Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CADENCE PHARMACEUTICALS INC | d643222d8k.htm |

Corporate

Presentation Improving the lives of hospitalized patients

December 16, 2013

EXHIBIT 99.1 |

Caution on

forward-looking statements CADENCE

®

, OFIRMEV

®

and the OFIRMEV design logo are registered trademarks of Cadence Pharmaceuticals, Inc.

©

2013 Cadence Pharmaceuticals, Inc. All rights reserved.

2

This presentation includes forward-looking statements, which are based on our current

beliefs and expectations. Such statements include, without limitation, statements

regarding: the anticipated U.S. market opportunity for OFIRMEV; our financial estimates

and projections; our expectations regarding growth in customer base, frequency of

product use, order rates, share of surgical patients, utilization per patient, expectations for future use, and their

ability to drive revenue growth for OFIRMEV; the sustainability of our core business; the

sufficiency of our capital resources to fund our operations; and our ability to execute

our strategies for acquiring, in-licensing, developing and commercializing

proprietary products principally for use in the hospital setting.

You are cautioned not to place undue reliance on these forward-looking statements, which

speak only as of the date hereof. Our actual future results may differ materially from

our current expectations due to the risks and uncertainties inherent in our business.

In addition, past results and trends may not be indicative or a guarantee of future

results or trends. These risks include, but are not limited to: our dependence on the successful

commercialization of OFIRMEV, which is our only product; our ability to achieve broad market

acceptance and generate revenues from sales of OFIRMEV; our ability to successfully

enforce our marketing exclusivities and intellectual property rights and to defend the

patents covering OFIRMEV, including in our current and any future, additional

intellectual property litigation and U.S. patent office challenges; the potential introduction of generic

competition to OFIRMEV; our dependence on our contract manufacturers and our ability to ensure

an adequate and continued supply of OFIRMEV to meet market demand; potential product

liability exposure; the risk that we may not be able to raise sufficient capital when

needed, or at all; and other risks detailed under “Risk Factors” and

elsewhere in our most recent Quarterly Report on Form 10-Q, and our other filings made

with the Securities and Exchange Commission from time to time.

All forward-looking statements are qualified in their entirety by this cautionary

statement, which is made under the safe harbor provisions of Section 21E of the Private

Securities Litigation Reform Act of 1995 and we undertake no obligation to revise or

update this presentation to reflect events or circumstances after the date hereof.

|

Investment

highlights •

Specialty biopharmaceutical company, focused on developing and

commercializing proprietary therapeutics utilized in the hospital setting

–

OFIRMEV®

(acetaminophen) injection –

Indicated for use in adults and

children >

2yrs for the:

•

Management of mild to moderate pain

•

Management of moderate to severe pain with adjunctive opioid analgesics

•

Reduction of fever

•

A differentiated, new class of IV pain medication

–

Non-opioid, non-NSAID analgesic

–

Foundation for multimodal approach to pain management

•

Widespread hospital formulary adoption and positive physician feedback

•

Solid revenue growth driven by a growing customer base, increasing re-order

rates and penetration in a variety of surgical settings

•

Sustainable OFIRMEV core business brings opportunities to diversify product

portfolio and leverage existing sales infrastructure

3 |

OFIRMEV®

(acetaminophen) injection

•

Proprietary IV acetaminophen

formulation

•

First and only IV formulation of

acetaminophen approved in the United

States

•

New class of IV medication

–

non-narcotic / opioid

–

non-NSAID

•

Same formulation of IV acetaminophen

marketed by BMY in Europe since 2002 as

Perfalgan™

4

PERFALGAN™

is

a

trademark

of

Bristol-Myers

Squibb

Company. |

Strong

foundation for commercial success Effective Pain

Control

•

$13.18/ vial**

•

Diagnosis-related group payment range for common procedures:

$12,000 -

$31,000

(3)

•

OFIRMEV may help reduce post surgical ambulation time

(4)

, time

to extubation in the ICU

(5)

, hospital length of stay

(6)

•

Significant pain relief

(1)

•

Reduced opioid consumption

(1)*

•

Improved patient satisfaction

(1),(2)

•

Sales force average >10 years hospital selling experience

•

Extensive relationships, significant overlap with prior territory

•

Substantial hospital commercial experience throughout

management

–

CEO > 25 years, CCO > 15 years, VP of Sales > 25 years

Experienced

Hospital Sales Force

Economic

Value

References: (1) Sinatra, et al., 2005, (2) Wininger, et al., 2010, (3) Birkmeyer,et al., 2010,

(4) Ohnesorge, et al., 2009, (5) Memis, et al., 2010, (6) Zafar, et al., 2010, Arici,

et al., 2009 * Clinical benefit of opioid reduction not evaluated or demonstrated in this

study ** WAC, effective July 2, 2013 5 |

Label supports

the message Broad Label

Mild to moderate pain

Moderate to severe pain with adjunctive opioids

Treatment of fever

Adults and children 2 and older

Message

Significant pain relief

Reduced opioid consumption

Improved patient satisfaction

Established safety profile

6 |

Limitations of

other IV pain therapies 7

Sedation

Nausea

Vomiting

Constipation

Headache

Cognitive impairment

Respiratory depression

Bleeding

GI complications

Kidney complications

Cardiovascular risks

Prolonged recovery

Increased length of stay

Higher costs to the institution

Limited use

Opioids

NSAIDs |

Pain

Intensity Historical

US Approach

Emerging

US Approach

Severe

Opioids

IV acetaminophen

+ opioids

Moderate

Opioids

IV acetaminophen

+ opioids, if necessary

Mild

Opioids

IV acetaminophen

Multimodal analgesia is becoming standard

8 |

Strong

commercial acceptance •

Rapid formulary adoption

–

On formulary in over 2,350 hospitals*

–

Minimal restrictions

•

Strong physician support and early experience positive

–

OFIRMEV physician market research:**

•

97% of physicians surveyed reported that OFIRMEV’s efficacy met or exceeded

their expectations

•

3 of 4 indicate they are very likely to recommend to colleagues

•

Rapid and sustained sales growth

–

Approximately 13.7 million vials purchased by hospitals***

–

Estimated 5.5 –

6.9 million patients treated through Oct. 31, 2013****

9

*

Launch through October 31, 2013

**

December 2012 attitude, trial, and usage (“ATU”) market research of surgeons and

anesthesiologists (n>180) conducted by GfK Healthcare (commissioned by

Cadence) ***

Cadence internal data through October 31, 2013

****

Based on our estimate of 2-2.5 doses per patient |

Source:

Source Healthcare Analytics, Source® PHAST Institution, November 20, 2013 and

Cadence internal data. Strong OFIRMEV®

sales growth

•

WAC sales reported to be $11.8M for October 2013

•

Monthly vial sales of 895K in October 2013

10

-

100

200

300

400

500

600

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

OFIRMEV Monthly Sales

Monthly Sales ($M)

Sales/Day ($ 000's) |

Historical

account growth metrics •

Growth in customer base

–

Number of unique customer accounts

increased to over 4,600 in Q3 2013

–

Number of repeat customers grew to over

3,900 in Q3 2013 and represents

approximately 85% of all customers

•

Increase in frequency of product use

–

Hospital reorder rates averaged

approximately 4.8 orders per account for

Q3 2013, an 8% increase over Q3 2012

•

Increase in average quantity of

product ordered per customer

–

Average order size in Q3 2013 increased

22% over Q3 2012 to over 105 vials/order

–

Anticipate increasing number of vials per

patient as adoption by surgeons broadens

11

Customer Base

Purchase Volume

Re-order rates

Product

Revenue |

•

As of end of Q3 2013:

–

Over 2,350 hospital formulary approvals

–

Over 4,600 accounts have ordered OFIRMEV

12

Broad adoption |

Significant

growth in new and repeat customers each quarter •

Approximately 33% growth in unique accounts ordering OFIRMEV in Q3 2013 vs. Q3 2012

•

39% increase in accounts that placed multiple orders in Q3 2013 vs. Q3 2012

Significant growth in new customers

13

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Q2 13

Q3 13

Cumulative Accounts Ordering OFIRMEV®

Multiple Order

Single Order |

Growing

average order size 14

Average Order Size/Quarter

(vials)

40

50

57

65

75

79

85

92

96

100

105

Q1 11

Q2 11

Q3 11

Q4 11

Q1 12

Q2 12

Q3 12

Q4 12

Q1 13

Q2 13

Q3 13 |

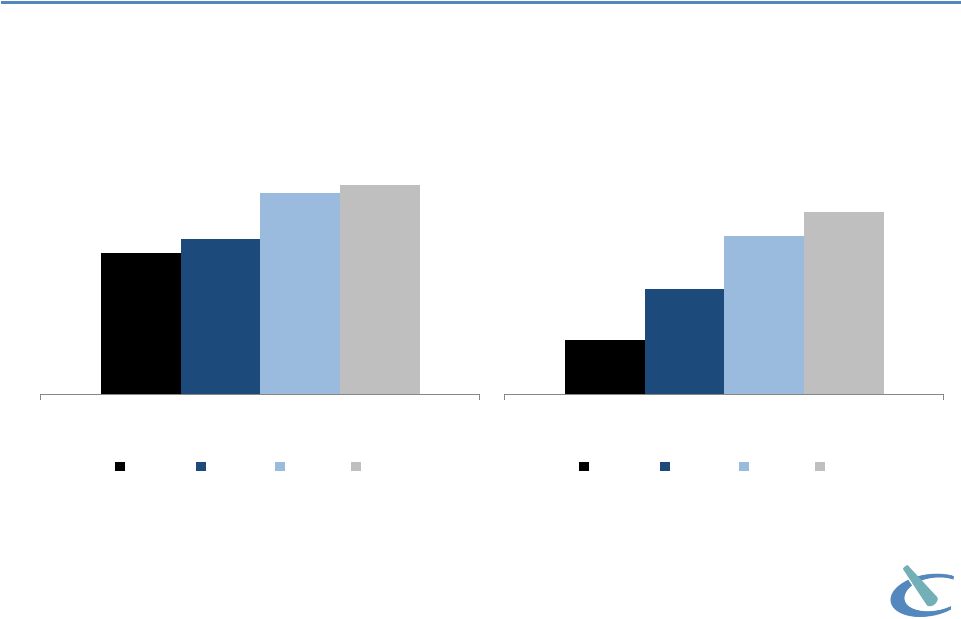

Growth

drivers •

Expanding physician user base*

–

Market research indicates growing user base in targeted accounts

–

Proportion of surgeons using OFIRMEV in targeted accounts has tripled in

less than 2 years

•

Increasing share of surgical patients

–

Data from Premier healthcare alliance indicates consistent growth through

Q2 2013**

•

Growing utilization per patient

–

Number of vials used per patient has grown steadily since 2011**

–

Anticipate

increasing

number

of

vials

per

patient

as

adoption

by

surgeons

broadens

15

*

ATU surveys conducted from Sept ‘11 through July ‘13 indicate (general and

orthopedic) surgeon utilization has increased from 23% to 76% during this time

period. **

Patient discharge data from the hospital research database maintained by the Premier

healthcare alliance (October 10, 2013) Sample includes over 400 hospitals representing

approximately 4.5M surgical patient discharges/year |

Market

research: increasing prescriber base More physicians in targeted accounts are using

OFIRMEV® Question:

Please

indicate

your

experience/familiarity

with

each

of

the

following

product

brands.

Those

indicating

“currently

use”

shown

on

this

chart.

Source: September 2011-December 2012 ATU market research of surgeons and

anesthesiologists conducted by GfK Healthcare and July 2013 ATU conducted by

Life Science Strategy Group, LLC (commissioned by Cadence) 16

Physicians Currently Using OFIRMEV

n=120

n=122 n=61 n=54

n=279

n=344 n=236 n=137

59%

65%

84%

87%

Anesthesiologist

Sept '11

May '12

Dec '12

July '13

23%

44%

66%

76%

Surgeon (General & Orthopedic)

Sept '11

May '12

Dec '12

July '13 |

Source:

Patient discharge data from the hospital research database maintained by the Premier

healthcare alliance (October 10, 2013) Sample includes over 400 hospitals representing

approximately 4.5M surgical patient discharges/year Increasing share of surgical

patients 17

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

OFIRMEV

®

Share of US Hospital Surgical Procedures

(Premier Healthcare Alliance Database)

Inpatient

All Surgical

Outpatient |

Source:

Patient discharge data from the hospital research database maintained by the Premier

healthcare alliance (October 10, 2013) Sample includes over 400 hospitals representing

approximately 4.5M surgical patient discharges/year Increasing utilization per

patient 18

2.00

2.25

2.50

2.75

3.00

3.25

3.50

OFIRMEV

®

Vial Utilization -

Surgical Inpatient Procedures

(Premier Healthcare Alliance Database) |

Long term

opportunity Physicians indicate higher expectations for future use of OFIRMEV®

Question (September 2011): What percentage of your (surgical procedures) would you

expect to fill for OFIRMEV when you reach the peak usage? Question (December

2012): Thinking ahead to 3 years from now, in what proportion of your surgical procedures requiring IV analgesics do you expect to

include the use of OFIRMEV?

Source: December 2012 ATU market research of surgeons and anesthesiologists

(n>180) conducted by GfK Healthcare (commissioned by Cadence)

19

42%

43%

55%

60%

Anesthesiologists

Surgeons

Projected Future Use

(% of patients treated)

Sep 2011 Survey

Dec 2012 Survey |

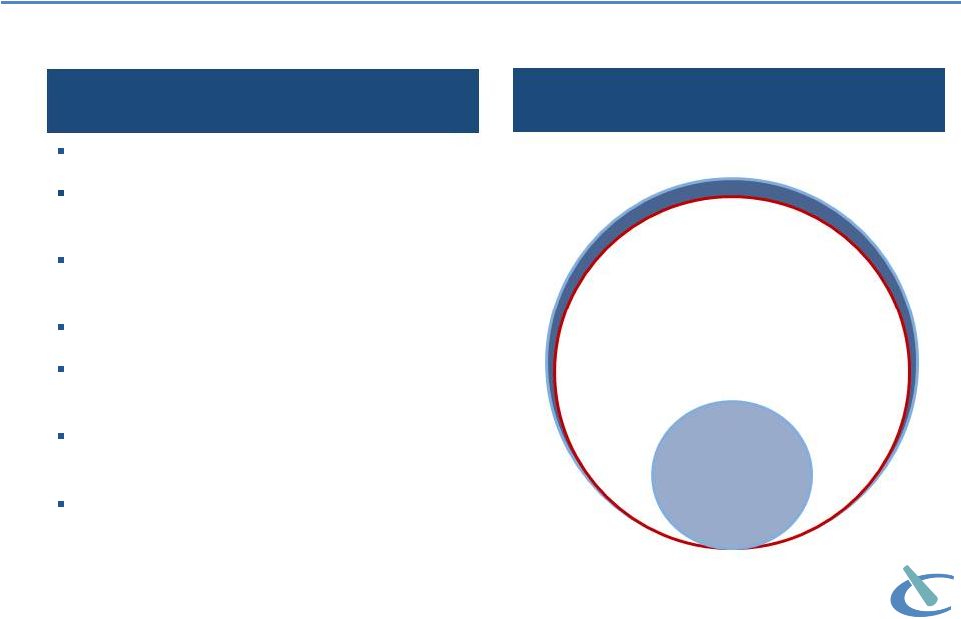

Long term

opportunity: ketorolac as a case study Limitations of NSAIDs

High Risk of Bleeding

Contraindicated as prophylactic analgesic

prior to any major surgery

Cardiovascular risks (CV thrombotic events,

MI and stroke)

Renal risks (advanced renal impairment)

Gastrointestinal risks (active or history of

peptic ulcers or GI bleeding)

Contraindicated in labor & delivery, and in

nursing mothers

Contraindicated in patients receiving aspirin

or other NSAIDs

Benchmarking potential future use of OFIRMEV®

against ketorolac utilization

OFIRMEV eligible

population

NSAID

treated

population

Perioperative Pain Population

20

Perioperative pain population |

Long term

opportunity: share of patients Physicians project OFIRMEV®

to be much more broadly utilized than NSAIDs

** Question: Thinking ahead to 3 years from now, what proportion of your surgical

procedures do you expect to include the use of OFIRMEV? Source: ATU study conducted by

GfK Healthcare, May 2012 (n=180 surgeons and anesthesiologists) * Source: Patient discharge data from the hospital research database maintained by the Premier healthcare alliance (October 10, 2013)

Projected OFIRMEV Use

(ATU Market Research**)

21

56%

12%

25%

92%

MD Projection of OFIRMEV

Utilization In 3 yrs**

OFIRMEV Q2 2013

NSAIDs

OPIOIDS

IV Analgesic Use in Surgical Inpatients

(Premier Hospital Database*) |

Long term

opportunity: doses per patient Physicians project significant increases in doses per

patient Source:

Awareness,

Trial,

Usage

Study

conducted

by

Life

Science

Strategy

Group,

LLC,

July

2013

Question 1: When you use OFIRMEV, how many vials are you using per one typical surgical

procedure? Question 2: How many vials of OFIRMEV do you expect to use per one typical

surgical procedure 3 years from now? Anesthesiologists

Surgeons

(n=43)

(n= 88)

Current Use

(July 2013)

Current Use

(July 2013)

Projected Use

in 3yrs

Projected Use

in 3yrs

22

(July 2013 Survey)

2.2

4.3

3.4

6.1

Doses Per Patient –

Inpatient Surgery |

Delivering

sustainable growth •

Continue

to

broaden

and

deepen

use

of

OFIRMEV®

in

treating

post-op

pain

–

Current trends and primary market research indicate potential for sustained

growth in patient share and vials per patient

•

Support implementation of multi-modal pain management strategies to help

hospitals improve economics and quality outcomes

–

A recently-presented study analyzing a large-scale hospital billing database

examined the impact of IV acetaminophen on improving outcomes and cost

of care for treating acute pain associated with common joint replacement

procedures*

•

Launch OFIRMEV flexible bag presentation

–

sNDA expected to be filed Q4 13

–

Anticipated launch Q4 14/Q1 15

•

Extend use of OFIRMEV into non-operative acute pain management

–

Non-operative acute pain management estimated to represent 30-40% of IV

analgesic use

–

Non-operative applications currently account for only about 10% of OFIRMEV

use

•

Expand product portfolio through business development transactions

23

* Evaluation of Patient Outcomes, Length of Stay, and Average Hospital Costs with IV

Acetaminophen: A Case-Matched Analysis of a National Inpatient Hospital Database.

Christian Apfel, M.D., Ph.D., Adjunct Associate Professor, Department of Epidemiology and Biostatistics, UCSF, San Francisco, CA.

(ASHP abstract 3-127) |

Business

development: target profile Accelerate growth by leveraging Cadence’s existing

infrastructure through acquisitions of products or companies

Near Term

Long Term

Region

US

US / Global*

Channel

Hospital

Hospital**

Product Status &

Sales Potential

•

Modest sized marketed or ready-to-

launch products

•

Moderate-large marketed or ready-

to-launch products

•

Development-stage assets with

significant peak sales potential

Cost Synergies

•

Will target products that can leverage our hospital-focused commercial

infrastructure

Deal Structures

•

Will consider transaction structures,

incl. co-promotion, asset purchases,

and in-licenses

•

Will consider transaction structures

including acquisitions, asset

purchases, and in-licenses

*Anticipate partnering ex-US

rights **Anticipate partnering non-hospital component

24 |

Financial

highlights 12 mos. ended

12/31/12

(in MM)

9 mos. ended

9/30/13

(in MM)

Net product revenue

$50.1

$77.2

Operating expenses

$103.6

$75.4

Cash, cash equivalents &

short-term investments

$62.1

$54.3

Shares outstanding

85.7

86.1

25 |

Investment

highlights •

Specialty biopharmaceutical company, focused on developing and

commercializing proprietary therapeutics utilized in the hospital setting

–

OFIRMEV®

(acetaminophen) injection –

Indicated for use in adults and

children >

2yrs for the:

•

Management of mild to moderate pain

•

Management of moderate to severe pain with adjunctive opioid analgesics

•

Reduction of fever

•

A differentiated, new class of IV pain medication

–

Non-opioid, non-NSAID analgesic

–

Foundation for multimodal approach to pain management

•

Widespread hospital formulary adoption and positive physician feedback

•

Solid revenue growth driven by a growing customer base, increasing re-order

rates and penetration in a variety of surgical settings

•

Sustainable OFIRMEV core business brings opportunities to diversify product

portfolio and leverage existing sales infrastructure

26 |

Take care when

prescribing, preparing, and administering OFIRMEV Injection to avoid dosing errors which could

result in accidental overdose and death.

OFIRMEV contains acetaminophen. Acetaminophen has been associated with cases of acute liver

failure, at times resulting in liver transplant and death. Most of the cases of liver

injury are associated with the use of acetaminophen at doses that exceed the recommended

maximum daily limits, and often involve more than one acetaminophen-containing product. OFIRMEV is contraindicated in patients with severe hepatic impairment, severe

active liver disease or with known hypersensitivity to acetaminophen or to any of the

excipients in the formulation. Acetaminophen should be used with caution in patients with

the following conditions: hepatic impairment or active hepatic disease, alcoholism, chronic

malnutrition, severe hypovolemia, or severe renal impairment. Rarely, acetaminophen may cause

serious skin reactions such as acute generalized exanthematous pustulosis (AGEP), Stevens-Johnson

Syndrome (SJS), and toxic epidermal necrolysis (TEN), which can be fatal.

Discontinue OFIRMEV immediately if symptoms associated with allergy or hypersensitivity

occur, or at the first appearance of skin rash. Do not use in patients with acetaminophen

allergy. The most common adverse reactions in patients treated with

OFIRMEV were nausea, vomiting, headache, and insomnia in adult patients and nausea, vomiting,

constipation, pruritus, agitation, and atelectasis in pediatric patients.

The antipyretic effects of OFIRMEV may mask fever in patients treated with postsurgical

pain. Do not exceed the recommended maximum daily dose of OFIRMEV.

OFIRMEV should be administered only as a 15-minute infusion.

To report SUSPECTED ADVERSE REACTIONS, contact Cadence Pharmaceuticals, Inc. at

1-877-647-2239 or FDA at 1-800-FDA-1088 or www.fda.gov/medwatch. OFIRMEV

is

approved

for

use

in

patients

2

years

of

age.

Important Safety Information about OFIRMEV®

(acetaminophen) injection

WARNING: RISK OF MEDICATION ERRORS AND HEPATOTOXICITY

Prescribing Information for OFIRMEV (acetaminophen) injection. San Diego, CA:

Cadence Pharmaceuticals, Inc., 2013. |