Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ASSEMBLY BIOSCIENCES, INC. | Financial_Report.xls |

| EX-23.1 - EXHIBIT 23.1 - ASSEMBLY BIOSCIENCES, INC. | v305263_ex23-1.htm |

| EX-32.1 - EXHIBIT 32.1 - ASSEMBLY BIOSCIENCES, INC. | v305263_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - ASSEMBLY BIOSCIENCES, INC. | v305263_ex31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - ASSEMBLY BIOSCIENCES, INC. | v305263_ex31-1.htm |

| EX-32.2 - EXHIBIT 32.2 - ASSEMBLY BIOSCIENCES, INC. | v305263_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from __________ to __________

Commission File Number 001-35005

VENTRUS BIOSCIENCES, INC.

(Exact name of registrant specified in its charter)

| Delaware | 2834 | 20-8729264 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

99 Hudson Street, 5th Floor

New York, New York 10013

(Address of Principal Executive Offices)

(646) 706-5208

(Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class |

Name of Exchange on which Registered | |

| Common Stock, $0.001 Par Value | Nasdaq Capital Market |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No £

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | |||

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant, as of June 30, 2011, was approximately $92.2 million. Such aggregate market value was computed by reference to the closing price of the common stock as reported on the Nasdaq Capital Market on June 30, 2011. For purposes of making this calculation only, the registrant has defined affiliates as including only directors and executive officers and shareholders holding greater than 10% of the voting stock of the registrant as of June 30, 2011.

As of March 8, 2012 there were 12,406,406 shares of the registrant’s common stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of t he Company’s definitive Proxy Statement for its 2012 Annual Meeting of Stockholders are incorporated herein by reference, as indicated in Part III.

VENTRUS BIOSCIENCES, INC.

TABLE OF CONTENTS

| Page | ||

| PART I | 1 | |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 42 |

| Item 1B. | Unresolved Staff Comments | 61 |

| Item 2. | Properties | 61 |

| Item 3. | Legal Proceedings | 61 |

| Item 4. | Mine Safety Disclosures | 61 |

| PART II | 62 | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 62 |

| Item 6. | Selected Financial Data | 64 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 65 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 72 |

| Item 8. | Financial Statements and Supplementary Data | 72 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 72 |

| Item 9A. | Controls and Procedures | 72 |

| Item 9B. | Other Information | 73 |

| PART III | 74 | |

| Item 10. | Directors, Executive Officers and Corporate Governance | 74 |

| Item 11. | Executive Compensation | 74 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 87 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 88 |

| Item 14. | Principal Accounting Fees and Services | 88 |

| Item 15. | Exhibits, Financial Statement Schedules | 88 |

| Financial Statements | F-1 | |

| i |

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are subject to risks and uncertainties, including those set forth under “Item 1A. Risk Factors” and “Cautionary Statement” included in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this report, that could cause actual results to differ materially from historical results or anticipated results.

PART I

Item 1. Business

Overview

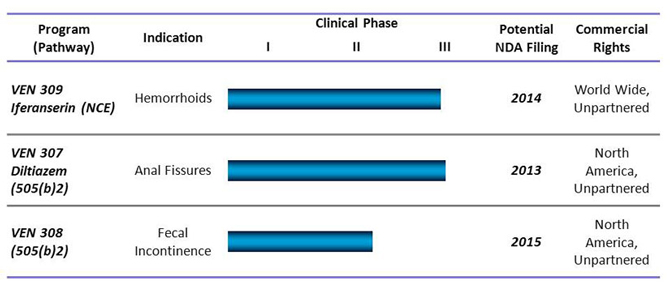

We are a development stage specialty pharmaceutical company currently focused on the development of late-stage prescription drugs for gastrointestinal disorders, specifically hemorrhoidal disease, anal fissures and fecal incontinence. Major pharmaceutical progress has been made in the gastrointestinal therapeutic areas of gastroesophageal reflux, peptic ulcer disease and inflammatory bowel disease. However, many major gastrointestinal disorders still lack medical treatments. We are pursuing treatments for three of the 10 most prevalent gastrointestinal disorders in the U.S. We estimate that the patient population of these three disorders is almost 30.0 million people in the U.S., based on the data we cite for each indication in this report.

We are not aware of any prescription drug treatments for hemorrhoids or fecal incontinence that have been approved by the U.S. Food and Drug Administration, or FDA for these indications, yet there currently are approximately 21.7 million Americans suffering from symptomatic hemorrhoids in the past year, and approximately 7.0 million from fecal incontinence. While there are approximately 1.1 million office visits per year for anal fissures in the U.S., we are aware of only one drug that has received FDA approval for the treatment of pain associated with anal fissures; Rectiv received approval in late June 2011, and is expected to come to market in the first quarter of 2012. Rectiv is effective in reducing the pain from anal fissures, but moderate and severe headaches are a frequent side effect of this drug whose active ingredient is nitroglycerin. Our lead product VEN 309 (iferanserin) is a new chemical entity, or NCE, for the topical treatment of symptomatic internal hemorrhoids. In seven clinical studies between 1993 and 2003 involving 359 patients, VEN 309 demonstrated good tolerability and no severe adverse events, and statistically significant improvements in bleeding, itchiness and pain. Beginning in 2008, we have had extensive discussions with the FDA under a Special Protocol Assessment, or SPA, process, for our first pivotal U.S. trial of VEN 309 for the treatment of symptomatic internal hemorrhoids. While we decided not to pursue an agreement letter, we received many recommendations from the FDA concerning the major and important elements of the trial during this process and we incorporated these into our protocol. To avoid delays and without having reached agreement with FDA on the SPA, we proceeded to file the protocol to our existing investigational new drug application, or IND, with the FDA in July 2011 and began enrolling and dosing patients in August 2011. We own all rights, title and interest in VEN 309.

Our additional product candidate portfolio consists of two in-licensed late-stage drugs. VEN 307 (diltiazem) is intended to treat pain associated with anal fissures and VEN 308 (phenylephrine) is intended to treat fecal incontinence. These candidates are two molecules that were previously approved and are currently marketed for other indications and that have been formulated into our proprietary topical treatments for these new gastrointestinal indications.

Diltiazem was first approved in 1982 in oral form for the treatment of angina and high blood pressure. It has been prescribed in the U.S. for millions of patients in oral dosages typically from 240 mg to 360 mg per day. In contrast, daily doses of VEN 307 for treatment of anal fissures will range from 15 mg to 45 mg. Because of the extensive patient exposure to diltiazem as a cardiovascular agent and the wide safety margin as a low dose topical therapy, we intend to develop the topical formulation as a Section 505(b)(2) new drug application, or NDA, based on our discussions with the FDA at our pre-IND meeting in August 2007.

| 1 |

Phenylephrine has been available since the early 1940s in oral and nasal form for the treatment of nasal congestion. It has also been used as a topical ophthalmic agent since 1936. Phenylephrine is prescribed more than 17 million times per year in the U.S., with 99% of the prescriptions being for cough/cold oral preparations. The typical oral dosing is 40 mg to 60 mg per day. Because of the extensive patient exposure to phenylephrine, we intend to develop VEN 308 as a topical formulation through a Section 505(b)(2) NDA.

In August 2007, we had a pre-IND meeting with the FDA concerning VEN 307 for the treatment of pain from anal fissures where we discussed necessary preclinical testing and product formulation to support an IND, established what clinical safety database would be required, and established that the next clinical studies needed for approval were two pivotal Phase III trials, preceded (if conducted in the U.S.) by three short-term dermal toxicology studies using final drug product formulation. In June 2007, we had a pre-IND meeting with the FDA concerning VEN 308 for the treatment of fecal incontinence associated with ileal pouch anal anastomosis (IPAA) where it was established that the next clinical study in the program should be a Phase IIb trial where multiple doses will be assessed and that existing toxicology data are sufficient to support Phase II testing. We have not had further meetings with the FDA on either VEN 307 or VEN 308 since the meetings in 2007. Beginning in February 2009, the development of the three products, VEN 307, VEN 308 and VEN 309, was delayed due to a lack of financial resources prior to the completion of our initial public offering in December 2010. We have used and are using the proceeds from that offering, as well as the proceeds from our July 2011 registered public offering of our common stock, to continue the development of VEN 309 and VEN 307 and we are using a portion of the proceeds from the July 2011 offering to fund the two pivotal Phase III trials for VEN 309.

Our Pipeline

Our Products and Development Strategy

Our three late-stage product candidates are:

Iferanserin ointment (VEN 309) for the topical treatment of symptomatic internal hemorrhoids. Hemorrhoids, which are characterized by the inflammation and swelling of veins around the anus or lower rectum, can cause bleeding, itching, pain and difficulty defecating. VEN 309, an NCE formulated as an ointment for intra-anal application, has highly selective, antagonistic activity against peripheral 5HT 2A receptors involved in clotting and the contraction of arteries and veins, two events believed to be associated with hemorrhoid formation. By limiting 5HT 2A receptor activity, VEN 309 improves the flow of blood out of the dilated veins that comprise the hemorrhoid, thereby reducing bleeding, itchiness and pain. As reported a survey of 10,000 adult consumers in the U.S. conducted on our behalf by Princeton Brand Econometrics, a consumer market research company, symptomatic hemorrhoids have affected approximately 21.7 million people in the past year and approximately 6.7 million adults on any given day in the U.S. Despite such a high prevalence, we are not aware of any FDA-approved prescription drugs for the treatment of hemorrhoids. While there are commonly used prescription drugs in the U.S. for hemorrhoids, such as Anusol®, none have been approved by the FDA or have been designated by the FDA as safe and effective for this indication. Various combination products (such as the Preparation H® line of products) are available in the U.S. over-the-counter, or OTC, under the FDA’s OTC monograph rule. The great majority of these OTC treatments provide only temporary relief from the symptoms of hemorrhoids, but do not address the cause of hemorrhoids. The mechanism of action of these treatments is either generally anti-inflammatory, such as steroids, or acting as a protective coating on the hemorrhoid or acting as local anesthetics, in the case of most of the OTC products, or unknown, in the case of herbal remedies, and we are not aware of any clinical trials published in medical journals on the efficacy or safety of any topical or oral drug currently marketed in the U.S. for the treatment of hemorrhoids. We believe VEN 309 to be more effective than the currently available conventional hemorrhoid topical or oral drug therapies and more attractive than surgical procedures, which are the only currently validated treatment options.

| 2 |

We originally licensed VEN 309 from Sam Amer & Co., Inc., or Amer, who had developed VEN 309 through Phase II trials and up to readiness for Phase III trials in the U.S. and Europe. On November 14, 2011, we acquired all rights, title and interest to VEN 309 from Amer. VEN 309 is covered for composition of matter in patents that will expire in August 2015 in the U.S. and February 2018 elsewhere. If approved by the FDA, VEN 309 will receive five years of data exclusivity in the U.S. as an NCE under the Hatch-Waxman Act and 10 years from the date of approval in Europe. We filed a new concentration range patent in August 2010, which, if issued, would grant patent protection until 2030 and prevent substitutable generic competition.

Our initial Phase III trial for VEN 309 (ClinicalTrials.gov Identifier: NCT01355874) is a multicenter double-blind randomized placebo-controlled parallel treatment group trial, consisting of three arms with a double-blind portion and an open-label extension portion consisting of:

Double blind part

| · | Approximately 600 male or female patients aged 18 – 75 years (200 patients per arm) recruited at up to approximately 70 sites in the U.S., randomized 1:1:1 ratio to: |

| º | Arm 1: placebo ointment twice daily intra-anally for 14 days; |

| º | Arm 2: iferanserin ointment twice daily for 14 days; |

| º | Arm 3: iferanserin ointment twice daily for 7 days followed by placebo ointment twice daily for 7 days; |

| · | After 14 days treatment, patients will be followed up at Day 28; |

| · | Inclusion criteria include symptomatic grade I to III internal hemorrhoids, bleeding from hemorrhoids every day for the two days immediately preceding the day that they are randomized and study medication applied, with pain or itching accompanying the bleeding for the two days; and |

| · | Exclusion criteria include: grade IV hemorrhoids; thrombosed internal or external hemorrhoids; prior or current history of heart disease or depression; use of laxatives, anticoagulants, over-the-counter anti-hemorrhoidal agents, topical steroids, suppositories of any kind, non-steroidal anti-inflammatory drugs (NSAIDs), Cox-2 inhibitors, and other drugs and conditions including potential inhibitors of CYP2D6 such as SSRI drugs. |

The endpoints for the double-blind part of the trial are:

| · | Primary: Proportion of patients with cessation of bleeding by Day 7 that persists for the remainder of the treatment period (through Day 14); and |

| · | Key Secondary: Proportion of patients with cessation of pain and/or itching by Day 7 that persists for the remainder of the treatment period (through Day 14). |

| 3 |

Open Label part

After the 28 day double blind portion of the trial, patients will be followed quarterly for one year and treated with active drug if they have a recurrence at any time during that period. We will assess time to first recurrence, and the overall recurrence rate over one year, and will be able to observe the unblinded response to treatment of recurrence during this part of the trial.

Although we did not obtain an SPA agreement with the FDA, we believe that our modeling of the endpoint definitions as proposed by the FDA using the German Phase IIb trial data, confirm a projected power of > 99% for the primary endpoint and > 95% for the key secondary endpoints for our proposed Phase III trial.

We filed the protocol to our existing IND with the FDA in July 2011 and began enrolling and dosing patients in August 2011, and estimate we will complete enrollment approximately in April 2012. We anticipate reporting the top line data from our ongoing U.S. Phase III trial of VEN 309 in hemorrhoids in June of 2012.

Diltiazem cream (VEN 307), a topical treatment for the relief of pain associated with anal fissures. Anal fissures are small tears or cuts in the skin that lines the anus. They can be extremely painful, cause bleeding and often require surgery, which itself can have unsatisfactory outcomes. In 2010, it was estimated by SDI Health LLC that there were approximately 1.1 million office visits per year for anal fissures. At present, we are aware of only one FDA-approved drug for the treatment of anal fissures. Rectiv (nitroglycerin) ointment 0.4%, for the treatment of moderate to severe pain associated with chronic anal fissures, received FDA approval in late June 2011, and is expected to come to market in the first quarter of 2012. Topical nitroglycerin, the active ingredient in Rectiv, also has been compounded by pharmacists to treat anal fissures, but has a substantially higher rate of side effects than topical diltiazem, notably moderate and severe headaches, which also are experienced with Rectiv. We also are aware of limited use of Botox as an injection into the anal sphincter to treat this condition. Several topical forms of nifedipine, a calcium-channel blocker, also are used to treat pain from anal fissures. Diltiazem cream, also a calcium-channel blocker, however, is currently used as the preferred treatment prior to surgery by many gastroenterologists across the U.S. in a version that must be specially mixed, or compounded, for each patient in the pharmacy. Compounded diltiazem is currently listed in the U.S. and E.U. anal fissure treatment guidelines as a preferred agent prior to attempting surgery. Neither compounded diltiazem nor nifedipine, however, is FDA-approved for the relief of pain associated with anal fissures nor is the cost typically reimbursed by Medicare or health insurance plans. We expect that VEN 307, if approved by FDA and Rectiv would be reimbursable under Medicare and health insurance plans. When applied topically for the treatment of anal fissures, diltiazem, which has been used for decades for hypertension and angina, dilates the blood vessels supplying the region, reduces anal sphincter tone, and thereby substantially decreases pain. In the majority of multiple clinical trials conducted against placebo or topical nitroglycerin conducted between 1999 and 2002 by various researchers in investigator initiated trials, diltiazem cream significantly reduced the pain associated with anal fissures.

Our product, VEN 307, is a pre-mixed and pre-packaged proprietary formulation of diltiazem that when applied topically yields lower blood levels (at one-tenth the amount) than the lowest oral dose used for cardiovascular treatment. We believe these low blood levels improve the safety profile and lower the risk of side effects. We have potential to capture immediate market share if VEN 307 is approved due to the familiarity of gastroenterologists with the current use of diltiazem to treat anal fissures, its ease of prescription as a pre-formulated FDA-approved product with no need for compounding necessary at the pharmacy, and the expected ability for patients to be reimbursed through their health insurance plans or Medicare. We have licensed the exclusive North American rights to VEN 307 for the topical treatment of anal fissures from S.L.A. Pharma, our development partner, who has completed early-stage clinical trials, toxicology studies and manufacturing for VEN 307 up to the end of Phase II. VEN 307 is covered by a method of use in a patent that will expire in February 2018.

In August 2007, we had a pre-IND meeting with the FDA concerning VEN 307 for the treatment of pain from anal fissures where we addressed necessary preclinical testing and product formulation to support an IND, established what clinical safety database would be required, and that the next clinical studies needed for approval were two pivotal Phase III trials, preceded (if conducted in the U.S.) by three short-term dermal toxicology studies using final drug product formulation. Prior to conducting any clinical Phase III trials in the U.S., we must complete three short-term dermal toxicology studies and file an IND for FDA approval. We plan to employ a two-pronged development strategy for VEN 307. While S.L.A. Pharma is conducting the first Phase III VEN 307 clinical trial in the E.U. which completed enrollment in December 2011 and is anticipated to be reporting data in May 2012, we intend to initiate development of a different formulation of VEN 307 with new intellectual property in the form of an extended release formulation. There are several proven methodologies for extended release topical formulations, and we believe that diltiazem is readily druggable in this regard. We intend to assess three to four alternatives preclinically with multiple contractors, and then assess absorption and effect on the internal anal sphincter (IAS) pressure with the most promising candidate, while we file Patent Cooperation Treaty applications for the specific technology combined with diltiazem for all formulations that are technically feasible.

| 4 |

S.L.A. Pharma began enrollment in the VEN 307 Phase III trial in November 2010 and completed enrollment of 465 patients at 32 sites in Europe in December 2011. Patients were treated for two months and then observed without treatment for one month in a randomized 1:1:1 double blind study that compares treatments of fiber plus 2% VEN 307 and fiber plus 4% VEN 307 to fiber plus placebo. The primary endpoint is reduction of pain upon defecation averaged across the fourth week of treatment, using a validated numerical rating scale for pain. Patients used daily diaries and were observed for one week prior to randomization to ensure sufficient pain prior to randomization. We expect initial top-line data from the VEN 307 EU Phase III study to be available in May 2012.

If there is successful completion of and satisfactory data from the E.U. trial, we will make the final decision on which formulation to pursue depending on several factors, including whether the new formulation is clinically superior, our access to capital, clinical and regulatory considerations, and our assessment of the then-current state of our intellectual property estate. If the new U.S. developed formulation is superior as demonstrated by sufficient data and the other factors are met, we plan to file an IND for the new formulation of VEN 307 and then initiate two pivotal trials in parallel in order to complete the NDA for an estimated FDA submission in 2014. If the new formulation is not superior, from the clinical. CMC and intellectual property perspectives, we plan to finish clinical development utilizing the current formulation which would require three short-term dermal toxicology studies and one additional pivotal Phase III trial in the U.S. We believe that continuing with the current formulation could result in an NDA submission in 2013 but would expect to continue to pursue other lifecycle options for VEN 307. We intend to use a portion of our current resources to continue the development of VEN 307.

Phenylephrine gel (VEN 308) for the treatment of fecal incontinence associated with ileal pouch anal anastomosis, an FDA orphan indication. Ileal pouch anal anastomosis, or IPAA, is a surgical procedure used as part of a colectomy, which is a surgical treatment for patients with ulcerative colitis. Fecal incontinence resulting from dysfunctional sphincter tone is a common consequence of this procedure. Patients with IPAA, secondary to a total colectomy, tend to have a high incidence of fecal incontinence, up to 30%, according to a 1987 study conducted by Dr. John Pemberton and others at the Mayo Medical School. According to a U.S. community based epidemiology study (Nelson et al., JAMA, 1995), 2.2% of the U.S. population suffer from fecal incontinence, which we estimate to be approximately 7.0 million people, based on 2009 Census Bureau population estimates. The surgery associated with IPAA can weaken sphincters and muscles necessary for continence and therefore can result in incontinence. About 30% of patients with ulcerative colitis, a form of inflammatory bowel disease which has a prevalence of 700,000 patients in the U.S. (according to Datamonitor 2008) will have had a colectomy, almost always an IPAA procedure (according to McGlauchlin and Clark, Practical Gastroenterology, 8/2008). IPAA-related fecal incontinence is considered an orphan indication by the FDA and the European Medicines Agency, or EMEA. In 2006, the total population of patients with IPAA-related fecal incontinence in the U.S. was estimated to be 50,000 to 100,000, according to IMS Health, Inc. Currently, there are few options available to treat this problem, consisting of OTC bulk laxatives, fiber diets, Imodium, which is a treatment for diarrhea, and invasive surgical procedures. In addition, Solesta, an injectable inert bulking agent product, was approved as a device by the FDA in May 2011 for the treatment of fecal incontinence in adult patients who have failed conservative therapy. Solesta is injected submucosally around the anal sphincter and consequently has to be administered in an outpatient setting by qualified physicians. In addition, Norgine is conducting a European Phase II program with NRL001, a suppository formulation of an alpha adrenergic stimulating agent for the treatment of fecal incontinence. We are not aware of any FDA-approved drugs for fecal incontinence. In multiple investigator initiated clinical trials with patients suffering from IPAA-associated fecal incontinence, topical phenylephrine significantly (and in some patients, dramatically) improved patient bowel control. In clinical trials with other forms of incontinence, improvements were also observed following application of topical phenylephrine, depending on the cause of the incontinence.

| 5 |

Our product, VEN 308, is a gel formulation of phenylephrine. Applied topically, VEN 308 increases anal sphincter tone, thereby improving fecal incontinence in patients where sphincter tone is the major cause of their symptoms, such as post-IPAA surgery. We believe VEN 308 has significant advantages over the limited treatment options currently available for fecal incontinence associated with IPAA, including but not limited to, increased efficacy and/or reduced invasiveness. We have licensed the exclusive North American rights to VEN 308 from S.L.A. Pharma who developed the specific formulation of phenylephrine for the topical use in fecal incontinence and developed the manufacturing method. S.L.A. Pharma’s previous partner, Solvay, conducted important pharmacokinetic studies. We currently do not expect to spend any time or resources developing VEN 308 in the short term. VEN 308 is covered by a patent that will expire in December 2017. If approved by the FDA, VEN 308 will receive seven years of data exclusivity in the U.S. under the Orphan Drug Act.

The FDA has granted VEN 308 orphan status for the treatment of IPAA-related fecal incontinence. In the U.S., orphan drug designation is given to a drug intended to treat a rare disease of condition, which is generally a disease or condition that affects fewer than 200,000 individuals in the U.S. Assuming sufficient resources in the future and positive results from a Phase IIb dose ranging trial in the U.S. in support of the orphan indication of IPAA-related fecal incontinence that we intend to undertake, we would expect to submit an orphan NDA for VEN 308 for this indication. Orphan status provides seven years of data exclusivity in the U.S. from the date of approval for a specific indication.

Our Development Efforts

We own VEN 309 (but prior to November 14, 2011, in-licensed it from Amer) and in-license our two other product candidates from S.L.A Pharma. All clinical trials to date have been conducted either by the licensor, the licensor’s previous partners or by independent investigators, as have the preclinical studies and product formulation activities. Since the time we licensed these products, we have focused our efforts on establishing and clarifying the regulatory pathway for late phase clinical trials and regulatory approval, on establishing the contract manufacturing capacity and methods necessary to allow late phase clinical trials to proceed, and on initiating late phase trials, preclinical toxicology and human pharmacology studies with our products, all of which will be conducted by contracted third parties under our direction. These development efforts have not required many employees and we have historically operated with only a limited number of employees with the expertise necessary to progress our product candidates down the development path outlined above. This helps us contain our operating costs.

Subsequent to the completion of our initial public offering in late December 2010, we began hiring a few employees and contracting with three individuals or entities to complete our staffing needs for our initial Phase III trial of VEN 309. Throughout 2011, we added several other employees. We also have contracted with contract research organizations to assist us in our Phase III trials for VEN 309. However, we remain dependent on the availability and competency of the third parties with whom we have contracted and with whom we plan to contract for the continued development of our product candidates.

Our Strategy

Our objective is to develop and commercialize highly differentiated products to address unmet medical needs of the lower gastrointestinal tract. We are developing our product candidates to treat hemorrhoids, anal fissures and fecal incontinence. Currently, there are no FDA-approved prescription drugs in the U.S. for the treatment of hemorrhoids. One product (Rectiv, a topical nitroglycerin) was approved by the FDA in June 2011 and we expect this product to be launched by Aptalis in 2012. There are no FDA-approved prescription drugs for the treatment of incontinence, but Solesta, a hyaluronic acid dermal filler, was approved as a device by the FDA in 2011 for intra-anal injection for fecal incontinence. We expect Salix Pharmaceuticals to launch this product in 2012.

To achieve this objective, we intend to:

| · | complete one of two planned pivotal Phase III trials in the U.S. of VEN 309 for the treatment of hemorrhoids, that began in August 2011 and for which enrollment is expected to be complete around April 2012 and for which top line results are expected around June 2012; |

| 6 |

| · | assuming positive data from the initial Phase III trial for VEN 309, conduct an additional pivotal Phase III trial as well as a Phase III double blind recurrence trial. Assuming acceptable results from these clinical trials, as well as from clinical pharmacology and other, non-clinical activities, such as carcinogenicity and toxicology studies, prepare and file an NDA for VEN 309 for the treatment of hemorrhoids in 2014; |

| · | assuming VEN 309 is approved by the FDA, and because there are no FDA-approved prescription drug competitors in the U.S., we intend to commercialize the product in the U.S. using either our own sales force or through an agreement with a suitable partner and to license the product for sale outside of the U.S.; |

| · | assuming receipt of positive data from an ongoing European Phase III trial of VEN 307, expected in May 2012, conduct one pivotal trial with the existing three times per day formulation or two parallel pivotal trials with a to-be-identified twice daily formulation as well as short-term dermal toxicology studies for VEN 307, with the goal to prepare and file an NDA for a Phase III trial of VEN 307 for the topical treatment of pain associated with anal fissures in 2013; |

| · | assuming VEN 307 is approved by the FDA, and because topical diltiazem is already used by colorectal surgeons in the U.S., we intend to engage our own gastrointestinal specialty sales force and marketing staff to commercialize this product and/or engage a suitable partner in the U.S. and to license it for sale in Canada; and |

| · | pending the outcome of the ongoing Phase III trials in VEN 309 and VEN 307, and the availability of additional capital, develop a final formulation of VEN 308 and advance that product through Phase IIB studies. |

History of Operations

We hired Dr. Russell Ellison, our Chief Executive Officer and Chief Medical Officer, and David Barrett, our Chief Financial Officer, in December 2010 upon the completion of our initial public offering. From June 2010 until they were hired, Dr. Ellison and Mr. Barrett served as consultants because our only business activities during that time consisted of maintaining our licenses with S.L.A. Pharma and Amer, and activities connected with our initial public offering. From late December 2010 through February 2011, we completed the staffing for our planned development of VEN 309, by adding a clinician, two clinical project managers, a head of manufacturing, and an executive assistant on a contract or permanent employment basis. We have used these consultancy arrangements to conserve our resources.

Although incorporated in 2005, we began active operations in the spring of 2007 upon the licensing of VEN 307 and VEN 308 by Paramount BioSciences from S.L.A. Pharma. Shortly thereafter, we hired Thomas Rowland as our chief executive officer (who was then one of our directors), Dr. Terrance Coyne as our chief medical officer, and Dr. John Dietrich as our vice president of clinical operations, as well as other employees. Due to our lack of capital, Drs. Coyne and Dietrich resigned in February 2009. Mr. Rowland resigned as our chief executive officer in February 2009, but he continued to act as our president from the date of his resignation in February 2009 until May 2010. Simultaneously with the resignation of Dr. Dietrich, we entered into a consulting agreement with him whereby he provided consultation on manufacturing, preclinical and clinical aspects of our drug programs on an as-needed basis. These arrangements with Mr. Rowland and Dr. Dietrich allowed us to continue minimal operations following their resignations until June 2010 when we contracted with Dr. Ellison and Mr. Barrett. In January 2011, we renewed the consulting agreement with Dr. Dietrich. Effective September 1, 2011, we hired Mr. Rowland as our Chief Business Officer.

| 7 |

Our Management

Our management team consists of: Russell H. Ellison, Chief Executive Officer and Chairman of the Board of Directors, who has over 30 years of experience in the pharmaceutical industry, including serving as vice president — medical affairs and Chief Medical Officer of Roche Laboratories, Inc., USA. and of Sanofi-Synthelabo, USA; David J. Barrett, Chief Financial Officer, previously chief financial officer of Neuro-Hitech, Inc., a publicly traded pharmaceutical company with development stage and marketed products; and Thomas Rowland, Chief Business Officer, who was hired effective September 1, 2011, has over 20 years of experience in the pharmaceutical industry, most of which was in the gastrointestinal area, and was our founding chief executive officer. Beginning in January 2011, we have increased the number of our employees to seven and have long-term contracts with seven consultants on manufacturing, preclinical and clinical aspects of our drug programs. We also have contracted with three contract research organizations to assist in our drug development plans. We use these consulting agreements to avoid the costs customarily associated with employees until our financial resources allow us to hire additional employees. We believe that the addition of these employees and consultants to the Ventrus team will help us advance our product candidates to the next stage of development.

Corporate History and Information

We were incorporated in Delaware in October 2005 under the name South Island Biosciences, Inc. and changed our name to Ventrus Biosciences, Inc. in April 2007. We began operations in April 2007 upon the acquisition of the licenses to VEN 307 and VEN 308 and the hiring of a development team. We acquired the license to VEN 309 in March 2008. We acquired the licenses to VEN 307, VEN 308 and VEN 309 from Paramount Bioscience, LLC and also borrowed funds from Paramount and one or more of its affiliates. Our largest stockholder, Dr. Lindsay Rosenwald, is the Chairman, Chief Executive Officer and sole stockholder of Paramount. We conducted operations until March 2009 when we terminated our employees due to a lack of financial resources. We retained the services of our then executive team through consulting agreements, pursuant to which those individuals, from February 2009 to June 2010, conducted minimal activities consisting of maintaining the licenses to our product candidates and business development and financing activities. We completed a series of convertible note financings in February, April and May of 2010 that provided us funds to hire as consultants our current chief executive officer and chief financial officer and undertake our initial public offering. The completion of our initial public offering in December 2010 and the related exercise of the underwriters’ over-allotment option in January 2011 raised approximately $17.5 million in net proceeds. In July 2011, we raised approximately $47.5 million in net proceeds in a registered public offering. We have used a portion of those net proceeds to resume the development of VEN 309 and VEN 307, including hiring employees, contracting with consultants, contracting with contract research organizations to assist us in executing and monitoring our Phase III trials for VEN 309 for the treatment of internal hemorrhoids, and contracting with manufacturers of clinical trial supplies for those studies.

IFERANSERIN OINTMENT (VEN 309)

Background on hemorrhoids

Incidence and prevalence

Hemorrhoids are a common anal disorder, characterized by bleeding, itching, pain, swelling, tenderness and difficulty defecating. Based on information from an article entitled The Prevalence of Hemorrhoids and Chronic Constipation by J. Johanson and A. Sonnenberg published in Gastroenterology (1990; 98: 380 – 386), the point prevalence of symptomatic hemorrhoids in the U.S. population currently is approximately 4.4%, representing approximately 12.5 million cases based on 2009 population data published by the U.S. Census Bureau. The prevalence of hemorrhoids peaks in adults aged 45 to 65 years.

According to IMS Health, Inc. (2009), 4.2 million prescriptions are written per year in the U.S. for hemorrhoid products and 22 million units per year are sold in the U.S. for the OTC hemorrhoid products. If VEN 309 receives FDA approval in the U.S., we expect our competition for patient use and physician prescribing will be these drugs which have not been approved by the FDA and, to our knowledge, lack any clinical trial data supporting their efficacy and safety. In Europe it appears that, from our discussions with experts and staff from other companies, many products exist, differently from country to country, and are mostly herbal extracts and mixtures in topical and systemic forms which are either prescribed or available over-the-counter. We do not have market data concerning these products in Europe, other than product acceptance market research, nor is their precise regulatory status clear to us.

| 8 |

Patho-physiology of hemorrhoids

Hemorrhoids are symptomatic abnormalities of normal vascular structures in the anal canal that are manifested by dilation of the local arteries and veins due to constriction and partial obstruction of the exiting colonic veins. Although the exact mechanism for hemorrhoid formation is not clear, the progressive occlusion of venous exit vessels (e.g., as seen in straining during defecation, heavy lifting and pregnancy) is thought to produce stretching of the vessels in the hemorrhoidal plexus combined with vascular stasis. This stasis could cause exposure of the blood to collagen, which in turn causes platelet clumping with the release of the platelet’s artery and vein constricting contents, including serotonin, which via stimulation of the 5HT 2 receptor causes localized constriction of the exit veins, where most of the vascular smooth muscles are, and, in combination with other factors, causes a cascade effect producing clot formation. These events result in additional stasis of the blood, perpetuating and further worsening the situation. As hemorrhoids worsen, the trapped blood forms piles (protruding skin folds filled with static and thrombosed blood), initially above the pectinate line (internal hemorrhoids) and then below the pectinate line (external hemorrhoids). The classification of internal hemorrhoid grades by Banov is accepted by most specialists. This system consists of four grades and symptoms: first degree (grade I): hemorrhoids bleed but do not protrude; second degree (grade II): hemorrhoids protrude but reduce on their own; third degree (grade III): hemorrhoids protrude and require manual re-insertion; and fourth degree (grade IV): hemorrhoids protrude and cannot be manually re-inserted.

The cardinal symptom and most common manifestation of internal hemorrhoids is bleeding. Bleeding is often the only sign in grade I hemorrhoids, but it can also be accompanied by other symptoms as the hemorrhoids further enlarge, such as discomfort, itching, prolapse, and fecal soilage.

Current treatments

Despite the high prevalence of hemorrhoids, we are not aware of any FDA-approved prescription drugs for the treatment of hemorrhoids in the U.S. While there are commonly used prescription drugs for hemorrhoids in the U.S., such as Anusol, none have been approved by the FDA nor been designated by the FDA as safe and effective. Various combination products (such as the Preparation H line of products) are available in the U.S. under the FDA’s OTC monograph rule. The great majority of these treatments provide only temporary relief from the symptoms of hemorrhoids and do not address the cause of hemorrhoids. The mechanism of action of these treatments is either generally anti-inflammatory, such as steroids, or acting as a protective coating on the hemorrhoid or acting as local anesthetics, in the case of most of the OTC products, or unknown, in the case of herbal remedies, and we are not aware of any clinical trials published in medical journals on the efficacy or safety of any topical or oral drug currently marketed in the U.S. for the treatment of hemorrhoids. Patients with persistent symptoms, especially bleeding, usually require an invasive procedure. The most common is rubber band ligation, which involves banding the internal hemorrhoid for four to seven days. Other procedures are the injection of a sclerosing agent, electrocoagulation, light therapy and hemorrhoidectomy. Most physicians treating hemorrhoids start with conservative therapy consisting of diet modification, fiber, sitz baths and stool softeners. In addition to this conservative therapy, physicians might prescribe topical steroids. The only other alternatives are invasive procedures and/or surgery. Because of the lack of effective prescription products, most hemorrhoid patients will use over-the-counter preparations or the prescription drugs available, which are similar to the over-the-counter treatment, but formulated with a higher dose of topical steroid.

By contrast, our product VEN 309 has highly selective, antagonistic activity against peripheral 5-HT 2A receptors (5HT 2A >5HT 2C >>5HT 2B ) involved in clotting and the contraction of arteries and veins, two events believed to be associated with hemorrhoid formation. By limiting 5-HT 2A receptor activity, VEN 309 improves the flow of blood out of the dilated veins that comprise the hemorrhoid, thereby reducing bleeding, itchiness and pain. We believe that the potential for side effects is likely to be limited because iferanserin is topically applied and iferanserin does not enter the brain to affect 5HT 2 CNS receptors, at the exposures seen with topical application. In multiple clinical trials, iferanserin ointment significantly reduced bleeding, pain and itchiness compared to placebo with minimal adverse effects. As a result, we believe VEN 309 to be more effective and/or less invasive than the currently available conventional hemorrhoid topical therapies and more attractive than surgical procedures, which are the only currently validated treatment options.

| 9 |

IFERANSERIN OINTMENT (VEN 309) DEVELOPMENT

Background on Iferanserin

The early proof of concept for the utilization of a 5-HT 2A antagonist for the treatment of hemorrhoid was developed by Sam Amer PhD, a former director of research and development at Bristol-Myers Squibb Company. Dr. Amer explored the potential application of serotonin drugs, which would not enter the brain at therapeutic concentrations, for use in various venous conditions. After successful preclinical and clinical experiments, Dr. Amer filed a method of use patent covering this molecule in 1992. Dr. Amer subsequently separated the S-isomer from this racemic mixture and filed new composition of matter patents for the S-isomer in 1998. Also in 1998, the early stage product was licensed to Tsumura, a Japanese company. Tsumura conducted over 350 pre-clinical and six clinical studies, but we believe was not able to continue development due to financial difficulty and returned the product to Dr. Amer. Upon the return, Dr. Amer’s company, Sam Amer & Co., Inc., or Amer, conducted a double-blind, placebo controlled, multi-center Phase IIb trial in Europe. After the successful completion of that study in 2003, Novartis Pharmaceuticals licensed iferanserin from Amer to be part of its gastroenterology portfolio strategy. Novartis improved the iferanserin manufacturing processes and completed important toxicology and metabolite studies. In 2005, Novartis’ lead gastroenterology product, Zelnorm TM was experiencing increased FDA scrutiny on the safety of that product, which would ultimately lead to its eventual withdrawal from the market. We believe that with the impending loss of their lead gastroenterology product, Novartis decided to dissolve the gastrointestinal franchise. In 2005, Novartis returned iferanserin to Amer. According to Amer, no safety or clinical issues were ever communicated as reasons for the return.

On February 5, 2008, in conjunction with Amer, we held an end of Phase II meeting with the FDA, to confirm the U.S. regulatory status and pathway to an NDA for iferanserin ointment where it was agreed that the product may enter late-stage Phase III development. In March 2008, we licensed exclusive worldwide rights to develop and market iferanserin ointment for the treatment of anorectal disorders from Amer. On November 14, 2011, we acquired all rights, title and interest in VEN 309 from Amer.

Mechanism of action on iferanserin

Iferanserin has selective antagonistic activity against 5-HT 2 receptors, especially against those involved in contraction of vascular smooth muscle and platelet aggregation (clotting), the 5HT 2A receptors. It is a particularly potent high-affinity antagonist of 5HT 2A , has less affinity for and is a moderate antagonist of 5HT 2C and has considerably less affinity for 5HT 2B receptors. In a specific validated model, iferanserin did not demonstrate any agonism activity at 5HT 2B receptors, but did demonstrate moderate antagonistic activity. Unlike other 5HT 2 receptor antagonists, iferanserin’s 5HT 2 receptor antagonism, clinically, is entirely peripheral, meaning it occurs outside the central nervous system because iferanserin does not cross the bloodbrain barrier except in extremely high exposures far above those seen with topical application. Studies conducted in 1997 and 1998 by Amer in rats addressed the potential effects of iferanserin on impaired rectal mucosal blood flow and increased peripheral vascular resistance after administration of serotonin or thrombin. At doses of 3 mg/kg and above administered intrarectally, iferanserin improved rectal mucosal blood flow and normalized the peripheral vascular resistance. Iferanserin had minimal effects on arterial blood pressure.

Preclinical safety

Iferanserin has been extensively tested in multiple preclinical models. The iferanserin exposure from dosing in humans topically using 0.5% applied twice daily (the dose to be used in our planned studies) ranges from 1/17th to 1/88th of the exposure that produces toxicity and from 1/45th to 1/85th of the exposure that produces cardiovascular effects in animal toxicology studies and 1/60th – 1/100th of the exposure that produces these effects in vitro. In addition, iferanserin exhibits low systemic exposure, with less than 10% bioavailability, based on a pre-clinical rat study.

| 10 |

Clinical trials and patent status

A total of seven clinical trials with iferanserin were completed by Amer (excluding Japan) and Tsumura in Japan between 1993 and 2003. One Phase I trial and one Phase II trial were completed using the racemic mixture of iferanserin. After the successful Phase II proof-of-principle trial, the licensor, Amer, separated the R- and S-isomers (the two active components of most small molecule pharmaceuticals), determined that the primary activity was focused in the S-isomer and filed a patent claiming this isomer. The patent issued in the U.S. and other countries and expires in 2015. In the U.S., the patent was filed with Dr. Amer as the inventor and in all foreign countries with Amer as the assignee. After the development of the S-isomer in the mid 1990s and the patent filing in 1998, the remaining trials — two Phase I trials, two Phase II trials, and one Phase III trial — were all conducted with the S-isomer product. This development progression (racemic to S-isomer) is a common pharmaceutical practice, enabling companies to use the purest form of the molecule in late-stage clinical trials.

On November 14, 2011, we acquired from Amer all rights to all intellectual property related to VEN 309 previously owned by or assigned to Amer as well as to any new improvements owned by or assigned to Amer. Different concentrations of a drug are separately patentable under certain circumstances. Because of unexpected differences between concentrations of the product that were observed in the clinical program (i.e., that 0.5% concentration is superior to a 0.25% and a higher 1.0% concentration in the comprehensive reduction in hemorrhoid symptoms), which data, to our knowledge, have not been previously published, we filed in August 2010 a patent claiming our specific concentration range (among other claims) which, we believe, if issued, could provide patent protection for 20 additional years. Dr. Amer is the inventor in this U.S. application and the assignee in the patent application (we now own all of the rights to VEN 309). However the original S-isomer patent could be challenged by a third party and invalidated, and the concentration patent may never issue and even if issued could be challenged by a third party, in which case we would still have five years of U.S. data exclusivity from the date of approval under the Hatch-Waxman Act.

An investigator IND for iferanserin was filed with the FDA in November 1991 and transferred to Amer as the sponsor in January 1994, which was transferred to us in April 2008, and remains open.

Trial Results

Overall safety

In the seven clinical studies of iferanserin conducted by Amer and Tsumura in 359 individuals, of whom 220 were exposed to iferanserin, the adverse effects, at least possibly related to the iferanserin administration, were mostly gastrointestinal (diarrhea, lower abdominal discomfort, residual stools, and anal irritation). These events were considered mild by the investigators and required no medical treatment. There were no serious adverse events judged by the investigator as related to iferanserin and no mortality in these studies. There was one report of exacerbation of atopic dermatitis requiring observation in hospital with an uncertain relationship to iferanserin.

Clinical Pharmacology in Normal Volunteers (Phase I)

Two clinical pharmacology studies were conducted in Japan by Tsumura in 1998 and 1999 in 18 healthy volunteers exposed to a single dose and in six healthy volunteers exposed to six days of dosing with the 1% preparation. Three mild adverse events where the drug could not be ruled out were observed in three patients in the single dose group and four mild adverse events were observed in three patients in the multi-dose group. There is no accumulation of the drug on twice daily dosing and the half life at one and six days is 1.6 hours. Peak concentrations are similar at one and six days and well below the lowest exposure where toxicity was observed in toxicology experiments in animals.

One patient was identified as having a very compromised activity of an enzyme, CYP2D6, and the maximum concentration of the drug in this patient was three times the maximum observed in the other patients and the total exposure (AUC) was 17 times that observed in the other patients. However, these exposures to the drug were still well below the lowest exposures where toxicity was observed in animal toxicology experiments, and this patient did not experience any adverse events.

| 11 |

As is typical of several modern drugs for depression such as Fluoxetine and older drugs such as tri-cyclic anti-depression agents and other drugs extensively prescribed, iferanserin is an inhibitor of the enzyme CYP2D6 and is at least partially dependant on this enzyme for its metabolism. Therefore, kinetic interactions with other drugs that are potent inhibitors of CYP2D6 and/or are highly dependent on CYP2D6 for their metabolism are possible. There are several of these drugs and most are psychiatric medications, and one is tamoxifen. We will exclude patients from the clinical trials who are taking such drugs, and will be conducting extensive drug-drug interaction studies as part of our clinical pharmacology program to clarify which drugs could be affected by or could affect iferanserin. We initiated these trials at the beginning of 2012 . The research is expected to allow narrowing of the exclusion criteria with respect to drugs acting on CYP2D6 for future studies.

Proof-of-concept trial (U.S.)

A double-blind, placebo-controlled trial of 26 patients conducted by Amer that was completed in August 1992 and published in August 1994 was the first clinical trial to test the activity of the racemic mixture of iferanserin. Topical 1% iferanserin ointment was applied three times daily for five days to calculate the effect on bleeding and other symptoms in patients with grade I to III external hemorrhoids. Treatment produced statistically significant improvements in ease of defecation, throbbing, fullness, bleeding and tenderness. Itchiness and pain were also reduced following treatment. These positive treatment effects started immediately after treatment and were maintained throughout the study.

Early Phase II dose-ranging trial (Japan)

Topical iferanserin ointment, in twice-a-day doses of 0.25%, 0.5%, and 1.0%, was provided to 72 patients for 14 days to treat symptomatic internal and mixed internal/external hemorrhoids. A total of 68 patients were evaluable for analysis: 23 patients in the 0.25% dose group, 24 patients in the 0.5% dose group, and 21 patients in the 1.0% dose group.

There was a significant change in ease of defecation between dose groups by Day 7 but no other differences in improvements of symptoms among the three dose groups. Anal discomfort and pain persistence improved with increasing dose on a visual analog scale, or VAS, of pain. For the symptom of bleeding, a significant difference between dose levels ( P = 0.016) and a paired comparison statistical analysis showed that the 0.5% dose was more effective than either the 0.25% dose or the 1.0% dose. By Day 14, hemorrhoid swelling was reduced in the 0.5% dose group (41%) and the 1.0% dose group (43%). A review of patient diaries revealed that all symptoms started improvement on Day 1, with improvement peaking at Day 7 and being maintained to Day 14. Comparison of all doses showed, unexpectedly, that the 0.5% dose provided the most consistent improvements.

There were 45 adverse events, but only five (11%) were judged as related to iferanserin ointment. These iferanserin-related adverse events were mostly mild diarrhea or lower abdominal discomfort, which required no medical treatment. Laboratory tests were generally normal, with the exception of one case of mild elevation of total bilirubin one month after trial completion, which required no therapy. Further evaluation of metabolites revealed no relationship to adverse events. The unexpected and novel finding that 0.5% concentration is superior to both a lower (0.25%) and higher (1.0%) concentration supports our patent claiming a specific concentration range that we filed in August 2010, which, if issued will expire in 2030.

Late Phase II trial (Japan)

A double-blind, placebo-controlled trial was conducted by Tsumura Company with three different concentrations of iferanserin ointment (0.25%, 0.5% and 1.0%) administered twice daily for four weeks for treatment of 104 patients with grade I to III internal hemorrhoids. The trial was completed in July 2002. Inclusion criteria required a minimal degree of either bleeding or prolapse. The primary endpoint was physician-rated size reduction of the hemorrhoids; secondary endpoints included subjective symptoms as assessed by patient diaries and VAS. By day 28, compared with placebo, the concentrations of 0.5% and 1.0% of iferanserin showed the most consistent improvements across groups for secondary symptoms, such as bleeding, pain severity and duration, and ease of defecation.

| 12 |

Phase IIb trial (E.U.)

Based on the results of the two Tsumura Phase II trials, a double-blind, randomized, placebo-controlled trial was conducted by Amer at five sites in Germany to evaluate the safety and efficacy of topical iferanserin ointment for the treatment of internal hemorrhoids. Patients with grades I – III internal hemorrhoids with bleeding episodes of at least every other day for two weeks prior to enrollment were eligible for the study. We refer to this trial as the “German Phase IIb trial.” Participants were instructed to self-administer two grams of either placebo ointment or 0.5% iferanserin ointment into the anal canal twice-a-day (12 hours apart) for 14 days. At the end of each treatment day patients were instructed to complete a patient diary and record the following symptoms: bleeding, itching, pain, tenderness, fullness, throbbing, gas and difficulty of a bowel movement, with bleeding being the primary endpoint for the study. All symptoms were recorded on a scale of 1 – 10, with 1 indicating the absence of the symptom and 10 denoting the worst symptom. The patients were contacted by telephone 45 days after completion of treatment to determine their general health and hemorrhoid status. Adverse events were recorded by the patients. Patients who had complete 14 day diaries for efficacy endpoints and identified to a treatment group were included in the statistical analysis. The patient assessment scores for hemorrhoid bleeding at the end of seven and 14 days of treatment were the primary efficacy endpoints for the study. Secondary endpoints included the effects of treatment on itching, pain, tenderness, feeling of fullness, throbbing, gas and difficulty of defecation. Statistical analysis consisted of two-sided two-sample t-tests, with a p value of p 0.05 being considered statistically significant. Secondary analyses included the difference in assessment score per day. One hundred and eleven patients were evaluable for the primary endpoint of bleeding and 60 patients were evaluable for itching and 40 patients were evaluable for pain.

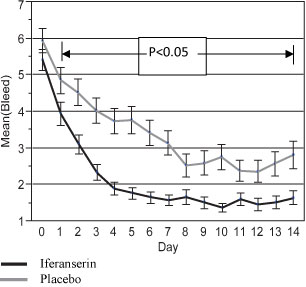

For the primary endpoint of bleeding, the difference in the scores on Day 0 between the two groups was not significant. There was a rapid and substantial decrease in the report of hemorrhoid-associated bleeding in the iferanserin group. The significant difference in bleeding scores between the groups started on Day 1 and remained significant until the end of the treatment period (Day 14) ( Figure 1). The primary endpoint of patient assessment scores for hemorrhoid bleeding at the end of seven and 14 days of treatment were significant with p values of p < 0.0001 and p < 0.0075, respectively.

Figure 1. Mean daily bleeding scores

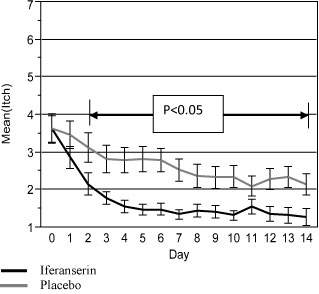

There was no difference in the itching scores on Day 0 between the two groups. As with bleeding, iferanserin produced a rapid, sustained reduction in itching. The significant difference in itching scores between the groups started on Day 2 and remained significant until the end of the treatment period (Day 14 (Figure 2)). The secondary endpoint of patient assessment scores for hemorrhoid itching at the end of seven and 14 days of treatment were significant with p values of p < 0.0008 and p < 0.0207, respectively.

| 13 |

Figure 2: Mean daily itching score

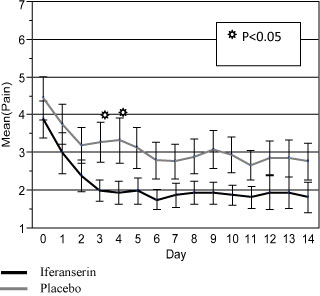

Finally, compared with placebo, iferanserin ointment significantly reduced pain (p < 0.05) by Day 3 (Figure 3). The effect of iferanserin was not significantly different from placebo on either Day 7 or Day 14, possibly due to the low number of patients with pain at baseline. Drug treatment was well tolerated in this trial. The rate of adverse events were similar in both treatment groups, and there were no serious adverse events. The majority of the adverse events were gastrointestinal related.

Figure 3: Mean daily pain scores

| 14 |

In this Phase IIb double-blind, randomized, placebo-controlled trial of 121 patients with grades I to III internal hemorrhoids, iferanserin provided rapid and sustained improvements of the main symptoms of this disorder: bleeding, itching and pain. Maximal improvements of symptoms, compared to baseline, occurred by Days 3 – 7 and were maintained to Day 14 at the end of the trial.

In order to determine the sample size and statistical power for our first pivotal Phase III trial, we have modeled the potential performance of the primary and secondary endpoints which were proposed by the FDA and which we will be using in that trial, using data from the German Phase IIb trial, because the principal elements of the German Phase IIb trial are substantially similar to our first Phase III trial. These endpoints are defined as:

| • | Primary: Proportion of patients with cessation of bleeding by Day 7 that persists for the remainder of the treatment period (through Day 14); and |

| • | Key Secondary: Proportion of patients with cessation of pain and/or itching by Day 7 that persists for the remainder of the treatment period (through Day 14) |

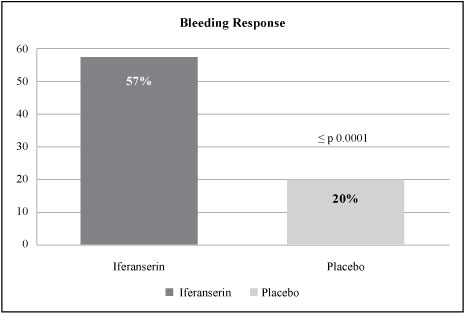

Applying the proposed statistical methodology and primary endpoint for our Phase III trial to the data from the German Phase IIb trial, the difference between the proportion of patients responding to treatment as defined by the new endpoint definition for cessation of bleeding in the VEN 309 arm (57% responders) and the placebo arm (20% responders) was considerable with p < 0.0001 ( Figure 4 ). Similarly, analyses of the key secondary endpoints of pain and/or itching also showed considerable differences between VEN 309 and placebo (itching: 59% response to VEN 309 versus 32% response to placebo, p < 0.034; pain: 50% response to VEN 309 versus 18% to placebo, p < 0.032).

Figure 4. Analysis of the proposed endpoint for the Phase III trial using the data from the German Phase IIb trial.

| 15 |

Iferanserin ointment (VEN 309) development plan

Overview

We had an end-of-Phase II meeting in February 2008 with the FDA and had several interactions with the FDA during an SPA process that we were engaged in with the FDA for several iterations. In these interactions, the FDA advised us that they consider VEN 309 to be a chronic repeated use product and as such, based on our preclinical and clinical data to date, the FDA advised us the following elements were required for an NDA submission:

| • | a total safety database of 1,500 patients exposed to iferanserin, a proportion of which need to be followed for repeat use for six months and 12 months (standard International Conference on Harmonization recommendation); |

| • | two pivotal Phase III trials, for the treatment of an episode of symptomatic hemorrhoids, and one double blind Phase III trial to determine the safety and efficacy of the treatment of recurrent episodes (which we might be able to combine with one of the pivotal trials depending on the recurrence rate and/or the ability to pre-identify patients who are likely to have recurrence); |

| • | a clinical pharmacology program consisting of a thorough QT study (standard for most drugs), drug-drug interaction studies, and pharmacology in special populations; and |

| • | as is usual for chronic or repeated use drugs, carcinogenicity studies in two species exposed for 104 weeks, preceded by a dose ranging study, and six months toxicology in rats and nine months in dogs. |

As the carcinogenicity study (including the prior dose ranging study) can take up to 40 months to complete, we intend to conduct the Phase III trials sequentially as this will not delay the program, will conserve funds, allow an assessment of the recurrence rate, and allow adjustments (for example, increased sample size) to the second Phase III study to optimize its potential. We initiated the first patient randomized into the first Phase III trial in August 2011 and expect to complete enrollment around April 2012, and we expect that data to be available around June 2012. We initiated the dose ranging part of the carcinogenicity studies in 2011, and plan to initiate the carcinogenicity studies in 2012.

First Pivotal Phase III trial

We originally filed, in June 2008, an SPA with the FDA to ensure its explicit agreement with our first pivotal Phase III protocol for VEN 309, using the 0.5% dose. Due to lack of funds we could not follow up or complete the process but were able to resume with another filing in March 2010 and made several filings thereafter based on the responses received from the FDA. In February 2011, we had a Type A meeting with the FDA when we accepted their new proposal for the endpoints in the trial and clarified statistical and other protocol elements. We refiled the protocol under the SPA and received the FDA’s response in May 2011 in which they accepted the changes but also proposed the addition of a third arm in the trial to study the safety and efficacy of seven days of treatment, in addition to the 14-day treatment arm and placebo arm that we had proposed in the original protocol. We agreed with the FDA to include the third arm because when we analyzed the Phase IIb German trial that compared iferanserin given twice daily for 14 days with placebo, using the proposed Phase III endpoints, we observed that the majority of iferanserin-treated patients started their response by Day 3. This raises the possibility that iferanserin therapy may require a shorter duration of treatment to show adequate efficacy to stop the bleeding, itching and pain associated with hemorrhoids. We believe that if this regimen proves to be effective, it could be even more acceptable to patients.

| 16 |

In late June 2011, we received a response to our last SPA submission of the revised protocol with the addition of the third arm, which, with the revised statistical plan, appeared to be acceptable to the FDA. However, in its response, the FDA requested that additional information be included in the protocol pertaining to some details of the study, and therefore did not issue an agreement letter for the SPA. The FDA’s recommendations included adding a standardized methodology to the protocol to assess patients’ comprehension of symptoms and symptom terms, such as “anus” or “anal-rectal area”; addressing the possibility that women in menses may not be able to determine whether the source of their bleeding is from hemorrhoids; and adding more clarity to the protocol regarding maintenance of blinding while preserving accurate dosing in the seven-day treatment arm. In addition, the FDA recommended adding a stratification to the efficacy analysis and a rewording for better clarity of the endpoint definition. None of these recommendations affected the previous recommendations from the FDA for the endpoints, overall statistical powering and subject number, and the overall clinical design. Inasmuch as we incorporated these latest changes into the protocol, in order to maintain our timelines for the trial, we filed the protocol to our existing IND with the FDA in July 2011, and decided to not continue to pursue the SPA process.

Following the progressive feedback from the FDA, the double-blinded randomized trial design of the three arms with a double blind portion and an open label portion consists of:

Double blind part

| • | 600 patients (200 patients per arm) recruited at up to 70 sites in the U.S., randomized 1:1:1 to: |

| º | Arm 1: placebo ointment twice daily intra-anally for two weeks; |

| º | Arm 2: iferanserin ointment twice daily for two weeks; and |

| º | Arm 3: iferanserin ointment twice daily for one week followed by placebo ointment twice daily for one week; |

| • | After 14 days treatment, patients will be followed up at Day 28; |

| • | Inclusion criteria to include patients with symptomatic grade I to III internal hemorrhoids, bleeding from hemorrhoids every day for the two days immediately preceding the day that they are randomized and study medication applied, with pain or itching accompanying the bleeding for the two days; and |

| • | Exclusion criteria to exclude patients with grade IV hemorrhoids; thrombosed internal or external hemorrhoids; laxatives, anticoagulants, over-the-counter anti-hemorrhoidal agents, topical steroids, suppositories of any kind, non-steroidal anti-inflammatory drugs (NSAIDs), Cox-2 inhibitors, and other drugs and conditions including potent inhibitors of CYP2D6 such as fluoxitene. |

For the double-blind part of the trial, where patients are treated twice daily for two weeks and then followed up on Day 28, the definitions for the endpoints are:

| • | Primary: Proportion of patients with cessation of bleeding by Day 7 that persists for the remainder of the treatment period (through Day 14); and |

| • | Key Secondary: Proportion of pati ents with cessation of pain and/or itching by Day 7 that persists for the remainder of the treatment period (through Day 14). |

Open Label part

After the 28 day double blind portion of the trial, patients will be followed quarterly for one year and treated with active drug if they have a recurrence at any time during that period. We will assess time to first recurrence, and the overall recurrence rate over one year, and will be able to observe the unblinded response to treatment of recurrence during this part of the trial.

We believe that our modeling of the endpoint definitions as proposed by the FDA using the German Phase IIb trial data, confirm a projected power of > 99% for the primary endpoint and > 95% for the key secondary endpoints for our proposed Phase III trial. All of our clinical study sites will be using central institutional review boards, or IRBs, with rapid review times. We initiated the study in August 2011, and estimate we will complete enrollment approximately in April 2012, and that data from the double blind part of the study will be available around June 2012.

| 17 |

While we believe that we addressed all of the FDA’s comments, we did not pursue the SPA and it was not agreed to by the FDA. The recommendations made by the FDA on the protocol to date and that we implemented are not binding on the FDA.

Subsequent Development

After the results of the Phase III trial are available and assuming the results are positive, and contingent on the availability of additional capital, we intend to:

| • | continue the carcinogenicity study, conduct the six- and nine-month chronic toxicology studies and conduct a substantially similar Phase III trial and a double blind recurrence trial (or combine this trial with the second pivotal Phase III trial, depending on the early recurrence rate observed in the first pivotal trial) which will also provide adequate numbers of patients exposed for the safety database; and |

| • | complete the clinical pharmacology program, which will include extensive drug-drug interaction studies to clarify the CYP2D6 interactions and a “thorough QT study” to test the arrythmogenic potential, which studies are routinely required by the FDA. |

We will also explore the feasibility of lifecycle options for follow-on products such as different formulations, which could be developed for launch after approval of the original VEN 309 product.

We expect that the earliest we will be able to file an NDA with the FDA will be 2014, and the earliest the product could be approved in the U.S. would be in 2015. However, the Phase III trial may not meet the primary endpoint, or unexpected safety problems could arise, or even if the trial is successful we may not be able to obtain more capital for other reasons, in which case we may not be able to complete the development of the product.

Supply of clinical trial product

We have identified qualified sources for the active pharmaceutical ingredient, or API, of VEN 309, a qualified source for drug product, and a qualified source for packaging and labeling as well as a source for the tubes and applicators for our Phase III trials for VEN 309. We have had an agent-in-plant at the manufacturing sites for the API and drug product to monitor quality and performance. Supplies have been produced to 10% of anticipated commercial lots to ensure that bridging studies will not be necessary for commercial supply and that the specifications are the same as used for the Phase II2b trial in Germany. The suppliers of the API and drug product are foreign, and the packaging and labeling source is in the U.S. Deliveries began in August 2011 and allowed us to begin the first Phase III trial in August 2011.

Commercial summary for iferanserin (VEN 309)

Market research regarding hemorrhoids

Market research conducted in 2001 by Amer with both patients and physicians shows a significant dissatisfaction with current treatment options and the need for a product that relieves multiple hemorrhoidal symptoms. In a survey conducted with 57 hemorrhoid patients, average satisfaction with current prescription treatment was rated at 6.0 on a 10-point scale. The most desired treatment effects of a new hemorrhoidal medication that patients described would be “fast onset,” and “bleeding cessation.” The most frequent hemorrhoidal symptoms these patients reported experiencing were itching (79%), bleeding (77%) and pain (68%).

A research study conducted by Amer of 40 physicians (30 primary-care physicians, five proctologists, and five colon and rectal surgeons) evaluated their satisfaction with current treatment for hemorrhoidal treatment on a 10-point scale. The level of satisfaction with current treatment for reducing bleeding was 6.4; for relieving itch, 7.1; and for reducing pain, 6.8. The physicians indicated that the most desirable treatment effects of new hemorrhoidal medication would be “fast onset (2 to 3 days)” and “multi-symptom relief.” Another research study of 98 physicians showed that most physicians would replace their current first line therapy with iferanserin ointment, if it is approved.

| 18 |