Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Mondelez International, Inc. | d592185d8k.htm |

| EX-99.1 - MONDELEZ INTERNATIONAL, INC. PRESS RELEASE, DATED SEPTEMBER 3, 2013. - Mondelez International, Inc. | d592185dex991.htm |

0

Mondel z International

Barclays Capital

Back to School Conference

September 3, 2013

Exhibit 99.2 |

Irene

Rosenfeld Chairman and CEO

1 |

| Forward-looking statements

2

This

slide

presentation

contains

a

number

of

forward-looking

statements.

The

words

“will,”

“expect,”

“intend,”

“plan,”

“drive,”

“commit,”

“accelerate,”

“improve,”

“increase,”

“deliver,”

“opportunity,”

“growth,”

“outlook,”

“guidance”

and

similar

expressions

are

intended

to

identify

our

forward-looking

statements.

Examples

of

forward-looking

statements

include,

but

are

not

limited

to,

statements

we

make

about

our

future

performance,

including

future

revenue

growth,

earnings

per

share

and

margins;

the

drivers

of

our

future

performance,

including

production,

and

productivity

and

cash

management

improvements;

our

investments

in

emerging

markets;

and

confidence

in

our

future.

These

forward-looking

statements

involve

risks

and

uncertainties,

many

of

which

are

beyond

our

control,

and

important

factors

that

could

cause

actual

results

to

differ

materially

from

those

in

our

forward-looking

statements

include,

but

are

not

limited

to,

continued

global

economic

weakness,

increased

competition,

continued

volatility

of

commodity

and

other

input

costs,

business

disruptions,

pricing

actions,

and

risks

from

operating

globally

and

tax

law

changes.

For

additional

information

on

these

and

other

factors

that

could

affect

our

forward-looking

statements,

see

our

risk

factors,

as

they

may

be

amended

from

time

to

time,

set

forth

in

our

filings

with

the

SEC,

including

our

most

recently

filed

Annual

Report

on

Form

10-K.

We

disclaim

and

do

not

undertake

any

obligation

to

update

or

revise

any

forward-looking

statement

in

this

slide

presentation,

except

as

required

by

applicable

law

or

regulation. |

Mondel

z International is well-positioned

for success

3

Advantaged

Geographic

Footprint

Fast-

Growing

Categories

Favorite

Snacks

Brands

Strong

Routes-to-

Market

Proven

Innovation

Platforms

World-Class

Talent &

Capabilities |

Virtuous cycle driving long-term targets

4

Adjusted

EPS Growth

5%-7%

Double-Digit

(cst. FX)

Organic Net

Revenue Growth

Long-Term Targets

Expand

Gross

Margin

Reinvest

in

Growth

Leverage

Overheads

Focus on

Power Brands &

Priority Markets

Operating

Income Growth

High Single-

Digit (cst. FX) |

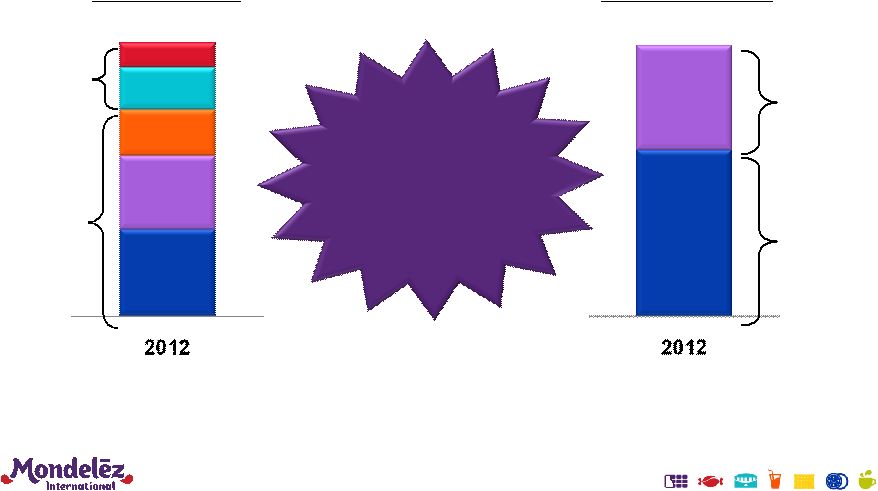

Top-tier, long-term revenue growth target

supported by advantaged portfolio

5

Double digit

growth

Low-to-mid

single digit

growth

Developed

Markets

Emerging

Markets

By Geography

Low-to-mid

single digit

growth

Mid-to-high

single digit

growth

Chocolate

Biscuits

Gum &

Candy

Beverages

Cheese/Grocery

By Category

5% -

7%

Organic Growth |

Significant operating income growth driven by

margin expansion

6

Strong track record of margin gains

250 bps of opportunity from gross margin expansion

(1) Please see the GAAP to non-GAAP reconciliations provided at the end of

this presentation. Adjusted Operating Income Margin

(1)

9.2%

9.6%

11.0%

11.5%

12.2%

14% -

16%

2008

2009

2010

2011

2012

LT Target |

Opportunity is largely in North America and Europe

Adjusted Operating Income Margin

North America

Europe

LA, AP, EEMEA

Combined

7

(1) Please see the GAAP to non-GAAP reconciliations provided at the end

of this presentation. |

Delivering base margin expansion critical to

delivering growth

8

Double Digit EPS Growth*

2012

Base

Margin

Expansion

Emerging

Markets

Investments

Ongoing

Restructuring

+60 to

+90 bps

(10) to

(20) bps

2013

12.2%

(1)

Base

Margin

Expansion

+60 to

+90 bps

High

12s

2014

~12%

Emerging

Markets

Investments

~(10) bps

Ongoing

Restructuring

(50) to

(70) bps

(10) to

(20) bps

Adjusted Operating Income Margin

Target

Ex.

Restructuring

14%-16%

14.5%-16.5%

* On a constant currency basis

(1)

Reported operating income margin was 10.4% for FY 2012. See GAAP to

Non-GAAP reconciliation at the end

of this presentation. |

Productivity is primary driver of base margin

expansion

9

Double Digit EPS Growth*

* On a constant currency basis

(1)

Reported operating income margin was 10.4% for FY 2012. See GAAP to

Non-GAAP reconciliation at the end

of this presentation.

2012

Base

Margin

Expansion

Emerging

Markets

Investments

Ongoing

Restructuring

2013

12.2%

(1)

Base

Margin

Expansion

High

12s

2014

~12%

Emerging

Markets

Investments

Ongoing

Restructuring

+60 to

+90 bps

+60 to

+90 bps

Adjusted Operating Income Margin

Target

Ex.

Restructuring

14%-16%

14.5%-16.5% |

Daniel Myers

EVP Integrated Supply Chain |

Focused plan to deliver world-class supply chain

Priorities

3 Year Financial Goals

$3B Gross Productivity

Cost Savings

(~$1B/per year; ~4.5% of COGS)

$1.5B Net Productivity

Cost Savings

(~$0.5B/per year; ~2.3% of COGS)

$1B Cash Flow

Step change leadership talent

& capabilities

Transform global

manufacturing platforms

Redesign the supply chain

network

Drive productivity programs to

fuel growth

Improve cash management

1

2

3

4

5

11 |

Acquisitions drove supply chain complexity

•

Significant number of SKUs, formats and formulas

•

Fragmented supplier base

•

Sub-scale plants with low efficiency assets

1990

2000

2010

12 |

Success begins with a step change in

leadership talent and capabilities

Benchmark

against

best in class

Right people

in the

right places

Break

down

silos

Multi-region,

multi-business

experience

13 |

2

Transform

Platforms

Global platform transformation process

14 |

Oreo: “Imagine if…”

became reality

•

30% reduction in

capital cost

•

$10MM in operating

cost savings per line

•

+500 bps gross

margin improvement

•

New capacity in 1/3

the time

•

Modular design for 7

days start-up

•

Global expansion in

less than 6 months

•

Standard building

block one-time design

•

Standard equipment

& operations

•

Supplier-enabled

scale and speed

Scale

Speed

Agility

2

Transform

Platforms

15 |

Making

Packing

Past

Now

Oreo: Double the capacity, with half

the footprint and fewer people

2

Transform

Platforms

Making

Packing

16 |

Growing on advantaged assets at

advantaged costs

3

Redesign

Network

Simplify, Standardize, Create Scale

Grow Capacity

•

Growth platforms on

advantaged assets in

strategic locations

Collaborate with

Suppliers

•

Increased supplier

collaboration &

co-location

Optimize Logistics

•

Minimize touches to

improve service delivery

and inventory levels

17 |

Capacity

Increase

+24%

+28%

New Greenfield

Sites

+8

+5

Power Brands

on Advantaged

Assets

~15%

~50%

by ’16

~80%

by ’20

Net Revenue

per Plant

~$210MM

~$300MM

by ‘16

~$500MM

by ‘20

2012

2013 -

2016

2017 -

2020

Redesigning supply chain to deliver

world-class efficiency

3

Redesign

Network

18 |

Our

new facility in Mexico will use an integrated supply chain approach

3

Redesign

Network

19 |

Stepping up productivity delivery

Integrated

Lean Six Sigma

Procurement

Transformation

Simplicity

20 |

Integrated Lean Six Sigma delivers best in

class reliability and efficiency

•

450 plant leaders trained

•

300 black belts certified &

2,000 green belts trained

•

14 plants commissioned as

lead sites; 103 sites by 2015

4

Productivity

21 |

Procurement Transformation continues to

drive productivity

2009 –

2012 leveraged

global scale

Shifting resources from

local to enterprise-wide

“spend towers”

Streamlining specifications

Strengthening relationships

with fewer, more strategic

suppliers

4

Productivity

22 |

Simplicity: Streamlining SKUs, packaging

and recipes

Today

2016

4,000

2,500

# SKUs

55

40

Food formats

39

26

Technologies

89

72

Production lines

Pan-EU brands as % Biscuits

45%

60%

Targeting a 60% reduction in complexity to deliver ~$100MM

European Biscuit Category

4

Productivity

23 |

Focus on cash management to fund

future investments in capital and growth

5

Cash

Management

DSO

•

Terms compliance

•

Sales phasing

•

Term negotiations

DIOH

•

Raw and pack

•

Finished goods

•

Infrastructure

•

Processes &

technology

DPO

•

Payment terms

rationalization

•

Frequency extension

•

Supply chain

financing

$1 billion in incremental cash over next three years

24 |

Focused plan to deliver world-class supply chain

Priorities

Step change leadership talent

& capabilities

Transform global platforms

Redesign the supply chain

network

Drive productivity programs to

fuel growth

Improve cash management

1

2

3

4

5

25

3 Year Financial Goals

$3B Gross Productivity

Cost Savings

(~$1B/per year; ~4.5% of COGS)

$1.5B Net Productivity

Cost Savings

(~$0.5B/per year; ~2.3% of COGS)

$1B Cash Flow |

Dave

Brearton EVP & CFO |

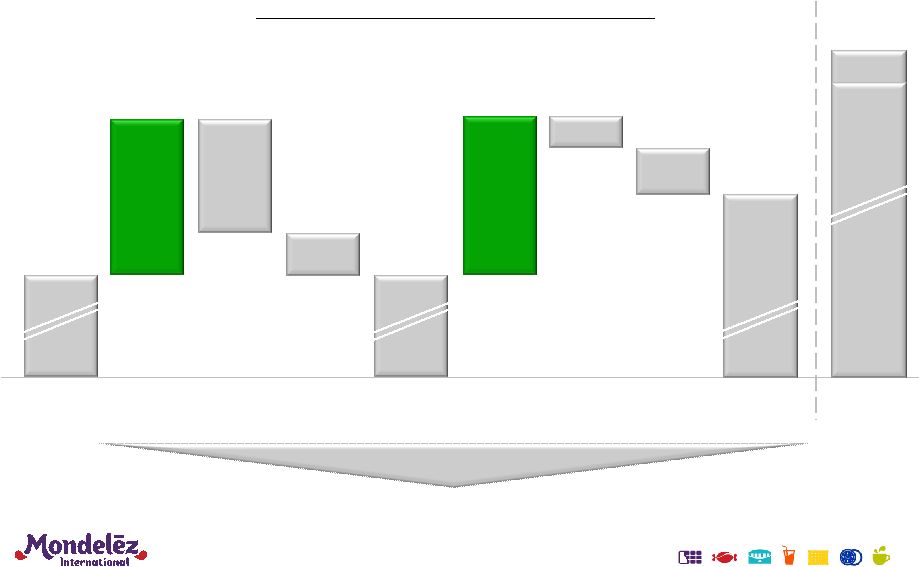

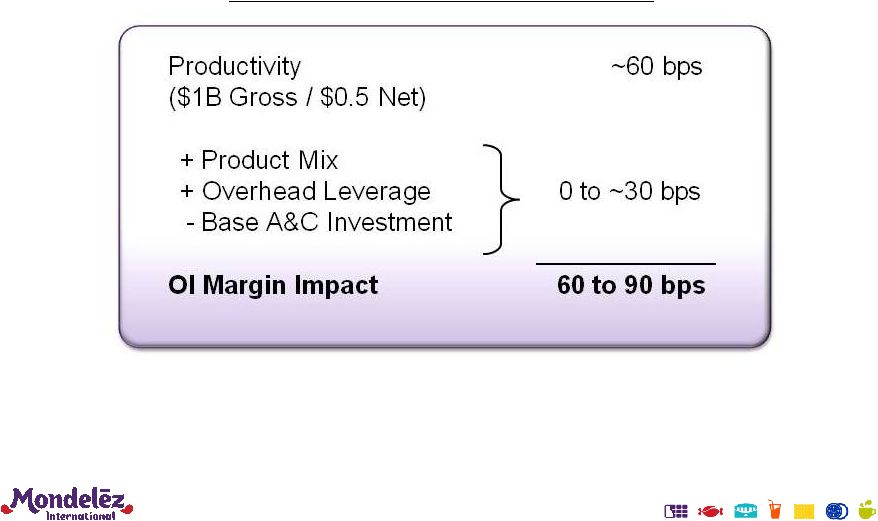

Productivity is primary driver of margin expansion

27

Base Margin Expansion Components |

Committed to delivering top-tier performance

Well-positioned for success

Virtuous growth cycle provides framework to deliver

top-tier performance

Integrated supply chain will drive base margin expansion

and generate strong cash flow

2013 outlook:

-

Organic revenue growth at low-end of 5%-7% range

-

Adjusted

EPS

of

$1.55-$1.60

(1)

28

(1)

Adjusted EPS Guidance includes an estimated ($0.04) impact from the Venezuelan

bolivar devaluation. It excludes the impact of all other currency translation. |

29

*

*

*

*

*

*

* |

GAAP

to Non-GAAP Reconciliation 30

As Revised

(GAAP)

Integration

Program Costs

and other

acquisition

integration

costs

(1)

Spin-Off Costs

and Related

Adjustments

(2)

Restructuring

Program

Costs

(3)

Acquisition-

Related

Costs

(4)

Impact of

Divestitures

(5)

(Gain)/Loss on

divestitures,

net

As Adjusted

(Non-GAAP)

For the Year Ended December 31, 2008

Net Revenues

22,872

$

-

$

-

$

-

$

-

$

(666)

$

-

$

22,206

$

Operating Income

1,148

81

91

708

-

(84)

91

2,035

Operating Income Margin

5.0%

9.2%

For the Year Ended December 31, 2009

Net Revenues

21,559

$

-

$

-

$

-

$

-

$

(377)

$

-

$

21,182

$

Operating Income

2,016

27

91

(76)

40

(73)

6

2,031

Operating Income Margin

9.4%

9.6%

For the Year Ended December 31, 2010

Net Revenues

31,489

$

1

$

-

$

-

$

-

$

(500)

$

-

$

30,990

$

Operating Income

2,496

646

91

(29)

273

(67)

-

3,410

Operating Income Margin

7.9%

11.0%

For the Year Ended December 31, 2011

Net Revenues

35,810

$

1

$

-

$

-

$

-

$

(429)

$

-

$

35,382

$

Operating Income

3,498

521

137

(5)

-

(67)

-

4,084

Operating Income Margin

9.8%

11.5%

For the Year Ended December 31, 2012

Net Revenues

35,015

$

-

$

-

$

-

$

-

$

(340)

$

-

$

34,675

$

Operating Income

3,637

140

512

110

1

(58)

(107)

4,235

Operating Income Margin

10.4%

12.2%

(1)

(2)

(3)

(4)

Acquisition-related costs for 2009 and 2010 relate to the acquisition of Cadbury

and include transaction advisory fees, U.K. stamp taxes and the impact of the

Cadbury inventory revaluation. (5)

Includes all divestitures that have occurred through 2013.

Restructuring Program costs represent non-recurring restructuring and related

implementation costs reflecting primarily severance, asset disposals and other manufacturing

related non-recurring costs. For the

years 2008 to 2011, refers to the 2004-2008 Restructuring Program. For the year

2012, refers to 2012-2014 Restructuring Program. Mondelez

International Reported to Adjusted Operating Income Margin

($ in millions, except percentages) (Unaudited)

Integration

Program

costs

are

defined

as

the

costs

associated

with

combining

the

Mondelez

International

and

Cadbury

businesses,

and

are

separate

from

those

costs

associated

with

the

acquisition.

Other

acquisition integration costs are defined as the costs associated with combining the

Mondelez International and LU businesses, and are separate from those costs associated with the acquisition.

Spin-Off Costs represent transaction and transition costs associated with

preparing the businesses for independent operations consisting primarily of financial advisory fees, legal fees, accounting

fees, tax

services and information systems infrastructure duplication, and

financing and related costs to redistribute debt and secure investment grade

ratings for both the Kraft Foods Group business and the Mondelez

International business. Spin-Off related adjustments refers to the pension

adjustment defined as the estimated benefit plan expense associated with

certain benefit plan obligations transferred to Kraft Foods Group in the

Spin-Off. |

GAAP

to Non-GAAP Reconciliation 31

As Revised

(GAAP)

Integration

Program

Costs

(1)

Spin-Off Costs

and Related

Adjustments

(2)

2012-2014

Restructuring

Program

Costs

(3)

Impact of

Divestitures

(4)

As Adjusted

(Non-GAAP)

Latin America

Net Revenues

5,396

$

-

$

-

$

-

$

-

$

5,396

$

Segment Operating Income

769

$

30

$

8

$

7

$

-

$

814

$

Segment Operating Income Margin

14.3%

15.1%

Asia Pacific

Net Revenues

5,164

$

-

$

-

$

-

$

-

$

5,164

$

Segment Operating Income

657

$

40

$

19

$

-

$

-

$

716

$

Segment Operating Income Margin

12.7%

13.9%

Eastern Europe, Middle East & Africa

Net Revenues

3,735

$

-

$

-

$

-

$

(96)

$

3,639

$

Segment Operating Income

506

$

13

$

-

$

-

$

(1)

$

518

$

Segment Operating Income Margin

13.5%

14.2%

LA, AP and EEMEA Combined

Net Revenues

14,295

$

-

$

-

$

-

$

(96)

$

14,199

$

Segment Operating Income

1,932

$

83

$

27

$

7

$

(1)

$

2,048

$

Segment Operating Income Margin

13.5%

14.4%

Europe

Net Revenues

13,817

$

-

$

-

$

-

$

(197)

$

13,620

$

Segment Operating Income

1,762

$

47

$

1

$

6

$

(51)

$

1,765

$

Segment Operating Income Margin

12.8%

13.0%

North America

Net Revenues

6,903

$

-

$

-

$

-

$

(47)

$

6,856

$

Segment Operating Income

781

$

6

$

77

$

98

$

(7)

$

955

$

Segment Operating Income Margin

11.3%

13.9%

(1)

(2)

(3)

(4)

Mondelez International

Segment Operating Income To Adjusted Segment Operating Income

For the Twelve Months Ended December 31, 2012

($ in millions, except percentages) (Unaudited)

Integration Program costs are defined as the costs associated with combining the

Mondelez International and Cadbury businesses, and are separate from those costs associated with

the acquisition.

Spin-Off Costs represent transaction and transition costs associated with

preparing the businesses for independent operations consisting primarily of financial advisory fees, legal fees,

accounting fees, tax services and information systems infrastructure duplication,

and financing and related costs to redistribute debt and secure investment grade ratings for both the

Kraft Foods Group business and the Mondelez International business.

Spin-Off related adjustments include the pension adjustment defined as the estimated benefit plan expense

associated with certain benefit plan obligations transferred to Kraft Foods Group

in the Spin-Off. Restructuring Program costs represent restructuring and

related implementation costs reflecting primarily severance, asset disposals and other manufacturing-related costs.

Includes all divestitures that have occurred through 2013.

|