Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NOVANTA INC | d658580d8k.htm |

Investor Presentation

Investor Presentation

January 15-16, 2014

January 15-16, 2014

Exhibit 99.1 |

Factors affecting future performance…

Factors affecting future performance…

…and use of Non-GAAP financial measures

…and use of Non-GAAP financial measures

2

Forward-Looking Statements

Non-GAAP Measures

The statements in this presentation that relate to guidance, pro forma presentations, future plans,

goals, business opportunities, events or performance are forward-looking statements that

involve risks and uncertainties, including risks associated with business and economic conditions,

failure to achieve expected benefits of the NDS acquisition, failure to comply with Food and Drug

Administration regulations, customer and/or supplier contract cancellations, manufacturing risks,

competitive factors, ability to successfully introduce new products, uncertainties pertaining to

customer orders, demand for products and services, growth and development of markets for the

Company's products and services, and other risks identified in our filings made with the

Securities and Exchange Commission. Actual results, events and performance may differ

materially. Readers are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this presentation. The Company disclaims any

obligation to update these forward-looking statements as a result of developments occurring

after the date of this presentation. Readers are encouraged to refer to the risk disclosures

described in the Company’s Form 10-K for the year ended December 31, 2012 and subsequent

filings with the SEC, as applicable. Please see “Safe Harbor and Forward-Looking

Information” in the Appendix to this presentation for more information.

In this presentation, we present the non-GAAP financial measures of Adjusted EBITDA , free cash flow

and net debt. Please see “Use of Non-GAAP Financial Measures” and the subsequent

slides in the Appendix to this presentation for the reasons we use these measures, a

reconciliation of these measures to the most directly comparable GAAP measures and other

information relating to these measures.

The Company neither updates nor confirms any guidance regarding the future operating results of the

Company which may have been given prior to this presentation.

|

•

•

Leading provider

Leading provider

of precision

of precision

laser, medical

laser, medical

and motion control technology

and motion control technology

•

•

Canadian Company

Canadian Company

founded in 1968, with U.S. Headquarters in Massachusetts

founded in 1968, with U.S. Headquarters in Massachusetts

•

•

$340M+ in annual

$340M+ in annual

revenue

and ~$50M in annual Adjusted EBITDA*

and ~$50M in annual Adjusted EBITDA*

•

Approximately

1,300

employees for continuing operations

employees for continuing operations

•

•

Trade on NASDAQ

Trade on NASDAQ

(GSIG)

(GSIG)

We are a leading supplier…

…of medical and laser technologies

Operational Excellence

Increased Medical Presence

Leading Technology Franchises

Global Presence and Reach

Highly Capable Team

3

* Reflects prior full year guidance. The company is neither updating, nor

confirming its prior guidance, but is simply using its prior guidance for comparison and illustrative purposes |

Our

aspirations… …are clear and achievable

Strategic Vision

Strategic Vision

A leading provider of precision photonic and

motion technologies for OEM’s in demanding

markets –

delivering attractive shareholder

returns through sustained profitable growth

4

•

Accelerate growth (organic and M&A)

•

Improve mix (growth, volatility) –

more

Medical, less Semiconductor

•

Strive to become a world class

operating company

Strategic Priorities

•

Organic growth mid to high

single digits

•

>20% Adj. EBITDA margins

•

Long term shareholder returns

above peer average

Performance Goals |

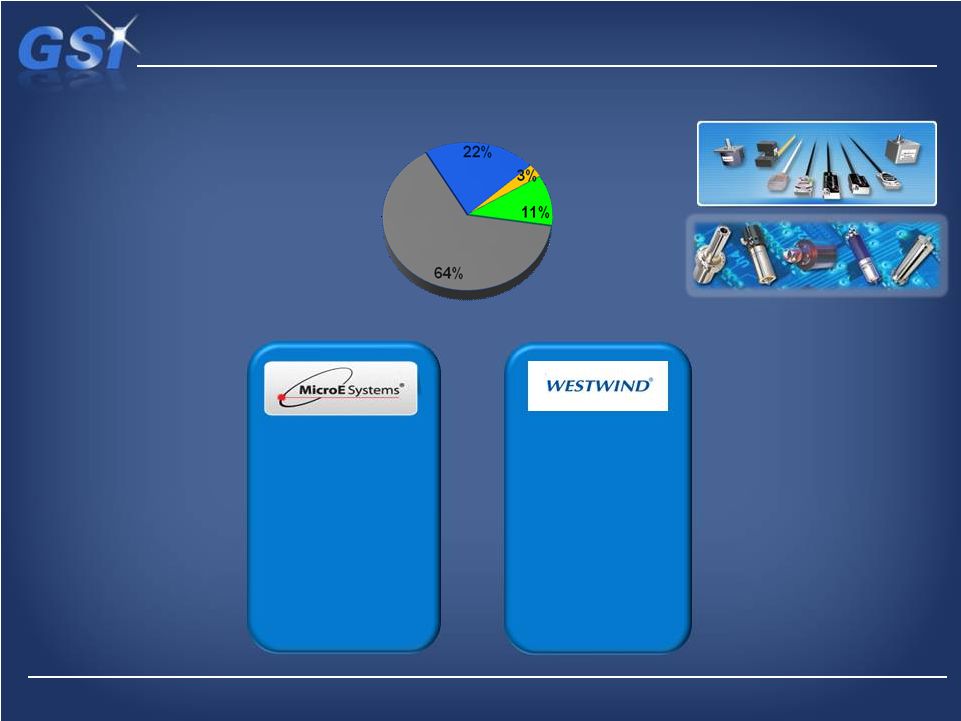

Medical end market sales are 35% of our portfolio…

Medical end market sales are 35% of our portfolio…

…with Microelectronics down to 15%

…with Microelectronics down to 15%

Laser

Laser

Products

Products

Medical

Technologies

Scientific

Medical

Micro-

electronics

GSI Profile

Industrial

Precision

Motion

Product Groups

End Market Mix

5

* Data presented represents last nine months, ending 3Q 2013

|

GSI

GSI

has a strong global presence…

…with significant reach into the Pacific Rim

•

Strong international presence -

68% of revenue from outside U.S.

•

Nine Production sites in the U.S., U.K. and China

Sales Breakdown

Sales Breakdown

Japan

Europe

Other

U.S.

Asia

Suzhou, PRC

Suzhou, PRC

Sri Lanka

Sri Lanka

Munich, Germany

Munich, Germany

Global Presence

Global Presence

* Reflects data presented in GSI Group Inc. 2012 10K

Zevenhuizen, Netherlands

Zevenhuizen, Netherlands

6

Mukilteo, WA

Mukilteo, WA

Santa Clara, CA

Santa Clara, CA

San Jose, CA

San Jose, CA

Chatsworth, CA

Chatsworth, CA

Bedford, MA

Bedford, MA

Rugby, UK

Rugby, UK

Poole, UK

Poole, UK

Taunton, UK

Taunton, UK

Tokyo, Japan

Tokyo, Japan

Production Site

Production Site

Sales/Support

Sales/Support

10%

30%

3%

25%

32% |

We

have built momentum… …to enable increased success in 2014

2013 Key Accomplishments

2013 Key Accomplishments

•

•

Successful integration of NDS acquisition

Successful integration of NDS acquisition

•

•

Completion of Semiconductor Systems divestiture

Completion of Semiconductor Systems divestiture

•

•

Balance

Balance

sheet

sheet

strength

strength

–

–

net

net

debt

debt

forecast

forecast

~$15M

~$15M

*

*

•

•

Significant leadership upgrades across businesses

Significant leadership upgrades across businesses

•

•

Strong progress on M&A pipeline

Strong progress on M&A pipeline

•

•

Return to organic growth in 2H’13

Return to organic growth in 2H’13

-

-

Growth platforms gain momentum

Growth platforms gain momentum

-

-

Some end market recovery

Some end market recovery

•

•

Increased focus on operational excellence

Increased focus on operational excellence

7

* Reflects prior full year guidance. The company is neither updating, nor

confirming its prior guidance, but is simply using its prior guidance for comparison and illustrative purposes |

Our

team was resilient… …in successfully working through several

challenges 2013 Challenges

2013 Challenges

•

Experienced extremely weak conditions in Scientific market

•

We scaled-back our Fiber Laser investments

•

Continue to see a sluggish and sometimes unpredictable

Industrial (Manufacturing) sector in China

•

Experienced an initial setback in NDA, related to a dual

sourcing at an OEM

•

Seeing some temporary weakness in medical CapEx spending

in the U.S., largely driven by the Affordable Care Act

8 |

Revenue

Revenue

Growth

Growth

Potential

Potential

Adj. EBITDA**

Adj. EBITDA**

Value Chain

Value Chain

Focus

Focus

Structure

Structure

Mix

Mix

Growth

Growth

Strategy

Strategy

Performance

Performance

Focus

Focus

~$480M*

~$480M*

Low single digit

Low single digit

~$70M

~$70M

33% systems

33% systems

67% components

67% components

<20 distinct P&L’s

>30 sites

>30 sites

>50% Semi

>50% Semi

<10% Medical

<10% Medical

Unrelated

Unrelated

acquisitions

acquisitions

Maximize margins

Maximize margins

Pre 2008

Pre 2008

+$340M

+$340M

Mid to high single digit

Mid to high single digit

~$50M

~$50M

~95%

~95%

components

components

3 focused groups

3 focused groups

<15 sites

<15 sites

~15% Semi

~15% Semi

~35% Medical

~35% Medical

Build growth platforms

Build growth platforms

Bolt-on M&A

Profit growth

Profit growth

Current

Current

$500M+

$500M+

High single digit

High single digit

$100M+

$100M+

~100%

~100%

components

components

3 focused groups

3 focused groups

<10 sites

<10 sites

<10% Semi

<10% Semi

~50% Medical

~50% Medical

Current approach

Current approach

plus selective

plus selective

transformative M&A

transformative M&A

Sustained profitable

Sustained profitable

revenue growth

revenue growth

Vision

Vision

The GSI transformation…

The GSI transformation…

…is making strong progress

…is making strong progress

* pro forma Excel Technologies + GSI Group Inc results as reported in GSI Group Inc.

8K filed on 07/18/08 ** adjusted EBITDA, non-GAAP financial metric

9

*** Current Reflects prior full year guidance. The company is neither

updating, nor confirming its prior guidance, but is simply using its prior guidance for

comparison and illustrative purposes |

Our

Medical market presence is gaining scale… …and offers significant

growth potential GSI Medical Business

GSI Medical Business

•

~$120M of revenue in enabling technologies for medical systems

•

8 distinct medical technologies sold to over a dozen applications

•

Significant share position with leading OEM’s

•

FDA Certification in San Jose, CA

•

ISO 13485 Certification in Bedford, MA

•

Global sales channel selling to medical OEM’s

Applications

Minimally Invasive Surgery

OCT for Retinal Scanning

Robotic Surgery

Laser Surgery

Digital Radiology

Patient Monitoring

OR Networking

Defibrillation

EKG

Pacemaker Programming

DNA Sequencing

Flow Cytometry

Strategy

Strategy

Overview

Overview

•

Drive further penetration of customers through key account

sales initiative (i.e. “cross sell”

GSI products)

•

Increase design-wins on next generation customer products

•

Move into adjacent applications via M&A to leverage existing

customer channels and quality systems

10 |

Our

Laser Scanning growth platform… …delivers profitable growth

Laser Scanning Growth

Laser Scanning Growth

•

•

#1 Position in Scanning Galvanometers

#1 Position in Scanning Galvanometers

•

•

$200M+ addressable market

$200M+ addressable market

•

•

Strong growth in 2013:

Strong growth in 2013:

-

-

+8% overall increase

+8% overall increase

-

-

+50% increase in scanning solutions

+50% increase in scanning solutions

•

•

Fastest & highest resolution products available

Fastest & highest resolution products available

•

•

One third of scanning revenue is in medical

One third of scanning revenue is in medical

applications

applications

Strategy

Strategy

GSI Position

GSI Position

•

•

Capture meaningful share of Scan Head

Capture meaningful share of Scan Head

market leveraging galvanometer position

market leveraging galvanometer position

-

-

Doubling addressable market

Doubling addressable market

-

-

~$25M revenue opportunity by 2015

~$25M revenue opportunity by 2015

•

•

Focus on new, emerging applications

Focus on new, emerging applications

•

•

Incorporate most advanced component

Incorporate most advanced component

technology into Scan Head designs

technology into Scan Head designs

~$100M

~$100M

Market

Market

~$200M

~$200M

Market

Market

11 |

We

are just beginning our journey… …toward Operational Excellence

Broader Opportunity

Broader Opportunity

Project Impact

Project Impact

•

New managers from strong operating cultures:

Danaher, Crane, Ingersoll-Rand, IDEX, GE, Boeing

•

~$150M direct material spend unleveraged today

•

Inventory turns only 3 times per year

•

Customer Satisfaction improvements (quality, OTD)

can drive meaningful share capture

12

Units/Shift

40 to 57

(43%)

Processing Time (min.)

56 to 30

(46%)

Throughput LT (min.)

480 to 30

(94%)

Travel Distance (ft.)

226 to 25

(89%)

Floor Space (sq. ft.)

440 to 306

(30%)

Overtime Reduction

$132K/yr.

•

Lean Cell

•

One-piece flow

•

Raw Materials kept in cell

•

Minimal travel distance

•

Immediate operator

feedback |

We

have clear focus… …for success in 2014

Key Priorities for 2014

•

Organic Growth: ~$5M of growth investment in key platforms

–

driven by confidence in long-term prospects

•

Acquisitions: Targeting +2 acquisitions in 2014, focused on

medical market adjacencies and extending core technologies

(scanning, precision motion)

•

Productivity: Driving $5M+ savings in 2014, funding internal

investments, mitigating risks, & potential upside results

13 |

Our

conservative view of 2014… assumes no improvement in

capital equipment markets $271M

Revenue Outlook

+25%*

Low Single

Digit Growth

14

*Includes acquisition of NDS Surgical Imaging on January 15, 2013. Reflects prior

full year guidance. The company is neither updating, nor confirming its prior guidance, but is simply using its prior guidance for comparison and illustrative purposes

2012

2013

2014 Outlook |

2014

is seeing significant improvements in productivity… $42M

~$50M

8%-10%

15

2012

2014 Outlook

2013

…which funds ~$5M of growth investment & delivers +8% profit growth

Adjusted EBITDA Outlook

*Adjusted EBITDA is a non-GAAP measure. The reconciliation to our most comparable GAAP

numbers is provided in the appendix. ** 2013 Reflects prior full year guidance. The

company is neither updating, nor confirming its prior guidance, but is simply using its prior guidance for comparison and illustrative purposes

|

Significant cash generation…

…provides capital for our growth strategy

$24M

Free Cash Flow Outlook

Free Cash Flow Outlook

$25M-$30M

*

+$35M

Net Debt

Net Debt

($16M)

($16M)

~$15M

~$15M

~($20M)

~($20M)

16

*EXCLUDES ~$12.5M cash refund related to U.S. IRS audit for the GSI Group’s

2000 through 2008 tax years. 2012

2013

2014 Outlook

*Free Cash Flow and Net Debt are non-GAAP measures. The reconciliation to our most

comparable GAAP numbers is provided in the appendix. Net Debt reflects prior full year guidance. The company is neither updating, nor confirming its prior guidance, but is simply using its prior

guidance for comparison and illustrative purposes

|

Appendix

17 |

Medical

GSI’s Laser Products Group…

…is focused on industrial & medical end-markets

Laser Products Overview

Revenue*

$143M

Industrial

Scientific

Brands

Range

Location

Primary

Applications

Sealed CO

10W to 400W

Mukilteo, WA

Marking, Engraving,

Date Coding of

non-metals

Fiber Lasers

50W to 2kW

Rugby, UK

Metal cutting,

welding, drilling

Specialty

High Speed/Power

Santa Clara, CA

Scientific Research

Specialty Industrial

Electronics

* Last nine months, ending 3Q 2013

Galvanometers

Scan Heads

Bedford, MA

Material

Processing

Marking

Ophthalmology

PCB Drilling

Scanners

18 |

GSI’s Medical Technologies…

…focused around medical peripherals & imaging technologies

Medical Technologies Overview

Brand

Technology

Location

Primary

Applications

Displays, Informatics,

Networking

San Jose, CA

Surgical OR’s

Radiology

Diagnostics; i.e.

Endoscopy

Thermal Printers

Bedford, MA

Patient Monitoring

Defibrillators

EKG

Revenue*

$65M

Industrial

Scientific

Electronics

Medical

Imaging

Recorders

* Last nine months, ending 3Q 2013

Photometers and

Spectroradiometers

Chatsworth, CA

Display Test

Color Measurement

19 |

GSI’s Precision Motion Technologies…

…making significant shift to Indrustial and Medical end-markets

Precision Motion Overview

Brand

Technology

Location

Primary

Applications

Air Bearing Spindles

Precision Machining

Poole, UK

Suzhou, China

PCB Drilling

Semiconductor

Energy (Turbines)

Revenue*

$46M

Industrial

Scientific

Electronics

Medical

Spindles

* Last nine months, ending 3Q 2013

Optical Encoders

Positioning Systems

Bedford, MA

Robotic Surgery

DNA Sequencing

Wire Bonding

Disk Drives

Encoders

20 |

The non-GAAP financial measures used in this presentation are non-GAAP are

Adjusted EBITDA, free cash flow, and net debt. The Company believes that the

non-GAAP financial measures provide useful and supplementary information to investors regarding the Company’s financial

performance. It is management’s belief that these non-GAAP financial

measures would be particularly useful to investors because of the significant changes that

have occurred outside of the Company’s day-to-day business in

accordance with the execution of the Company’s strategy. This strategy includes streamlining the

Company’s existing operations through site and functional consolidations,

strategic divestitures, expanding the Company’s business through significant internal

investments, and broadening the Company’s product and service offerings

through acquisition of innovative and complementary technologies and solutions. The

financial impact of certain elements of these activities, particularly

acquisitions, divestitures, and site and functional restructurings, are often large relative to the

Company’s overall financial performance, which can adversely affect the

comparability of its operating results and investors’ ability to

analyze the business from period to period.

The Company’s Adjusted EBITDA, a non-GAAP financial measure, is used by

management to evaluate operating performance, communicate financial results to the

Board of Directors, benchmark results against historical performance and the

performance of peers, and evaluate investment opportunities including acquisitions

and divestitures. In addition, Adjusted EBITDA is used to determine bonus payments

for senior management and employees. Accordingly, the Company believes

that this non-GAAP measure provides greater transparency and insight into

management’s method of analysis. Non-GAAP financial measures should

not be considered as substitutes for, or superior to, measures of financial performance prepared in accordance with GAAP.

They are limited in value because they exclude charges that have

a material effect on the Company’s reported results and, therefore, should

not be relied upon as the sole financial measures to evaluate the

Company’s financial results. The non-GAAP financial measures are meant to supplement, and to be viewed in

conjunction with, GAAP financial measures. Investors are encouraged to review the

reconciliation of these non-GAAP financial measures to their most directly

comparable GAAP financial measures as provided in the tables accompanying this

presentation. 21

Use of Non-GAAP Financial Measures |

Non-GAAP Free Cash Flow*

& Net Debt

(a)

Free cash flow, a non-GAAP measure, is defined as cash provided by

operating activities less capital expenditures. (b)

Net debt, a non-GAAP measure, is defined as total debt less cash and cash

equivalents. Nine Months Ended

Twelve Months Ended

September 27, 2013

September 27, 2013

December 31, 2012

December 31, 2012

Cash provided by operating activities

Cash provided by operating activities

$34,448

$34,448

$28,430

$28,430

Less: Capital expenditures

Less: Capital expenditures

3,073

3,073

4,308

4,308

Free Cash Flow (a)

Free Cash Flow (a)

$31,375

$31,375

$24,122

$24,122

Debt

Debt

($78,375)

($78,375)

($50,000)

($50,000)

Less: Cash and cash equivalents

Less: Cash and cash equivalents

53,690

53,690

65,788

65,788

Net Debt (b)

Net Debt (b)

$24,665

$24,665

$15,788

$15,788

* Free Cash Flow includes the cash flows of Continuing and Discontinued

Operations 22 |

Non-GAAP Adjusted EBITDA Reconciliation

Twelve Months Ended

Last Twelve Months

December 31, 2012

December 31, 2011

September 27, 2013

(in thousands of dollars)

Income from operations (GAAP)

$ 15,007

$ 35,848

$ 14,311

Depreciation and amortization

13,196

14,467

18,458

Share-based compensation

4,580

3,276

5,313

Restructuring and other costs

8,842

2,406

7,338

Acquisition fair value adjustments

_

_

903

Net income attributable to noncontrolling interest

(40)

(28)

(37)

Adjusted EBITDA (Non-GAAP)

$ 41,585

$ 55,969

$ 46,286

23 |

24

Safe Harbor and Forward-Looking Information

Certain statements in this presentation are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995 and are based on current

expectations and assumptions that are subject to risks and uncertainties. All statements contained in this presentation that do not relate to matters of

historical fact should be considered forward-looking statements, and are generally identified by

words such as “expect,” “intend,” “anticipate,” “estimate,” “believe,”

“future,” “could,” “should,” “plan,” “aim,” and

other similar expressions. These forward-looking statements include, but are not limited to, expectations regarding

anticipated financial performance; management’s goals, plans, strategies and business

opportunities; expectations regarding returns to shareholders; anticipated sales of fiber laser

and scanning solutions products; plans regarding the development and deployment of a lower cost fiber laser products; expected liquidity and

capitalization; drivers of revenue growth; expectations regarding future potential acquisitions and

investments; expenditures and product development; business prospects; expectations regarding

recent and potential future products; anticipated sales performance; industry trends; market conditions; anticipated benefits from

acquisitions; and other statements that are not historical facts.

These forward-looking statements are neither promises nor guarantees, but involve risks and

uncertainties that may cause actual results to differ materially from those contained in the

forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements for many

reasons, including, but not limited to, the following: loss of customers, reductions in orders by

customers, and customer order cancellations; economic and political conditions and the effects

of these conditions on our customers’ businesses and level of business activities; our significant dependence upon our customers’

capital expenditures, which are subject to cyclical market fluctuations; our dependence upon our

ability to respond to fluctuations in product demand; our ability to continually innovate and

successfully commercialize our innovations; delays in our delivery of new products; our reliance upon third party distribution channels

subject to credit, business concentration and business failure risks beyond our control; fluctuations

in our quarterly results, and our failure to meet or exceed our expected financial performance;

customer order timing and other similar factors beyond our control; our dependence on one customer in our medical components

business; disruptions or breaches in security of our information technology systems; changes in

interest rates, credit ratings or foreign currency exchange rates; risk associated with our

operations in foreign countries; disruptions to our manufacturing operations as a result of natural disasters; our increased use of

outsourcing in foreign countries; our failure to comply with local import and export regulations in

the jurisdictions in which we operate; our history of operating losses and our ability to

sustain our profitability; our exposure to the credit risk of some of our customers and in weakened markets; violations of our intellectual

property rights and our ability to protect our intellectual property against infringement by third

parties; risk of losing our competitive advantage; our ability to make divestitures that

provide business benefits; our failure to successfully integrate recent and future acquisitions into our business; our ability to attract and retain key

personnel; our restructuring and realignment activities and disruptions to our operations as a result

of consolidation of our operations; product defects or problems integrating our products with

other vendors’ products; disruptions in the supply of or defects in raw materials, certain key components or other goods from our

suppliers; production difficulties and product delivery delays or disruptions; our failure to comply

with various federal, state and foreign regulations; changes in governmental regulation of our

business or products; our failure to implement new information technology systems and software successfully; our failure to realize

the full value of our intangible assets; our ability to utilize our net operating loss carryforwards

and other tax attributes; fluctuations in our effective tax rates; being subject to U.S.

federal income taxation even though we are a non-U.S. corporation; any need for additional capital to adequately respond to business challenges

or opportunities and repay or refinance our existing indebtedness, which may not be available on

acceptable terms or at all; volatility in the market price for our common shares; our

dependence on significant cash flow to service our indebtedness and fund our operations; our ability to access cash and other assets of our

subsidiaries; the influence of certain significant shareholders over our business; provisions of our

articles of incorporation may delay or prevent a change in control our significant existing

indebtedness may limit our ability to engage in certain activities; and our failure to maintain appropriate internal controls in the future.

Other important risk factors that could affect the outcome of the events set forth in these statements

and that could affect the Company’s operating results and financial condition are

discussed in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2012, our subsequent filings with the

Securities and Exchange Commission (“SEC”), and in our future filings with the SEC. Such

statements are based on the Company’s management’s beliefs and assumptions and on

information currently available to the Company’s management. The Company disclaims any obligation to update any forward-looking

statements as a result of developments occurring after the date of this document except as required by

law. |