Attached files

| file | filename |

|---|---|

| EX-21 - EX-21 - Blue Capital Reinsurance Holdings Ltd. | a14-7530_1ex21.htm |

| EX-14 - EX-14 - Blue Capital Reinsurance Holdings Ltd. | a14-7530_1ex14.htm |

| EX-32 - EX-32 - Blue Capital Reinsurance Holdings Ltd. | a14-7530_1ex32.htm |

| EX-31.2 - EX-31.2 - Blue Capital Reinsurance Holdings Ltd. | a14-7530_1ex31d2.htm |

| EX-10.9 - EX-10.9 - Blue Capital Reinsurance Holdings Ltd. | a14-7530_1ex10d9.htm |

| EX-31.1 - EX-31.1 - Blue Capital Reinsurance Holdings Ltd. | a14-7530_1ex31d1.htm |

| EX-10.8 - EX-10.8 - Blue Capital Reinsurance Holdings Ltd. | a14-7530_1ex10d8.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-36169

BLUE CAPITAL REINSURANCE HOLDINGS LTD.

(Exact name of registrant as specified in its charter)

|

Bermuda |

|

98-1120002 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

94 Pitts Bay Road

Pembroke, Bermuda HM 08

(Address of principal executive offices)

Registrant’s telephone number, including area code: (441) 278-5004

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Name of each exchange on which registered |

|

Common Shares, par value $1.00 per share (“Common Shares”) |

|

New York Stock Exchange and Bermuda Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer o |

|

Accelerated filer o |

|

|

|

|

|

Non-accelerated filer x |

|

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

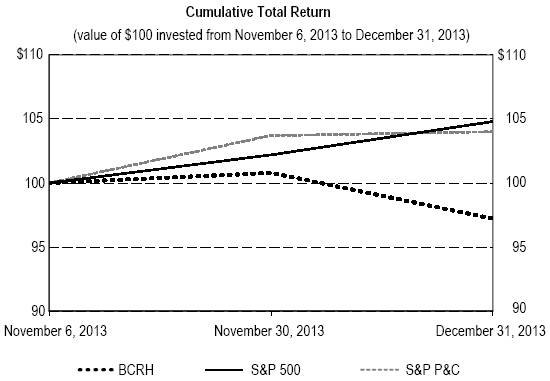

As of June 28, 2013, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public market for Common Shares. The registrant’s Common Shares began trading on The New York Stock Exchange on November 6, 2013.

As of March 3, 2014, 8,750,000 Common Shares were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

The definitive proxy statement relating to Blue Capital Reinsurance Holdings Ltd.’s Annual General Meeting of Shareholders, to be held May 14, 2014, is incorporated by reference in Part III of this Report on Form 10-K to the extent described therein.

|

|

| |

|

|

|

|

|

2 | ||

|

|

|

|

|

4 | ||

|

|

|

|

|

|

4 | |

|

|

|

|

|

|

10 | |

|

|

|

|

|

|

12 | |

|

|

|

|

|

|

13 | |

|

|

|

|

|

|

14 | |

|

|

|

|

|

|

16 | |

|

|

|

|

|

|

17 | |

|

|

|

|

|

|

17 | |

|

|

|

|

|

|

18 | |

|

|

|

|

|

|

24 | |

|

|

|

|

|

|

24 | |

|

|

|

|

|

|

25 | |

|

|

|

|

|

|

25 | |

|

|

|

|

|

25 | ||

|

|

|

|

|

48 | ||

|

|

|

|

|

48 | ||

|

|

|

|

|

48 | ||

|

|

|

|

|

48 | ||

|

|

|

|

|

|

| |

|

|

|

|

|

48 | ||

|

|

|

|

|

52 | ||

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

53 | |

|

|

|

|

|

62 | ||

|

|

|

|

|

63 | ||

|

|

|

|

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

63 | |

|

|

|

|

|

63 | ||

|

|

|

|

|

64 | ||

|

|

|

|

|

|

| |

|

|

|

|

|

64 | ||

|

|

|

|

|

64 | ||

|

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

64 | |

|

|

|

|

|

Certain Relationships and Related Transactions, and Director Independence |

64 | |

|

|

|

|

|

64 | ||

|

|

|

|

|

|

| |

|

|

|

|

|

64 | ||

|

|

|

|

|

66 | ||

This Report on Form 10-K contains forward-looking statements within the meaning of the United States (the “U.S.”) federal securities laws, pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, that are not historical facts, including statements about our beliefs and expectations. These statements are based upon current plans, estimates and projections. Forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of uncertainties and various risk factors, many of which are outside our control. See “Risk Factors” contained in Item 1A herein for specific important factors that could cause actual results to differ materially from those contained in forward looking statements. You can identify forward-looking statements in this Report on Form 10-K by the use of words such as “anticipates,” “estimates,” “expects,” “intends,” “plans” and “believes,” and similar expressions or future or conditional verbs such as “will,” “should,” “would,” “may” and “could.” These forward-looking statements include, among others, statements relating to our future financial performance, our business prospects and strategy, our dividend policy and expected dividend payout, anticipated financial position, liquidity and capital needs and other similar matters. These forward-looking statements are based on management’s current expectations and assumptions about future events, which are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict.

Our actual results may differ materially from those expressed in, or implied by, the forward-looking statements included in this Form10-K as a result of various factors, including, among others:

· the fact that we have little operating history;

· the possibility of severe or unanticipated losses from natural and man-made catastrophes, including those that may result from changes in climate conditions, including global temperatures and expected sea levels;

· the effectiveness of our loss limitation methods;

· our dependence on our Chief Executive Officer and interim Chief Financial Officer and our service providers;

· our ability to effectively execute our business plan and any new ventures that we may enter into;

· acceptance of our business strategy, security and financial condition by regulators, brokers and insureds;

· failure by any service provider to carry out its obligations to us in accordance with the terms of its appointment;

· conflicts of interest that could result from our relationships and potential overlaps in business with related parties, including Montpelier Re Holdings Ltd. and its subsidiaries;

· the cyclical nature of the property catastrophe insurance and reinsurance industry;

· the availability of capital and financing, including our ability to raise more equity capital and our ability to release capital from existing obligations to redeploy annually;

· the levels of new and renewal business achieved;

· the availability of opportunities to increase writings in our core property and specialty insurance and reinsurance lines of business and in specific areas of the casualty reinsurance market and our ability to capitalize on those opportunities;

· the inherent uncertainty of our risk management process, which is subject to, among other things, industry loss estimates and estimates generated by modeling techniques;

· the accuracy of those estimates and judgments used in the preparation of our financial statements, including those related to revenue recognition, insurance and other reserves, reinsurance recoverables, asset valuations, contingencies and litigation which, for a new reinsurance company like us, are even more difficult to make than those made in a mature company because of limited historical information;

· the inherent uncertainties of establishing reserves for loss and loss adjustment expenses (“LAE”) and unanticipated adjustments to premium estimates;

· changes in the availability, cost or quality of reinsurance or retrocessional coverage;

· general economic and market conditions, including inflation, volatility in the credit and capital markets, interest rates and foreign currency exchange rates, and conditions specific to the insurance and reinsurance markets in which we operate;

· changes in and the impact of governmental legislation or regulation, including changes in tax laws in the jurisdictions where we conduct business;

· statutory or regulatory developments, including as to tax policy and reinsurance and other regulatory matters such as the adoption of proposed legislation that would affect Bermuda-headquartered companies or Bermuda-based insurers or reinsurers;

· potential treatment of us as an investment company or a passive foreign investment company for purposes of U.S. securities laws or U.S. federal taxation, respectively;

· the amount and timing of reinsurance recoverables and reimbursements we actually receive from our reinsurers;

· the overall level of competition, and the related supply and demand dynamics in our markets relating to growing capital levels in our industry;

· declining demand due to increased retentions by cedants and other factors;

· acts of terrorism, political unrest, outbreak of war and other hostilities or other non-forecasted and unpredictable events;

· unexpected developments concerning the small number of insurance and reinsurance brokers upon whom we rely for a large portion of revenues;

· operational risks, including the risk of fraud and any errors and omissions, as well as technology breaches or failures;

· our dependence as a holding company upon dividends or distributions from our operating subsidiaries;

· changes in accounting principles or the application of such principles by regulators; and

· the impact of foreign currency fluctuations.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the dates on which they are made.

Unless the context suggests otherwise, references in this Report on Form 10-K to “Blue Capital Reinsurance Holdings” or the “Company,” refer to Blue Capital Reinsurance Holdings Ltd., and references to “we,” “us,” “our” or “Blue Capital” refer to Blue Capital Reinsurance Holdings Ltd. and its consolidated subsidiaries. References to “Blue Capital Re” refer to Blue Capital Re Ltd., the Company’s wholly-owned reinsurance company, and references to “Blue Capital Re ILS” refer to Blue Capital Re ILS Ltd., Blue Capital Re’s wholly-owned subsidiary. References to “Montpelier” refer to Montpelier Re Holdings Ltd., a leading global provider of property catastrophe and short-tail reinsurance solutions (New York Stock Exchange; symbol “MRH”) that made a concurrent private investment (the “Private Placement”) through its wholly-owned subsidiary, Montpelier Reinsurance Ltd. (“Montpelier Re”), in our Common Shares upon the completion of our initial public offering (the “IPO”). Montpelier Re is registered as a Bermuda Class 4 insurer and provides insurance and reinsurance on a rated basis. References to “Blue Water Re” refer to Blue Water Re Ltd., a wholly-owned subsidiary of Montpelier. Blue Water Re is registered as a Bermuda special purpose insurance vehicle and provides collateralized property catastrophe reinsurance coverage and related products. References to the “Investment Manager” refer to Blue Capital Management Ltd. and references to the “Reinsurance Manager” refer to Blue Capital Insurance Managers Ltd., each a wholly-owned subsidiary of Montpelier. References to the “Managers” refer to the Investment Manager and the Reinsurance Manager, collectively.

References in this Report on Form 10-K to “GAAP,” refers to accounting principles generally accepted in the U.S.

The Company

We are a Bermuda exempted limited liability company which, through our subsidiaries, offers collateralized reinsurance in the property catastrophe market and invests in various insurance-linked securities. We were incorporated under the laws of Bermuda on June 24, 2013, we commenced our operations on November 12, 2013, and we do not have any material operating history. Our headquarters and principal executive offices are located at 94 Pitts Bay Road, Pembroke, Bermuda HM 08, and our registered office is located at Canon’s Court, 22 Victoria Street, Hamilton, Bermuda HM 12.

On November 5, 2013, our registration statement on Form S-1 was declared effective, pursuant to which we sold 6,250,000 Common Shares to the public at a price of $20.00 per share. Concurrent with the IPO, we completed the Private Placement with Montpelier Re pursuant to which we sold an additional 2,500,000 Common Shares at a price of $20.00 per share. Our total gross proceeds from the IPO and the Private Placement were $175.0 million, and our total net proceeds (expressed after our net expenses associated with the IPO) were $174.0 million. Our Common Shares began trading on the New York Stock Exchange on November 6, 2013 under the symbol “BCRH” and were subsequently listed on the Bermuda Stock Exchange under the symbol “BCRH.BH.”

Our business strategy is to build a diversified portfolio of reinsurance risks that will generate underwriting profits, which we intend to principally distribute through the payment of dividends, with returns commensurate with the amount of risk assumed. We seek to provide our shareholders with the opportunity to own an alternative asset class whose returns we believe have historically been largely uncorrelated to those of other asset classes, such as global equities, bonds and hedge funds. Subject to the discretion of our board of directors (the “Board”), we currently intend to distribute a minimum of 90% of our Distributable Income in the form of cash dividends to holders of our Common Shares. “Distributable Income,” a non-GAAP measure, means our GAAP net income excluding any non-cash compensation expense, unrealized gains and losses and other non-cash items recorded in our net income for the period. Subject to the discretion of the Board, we intend to make regular quarterly dividend payments for each of the first three quarters of each year, followed by a fourth “special” dividend after the end of the year to meet our dividend payout target for each calendar year. See “Executive Overview” contained in Item 7 herein.

We operate as a single business segment through our wholly-owned subsidiaries: (i) Blue Capital Re, a Bermuda exempted limited liability company registered as a Class 3A insurer in Bermuda, which offers collateralized reinsurance; and (ii) Blue Capital Re ILS, a Bermuda exempted limited liability company which conducts hedging and other investment activities, including entering into industry loss warranties and purchasing catastrophe bonds, in support of Blue Capital Re’s operations.

Subsidiaries of Montpelier manage our reinsurance underwriting decisions and provide us with the services of our Chief Executive Officer and our interim Chief Financial Officer. Through this relationship, we will leverage Montpelier’s reinsurance underwriting expertise and infrastructure to conduct our business.

We initially retained $14.0 million of the total net proceeds of the IPO and the Private Placement, which we believe will be sufficient to fund our anticipated cash obligations, including our first three regular quarterly dividend payments, for the initial year of our operations. We expect to deploy substantially all of the $160.0 million of remaining net proceeds (the “Deployable Capital”) in indemnity reinsurance contracts and related instruments during the first six months of our operations. As of December 31, 2013, we had deployed $8.5 million of the Deployable Capital in the form of an investment in an insurance-linked security and, through the January 1, 2014 annual renewal period, we had cumulatively deployed $144.2 million, or 90%, of the Deployable Capital in indemnity reinsurance contracts and investments insurance-linked securities. We expect to deploy substantially all of the remaining Deployable Capital throughout the first half of 2014.

The Property Reinsurance Market

Property insurance companies write insurance policies in exchange for premiums paid by the policyholder. An insurance policy is a contract between the insurance company and the policyholder whereby the insurance company agrees to pay for losses suffered by the policyholder that are covered under that contract. Property insurance typically covers the financial consequences of accidental losses to the policyholder’s property due to natural and man-made catastrophes, subject to deductibles and other policy limitations. Casualty insurance mainly protects a person or a business against legal liability for losses caused by injury to other people or the property of others. Many insurance policies will cover both property and casualty risks. However, given the difference in nature between property and casualty risks, the reinsurance markets for these types of risks tend to be separate and distinct. Our reinsurance activities will focus on property risks.

Property reinsurance companies assume, from both insurance companies (known as “ceding companies” or “cedants”) and other reinsurance companies (known as “retrocedants”), as well as other property insurance capital providers, such as government-or state-sponsored catastrophe funds, all or a portion of the property insurance or reinsurance risks that the ceding company has underwritten under one or more insurance or reinsurance policies. In return, the reinsurer receives a premium for the risks assumed from the ceding company. When reinsurance companies purchase reinsurance to cover their own risks assumed from ceding companies, this is known as “retrocessional reinsurance.” Reinsurance or retrocessional reinsurance can benefit a ceding company or retrocedant, as applicable, in various ways, such as by reducing exposure to individual risks and by providing catastrophe protection from larger or multiple losses. Ceding companies and retrocedants can use reinsurance or retrocessional reinsurance to manage their overall risk profile or to create additional underwriting capacity, allowing them to accept larger risks or to write more business than would otherwise be possible, absent an increase in their capital or surplus.

The following illustrates a typical risk distribution chain in the property reinsurance market.

The principal providers of retrocessional protection are other reinsurance companies, but alternative capital providers, such as hedge funds, insurance-linked security funds and sidecars, may also provide retrocessional protection using a variety of financial or other securities, such as industry loss warranties and catastrophe bonds, as well as collateralized reinsurance. Alternative capital providers represent an increasingly significant portion of the property reinsurance market, as the property reinsurance market’s low correlation with other asset classes has increased the attractiveness of the class to institutional investors.

Property reinsurance products are often written in the form of treaty reinsurance contracts, which are contractual arrangements that provide for the automatic reinsurance of a type or category of risk underwritten. Treaty reinsurance premiums, which are typically due in installments, are a function of the number and type of contracts written, as well as prevailing market prices. The timing of premiums written varies by line of business. The majority of property catastrophe business is written at the January and June annual renewal periods, depending on the type and location of the risks covered.

Property catastrophe reinsurance contracts are typically “all risk” in nature, providing protection to the ceding company against losses from earthquakes and hurricanes, as well as other natural and man-made catastrophes such as floods, tornadoes, storms and fires, also known as “perils.” The predominant exposures covered by these contracts are losses stemming from property damage and business interruption resulting from a covered peril. Coverage can also vary from “all natural” perils, which is the most expansive form, to more limited types such as windstorm-only coverage.

Property catastrophe reinsurance contracts are typically written on an excess-of-loss basis, which provides coverage to the ceding company when aggregate losses and LAE from a single occurrence for a covered peril exceed an amount that is specified in a particular contract. Under these contracts, protection is provided to an insurer for a portion of the total losses in excess of a specified loss amount, up to a maximum amount per loss specified in the contract. The coverage provided under excess-of-loss reinsurance contracts may be on a worldwide basis or may be limited in scope to specific regions or geographical areas.

Excess-of-loss contracts are typically written on a losses-occurring basis, which means that they cover losses that occur during the contract term, regardless of when the underlying policies came into force. Premiums from excess-of-loss contracts are earned ratably over the contract term, which is ordinarily 12 months. Most excess-of-loss contracts provide for a reinstatement of coverage following a covered loss event in return for an additional premium.

Reinsurance contracts do not discharge ceding companies from their obligations to policyholders. Ceding companies therefore generally require their reinsurers to have, and to maintain, either a strong financial strength rating or security, in the form of collateral, as assurance that their claims will be paid.

Catastrophe retrocessional reinsurance is placed to afford additional capacity to the original reinsurer, or to contain or reduce the original reinsurer’s risk of loss. Facultative retrocessional reinsurance involves the offer of each risk the retrocedant wishes to reinsure in a single transaction. The retrocedant submits the risks as a package to the retrocessionaire, but the retrocessionaire may choose to accept all, some or none of the risks. Any risks the retrocessionaire accepts will generally be covered by a single facultative retrocessional contract with each risk priced separately. Blanket retrocessional reinsurance covers the original reinsurer’s entire net portfolio of reinsured business, and is normally structured on an excess-of-loss reinsurance basis, arranged separately by major line of reinsured business.

Insurers generally purchase multiple tranches of reinsurance protection above an initial retention elected by the insurer. The amount of reinsurance protection purchased by an insurer is typically determined by the insurer through both quantitative and qualitative methods. In the event of losses, the amount of loss that exceeds the amount of reinsurance protection purchased is retained by the insurer. As a program is constructed from the ground up, each tranche added generally has a lower probability of loss than the prior tranche and therefore is generally subject to a lower reinsurance premium charged for the reinsurance protection purchased. To diversify risk, insurer catastrophe programs are typically supported by multiple reinsurers per program.

Reinsurance brokers play an important role in the reinsurance market. Brokers are intermediaries that assist the ceding company in structuring a particular reinsurance program and in negotiating and placing risks with third-party reinsurers. In this capacity, the broker is selected and retained by the ceding company on a treaty-by-treaty basis, rather than by the reinsurer. Though brokers are not parties to reinsurance contracts, reinsurers generally receive premium payments from brokers rather than directly from ceding companies, and reinsurers that do not provide collateralized reinsurance are frequently required to pay amounts owed on claims under their policies to brokers. These brokers, in turn, pay these amounts to the ceding companies that have reinsured a portion of their liabilities with reinsurers.

Insurance and reinsurance companies derive substantially all of their revenues from net earned premiums, net investment income and net gains and losses from investment securities. Premiums represent amounts received from policyholders and ceding companies, and net earned premiums represent the portion of net premiums (gross premiums less reinsurance purchased from third-parties) which are recognized as revenue over the period of time that coverage is provided (e.g., ratably over the life of the policy). In insurance and reinsurance operations, “float” arises when premiums are received before losses and other expenses are paid, an interval that sometimes extends over many years. During that time, the insurer invests the premiums, earns investment income and may generate investment gains and losses. We do not currently expect to derive significant revenue from investing our available cash and cash equivalents. Because the risks we underwrite will be underwritten on a fully-collateralized basis, most of our capital will be held in restricted trust accounts as cash and cash equivalent collateral, and our capital that is not deployed will generally be held in the form of cash and cash equivalents until it is deployed.

The length of time between receiving premiums and paying out claims, commonly referred to as the “tail,” can significantly affect how profitable float can be. Long-tail losses pay out over longer periods of time, providing the insurance or reinsurance company the opportunity to generate significant investment earnings from float. Short-tail losses pay out over shorter periods of time, providing the insurance or reinsurance company with a reduced opportunity to generate significant investment earnings from float, but increasing certainty regarding the timing and amount of realization of profit, making them more suitable for the alternative reinsurance market. Most of our business will involve exposure to short-tail losses from natural and man-made catastrophes.

Our Competitive Strengths

We believe we have the following competitive strengths:

· Access to a Leading Global Reinsurance Provider with an Extensive Infrastructure. We expect to benefit substantially from the Managers’ relationships with Montpelier by accessing and leveraging Montpelier’s management talent, proprietary reinsurance modeling tools, underwriting expertise, proprietary risk management systems and longstanding broker/client relationships. We believe that the Managers’ affiliations with Montpelier will enable us to deploy our capital to build a diversified portfolio of reinsurance risks with an attractive risk-adjusted return potential for our shareholders. In addition, we believe that we will benefit from Montpelier’s scale, experience and reputation in pricing reinsurance contracts and achieving key policy terms and conditions, which we believe to be a competitive advantage relative to other independent or small reinsurance platforms. We also expect to benefit from Montpelier’s existing middle- and back-office support infrastructure, given Montpelier’s experience as a public company.

· Differentiated Approach to Reinsurance Risk Selection. The Managers perform our risk selection process, subject to the oversight of the Board, and primarily target counterparties who can supply us with the full spectrum of information associated with each exposure. Our risk selection process includes using the Managers’ specific knowledge of the ceding insurer and underlying risks, including detailed portfolio data, such as home type, location, building code and date of construction. Additionally, the Managers analyze the historical loss performance of the ceding insurer, its market position, management’s capabilities and claims mitigation history. The Reinsurance Manager generally acts as a “quoting market” participant, which means that it provides an initial quote to the broker rather than responding to quotes provided by the broker. We believe that this will allow the Reinsurance Manager to be more selective in choosing the reinsurance contracts it selects for us and enhances its relationship with brokers. We believe that we will benefit from the Managers’ use of Montpelier’s analytics, risk management and actuarial team, which will enable the Managers to analyze the granular data collected using proprietary analytical systems on our behalf in order to determine the appropriate pricing for the risks assumed. The Managers will use Montpelier’s proprietary catastrophe pricing and risk management system (which they refer to as “CATM®“), various third-party models and their underwriting judgment in order to achieve the highest available price per unit of risk assumed. The Managers also seek to exploit pricing inefficiencies that may exist in the market from time to time.

· Access to Reinsurance Products Not Generally Available to Collateralized Reinsurers. In addition to offering collateralized reinsurance directly to third-party insurance and reinsurance companies, we expect to further benefit from leveraging our relationship with Montpelier in order to gain access to a broader range of reinsurance business than we believe is typically available to most collateralized reinsurers. Through a retrocessional contract dated December 31, 2013 (the “BW Retrocessional Contract”), between Blue Capital Re and Blue Water Re, Blue Water Re has the option to cede to Blue Capital Re up to 100% of its participation in the ceded reinsurance business it writes, provided that such business is in accordance with Blue Capital Re’s underwriting guidelines. Pursuant to the BW Retrocessional Contract, beginning in 2014 we may participate in: (i) retrocessional, quota share or other agreements between Blue Water Re and Montpelier Re or other third-party reinsurers, which provide us with the opportunity to participate in a diversified portfolio of risks on a proportional basis; and (ii) fronting agreements between Blue Water Re and Montpelier Re or other well capitalized third-party rated reinsurers, which allow us to transact business with counterparties who prefer to enter into contracts with rated reinsurers. We believe that these arrangements will enhance the depth of opportunities available to us, increase the diversification of our portfolio and provide enhanced risk-adjusted returns compared to most other collateralized reinsurers.

· Experienced Management Team. Our executive officers and Montpelier’s senior managers responsible for the day-to-day oversight of the Managers have significant experience in the reinsurance industry, including the supervision of both traditional reinsurance markets and insurance-linked securities. We also expect to benefit from the significant experience of the Investment Manager’s Investment Committee and the Reinsurance Manager’s Underwriting Committee.

· Alignment of Interests Between Our Shareholders and Montpelier. Through the Private Placement, Montpelier owns 28.6% of our outstanding Common Shares. Montpelier has agreed not to sell the Common Shares for a period of 12 months after the IPO. We believe that Montpelier’s investment in us and our relationship with the Managers align Montpelier’s interests with those of our shareholders and creates an incentive to maximize returns, while managing risks, for our shareholders.

Our Strategy

Our business strategy is to build a diversified portfolio of reinsurance risks that will generate underwriting profits, which we intend to principally distribute through the payment of dividends, with returns commensurate with the amount of risk assumed. We will implement our strategy through our subsidiaries Blue Capital Re and Blue Capital Re ILS. Blue Capital Re offers collateralized reinsurance and may also enter into industry loss warranties in the form of insurance contracts. Blue Capital Re ILS conducts hedging and other investment activities, including investing in insurance-linked securities, in support of Blue Capital Re’s operations.

We aim to maintain a balanced portfolio of predominantly, but not exclusively, natural and man-made catastrophe risks, diversified by peril, geography and attachment point. The Managers have access to select on our behalf risks primarily from the global property catastrophe reinsurance market. Our strategy is to build a flexible and diversified portfolio of reinsurance risk exposures by pursuing a broad range of reinsurance opportunities. We believe that allocations to traditional reinsurance contracts, either fronted or collateralized by trust account or letter of credit, industry loss warranties, catastrophe bonds and other insurance-linked securities will enhance our overall risk diversification and may offer attractive relative value at different points in time, depending on market conditions. The Managers use Montpelier’s sophisticated risk management techniques to monitor correlation risk, and they seek to enhance our underwriting returns through careful risk selection using advanced capital allocation methodologies. We also actively seek to write more business in classes that we consider to be favorably priced based on the risk-adjusted return potential and to avoid those classes that we consider to be comparatively unfavorably priced, such as those suffering from intense price competition or poor fundamentals. We believe a balanced portfolio of risks reduces the volatility of returns and optimizes value for our shareholders. From time to time, however, we may choose to be overweight in certain classes, products or geographies based on market opportunities.

Third-Party Reinsurance, Direct with Cedant or via a Fronting Arrangement

Blue Capital Re offers reinsurance to third-party insurance and reinsurance companies through reinsurance contracts, either directly with the cedant or on a fronted basis. Blue Capital Re’s exposure under these reinsurance contracts is calculated on an ultimate net loss basis, ultimate net loss meaning the actual loss or losses paid out by the retrocedant and for which the retrocedant has become liable in respect of insurance policies entered into by the cedant as an insurer or reinsurer. Generally, cedants decide to cede business to a reinsurer based on the strength of a reinsurer’s financial strength rating or, if it is unrated, on the demonstrated ability of a reinsurer to cover claims. Blue Capital Re fully collateralizes its reinsurance obligations and has no current intention to obtain a financial strength rating. The collateral is held in trust for the term of the related contract (or, in the event of a covered loss, the resolution of any claims under the contract).

As an alternative to the collateralized markets, Blue Capital Re also offers participation in fronting arrangements, either through the BW Retrocessional Agreement or directly with other well capitalized third-party rated reinsurers that satisfy the Reinsurance Manager’s detailed credit review. Under a typical fronting arrangement, a rated insurer issues an insurance policy on behalf of an unrated, often cash-collateralized, reinsurer without the intention of retaining any of the risk. The economic risk remains with the unrated reinsurer via an indemnity/reinsurance agreement but the contractual and credit risk is assumed by the fronting company since it is required to honor obligations under the policy if the unrated reinsurer fails to indemnify the fronting company.

The reason for these fronting arrangements is that, just as some counterparties may prefer fully collateralized reinsurance, other counterparties may prefer to enter into reinsurance contracts with a rated reinsurer. Alternatively, there may be situations in which the structure of the reinsurance contract would otherwise render direct collateralization uneconomic (for example, if the contract provided for reinstatable limits, which are described below). By entering into a fronting arrangement, Blue Capital Re is able to participate in reinsurance opportunities that would not otherwise be available to us, although Blue Capital Re is still required to provide collateral to the fronting reinsurer.

Under typical fronting agreements, all of the reinsurance risks are retroceded to the reinsurer who, in turn, provides the fronting reinsurer with collateral in an amount equal to or greater than the contractual limit less the premium receivable plus any origination fees owed. A fronting fee, which is a percentage of net premiums written, is deducted from premiums paid to the reinsurer.

Other fronting agreements may include an agreement that the fronting reinsurer retains the second or reinstated limit. Reinsurance contracts that are written on a reinstateable basis may not be economic for Blue Capital Re to write efficiently, because both limits are required to be fully collateralized. Traditional reinsurance contracts often provide for reinstatement of the original policy limit once a covered loss has occurred. Reinstatement generally occurs under two circumstances: (i) automatically and with no additional premium other than the original premium; or (ii) automatically with an additional premium that is agreed upon when the policy is written. Blue Capital Re may enter into some arrangements whereby the reinstatement premium paid is apportioned on a pre-agreed basis between Blue Capital Re and the fronting reinsurer. This arrangement gives Blue Capital Re access to the reinstatement reinsurance market, a market to which it would otherwise have limited access.

Blue Water Re Retrocession

Blue Capital Re also offers participation in facultative retrocessional reinsurance to Blue Water Re pursuant to the BW Retrocessional Agreement. The terms of this agreement mirror those of the original insurance policies. See “Conflicts of Interest” for information about the affiliation between Montpelier and us.

Blue Water Re is Montpelier’s market-facing collateralized reinsurer, and it focuses on providing reinsurance protection to primary insurance companies globally. Blue Water Re underwrites and enters into collateralized reinsurance contracts with Montpelier Re and other third-party insurance companies, which transfer all or a portion of the risks and the premiums under these third-party insurance companies’ contracts to Blue Water Re. All or a portion of these risks and premiums will then be allocated to Blue Capital Re by way of the BW Retrocessional Agreement. Under this agreement, Blue Capital Re will accept risks from Blue Water Re in exchange for the corresponding premiums relating to the accepted risks.

Quota Share Retrocessional Agreements with Montpelier Re or Other Third-Party Reinsurers

Blue Capital Re also offers participation in quota share retrocessional agreements with Montpelier Re pursuant to the BW Retrocessional Agreement, or directly with other sophisticated reinsurance or insurance companies (those with either a minimum A.M. Best financial strength rating of “A-” (Excellent) or better, or otherwise well capitalized, sophisticated reinsurance or insurance companies that satisfy the Reinsurance Manager’s detailed credit review). These agreements allow Blue Capital Re to participate in an agreed percentage of the risks and premiums of certain reinsurance contracts up to a certain amount on a proportional basis. In exchange, the ceding reinsurer charges Blue Capital Re a commission override, which is a percentage of the premiums on these contracts, to compensate it for sourcing the business and retaining the tail risk of these reinsurance contracts. The ceding reinsurer will also be reimbursed for acquisition costs, including brokerage and federal excise taxes, and may receive a profit commission in the event of favorable loss experience. These arrangements will be negotiated on a case-by-case basis, allowing Blue Capital Re to partake either in a portion or the entirety of the reinsurer’s portfolio or only in certain classes of reinsurance, as determined by the Reinsurance Manager, subject to our underwriting guidelines and the oversight of the Board.

Industry Loss Warranties

Blue Capital Re or Blue Capital Re ILS may buy and sell industry loss warranties as a way to access certain risks. An industry loss warranty is a financial instrument designed to protect insurers or reinsurers from severe losses due to natural and man-made catastrophes and can take the form of either an insurance contract or a swap agreement. Under both forms, a premium is paid at the inception of the contract and, in return, a payout is made if a catastrophic event causes losses to the insurance industry in excess of a predetermined trigger amount. Industry loss warranties in the form of an insurance contract (also referred to as the “indemnity form”) are typically dual-trigger instruments and, in addition to requiring a loss to the industry, require that the buyer of the protection actually suffer a loss from the triggering event. Blue Capital Re may buy and sell industry loss warranties in the form of an insurance contract, and Blue Capital Re ILS may buy and sell industry loss warranties in the form of a derivative contract

Catastrophe Bonds

Blue Capital Re ILS may purchase catastrophe bonds to access certain risks. A catastrophe bond provides reinsurance protection in the event of a catastrophic event. The issuer pays the bondholder interest and repays the principal at maturity, but if a specified trigger condition, such as indemnity, industry or parametric index or modeled loss, are met, then the issuer is no longer required to pay interest or repay some or all of the principal.

Blue Capital Re ILS will primarily use catastrophe bonds as another means to operate our reinsurance business and to complement or hedge other risks to which we are exposed. We currently only intend to buy or sell catastrophe bonds, but we may issue catastrophe bonds in the future, given sufficient scale to do so.

Other

While our initial focus is to provide reinsurance against natural property catastrophe risks, our strategy may evolve to the extent that man-made or other non-property catastrophe reinsurance risks (e.g., terrorism reinsurance, workers compensation catastrophe reinsurance) offer more attractive expected risk-adjusted returns or diversification benefits. Blue Capital Re ILS’s portfolio may include over-the-counter or exchange-traded futures or options listed on catastrophe indexes, such as catastrophe or weather derivatives.

Financing, Hedging and Other Investment Activities

We may borrow in order to, among other things: write new business; enter into other reinsurance opportunities; manage our capital requirements; purchase our Common Shares; respond to, or comply with, changes in capital requirements, if any, that the Bermuda Monetary Authority (the “BMA”) or other regulatory bodies use to evaluate us; acquire new businesses; or invest in existing businesses. In the event we borrow for any of these purposes or other purposes, we intend to limit our borrowing to an amount no greater than 50% of our shareholders’ equity at the time of the borrowing. However, subject to the approval of the Board, we may borrow an amount in excess of 50% of our shareholders’ equity at the time of the borrowing.

We may, from time to time, for the purposes of portfolio optimization or to hedge certain risks in the portfolio, enter into a retrocessional contract, invest in an insurance-linked security, enter into a derivative contract or issue a catastrophe bond. At all times any hedging contracts or investments will be governed by our underwriting guidelines and will be approved by the Investment Manager’s Investment Committee and the Reinsurance Manager’s Underwriting Committee.

The Managers have broad discretion to execute our underwriting strategy, subject to our underwriting guidelines and the oversight of the Board.

Our underwriting guidelines apply in respect of any new underwriting decision at the time of such decision, using the information available to the Managers at that time. This includes information on the existing portfolio contract limits and modeled loss exposures by zone, as well as estimations of the potential impact on the portfolio limits and modeled loss exposures from unquantified external factors. These factors include industry loss events that have the potential to cause loss to our portfolio and changes in methodology for calculating modeled losses. Based on the information available to the Managers at the time, if a new opportunity being considered would cause a restriction to be breached, or if a restriction relevant to that new opportunity is already in breach, then that new opportunity will not be allocated to us. The existence of restriction breaches does not preclude us from entering into any new opportunity; it only restricts us from entering into new opportunities that would result in a new breach or exacerbate existing breaches of restrictions.

Our current underwriting guidelines are summarized below, but the Board may change our underwriting guidelines or our strategy at any time without a vote or approval of our shareholders.

Class of Reinsurance

Our underwriting guidelines establish maximum and minimum thresholds for the amount of each class of reinsurance, as follows (each expressed as a percentage of Deployable Capital):

· 0% to 100% in indemnity reinsurance;

· 0% to 50% in indemnity retrocession;

· 0% to 50% in quota share retrocessional agreements;

· 0% to 50% in industry loss warranties;

· 0% to 20% in catastrophe bonds; and

· 0% to 20% in other non-property catastrophe risks.

We currently expect to deploy at least 50% of our portfolio in indemnity reinsurance, indemnity retrocession and quota share retrocessional agreements. Taking into account our underwriting guidelines and the targeted allocation described above, we currently estimate that our portfolio will be allocated 50% to 100% to traditional reinsurance and 0% to 50% to industry loss warranties, catastrophe bonds and non-property catastrophe risks.

Geographic Diversity

We intend to pursue a geographically diversified reinsurance strategy with an emphasis on the 20 individual zones set out below such that our projected net exposure from any one catastrophe loss event in any individual zone will not exceed 50% of our shareholders’ equity.

North America

· U.S. Northeast

· U.S. Mid-Atlantic

· U.S. Florida

· U.S. Gulf

· U.S. New Madrid

· U.S. Midwest

· U.S. California

· U.S. Hawaii

· Eastern Canada

· Western Canada

Europe

· Western Central Europe (France, Germany, Switzerland and Austria)

· Eastern Europe

· Southern Europe

· Northern Europe, Benelux and Scandinavia

· United Kingdom (the “U.K.”) and Ireland

Rest of World

· Australia

· New Zealand

· Japan

· South America

· Middle East

Examples of individual zones include: U.S. Florida Windstorm (1st event), U.S. Florida Windstorm (2nd event), U.K. and Ireland Windstorm (1st event), U.K. and Ireland Windstorm (2nd event), U.S. California Earthquake (1st event), Japan Earthquake (1st event) and U.S. Midwest Aggregate.

Other Limitations

The projected net impact from any one catastrophe loss event at the 1 in 100 year return period for any one zone will not exceed 35% of our shareholders’ equity. A 100 year return period can also be referred to as the 1.0% occurrence exceedance probability, meaning there is a 1.0% chance in any given year that this level will be exceeded. The projected net impact from any one earthquake loss event at the 1 in 250 year return period for any zone will not exceed 35% of our shareholders’ equity. A 250 year return period can also be referred to as the 0.4% occurrence exceedance probability, meaning there is a 0.4% chance in any given year that this level will be exceeded. For these risks, the projected net impact will be determined by the Reinsurance Manager using various systems, including Montpelier’s proprietary systems and data.

We may also: (i) purchase retrocessional protection to mitigate the impact of large catastrophe events on our portfolio or to optimize the expected return of our portfolio; and (ii) enter into foreign exchange derivative contracts to hedge our exposure to non-U.S. dollar currencies.

REINSURANCE RISK SELECTION AND UNDERWRITING PROCESS

We employ a granular approach to risk selection and portfolio construction. We target reinsurance counterparties through which we can access the full spectrum of information associated with each reinsurance loss exposure. We expect that, in a majority of the reinsurance transactions that we enter into, we will be a “quoting reinsurer,” meaning that we will provide an initial quote to the broker rather than responding to quotes provided by the broker. By contrast, we believe some other reinsurance providers act as price followers and only access exposure at an industry loss level and, accordingly, cannot evaluate specific information related to individual elements of underlying risk or control the underwriting process. We believe this holistic approach will enable us to build a portfolio of reinsurance contracts with attractive risk-adjusted returns.

The schematic below illustrates our underwriting process. The process entails a detailed underwriting due diligence process, analyzing the impact of any new instrument on the overall portfolio composition based on our proprietary catastrophe pricing and risk management systems. In certain cases, we may not accept an underwriting opportunity based on the initial pricing, but upon renegotiation of the pricing, we may accept this underwriting opportunity.

The Reinsurance Manager, on our behalf and subject to the oversight of the Board, employs selective underwriting criteria in the contracts it chooses to underwrite and spends a significant amount of time with our cedants and brokers to understand the risks and appropriately structure the contracts. As part of our pricing and underwriting process, the Reinsurance Manager assesses, among other factors:

· the client’s and industry historical loss data and current market conditions;

· the business purpose served by a proposed contract;

· the client’s pricing and underwriting strategies;

· the client’s (or cedant’s) claims management and mitigation practices;

· the expected duration for claims to fully develop;

· the geographic areas in which the client is doing business and its market share;

· the reputation and financial strength of the client;

· the reputation and expertise of the broker;

· proposed contract terms and conditions; and

· reports provided by independent industry specialists.

We conduct our business through our wholly-owned subsidiaries Blue Capital Re and Blue Capital Re ILS.

We conduct our reinsurance business through Blue Capital Re. As a result of the approvals received from the BMA and the terms of our approved business plan, Blue Capital Re may only enter into reinsurance contracts that are fully collateralized at 100% of the aggregate limit of the inception of each reinsurance contract. Blue Capital Re is subject to less stringent regulatory oversight and modest capital and surplus requirements. Blue Capital Re is not a rated entity, and we do not currently intend to obtain financial strength ratings for Blue Capital Re from any rating agencies. In the future, we may choose not to write insurance solely on a fully collateralized basis, in which case we may obtain financial strength ratings for Blue Capital Re and will make the relevant applications to the BMA either to: (i) change our business plan; (ii) register Blue Capital Re as another class of reinsurer (if necessary); or (iii) remove any waivers that have been granted on the basis of writing fully collateralized reinsurance contacts.

We conduct certain hedging and other investment activities through Blue Capital Re ILS, including investing in insurance-linked securities.

The following chart summarizes our corporate structure and certain of our key service agreements with Montpelier:

We rely on the Managers for services that are essential to the operation of our business. Each of the Managers is a wholly-owned subsidiary of Montpelier. The Managers manage our assets and make all of our underwriting and investment decisions, subject to our underwriting guidelines and the oversight of the Board.

The Managers each currently manage other accounts with areas of focus that overlap with our strategy, and each expects to continue to do so in the future. Neither of the Managers is restricted in any way from sponsoring or accepting business or capital from new clients, insurance companies, funds or other accounts, including businesses that are similar to, or that overlap with, our business. Therefore, the Managers’ time and attention may be divided between us and other businesses.

Investment Management Agreement

The Company has entered into an investment management agreement with the Investment Manager, which we refer to as the “Investment Management Agreement.” Pursuant to the terms of the Investment Management Agreement, the Investment Manager has full discretionary authority, including the delegation of the provision of its services, to manage our assets, subject to our underwriting guidelines, the terms of the Investment Management Agreement and the oversight of the Board.

Underwriting and Insurance Management Agreement

The Company, Blue Capital Re and the Reinsurance Manager have entered into an underwriting and insurance management agreement, which we refer to as the “Underwriting and Insurance Management Agreement.” Pursuant to the Underwriting and Insurance Management Agreement, the Reinsurance Manager provides underwriting, risk management, claims management, ceded retrocession agreements management, and actuarial and reinsurance accounting services to Blue Capital Re. The Reinsurance Manager has full discretionary authority to manage the underwriting decisions of Blue Capital Re, subject to our underwriting guidelines, the terms of the Underwriting and Insurance Management Agreement and the oversight of the Board and of the board of directors of Blue Capital Re.

Administrative Services Agreement

The Company has entered into an administrative services agreement with the Investment Manager, which we refer to as the “Administrative Services Agreement.” Pursuant to the terms of the Administrative Services Agreement, the Investment Manager provides us with support services, including the services of our Chief Executive Officer, Mr. William Pollett, and our interim Chief Financial Officer, Mr. Michael S. Paquette, as well as finance and accounting, claims management, policy wording, modeling software licenses, office space, information technology, human resources and administrative support. The Investment Manager has the right to sub-contract the provision of these services (other than the services of our Chief Executive Officer and of our interim Chief Financial Officer) to a third-party.

The following table summarizes the fees payable to our Managers pursuant to the Investment Management Agreement, the Underwriting and Insurance Management Agreement and the Administrative Services Agreement and certain other terms of these agreements:

Summary Description

|

Management Fee |

|

The Investment Manager is entitled to a management fee (which we refer to as the “Management Fee”) of 1.5% of our average total shareholders’ equity per annum, calculated and payable in arrears in cash each quarter (or part thereof) that the Investment Management Agreement is in effect. For purposes of calculating the Management Fee, our total shareholders’ equity means: (1) the net proceeds from all issuances of our equity securities since inception (allocated on a pro rata daily basis for such issuances during the quarter of any such issuance), plus (2) our retained earnings as of the end of the most recently completed quarter (without taking into account any non-cash compensation expense incurred in current or prior periods), minus (3) any amount that we may have paid to repurchase our Common Shares on a cumulative basis since inception. It also excludes (x) any unrealized gains and losses and other non-cash items that have impacted shareholders’ equity as reported in our financial statements prepared in accordance with GAAP, other than unrealized gains and losses and other non-cash items relating to insurance-linked securities, and (y) one-time events pursuant to changes in GAAP after discussions between the Investment Manager and our independent directors and approval by both a majority of our independent directors and the Investment Manager for all such adjustments. As a result, our shareholders’ equity, for purposes of calculating the Management Fee, could be greater or less than the amount of shareholders’ equity shown on our financial statements. |

|

|

|

|

|

Performance Fee |

|

The Reinsurance Manager is entitled to a performance fee (which we refer to as the “Performance Fee”) calculated and payable in arrears in cash each quarter (or part thereof) that the Underwriting and Insurance Management Agreement is in effect in an amount, not less than zero, equal to the product of (1) 20% and (2) the difference between (A) our pre-tax, pre-Performance Fee Distributable Income for the then current quarter and (B) a hurdle amount calculated as the product of (i) the weighted average of the issue price per Common Share pursuant to each of our public or private offerings of Common Shares since our inception multiplied by the weighted average number of all Common Shares outstanding (including any restricted share units, any restricted Common Shares and other Common Shares underlying awards granted under our equity incentive plans), as further reduced by the amount, if any, by which our inception-to-date dividends to shareholders exceeds our inception-to-date GAAP net income, and (ii) 2% (equivalent to an 8% annualized hurdle rate); provided, however, that the foregoing Performance Fee is subject to a rolling three-year high water mark (except that for periods prior to the completion of the three-year period following the IPO, the high water mark calculation will be done over the inception-to-date period). |

|

|

|

|

|

Term |

|

We generally may not terminate either the Investment Management Agreement, the Underwriting and Insurance Management Agreement or the Administrative Services Agreement for five years after the completion of the IPO, whether or not the Managers’ performance results are satisfactory. These agreements each renew automatically on the fifth anniversary of the completion of the IPO, and upon every third anniversary thereafter, unless terminated in accordance with their terms. During the term of these agreements, we may not enter into any other investment management, underwriting and insurance management or services agreement. |

|

|

|

|

|

Termination Fee |

|

Upon any termination or non-renewal of either of the Investment Management Agreement or the Underwriting and Insurance Management Agreement (other than for a material breach by, or the insolvency of, the applicable Manager), we will pay a one-time termination fee to either the Investment Manager or the Reinsurance Manager, as applicable, equal to 5% of our GAAP shareholders’ equity, calculated as of the most recently completed quarter prior to the date of termination. |

|

|

|

|

|

Expense Reimbursement |

|

Under the terms of the Investment Management Agreement and the Underwriting and Insurance Management Agreement, we reimburse the Managers for various fees, expenses and other costs in connection with the services provided under the terms of these agreements. The only fees payable under the terms of the Administrative Services Agreement are to reimburse the Investment Manager for various fees, expenses and other costs in connection with the services provided under the terms of this agreement, including the services of our interim Chief Financial Officer, modeling software licenses and finance, legal and administrative support. |

The Company currently intends to distribute a minimum of 90% of its Distributable Income in the form of cash dividends in order to provide its shareholders with an attractive annual return on their investment. The Company expects to make such distributions through regular quarterly dividend payments for each of the first three quarters of each year, followed by a fourth “special” dividend after the end of the year. See “Executive Overview” contained in Item 7 herein. Although the Company’s year-end net income (if any) will vary from year to year, the Company expects that in most years the sum of its regular quarterly dividend payments will be less than 90% of its Distributable Income. If this is the case, the Company intends to declare a special dividend in the following year to distribute an amount that, taken together with the prior year’s quarterly dividends, will be at least 90% of its Distributable Income for the prior calendar year. The declaration and payment of a special dividend, if any, may not occur until a significant period of time after the completion of the Company’s calendar year.

The declaration of quarterly and special dividends, if any, and, if declared, the amount of any such dividend will be subject to the discretion of the Board and to the consideration of various additional risks and uncertainties, including those discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Report on Form 10-K. The Board may take into account a variety of factors when determining whether to declare a dividend and, if declared, the amount of any such dividend, including: (i) the Company’s financial condition, liquidity, results of operations (including its ability to generate cash flow in excess of its expenses and its expected or actual net income), retained earnings and collateral and capital requirements; (ii) general business conditions; (iii) legal, tax and regulatory limitations; (iv) contractual prohibitions and other restrictions; and (v) any other factors that the Board deems relevant.

Pursuant to our Audit Committee Charter, a majority of the Board’s independent directors must approve any adjustments or exclusions to our net income used to calculate Distributable Income.

The Company has no substantial operations of its own and relies primarily on cash dividends or distributions from its subsidiaries to pay its operating expenses and dividends to its shareholders. Furthermore, Blue Capital Re, the Company’s wholly owned reinsurance subsidiary, is regulated by the BMA, and the ability of Blue Capital Re to pay dividends to the Company is limited under Bermuda law and regulations. Blue Capital Re is registered as a Class 3A insurer under the Insurance Act of 1978, as amended (the “Insurance Act”). The Insurance Act, the conditions listed in the insurance license and the approvals issued by the BMA provide that Blue Capital Re is required to maintain a minimum solvency margin of $1.0 million at all times. See “Regulation and Capital Requirements” for more information. A Class 3A insurer is prohibited from declaring or paying a dividend if it fails to meet, before or after declaration or payment of such dividend, its: (i) requirements under the Insurance Act and the Bermuda Companies Act of 1981, as amended (the “Companies Act”); (ii) minimum solvency margin; or (iii) enhanced capital requirement or minimum liquidity ratio. If a Class 3A insurer fails to meet its minimum solvency margin or minimum liquidity ratio on the last day of any financial year, it is prohibited from declaring or paying any dividends during the next financial year without the approval of the BMA. See “Regulation and Capital Requirements” for more information.

In addition, under the Companies Act, the Company, Blue Capital Re and Blue Capital Re ILS each may only declare or pay a dividend to its parent if it has no reasonable grounds to believe that: (i) it is, or would after the payment be, unable to pay its liabilities as they become due; or (ii) the realizable value of its assets would be less than its liabilities. See “Regulation and Capital Requirements” for more information.

The Company’s ability to pay dividends to its shareholders will depend upon its performance, which depends in turn upon the performance of its subsidiaries. We expect that dividends will be made in cash to the extent that cash is available for distribution. However, the Company may not be able to generate sufficient cash to pay dividends to its shareholders. In addition, the Board may change the Company’s dividend policy in the future.

Subject to the provisions of the Companies Act, the Company expects to make distributions by way of dividend from its retained earnings or from its contributed surplus or otherwise in accordance with the Companies Act and its bye-laws to the extent that the Board considers this to be appropriate.

We do not currently have any contractual arrangements, including indebtedness, that prohibit or otherwise restrict the Company’s ability to pay dividends to its shareholders or its subsidiaries’ ability to pay dividends to their parent, but we may enter into contracts or financing arrangements that prohibit or otherwise restrict the Company’s ability or the ability of its subsidiaries to pay dividends in the future.

There may be conflicts of interest that arise out of our relationship with Montpelier and the Managers. Our Chief Executive Officer, who is also one of our directors, our interim Chief Financial Officer and our Chairman are also employees of Montpelier. In addition, each of the Managers is wholly-owned by Montpelier. As a result, our officers, two of our initial directors (Mr. Christopher L. Harris and Mr. William Pollett), the Investment Manager and the Reinsurance Manager may have conflicts between their duties to us and their duties to, and interests in, Montpelier or other parties.

As part of our business model and strategy, we rely on affiliates of Montpelier for access to certain segments of the reinsurance market. In particular, pursuant to the BW Retrocessional Contract, beginning in 2014 we may participate in: (i) retrocessional, quota share or other agreements in which Montpelier or its affiliates have an interest; and (ii) fronting arrangements with Montpelier Re. Although these transactions may present conflicts of interest, we nonetheless may pursue and consummate these transactions.

Our business overlaps with portions of Montpelier’s business. In addition to managing some of Montpelier’s accounts, each of the Managers manages other accounts that may compete with us, including other accounts affiliated with Montpelier. The Managers make available to us opportunities to enter into reinsurance contracts and insurance-linked securities and make investments that they determine are appropriate for us in accordance with their allocation policies and our underwriting guidelines. Neither of the Managers has any duty to allocate any or all such opportunities to us. We expect that the Managers will primarily allocate any overlapping opportunities on a proportional basis among the various accounts that they manage.

Service Agreements with Montpelier

We rely on the Managers for services that are essential to the operation of our business. Each of the Managers is a wholly-owned subsidiary of Montpelier. As of December 31, 2013, Montpelier owned 28.6% of our outstanding Common Shares and had two representatives, Messrs. Harris and Pollett, on our Board of five directors.

The Managers manage our assets and make all of our underwriting and investment decisions, subject to our underwriting guidelines and the oversight of the Board.

Neither of the Managers is restricted in any way from sponsoring or accepting business or capital from new clients, insurance companies, funds or other accounts, including businesses that are similar to, or that overlap with, our business. Therefore, the Managers’ time and attention may be divided between us and other businesses.

See “The Managers” for detailed information concerning each of our service agreements with Montpelier.

We consider our primary competitors to include: Aeolus Capital Management, CatCo, Credit Suisse Asset Management, Leadenhall Capital, Lloyd’s of London, Nephila Capital Ltd., Pillar Capital, RenaissanceRe Holdings Ltd., Validus Holdings, Ltd. and sidecars and other vehicles managed or sponsored by any of these competitors. Many of our competitors are private companies, and therefore the results of these competitors are not readily available.

We compete with a variety of operators, including: (i) major global reinsurance companies, many of which have extensive experience in reinsurance and have greater financial, marketing and management resources than we do; (ii) other Bermuda-based reinsurers that write reinsurance and that target the same markets and utilize similar business strategies as we do, many of which currently have more capital than we do; and (iii) capital markets participants such as investment banks and investment funds that access business in securitized form, including through the issuance of insurance-linked securities, or through special purpose vehicles, derivative transactions or other instruments.

Competition in the insurance and reinsurance industry has increased over the past several years and may increase further, either as a result of capital provided by new entrants or of the commitment of additional capital by existing insurers or reinsurers. In addition, alternative products, such as the collateralized reinsurance contracts that we and others write and the insurance-linked securities that we and others may invest in, may also provide increased capacity. Continued increases in the supply of property reinsurance may have consequences for us and for the property catastrophe industry generally, including fewer contracts written, lower premium rates, increased expenses for customer acquisition and retention and less favorable policy terms and conditions.

REGULATION AND CAPITAL REQUIREMENTS

Bermuda Regulation

The Insurance Act provides that no person may carry on an insurance business in or from within Bermuda unless registered as an insurer under the Insurance Act by the BMA. The BMA, in deciding whether to grant registration, has broad discretion to act as it thinks fit in the public interest. The BMA is required by the Insurance Act to determine whether the applicant is a fit and proper body to be engaged in the insurance business and, in particular, whether it has, or has available to it, adequate knowledge and expertise. The registration of an applicant as an insurer is subject to its complying with the terms of its registration and such other conditions as the BMA may impose at any time. The Insurance Act also grants to the BMA powers to supervise, investigate and intervene in the affairs of insurance companies.

Regulatory Framework

The Insurance Act imposes on Bermuda insurance companies solvency and liquidity standards, as well as auditing and reporting requirements. Certain significant aspects of the Bermuda insurance regulatory framework are set forth below.

Classification of Insurers. The Insurance Act distinguishes between insurers carrying on long-term business, insurers carrying on general business (“general business” being everything except for life, annuity and certain types of accident and health insurance) and insurers carrying on special purpose business. There are six classifications of insurers carrying on general business, ranging from Class 1 insurers (pure captives) to Class 4 insurers (very large commercial underwriters). Blue Capital Re is registered as a Class 3A insurer.

An entity is registrable as a Class 3A insurer when: (i) it intends to carry on general insurance business in circumstances where (a) 50% or more of the net premiums written or (b) 50% or more of the loss and loss exchange provisions, represent unrelated business; and (ii) its total net premiums written from unrelated business are less than $50.0 million. Class 3A insurers are required to maintain fully paid-up share capital of $120,000.

It is anticipated that the total net premiums from unrelated business written by Blue Capital Re may exceed $50.0 million. The BMA has the discretion to license a body corporate as a Class 3A insurer even if it may write more than $50.0 million in total net premiums. The BMA has exercised this discretion in the instance of Blue Capital Re.

Principal Representative and Principal Office. An insurer is required to maintain a principal office in Bermuda and to appoint and maintain a principal representative in Bermuda. For the purposes of the Insurance Act, the principal office of Blue Capital Re is located at 94 Pitts Bay Road, Pembroke HM 08, Bermuda. Blue Capital Re’s principal representative is the Reinsurance Manager whose principal office is also located at 94 Pitts Bay Road, Pembroke HM 08, Bermuda.

Without a reason acceptable to the BMA, an insurer may not terminate the appointment of its principal representative, and the principal representative may not cease to act as such, unless 30 days’ notice in writing to the BMA is given of the intention to do so. It is the duty of the principal representative to immediately provide a verbal notification, and thereafter make a written report to the BMA, where the principal representative believes there is a likelihood of the insurer (for which the principal representative acts) becoming insolvent or that a reportable “event” has, to the principal representative’s knowledge, occurred or is believed to have occurred. Examples of a reportable “event” include failure by the insurer to comply substantially with a condition imposed upon the insurer by the BMA relating to a solvency margin (described below). The written report must set out all the particulars of the case that are available to the principal representative and must be submitted within 14 days of the principal representative’s prior verbal notification to the BMA.

Loss Reserve Specialist. Generally, a Class 3A insurer must appoint an individual approved by the BMA to be its loss reserve specialist and submit annually an opinion of its approved loss reserve specialist with its financial statements and return in respect of its loss and loss expense provisions. However, an insurer may file an application under the Insurance Act to waive the aforementioned requirements. In this instance, Blue Capital Re has obtained such a waiver from the BMA.