Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AZZ INC | form8kinvestorpresentation.htm |

| EX-99.2 - EXHIBIT 99.2 GUIDANCE - AZZ INC | ex992guidance.htm |

October 2013

2 Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as, “may,” “should,” “expects, “ “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward- looking statements. In addition, certain factors could affect the outcome of the matters described herein. This presentation may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand and response to products and services offered by AZZ, including demand by the electrical power generation markets, electrical transmission and distribution markets, the industrial markets, and the hot dip galvanizing markets; prices and raw material cost, including zinc and natural gas which are used in the hot dip galvanizing process; changes in the economic conditions of the various markets that AZZ serves, foreign and domestic, customer request delays of shipments, acquisition opportunities, currency exchange rates, adequacy of financing, and availability of experienced management employees to implement AZZ’s growth strategy. AZZ has provided additional information regarding risks associated with the business in AZZ’s Annual Report on Form 10-K for the fiscal year ended February 28, 2013 and other filings with the SEC, available for viewing on AZZ’s website at www.azz.com and on the SEC’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise. Forward Looking Statement

3 AZZ is a global provider of specialty electrical equipment and highly engineered services to the power generation, transmission, distribution and industrial markets as well as a leading provider of hot dip galvanizing services to the North American steel fabrication market. Company Overview

4 60% 40% Actual FY2012 $469 (in millions) Total Company Sales by Segment 59% 41% Actual FY2013 $571 (in millions) 44% 56% Projected FY2014 $780 to $810 (in millions) Electrical and Industrial Galvanizing

5 54% 25% 21% Actual FY2012 $469 (in millions) Total Company Sales by Market Segment 47% 21% 32% Actual FY2013 $571 (in millions) 48% 14% 38% Projected FY2014 $780 to $810 (in millions) Transmission & Distribution Industrial Power Generation

6 Electrical and Industrial Products & Services

7 25% 29% 46% Actual FY2013 $234 (in millions) 33% 15% 52% Six Months Ended 8/31/13 $201 (in millions) 31% 37% 32% Actual FY2012 $189 (in millions) 40% 60% 94% 6% 77% 23% Revenue projected to be between $430 and $450 million in FY2014 Electrical and Industrial Products & Services Revenue Mix Transmission & Distribution Industrial Power Generation Service Product B y M ar ke t B y Ty p e

8 Electrical and Industrial Products & Services Fossil Power Oil & Gas Petrochemical Nuclear Renewable Industrial Transmission & Distribution The WSI acquisition expands AZZ’s capabilities to include complex repair and life extension solutions for critical process equipment Enclosure Systems Specialty Lighting Enclosure Systems Hazardous Lighting Safety Related Solutions Post Fukushima Bus Systems Enclosure Systems Bus Systems Switchgear Enclosure Systems Bus Systems

9 Fiscal 2012 Fiscal 2013 1st Qtr 2014 2nd Qtr 2014 Beginning Backlog $108.4 $138.6 $221.7 $219.6 Bookings $499.3 $575.2 $181.1 $181.5 Acquired Backlog -0- $78.5 -0- -0- Shipments $469.1 $570.6 $183.2 $189.8 Ending Backlog $138.6 $221.7 $219.6 $211.4 Book to Ship Ratio 106% 101% 99% 96% Backlog ($ In Millions)

10 Galvanizing Services

11 Includes Galvanized: • Steel Sheet • Tube Steel Global Galvanized Steel Market Galvanizing Market Opportunity Post-Fabrication Galvanized Steel Electrical Utility Industrial Petrochemical Bridge & Highway OEM AZZ Served Markets

12 Application: “After-fabrication” steel corrosion protection Locations: 35 facilities in 17 states and 3 Canadian Provinces

13 39% 11% 30% 8% 12% Actual FY 2013 $337 (in millions) Electrical & Telecommunication OEM's Industrial Bridge & Highway Petrochemical 34% 12% 34% 8% 12% 6mo Ended 8-31-13 $172 (in millions) Galvanizing Services Revenue projected to be between $350 and $360 million in FY2014

14 $357 $381 $469 $571 $780 to $810 $0 $100 $200 $300 $400 $500 $600 $700 $800 $900 2010 2011 2012 2013 2014 Fiscal Year Actual Projected Consolidated Net Sales ($ In Millions)

15 $1.51 $1.39 $1.61 $2.37 $2.45 to $2.65 $0.00 $0.50 $1.00 $1.50 $2.00 $2.50 $3.00 2010 2011 2012 2013 2014 Fiscal Year Actual Projected Earnings Per Share (Fully Diluted)

16 20.0% 16.7% 13.6% 14.7% 12% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 2010 2011 2012 2013 2014 Electrical and Industrial Products and Services Actual Projected Operating Margins 29.2% 26.1% 26.1% 26.1% 28% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 2010 2011 2012 2013 2014 Galvanizing Services Actual Projected

17 Cash Provided By Operations / EBITDA / Free Cash Flow ($ In Millions) ($5.0) $15.0 $35.0 $55.0 $75.0 $95.0 $115.0 $135.0 $155.0 $175.0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Fiscal Year Cash Pro. By Oper. Free Cash Flow EBITDA *Excludes $12 million for the rebuild of the Joliet Galvanizing facility in Fiscal 2014 * Projected

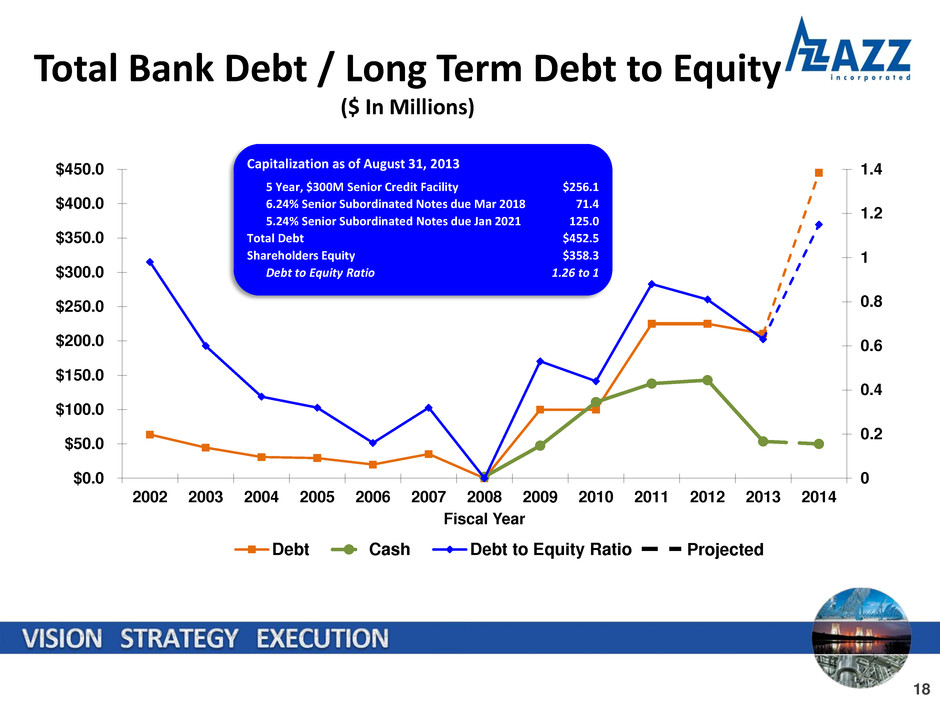

18 0 0.2 0.4 0.6 0.8 1 1.2 1.4 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 $450.0 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Fiscal Year Debt Cash Debt to Equity Ratio Projected Total Bank Debt / Long Term Debt to Equity ($ In Millions) Capitalization as of August 31, 2013 5 Year, $300M Senior Credit Facility $256.1 6.24% Senior Subordinated Notes due Mar 2018 71.4 5.24% Senior Subordinated Notes due Jan 2021 125.0 Total Debt $452.5 Shareholders Equity $358.3 Debt to Equity Ratio 1.26 to 1

19 $12.0 $16.4 $19.8 $24.9 $17.5 $22.2 $22.6 $29.4 * $38.0 $45.0 $0 $10 $20 $30 $40 $50 2010 2011 2012 2013 2014E Capital Expenditures D&A Projected CE Projected D&A Capital Expenditures / Depreciation & Amortization ($ In Millions) *Excludes $12 million for the rebuild of the Joliet Galvanizing facility in Fiscal 2014.

20 21% 18% 17% 0% 5% 10% 15% 20% 25% 2011 2012 2013 Electrical and Industrial Products and Services Return On Assets 27% 25% 26% 0% 5% 10% 15% 20% 25% 30% 35% 2011 2012 2013 Galvanizing Services

21 • Strong Historical Performance • FY13 is the 26th consecutive year of profitability • 10 Yr CAGR – Revenues 12%, Net Income 22%, EPS 19% • Significant Operating Margins (above industry averages) • Key Growth Drivers • Aging U.S. energy infrastructure and required investment • Emerging North American energy independence • International demand for electrical power and energy • Niche products and value added services with strong market share position • Strong Management Team • Successful acquisition track record and opportunities for further expansion and growth • Strong balance sheet and cash flows • Cash Dividend AZZ Investment Summary

22