Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESCO INTERNATIONAL INC | q32013earningsrelease8-k.htm |

| EX-99.1 - EARNINGS RELEASE - WESCO INTERNATIONAL INC | wcc-09302013xexhibit991x8x.htm |

Q3 2013 Earnings Webcast Presentation October 24, 2013

2 Q3 2013 Earnings Webcast 10/24/2013 Safe Harbor Statement Note: All statements made herein that are not historical facts should be considered as “forward- looking statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to: adverse conditions in the global economy; increase in competition; debt levels, terms, financial market conditions or interest rate fluctuations; risks related to acquisitions, including the integration of EECOL; disruptions in operations or information technology systems; expansion of business activities; litigation, contingencies or claims; product, labor or other cost fluctuations; and other factors described in detail in the Form 10-K for WESCO International, Inc. for the year ended December 31, 2012 and any subsequent filings with the Securities & Exchange Commission. Any numerical or other representations in this presentation do not represent guidance by management and should not be construed as such. The following presentation includes a discussion of certain non-GAAP financial measures. Information required by Regulation G with respect to such non-GAAP financial measures can be obtained via WESCO’s website, www.wesco.com.

3 Q3 2013 Earnings Webcast 10/24/2013 Financial results throughout this presentation reference adjusted results. See Appendix for reconciliation. Q3 2013 Highlights • Sales of $1.93 billion, up 16.6% YOY − Achieved record quarterly sales − 14.1 points from acquisitions; EECOL sales of $233 million − 3.2 points organic growth; 1.6 points workday adjusted • Gross margin 20.5%, flat YOY • SG&A 13.2% of sales, down 40 bps YOY − SG&A $ flat YOY without acquisitions • Operating profit up 20% YOY, achieved record quarterly operating profit • Operating margin 6.4%, up 20 bps YOY • Net income of $74.7 million, up 17.8% YOY • EPS of $1.42, up 13.6% YOY − EECOL contributed approximately $0.33 of EPS accretion, $0.74 YTD • Free cash flow of $72.3 million, 97% of net income − YTD free cash flow of $180 million, 91% of net income • Financial leverage reduced to approximately 3.4X on a proforma basis − Below the top end of our targeted range of 2.0X to 3.5X

4 Q3 2013 Earnings Webcast 10/24/2013 7.7% 0.8% (2.7%) 0.2% Industrial End Market • Q3 2013 Sales − Up 0.2% versus prior year − Flat sequentially • Conney Safety up over 10% versus prior year in the third quarter after growing 5% in the first half. • Channel inventory levels appear to be in balance with demand. • Bidding activity remains robust with notable customer trends including outsourcing and supplier consolidation continuing. • Global Accounts and Integrated Supply opportunity pipeline increased to over $2.5 billion. Renewed a long term contract with a large Canadian mining company. Scope of supply includes electrical MRO and project-based materials, with additional opportunity to expand service footprint outside of Canada. Industrial Core Sales Growth versus Prior Year 43% Industrial • Global Accounts • Integrated Supply • OEM • General Industrial 12% Note: Excludes acquisitions during the first year of ownership. Q1 2013 Q4 2012 Q2 2013 Q3 2012 Q2 2012 2012 5.1% Q3 2013 0.7% (5.4%)

5 Q3 2013 Earnings Webcast 10/24/2013 3.8% 0.0% 1.1% Construction • Non-Residential • Residential 31% Core Sales Growth versus Prior Year Construction End Market • Q3 2013 Sales − Up 1.1% versus prior year − Up 4.0% sequential • Backlog grew sequentially in the quarter and is up approximately 8% versus year end 2012. • U. S. non-residential construction market remains weak, but residential recovery continues to be a positive leading indicator. • Canadian economy and construction market stabilized in third quarter. Secured an automation control and switchgear order for an oil pipeline pumping station in Canada. We anticipate additional bidding opportunities for other electrical products prior to year-end. Construction Note: Excludes acquisitions during the first year of ownership. 2012 0.9% Q1 2013 Q4 2012 Q2 2013 Q3 2012 Q2 2012 (6.6%) (5.8%) (4.8%) Q3 2013

6 Q3 2013 Earnings Webcast 10/24/2013 Utility End Market Core Sales Growth versus Prior Year 14% Utility • Investor Owned • Public Power • Utility Contractors • Q3 2013 Sales − Up 11.1% versus prior year − Up 1.0% sequential • Tenth consecutive quarter of year-over- year organic sales growth. • Implementation of recent customer wins providing strong YOY growth. • Scope expansion with IOU, public power and generation customers also providing sales growth. • Strong interest for WESCO Integrated Supply across all utility customer groups. Awarded a high voltage infrastructure upgrade project for material supply, logistics, and procurement management services with a large investor owned utility. Project scope includes multiple transmission segments, substation upgrades and underground power lines. Utility Note: Excludes acquisitions during the first year of ownership. 11.7% 4.3% 6.9% 17.5% 22.5% 11.1% Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 2012 10.9%

7 Q3 2013 Earnings Webcast 10/24/2013 14.3% 0.0% (3.3%) (8.5%) (4.3%) 5.1% CIG End Market • Q3 2013 Sales − Up 5.1% versus prior year − Up 5.5% sequential • Bidding activity remains active in commercial and institutional markets, particularly in education. • Federal contracts continue but awards have slowed due to budget constraints and sequestration. • Government opportunity pipeline remains healthy at over $500 million. Awarded a multi-year contract to provide electrical materials and supplies for a large U.S. international airport. Multiple distributors serving several customer locations were consolidated with WESCO being selected as the preferred supplier. Government Core Sales Growth versus Prior Year CIG • Commercial • Institutional • Government 12% Note: Excludes acquisitions during the first year of ownership. 2012 3.8% Q1 2013 Q4 2012 Q2 2013 Q3 2012 Q2 2012 Q3 2013

8 Q3 2013 Earnings Webcast 10/24/2013 Q3 2013 Results versus Outlook Q3 Outlook Q3 Actual Sales Growth of 17% to 19% 2% to 4% organic Growth of 16.6% 1.6% normalized organic sales Gross Margin Approximately 20.8% 20.5% Operating Margin Approximately 6.2% 6.4% Effective Tax Rate Approximately 26% to 27% 27.2%

9 Q3 2013 Earnings Webcast 10/24/2013 Q3 2012 Core EECOL Q3 2013 (0.16) 1.25 0.33 1.42 EPS Roadmap ($) 2% organic (90) bps GM Flat SG&A $ Share count growth +14%

10 Q3 2013 Earnings Webcast 10/24/2013 170.1 180.3 YTD 2012 YTD 2013 Cash Generation Free Cash Flow (1) ($ Millions) 91% of adjusted net Income (1) 98% of adjusted net income (1) (1) Reconciliation of these non-GAAP financial measures is included in the Appendix to this webcast presentation. 2011 2012 (Total Par Debt to TTM EBITDA) Leverage 2013 1.5 2 2.5 3 3.5 4 4.5 5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Target Leverage 2.0x – 3.5x 3.6X 3.4X Reported 4.7X Estimated Proforma < 4.0X

11 Q3 2013 Earnings Webcast 10/24/2013 Outlook 2013 Outlook Q4 Full Year Sales Growth of 14% to 17%; 2% to 4% organic Growth of 14% to 15%; Approximately flat organic Gross Margin Approximately 20.5% Approximately 20.7% Operating Margin Approximately 6.0% Approximately 5.9% - 6.0% Effective Tax Rate Approximately 26% to 28% Approximately 26% to 27% Adjusted Earnings Per Diluted Share Approximately $5.00 to $5.20

12 Q3 2013 Earnings Webcast 10/24/2013 Appendix

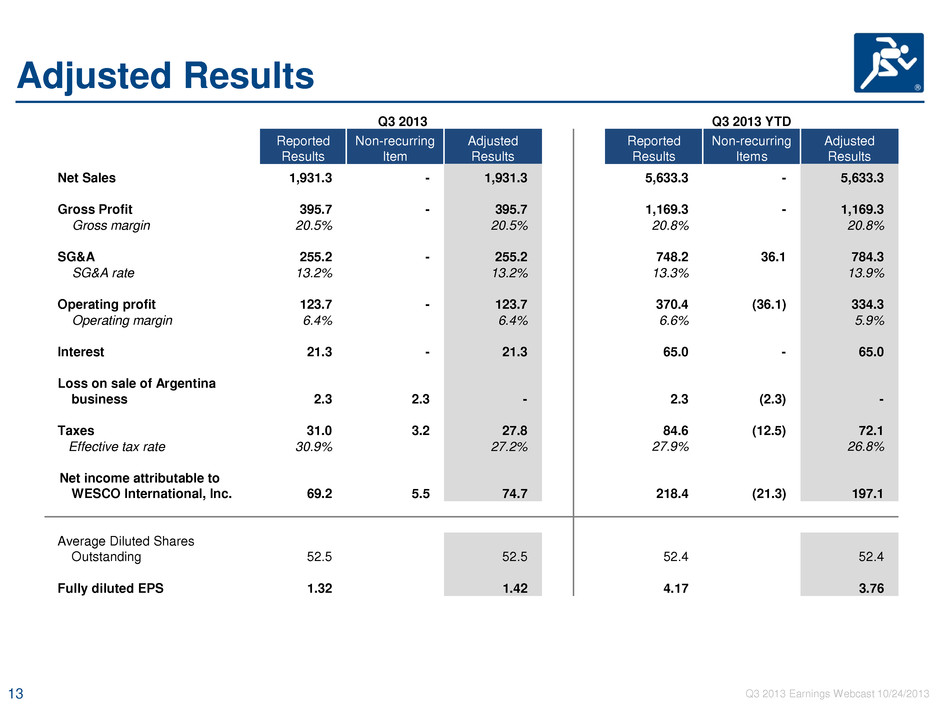

13 Q3 2013 Earnings Webcast 10/24/2013 Adjusted Results Q3 2013 Q3 2013 YTD Reported Results Non-recurring Item Adjusted Results Reported Results Non-recurring Items Adjusted Results Net Sales 1,931.3 - 1,931.3 5,633.3 - 5,633.3 Gross Profit 395.7 - 395.7 1,169.3 - 1,169.3 Gross margin 20.5% 20.5% 20.8% 20.8% SG&A 255.2 - 255.2 748.2 36.1 784.3 SG&A rate 13.2% 13.2% 13.3% 13.9% Operating profit 123.7 - 123.7 370.4 (36.1) 334.3 Operating margin 6.4% 6.4% 6.6% 5.9% Interest 21.3 - 21.3 65.0 - 65.0 Loss on sale of Argentina business 2.3 2.3 - 2.3 (2.3) - Taxes 31.0 3.2 27.8 84.6 (12.5) 72.1 Effective tax rate 30.9% 27.2% 27.9% 26.8% Net income attributable to WESCO International, Inc. 69.2 5.5 74.7 218.4 (21.3) 197.1 Average Diluted Shares Outstanding 52.5 52.5 52.4 52.4 Fully diluted EPS 1.32 1.42 4.17 3.76

14 Q3 2013 Earnings Webcast 10/24/2013 WESCO Profile Q3 2013 YTD 43% 31% 14% 12% 40% 14% 16% 11% 10% 9% Controls & Motors Lighting & Controls General Supplies Data & Broadband Communications Wire, Cable & Conduit Distribution Equipment Note: Markets & Customers and Products & Services percentages reported on consolidated basis. Products & Services Markets & Customers Utility CIG Industrial Construction Investor Owned | Public Power Utility Contractors Commercial | Institutional | Government Global Accounts | Integrated Supply OEM | General Industrial Non-Residential | Residential

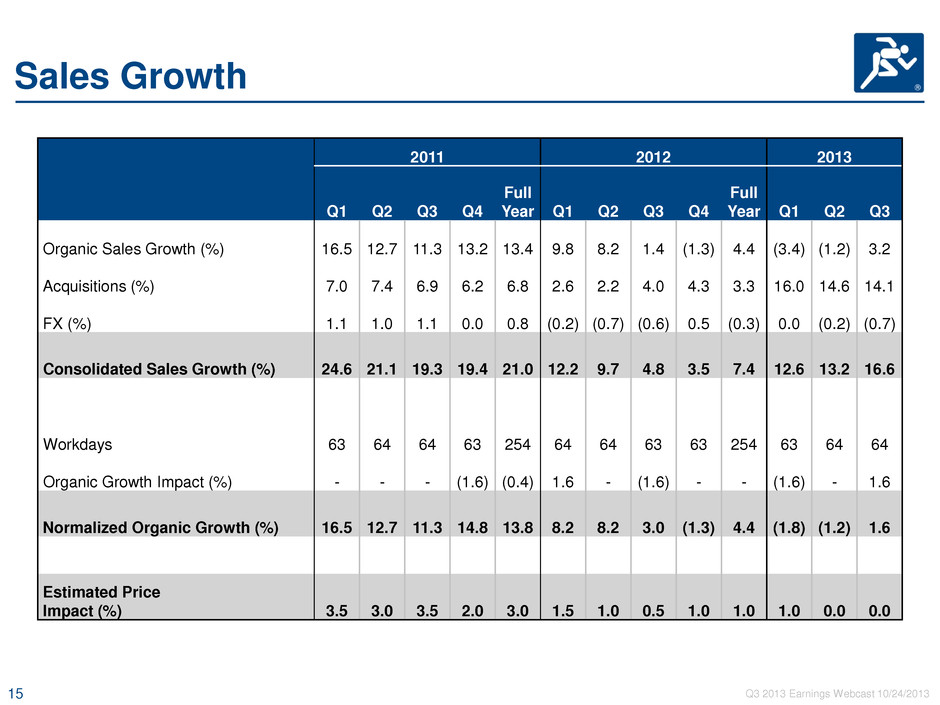

15 Q3 2013 Earnings Webcast 10/24/2013 Sales Growth 2011 2012 2013 Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Q4 Full Year Q1 Q2 Q3 Organic Sales Growth (%) 16.5 12.7 11.3 13.2 13.4 9.8 8.2 1.4 (1.3) 4.4 (3.4) (1.2) 3.2 Acquisitions (%) 7.0 7.4 6.9 6.2 6.8 2.6 2.2 4.0 4.3 3.3 16.0 14.6 14.1 FX (%) 1.1 1.0 1.1 0.0 0.8 (0.2) (0.7) (0.6) 0.5 (0.3) 0.0 (0.2) (0.7) Consolidated Sales Growth (%) 24.6 21.1 19.3 19.4 21.0 12.2 9.7 4.8 3.5 7.4 12.6 13.2 16.6 Workdays 63 64 64 63 254 64 64 63 63 254 63 64 64 Organic Growth Impact (%) - - - (1.6) (0.4) 1.6 - (1.6) - - (1.6) - 1.6 Normalized Organic Growth (%) 16.5 12.7 11.3 14.8 13.8 8.2 8.2 3.0 (1.3) 4.4 (1.8) (1.2) 1.6 Estimated Price Impact (%) 3.5 3.0 3.5 2.0 3.0 1.5 1.0 0.5 1.0 1.0 1.0 0.0 0.0

16 Q3 2013 Earnings Webcast 10/24/2013 Outstanding at December 31, 2012 Outstanding at September 30, 2013 Debt Maturity Schedule AR Revolver (V) 445 500 2016 Inventory Revolver (V) 218 58 2016 Real Estate Mortgage (F) 26 - 2019 Term Loans (V) 850 820 2019 2029 Convertible Bonds (F) 345 345 2029 (No Put) Other (V) 35 35 N/A Total Par Debt 1,919 1,758 Capital Structure Key Financial Metrics YTD Q3 2012 YE 2012 YTD Q3 2013 Cash 108 86 99 Capital Expenditures 20 23 21 Free Cash Flow 170 265 180 Liquidity (1) 489 299 546 ($ Millions) V = Variable Rate Debt 1 = Asset-backed credit facilities total availability plus invested cash. F = Fixed Rate Debt

17 Q3 2013 Earnings Webcast 10/24/2013 Note: The prior period end market amounts noted above may contain reclassifications to conform to current period presentation. Reconciliation of Non-GAAP Financial Measures ($ Millions) Unaudited Sales Full Year 2012 vs. 2011 Q3 2013 vs. Q3 2012 Q3 2013 vs. Q2 2013 Q3 Q3 Q3 Q2 2012 2011 % Growth 2013 2012 % Growth 2013 2013 % Growth Industrial Core 2,736 2,604 5.1 % 707 705 0.2% 811 813 (0.1)% Construction Core 2,088 2,071 0.9 % 536 530 1.1% 630 606 4.0% Utility Core 759 685 10.9 % 236 213 11.1% 260 258 1.0% CIG Core 817 787 3.8 % 225 214 5.1% 237 224 5.5% Total Core Gross Sales 6,400 6,147 4.1 % 1,704 1,662 2.5% 1,938 1,901 2.0% Total Gross Sales from Acquisitions 201 - - 234 - - - - - Total Gross Sales 6,601 6,147 7.4 % 1,938 1,662 16.6% 1,938 1,901 2.0% Gross Sales Reductions/Discounts (22) (21) - (7) (6) - (7) (7) - Total Net Sales 6,579 6,126 7.4 % 1,931 1,656 16.6% 1,931 1,894 2.0%

18 Q3 2013 Earnings Webcast 10/24/2013 ($ Millions) Maturity Par Value of Debt Debt Discount Debt per Balance Sheet 2029 344.9 (171.5) 173.4 Convertible Debt At September, 30, 2013 Non-Cash Interest Expense ($ Millions) 2011 2012 Q3 YTD 2013 Convertible Debt 2.5 2.3 3.2 Amortization of Deferred Financing Fees 4.4 2.6 3.7 FIN 48 1.9 (3.4) (0.2) Total 8.8 1.5 6.7 Convertible Debt and Non-Cash Interest

19 Q3 2013 Earnings Webcast 10/24/2013 EPS Dilution Weighted Average Quarterly Share Count Stock Price Incremental Shares from 2029 Convertible Debt (in millions)3 Incremental Shares from Equity Awards (in millions) Total Diluted Share Count (in millions)4 $50.00 5.05 0.66 49.89 $60.00 6.20 0.76 51.14 $70.00 7.02 1.01 52.21 Q3 2013 Average $74.17 7.29 1.07 52.54 $80.00 7.64 1.15 52.97 $90.00 8.12 1.26 53.56 $100.00 8.50 1.36 54.04 2029 Convertible Debt Details Conversion Price $28.8656 Conversion Rate 34.6433 1 Underlying Shares 11,948,894 2 Footnotes: 2029 Convertible Debenture 1 1000/28.8656 2 $345 million/28.8656 3 (Underlying Shares x Avg. Quarterly. Stock Price) minus $345 million Avg. Quarterly Stock Price 4 Basic Share Count of 44.18 million shares

20 Q3 2013 Earnings Webcast 10/24/2013 Work Days Q1 Q2 Q3 Q4 FY 2012 64 64 63 63 254 2013 63 64 64 63 254 2014 63 64 64 62 253

21 Q3 2013 Earnings Webcast 10/24/2013 Free Cash Flow Reconciliation Q3 2012 Q3 2013 Q3 YTD 2012 Q3 YTD 2013 Cash flow provided by operations 74.4 59.9 189.6 179.7 Less: Capital expenditures (7.2) (8.7) (19.5) (20.5) Add: Non-recurring pension contribution - 21.1 - 21.1 Free Cash Flow 67.2 72.3 170.1 180.3 Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to provide a source of funds for any of the Company's financing needs. During the quarter ended September 30, 2013, a non-recurring contribution was made to fund the Canadian EECOL pension plan. This contribution was required pursuant to the terms of the share purchase agreement by which the Company acquired EECOL in 2012. EECOL sellers fully funded this contribution by way of a direct reduction in the purchase price at the date of acquisition. U.S. GAAP requires the contribution to be shown as a reduction of operating cash flow, however, it is added back to accurately reflect free cash flow. ($ Millions)