Attached files

| file | filename |

|---|---|

| 8-K - LIVE FILING - HARVEST NATURAL RESOURCES, INC. | htm_49829.htm |

FOR IMMEDIATE RELEASE

FOR IMMEDIATE RELEASE

Harvest Natural Resources Announces

2014 First Quarter Results

HOUSTON, May 12, 2014 — Harvest Natural Resources, Inc. (NYSE: HNR) (Harvest or the Company) today announced 2014 first quarter earnings and provided an operational update.

Harvest reported a first quarter net loss of approximately $8.0 million compared to net income of $36.1 million for the same period last year. The first quarter results included exploration charges of $1.8 million and non-recurring charges of a $1.0 million loss associated with the sale of a portion of Harvest-Vinccler Dutch Holding, B.V. (Harvest Holding), $4.5 million in impairment costs related to expensing the Company’s investment in the Budong Budong block and a loss on extinguishment of debt of $4.8 million. Adjusted for exploration charges and non-recurring items, Harvest would have posted first quarter net income of approximately $4.1 million, or $0.10 per diluted share, before any adjustment for income taxes.

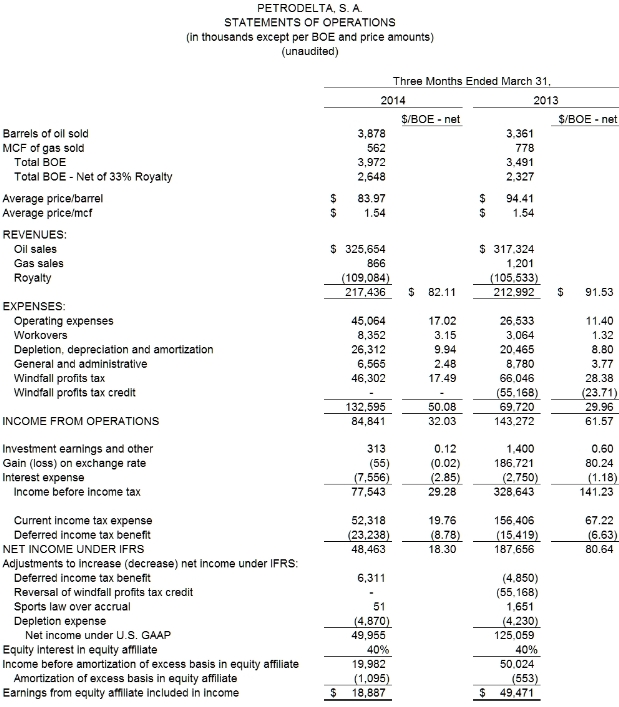

Petrodelta, S.A. (Petrodelta), Harvest’s Venezuelan affiliate, reported first quarter operating income, before taxes and non-operating items, of $84.8 million ($17.3 million net to Harvest’s equity, under IFRS). Petrodelta reported net income for the first quarter of $48.5 million ($9.9 million net to Harvest’s equity interest, under IFRS). After adjustments to Petrodelta’s IFRS earnings, primarily to conform to US GAAP, Harvest’s equity interest in Petrodelta’s earnings was $9.6 million compared to $39.6 million for the same period during 2013.

Highlights for the first quarter of 2014 include:

Venezuela

| • | On May 7, 2014, Harvest’s stockholders voted to authorize the sale of the remaining interest in Venezuela. The closing of the transaction continues to be subject to the approval of the Government of Venezuela; |

| • | During the first three months of 2014, Petrodelta drilled and completed three development wells and sold approximately 3.9 million barrels of oil (MMBO) for a daily average of approximately 43,091 barrels of oil per day (BOPD), an increase of 15 percent over the same period in 2013; |

| • | Petrodelta’s current production rate is approximately 45,000 BOPD and the 2014 expected average production rate is 46,000 BOPD with capital expenditures projected at $350.0 million; |

| Gabon |

| • | Harvest has received a Contingent Resources Report from Gaffney, Cline & Associates on the Dussafu Marine License which indicates 1C, 2C and 3C contingent resources for the four oil discoveries on the Dussafu block; |

| • | The 1C contingent resources on a gross basis before government share are 17.0 MMBO. The 2C contingent resources on the same basis are 36.3 MMBO and 3C contingent resources are 70.6 MMBO; |

| • | Continued the planning for a cluster field development and preparation of a field development plan; |

| Indonesia |

||

•

|

Actively discussing the sale of our interests in the Budong Block in Indonesia; | |

| Corporate |

| • | On January 11, 2014, the Company completed the redemption of all $79,750,000 of its outstanding 11% Senior Notes due 2014. |

VENEZUELA

During the three months ended March 31, 2014, Petrodelta sold approximately 3.9 MMBO for a daily average of 43,091 BOPD, an increase of 15 percent over the same period in 2013. Petrodelta also sold 0.56 billion cubic feet (BCF) of natural gas for a daily average of 6.2 million cubic feet per day (MMCFD). Petrodelta’s current production rate is approximately 45,000 BOPD.

During the first quarter of 2014, Petrodelta drilled and completed one development well in the Isleño Field, one development well in the Temblador Field and one development well in the El Salto Field. Currently, Petrodelta is operating six drilling rigs and one workover rig and is continuing with infrastructure enhancement projects in the El Salto and Temblador Fields.

Petrodelta’s production target for 2014 is projected to be approximately 46,000 BOPD. The 2014 Petrodelta capital expenditures are expected to be approximately $350 million. Petrodelta expects to drill 25 oil wells during 2014.

As discussed further in the 2013 Financial Statements, on December 16, 2013, Harvest and HNR Energia, B.V. (HNR Energia) entered into a Share Purchase Agreement (Share Purchase Agreement) with Petroandina Resources Corporation N.V. (Petroandina, a wholly-owned subsidiary of Pluspetrol Resources Corporation B.V. [Pluspetrol]) and Pluspetrol to sell all of our 80 percent equity interest in Harvest Holding to Petroandina in two closings for an aggregate cash purchase price of $400 million. The first closing occurred on December 16, 2013, contemporaneously with the signing of the Share Purchase Agreement, when the Company sold a 29 percent equity interest in Harvest Holding for a purchase price of $125 million. Prior to December 16, 2013, Harvest indirectly owned 80 percent of Harvest Holding, and the Company had one partner, Oil & Gas Technology Consultants (Netherlands) Coöperatie U.A., (Vinccler), which owned the remaining noncontrolling interest in Harvest Holding of 20 percent. As a result of this first sale, the Company indirectly owns 51 percent of Harvest Holding beginning December 16, 2013 and the noncontrolling interest owners hold the remaining 49 percent with Petroandina having 29 percent and Vinccler continuing to own 20 percent. The second closing, for the sale of a 51 percent equity interest in Harvest Holding for a cash purchase price of $275 million, will be subject to, among other things, approval by the Government of Venezuela. On May 7, 2014, Harvest’s stockholders voted to authorize the sale of the remaining interests in Venezuela. Two other proposals related to the transaction were also approved by the stockholders.

As a result of legislation enacted in December 2013, and January and February of 2014, Venezuela now has a multiple exchange rate system. Most of Petrodelta’s transactions are subject to a fixed official exchange rate of 6.3. In addition, there is a variable official exchange rate system in which the exchange rate is determined through auctions (11.3 rate as of December 31, 2013). The third system became available on March 24, 2014. The financial information is prepared using the official fixed exchange rate (6.3 from February 2013 to date). At March 31, 2014, the balances in Petrodelta’s Bolivar denominated monetary assets and liabilities accounts that are exposed to exchange rate changes are 1,292 million Bolivars and 6,208 million Bolivars, respectively. The average sales price for crude oil produced during the quarter was approximately $83.97 per barrel.

EXPLORATION AND OTHER ACTIVITIES

Dussafu Project — Gabon (Dussafu PSC)

Operational activities during the three months ended March 31, 2014 included continuation of planning for a cluster field development and preparation of a field development plan. The Dussafu JV partners have determined and agreed that the fields are commercial to develop, and on April 10, 2014, Harvest formally petitioned the Government of Gabon for a Declaration of Commerciality and an Exclusive Exploitation Area encompassing the discovered fields pursuant to the concession agreement.

The Dussafu JV has received a Contingent Resources Report from Gaffney, Cline & Associates on the Dussafu Marine License which indicates 1C, 2C and 3C contingent resources for the four oil discoveries on the Dussafu block, where Harvest is operator of the Dussafu JV with a 66.667 percent working interest. The 1C contingent resources on a gross basis before government share and application of the economic limit test are 17.0 MMBO. The 2C contingent resources on the same basis are 36.3 MMBO and the 3C contingent resources are 70.6 MMBO. The economically recoverable contingent resources net entitlement to the Dussafu JV are estimated to be 9.6 MMBO for 1C, 20.5 MMBO for 2C, and 37.6 MMBO for 3C. The report was prepared using SPE PRMS guidelines with an effective date of December 31, 2013, based on the preliminary development plan provided by Harvest dated November 2013. The report assumed constant costs and a constant oil price of $108 per barrel.

Contingent Resources are those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations, but the applied project(s) are not yet considered mature enough for commercial development due to one or more contingencies. In the case of this Contingent Resources Report, the objective was to assess how much of the Contingent Resource volumes might be incorporated into the field development plan and potentially be reclassified in the future as Reserves once an investment decision to develop was made by the Dussafu JV. The report concludes that the potentially recoverable volumes are classified as Contingent Resources pending a Declaration of Commerciality and finalization of the Field Development Plan (FDP). Harvest is currently conducting the detailed analysis to finalize the FDP and present it for approval, first to the JV partners and then to the Government of Gabon.

Harvest has begun reviewing the first high quality seismic products from the acquisition of the outboard 1,260 Sq Km of 3D seismic data during October and mid-November 2013. This survey provides the first 3D coverage over the outboard portion of the block where significant pre-salt prospectivity has been already recognized on 2D seismic data. The new 3D seismic data should also enhance the placement of future development wells in the Ruche and Tortue development program.

Budong-Budong PSC — Indonesia

Harvest is actively discussing the sale of its interests in Budong, and based on indications of interest received in December 2013, the Company determined that it was appropriate to recognize an impairment expense of $0.6 million and a charge included in general and administrative expenses related to a valuation allowance on VAT Harvest does not expect to recover of $2.8 million. During the three months ended March 31, 2014, the Company fully impaired this property resulting in an additional charge of $4.5 million.

Corporate

On January 11, 2014, Harvest completed the redemption of all $79,750,000 of its outstanding 11% Senior Notes due 2014, plus accrued interest to the date of redemption. The Company currently has no long-term debt.

Conference Call

Harvest will hold a conference call at 10:00 a.m. Central Daylight Time on Monday, May 12, 2014, during which management will discuss Harvest’s 2014 first quarter results. The conference leader will be James A. Edmiston, President and Chief Executive Officer. To access the conference call, dial 719-325-2354 or 888-576-4387, five to ten minutes prior to the start time. At that time you will be asked to provide the conference number, which is 7760935. A recording of the conference call will also be available for replay at 719-457-0820, passcode 7760935, through May 15, 2014.

The conference call will also be transmitted over the internet through the Company’s website at www.harvestnr.com. To listen to the live webcast, enter the website fifteen minutes before the call to register, download and install any necessary audio software. For those who cannot listen to the live broadcast, a replay of the webcast will be available beginning shortly after the call and will remain on the website for approximately 90 days.

About Harvest Natural Resources:

Harvest Natural Resources, Inc., headquartered in Houston, Texas, is an independent energy company with principal operations in Venezuela, exploration assets in Indonesia, West Africa, and China and a business development office in Singapore. For more information visit the Company’s website at www.harvestnr.com.

CONTACT:

Stephen C. Haynes

Vice President, Chief Financial Officer

(281) 899-5716

This press release may contain projections and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. They include estimates and timing of expected oil and gas production, oil and gas reserve projections of future oil pricing, future expenses, planned capital expenditures, anticipated cash flow and our business strategy. All statements other than statements of historical facts may constitute forward-looking statements. Although Harvest believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. Actual results may differ materially from Harvest’s expectations as a result of factors discussed in Harvest’s 2013 Annual Report on Form 10-K and other public filings.

Harvest may use certain terms such as resource base, contingent resources, prospective resources, probable reserves, possible reserves, non-proved reserves or other descriptions of volumes of reserves. These estimates are by their nature more speculative than estimates of proved reserves and accordingly, are subject to substantially greater risk of being actually realized by the Company.