Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MITEL NETWORKS CORP | d626272d8k.htm |

| EX-99.1 - EX-99.1 - MITEL NETWORKS CORP | d626272dex991.htm |

Exhibit 99.2

Mitel & Aastra Technologies Announce Plans to Merge

A Newly Created $Billion Company

#1 Market Share in Western Europe US$100M Cloud Business

Large Global Customer Footprint with 60 Million End Users Strongly Positions Mitel for Transition to Cloud Services

November 11th, 2013

Exhibit 99.2

SAFE HARBOR STATEMENT

Forward Looking Statements

Some of the statements in this document are forward-looking statements (or forward-looking information) within the meaning of applicable U.S. and Canadian securities laws. These include statements using the words target, outlook, may, will, should, could, estimate, continue, expect, intend, plan, predict, potential, project and anticipate, and similar statements which do not describe the present or provide information about the past. There is no guarantee that the expected events or expected results will actually occur. Such statements reflect the current views of management of Mitel and Aastra and are subject to a number of risks and uncertainties. These statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, corporate approvals, regulatory approvals, operational factors and other factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations. All forward-looking statements attributable to Mitel and Aastra, or persons acting on their behalf, and are expressly qualified in their entirety by the cautionary statements set forth in this paragraph. Undue reliance should not be placed on such statements. Forward-looking statements speak only as of the date they are made. In addition, material risks that could cause results of operations to differ include the merged company’s ability to achieve or sustain profitability in the future; fluctuations in the quarterly and annual revenues and operating results; fluctuations in foreign exchange rates; current and ongoing global economic instability; intense competition; reliance on channel partners for a significant component of sales; dependence upon a small number of outside contract manufacturers to manufacture products; the ability to successfully integrate the acquisition and realize certain synergies; and, our ability to implement and achieve our business strategies successfully. Additional risks are described under the heading “Risk Factors” in Mitel’s Annual Report on Form 10-K and Aastra’s Annual Information Form. Except as required by law, we do not have any intention or obligation to update or to publicly announce the results of any revisions to any of the forward-looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. You are advised, however, to consult any further public disclosures made by Mitel and Aastra on related subjects in reports and communications filed on Electronic Data-Gathering, Analysis, and Retrieval (EDGAR) or System for Electronic Document Analysis and Retrieval (SEDAR).

Non-GAAP Financial Measurements

This presentation includes references to non-GAAP financial measures including adjusted EBITDA, non-GAAP income and non-GAAP operating expenses. Non-GAAP financial measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. We use these non-GAAP financial measures to assist management and investors in understanding our past financial performance and prospects for the future, including changes in our operating results, trends and marketplace performance, exclusive of unusual events or factors which do not directly affect what we consider to be our core operating performance. Non-GAAP measures are among the primary indicators management uses as a basis for our planning and forecasting of future periods. Investors are cautioned that non-GAAP financial measures should not be relied upon as a substitute for financial measures prepared in accordance with generally accepted accounting principles. Please see the reconciliation of non-GAAP financial measures to the most directly comparable U.S. GAAP measure included in this presentation and, if not contained in this presentation, contained in Mitel’s Reports on Form 8-K which have been filed with the 2 U.S. Securities and Exchange Commission on June 24, 2013 (fiscal 2013) and August 29, 2013 (Q1 of fiscal 2014).

Transaction Overview

Terms:

Aastra shareholders receive 3.6 Mitel shares and US$6.52 in cash for for every Aastra share

Total Consideration

Cash and stock transaction valued on closing at approximately CAD$392M

Using the Mitel closing common share price on November 8, 2013, this amounts to CAD$31.96 per Aastra common share. This price represents a 20.9% premium to the 30-day volume weighted average price (VWAP) of Aastra common shares as of November 8, 2013.

Pro Forma Ownership:

57% Mitel shareholders, 43% Aastra shareholders

Combined company retains Mitel name

Company shares will continue to trade publicly on NASDAQ & TSX under Mitel’s listing

Headquarters in Ottawa, ON, Canada

Leadership:

Richard McBee—President & Chief Executive Officer

Steve Spooner—Chief Financial Officer

BoD will consist of 9 members, 6 appointed by Mitel and 3 appointed by Aastra

Transaction Overview

Key Pro Forma Financials (trailing 12 month):

Revenues* are estimated to be US$1.1B

Net Income is estimated to be US$39M

Adjusted EBITDA* is estimated to be US$141M

Approximately US$110M of cash on the balance sheet is expected at closing

Annual net synergies are expected to be approximately US$45M, realized within 24 months

Expected net leverage at close of approximately 2.0x

Financed in part by a new committed credit facility provided by Jefferies and Toronto-Dominion Bank Anticipated to close first quarter 2014

* Revenue and EBITDA numbers do not include anticipated synergies. TTM period represents 7/31/13 for Mitel and 9/30/13 for Aastra

4

Mitel Overview

Provides business communications and collaboration software and services to the SMB market worldwide

Strong presence in North America and the UK

Channel sales model with 1,600 partners globally

~9,000 SME and Enterprise customers in over 100 countries

Installed base of over 10 million end users

More than 300,000 cloud users

Strong financial profile

- One of the most profitable enterprise communications companies

- LTM 7/31/13 Revenue: US$580.0M

- Gross margin and EBITDA margin expansion over past several years

~1,800 employees

1,700 patent portfolio and a leader in virtualized solutions

5

Aastra Overview

Develops and delivers communications products and applications for the global enterprise and SMB market

Strong presence in Europe, holds #1 / #2 position in several key markets

Channel partners in more than 100 countries and more than 1,000 resellers

Installed base of over 50 million end users

Strong financial profile

- 62 consecutive profitable quarters

- LTM 9/30/13 Revenue: US$571.1M

- Strong cash generation over the past several years

~1,900 employees

Emerging cloud business gaining traction

6

Creating a Leading Provider of Business Communications & Collaboration Solutions

Delivers As A Combined Company:

Expanded Geographic Footprint & Market Leadership

Comprehensive Solution Portfolio

Enhanced Scale & Attractive Synergy Potential

Leading Cloud Capabilities

Deleveraged Balance Sheet

Attractive Operating Model/Cash Flow Generation

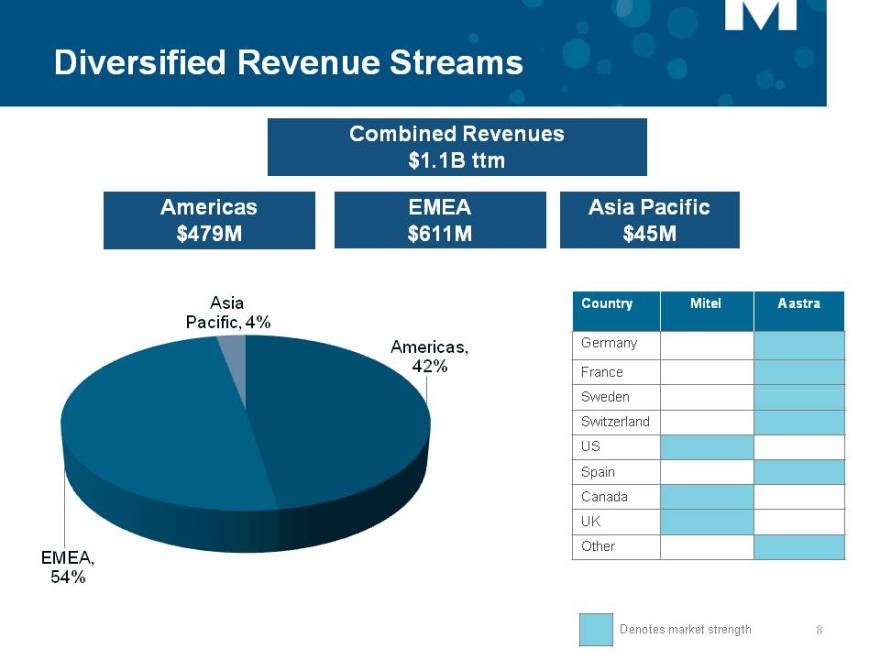

Diversified Revenue Streams

Combined Revenues $1.1B ttm

Americas EMEA Asia Pacific $479M $611M $45M

Asia

Pacific, 4%

Americas,

42%

EMEA,

54%

Country Mitel Aastra

Germany

France

Sweden

Switzerland

US

Spain

Canada

UK

Other

Denotes market strength

8

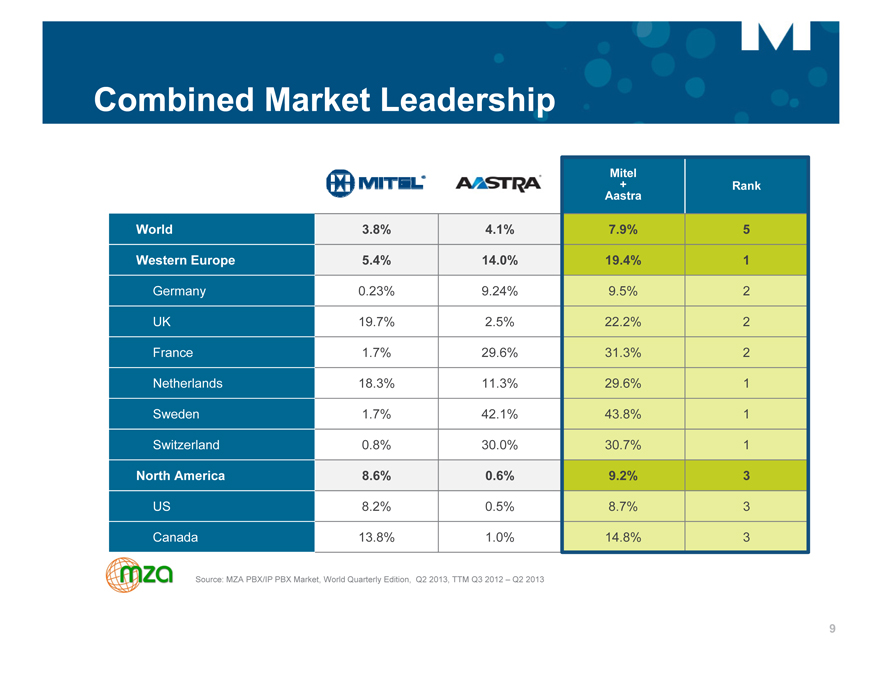

Combined Market Leadership

Mitel

+ Rank

Aastra

World 3.8% 4.1% 7.9% 5

Western Europe 5.4% 14.0% 19.4% 1

Germany 0.23% 9.24% 95% 2

UK 19.7% 2.5% 22.2% 2

France 1.7% 29.6% 31.3% 2

Netherlands 18.3% 11.3% 29.6% 1

Sweden 1.7% 42.1% 43.8% 1

Switzerland 0.8% 30.0% 30.7% 1

US 8.2% 0.5% 8.7% 3

Canada 13.8% 1.0% 14.8% 3

North America 8.6% 0.6% 9.2% 3

Source: MZA PBX/IP PBX Market, World Quarterly Edition, Q2 2013, TTM Q3 2012 – Q2 2013

9

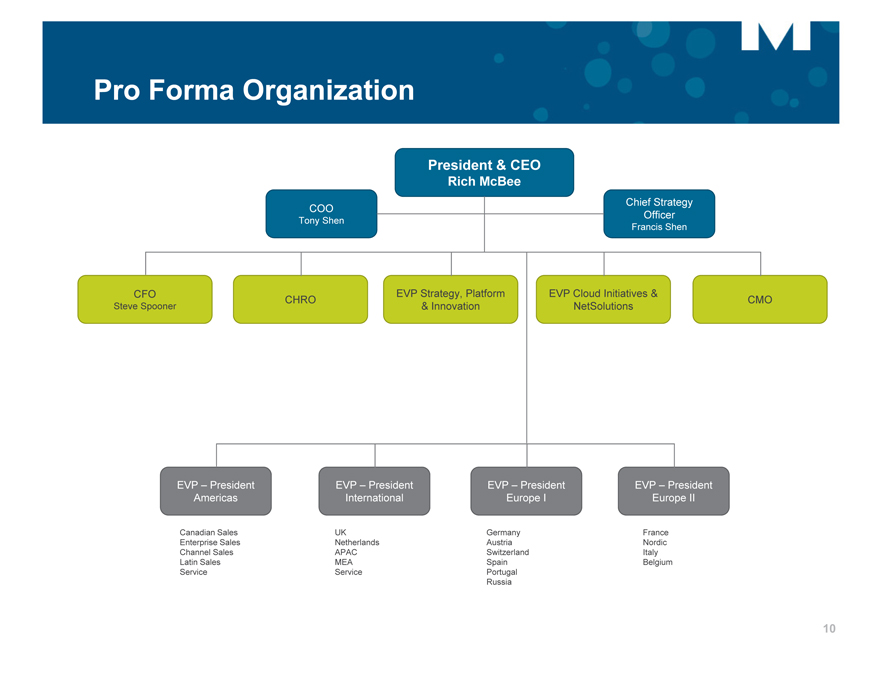

Pro Forma Organization

President & CEO

Rich McBee

COO Chief Strategy

Tony Shen Officer

Francis Shen

EVP Strategy, Platform EVP Cloud Initiatives &

CHRO CMO CFO

Steve Spooner & Innovation NetSolutions

EVP – President EVP – President EVP – President EVP – President

Americas International Europe I Europe II

Canadian Sales UK Germany France

Enterprise Sales Netherlands Austria Nordic

Channel Sales APAC Switzerland Italy

Latin Sales MEA Spain Belgium

Service Service Portugal

Russia

10

Financial Overview

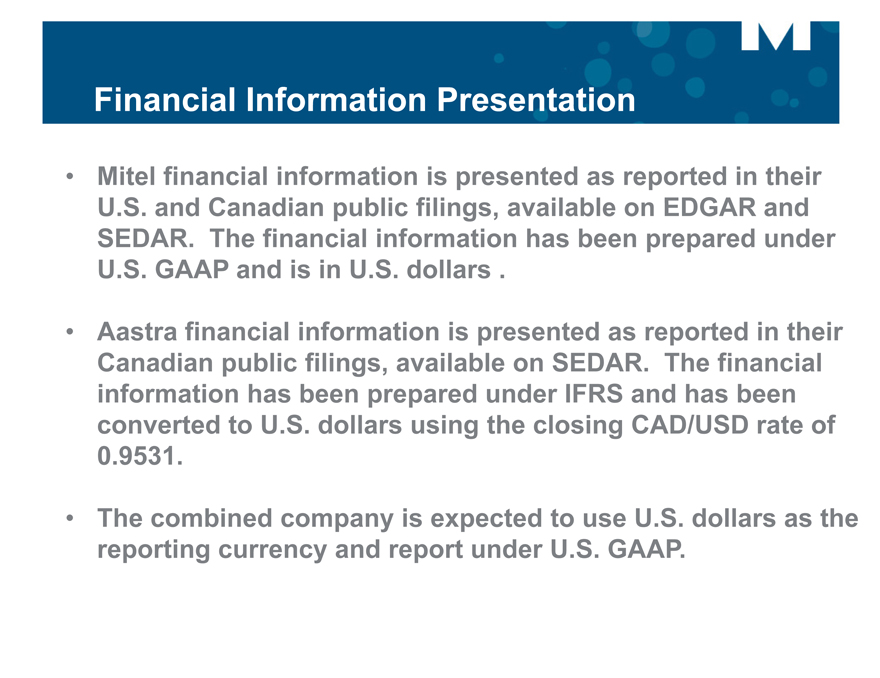

Financial Information Presentation

Mitel financial information is presented as reported in their U.S. and Canadian public filings, available on EDGAR and SEDAR. The financial information has been prepared under U.S. GAAP and is in U.S. dollars .

Aastra financial information is presented as reported in their Canadian public filings, available on SEDAR. The financial information has been prepared under IFRS and has been converted to U.S. dollars using the closing CAD/USD rate of 0.9531.

The combined company is expected to use U.S. dollars as the reporting currency and report under U.S. GAAP.

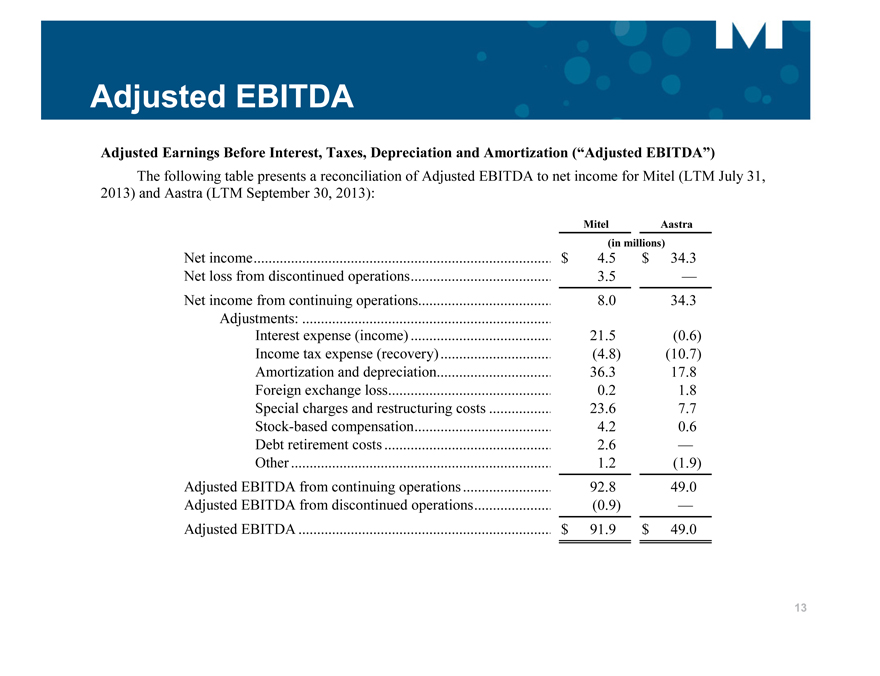

Adjusted EBITDA

Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”)

The following table presents a reconciliation of Adjusted EBITDA to net income for Mitel (LTM July 31,

2013) and Aastra (LTM September 30, 2013):

Mitel Aastra

(in millions)

Net income $ 4.5 $ 34.3

Net loss from discontinued operations 3.5 —

Net income from continuing operations 8.0 34.3

Adjustments:

Interest expense (income) 21.5 (0.6)

Income tax expense (recovery) (4.8) (10.7)

Amortization and depreciation 36.3 17.8

Foreign exchange loss 0.2 1.8

Special charges and restructuring costs 23.6 7.7

Stock-based compensation 4.2 0.6

Debt retirement costs 2.6 —

Other 1.2 (1.9)

Adjusted EBITDA from continuing operations 92.8 49.0

Adjusted EBITDA from discontinued operations (0.9) —

Adjusted EBITDA $ 91.9 $ 49.0

13

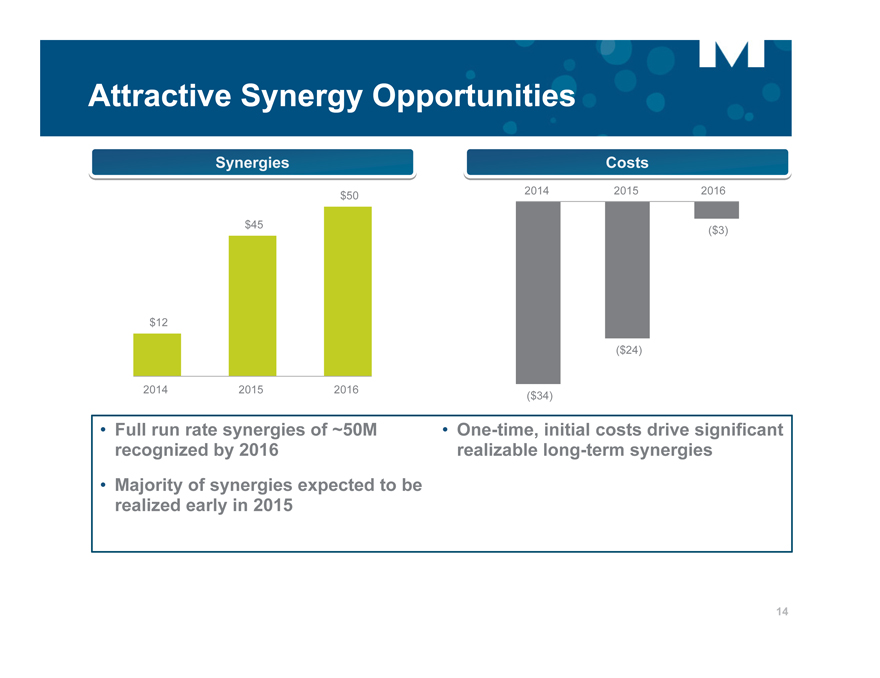

Attractive Synergy Opportunities

Synergies Costs

$50 2014 2015 2016

$45 ($3)

$12

($24)

2014 2015 2016 ($34)

Full run rate synergies of ~50M One-time, initial costs drive significant

recognized by 2016 realizable long-term synergies

Majority of synergies expected to be

realized early in 2015

14

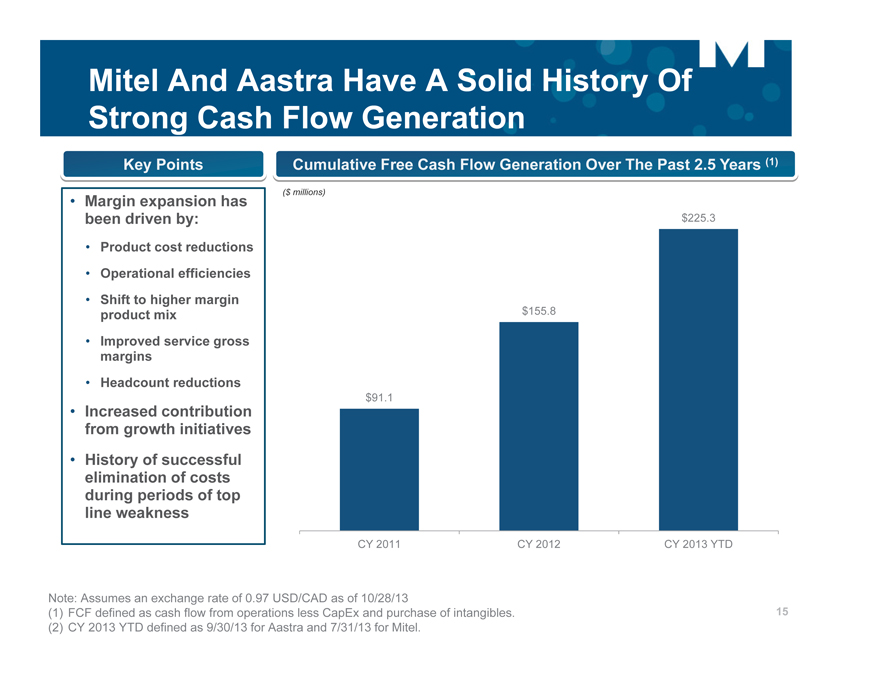

Mitel And Aastra Have A Solid History Of

Strong Cash Flow Generation

Key Points Cumulative Free Cash Flow Generation Over The Past 2.5 Years (1)

($ millions)

• Margin expansion has

been driven by: $225.3

• Product cost reductions

• Operational efficiencies

• Shift to higher margin

product mix $155.8

• Improved service gross

margins Headcount reductions

$91.1

• Increased contribution

from growth initiatives

• History of successful

elimination of costs

during periods of top

line weakness

CY 2011 CY 2012 CY 2013 YTD

Note: Assumes an exchange rate of 0.97 USD/CAD as of 10/28/13

(1) FCF defined as cash flow from operations less CapEx and purchase of intangibles. 15

(2) CY 2013 YTD defined as 9/30/13 for Aastra and 7/31/13 for Mitel.

Mitel Today…and In Future: Strategy to Drive Profitable Growth

Three key elements:

1 Leverage Our Strength in the Core

2 Maximize Our Position in the Cloud

3 Rapidly Expand in the Contact Center

16

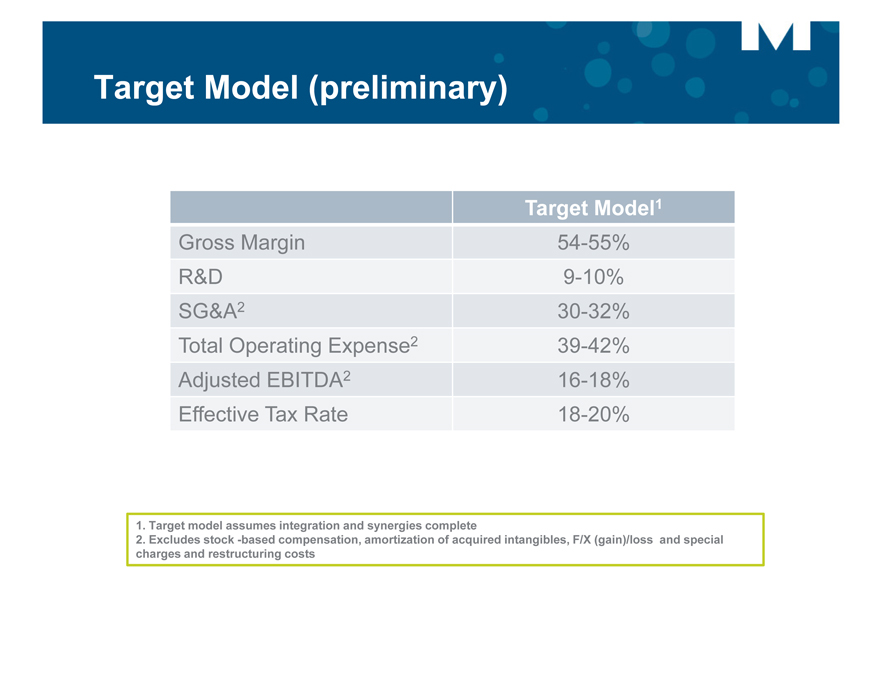

Target Model (preliminary)

Target Model 1

Gross Margin 54-55% R&D 9-10% SG&A2 30-32% Total Operating Expense2 39-42% Adjusted EBITDA2 16-18% Effective Tax Rate 18-20%

1. Target model assumes integration and synergies complete

2. Excludes stock -based compensation, amortization of acquired intangibles, F/X (gain)/loss and special charges and restructuring costs

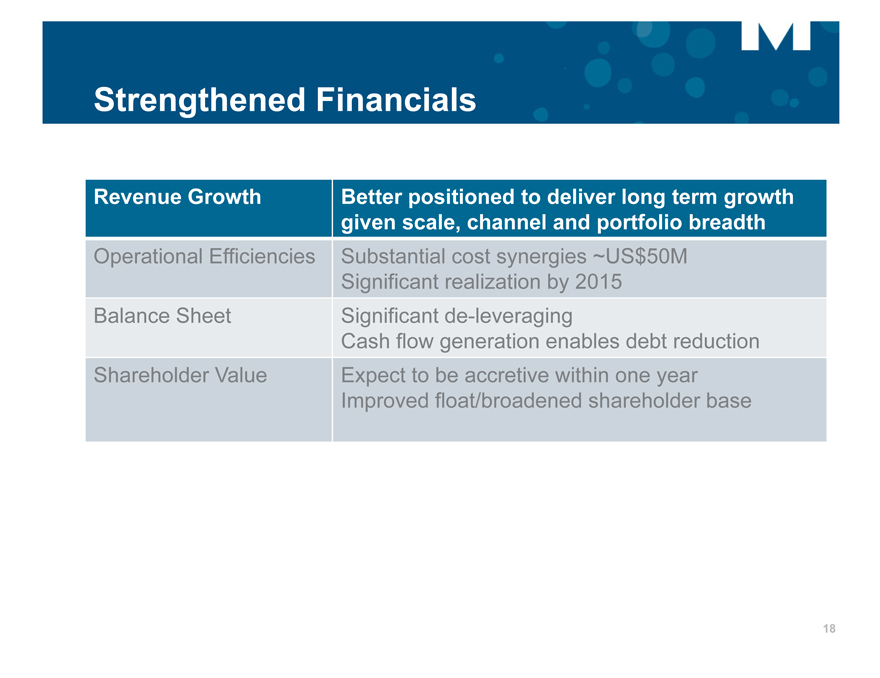

Strengthened Financials

Revenue Growth Better positioned to deliver long term growth given scale, channel and portfolio breadth

Operational Efficiencies Substantial cost synergies ~US$50M Significant realization by 2015 Balance Sheet Significant de-leveraging Cash flow generation enables debt reduction Shareholder Value Expect to be accretive within one year Improved float/broadened shareholder base

18

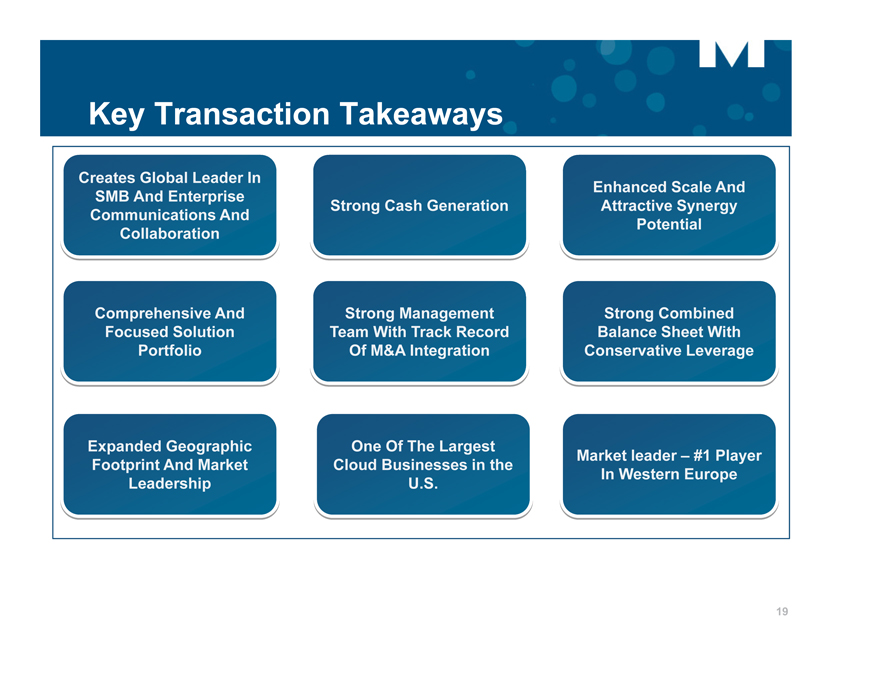

Key Transaction Takeaways

Creates Global Leader In

SMB And Enterprise Enhanced Scale And

Communications And Strong Cash Generation Attractive Synergy

Collaboration Potential

Comprehensive And Strong Management Strong Combined

Focused Solution Team With Track Record Balance Sheet With

Portfolio Of M&A Integration Conservative Leverage

Expanded Geographic One Of The Largest

Footprint And Market Cloud Businesses in the Market leader – #1 Player

Leadership U.S. In Western Europe

19

Mitel & Aastra Technologies Announce Plans to Merge

A Newly Created $Billion Company

#1 Market Share in Western Europe US$100M cloud business

Large Global Customer Footprint with 60 Million End Users Strongly Positions Mitel for Transition to Cloud Services

November 11th, 2013