Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EL PASO ELECTRIC CO /TX/ | form8-ker03x31x2014.htm |

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh990103-31x2014.htm |

First Quarter 2014 Earnings Conference Call

Vision Mission Integrity Safe Harbor Statement This presentation includes statements that may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. This information may involve risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to: Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates Recovery of capital investments and operating costs through rates in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Changes in customers’ demand for electricity as a result of energy efficiency initiatives and emerging competing services and technologies Unanticipated increased costs associated with scheduled and unscheduled outages of generating plant The size of our construction program and our ability to complete construction on budget Potential delays in our construction schedule due to legal challenges or other reasons Costs at Palo Verde Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the IRS or state taxing authorities Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Other factors detailed by EE in its public filings with the Securities and Exchange Commission. EE’s filings are available from the Securities and Exchange Commission or may be obtained through EE’s website May 7, 2014 2

Vision Mission Significant Development Environmental Protection Agency (EPA) air permit to build Montana Power Station (MPS) in Far East El Paso issued on March 25, 2014 No appeals were filed by deadline and the permit became effective on April 25, 2014 Commence construction on MPS Units 1 & 2 in early June Commercial operation of MPS Units 1 & 2 anticipated by the summer peak of 2015 May 7, 2014 3

Vision Mission EE’s Pillars of Value EE is dedicated to the long-term success and well-being of our region and our stakeholders EE’s long-term strategic plan incorporates four Pillars of Value as a foundation Operational Excellence Stakeholder Satisfaction People/Technology Development Financial/Regulatory Success May 7, 2014 4

Vision Mission Recent Accomplishments Obtained final approval from the EPA for the MPS air permit Macho Springs solar project is under testing and has begun delivering power to EE Received highest customer satisfaction rating in 5 years Ranked #1 in reliability in Texas third year in a row Restructured pension plan Moody’s Investors Service upgraded EE’s senior unsecured and issuer ratings to Baa1 from Baa2 May 7, 2014 5

Vision Mission Near-Term Goals Complete construction of MPS Units 1 & 2 by the summer peak of 2015 Complete construction of Eastside Distribution Operations Center by early 2015 Obtain Certificates of Convenience & Necessity in Texas & New Mexico for MPS Units 3 & 4 Support Four Corners participants in the operation of the plant EE will not participate in a life extension beyond July 2016 EE is seeking to sell its ownership interest in Four Corners Issue debt to fund construction program Incorporate 10MW of solar energy into our portfolio May 7, 2014 6

Vision Mission Executive Additions Michael D. Blanchard elected as the new Vice President of Regulatory Affairs Michael brings over 30 years of legal, regulatory and rate making experience John Boomer elected as Vice President and Treasurer John returns to EE after previously serving as assistant general counsel and brings over 20 years of legal, investor relations and international executive experience May 7, 2014 7

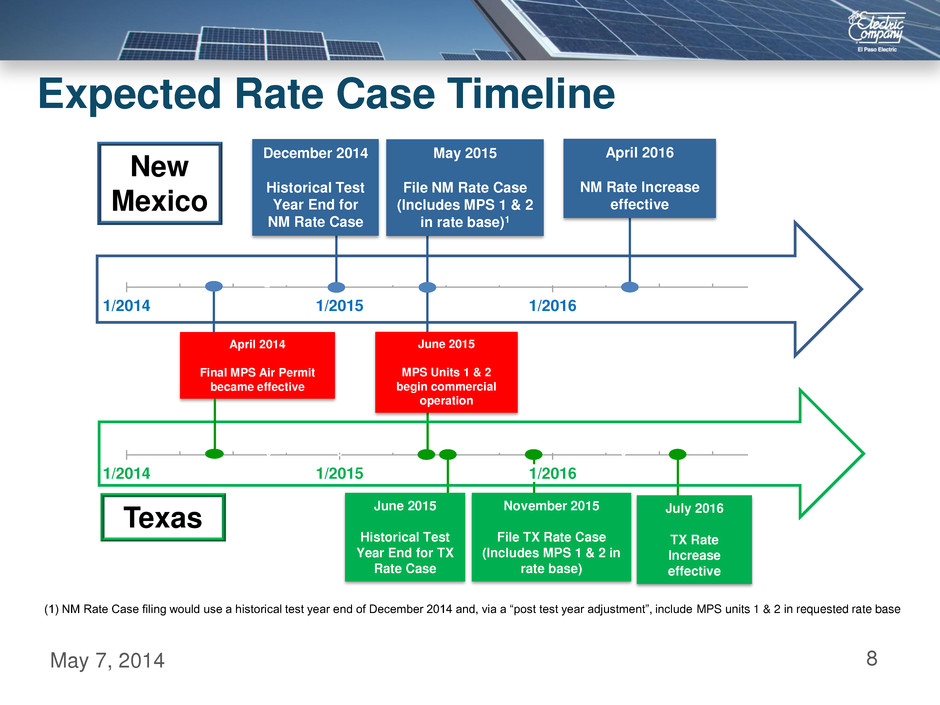

1/2014 1/2015 1/2016 1/2014 1/2015 1/2016 May 7, 2014 8 Expected Rate Case Timeline New Mexico December 2014 Historical Test Year End for NM Rate Case May 2015 File NM Rate Case (Includes MPS 1 & 2 in rate base)1 April 2016 NM Rate Increase effective April 2014 Final MPS Air Permit became effective June 2015 MPS Units 1 & 2 begin commercial operation Texas June 2015 Historical Test Year End for TX Rate Case November 2015 File TX Rate Case (Includes MPS 1 & 2 in rate base) July 2016 TX Rate Increase effective (1) NM Rate Case filing would use a historical test year end of December 2014 and, via a “post test year adjustment”, include MPS units 1 & 2 in requested rate base

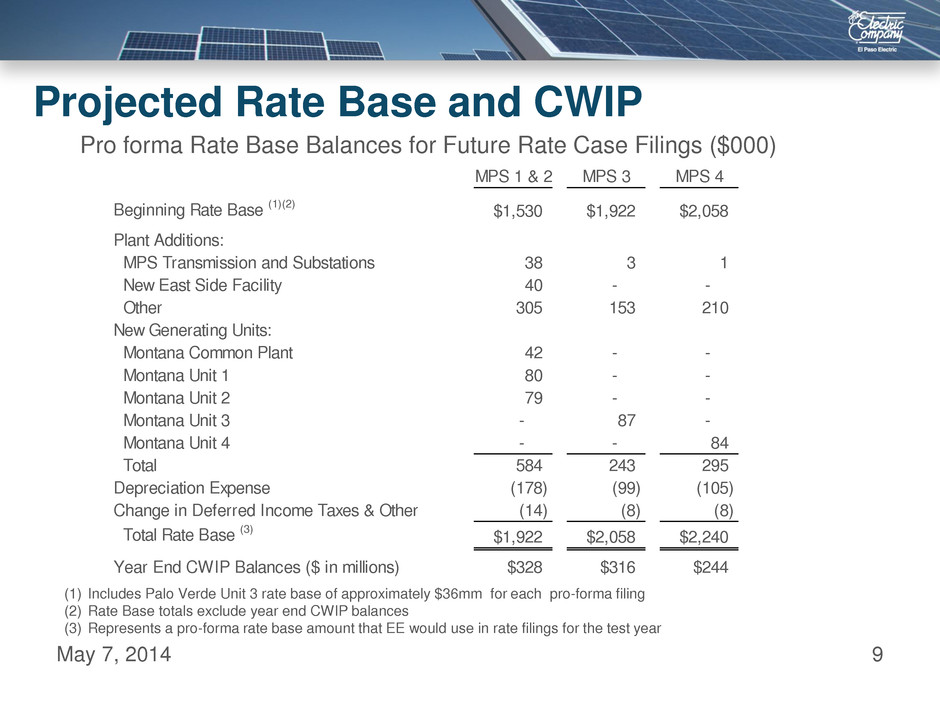

9 Pro forma Rate Base Balances for Future Rate Case Filings ($000) (1) Includes Palo Verde Unit 3 rate base of approximately $36mm for each pro-forma filing (2) Rate Base totals exclude year end CWIP balances (3) Represents a pro-forma rate base amount that EE would use in rate filings for the test year May 7, 2014 Projected Rate Base and CWIP MPS 1 & 2 MPS 3 MPS 4 Beginning Rate Base (1)(2) $1,530 $1,922 $2,058 Plant Additions: MPS Transmission and Substations 38 3 1 New East Side Facility 40 - - Other 305 153 210 New Generating Units: Montana Common Plant 42 - - Montana Unit 1 80 - - Montana Unit 2 79 - - Montana Unit 3 - 87 - Montana Unit 4 - - 84 Total 584 243 295 Depreciation Expense (178) (99) (105) Change in Deferred Income Taxes & Other (14) (8) (8) Total Rate Base (3) $1,922 $2,058 $2,240 Year End CWIP Balances ($ in millions) $328 $316 $244

Vision Mission 2014 Financial Results 1st Quarter 2014 net income of $4.6 million or $0.11 per share, compared to 1st Quarter 2013 net income of $7.6 million or $0.19 per share May 7, 2014 10

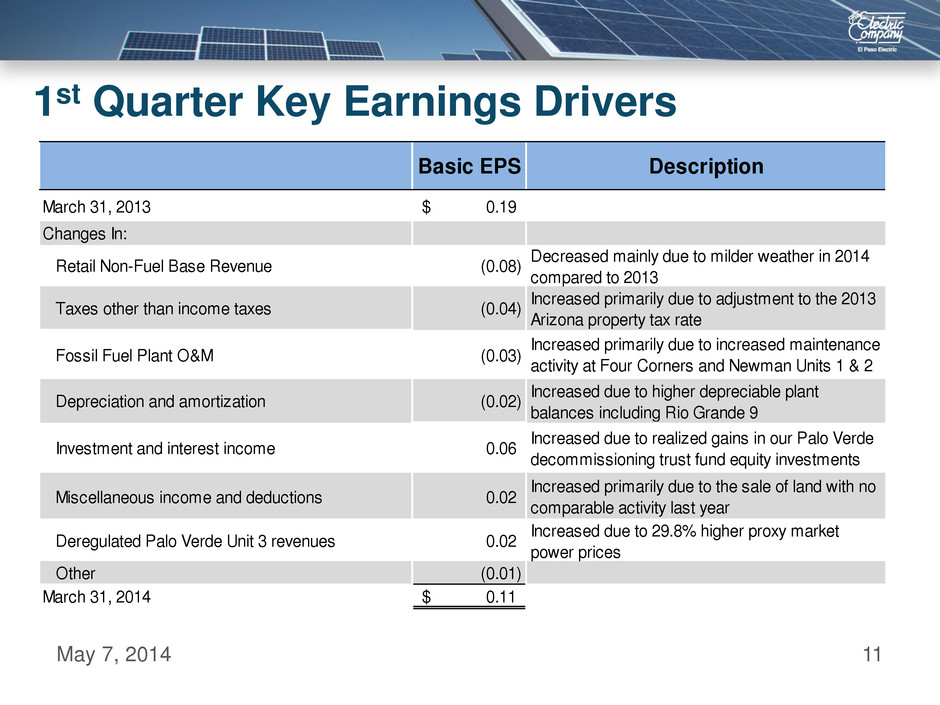

Vision Mission 1st Quarter Key Earnings Drivers May 7, 2014 11 Basic EPS Description March 31, 2013 0.19$ Changes In: Retail Non-Fuel Base Revenue (0.08) Decreased mainly due to milder weather in 2014 compared to 2013 Taxes other than income taxes (0.04) Increased primarily due to adjustment to the 2013 Arizona property tax rate Fossil Fuel Plant O&M (0.03) Increased primarily due to increased maintenance activity at Four Corners and Newman Units 1 & 2 Depreciation and amortization (0.02) Increased due to higher depreciable plant balances including Rio Grande 9 Investment and interest income 0.06 Increased due to realized gains in our Palo Verde decommissioning trust fund equity investments Miscellaneous income and deductions 0.02 Increased primarily due to the sale of land with no comparable activity last year Deregulated Palo Verde Unit 3 revenues 0.02 Increased due to 29.8% higher proxy market power prices Other (0.01) March 31, 2014 0.11$

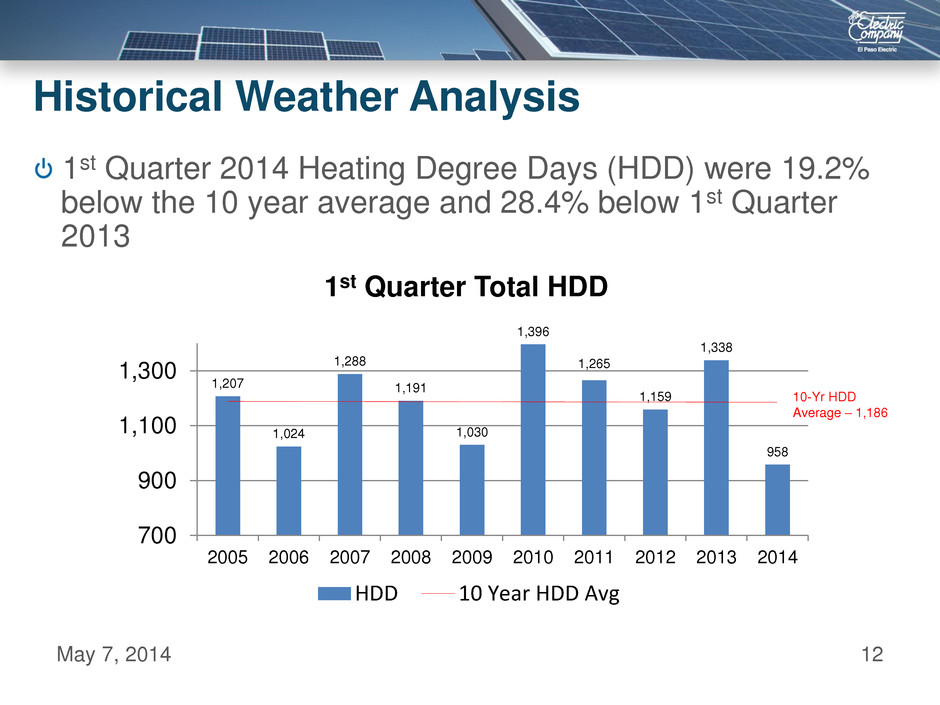

Vision Mission Historical Weather Analysis 1st Quarter 2014 Heating Degree Days (HDD) were 19.2% below the 10 year average and 28.4% below 1st Quarter 2013 May 7, 2014 12 1,207 1,024 1,288 1,191 1,030 1,396 1,265 1,159 1,338 958 700 900 1,100 1,300 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 1st Quarter Total HDD HDD 10 Year HDD Avg 10-Yr HDD Average – 1,186

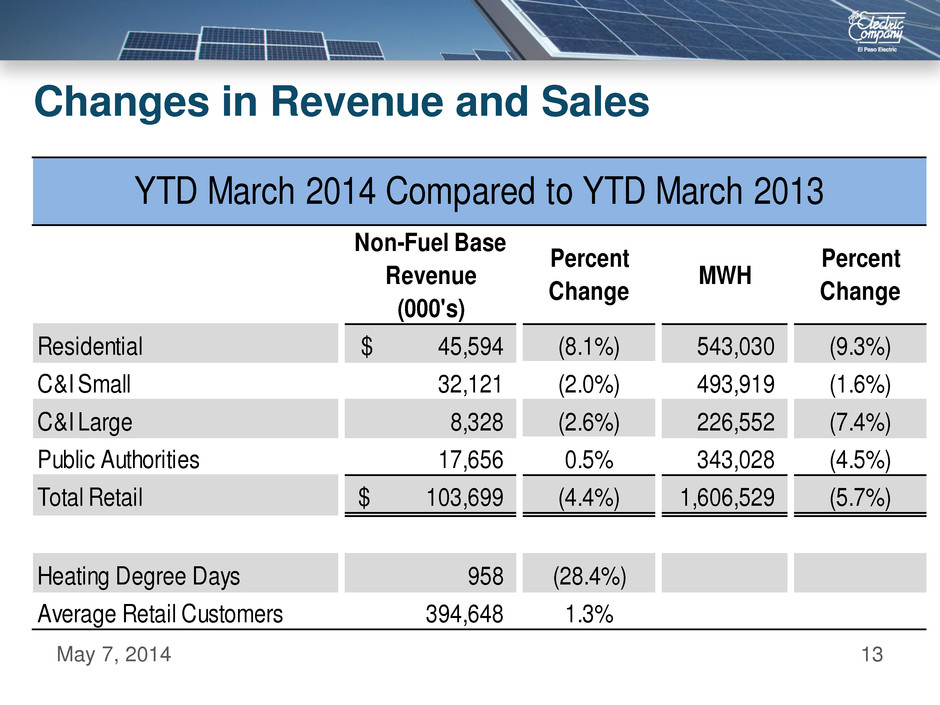

Vision Mission May 7, 2014 13 Non-Fuel Base Revenue (000's) Percent Change MWH Percent Change Residential 45,594$ (8.1%) 543,030 (9.3%) C&I Small 32,121 (2.0%) 493,919 (1.6%) C&I Large 8,328 (2.6%) 226,552 (7.4%) Public Authorities 17,656 0.5% 343,028 (4.5%) Total Retail 103,699$ (4.4%) 1,606,529 (5.7%) Heating Degree Days 958 (28.4%) Average Retail Customers 394,648 1.3% YTD March 2014 Compared to YTD March 2013 Changes in Revenue and Sales

Vision Mission Capital Requirements and Liquidity EE has expended $48.3mm for additions to utility plant for the three months ended March 31, 2014 Capital expenditures for utility plant in 2014 are anticipated to be approximately $316.4mm EE made $10.7mm in dividend payments for the three months ended March 31, 2014 At March 31, 2014, EE had a cash balance of $13.4mm At March 31, 2014, EE had liquidity of $267.0mm including cash and the revolving credit facility Anticipate issuing Senior Notes in second half of 2014 May 7, 2014 14

Vision Mission 2014 Earnings Guidance We are affirming our earnings guidance range for 2014 of $2.10 to $2.50 per share May 7, 2014 15

Vision Mission Q & A May 7, 2014 16