Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HALOZYME THERAPEUTICS, INC. | a8k_13jan2014.htm |

| EX-99.1 - EX991_PRESSRELEASE13JAN2014 - HALOZYME THERAPEUTICS, INC. | exh991_pressrelease13jan20.htm |

Halozyme Therapeutics, Inc. The Next Chapter Begins: Creating Value Through Growth 32nd Annual J. P. Morgan Healthcare Conference January 2014 Helen Torley, M.B., CH. B., M.R.C.P. President and Chief Executive Officer EXHIBIT 99.2

2 <#> All of the statements in this presentation that are not statements of historical facts constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Examples of such statements include future product development and regulatory events and goals, product collaborations, our business intentions and financial estimates and results. These statements are based upon management’s current plans and expectations and are subject to a number of risks and uncertainties which could cause actual results to differ materially from such statements. A discussion of the risks and uncertainties that can affect these statements is set forth in the Company’s annual and quarterly reports filed from time to time with the Securities and Exchange Commission under the heading “Risk Factors.” The Company disclaims any intention or obligation to revise or update any forward-looking statements, whether as a result of new information, future events, or otherwise. Forward-Looking Statements

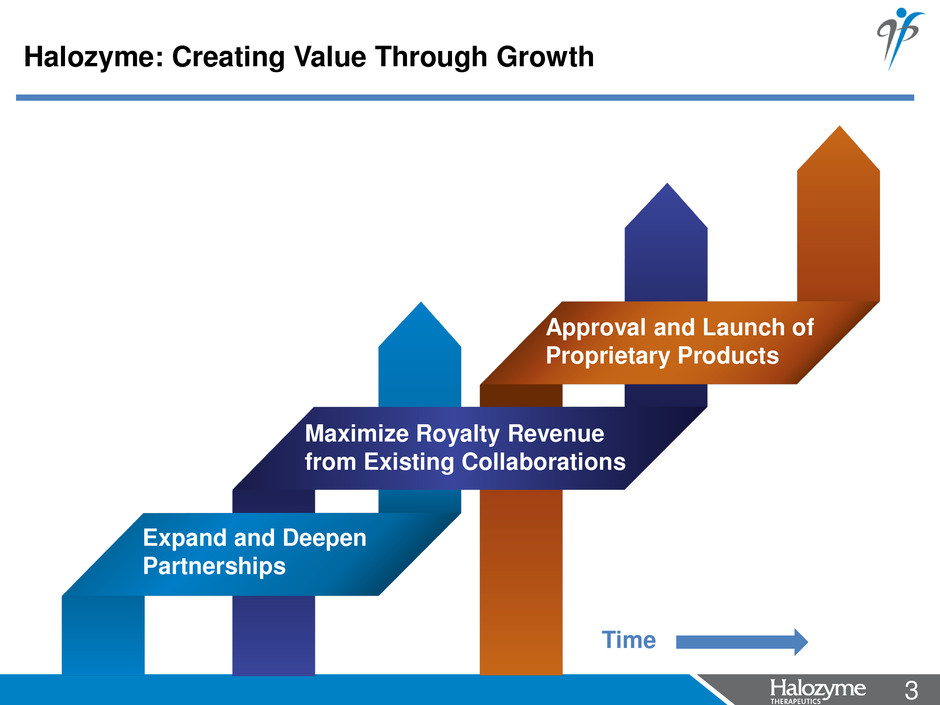

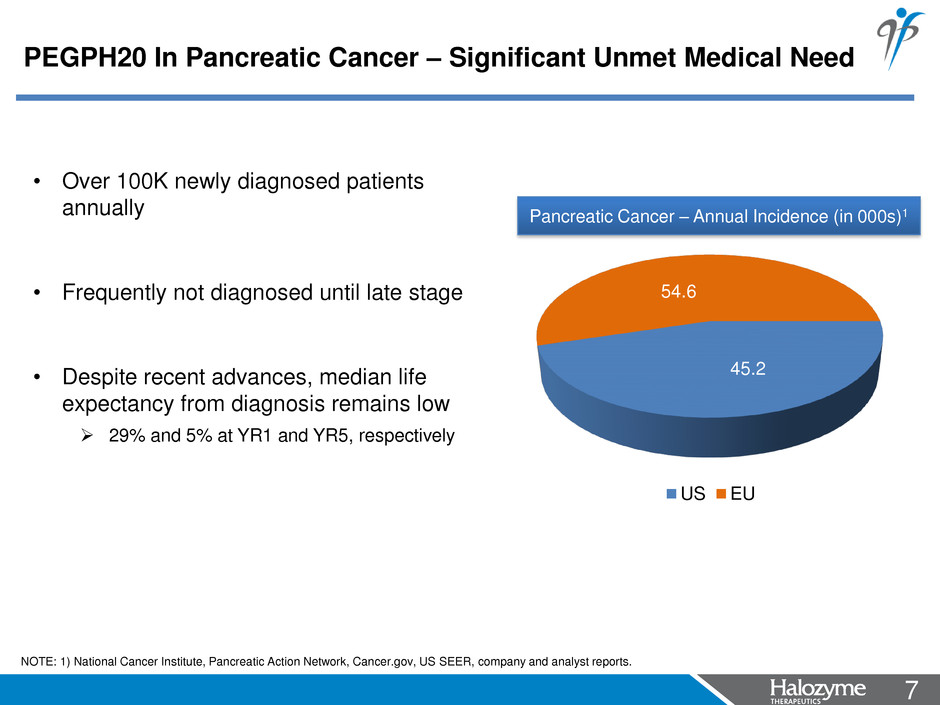

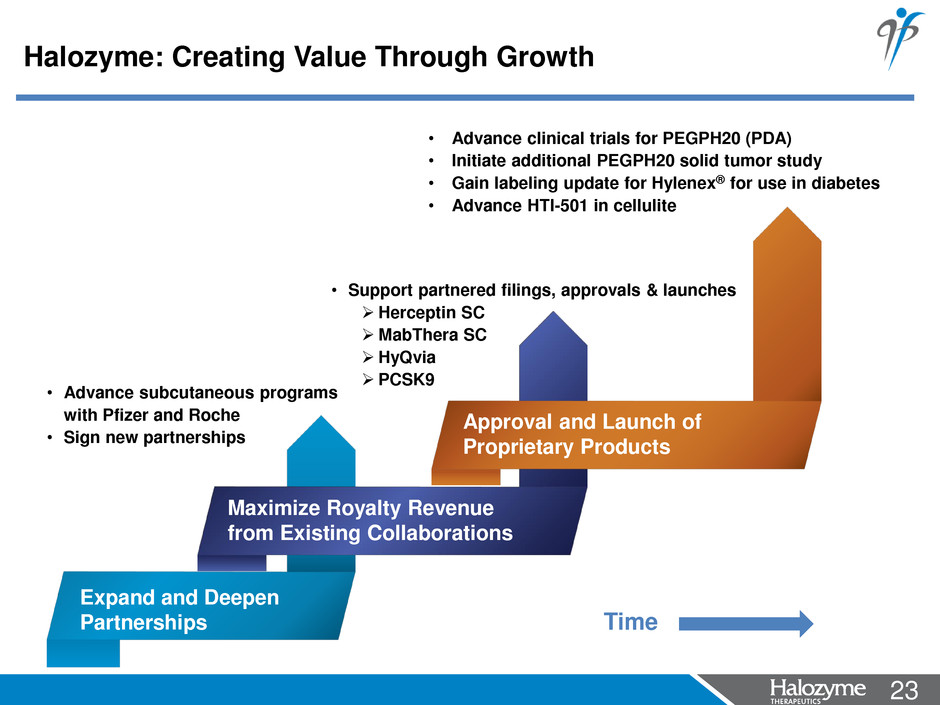

3 <#> Approval and Launch of Proprietary Products Maximize Royalty Revenue from Existing Collaborations Expand and Deepen Partnerships Halozyme: Creating Value Through Growth Time

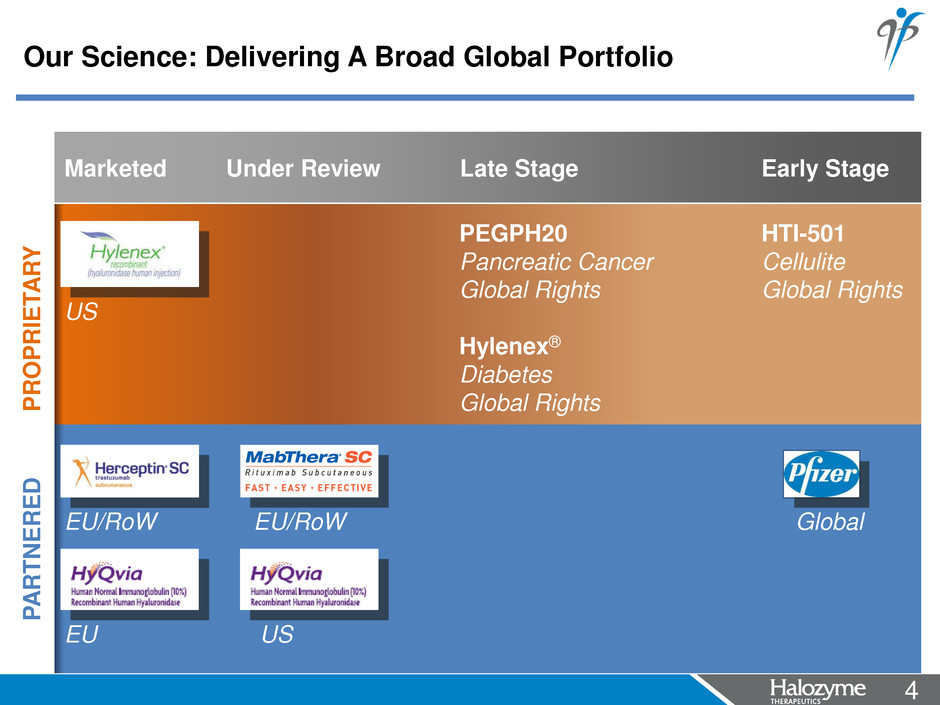

4 <#> Marketed Under Review Late Stage Early Stage PROPRIE T A R Y US P A RTNE R E D EU/RoW EU/RoW Global EU US PEGPH20 Pancreatic Cancer Global Rights Hylenex® Diabetes Global Rights HTI-501 Cellulite Global Rights Our Science: Delivering A Broad Global Portfolio

5 <#> Approval and Launch of Proprietary Products Halozyme: Creating Value Through Growth Time

6 <#> • Approved by FDA to increase dispersion and absorption of other injected drugs and fluids • Commercial infrastructure established in U.S. • Established as the #1 prescribed hyaluronidase1 Hylenex®: First Proprietary Product NOTE: 1) IMS monthly hyaluronidase market share (May 2013 – September 2013).

7 <#> 45.2 54.6 US EU Pancreatic Cancer – Annual Incidence (in 000s)1 NOTE: 1) National Cancer Institute, Pancreatic Action Network, Cancer.gov, US SEER, company and analyst reports. • Over 100K newly diagnosed patients annually • Frequently not diagnosed until late stage • Despite recent advances, median life expectancy from diagnosis remains low 29% and 5% at YR1 and YR5, respectively PEGPH20 In Pancreatic Cancer – Significant Unmet Medical Need

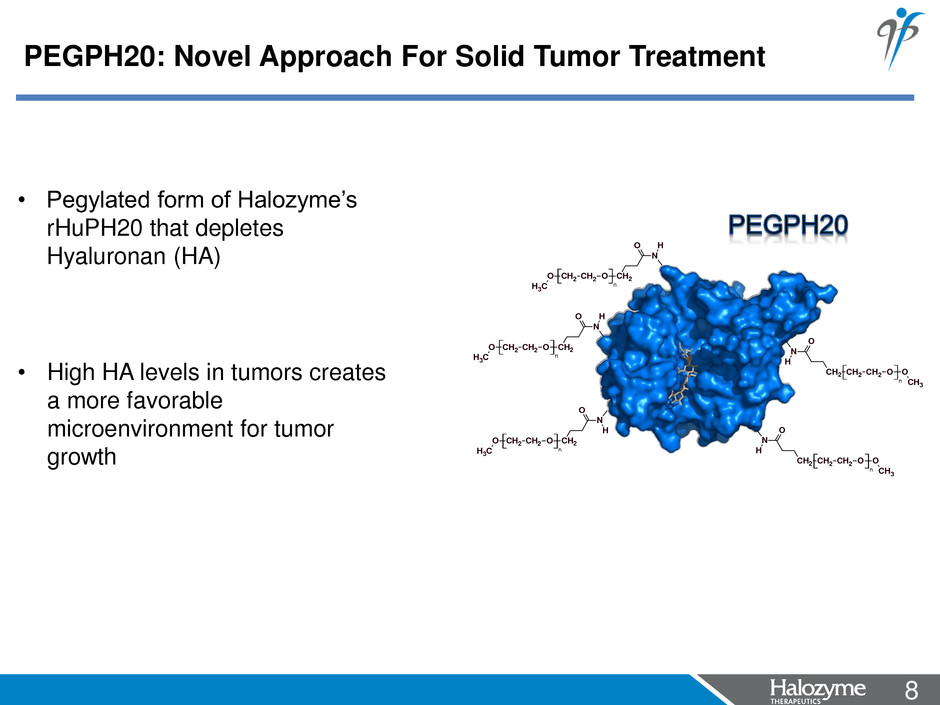

8 <#> n CH2 CH2 OCH2 O CH3 N H O CH2 CH2 OO CH2 CH3 N H O n CH2 CH2 OO CH2 CH3 N O H n n CH2 CH2 OCH2 O CH3 N H O CH2 CH2 OO CH2 CH3 N O H n • Pegylated form of Halozyme’s rHuPH20 that depletes Hyaluronan (HA) • High HA levels in tumors creates a more favorable microenvironment for tumor growth PEGPH20: Novel Approach For Solid Tumor Treatment

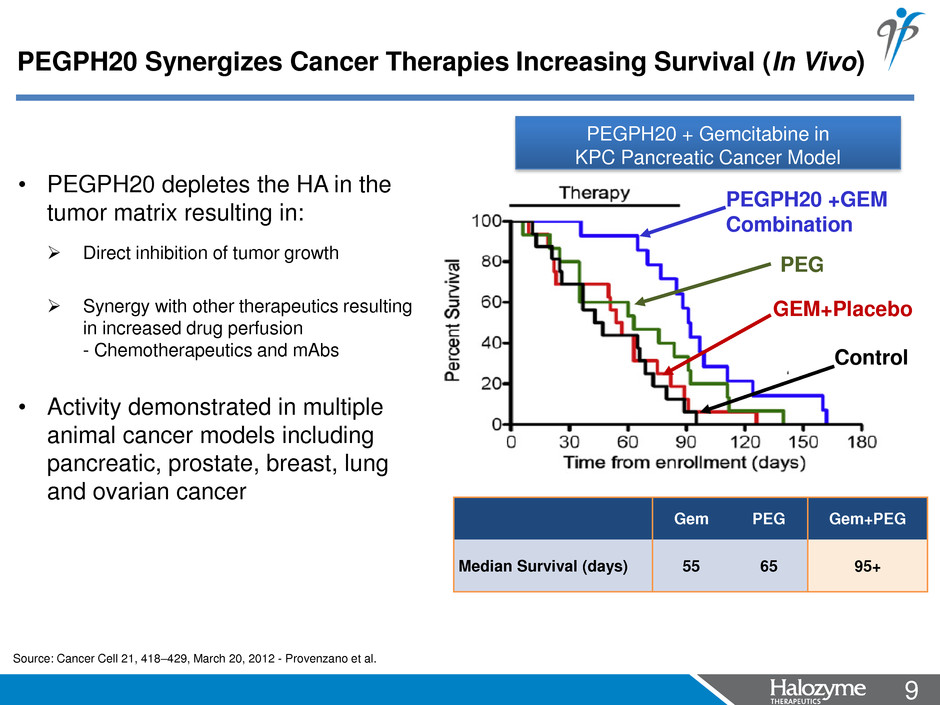

9 <#> Gem PEG Gem+PEG Median Survival (days) 55 65 95+ * • PEGPH20 depletes the HA in the tumor matrix resulting in: Direct inhibition of tumor growth Synergy with other therapeutics resulting in increased drug perfusion - Chemotherapeutics and mAbs • Activity demonstrated in multiple animal cancer models including pancreatic, prostate, breast, lung and ovarian cancer Source: Cancer Cell 21, 418–429, March 20, 2012 - Provenzano et al. PEGPH20 + Gemcitabine in KPC Pancreatic Cancer Model PEGPH20 Synergizes Cancer Therapies Increasing Survival (In Vivo) Control PEG PEGPH20 +GEM Combination GEM+Placebo

10 <#> 0 50 100 150 200 250 300 0.0 0.2 0.4 0.6 0.8 1.0 ITT=154 days HA high HA low 219 days 108 days Time (days) P ro p o rt io n o f P F S 0 90 18 7 6 450 540 0.0 0.2 0.4 0.6 0.8 1.0 ITT =200 days HA high HA low 529 days 174 days Time (days) P ro p o rt io n o f S u rv iv a l N Median OS (days) Censored(%) HAhigh 6 529 4(67) HAlow 11 174 2(18) N ORR(%) Median PFS (days) Censored(%) HAhigh 6 5 (83) 219 2(33) HAlow 11 4 (36) 108 1(9) Overall Survival (OS) Progression-Free Survival (PFS) Source: Hingorani, S, et al, Poster 2.598, ESMO September 2013. Median Overall Survival data, as presented, is not mature. Single-arm Phase1b evaluation PEGPH20+Gemcitabine in Stage IV metastatic Pancreatic Ductal Adenocarcinoma (n=17) Phase 1b Patients With Tumor Cell Associated HA+ Had Longer PFS and OS

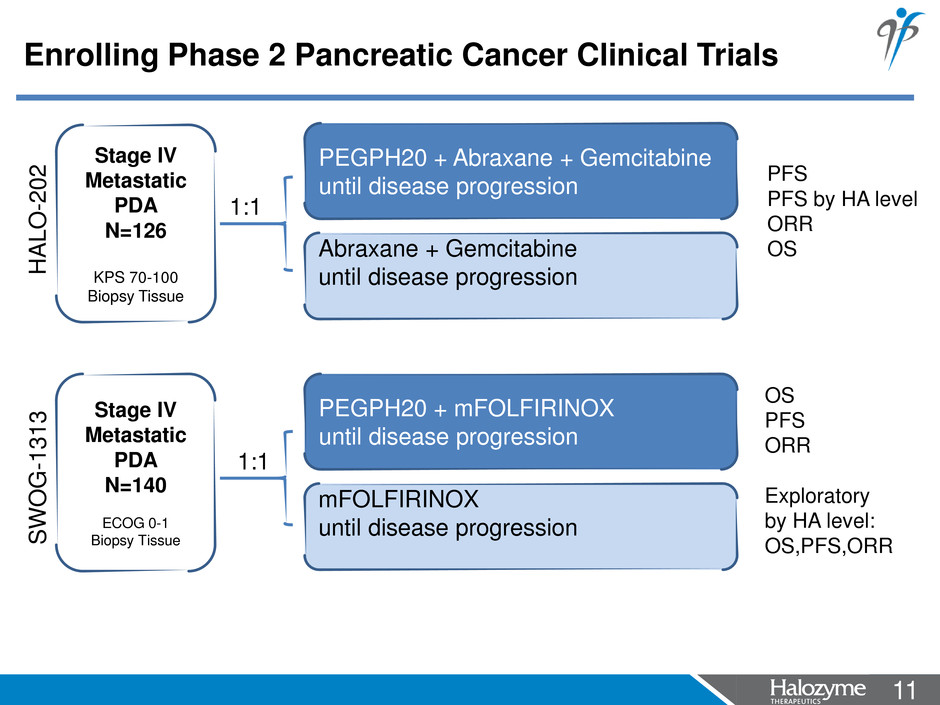

11 <#> PEGPH20 + Abraxane + Gemcitabine until disease progression Abraxane + Gemcitabine until disease progression Stage IV Metastatic PDA N=126 KPS 70-100 Biopsy Tissue 1:1 PEGPH20 + mFOLFIRINOX until disease progression mFOLFIRINOX until disease progression Stage IV Metastatic PDA N=140 ECOG 0-1 Biopsy Tissue 1:1 PFS PFS by HA level ORR OS OS PFS ORR Exploratory by HA level: OS,PFS,ORR H A L O -2 0 2 SWO G -1 3 1 3 Enrolling Phase 2 Pancreatic Cancer Clinical Trials

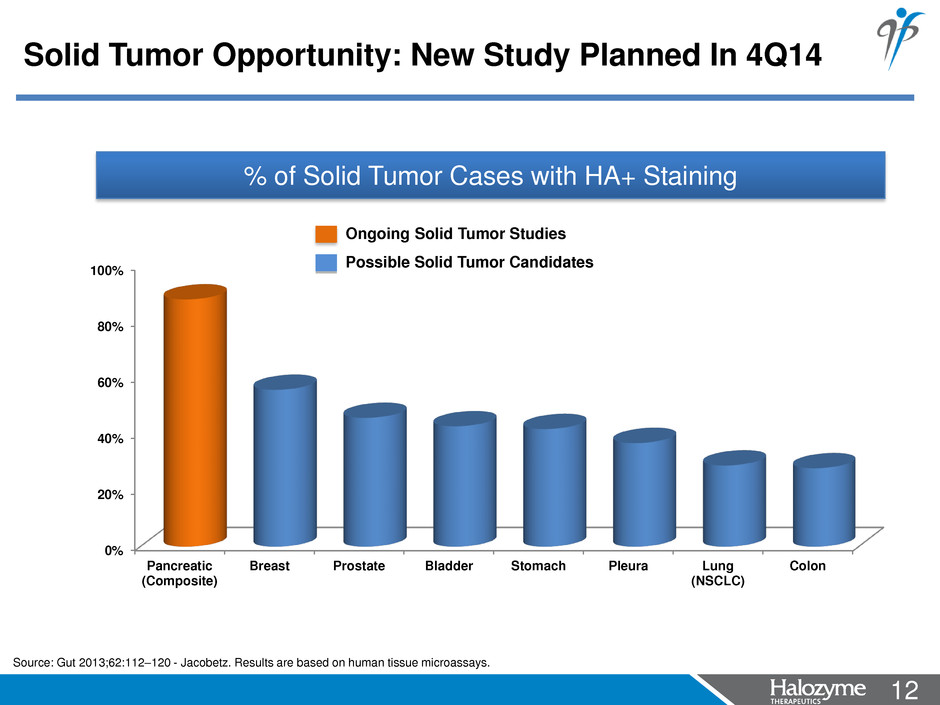

12 <#> % of Solid Tumor Cases with HA+ Staining Source: Gut 2013;62:112–120 - Jacobetz. Results are based on human tissue microassays. 0% 20% 40% 60% 80% 100% Pancreatic (Composite) Breast Prostate Bladder Stomach Pleura Lung (NSCLC) Colon Ongoing Solid Tumor Studies Solid Tumor Opportunity: New Study Planned In 4Q14 Possible Solid Tumor Candidates

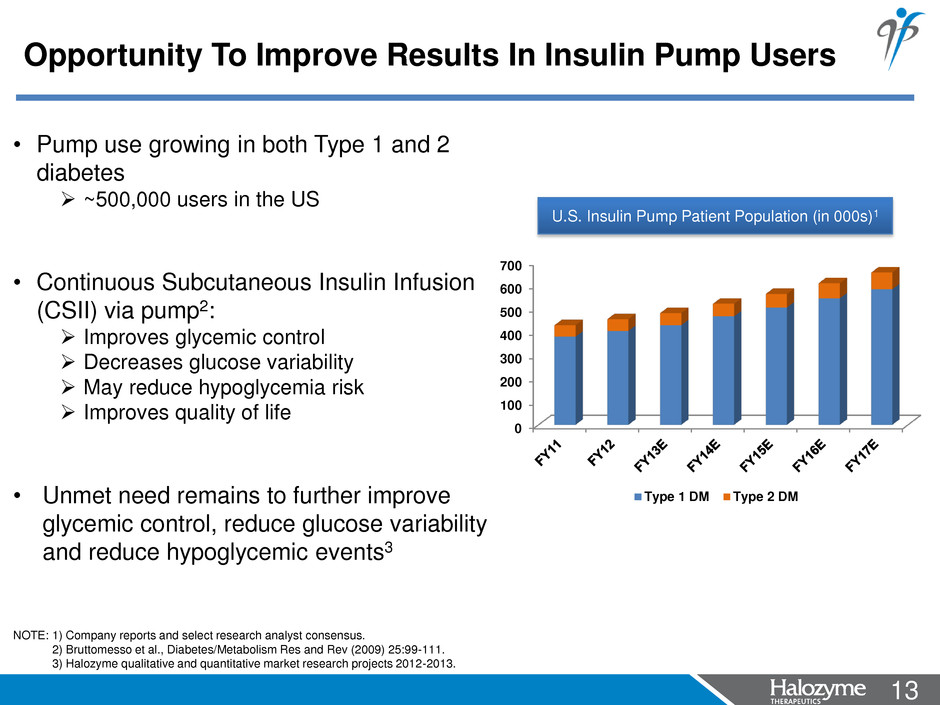

13 <#> • Pump use growing in both Type 1 and 2 diabetes ~500,000 users in the US • Continuous Subcutaneous Insulin Infusion (CSII) via pump2: Improves glycemic control Decreases glucose variability May reduce hypoglycemia risk Improves quality of life • Unmet need remains to further improve glycemic control, reduce glucose variability and reduce hypoglycemic events3 NOTE: 1) Company reports and select research analyst consensus. 2) Bruttomesso et al., Diabetes/Metabolism Res and Rev (2009) 25:99-111. 3) Halozyme qualitative and quantitative market research projects 2012-2013. Opportunity To Improve Results In Insulin Pump Users U.S. Insulin Pump Patient Population (in 000s)1 0 100 200 300 400 500 600 700 Type 1 DM Type 2 DM

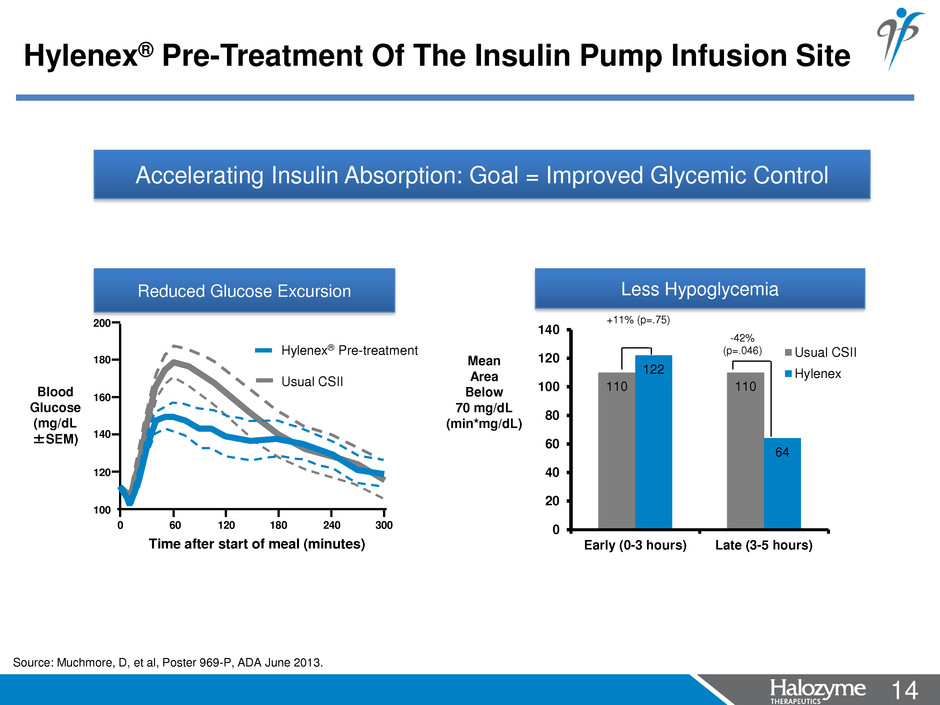

14 <#> Accelerating Insulin Absorption: Goal = Improved Glycemic Control 110 110 122 64 0 20 40 60 80 100 120 140 Early (0-3 hours) Late (3-5 hours) Usual CSII Hylenex Mean Area Below 70 mg/dL (min*mg/dL) +11% (p=.75) -42% (p=.046) Less Hypoglycemia 200 180 160 140 120 100 0 60 120 180 240 300 Time after start of meal (minutes) Hylenex® Pre-treatment Usual CSII Blood Glucose (mg/dL ±SEM) Reduced Glucose Excursion Hylenex® Pre-Treatment Of The Insulin Pump Infusion Site Source: Muchmore, D, et al, Poster 969-P, ADA June 2013.

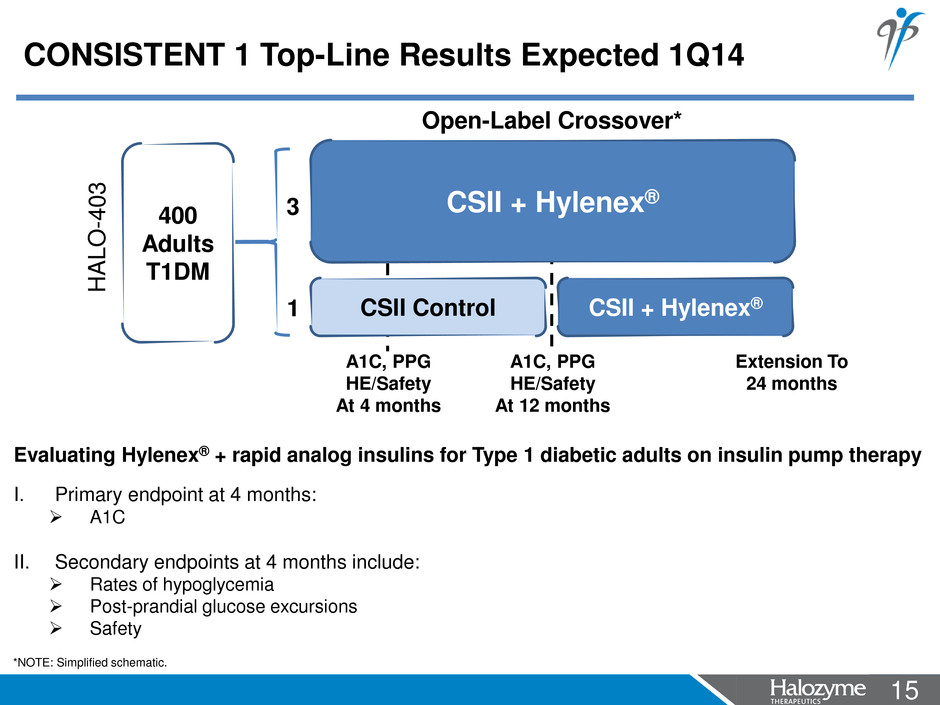

15 <#> Evaluating Hylenex® + rapid analog insulins for Type 1 diabetic adults on insulin pump therapy I. Primary endpoint at 4 months: A1C II. Secondary endpoints at 4 months include: Rates of hypoglycemia Post-prandial glucose excursions Safety CSII + Hylenex® CSII Control CSII + Hylenex® A1C, PPG HE/Safety At 4 months A1C, PPG HE/Safety At 12 months 400 Adults T1DM 3 1 HA L O -4 0 3 Extension To 24 months *NOTE: Simplified schematic. CONSISTENT 1 Top-Line Results Expected 1Q14 Open-Label Crossover*

16 <#> Top-line CONSISTENT 1 Data - (1Q2014) CONSISTENT 1 Data Submitted to Major Medical Conference - (2014) Late-Stage Clinical Trials Compatibility Demonstrated with Multiple Tubing Sets Pre- Administration Solutions sNDA Under Review for High Capacity Fill and Finish – (2014) Manufacturing Scale Up FDA Input on Labeling Update Pathway - (1Q2014) Regulatory Hylenex® (Insulin Pumps): Key Steps To Commercialization

17 <#> • Recombinant Human Cathepsin-L Digests collagen Focal control of collagen degradation • Current Status and Upcoming Activities Phase 1 completed Doses well tolerated Phase 2 results expected 1Q2014 Strategic evaluation underway HTI-501 (rHuCAT-L): A Potential Treatment For Cellulite rHuCAT-L Ribbon Diagram

18 <#> Maximize Royalty Revenue from Existing Collaborations Expand and Deepen Partnerships Halozyme: Creating Value Through Growth Time

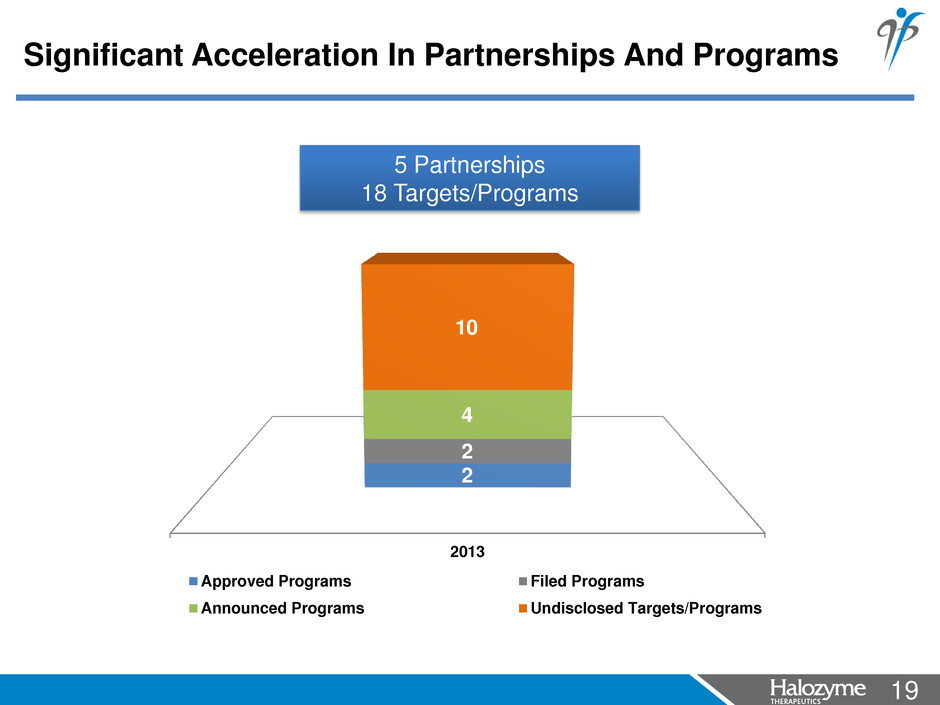

19 <#> Significant Acceleration In Partnerships And Programs 2013 2 2 4 10 Approved Programs Filed Programs Announced Programs Undisclosed Targets/Programs 5 Partnerships 18 Targets/Programs

20 <#> Royalties from top-line sales plus milestones UP TO 6 ADDITIONAL TARGETS • 4 Exclusive targets for Primary & Specialty Care (First disclosed target is PCSK-9) UP TO 2 ADDITIONAL TARGETS Partnered Programs Drive Short- And Long-Term Revenue

21 <#> *This information presented below is not intended to be a sales projection and is for illustrative purposes only. Roche has not provided any guidance on the commercial potential for these products* NOTE: 1) Financial information obtained from Roche investor update (January 30, 2013). Amounts presented in $US Dollars (1 CHF = 1.0669 $USD). Rounded. 2) Revenues as a percentage of sales for Herceptin and Mabthera/Rituxan were obtained from Roche investor update (January 30, 2013). 3) Information obtained from Roche investor presentation (July 25, 2013). 4) Halozyme receives a mid-single digit royalty payment on net product sales of Herceptin SC and MabThera SC from Roche; royalties subject to IV to SC conversion rate, countries where launched, approvals, reimbursements, timelines, pricing and other commercial factors. 5) Approved in EU September 2013. 6) EU application filed December 2012. Awaiting CHMP decision and approval. IV Formulation WW Revenues (2012)1: IV Implied Revenues (x-US, x-Japan): SC Addressable Indication(s)3: Adjusted rHuPH20 Potential Market Opportunity4: $6.3BN $7.2BN $4.1BN $3.5BN (or ~66% WW Sales)2 (or ~49% WW Sales)2 ~70% ~83% ~$2.9BN5 ~$2.9BN6 Roche Partnered Programs Represent Significant Opportunity Herceptin MabThera/Rituximab

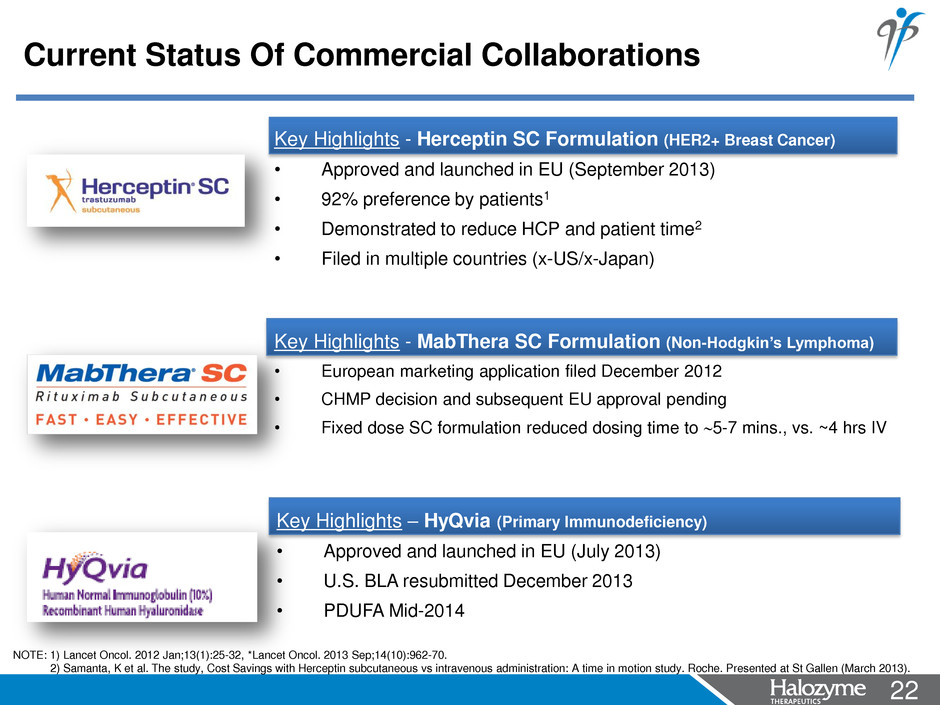

22 <#> Key Highlights - Herceptin SC Formulation (HER2+ Breast Cancer) • Approved and launched in EU (September 2013) • 92% preference by patients1 • Demonstrated to reduce HCP and patient time2 • Filed in multiple countries (x-US/x-Japan) Key Highlights - MabThera SC Formulation (Non-Hodgkin’s Lymphoma) • European marketing application filed December 2012 • CHMP decision and subsequent EU approval pending • Fixed dose SC formulation reduced dosing time to 5-7 mins., vs. ~4 hrs IV Key Highlights – HyQvia (Primary Immunodeficiency) • Approved and launched in EU (July 2013) • U.S. BLA resubmitted December 2013 • PDUFA Mid-2014 Current Status Of Commercial Collaborations NOTE: 1) Lancet Oncol. 2012 Jan;13(1):25-32, *Lancet Oncol. 2013 Sep;14(10):962-70. 2) Samanta, K et al. The study, Cost Savings with Herceptin subcutaneous vs intravenous administration: A time in motion study. Roche. Presented at St Gallen (March 2013).

23 <#> • Support partnered filings, approvals & launches Herceptin SC MabThera SC HyQvia PCSK9 Maximize Royalty Revenue from Existing Collaborations • Advance subcutaneous programs with Pfizer and Roche • Sign new partnerships Expand and Deepen Partnerships • Advance clinical trials for PEGPH20 (PDA) • Initiate additional PEGPH20 solid tumor study • Gain labeling update for Hylenex® for use in diabetes • Advance HTI-501 in cellulite Approval and Launch of Proprietary Products Halozyme: Creating Value Through Growth Time

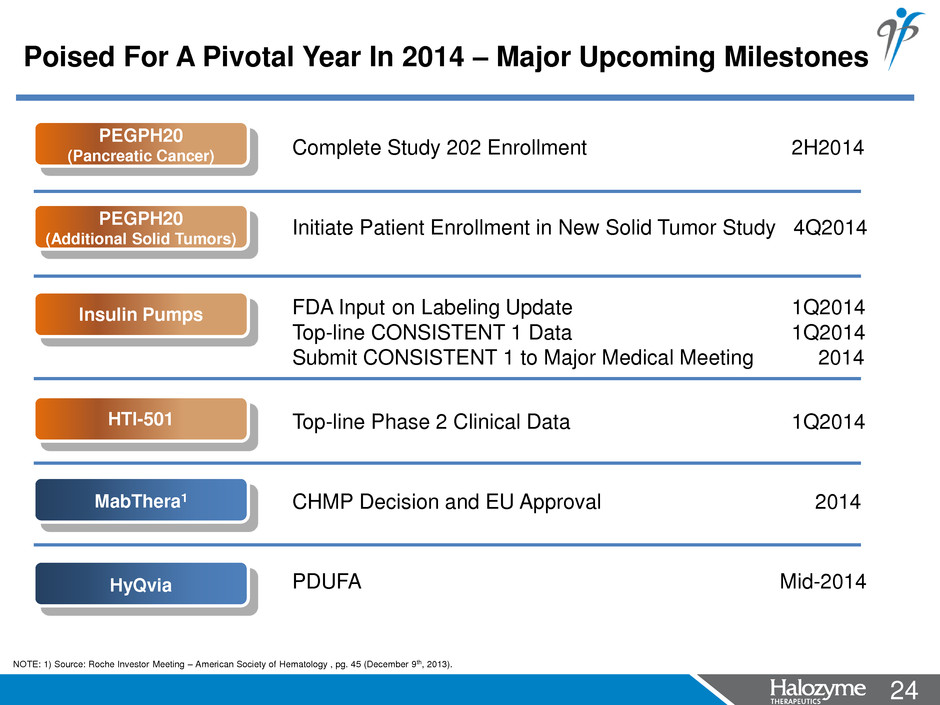

24 <#> NOTE: 1) Source: Roche Investor Meeting – American Society of Hematology , pg. 45 (December 9th, 2013). Poised For A Pivotal Year In 2014 – Major Upcoming Milestones HyQvia PEGPH20 (Pancreatic Cancer) MabThera1 Complete Study 202 Enrollment 2H2014 Initiate Patient Enrollment in New Solid Tumor Study 4Q2014 FDA Input on Labeling Update 1Q2014 Top-line CONSISTENT 1 Data 1Q2014 Submit CONSISTENT 1 to Major Medical Meeting 2014 Top-line Phase 2 Clinical Data 1Q2014 CHMP Decision and EU Approval 2014 PDUFA Mid-2014 PEGPH20 (Additional Solid Tumors) Insulin Pumps HTI-501

25 <#> Approval and Launch of Proprietary Products Maximize Royalty Revenue from Existing Collaborations Expand and Deepen Partnerships Halozyme: Creating Value Through Growth Time