Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MOLINA HEALTHCARE, INC. | d658511d8k.htm |

Molina Healthcare

J. Mario Molina, MD

President & Chief Executive Officer

32

J.P.

Morgan

Healthcare

Conference

January 13-16, 2014

San Francisco

Exhibit 99.1

nd |

2

©

2014 Molina Healthcare, Inc.

Cautionary Statement

Safe

Harbor

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This

slide

presentation

and

our

accompanying

oral

remarks

contain

numerous

“forward-looking

statements”

regarding,

without limitation: our revenue, membership, and profitability growth projections; market and

growth opportunities related to Medicare and Medicaid dually eligible members, to the

Affordable Care Act (ACA) Medicaid expansion, and to the state insurance exchanges or

marketplaces; the ACA annual health industry fee and its expected reimbursement by states,

including any tax impact; rate matters in Washington; and various other matters.

All of our forward-looking statements are subject to numerous risks, uncertainties,

and

other factors that could cause our actual results to differ materially. Anyone viewing or listening to

this presentation is urged to read the risk factors and cautionary statements found under Item

1A in our annual report on Form 10-K, as well as the risk factors and cautionary statements

in our quarterly reports and in our other reports and filings with the Securities and Exchange

Commission and available for viewing on its website

at

www.sec.gov.

Except

to

the

extent

otherwise

required

by

federal

securities

laws,

we

do

not

undertake to address or update forward-looking statements in future filings or communications

regarding our

business or operating results. |

3

©

2014 Molina Healthcare, Inc.

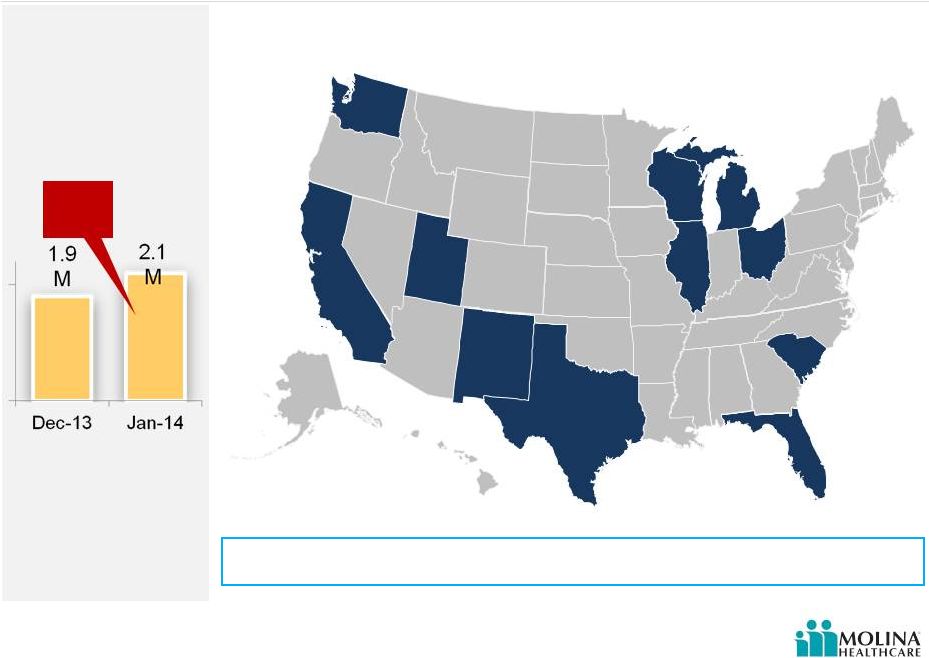

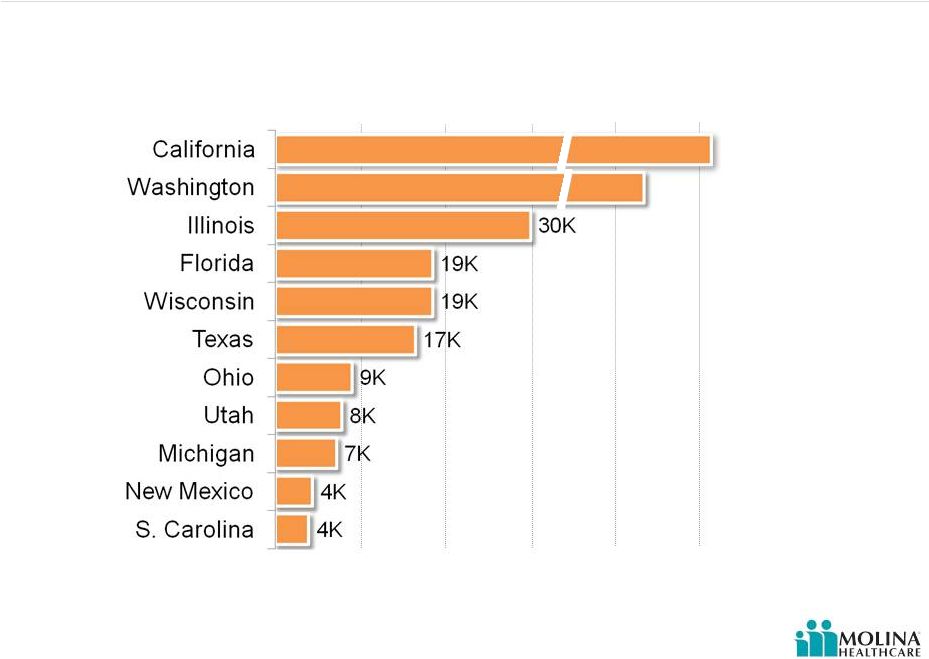

Health Plan Enrollment as of January 10, 2014

1

1.

Reflects preliminary enrollment figures.

2.

January 2014 enrollment includes South Carolina acquisition.

3.

As of September 1, 2013, Illinois health plan began serving ABD members.

4.

As of January 1, 2014, South Carolina health plan began serving South Carolina Medicaid members, as a

result of the South Carolina Solutions asset acquisition. Molina Healthcare

Health Plan Enrollment

Growth

Dec 2013 -

Jan 2014

2

2.1 million members

WA

409K

CA

441K

UT

86K

NM

162K

TX

249K

FL

89K

SC

4

137K

IL

3

5K

WI

92K

MI

213K

OH

255K

11%

Growth |

4

©

2014 Molina Healthcare, Inc.

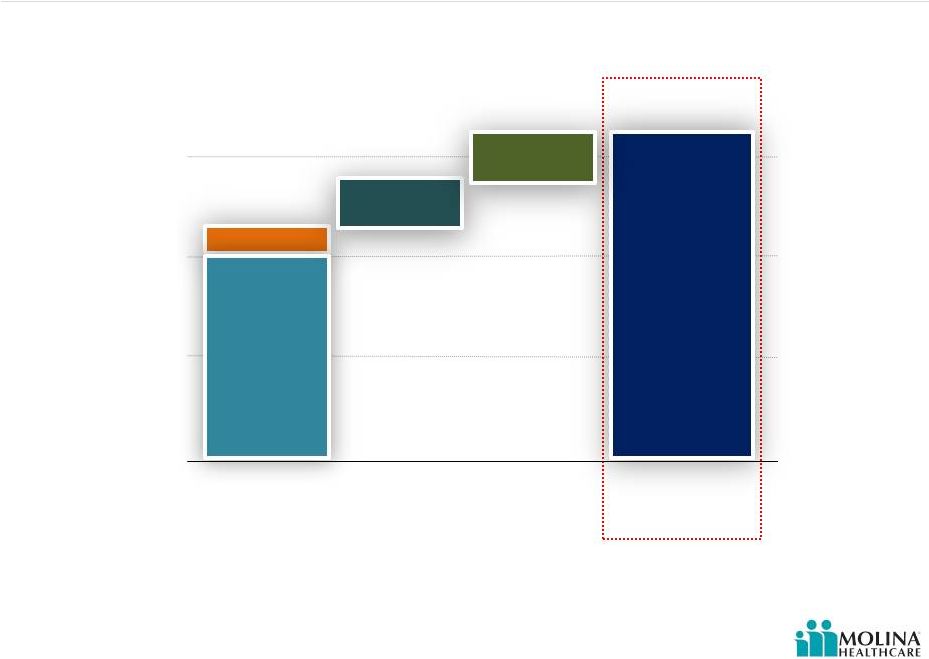

Long Term Incremental Growth Drivers

1.

All amounts are estimates and subject to change.

2.

Acquisitions denote New Mexico (Lovelace), and South Carolina (Community Health Solutions

assets). 3.

Duals denotes revenue potential for dual eligibles in CA, MI, OH, TX, IL.

4.

ACA denotes revenue potential as a result of Medicaid expansion in CA, IL, MI, NM, and WA; and

Marketplace in CA, FL, MI, NM, TX, UT, WA, OH, and WI. Estimated potential revenue run-rate

by year-end 2015 associated with growth activities

Current

Health Plan Business

& Acquisitions

2015

~$12.5B

Duals

3

~$8.5B

~$2B

ACA

4

Total

2015

~$2B

Revenue

1

Please refer to the Company’s cautionary statements.

2 |

5

©

2014 Molina Healthcare, Inc.

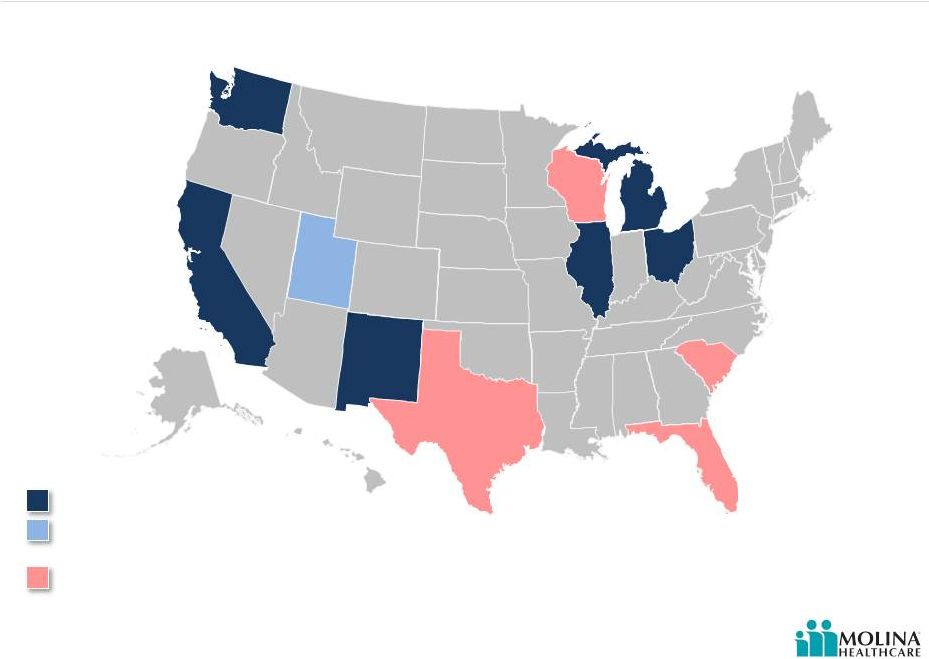

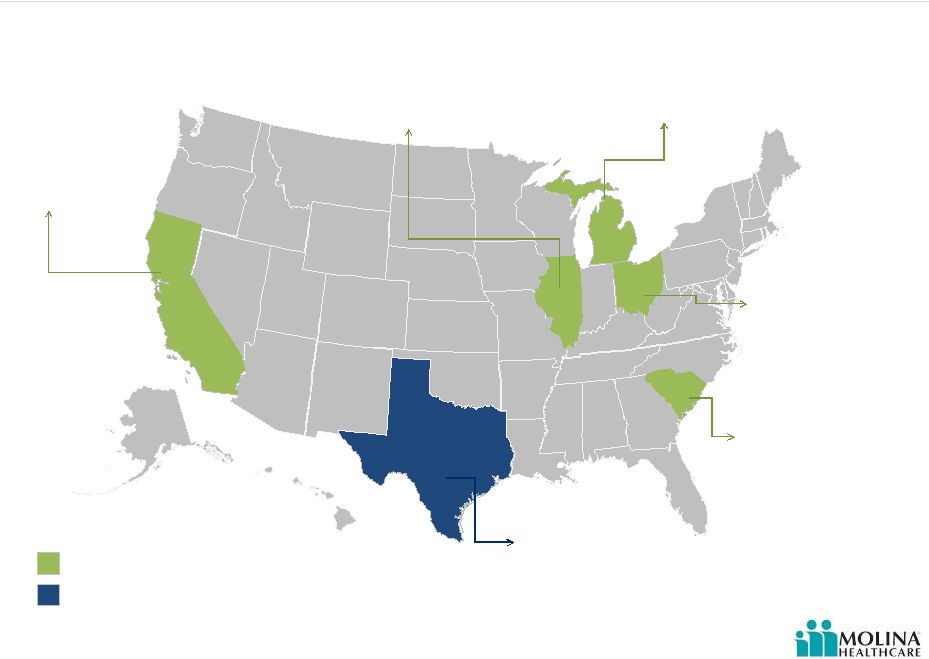

Health Plan Footprint & Planned Growth

Fully Integrated Dual Eligible

Pilots

Long Term Care

Medicaid

Health Plan Markets

WA

CA

UT

NM

TX

SC

FL

WI

MI

IL

OH |

6

©

2014 Molina Healthcare, Inc.

Medicaid Expansion

Where Molina States Stand on Medicaid Expansion as of

December 20, 2013

1

Expanding Coverage

Considering

Expansion

Not Expanding Coverage

at this Time

CA

WA

UT

NM

TX

WI

MI

FL

OH

SC

IL

1.

The Advisory Board Company. Beyond the pledges: Where the states stand on Medicaid.

|

7

©

2014 Molina Healthcare, Inc.

Medicaid Application Activity

Marketplace Applicants Determined Eligible for Medicaid

in Molina States

Oct 1, 2013 to Nov 30, 2013

(1)(2)

1.

U.S.

Department

of

Health

and

Human

Services

.“Health

Insurance

Marketplace:

December

Enrollment

Report,

November

13,

2013.

2.

Does not represent Molina enrollment expectations.

# Marketplace

Applicants Determined

Eligible for Medicaid

182K

154K |

8

©

2014 Molina Healthcare, Inc.

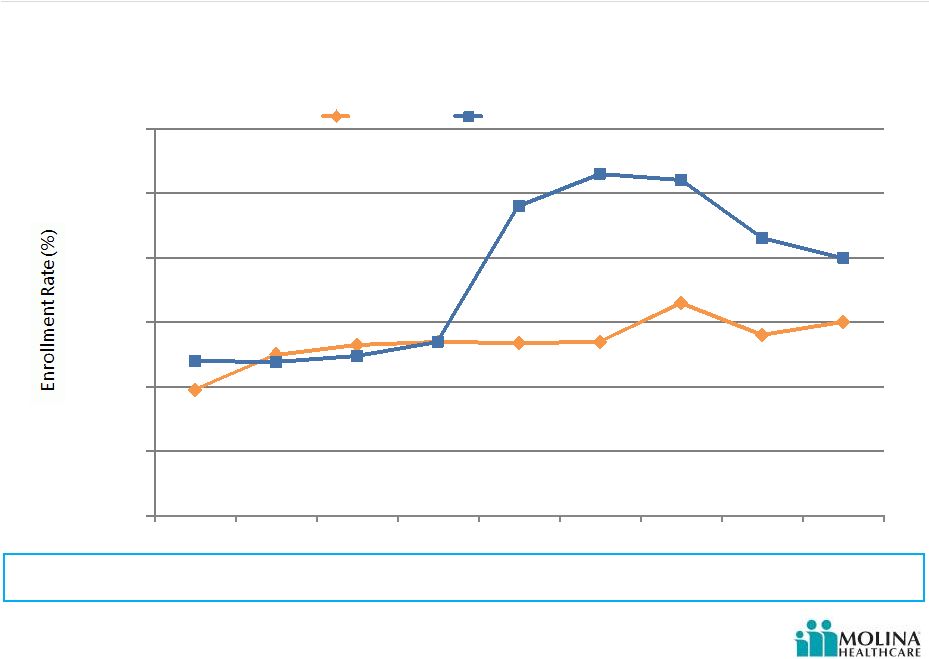

Welcome-Mat Effect

Medicaid enrollment increased by ~16% in MA as a result of outreach efforts

The intensity of outreach and awareness efforts associated with the Affordable Care Act may

affect the increase in Medicaid enrollment and participation among individuals previously eligible

but who did not enroll.

MA Medicaid Unadjusted Enrollment Rates

1

20%

30%

40%

50%

60%

70%

80%

2003

2004

2005

2006

2007

2008

2009

2010

2011

Controls

Massachusetts

1. Health Affairs Journal. “Medicaid ‘Welcome-Mat’ Effect of

Affordable Care Act Implementation Could be Substantial”, July 2013. |

9

©

2014 Molina Healthcare, Inc.

Texas

Going Live: 1/1/15

State will work with existing

Medicaid Providers

California

Molina Counties: San

Diego,

Riverside, San Bernardino

Going Live: 4/1/14

Medicare-Medicaid Plan (MMP) Implementations

Illinois

Molina Counties: Central

Region

Going Live: 2/1/14

Ohio

Molina Counties: 13 counties

in 3 Regions (Southwest,

Central

and West Central Regions)

Going Live: 3/1/14

South Carolina

Selected for demonstration

project, Readiness Review Next

Going Live: 7/1/14

Michigan

Molina Counties: Wayne, Macomb

Going Live: 10/1/14

Contracts awarded to MOH

State working with existing

providers

Dual Eligible |

10

©

2014 Molina Healthcare, Inc.

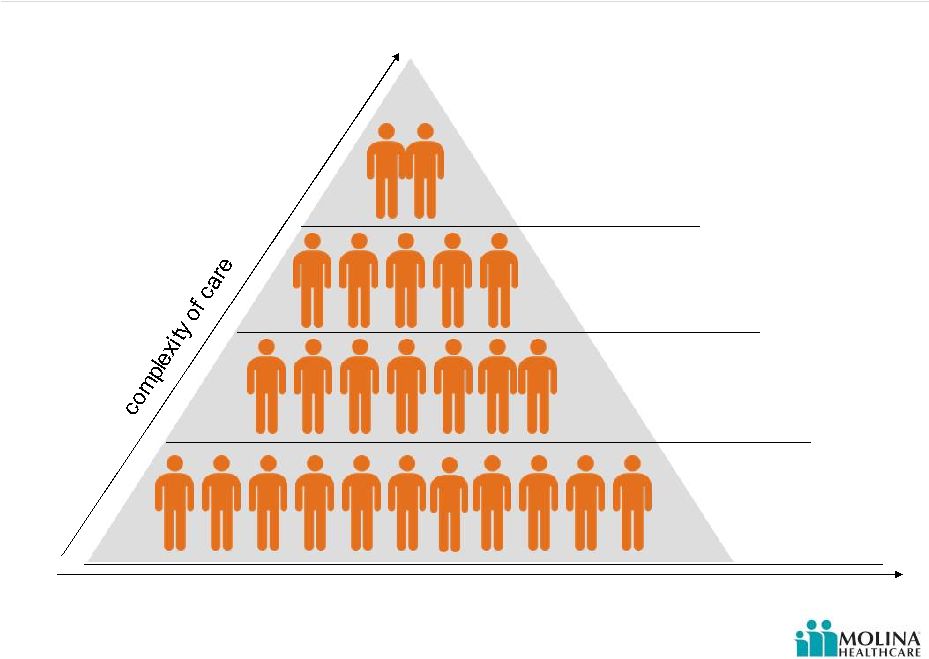

Levels of Patient Care

Long Term Care

Dual Eligible

Seniors & Persons

with Disabilities

Temporary

Assistance to

Needy Families

Number of potential enrollees |

11

©

2014 Molina Healthcare, Inc.

Duals –

Model of Care

Integrated

LTSS/Acute

And Rx

Care Transition

Programs

Measuring

Improvements

Individualized

Care Plans

Medication

Reviews and

Medication

Therapy Mgmt.

Interdisciplinary

Care Teams

Health Risk

Assessments

Care

Management

Dual Eligibles

Most Common Diagnoses

Inpatient Services:

Affective psychosis

Septicemia

Pneumonia

Chronic bronchitis

Outpatient Services:

Essential hypertension

Respiratory and other chest

Diabetes mellitus

Fever and fatigue

Joint disorders

1.

KFF.org.

Care involving use

of rehab procedures |

12

©

2014 Molina Healthcare, Inc.

Enrollment ramp up has been slow due to

delays on federal and state websites

•

Spanish language sites later start

8 out of 10 low-income Americans still don’t

understand the program

1

Molina pricing assumed higher medical costs

and utilization compared to existing

membership

Enrolled individuals at Molina health plans are

primarily the uninsured and previous Medicaid

recipients that had lost their eligibility

Marketplace

Please refer to the Company’s cautionary statements.

1.

Thomson Reuters. “Most Uninsured Americans lack knowledge about Obamacare: survey”, January

9, 2014. |

13

©

2014 Molina Healthcare, Inc.

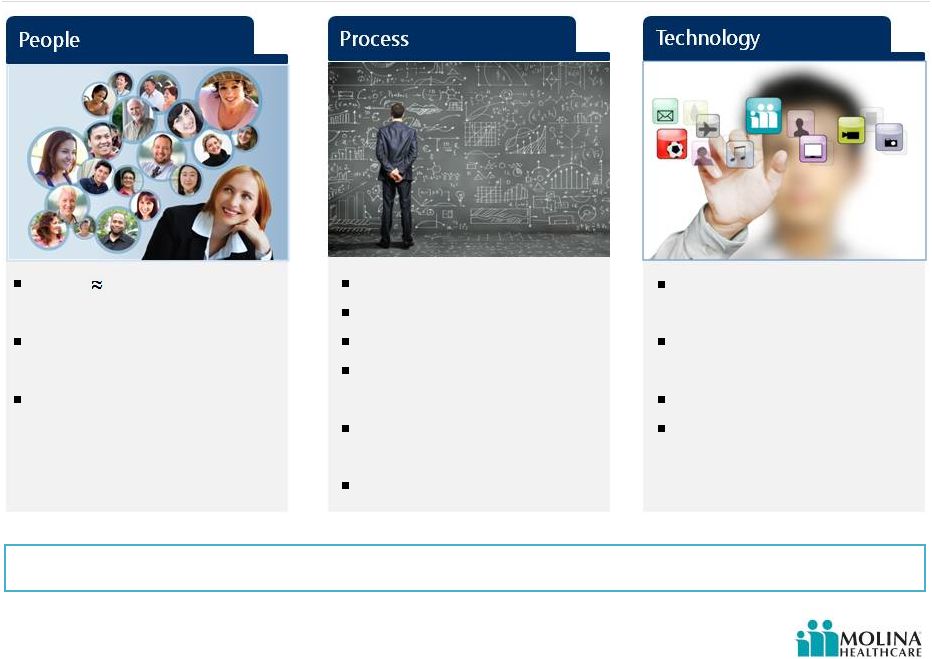

Preparing for Growth –

Operational Priorities

Infrastructure build precedes revenue

Product development

Pricing

Network customization

Premium billing and

collection

Marketing/Sales/

Advertising

LTSS management

Hired

4K

employees

in 2013

Dedicated team for

Marketplace

Expanded Medicare

team for Duals

Demonstration

Premium billing &

collections

Upgraded care

management software

Clear Coverage™

Telephony upgrade |

14

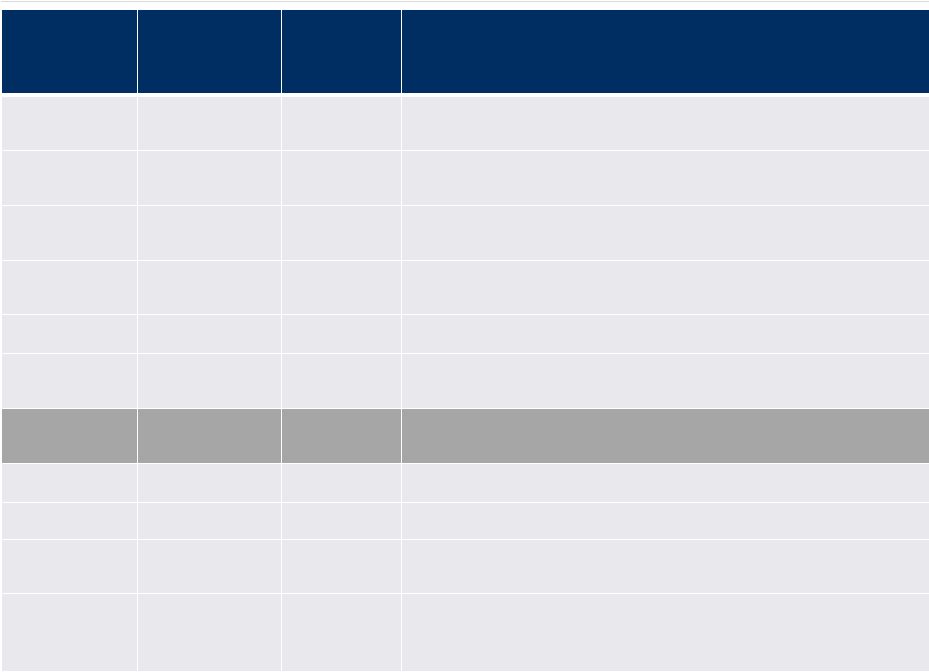

Status of Reimbursement –

ACA Fee in Molina States

State

Fee

Reimburse

ment

Tax

Gross

Up

Comments

California

Yes

Unknown

Health plan association has received email from state

committing to reimbursement of fee.

Florida

Yes

Yes

Actuarial rate memorandum (Milliman) calls for

reimbursement of fee and tax impact.

Illinois

Yes

Yes

Actuarial rate memorandum (Milliman) calls for

reimbursement of fee and tax impact.

Michigan

Yes

Yes

Actuarial rate memorandum (Milliman) calls for

reimbursement of fee and tax impact.

New Mexico

Yes

Unknown

Verbal representation to HPs at rate meeting only.

Ohio

Yes

Unknown

Actuarial rate memorandum (Mercer) calls for reimbursement

of fee -

silent on tax impact.

South

Carolina

No revenue in 2013.

Texas

Yes

Unknown

Verbal representation to HPs at rate meeting only.

Utah

No

No

Washington

Yes

Yes

Contract specifically calls for reimbursement of fee and tax

impact.

Wisconsin

Yes

Unknown

Per contract: "The parties agree to amend the contract as

needed to address federal regulations and guidance

regarding application of the health insurance tax.” |

15

©

2014 Molina Healthcare, Inc.

State of Washington is seeking to recover premiums

previously paid to the company as part of a retroactive

premium change

One-time recovery affects revenue recorded during

July through December of 2013

The premium recovery is estimated to reduce pre-tax

income for 4Q2013 by approximately $15M

This item was not included in guidance issued October

30, 2013

Washington Retroactive Rate Reduction

Please refer to the Company’s cautionary statements. |

16

©

2014 Molina Healthcare, Inc.

Tailwinds & Headwinds

Medicaid expansion

Tailwinds

Footprint includes 4 of 5 largest

Medicaid markets

Uniquely positioned to capture

dual eligible enrollment

Delayed state implementations

Headwinds

Industry tax

Medical cost pressure associated

with new contracts/populations |

17

©

2014 Molina Healthcare, Inc.

Investment Highlights

Attractive sector growth prospects driven by

government policies and economic conditions

Focus on government-sponsored health care

programs

Proven flexible health care services portfolio (risk-

based, fee-based and direct delivery)

Diversified geographic exposure in 16 states with

significant presence in high growth regions

Scalable administrative efficiencies stemming from

centralized and standardized functions

Seasoned management team with strong track

record of delivering earnings growth

Over 30 years of experience

Please refer to the Company’s cautionary statements. |

18

©

2014 Molina Healthcare, Inc.

Breakout |