Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ConnectOne Bancorp, Inc. | v365796_8k.htm |

Creating New Jersey’s Premier Community Bank Center Bancorp, Inc. and ConnectOne Bancorp, Inc. Combine to Create New Jersey’s Premier Community Bank January 21, 2014 NASDAQ: CNBC NASDAQ: CNOB

Creating New Jersey’s Premier Community Bank Forward Looking Statements 1 All non - historical statements in this investor presentation (including without limitation statements regarding the pro forma effect of the proposed transaction, annual cost savings, anticipated expense totals, the accretive nature of the proposed transaction, revenue enhancement opportunities, anticipated capital ratios and capital, positioning, value creation, growth prospects and timing of the closing) constitute forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "target," "estimate," "continue," "positions," "prospects" or "potential," by future conditional verbs such as "will," "would," "should," "could" or "may", or by variations of such words or by similar expressions . Such forward - looking statements include, but are not limited to, statements about the benefits of the business combination transaction involving Center Bancorp, Inc . (“Center”) and ConnectOne Bancorp, Inc . (“ConnectOne”), including future financial and operating results, and the combined company's plans, objectives, expectations and intentions . These forward - looking statements are subject to numerous assumptions, risks and uncertainties which change over time . Forward - looking statements speak only as of the date they are made . Center and ConnectOne assume no duty to update forward - looking statements . In addition to factors previously disclosed in Center’s and ConnectOne's reports filed with the Securities and Exchange Commission, the following factors among others, could cause actual results to differ materially from forward - looking statements : ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by Center and ConnectOne shareholders, on the expected terms and schedule ; delay in closing the merger ; difficulties and delays in integrating the Center and ConnectOne businesses or fully realizing cost savings and other benefits ; business disruption following the proposed transaction ; changes in asset quality and credit risk ; the inability to sustain revenue and earnings growth ; changes in interest rates and capital markets ; inflation ; customer borrowing, repayment, investment and deposit practices ; customer disintermediation ; the introduction, withdrawal, success and timing of business initiatives ; competitive conditions ; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures ; economic conditions ; changes in Center's stock price before closing, including as a result of the financial performance of ConnectOne prior to closing ; the reaction to the transaction of the companies' customers, employees and counterparties ; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms . Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results .

Creating New Jersey’s Premier Community Bank Additional Information for Stockholders 2 Additional Information and Where to Find It In connection with the proposed merger, Center will file with the Securities and Exchange Commission ("SEC") a Registration Statement on Form S - 4 that will include a joint proxy statement of Center and ConnectOne and a prospectus of Center, as well as other relevant documents concerning the proposed transaction . Center and ConnectOne will each mail the joint proxy statement/prospectus to its stockholders . SHAREHOLDERS OF CENTER AND CONNECTONE ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER IN THEIR ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION . Investors and security holders may obtain a free copy of the joint proxy statement/prospectus (when available) and other filings containing information about Center and ConnectOne at the SEC's website at www . sec . gov . The joint proxy statement/prospectus (when available) and the other filings may also be obtained free of charge at Center's website at www . centerbancorp . com under the tab "Investor Relations," and then under the heading "SEC Filings" or at ConnectOne's website at www . connectonebank . com under the tab "Investor Relations," and then under the heading "SEC Filings . " Center , ConnectOne and certain of their respective directors and executive officers, under the SEC's rules, may be deemed to be participants in the solicitation of proxies of Center and ConnectOne's shareholders in connection with the proposed merger . Information regarding the directors and executive officers of Center and their ownership of Center common stock is set forth in the proxy statement for Center's 2013 annual meeting of shareholders, as filed with the SEC on Schedule 14 A on April 15 , 2013 . Information regarding the directors and executive officers of ConnectOne and their ownership of ConnectOne common stock is set forth in the proxy statement for ConnectOne’s 2013 annual meeting of shareholders, as filed with the SEC on Schedule 14 A on April 8 , 2013 . Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes available . Free copies of this document may be obtained as described in the preceding paragraph . This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction .

Creating New Jersey’s Premier Community Bank Participants 3 Frank Sorrentino III ConnectOne Chairman & CEO Anthony Weagley Center CEO William S. Burns ConnectOne CFO

Creating New Jersey’s Premier Community Bank Transaction Rationale 4 Strategically Compelling Financially Attractive □ Combines two high performing New Jersey banks situated in some of the most affluent markets in the nation □ Creates a $3 billion institution with a significantly enhanced platform for continued growth in middle market commercial business lending □ Combines Center’s robust core deposit base with ConnectOne’s strong organic loan generation □ Improves trading liquidity □ Expands ConnectOne’s loan platform for continued growth and increases legal lending limit □ Similar cultures and business focus, with demonstrated commitment and service to their communities □ Builds franchise value □ Meaningful financial impact to the combined company ¨ 5.5% Accretive to 2015 EPS ¨ Minimal dilution to tangible book value per share with short earnback period ¨ Internal rate of return in the high teens □ Impressive pro forma financial metrics ¨ Enhanced earnings profile; ROA of 1.3% and ROATE of 14.2% in 2015 ¨ Well capitalized with Tier 1 Leverage Ratio of 9.7% and Total RBC Ratio of 11.8% □ Pro forma company to maintain Center’s dividend post merger (subject to Board approval)

Creating New Jersey’s Premier Community Bank Transaction Overview 5 □ Fixed exchange ratio of 2.6 shares of Center common stock for each share of ConnectOne common stock □ 100% stock; no collars □ Implied transaction value of $242.9 million, or $45.60 per share (1) □ Represents a 14% premium to ConnectOne’s closing price and 1.79x Q4 ’13 tangible book value Consideration □ 54% Center / 46% ConnectOne Pro Forma Ownership □ Center is legal and accounting acquiror □ Pro forma company to adopt ConnectOne’s name and brand Corporate □ Frank Sorrentino III, Chairman & Chief Executive Officer (ConnectOne) □ Anthony Weagley, Chief Operating Officer (Center) □ William S. Burns , Chief Financial Officer (ConnectOne) Named Executives Board Composition Required Approvals Targeted Close □ Approval of Center and ConnectOne shareholders □ Customary regulatory approvals □ Late ‘Q2 or early ‘Q3 2014 □ 6 Center directors / 6 ConnectOne directors Key Stakeholder □ Larry Seidman, current Center board member and significant Center stakeholder, to sell down his 12.7% position in the combined pro forma company to 4.9%. He will not continue as a board m ember (1) Based on CNBC share price of $17.54 as of as of 1/17/2014

Creating New Jersey’s Premier Community Bank Company Introductions 6 Corporate Overview (1) Headquarters Englewood Cliffs, NJ Branches 8 Assets ($mm) 1,242.7 Loans ($mm) 1,152.5 Deposits ($mm) 965.8 Corporate History Corporate History Corporate Overview (1) Headquarters Union, NJ Branches 16 Assets ($mm) 1,678.3 Loans ($mm) 960.9 Deposits ($mm) 1,342.0 □ Founded in 1923 as Union Center National Bank □ 2007 : Tony Weagley appointed as CEO, Larry Seidman elected to Board of Directors □ 2008: Realigned corporate strategy to focus on generating earnings and core banking growth; overhauled Board of Directors to include prominent NJ business leaders □ 2009: Issued $10 mm of TARP and $11 million of common equity □ 2010: Issued $12.1 mm of common equity □ 2011: Repaid TARP and received $11.3 million of SBLF □ 2012: Acquired certain assets and liabilities of Saddle River Valley Bank for $ 10.3 million □ Founded in 2005 as North Jersey Community Bank □ 2005 : Raised $12 million in de novo offering; reached $100 mm of assets at year end □ 2006: Completed $ 6 million common stock offering, achieved profitability in 8th quarter of operation □ 2009 : Assumed $43.7 million of deposits from Citizens Community Bank in FDIC assisted transaction □ 2013: Raised $47.8 million of proceeds in IPO at $28.00 per share, changed name to ConnectOne, reached $1.0 billion of assets (1) Financial data is presented as of 12/31/2013

Creating New Jersey’s Premier Community Bank $602.4 $729.7 $929.9 $1,242.7 $0.0 $300.0 $600.0 $900.0 $1,200.0 $1,500.0 FY 2010 FY 2011 FY 2012 FY 2013 $5.79 $6.60 $8.11 $8.56 $5.79 $6.72 $8.43 $9.16 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 FY 2010 FY 2011 FY 2012 FY 2013 Combines Two of New Jersey’s Highest Performing Banks 7 Tangible Book Value Per Share ($) 27.3% CAGR 16.5% CAGR Source: SNL Financial, company earnings releases Net Income ($mm) Assets ($mm) $1,207.4 $1,432.7 $1,629.8 $1,678.3 $0.0 $400.0 $800.0 $1,200.0 $1,600.0 $2,000.0 FY 2010 FY 2011 FY 2012 FY 2013 Tangible Book Value Per Share ($) $7.0 $13.9 $17.5 $19.9 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 FY 2010 FY 2011 FY 2012 FY 2013 11.6% CAGR 41. 7 % CAGR Assets ($mm) Net Income ($mm) $15.04 $17.87 $22.77 $25.43 $0.00 $6.00 $12.00 $18.00 $24.00 $30.00 FY 2010 FY 2011 FY 2012 FY 2013 $4.7 $6.7 $8.4 $10.3 $0.0 $2.5 $5.0 $7.5 $10.0 $12.5 FY 2010 FY 2011 FY 2012 FY 2013 19.1% CAGR 29.5% CAGR Center Historical Performance ConnectOne Historical Performance

Creating New Jersey’s Premier Community Bank Rank Institution (ST) Number of Branches Deposits in Market ($mm) Market Share (%) 1 Valley National Bancorp (NJ) 94 4,281 11.7 2 Investors Bancorp Inc. (MHC) (NJ) 46 4,272 11.7 3 Provident Financial Services Inc. (NJ) 41 2,765 7.6 Pro Forma 24 2,105 5.8 4 Kearny Financial Corp. (MHC) (NJ) 28 1,903 5.2 5 Columbia Bank MHC (NJ) 21 1,842 5.0 6 Union County Savings Bank (NJ) 4 1,415 3.9 7 Oritani Financial Corp. (NJ) 23 1,345 3.7 8 Center Bancorp Inc. (NJ) 16 1,281 3.5 9 Lakeland Bancorp Inc. (NJ) 22 1,120 3.1 10 Spencer Savings Bank SLA (NJ) 14 1,090 3.0 11 Boiling Springs MHC (NJ) 15 1,009 2.8 12 ConnectOne Bancorp Inc. (NJ) 8 823 2.3 13 BCB Bancorp Inc. (NJ) 8 814 2.2 14 First Choice Bk (NJ) 5 724 2.0 15 Cenlar Capital Corp. (NJ) 1 607 1.7 Total (1-15) 346 25,291 69.2 Total (1-61) 555 36,523 100.0 Enhances Scale in New Jersey’s Best Markets 8 Pro Forma Branch Map Deposit Market Share by Counties of Operation (NJ Headquartered Institutions Only) □ The combined company is well - positioned in some of the most affluent markets in the nation □ New Jersey ranks 2 nd in the nation in median household income, 4 th in per capita income and 2 nd in population density Source: SNL Financial; Deposit data as of 6/30/2013 • CNOB (8) • CNBC (16) Sussex Warren Hunterdon Mercer Somerset Middlesex Monmouth Union Essex Hudson Bergen Passaic Morris NEW JERSEY PA NY

Creating New Jersey’s Premier Community Bank Reciprocal Due Diligence and Credit Review 9 □ Comprehensive due diligence process including core systems, legal and credit due diligence ¨ Identified efficient consolidation of data processing software □ Two tiered credit due diligence process completed by senior management and 3 rd party loan review teams at both banks □ Analyzed credit files, underwriting methodologies and policies and portfolio management processes □ Reciprocal credit review focused on the largest relationships, adversely classified assets and watch list loans ¨ Individually reviewed approximately 90% of commercial loan relationships with a balance greater than $2.5 million ¨ Individually reviewed more than 50% of all commercial loans ¨ Individually reviewed approximately 90% of all adversely classified and criticized assets

Creating New Jersey’s Premier Community Bank Planning and Investing for Continued Growth 10 □ Strong, complementary institutions, well positioned for continued profitable growth □ Organizations have an established track record investing in and adapting their scalable infrastructure to strengthen competitive positions □ Enhanced opportunities and broader platform to leverage ConnectOne’s progressive investments in mobile and digital banking and utilize best - in - class technology to serve customers □ Combined infrastructure strength leverages state of the art technology and top industry talent versus an exclusive focus on traditional brick and mortar growth □ Ongoing smart investments in technology and enhanced cash management services expand current and future opportunities □ Appropriate structural investments in key areas to ensure quality growth: ¨ Credit processes ¨ Compliance and operations ¨ Maintaining and recruiting top talent

Creating New Jersey’s Premier Community Bank Conservative Cost Savings Estimated 11 Noninterest Expense Items Estimated Cost Savings ($mm) Compensation & Benefits $3.1 Occupancy & Equipment 0.7 Data Processing & Communications 0.9 Legal, Audit & Professional 1.2 Marketing 0.3 Other 0.8 Pre-tax Total $7.0 □ Identified cost savings represents approximately 14% of combined expense base

Creating New Jersey’s Premier Community Bank Financial Impact 12 Attractive Returns Key Transaction and Model Assumptions 2015 EPS Impact Tangible Book Value Capital Internal Rate of Return □ 5.5% accretive to Center □ 1.7% dilutive to Center at close □ Earnback period of 2 years □ Pro forma capital ratios in excess of well capitalized at close ¨ TCE Ratio: 8.9% ¨ Tier 1 Leverage: 9.7% ¨ Total RBC: 11.8% □ ~19% □ Earnings estimates based on First Call consensus □ No revenue enhancements have been assumed □ Gross credit mark of $ 17.3 million, or 1.5% of loans □ Interest rate marks: ¨ Write - up of loans of $3.4 million ¨ Write - up of time deposits of $2.5 million ¨ Write - up of borrowings of $2.5 million □ Fully phased - in cost savings of approximately 14% of combined expense base □ After - tax restructuring charge of $11.2 million □ Core deposit intangible of 1.5% of non - time deposits, amortized over 10 years using the sum of the years’ digits method □ Plans to maintain current Center’s annual dividend of $0.30 per share, subject to board approval □ Estimated closing date of June 30, 2014

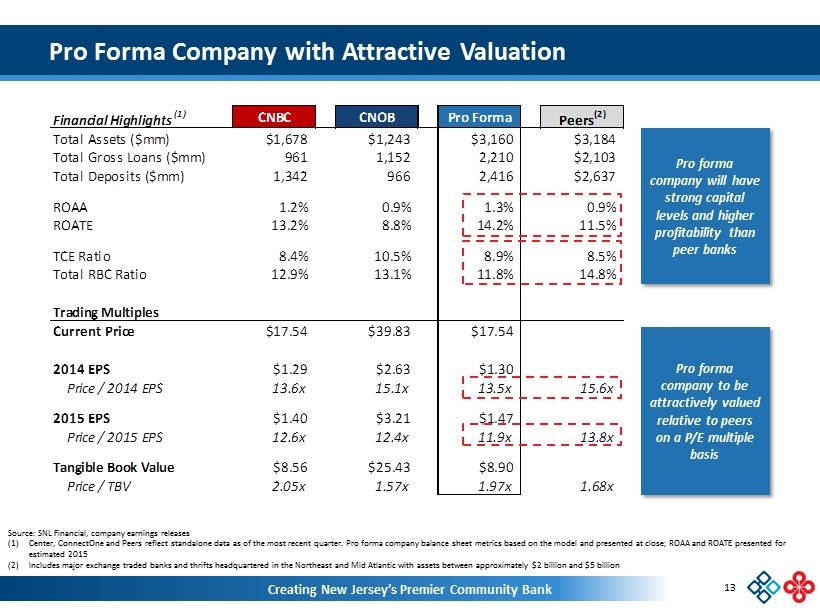

Creating New Jersey’s Premier Community Bank Financial Highlights (1) CNBC CNOB Pro Forma Peers (2) Total Assets ($mm) $1,678 $1,243 $3,160 $3,184 Total Gross Loans ($mm) 961 1,152 2,210 $2,103 Total Deposits ($mm) 1,342 966 2,416 $2,637 ROAA 1.2% 0.9% 1.3% 0.9% ROATE 13.2% 8.8% 14.2% 11.5% TCE Ratio 8.4% 10.5% 8.9% 8.5% Total RBC Ratio 12.9% 13.1% 11.8% 14.8% Trading Multiples Current Price $17.54 $39.83 $17.54 2014 EPS $1.29 $2.63 $1.30 Price / 2014 EPS 13.6x 15.1x 13.5x 15.6x 2015 EPS $1.40 $3.21 $1.47 Price / 2015 EPS 12.6x 12.4x 11.9x 13.8x Tangible Book Value $8.56 $25.43 $8.90 Price / TBV 2.05x 1.57x 1.97x 1.68x Pro Forma Company with Attractive Valuation 13 Source: SNL Financial, company earnings releases (1) Center, ConnectOne and Peers reflect standalone data as of the most recent quarter. Pro forma company balance sheet metrics b ase d on the model and presented at close; ROAA and ROATE presented for estimated 2015 (2) Includes major exchange traded banks and thrifts headquartered in the Northeast and Mid Atlantic with assets between approximately $ 2 billion and $5 billion Pro forma company will have strong capital levels and higher profitability than peer banks Pro forma company to be attractively valued relative to peers on a P/E multiple basis

Creating New Jersey’s Premier Community Bank Strategically compelling merger between two top performing NJ banks Highly attractive franchise with enhanced size, scale and geographic footprint in key New Jersey markets Combines Center’s robust core deposit base with ConnectOne’s strong organic loan generation Solid asset quality and strong credit culture Engaged and experienced management team and board Significant potential value creation opportunity for shareholders x Summary 14 x x x x x On a combined basis, trades at a discounted price/earnings multiple x

Creating New Jersey’s Premier Community Bank Appendix Creating New Jersey’s Premier Community Bank NASDAQ: CNBC NASDAQ: CNOB

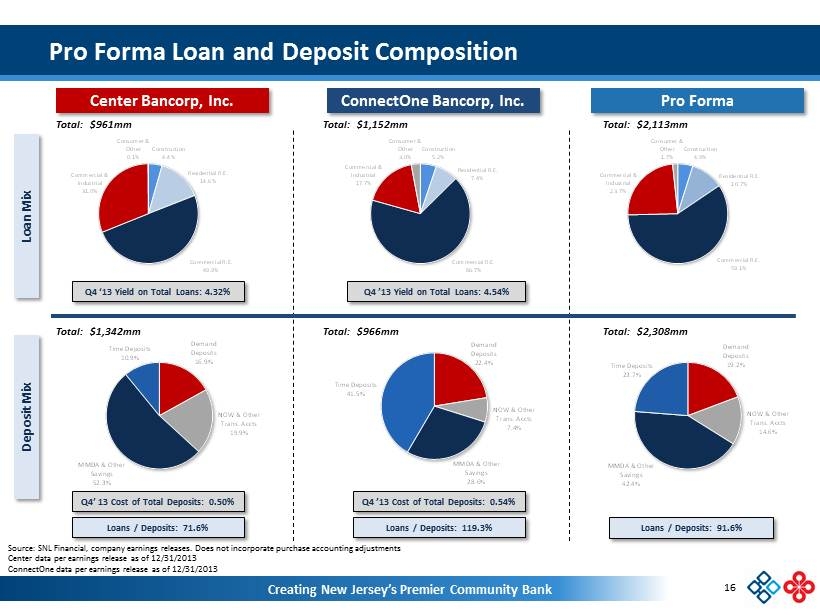

Creating New Jersey’s Premier Community Bank Pro Forma Loan and Deposit Composition 16 Q4’ 13 Cost of Total Deposits : 0.50% Q4 ’13 Cost of Total Deposits : 0.54% Deposit Mix Loan Mix Total: Total: Total: Q4 ‘13 Yield on Total Loans: 4.32% Q4 ’13 Yield on Total Loans: 4.54% Total: Total: Total: Construction 5.2% Residential R.E. 7.4% Commercial R.E. 66.7% Commercial & Industrial 17.7% Consumer & Other 3.0% $961mm $1,152mm $2,113mm $1,342mm $966mm $2,308mm Demand Deposits 22.4% NOW & Other Trans. Accts 7.4% MMDA & Other Savings 28.6% Time Deposits 41.5% Construction 4.4% Residential R.E. 14.6% Commercial R.E. 49.9% Commercial & Industrial 31.0% Consumer & Other 0.1% Construction 4.9% Residential R.E. 10.7% Commercial R.E. 59.1% Commercial & Industrial 23.7% Consumer & Other 1.7% Demand Deposits 16.9% NOW & Other Trans. Accts 19.9% MMDA & Other Savings 52.3% Time Deposits 10.9% Demand Deposits 19.2% NOW & Other Trans. Accts 14.6% MMDA & Other Savings 42.4% Time Deposits 23.7% Source: SNL Financial, company earnings releases. Does not incorporate purchase accounting adjustments Center data per earnings release as of 12/31/2013 ConnectOne data per earnings release as of 12/31/2013 Center Bancorp, Inc. ConnectOne Bancorp, Inc . Pro Forma Loans / Deposits: 71.6% Loans / Deposits: 119.3% Loans / Deposits: 91.6%

Creating New Jersey’s Premier Community Bank Financial Highlights 17 Center Historical Financial Highlights ConnectOne Historical Financial Highlights Balance Sheet ($mm) FY 2010 FY 2011 FY 2012 FY 2013 CAGR Assets $1,207.4 $1,432.7 $1,629.8 $1,678.3 11.6% Loans 708.4 756.0 891.2 960.9 10.7% Deposits 860.3 1,121.4 1,306.9 1,342.0 16.0% Tangible Common Equity 94.3 107.8 132.6 140.1 14.1% Profitability Net Income ($mm) $7.0 $13.9 $17.5 $19.9 41.7% ROAA (%) 0.59 1.05 1.14 1.22 NIM (%) 3.30 3.53 3.32 3.30 Efficiency Ratio (%) 60.0 51.7 49.3 47.1 Fee Income / Revenue (%) 10.1 8.8 9.0 10.0 Balance Sheet Ratio / Capital (%) TCE Ratio 7.92 7.61 8.22 8.43 Total Risk Based Capital Ratio 14.3 12.9 12.2 12.9 Loans / Deposits 82.3 67.3 68.1 71.6 Securities / Assets 32.1 34.6 34.6 32.1 Asset Quality (%) NPAs / Assets 1.51 1.04 0.72 0.29 NPAs / Loans + OREO 2.57 1.97 1.31 0.51 Reserves / Loans 1.25 1.27 1.15 1.08 NCOs / Avg. Loans 0.69 0.24 (0.04) 0.03 Source: SNL Financial, c ompany earnings releases; NPAs include nonaccrual loans, OREO and TDRs Balance Sheet ($mm) FY 2010 FY 2011 FY 2012 FY 2013 CAGR Assets $602.4 $729.7 $929.9 $1,242.7 27.3% Loans 494.5 629.5 849.2 1,152.5 32.6% Deposits 482.7 609.4 769.3 965.8 26.0% Tangible Common Equity 33.7 40.1 72.1 129.9 56.8% Profitability Net Income ($mm) $4.7 $6.7 $8.4 $10.3 29.5% ROAA (%) 0.84 1.00 1.01 0.96 NIM (%) 4.22 4.21 4.20 3.87 Efficiency Ratio (%) 54.3 52.8 49.1 49.1 Fee Income / Revenue (%) 3.8 3.6 3.2 2.9 Balance Sheet Ratio / Capital (%) TCE Ratio 5.60 5.50 7.76 10.45 Total Risk Based Capital Ratio 11.4 11.2 10.5 13.1 Loans / Deposits 102.3 103.3 110.3 119.3 Securities / Assets 7.8 4.7 2.8 2.3 Asset Quality (%) NPAs / Assets 0.67 1.54 1.22 1.08 NPAs / Loans + OREO 0.82 1.79 1.34 1.16 Reserves / Loans 1.50 1.53 1.56 1.39 NCOs / Avg. Loans 0.06 0.03 0.05 0.19

Creating New Jersey’s Premier Community Bank For the quarter ended 12/31/2013 CNBC CNOB Net income $4,984 $2,850 Average stockholders’ equity $168,283 $129,447 Average tangible stockholders’ equity $151,452 $129,187 Return on average stockholders’ equity (1) 11.85% 8.73% Add: Average goodwill and other intangible assets (1) 1.31% 0.02% Return on average tangible stockholders’ equity (1) 13.16% 8.75% At the quarter ended 12/31/2013 CNBC CNOB Common shares outstanding 16,369,012 5,106,455 Stockholders’ equity $168,189 $130,128 Less: Preferred stock 11,250 - Less: Goodwill and other intangible assets 16,827 260 Tangible common stockholders’ equity $140,112 $129,868 Book value per common share $9.59 $25.48 Less: Goodwill and other intangible assets 1.03 0.05 Tangible book value per common share $8.56 $25.43 Total assets $1,678,296 $1,242,673 Less: Goodwill and other intangible assets 16,827 260 Tangible assets $1,661,469 $1,242,413 Total stockholders' equity / total assets 10.02% 10.47% Tangible common stockholders' equity / tangible assets 8.43% 10.45% Non - GAAP Reconciliations 18 (1) Annualized