Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2009

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-33103

CADENCE PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 41-2142317 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

12481 High Bluff Drive, Suite 200

San Diego, California 92130

(858) 436-1400

(Address, including zip code, and telephone number, including area code, of principal executive offices)

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $0.0001 par value per share | NASDAQ Global Market | |

| (Title of class) | (Name of exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer x | Non-accelerated filer ¨ | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common stock held by non-affiliates of the registrant, based upon the closing sale price of the common stock on June 30, 2009, the last business day of the Registrant’s second fiscal quarter, reported on the NASDAQ Global Market, was approximately $245,681,033. Shares of common stock held by each executive officer and director and by each person who owns 10% or more of the Registrant’s outstanding common stock have been excluded from this computation. The determination of affiliate status for this purpose is not necessarily a conclusive determination for other purposes. The Registrant does not have any non-voting common equity securities.

As of February 28, 2010, there were 50,512,429 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the Registrant’s Definitive Proxy Statement to be filed with the Commission pursuant to Regulation 14A in connection with the Registrant’s 2010 Annual Meeting of Stockholders, which is scheduled to be held on June 16, 2010. Such Definitive Proxy Statement will be filed with the Commission not later than 120 days after the conclusion of the Registrant’s fiscal year ended December 31, 2009.

Table of Contents

Forward-Looking Statements

You should read the following together with the more detailed information regarding our company, our common stock and our financial statements and notes to those statements appearing elsewhere in this document or incorporated by reference. The Securities and Exchange Commission, or SEC, allows us to “incorporate by reference” information that we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this Annual Report on Form 10-K, or Annual Report.

This Annual Report and the information incorporated herein by reference contain forward-looking statements that involve a number of risks and uncertainties. Although our forward-looking statements reflect the good faith judgment of our management, these statements can only be based on facts and factors currently known by us. Consequently, these forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from results and outcomes discussed in the forward-looking statements.

Forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “hopes,” “may,” “will,” “plan,” “intends,” “estimates,” “could,” “should,” “would,” “continue,” “seeks,” “pro forma,” or “anticipates,” or other similar words (including their use in the negative), or by discussions of future matters such as the development of new products, technology enhancements, possible changes in legislation or the regulations that impact our business and other statements that are not historical. These statements include but are not limited to statements under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business” as well as other sections in this report. You should be aware that the occurrence of any of the events discussed under the heading “Item 1A. Risk Factors” and elsewhere in this report could substantially harm our business, results of operations and financial condition and that if any of these events occurs, the trading price of our common stock could decline and you could lose all or a part of the value of your shares of our common stock.

The cautionary statements made in this report are intended to be applicable to all related forward-looking statements wherever they may appear in this report. We urge you not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. Except as required by law, we assume no obligation to update our forward-looking statements, even if new information becomes available in the future.

Table of Contents

CADENCE PHARMACEUTICALS, INC.

Annual Report on Form 10-K

For the Fiscal Year Ended December 31, 2009

Table of Contents

| Item 1. | Business |

Company Overview

We are a biopharmaceutical company focused on in-licensing, developing and commercializing product candidates principally for use in the hospital setting. We currently have rights to one product candidate, Ofirmev™, a proprietary intravenous formulation of acetaminophen for the management of pain and reduction of fever in adults and children. We in-licensed the exclusive United States, or U.S., and Canadian rights to Ofirmev from Bristol-Myers Squibb Company, or BMS, which sells this product candidate in Europe and other markets for the treatment of acute pain and fever under the brand name Perfalgan®.

We submitted a New Drug Application, or NDA, for Ofirmev to the Food and Drug Administration, or FDA, in May, 2009. The NDA was accepted for filing in July 2009, and designated for priority review. Pursuant to Prescription Drug User Fee Act, or PDUFA, guidelines, the FDA was expected to complete its review and provide an action letter with respect to the NDA in November 2009; however, the agency instead indicated that its review would be extended for up to three additional months, resulting in a new PDUFA goal date in February 2010. On February 10, 2010, we received a complete response letter from the FDA, which stated that the NDA could not be approved in its present form due to deficiencies with respect to good manufacturing practices observed during the agency’s inspection of the facilities of our third party manufacturer, which was completed on February 5, 2010. In the complete response letter, the FDA did not indicate that any additional clinical trials were required in order to approve the NDA for Ofirmev and did not cite any safety or efficacy deficiencies. On February 18, 2010, our third party manufacturer submitted a response letter concerning the good manufacturing practice observations to the FDA. As soon as the inspectional observations are resolved, we plan to re-submit the NDA for Ofirmev.

If approved, we believe that Ofirmev will fulfill significant unmet needs for the management of pain and reduction of fever in children and adults. We also believe that the hospital pharmaceuticals market is both concentrated and underserved, and we are preparing to build our own hospital-focused sales force to promote Ofirmev to this market, along with any other product candidates we may acquire in the future. We intend to build a leading franchise in the hospital setting, continuing to focus on products that are in late stages of development, currently commercialized outside the U.S., or approved in the U.S. but with significant commercial potential for proprietary new uses or formulations.

We were incorporated under the laws of the State of Delaware in May 2004. Our principal executive offices are located at 12481 High Bluff Drive, Suite 200, San Diego, California 92130 and our telephone number is (858) 436-1400. Information about the company is also available at our website at www.cadencepharm.com, which includes links to reports we have filed with the Securities and Exchange Commission, or SEC, which are available free of charge. The contents of our website are not incorporated by reference in this Annual Report on Form 10-K. The public may read and copy any materials that we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street, NW, Washington, DC 20549. Information on the operation of the Public Reference Room is available by calling the SEC at 1-800-SEC-0330. These reports may also be accessed free of charge via the SEC website, www.sec.gov.

The U.S. Patent and Trademark Office has issued a Notice of Allowance in connection with our intent-to-use trademark application for the mark Cadence™, and we have applied for U.S. trademark registration of Ofirmev™. This report also contains trademarks of others, including Caldolor®, Darvocet®, DepoDur®, Percocet®, Perfalgan®, Toradol®, Tylenol®, Tylenol Codeine 3 McNeil®, Ultram®, and Vicodin®.

Our Business Strategy

Our goal is to become a leading biopharmaceutical company focused on the development and commercialization of proprietary pharmaceuticals principally for use in the hospital setting. Our near-term

1

Table of Contents

strategy is to focus on obtaining FDA approval for and commercializing Ofirmev. Longer-term, our strategy is to in-license, acquire, develop and commercialize additional product candidates that are in late-stages of development, currently commercialized outside the U.S. or approved in the U.S. but with significant commercial potential for proprietary new uses or formulations. Specifically, we intend to:

| • | Obtain regulatory approval for our product candidate, Ofirmev We expect to re-submit an NDA for Ofirmev as soon as possible following the successful resolution of the deficiencies noted during the FDA’s recent inspection of our third party manufacturer’s facility. We do not anticipate that we will need to conduct any additional clinical trials in order to obtain approval of the NDA for Ofirmev. |

| • | Prepare to successfully launch and expand the sales of Ofirmev We plan to continue our preparations for launching Ofirmev upon NDA approval. These preparations include finalizing agreements with wholesalers for the distribution of Ofirmev to hospitals, completing the development of our internal commercialization infrastructure and systems, and developing promotional and medical education materials that will be used by our sales force and medical science liaisons, respectively, to inform and educate hospital-based physicians who treat patients with mild to severe pain and fever. These physicians include anesthesiologists, surgeons, intensivists, internists, emergency medicine physicians, and others. |

| • | Build a highly leverageable sales organization targeting hospitals We are continuing to develop a commercial sales and marketing organization that will focus on promoting Ofirmev to hospitals in the U.S. To date, we have hired a highly experienced sales management team and, upon the approval of Ofirmev, we are prepared to hire approximately 150 hospital sales specialists. Because the number of institutions comprising the hospital marketplace is relatively limited, we believe that we can successfully promote Ofirmev with our own sales force by focusing on the relatively small number of these institutions that account for a substantial portion of the prescribing activity. The concentrated nature of this market creates the opportunity for significant marketing synergies, and we intend to ultimately leverage our sales force with multiple products across multiple therapeutic categories in the hospital. Outside the U.S., we intend to establish strategic partnerships for the commercialization of Ofirmev, along with any other product candidates we may acquire in the future, in areas where we have commercialization rights. |

| • | Expand our product portfolio through acquiring or in-licensing additional late-stage, hospital-focused products with well-understood risk profiles We will seek additional opportunities to acquire or in-license products to continue to exploit our commercial and development capabilities. We believe that our focus on the hospital market enables us to evaluate a broad range of products across multiple therapeutic areas for possible acquisition. To reduce the time to market and the risks and costs of clinical development, we will continue to focus on products that are in late stages of development, currently commercialized outside the U.S., or approved in the U.S. but with significant commercial potential for proprietary new uses or formulations. |

| • | Pursue additional indications and commercial opportunities for Ofirmev and future product candidates We will seek to maximize the value of Ofirmev and any other product candidates we may in-license, acquire or develop. These activities may include pursuing additional indications and commercial opportunities for Ofirmev and any other product candidates we may acquire. |

Product Candidates

Ofirmev™ Product Overview

As soon as possible following the resolution of deficiencies at our third party manufacturer’s facility, we plan to re-submit an NDA for Ofirmev, our proprietary intravenous formulation of acetaminophen, seeking approval for the use of this product candidate for the management of pain and reduction of fever in adults and children.

In its oral form, acetaminophen is the most widely used drug for the treatment of pain and fever in the U.S. Acetaminophen was discovered in the late 19th century and was made available for sale in 1955, when it was

2

Table of Contents

introduced in the U.S. under the brand name Tylenol. Acetaminophen is currently available in over 600 combination and single-ingredient prescription and over-the-counter medicines, including tablet, caplet, orally-dosed liquid suspension, powder and suppository forms for both adults and children. Despite the broad usage of acetaminophen, there is no intravenous formulation currently available in the U.S. for patients who are unable to take medications by mouth, require faster onset of pain relief or fever reduction, or for whom it is otherwise more convenient to receive an injectable analgesic.

Our licensor, BMS, currently markets this proprietary intravenous formulation of acetaminophen for the treatment of acute pain and fever in Europe and several other markets outside the U.S., where it is known as paracetamol and marketed under the brand name Perfalgan. We in-licensed the exclusive U.S. and Canadian rights to Ofirmev from BMS in March 2006.

Pain Management

Despite major improvements in surgical techniques and the introduction of novel drugs, the overall treatment of post-operative pain has not substantially improved over the last 20 years. According to the industry research group Datamonitor, up to 75% of patients report inadequate pain relief after surgery. Inadequate treatment of pain may lead to a variety of symptoms, including anxiety, depression, insomnia, fatigue, decreased appetite, nausea and vomiting. Decreased mobilization may also result from the inadequate treatment of pain, which may increase the risk of deep venous thrombosis, reduced lung tidal volume, and partial collapse or incomplete inflation of the lungs, as well as potentially prolonging hospital stays. All of these factors have the potential to significantly impact patient care and create additional costs for hospitals.

Drugs used to treat pain are collectively known as analgesics. Injectable formulations of analgesics are typically used when patients are unable to take medications by mouth, would benefit from a faster onset of analgesia, when other administration routes are medically contraindicated, or when it is more convenient to administer drugs in injectable form. Hospitalized patients may be unable to take medications by mouth for a variety of reasons, including gastric or intestinal dysfunction, pre-operative or pre-procedural restrictions, sedation, mental status changes or neurological conditions that increase the risk of aspiration, nausea or vomiting, or as a result of conditions that make swallowing painful, such as oral or esophageal infections, inflammation or ulceration. Only two classes of injectable analgesics are available in the U.S. for the treatment of acute pain, opioids and non-steroidal anti-inflammatory drugs, or NSAIDs.

Opioids have been used as analgesics for over 2,000 years and continue to be the mainstay of post-operative pain management. Opioids interact with certain receptors in the central and peripheral nervous system to produce beneficial effects, which include analgesia, sedation and euphoria. A range of naturally occurring, semi-synthetic and synthetic opioids are available for intravenous use, including morphine, fentanyl, hydromorphone, meperidine, sufentanil, and alfentanil.

Opioids, however, may also be associated with a variety of unwanted side effects when used to treat acute pain, including respiratory depression, excessive sedation, nausea, vomiting, constipation, urinary retention, itchiness, chest wall rigidity, cognitive impairment, and seizures. Respiratory depression may lead to death if not monitored closely. Side effects from opioids have been demonstrated to reduce patients’ quality of life. Opioid use may prolong a patient’s stay in the post-anesthesia care unit or ambulatory surgical facility, as well as a patient’s overall length of stay in the hospital, as a result of opioid side effects and the need to administer additional medications or treatments to resolve opioid side effects. Studies have demonstrated that surgical costs may be increased by opioid use, not only due to additional personnel time required to handle and dispose of these controlled substances, but also as a result of costs associated with treating opioid-related side effects, including the potential need for the patient to remain in the hospital for an extended period of time.

The only non-opioid intravenous analgesics currently available in the U.S. are the NSAIDs Toradol (ketorolac tromethamine), a generic form of which is also available in the U.S. from a number of manufacturers,

3

Table of Contents

and Caldolor (ibuprofen), which was approved by the FDA in mid-2009 for the treatment of mild to moderate pain in adults, and moderate to severe pain in adults as an adjunct to opioid therapy. Neither of these products are currently indicated for use in pediatric patients. NSAIDs act as non-selective inhibitors of the enzyme cyclooxygenase, inhibiting both the cyclooxygenase-1, or COX-1, and cyclooxygenase-2, or COX-2, enzymes. The inhibition of COX-2 produces an anti-inflammatory effect resulting in analgesia. Since NSAIDs do not produce respiratory depression or impair gastrointestinal motility, they are considered to be useful alternatives or adjuncts to opioids for the relief of acute pain.

However, the use of NSAIDs is limited in the post-operative period due to their potential to cause increased bleeding. Non-specific NSAIDs, such as ketorolac, block both COX-1 and COX-2, which results in an anti-inflammatory effect but also reduces platelet aggregation and increases gastric irritation, creating the potential for gastric ulcers and bleeding. Additionally, renal toxicity and the potential for increased cardiovascular events further limit the post-operative use of NSAIDs. All NSAIDs carry a boxed warning for a number of side effects. A boxed warning is the strongest type of warning that the FDA can require for a drug and is generally reserved for situations where prescribers should be aware of the potential for adverse drug reactions that can cause serious injury or death.

Fever Reduction

Fever is an increase in internal body temperature above its average normal value. A significant fever is usually defined as an oral temperature of greater than 101.5 degrees Fahrenheit (38 degrees Centigrade). Fever is typically a sign of the body’s response to an underlying infection, disease process or allergic reaction. Very high fevers may cause hallucinations, confusion, irritability, convulsions or death.

Hospitalized patients are at especially high risk for developing fever due to the prevalence of infections, whether community- or hospital-acquired, and as a result of invasive procedures and treatments that may cause fevers. Surgery is the most common predisposing factor for fever in the hospital setting, with published incidence rates ranging from 14% to 91% of post-operative patients. Infections such as surgical wound infections, urinary tract infections, and pneumonia are the most common causes of post-operative fevers. However, deep venous thrombosis, pulmonary emboli, myocardial infarction, transfusions of blood products, and medications are also important potential causes of post-operative fever. Many patients also enter hospitals and emergency rooms with fevers that caused by infections or complications from an underlying disease or medical condition. While the origin of a fever is often unknown, treatment to reduce fever will typically be given even if the cause cannot be determined.

Fever is also the most common reason parents bring their children to hospital emergency rooms. Pediatric fever is particularly worrisome, as approximately 4% of children under age five and nearly one in five children born prematurely experience fever-induced seizures, or febrile seizures. The signs of febrile seizures, which occur when a child’s temperature rises or falls rapidly, include loss of consciousness and convulsions.

Acetaminophen, ibuprofen and aspirin are the most commonly used oral medications to treat fever. Caldolor (intravenous ibuprofen) is not approved for the treatment of fever or pain in children. Aspirin is contraindicated in children and teenagers with viral infections due to the risk of acquiring Reye’s syndrome, a potentially fatal disease.

Treating fever in a hospitalized patient with oral medication may be difficult or not feasible due to the severe nausea and vomiting that often accompany a high fever, or because the patient is unconscious, sedated, fasting or experiencing gastrointestinal dysfunction. Oral medications are also precluded in patients on a restricted oral intake regimen due to a concomitant medical condition or upcoming medical procedure. In the U.S., neither acetaminophen nor aspirin are currently available in intravenous dosage forms. While rectal delivery of these medications is sometimes possible, drug absorption using this method may be highly variable, resulting in the potential for inadequate levels of efficacy. Rectal delivery is further complicated if the drug is

4

Table of Contents

expelled with a bowel movement, which leads to difficulty determining the amount of medication delivered. This is a particular issue for neonates and infants. As a result, pediatric dosing guidance for rectally administered acetaminophen calls for higher loading doses and higher daily maximum doses than for orally administered acetaminophen, which may place some neonates and infants at risk for toxicity if the drug is absorbed at a level greater than expected.

Therapeutic drug levels often may be achieved more rapidly when a drug is administered intravenously compared to oral or rectal administration, offering the potential advantage of a more rapid onset of action. This may be particularly desirable in patients with high fever, or in whom fever is causing undesirable symptoms or complications such as febrile seizures. It may also be more convenient to administer medications in an intravenous dosage form, particularly for patients who currently have an intravenous line in place. While Caldolor (intravenous ibuprofen) is approved for the treatment of fever in adults, it has not been approved for the treatment of fever in children. We believe that the availability of Ofirmev in the U.S. would offer a significant new treatment option for hospitalized patients with fever and address unmet medical needs, particularly with respect to the management of fever in children and infants, including premature newborns.

Multi-Modal Pain Management

Multimodal analgesia is the use of two or more analgesic agents that act by different mechanisms to provide superior analgesic efficacy with equivalent or reduced adverse effects. The Practice Guidelines for Acute Pain Management in the Peri-operative Setting from the American Society of Anesthesiologists, or ASA, recommend that multi-modal pain management therapy should be employed whenever possible. The ASA guidelines recommend that all surgical patients receive an around-the-clock regimen of acetaminophen, NSAIDs, or COX-2 inhibitors, and that dosing regimens should be administered to optimize efficacy while minimizing the risk of adverse events. The only intravenous NSAIDs approved in the U.S., Caldolor (ibuprofen), Toradol (ketorolac tromethamine), and generic ketorolac, all carry a boxed warning for the risk of bleeding, renal dysfunction, and other adverse effects.

The concept of using acetaminophen for multi-modal management of pain to improve pain relief and reduce opioid consumption is not new to physicians. In fact, oral acetaminophen-opioid combination products are very commonly prescribed for the treatment of acute pain, including post-operative pain. Such products include Vicodin (hydrocodone plus acetaminophen), Percocet (oxycodone plus acetaminophen), Tylenol Codeine #3 McNeil (codeine plus acetaminophen), Ultram (tramadol plus acetaminophen), and Darvocet (propoxyphene plus acetaminophen). Approximately 73% of the 14.4 billion doses of oral opioids sold in the U.S. in 2008 were combination products that included acetaminophen. Since an intravenous formulation of acetaminophen has not been available in the U.S., physicians have not been able to extend this common multi-modal approach to the peri-operative setting, when patients are unable to take oral medications.

Sales Performance of Intravenous Acetaminophen in Europe

Intravenous acetaminophen is marketed by BMS outside of the U.S. and Canada under the brand name Perfalgan. This product is currently approved in approximately 80 countries and is marketed throughout Europe and other parts of the world. Intravenous acetaminophen was launched on a country-by-country basis, beginning in France in 2002, followed by Germany and Spain in 2003, and Italy and the United Kingdom in 2004. Based on 2008 data from IMS Health, Inc., or IMS, an independent marketing research firm, we estimate that more than 400 million doses of intravenous acetaminophen have been distributed since the introduction of this product in Europe, and it has become the market and unit share leader among injectable analgesics, with approximately 90 million units sold, or approximately $250 million in product sales, in 2008. This performance corresponds to an estimated market share in Europe in 2008 of 20% of all injectable analgesic units, and an estimated 45% market share of all injectable analgesic dollar sales. In some European Union, or E.U., countries, such as France and Belgium, intravenous acetaminophen has a unit market share greater than 40% based on 2008 data from IMS. We believe these and other countries are utilizing intravenous acetaminophen as the foundation for multi-modal analgesia, particularly in the post-operative setting.

5

Table of Contents

U.S. Market Opportunity

We believe that the U.S. market represents a potentially larger sales opportunity for intravenous acetaminophen than Europe with respect to potential unit market share and pricing. We estimate that the U.S. market is comparable to the European market when viewed from the perspective of the number of days of analgesic therapy administered to patients annually, which is calculated based on analgesic equivalent doses of the various therapeutic options. Based on sales reported to IMS in 2008, we have estimated that analgesic equivalent doses represented approximately 90 million analgesic patient days in the E.U., compared to approximately 80 million patient days in the U.S. The E.U. analgesic therapy market consists of intravenous opioids, NSAIDs and acetaminophen. There are multiple intravenous NSAIDs available in Europe, as well as other intravenous opioids not available in the U.S. According to IMS, 287 million vials of injectable analgesics were sold in the U.S. in 2009. Morphine is the current market leader and accounted for more than 159 million vials sold in 2009. Approximately 90 million vials of other injectable opioids, such as meperidine, hydromorphone and fentanyl, which are all available in generic forms, were sold in 2009. Toradol (ketorolac tromethamine), an NSAID that is available as a generic drug, and Caldolor (ibuprofen), another NSAID, are the only non-opioid intravenous injectable analgesics available for treating acute pain in adults in the U.S. According to IMS, more than 38 million vials of injectable ketorolac were sold in the U.S. in 2009.

On average, pharmaceutical pricing continues to be higher in the U.S. than in Europe. According to IMS, the average selling price in Europe in 2008 was approximately $2.85 (U.S. dollars) per vial of Perfalgan, or intravenous acetaminophen. We believe the unit price of Perfalgan in major European countries was largely driven by government-controlled reference pricing in those markets. In Scandinavian countries with less restrictive pricing controls, the average Perfalgan selling price is as high as $10.42 (U.S. dollars) per vial. The price of ketorolac in the U.S. in 1997, prior to the entry of generic competitors, was approximately $7.00 (U.S. dollars) per vial, according to the American Journal of Health-System Pharmacy. The price of Caldolor in the U.S. was $10.50 (U.S. dollars) per 800 mg vial at launch in 2009.

We believe that, upon the approval of Ofirmev in the U.S., the key product attributes that will drive the adoption of this product candidate include the efficacy and safety profile of Ofirmev demonstrated in multiple clinical studies, the excellent safety profile and familiarity physicians have with oral acetaminophen, alone and in combination with opioids, the potential for reducing concomitant use of morphine and other opioids, the need for a more convenient dosage form for patients unable to take mediation orally, and a more rapid onset of action. In a market survey by IMS commissioned by us in 2007, 81% of the 126 U.S. physicians surveyed indicated readiness to use Ofirmev immediately following the product’s approval by the FDA.

Clinical Development

Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act permits the submission of an NDA where at least some of the information required for approval comes from studies not conducted by or for the applicant, and for which the applicant has not obtained a right of reference. Supportive information may also include scientific literature and publicly available information contained in the labeling of other medications. Accordingly, the NDA we submitted for Ofirmev in May 2009 included data from our own clinical trials in the U.S., trials of Ofirmev previously completed by BMS in the U.S. and Europe, and other studies published in the scientific and medical literature. A total of 1,020 adult patients and 355 pediatric patients, consisting of 47 neonates, 64 infants, 171 children and 73 adolescents, received Ofirmev in clinical trials.

New Drug Application (NDA)

We submitted an NDA for Ofirmev to the FDA in May 2009. The NDA was accepted for filing in July 2009, and designated for priority review. In February 2010, we received a complete response letter from the FDA, which stated that the NDA could not be approved in its present form due to deficiencies observed during an inspection of the facilities of our third party manufacturer for this product candidate, which was completed on

6

Table of Contents

February 5, 2010. Our third party manufacturer submitted a response to the FDA on February 18, 2010, and we intend to re-submit a 505(b)(2) NDA for Ofirmev as soon as possible following the resolution of the inspectional observations. The re-submitted NDA will incorporate by reference all of the data in the original NDA and contain updated safety information derived from the use of this product candidate in European and other countries, along with an indication that the deficiencies with respect to good manufacturing practices have been resolved by our third party manufacturer.

We believe that, prior to the receipt of the complete response letter in February 2010, we had substantially completed labeling discussions with the FDA for Ofirmev. Based upon these discussions, we plan to seek approval for the use of Ofirmev for the management of pain and reduction of fever in adults and children. In the complete response letter, the FDA did not indicate that any additional clinical trials were required in order to approve the NDA for Ofirmev and did not cite any safety or efficacy deficiencies. As a result, the following table summarizes the pivotal clinical trial data that will be included in the NDA that we plan to re-submit for Ofirmev:

| Study |

Number of Patients |

Trial Design |

Trial Outcome | |||

| Adult Pain | ||||||

| Pain Study 1: |

||||||

| RC 210 3 002 / Sinatra Study (BMS) |

101 | Total hip or knee replacement | Intravenous acetaminophen statistically superior to placebo for reduction in pain intensity over 24 hours. Median time to use of rescue medication 3 hours with intravenous acetaminophen compared to 0.8 hours with placebo. Greater reduction in mean morphine consumption through 24 hours with intravenous acetaminophen compared to placebo (38 mg and 57 mg, respectively). | |||

| Pain Study 2: |

||||||

| Cadence Study 304 |

244 | Abdominal laparoscopic surgery | Intravenous acetaminophen demonstrated statistically significant greater reduction in pain intensity over 24 hours compared to placebo. | |||

| Adult Fever |

||||||

| Fever Study 1: |

||||||

| Cadence Study 302 |

60 | Endotoxin-induced fever | Intravenous acetaminophen demonstrated statistically significant antipyretic effect through 6 hours in comparison to placebo. | |||

Pivotal Clinical Trials Supporting Efficacy of Ofirmev in Adult Patients

The pivotal clinical trials supporting the efficacy of Ofirmev for the management of pain and reduction of fever are as follows:

| • | Pain Study 1: RC 210 3 002, a Phase III clinical trial in adults with moderate-to-severe pain following total hip or knee replacement surgery. This trial was a randomized, placebo-controlled, double-blind, |

7

Table of Contents

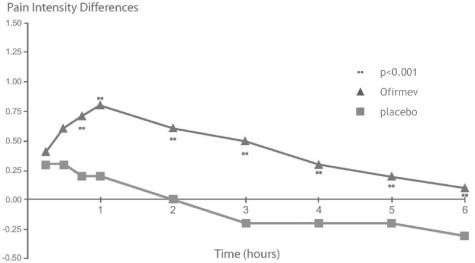

| multi-center Phase III study to assess the efficacy and safety of multiple doses of intravenous acetaminophen versus intravenous propacetamol or placebo. The primary efficacy endpoint of time-specific pain relief scores from 15 minutes to six hours was statistically significant (p<0.05) in favor of Intravenous acetaminophen compared to placebo at all time points. Key secondary endpoints of time-specific pain intensity differences through six hours, weighted sum of pain intensity differences over six hours, weighted sum of pain relief differences over six hours, time to administration of the first rescue medication, patient global evaluation at 24 hours, and rescue medication consumption over 24 hours, were all statistically significant (p<0.05) in favor of Intravenous acetaminophen compared to placebo. There was a 33% reduction in the amount of opioid used as rescue medication in the group treated with Intravenous acetaminophen, and yet they reported a superior pain experience, as indicated by the global satisfaction rating. In addition to the results originally reported, we have performed a re-analysis of the data from this trial using endpoints that the FDA currently favors for acute pain studies. Based upon our re-analysis of the sum of pain intensity differences over 24 hours, or SPID24, Intravenous acetaminophen was shown to be superior to placebo (p<0.0001). The following graph presents the pain intensity differences from the baseline measurements reported by patients in this study at each time point from 15 minutes to six hours: |

Study RC 210 3 002 also demonstrated a statistically significant improvement in patient satisfaction with pain treatment for patients who received intravenous acetaminophen compared to placebo. The study results indicate that nearly twice as many subjects noted good or excellent results at 24 hours compared to placebo. The number of drug-related adverse events reported for the group of patients who received intravenous acetaminophen in this trial was similar to the number of events reported for the placebo group. The table below provides a summary of these data from the trial:

| Intravenous acetaminophen |

Intravenous placebo |

p-value | ||||

| Sum of pain intensity differences over |

0.4 | -235 | <0.0001 | |||

| Weighted sums of pain relief over |

6.6 | 2.2 | <0.05 | |||

| Good/excellent global evaluation at |

41% | 23% | <0.01 | |||

| Rescue medication (morphine) consumption over 24 hours (mg) |

38.3 (33% decrease) | 57.4 | <0.001 | |||

| Safety |

Intravenous acetaminophen was comparable to placebo | |||||

8

Table of Contents

| • | Pain Study 2: Cadence Study 304, a Phase III clinical trial in adult patients with moderate to severe pain following abdominal laparoscopic surgery. This trial was a randomized, placebo-controlled, double-blind, multi-center study of 244 patients to assess the efficacy and safety of two dosing regimens of Ofirmev, 1000 mg administered every six hours and 650 mg administered every four hours, compared to placebo over a 24-hour period. In December 2008, we announced that this study successfully met its primary endpoint of a statistically significant reduction in summed pain intensity differences from baseline over 24 hours, or SPID24, for Ofirmev1000 mg compared to placebo (p < 0.01). The trial also achieved a statistically significant reduction in SPID24 for the 650 mg dose administered every four hours (p = 0.02). Consistent with other placebo-controlled clinical trials with Ofirmev, the number of safety events reported for the group of patients who received Ofirmev was similar to the number of safety events reported for the placebo treatment group. |

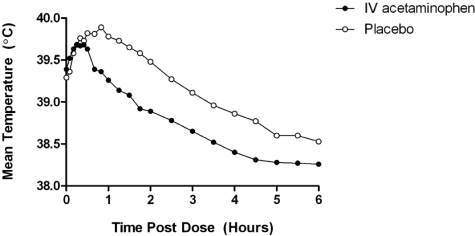

| • | Fever Study 1: Cadence Study 302, a Phase III clinical trial in adults with fever. The efficacy of Ofirmev1000 mg in the treatment of adult fever was evaluated in one randomized, double-blind, placebo- controlled clinical trial. The study was a 6-hour, single-dose, endotoxin-induced fever study in 60 healthy adult males. A statistically significant antipyretic effect of Ofirmev was demonstrated through 6 hours in comparison to placebo. The mean temperature over time is shown below: |

Clinical Trials Supporting Safety and Pharmacokinetics in Adult Patients

A total of 1,020 adult patients have received Ofirmev in clinical trials, including 380 patients (37.3%) who received five or more doses, and 173 patients (17.0%) who received more than ten doses. Most patients were treated with 1,000 mg of Ofirmev every six hours. A total of 134 patients (13.1%) received 650 mg of Ofirmev every four hours. The most common adverse events in adult patients treated with Ofirmev (incidence ³ 5% and greater than placebo) were nausea, vomiting, headache, and insomnia.

The safety of acetaminophen has been well-established through decades of use in oral and suppository formulations. The primary safety concern with acetaminophen is hepatotoxicity, which is a well-understood and dose-dependent effect. Liver failure can occur in people who have taken a substantial overdose of acetaminophen, but it occurs only rarely when acetaminophen is dosed in accordance with the recommended guidelines. In addition, an effective antidote, N-acetylcysteine, is available to treat acetaminophen overdose.

In pharmacokinetic trials, the average peak plasma concentration of acetaminophen was briefly higher for Ofirmev when compared to the same dose of oral acetaminophen, but levels over time were not meaningfully different. These trials also demonstrated that Ofirmev does not accumulate over multiple doses after 12 hours and that urinary elimination of acetaminophen metabolites, including metabolites with potential to interact with the liver, was not meaningfully different for Ofirmev compared to oral acetaminophen at 12 and 24 hour measurements.

9

Table of Contents

In addition to the pivotal clinical trials described above, data from the following clinical trials will be included in our re-submitted NDA to support the safety and the pharmacokinetic profile of Ofirmev in adults:

| • | Cadence Study 301, a Phase III clinical trial in adult patients with moderate-to-severe pain following gynecologic surgery. This clinical trial was a randomized, placebo-controlled, double-blind, multi-center study to assess the safety and efficacy in adult, female patients of single and multiple doses of Ofirmev versus placebo over a 48-hour period. While this study conducted in 331 patients did not meet its primary efficacy endpoint, the number of adverse events in the group of patients that received Ofirmev was comparable to the group of patients in the placebo arm. There were no clinically relevant differences in adverse event reports over the 48-hour study period, and at the follow-up on day seven, between Ofirmev and placebo patients in the frequency of serious, severe, related, hepatic or overall adverse events. There was no evidence of local venous irritation or infusion-related pain with Ofirmev. The frequency of quantitative liver enzyme elevations (alanine aminotransferase or aspartate aminotransferase), while comparable between the treatment groups, was more than twice as high in the placebo group as compared to the Ofirmev group. |

| • | Cadence Study 303, a Phase III clinical trial in adults with experimentally-induced fever versus oral acetaminophen. This trial was a single-dose, endotoxin-induced fever study conducted in 81 healthy adult males. Ofirmev was more efficacious than oral acetaminophen in rapidly blunting and reducing endotoxin-induced fever within 2 hours after administration (WSTD2, p=0.0039). Ofirmev demonstrated a more rapid onset of action compared to oral acetaminophen at 30 minutes (p=0.0202). |

| • | Cadence Study 351, a Phase III safety study in adult patients. This clinical trial, which was designed to evaluate the safety of repeated doses of Ofirmev in adults for up to five days, was an open-label, multi-center study of 213 hospitalized patients randomized to receive repeated doses of Ofirmev 1,000 mg every six hours, Ofirmev 650 mg every four hours, or standard of care treatment. In this trial, the hepatic and general safety profile of the group of patients that received Ofirmev was comparable to the standard of care treatment group, with numerically lower proportions of patients with elevated liver function tests in the two Ofirmev groups compared to the standard of care treatment group. |

| • | Cadence Study 101, a pharmacokinetic study in adults. This clinical trial was a randomized, single-center study to assess the pharmacokinetics in adults of single and multiple doses of Ofirmev compared to oral acetaminophen. The results of this trial demonstrated that Ofirmev produced a mean first dose maximum plasma concentration that was briefly up to approximately 75% higher than oral acetaminophen. However, overall drug exposure, which is also known as the area under the curve, was essentially the same for Ofirmev and oral acetaminophen. The maximum plasma concentration for Ofirmev occurred at the end of the 15 minute infusion and occurred 30 minutes earlier than the observed maximum value for oral acetaminophen. The elimination half-life and volume of distribution values were comparable and not significantly different across treatment groups. Oral acetaminophen was 94% bioavailable in this study, indicating there should not be a need for physicians to convert their preferred dosage amounts when they switch between Ofirmev and oral acetaminophen. Steady state levels of acetaminophen were achieved rapidly, as no drug accumulation occurred from 12 to 48 hours with repeated dosing. As expected, neither Ofirmev nor oral acetaminophen had a significant effect on platelet aggregation. There were no significant differences observed between the intravenous and oral acetaminophen groups with respect to the number of adverse events, including adverse hepatic events. |

Clinical Trials Supporting Safety and Efficacy in Pediatric Patients

A total of 355 pediatric patients, consisting of 47 neonates, 64 infants, 171 children, and 73 adolescents, have received Ofirmev, including 212 patients (59.7%) who received five or more doses and 153 (43.1%) who received more than ten doses. Pediatric patients received Ofirmev doses up to 15 mg of Ofirmev per kg of body weight every four, six or eight hours. The maximum exposure was 7.7 days in neonates, 6.4 days in infants, 6.8 days in children and 7.1 days in adolescents. The most common adverse events (incidence ³ 5%) in pediatric patients treated with Ofirmev were nausea, vomiting, constipation, pruritus, agitation, and atelectasis.

10

Table of Contents

Data from the following clinical trials will be included in our NDA for Ofirmev to demonstrate comparable pharmacokinetics between children and adults:

| • | Cadence Study 102, a pharmacokinetic study in pediatric patients. This clinical trial, which was designed to evaluate the pharmacokinetics of single and multiple doses of Ofirmev in 75 pediatric patients, demonstrated a pharmacokinetic profile for Ofirmev generally comparable to adults, with an age-related reduction in clearance in newborns. Ofirmev was well-tolerated across all age groups, ranging from newborns to adolescents. |

| • | Cadence Study 352, a safety study in pediatric patients. This clinical trial was an open-label, multi-center, multi-day study to assess the safety in children of repeated doses of up to 15 mg of Ofirmev per kg of body weight over at least five days. One neonate, eight infants and 91 children and adolescents requiring analgesic or antipyretic therapy were included in this study. Ofirmev was administered at a dose of 30 to 50 mg per kg of body weight per day every six or eight hours for neonates and 40 to 75 mg per kg of body weight per day every four or six hours for older pediatric patients, for periods of up to seven days. Ofirmev was well tolerated in this relatively sick and complicated pediatric inpatient population. There were no clinically relevant differences between the treatment groups in the frequency of serious, severe, or overall treatment-emergent adverse effects. The majority of treatment-emergent adverse effects was deemed unrelated to Ofirmev and nearly all cases were mild or moderate in severity. A small number of patients experienced hepatic treatment-emergent adverse effects which may have been related to the treatment, or which could have resulted from a reporting bias inherent in the open-label design of the clinical trial, and the possibility that clinical study staff may have been hypervigilant in checking for liver function test elevations. |

Published Clinical Trial Data Supporting Efficacy and Safety

We plan to also reference the following non-pivotal clinical trials from published medical literature in our re-submitted NDA for Ofirmev:

| • | Cattabriga, et al., a clinical trial in adults following cardiac surgery. This clinical trial evaluated the analgesic efficacy of repeated 1,000 mg doses of intravenous acetaminophen given every six hours over 72 hours as part of an adjunctive, multimodal treatment program with intravenous tramadol given to 113 patients as a continuous infusion to treat pain after open-heart surgery. At 12, 18, and 24 hours after the end of the surgery, patients who received intravenous acetaminophen plus tramadol had significantly less pain at rest than those who received placebo plus tramadol (p=0.0041, p=0.0039, and p=0.0044, respectively). The group of patients who received intravenous acetaminophen also required less cumulative morphine than the placebo group (48 mg versus 97 mg). |

| • | Atef, et al., a clinical trial in adults following elective tonsillectomy. This clinical trial evaluated the analgesic efficacy of repeated doses of intravenous acetaminophen in 76 adult patients undergoing tonsillectomy. Intravenous acetaminophen was significantly better than placebo on average pain at rest and on swallowing (p<0.001), and the frequency of insufficient pain relief, which was defined as a visual analog scale, or VAS, score of >30 mm at rest and >50 mm on swallowing (p<0.001). Significantly more patients in the intravenous acetaminophen group did not require any rescue opioid medication (71%) compared with the placebo group (0%), and total average consumption of the opioid meperedine over 24 hours was reduced by 77% (p<0.001). |

Post-Approval Commitments

As part of the approval process for Ofirmev, the FDA issued a formal written request under Section 505A of the U.S. Food, Drug and Cosmetic Act, requiring us to perform an additional pediatric clinical trial as a post-approval commitment. Following the approval of an NDA for Ofirmev, we plan to complete this pediatric clinical trial and, upon the acceptance by the FDA of the data from this study, we will be eligible for an additional six months of marketing exclusivity for Ofirmev. To date, the FDA has not communicated any other post-approval commitments to us.

11

Table of Contents

Commercialization Strategy

We are preparing to build a commercial organization in the U.S. focused on promoting Ofirmev to physicians, nurses and pharmacists principally in the hospital setting. We believe that we can achieve our strategic goals by deploying an experienced sales organization supported by an internal marketing infrastructure that targets institutions with the greatest use of pharmaceutical products. We will consider opportunities to partner Ofirmev, along with any other product candidates we may acquire in the future, to reach markets outside the U.S. or to expand our reach to other physician groups outside the hospital, where applicable.

The U.S. Hospital Market

Large, multinational pharmaceutical companies have generally decreased marketing efforts focused on hospital-use drugs, instead focusing on drugs that can be marketed in the larger outpatient setting. We believe this reduced emphasis on the hospital marketplace presents us with an excellent opportunity to market products that address unmet medical needs in the hospital setting. We believe the concentrated nature of the hospital marketplace will allow for our expansion into other therapeutic areas without substantial investment in additional commercial infrastructure.

According to IMS, in 2004 approximately $28 billion was spent on promotional activities by the pharmaceutical industry in the U.S. Of this amount, IMS estimates that only $1 billion was directed towards hospital-based physicians and directors of pharmacies. This hospital-focused spending represents approximately 3% of total promotional expenditures and has declined from approximately 6% of total spending in 1996. The significant imbalance towards the outpatient market is highlighted by spending on direct-to-consumer campaigns and drug sampling which now make up close to 80% of promotional spending for pharmaceuticals.

Despite these declining promotional expenditures, U.S. hospitals and clinics accounted for approximately $54 billion or 21% of U.S. pharmaceutical sales in 2005, according to IMS. Furthermore, we believe pharmaceutical sales to acute care hospitals are highly concentrated among a relatively small number of large institutions. For example, according to Wolters Kluwer Health, an independent marketing research firm, 1,800 of the approximately 5,000 acute care hospitals in the U.S. represent approximately 80% of hospital injectable analgesic sales. The concentration of high-prescribing institutions enables effective promotion of pharmaceuticals utilizing a relatively small, dedicated sales and marketing organization. We believe the relative lack of promotional efforts directed toward the highly concentrated hospital marketplace makes it an underserved and compelling opportunity, especially for a biopharmaceutical company commercializing its products directly through its own dedicated sales force.

We believe a typical sales representative focused on office-based physicians can generally promote only two to three products effectively; whereas, a typical hospital-focused sales representative can effectively promote five to six products. Furthermore, we believe a typical sales representative focused on office-based physicians can effectively reach five to seven physicians per day; whereas, a typical hospital-focused sales representative can reach many more physicians, nurses and pharmacy directors within a given institution. Notably, a hospital-focused sales representative also faces significantly less travel time between sales calls and less wait time in physician offices as a large number of prescribers can be found in a single location. Furthermore, drug sampling generally does not occur in hospitals, which represents a significant cost advantage versus marketing to office-based physicians. A single sales representative can promote products from multiple therapeutic categories to multiple prescribers within the institution.

Sales and Marketing

We are building a commercial organization in anticipation of the approval and launch of Ofirmev. To date, we have hired an experienced commercial management, marketing and sales operations team, and plan to hire a field sales force of approximately 150 fully-dedicated hospital sales specialists following approval of our NDA for Ofirmev.

12

Table of Contents

The primary target audience for Ofirmev will include anesthesiologists and surgeons. Other targets will include certified registered nurse anesthetists, emergency medicine physicians, intensivists, internists, obstetricians and other physicians throughout the hospital. Our commercial sales force will focus on reaching the top 1,800 U.S. hospitals, which we believe represent approximately 80% of the market opportunity for Ofirmev.

We believe that our sales force will be differentiated by its level of experience and background in the industry. Our sales management team has an average of 16 years of pharmaceutical industry experience, and an average of seven years of hospital sales management experience. We will require that our sales representatives complete a comprehensive training program focused on our product, therapeutic area, competitive products, sales techniques and compliance with applicable laws and regulations. This training program will include field-based learning to provide our representatives with a comprehensive understanding and perspective on the unmet medical needs in the management of pain and fever in adults and children and how Ofirmev, if approved, may address those needs.

Field-based regional business directors and district sales managers will provide oversight for our hospital sales specialists and direct our efforts to provide hospital customers with the information needed to obtain Ofirmev formulary adoption and utilization. Because our clinical studies of Ofirmev have been conducted across a wide range of surgical procedures, we believe that providing access to this data and the unique characteristics of Ofirmev will assist physicians in using Ofirmev safely and effectively. In addition to our hospital sales specialists, we will also implement a variety of marketing programs to educate customers, including direct-to-physician promotional materials, peer-to-peer educational programs, medical journal advertising, and participation in targeted medical convention programs.

Licensing Agreements

In March 2006, we in-licensed from BMS the patents and the exclusive development and commercialization rights to Ofirmev in the U.S. and Canada. BMS has sublicensed these rights to us under a license agreement with SCR Pharmatop S.A., or Pharmatop.

As consideration for the license, we paid a $25.0 million up-front fee and will be required to pay a $15.0 million fee within ten business days after approval of the product. In addition to the payment upon approval, we may be required to make future milestone payments totaling up to $25.0 million upon the achievement of various milestones related achievement of certain net sales levels of Ofirmev. We are also obligated to pay a royalty on net sales of the product. We have the right to grant sublicenses to our affiliates.

The term of the Ofirmev agreement generally extends on a country-by-country basis until the last licensed patent expires, which is expected to occur in 2022. Either party may terminate the Ofirmev agreement upon delivery of written notice if the other party commits a material breach of its obligations and fails to remedy the breach within a specified period or upon the occurrence of specified bankruptcy, reorganization, liquidation or receivership proceedings. In addition, BMS may terminate the Ofirmev agreement if we breach, in our capacity as a sublicensee, any provision of the agreement between BMS and Pharmatop. The Ofirmev agreement will automatically terminate in the event of a termination of the license agreement between BMS and Pharmatop. We may terminate the Ofirmev agreement at any time upon specified written notice to BMS after the occurrence of events of default that relate to our territory and would entitle BMS to terminate the Pharmatop license agreement. The events of default include Pharmatop’s inability to maintain specified claims under listed patents, the marketing by a third party of a parenterally-administered product containing acetaminophen, subject to certain conditions, or a successful third party action that deprives Pharmatop of its rights to specified patents. We may also terminate the Ofirmev agreement upon specified written notice after an uncured failure by Pharmatop to perform any of its material obligations under the Pharmatop license agreement with respect to our territory that would permit BMS to terminate the Pharmatop license agreement.

13

Table of Contents

Either BMS or Pharmatop may terminate the license agreement between them upon delivery of written notice after an uncured failure by the other party to perform any of its material obligations under the license agreement. BMS may generally terminate the agreement upon written notice to Pharmatop within a specified period so long as all payments due under the agreement to Pharmatop are current. Pharmatop may terminate the agreement upon specified written notice if BMS opposes any of the listed patent applications or challenges the validity or enforceability of any of the listed licensed patents. BMS is also entitled to terminate the Pharmatop agreement upon the occurrence of events of default that relate to the territory described above.

Intellectual Property

We are the exclusive licensee of two U.S. patents and two pending Canadian patent applications from Pharmatop, under BMS’s license to these patents from Pharmatop. U.S. Patent No. 6,028,222 (Canadian patent application 2,233,924) covers the formulation of Ofirmev and expires in August 2017. U.S. Patent No. 6,992,218 (Canadian patent application 2,415,403) covers the process used to manufacture Ofirmev and expires in June 2021.

Manufacturing and Distribution

In July 2007, we entered into a development and supply agreement with Baxter Healthcare Corporation, or Baxter, for the completion of pre-commercialization manufacturing development activities and the manufacture of commercial supplies of Ofirmev. Pursuant to the terms of the agreement with Baxter, Baxter will receive development fees from us upon the completion of specified development activities, which we are expensing as incurred. In addition, Baxter will receive a set manufacturing fee based on the amount of the finished Ofirmev drug product produced, which prices may be adjusted by Baxter, subject to specified limitations. We are also obligated to purchase a minimum number of units each year throughout the five-year term of the agreement, or pay Baxter an amount equal to the per-unit purchase price multiplied by the amount of the shortfall. Further, we are obligated to reimburse Baxter for all reasonable costs directly related to work performed by Baxter in support of any change in the active pharmaceutical ingredient, or API, source or API manufacturing process.

On February 10, 2010, we received a complete response letter from the FDA, which stated that the NDA could not be approved in its present form due to deficiencies with respect to good manufacturing practices observed during the agency’s inspection of Baxter’s facilities used to manufacture Ofirmev, which was completed on February 5, 2010. In the complete response letter, the FDA did not indicate that any additional clinical trials were required in order to approve the NDA for Ofirmev and did not cite any safety or efficacy deficiencies. On February 18, 2010, Baxter submitted a response letter concerning the good manufacturing practice observations to the FDA. As soon as the inspectional observations are resolved, we plan to re-submit the NDA for Ofirmev.

We plan to distribute Ofirmev primarily to drug wholesalers, who in turn will distribute the product to hospital pharmacies and other institutional customers. We have retained third-party service providers to perform a variety of functions related to the distribution of Ofirmev, including warehousing, customer service, order-taking, invoicing, collections, shipment and returns processing. We are also planning to enter into agreements with wholesalers, under which we will receive certain distribution management services and data reporting in exchange for a fee.

Competition

The pharmaceutical industry is subject to intense competition and characterized by extensive research efforts and rapid technological progress. Competition in our industry occurs on a variety of fronts, including developing and bringing new products to market before others, developing new technologies to improve existing products, developing new products to provide the same benefits as existing products at lower cost and developing new products to provide benefits superior to those of existing products. There are many companies, including

14

Table of Contents

generic manufacturers as well as large pharmaceutical companies, that have significantly greater financial and other resources than we do, as well as academic and other research institutions that are engaged in research and development efforts for the indications targeted by our product.

A variety of competitive products from two main drug classes, opioids and NSAIDs, are currently available in the market for treatment of pain and fever in hospitalized patients, including:

Injectable opioids

| • | morphine, the leading product for the treatment of acute post-operative pain, a generic version of which is available from several manufacturers; |

| • | DepoDur, an extended release injectable (epidural) formulation of morphine; and |

| • | other injectable opioids, including fentanyl, meperidine and hydromorphone, each of which is available generically from several manufacturers. |

Injectable NSAIDs

| • | Toradol (ketorolac tromethamine), an injectable NSAID, a generic version of which is available from several manufacturers; and |

| • | Caldolor (ibuprofen), another injectable NSAID. |

Product Candidates

We are also aware of a number of product candidates in development to treat acute pain, including injectable NSAIDs, novel opioids, new formulations of currently available opioids, long-acting local anesthetics and new chemical entities as well as alternative delivery forms of various opioids, COX2 inhibitors, and NSAIDs. A variety of pharmaceutical and biotechnology companies are developing these new product candidates, including but not limited to Acusphere, Inc., Anesiva, Inc., Cara Therapeutics, Inc., Cephalon, Inc., Durect Corporation, Javelin Pharmaceuticals, Inc., NeurogesX, Inc., Pacira Pharmaceuticals, Inc., Paion AG, St. Charles Pharmaceuticals, Inc., and TheraQuest Biosciences, LLC.

Government Regulation

Governmental authorities in the U.S. and other countries extensively regulate the testing, manufacturing, labeling, storage, record-keeping, advertising, promotion, export, marketing and distribution, among other things, of pharmaceutical products. In the U.S., the FDA, under the Federal Food, Drug and Cosmetic Act and other federal statutes and regulations, subjects pharmaceutical products to rigorous review. If we do not comply with applicable requirements, we may be fined, the government may refuse to approve our marketing applications or allow us to manufacture or market our products, and we may be criminally prosecuted.

We and our manufacturers and clinical research organizations may also be subject to regulations under other federal, state and local laws, including the Occupational Safety and Health Act, the Environmental Protection Act, the Clean Air Act and import, export and customs regulations as well as the laws and regulations, of other countries.

FDA Approval Process

To obtain approval of a new product from the FDA, we must, among other requirements, submit data supporting safety and efficacy as well as detailed information on the manufacture and composition of the product and proposed labeling. The testing and collection of data and the preparation of necessary applications are

15

Table of Contents

expensive and time-consuming. The FDA may not act quickly or favorably in reviewing these applications, and we may encounter significant difficulties or costs in our efforts to obtain FDA approvals that could delay or preclude us from marketing our products.

The process required by the FDA before a new drug may be marketed in the U.S. generally involves the following: completion of preclinical laboratory and animal testing in compliance with FDA regulations, submission of an investigational new drug application, or IND, which must become effective before human clinical trials may begin, performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the proposed drug for its intended use, and submission and approval of an NDA by the FDA. The sponsor typically conducts human clinical trials in three sequential phases, but the phases may overlap. In Phase I clinical trials, the product is tested in a small number of patients or healthy volunteers, primarily for safety at one or more dosages. In Phase II clinical trials, in addition to safety, the sponsor evaluates the efficacy of the product on targeted indications, and identifies possible adverse effects and safety risks in a patient population. Phase III clinical trials typically involve testing for safety and clinical efficacy in an expanded population at geographically-dispersed test sites.

Clinical trials must be conducted in accordance with the FDA’s good clinical practices requirements. The FDA may order the partial, temporary or permanent discontinuation of a clinical trial at any time or impose other sanctions if it believes that the clinical trial is not being conducted in accordance with FDA requirements or presents an unacceptable risk to the clinical trial patients. The institutional review board, or IRB, generally must approve the clinical trial design and patient informed consent at each clinical site and may also require the clinical trial at that site to be halted, either temporarily or permanently, for failure to comply with the IRB’s requirements, or may impose other conditions.

The applicant must submit to the FDA the results of the preclinical and clinical trials, together with, among other things, detailed information on the manufacture and composition of the product and proposed labeling, in the form of an NDA, including payment of a user fee. The FDA reviews all NDAs submitted before it accepts them for filing and may request additional information rather than accepting an NDA for filing. Once the submission is accepted for filing, the FDA begins an in-depth review of the NDA. Under the policies agreed to by the FDA under PDUFA, the FDA has 10 months in which to complete its initial review of a standard NDA and respond to the applicant. The review process and the PDUFA goal date may be extended by three months if the FDA requests or the NDA sponsor otherwise provides additional information or clarification regarding information already provided in the submission within the last three months of the PDUFA goal date. If the FDA’s evaluations of the NDA and the clinical and manufacturing procedures and facilities are favorable, the FDA may issue either an approval letter or an approvable letter, which contains the conditions that must be met in order to secure final approval of the NDA. If and when those conditions have been met to the FDA’s satisfaction, the FDA will issue an approval letter, authorizing commercial marketing of the drug for certain indications. If the FDA’s evaluation of the NDA submission and the clinical and manufacturing procedures and facilities is not favorable, the FDA may refuse to approve the NDA and issue a complete response letter.

Section 505(b)(2) New Drug Applications

As an alternate path to FDA approval for new indications or improved formulations of previously-approved products, a company may file a Section 505(b)(2) NDA, instead of a “stand-alone” or “full” NDA. Section 505(b)(2) of the Federal Food, Drug and Cosmetic Act was enacted as part of the Drug Price Competition and Patent Term Restoration Act of 1984, otherwise known as the Hatch-Waxman Amendments. Section 505(b)(2) permits the submission of an NDA where at least some of the information required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of reference. For example, the Hatch-Waxman Amendments permit the applicant to rely upon the FDA’s findings of safety and effectiveness for an approved product. The FDA may also require companies to perform additional studies or measurements to support the change from the approved product. The FDA may then approve the new formulation for all or some of the label indications for which the referenced product has been approved, or the new indication sought by the Section 505(b)(2) applicant.

16

Table of Contents

To the extent that the Section 505(b)(2) applicant is relying on the FDA’s findings for an already-approved product, the applicant is required to certify to the FDA concerning any patents listed for the approved product in the FDA’s Orange Book publication. Specifically, the applicant must certify that: (1) the required patent information has not been filed; (2) the listed patent has expired; (3) the listed patent has not expired, but will expire on a particular date and approval is sought after patent expiration; or (4) the listed patent is invalid or will not be infringed by the manufacture, use or sale of the new product. A certification that the new product will not infringe the already approved product’s Orange Book-listed patents or that such patents are invalid is called a paragraph IV certification. If the applicant does not challenge the listed patents, the Section 505(b)(2) application will not be approved until all the listed patents claiming the referenced product have expired. The Section 505(b)(2) application may also not be approved until any non-patent exclusivity, such as exclusivity for obtaining approval of a new chemical entity, listed in the Orange Book for the referenced product has expired.

If the applicant has provided a paragraph IV certification to the FDA, the applicant must also send notice of the paragraph IV certification to the NDA and patent holders once the NDA has been accepted for filing by the FDA. The NDA and patent holders may then initiate a legal challenge to the paragraph IV certification. The filing of a patent infringement lawsuit within 45 days of their receipt of a paragraph IV certification automatically prevents the FDA from approving the Section 505(b)(2) NDA until the earliest of 30 months, expiration of the patent, settlement of the lawsuit or a decision in the infringement case that is favorable to the Section 505(b)(2) applicant. For drugs with five-year exclusivity, if an action for patent infringement is initiated after year four of that exclusivity period, then the 30-month stay period is extended by such amount of time so that 7.5 years has elapsed since the approval of the NDA with five-year exclusivity. This period could be extended by six months if the NDA sponsor obtains pediatric exclusivity. Thus, the Section 505(b)(2) applicant may invest a significant amount of time and expense in the development of its products only to be subject to significant delay and patent litigation before its products may be commercialized. Alternatively, if the listed patent holder does not file a patent infringement lawsuit within the required 45-day period, the applicant’s NDA will not be subject to the 30-month stay.

Notwithstanding the approval of many products by the FDA pursuant to Section 505(b)(2), over the last few years, certain brand-name pharmaceutical companies and others have objected to the FDA’s interpretation of Section 505(b)(2) and one pharmaceutical company has sued the FDA on the matter. Although the issues in that litigation are specific to the products involved, if the FDA does not prevail, it may be required to change its interpretation of Section 505(b)(2), which could delay or even prevent the FDA from approving any Section 505(b)(2) NDA that we submit.

Fast Track Designation

A drug designated as a fast track product by the FDA must be intended for the treatment of a serious or life-threatening condition and demonstrate the potential to address unmet medical needs for the condition. Fast track designation does not apply to a product alone, but applies to a combination of the product and specific indication for which it is being studied. A sponsor may submit a request for fast track designation at the time of original submission of its IND, or at any time thereafter prior to receiving marketing approval of its NDA. Fast track status enables the sponsor to have more frequent and timely communication and meetings with the FDA regarding the product development plans. Fast track status may also result in eligibility for NDA priority review, under which the PDUFA review goal for the NDA is six months rather than ten months.

The Hatch-Waxman Act

Under the Hatch-Waxman Act, newly-approved drugs and indications benefit from a statutory period of non-patent marketing exclusivity. The Hatch-Waxman Act provides five-year marketing exclusivity to the first applicant to gain approval of an NDA for a new chemical entity, meaning that the FDA has not previously approved any other new drug containing the same active moiety. Hatch-Waxman prohibits the submission of an abbreviated new drug application, or ANDA, or a Section 505(b)(2) NDA for another version of such drug

17

Table of Contents