Attached files

| file | filename |

|---|---|

| 8-K - 8-K - OLD DOMINION ELECTRIC COOPERATIVE | d703088d8k.htm |

Year

End 2013 Investor Briefing

March 27, 2014

Exhibit 99.1 |

Management Participants

Year End 2013 Investor Briefing

Jack Reasor

Chief Executive Officer

Bob Kees

Senior Vice President and

Chief Financial Officer

Rick Beam

Senior Vice President of Power Supply

Todd Brickhouse

Vice President –

Treasurer

Lynn Maloney

Vice President –

Financial Reporting

and Investor Relations

Page 2 |

Note Regarding

Forward Looking and Other Statements The

information

contained

herein,

and

presented

by

representatives

of

Old

Dominion

Electric

Cooperative

(ODEC

or

we

or

our),

include,

or

are

based

upon,

forward

looking

statements

and

assumptions

regarding

matters

that

could

have

an

impact

on

our

business,

financial

condition,

and

future

operations.

These

statements

and

assumptions,

based

on

our

expectations

and

estimates,

are

not

guarantees

of

future

performance,

and

are

subject

to

risks,

uncertainties,

and

other

factors

that

could

cause

our

actual

results

to

differ

materially

from

those

described

herein.

These

risks,

uncertainties

and

other

factors

include,

but

are

not

limited

to,

general

business

conditions,

federal

and

state

legislative

and

regulatory

actions,

and

general

credit

and

capital

market

conditions.

Any

forward

looking

statement

or

assumption

speaks

only

as

of

the

date

on

which

the

statement

or

assumption

is

made,

and

we

undertake

no

obligation

to

update

any

forward

looking

statements

or

assumptions

to

reflect

events

or

circumstances

after

this

date,

even

if

new

information

becomes

available

or

other

events

occur

after

the

date

of

this presentation.

These

presentation

materials

highlight

some

of

the

information

contained

in

our

SEC

filings

and

is

qualified

in

its

entirety

by

the

detailed

information

contained

in

our

SEC

filings

and

elsewhere

in

this

presentation.

This

presentation

may

not

contain

all

the

information

that

is

important

to

you.

You

should

read

this

information

in

conjunction

with

the

detailed

information

contained

elsewhere

in

our

SEC

filings.

Year End 2013 Investor Briefing

Page 3 |

OVERVIEW |

ODEC

Overview Our Business

•

Not-for-profit tax-exempt

power supply cooperative

•

Provide power to 11

distribution cooperatives

(Members) in VA, DE, and

MD who are our owners

•

Own 2,021 MW of primarily

nuclear, coal, and natural

gas generation

•

PJM RTO member

•

FERC regulated

•

SEC registrant

•

Non-RUS borrower

Our Members

•

Purchase ODEC power

under all-requirements,

take-or-pay wholesale

power contracts through

at least 2053

•

Providers of power to

over 550,000 customers

(1.2 million people)

•

VA and MD Members’

distribution rates

regulated by state

commissions

Our 2013 Results

•

Continued growth and

strong financial performance

•

Peak demand = 2,555 MW

•

Energy sales = 12,983 GWh

•

Revenues = $842 million

•

Total assets = $1.5 billion

•

Equity ratio = 32% *

Our Credit Ratings

•

S&P –

A (secured and issuer), stable outlook

•

Moody’s –

A2 (secured), stable outlook

•

Fitch –

A (secured and implied unsecured), stable outlook

*

Equity ratio equals patronage capital divided by the sum of our long-term debt,

long-term debt due within one year, revolving credit facilities, and

patronage capital.

Year End 2013 Investor Briefing

Page 5 |

Highlights

Year End 2013 Investor Briefing

Page 6

Wildcat Point

Generation Facility

•

Pursuing construction of natural gas-fueled combined

cycle facility in Rock Springs, Maryland

•

1,000 MW approximate size

•

Mid-2017 anticipated in-service

FERC Formula

Revision

•

Revised formula to better align cost recovery with PJM

cost allocation methodologies

•

Formula continues to collect all costs and expenses

plus net margin

Debt Portfolio

Changes

•

Optionally redeemed $60 million of tax-exempt debt

with weighted interest rate of approximately 5.3%

•

Issued $100 million of taxable debt with weighted

interest rate of approximately 4.3%

•

Extended $500 million revolver until March 2019

Credit Rating

Upgrade

•

Moody’s senior secured debt ratings increased from

“A3”

to “A2” |

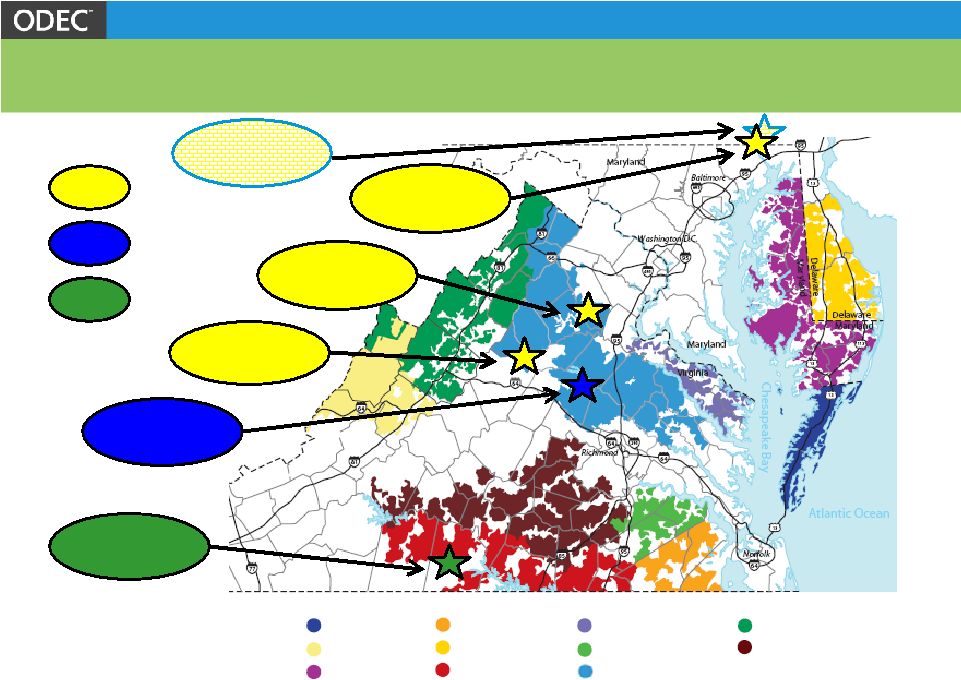

Rock

Springs 336 MW

Marsh Run

504 MW

Louisa

504 MW

Clover

437 MW

North Anna

220 MW

Natural

Gas

Nuclear

Coal

A&N

BARC

Choptank

Community

Delaware

Mecklenburg

Northern Neck

Prince George

Rappahannock

Shenandoah Valley

Southside

Members’

Service Territories

Year End 2013 Investor Briefing

Page 7

Wildcat Point

1,000 MW |

Wholesale Power Contracts (WPCs)

WPCs, which extend through at least 2053, obligate ODEC to

deliver,

and

the

Members

to

purchase,

all

of

the

Members’

power

requirements with the following exceptions:

•

ODEC’s mainland Virginia Members can purchase hydroelectric

power from the Southeastern Power Administration (SEPA)

Approximately 1.5% of Members’

2013 energy requirements

•

Members can receive up to the greater of 5% or 5 MW of their power

requirements from owned generation or other suppliers, and in limited

circumstances, additional amounts if so approved by ODEC’s Board

During 2013, Members received 6.7 MW under these exceptions

During 2014, we currently anticipate Members will receive approximately

69 MW under these exceptions

Year End 2013 Investor Briefing

Page 8 |

Members

ODEC’s load is diversified across 11 Members, with our largest

member, Rappahannock Electric Cooperative, accounting for 34%

of our 2013 revenues from sales to Members

Member

Revenues

(in millions)

(%)

Rappahannock

$275.9

34.0

Shenandoah Valley

150.4

18.6

Delaware

94.7

11.7

Choptank

72.1

8.9

Southside

64.5

8.0

A&N

47.8

5.9

Mecklenburg

39.7

4.9

Prince George

21.6

2.7

Northern Neck

19.5

2.4

Community

13.9

1.7

BARC

10.0

1.2

$810.1

100.0%

Year End 2013 Investor Briefing

Page 9 |

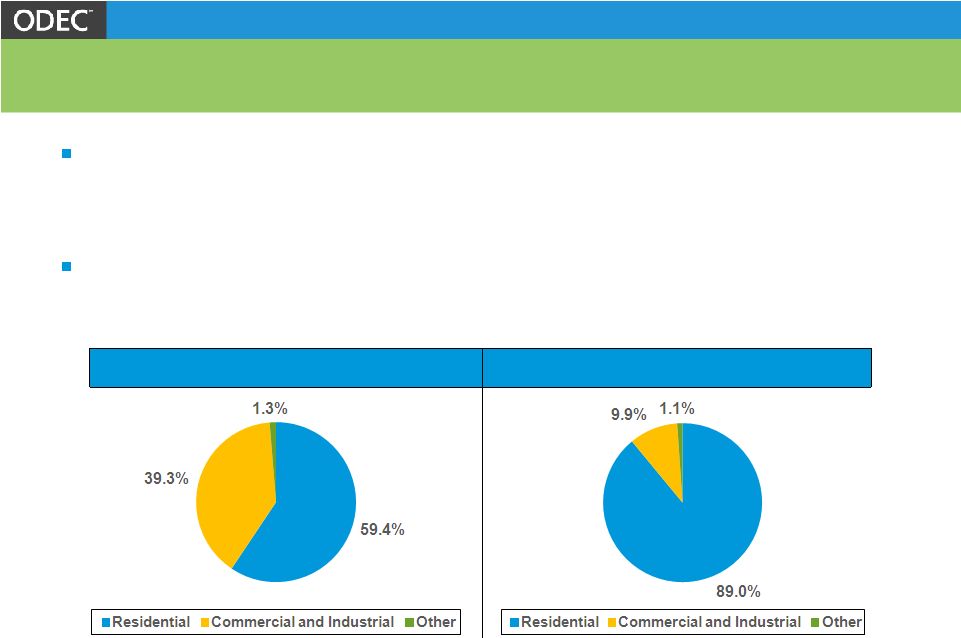

Members

Members

continue

to

experience

growth

–

from

2008

through

2013,

compound

annual

growth

rates

*

were:

•

0.4% in total number of customers

No individual retail customer constituted more than 3.2% of ODEC’s

2013 total revenues from sales to Members

*

Excludes 2010 Potomac Edison acquisition and West Virginia disposition; growth

includng these events equals 4.8% and 7.3% in total number

of

customers

and

total

energy

sales

volume,

respectively.

Also,

excludes

Northern

Virginia

Electric

Cooperative

(NOVEC)

which withdrew as a Member January 1, 2009.

Year End 2013 Investor Briefing

Page 10

•

1.3% in total energy sales volume

2013 Percentage of MWh Sales

2013 Percentage of Customers |

RATES

AND

POWER SUPPLY |

Rate

Regulation Entity

Regulator

Changes that Require

Approval

Changes that Do Not Require

Approval

Virginia Members

VSCC

Members’

distribution rates

ODEC’s energy and demand rates

Maryland Member

MPSC

Member’s distribution rates

ODEC’s energy and demand rates

Delaware Member

None

N/A

ODEC’s energy and demand rates

ODEC

FERC

Formula rate components

ODEC’s energy and demand rates

ODEC’s cost-based FERC formula rate allows us to collect

revenues to meet all costs, expenses, and financial obligations

plus additional board-approved equity contributions, and to

change rates in accordance with the formula without seeking

FERC approval

•

Exceptions are decommissioning costs (currently $0), changes to

depreciation rates, and changes to account classifications or the

addition of accounts to the formula

Year End 2013 Investor Briefing

Page 12 |

FERC

Formula Rate September 30, 2013 –

ODEC filed revised rate schedule at FERC to more

closely align our cost recovery from our Members with methodologies used

by PJM to allocate costs

•

Major revision –

demand rate, previously one rate, became three rates:

Transmission

service

rate

–

Designed

to

collect

transmission-related

and

distribution-

related

costs

RTO

capacity

service

rate

–

Proxy

rate

based

on

capacity

prices

in

PJM

which

PJM

allocates

to

ODEC

and

all

other

RTO

members

Remaining

owned

capacity

service

rate

–

Recovers

all

remaining

demand

costs

not

billed

and/or

recovered

under

other

two

rates

•

Formula continues to collect all costs and expenses plus net margin

December 2, 2013 –

FERC accepted revised rate schedule, subject to

refund, and established hearing and settlement procedures in response to

intervention by Bear Island Paper WB LLC

•

January 1, 2014 –

Revised rate schedule became effective

•

Settlement discussions with Bear Island are on-going and the outcome cannot

currently be determined

Year End 2013 Investor Briefing

Page 13 |

2013

Resource Mix Energy

(MWh)

2013 Peak Demand = 2,555 MW (January)

2013 Energy Sales = 12,982,861 MWh

Capacity

(MW)

Year End 2013 Investor Briefing

Page 14

*

We sell renewable energy credits related to these purchases to our Members and

non-members. North

Anna

(nuclear)

Clover

(coal)

North

Anna

(nuclear)

45%

|

Owned

Generation Statistics – December 31, 2013

Facilities

1

Clover

North Anna

CTs

2

Primary Fuel Type

coal

nuclear

natural gas

Operator

VA Power

VA Power

ODEC/EP

2

Net Utility Plant in Service (w/o CWIP)

$323 million

$151 million

3

$387 million

Net Capacity Entitlement

437 MW

220 MW

1,344 MW

Net Capital Investment

$739/KW

$686/KW

$288/KW

Average Operational Availability

96.3%

88.8%

96.8%

Average Capacity Factor

78.0%

90.6%

-

1

ODEC also owns 10 diesel units (20 MW), primarily to enhance system

reliability. 2

ODEC

owns

three

combustion

turbine

facilities.

We

operate

our

two

facilities

in

Virginia;

Essential

Power

Operating

Co.,

LLC

(EP)

operates

our Rock Springs, Maryland units.

3

Excludes decommissioning and nuclear fuel.

Year End 2013 Investor Briefing

Page 15 |

Wildcat Point Generation Facility

Size –

Approximately 1,000 MW

Type –

Natural gas-fueled combined

cycle (2X1)

Composition:

•

2 Mitsubishi combustion turbines

•

2 Alstom heat recovery steam

generators

•

1 Alstom steam turbine generator

Location –

Existing Rock Springs

Generation Facility, Cecil County

Maryland

•

Rock Springs owned 50/50 with

Essential Power, LLC

•

Wildcat Point will be owned 100% by

ODEC

Costs –

Preliminary estimated overnight

costs of $675 million (excludes certain

owners costs and financing costs)

Photo simulation of proposed plant at existing Rock Springs CT site.

Year End 2013 Investor Briefing

Page 16 |

Wildcat Point Generation Facility

Year End 2013 Investor Briefing

Page 17

Major Milestones

to Date

•

April 23, 2013

–

ODEC announced plans to construct

Wildcat Point

•

May 20, 2013

–

ODEC applied to the Maryland Public

Service Commission (MPSC) for a Certificate of Public

Convenience and Necessity (CPCN) to construct facility

•

March 24, 2014

–

MPSC issued a Proposed Order granting

the CPCN

Future

Anticipated

Milestones

•

April 8, 2014

–

Proposed Order becomes a Final Order

•

Mid-2014

–

Approval of engineering, procurement and

construction (EPC) contractor by ODEC Board

•

Late 2014

–

Construction commencement

•

Mid-2017

–

Commercial operation |

Capital Expenditures (including nuclear fuel and capitalized

interest) Projected =

$878.5 million

Actual

=

$110.6 million

Wildcat Point

-----

-----

6.0

98.7

455.8

185.4

Existing Assets

46.1

32.4

26.1

51.9

46.5

40.2

Total

46.1

32.4

32.1

150.6

502.3

225.6

Year End 2013 Investor Briefing

Page 18 |

FINANCE |

9%

3 %

4%

11%

4 %

2%

9%

1 %

2%

Sales and Revenues

Factors affecting results:

2011

•

First full year with

Potomac Edison

acquisition load

•

Milder temperatures

2012

•

Decrease in energy rate

•

Decrease in demand

costs

2013

•

Net decrease in energy

rate

•

Wildcat Point

preconstruction costs

Revenues from Non-members

37.6

15.9

31.9

Demand Revenues from Members

312.7

299.3

305.3

Energy Revenues from Members

541.2

527.5

504.9

MWh Sales to Members (right axis)

12.2

12.1

12.4

Year End 2013 Investor Briefing

Page 20 |

Income Statement Analysis

2013 % change

2012 % change

2011

Energy Sales to Members

12,356,005 MWh

2.1%

12,096,230 MWh

(0.9%)

12,205,602 MWh

Energy Sales to Non-members

626,856 MWh

23.3%

508,443 MWh

(46.0%)

941,908 MWh

Total Energy Sales

12,982,861 MWh

3.0%

12,604,673 MWh

(4.1%)

13,147,510 MWh

Demand Sales to Members

24,589 MW

2.3%

24,027 MW

(0.6%)

24,166 MW

Revenues from Sales to Members

$810.1 million

(2.0%)

$826.8 million

(3.2%)

$853.9 million

Total Operating Revenues

$842.1 million

(0.1%)

$842.7 million

(5.5%)

$891.5 million

Total Operating Expenses

$789.5 million

0.8%

$783.5 million

(5.5%)

$828.9 million

Net Margin attributable to ODEC

$9.6 million

(3.7%)

$9.9 million

(8.0%)

$10.8 million

Margin Stabilization Refund

$9.8 million

$15.0 million

$14.9 million

Average Total Cost to Members

$65.57/MWh

(4.1%)

$68.35/MWh

(2.3%)

$69.96/MWh

Margins for Interest (MFI) Ratio *

1.21

1.21

1.22

*

Per

the

Indenture

we

must

establish

and

collect

rates

which

are

reasonably

expected

to

yield

an

MFI

ratio

of

at

least

1.10.

MFI

ratio

is

calculated

by

dividing

margins

for

interest

by

interest

charges,

as

those

terms

are

defined

in

the

Indenture.

For

further

description

of

these

terms and calculation, see ITEM 6. SELECTED FINANCIAL DATA in ODEC’s 2013

Annual Report on Form 10-K. Year End 2013 Investor Briefing

Page 21 |

Balance Sheet Analysis

2013 %

change 2012

% change 2011

Net Electric Plant

$965.4 million

(2.6%)

$991.3 million

(2.1%)

$1,012.9 million

Total Investments

256.0 million

(2.7%)

263.0 million

11.8%

235.2 million

Other Assets

309.2 million

6.9%

289.2 million

(11.3%)

325.9 million

Total Assets

$1,530.6 million

(0.8%)

$1,543.5 million

(1.9%)

$1,574.0 million

Patronage Capital

$370.0 million

2.7%

$360.4 million

2.8%

$350.5 million

Non-controlling Interest

5.7 million

(57.1%)

13.3 million

1.3%

13.1 million

Long-term Debt

749.3 million

1.6%

737.8 million

(3.7%)

766.1 million

Long-term Debt due w/in One Year

28.3 million

-

28.3 million

-

28.3 million

Revolving Credit Facilities

-

-

-

-

-

Total Capitalization and

Short-term Debt

$1,153.3 million

1.2%

$1,139.8 million

(1.6%)

$1,158.0 million

Equity Ratio *

32.2%

32.0%

30.6%

Deferred Energy

$37.2 million

(33.6%)

$56.0 million

61.4%

$34.7 million

*

Equity ratio equals patronage capital divided by the sum of our

long-term debt, long-term debt due within one year, revolving credit facilities,

and patronage capital.

Year End 2013 Investor Briefing

Page 22 |

Debt

Portfolio Changes June 1, 2013

–

Optionally redeemed $60.2 million of tax-exempt debt

•

$27,755,000 2002 Series A Bonds at 5.000%

•

$32,455,000 2002 Series A Bonds at 5.625%

June 28, 2013

–

Issued $100 million in a private placement

•

$50 million First Mortgage Bonds, 2013 Series A due 2043 at 4.21%,

•

$50 million First Mortgage Bonds, 2013 Series B due 2053 at 4.36%

March 12, 2014

–

Extended $500 million syndicated revolving credit

facility to March 5, 2019

Year End 2013 Investor Briefing

Page 23 |

Summary

Year End 2013 Investor Briefing

Page 24

•

Economically stable, highly residential service territory

•

Long-term all-requirements wholesale power contracts

•

Favorable regulatory environment

•

Diversified portfolio of power supply resources

•

Wildcat Point to reduce reliance on purchased power

•

Consistently strong financial performance

•

SEC registrant and Sarbanes-Oxley compliant

•

Proven ability to secure liquidity and access capital

•

“A”

(stable outlook) and “A2”

(stable outlook) credit ratings |

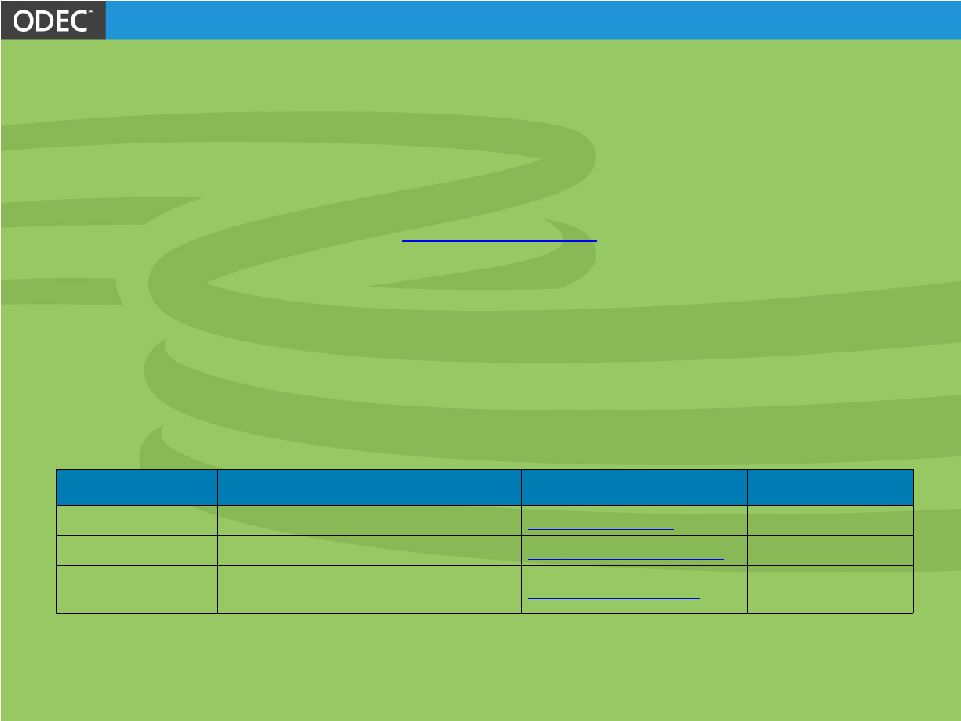

Additional Information

Year End 2013 Investor Briefing

Name

Title

E-mail Address

Phone Number

Bob Kees

SVP and Chief Financial Officer

bkees@odec.com

804-968-4034

Todd Brickhouse

VP –

Treasurer

tbrickhouse@odec.com

804-968-4012

Lynn Maloney

VP –

Financial Reporting and

Investor Relations

lmaloney@odec.com

804-968-4065

Page 25

A link to this presentation will be posted on ODEC’s website

www.odec.com

ODEC’s SEC filings, including Forms 10-K, 10-Q and 8-K, are also

available on our website

For additional information please refer to the contacts below

|