Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AEROJET ROCKETDYNE HOLDINGS, INC. | d714871d8k.htm |

IDEAS

POWERING FREEDOM CORPORATE OVERVIEW

Exhibit 99.1 |

Forward Looking

Statements 1

Certain information contained in this report should be considered “forward-looking

statements” as defined by Section 21E of the Private Securities Litigation Reform

Act of 1995. All statements in this report other than historical information may be

deemed forward-looking statements. These statements present (without limitation) the

expectations, beliefs, plans and objectives of management and future financial performance and

assumptions underlying, or judgments concerning, the matters discussed in the statements. The

words “believe,” “estimate,” “anticipate,”

“project” and “expect,” and similar expressions, are intended to identify forward-

looking statements. Forward-looking statements involve certain risks, estimates, assumptions

and uncertainties, including with respect to future sales and activity levels, cash

flows, contract performance, the outcome of litigation and contingencies, environmental

remediation and anticipated costs of capital. A variety of factors could cause actual

results or outcomes to differ materially from those expected and expressed in our forward-

looking statements. Important risk factors that could cause actual results or outcomes to differ

from those expressed in the forward-looking statements are described in the section

“Risk Factors” in Item 1A of our Annual Report to the Securities Exchange

Commission on Form 10-K for the fiscal year ended November 30, 2013. Additional risk

factors may be described from time to time in our future filings with the Securities and Exchange

Commission.

2014 Annual Shareholder Meeting– Rev K 13Mar2014

|

GenCorp At A

Glance Business Portfolio

Tactical Systems

Real Estate

Advanced Programs

Space and Launch

Systems

Missile Defense and

Strategic Systems

2

SSST

SM-3

Antares

Dreamchaser

X-51 2013 Revenues of $1,383.1M

Aerojet Rocketdyne –

$1,377.4M

Easton –

$5.7M

Key Capabilities Enabling

Space and Launch Systems

Tactical Systems

Missile Defense and Strategic

Systems

Advanced Programs

Significant Real Estate Holdings

2014 Annual Shareholder Meeting– Rev K 13Mar2014

|

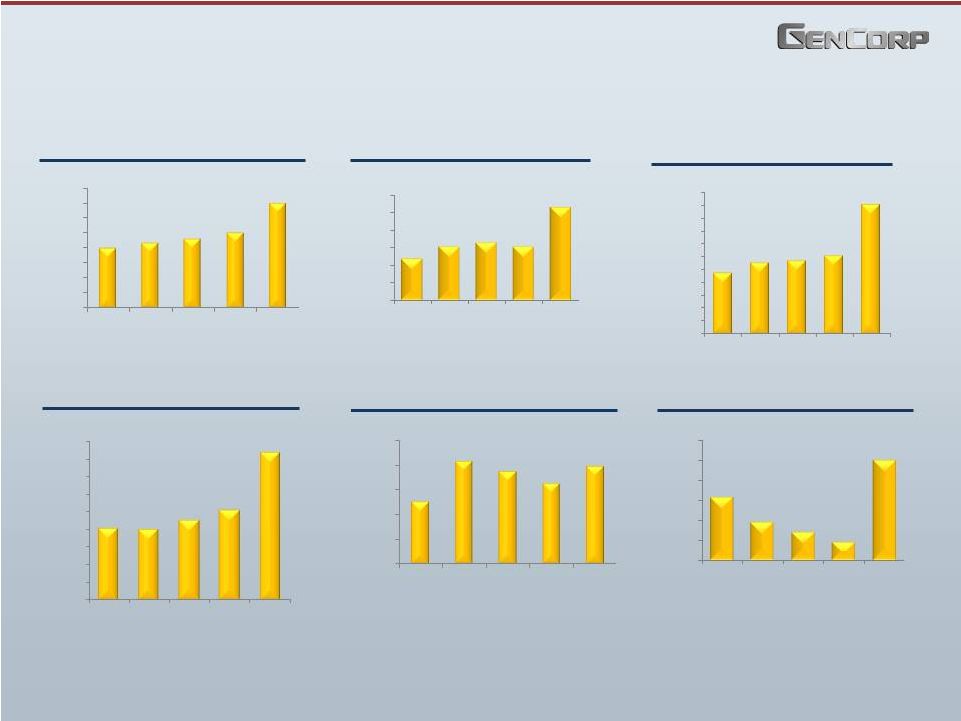

Steadily

Improving Financial Performance 3

Net Debt

(3)

($ in millions)

Adjusted EBITDAP

(1)

($ in millions)

Net

Sales

($ in millions)

Cash & Cash Equivalents

(2)

($ in millions)

Total Contract Backlog

($ in millions)

Funded Backlog

($ in millions)

$795.4

$857.9

$918.1

$994.9

$1,383.1

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

FY09

FY10

FY11

FY12

FY13

$96.4

$110.7

$115.4

$110.9

$155.6

$50

$70

$90

$110

$130

$150

$170

FY09

FY10

FY11

FY12

FY13

$1,191

$1,377

$1,422

$1,526

$2,523

$0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

$2,500

$2,750

2009

2010

2011

2012

2013

$811

$804

$902

$1,018

$1,664

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

2009

2010

2011

2012

2013

$126.3

$208.2

$188.0

$162.1

$197.6

$0

$50

$100

$150

$200

$250

2009

2010

2011

2012

2013

$312.3

$188.5

$138.4

$86.6

$501.6

$0

$100

$200

$300

$400

$500

$600

2009

2010

2011

2012

2013

(1) Non-GAAP Measure. The Company defines Adjusted EDITDAP as GAAP income before income

taxes adjusted by interest expense, interest income, depreciation and

amortization, retirement benefit plan costs and unusual items.

(2) Includes cash and cash equivalents, restricted cash and marketable securities. (3)

Non-GAAP Measure. Defined as debt principal less cash and marketable securities.

2014 Annual Shareholder Meeting– Rev K 13Mar2014

|

Balanced Capital

Deployment Strategy CAPITAL STRUCTURE

•

MERGERS & ACQUISITIONS

SHAREHOLDERS

INTERNAL INVESTMENTS

•

•

INTEGRATED

CAPITAL

DEPLOYMENT

PLAN

4

RETURN CASH TO

Planning (ERP)

Enterprise Resource

•

•

Surety Bonds utilized

to generate more

liquidity

Increased Research &

Development

2013

$43M

2012

$30M

2011

$27M

Rocketdyne business

acquisition completed June

2013

Share Repurchase

authorized for $75M

Flexible Capital

Structure allowing use

of value creation tools

• |

Aerojet

Rocketdyne Business Strategy DELIVER

excellent performance in our core business

DRIVE

initiatives across all aspects of the operating model to

maximize our competitive posture

CREATE

value by enhancing and expanding the core

and diversifying into broader markets

5

2014 Annual Shareholder Meeting– Rev K 13Mar2014

|

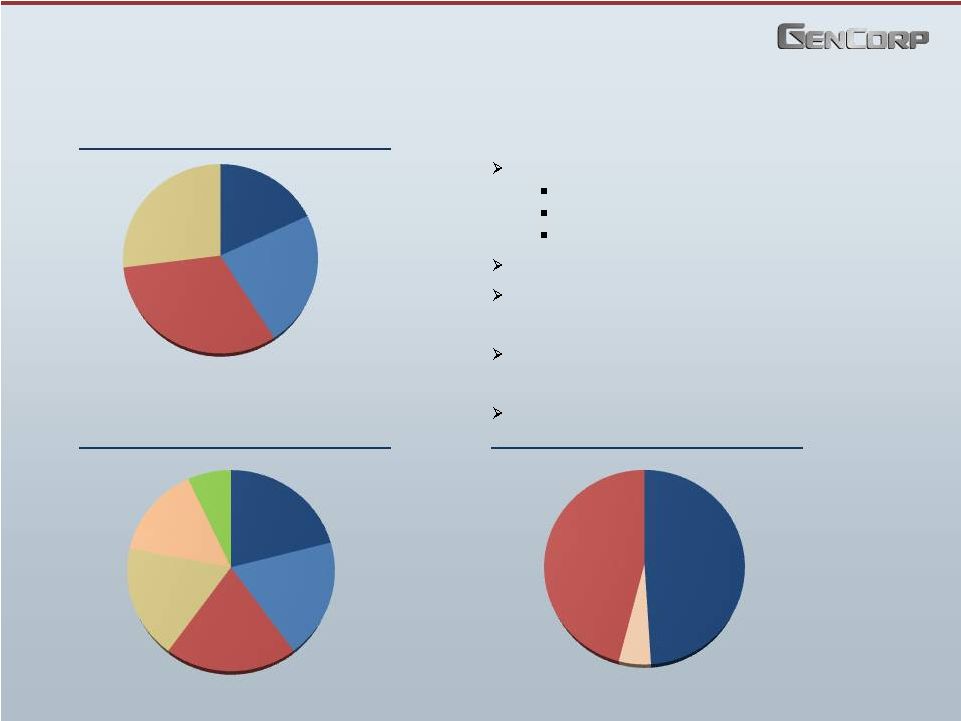

6

Aerojet Rocketdyne: Diversified and Balanced

Portfolio Aligned With Government Priorities

Major Customers

(1)

Lockheed

Martin

Raytheon

All Other

ULA

Portfolio Attributes:

Cost Reimbursable

End Users

(1)

MDA

Army

NASA

Air Force

All Other

Navy

Contract Type

Fixed Price

Other

(1) Based on total GenCorp revenue.

2014 Annual Shareholder Meeting– Rev K 13Mar2014

Missile defense

Access to and exploration of space

Tactical weapon systems

49%

5%

46%

21%

19%

20%

18%

15%

7%

18%

23%

32%

27%

Leading positions in core markets

Strong and growing backlog

Compelling “technology pipeline”

to fuel

further expansion and growth

Exceptionally high percentage of

follow-on business

High revenue visibility |

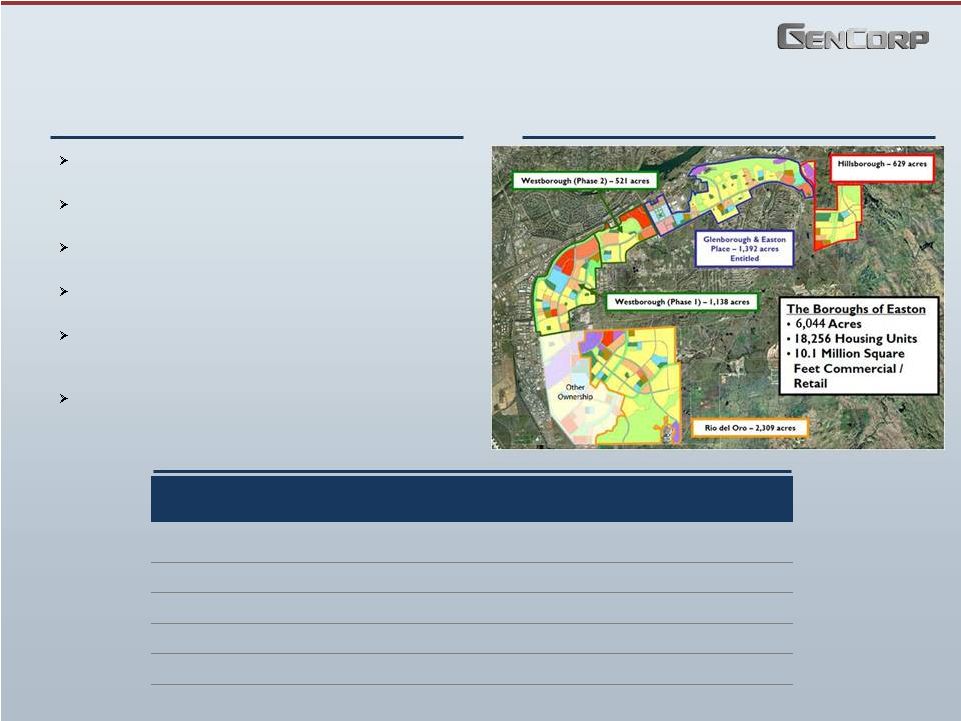

Substantial Real

Estate Holdings GenCorp owns over 12,000 acres of land in the

Sacramento metropolitan region

6,000 acres (Easton) have been targeted for

monetization

Major development opportunity with desirable

in-fill location along a key growth corridor

Long-term regional demographics favor population and

job growth

Development Agreement for Easton Place &

Glenborough now completed with significant progress

on others

Real Estate asset provides GenCorp additional financial

flexibility

7

Business Overview

Regional Context

Easton Projects

Acres

Environmentally

Unrestricted

Environmentally

Restricted

Total

Entitled

Limited

Entitlement

Glenborough & Easton Place

1,043

349

1,392

1,392

–

Rio del Oro at Easton

1,818

491

2,309

–

2,309

Westborough

1,387

272

1,659

–

–

Hillsborough

532

97

629

–

629

Office Park and Auto Mall

47

8

55

55

-

Total Easton

4,827

1,217

6,044

1,447

2,938

2014 Annual Shareholder Meeting– Rev K 13Mar2014

|

Easton Represents

a Value Creation Opportunity 8

GenCorp’s Opportunity

Attractive master planned community between

San Francisco and Lake Tahoe

Wide range of property and product types

Glenborough and Easton Place fully entitled

Long lead times for competition

Flexible options on monetization tied to market

dynamics and demand

Easton’

s Focus

Position Easton to meet evolving market

demands

Pursuing full entitlement vested by

development agreements on all projects

Establish Easton as one of the best master

planned communities in California

Setting quality and land use standards to drive

value creation

2014 Annual Shareholder Meeting– Rev K 13Mar2014

|

Summary

Large, diversified and well positioned program portfolio

Strong revenue and backlog visibility

Extended history of growth, increased profitability and strong

cash flow generation

Substantial real estate holdings additive to financial flexibility

Demonstrated Capital Deployment Strategy

9

2014 Annual Shareholder Meeting– Rev K 13Mar2014

|