect a merger, capital stock exchange, asset acquisition or other similar business combination with an entity that has an operating business in the security industry. Our principal executive offices are located at 102 North Ave, Mt. Clemens, Michigan 48043. Our telephone number is (586) 430-5605.

We completed an initial public offering on March 15, 2006 based on that business plan. Stockholder funds raised in the offering were segregated in a trust account and we were obligated to return the segregated funds to the investors in the event that we did not complete a business combination within 18-months (24 months, under certain circumstances). By the end of the 18-month period we had not engaged in any operations, generated any revenues, or incurred any debt or expenses other than in connection with the initial public offering. Since we were not able to consummate our business plan and no business combination was completed within the required time period, we liquidated the segregated funds held in the trust account, returned the funds to the investors in the offering, redeemed the Class B common stock the investors acquired in the offering and reconstituted our company as an ongoing business corporation. As a result of the foregoing, we became a public shell company.

The securities issued in our initial public offering consisted of Class A common stock, which is now regular common stock; Class W warrants; Class Z warrants; Class B common stock, which was redeemed from the stockholders when the funds raised in the initial public offering were returned to them and is no longer outstanding; Class A units, which consisted of two shares of Class A common stock and ten Class Z warrants; and Class B units, which consisted of two shares of Class B common stock and two Class W warrants. The Class W and Class Z warrants have expired.

| 15 |

We experienced a change in control on June 30, 2010, both at the stockholder and director levels, as the result of the purchase of 35,095,100 shares of our common stock, approximately 95.6% of our common stock which was issued and outstanding on that date, by eight persons and the simultaneous reconstitution of our board of directors. Our new board of directors created a new business plan and initiated a business involving the sale and appraisal of authentic and high quality works of art, primarily paintings, initially in Taiwan.

In July 2010, two of our stockholders, David Chen-Te Yen and Yuan-Hao Chang, loaned us $300,000 and $200,000, respectively. David Chen-Te Yen, our former president and the chairman of our board of directors, owns approximately 42.1% of our common stock. These loans were evidenced by demand promissory notes bearing interest at the rate of 8% per annum, compounded daily. The $300,000 loan from David Chen-Te Yen was repaid in December 2010; accrued interest of $8,482 remains unpaid at September 30, 2013. The $200,000 loan from Yuan-Hao Chang was repaid on November 1, 2011. The related accrued interest of $27,317 was repaid in March 2012. In August 2010, we changed our name to UAN Cultural & Creative Co., Ltd. and effected a 1 new for 10 old reverse stock split of our common stock. We commenced operations in August 2011.

In October and November 2010, we completed an “offshore” private placement of 50,000,000 shares of common stock at a price of $0.02 per share, which generated gross proceeds of $1,000,000. We used the funds from these loans and from our private placement to initiate and further our art business plan

On February 14, 2012, our company established UAN Cultural and Creative Company Limited (“UAN Hong Kong”) in Hong Kong to take advantage of tax benefits.

On August 9, 2012, our company and UAN Hong Kong established UAN Yeh Cultural and Creative Company Limited Taiwan Branch in Taiwan.

As at August 12, 2012, UAN Hong Kong became wholly owned subsidiary of our company with 10,000 capital shares authorized at HKD1.00 par value and 10,000 shares issued and outstanding.

Concurrently, with our acquisition of UAN Hong Kong, the operations of our old Taiwan Branch were discontinued and subsequently transferred to UAN Yeh.

On December 1, 2012, our board of directors decided to abandon our art gallery business in Taiwan as it was not able to generate sufficient revenue or financing interest to merit continuation. Consequently, we discontinued the operations of our subsidiary, UAN Yeh, and we became a development stage company to serve as a vehicle to effect a merger, capital stock exchange, asset acquisition or other similar business combination with an operating business.

Also effective November 18, 2012, our company decreased the number of directors on our board of directors to three. Our board of directors now consists of Wan-Fang Liu, Parashar Patel and Chih-Hung Cheng.

Our Current Business

As at December 1, 2012 and the date of this report, we are a shell company as that term is defined in Rule 12b-2 of the Exchange act. Our management is presently engaged in the search and evaluation of available opportunities to preserve our business as a going concern and to create shareholder value by effecting a merger, capital stock exchange, asset acquisition or other similar business combination with an operating business.

Our company is currently considered to be a “blank check” company. The Securities and Exchange Commission (“SEC”) defines those companies as any (i) “development stage company that has no specific business plan or purpose or has indicated that its business is to engage in a merger or acquisition with an unidentified company or companies, or other entity or person; and (ii) is issuing a ‘penny stock’,” within the meaning of Rule 3a51-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

| 16 |

Because of the nature of blank check companies, the SEC does not allow them to use some of the exemptions from the registration requirements when selling their securities. In addition, a blank check company registering for a securities offering may be subject to additional requirements for the protection of investors, including depositing most of the raised funds in an escrow account until an acquisition is agreed to and requiring shareholder approval of any identified acquisition.

Under Rule 12b-2 under the Exchange Act, our company also qualifies as a “shell company,” because it has no or nominal assets (other than cash) and no or nominal operations. Many states have enacted statutes, rules and regulations limiting the sale of securities of “blank check” companies in their respective jurisdictions.

Management does not intend to undertake any efforts to cause a market to develop in our equity or debt securities until we have successfully concluded a business combination. Our company intends to comply with the periodic reporting requirements of the Exchange Act for so long as it is subject to those requirements.

Results of Operations

Three Months Ended March 31, 2014 and March 31, 2013.

| Three Months Ended March 31, |

|||||||

| 2014 | 2013 | ||||||

| Revenue | $ | Nil | $ | Nil | |||

| Cost of Sales | $ | Nil | $ | Nil | |||

| Operating Expenses | $ | 34,165 | $ | 29,683 | |||

| Total Other (Income) / Expense | $ | Nil | $ | (20 | ) | ||

| Loss from discontinued operations, net of tax | $ | 39,164 | $ | Nil | |||

| Net Income (Loss) | $ | 73,329 | $ | (29,663 | ) | ||

Revenues

We discontinued our art gallery business on December 1, 2012 and did not recognize any revenues from operations.

Operating Expenses

Our operating expenses for the three months ended March 31, 2014 consisted of selling, general and administrative expenses, which include bank service charges, printing costs, legal and accounting fees, rent, telephone, travel expense, consulting fees, media relations fees, transfer agency fees and other miscellaneous administrative expenses. Our selling, general and administrative expenses were $34,165 during the three months ended March 31, 2014 compared to $29,683 during the same period in 2013. Our company reduced its spending in legal and travel fees in search of new business venture.

Other Income/(Expenses)

We earned nominal income of $0 from interest during the three months ended March 31, 2014 compared to $20 of interest income during the three month ended March 31, 2013. The decrease in income during the first quarter of fiscal 2014 resulted primarily from lower cash balance in the bank.

Provision for Income Tax

To date we have made no provisions for income tax. Our company has certain deferred tax asset such as net operating loss carryover and foreign tax credit to offset future income.

| 17 |

Net Income (Loss)

We had a net loss of $73,329 for the three months ended March 31, 2014, compared to our net loss of $29,663 incurred in the three months ended March 31, 2013. Our net loss of $34,165was attributable to selling, general and administrative expenses incurred for the three months ended March 31, 2014. Our net loss of $29,683 was attributable to selling, general and administrative expenses, and $20 of interest expense incurred for the three months ended March 31, 2013.

Liquidity and Capital Resources

Working Capital

| At | At | |||||||

| March 31, | December 31, | |||||||

| 2014 | 2013 | |||||||

| Current Assets | $ | 600 | $ | 6,381 | ||||

| Current Liabilities | $ | 264,175 | $ | 233,528 | ||||

| Working Capital (Deficit) | $ | (263,575 | ) | $ | (227,147 | ) | ||

Cash Flows

| Three Months | Three Months | |||||||

| Ended | Ended | |||||||

| March 31, | March 31, | |||||||

| 2014 | 2013 | |||||||

| Net Cash provided by (used in) Operating Activities | $ | (56,918 | ) | $ | 43,393 | |||

| Net Cash used in Investing Activities | $ | Nil | $ | (24,972 | ) | |||

| Net Cash provided by (used in) Financing Activities | $ | 36,320 | $ | (23,677 | ) | |||

As of March 31, 2014 we had total assets of $600, total liabilities of $264,175, and shareholders’ deficit of $263,575, compared to total assets of $26,270, total liabilities of $233,528 and shareholders’ deficit of $207,258 as of December 31, 2013. Our current assets as at March 31, 2014 were $600, including cash and cash equivalents of $ 600. As at December 31, 2013 we had current assets of $6,381 including cash and cash equivalents of $4,117 and current assets from discontinued operations of $2,264.

Cash and cash equivalents as of March 31, 2014 decreased by $3,517 from December 31, 2013. Our working capital deficit was $263,575 as at March 31, 2014 compared to a working capital deficit of $227,147 as at December 31, 2013.

Net cash used in our operating activities during the three months ended March 31, 2014 was $56,918, as compared to net cash provided by operating activities of $43,393 for the three months ended March 31, 2013.

Net cash provided by financing activities in the three months ended March 31, 2014 was $36,320, compared to $23,677 used in financing activities in the three months ended March 31, 2013. The net increase in cash provided by financing activities in 2014 resulted primarily from proceeds of advances from shareholders and officers.

| 18 |

Critical Accounting Policies

Interim Financial Statements

The accompanying unaudited consolidated financial statements have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission and should be read in conjunction with our company’s audited financial statements and footnotes thereto for the year ended December 31, 2013, included in our company’s Form 10-K filed on April 15, 2014. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to such rules and regulations. However, our company believes that the disclosures are adequate to make the information presented not misleading. The financial statements reflect all adjustments (consisting primarily of normal recurring adjustments) that are, in the opinion of management necessary for a fair presentation of our company’s financial position and results of operations. The operating results for the three months ended March 31, 2014 are not necessarily indicative of the results to be expected for any other interim period of a future year.

Basis of Presentation

Our company has prepared the accompanying consolidated financial statements in conformity with accounting principles generally accepted in the United States of America. All significant intercompany accounts and transactions between our company and its subsidiaries have been eliminated in consolidation.

Reclassification

Certain amounts in the prior period financial statements have been reclassified to conform to the current period presentation. These reclassifications had no effect on reported losses.

Discontinued Operations

On December 1, 2012, our company ceased its Taiwan’s business operations. The consolidated financial statements have been recast to present the Taiwan’s business operation as discontinued operations as described in “Note 5 - Discontinued Operations.” Unless noted otherwise, discussion in the Notes to consolidated financial statements pertain to continuing operations.

Use of Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash and cash equivalents are deposits in financial institutions as well as short-term money market instruments with maturities of three months or less when purchased.

Concentration of Credit Risk

Financial instruments that potentially subject our company to a significant concentration of credit risk consist primarily of cash and cash equivalents. Our company maintains deposits in federally insured financial institutions in excess of federally insured limits. However, management believes our company is not exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held.

| 19 |

Comprehensive Income

Our company adopted Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 220, “Comprehensive Income,” which establishes standards for reporting and presentation of comprehensive income (loss) and its components in a full set of general-purpose financial statements. Our company has chosen to report comprehensive income (loss) in the statements of income and comprehensive income. Comprehensive income (loss) is comprised of net income and all changes to stockholders’ equity except those due to investments by owners and distributions to owners.

Earnings (Loss) Per Share

Basic earnings (loss) per share is computed by dividing income (loss) available to common stockholders by the weighted average common shares outstanding for the period and Class B common stock outstanding prior to its redemption. Diluted earnings per share reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock or resulted in the issuance of common stock that then shared in the earnings of the entity. The average market price of the common shares is below the exercise price of the outstanding warrants therefore not included in the calculation for dilutive share.

The computation of basic and diluted earnings (loss) per share for the three months ended March 31, 2014 and 2013 as follows:

| For the Three Months Ended | ||||||||

| March 31, 2014 | March 31, 2013 | |||||||

| Numerator: | ||||||||

| Net Income/(Loss) from continuing operation | $ | (34,165 | ) | $ | (29,663 | ) | ||

| Net income/(loss) from discontinued operation | $ | (39,164 | ) | $ | — | |||

| Denominator | ||||||||

| Weighted average common shares outstanding – basic | 53,672,708 | 53,672,708 | ||||||

| Dilution associated with W and Z warrants | — | |||||||

| Weighted average common share outstanding – diluted | 53,672,708 | 53,672,708 | ||||||

| Basic earnings (loss) per share | ||||||||

| Continuing operations | $ | (0.001 | ) | $ | (0.001 | ) | ||

| Discontinuing operations | $ | (0.001 | ) | $ | — | |||

| Diluted earnings (loss) per share | ||||||||

| Continuing operations | $ | (0.001 | ) | $ | (0.001 | ) | ||

| Discontinuing operations | $ | (0.001 | ) | $ | — | |||

| 20 |

Fair Value of Financial Instruments

FASB ASC Topic 820, “Fair Value measurement and Disclosures”, an Accounting Standard Update. In September 2009, the FASB issued this Update to amendments to Subtopic 820-10, “Fair Value Measurements and Disclosures”. Overall, for the fair value measurement of investments in certain entities that calculates net asset value per share (or its equivalent). The amendments in this Update permit, as a practical expedient, a reporting entity to measure the fair value of an investment that is within the scope of the amendments in this Update on the basis of the net asset value per share of the investment (or its equivalent) if the net asset value of the investment (or its equivalent) is calculated in a manner consistent with the measurement principles of Topic 946 as of the reporting entity’s measurement date, including measurement of all or substantially all of the underlying investments of the investee in accordance with Topic 820. The amendments in this Update also require disclosures by major category of investment about the attributes of investments within the scope of the amendments in this Update, such as the nature of any restrictions on the investor’s ability to redeem its investments at the measurement date, any unfunded commitments (for example, a contractual commitment by the investor to invest a specified amount of additional capital at a future date to fund investments that will be made by the investee), and the investment strategies of the investees. The major category of investment is required to be determined on the basis of the nature and risks of the investment in a manner consistent with the guidance for major security types in GAAP on investments in debt and equity securities in paragraph 320-10-50-lB. The disclosures are required for all investments within the scope of the amendments in this Update regardless of whether the fair value of the investment is measured using the practical expedient. The amendments in this Update apply to all reporting entities that hold an investment that is required or permitted to be measured or disclosed at fair value on a recurring or non-recurring basis and, as of the reporting entity’s measurement date, if the investment meets certain criteria The amendments in this Update are effective for the interim and annual periods ending after December 15, 2009. Early application is permitted in financial statements for earlier interim and annual periods that have not been issued.

Revenues

Our company is a development stage company as such has not realized any revenues or directly related expenses.

Advertising Costs

Advertising costs are expensed as incurred and included in selling, general and administrative expenses. Our company has not incurred any advertising expense for the three months ended March 31, 2014 and 2013, respectively.

Foreign Currency Translations

The functional currency of UAN CCC is U.S. Dollar (“USD”).

The functional currency of UAN CCC HK is Hong Kong Dollar (“HKD”).

The functional currency of UAN CCC’s branch in Taiwan (discontinued operations) and UAN Yeh CCC (discontinued operations) is New Taiwan Dollar (“TWD”).

Transactions denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the date of the transactions. Exchange gains or losses on transactions are included in earnings.

| 21 |

The consolidated financial statements of our company are translated into U.S. dollars in accordance with the standard, “Foreign Currency Translation,” codified in ASC 830, using rates of exchange at the end of the period for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for equity. Translation adjustments resulting from the process of translating the local currency combining financial statements into U.S. dollars are included in determining comprehensive income.

At March 31, 2014, the cumulative translation adjustments of $14,850, were classified as items of accumulated other comprehensive income in the stockholders’ equity section of the balance sheet. Other comprehensive income (loss) was $17,012 and $(48) for three months ended March 31, 2014 and 2013, respectively.

The exchange rates used to translate TWD amounts into USD at (1USD=TWD) as follows:

| Balance Sheet Rate |

Average Rate | ||

| March 31, 2014 | 30.44 | 30.32 | |

| December 31, 2013 | 30.00 | 29.70 | |

| March 31, 2013 | 29.08 | 29.48 |

The exchange rates used to translate HKD amounts into USD at (1USD=HKD) as follows:

| Balance Sheet Rate |

Average Rate | ||

| March 31, 2014 | 7.76 | 7.76 | |

| December 31, 2013 | 7.75 | 7.76 |

Income Taxes

Our company accounts for income taxes following the liability method pursuant to FASB ASC 740 “Income Taxes”. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the period in which the differences are expected to reverse. Our company records a valuation allowance to offset deferred tax assets if, based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rate is recognized in income in the period that includes the enactment date.

Our company accounts for uncertainty in income taxes in accordance with FASB ASC 740-10 “Income Taxes-Overall”. Our company has elected to classify interest and penalties related to an uncertain position, if and when required, as part of interest expenses and other expenses, respectively, in the consolidated statements of income and comprehensive income.

Recent Accounting Pronouncements

In July 2013, the FASB issued ASU 2013-11, “Presentation of an Unrecognized Tax Benefit When a Net Operating Loss Carryforward, a Similar Tax Loss, or a Tax Credit Carryforward Exists.” This standard requires that an unrecognized tax benefits, or a portion of an unrecognized tax benefit be presented on a reduction to a deferred tax asset for an NOL carryforward, a similar tax loss, or a tax credit carryforward with certain exceptions to this rule. If certain exception conditions exist, an entity should present an unrecognized tax benefit in the financial statements as a liability and should not net the unrecognized tax benefit with a deferred tax asset. This standard is effective for fiscal years and interim periods within those years beginning after December 15, 2013. Our company does not expect the adoption of the new provisions to have a material impact on our financial condition or results of operations.

| 22 |

In March 2013, the FASB issued ASU No. 2013-05, Foreign Currency Matters. This standard provides additional guidance with respect to the reclassification into income of the cumulative translation adjustment (CTA) recorded in accumulated other comprehensive income associated with a foreign entity of a parent company. The ASU differentiates between transactions occurring within a foreign entity and transactions/events affecting an investment in a foreign entity. For transactions within a foreign entity, the full CTA associated with the foreign entity would be reclassified into income only when the sale of a subsidiary or group of net assets within the foreign entity represents the substantially complete liquidation of that foreign entity. For transactions/events affecting an investment in a foreign entity (for example, control or ownership of shares in a foreign entity), the full CTA associated with the foreign entity would be reclassified into income only if the parent no longer has a controlling interest in that foreign entity as a result of the transaction/event. In addition, acquisitions of a foreign entity completed in stages will trigger release of the CTA associated with an equity method investment in that entity at the point a controlling interest in the foreign entity is obtained. This ASU is effective prospectively beginning January 1, 2014, with early adoption permitted. This ASU would impact our company’s consolidated results of operations and financial condition only in the instance of an event/transaction as described above.

In February 2013, the FASB issued ASU No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified out of Accumulated Other Comprehensive Income. Under this standard, an entity is required to provide information about the amounts reclassified out of accumulated other comprehensive income (“AOCI”) by component. In addition, an entity is required to present, either on the face of the financial statements or in the notes, significant amounts reclassified out of AOCI by the respective line items of net income, but only if the amount reclassified is required to be reclassified in its entirety in the same reporting period. For amounts that are not required to be reclassified in their entirety to net income, an entity is required to cross-reference to other disclosures that provide additional details about those amounts. ASU 2013-02 does not change the current requirements for reporting net income or other comprehensive income in the financial statements. For our company, this ASU is effective beginning January 1, 2013, and interim periods within those annual periods. The adoption of this standard is not expected to have an impact on our company’s financial results or disclosures.

Our company believes that there were no other accounting standards recently issued that had or are expected to have a material impact on our financial position or results of operations.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Item 3. Quantitative and Qualitative Disclosure About Market Risks

We are a smaller reporting company and are not required to provide the information under this item.

Item 4. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in our reports filed under the Securities Exchange Act of 1934, as amended, is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission's rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer (our principal executive officer) and our chief financial officer (our principal financial officer and principal accounting officer) to allow for timely decisions regarding required disclosure.

| 23 |

As of the end of our quarter covered by this report, we carried out an evaluation, under the supervision and with the participation of our chief executive officer (our principal executive officer) and our chief financial officer (our principal financial officer and principal accounting officer), of the effectiveness of the design and operation of our disclosure controls and procedures. Based on the foregoing, our chief executive officer (our principal executive officer) and our chief financial officer (our principal financial officer and principal accounting officer) concluded that our disclosure controls and procedures were effective as of the end of the period covered by this quarterly report.

Changes in Internal Controls

During the period covered by this report there were no changes in our internal control over financial reporting that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II - OTHER INFORMATION

Item 1. Legal Proceedings

In November 2012, our company’s prior president, chairman and director is subject to lawsuit for marketing manners used in sales of artwork in Taiwan. In accordance with Taiwan’s Law, our company’s bank accounts in Taiwan are frozen during the litigation period . As of March 31, 2014, the litigation is still on going.

Item 1A. Risk Factors

We are a smaller reporting company and are not required to provide the information under this item.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

None.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

Not applicable.

Item 5. Other Information

None.

| 24 |

Item 6. Exhibits

| Exhibit Number |

Description |

| (3) | Articles of Incorporation; Bylaws |

| 3.1 | Certificate of Incorporation (incorporate by reference to our Registration Statement on Form S-1 filed on September 15, 2005) |

| 3.2 | Form of Amended and Restated Certificate of Incorporation (incorporate by reference to our Registration Statement on Form S-1 filed on September 15, 2005) |

| 3.3 | Bylaws(incorporate by reference to our Registration Statement on Form S-1 filed on September 15, 2005) |

| 3.4 | Form of Amended and Restated Bylaws (incorporate by reference to our Registration Statement on Form S-1 filed on September 15, 2005) |

| 3.5 | Amendment to Certificate of Incorporation dated January 31, 2008 (incorporated by reference to our Current Report on Form 8-K filed on February 1, 2008) |

| 3.6 | Form of Amended and Restated Certificate of Incorporation dated January 31, 2008 (incorporated by reference to our Current Report on Form 8-K filed on February 1, 2008) |

| 3.8 | Amendment to Amended and Restated Bylaws (incorporated by reference to our Current Report on Form 8-K filed on June 20, 2008) |

| Certificate of Amendment of Certificate of Incorporation (incorporated by reference to our Current Report on Form 8-K filed on October 12, 2010) | |

| (10) | Material Contracts |

| 10.1 | Form of Registration Rights Agreement between our company and the Initial Security holders (incorporate by reference to our Registration Statement on Form S-1 filed on September 15, 2005) |

| 10.2 | Form of Warrant Agreement between our company and American Stock Transfer & Trust Company (incorporate by reference to our Registration Statement on Form S-1 filed on September 15, 2005) |

| 10.3 | Promissory Note dated May 12, 2009 between our company and Ralph Sheridan (incorporated by reference to our Quarterly Report on Form 10-Q filed on May 15, 2009) |

| 10.4 | Promissory Note dated May 12, 2009 between our company and Ira Scott Greenspan (incorporated by reference to our Quarterly Report on Form 10-Q filed on May 15, 2009) |

| 10.5 | Promissory Note dated May 12, 2009 between our company and William McClusky (incorporated by reference to our Quarterly Report on Form 10-Q filed on May 15, 2009) |

| 10.6 | Promissory Note dated May 12, 2009 between our company and Hummingbird Value Fund, LP (incorporated by reference to our Quarterly Report on Form 10-Q filed on May 15, 2009) |

| 10.7 | Repurchase Agreement dated June 18, 2009 between our company and HCFP Brenner Holdings, LLC (incorporated by reference to our Current Report on Form 8-K filed on June 24, 2009) |

| 10.8 | Common Stock Purchase Agreement dated June 18, 2009 between our company and The Tarsier Nanocap Value Fund, LP (incorporated by reference to our Current Report on Form 8-K filed on June 24, 2009) |

| 10.9 | Form of Common Stock Purchase Agreement dated November 13, 2009 (incorporated by reference to our Quarterly Report on Form 10-Q filed on November 16, 2009) |

| 10.10 | Demand Promissory Note dated July 23, 2010 between our company and David Chen-Te Yen (incorporated by reference to our Registration Statement on Form S-1 filed on October 12, 2010) |

| 10.11 | Demand Promissory Note dated July 23, 2010 between our company and Yuan-Hao Chang (incorporated by reference to our Registration Statement on Form S-1 filed on October 12, 2010) |

| (14) | Code of Ethics |

| 14.1 | Code of Ethics (incorporated by reference to our Annual Report on Form 10-K filed on March 7, 2011) |

| (21) | Subsidiaries of Registrant |

| 21.1 | UAN Cultural and Creative Company Limited, a Hong Kong company |

| 25 |

| Exhibit Number |

Description |

| (31) | Rule 13a-14(a)/15d-14(a) Certifications |

| 31.1* | Certification of Chief Executive Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| 31.2* | Certification of Chief Financial Officer Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| (32) | Section 1350 Certifications |

| 32.1* | Certification of the Chief Executive Officer Pursuant to 18 U.S.C. 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| 32.2* | Certification of the Chief Financial Officer Pursuant to 18 U.S.C. 1350, as adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| (101)** | Interactive Data Files |

| 101.INS | XBRL Instance Document |

| 101.SCH | XBRL Taxonomy Extension Schema Document |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase Document |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document |

| * | Filed herewith. |

| ** | Furnished herewith. Pursuant to Rule 406T of Regulation S-T, the Interactive Data Files on Exhibit 101 hereto are deemed not filed or part of any registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, are deemed not filed for purposes of Section 18 of the Securities and Exchange Act of 1934, and otherwise are not subject to liability under those sections. |

| 26 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| UAN CULTURAL & CREATIVE CO., LTD. | |||

| Dated: May 20, 2014 | By: | /s/ Parashar Patel | |

| Parashar Patel | |||

| Chief Executive Officer, Secretary and Director | |||

| (Principal Executive Officer) | |||

| Dated: May 20, 2014 | By: | /s/ Yun-Mi Han | |

| Yun-Mi Han | |||

| Chief Financial Officer | |||

| (Principal Financial Officer and Chief Accounting Officer) | |||

| 27 |