Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ROYAL GOLD INC | a14-4687_18k.htm |

| EX-10.1 - EX-10.1 - ROYAL GOLD INC | a14-4687_1ex10d1.htm |

| EX-99.1 - EX-99.1 - ROYAL GOLD INC | a14-4687_1ex99d1.htm |

Exhibit 99.2

|

|

Second Quarter Fiscal 2014 Results January 30, 2014 |

|

|

Today’s Speakers January 30, 2014 2 Tony Jensen President and CEO Stefan Wenger CFO and Treasurer Bill Zisch VP Operations |

|

|

Cautionary Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained herein and include, but are not limited to; that a second shipment from Mt Milligan is expected in January 2014; the Pascua-Lama suspension is a temporary setback that doesn’t currently trigger any changes to carrying value; that Mt. Milligan is expected to achieve commercial production in the first quarter or calendar 2014; that the Company expects to have an effective tax rate of between 30% and 34% for fiscal 2014 and that adjusted EBITDA will be approximately 80% to 85% of revenue; that the Company continues to expect DD&A rates of $425 to $500 for fiscal 2014; and statements regarding projected steady or increasing production and estimates of timing of commencement of production from operators of properties where we have royalty interests, including operator estimates; and indefinite suspension of construction at Pascua-Lama; completion of water replacement systems and the receipt of regulatory and legal approvals at Pascua-Lama; the resumption of construction activities leading to the commencement of operations at Pascua-Lama. Factors that could cause actual results to differ materially from these forward-looking statements include, among others: the risks inherent in construction, development and operation of mining properties, including those specific to a new mine being developed and operated by a base metals company; changes in gold and other metals prices; decisions and activities of the Company’s management; unexpected operating costs; decisions and activities of the operators of the Company’s royalty and stream properties; unanticipated grade, geological, metallurgical, processing or other problems at the properties; inaccuracies in technical reports and reserve estimates; revisions by operators of reserves, mineralization or production estimates; changes in project parameters as plans of the operators are refined; the results of current or planned exploration activities; discontinuance of exploration activities by operators; economic and market conditions; operations on lands subject to First Nations jurisdiction in Canada; the ability of operators to bring non-producing and not-yet-in development projects into production and operate in accordance with feasibility studies; erroneous royalty payment calculations; title defects to royalty properties; future financial needs of the Company; the impact of future acquisitions and royalty financing transactions; adverse changes in applicable laws and regulations; litigation; and risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, environmental laws, enforcement and uncertain political and economic environments. These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission. Statements made herein are as of the date hereof and should not be relied upon as of any subsequent date. The Company’s past performance is not necessarily indicative of its future performance. The Company disclaims any obligation to update any forward-looking statements. The Company and its affiliates, agents, directors and employees accept no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. Endnotes located on page 17. January 30, 2014 3 |

|

|

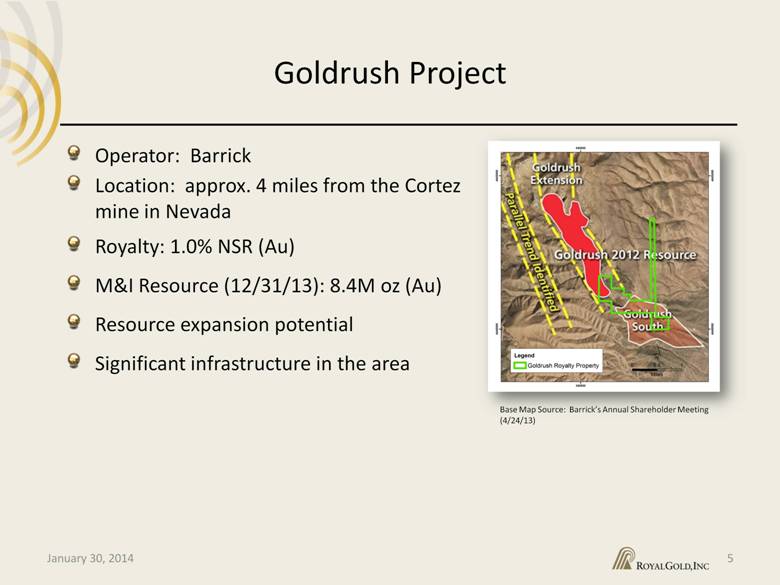

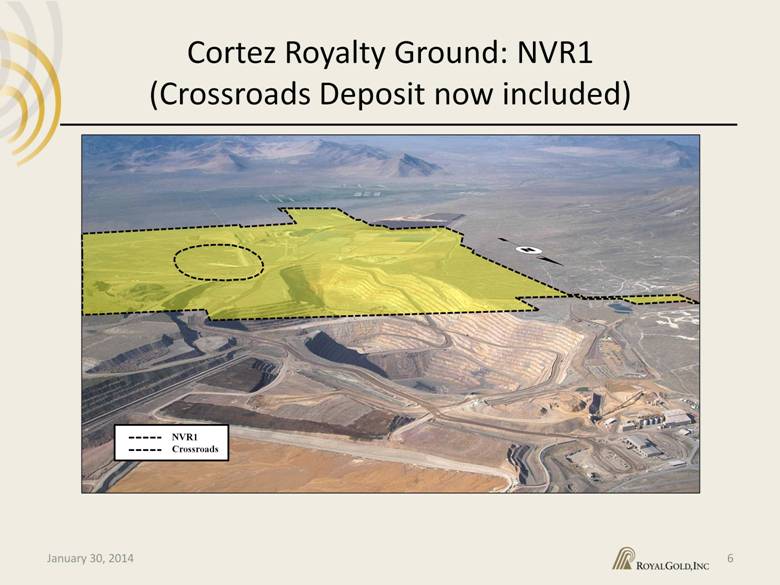

Q2 2014 Highlights & Recent Developments January 30, 2014 4 Operating results mostly in line with expectations Initial revenue from Mt. Milligan First gold shipment of 2,149 oz to Royal Gold (revenue of $2.6M) Second shipment of 10,475 oz on January 23, 2014 Expanded Credit Facility Additions to portfolio: 1.0% royalty on Barrick’s Goldrush Deposit Increased ownership in the NVR1 royalty at Cortez from 0.39% to 1.01% outside of the Crossroad Claims, and from 0.00% to 0.62% within the Crossroad Claims |

|

|

Goldrush Project January 30, 2014 5 Operator: Barrick Location: approx. 4 miles from the Cortez mine in Nevada Royalty: 1.0% NSR (Au) M&I Resource (12/31/13): 8.4M oz (Au) Resource expansion potential Significant infrastructure in the area |

|

|

Cortez Royalty Ground: NVR-1 (Crossroads Deposit now included) January 30, 2014 6 NVR1 Crossroads |

|

|

Royalty Boundaries at Cortez January 30, 2014 7 |

|

|

Cortez Royalty Ground: GSR1 January 30, 2014 8 GSR1 |

|

|

Cortez Royalty Ground: GSR2 January 30, 2014 9 GSR2 |

|

|

Cortez Royalty Ground: GSR3 January 30, 2014 10 |

|

|

Financial Highlights January 30, 2014 11 Second quarter FY2014 Revenue of $52.8 million Adjusted EBITDA 86% of revenue Cash dividend of $13.7M; payout ratio of 39% of operating cash flow Effective tax rate of 37% was flat vs prior year First revenue from Mt. Milligan 5,485 payable ounces*52.25% (Royal Gold’s interest)*provisional payment = 2,149 ounces received Royal gold pays $435/oz |

|

|

Credit Facility Expansion January 30, 2014 12 Credit Facility Increased to $450M from $350M Matures in January 2019 $150 million accordion Reduced commitment fee to 0.25% from 0.375% Reduced interest rate to LIBOR +1.25% from LIBOR +1.75% |

|

|

Financial Strength 13 Strong Balance Sheet and Cash Flow in an Attractive Market January 30, 2014 $350M Undrawn Credit $704.8M Working Capital $370M convertible debt 2019 @2.875% * $178.4M |

|

|

Production and Revenue Waterfall January 30, 2014 14 Thousands of Gold Equivalent Ounces |

|

|

Mt. Milligan Update January 30, 2014 15 Ramp-up underway Gold concentrate production through Dec 31, 2013: 21.1K oz 5,485 payable gold ounces shipped in December 2013 10,475 payable gold ounces shipped in January 2014 |

|

|

Well-positioned January 30, 2014 16 Two new additions to the portfolio Deliveries from Mt. Milligan have begun Strong balance sheet with over $1.1 billion in liquidity Few commitments for cash flow Growth profile already embedded in the company Attractive market environment |

|

|

Endnotes January 30, 2014 |

|

|

Endnotes January 30, 2014 18 PAGE 13 FINANCIAL STRENGTH Undrawn credit facility has increased to $450M, as of January 2014. $50M commitment for the Tulsequah Chief project to be paid over the development period of the project. |

|

|

Appendix A: Property Portfolio January 30, 2014 |

|

|

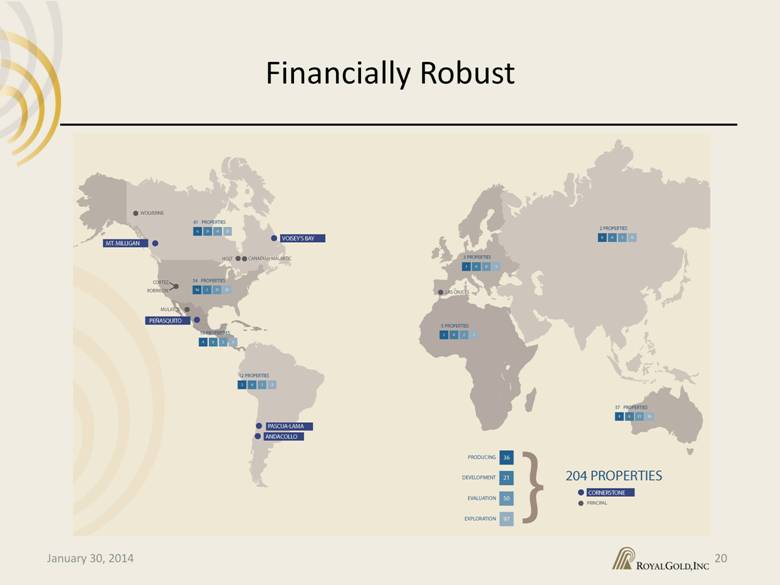

Financially Robust 20 Diverse Portfolio of Assets January 23, 2014 |

|

|

1660 Wynkoop Street Denver, CO 80202-1132 303.573.1660 info@royalgold.com www.royalgold.com January 30, 2014 |