Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASSEMBLY BIOSCIENCES, INC. | v364881_8k.htm |

Exhibit 99.1

Forward Looking Statements This material contains estimates and forward - looking statements. The words “believe,” “may,” “might,” “will,” “aim,” “estimate,” “continue,” “would,” “anticipate, ”“intend,” “expect,” “plan” and similar words are intended to identify estimates and forward - looking statements. Our estimates and forward - looking statements are mainly based on our current expectations and estimates of future events and trends, which affect or might affect our businesses and operations. Although we believe that these estimates and forward - looking statements are based upon reasonable assumptions, they are subject to many risks and uncertainties and are made in light of information currently available to us. Our estimates and forward - looking statements may be influenced by the following factors, among others : risks related to the costs, timing, regulatory review and results of our studies and clinical trials; our ability to obtain FDA approval of our product candidates; differences between historical studies on which we have based our ongoing and planned clinical trials and actual results from our trials; our anticipated capital expenditures, our estimates regarding our capital requirements, and our need for future capital; our liquidity and working capital requirements; our expectations regarding our revenues, expenses and other results of operations; the unpredictability of the size of the markets for, and market acceptance of, any of our products; our ability to sell any approved products and the price we are able realize; our need to obtain additional funding to develop our products, and our ability to obtain future funding on acceptable terms; our ability to retain and hire necessary employees and to staff our operations appropriately; our ability to compete in our industry and innovation by our competitors; our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business; estimates and estimate methodologies used in preparing our financial statements; the future trading prices of our common stock and the impact of securities analysts’ reports on these prices; and the risks set out in our filings with the SEC, including our Annual Report on Form 10 - K. Estimates and forward - looking statements involve risks and uncertainties and are not guarantees of future performance. As a result of known and unknown risks and uncertainties, including those described above, the estimates and forward - looking statements discussed in this material might not occur and our future results and our performance might differ materially from those expressed in these forward - looking statements due to, including, but not limited to, the factors mentioned above. Estimates and forward - looking statements speak only as of the date they were made, and, except to the extent required by law, we undertake no obligation to update or to review any estimate and/or forward - looking statement because of new information, future events or other factors. 1

» A phase 3 specialty pharmaceutical company focused on neglected and new areas of drug development: primary focus is anal disorders » Current portfolio – Expected Timelines VEN 307: Diltiazem cream for anal fissures – 505(b)(2) NDA filing Q2 2014 1 Phase III completed – hit primary endpoint Data readout from 2 nd PH III trial Q1 2014, NDA filing Q2 2014, PDUFA Q2 2015, launch Q3 2015, accretive Q4 2015 VEN 310 series: oral colonic release of bacteria, viruses, proteins, small molecules POP of technology for bacteria,Q3 – Q4 2014; viral antigens with in vivo immune response Q2 2015 POP in vivo CDAD and VRE Q2 2015 Launch PH II trials CDAD VRE Q1 2016 VEN 308: Topical phenylephrine for fecal incontinence – 505(b)(2) Potential unmet need with Colorectal Surgeons Being reformulated for longer IP » Sufficient cash to Q1 2016 Company Overview 2

VEN 307: Diltiazem Cream Novel Treatment for Anal Fissures

Anal Fissures: Cause and Management Increased sphincter tone Local ischemia Tear (fissure) in anal canal Cause Severe pain on defecation Treatment Options Control constipation, topical steroids Reduce sphincter tone Compounded t opical drugs: • GTN* • D iltiazem Botox Surgery Sphincters (muscles) Anal fistula Anal Fissure 1.1 million office visits/year † * Rectiv (topical GTN) recently approved by FDA; launched 3/2012 by Aptalis . † Physician Drug & Diagnosis Audit (PDDA), 2010. 4

VEN 307 ( Diltiazem ) Summary 2% Topical Diltiazem Cream Applied Peri - anally TID Mechanism of Action » Topical c alcium channel blocker Relaxes the internal anal sphincter, reducing pain and increasing tissue blood flow Preclinical Safety » Preclinical topical safety with 2% diltiazem twice daily for ninety days Clinical Pharmacology » Topical has < 10% of the systemic exposure as oral dosage but significantly greater effect on sphincter tone (i.e ., blood levels do not predict activity). Low exposure = better tolerability than oral diltiazem Clinical Data » Numerous clinical trials with ~1,200 subjects Infrequent mild adverse events (AE) reported Similar or better reduction in pain, significantly better tolerability than with nitroglycerin (GTN) » First pivotal trial complete: 3 arms, 465 subjects, significant improvement vs placebo, tolerability confirmed » Second PH III ongoing; data expected Q1 - 2014 5

FDA meeting (EOPII/pre - NDA) 8/30/2012: » NDA to include: x Cutaneous sensitivity/irritation and formal PK data (completed) x Short - term tox studies - completed (FDA confirmed acute episodic use – long term tox and clinical studies not required) x 2 pivotal trials x 1 pivotal trial completed in EU 2012 □ Second pivotal trial: design, endpoints etc accepted by FDA; data expected in Q1 - 2014 x CMC: 700Kg lots of drug product in addition to 70Kg lots used in clinical studies 6 NDA submission planned for Q2 - 2014

Formal PK and cutaneous tolerability clinical studies 7 x PK ▪ 1 US site, 12 subjects: sequential dosing of all subjects with diltiazem 2% topical single and multi - dose, and oral to determine PK in AF patients ▪ All PK parameters were as expected and the systemic exposure to diltiazem from topical diltiazem compared to oral diltiazem was confirmed at <10% x Cutaneous tolerability ▪ Sensitization and Irritation studies, 200 and 35 healthy volunteers respectively ▪ Diltiazem 2%, vehicle , saline control, active control (SLS )* ▪ The irritation scores were similar for diltiazem , placebo, and saline, all significantly better than SLS (active control) ▪ There were minimal AEs and no severe or serious AEs ▪ No irritation or sensitization potential with drug product or vehicle (placebo in PH III trials) * Saline solution

First Pivotal Phase III Trial » FDA (Analgesia Division) pre - IND meeting conducted in August 2007 Achieved clarity on primary endpoint: Reduction in pain Confirmed safety database and toxicology requirement » Phase III trial conducted by SLA Pharma (Ex - North America licensor) 3 arms with 155 patients per arm in 31 sites in Europe 2% and 4% diltiazem three times a day (TID) and placebo in 31 sites across Europe Romania (11 centers, 66%), Bulgaria, Spain, UK, Germany and Lithuania 94.6% of subjects completed the 12 - week study Primary outcome: Change from baseline in average of worst anal pain associated with or following defecation at Week 4 on an 11 - point numerical rating scale ( Likert - like scale) Selected secondary outcomes: Change from baseline in average of daily overall anal fissure - related pain at Week 4 Proportion of subjects who have complete healing of anal fissure at Week 8 Change in the Patient’s Global Impression of Improvement (PGI - I) at Week 4 Statistical analysis consistent with Division guidelines re. missing data 8

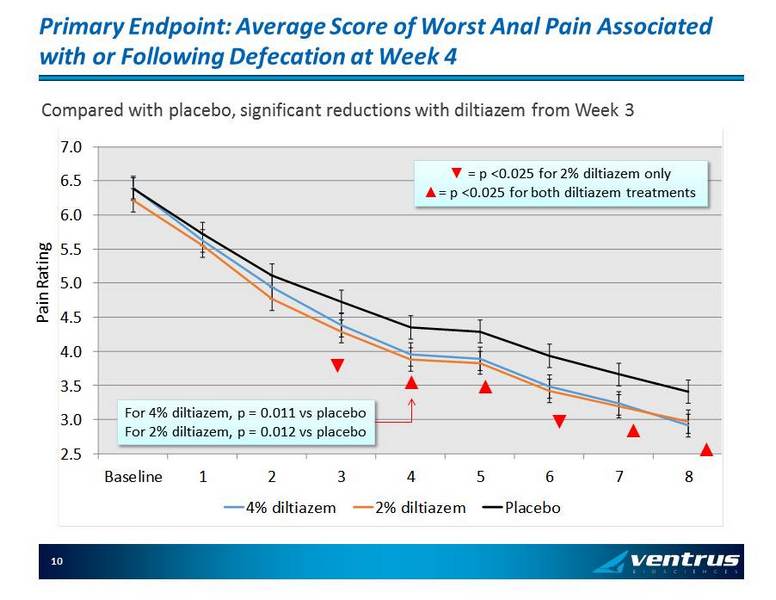

Summary of First Phase III Results (May 14, 2012) » Double - blind, placebo - controlled clinical trial randomized 465 subjects to diltiazem hydrochloride 4% or 2% by weight (w/w) cream, or placebo, applied topically three times daily (TID) for 8 weeks, followed by a 4 week blinded observation period. Conducted by licensor SLA in Europe » At 4 weeks, the 2% diltiazem treatment arm demonstrated improvements compared to placebo: Primary endpoint of average of worst anal pain associated with or following defecation: Pain score improvement of 0.43 for 2% diltiazem (p=0.0122) Secondary endpoint of overall anal - fissure - related pain: Pain score improvement of 0.42 for 2% diltiazem (p=0.0143) » 2% diltiazem improved the Patient’s Global Impression of Improvement measure at Week 4 (p = 0.0084 ) and at Week 8, healing was improved for the 2% diltiazem arm (31.2% healing; p=0.0426) compared to placebo (23.9%) » Effects of 4% were similar or less (dose asymptote for efficacy = 2%) » Adverse events (i.e., incidence of headaches) were similar across all 3 treatment arms (4%, 2%, placebo) 9

Primary Endpoint: Average Score of Worst Anal Pain Associated with or Following Defecation at Week 4 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 Baseline 1 2 3 4 5 6 7 8 4% diltiazem 2% diltiazem Placebo ▲ ▲ ▲ ▲ Compared with placebo, significant reductions with diltiazem from Week 3 For 4% diltiazem, p = 0.011 vs placebo For 2% diltiazem, p = 0.012 vs placebo ź = p < 0.025 for 2% diltiazem only Ÿ = p < 0.025 for both diltiazem treatments ▼ ▼ Pain Rating 10

2 nd PH III trial: 11 434 subjects at 90 sites: diltiazem 2% vs placebo Design , inclusion and exclusion criteria and endpoints are the same as 1 st Pivotal except entry pain scores higher (5 vs 4 ) and SSRI’s allowed 311 US subjects; 28 Canada/Israel; 95 Eastern Europe Enrollment complete 11/25/2013; full data set data expected in Q1 - 2014; NDA filing expectedQ2 - 2014

VEN 307 Life Cycle: » Licensed from SLA P harma for U.S. and Canada in return for single digit royalties and approval milestones » U.S. patent protects IP through February 2018 and with HW extension to August 2019. Possible pediatric extension to Q2 - 2020 (written request process initiated). After expiration, the Company expects generic approval to be difficult due to topical dosage, trade secret protection, re - formulation obstacles and the probable need for clinical study and comparative PK data in AF patients » Have completed technical development of four extended release formulations All patentable with expected protection through 2033 All B.I.D. or O.D. At least one Phase 3 trial with one extended release formulation will be required (if one formulation is acceptable in manometry /PK studies). 12

Commercialization VEN 307

VEN 307 Focused Target & Messaging Opportunity » Customer target is concentrated Primary focus: Colorectal surgeons and general surgeons with a colorectal - oriented practice They see 76% of the anal fissure patients (424K patients/ yr ) in the United States 1 Secondary focus: High Rectiv prescribing GIs and PCPs » Message is simple Quality and availability of GMP diltiazem exceeds compounded diltiazem The safety profile of diltiazem is superior to that of nitroglycerin VEN 307 is reimbursed and a copay program is available » Customer target is receptive to the message Colorectal surgeons already prefer compounded calcium channel blockers for anal fissures 14 1. AF Patients who visited a physician (IMS NDTI , 2012)

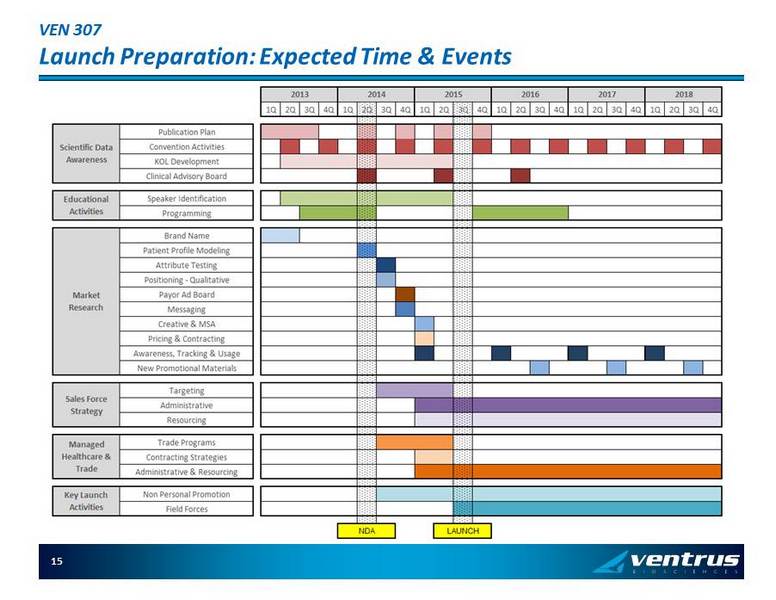

VEN 307 Launch Preparation : Expected Time & Events 15

VEN 310 SERIES

VEN 310 platform: targeted colonic delivery of bacteria, viruses, proteins, small molecules » Considerable academic interest in the human microbiome in health & disease since the early 2000’s, with an acceleration with NIH’s $180 million project and the availability of 16S rRNA sequencing » With the dramatic response to Fecal Material Transplant in recalcitrant C.difficle 1 , several startups were formed, targeting C.diff and IBD for treatment with selections of bacteria ( eg : Vedanta, IBD; Seres , CDAD) or bacterial products ( eg S econd Genome), with some big pharma venture interest ( eg JNJ with Second Genome and Vedanta) » In addition other small biotechs ( eg Amplifi , Avid and others) are investigating recombinant and natural phages, host bacteriocins , and specifically engineered bacteria » For some viral vaccines, oral delivery is problematic: can the antigen be delivered intact to the Peyer’s patches (terminal illeum , appendix, proximal colon), and if so will there be an adequate immune response » All of the above potential products may require a delivery mechanism 1: N Engl J Med 2013; 368:407 - 415 January 31 2013 17

VEN 310 platform: targeted colonic delivery of bacteria, viruses, proteins, small molecules » Ventrus has in - licensed technology for targeted colonic (and/or terminal ileum) delivery of bacteria, viruses, proteins and small molecules: pH sensitive delivery of living organisms, proteins, and small molecules, exploiting recent data on pH gradients from the stomach to the distal colon, and recent advances in encapsulation technologies, Field = GI disorders (including bacterial dysbioses and IBD, IBS) metabolic disorders, autism; oral bacterial and viral vaccines; oral small molecules for colonic delivery Patents filed March 2013 » Plan: 1. Bacteria: 1. D emonstrate for an aerobe and obligatory anaerobe, preservation of the organism after coating and colonic release and viability under in vitro gut conditions = Proof of Principle: we estimate Q3 - 2014. 2. In parallel, identify bacterial components for C. Diff (CDAD) and Vancomycin Resistant Enterococci (VRE) colonization Rx and prevention in animal models: we estimate Q2 - 2015 3. Launch PH II trials in CDAD and VRE: we estimate Q1 - 2016 2. Viral Vaccine: demonstrate preservation of an antigen, colonic release under in vitro gut conditions AND immunogenicity in a mouse model = Proof of Principle, estimate Q2 - 2015 18

Ventrus Biosciences Potential Pipeline 19

20 Financial Update as of Q3 - 2013 » Cash balance Cash and cash equivalents at Sept 30, 2013 $ 32.3 Mil Expected cash burn next 12 months $ 12 - $ 16 Mil » Stock data Fully diluted shares outstanding 26.2 Mil Shares outstanding 20.6 Mil » Major sources of funding 2007 to present Funding pre - IPO $ 10 Mil IPO December 2010 $ 18 Mil Secondary public offering July 2011 $ 47.5 Mil Secondary public offering Feb 2013 $ 21 Mil