Attached files

| file | filename |

|---|---|

| 10-K/A - 10-K/A - STILLWATER MINING CO /DE/ | d686443d10ka.htm |

| EX-31.2 - EX-31.2 - STILLWATER MINING CO /DE/ | d686443dex312.htm |

| EX-10.66 - EX-10.66 - STILLWATER MINING CO /DE/ | d686443dex1066.htm |

| EX-31.1 - EX-31.1 - STILLWATER MINING CO /DE/ | d686443dex311.htm |

Exhibit 10.65

Portions of this Exhibit have been redacted pursuant to a request for confidential treatment under Rule 24b-2 of the General Rules and Regulations under the Securities Exchange Act. Omitted information marked “[***]” in this Exhibit has been filed with the Securities and Exchange Commission together with such request for confidential treatment.

THIRD AMENDED AND RESTATED SECONDARY

MATERIALS PROCESSING AGREEMENT

THIS THIRD AMENDED AND RESTATED SECONDARY MATERIALS PROCESSING AGREEMENT (this “Agreement”) is dated effective as of November 1, 2013, by and between STILLWATER MINING COMPANY, a Delaware corporation with its principal place of business in Montana (“Stillwater”), and POWER MOUNT INCORPORATED, a Kentucky corporation with its principal place of business in Kentucky (“Power Mount”).

WHEREAS, Power Mount and Stillwater previously entered into that certain Secondary Materials Processing Agreement, dated September 15, 2003 (the “Initial Agreement”), as amended by the Amended and Restated Secondary Materials Processing Agreement, dated June 7, 2005, as amended by the Second Amended and Restated Secondary Materials Processing Agreement, dated November 1, 2012 (together with the Initial Agreement, the “Previous Agreement”), whereby Power Mount supplied Secondary Materials to Stillwater, and Stillwater processed and refined such Secondary Materials; and

WHEREAS, Power Mount and Stillwater desire to enter into this Agreement to amend and restate the terms of the Previous Agreement;

NOW, THEREFORE, for good and valuable consideration, the receipt of which is hereby acknowledged, the parties agree as follows:

| 1. | DEFINITIONS. |

Throughout this Agreement, the following terms shall have the following meanings:

1.1 Applicable Supplier Percentage has the meaning set forth in Section 14.2.

1.2 Business Day means every Monday, Tuesday, Wednesday, Thursday and Friday that is not a day on which banking institutions in the United States are authorized or obligated by law or executive order to close.

1.3 Environmental Laws means any laws concerning pollution or protection of the environment, public health and safety, or employee health and safety, including laws relating to the Release of Hazardous Substances or otherwise relating to the disposal, storage, use, transport, treatment or handling of any pollutant, contaminant, chemical, waste, material or substance, including Hazardous Substances.

1.4 Estimated Delivery Date means the date estimated by Power Mount for delivery at the Facility of Offered Ounces.

1.5 Estimated Ounces means, with respect to a specific Lot, the number of troy ounces of each Metal estimated by Power Mount to be contained in such Lot and set forth by Power Mount on a Shipment Verification Form.

1.6 Event of Default has the meaning set forth in Section 12.

1.7 Facility means Stillwater’s processing complex located in Columbus, Montana.

1.8 Final Assay means, with respect to a specific Lot, the final settlement figures expressed as the amount of troy ounces per Short Ton of each Platinum Group Metal, determined in accordance with Section 8.3.

1.9 Final Dry Lot Weight means, with respect to a specific Lot, the weight in Short Tons as determined in accordance with Section 8.3.

1.10 Final Lot Value means, with respect to each Metal, the product of (i) the Final Dry Lot Weight, (ii) the Final Assay, (iii) the Return Percentage, and (iv) the Purchase Price.

1.11 Final Ounces means, with respect to each Metal, the product of the Final Dry Lot Weight and the Final Assay.

1.12 Final Payment has the meaning set forth in Section 9.2.

1.13 Final Payment Finance Charge means the interest assessed by Stillwater on the amount of the Final Payment and calculated as the product of (i) the amount of the Final Payment prior to deducting the Final Payment Finance Charge; (ii) Stillwater’s Cost of Borrowing; and (iii) the number of days from the date of Final Payment until the Value Date divided by 360.

1.14 Final Treatment Charge means, with respect to a specific Lot, the product of (a) the Final Dry Lot Weight, (b) 2,000, and (c) the Treatment Charge.

1.15 Force Majeure has the meaning set forth in Section 16.1.

1.16 Hazardous Substances means any substance, whether solid, liquid or gaseous, that, whether by its nature or its use or any other cause, is regulated or from which liability might arise under any applicable Environmental Law or which causes or poses a threat to cause contamination or a nuisance on property or a hazard to the environment or to the health, safety and welfare of persons.

1.17 Lot means a quantity of Secondary Materials delivered to Stillwater as one Shipment or as part of a Shipment and designated by Power Mount based on the type of automobile catalytic converter.

2

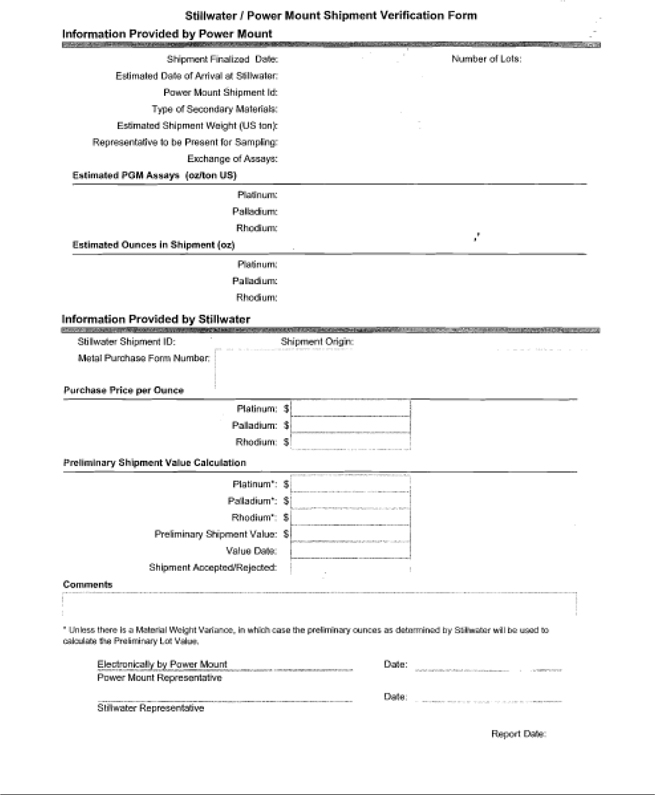

1.18 Shipment Verification Form means the form attached as Appendix A and completed by Power Mount and Stillwater in accordance with Sections 3.3 and 3.4.

1.19 Material Weight Variance has the meaning set forth in Section 8.2.

1.20 Metal means platinum, palladium or rhodium.

1.21 MSDS means Material Safety Data Sheet.

1.22 Notices has the meaning set forth in Section 19.4.

1.23 Offered Metal Value means, with respect to each Metal, the product of the (i) Offered Ounces, (ii) the Return Percentage, and (iii) the Purchase Price.

1.24 Offered Ounces means, with respect to each Metal, the number of troy ounces offered by Power Mount for purchase by Stillwater.

1.25 Party or Parties means Power Mount and Stillwater, individually or collectively as the context implies, and the successors and assigns of any Party that shall have become a Party hereto in accordance with the terms hereof.

1.26 Platinum Group Metals means, collectively, platinum, palladium and rhodium.

1.27 PM Referral Fee has the meaning set forth in Section 14.1.

1.28 PM Supplier has the meaning set forth in Section 14.1.

1.29 PM Supplier Payment has the meaning set forth in Section 14.2.

1.30 Preliminary Ounces means, with respect to each Metal in a specific Lot, the number of troy ounces of such Metal contained in the Lot, as determined in accordance with Section 8.2.

1.31 Prepayment has the meaning set forth in Section 9.1.

1.32 Prepayment Finance Charge means the interest assessed by Stillwater on the amount of the Prepayment and calculated as the product of (i) the amount of the Prepayment prior to deducting the Prepayment Finance Charge; (ii) Stillwater’s Cost of Borrowing; and (iii) the number of days from the date of the Prepayment until the estimated Value Date divided by 360.

1.33 Prepayment Percentage means the percentage of the Offered Metal Values used to determine the amount, if any, of the Prepayment from Stillwater to Power Mount, which is set forth on Schedule 1 hereto.

1.34 Purchase Price means, with respect to any Metal, a set price per ounce of a Metal established by Stillwater for settlement on the Value Date, which price will be based on the Estimated Date of Delivery or the date of actual delivery, applied on a first-in-first-out basis.

3

1.35 Release means the spilling, leaking, disposing, discharging, emitting, depositing, ejecting, leaching, escaping or any other release or threatened release, however defined, whether intentional or unintentional, of any substance, including Hazardous Substances.

1.36 Return Percentage shall mean, with respect to each Metal, that percentage, set forth on Schedule 1 hereto, of the ounces of Metal on which Stillwater makes payment.

1.37 Sample Split means a portion of a Lot sample taken prior to assaying.

1.38 Secondary Materials means decanned beads, honeycombs, and metal foil only from manufactured automobile catalytic converter products containing Platinum Group Metals.

1.39 Shipment means a delivery of Secondary Materials of up to 21 Short Tons delivered to the Facility.

1.40 Shipping Documentation means, with respect to each Lot, the bill of lading from the transportation company, the packing list and the Lot Verification Form with the top part completed by Power Mount.

1.41 Short Ton means 2,000 pounds.

1.42 Stillwater’s Cost of Borrowing means Stillwater’s quarterly, pretax, weighted average cost of borrowing, as determined in Stillwater’s sole discretion.

1.43 Treatment Charge shall mean the amount payable by Power Mount to Stillwater to treat and refine the Secondary Materials, which is based on the volume of Secondary Materials delivered and set forth on Schedule 1 hereto.

1.44 Value Date means the first Business Day following the date that is 83 days following the date of actual delivery, subject to extension pursuant to Sections 5 and 16.2.

| 2. | TERM. |

The term of this Agreement shall be for a period of one (1) year commencing on the effective date hereof and ending October 31, 2014. Notwithstanding the foregoing, this Agreement may be earlier terminated in accordance with the provisions of Section 13 or extended in accordance with the provisions of Section 16.2.

| 3. | OFFERED OUNCES; SHIPMENT VERIFICATION FORM; RECEIPT AND ACCEPTANCE. |

3.1 Offered Ounces. Via email, Power Mount will from time to time offer Stillwater Offered Ounces of Metal at a price to be determined by Stillwater and will provide Stillwater with the Estimated Delivery Date of the Secondary Materials containing such Offered Ounces. Power Mount will also indicate in such communication when Power Mount wants Stillwater to set the Purchase Price for the Offered Ounces, which may be as early as 30 days prior to the Estimated Delivery Date and as late as the Value Date. If Power Mount does not indicate when it wants Stillwater to set a Purchase Price for the Offered Ounces of Metal, Stillwater will

4

determine the Purchase Price of the Offered Ounces of each Metal on receipt of the Final Assay for the Lot containing such Offered Ounces of Metal. Power Mount shall not include in its email regarding Offered Ounces any Metal that Power Mount does not reasonably expect to deliver to the Facility within 30 days from the date of such offer. Within three (3) Business Days following an offer from Power Mount, Stillwater will send an email to Power Mount with the following information: (a) the Purchase Price for each Metal (if set by Stillwater); and (b) the Offered Metal Value and the Prepayment amount, if any. Stillwater will match deliveries of Lots with the applicable Offered Ounces according to the Estimated Delivery Date on a first-in-first-out basis.

3.2 Shipment. Power Mount will deliver Secondary Materials to the Facility in the quantities and with the composition in accordance with this Agreement. Power Mount will transport, or arrange for the transportation of, Secondary Materials in accordance with all applicable Environmental Laws. Power Mount will label each Lot based on the type of Secondary Material contained in such Lot. Each Shipment must be accompanied by an MSDS. Power Mount will bear the costs of transporting the Secondary Materials to the Facility. The Secondary Materials must be packaged in gaylord boxes unless alternative packaging is pre-approved by Stillwater. Catalyst dusts must be packaged in super sacks (bulk bags).

3.3 Shipment Verification Form. Power Mount shall electronically enter the metal data to complete the top portion of the Shipment Verification Form for each Lot shipped to Stillwater. Stillwater will confirm via email its receipt of the Shipment Verification Form. Power Mount shall indicate on the Shipment Verification Form, among other things, whether or not Power Mount will have a representative present for weighing and sampling.

3.4 Receipt and Acceptance. Stillwater shall notify Power Mount when Stillwater has received a Lot of Secondary Materials at the Facility. Within three (3) Business Days following Stillwater’s receipt of a Lot of Secondary Materials, Stillwater shall notify Power Mount whether or not Stillwater will accept or reject that Lot by completing the bottom portion of the Shipment Verification Form and forwarding a copy of the completed form to Power Mount via facsimile or email. If Stillwater rejects a Lot, Stillwater will have no further obligations to Power Mount with respect to such Lot, and Power Mount shall promptly remove such Lot from the Facility and shall bear the costs of such removal. No payment will be due from Stillwater for any Lot that Stillwater rejects. To the extent Stillwater has made any Prepayment for the Metal estimated to be contained in a rejected Lot, such Prepayment amount will be deducted from future payments owed Power Mount and, if payments owed to Power Mount within three (3) months after such rejection are insufficient to repay Stillwater the amount of such Prepayment, Power Mount shall thereupon pay Stillwater all amounts remaining due.

| 4. | TITLE; RISK OF LOSS; WARRANTIES OF POWER MOUNT; INDEMNIFICATION. |

4.1 Title. Title to the Secondary Materials in any Lot in a Shipment shall transfer from Power Mount to Stillwater following receipt and acceptance of such Lot by Stillwater at the Facility. Power Mount shall have responsibility for and assume all liability with respect to the Secondary Materials prior to title passing to Stillwater.

5

4.2 Risk of Loss. Power Mount shall bear all risk of loss of or damage to the Secondary Materials during transit to the Facility, and risk of loss of the Secondary Materials shall pass to Stillwater only upon receipt and acceptance of the Secondary Materials at the Facility. Power Mount shall acquire and maintain adequate insurance to cover 100% of the value while in Power Mount’s possession.

4.3 Warranties of Power Mount. Power Mount warrants and covenants to Stillwater that Power Mount will have full legal and beneficial title, free, clear and unencumbered by security interests and liens, to all Secondary Materials upon Stillwater’s receipt and acceptance of the Secondary Materials by Stillwater; that Stillwater shall upon receipt and acceptance, acquire full legal and beneficial title to such Secondary Materials, free, clear and unencumbered by security interests and liens (other than security interests and liens of Stillwater); and that the Secondary Materials shall be of the quality set forth in Section 6.1.

4.4 Indemnification. Power Mount shall indemnify and hold Stillwater harmless from and against any and all costs, losses, judgments, orders, decrees, expenses, including reasonable attorneys’, costs of court, and expert witness fees, and damages arising as the result of Power Mount’s failure to (a) have full and unencumbered title as provided in Section 4.3; (b) provide Secondary Materials of the quality set forth in Section 6.1 (unless Stillwater elects to accept nonconforming Secondary Materials under Section 6.2); and (c) comply with Environmental Laws.

| 5. | QUANTITIES. |

Power Mount may offer any amount of Secondary Materials to Stillwater pursuant to this Agreement. No Lot shall be less than 1,000 pounds. An additional [***] lot charge will be included for any lot that is received and accepted weighing less than 2,000 pounds. Stillwater may delay receipt and acceptance and the Value Date for any Lot that does not meet the requirements of this Section 5.

| 6. | QUALITY. |

6.1 Minimum Quality of Secondary Materials. Each Lot of Secondary Materials must have, at a minimum, 20 troy ounces of Metal per Short Ton. Power Mount represents and warrants that all Secondary Materials delivered to Stillwater from Power Mount shall be (a) free of lead, zinc, arsenic, chlorine, fluorine, mercury, selenium or other deleterious materials and free of any other impurities the solubility of which will negatively impact the processing and refining process (as determined solely by Stillwater), (b) free of Hazardous Substances (other than Hazardous Substances exempt under Environmental Laws), and (c) free of iron, stainless steel and other scrap.

6.2 Material Differences in Composition. If the results of sampling conducted by Stillwater indicate that a Lot of Secondary Materials delivered hereunder does not meet the requirements of Section 6.1, Stillwater shall have the absolute right (a) to refuse to accept that particular Lot of Secondary Materials for processing and refining, in which event Stillwater shall so notify Power Mount of such rejection; or (b) to accept, process and refine the Lot and to charge Power Mount $0.50 per pound of Secondary Material or such greater amount as

6

determined by Stillwater as necessary to cover additional costs of processing. If Stillwater refuses to accept any Lot, Power Mount will promptly remove that Lot from the Facility at Power Mount’s sole expense. No payment will be due from Stillwater for any Lot that Stillwater rejects pursuant to this Section 6.2. To the extent Stillwater has prepaid for the Metal estimated to be contained in such Lot, such amount will be deducted from future payments owed Power Mount, and, if payments owed to Power Mount within three months after such rejection are insufficient to repay Stillwater the amount of such Prepayment, Power Mount shall thereupon pay Stillwater all amounts remaining due.

| 7. | PROCESSING. |

7.1 Processing of Secondary Materials. Subject to Sections 4, 5 and 6, Stillwater will take delivery and possession at the Facility of the Secondary Materials provided by Power Mount under this Agreement, and, following acceptance, Stillwater will process the Secondary Materials.

7.2 Smelter Capacity. On any occasion during the term of this Agreement that Stillwater’s Facility is shut down for any reason, Stillwater may delay the processing of any Secondary Materials and will promptly notify Power Mount of such delay. Stillwater shall have no liability to Power Mount due to a shutdown if the shutdown (i) is for any reason and Stillwater has delivered to Power Mount not less than fifteen (15) days’ prior written notice of such shutdown, and provided further that Stillwater complies with all of its obligations under this Agreement with respect to any Secondary Materials previously shipped to Stillwater and any Secondary Materials shipped to Stillwater pursuant to this Section 7.2, or (ii) results from an event of Force Majeure. If Stillwater has notified Power Mount that a shutdown will occur for a reason other than an event of Force Majeure, then upon receipt of such notification, Power Mount will ship to Stillwater only the number of outstanding Offered Ounces due Stillwater. Power Mount will make no other shipments of Secondary Materials to Stillwater until such time as Power Mount receives written notification from Stillwater to resume shipments.

| 8. | WEIGHING; SAMPLING; ASSAYING; COMMINGLING. |

8.1 Weighing; Representation. Power Mount reserves the right, at its expense, to have its representative present to observe the process of the preliminary weighing of each Lot and the collecting of samples for assaying. If Power Mount has elected to have its representative present at weighing and sampling, then the weighing of such Lot and the collection of the samples from such Lot shall not occur until Power Mount’s representative has arrived at the Facility. Such representative must arrive at the Facility on the day that Stillwater has indicated that it will conduct the sampling of that particular Lot; provided that Stillwater has given Power Mount at least three (3) Business Days’ notice of such date.

8.2 Preliminary Ounces. Within two (2) Business Days following delivery of the Lot at the Facility, Stillwater will weigh and test the preliminary content of such Lot. If the number of troy ounces of each Metal as determined by Stillwater on receipt differs by five percent (5%) or more from the Estimated Ounces of each Metal as determined and set forth on the Shipment Verification Form by Power Mount (a “Material Weight Variance”), Stillwater will promptly notify Power Mount of such Material Weight Variance. The Preliminary Ounces of

7

each Metal shall equal the Estimated Ounces of each Metal unless there is a Material Weight Variance. If there is a weight variance, the Preliminary Ounces of each Metal shall be as determined by Stillwater pursuant to this Section 8.2.

8.3 Sampling; Final Dry Lot Weight; Final Assays. Stillwater will sample each Lot for moisture content and for assaying. Within fifteen (15) days after the date of Power Mount’s delivery of the particular Lot, Stillwater will send a Sample Split to Power Mount and a Sample Split to the Stillwater Mining Laboratory, and Stillwater will retain a Sample Split on file at the Facility for use as an umpire sample (if needed). Each Lot received by Stillwater will be considered complete and separate for sampling purposes under this Agreement. Stillwater will keep a separate record of the specific procedures performed in sampling the Secondary Materials supplied by Power Mount. Stillwater will determine and provide Power Mount with the Final Assay results, the Final Dry Lot Weight and the number of Final Ounces for such Lot within thirty (30) days after the date of Power Mount’s delivery of the particular Lot.

8.4 Commingling. Stillwater shall have the right to commingle in the Facility any Secondary Materials from Power Mount with any other materials, provided that the commingling occurs only after the Secondary Materials have been (i) weighed and sampled by Stillwater and (ii) accepted by Stillwater pursuant to Section 3.4.

| 9. | PAYMENT; SECURITY INTEREST. |

9.1 Prepayment. Within one (1) Business Day following receipt of Shipping Documentation from Power Mount and provided a Purchase Price has been set, Stillwater may, at its option, forward Prepayment if it has been requested by Power Mount for such Lot via wire transfer to Power Mount. The “Prepayment” to Power Mount for such Offered Ounces shall equal (A) the product of (i) the Prepayment Percentage and (ii) the sum of the Offered Metal Values for each Metal less (B) the Prepayment Finance Charge.

9.2 Calculation of Final Payment. Within two (2) Business Days following notice to Power Mount of the Final Lot Value for a Lot of Secondary Materials, Stillwater will forward the Final Payment via wire transfer to Power Mount. The “Final Payment” shall be calculated as follows:

| (a) | the sum of the Final Lot Values for each Metal in such Lot; less |

| (b) | the Prepayment; less |

| (c) | the Prepayment Finance Charge; less |

| (d) | the Final Payment Finance Charge; less |

| (e) | the Final Treatment Charge; less |

| (f) | any Section 5.0 lot charges. |

Attached as Appendix B is a sample calculation of a Final Payment and Final Payment Finance Charge. If the calculation of the Final Payment pursuant to this Section 9.2 results in a

8

negative number such that Stillwater has overpaid for a given Lot, such amount will be deducted from future amounts owed to Power Mount, and, if payments owed to Power Mount within three (3) months after such overpayment are insufficient to repay Stillwater the amount of such overpayment, Power Mount shall promptly (with two (2) Business Days) pay Stillwater all amounts remaining due.

9.3 Maximum Prepayments; Obligation to Make Prepayment May Be Suspended or Terminated by Stillwater. Stillwater shall not prepay Power Mount for any Lot unless Stillwater has received Shipping Documentation from Power Mount and has been directed by Power Mount to set a Purchase Price for each Metal in the Lot. Notwithstanding Sections 9.1 or 9.2 above, Stillwater may elect to suspend or terminate prepayments to Power Mount at any time during this Agreement for whatever reason. If Stillwater does suspend or terminate prepayments, Stillwater will forward Final Payment for each Lot of Secondary Material to Power Mount in one Final Payment, which shall be determined as follows:

| (a) | the sum of the Final Lot Values for each Metal in such Lot; less |

| (b) | the Final Treatment Charge. |

9.4 Right of Set-off. Stillwater may set-off any amounts that Power Mount owes Stillwater against any amounts that Stillwater owes Power Mount.

9.5 Security Interest. As security for all obligations of Power Mount under this Agreement, Power Mount hereby assigns, pledges and grants to Stillwater, its successors and assigns, a security interest in each Lot of Offered Ounces shipped to Stillwater pursuant to Article 3 of this Agreement, which Power Mount owns or hereafter acquires and offers to Stillwater.

| 10. | PUBLICITY: CONFIDENTIALITY. |

10.1 Publicity. Power Mount will not issue or approve an advertisement, promotional material, news release or other form of publicity concerning this Agreement or the transactions contemplated herein without the prior approval of Stillwater as to the content of such advertisement, promotional material, news release or publicity and the timing of its release.

10.2 Confidentiality. Each party will keep the terms of this Agreement confidential except as disclosure may be required by law or regulation. Each Party will treat all information, documents and other materials provided by the other Party hereunder as confidential and proprietary information of the disclosing Party, and the receiving Party agrees to maintain in confidence all such confidential information and will not divulge such confidential information in whole or in part to any third party (other than its employees, lenders, accountants, counsel and financial advisors) and except as required by law or regulation.

9

| 11. | REPRESENTATIONS AND WARRANTIES. |

| 11.1 | Representations and Warranties of Stillwater. |

11.1.1 Organization, Good Standing and Qualification. Stillwater is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware. Stillwater has all requisite corporate power and authority to own its property and assets and to carry on its business as now conducted and as currently proposed to be conducted. Stillwater is duly qualified to transact business and is in good standing in each other jurisdiction in which the failure to so qualify would have a material adverse effect on Stillwater. Stillwater has the power and authority to execute, deliver and perform its obligations under this Agreement.

11.1.2 Authorization. All corporate action on the part of Stillwater, its officers, directors and stockholders necessary (a) for the authorization, execution and delivery (or acceptance, as the case may be) of this Agreement and (b) for the performance of all obligations of Stillwater hereunder has been taken. The person executing this Agreement on behalf of Stillwater is authorized to execute this Agreement.

11.1.3 No Conflicts. The execution, delivery and performance of this Agreement will not (a) violate any provision of law or statute or any order of any court or other governmental authority binding on Stillwater; (b) contravene or conflict with Stillwater’s certificate of incorporation or bylaws; or (c) conflict with or result in any breach of any of the terms, conditions or provisions of, or constitute (with due notice or lapse of time or both) a default, or result in the creation of any lien upon any of the properties or assets of Stillwater, under any indenture, mortgage, lease agreement or other agreement or instrument to which Stillwater is a party or by which it or any of its property is bound or affected, except, for purposes of this clause (c), such conflict, breach or default as to which requisite waivers or consents shall have been obtained by Stillwater and delivered to Power Mount or which would not reasonably be expected to have a material adverse effect on Stillwater.

| 11.2 | Representations and Warranties of Power Mount. |

11.2.1 Organization, Good Standing and Qualification. Power Mount is a corporation duly organized, validly existing and in good standing under the laws of the Commonwealth of Kentucky. Power Mount has all requisite corporate power and authority to own its property and assets and to carry on its business as now conducted and as currently proposed to be conducted. Power Mount is duly qualified to transact business and is in good standing in each other jurisdiction in which the failure to so qualify would have a material adverse effect on Power Mount. Power Mount has the power and authority to execute, deliver and perform its obligations under this Agreement.

11.2.2 Authorization. All corporate action on the part of Power Mount, its officers, directors and stockholders necessary (a) for the authorization, execution and delivery (or acceptance, as the case may be) of this Agreement and (b) for the performance of all obligations of Power Mount hereunder has been taken. The person executing this Agreement on behalf of Power Mount is authorized to execute this Agreement.

10

11.2.3 No Conflicts. The execution, delivery and performance of this Agreement will not (a) violate any provision of law or statute or any order of any court or other governmental authority binding on Power Mount; (b) contravene or conflict with Power Mount’s certificate of incorporation or bylaws; or (c) conflict with or result in any breach of any of the terms, conditions or provisions of, or constitute (with due notice or lapse of time or both) a default, or result in the creation of any lien upon any of the properties or assets of Power Mount, under any indenture, mortgage, lease agreement or other agreement or instrument to which Power Mount is a party or by which it or any of its property is bound or affected, except, for purposes of this clause (c), such conflict, breach or default as to which requisite waivers or consents shall have been obtained by Power Mount and delivered to Power Mount or which would not reasonably be expected to have a material adverse effect on Power Mount.

| 12. | EVENTS OF DEFAULT. |

The occurrence at any time with respect to a Party of any of the events set forth in this Section 12 shall constitute an event of default (an “Event of Default”) with respect to such Party.

12.1 Failure to Pay. Failure by the Party to make, when due, any payment under this Agreement required to be made by it, if such failure is not remedied on or before the third (3rd) Business Day after notice of such failure is given to the Party.

12.2 Breach of Agreement. Failure by the Party to comply with or perform any material agreement or obligation (other than an obligation to make payment under this Agreement) to be complied with or performed by the Party in accordance with this Agreement if such failure is not remedied on or before the thirtieth (30th) day after notice of such failure is given to the Party.

12.3 Breach of Representations and Warranties. Any representation or warranty made by the Party contained in this Agreement was when given false or misleading in any material respect (provided, however, if any representation or warranty that is qualified by materiality, including with reference to a material adverse effect, shall prove to be false or misleading in any respect, the same shall be an Event of Default hereunder).

12.4 Bankruptcy. The Party (a) is dissolved (other than pursuant to a consolidation, amalgamation or merger); (b) admits in writing its inability generally to pay its debts as they become due; (c) makes a general assignment for the benefit of creditors; (d) institutes or has instituted against it a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or a petition is presented for its winding-up or liquidation, and in the case of any such proceeding or petition instituted or presented against it, such proceeding or petition is not dismissed, discharged, stayed or restrained in each case within 60 days of the institution or presentation thereof; (e) has a resolution passed for its winding-up or liquidation (other than pursuant to a consolidation, amalgamation or merger); (f) seeks or becomes subject to the appointment of an administrator, receiver, trustee or custodian or other similar official for it or for all or substantially all of its assets; (g) has a secured party take possession of all or substantially all its assets or has a distress, execution, attachment, sequestration or other legal process levied, enforced or sued on or against all or substantially all its assets and such secured party maintains

11

possession or any such process is not dismissed, discharged, stayed or restrained, in each case, within 30 days thereafter; or (h) takes any action in furtherance of or indicating its consent to approval of or acquiescence in any of the foregoing acts.

| 13. | TERMINATION. |

13.1 Event of Default. If at any time an Event of Default with respect to a Party has occurred and is then continuing, the other Party may, in addition to any other remedies available to such Party, terminate this Agreement by sending written notice of termination to the defaulting Party, which notice shall be effective, subject to Section 13.3, upon receipt by the defaulting Party.

13.2 Termination by Stillwater. Stillwater may terminate this Agreement by sending written notice of termination to Power Mount if Stillwater, in its sole discretion, has determined that the processing of Secondary Materials conflicts with Stillwater’s processing or production goals. Notice of termination pursuant to this Section 13.2 shall be effective, subject to Section 13.3, upon the ninetieth (90th) day following Power Mount’s receipt of such notice.

13.3 Effect of Notice of Termination. Upon notice of termination, Power Mount will make no further shipments of Secondary Materials to Stillwater. Subject to Sections 4, 5 and 6 hereof and provided Stillwater has accepted the Lot of Secondary Materials, Stillwater shall process all Secondary Materials that Power Mount had offered or shipped to Stillwater prior to termination. Until such time as all Secondary Materials delivered to Stillwater have been processed by Stillwater and payment for same has been received by Power Mount, this Agreement will continue in full force and effect. Termination shall be without prejudice to any right of action or claim accrued on or before the date of termination or pursuant to applicable law.

13.4 Survival. The provisions of Sections 4.3, 10, 13.3, 14, 16, 17 and 19 will survive termination.

| 14. | REFERRAL FEE PAYMENTS. |

14.1 PM Suppliers. From time to time, Power Mount may arrange with third party suppliers (each, a “PM Supplier”) to supply Secondary Materials directly to Stillwater. If Power Mount refers a PM Supplier to Stillwater and Stillwater enters into an agreement with such PM Supplier for the purchase and sale of Secondary Materials, Stillwater will pay to Power Mount a referral fee (the “PM Referral Fee”) as determined pursuant to this Section 14.

14.2 Calculation of PM Referral Fee. For each Lot of Secondary Materials delivered by a PM Supplier, Stillwater will calculate the amount due the PM Supplier under its applicable agreement (the “PM Supplier Payment”). Stillwater will pay to Power Mount a PM Referral Fee based on the PM Supplier Payment but calculated instead by substituting the Referral Fee Percentage (defined below) for each Metal for the stated return percentage for such Metal set forth in the agreement with the applicable PM Supplier (the “Applicable Supplier Percentage”). The “Referral Fee Percentage” shall be, with respect to each Metal, the difference between (a) the Return Percentage and Treatment Charge set forth in this Agreement and (b) the Applicable Supplier Percentage. Stillwater will provide Power Mount with advance written

12

notice of the Applicable Supplier Percentages for each PM Supplier. If the Return Percentage or Treatment Charge under this Agreement or the Applicable Supplier Percentage under any agreement with a PM Supplier are amended to increase or decrease such percentage, the Referral Fee Percentage shall be adjusted accordingly. The Referral Fee Percentage plus the Applicable Supplier Percentage for each Metal shall never exceed the Return Percentage for such Metal under this Agreement.

14.3 Payment of the PM Referral Fee. The PM Referral Fees for all shipment payments made to the PM Suppliers in any calendar month will be aggregated and paid to Power Mount within five (5) Business Days following the end of such calendar month. Stillwater may set-off any amounts that a PM Supplier owes to Stillwater against any amounts that Stillwater owes to Power Mount for a PM Referral Fee on that specific PM Supplier.

14.4 Stillwater’s Right to Terminate. Nothing in this Agreement shall limit Stillwater’s right to terminate or amend its agreement with any PM Supplier at any time for any reason or no reason.

| 15. | RELATIONSHIP OF THE PARTIES. |

Nothing contained in this Agreement shall be deemed to constitute either Party the partner of the other, nor, except as otherwise herein expressly provided, to constitute either Party the agent or legal representative of the other, nor to create any fiduciary relationship between them. It is not the intention of the Parties to create, nor shall this Agreement be construed to create, any mining, commercial or other partnership. Neither Party shall have any authority to act for or to assume any obligation or responsibility on behalf of the other Party, except as otherwise expressly provided herein. Each Party shall be responsible only for its obligations as herein set out and shall be liable only for its share of the costs and expenses as provided herein. Each Party shall indemnify, defend and hold harmless the other Party, its directors, officers, employees, agents and attorneys from and against any and all losses, claims, damages and liabilities claimed by any third party or parties arising out of any act or any assumption of liability by the indemnifying Party, or any of its directors, officers, employees, agents and attorneys done or undertaken, or apparently done or undertaken, on behalf of the other Party, except pursuant to the authority expressly granted herein or as otherwise agreed in writing between the Parties.

| 16. | FORCE MAJEURE. |

16.1 Definition. The term “Force Majeure” as employed herein, shall mean acts of God, strikes, insurrections, lockouts or other labor or industrial disturbances, unavoidable accidents, uncontrollable delays in transportation, compliance with any state or federal laws, regulations or requirements (expressly including inability to obtain necessary governmental approvals, licenses or permits on reasonably acceptable terms), inability to obtain timely refining of materials, actions of any competent governmental authority or agency, court orders, future orders of any regulatory body having jurisdiction, acts of the public enemy, terrorist acts, wars (declared or undeclared), riots, sabotage, blockades, embargoes, shortages of or inability to secure fuel, power, contractors, labor, raw materials, railroad or transport facilities, failure of, damage to or destruction of machinery, plant and equipment, earthquakes, snowslides,

13

landslides, lightning, weather conditions materially preventing or impairing work, fires, storms, floods, washouts and explosions, or other matters beyond the reasonable control of the Party obligated to perform, whether similar to matters herein specifically enumerated or not; provided, however, that performance shall be resumed within a reasonable period of time after such cause has been removed; and provided, further, that neither Party shall be required against its will to adjust any labor dispute or to question the validity of or to refrain from judicially testing the validity of any federal, state or local order, regulation or statute.

16.2 Effect of Occurrence. If either Party is rendered unable, wholly or in part, by Force Majeure applying to it, to carry out its obligations under this Agreement, it is agreed that such obligations of such Party, so far as they are affected by such Force Majeure, shall be suspended during the continuance of any inability so caused, but for no longer period, and that the various periods and terms provided for herein shall be extended for a period equivalent to such period of Force Majeure. The Party claiming that an event of Force Majeure has occurred will promptly notify the other Party of the commencement and termination of any event of Force Majeure.

| 17. | NO IMPLIED COVENANTS. |

There are no implied covenants contained in this Agreement other than those of good faith and fair dealing.

| 18. | COMPLIANCE WITH LAWS. |

To the extent applicable, the Parties agree to comply in all material respects with all laws, ordinances, rules, codes, regulations and lawful orders of any federal, state or local governmental authority applicable to performance of this Agreement. Without limiting the generality of the foregoing, (i) each Party represents that it will not engage in any business practice that is in violation of the Foreign Corrupt Practices Act of 1977, as amended, or applicable similar laws; and (ii) Power Mount shall comply with all Environmental Laws applicable to the sorting, handling, testing, loading, transporting, and delivery of the Secondary Materials to Stillwater. Power Mount shall ensure that the Secondary Materials are properly contained, secured, labeled, marked, documented, and inspected at all times during the course of sorting, handling, testing, loading, transporting, and delivering so as to comply with all applicable Environmental Laws. Power Mount shall further ensure that its employees, contractors, and agents have been properly trained and are properly supervised with respect to the sorting, handling, testing, loading, transporting, and delivery of the Secondary Materials to Stillwater. If Power Mount engages third parties for the requirements outlined herein, Power Mount shall exercise due care to select persons who will perform the functions to the same standards required by the Power Mount herein. Power Mount shall monitor such third parties to ensure that such persons comply with all applicable Environmental Laws for sorting, handling, testing, loading, transporting, and delivering Secondary Materials to Stillwater.

| 19. | MISCELLANEOUS. |

19.1 Entire Agreement. This Agreement represents the complete agreement between the Parties hereto and supersedes all prior or contemporaneous oral or written agreements between Power Mount and Stillwater to the extent they relate in any way to the subject matter hereof.

14

19.2 Binding Effect; Assignment. This Agreement shall bind and inure to the benefit of and be enforceable by the Parties hereto and may not be assigned by either Party without the prior written consent of the other Party, which consent shall not be unreasonably withheld. Notwithstanding the foregoing, the consent of Power Mount shall not be required with respect to (a) any assignment by Stillwater to provide security in connection with any financing, expressly including, by way of example and not limitation, assignments of royalty, overriding royalties or net profits interests or production payments, or (b) any merger, consolidation or other reorganization or transfer by operation of law involving Stillwater or any purchase or sale of substantially all of the assets of Stillwater, provided that, as to this clause (b), Stillwater notifies Power Mount of the assignment and the name and address of the assignee,

19.3 Amendment and Waiver. Except as otherwise provided herein, no modification, amendment or waiver of any provision of this Agreement shall be effective against either Party unless such modification, amendment or waiver is approved in writing by the Parties hereto. The failure by either Party to demand strict performance and compliance with any part of this Agreement shall not be deemed to be a waiver of the rights of such Party under this Agreement or by operation of law. Any waiver by either Party of a breach of any provision of this Agreement shall not operate as or be construed as a waiver of any subsequent breach thereof.

19.4 Notices. Unless otherwise stated in this Agreement, any notice, election, report or other correspondence (collectively, “Notices”) required or permitted hereunder shall be in writing and (i) delivered personally to the individual listed below for Notices (or an officer) of the party to whom directed; (ii) sent by registered or certified United States mail, postage prepaid, return receipt requested; (iii) sent by reputable overnight courier; (iv) sent by facsimile transmission with confirmation of receipt; or (v) to the extent specifically provided for in this Agreement, sent by email. All such Notices shall be addressed to the party to whom directed as follows:

| If to Stillwater: | Stillwater Mining Company 1600 1st Ave. South Columbus, Montana 59019 Attn: Metals Marketing Department Phone: 406-373-8711 or 406-373-8883 Facsimile: 406-322-6357 Email: JBinando@stillwatermining.com |

15

| With copies to: | Stillwater Mining Company 1321 Discovery Drive Billings, Montana 59102 Attn: Smelter Manager Phone: 406-322-8901 Facsimile: 406-322-5975 Email: GRoset@stillwatermining.com Attn: Secondary Business Supervisor Phone: 406-322-8904 Facsimile: 406-322-5975 Email: MGaustad@stillwatermining.com | |||

| In the event of notices sent pursuant to Section 12 and Section 13, with copies to: |

Stillwater Mining Company 1321 Discovery Drive Billings, Montana 59102 Attn: General Counsel Phone: 406-373-8792 Facsimile: 406-373-8701 Email: BWadman@stillwatermining.com | |||

| If to Power Mount: | Power Mount Incorporated 2260 Highway 192 Somerset, KY 42501 Attn: Paul Meece, President Phone: 606-678-5584 Facsimile: 606-679- 4188 Email: DMeece@powermount.net | |||

Either party may, from time to time, change its address for future Notices hereunder by Notice in accordance with this Section 19.4. All Notices shall be complete and deemed to have been given or made (i) when delivered personally to an officer of the party to whom delivered, (ii) within three (3) Business Days of when sent if sent via registered or certified United States mail; (iii) when sent if sent by reputable overnight courier, (iv) when receipt is confirmed if sent by facsimile transmission; or (v) when sent if sent via email.

19.5 Severability. Whenever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement is held to be invalid, illegal or unenforceable in an respect under any applicable law or rule in any jurisdiction, such invalidity, illegality or unenforceability shall not affect the validity, legality or enforceability of any other provision of this Agreement in such jurisdiction or affect the validity, legality or enforceability of any provision in any other jurisdiction, but this Agreement shall be reformed, construed and enforced in such jurisdiction as if such invalid, illegal or unenforceable provision had never been contained herein.

19.6 Governing Law. The Parties are domiciled in two different states. In order to create greater certainty with respect to their legal rights and obligations under this Agreement, the Parties desire to adopt as the substantive law of this Agreement the laws of a state that has a

16

well developed commercial law and precedent and that is not the domicile of either party. The Parties hereby agree that this Agreement shall be construed in accordance with the laws of the State of Colorado as though this Agreement were performed in full in the State of Colorado, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Colorado or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Colorado.

19.7 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument.

19.8 Waiver of Jury Trial; Jurisdiction. ANY CONTROVERSY OR CLAIM BETWEEN THE PARTIES ARISING OUT OF OR RELATING TO THIS AGREEMENT OR ANY AGREEMENTS OR INSTRUMENTS RELATING HERETO OR DELIVERED IN CONNECTION HEREWITH SHALL BE TRIED TO A COURT AND NOT A JURY. EACH PARTY WAIVES ITS RIGHTS TO A JURY. THE PARTIES STIPULATE THAT ALL LITIGATION UNDER THIS AGREEMENT WILL BE BROUGHT IN THE FEDERAL DISTRICT COURT LOCATED IN THE CITY AND COUNTY OF DENVER, COLORADO, AND EACH OF THE PARTIES HEREBY SUBMITS TO THE PERSONAL JURISDICTION OF SUCH COURT.

19.9 Counterparts; Construction. This Agreement may be executed in counterparts, each of which shall be deemed an original and all of which together shall constitute one instrument. The Parties agree that any rule of construction to the effect that ambiguities are to be resolved against the drafting party shall not be applied in the construction or interpretation of this Agreement. The Parties acknowledge that each of them has had the benefit of legal counsel of its own choice and has been afforded an opportunity to review this Agreement with its legal counsel and that this Agreement shall be construed as if jointly drafted by Stillwater and Power Mount.

19.10 Further Documents. At the request of either Party, the Parties shall execute and deliver any further instruments, agreements, documents or other papers reasonably requested by that Party to effect the purposes of this Agreement and the transactions contemplated hereby

[SIGNATURE PAGE FOLLOWS.]

17

IN WITNESS WHEREOF, the Parties have executed this instrument effective as of the date first above written.

| STILLWATER MINING COMPANY | POWER MOUNT INCORPORATED | |||||||

| By: | /s/ Terrell Ackerman |

By: | /s/ Paul Meece | |||||

| Name: Terrell I. Ackerman | Name: Paul Meece | |||||||

| Title: Interim - Chief Executive Officer | Title: President | |||||||

18

APPENDIX A

A-1

APPENDIX B

Example - Payment Calculations

Pursuant to an emailed request for price quote, Power Mount offers 100 Platinum Ounces, 50 Palladium Ounces and 25 Rhodium Ounces to Stillwater with an Estimated Delivery Date of 30 days from the date of the request for price quote. Power Mount elects to set a Purchase Price 20 days prior to the Estimated Delivery Date. Stillwater sets the Purchase Price at $1,800 per ounce for Platinum, $800 per ounce for Palladium and $2,400 per ounce for Rhodium. Power Mount sends Shipping Documentation to Stillwater four days prior to the Estimated Delivery Date.

Stillwater determines the Offered Metal Value to be $268,000 and agrees to make a Prepayment three days prior to the Estimated Delivery Date. Stillwater’s Cost of Borrowing at the time of the Prepayment is 7.5% and at the time of the Final Payment is 7.5%. The Value Date is the 84th day following delivery of the Lot at the Facility. There is no exchange of assays; therefore, the Final Payment Date is 33 days (based on completion of final assays) following delivery of the Lot to Stillwater.

Prepayment. Stillwater makes a Prepayment to Power Mount calculated as follows:

| Offered Metal Value Multiplied by [***] |

$ | [***] | ||

| Less: |

||||

| Prepayment Finance Charge (product of (a) $[***], (b) .075 and (c) 87/360 |

[***] | |||

|

|

|

|||

| Prepayment |

$ | [***] |

Final Payment. Final Ounces contained of each Metal are determined to be as follows: 98 ounces of Platinum, 48 ounces of Palladium and 23 ounces of Rhodium. The Final Payment owed to Power Mount would be calculated as follows:

| Sum of the Final Lot Values |

$ | 258,588 | ||

| Less: |

||||

| Final Treatment Charge |

[***] | |||

| Prepayment |

[***] | |||

| Prepayment Finance Charge |

[***] | |||

| Final Payment Finance Charge (product of (a) [***] (b) .075 and (c) 51/360 |

[***] | |||

|

|

|

|||

| Final Payment |

$ | [***] |

B-1

SCHEDULE 1

TERMS

| 1. | Prepayment Percentage: [***] |

| 2. | Return Percentage: |

Platinum – [***]

Palladium – [***]

Rhodium – [***]

| 3. | Treatment Charge |

[***] wet lb. of catalyst received and accepted

B-2