Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Northrop Grumman Innovation Systems, Inc. | atk1082013x8-k.htm |

A premier aerospace and defense company Alliant Techsystems Inc. Lender Meeting October 8, 2013 Mark DeYoung, President & CEO Neal Cohen, EVP & CFO Exhibit 99.1

2 Recent Developments • To-date, no material impact on ATK from government shutdown • ATK contingency planning in place for government shutdown • If any material impact occurs, contingency plans allow for actions to mitigate • Opportunity to recapture any impact as work resumes post shutdown • 2Q FY14 quarter-end liquidity of ~$500 million (cash on hand + available revolver) • Expecting positive 2Q FY14 operating performance • Historically, third quarter generally produces strong free cash flow

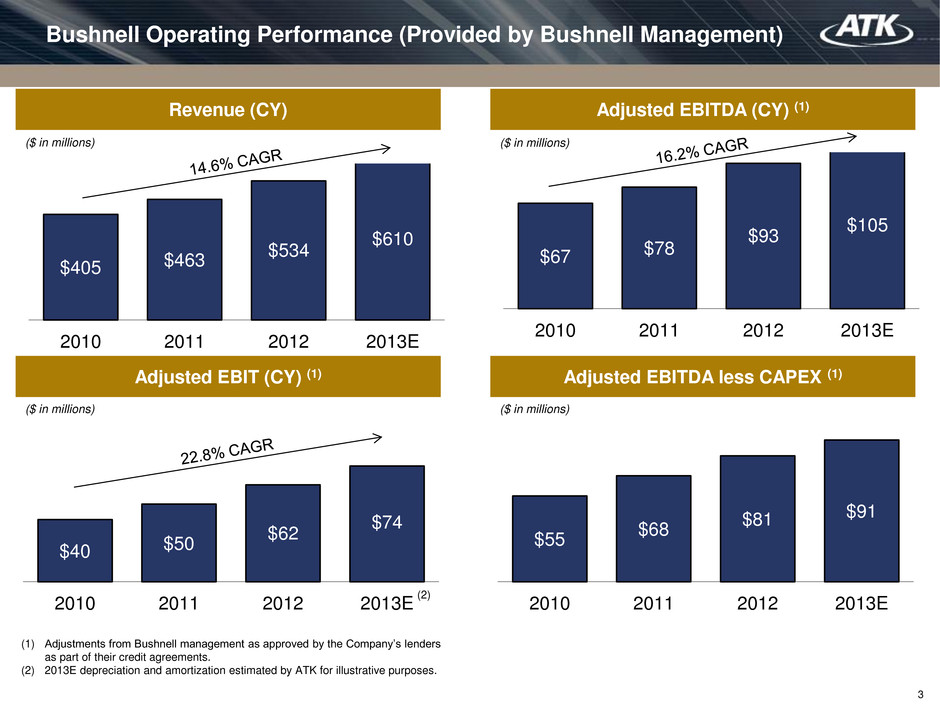

3 $55 $68 $81 $91 2010 2011 2012 2013E $40 $50 $62 $74 2010 2011 2012 2013E Bushnell Operating Performance (Provided by Bushnell Management) Revenue (CY) Adjusted EBITDA (CY) (1) $67 $78 $93 $105 2010 2011 2012 2013E Adjusted EBIT (CY) (1) Adjusted EBITDA less CAPEX (1) $405 $463 $534 $610 2010 2011 2012 2013E ($ in millions) ($ in millions) ($ in millions) ($ in millions) (1) Adjustments from Bushnell management as approved by the Company’s lenders as part of their credit agreements. (2) 2013E depreciation and amortization estimated by ATK for illustrative purposes. (2)

4 Transaction Overview Transaction Overview • ATK has engaged Merrill Lynch, Pierce, Fenner & Smith Incorporated, the Bank of Tokyo- Mitsubishi UFJ, Ltd., RBC Capital Markets, SunTrust Robinson Humphrey, Inc., U.S. Bank National Association and Wells Fargo Securities, LLC as Joint Lead Arrangers and Joint Bookrunners to arrange and syndicate $1,860 million of new Senior Secured Credit Facilities (the “Credit Facilities”) • The new Credit Facilities will consist of: − $600 million 5-year Revolver − $1,010 million 5-year Term Loan A − $250 million 7-year Term Loan B • The Company also intends to issue $300 million of New Senior Unsecured Notes (the “Notes”) • The proceeds from both the Credit Facilities and the Notes will be used to (i) finance the Acquisition; (ii) refinance in full all indebtedness under the Existing Senior Credit Facilities; and (iii) pay fees and expenses incurred in connection with the Acquisition • Pro Forma Senior Secured and Total Leverage will be 2.0x and 3.2x (as of 6/30/13)

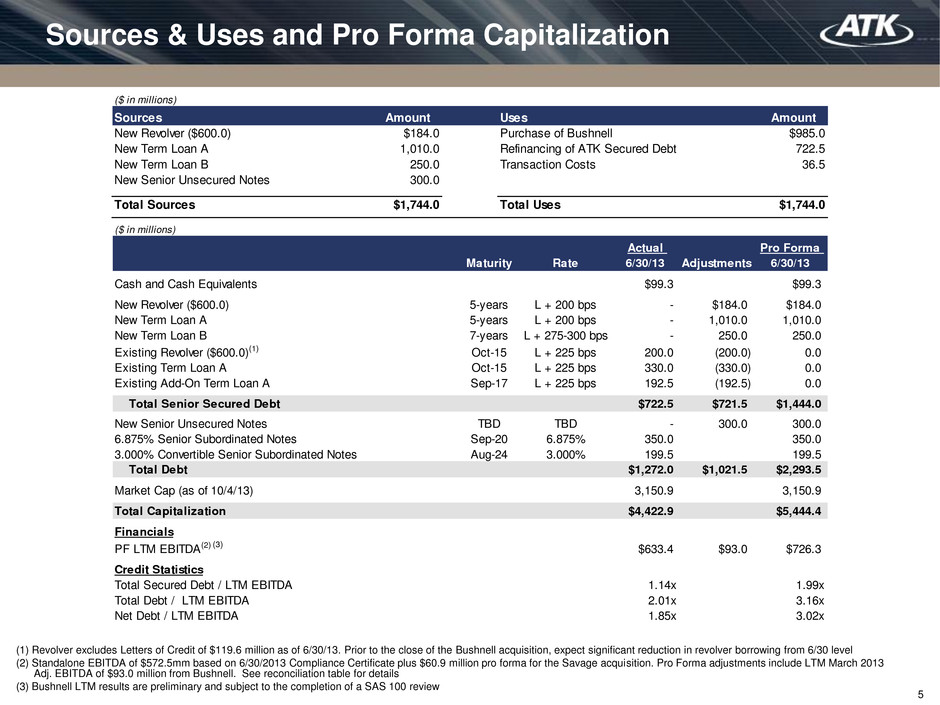

5 Sources & Uses and Pro Forma Capitalization (1) (1) Revolver excludes Letters of Credit of $119.6 million as of 6/30/13. Prior to the close of the Bushnell acquisition, expect significant reduction in revolver borrowing from 6/30 level (2) Standalone EBITDA of $572.5mm based on 6/30/2013 Compliance Certificate plus $60.9 million pro forma for the Savage acquisition. Pro Forma adjustments include LTM March 2013 Adj. EBITDA of $93.0 million from Bushnell. See reconciliation table for details (3) Bushnell LTM results are preliminary and subject to the completion of a SAS 100 review ($ in millions) Sources Amount Uses Amount New Revolver ($600.0) $184.0 Purchase of Bushnell $985.0 e Term Loan A 1,010.0 Refinancing of ATK Secured Debt 722.5 New Ter Loan B 250.0 Transaction Costs 36.5 e Senior Unsecured Notes 300.0 Total Sources $1,744.0 Total Uses $1,744.0 ($ in millions) Maturity Rate Actual 6/30/13 Adjustments Pro Forma 6/30/13 Cash and Cash Equivalents $99.3 $99.3 New Revolver ($600.0) 5-years L + 200 bps - $184.0 $184.0 New Term Loan A 5-years L + 200 bps - 1,010.0 1,010.0 New Term Loan B 7-years L + 275-300 bps - 250.0 250.0 Existing Revolver ($600.0)(1) Oct-15 L + 225 bps 200.0 (200.0) 0.0 Existing Term Loan A Oct-15 L + 225 bps 330.0 (330.0) 0.0 Existing Add-On Term Loan A Sep-17 L + 225 bps 192.5 (192.5) 0.0 Total Senior Secured Debt $722.5 $721.5 $1,444.0 New Senior Unsecured Notes TBD TBD - 300.0 300.0 6.875% Senior Subordinated Notes Sep-20 6.875% 350.0 350.0 3.000% Convertible Senior Subordinated Notes Aug-24 3.000% 199.5 199.5 Total Debt $1,272.0 $1,021.5 $2,293.5 Market Cap (as of 10/4/13) 3,150.9 3,150.9 Total Capitalization $4,422.9 $5,444.4 Fin ncials PF LTM EBITDA(2) $633.4 $93.0 $726.3 Credit Statistics Total Secured Debt / LTM EBITDA 1.14x 1.99x Total Debt / LTM EBITDA 2.01x 3.16x Net Debt / LTM EBITDA 1.85x 3.02x (3)

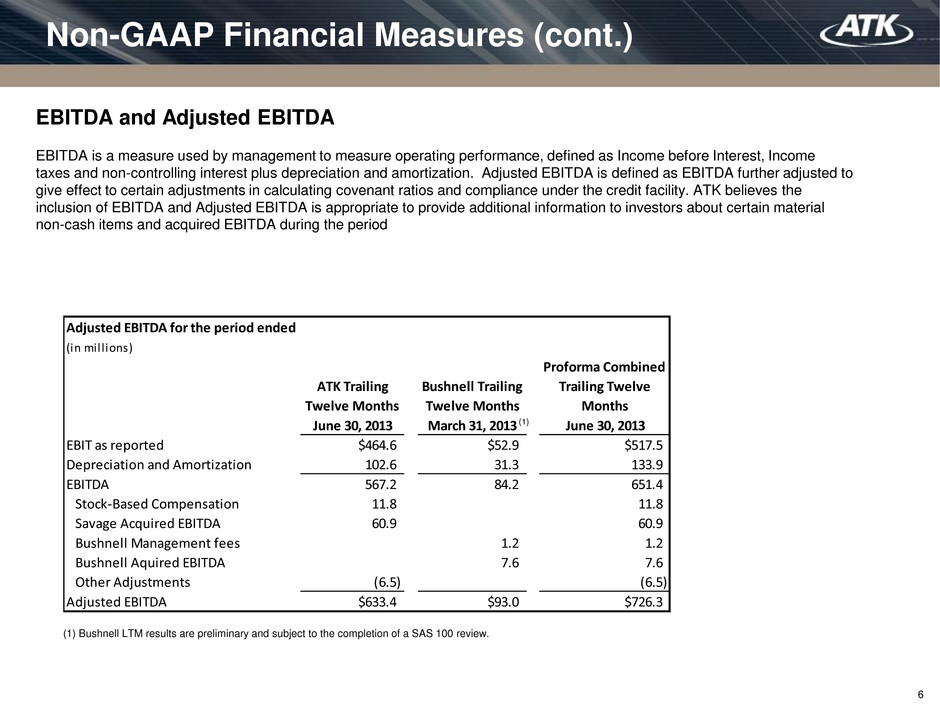

6 Non-GAAP Financial Measures (cont.) EBITDA and Adjusted EBITDA EBITDA is a measure used by management to measure operating performance, defined as Income before Interest, Income taxes and non-controlling interest plus depreciation and amortization. Adjusted EBITDA is defined as EBITDA further adjusted to give effect to certain adjustments in calculating covenant ratios and compliance under the credit facility. ATK believes the inclusion of EBITDA and Adjusted EBITDA is appropriate to provide additional information to investors about certain material non-cash items and acquired EBITDA during the period Adjusted EBITDA for the period ended (in mill ions) ATK Trailing Twelve Months Bushnell Trailing Twelve Months Proforma Combined Trailing Twelve Months June 30, 2013 March 31, 2013 June 30, 2013 EBIT as reported $464.6 $52.9 $517.5 Depreciation and Amortization 102.6 31.3 133.9 E ITD 567.2 84.2 651.4 Stock-Based Compensation 11.8 11.8 Savage Acquired EBITDA 60.9 60.9 Bushnell Management fees 1.2 1.2 Bushnell Aquired EBITDA 7.6 7.6 Other Adjustments (6.5) (6.5) Adjusted EBITDA $633.4 $93.0 $726.3 (1) Bushnell LTM results are preliminary and subject to the completion of a SAS 100 review. (1)