Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Protea Biosciences Group, Inc. | v365051_ex23-1.htm |

| As filed with the Securities and Exchange Commission on January 13, 2014 | Registration Statement No. 333- ______________ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Protea Biosciences Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 20-2903252 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

955 Hartman Run Road

Morgantown, West Virginia 26507

(304) 292-2226

(Address, including zip code, and telephone number, including area code,

of registrant’s principal executive offices)

Stephen Turner

Chief Executive Officer

Protea Biosciences Group, Inc.

955 Hartman Run Road

Morgantown, West Virginia 26507

(304) 292-2226

Copies to:

David N. Feldman, Esq.

RICHARDSON & PATEL LLP

405 Lexington Avenue, 49th Floor

New York, New York 10174

Tel: (212) 931-8700

Fax: (917) 677-8165

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer | ¨ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | þ |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of

Securities to be Registered(1) | Amount to be Registered (2) | Proposed Maximum Offering Price Per Unit | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common stock, $0.0001 par value per share | 17,511,197 | $ | 0.50 | $ | 8,755,599 | $ | 1,127.72 | (3) | ||||||||

| Common stock, $0.0001 par value per share, underlying $2.25 Warrants | 986,250 | $ | 2.25 | $ | 2,219,063 | $ | 285.82 | (4) | ||||||||

| Common stock, $0.0001 par value per share, underlying $1.10 Warrants | 2,898,375 | $ | 1.10 | $ | 3,188,213 | $ | 410.64 | (4) | ||||||||

| Common stock, $0.0001 par value per share, underlying A Warrants | 12,341,197 | $ | 0.50 | $ | 6,170,599 | $ | 794.77 | (4) | ||||||||

| Common stock, $0.0001 par value per share, underlying B Warrants | 6,170,598 | $ | 0.75 | $ | 4,627,949 | $ | 596.08 | (4) | ||||||||

| Common stock, $0.0001 par value per share, underlying Winter 2013 Placement Agent Warrants | 3,302,826 | $ | 0.75 | $ | 2,477,120 | $ | 319.05 | (4) | ||||||||

| TOTAL | 43,210,443 | $ | 27,438,543 | $ | 3,534.08 | (4) | ||||||||||

| (1) | This registration statement covers the resale (the “Resale”) of an aggregate of 17,511,197 shares of our common stock and 25,699,246 shares of common stock underlying warrants owned by two hundred nine (209) selling security holders identified in the prospectus below. The Company will not receive any proceeds from the Resale. |

| (2) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or similar transaction. |

| (3) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act of 1933. |

| (4) | Calculated in accordance with Rule 457(g) of the Securities Act based upon the exercise price of the warrants held by the selling security holders named in this Registration Statement. |

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. The selling security holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated ________, 2014

PROSPECTUS

PROTEA BIOSCIENCES GROUP, INC.

43,210,443 Shares of Common Stock

This prospectus covers the resale by the selling security holders (the “Selling Security Holders”) named on page 65 of up to 43,210,443 shares of our common stock which include up to:

(i) 17,511,197 shares of common stock;

(ii) 986,250 shares of common stock issuable upon exercise of $2.25 Warrants;

(iii) 2,898,375 shares of common stock issuable upon exercise of $1.10 Warrants;

(iv) 12,341,197 shares of our Common Stock issuable upon exercise of A Warrants issued in connection with the Winter 2013 Offering (as defined below) at an exercise price of $0.50 per share;

(v) 6,170,598 shares of our Common Stock issuable upon exercise of B Warrants issued in connection with the Winter 2013 Offering at an exercise price of $0.75 per share; and

(vi) 3,302,826 shares of our common stock issuable upon exercise of Winter 2013 Placement Agent Warrants held by the Winter 2013 Placement Agent at an exercise price of $0.75 per share.

The shares being sold by the Selling Security Holders were issued to them in private placement transactions which were exempt from the registration and prospectus delivery requirements of the Securities Act. Our common stock and warrants are more fully described in “Description of Securities.”

There is not currently, and there has never been, any public market for our common stock. Our common stock is not currently eligible for trading on any national securities exchange, NASDAQ or any over-the-counter markets, including the OTC Bulletin Board or an OTC Market Group quotation system such as the OTCQB, and we cannot assure you that our common stock will become eligible for trading. We have arranged for a registered broker-dealer to apply to have our common stock quoted on the OTC Bulletin Board and/or an OTC Market Group quotation system such as the OTCQB. As a mandatory reporting company, we file annual, quarterly and current reports, proxy statements and other information about us with the SEC, as required.

We do not expect any secondary market in our common stock to develop for the foreseeable future. As a result, you should not expect to be able to resell your common stock regardless of how we perform and, if you are able to sell your common stock, you are likely to receive less than your purchase price. While we are currently in the process of seeking quotation of our shares on the OTC Bulletin Board and/or the OTCQB, there can be no assurance that we will be successful in listing our shares on the OTC Bulletin Board and/or the OTCQB. As a result of these factors, an investment in our common stock is not suitable for investors who require short or medium term liquidity.

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements. An investment in our common stock may be considered speculative and involves a high degree of risk, including the risk of a substantial loss of your investment. See “Risk Factors” beginning on page 8 to read about the risks you should consider before buying shares of our common stock. An investment in our common stock is not suitable for all investors. We intend to continue to issue common stock in this offering and, as a result, your ownership in us is subject to dilution. See “Risk Factors—Risks Relating to this Offering and Our Common Stock.”

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is _______, 2014

Table of Contents

| Prospectus Summary | 1 | |

| Risk Factors | 8 | |

| Special Note Regarding Forward-Looking Statements | 16 | |

| Business | 17 | |

| Management’s Discussion and Analysis or Plan of Operation | 42 | |

| Directors, Executive Officers, Promoters and Control Persons | 50 | |

| Executive Compensation | 54 | |

| Certain Relationships and Related Transactions | 56 | |

| Shares Eligible for Future Sale | 62 | |

| Market for Common Equity and Related Stockholder Matters | 63 | |

| Selling Security Holders | 64 | |

| Plan of Distribution | 71 | |

| Security Ownership of Certain Beneficial Owners and Management | 74 | |

| Description of Securities | 77 | |

| Disclosure of Commission Position on Indemnification for Securities Act Liabilities | 82 | |

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 83 | |

| Where You Can Find More Information | 83 | |

| Experts | 83 | |

| Legal Matters and Interests of Named Experts | 83 | |

| Financial Information | F-1 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with information different from that contained in this prospectus. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus speaks only as of the date of this prospectus unless the information specifically indicates that another date applies, regardless of the time of delivery of this prospectus or of any sale of our common stock.

We obtained industry and market data used throughout this prospectus through our research, surveys and studies conducted by third parties and industry and general publications. We have not independently verified market and industry data from third-party sources.

Prospectus Summary

This summary provides a brief overview of the key aspects of our business and our securities. The reader should read the entire prospectus carefully, especially the risks of investing in our common stock discussed under “Risk Factors.” Some of the statements contained in this prospectus, including statements under “Summary” and “Risk Factors” as well as those noted in the documents incorporated herein by reference, are forward-looking statements and may involve a number of risks and uncertainties. We note that our actual results and future events may differ significantly based upon a number of factors. The reader should not put undue reliance on the forward-looking statements in this document, which speak only as of the date on the cover of this prospectus. References to “we,” “our,” “us,” the “Company,” the “registrant,” or “Protea” refer to Protea Biosciences Group, Inc., a Delaware corporation.

About Our Business

Overview of Our Business

Protea operates in the field of bioanalytics. Bioanalytics is the identification and characterization of proteins, metabolites and other biomolecules, which are the products of all living cells and life forms. The Company is applying its technology to the development of a new generation of products and services that enable more rapid and comprehensive analysis of living cells and biofluids, thereby providing data that helps to define normal and disease processes. We believe that our proprietary technology is useful to support medical research and pharmaceutical development. Protea’s technologies enable the discovery and analysis of the proteins, metabolites and other biomolecules that regulate the biological functions of the human body and all other forms of life. Management believes this is a critical area of research, as pharmaceutical research is in need of more comprehensive biomolecular datasets that can be made available rapidly, in order to improve and accelerate the development of new therapeutics and diagnostic tests.

Risks Related to Our Business

Our business is subject to a number of risks. You should be aware of these risks before making an investment decision. These risks are discussed more fully in the section of this prospectus titled “Risk Factors”, which begins on page 8 of this prospectus.

Information Regarding our Capitalization

As of January 10, 2014, we had 65,442,735 shares of common stock issued and outstanding. This amount excludes the following securities that were outstanding as of January 10, 2014:

(i) $100,000 in convertible debt issued in April 2012 to the West Virginia Jobs Investment Trust Board as part of an original 3-month note in the amount of $400,000. The note bears interest at 10% providing for monthly interest-only payments starting May 2012 through June 2012, then final interest and principal payments due July 2012. The note includes a stock warrant for 88,889 shares. On June 18, 2012, the West Virginia Jobs Investment Trust Board signed an addendum to the note agreeing to extend the maturity date by 90 days to October 15, 2012. On March 11, 2013, the West Virginia Jobs Investment Trust Board approved an additional deferral of principal and interest until May 15, 2013 and reduced the price of converting into common shares to $0.50 per share. Subsequently the West Virginia Jobs Investment Trust Board further extended the maturity date until October 15, 2013. In November 2013 the West Virginia Jobs Investment Trust Board was paid $100,000 and the final $100,000 of the principal amount had its maturity date extended to January 15, 2014. An executive member of the West Virginia Jobs Investment Trust Board is a board member of the Company. Pursuant to the terms of the note, $200,000 of the principal amount is to be repaid in cash only.

| 1 |

(ii) $95,177 in convertible debt issued on May 24, 2012 to the West Virginia High Technology Consortium Foundation (“WVHTCF”) issued as a 30-month note in the amount of $200,000. The note bears interest at 8% providing for 25 monthly principal and interest payments of $9,001 starting December 2012 through November 2014, then final interest and principal payments due December 2014. The note is secured by a security interest in certain equipment and machinery owned by the Company pursuant to a security agreement dated May 24, 2012 in favor of WVHTCF, as amended by that certain Intercreditor Agreement dated June 11, 2012. In its sole discretion, at any time during the term of the WVHTCF note, elect to convert all or any portion of the unpaid principal and accrued interest due and payable under the WVHTCF note, into shares of Common Stock at an initial conversion price of $2.00 per share (the “Conversion Price”) subject to certain adjustments. In addition, if the Company issues any shares of Common Stock for a per share purchase price that is less than the Conversion Price then in effect (the “Original Conversion Price”), then the Original Conversion Price shall be reduced concurrently with such issue to a price determined by multiplying such Original Conversion Price by a fraction (x) the numerator of which shall be the number of shares of common stock outstanding immediately prior to such issue plus the number of shares of common stock which the aggregate consideration received by the Company for the total number of additional shares of common stock so issued would purchase at such Original Conversion Price, and (y) the denominator of which shall be the number of shares of common stock outstanding immediately prior to such issue plus the number of such additional shares of common stock so issued; provided, that, all shares of common stock issuable upon conversion of convertible securities shall be deemed to be outstanding. The WVHTCF Note is secured by a first lien interest, shared with the West Virginia Economic Development Authority (“WVEDA”), in all of the Company’s right, title and interest in and to the Collateral pursuant to the terms and conditions of a Security Agreement, dated May 24, 2012 by and between the Company and WVHTCF.

Unless otherwise specifically stated, information throughout this prospectus does not assume the exercise of outstanding options or warrants to purchase shares of our common stock or the conversion of convertible promissory notes.

| 2 |

Securities to be Registered

This prospectus relates to the resale of up to 43,210,443 shares of common stock and shares of common stock underlying warrants issued in connection with recent financings completed by the Company and described below.

December 2011 Offering

As of March 1, 2012, in connection with the terms of a private placement offering (the “December 2011 Offering”) of up to 100 units (the “December 2011Units”), each December 2011 Unit consisting of 50,000 shares of common stock and warrants to purchase 25,000 shares of common stock (the “December 2011 Warrants”), the Company issued an aggregate of 1,370,000 shares of common stock and December 2011 Warrants to purchase an aggregate of 685,000 shares of common stock at a per December 2011 Unit purchase price equal to $100,000, for aggregate gross proceeds equal to $2,740,000. The December 2011 Warrants are exercisable at an exercise price of $2.25 per share any time after the date of issuance (the “December 2011 Issue Date”) until the earlier of (i) a Qualified Public Offering (as defined below), or (ii) 5:00 p.m. Eastern time on the fifth anniversary of the December 2011 Issue Date of the December 2011 Warrant. The term “Qualified Public Offering” means the closing of a firm commitment underwritten offering pursuant to an effective registration statement under the Securities Act covering the offer and sale of common stock for the account of the Company in which the net cash proceeds to the Company (after deduction of underwriting discounts, commissions and fees) are at least $15,000,000. The placement agent (the " December 2011 Placement Agent") in the December 2011 Offering received total cash commissions equal to $140,000, which amount represents 8% of the total gross proceeds received from investors that participated in the Offering and were introduced to the Company by the December 2011 Placement Agent. In addition, the December 2011 Placement Agent also received warrants to purchase an aggregate of 70,000 shares of common stock at an exercise price of $2.20 per share (the "December 2011 Placement Agent Warrants"). The December 2011 Placement Agent Warrants are exercisable any time after the December 2011 Issue Date until the earlier of (1) a Qualified Public Offering or (ii) 5:00 p.m. Eastern time on the fifth anniversary of the December 2011 Issue Date.

The securities underlying the December 2011 Units and December 2011 Placement Agent Warrants were issued to accredited investors in accordance with Rule 506 of Regulation D under the Securities Act. The Company did not engage in any general advertisement or general solicitation in connection with the offering of the December 2011Units.

A total of 945,000 shares of common stock and 472,500 shares of common stock underlying December 2011 Warrants are being offered for resale pursuant to this prospectus.

May 2012 Offering

As of June 29, 2012, in connection with the terms of a private placement offering (the “May 2012 Offering”) of up to $6,000,000 of units (the “May 2012 Units”), each May 2012 Unit consisting of 50,000 shares of common stock and warrants to purchase 25,000 shares of common stock (the “May 2012 Warrants”), the Company issued an aggregate of 525,000 shares of Common Stock and Warrants to purchase an aggregate of 262,500 shares of common stock at a per May 2012 Unit purchase price of $100,000 for aggregate gross proceeds equal to $1,050,000. The May 2012 Warrants are exercisable at an exercise price of $2.25 per share any time after the date of issuance (the “May 2012 Issue Date”) until the earlier of (i) a Qualified Public Offering, or (ii) 5:00 p.m. Eastern time on the fifth anniversary of the May 2012 Issue Date of the May 2012 Warrant. The term “Qualified Public Offering” means the closing of a firm commitment underwritten offering pursuant to an effective registration statement under the Securities Act covering the offer and sale of common stock for the account of the Company in which (i) the net cash proceeds to the Company (after deduction of underwriting discounts and commissions) are at least $15,000,000 and (ii) the offering price of the common stock in the Qualified Public Offering is at least 200% of the exercise price set forth in the May 2012 Warrants, as may be adjusted in accordance with the terms of the May 2012 Warrants.

| 3 |

All of the May 2012 Units, and securities underlying the May 2012 Units issued in the May 2012 Offering were issued to accredited investors in accordance with Rule 506 of Regulation D under the Securities Act. The placement agent in the May 2012 Offering has received total cash compensation equal to $103,862. The Company did not engage in any general advertisement or general solicitation in connection with the offering of the May 2012 Units.

A total of 437,500 shares of common stock and 218,750 shares of common stock underlying May 2012 Warrants are being offered for resale pursuant to this prospectus.

Summer 2012 Direct Issuances

As of September 21, 2012, in connection with a private placement offering (the “Summer 2012 Direct Issuances”) the Company issued an aggregate of 375,000 shares of common stock and warrants to purchase 187,500 shares of common stock (the “Summer 2012 Warrants”) to accredited investors at a per unit (the “Summer 2012 Units”) purchase price equal to $100,000 for an aggregate purchase price equal to $750,000. The Summer 2012 Warrants are exercisable at an exercise price of $2.25 per share any time after the date of issuance until the earlier of (i) the closing of a firm commitment underwritten offering pursuant to an effective registration statement under the Securities Act covering the offer and sale of common stock for the account of the Company in which the net cash proceeds to the Company (after deduction of underwriting discounts and commissions) are at least $15,000,000 or (ii) 5:00 p.m. Eastern time on the fifth anniversary of the issue date thereof.

All of the Summer 2012 Units, and securities underlying the securities issued under the Summer 2012 Direct Issuances described above were issued to accredited investors in accordance with the exemption from registration provided by Section 4(2) of the Securities action in that the securities were offered and sold to accredited investors and the Company did not engage in any general advertisement or general solicitation in connection with the offering of the Summer 2012 Units.

A total of 375,000 shares of common stock and 187,500 shares of common stock underlying Summer 2012 Warrants are being offered for resale pursuant to this prospectus.

July 2012 Issuance

On July 27, 2012, the Company issued units (the “July 2012 Units”) consisting of an aggregate of 100,000 shares of common stock and warrants to purchase 50,000 shares of common stock (the “July 2012 Warrants”) to accredited investors at a per unit purchase price equal to $100,000 for an aggregate purchase price equal to $200,000. The July 2012 Warrants are exercisable at an exercise price of $2.25 per share any time after the date of issuance until the earlier of (i) the closing of a firm commitment underwritten offering pursuant to an effective registration statement under the Securities Act covering the offer and sale of common stock for the account of the Company in which the net cash proceeds to the Company (after deduction of underwriting discounts and commissions) are at least $15,000,000 or (ii) 5:00 p.m. Eastern time on the fifth anniversary of the warrant issue date hereof.

All of the July 2012 Units, and securities underlying the July 2012 Units were issued to accredited investors in accordance with the exemption from registration provided by Section 4(2) of the Securities Act in that the securities were offered and sold to accredited investors and the Company did not engage in any general advertisement or general solicitation in connection with the offering of the units.

A total of 75,000 shares of common stock and 37,500 shares of common stock underlying July 2012 Warrants are being offered for resale pursuant to this prospectus.

| 4 |

Fall 2012 Offering

As of October 17, 2012, in connection with the terms of a private placement offering (the “Fall 2012 Offering”) of up to $6,000,000 of units (the “Fall 2012 Units”), each Fall 2012 Unit consisting of 50,000 shares of common stock and warrants to purchase 25,000 shares of Common Stock (the “Fall 2012 Warrants”), the Company issued an aggregate of 452,500 shares of common stock and Fall 2012 Warrants to purchase an aggregate of 226,250 shares of common stock at a per Fall 2012 Unit purchase price of $100,000 for aggregate gross proceeds equal to $905,000. The Fall 2012 Warrants are exercisable at an exercise price of $2.25 per share any time after the date of issuance until the earlier of (i) the closing of a firm commitment underwritten offering pursuant to an effective registration statement under the Securities Act covering the offer and sale of Common Stock for the account of the Company in which the net cash proceeds to the Company (after deduction of underwriting discounts and commissions) are at least $15,000,000 or (ii) 5:00 p.m. Eastern time on the fifth anniversary of the warrant issue date hereof. The shares of common stock and Fall 2012 Warrants issued in connection with the Fall 2012 Offering Documents were subject to anti-dilution protection in the event the Company subsequently sold shares of common stock at a price per share that is less than $2.00 per share. The Company has since issued shares at a price equal to $0.50 per share, and therefore, on March 22, 2013, the Company’s board of directors (the “Board”) approved the issuance of an additional 1,057,500 shares of common stock and reduced the exercise price of the warrants to $1.12 per share.

All of the Fall 2012 Units, and securities underlying the Fall 2012 Units issued in the Fall 2012 Offering were issued to accredited investors in accordance with Rule 506 of Regulation D under the Securities Act. The Company did not engage in any general advertisement or general solicitation in connection with the offering of the Fall 2012 Units. The placement agent in the Fall 2012 Offering received total cash compensation equal to $56,400.

A total of 140,000 shares of common stock and 70,000 shares of common stock underlying Fall 2012 Warrants are being offered for resale pursuant to this prospectus.

Spring 2013 Direct Issuances

From April 23, 2013 to September 11, 2013, in connection with Company direct issuances (the “Spring 2013 Company Issuances”), the Company issued an aggregate of 3,197,500 shares of the Company’s common stock and warrants to purchase an aggregate of 2,898,375 shares of common stock to certain accredited investors for aggregate gross proceeds equal to $1,530,000 pursuant to the terms and conditions of a Securities Purchase Agreement and a warrant (the “Spring 2013 Warrants”). The Spring 2013 Warrants are exercisable for a term of five years from the issue date, and each purchaser has the right to purchase the number of shares of common stock equal to 75% of the number of shares purchased by such investor, at an exercise price of $1.10 per share. The shares and Spring 2013 Warrants are subject to certain anti-dilution rights in accordance with the terms of the Securities Purchase Agreement, if at any time after the issue date of the securities through December 31, 2013, the Company issues or sells any additional shares of common stock at a purchase price less than $0.50 per share.

The shares and Spring 2013 Warrants were issued pursuant to the exemption from registration provided by Rule 506 of Regulation D under the Securities Act in that they were issued to accredited investors, the Company did not engage in any general advertisement or general solicitation in connection with the offering of the securities, and the Company was available to answer any questions by and purchaser. Cash commissions were not paid in connection with the sale of the shares and Spring 2013 warrants.

A total of 3,197,500 shares of common stock and 2,898,375 shares of common stock underlying Spring 2013 Warrants are being offered for resale pursuant to this prospectus.

| 5 |

Winter 2013 Offering

As of December 31, 2013, the “Company had received $5,448,973 in aggregate gross cash proceeds from 131 accredited investors in connection with the sale of approximately 55 units (each a “Winter 2013 Unit” and collectively, the “Winter 2013 Units”) in an offering (the “Winter 2013 Offering”) of a minimum of $2,000,000 and up to a maximum of $6,000,000 (the “Maximum Offering Amount”), in Units of securities of the Company pursuant to the terms and conditions of a Subscription Agreement and Unit Purchase Agreement by and among the Company and each of the purchasers thereto. The Maximum Offering Amount excludes up to an additional $2,000,000 in Winter 2013 Units that may be sold to any existing stockholders, officers, and directors of the Company, including any of their affiliates (the “Company Investors”). Each Winter 2013 Unit consists of (i) 200,000 shares of common stock, par value $.0001 per share, (ii) and two warrants, including (a) a 1 year warrant to purchase 200,000 shares of common stock at an exercise price of $0.50 per share (the “A Warrants”) and (b) a 5 year warrant to purchase 100,000 shares of common stock at an exercise price of $0.75 per share (the “B Warrants” and together with the A Warrants the “Investor Warrants”). In addition, the Company issued an aggregate of approximately 21.5 in additional Units to the holders of bridge notes, in connection with the conversion of $1,994,500 (the “Conversion Amount”) in outstanding principal and accrued unpaid interest in bridge notes.

The Company also paid to the placement agent (the “Winter 2013 Placement Agent”) an aggregate of $733,410.67 in cash commissions, representing (1) 10% of the gross proceeds raised in the Winter 2013 Offering from purchasers introduced to the Company by the Winter 2013 Placement Agent; (2) 2% of the aggregate gross proceeds raised in the Winter 2013 Offering from Company Investors, including the Conversion Amount and (3) 2% of the aggregate gross proceeds raised in the Winter 2013 Offering, including the Conversion Amount, in connection with a non-accountable expense allowance. In addition, the Company agreed to issue warrants (the “Winter 2013 Placement Agent Warrants”) to purchase an aggregate of 3,302,826 of common stock underlying the Winter 2013 Units sold in the Winter 2013 Offering, including the shares of common stock underlying the Investor Warrants and (ii) 5% of the number of shares of common stock underlying the Winter 2013 Units issued in connection with the conversion of the bridge notes, including the shares of common stock underlying the Investor Warrants issued to bridge note holders.

In accordance with the terms of the Unit Purchase Agreement, until the one year anniversary of the closing date, purchasers shall have the right to participate in any subsequent offering by the Company of common stock or Common Stock Equivalents (as such terms is defined in the Unit Purchase Agreement) in which the Company raises gross proceeds of at least $1,000,000 (each a “Subsequent Offering”), on the same terms, conditions and price as provided for in the Subsequent Offering, in up to an amount of the Subsequent Offering equal to each purchaser’s proportionate share of the Subsequent Offering based on such purchaser’s participation in this Winter 2013 Offering. In addition, from the earlier of (1) five years from the closing Date or (2) the date on which any purchaser no longer owns shares of common stock sold in the Winter 2013 Offering, if the Company issues or sells any shares of common stock or any Common Stock Equivalent pursuant to which shares may be acquired at a price less than $0.50 per share (the “Base Price”) (subject to appropriate adjustments for any stock dividend, stock split, stock combination, reclassification or similar transaction) (each a “Dilutive Issuance”), the Company shall be required to issue additional shares of common stock to each purchaser, for no additional consideration, in an amount sufficient such that the pro rata portion of the Purchase Price paid by such purchaser for the shares of common stock then held, when divided by the total number of shares of common stock then held by such purchaser plus those shares of common stock issued as a result of the Dilutive Issuance will equal the Base Price.

The Winter 2013 Units, including the shares of common stock underlying the Winter 2013 Units, the Investor Warrants and the Winter 2013 Placement Agent Warrants were issued in connection with the exemption from registration provided by Rule 506(b) of Regulation D as promulgated under the Securities Act in that all purchasers and the Placement Agent were accredited investors and the Company did not engage in any general advertisement or general solicitation in connection with the purchase and sale of the Winter 2013 Units.

A total of 12,341,197 shares of common stock, 12,341,197 shares of common stock underlying A Warrants and 6,170,598 shares of common stock underlying B Warrants are being offered for resale pursuant to this prospectus.

| 6 |

Additional information regarding our issued and outstanding securities may be found in the section of this prospectus titled “Description of Securities.”

Corporate Information

Our principal executive office is located 955 Hartman Run Road, Morgantown, West Virginia 26507. Our telephone number is (304) 292-2226. Our web address is www.proteabio.com. Information included on our website is not part of this prospectus.

| 7 |

RISK FACTORS

You should carefully consider the risks described below, together with all other information included in this prospectus including our financial statements and related notes, before making an investment decision. The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and investors in our securities may lose all or part of their investment.

Risks Related to Our Business

We are a development stage company with a limited operating history and limited sales to date.

The Company is subject to all of the risks inherent in the establishment of a development stage company, including the absence of an operating history, and the risk that we may be unable to successfully develop, manufacture and sell our products. There can be no assurance that the Company will be able to execute its business plan, including without limitation the Company’s plans to develop, then manufacture, market and sell, its technologies, products and services. The Company has engaged in limited manufacturing operations to date, and although the Company believes that its plans to conduct manufacturing of its products internally will work, there is no assurance that this will be the case. The Company began to sell products and services in the fourth quarter of 2007, and sales to date are limited. There can be no assurance that the Company’s sales projections and marketing plans will be achieved as anticipated and planned. It is likely that losses will be incurred during the early stages of operations. The Company believes that its future success will depend on its ability to develop and introduce its instruments and services for mass spec molecular imaging, to meet a wide range of customer needs and achieve market acceptance. The Company cannot assure prospective investors that it will be able to successfully develop and market its products or that it will recover the initial investment that must be made to develop and market such products.

We have incurred net losses since inception.

The incurred a net loss of $9,531,259 and $11,497,332 for the fiscal years ended December 31, 2012 and 2011, respectively, a net loss of $7,916,882 for the nine months ended September 30, 2013 and net losses of $54,891,560 since inception. The opinion of our independent registered public accountants on our audited financial statements as of and for the year ended December 31, 2012 contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon raising capital from financing transactions. To stay in business, we will need to raise additional capital through public or private sales of our securities, debt financing or short-term bank loans, or a combination of the foregoing. The Company can provide no assurance as to whether our capital raising efforts will be successful or as to when, or if, we will be profitable in the future. Even if the Company achieves profitability, it may not be able to sustain such profitability.

Issuance of Common Stock to fund our operations or upon the exercise of outstanding warrants and options may dilute your investment.

We have been operating at a loss since inception and our working capital requirements continue to be significant. We have been supporting our business through the sale of debt and equity since inception. We will need additional funding for developing products and services, increasing our sales and marketing capabilities, technologies and assets, as well as for working capital requirements and other operating and general corporate purposes. Our working capital requirements depend and will continue to depend on numerous factors, including the timing of revenues, the expense involved in development of our products, and capital improvements. Accordingly, the proceeds from the Offering may not be sufficient to fund our future operations. If we are unable to generate sufficient revenue and cash flow from operations, we will need to seek additional equity or debt financing to provide the capital required to maintain or expand our operations, which may have the effect of diluting our existing stockholders or restricting our ability to run our business.

| 8 |

There can be no assurance that we will be able to raise sufficient additional capital on acceptable terms, or at all. If such financing is not available on satisfactory terms, or is not available at all, we may be required to delay, scale back or eliminate the development of business opportunities and our operations and financial condition may be materially adversely affected. Debt financing, if obtained, may involve agreements that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, could increase our expenses and require that our assets be provided as a security for such debt. Debt financing would also be required to be repaid regardless of our operating results. Equity financing, if obtained, could result in dilution to our then existing stockholders. As of the date of this filing, we have warrants to purchase an aggregate of 54,752,952 shares of Common Stock issued and outstanding. The Company also has reserved an aggregate of 4,150,000 shares of Common Stock for issuance under its 2002 Equity Incentive Plan (the “2002 Plan”) and 5,000,000 shares of Common Stock have been reserved for issuance under the Company’s 2013 Equity Incentive Plan (the “2013 Plan”). As of the date of this filing, options to purchase an aggregate of 5,082,750 shares of Common Stock have been granted and are outstanding under the 2002 Plan and the 2013 Plan, collectively. There are also an additional 249,697 shares of Common underlying outstanding convertible promissory notes. The conversion of the notes and the exercise of the outstanding warrants and options could result in substantial dilution to stockholders. See “Description of Securities”.

We license a significant portion of our Intellectual Property from third parties; if the Company fails to remain in compliance with these agreements the Company’s business may be adversely affected.

The Company has entered into a number of technology license agreements with various universities for the exclusive use of a significant portion of the patent based intellectual property that the Company uses. While the Company is currently in compliance with the respective terms of these agreements, if there be one or more breaches thereunder, such as the failure to pay the applicable royalties, and one or more of these agreements are terminated, the Company will not be able to use such technology and the Company’s business may be adversely affected.

We may be unable to obtain or maintain patent or other intellectual property protection for any products or processes that we may develop.

The Company faces risks and uncertainties related to intellectual property rights. The Company may be unable to obtain or maintain its patents or other intellectual property protection for any products or processes that it may develop; third parties may obtain patents covering the manufacture, use or sale of these products or processes which may prevent the Company from commercializing its technology; or any patents that the Company may obtain may not prevent other companies from competing with it by designing their products or conducting their activities so as to avoid the coverage of the Company’s patents.

Since patent applications in the U.S. are maintained in secrecy for at least portions of their pendency periods (published on U.S. patent issuance or, if earlier, 18 months from earliest filing date for most applications) and since other publication of discoveries in the scientific or patent literature often lags behind actual discoveries, we cannot be certain that we are the first to make the inventions to be covered by our patent applications. The patent position of biopharmaceutical firms generally is highly uncertain and involves complex legal and factual questions. The U.S. Patent and Trademark Office has not established a consistent policy regarding the breadth of claims that it will allow in biotechnology patents.

Proceedings to obtain, enforce or defend patents and to defend against charges of infringement are time consuming and expensive activities, and it is possible that the Company could become involved in such proceedings. Unfavorable outcomes in these proceedings could limit the Company’s activities and any patent rights that the Company may obtain, which could adversely affect its business or financial condition. Even if such proceedings ultimately are determined to be without merit, they can be expensive and distracting for the Company’s operations and personnel.

In addition, the Company’s success will depend in part on the ability of the Company to preserve its trade secrets. The Company cannot ensure investors that the obligations to maintain the confidentiality of trade secrets or proprietary information will not wrongfully be breached by employees, consultants, advisors or others or that the Company’s trade secrets or proprietary know how will not otherwise become known or be independently developed by competitors in such a manner that the Company has no legal recourse.

| 9 |

We are in a highly competitive market.

The Company is engaged in the highly competitive field of biotechnology. Competition from numerous existing biotechnology companies and others entering the proteomics field is intense and expected to increase. Many of these companies are larger, more established and recognized in the marketplace, and/or have substantially greater financial and business resources than the Company. Moreover, competitors who are able to develop and to commence commercial sales of their products before the Company could do so enjoy a significant competitive advantage. Likewise, innovations by competitors could cause the Company products or services to become obsolete or less attractive in the marketplace, adversely affecting sales and/or sales projections. The Company cannot assure investors that its technology will enable it to compete successfully in the future.

We are dependent on certain key personnel.

The success of the Company is dependent to a significant degree upon the skill and experience of its founders and other key personnel including Stephen Turner, Alessandro Baldi, Stanley Hostler, Daniel Dupret, Matthew Powell, Edward Hughes, and others. The loss of the services of any of these individuals would adversely affect the Company’s business. Although the Company has obtained a key man life insurance policy on Mr. Turner, its President and CEO, there is no assurance that policy proceeds would cover all potential costs or operational challenges that would result from the loss of services from Mr. Turner and in any event such policy would not cover the lives or loss of these other individuals. The Company cannot assure prospective investors that it would be able to find adequate replacements for these key individuals. In addition, the Company believes that its future success will depend in large part upon its continued ability to attract and retain highly skilled employees, who are in great demand. While the Company believes that its location in Morgantown, West Virginia, the home of West Virginia University, is helpful in attracting and retaining highly skilled employees, the Company cannot assure investors that it will be able to do so.

We are developing products in a rapidly evolving field and there are no assurances that the results of our research and development efforts will not be rendered obsolete by the research efforts and technological activities of others.

The bioanalytics field in which the Company is developing products is rapidly evolving. The Company cannot assure prospective investors that any results of the Company’s research and development efforts will not be rendered obsolete by the research efforts and technological activities of others, including the efforts and activities of governments, major research facilities, and large multinational corporations. While the Company believes that its initial efforts to develop its bioanalytics technology platform have been successful thus far, there can be no assurance that the Company will be able to successfully expand its operations in the future, to commercialize, market and sell products and services at projected levels, or to fully develop the technology in a timely and successful manner.

All of our pharmaceutical product candidates are in an early stage of development and we may never succeed in developing and/or commercializing them.

All of our pharmaceutical product candidates are in an early stage of development and we may never succeed in developing and/or commercializing them. If the Company is unable to commercialize them, or experiences significant delays in doing so, the Company’s business may be adversely affected. Even if the Company’s most advanced pharmaceutical candidate progresses through clinical trials as currently anticipated, it is not expected that it will be commercially available for at least several years. The Company will need to devote significant additional research and development, financial resources and personnel to develop commercially viable products and obtain regulatory approvals. The Company is likely to encounter hurdles and unexpected issues as it proceeds in the development of its pharmaceutical product candidates. There are many reasons that the Company may not succeed in its efforts to develop its product candidates, including the possibility that its product candidates will be deemed ineffective, unsafe or will not receive regulatory approvals; its product candidates will be too expensive to manufacture or market or will not achieve broad market acceptance; others will hold proprietary rights that will prevent the Company from marketing its pharmaceutical product candidates; or the Company’s competitors will market pharmaceutical products that are perceived as equivalent or superior.

| 10 |

There is no assurance that the Company’s manufacturing plans will be successful.

The Company employs internal and contract manufacturing. There is no assurance that the Company’s manufacturing plans will be successful. While the Company has a quality assurance program for its products, there nonetheless is inherent in any manufacturing process the risk of product defects or manufacturing problems that could result in potential liability for product liability risks.

Risks Relating to Ownership of Our Securities

There is no public trading market for our common stock and we cannot assure you that an active trading market may develop in the near future.

There is no public trading market for our Common Stock. Our Common Stock is not quoted in the over-the-counter markets or listed on any stock exchange. Therefore, outstanding shares of Common Stock cannot be offered, sold, pledged or otherwise transferred unless registered pursuant to, or exempt from registration under, the Securities Act and any other applicable federal or state securities laws or regulations. Stockholders may rely on the exemption from registration provided by Rule 144 of the Securities Act (“Rule 144”), subject to certain restrictions, only if the Company has been current in all of its periodic SEC filings for the 12 months preceding the contemplated sale of stock. Compliance with the criteria for securing exemptions under federal securities laws and the securities laws of the various states is extremely complex, especially in respect of those exemptions affording flexibility and the elimination of trading restrictions in respect of securities received in exempt transactions and subsequently disposed of without registration under the Securities Act or state securities laws. In addition, even if the Securities underlying the Units are registered pursuant to an effective registration statement filed in accordance with the Securities Act of 1933, as amended, if requested by the Company or an underwriter, the Securities and the Warrant Shares are subject to a market standoff agreement restricting their sale for up to 180 days following the date such securities are registered.

We intend to have a market maker file with the Financial Industry Regulatory Authority (FINRA) a Form 211 application to have our common stock quoted on the over-the-counter market, either through OTC Markets Group Inc. or the OTC Bulletin Board, or both. If we determine to have a market maker file the Form 211, we cannot predict when and whether FINRA will approve our application. Even if we are able to have our Common Stock become quoted in the over-the-counter market, an active trading market for our common stock may not develop in the future due to a number of other factors, including the fact that we are a small company that is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. Once our Common Stock is listed or quoted on an active trading market, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales. We cannot give you any assurance that an active public trading market for our Common Stock will develop or be sustained. You may not be able to liquidate your shares quickly or at the market price if trading in our Common Stock is not active.

Investors may face significant restrictions on the resale of our common stock due to federal regulation of penny stocks.

If our common stock be approved for quotation on the over-the-counter market, it may be subject to the requirements of Rule 15(g)-9, promulgated under the Securities Exchange Act so long as the price of our common stock is below $5.00 per share. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser's consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990, also requires additional disclosure in connection with any trades involving a stock defined as a penny stock. Generally, the Commission defines a penny stock as any equity security not traded on a national exchange or quoted on NASDAQ that has a market price of less than $5.00 per share.

| 11 |

The required penny stock disclosures include the delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market.

We have established preferred stock which can be designated by the Company’s board of directors without shareholder approval.

The Company has authorized 10,000,000 shares of preferred stock. The shares of preferred stock of the Company may be issued from time to time in one or more series, each of which shall have a distinctive designation or title as shall be determined by the board of directors of the Company prior to the issuance of any shares thereof. The preferred stock shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof as adopted by the board of directors. In each such case, we will not need any further action or vote by our stockholders. One of the effects of undesignated preferred stock may be to enable the board of directors to render more difficult or to discourage an attempt to obtain control of us by means of a tender offer, proxy contest, merger or otherwise, and thereby to protect the continuity of our management. The issuance of shares of preferred stock pursuant to the board of director's authority described above may adversely affect the rights of holders of common stock. For example, preferred stock issued by us may rank prior to the common stock as to dividend rights, liquidation preference or both, may have full or limited voting rights and may be convertible into shares of common stock. Accordingly, the issuance of shares of preferred stock may discourage bids for the common stock at a premium or may otherwise adversely affect the market price of the common stock.

Most of our total outstanding shares are subject to a market standoff agreement which provides that the purchaser will not, sell, assign or otherwise transfer or dispose of any common stock, warrants or other securities of the Company if so requested by an underwriter for a period not to exceed 180 days. If our securities are locked up at the request of any underwriter, and there are substantial sales of shares of our common stock, the price of our common stock could decline.

Most of our total outstanding shares are subject to a market standoff agreement which provides that the purchaser will not, sell, assign or otherwise transfer or dispose of any common stock, warrants or other securities of the Company if so requested by an underwriter for a period not to exceed 180 days. If our securities are locked up at the request of any underwriter, the price of our common stock could decline if there are substantial sales of our common stock following the “lock-up” period, particularly sales by our directors, executive officers and significant stockholders, or if there is a large number of shares of our common stock available for sale.

Our Certificate of Incorporation provides our directors with limited liability.

Article Seven of our Certificate of Incorporation states that our directors shall not be personally liable to us or any stockholder for monetary damages for breach of fiduciary duty as a director, except for any matter in respect of which such director shall be liable under Section 174 of the Delaware General Corporation Law or shall be liable because the director (1) shall have breached his duty of loyalty to us or our stockholders, (2) shall have acted not in good faith or in a manner involving intentional misconduct or a knowing violation of law or, in failing to act, shall have acted not in good faith or in a manner involving intentional misconduct or a knowing violation of law, or (3) shall have derived an improper personal benefit.

Article Seven further states that the liability of our directors shall be eliminated or limited to the fullest extent permitted by the Delaware General Corporation Law, as amended. These provisions may discourage stockholders from bringing suit against a director for breach of fiduciary duty and may reduce the likelihood of derivative litigation brought by stockholders on our behalf against a director.

Certain provisions of our Certificate of Incorporation and Delaware law make it more difficult for a third party to acquire us and make a takeover more difficult to complete, even if such a transaction were in the stockholders’ interest.

Our Certificate of Incorporation and the Delaware General Corporation Law contain provisions that may have the effect of making it more difficult or delaying attempts by others to obtain control of the Company, even when these attempts may be in the best interests of our stockholders.

| 12 |

We also are subject to the anti-takeover provisions of the Delaware General Corporation Law, which prohibit us from engaging in a “business combination” with an “interested stockholder” unless the business combination is approved in a prescribed manner and prohibit the voting of shares held by persons acquiring certain numbers of shares without obtaining requisite approval. The statutes have the effect of making it more difficult to effect a change in control of a Delaware company.

We are subject to the “seasoning” requirements imposed by the NYSE Euronext, NYSE MKT, and the NASDAQ Stock Market which will make us ineligible to list and trade on a national exchange until after trading for at least one year in the over-the-counter markets (or some other national or foreign regulated exchange), unless we are able to complete a firm commitment underwritten public offering with gross proceeds of at least $40 million.

Because of our status as a former SEC-reporting shell company, we are subject to SEC rules which require such companies to (1) trade in the over-the-counter markets (or some other national or foreign regulated exchange) for at least one year following the filing with the SEC of all required information about the reverse merger, including audited financial statements for the combined entity and (2) to timely file all required periodic reports with the SEC, including one annual report that includes audited financial statements for a full fiscal year commencing after filing the required information about the reverse merger, before seeking to “uplist” to a national securities exchange like NASDAQ, NYSE MKT or NYSE Euronext. We completed a reverse merger in September of 2011 and our Form 10-K filed for the fiscal year ended December 31, 2012 includes audited financial statements for a full fiscal year commencing after filing our Current Report on Form 8-K containing Form 10 information following the reverse merger. This means we will not be eligible to apply for listing on such exchanges until a market maker has filed a Form 211 to initiate trading and our securities begin to trade in the over-the-counter markets for at least one year. We may only bypass the requirements set forth above if we can complete a firm commitment underwritten public offering with gross proceeds of at least $40 million. As a result, our stockholders may find it more difficult to dispose of shares or obtain accurate quotations as to the market value of our Common Stock. In addition, we would be subject to an SEC rule that, if we failed to meet the criteria set forth in such rule, imposes various practice requirements on broker-dealers who sell securities governed by the rule to persons other than established customers and accredited investors. Consequently, such rule may deter broker-dealers from recommending or selling our Common Stock, which may further affect its liquidity. This would also make it more difficult for us to raise additional working capital through subsequent financings. In the event we do seek the listing of our Common Stock on a national securities exchange such as NASDAQ, NYSE MKT or NYSE Euronext, we cannot assure you that we will be able to meet the initial listing standards of either of those or any other stock exchange, or that we will be able to maintain a listing of our Common Stock on either of those or any other stock exchange.

Our financial controls and procedures may not be sufficient to ensure timely and reliable reporting of financial information, which, as a public company, could materially harm our stock price.

As a public reporting company, we require significant financial resources to maintain our public reporting status. We cannot assure you we will be able to maintain adequate resources to ensure that we will not have any future material weakness in our system of internal controls. The effectiveness of our controls and procedures may in the future be limited by a variety of factors, including:

| • | faulty human judgment and simple errors, omissions or mistakes; |

| • | fraudulent action of an individual or collusion of two or more people; |

| • | inappropriate management override of procedures; and |

| • | the possibility that any enhancements to controls and procedures may still not be adequate to assure timely and accurate financial information. |

If we fail to have effective controls and procedures for financial reporting in place, we could be unable to provide timely and accurate financial information and be subject to SEC investigation and civil or criminal sanctions.

| 13 |

We must implement additional and expensive procedures and controls in order to grow our business and organization and to satisfy new reporting requirements, which will increase our costs and require additional management resources.

As a public reporting company, we are required to comply with the Sarbanes-Oxley Act of 2002 and the related rules and regulations of the SEC, including the requirements that we maintain disclosure controls and procedures and adequate internal control over financial reporting. In the future, if our securities are listed on a national exchange, we may also be required to comply with marketplace rules and the heightened corporate governance standards. Compliance with the Sarbanes-Oxley Act and other SEC and national exchange requirements will increase our costs and require additional management resources. We recently have begun upgrading our procedures and controls and will need to continue to implement additional procedures and controls as we grow our business and organization and to satisfy new reporting requirements. If we are unable to complete the required assessment as to the adequacy of our internal control over financial reporting, as required by Section 404 of the Sarbanes-Oxley Act or if we fail to maintain internal control over financial reporting, our ability to produce timely, accurate and reliable periodic financial statements could be impaired.

If we do not maintain adequate internal control over financial reporting, investors could lose confidence in the accuracy of our periodic reports filed under the Securities Exchange Act of 1934, as amended. Additionally, our ability to obtain additional financing could be impaired or a lack of investor confidence in the reliability and accuracy of our public reporting could cause our stock price to decline.

We are an "emerging growth company" under the JOBS Act of 2012 and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We are choosing to take advantage of the extended transition period for complying with new or revised accounting standards.

We will remain an “emerging growth company” for up to five years following our initial public offering, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our Common Stock that is held by non-affiliates exceeds $700 million as of the last day of our most recently completed second fiscal quarter.

Our status as an “emerging growth company” under the JOBS Act may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company” and because we will have an extended transition period for complying with new or revised financial accounting standards, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. Investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent as other companies in our industry.

| 14 |

If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

Our directors, officers and principal stockholders have significant voting power and may take actions that may not be in the best interests of our other stockholders.

Our officers, directors and principal stockholders collectively beneficially own approximately 56% of our outstanding common stock, without giving effect to the purchase of Units in this Offering. As a result, these stockholders, if they act together, will be able to control the management and affairs of our company and most matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership may have the effect of delaying or preventing a change in control and might adversely affect the market price of our common stock. This concentration of ownership may not be in the best interests of our other stockholders.

We have not paid dividends in the past and do not expect to pay dividends in the future, and any return on investment may be limited to the value of our stock.

We have never paid cash dividends on our common stock and do not anticipate paying cash dividends on our common stock in the foreseeable future. We currently intend to retain any future earnings to support the development of our business and do not anticipate paying cash dividends in the foreseeable future. Our payment of any future dividends will be at the discretion of our board of directors after taking into account various factors, including but not limited to our financial condition, operating results, cash needs, growth plans and the terms of any credit agreements that we may be a party to at the time. In addition, our ability to pay dividends on our Common Stock may be limited by Delaware state law. Accordingly, investors must rely on sales of their Common Stock after price appreciation, which may never occur, as the only way to realize a return on their investment. Investors seeking cash dividends should not purchase our Common Stock.

You should consult your own independent tax advisor regarding any tax matters arising with respect to the Units.

Participation in the Offering could result in various tax-related consequences for investors. All prospective purchasers of the Units are advised to consult their own independent tax advisors regarding the U.S. federal, state, local and non-U.S. tax consequences relevant to the purchase, ownership and disposition of the securities underlying the Units in their particular situations.

IRS CIRCULAR 230 DISCLOSURE: TO ENSURE COMPLIANCE WITH REQUIREMENTS IMPOSED BY THE INTERNAL REVENUE SERVICE, WE INFORM YOU THAT ANY U.S. TAX ADVICE CONTAINED HEREIN (INCLUDING ANY ATTACHMENTS) IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING PENALTIES UNDER THE INTERNAL REVENUE CODE. IN ADDITION, ANY U.S. TAX ADVICE CONTAINED HEREIN (INCLUDING ANY ATTACHMENTS) IS WRITTEN TO SUPPORT THE “PROMOTION OR MARKETING” OF THE MATTER(S) ADDRESSED HEREIN. YOU SHOULD SEEK ADVICE BASED ON YOUR PARTICULAR CIRCUMSTANCES FROM YOUR OWN INDEPENDENT TAX ADVISOR.

| 15 |

IN ADDITION TO THE ABOVE RISKS, BUSINESSES ARE OFTEN SUBJECT TO RISKS NOT FORESEEN OR FULLY APPRECIATED BY MANAGEMENT. IN REVIEWING THIS FILING, POTENTIAL INVESTORS SHOULD KEEP IN MIND THAT OTHER POSSIBLE RISKS MAY ADVERSELY IMPACT THE COMPANY’S BUSINESS OPERATIONS AND THE VALUE OF THE COMPANY’S SECURITIES.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements”. These forward-looking statements are based on our current expectations, assumptions, estimates and projections about our business and our industry. Words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “may,” “will,” “would,” and other similar expressions identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those risks set forth in this prospectus under the title “Risk Factors” as well as the following:

| • | The current economic situation in the United States, which may reduce the funds available to businesses and government entities to purchase our products; |

| • | whether we will be able to raise capital as and when we need it; |

| • | our overall ability to successfully compete in our market and our industry; |

| • | unanticipated increases in development, production or marketing expenses related to our product and our business activities; and |

| • | other factors, some of which will be outside our control. |

You are cautioned not to place undue reliance on these forward-looking statements, which relate only to events as of the date on which the statements are made. We undertake no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof. You should refer to and carefully review the information in future documents we file with the Securities and Exchange Commission (the “Commission”.

Consequently, all of the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results anticipated by management will be realized or, even if substantially realized, that they will have the expected consequences to or effects on our business operations.

| 16 |

BUSINESS

History

Protea Biosciences Group, Inc. was incorporated under the name SRKP 5, Inc. in the State of Delaware on May 24, 2005 and was originally organized as a “blank check” shell company to investigate and acquire a target company or business seeking the perceived advantages of being a publicly held corporation.

On September 2, 2011, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Protea Biosciences, Inc., a Delaware corporation (“Protea Bio”) and SRKP 5 Acquisition Corp., a Delaware corporation and our wholly-owned subsidiary (“MergerCo”). Pursuant to the Merger Agreement, MergerCo merged with and into Protea Bio (the “Merger”). To effectuate the Merger and subject to the right of the Protea Bio stockholders to dissent, each share of Protea Bio common stock was automatically converted into one share of our common stock, all shares of Protea Bio common stock in treasury were canceled and we assumed all of Protea Bio’s rights and obligations for outstanding convertible securities and warrants. Following the Merger, we changed our name to Protea Biosciences Group, Inc.

Emerging Growth Company

The Company is an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404(b) of the Sarbanes-Oxley Act, and exemptions from the requirements of Sections 14A(a) and (b) of the Securities Exchange Act of 1934 to hold a nonbinding advisory vote of shareholders on executive compensation and any golden parachute payments not previously approved.

The Company has elected to use the extended transition period for complying with new or revised accounting standards under Section 102(b)(1) of the JOBS Act. This election allows us to delay the adoption of new or revised accounting standards that have different effective dates for public and private companies until those standards apply to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public company effective dates.

We will remain an “emerging growth company” for up to five years following our initial public offering, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any June 30.

To the extent that we continue to qualify as a “smaller reporting company”, as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (1) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (2) scaled executive compensation disclosures; and (3) the requirement to provide only two years of audited financial statements, instead of three years.

| 17 |

INDUSTRY AND MARKET OVERVIEW

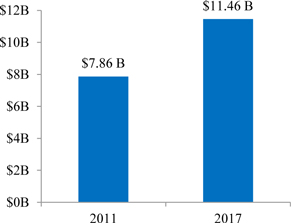

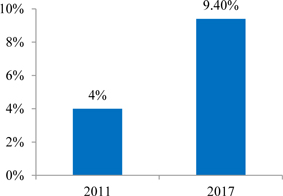

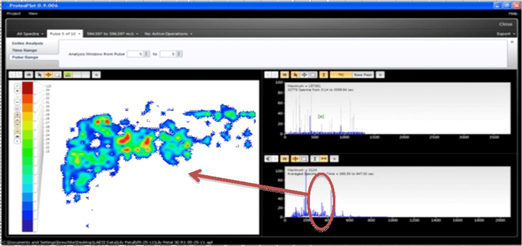

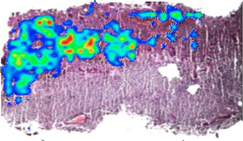

The Mass Spectrometry Market