Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ROYAL GOLD INC | v359761_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - ROYAL GOLD INC | v359761_ex99-1.htm |

First Quarter Fiscal 2014 Results November 7, 2013

Today’s Speakers November 7, 2013 2 Tony Jensen President and CEO Stefan Wenger CFO and Treasurer Bill Zisch VP Operations

Cautionary Statement 40 This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained herein and include, but are not limited to, that higher grade ore is expected at Penasquito in the December quarter ; that lower grade ore is expected at Andacollo in the December quarter ; that initial shipments from Mt Milligan are expected in the December quarter ; that typically we experience seasonally stronger sales from Voisey’s Bay in the December quarter ; the Pascua - Lama suspension is a temporary setback that doesn’t currently trigger any changes to carrying value ; that Mt . Milligan is well on its way to achieving commercial production by the end of this year ; that our second fiscal quarter contribution from Andacollo may be lower than the first fiscal quarter ; that the Company expects to have an effective tax rate of between 30 % and 34 % for fiscal 2014 and that adjusted EBITDA will be approximately 80 % to 85 % of revenue ; that the Company continues to expect DD&A rates of $ 425 to $ 500 for fiscal 2014 ; and statements regarding projected steady or increasing production and estimates of timing of commencement of production from operators of properties where we have royalty interests, including operator estimates ; and that commercial production is expected during the fourth quarter of calendar 2013 at Mt . Milligan, and indefinite suspension of construction at Pascua - Lama ; completion of water replacement systems and the receipt of regulatory and legal approvals at Pascua - Lama ; the resumption of construction activities leading to the commencement of operations at Pascua - Lama . Factors that could cause actual results to differ materially from these forward-looking statements include, among others : the risks inherent in construction, development and operation of mining properties, including those specific to a new mine being developed and operated by a base metals company ; changes in gold and other metals prices ; decisions and activities of the Company’s management ; unexpected operating costs ; decisions and activities of the operators of the Company’s royalty and stream properties ; unanticipated grade, geological, metallurgical, processing or other problems at the properties ; inaccuracies in technical reports and reserve estimates ; revisions by operators of reserves, mineralization or production estimates ; changes in project parameters as plans of the operators are refined ; the results of current or planned exploration activities ; discontinuance of exploration activities by operators ; economic and market conditions ; operations on lands subject to First Nations jurisdiction in Canada ; the ability of operators to bring non-producing and not - yet - in development projects into production and operate in accordance with feasibility studies ; erroneous royalty payment calculations ; title defects to royalty properties ; future financial needs of the Company ; the impact of future acquisitions and royalty financing transactions ; adverse changes in applicable laws and regulations ; litigation ; and risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, environmental laws, enforcement and uncertain political and economic environments . These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission . Statements made herein are as of the date hereof and should not be relied upon as of any subsequent date . The Company’s past performance is not necessarily indicative of its future performance . The Company disclaims any obligation to update any forward-looking statements . The Company and its affiliates, agents, directors and employees accept no liability whatsoever for any loss or damage of any kin d arising out of the use of all or any part of this material. Endnotes located on page 12. November 7, 2013 3

First Quarter Fiscal 2014 Highlights November 7, 2013 4 Financial and operational results as expected: Gold price 20% lower, and p roduction ~10% lower than a year ago Gold price 6% lower, and p roduction 5% higher than June quarter Operational matters worth noting for December quarter: Favorable volume trend at Peñasquito, higher grades expected Andacollo transitioning to phase 3, lower grade ore expected Initial shipments from Mt. Milligan expected Typically we see seasonally stronger sales from Voisey’s Bay Development property updates: Final payment made to Thompson Creek for stream purchase El Morro acquisition complete, environmental permit reinstated Pascua Lama temporary suspension, no change to our carrying value

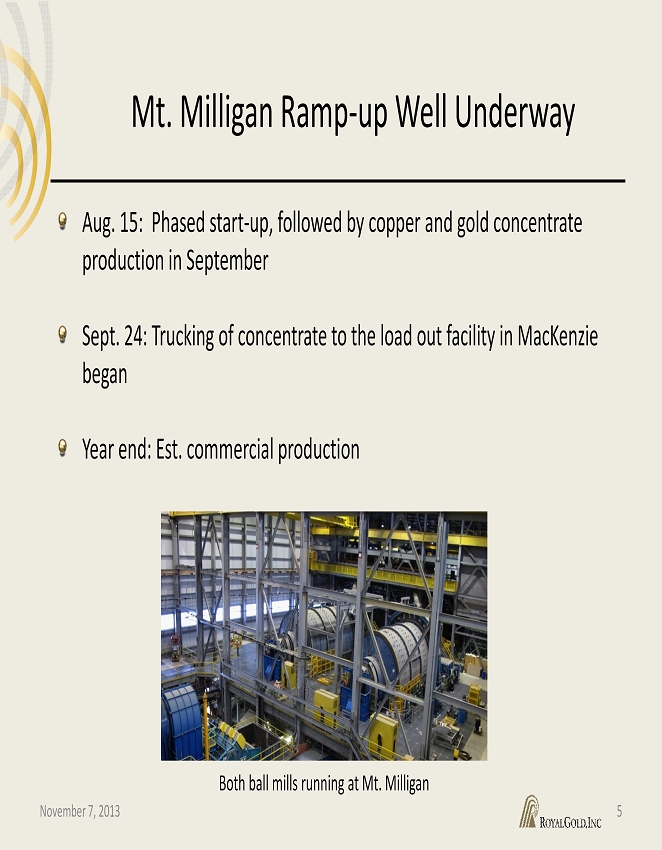

Mt. Milligan Ramp - up Well Underway 5 November 7, 2013 Aug. 15: Phased start - up, followed by copper and gold concentrate production in September Sept. 24: Trucking of concentrate to the load out facility in MacKenzie began Year end: Est. commercial production Both ball mills running at Mt. Milligan

Inaugural Concentrate Shipment November 7, 2013 6

Financial Highlights November 7, 2013 7 Q1FY2014 – Net income of $15M or $0.23/share – Cash dividend of $13M; payout ratio of 37% – Effective tax rate of 24% vs. 39%, year over year Full Year Outlook – E st. effective tax rate of 30% to 34% – Est. Adj. EBITDA at 80% to 85% of revenue – Est. DD&A of $425 to $500/GEO

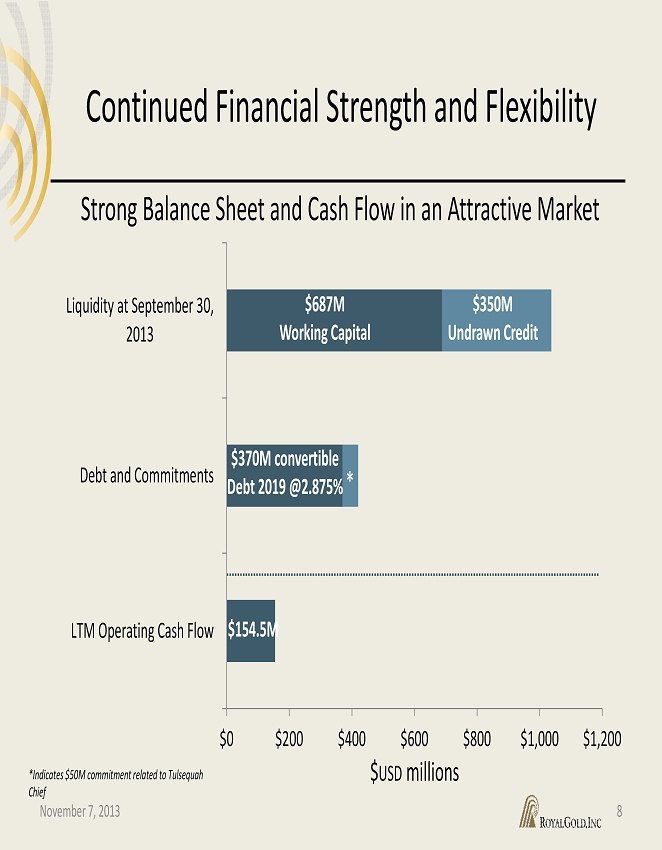

$0 $200 $400 $600 $800 $1,000 $1,200 LTM Operating Cash Flow Debt and Commitments Liquidity at September 30, 2013 Continued Financial Strength and Flexibility 8 $687M Working Capital $350M Undrawn Credit $370M convertible Debt 2019 @2.875% $ USD millions Strong Balance Sheet and Cash Flow in an Attractive Market $ 154.5M * *Indicates $50M commitment related to Tulsequah Chief November 7, 2013

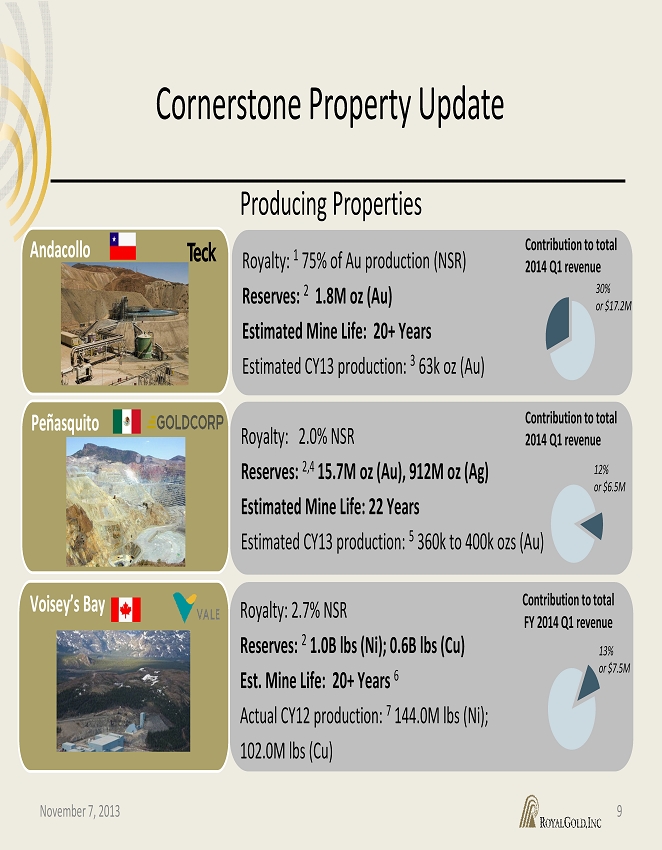

Cornerstone Property Update Andacollo Peñasquito Voisey’s Bay Producing Properties November 7, 2013 Royalty: 2.0% NSR Reserves: 2,4 15.7M oz (Au), 912M oz (Ag) Estimated Mine Life: 22 Years Estimated CY13 production: 5 360k to 400k ozs (Au) Royalty: 1 75% of Au production (NSR) Reserves: 2 1.8M oz (Au) Estimated Mine Life: 20+ Years Estimated CY13 production: 3 63k oz (Au) Royalty: 2.7% NSR Reserves: 2 1.0B lbs (Ni); 0.6B lbs (Cu) Est. Mine Life: 20+ Years 6 Actual CY12 production: 7 144.0M lbs (Ni); 102.0M lbs (Cu) 9 12% or $6.5M Contribution to total FY 2014 Q1 revenue Contribution to total 2014 Q1 revenue 30% or $17.2M 13% or $7.5M Contribution to total 2014 Q1 revenue

Strong Positioning November 7, 2013 10 Robust balance sheet with nearly $1 billion in liquidity Strong and uncommitted cash flow G rowth profile embedded in the company A ttractive market environment where there is a demand for our investment

Endnotes

Endnotes November 7, 2013 12 PAGE 7 CORNERSTONE PROPERTY UPDATES – Producing Properties 1. 75 % of payable gold until 910 , 000 payable ounces ; 50 % thereafter . As of September 30 , 2013 , there have been approximately 184 , 000 cumulative payable ounces produced . 2. Reserves as of December 31 , 2012 , as reported by the operator . 3. Recovered metal is contained in concentrate and is subject to third party treatment charges and recovery losses . 4. Reserves also include 5 . 8 billion pounds of lead and 13 . 9 billion pounds of zinc . 5. Goldcorp’s CY 2013 estimated production also includes 20 million to 21 million ounces of silver, 145 million to 160 million pounds of lead and 285 million to 305 million pounds of zinc . 6. Per BoAML 2008 Vale Inco EIS 7. FY 2013 actual production also included 2 . 7 million pounds of cobalt PAGE 8 CORNERSTONE PROPERTIES UPDATE - Development Properties 1. This is a metal stream whereby the purchase price for gold ounces delivered is $ 435 per ounce, or the prevailing market price of gold, if lower ; no inflation adjustment . Per Thompson Creek’s National Instrument 43 - 101 technical report filed on SEDAR, under Thompson Creek’s profile, on October 13 , 2011 . 2. Reserves as of October 23 , 2009 . 3. Estimated production of 262 , 000 ounces of gold annually during the first six years ; 195 , 000 ounces of gold thereafter, per Thompson Creek’s National Instrument 43 - 101 technical report filed on SEDAR, under Thompson Creek’s profile, on October 13 , 2011 . 4 . NSR sliding - scale schedule (price of gold per ounce – royalty rate) : less than or equal to $ 325 – 0 . 78 % ; $ 400 – 1 . 57 % ; $ 500 – 2 . 72 % ; $ 600 – 3 . 56 % ; $ 700 – 4 . 39 % ; greater than equal to $ 800 – 5 . 23 % . The royalty is interpolated between upper and lower endpoints . 5. Approximately 20 % of the royalty is limited to the first 14 . 0 M ounces of gold produced from the project . Also, 24 % of the royalty can be extended beyond 14 . 0 million ounces produced for $ 4 . 4 million . In addition, a one - time payment totaling $ 8 . 4 million will be made if gold prices exceed $ 600 per ounce for any six - month period within the first 36 months of commercial production . 6. Reserves as of December 31 , 2011 . Royalty applies to all gold production from an area of interest in Chile . Only that portion of reserves pertaining to our royalty interest in Chile is reflected here . 7. On October 31 , 2013 , Barrick announced a temporary suspension of construction activities at Pascua - Lama, except for those required for environmental protection and regulatory compliance . It also stated that a restart decision will depend upon improved project economics such as go - forward costs, the outlook for metal prices, and reduced uncertainty associated with legal and other regulatory requirements . 8. Based on Barrick’s guidance of 800 , 000 - 850 , 000 ounces of gold production during the first five years .

Appendix A: Property Portfolio

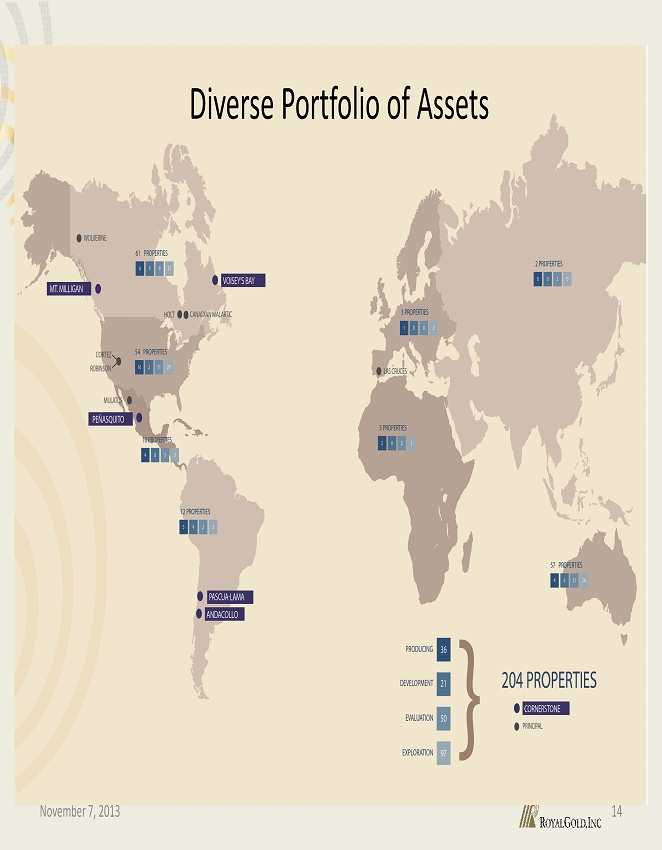

November 7, 2013 14 Diverse Portfolio of Assets

1660 Wynkoop Street Denver, CO 80202 - 1132 303.573.1660 info @royalgold.com www.royalgold.com