Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

[X] |

ANNUAL REPORT UNDER TO SECTION 13 OR 15(d) OF THE SECURITIES |

|

|

EXCHANGE ACT OF 1934

|

|

|

For the fiscal year ended July 31, 2013 |

|

|

|

|

|

or |

|

|

|

|

[ ] |

TRANSITIOINAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

|

|

EXCHANGE ACT OF 1934 |

|

|

For the transitional period from _____________ to ______________ |

Commission file number 333-169503

SANTO MINING CORP.

(Exact name of registrant as specified in its charter)

|

NEVADA |

|

27-0518586 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

Ave. Sarasota #20, Torre Empresarial, Suite 1103

Santo Domingo, Dominican Republic

(Address of principal executive offices) including zip code)

Registrant’s telephone number, including area code: 1-809-535-9443

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Class |

Name of exchange in which registered |

|

None |

None |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

Yes [ ] No [X]

Indicate by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 day. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes[X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 if the Exchange Act.

|

Large Accelerated filer |

|

[ ] |

|

Accelerated filer |

|

[ ] |

|

Non-accelerated filer |

|

[ ] |

|

Smaller reporting company |

|

[X] |

|

(Do not check if a smaller reporting company) |

|

|

|

| ||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, January 31, 2013 was $6,026,628.20.

As of November 12, 2013, the registrant had 70,133,141 shares issued and outstanding.

2

|

TABLE OF CONTENTS | ||||

|

| ||||

|

|

|

|

|

Page |

|

|

|

|

|

|

|

| ||||

|

|

|

PART I |

|

|

|

Item 1. |

|

|

| |

|

Item 1A. |

|

|

| |

|

Item 1B. |

|

|

| |

|

Item 2. |

|

|

| |

|

Item 3. |

|

|

| |

|

Item 4. |

|

|

| |

|

| ||||

|

|

|

PART II |

|

|

|

Item 5. |

|

Market for the Registrant’s Common Equity, Related Stockholders Matters. |

|

|

|

Item 6. |

|

|

| |

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of |

|

|

|

Item 7A. |

|

|

| |

|

Item 8. |

|

|

| |

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial |

|

|

|

Item 9A. |

|

|

| |

|

Item 9B. |

|

|

| |

|

| ||||

|

|

|

PART III |

|

|

|

Item 10. |

|

|

| |

|

Item 11. |

|

|

| |

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

|

|

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence. |

|

|

|

Item 14. |

|

|

| |

|

| ||||

|

|

|

PART IV |

|

|

|

Item 15. |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

3

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking statements may include words such as “anticipate,” “believe,” “estimate,” “intend,” “could,” “should,” “would,” “may,” “seek,” “plan,” “might,” “will,” “expect,” “anticipate,” “predict,” “project,” “forecast,” “potential,” “continue” negatives thereof or similar expressions. Forward-looking statements speak only as of the date they are made, are based on various underlying assumptions and current expectations about the future and are not guarantees. Such statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievement to be materially different from the results of operations or plans expressed or implied by such forward-looking statements.

We cannot predict all of the risks and uncertainties. Accordingly, such information should not be regarded as representations that the results or conditions described in such statements or that our objectives and plans will be achieved and we do not assume any responsibility for the accuracy or completeness of any of these forward-looking statements. These forward-looking statements are found at various places throughout this Annual Report on Form 10-K and include information concerning possible or assumed future results of our operations, including statements about potential acquisition or merger targets; business strategies; future cash flows; financing plans; plans and objectives of management; any other statements regarding future acquisitions, future cash needs, future operations, business plans and future financial results, and any other statements that are not historical facts.

These forward-looking statements represent our intentions, plans, expectations, assumptions and beliefs about future events and are subject to risks, uncertainties and other factors. Many of those factors are outside of our control and could cause actual results to differ materially from the results expressed or implied by those forward-looking statements. In light of these risks, uncertainties and assumptions, the events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of the Annual Report on Form 10-K. All subsequent written and oral forward-looking statements concerning other matters addressed in this Annual Report on Form 10-K and attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this Annual Report on Form 10-K.

Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, a change in events, conditions, circumstances or assumptions underlying such statements, or otherwise.

CERTAIN TERMS USED IN THIS REPORT

When this report uses the words “we,” “us,” “our,” and the “Company,” they refer to Santo Mining Corp. and its consolidated subsidiaries. “SEC” refers to the Securities and Exchange Commission. The words “Property” or “Claim” refer to a “concession application” which according to the Dominican Mining Law grants the holder with certain preferential rights including future exclusive rights to prospect, explore and exploit metallic minerals within its designated boundaries.

4

PART I

Santo Mining Corp. is a company which acquires various metallic exploration concession applications in the Dominican Republic for the purpose of exploration and extraction. We target near-term production opportunities in the Dominican Republic. Our vision is to define deposits and extract metals from both alluvial deposits that require minimal processing and bulk-tonnage, open-pit oxide and sulfide gold deposits where poly-metallic ores with economic concentrations of precious and base metals may be extracted and transported to local or offshore processing plants and refineries.

The Company plans to combine rapid exploration methodology with innovative operational and logistical approaches to ensure the efficient and effective extraction of gold and other metals in the future. It has use of a self-contained modular office facility which is currently parked in Santo Domingo and moved around the concessions as and when needed. As the properties are more or less in three clusters, we found this to be the most practical solution. The Company itself owns no vehicles which are provided to us by our CEO to tow Company owned enclosed cargo trailer to transport and park where we are conducting exploration operations. The exploration crew rents a local house or sleep in more remote areas sleep in acamp tents. Local porters, cooks and pack animals are hired on a daily basis. Helicopters are occasionally rented on an as needed basis. The Company has a pre-treatment laboratory consisting of electric kilns, chlorine gas generator, and chlorine gas reactor, leased rock crushing and grinding mills. The Company has identified two used Hydracore 2000 drill rigs which are man portable and ideally suited for our near-term exploration activities.

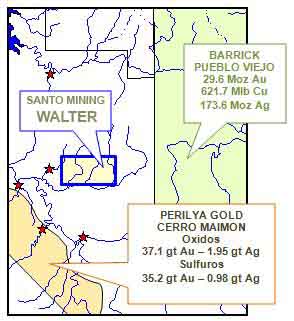

This swift mobilization and on-site sampling analysis capability was developed to drive growth and value in the near and long terms. Our Claims are 100% owned, and lie in the core of the mineral rich Hispaniola Gold-Copper Back-Arc.

History

We were incorporated in the State of Nevada on July 8, 2009. From our inception, we were engaged in the operation of a website portal, www.drdentalspa.com, andwww.drdientesblancos.com where both dentists and patients could access dental information, as well as operating a teeth whitening business. Recently, our management decided to redirect our business focus towards identifying and pursuing options regarding the acquisition of mineral exploration property with the focus on gold and other precious metals. Our new operational website is www.santomining.com.

From July 8, 2009 through to the date of the acquisition of our first Claim we were a designated shell company with minimal operations. As described below, on July 30, 2012, we entered into an acquisition agreement and began operations and ceased to be a shell.

On July 30, 2012, (the “Acquisition Closing Date”), we entered into a mineral property acquisition agreement (the “Acquisition Agreement”), with Gexplo, SRL (the “Vendor”) and Rosa Habeila Feliz Ruiz, an officer and director of the Company, whereby the Company agreed to acquire from the Vendor an undivided one hundred percent (100%) interest in and to a Claim known as Alexia (the “Alexia Claim”), which is located in the province of Dajabon, in the municipalities of Dajabon and Partido, specifically in the sections Chaucey, La Gorra and Partido Arriba, covering Los Indios, Pueblo Nuevo, Hatico Viejo, El Junco, La Gallina, Tahuique and Charo located in the Dajabon 5874-I (11) and Loma de Cabrera 5874-II (19) topographical sheets, complying with the terms of mining law No. 146 and its regulations, as described in the Acquisition Agreement, or the Acquisition. The Vendor is owned by Alain French, our President, Chief Executive Officer, Secretary, Treasurer and Director.

Pursuant to the terms of the Acquisition Agreement, in consideration of an undivided 100% interest in and to the Alexia Claim, the Vendor received 6,456,600 shares of the Company’s common stock transferred from Ms. Ruiz and the cancellation of the promissory note for $59,770 from the Company to the Vendor dated May 31, 2012. The loan was cancelled by the Company as consideration in the Acquisition Agreement, on July 30, 2012.

5

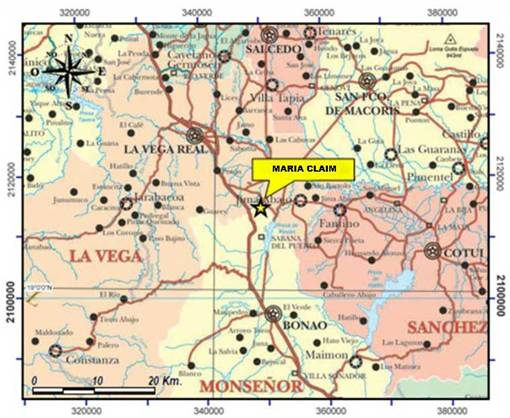

On September 17, 2012, the Company exercised its right of first refusal to purchase two additional metallic exploration concession applications, Walter (the “Walter Claim”), and Maria (the “Maria Claim”), from the Vendor pursuant to the “Acquisition Agreement”. In exchange for the Walter Claim and the Maria Claim, Rosa Habeila Feliz Ruiz, the Secretary of the Company, transferred 13,181,460 of her shares of the Company’s common stock to the Vendor.

On October 12, 2012, the Company amended the Acquisition Agreement (the “Acquisition Amendment”), with the Vendor and Rosa Habeila Feliz Ruiz, an officer and director of the Company. Pursuant to the Acquisition Amendment, the Company would no longer have right of first refusal to purchase the Shalee and Daniel Claims and instead would have right of first refusal to purchase the Henry, Francesca, Eliza, and Nathaniel Claims.

On October 12, 2012, the Company exercised its right of first refusal to purchase four additional mineral properties, Henry (the “Henry Claim”), Francesca (the “Francesca Claim”), Kato (f/k/a Eliza) (the “Kato Claim”), and Nathaniel (the “Nathaniel Claim”), from the Vendor pursuant to the Acquisition Agreement. In exchange for the Claims, Rosa Habeila Feliz Ruiz transferred 12,644,943 of her shares of the Company’s common stock to the Vendor.

On March 13, 2013, the Company entered into a definitive long-term license agreement (the “License Agreement”) with Campania Minera Los Angeles Del Desierto CA De CV, a Mexican company (the “Concessionaire”), to develop and mine three metallic concessions (the “Concessions”) located in Ocampo, Coahuila in Mexico owned by the Concessionaire. Pursuant to the License Agreement, the Concessionaire will receive 40% of any royalty from the Concessions, and the remaining 60% will be retained by the Company. The Company is also required to make payments totaling $210,000 (the “Initial Payment”) within a year of signing the License Agreement as well as issue 1,000,000 shares of the Company’s common stock to the Concessionaire by June 14, 2013. $100,000 of the Initial Payment will be advanced towards the royalty fee.

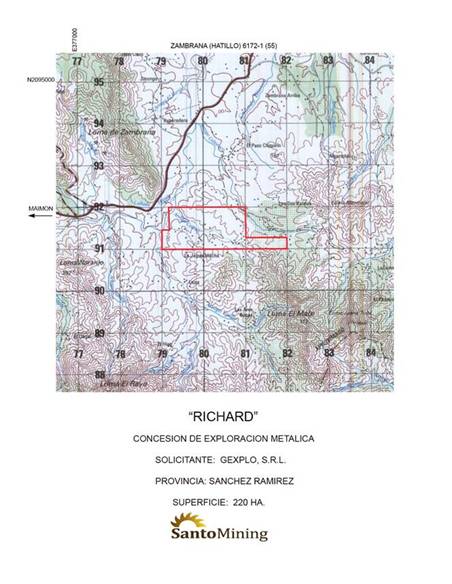

On March 25, 2013, the Company entered into a Mining Property Acquisition Agreement (the “Richard Acquisition Agreement”) with the Vendor pursuant to which the Company acquired an undivided one hundred percent (100%) interest in and to a mineral exploration concession application consisting of 220 hectares. in the Dominican Republic known as Richard (the “Richard Claim”) (the “Richard Acquisition”). In consideration for the Richard Acquisition, the Vendor will receive a payment of $10,000 and 1,000,000 shares of the Company’s common stock.

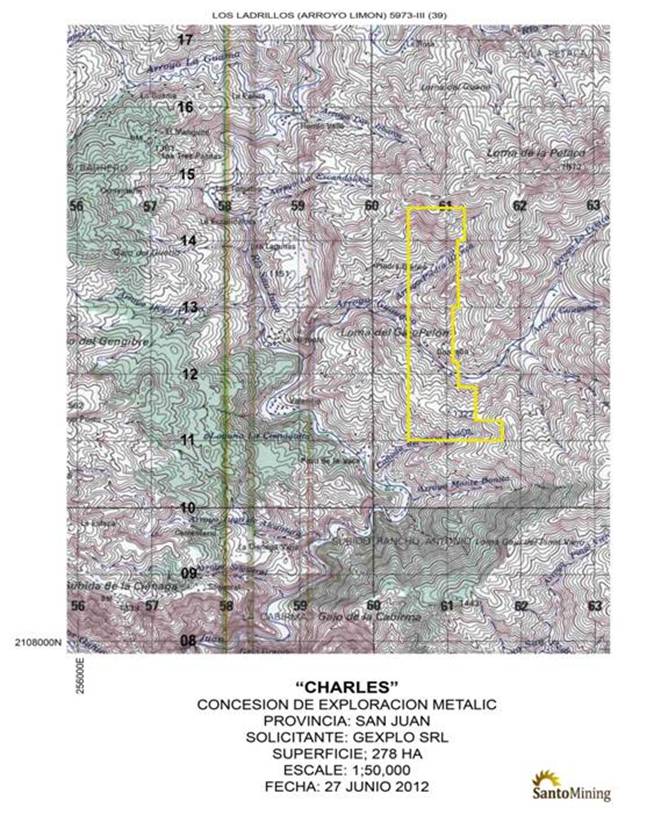

On April 3, 2013, the Company entered into a Mineral Property Acquisition Agreement (the “Charles Acquisition Agreement”) with the Vendor, pursuant to which the Company acquired from the Vendor an undivided one hundred percent (100%) interest in and to a mineral exploration concession application consisting of 278 hectares located in the Dominican Republic known as Charles (the “Charles Claim”) (the “Charles Acquisition”). In consideration for the Charles Acquisition, the Vendor will receive a $10,000 upon closing, a second payment of $50,000 within 90 days, and 1,500,000 shares of the Company’s common stock.

Asher Financing

On April 22, 2013, the Company closed a Securities Purchase Agreement, dated April 16, 2013 with Asher Enterprises, Inc. (“Asher”), pursuant to which Asher purchased, and the Company issued, a convertible promissory note dated April 16, 2013 as of the same date in the principal amount of $53,000 (the “First Asher Note”) with a maturity date of January 22, 2014. The interest rate of the Asher Note is 8% per annum through the maturity date.

On July 1, 2013, the Company closed a Second Securities Purchase Agreement (the “Second Asher Agreement”), pursuant to which Asher purchased, and the Company issued, a convertible promissory note with a principal amount of $32,500 (the “Second Asher Note”) with a maturity date of April 3, 2014. The interest rate of the Asher Note is 8% per annum through the maturity date.

On October 23, 2013, the Company closed a Third Securities Purchase Agreement (the “Third Asher Agreement”),, pursuant to which Asher purchased, and the Company issued, a convertible promissory note with a principal amount of $32,500 (the “Third Asher Note”) with a maturity date of January 25, 2014. The interest rate of the Asher Note is 8% per annum through the maturity date.

6

JMJ Financing

On June 12, 2013, the Company issued to JMJ Financial (“JMJ”), a convertible promissory note as of the same date in the principal amount of $335,000 (the “JMJ Note”), with a maturity date of June 11, 2012, for total consideration of $300,000 (the “Note Consideration”). The interest rate of the JMJ is 0% if repaid within the first 90 days, and shall increase to 12% after 90 days. Upon the closing on June 12, 2013, JMJ paid to the Company consideration in the amount of $60,000.

On September 25, 2013, JMJ paid the Company additional $25,000.

Equity Enhancement Program with Hanover

On June 20, 2013, Company entered into a common stock purchase agreement with Hanover Holdings I LLC (the “Purchase Agreement”). The Purchase Agreement provided that, upon the terms and subject to the conditions set forth therein, Hanover is committed to purchase up to $16,000,000 (the “Total Commitment”), worth of the Company’s common stock, over the 36-month term of the Purchase Agreement. Pursuant to the Purchase Agreement, the Company issued 1,690,484 shares of Common Stock to Hanover as initial commitment shares.

In connection with the execution of the Purchase Agreement, on the Closing Date, the Company and Hanover also entered into a registration rights agreement dated June 20, 2013 (the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, the Company agreed to have an initial registration statement declared effective within a certain time frame. If the initial registration statement was not declared effective by the effectiveness deadline, the Company was required to issue to Hanover additional shares of the Company’s Common Stock equal to the quotient obtained by dividing (a) $83,750 by (b) the arithmetic average of the VWAPs over the 10 trading day period immediately preceding the effectiveness deadline, rounded up to the nearest whole share. The mechanics triggering the issuance of those securities were fully negotiated and set forth in the Purchase Agreement. On the date of the trigger, the Company was required to issue 1,072,343 (based on the calculation described in the Purchase Agreement) to Hanover.

On August 14, 2013, the Company and Hanover executed an addendum (the “Addendum”) to the Purchase Agreement, pursuant to which Hanover would receive 536,172 of the shares on August 14, 2013 and 536,171 of the shares if the registration statement was not deemed effective within 30 calendar days. The Company issued 536,172 additional commitment shares to Hanover on August 14, 2013. As of the date of this Annual Report, the Registration Statement has not been declared effective. The remaining 536,171 shares have not been issued yet.

IBC Funds Settlement Agreement

On October 2, 2013, the Company entered into an Amended Settlement and Agreement and Release (the “Settlement Agreement”) with IBC Funds, LLC, a Nevada limited liability company (“IBC”) pursuant to which the Company agreed to issue common stock to IBC in exchange for the settlement of $123,028 (the “Settlement Amount”) of past-due accounts payable of the Company.

Pursuant to the terms of the Settlement Agreement approved by the Order, on October 3, 2013, the Company agreed to issue to IBC shares (the “Settlement Shares”) of the Company’s Common Stock in exchange for the Settlement Amount. The Settlement Agreement provides that the Settlement Shares will be issued in one or more tranches, as necessary, sufficient to satisfy the Settlement Amount through the issuance of freely trading securities issued pursuant to Section 3(a)(10) of the Securities Act. Pursuant to the Settlement Agreement, IBC may deliver a request to the Company which states the dollar amount (designated in U.S. Dollars) of Common Stock to be issued to IBC (the “Share Request”). The parties agree that the total amount of Common Stock to be delivered by the Company to satisfy the Share Request shall be issued at a forty-five percent (45%) discount to lowest price based upon the average of the volume weighted average price of the Common Stock over the ten (10) trading day period preceding the Share Request. Additional tranche requests shall be made as requested by IBC until the Settlement Amount is paid in full so long as the number of shares requested does not make IBC the owner of more than 4.99% of the outstanding shares of Common Stock at any given time.

On October 11, 2013, the Circuit Court of the Twelfth Judicial Circuit for Sarasota County, Florida (the “Court”), entered an order (the “Order”) approving, among other things, the fairness of the terms and conditions of an exchange pursuant to Section 3(a)(10) of the Securities Act of 1933, as amended (the “Securities Act”), in accordance with a stipulation of settlement, pursuant to the Settlement Agreement between the Company and IBC, in the matter entitled IBC Funds, LLC v. Santo Mining Corp. (the “Action”). IBC commenced the Action against the Company to recover an aggregate of $123,028 of past-due accounts payable of the Company (the “Claim”), which IBC had purchased from certain vendors of the Company pursuant to the terms of separate receivable purchase agreements between IBC and each of such vendors (the “Assigned Accounts”). The Assigned Accounts relate to certain legal, accounting, and financial services provided to the Company. The Order provides for the full and final settlement of the Claim and the Action. The Settlement Agreement became effective and binding upon the Company and IBC upon execution of the Order by the Court on October 11, 2013.

7

Business Strategy

The Company’s business strategies are as follows:

· Concentrating its exploration and mining efforts in regions that have favorable commercial and fiscal terms.

· Stable locations that provide extensive existing infrastructure.

· Regions that have an experienced and trained workforce.

· Santo Mining Corp. will use new technical advances in exploration.

· These exploration techniques will help Santo Mining Corp. identify structures and formations previously unidentified using older techniques.

· Focus on identifying further major gold deposits.

· Target bulk tonnage, open pit oxide and sulphide gold deposits.

· Fully committed to a “Fast Track” production taking advantage of gold's unprecedented prices.

Strategy

Santo Mining Corp. looks at creating shareholder value by:

1. Investing in our Claims to identify and to discover and delineate economic gold resources

2. Advancing promising gold deposits through to engineering and feasibility stage and partnering with leading mining companies and end user companies to finance and manage operations. For more details on the time frame and costs relating to the feasibility study, please refer to the description of El Angel Del Desierto under the “Item 2. Properties.”

3. Searching for accretive merger and acquisition projects

Strategic Goals for 2013-2104

· Test new target areas with the objective of outlining new gold resources

· Start drilling to test new surface discoveries and expand any found deposits

· Conduct additional metallurgical testing and mineralogy balance and deportment

· Design process to concentrate gold and silver ore in Mexico project

· Set-up pilot gold and silver concentrating plant at Mexico project

· Install full size concentrating gold and silver processing plant at Mexico project

· Examine M&A and regional consolidation opportunities

· Plan to move from OTC to NASADQ or other stock exchange

Competitive Strengths

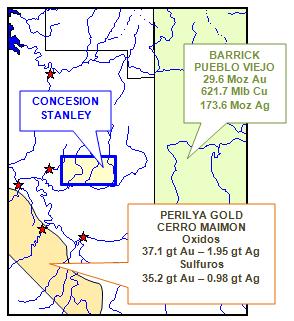

· The Company is located in The Dominican Republic which is experiencing an gold mining rush. During the last three years it is estimated total investment in the mining sector is between $4-5 Billion. New exploration around Spanish Colonial metal workings and some Greenfield locations resulted in a proliferation of near-term gold production opportunities.

· The Company has Claims in the mineral rich Hispaniola Gold-Copper Back-Arc, rising to 10,000 feet, cuts a diagonal swath across the island where Taino Indians collected gold nuggets from the river and later Columbus was first to systematically extract gold. Today the island is peppered with historical gold, silver and copper works. Some of these former sites have been explored and resulted in major discoveries; while others have yet to be investigated.

· There have been some major and significant mineral discoveries in the Dominican Republic.

8

· The Dominican Republic is a democratic country with similar political structure to USA. Santo Domingo is a modern bustling city with all the amenities and technologies of its US counterparts. Following recent presidential elections, the new republican president installed his cousin Mr. Alexander Medina (Former Falconbridge executive) as the new Director of the Mining Management Office and Mr. Lisandro Lembert as Vice-Minister of Mines and Energy. Both appointments have been received well by the mining sector and both are making significant improvements to their respective agencies.

· The Company has precious and base metal Claims in the heart of the mineral rich geology, an agile exploration team with many years of local experience, a pipeline of highly prospective Claims, close ties with many community leaders, and field efforts supported by seasoned financial consultants.

· Our officers and directors include experienced and respected executives with experience in the junior mining industry.

· The Company has been financed to get it through its first stage of development.

Sources of Available Land for Mining and Exploration

Much of the desirable land for mining and exploration in the Dominican Republic has been claimed by international mining companies.

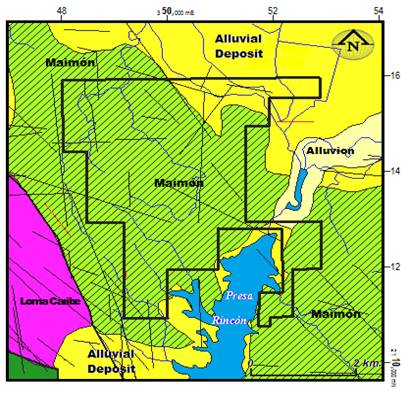

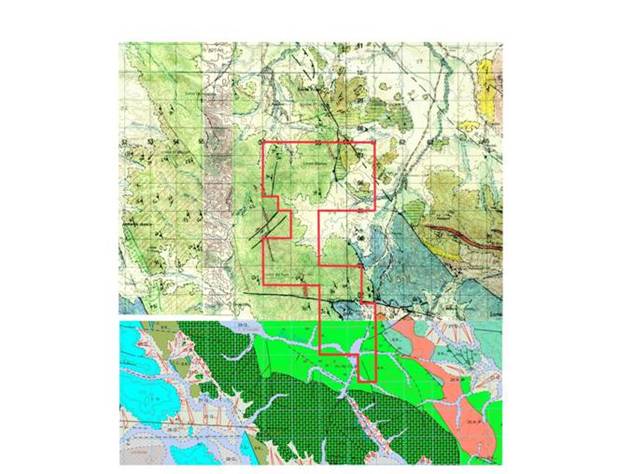

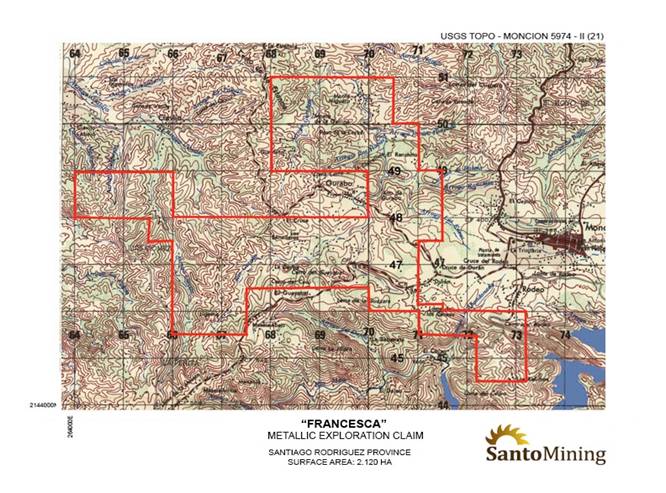

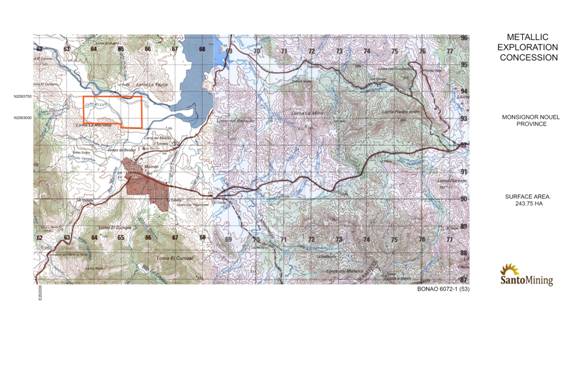

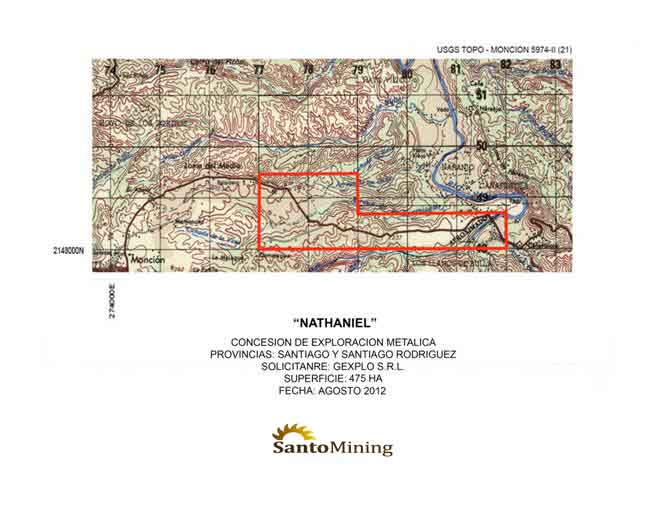

The Alexia Claim totals 2,775 mining hectares. The Walter Claim totals 200 mining hectare. The Maria Claim totals 1,486 mining hectares. The Henry Claim totals 1,900 mining hectares. The Francesca Claim totals 2,120 mining hectares. The Eliza Claim totals 243.75 mining hectares. The Nathaniel Claim totals 475 mining hectares. The Richard Claim has 200 mining hectares. The Charles Claim has 278 mining hectares.

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration. This competition could adversely impact on our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral property.

Government Regulation

We are committed to complying with and are, to our knowledge, in compliance with, all governmental and environmental regulations applicable to our Company and our property. Permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. We cannot predict the extent to which these requirements will affect our company or our property if we identify the existence of minerals in commercially exploitable quantities. In addition, future legislation and regulation could cause additional expense, capital expenditure, restrictions and delays in the exploration of our property.

As per information obtained from the Central Bank of the Dominican Republic and the General Director of Mining, mining activities in the Dominican Republic focus mainly on mining of ferronickel and gold. The Dominican Republic has a very active mineral exploration sector, with the mining of minerals, both metallic and non-metallic, being an important aspect of the economy. The dominant producers are Perilya Gold and Falcondo Xstrata Nickel, which mine deposits in central Dominican Republic as well as Barrick Gold’s scheduled production of gold at the Pueblo Viejo mine in the Cotui area. The government sees the mining industry as representing one of the main sources for socio-economic development of the Dominican Republic. Government policy concerning the mining industry is geared towards the protection of the environment and the integration of affected communities to the mining projects. The major mining opportunities in the Dominican Republic are found in ferronickel, marble, salt and plaster, construction aggregates (such as limestone), gold and silver. According to a speech in February 2012 by President Leonel Fernandez the Dominican Republic’s economy expanded 4.5 percent in 2011 behind “astronomical growth” in the mining sector and further growth is expected in 2012 due to continued extraction expansion and of nickel at the Xstrata Plc Falcondo mine and the beginning of gold production this year at the Pueblo Viejo mine by the Barrick Gold Corp.

9

The legal framework that governs mining operations in the Dominican Republic is comprised of the following legal provisions: the Constitution of the Dominican Republic, and the various laws of the mining operations of the Dominican Republic, herein referred to as the “Law”; Law No. 146 of 1971, also known as the Dominican Mining Law, and its regulation for enforcement; and presidential decrees (Decree No. 613-00, regarding the creation of the National Council for Mining Development; Decree No. 839-00 dated 26 September 2000, regarding the declaration of mining as an activity of the highest priority of the Dominican state, thereby instructing the Corporate Mining Authority to enter into certain agreements regarding the development of certain mining sectors of the country; and Decree No. 947-01 dated 19 September 2001, regarding the creation of Industrial mining parks for whom the tax incentives of the Dominican Industrial Free Zone Law No. 8-90 are extended to). Law No. 123-71, along with its regulation of enforcement, also regulates certain mining activities, namely the extraction of sand, gravel, chippings, rocks and similar materials.

As in most nations, the Constitution of the Dominican Republic is the general framework that establishes broad norms for the functioning of the state. The Constitution enshrines the protection of property and the inviolability of such in article 51. However, article 17 of the same sets forth that "mining and hydrocarbon deposits and, in general, all non-renewable resources, may only be explored or exploited by private parties, under sustainable environmental criterion, in accordance with concessions, agreements, licenses, permits or quotas, under the conditions determined by law". Thus, any person seeking to undertake mining operations in the Dominican Republic must take into account that the Dominican state is a necessary participant in any mining operation, and that the property of the minerals is that of the state, although the entity awarded with a concession has the right to profit from the extracted minerals. Property of the state, as may be construed from the provisions set forth in Law No. 146's Regulation for Application refers to the mineral reserve, and not the extracted minerals which belong to the concessionaire. The Dominican Mining Law No. 146 of 4 June 1971, which we refer to as Law 146, is the legislation currently in force in the Dominican Republic relating to the exploration and exploitation of mining materials. The Law is complemented by its Regulation for enforcement number 207-98 of 3 June 1998, which clarifies certain aspects of the Law and establishes specific administrative processes in order to implement the norms contained in the Law.

Law 146, as well as its regulation, establish that the state is the owner of all mineral deposits, of any nature, on Dominican soil and that the exploitation or mining of such deposits are undertaken by means of concessions or agreements granted exclusively by the government. Furthermore, the Law is highly protective of the local legal regime providing that all concessions granted within national territory are exclusively governed by the laws and courts of the Dominican Republic, and when foreigners are the concessionaires, such concessionaires are deemed to have validly waived any right to diplomatic protection in relation to the concession. The Law also creates the General Mining Directorate, which is the administrative body in charge of implementing the Law and regulating mining activities in the Dominican Republic.

We should also point out that our General Environmental and Natural Resources Law No. 64-00 (Law 64-00), which governs all environmental related issues in the Dominican Republic also plays an important role with respect to mining activities in said country. The purpose of this law is to set the general rules towards the conservation, protection, improvement and restoration of the environment and the natural resources, intending to assure a sustainable use having unified segregated rules concerning environmental protection and creating a governmental authority - the Ministry of Environment and Natural Resources - with wide authority to oversee and regulate the application of Law 64-00. Article 38 of Law 64-00 establishes the process of environmental evaluation, in order to prevent, control and mitigate the impacts over the environment and natural resources caused by works, projects and other activities. According to the list published by the Ministry of Environment and Natural Resources regarding projects that require environmental impact studies in order to obtain an environmental license, the activities involving the mining sector are the following: development, exploitation and processing of metallic and non metallic mining; exploration and mining prospection; extractive metallurgy and mining parks.

Law 146 regulates investments in mining activities, although there is also a general foreign investment law (Law No. 16-95 and its amendments), which requires registration of foreign investments for statistical purposes. Under Law 146 mining rights may be acquired both by domestic and foreign parties; however, foreign investors in these activities are required to incorporate a Dominican subsidiary prior to holding exploration concessions over mineral rights. The possibility of operating through a branch, in lieu of a Dominican subsidiary may be reached through special agreements entered with the executive branch and subject to Congress approval. Although Law 146 provides for certain rules governing the exemption to foreign exchange requirements, such provisions are no longer relevant as per freedom of convertibility and transferability principles in force since 2002 with the enactment of our current Monetary and Financial Law No. 183-02. Accordingly, in connection with foreign exchange regulations, including the external debt service, no approvals are currently required from any governmental authorities for purposes of assuming debt in foreign currencies, accessing the currency exchange markets or transferring funds abroad, provided that such exchange and transfer activities are done through duly authorized financial and exchange intermediation entities of the Dominican Republic.

10

The Dominican Republic is party to numerous international investments and free-trade treaties including DR-CAFTA; however, none apply specifically to mining activities, and such operations sometimes are excluded from these treaties in most cases. As to dispute resolution mechanisms we should point out that the Dominican Republic is a party to the Convention on the Recognition and Enforcement of Foreign Arbitral Awards (New York Convention), and that arbitration clauses are not in contradiction of or subject to restrictions under the laws of the Dominican Republic, except for judicial homologation (exequatur) requirements.

Law 146 recognizes two distinct types of concessions that may be granted by the state: concessions for the exploration of mining materials; and concessions for the mining itself or exploitation of the mining materials. Article 17 allows additionally, the creation of 'fiscal reserves' by the executive branch, within a determined mining zone, and following such creation, allow the exploration and evaluation of mining sources, and allow exploitation activities through special contracts. The process of obtaining a mining concession is relatively straightforward, and is contained in articles 143 through 176 of Law 146, as well as certain other provisions of Regulation 207-98. In summary, the entity interested in mining a piece of land must fulfill the requirements established by Law 146, Regulation 207-98, and those of the General Mining Directorate. The General Mining Directorate then either approves the concession or rejects it. If approval is granted, the Ministry of Industry and Commerce proceeds to issue a resolution authorizing the concession. The General Mining Directorate also grants any and all rights of passage and rights of use of the land of third parties once the concession is granted, notwithstanding if the permit is granted either for exploration purposes or for mining operations. If a foreign entity seeks to receive a concession for exploration purposes only, then it is allowed to do so as a foreign entity, though it must prove its existence to the General Mining Directorate through the filing of certain documents. However, the Law expressly establishes that foreign entities that seek mining (or exploitation) concessions must do so through the incorporation of a Dominican company fulfilling all the requirements under Dominican law. Nevertheless, if the foreign entity had begun exploration operations as such, and requested the granting of a mining concession, while the incorporation of the Dominican company is being undertaken, the foreign entity may initiate mining activities. The concession granted is intuitu personae, and consequently, may not be assigned without prior written approval from Ministry of Industry and Commerce.

Pursuant to the provisions of Law No. 146, a mining concession gives the exclusive right over all substances found within the perimeter thereof, to explore, exploit or develop such substances in accordance with the provisions of applicable laws.

Among the obligations of the holder of a concession are the following, which may be construed as covenants to maintain its concession:

· Protection of life and health of the workers;

· Submission of semi-annual progress and annual operation reports;

· Compliance with environmental standards;

· Payment of annual patents, royalty fees and income taxes;

· keeping of legal accounting books in accordance with applicable accounting rules;

· Execution of works in accordance to methods and techniques avoiding damages to the landowner and to the adjoining concessionaires; and

· Starting the works within six months after the date of the granting of the concession, under sanction of forfeiture.

The executive branch may declare a mining zone as a fiscal reserve, and grant exploitation rights over such reserve through special contracts. The requirement for such exploitation rights, as per the provisions of article 19 of Law 146, is that any such mining exploitation within a fiscal reserve, must be granted by means of a public bidding process. Congress approval is not necessary for these purposes; however, such Congress approval becomes mandatory when tax incentives are provided through the special contract. The use of the fiscal reserve and 'special contract' combination, although not uncommon, is treated as the exception as opposed to the rule when it comes to the granting of mining concessions under Law 146. They simply allow for the executive branch to reach mining arrangements with private parties in conditions that may differ from those generally provided under Law 146. In general, this combination will have equivalent standing as compared to a concession, but following the amendment made to article 19 of Law 146, special agreements may provide for conditions or rights that are less favorable to those generally granted under Law 146 with respect to mining concessions in general.

11

As may be construed from the descriptions detailed above, the jurisdiction authority over mining activities is generally placed in the executive branch, comprised by the presidency and the Ministries of Industry and Trade, and Environment and Natural Resources.

Mining concessionaires must pay three distinct taxes or fees: royalty fees to the Dominican government; export fees; and income tax. First, the royalty fee contemplated by the law is calculated on the basis of the size of the land covered by the concession, as well as the type of concession granted. However, the amount paid in royalty is not very large, since in no case does any royalty payment exceed 45,000 Dominican Republic pesos. This fee is paid on a yearly basis, but in two installments. On the other hand, the second fee that must be paid is an export fee, equivalent to 5 per cent of the invoice value of the mineral exported, paid in full within three months of the export. Finally, we must note that in the concession and mining agreement executed between the state and the concessionaire, the parties are free to establish any royalty payment that is agreed upon, in addition to those contemplated by the law.

In addition to those taxes and royalties payable by mining concessionaires, which include a 25 per cent income tax, the latter would also need to consider and may be required to pay an annual asset tax of 1 per cent over the value of the assets of the concessionaire and tax withholding obligations over salaries paid to employees and dividends distributed to shareholders.

In case of non-renewable natural resources, parties are required to pay a 5 per cent contribution of their generated net profits produced from the exploitation activity to the municipality. Right holders of concession permits under Law No. 123-71 are required to pay the above mentioned income and municipal taxes. In addition, such right holders must pay a contribution equal to 4.10 Dominican Republic pesos per cubic meter of mineral extracted, removed or excavated. The above tariff may be increased from time to time.

Upon the occurrence of payment defaults, as a cause of forfeiture, the Ministry of Industry and Commerce, before pronouncing the forfeiture must require, by means of a written notice, that the concessionaire rectify the fault within a period of 30 working days. After the expiration of said period, the Ministry of Industry and Commerce may dictate the forfeiture by means of a resolution which must be published in the Official Gazette. The concessionaire may also be penalized with a 10 per cent surcharge. There are no rules prohibiting a creditor to step in and cure in lieu of the mining company. Income tax payment defaults are subject also to penalties provided under the Dominican Tax Code.

Under Article 15 of the Dominican Constitution, water constitutes a strategic national heritage of public use, unalienable, imprescriptibly, not subject to attachments, and essential for life. Human consumption has priority over any other use, while the state must elaborate and implement effective policies towards the protection of country´s water resources.

Several institutions are in charge of issuing required permits and authorizations for the use of waters resources. Law No. 5852 on the Distribution of Public Waters provides that any party wishing to use public waters must obtain a water title. In accordance with article 48 of Law No. 5825, a petition in this sense must be filed before the National Institute of Hydraulic Resources (INDRHI). If granted, the water rights are subject to certain fees based on invested capital in installed facilities and annual permitting fees. Other authorizations or permits may be required from the Natural Potable Water and Sewage Institute (INAPA) particular in connection with the use or installation of water lines and sewers, or both. For the construction of wells and for the exploitation and use of underground waters, parties are required also to obtain a permit from the sub-ministry of soil and water of the Ministry of Environment and Natural Resources.

Under article 6 of Law146, the mining concession constitutes a different right than that of an owner of a real property, whether the mining concession and the ownership right over the property, belong to the same person. The usufruct of mining sources gives the right to the concessionaire to use also the surface of the land, whether it owns such land or not, provided however that the concessionaire must indemnify the corresponding third party for damages causes during the mining operations (article 63 of the Law 146). Article 78 of the Law 146 provides that concessionaires must reach agreements with the owners or occupants of land they require for their mining operations, or both. Such agreements must include provisions relating to the superficial extension of the land required for purposes of building dwellings, storage spaces, shops, plants, tailings deposits, water tanks, construction deposits, and other types of improvements. Easements relating to electric line routes are governed by our General Electricity Law No. 125-01, its amendments and rules of enforcement. Under said legislation easements are usually granted through the concession agreement required for purposes of distributing or transmitting energy; the use of the national grid transmission lines are subject to the payment of special tolls and other similar fees.

12

Subject to the obtainment of required permits or concession rights under our General Electricity Law No. 125-01 and its amendments and rules of enforcement, mining concessionaires may elect to procure their supply of electricity under different modalities that include total or partial self generation, the purchase of energy in the National Interconnected Electricity System of the Dominican Republic (national grid) under special contractual rights and as an Un-Regulated User (URU); or purchase of electricity from a third party outside the NIES, or national grid, under any contractual modality and as a URU, or both.

Pursuant to the Mining Law, exploitation concessions are granted for a maximum term of 75 years. The termination of the concession occurs upon expiration of the applicable tenure. Anticipated termination of rights under a mining concession may occur upon the following:

· Through a waiver or reduction upon request of the concessionaire.

· Upon a declaration of nullity or invalidity following a determination that:

· The concession was granted to an unqualified person as per article 13 of Law 146.

· That the concession was granted directly or indirectly to foreign governments.

· That the concession was granted within the perimeter of an existing fiscal reserve or existent concessions.

· That the concession was granted to the same person in excess of the maximum limits provided under articles 32 and 43 of Law 146.

· Upon termination pursued by the Ministry of Industry and Trade subject to the lawful causes detailed in Law 146, which include the following in connection with exploration concessions:

· Failure to start exploration within six months following the issuance of the concession.

· Interruption of exploration activities for more than six continuous months.

· Carrying out exploitation activities during exploration tenures under an exploration concession.

· Failure to pay mining fees, taxes and royalties.

· Upon failure to comply with programmed works.

· Failure to carry out reporting obligations as required under articles 72 and 192 of Law 146.

And the following causes in connection with exploitation concessions:

· Failure to initiate exploitation within a one-year term following issuance of the concession;

· Interruption of exploitation activities for more than two continuous years;

· Failure to pay applicable mining fees, royalties and taxes;

· Suspension of commercial production (defined as the sale of exploited metallurgic minerals without benefits for the state in the form of income tax for more than two consecutive years);

· Failure to incorporate a Dominican subsidiary within a six-month term following issuance of the concession; and

· Failure to comply with reporting requirements.

Upon the occurrence of the causes of termination specified above, the Ministry of Industry and Commerce, before pronouncing the forfeiture must require, by means of a written notice, that the concessionaire rectify the fault within a period of 30 working days. Upon expiration of said period, the Ministry of Industry and Commerce may dictate the forfeiture by means of a resolution, which must be published in the Official Gazette.

Affected parties may file administrative appeals before the Ministry of Industry and Commerce, and before the Administrative Courts of the Dominican Republic which are part of the Judicial Branch.

Concession rights granted by the Dominican government may be subject to pledges under Dominican law, provided that such granting party agrees to the awarding of the security interest. These types of securities are governed by the provisions set forth in articles 91 et al of the Commercial Code that relate to the commercial pledge. A commercial pledge is usually the type of security considered for purposes of pledging all types of intangible assets, in connection with international and domestic credit facilities or other finance arrangements. Applicable to all pledges over intangible assets, creation is done through the execution of a bilateral pledge agreement, signatures of which are usually certified by a local notary public (since the agreement will be subject to filings and public notices, it is important, as to all other collateral agreements aiming to create a security interest in local assets, to be drafted in Spanish, and as per conventional forms usually resorted to for such purposes). Perfection of the security takes place through a notice of the pledge agreement by an appointed local and territorially qualified bailiff. This notice is required under articles 91 of the Commercial Code, and article 2075 of the Civil Code. The notice documentation is registered by the bailiff before the Civil Registry, as required for all bailiff acts. When attempting to create a security interest over concession rights, prior approval from the governmental institution or agency providing such concession is required, as ordinarily, transfer restrictions are imposed in these concessions, or apply in the absence of any particular language, as a general rule deriving from administrative law principles. Other permits, such as environmental permits are not subject to pledges or prior approvals from the granting authority, as these permits are usually only issued once for the entire life of the approved project. In case of a foreclosure resulting in a change of control over the project, a notice of such change of control, and the responsible party named in the environmental license is to be served to the Ministry of Environment and Natural Resources. Similar creation and perfection requirements apply in connection with the granting of pledges over other intangibles, including rights under project agreements, onshore bank accounts and trademarks, insurance proceeds and share of local companies. All security agreements must be recorded also before the public registry maintained by the mining directorate. Mortgages may also be granted over real property owned by the concessionaire or an affiliate guarantor; non-possessory pledges (similar to chattel mortgages) may also be granted over the concessionaire's inventory, its equipment and other personal property.

13

It is accepted practice for creditors financing mining projects and other major projects subject to governmental concessions to enter into direct agreement with the Government for further strengthening the step-in rights of such creditors, namely by allowing lenders to become qualified successor owners or operators following foreclosure procedures.

In general, the Dominican Republic laws governing security interests have organized certain special protection for the benefit of the credit itself, and also for the benefit of the debtor, when requiring a public auction: the creditor must proceed to the court so that it may order the sale, and give a chance to the debtor, since the latter may have means of defense to present against the proceedings. Accordingly, a creditor may not seize property directly; instead it must attempt to receive proceeds from the public sale of the pledged or mortgaged asset of its obligor.

In general, as per the provisions of our current Insurance Law No. 146-02, all insurance obtained for assets and interests located in the Dominican Republic must be obtained through duly authorized insurance companies or intermediaries of said jurisdiction. Risks assumed by local insurance companies may be reinsured with foreign insurance or reinsurance companies, although in practice, many projects resort to fronting policy schemes.

In accordance with Article 135 of the Dominican Labor Code, at least 80 per cent of the total number of employees of any local business must be made up of Dominican citizens. The salaries earned by Dominican employees must also amount to at least 80 per cent of the total sum of payments made by the employer to all its employees. Note that the salaries earned by employees that work in technical functions, as well as positions of direction and management are excluded from the calculation as to the above provision.

Company owners may be liable for labor and tax liabilities as per the provisions set forth in the Dominican Labor Code and the Dominican Tax Code. These liabilities should not extend beyond the mining project company to mortgagees or creditors, although the rights of employees for the payment of their salaries and the rights of the government in connection with the payment of applicable taxes benefit from a legal privilege that would allow for payment ahead of any other creditors of the mining concessionaire. Unless involved directly, environmental liabilities should not extend beyond the mining project company or its directors, to any other third party.

Special attention and due diligence efforts should always be carried out in connection with the financing of mining projects, mainly in connection with all environmental licensing and permitting requirements.

Although we may not rule out that mandated concession renegotiations may occur in light of increased commodity values, subject to compliance with general provisions of law, we are not aware of any activity in the Dominican Republic leading to such mandated renegotiation processes.

The General Mining Directorate's website, on which most mining laws and regulations may be found in electronic form, is http://www.dgm.gov.do.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

14

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

In addition to the requirements for the obtainment of a mining concession there is also a requirement for an Environmental License. The applicant must file a preliminary application and if approved will require amongst other things an environmental impact study. Article 38 of Law 64-00 establishes the process of environmental evaluation, in order to prevent, control and mitigate the impacts over the environment and natural resources caused by works, projects and other activities. This evaluation is pursued in accordance with the following instruments:

· Environmental impact statement (DIA in Spanish);

· Strategic evaluation impact;

· Study of environmental impact;

· Environmental report;

· Environmental license;

· Environmental permit;

· Environmental audits; and

· Public consultation.

According to Law 64-00, any project which in nature entails a substantial alteration to the environment in which it is to be developed, shall follow an evaluation process, be it for the obtainment of an environmental permit or license, as the case may be, depending on the magnitude of the effects that the project may cause, destined to the prevention of negative impacts to the environment and natural resources. The criterion for the determination of whether a project requires an environmental license or an environmental permit is established by the Ministry of Environment and Natural Resources. Environmental permits and licenses must comply with the program from the environmental management and adaptation (PMAA in Spanish), which shall be executed by the person in charge of the activity or project, establishing the criteria to pursue such program and observe its terms. It is noteworthy that the environmental permits and licenses compel the beneficiary of the same to: assume the administrative, civil and criminal liabilities for the damages caused to the environment and natural resources; observe the provisions of the regulations and rulings in force; execute the PMAA; and allow the environmental control by the competent authorities. The Ministry of Environment and Natural Resources shall pursue audits for environmental evaluation. In order to assure compliance with the environmental license and permit, regarding the PMAA, the person in charge of the project must provide a compliance bond for an amount equivalent to 10 per cent of the total costs of the physical works or investments that are required to comply with the PMAA. The Ministry of Environment and Natural Resources will have a public record of the environmental permits and licenses granted, as well as the individuals or corporations that are punished under an administrative or judicial action. For the purpose of regulating the issuance of environmental permits and licenses, the Ministry of Environment and Natural Resources issued the Regulation for the System of Environmental Permits and Licenses as of June 2004, (the Regulation). According to the Regulation, projects and establishments that at the moment of its enforceability were already operating were required to initiate the relevant process for compliance with Law 64-00, in accordance with the procedure established for environmental permits for existing establishments or projects. These installations will have a term of one year after the issuance of the Regulation to complete the process of obtainment of the environmental permit, except in the event it is evidenced that such establishments or projects constitute an imminent danger to the health and security of people or the conservation of the ecosystem. In this latter case, the Ministry of Environment and Natural Resources will decide the conditions for the operation of the establishments or projects or will order their cease in operations. The type of study required for existing establishments or projects is an environmental report, which is the result of a multidisciplinary diagnosis, which describes the project and its main impacts, from an environmental and socio-economic perspective, and identifies the relevant mitigating measures, by means of the creation of the PMAA for the same.

For existing projects and establishments, the evaluation of the environmental report and the PMAA will be carried out by the Directorate of Environmental Quality and the sub-ministry of environmental management of the Ministry of Environment and Natural Resources. It is important to point out that the Regulation states in its article 8 that the environmental licenses and permits are of contractual nature and that are issued only one time during the enforceability of the project. Nonetheless, its validity will depend on the results arising from the application of the PMAA, which will be audited in the terms established by the relevant permit or license. Note that the Ministry of Environment and Natural Resources can temporarily or permanently repeal the license in case of violation of its terms or damage to the environment. The violating party is subject to penal and civil liabilities. The Ministry of Environment and Natural Resources will perform periodic inspections and audits regarding the compliance with the PMAA and in general, the compliance with the legislation in force. In this sense, in the cases where the inspections and audits demonstrate that the project complies with the PMAA and the relevant legislation, as well as with the conditions established in the permit or license, the Ministry of Environment and Natural Resources will issue certifications of environmental compliance.

15

For the cases of projects with respect to which construction activities, installations or operations are initiated without obtaining the corresponding environmental permit or license, the activities undertaken in such projects must cease until the relevant process is fulfilled. This project may be penalized under the administrative procedure with the payment of fines, without prejudice of the criminal and civil sanctions that may arise from such violation. As mentioned before, according to the list published by the Ministry of Environment and Natural Resources regarding projects that require environmental impact study in order to obtain an environmental license, the activities involving the mining sector are the following: development, exploitation and processing of metallic and non-metallic mining; exploration and mining prospection; extractive metallurgy; mining parks and aggregate processing plants among others.

Pursuant to the provisions of article 126 of Environmental Law No. 64-00 water resources in general are owned by the Dominican state and are not subject to private ownership in any case. However, as per the provisions of Law 146, in general, all concessionaires of exploration and exploitation mining rights, subject to prior compliance with applicable legal provisions in force over water sources and environmental protection, have a non-exclusive right to use fluvial waters needed for such mining activities. They are also entitled to use the water that flows or is discovered during the mining operations, or water that is drained from the mines, or from Property of third parties (article 167 of law 64-00. Concessionaires are also entitled to use the water that freely flows through their concessions, whether to put into use for the production of hydraulic energy, or any other use necessary for exploration or extraction of mineral activities, provided that the water is restored to its bed following its use, once adequately purified and made free of any hazardous substances (article 134 of the Law). Should the water sources required by a concessionaire be available only in land owned by private third parties, the concessionaire may only resort to such sources upon an agreement with such third parties, or upon the initiation of expropriation proceedings with the explicit authorization of the general mining directorate. This expropriation would not be granted if resorting to water source would interrupt or result detrimental to the potable water sources of nearby towns or villages (Article 135).

Water rights may be subject to liens in the benefit of creditors of the concessionaire following prior authorization from the granting authority.

Other causes of termination may be found in Environmental Law No. 64-00, mostly in connection with the failure to comply with reporting requirements, and the requirements under applicable environmental licenses, permits and PMAAs. Water rights may be lost upon failure by the concession to pay applicable fees for the use of water or installation of water facilities, and failure to cure any environmental defaults within a six-month period. Finally, concessions for electricity generation, distribution or transmission are subject to termination upon the causes detailed in our General Electricity Law No. 125-01 and its amendments.

As per the provisions set forth in article 64 of Law 146, mining concession allow the concessionaire to build any infrastructure necessary in order to carry out the process, particularly ports and other systems of transportation. Installation of such essential infrastructure is however subject to numerous permitting requirements, involving the Ministry of Environment and Natural Resources, the Ministry of Public Works and Communications and municipal permits, the Ports Authority and the Superintend of Electricity.

Research and Development

We have not incurred any research and development expenditures over the past two fiscal years.

Intellectual Property

We do not own, either legally or beneficially, any patents or trademarks.

Employees

Currently, we do not have any employees. Our directors, executive officers and certain contracted individuals play an important role in the running of our Company. We engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our exploration programs.

16

Legal Proceedings

We know of no material pending legal proceedings to which our Company is a party or of which any of our property is the subject. In addition, we do not know of any such proceedings contemplated by any governmental authorities.

We know of no material proceedings in which any director, officer or affiliate of our Company, or any registered or beneficial stockholder of our Company, or any associate of any such director, officer, affiliate, or stockholder is a party adverse to our Company or has a material interest adverse to our Company.

Item 1A. Risk Factors

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information under this item.

Item 1B. Unresolved Staff Comments

Headquarters and Administration Offices

We maintain our statutory registered agent's office at State Agent and Transfer Syndicate, Inc., 112 N. Curry Street, Carson City, Nevada 89703 and our business office is located atAvenida Sarasota No. 20, Torre Empresarial AIRD Local 1103, La Julia, Santo Domingo, Dominican Republic. This is also our mailing address. Our telephone number is (809) 535-9443. We are currently renting office space owned by Boyter Island Property Inc., where they are also a tenant. Boyter leases us office space on a contractual agreement basis. We have entered into a month to month rental contract for $175.00 plus taxes. We have also secured a larger office facility in a central location utilizing about 1,000 sqft from the first floor of the home of our Chief Executive Officer, dedicated specifically to act as the Company’s corporate head office.

Mineral Claims

The nine Dominican exploration concession applications were acquired from Gexplo SRL by mineral property acquisition agreements and an amendment to the mineral property acquisition agreements as follows: (1) Alexia was acquired on July 30, 2012, pursuant to the Acquisition Agreement, dated July 30 2012 and amended on October 12, 2013; (2) Walter and Maria were acquired on September 17, 2012, pursuant to the Company’s right of first refusal in the Acquisition Agreement; Henry, Francesca, Kato (formerly Eliza), and Nathaniel, were acquired on October 12, 2012 pursuant to Amendment No. 1 to the Acquisition Agreement, dated October 12, 2012; (3) Richard was acquired on March 25, 2013 pursuant to the Richard Acquisition Agreement, dated March 25, 2013; (4) and Charles was acquired on April 3, 2013, pursuant to the Charles Acquisition Agreement, dated April 3, 2013.

Each claim, date of acquisition, the agreement pursuant to which such claim was acquired, and its corresponding exhibit number under “Item 15. Exhibits” are as follows:

|

Claim |

Date Acquired |

Acquisition Agreement/Amendment |

Exhibit No. |

|

Alexia |

July 30, 2012 |

Mineral Property Acquisition Agreement, dated July 30, 201, by and between Santa Pita Corporation, Gexplo, SRL., and Rosa Habeila Feliz Ruiz |

10.7 (1) |

|

Walter |

September 17, 2012 |

Mineral Property Acquisition Agreement, dated July 30, 201, by and between Santa Pita Corporation, Gexplo, SRL., and Rosa Habeila Feliz Ruiz |

10.7 (1) |

17

|

Maria |

September 17, 2012 |

Mineral Property Acquisition Agreement, dated July 30, 201, by and between Santa Pita Corporation, Gexplo, SRL., and Rosa Habeila Feliz Ruiz |

10.7 (1) |

|

Henry |

October 12, 2012 |

Amendment No. 1 to Mineral Property Acquisition Agreement, dated October 12, 2012, by and between Santa Pita Corporation, Gexplo, SRL., and Rosa Habeila Feliz Ruiz |

10.9 (2) |

|

Francesca |

October 12, 2012 |

Amendment No. 1 to Mineral Property Acquisition Agreement, dated October 12, 2012, by and between Santa Pita Corporation, Gexplo, SRL., and Rosa Habeila Feliz Ruiz |

10.9 (2) |

|

Kato (fka Eliza) |

October 12, 2012 |

Amendment No. 1 to Mineral Property Acquisition Agreement, dated October 12, 2012, by and between Santa Pita Corporation, Gexplo, SRL., and Rosa Habeila Feliz Ruiz |

10.9 (2) |

|

Nathaniel |

October 12, 2012 |

Amendment No. 1 to Mineral Property Acquisition Agreement, dated October 12, 2012, by and between Santa Pita Corporation, Gexplo, SRL., and Rosa Habeila Feliz Ruiz |

10.9 (2) |

|

Richard |

March 25, 2013 |

Mineral Property Acquisition Agreement, dated March 25, 2013, by and between Santo Mining Corporation and Gexplo SRL |

10.13 (3) |

|

Charles |

April 3, 2013 |

Mineral Property Acquisition Agreement, dated April 3, 2013, by and between Santo Mining Corporation and Gexplo SRL |

10.13 (4) |

(1) Filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Commission on July 31, 2012

(2) Filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the Commission on October 19, 2012

(3) Filed as Exhibit 10.2 to the Company’s Current Report on Form 8-K filed with the Commission on April 8, 2013

(4) Filed as Exhibit 10.3 to the Company’s Current Report on Form 8-K filed with the Commission on April 8, 2013

Surface Rights: According to Dominican mining law the surface rights owner or land owners have no rights to the sub-surface of minerals under their property. These are owned by the sovereign state who may grant concessions to explore and mine the sub-surface. The Company has not acquired or contracted any of the surface rights at this time because the area of the exploration concession applications is vast and the cost would be prohibitive until such time as potential mineral resources have been confirmed. Access to the exploration concession application area to conduct surface exploration and geochemical sampling is generally granted by the individual owners. Should a viable mineral reserve be discovered, the area is usually a fraction of the entire exploration concession area, and only the mineralized area would need to be contracted and not the entire concession. Again it is extremely rare that surface exploration on the land of the individual owners be denied.

The countryside is mostly low production pastoral or mountain grazing land and agreements to purchase, lease or royalty contract this type of land is positively received. The Dominican Mining law requires the land owner is fairly compensated to the appraised value of the surface land even in the case of expropriation.

18

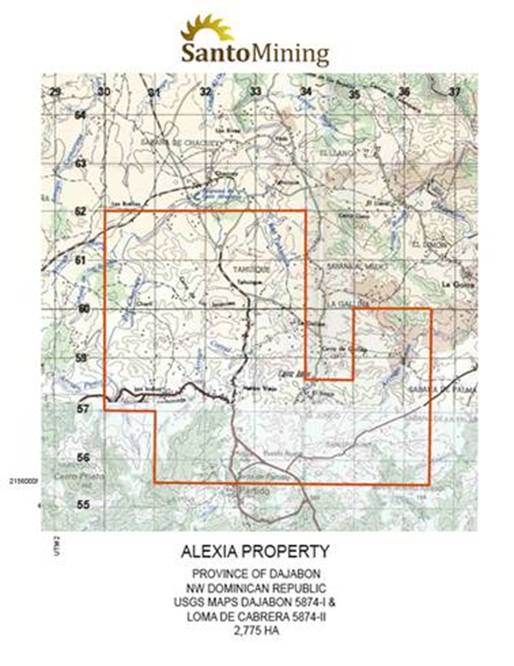

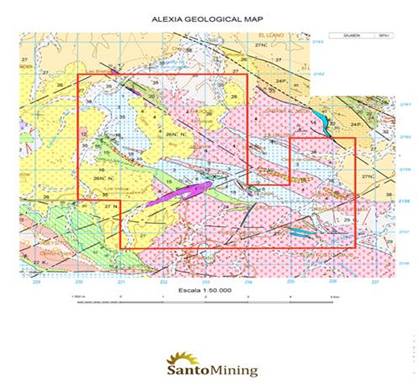

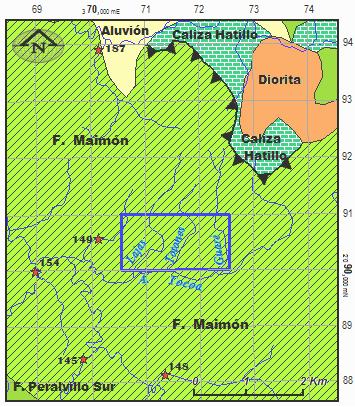

ALEXIA

Location: The “ALEXIA CLAIM”, is located in the province of Dajabon, in the municipalities of Dajabon and Partido, specifically in the sections Chaucey, La Gorra and Partido Arriba, covering Los Indios, Pueblo Nuevo, Hatico Viejo, El Junco, La Gallina, Tahuique and Charo located in the Dajabon 5874-I (11) and Loma de Cabrera 5874-II (19) topographical sheets,complying with the terms of mining law No. 146 and its regulations. The Alexia Claim is located approximately 3.5 hours northwest of the capital city of Santo Domingo by car and immediately north of the town of Partido. The Alexia Claim has good asphalt paved road access and an internal network of graded clay roads. The total area covered by the exploration request is 2,775 mining hectares.

19

Boundary: The ALEXIA Claim boundaries will follow the direction of the Universal Transverse Mercator (UTM) grid, on vertices with incoming and outgoing angles of 90o, according to that outlined in the following table:

|

From Point

|

To Point |

Open Direction |

Distance ( Meters) |

UTM North (From Point) |

UTM East (From Point) |

|

PP |

1 |

North |

33.0 |

N2161967 |

E232742 |

|

1 |

2 |

East |

1,258 |

N2162000 |

E232742 |

|

2 |

3 |

South |

3,500 |

N2162000 |

E234000 |

|

3 |

4 |

East |

1,000 |

N2158500 |

E234000 |

|

4 |

5 |

North |

1,500 |

N2158500 |

E235000 |

|

5 |

6 |

East |

1,500 |

N2160000 |

E235000 |

|

6 |

7 |

South |

3,500 |

N2160000 |

E236500 |

|

7 |

8 |

West |

5,500 |

N2156500 |

E236500 |

|

8 |

9 |

North |

1,500 |

N2156500 |

E231000 |

|

9 |

10 |

West |

1,000 |

N2158000 |

E231000 |

|

10 |

11 |

North |

4,000 |

N2158000 |

E230000 |

|

11 |

12 |

East |

2,742 |

N2162000 |

E230000 |

The data for the preparation of the map for this exploration Claim was taken from the topographic sheet named Dajabon 5874-I (11) and Loma de Cabrera 5874-II (19) on a scale of 1:50,000.

Type of Ownership: One hundred percent (100%) of the Alexia exploration concession application was acquired by the Company from Gexplo SRL via a Mineral Property Acquisition Agreement dated July 30, 2012. The property was duly transferred by way of the “Alexia Mining Concession Transfer Contract”. The transfer was signed and notarized on19 September 2012 and deposited at the Dominican Mining Office (DGM) registry office for recording on November 23, 2012, to be processed. . The original transfer documents required the additional word “Application” in the document headings and were signed and notarized on 13th September 2013 and re-deposited at the Dominican Mining Office (DGM) registry office for recording on 13th Nov 2013 to be processed.