Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Viva Entertainment Group Inc. | Financial_Report.xls |

| EX-31.1 - EXHIBIT 31.1 - Viva Entertainment Group Inc. | v366148_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Viva Entertainment Group Inc. | v366148_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | Annual Report Under Section 13 Or 15(d) Of The Securities Exchange Act Of 1934 |

| For the fiscal year ended October 31, 2013 | |

| Or | |

| o | Transition Report Under Section 13 Or 15(d) Of The Securities Exchange Act Of 1934 |

| For the transition period from _____to _____ |

COMMISSION FILE NUMBER: 333-163815

Black River Petroleum Corp.

(Exact name of registrant as specified in its charter)

| Nevada | 98-0642409 | |

| (State or other jurisdiction of organization) | (IRS Employer Identification #) |

424 Church Street, Suite 2000

Nashville, Tennessee, TN 37219

(Address of principal executive offices)(Zip Code)

Registrant's telephone number, including area code: 615-651-7383

N/A

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.00001 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of the chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | ||

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 126-2 of the act): Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, April 30, 2013 was $16,500,000.00.

As of January 28, 2014, 72,093,414 shares of common stock, $0.00001 par value per share, were outstanding.

Table of Contents

| Page | ||

| PART I | ||

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 6 |

| Item 1B. | Unresolved Staff Comments | 6 |

| Item 2. | Properties | 6 |

| Item 3. | Legal Proceedings | 9 |

| Item 4. | Mine Safety Disclosures | 9 |

| PART II | ||

| Item 5. | Market for Registrant’s common Equity, Related Stockholders Matters, and Issuer Purchases of Equity Securities | 10 |

| Item 6. | Selected Financial Data | 11 |

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operation | 11 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 14 |

| Item 8. | Financial Statements and Supplementary Data | 15 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 16 |

| Item 9A. | Controls and Procedures | 16 |

| Item 9B. | Other Information | 17 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 17 |

| Item 11. | Executive Compensation | 19 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management | 20 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 20 |

| Item 14. | Principal Legal and Accounting Fees and Services | 21 |

| PART IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 21 |

| Signature Page | 23 | |

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Report and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. All subsequent written and oral forward-looking statements concerning other matters addressed in this Report and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Report.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to Black River Petroleum Corp. and its consolidated subsidiaries. “SEC” refers to the Securities and Exchange Commission.

| 3 |

PART I

ITEM 1. BUSINESS.

Overview

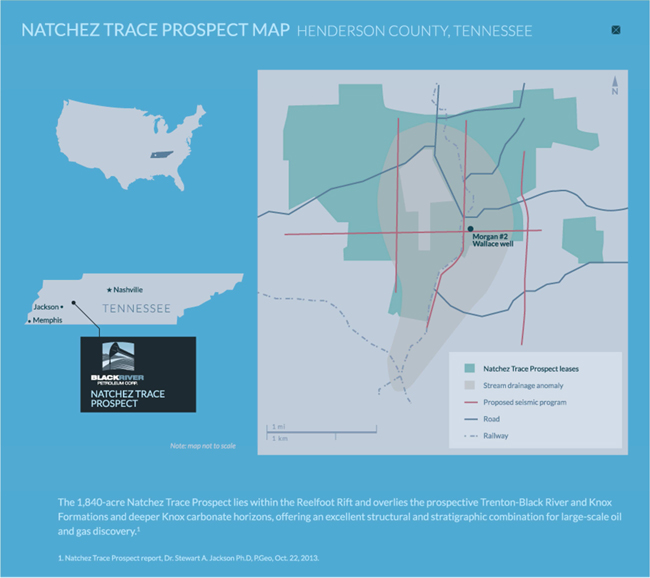

Black River Petroleum is an Oil and Gas exploration stage company. The Company is based in Nashville, Tennessee and its current focus lies in the exploration of the Natchez Trace Prospect in Henderson County, Western Tennessee.

The Company was incorporated in the State of Nevada on October 26, 2009. From inception, the Company was engaged in the development of a website and also the design and development of a catalogue to sell over the counter and prescription medications, and supplements. In 2012 our management undertook a change in the Company’s focus to the Natural Resources sector where it was initially engaged in the acquisition and exploration of base metals and mineral mining properties. After an unsuccessful exploration program on our mineral properties we decided to remain in the Natural Resources sector but shift our focus to exploration for oil and gas.

On December 17, 2012, the Company, Irina Cudina and Alexander Stanbury entered into and closed a stock purchase agreement (the “Stock Purchase Agreement”), whereby Mr. Stanbury purchased from Ms. Cudina, 36,300,000 shares of common stock, par value $0.00001 per share, of the Company (the “Shares”), representing approximately 52% of the issued and outstanding shares of the Company, for an aggregate purchase price of $40,000 (the “Purchase Price”) (the “Stock Purchase”).

On December 17, 2012, the board of directors of the Company (the “Board”) and the stockholders of the Company (the “Shareholders”) accepted the resignation of Irina Cudina and appointed Alexander Stanbury on to serve as the President, Chief Executive Officer, Secretary, Treasurer, Chief Financial Officer and sole director of the Company.

On January 4, 2013, we effected a 33-for-1 forward stock split for our common stock (the “Forward Split”). Except as otherwise indicated, all of the share and per share information referenced in this Report has been adjusted to reflect the Forward Split of our common stock.

On March 25, 2013, the Company entered into a Mineral Property Acquisition Agreement (the “Acquisition Agreement”), with US Copper Investments Ltd. (the “US Copper”) whereby the Company acquired from US Copper a right to acquire a 100% right, title, and interest in and to a certain property known as The Ridgestake Copper-Gold Prospect, which comprises 7 mineral claims covering, in aggregate, 7,733 acres (3,129.48 ha) (the “Ridgestake Property”). The Ridgestake Property, which is a copper-gold-silver-molybdenum prospect, is located 125 km south-west of Williams Lake in south-central British Columbia (BC), Canada. Pursuant to the Acquisition Agreement, in consideration of an undivided 100% interest in and to the Property, the Vendor would receive 5,000,000 restricted shares of the Company’s common stock. As a result of the Company’s decision to change its strategy to focus on the oil and gas industry, the parties have agreed to allow the Acquisition Agreement, as well as the Leases, to expire. As of the date of this Report, a total of 2,000,000 of the shares were issued to US Copper and no additional shares shall be issued under the Acquisition Agreement.

On July 3, 2013, the Company entered into an investment agreement (the “Investment Agreement”), with US Copper whereby the US Copper shall have the option to purchase up to $12,500,000 of Common Stock. As a result of the Company’s decision to change its strategy to focus on the oil and gas industry, the parties have agreed to allow the Investment Agreement to expire. The Company will issue no further put notices nor receive any further funds pursuant to the Investment Agreement.

On July 11, 2013, the Board of Directors of the Company authorized to increase the authorized stock of the Company from 75,000,000 to 2,475,000,000 shares of Common Stock. The increase in authorized shares is effective as of the date of this report.

On October 17, 2013, the Company, entered into a Purchase and Sale Agreement (the “Purchase Agreement”), with American Land and Exploration Company (“American Land”) whereby the Company acquired from American Land a 100% undivided right, title and working interest in certain oil and gas interests (the “Leases”) which comprise a parcel of 1,840.69 M/L acres in Henderson County Tennessee, the Natchez Trace Prospect (the “Natchez Trace Prospect”) in exchange for $250,000 (the “Purchase Price”) to be paid as follows: (i) $25,000 within ten (10) days of the Effective Date; (ii) $25,000 within forty-five (45) days of the Effective Date, (iii) $100,000 within one hundred and thirty-five (135) days of the Effective Date; and (iv) $100,000 within two hundred and twenty-five (225) days of the Effective Date. The Company will also receive an 80% net revenue interest in the Leases. The closing is conditioned on the Company making full payment of the Purchase Price, which shall occur no later than two hundred and twenty-five days following the Effective Date. American Land is entitled to receive 7.5% of any Overriding Royalty Interest in the Leases. Pursuant to the Purchase Agreement, the Company has agreed to pay an additional $100,000 to American Land within three hundred and fifteen (315) days of the Effective Date, subject to: (i) American Land providing the Company with a 100% undivided right, title and working interest in leases comprising an additional 2,000 acre property; (ii) the Company obtaining a first right to purchase any additional acreage in excess of 2,000 acres acquired by American Land within certain areas; and (iii) American Land shall be entitled to receive 7.5% of any Overriding Royalty Interest in such property.

| 4 |

On October 24, 2013, the Company filed a Certificate of Amendment to its Articles of Incorporation (the “2013 Amendment”) to change its name from “American Copper Corp.” to “Black River Petroleum Corp.”

The Company has changed its name to reflect the change in strategy to focus on the oil and gas industry. This decision was taken by management in response to disappointing results from the exploration program undertaken on the Ridgestake Copper-Gold prospect in British Columbia. It was decided that it was in the best interests of the Company not to expend any more of its resources on metals exploration in British Columbia

The Company’s management are of the opinion that, in the current economic cycle, raising further capital for grass roots metals exploration programs would be extremely challenging and it is difficult to predict when investors’ confidence in these sorts of assets will improve, as such, the Company’s management has decided to change the focus of the Company to a different, mainstream, part of the natural resources sector, specifically oil and gas, where we feel we will have a better chance of raising capital and developing a successful project.

The Company's office is located at 424 Church Street, Suite 2000, Nashville, Tennessee, TN 37219. The Company's telephone number is 615-651-7383.

Strategy

Black River Petroleum's strategy is to explore eastern America's frontier oil and gas resources. The Company has positioned itself in western Tennessee, a relatively unexplored region and is focusing on the prospective Trenton-Black River and Knox Formations. As an exploration stage company, Black River Petroleum understands the need to balance the development of its assets with building value by keeping its overheads to a minimum. As such, the Company will rely on industry professionals and consult with third party experts for the development and execution of a comprehensive exploration plan for the prospect. If the results of this exploration plan generate drill targets then the Company will aim to drill a well on the prospect in the near future.

Competition

We intend to engage in the acquisition, exploration, and development of Oil and Gas prospects. As such, we compete with other Oil and Gas exploration and development companies for financing and for the acquisition of new properties. We will also be competing with companies in obtaining exploration licenses. The Oil and Gas exploration companies with whom we compete may have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of exploration properties of merit, on exploration of their properties and on development of their properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of such properties. This competition could result in competitors having properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our property.

Government Regulations

The Company’s planned exploration activities in all operating areas are subject to various federal, state, and local laws and regulations governing exploration, development, production, labor standards, occupational health and mine safety, control of toxic substances, and other matters involving environmental protection and taxation. It is possible that future changes in these laws or regulations could have a significant impact on the Company’s business, causing those activities to be economically reevaluated at that time.

| 5 |

Research and Development

We have not incurred any research and development expenditures over the past two fiscal years.

Employees

We do not currently have any employees other than Alex Stanbury, our sole officer and director. Over the next 12 months, we intend to engage consultants to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs as well as potentially hiring a Head of Exploration.

Intellectual Property

We do not own, either legally or beneficially, any patents or trademarks.

ITEM 1A. RISK FACTORS.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

Headquarters and Administration Offices

Our offices are currently located at 424 Church Street, Suite 200, Nashville, Tennessee 37219. Our telephone number is (615) 651- 7383.

The Ridgestake Copper-Gold Prospect

The Ridgestake Copper-Gold Prospect, which comprises 7 mineral claims covering, in aggregate, 7,733 acres (3,129.48 ha). The Ridgestake Property, which is a copper-gold-silver-molybdenum prospect, is located 125 km south-west of Williams Lake in south-central British Columbia (BC), Canada. As a result of the Company’s decision to change its strategy to focus on the oil and gas industry, the Company has discontinued operations on the Ridgestake Copper-Gold Prospect and intends to allow the leases relating to the properties to expire. As of the date of this Report, no amounts remain due on the Ridgestake Property.

Description of the Ridgestake Property

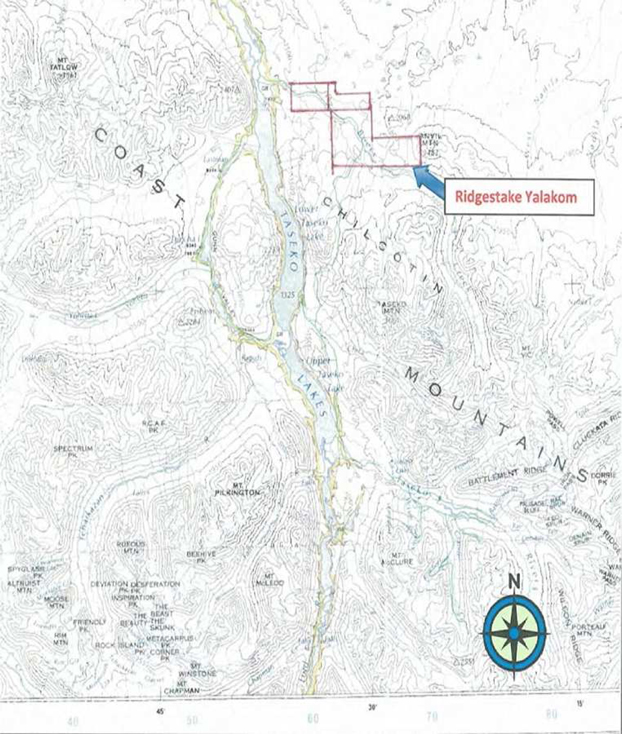

The location of the Ridgestake Property is shown in Figure 1 below, it is 125 km south-west of Williams Lake in the Cariboo-Chilcotin region of south central British Columbia (BC), Canada. The Property comprises 7 mineral claims, Taseko 1 and Taseko 2, and Cu, Cu1, Cu2, Cu3 and Cu4 totaling 7,733 acres (3,129.48 ha). The first two claims expire on 14 March 2014, the subsequent five expire on 27 June 2014.

Vehicle access, to the Ridgestake Property, is via Provincial Highway No.20 to Lee’s Corner and via forestry resource roadways. The Property lies approximately 15 km south-southeast of the New Prosperity Project of Taseko Mines Limited and lies on the east flank of North Taseko Lake. It lies along Reece Creek and on the west flank of Anvil Mountain. The Property also lies west of and adjacent to the Yalakom fault with sequence sediments and volcanic of Lower to Upper Cretaceous in age.

The Ridgestake Property is currently without known reserves.

| 6 |

Figure 1: Location of the Ridgestake Property

Natchez Trace Prospect

On October 17, 2013, the Company entered into a Purchase Agreement with American Land whereby the Company acquired from American Land a 100% undivided right, title and working interest in certain oil and gas interests which comprise a parcel of 1,840.69 M/L acres in Henderson County Tennessee, the Natchez Trace Prospect in exchange for $250,000 to be paid as follows: (i) $25,000 within ten (10) days of the Effective Date; (ii) $25,000 within forty-five (45) days of the Effective Date, (iii) $100,000 within one hundred and thirty-five (135) days of the Effective Date; and (iv) $100,000 within two hundred and twenty-five (225) days of the Effective Date. The Company will also receive an 80% net revenue interest in the Leases. The closing is conditioned on the Company making full payment of the Purchase Price, which shall occur no later than two hundred and twenty-five days following the Effective Date. American Land is entitled to receive 7.5% of any Overriding Royalty Interest in the Leases.

| 7 |

Description of the Property

Location

The Natchez Trace Prospect is a large geomorphic anomaly located on the northeastern edge of the Mississippi Embayment in Henderson County, Western Tennessee, approximately 6.5 miles northwest of the town of Lexington. Geologically the Natchez Trace Prospect is on the eastern margin of the ancient Reelfoot Rift and the prospective Trenton-Black River and Knox formations occur at a depth of only 3,000ft. An underlying 4,000ft of deeper Knox carbonate horizons, projected to continue to depth, offer potential for thick reservoir units.

Morgan No.2 Wallace Well

In 1990, a small operator attempted to drill a well on the crest of the apparent sheepherder anticline. The feature is located on the northern flanks of residual aeromagnetic and Bouger gravity anomalies. The well was drilled to a depth of 3,005ft before the hole was lost. Cuttings from several intervals between 1120ft and 1620ft exhibited solid fluorescence and oil and gas cut mud were reported on the pits. Hydrocarbons were encountered in fractured and karsted dolomite with apparent hydrothermal alteration.

Western Tennessee can be considered a frontier exploration area as only a few wells have been drilled and very little seismic data acquired.

| 8 |

ITEM 3. LEGAL PROCEEDINGS.

From time to time, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

ITEM 4. MINE SAFETY DISCLOSURES.

Mine Safety and Health Administration Regulations

We consider health, safety and environment stewardship to be a core value for the Company. for the fiscal year ended October 31, 2013, our properties were subject to regulation by the Federal Mine Safety and Health Administration (“MSHA”) under the Federal Mine Safety and HealthAct of 1977 (the “Mine Act”). Pursuant to Section 1503(a) of the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd Frank Act”), issuers that are operators, or that have a subsidiary that is an operator, of a coal or other mine in the United States are required to disclose in their periodic reports filed with the SEC information regarding specified health and safety violations, orders and citations, related assessments and legal actions, and mining-related fatalities. During the fiscal year ended October 31, 2013, the Company had no such specified health and safety violations, orders or citations, related assessments or legal actions, mining-related fatalities, or similar events in relation to our United States operations requiring disclosure pursuant to Section 1503(a) of the Dodd-Frank Act and Item 104 of Regulation S-K. Due to the Company’s change in business strategy and operations the Company is no longer a mining company as of the date of this Report.

| 9 |

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS, AND ISSUER PURCHASE OF EQUITY SECURITIES.

Market Information.

Public Market for Common Stock

Our common stock is listed on the OTCBB as of July 5, 2012. The OTCBB is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter, or the OTC, equity securities. An OTCBB equity security generally is any equity that is not listed or traded on a national securities exchange. The following table shows, for the periods indicated, the high and low bid prices per share of our common stock as reported by the OTCBB quotation service. These bid prices represent prices quoted by broker-dealers on the OTCBB quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions. Our common stock began trading on December 11, 2012. On October 17, 2013, we changed our symbol from “AMCU” to “BRPC.”

Price range of common stock

The following table shows, for the periods indicated, the high and low bid prices per share of our common stock as reported by the OTCBB quotation service. These bid prices represent prices quoted by broker-dealers on the OTCBB quotation service. The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commissions, and may not represent actual transactions.

| Fiscal October 31, 2013 | ||||||||

| High | Low | |||||||

| First Quarter (November 1, 2012 – January 31, 2013) | $ | 0.5 | (1) | $ | 0.0303 | (1) | ||

| Second Quarter (February 1, 2013 - April 30, 2013) | $ | 0.5 | $ | 0.5 | ||||

| Third Quarter (May 1, 2013 - July 31, 2013) | $ | 0.5 | $ | 0.5 | ||||

| Fourth Quarter (August 1, 2013 – October 31, 2013) | $ | 0.60 | $ | 0.45 | ||||

| (1) | Our common stock did not trade on a public market until December 11, 2012. |

The market price of our common stock will be subject to significant fluctuations in response to variations in our quarterly operating results, general trends in the market, and other factors, over many of which we have little or no control. In addition, broad market fluctuations, as well as general economic, business and political conditions, may adversely affect the market for our common stock, regardless of our actual or projected performance.

Holders of Common Stock

We have 15 record holders of our common stock as of January 28, 2014.

Dividends

We have never paid any cash dividends on our common shares, and we do not anticipate that we will pay any dividends with respect to those securities in the foreseeable future. Our current business plan is to retain any future earnings to finance the expansion and development of our business.

Securities Authorized for Issuance under Equity Compensation Plans.

The Company, at the current time, has no stock option plan or any equity compensation plans.

| 10 |

Registration Rights

We have not granted registration rights to any shareholders or to any other persons.

ITEM 6. SELECTED FINANCIAL DATA.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION.

The following provides information which management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with our financial statements and notes thereto. The following discussion and analysis contains forward-looking statements, which involve risks and uncertainties. Our actual results may differ significantly from the results, expectations and plans discussed in these forward-looking statements. See “Cautionary Note Regarding Forward Looking Statements.”

Overview

We are an exploration stage corporation and have not yet generated or realized any revenues.

Our auditors have issued a going concern opinion. This means that our auditors believe there is substantial doubt that we can continue as an on-going business for the next twelve months unless we obtain additional capital to pay our bills. This is because we have not generated any revenues or profits. Recently, our management has undertaken a change in its focus and is now engaged in the acquisition, exploration and development of Oil and Gas properties. We are not anticipated to start generating revenues for the foreseeable future until we have acquired, explored and developed Oil and Gas properties. All of which may not occur successfully.

We have only one officer and director. He is responsible for our managerial and organizational structure which will include preparation of disclosure and accounting controls under the Sarbanes Oxley Act of 2002. When these controls are implemented, he will be responsible for the administration of the controls. Should he not have sufficient experience, he may be incapable of creating and implementing the controls which may cause us to be subject to sanctions and fines by the SEC which ultimately could cause you to lose your investment.

Limited Operating History

There is no historical financial information about us upon which to base an evaluation of our performance. We are an early exploration stage company and have not generated any revenues to date. We cannot guarantee we will be successful in our business operations. Our business is subject to risks inherent in the establishment of a new business enterprise, including limited capital resources. There is no guarantee that we will find economic quantities of Oil or Gas.

Results of Operations

Comparison of the year ended October 31, 2013 and 212

The following table presents the statement of operations for the year ended October 31, 2013 as compared to the comparable period of the year ended October 31, 2012. The discussion following the table is based on these results.

| 11 |

| Fiscal Year Ended October 31, 2013 | Fiscal Year Ended October 31, 2012 | |||||||

| Operating Expenses | ||||||||

| Consulting services | $ | 3,000 | $ | 3,000 | ||||

| Rent | 14,555 | 3,000 | ||||||

| Legal and accounting | 27,214 | 29,349 | ||||||

| General and administrative | 99,868 | 1,184 | ||||||

| Wages | 40,000 | - | ||||||

| Geological Research | 76,845 | - | ||||||

| Website Development | 50,930 | - | ||||||

| Impairment of Mining Claims | 2,500,000 | - | ||||||

| Loss from Operations | 2,812,412 | 36,533 | ||||||

| Total Other Expense | 6,406 | - | ||||||

| Net Loss | $ | (2,818,818 | ) | $ | (36,533 | ) | ||

Revenues

As of the date of this report, we have yet to generate any revenues from our business operations.

Operating Expenses

For the years ended October 31, 2013 and 2012 we incurred operating expenses in the amount of $2,812,412 and $36,533 respectively. The increase in expenses was the result of an increase in general and administrative expenses fees from $1,184 for the year ended October 31, 2012 to $99,868 for the year ended October 31, 2013. Also in the year ended October 31, 2013 we added wages of $40,000, geological research expenses of $76,845, website development expenses of 50,930 and impairment of mining claims of $2,500,000.

From Inception on October 26, 2009 to October 31, 2013

During this period we incorporated the company, hired an attorney, and hired an auditor for the preparation of SEC filings. We also prepared an internal business plan. Our loss since inception is $2,892,502. This loss is primarily attributed to funds spent on website development, our exploration program, salaries, audit, office and an impairment charge for the mineral properties in BC of $2,500,000.

Liquidity and Capital Resources

Currently the Company has no operations and one salaried employee, Alex Stanbury, our sole officer and director. We currently require very limited resources but intend to hire consultants in the beginning of 2014 to being exploration on the Natchez Trace Prospect. In due course, should the Company require capital for acquisition of licenses and/or for exploration we will need to raise additional capital. There is no guarantee that the Company will be able to raise further capital. At present, we have not made any arrangements to raise additional capital.

If we need additional capital and cannot raise it we will either have to suspend operations until we do raise the capital or cease operations entirely. Other than as described in this paragraph, we have no other financing plans.

As of the date of this report, we have yet to generate any revenues.

On July 3, 2013, the Company entered into an Investment Agreement, with US Copper whereby the US Copper shall have the option to purchase up to $12,500,000 of Common Stock. As a result of the Company’s decision to change its strategy to focus on the oil and gas industry, the parties have agreed to allow the Investment Agreement to expire. The Company will issue no further put notices, nor receive any further funds pursuant to the Investment Agreement.

As of October 31, 2013, our total assets were $29,005 and our total liabilities were $150,711.

As of October 31, 2013, Black River Petroleum Corp had issued 71,725,925 common shares.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

| 12 |

Recent Accounting Pronouncements

We have reviewed accounting pronouncements and interpretations thereof that have effectiveness dates during the periods reported and in future periods. The Company has carefully considered the new pronouncements that alter previous generally accepted accounting principles and does not believe that any new or modified principles will have a material impact on the corporation’s reported financial position or operations in the near term. The applicability of any standard is subject to the formal review of our financial management and certain standards are under consideration. Those standards have been addressed in the notes to the audited financial statement and in this, our Annual Report, filed on Form 10-K for the period ended October 31, 2013.

In February 2013, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income, to improve the transparency of reporting these reclassifications. Other comprehensive income includes gains and losses that are initially excluded from net income for an accounting period. Those gains and losses are later reclassified out of accumulated other comprehensive income into net income. The amendments in the ASU do not change the current requirements for reporting net income or other comprehensive income in financial statements. All of the information that this ASU requires already is required to be disclosed elsewhere in the financial statements under U.S. GAAP. The new amendments will require an organization to:

| - | Present (either on the face of the statement where net income is presented or in the notes) the effects on the line items of net income of significant amounts reclassified out of accumulated other comprehensive income - but only if the item reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period; and |

| - | Cross-reference to other disclosures currently required under U.S. GAAP for other reclassification items (that are not required under U.S. GAAP) to be reclassified directly to net income in their entirety in the same reporting period. This would be the case when a portion of the amount reclassified out of accumulated other comprehensive income is initially transferred to a balance sheet account (e.g., inventory for pension-related amounts) instead of directly to income or expense. |

The amendments apply to all public and private companies that report items of other comprehensive income. Public companies are required to comply with these amendments for all reporting periods (interim and annual). The amendments are effective for reporting periods beginning after December 15, 2012, for public companies. Early adoption is permitted. The adoption of ASU No. 2013-02 is not expected to have a material impact on our financial position or results of operations.

In January 2013, the FASB issued ASU No. 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities, which clarifies which instruments and transactions are subject to the offsetting disclosure requirements originally established by ASU 2011-11. The new ASU addresses preparer concerns that the scope of the disclosure requirements under ASU 2011-11 was overly broad and imposed unintended costs that were not commensurate with estimated benefits to financial statement users. In choosing to narrow the scope of the offsetting disclosures, the Board determined that it could make them more operable and cost effective for preparers while still giving financial statement users sufficient information to analyze the most significant presentation differences between financial statements prepared in accordance with U.S. GAAP and those prepared under IFRSs. Like ASU 2011-11, the amendments in this update will be effective for fiscal periods beginning on, or after January 1, 2013. The adoption of ASU 2013-01 is not expected to have a material impact on our financial position or results of operations.

In October 2012, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2012-04, “Technical Corrections and Improvements” in Accounting Standards Update No. 2012-04. The amendments in this update cover a wide range of Topics in the Accounting Standards Codification. These amendments include technical corrections and improvements to the Accounting Standards Codification and conforming amendments related to fair value measurements. The amendments in this update will be effective for fiscal periods beginning after December 15, 2012. The adoption of ASU 2012-04 is not expected to have a material impact on our financial position or results of operations.

In August 2012, the FASB issued ASU 2012-03, “Technical Amendments and Corrections to SEC Sections: Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin (SAB) No. 114, Technical Amendments Pursuant to SEC Release No. 33-9250, and Corrections Related to FASB Accounting Standards Update 2010-22 (SEC Update)” in Accounting Standards Update No. 2012-03. This update amends various SEC paragraphs pursuant to the issuance of SAB No. 114. The adoption of ASU 2012-03 is not expected to have a material impact on our financial position or results of operations.

In July 2012, the FASB issued ASU 2012-02, “Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment” in Accounting Standards Update No. 2012-02. This update amends ASU 2011-08, Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment and permits an entity first to assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform the quantitative impairment test in accordance with Subtopic 350-30, Intangibles - Goodwill and Other - General Intangibles Other than Goodwill. The amendments are effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. Early adoption is permitted, including for annual and interim impairment tests performed as of a date before July 27, 2012, if a public entity’s financial statements for the most recent annual or interim period have not yet been issued or, for nonpublic entities, have not yet been made available for issuance. The adoption of ASU 2012-02 is not expected to have a material impact on our financial position or results of operations.

In December 2011, the FASB issued ASU 2011-12, “Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items out of Accumulated Other Comprehensive Income” in Accounting Standards Update No. 2011-05. This update defers the requirement to present items that are reclassified from accumulated other comprehensive income to net income in both the statement of income where net income is presented and the statement where other comprehensive income is presented. The adoption of ASU 2011-12 is not expected to have a material impact on our financial position or results of operations.

In December 2011, the FASB issued ASU No. 2011-11 “Balance Sheet: Disclosures about Offsetting Assets and Liabilities” (“ASU 2011-11”). This Update requires an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The objective of this disclosure is to facilitate comparison between those entities that prepare their financial statements on the basis of U.S. GAAP and those entities that prepare their financial statements on the basis of IFRS. The amended guidance is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The Company is currently evaluating the impact, if any, that the adoption of this pronouncement may have on its results of operations or financial position.

| 13 |

Subsequent Events

On December 1, 2013, the Company entered into an employment agreement with Alexander Stanbury, the Company’s President, Chief Executive Officer, Secretary, Treasurer, Chief Financial Officer and sole member of the Board of Directors (the “Employment Agreement”).

Pursuant to the Employment Agreement, Mr. Stanbury will receive annual base compensation of $120,000, which may be increased but not decreased from time to time as determined by the Board of Directors of the Company. Mr. Stanbury is entitled to receive 3,000,000 shares (the “Employment Shares”) of the Company’s Common Stock, 1,000,000 to vest on the date of the Employment Agreement, 1,000,000 to vest on the first anniversary of the Employment Agreement, and 1,000,000 to vest on the second anniversary of the Employment Agreement. The Employment Agreement also provides for bonus awards, as well as a benefit package, including medical, disability, and other equity programs. The term of the Employment Agreement is three (3) years and shall automatically be renewed for successive one (1) year terms thereafter, unless otherwise notified in writing three (3) months prior to the termination of the agreement.

The Employment Agreement may be terminated by the Company and by Mr. Stanbury. Should the Employment Agreement be terminated by the Company without cause, by Mr. Stanbury for good reason, or pursuant to a change of control, Mr. Stanbury is entitled to receive one times his base salary and other benefits at the time of termination (including any bonus); any earned but unpaid base salary, and accrued but unpaid vacation time. Should the Employment Agreement be terminate by the Company for cause or by Mr. Stanbury other than for good reason, Mr. Stanbury is entitled to receive any earned but unpaid base salary, including any bonus and accrued but unpaid vacation time.

On December 11, 2013, the Company issued 367,489 shares (the “Settlement Shares”) of our common stock, par value $0.00001 per share (the “Common Stock”) pursuant to a debt settlement agreement (the “Settlement Agreement”) with Mr. Stanbury, the sole officer and director of the Company, in exchange for a settlement of $148,833 owed to Mr. Stanbury. The deemed price of the shares issued was $0.405 per share, calculated at a 10% discount to the trading price of the common stock on the date of the Settlement Agreement.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

| 14 |

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

FINANCIAL STATEMENTS

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

October 31, 2013

| Index | |

| Report of Independent Registered Public Accounting Firm | F-1 |

| Balance Sheets | F-2 |

| Statements of Operations | F-3 |

| Statements of Cash Flows | F-4 |

| Statement of Changes in Stockholders’ Deficit | F-5 |

| Notes to the Financial Statements | F-6 |

| 15 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Black River Petroleum Corp.

(An Exploration Stage Company)

We have audited the accompanying balance sheets of Black River Petroleum Corp. (An Exploration Stage Company) as of October 31, 2013 and 2012, and the related statements of operations, stockholders’ equity (deficit) and cash flows for the years then ended and the period from October 26, 2009 (inception) through October 31, 2013. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Black River Petroleum Corp. as of October 31, 2013 and 2012, and the results of its operations, changes in stockholders’ equity (deficit) and cash flows for the periods described above in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, the Company suffered a net loss from operations and has a net capital deficiency, which raises substantial doubt about its ability to continue as a going concern. Management’s plans regarding those matters are also described in Note 1. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ M&K CPAS, PLLC

www.mkacpas.com

Houston, Texas

January 29, 2014

| F-1 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Balance Sheets

October 31, 2013 and 2012

| October 31, 2013 | October 31, 2012 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 4,005 | $ | 816 | ||||

| Total Current Assets | 4,005 | 816 | ||||||

| Deposit on lease | 25,000 | - | ||||||

| Total Assets | $ | 29,005 | $ | 816 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current Liabilities | ||||||||

| Accounts Payable and Accrued Liabilities | $ | 1,878 | $ | 1,110 | ||||

| Due to Directors | 148,833 | - | ||||||

| Total Liabilities | 150,711 | 1,110 | ||||||

| Stockholders’ Equity (Deficit) | ||||||||

| Common Stock (2,475,000,000 shares authorized, par value 0.00001, 71,725,925 and 198,000,000 shares issued and outstanding) at October 31, 2013 and October 31, 2012, respectively | 717 | 1,980 | ||||||

| Additional paid-in capital | 1,270,079 | 71,410 | ||||||

| Stock payable | 1,500,000 | - | ||||||

| Deficit accumulated during the exploration stage | (2,892,502 | ) | (73,684 | ) | ||||

| Total Stockholders’ Equity (Deficit) | (121,706 | ) | (294 | ) | ||||

| Total Liabilities and Stockholders’ Equity (Deficit) | $ | 29,005 | $ | 816 | ||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

| F-2 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Statements of Operations

For the Fiscal Years Ended October 31, 2013 and 2012

and from October 26, 2009 (Inception) to October 31, 2013

| Fiscal Year Ended October 31, 2013 | Fiscal Year Ended October 31, 2012 | Inception October 26, 2009 (Inception) through October 31, 2013 | ||||||||||

| Operating Expenses | ||||||||||||

| Consulting services | $ | 3,000 | $ | 3,000 | $ | 12,250 | ||||||

| Rent | 14,555 | 3,000 | 23,805 | |||||||||

| Legal and accounting | 27,214 | 29,349 | 79,168 | |||||||||

| General and administrative | 99,868 | 1,184 | 103,098 | |||||||||

| Wages | 40,000 | - | 40,000 | |||||||||

| Geological Research | 76,845 | - | 76,845 | |||||||||

| Website Development | 50,930 | - | 50,930 | |||||||||

| Impairment of Mining Claims | 2,500,000 | - | 2,500,000 | |||||||||

| Loss from Operations | 2,812,412 | 36,533 | 2,886,096 | |||||||||

| Other Expense | ||||||||||||

| Interest Expense | $ | 6,406 | $ | - | $ | 6,406 | ||||||

| Total Other Expense | 6,406 | - | 6,406 | |||||||||

| Net Loss | $ | (2,818,818 | ) | $ | (36,533 | ) | $ | (2,892,502 | ) | |||

| Net Loss Per Common Share – Basic and Diluted | $ | (0.04 | ) | $ | (0.00 | ) | ||||||

| Weighted Average Number of Common Shares Outstanding | 76,435,068 | 198,000,000 | ||||||||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

| F-3 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Statements of Cash Flows

For the Fiscal Years Ended October 31, 2013 and 2012

and Inception October 26, 2009 to October 31, 2013

| Fiscal Year Ended October 31, 2013 | Fiscal Year Ended October 31, 2012 | Inception October 26, 2009 to October 31, 2013 | ||||||||||

| Operating Activities | ||||||||||||

| Net loss | $ | (2,818,818 | ) | $ | (36,533 | ) | $ | (2,892,502 | ) | |||

| Adjustments to reconcile net loss to cash used in operating activities: | ||||||||||||

| Donated capital, consulting services and rent | 6,000 | 6,000 | 39,340 | |||||||||

| Impairment of Mining Claims | 2,500,000 | - | 2,500,000 | |||||||||

| Imputed Interest | 6,406 | - | 6,406 | |||||||||

| Changes in operating assets and liabilities: | ||||||||||||

| Accounts payable and accrued liabilities | 768 | (220 | ) | 1,878 | ||||||||

| Other current assets | (25,000 | ) | - | (25,000 | ) | |||||||

| Net Cash Used in Operating Activities | (330,644 | ) | (30,753 | ) | (369,878 | ) | ||||||

| Financing Activities | ||||||||||||

| Due to directors | 148,833 | (1,167 | ) | 148,833 | ||||||||

| Proceeds from the sale of common stock | 185,000 | - | 225,050 | |||||||||

| Net Cash Provided by Financing Activities | 333,833 | (1,167 | ) | 373,883 | ||||||||

| Increase (Decrease) in Cash | 3,189 | (31,920 | ) | 4,005 | ||||||||

| Cash - Beginning of Period | 816 | 32,736 | - | |||||||||

| Cash - End of Period | $ | 4,005 | $ | 816 | $ | 4,005 | ||||||

| Supplemental Disclosure of Cash Flow Information | ||||||||||||

| Interest | $ | - | $ | - | $ | - | ||||||

| Income taxes | $ | - | $ | - | $ | - | ||||||

| Non Cash Information | ||||||||||||

| Share Cancellation | $ | 1,287 | $ | - | $ | 1,287 | ||||||

| Common stock for mineral property | $ | 2,500,000 | $ | - | $ | 2,500,000 | ||||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

| F-4 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Statement of Changes in Stockholders’ Deficit

From Inception, October 26, 2009, to October 31, 2013

| Deficit Accumulated | ||||||||||||||||||||||||

| Common Stock | Additional Paid-in | During the Exploration | ||||||||||||||||||||||

| Shares | Amount | Capital | Stock Payable | Stage | Total | |||||||||||||||||||

| Balance at October 1, 2009 | - | $ | - | $ | - | $ | - | $ | - | $ | - | |||||||||||||

| Issuance of founder’s share | 165,000,000 | 1,650 | (1,650 | ) | - | - | - | |||||||||||||||||

| Donated services | - | - | 500 | - | - | 500 | ||||||||||||||||||

| Net loss | - | - | - | - | (775 | ) | (775 | ) | ||||||||||||||||

| Balances at October 31, 2009 | 165,000,000 | 1,650 | (1,150 | ) | - | (775 | ) | (275 | ) | |||||||||||||||

| Donated services | - | - | 6,150 | - | - | 6,150 | ||||||||||||||||||

| Net loss | - | - | - | - | (17,685 | ) | (17,685 | ) | ||||||||||||||||

| Balances at October 31, 2010 | 165,000,000 | 1,650 | 5,000 | - | (18,460 | ) | (11,810 | ) | ||||||||||||||||

| Shared issued for cash | 33,000,000 | 330 | 39,670 | - | - | 40,000 | ||||||||||||||||||

| Donated capital and services | - | - | 20,740 | - | - | 20,740 | ||||||||||||||||||

| Net loss | - | - | - | - | (18,691 | ) | (18,691 | ) | ||||||||||||||||

| Balances at October 31, 2011 | 198,000,000 | 1,980 | 65,410 | - | (37,151 | ) | 30,239 | |||||||||||||||||

| Donated services | - | - | 6,000 | - | - | 6,000 | ||||||||||||||||||

| Net loss | - | - | - | - | (36,533 | ) | (36,533 | ) | ||||||||||||||||

| Balances at October 31, 2012 | 198,000,000 | 1,980 | 71,410 | - | (73,684 | ) | (294 | ) | ||||||||||||||||

| Cancelled shares | (128,700,000 | ) | (1,287 | ) | 1,287 | - | - | - | ||||||||||||||||

| Donated services | - | - | 6,000 | - | - | 6,000 | ||||||||||||||||||

| Imputed interest | - | - | 6,406 | - | - | 6,406 | ||||||||||||||||||

Common stock for mineral property | 2,000,000 | 20 | 999,980 | 1,500,000 | - | 2,500,000 | ||||||||||||||||||

| Proceeds from common stock | 425,925 | 4 | 184,996 | - | - | 185,000 | ||||||||||||||||||

| Net loss | - | - | - | - | (2,818,818 | ) | (2,818,818 | ) | ||||||||||||||||

| Balances at October 31, 2013 | 71,725,925 | $ | 717 | $ | 1,270,079 | $ | 1,500,000 | $ | (2,892,502 | ) | $ | (121,706 | ) | |||||||||||

(The Accompanying Notes are an Integral Part of These Financial Statements)

| F-5 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Notes to the Financial Statements

NOTE 1 – NATURE OF OPERATIONS

DESCRIPTION OF BUSINESS AND HISTORY

The Company was incorporated on October 26, 2009 in the State of Nevada. The Company is an exploration stage corporation and is engaged in the search for oil and gas deposits or reserves which are not in the development or production stage. The Company intends to explore for oil and gas on its mineral leases.

The Company does not have any revenues and has incurred losses since inception. Currently, the Company has no operations, has been issued a going concern opinion and relies upon the sale of our securities and loans from its sole officer and director to fund operations.

GOING CONCERN - These financial statements have been prepared on a going concern basis, which implies Black River Petroleum Corp. will continue to meet its obligations and continue its operations for the next fiscal year. Realization value may be substantially different from carrying values as shown and these financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should Black River Petroleum Corp. be unable to continue as a going concern. As at October 31, 2013 Black River Petroleum Corp. has a working capital deficiency, has not generated revenues and has accumulated losses of $2,892,502 (2012: $73,684) since inception. The continuation of Black River Petroleum Corp. as a going concern is dependent upon the continued financial support from its shareholders, the ability of Black River Petroleum Corp. to obtain necessary equity financing to continue operations, and the attainment of profitable operations. These factors raise substantial doubt regarding the Black River Petroleum Corp. ability to continue as a going concern.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

BASIS OF PRESENTATION -These financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States, and are expressed in U.S. dollars. The Company’s fiscal year-end is October 31.

USE OF ESTIMATES - The preparation of financial statements in accordance with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of net revenue and expenses in the reporting period. We regularly evaluate our estimates and assumptions related to the useful life and recoverability of long-lived assets, stock-based compensation and deferred income tax asset valuation allowances. We base our estimates and assumptions on current facts, historical experience and various other factors that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by us may differ materially and adversely from our estimates. To the extent there are material differences between our estimates and the actual results, our future results of operations will be affected.

CASH AND CASH EQUIVALENTS - The Company considers all highly liquid instruments with original maturities of three months or less when acquired, to be cash equivalents. We had no cash equivalents at October 31, 2013 or October 31, 2012.

EXPLORATION STAGE ENTITY – The Company complies with FASB guidelines for its description as an exploration stage company.

| F-6 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Notes to the Financial Statements

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – Continued

IMPUTED INTEREST – The Company calculates imputed interest at a rate of 8% per annum. On due to Director balance of $148,833, charged to additional paid in capital.

IMPAIRMENT POLICY – In 2013, the Company authorized the issuance of 5,000,000 shares of restricted shares of common stock and paid $10,000 for the mineral property. At October 31, 2013, the Company did an assessment of whether this payment would meet the characteristics required to record it as an asset at year-end and determined that an impairment charge of $2,500,000 should be reflected as of October 31, 2013 because the Company could not substantiate that there would be a future economic benefit arising from this payment.

INCOME TAXES - The Company accounts for income taxes under the provisions issued by the FASB which requires recognition of deferred tax liabilities and assets for the expected future tax consequences of events that have been included in the consolidated financial statements or tax returns. Under this method, deferred tax liabilities and assets are determined based on the difference between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the year in which the differences are expected to reverse. The Company computes tax asset benefits for net operating losses carried forward. The potential benefit of net operating losses has not been recognized in these financial statements because the Company cannot be assured it is more likely than not it will utilize the net operating losses carried forward in future years.

MINERAL CLAIM EXPENDITURES – The Company capitalizes all direct costs related to the acquisition and exploration of specific mining properties as incurred. These costs will be amortized against the income generated from the property. If the property is abandoned or impaired, an appropriate impairment charge will be made.

LOSS PER COMMON SHARE - The Company reports net loss per share in accordance with provisions of the FASB. The provisions require dual presentation of basic and diluted loss per share. Basic net loss per share excludes the impact of common stock equivalents. Diluted net loss per share utilizes the average market price per share when applying the treasury stock method in determining common stock equivalents. As of October 31, 2013 and 2012, there were no common stock equivalents outstanding.

FAIR VALUE OF FINANCIAL INSTRUMENTS - Pursuant to ASC No. 820, “Fair Value Measurements and Disclosures”, the Company is required to estimate the fair value of all financial instruments included on its balance sheet as of October 31, 2013 and 2012. The Company’s financial instruments consist of cash. The Company considers the carrying value of such amounts in the financial statements to approximate their fair value due to the short-term nature of these financial instruments.

RECENTLY ISSUED ACCOUNTING STANDARDS –

In February 2013, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2013-02, Comprehensive Income (Topic 220): Reporting of Amounts Reclassified Out of Accumulated Other Comprehensive Income, to improve the transparency of reporting these reclassifications. Other comprehensive income includes gains and losses that are initially excluded from net income for an accounting period. Those gains and losses are later reclassified out of accumulated other comprehensive income into net income. The amendments in the ASU do not change the current requirements for reporting net income or other comprehensive income in financial statements. All of the information that this ASU requires already is required to be disclosed elsewhere in the financial statements under U.S. GAAP. The new amendments will require an organization to:

| - | Present (either on the face of the statement where net income is presented or in the notes) the effects on the line items of net income of significant amounts reclassified out of accumulated other comprehensive income - but only if the item reclassified is required under U.S. GAAP to be reclassified to net income in its entirety in the same reporting period; and |

| F-7 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Notes to the Financial Statements

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued

RECENTLY ISSUED ACCOUNTING STANDARDS – Continued

| - | Cross-reference to other disclosures currently required under U.S. GAAP for other reclassification items (that are not required under U.S. GAAP) to be reclassified directly to net income in their entirety in the same reporting period. This would be the case when a portion of the amount reclassified out of accumulated other comprehensive income is initially transferred to a balance sheet account (e.g., inventory for pension-related amounts) instead of directly to income or expense. |

The amendments apply to all public and private companies that report items of other comprehensive income. Public companies are required to comply with these amendments for all reporting periods (interim and annual). The amendments are effective for reporting periods beginning after December 15, 2012, for public companies. Early adoption is permitted. The adoption of ASU No. 2013-02 is not expected to have a material impact on our financial position or results of operations.

In January 2013, the FASB issued ASU No. 2013-01, Balance Sheet (Topic 210): Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities, which clarifies which instruments and transactions are subject to the offsetting disclosure requirements originally established by ASU 2011-11. The new ASU addresses preparer concerns that the scope of the disclosure requirements under ASU 2011-11 was overly broad and imposed unintended costs that were not commensurate with estimated benefits to financial statement users. In choosing to narrow the scope of the offsetting disclosures, the Board determined that it could make them more operable and cost effective for preparers while still giving financial statement users sufficient information to analyze the most significant presentation differences between financial statements prepared in accordance with U.S. GAAP and those prepared under IFRSs. Like ASU 2011-11, the amendments in this update will be effective for fiscal periods beginning on, or after January 1, 2013. The adoption of ASU 2013-01 is not expected to have a material impact on our financial position or results of operations.

In October 2012, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2012-04, “Technical Corrections and Improvements” in Accounting Standards Update No. 2012-04. The amendments in this update cover a wide range of Topics in the Accounting Standards Codification. These amendments include technical corrections and improvements to the Accounting Standards Codification and conforming amendments related to fair value measurements. The amendments in this update will be effective for fiscal periods beginning after December 15, 2012. The adoption of ASU 2012-04 is not expected to have a material impact on our financial position or results of operations.

In August 2012, the FASB issued ASU 2012-03, “Technical Amendments and Corrections to SEC Sections: Amendments to SEC Paragraphs Pursuant to SEC Staff Accounting Bulletin (SAB) No. 114, Technical Amendments Pursuant to SEC Release No. 33-9250, and Corrections Related to FASB Accounting Standards Update 2010-22 (SEC Update)” in Accounting Standards Update No. 2012-03. This update amends various SEC paragraphs pursuant to the issuance of SAB No. 114. The adoption of ASU 2012-03 is not expected to have a material impact on our financial position or results of operations.

| F-8 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Notes to the Financial Statements

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - Continued

RECENTLY ISSUED ACCOUNTING STANDARDS – Continued

In July 2012, the FASB issued ASU 2012-02, “Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment” in Accounting Standards Update No. 2012-02. This update amends ASU 2011-08, Intangibles – Goodwill and Other (Topic 350): Testing Indefinite-Lived Intangible Assets for Impairment and permits an entity first to assess qualitative factors to determine whether it is more likely than not that an indefinite-lived intangible asset is impaired as a basis for determining whether it is necessary to perform the quantitative impairment test in accordance with Subtopic 350-30, Intangibles - Goodwill and Other - General Intangibles Other than Goodwill. The amendments are effective for annual and interim impairment tests performed for fiscal years beginning after September 15, 2012. Early adoption is permitted, including for annual and interim impairment tests performed as of a date before July 27, 2012, if a public entity’s financial statements for the most recent annual or interim period have not yet been issued or, for nonpublic entities, have not yet been made available for issuance. The adoption of ASU 2012-02 is not expected to have a material impact on our financial position or results of operations.

In December 2011, the FASB issued ASU 2011-12, “Deferral of the Effective Date for Amendments to the Presentation of Reclassifications of Items out of Accumulated Other Comprehensive Income” in Accounting Standards Update No. 2011-05. This update defers the requirement to present items that are reclassified from accumulated other comprehensive income to net income in both the statement of income where net income is presented and the statement where other comprehensive income is presented. The adoption of ASU 2011-12 is not expected to have a material impact on our financial position or results of operations.

In December 2011, the FASB issued ASU No. 2011-11 “Balance Sheet: Disclosures about Offsetting Assets and Liabilities” (“ASU 2011-11”). This Update requires an entity to disclose information about offsetting and related arrangements to enable users of its financial statements to understand the effect of those arrangements on its financial position. The objective of this disclosure is to facilitate comparison between those entities that prepare their financial statements on the basis of U.S. GAAP and those entities that prepare their financial statements on the basis of IFRS. The amended guidance is effective for annual reporting periods beginning on or after January 1, 2013, and interim periods within those annual periods. The Company is currently evaluating the impact, if any, that the adoption of this pronouncement may have on its results of operations or financial position.

NOTE 3 -INCOME TAXES

Deferred income taxes arise from temporary differences resulting from income and expense items reported for financial accounting and tax purposes in different periods. Deferred taxes are classified as current or non-current, depending on the classification of assets and liabilities to which they relate. Deferred taxes arising from temporary differences that are not related to an asset or liability are classified as current or non-current depending on the periods in which the temporary differences are expected to reverse. The company does not have any uncertain tax positions.

The Company currently has net operating loss carryforwards aggregating $392,502 (2012: $73,684), which expire through 2030. The deferred tax asset related to the carryforwards has been fully reserved.

The Company has deferred income tax assets, which have been fully reserved, as follows as of October 31, 2013:

| 2013 | 2012 | |||||||

| Deferred tax assets | $ | 133,451 | $ | 25,053 | ||||

| Valuation allowance for deferred tax assets | (133,451 | ) | (25,053 | ) | ||||

| Net deferred tax assets | $ | - | $ | - | ||||

| F-9 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Notes to the Financial Statements

NOTE 4 – FAIR VALUE MEASUREMENTS

The Company adopted ASC No. 820-10 (ASC 820-10), Fair Value Measurements. ASC 820-10 relates to financial assets and financial liabilities.

ASC 820-10 defines fair value, establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (GAAP), and expands disclosures about fair value measurements. The provisions of this standard apply to other accounting pronouncements that require or permit fair value measurements and are to be applied prospectively with limited exceptions.

ASC 820-10 defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. This standard is now the single source in GAAP for the definition of fair value, except for the fair value of leased property as defined in SFAS 13. ASC 820-10 establishes a fair value hierarchy that distinguishes between (1) market participant assumptions developed based on market data obtained from independent sources (observable inputs) and (2) an entity’s own assumptions, about market participant assumptions, that are developed based on the best information available in the circumstances (unobservable inputs). The fair value hierarchy consists of three broad levels, which gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The three levels of the fair value hierarchy under ASC 820-10 are described below:

| • | Level 1 |

Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities.

|

| • | Level 2 | Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets or liabilities in active markets; quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability (e.g., interest rates); and inputs that are derived principally from or corroborated by observable market data by correlation or other means. |

| • | Level 3 | Inputs that are both significant to the fair value measurement and unobservable. These inputs rely on management's own assumptions about the assumptions that market participants would use in pricing the asset or liability. (The unobservable inputs are developed based on the best information available in the circumstances and July include the Company's own data.) |

The following presents the Company's fair value hierarchy for those assets and liabilities measured at fair value on a non-recurring basis as of October 31, 2013 and October 31, 2012:

Level 1: None

Level 2: None

Level 3: None

Total Gain (Losses): None

| F-10 |

Black River Petroleum Corp. (formerly American Copper Corp.)

(An Exploration Stage Company)

Notes to the Financial Statements

NOTE 5 - RELATED PARTY TRANSACTIONS

During the year ended October 31, 2013 the Company recognized a total of $6,000 (2012: $4,500) for rent and services from directors for rent at $250 per month and $250 per month for consulting services provided by the President and Director of the Company. These transactions are recorded at the exchange amount which is the amount agreed to by the transacting parties.

A director has advanced funds to us for our legal, audit, filing fees, general office administration and cash needs. As of October 31, 2013, the director has advanced a total of $148,833 (2012: $0).

NOTE 6 – ACQUISITION OF MINERAL CLAIMS

The Company does not intend to conduct further exploration activities on the Ridgetake Copper-Gold Prospect, which is located 125 kilometers south-west of Williams Lake in the Cariboo-Chilcotin region of south central British Columbia (BC), Canada. The Property comprises 7 mineral claims, Taseko 1 and Taseko 2, and Cu, Cu1, Cu2, Cu3, and Cu4 totaling 7,733 acres (3,129.48 ha). The first two claims were renewed and now expire on March 14, 2014, the subsequent five will expire on June 27, 2014. On March 25, 2013, the Company authorized the issuance of 5,000,000 restricted shares of common stock. The share consideration is recorded at fair market value at the date of the transaction. As of October 31, 2013, 2,000,000 common shares have been issued. The remaining 3,000,000 common shares have not been issued and the share consideration is recorded as a stock payable. Management has determined to record an impairment charge of $2,500,000 because the property is not revenue producing and the future economic benefits are not substantiated.

NOTE 7 – LEASE OF OIL AND GAS CLAIMS

On October 17, 2013, the company entered into an agreement with American Land and Exploration Company (“American Land”) to purchase 100% working interest in the 1,840.69 M/L acres in the oil and gas leases in Henderson, Tennessee. The Company agreed to pay $250,000 as follows:

| - | $25,000 within 10 days of the agreement (paid) |

| - | $25,000 within 45 days of the agreement (paid) |

| - | $100,000 within 135 days of the agreement |

| - | $100,000 within 225 days of the agreement |

American Land will hold the lease interest in trust for Black River Petroleum Corp. until such time as the agreement is completed or terminated. In the event of non-payment, the Company will forfeit its lease interest. American Land is entitled to receive a 7.5% royalty on all production.

The Company has an option to purchase additional 2,000 acres within a 5 mile radius of the property for $100,000 with 315 days of the date of the agreement.

NOTE 8 – IMPAIRMENT OF MINING CLAIMS