Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enertopia Corp. | form8k.htm |

| EX-10.1 - EXHIBIT 10.1 - Enertopia Corp. | exhibit10-1.htm |

| EX-99.1 - EXHIBIT 99.1 - Enertopia Corp. | exhibit99-1.htm |

| EX-10.3 - EXHIBIT 10.3 - Enertopia Corp. | exhibit10-3.htm |

NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain information in this Offering Memorandum is “forward looking information” within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” or other similar words, or statements that certain events or conditions “may” or “will” occur. Forward looking information involves significant known and unknown risks and uncertainties. A number of factors, many of which are beyond the control of the Issuer, could cause actual results to differ materially from the results discussed in the forward looking information. Although the forward looking information contained in this Offering Memorandum is based upon assumptions which management of the Issuer believes to be reasonable, the Issuer cannot assure investors that actual results will be consistent with this forward looking information. Because of the risks, uncertainties and assumptions inherent in forward looking information, prospective investors in the Issuer’s securities should not place undue reliance on this forward looking information.

In particular, this Offering Memorandum contains forward looking information pertaining to business development plans, mineral exploration and other expectations, beliefs, plans, goals, objectives, assumptions, information. Undue reliance should not be placed on forward-looking information. Forward-looking information is based on current expectations, estimates and projections that involve a number of risks which could cause actual results to vary and, in some instances to differ materially from those anticipated by the Issuer and described in the forward-looking information contained in this Offering Memorandum.

Some but not all of the factors affecting forward-looking statements include: the speculative nature of mining exploration, production and development activities; limited history of the new Canadian medical marihuana purposes regulations; changes in reserve estimates; the productivity of the Issuer's proposed properties; changes in the operating costs; changes in economic conditions and conditions in the resource, foreign exchange and other financial markets; changes of the interest rates on borrowings; hedging activities; changes in commodity prices; changes in the investments and exploration expenditure levels; litigation; legislation; environmental, judicial, regulatory, political and competitive developments in the industries and areas in which the Issuer operates; inability to secure required financing; technological, and mechanical and operational difficulties encountered in connection with the Issuer's exploration and development activities. The foregoing list of risk factors is not exhaustive. Prospective investors should refer to the risk disclosures set out in the periodic reports and other disclosure documents filed by the Issuer from time to time with regulatory authorities.

Forward-looking information is based on the estimates and opinions of the Issuer at the time the information is presented. The Issuer assumes no obligation to update forward-looking information should circumstances or the Issuer’s estimates or opinions change, except as required by law.

PROSPECTIVE INVESTORS SHOULD THOROUGHLY REVIEW THIS OFFERING MEMORANDUM AND ARE ADVISED TO CONSULT WITH THEIR OWN LEGAL AND TAX ADVISORS CONCERNING THIS INVESTMENT.

2

ENERTOPIA CORPORATION

OFFERING MEMORANDUM

Form 45-106F3

January •, 2014

Form 45-106F3 – Offering Memorandum for Qualifying Issuers

| Date: | January 16, 2014. |

| The Issuer: | |

| Name: | Enertopia Corp. (the "Issuer" or the “Company”) |

| Head

Office: |

950 – 1130 West Pender Street Vancouver, British Columbia Canada, V6E 4A4 |

| Issuer’s

Solicitors: |

Macdonald Tuskey, Corporate and Securities

Lawyers 4th Floor - 570 Granville Street, Vancouver BC V6C 3P1 |

| Phone Number: | 604-602-1675 |

| E-mail address: | mcallister@enertopia.com |

| Fax Number: | 604-685-1602 |

| Current Listing and/or | The Issuer is quoted for trading on the Over-the-Counter Bulletin Board and listed for |

| Quotation: | trading on the Canadian Securities Exchange. |

| Reporting Jurisdictions: | The Issuer reports in the Provinces of British Columbia and Ontario and in the United States. |

| The Offering: | |

| Securities Offered: | Up to 10,000,000 units (the "Units"), each Unit to consist of one common share of the Issuer (each, a “Share”) and one half (1/2) of one non-transferable Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.15 per Warrant Share for a period of twenty- four (24) months following closing. See Item 5. |

| Price per Security: | US$0.10 per Unit |

| Maximum

Offering: |

The offering of Units is subject to a maximum

overall subscription of 10,000,000 Units for gross proceeds of

US$1,000,000 (the “Maximum Subscription”). There is no minimum.

You may be the only purchaser. Funds available under the offering may not be sufficient to accomplish our proposed objectives. |

| Minimum Subscription Amount: | Each investor must invest a minimum of US$1,000. |

| Payment terms: | The subscription proceeds must accompany the form of subscription agreement attached to and forming a part of this Offering Memorandum, and shall be paid by immediately available good funds in US currency, drawn on a Canadian, or other chartered bank reasonably acceptable to the Issuer, made payable by certified cheque and/or bank draft and made payable and delivered to the Issuer, at Suite 950 - 1130 West Pender Street, Vancouver BC V6E 4A4. Alternatively, payment of the subscription proceeds can be made by wire transfer of funds to a bank account of the Issuer, the particulars of which will be provided to investors. |

| Proposed Closing Date: | Closings will occur periodically on a "first come, first served" basis. See Item 5. |

| Income Tax Consequences: | There are important tax consequences to these securities. See item 6. |

2

| Selling Agent: | Yes. See item 7. |

| Resale Restrictions: |

You will be restricted from selling your

securities for 4 months and a day. See item 10. There are also United States resale restrictions on the securities. |

| Purchaser’s Rights: | You have two business days to cancel your agreement to purchase these securities. If there is a misrepresentation in this Offering Memorandum, you have the right to sue either for damages or to cancel the agreement. See item 11. |

No securities regulatory authority or regulator has assessed the merits of these securities or reviewed this Offering Memorandum. Any representation to the contrary is an offence. This is a risky investment. See item 8.

Currency

In this Offering Memorandum, unless otherwise noted, all dollar amounts are expressed in US dollars.

ITEM 1: USE OF AVAILABLE FUNDS

Available Funds

Upon completion of the Offering, the Issuer anticipates that the following funds will be available to it for the next twelve month period:

| Assuming Completion of the Maximum Subscription(1) | ||

| A | Amount to be raised by this offering | $1,000,000 |

| B | Selling commissions and fees | $80,000 |

| C | Estimated offering costs (e.g., legal, accounting, audit) | $30,000 |

| D | Available funds: D = A – (B + C) | $890,000 |

| E | Additional sources of funding required | $0 |

| F | Working capital deficiency (As at December 31, 2013) | ($398,161) |

| G | Total: G = (D + E) – F | $491,839 |

(1) There is no minimum subscription in the Offering.

Use of Available Funds

The Issuer anticipates that up to $890,000 will be available to it upon completion of the Maximum Subscription. No funds will be applied towards the Issuer’s working capital deficiency. The principal purposes for which these funds will be used over the next twelve months are as follows:

| Description | Assuming Completion of the Maximum Subscription(1) |

| Payments under Joint Venture Agreement dated January 16, 2014 and pursuit of similar opportunities in legal Marijuana | $575,000 |

| General and Administrative Expenses | $315,000 |

| Total: | $890,000 |

(1) There is no minimum amount for the Offering.

Reallocation

We intend to spend the available funds as stated. We will reallocate funds only for sound business reasons.

Insufficient Funds

The funds available as a result of the Offering may not be sufficient to accomplish the Issuer’s proposed objectives and there is no assurance that alternative financing will be available.

ITEM 2: INFORMATION ABOUT THE ISSUER

General

The Issuer is a mineral resource and renewable energy company that is pursuing business opportunities in the Canadian medical marihuana sector and clean technology sectors.

Reference is made to Item 1. (Business) in the Issuer’s Form 10-Q (Quarterly Information Form), filed on SEDAR on January 14, 2014, for disclosure relating to the Issuer’s business history and current business.

Canadian medical marihuana division

On January 16, 2014, the Issuer entered into a joint venture agreement (the "Joint Venture Agreement") with World of Marihuana Productions Ltd. ("WOM") pursuant to which the Issuer may acquire up to a 51% interest in the medical marihuana business of WOM (the "Business"). WOM is currently in the process of applying to Health Canada to become a "Licensed Producer" pursuant to Canada's new Medical Marihuana Purposes Regulations ("MMPR"). The new MMPR regime is expected to streamline

the process for patients and health care practitioners, enabling patients to purchase quality-controlled medical marihuana directly from a Licensed Producer approved by Health Canada.

Specifically, the terms of the Joint Venture Agreement provide that in order to earn its 51% interest, the Issuer is required to make aggregate cash payments of CDN$1,375,000 and issue an aggregate of 20,000,000 shares of its common stock all over a four year period WOM. To date, the Issuer has issued 10,000,000 shares to WOM, which are subject to applicable hold periods under Canadian and United States securities laws. In the event WOM has not been designated as a Licensed Producer by Health Canada by January 16, 2015, WOM will be entitled to retain the cash payments paid to it under the Joint Venture Agreement to that point but will be required to return all but 5,000,000 shares to the Issuer.

Reference is made to the Issuer's News Release dated January 16, 2014, Material Change Report dated 16, 2014 for further information regarding the Joint Venture Agreement.

Oil & Gas Division

On September 17, 2013 the Issuer signed an AMI for the option to drill up to 100 light oil wells in Venango and Warren Co, PA.

Terms of the AMI:

Issued to Downhole Energy LLC the 100,000 common shares in the capital stock of the Issuer as soon as practicable following the execution of the Agreement (PAID),

Drilling up to 10 wells in year one and issuing 10,000 common shares per producing well after 60 days of commercial production on or before the first anniversary of this Agreement,

Drilling up to 20 wells in year two and issuing 10,000 common shares per producing well after 60 days of commercial production on or before the second anniversary of this Agreement,

Drilling up to 30 wells in year three and issuing 10,000 common shares per producing well after 60 days of commercial production on or before the third anniversary of this Agreement, and

Drilling up to 40 wells in year four and issuing 10,000 common shares per producing well after 60 days of commercial production on or before the fourth anniversary of this Agreement.

Oil Field History

The oil field was first developed for commercial production by Quaker State Oil in the 1970’s. Well spacing was conducted on 600 foot spacing with the Red Valley and 2nd Sands formations being the main formations that were targeted and exploited. Formation depth was from 680’ to 980’ in depth. Recent work by the vendor has resulted in the successful exploitation for the deeper 3rd and 4th sands to depths of 1,300’

Proven and Probable Oil Reserves

None attributable to the Company today

Current Oil Production

42 currently producing oil wells on the leases under the AMI but excluded from the AMI agreement.

Oil Development Proposal

Downhole Energy LLC. hereby grants to the Issuer the Participation right to acquire up to an undivided 100% gross, 75% net revenue interest to Downhole Energy, LLC right, title and interest in and to the 100 wells the Issuer funds, free and clear of all charges, encumbrances, claims, liabilities and adverse interests of any nature or kind.

Reference is made to Item 1. (Business) in the Issuer’s Form 10-Q (Quarterly Information Form), filed on SEDAR on January 14, 2014, for disclosure relating to the AMI property agreement for the Downhole Energy LLC agreement.

Clean Technology Division

The Issuer is currently involved in the following clean technology sectors, Solar Thermal (Hot Water), Energy Retrofits and Recovery and Solar powered Filtered Drinking Water.

The Issuer’s involvement in the clean technology sector is indirect through equity holdings in companies that are involved in each respective sector.

The Issuer, as of November 30, 2013, held an 8.14% interest in Global Solar Water Power Systems Inc., (“GSWPS”) a private company beneficially owned by Mark Snyder, our company’s former Chief Technical Officer and now our clean energy advisor. GSWPS owns certain technology invented and developed by Mark Snyder for the design and manufacture of certain water filtration equipment, and is pursuing other clean energy opportunities. Current products offered by GSWPS include a portable solar powered trailer mounted water purification unit that can be delivered and operated nearly anywhere in the world and can provide a village, resort, or remote work-camps with all their drinking water and domestic water requirements.

Note: On December 2, 2013 the Issuer sold its equity interest in Pro Eco Energy Ltd. as per disclosure on both EDGAR and SEDAR, and is listed in the Description of Document table below.

Reference is made to Item 1. (Business) in the Issuer’s Form 10-Q (Quarterly Information Form), filed on SEDAR on January 14, 2014, for disclosure relating to the Issuer’s clean technology division.

Existing Documents Incorporated by Reference

Information has been incorporated by reference into this Offering Memorandum from documents listed in the table below, which have been filed with securities regulatory authorities or regulators in Canada. The documents incorporated by reference are available for viewing on the SEDAR website at www.sedar.com. In addition copies of the documents may be obtained on request without charge from the Issuer at Suite 950, 1130 West Pender St, Vancouver, BC V6E-4A4 or from our Solicitors Macdonald Tuskey, Corporate and Securities Lawyers at 4th Floor - 570 Granville Street, Vancouver BC V6C 3P1

Documents listed in the table and information provided in those documents are not incorporated by reference to the extent that their contents are modified or superseded by a statement in this Offering Memorandum or in any other subsequently filed document that is also incorporated by reference in this Offering Memorandum.

| Description of Document | Date of Document and/or SEDAR Filing |

| Material Change Report announcing entry into Joint Venture Agreement | January 16, 2014 |

| News Release of the Issuer, announcing entry into Joint Venture Agreement | January 16, 2014 |

| Quarterly Financial Statements ( Form 10-Q) ( includes November 30, 2013 Financial Statements and MD&A) | January 13, 2014 |

| Material Change Report announcing Corporate Development Consultant | January 13, 2014 |

| News Release of the issuer, announcing terms of Offering | January 10, 2014 |

| Press Release of the Issuer announcing Social Media & Marketing Program | January 2, 2014 |

| Material Change Report announcing Second Tranche Closing | December 23, 2013 |

| Press Release of the Issuer, Corporate update and MMJ Summary | December 18, 2013 |

| Press Release of the Issuer, MMJ update | December 11, 2013 |

| Annual Financial Statements (Form 10-K) (includes August 31, 2013 Financial Statements and MD&A) | December 6, 2013 |

| Material Change Report announcing sale of Pro Eco Energy | December 2, 2013 |

| Material Change Report of the Issuer, announcing First Tranche Closing | November 26, 2013 |

| Material Change Report announcing IR Coal Harbor Communications | November 18, 2012 |

| News Release of the Issuer, announcing terms of the Offering | November 12, 2013 |

| Press Release relating to Medical Marijuana Update | November 7, 2013 |

| Material Change Report for Medical Marijuana intent of Acquisition | November 4, 2013 |

| Material Change Report announcing the signing of Olibri Consulting for acquisitions | October 4, 2013 |

| Material Change Report relating to the dissemination of news regarding proposed financing for $1,070,000 for oil field development | September 24, 2013 |

| Description of Document | Date of Document and/or SEDAR Filing |

| Material Change Report relating to AMI Participation Agreement | September 19, 2013 |

Existing Documents Not Incorporated by Reference

Other documents available on the SEDAR website (for example, most press releases, take-over bid circulars, prospectuses and rights offering circulars) are not incorporated by reference into this Offering Memorandum unless they are specifically referenced in the table above. Your rights as described in Item 11 of this Offering Memorandum apply only in respect of information contained in this Offering Memorandum and documents or information incorporated by reference.

Future Documents Not Incorporated by Reference

Documents filed after the date of this Offering Memorandum are not deemed to be incorporated into this Offering Memorandum. However, if you subscribe for securities and an event occurs, or there is a change in the Issuer's business or affairs, that makes the Certificate to this Offering Memorandum no longer true, the Issuer will provide you with an update of this Offering Memorandum, including a newly dated and signed Certificate, and will not accept your subscription until you have re-signed the subscription agreement.

ITEM 3: INTERESTS OF DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND PRINCIPAL HOLDERS

To the knowledge of the Issuer, the following persons or company beneficially owns, directly or indirectly, or exercises control or direction over, Common Shares carrying more than 10% of the voting rights attached to the outstanding Common Shares of the Issuer as at January 14, 2014.

Name and Address of Beneficial Owner |

Position with the Issuer |

Amount and Nature

of Beneficial Ownership |

Percentage of Class |

| Robert McAllister Kelowna, British Columbia, Canada |

President, CEO and Director |

4,295,000(1) |

6.47% |

| Bal Bhullar Vancouver, British Columbia, Canada |

Chief Financial Officer |

751,000(2) |

1.13% |

| Donald Findlay Calgary, Alberta, Canada |

Director |

3,652,000(3) |

5.50% |

| Greg Dawson Vancouver, British Columbia, Canada |

Director |

500,000(4) |

0.75% |

| John Thomas Vancouver, British Columbia, Canada |

Director |

900,000(5) |

1.36% |

| 0984329 B.C. LTD | 10% Shareholder | 15,000,000(6) | 22.61% |

Notes: (1) Consists of beneficial ownership of an aggregate of 4,295,000 shares of common stock of the Issuer broken down as follows: (i) 3,210,000 shares of common stock held directly by Mr. McAllister, and (ii) 280,000 shares of common stock acquirable on exercise of outstanding warrants, and (iii) 805,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days of the date hereof.

(2) Consists of beneficial ownership of an aggregate of 751,000 shares of common stock of the Issuer broken down as follows: (i) 1,000 shares of common stock held directly by Ms. Bhullar, and (ii) 750,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days of the date hereof.

(3) Consists of beneficial ownership of an aggregate of 3,652,000 shares of common stock of the Issuer broken down as follows: (i) 1,702,000 shares of common stock held directly by Mr. Findlay, and (ii) 1,700,000 shares of common stock acquirable on exercise of outstanding warrants, (iii) 250,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

(4) Consists of beneficial ownership of an aggregate of 500,000 shares of common stock of the Issuer broken down as follows: (i) 100,000 shares of common stock held directly by Mr. Dawson, and (ii) 100,000 shares of common stock acquirable on exercise of outstanding warrants, (iii) 300,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

(5) Consists of beneficial ownership of an aggregate of 900,000 shares of common stock of the Issuer broken down as follows: (i) 300,000 shares of common stock held directly by Mr. Thomas, and (ii) 300,000 shares of common stock acquirable on exercise of outstanding warrants, (iii) 300,000 shares of common stock acquirable on exercise of outstanding stock options within 60 days hereof.

(6) Consists of beneficial ownership of an aggregate of 15,000,000 shares of common stock of the Issuer.

You can obtain further information about directors and executive officers from the Issuer’s Form 10-K (Annual Information Form) filed on SEDAR on December 6, 2013.

Current information regarding the securities held by directors, executive officers and principal holders can be obtained from the SEDI website at www.sedi.ca and from the U.S. Securities and Exchange Commission’s EDGAR system at www.sec.gov. The Issuer cannot guarantee the accuracy of this information.

Loans

A loan exists in the form of a CDN $50,000 non secured loan bearing 10%, repayable at any time by the Company and currently on a month to month basis. The lender is President and a Director of the Company.

ITEM 4: CAPITAL STRUCTURE

| Description of security | Number authorized to be issued | Price per security | Number outstanding as at January 16, 2014 | Number outstanding after completion of Maximum Subscription |

| Common Shares | 200,000,000 | N/A(1) | 51,862,415 | 61,862,415 |

| Offering Warrants(2) | 5,400,000 | US$0.15 | 5,400,000 | 5,400,000 |

| Warrants(3) | 10,880,600 | US$0.10 - $0.20 | 10,880,600 | 10,880,600 |

| Options(4) | 3,605,000 | US$0.06 – US$0.25 | 3,605,000 | 3,605,000 |

| TOTAL | 66,348,015 | 81,748,015 |

Notes:

| (1) |

Common shares of the Issuer have been issued from treasury at prices ranging from US$0.02 per share to US$0.50 per Share. |

| (2) |

Represents the Warrants to be issued under this Offering (including broker warrants), exercisable to acquire common shares at an exercise price of US $0.15 per common share for a period of 24 months from the date of issuance. |

| (3) |

Represents an aggregate of 5,429,800 warrants exercisable at the price of US $0.20 until April 16, 2014, July 27, 2015, August 24, 2015, September 28, 2015, November 15, 2015 and exercisable at a price of US $0.10 until November 16, 2016 and December 23, 2016. |

| (4) |

Represents incentive stock options granted pursuant to the Issuer’s former and current equity compensation and stock option plans. |

ITEM 5: SECURITIES OFFERED

Terms of Securities

The Issuer is offering for sale by way of private placement (the "Offering") up to 10,000,000 units (the "Units"), each Unit to consist of one common share (each, a “Share”) of the Issuer and one half (1/2) of one non-transferable Share purchase warrant (each whole warrant, a “Warrant”). Each Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.15 per Warrant Share for a period of twenty four (24) months following closing.

The Warrants are subject to an early acceleration provision pursuant to which, in the event that the Company’s common shares at any time after 4 months and 1 day have elapsed from the closing of the Offering, as listed on a Principal Canadian Market – currently the Canadian Securities Exchange with symbol TOP, has been at or above CDN$0.30 for a period of 20 consecutive trading days, the Company may, within five (5) days thereafter issue to the Subscribers a written notice advising of the accelerated expiry of the Warrants. Such written notice shall identify in reasonable detail the particulars of the acceleration event and identify the date (the "Warrant Accelerated Expiry Date") set for accelerated expiry, which in no event shall be less than 30 days after the mailing date of the written notice. For greater certainty, all Warrants shall expire and be of no further force or effect as of 4:30 pm (Pacific Time) on the Warrant Accelerated Expiry Date.

The holders of common shares are entitled to one vote at meetings of shareholders for each share held and all common shares rank equally with respect to the payment of dividends and on any distribution of the assets of the Issuer on dissolution or winding up.

Reference is also made to Item 7 (Compensation Paid to Sellers and Finders) below for particulars with respect to commissions and finders' fees payable in connection with the Offering.

Subscription Procedure

In order to subscribe for the Units, purchasers will be required to complete and deliver the following documents to the Issuer or its legal counsel on or before January 31, 2014, or such other date as the Issuer may determine.

| 1. |

a completed subscription agreement in the form attached hereto as Schedule "A", with such subscription agreement containing, among other things, representations by the subscriber that it is duly authorized to purchase the Units, that it is purchasing the Units for investment and not with a view for resale, and as to its status to purchase the Units on a private placement basis; |

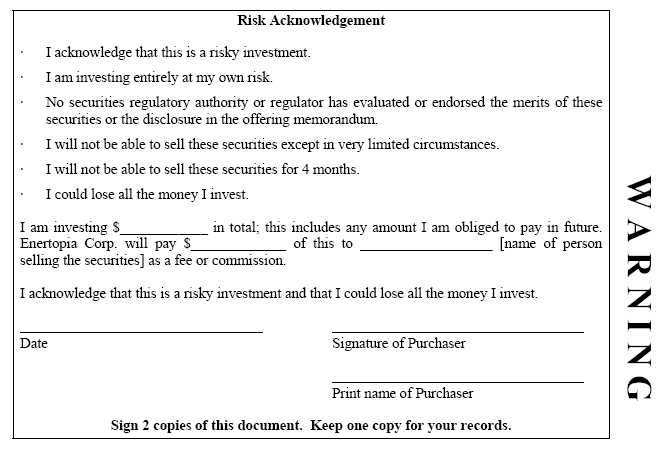

| 2. |

a completed copy of a Risk Acknowledgment (Form 45-106F4) in the form attached hereto as Schedule "B"; and |

| 3. |

cash, solicitor's trust cheque, certified cheque, bank draft, money order in the amount of your investment payable to "Enertopia Corporation". |

Your subscription funds will be held in trust until midnight on the second business day after the day on which the Issuer or its legal counsel received your signed subscription agreement and if the closing is after this time, the Issuer and/or its legal counsel will hold the funds in trust pending closing. We expect to close this Offering on or before Janaury 31, 2014.

The Issuer reserves the right to accept or reject subscriptions in whole or in part at its discretion and to close the subscription books at any time without notice. Any subscription funds or subscriptions that the Issuer does not accept will be returned promptly after it has been determined not to accept the funds.

At the closing of the Offering, or as soon as practicable thereafter, you will receive certificates representing the Shares and certificates representing the Warrants, provided that the subscription price has been paid in full.

ITEM 6: INCOME TAX CONSEQUENCES AND RRSP ELIGIBILITY

The Issuer has not undertaken a study of potential income tax consequences to investors.

You should consult your own professional advisers to obtain advice on the income tax consequences that apply to you.

Not all securities are eligible for investment in a registered retirement savings plan (“RRSP”) . You should consult your own professional advisers to obtain advice on the RRSP eligibility of these securities.

ITEM 7: COMPENSATION PAID TO SELLERS AND FINDERS

The Issuer may pay finder's fees to certain arm's length parties (the "Finders") in connection with the completion of the Offering and in accordance with application securities laws. Such finder's fee will be equal to 8% of the aggregate subscription proceeds realized from the sale of the Units by the respective Finder, payable in cash or Shares, and Broker’s warrants equal to 8% of the aggregate Units sold by the applicable Finder. Each broker’s Warrant will be exercisable into one further Share (a “Warrant Share”) at a price of US$0.15 per Warrant Share for a period of twenty four (24) months following closing of the Offering.

ITEM 8: RISK FACTORS

Investment in the Units should only be made after consulting with independent and qualified sources of investment and tax advice. Investment in the Units at this time is highly speculative due to the stage of the Issuer’s development and requirement to raise additional financing to carry out the long-term business objectives of the Issuer. Any investment in the Issuer at this stage involves a high degree of risk.

Reference is made to Item 1A. (Risk Factors) in the Issuer’s Form 10-Q (Quarterly Information Form), filed on SEDAR on January 14, 2014, for a discussion of the risks and uncertainties that the Issuer believes to be material.

Additional risk factors relating to the Offering include:

| 1. |

Purchasers of the Units will not have the benefit of a review of this Offering Memorandum by any regulatory authority. |

| 2. |

Purchasers of Units have no individual legal representation in connection with the Offering. Accordingly, purchasers should consult with their own counsel prior to purchasing Units. |

| 3. |

Purchasers of the Units offered hereby will experience an immediate and substantial dilution in the net tangible book value of the Units from the Offering Price of this Offering. |

| 4. |

Purchasers of the Units must be aware of the long-term nature of their investment and be able to bear the economic risks of their investment. The right of any purchaser to sell, transfer, pledge or otherwise dispose of the Shares or the Warrant Shares will be limited by applicable legislation, including a number of resale restrictions, including a restriction on trading. Until the restriction on trading expires, you will not be able to trade the Securities unless you comply with an exemption from prospectus and registration requirements under applicable securities legislation. The restriction on trading may be indefinite depending on the holder's jurisdiction of residence. Consequently, a holder of the Units may not be able to readily liquidate his/her/its investment. Prospective purchasers should be able to afford the entire loss of their investment in the Issuer. |

| 5. |

Publicly quoted securities are subject to a relatively high degree of price volatility. It may be anticipated that the quoted market for the Shares of the Issuer will be subject to market trends generally, notwithstanding any potential success of the Issuer in creating revenue. |

| 6. |

Shareholders of the Issuer may be unable to sell significant quantities of Shares into the public trading markets without a significant reduction in the price of their Shares, if at all. There can be no assurance that the Issuer will continue to meet the listing requirements of the Canadian National Stock Exchange, the Over-The-Counter Bulletin Board or achieve listing on any other public listing exchange. |

Additional risk factors relating to the Joint Venture Agreement include the following:

| 1. |

The medical marihuana business of WOM and the new Canadian Medical Marihuana Purposes Regulations, or MMPR, are part of a new and emerging industry with accompanying risks and uncertainties. Among other things there can be no assurance that WOM will ever obtain designation as a Licensed Producer under MMPR in which case the Issuer will not continue with the Joint Venture Agreement. Similarly, the Issuer may fail to obtain the necessary financing to meet its funding obligations pursuant to the Joint Venture Agreement. There may also be changes to the MMPR framework as a result of legislative initiative or judicial rulings which could have an adverse impact on the Issuer. |

ITEM 9: REPORTING OBLIGATIONS

Other than notices of annual and special meetings of the shareholders, and related information circulars, form of proxies, and financial statement request forms, the Issuer does not provide documents to its shareholders on an annual or ongoing basis.

The Issuer is a reporting issuer (or equivalent) in British Columbia, Ontario and in the United States. You can obtain corporate and securities information about the Issuer from the SEDAR website at www.sedar.com, the SEDI website at www.sedi.ca, and from the U.S. Securities and Exchange Commission’s EDGAR system at www.sec.gov. The Issuer cannot guarantee the accuracy of this information. Additionally, you can obtain quotations for the Issuer’s shares of common stock, under the symbol TOP, from the Canadian Securities Exchange and/or under the symbol ENRT, from OTC Markets at www.otcmarkets.com.

ITEM 10: RESALE RESTRICTIONS

Canadian Resale Restrictions

These securities will be subject to a number of resale restrictions, including a restriction on trading. Until the restriction on trading expires, you will not be able to trade the securities unless you comply with an exemption from the prospectus and registration requirements under securities legislation.

Unless permitted under securities legislation, you cannot trade the securities before the date that is 4 months and a day after the distribution date.

United States Resale Restrictions

The Shares and Warrants to be issued to security holders will not be registered under the U.S. Securities Act or applicable state securities laws. Such securities will be issued in reliance upon the exemption from registration provided by Regulation S of the U.S. Securities Act of 1933, as amended.

Likewise, the Warrant Shares will not be registered under the U.S. Securities Act or applicable states securities laws, and accordingly may not be issued to U.S. Persons as defined in Regulation S or persons in the United States, unless an exemption from registration under the U.S. Securities Act and applicable states securities laws is available.

In addition, the Shares, the Warrants and the Warrant Shares issuable upon the exercise of the Warrants will be "restricted securities" within the meaning of Rule 144 under the U.S. Securities Act, certificates representing such securities will bear a legend to that effect, and such securities may be resold only pursuant to an exemption from the registration requirements of the U.S. Securities Act and all applicable state securities laws. Subject to certain limitations, such securities may be resold outside the United States without registration under the U.S. Securities Act pursuant to Regulation S under the U.S. Securities Act.

Moreover, the Warrants may be exercised only pursuant to an exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. As a result, the Warrants may only be exercised by a holder who represents that, at the time of exercise, the holder is not then located in the United States, is not a "U.S. person", as defined in Rule 902 of Regulation S under the U.S. Securities Act (a "U.S. Person"), and is not exercising the Warrants for the account or benefit of a U.S. Person or a person in the United States, unless the holder provides a legal opinion or other evidence reasonably satisfactory to the Company to the effect that the exercise of the Warrants does not require registration under the U.S. Securities Act or applicable state securities laws, or any other such documents that the Company may deem necessary.

The foregoing discussion is only a general overview of certain requirements of United States securities laws applicable to the securities received upon completion of the Private Placement. All holders of such securities are urged to consult with counsel to ensure that the resale of their securities complies with applicable securities legislation.

ITEM 11: PURCHASERS’ RIGHTS

If you purchase these securities you will have certain rights, some of which are described below. For information about your rights you should consult a lawyer.

Two-Day Cancellation Right

You can cancel your agreement to purchase these securities. To do so, you must send a notice to the Issuer by midnight on the 2nd business day after you sign the subscription agreement to buy the securities.

Statutory Rights of Action in the Event of a Misrepresentation

If there is a misrepresentation in this Offering Memorandum, you have a statutory right to sue:

| (a) |

the Issuer to cancel your agreement to buy these securities, or |

| (b) |

for damages against the Issuer, every person who was a director of the Issuer at the date of this Offering Memorandum, and every other person who signed this Offering Memorandum. |

This statutory right to sue is available to you whether or not you relied on the misrepresentation. However, there are various defences available to the persons or companies that you have a right to sue. In particular, they have a defence if you knew of the misrepresentation when you purchased the securities.

If you intend to rely on the rights described in (a) or (b) above, you must do so within strict time limitations. You must commence your action to cancel the agreement within180 days after you signed the subscription agreement to purchase the securities. You must commence your action for damages within the earlier of 180 days after learning of the misrepresentation and three years after you signed the subscription agreement to purchase the securities.

ITEM 12: DATE AND CERTIFICATE

Dated this •th day of January, 2014.

This Offering Memorandum does not contain a misrepresentation.

ENERTOPIA CORP.

| Robert McAllister | Bal Bhullar | |

| President, CEO | Chief Financial Officer | |

| ON BEHALF OF THE BOARD OF DIRECTORS | ||

| Donald Findlay | ||

| Director | ||

| Greg Dawson | John Thomas | |

| Director | Director |

Form 45-106F4

You have 2 business days to cancel your purchase. To do so, send a notice to Enertopia Corporation stating that you want to cancel your purchase. You must send the notice before midnight on the 2nd business day after you sign the agreement to purchase the securities. You can send the notice by fax or email or deliver it in person to Enertopia Corporation at its business address. Keep a copy of the notice for your records.

Issuer Name and Address:

Enertopia Corporation.

Suite 950, 1130 West Pender

Vancouver, British Columbia

Canada, V6E 4A4

Phone: 604-602-1675

Fax: 604-685-1602

E-mail: bbspa@hotmail.com

You are buying Exempt Market Securities

They are called exempt market securities because two parts of securities law do not apply to them. If an issuer wants to sell exempt market securities to you:

- the issuer does not have to give you a prospectus (a document that describes the investment in detail and gives you some legal protections), and

- the securities do not have to be sold by an investment dealer registered with a securities regulatory authority or regulator.

There are restrictions on your ability to resell exempt market securities. Exempt market securities are more risky than other securities.

You will receive an offering memorandum. Read the offering memorandum carefully because it has important information about the issuer and its securities. Keep the offering memorandum because you have rights based on it. Talk to a lawyer for details about these rights.

For more information on the exempt market, call your local securities regulatory authority or regulator.

British Columbia Securities Commission

P.O. Box

10142, Pacific Centre

701 West Georgia Street

Vancouver, British

Columbia V7Y 1L2

Telephone: (604) 899-6500

Toll free in British Columbia

and Alberta 1-800-373-6393

Facsimile: (604) 899-6506

Alberta Securities Commission

4th Floor, 300 – 5th

Avenue SW

Calgary, Alberta T2P 3C4

Telephone: (403) 297-6454

Facsimile: (403) 297-6156