Attached files

| file | filename |

|---|---|

| 8-K - 8-K - FEDERAL SIGNAL CORP /DE/ | d584619d8k.htm |

Disciplined

Growth Investor Presentation

August 14, 2013

Exhibit 99.1 |

Advancing

security and well-being. This

presentation

contains

forward

looking

statements

made

by

management

and

may

contain

words

such

as

“may,”

“will,”

“believe,”

“expect,”

“anticipate,”

“intend,”

“plan,”

“project,”

“estimate”

and

“objective”

or

the

negative

thereof

or

similar terminology concerning the Company’s future financial

performance, business strategy, plans, goals and objectives. These expressions are intended to

identify forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include information concerning the Company’s possible or assumed future

performance or results of operations and are not guarantees. While these statements are based

on assumptions and judgments that management has made in light of industry experience

as well as perceptions of historical trends, current conditions, expected future developments and other factors believed to be

appropriate under the circumstances, they are subject to risks, uncertainties and other

factors that may cause the Company’s actual results, performance or achievements

to be materially different. These risks and uncertainties, some of which are beyond the

Company’s control, include the cyclical nature of the Company’s industrial, municipal,

governmental and commercial markets; domestic and foreign governmental policy changes;

restrictive debt covenants; availability of credit and third-party financing for

customers; our ability to anticipate and meet customer demands for new products and product enhancements and the resulting new and

enhanced products generating sufficient revenues to justify research and development expenses;

our incurrence of restructuring and impairment charges as we continue to evaluate

opportunities to restructure our business; highly competitive markets; increased product liability, warranty, recall claims, client

service interruptions and other lawsuits and claims; technological advances by competitors;

disruptions in the supply of parts and components from suppliers and subcontractors;

attraction and retention of key employees; disruptions within our dealer network; work stoppages and other labor relations matters;

increased pension funding requirements and expenses beyond our control; costs of compliance

with environmental and safety regulations; our ability to use net operating loss and

tax credit carryovers to reduce future tax payments; charges related to goodwill and other long-lived intangible assets; our ability to

expand our business through successful future acquisitions; and unknown or unexpected

contingencies in our existing business or in businesses acquired by us. These risks and

uncertainties include, but are not limited to, the risk factors described under Item 1A, Risk Factors, in the Company’s Annual Report on

Form 10-K and in other filings with the SEC. These factors may not constitute all factors

that could cause actual results to differ materially from those discussed in any

forward-looking statement. The Company operates in a continually changing business environment and new factors emerge from time to

time.

The

Company

cannot

predict

such

factors,

nor

can

it

assess

the

impact,

if

any,

of

such

factors

on

its

financial

position

or

results

of

operations.

Accordingly, forward-looking statements should not be relied upon as a predictor of actual

results. This presentation also contains certain non-GAAP financial measures.

Such measures should not be viewed as a substitute for GAAP financial measures, and a

reconciliation of these items to the most comparable GAAP measures is provided in our filings with the SEC.

2

Safe Harbor Statement |

Advancing

security and well-being. 3

Agenda

•

Management

•

Company overview

•

Investment case

•

Recent progress

•

Growth strategy

•

Business groups and products

•

Financial results and outlook |

Experienced

Management Team Dennis Martin, President and Chief Executive Officer

4

Brian Cooper, SVP and Chief Financial Officer

Jennifer Sherman, SVP, Chief Administrative Officer,

General Counsel and Secretary

President and Chief Executive Officer since October 2010

Previously served as Chairman, President and CEO of General Binding Corporation

35+ years operational and leadership experience, primarily at Illinois Tool Works

and Ingersoll-Rand

Chief Administrative Officer since November 2010, Secretary and General Counsel since

March 2004

Operating executive for Safety and Security Systems Group

Joined Federal Signal in 1994 as Corporate Counsel

Appointed Chief Financial Officer May 28, 2013

Chief Financial Officer of Westell Technologies, Inc. from 2009-2013

Previously with Fellowes, Inc. (CFO), United Stationers, Borg-Warner Security and

Amoco Strong treasury, financial, M&A and strategic background

Advancing security and well-being. |

Advancing

security and well-being. 5

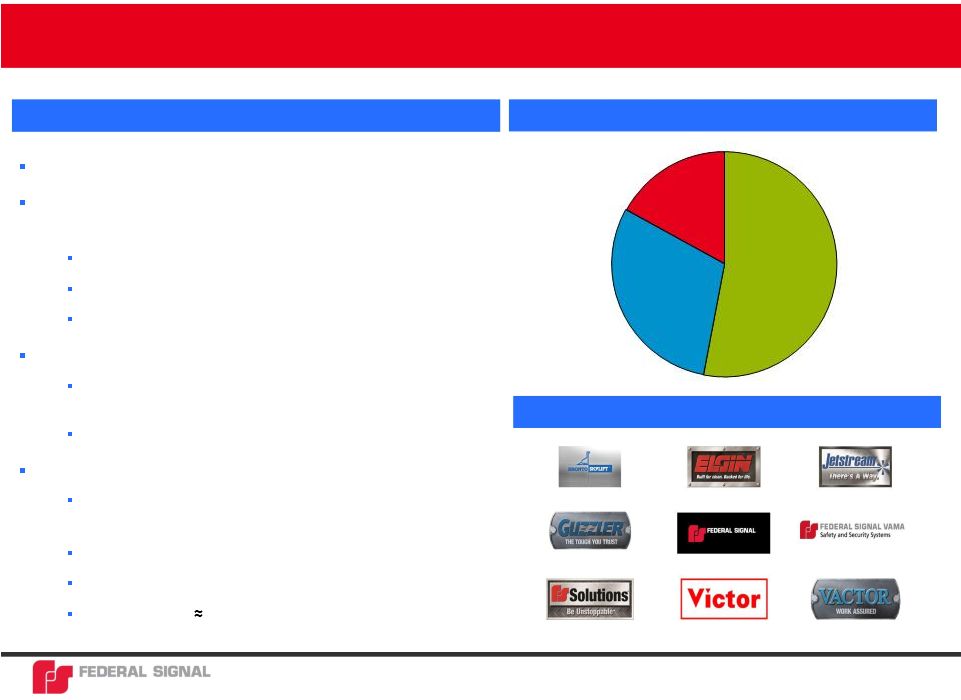

Federal Signal Overview

Founded in 1901, joined NYSE in 1969 (“FSS”)

Safety, security and environmental products and

services that protect people and the planet

Environmental Solutions Group (ESG)

Safety & Security Systems Group (SSG)

Fire Rescue Group (Bronto)

Recently restructured for growth and profitability

$825 million revenue, $56 million operating income

(TTM as of 6/30/13)

$657 million market capitalization (8/12/13)

Increasing global presence and customer base

Leading brands serving municipal, governmental,

industrial and commercial markets

Diversified manufacturing, 11 facilities in 6 countries

Over 3,000 customers in more than 100 countries

Employees: 2,600 worldwide

Company Overview

Sales by Segment, June 2013 TTM, $ Millions

Fire Rescue Group

17%

Environmental

Solutions Group

54%

Safety & Security

Systems Group

29%

Valuable Brands

$448

$137

$240 |

•

•

•

–

Funding internal growth and potential renewal of dividends

•

•

–

Aging public infrastructure

–

Improving municipal markets

–

Industrial markets opportunities

–

Growing investments in energy sector

–

Security requirements for man-made and natural disasters

•

–

Management depth in sales, marketing, engineering and operations

–

Successful focus on “80/20”

continuous improvement

6

Investment Case

Advancing security and well-being.

Dominant market position in critical infrastructure markets

Unparalleled brand equity and distribution franchise in core markets

Strengthened balance sheet and improving profitability and free cash flow

Flexible manufacturing capacity ready to deliver higher revenues

and profits

Favorable long-term market dynamics

Management execution |

Advancing

security and well-being. Recent Progress and Accomplishments

•

Major repositioning with sale of FSTech

•

Debt refinancing to improve balance sheet and interest costs

•

80/20 focus and continuous improvement

–

Lean manufacturing changes

–

Customer prioritization and pricing

–

Working capital efficiency targets

•

Investments to promote growth and innovation

–

Additional engineering resources at Jetstream

–

Jetstream plant capacity expansions

–

Flexible manufacturing model at Vactor

–

Extensive lean process improvements at Bronto

–

Innovation initiative

•

Significant turnaround in financial performance

7 |

8

Growth Strategy

Geographic Expansion

•

•

•

New Markets for Existing

Products

New Product

Development and

Acquisitions

Advancing security and well-being.

Jetstream and Industrial

Systems in the Asia Pacific

and Middle East

Export markets from U.S.

Bronto in North America

Waterblasting

Hydro-excavation

Security systems

Innovation program

Effective use of

established platforms

•

•

•

•

• |

Growth Markets

and Opportunities 9

* (as of 6/30/13 TTM)

Developing growth product areas

Other markets

Advancing security and well-being.

•

–

Vactor (hydro-excavation and sewer cleaning)

–

Jetstream (waterblasting)

–

Industrial Systems (integrated communication safety systems)

These areas aggregate to

50% of total revenue *

•

–

Industrial uses for high-reach lifts (Bronto)

–

Recovering U.S. municipal spending (Elgin, among others)

–

Recovering government spending in Europe (Bronto, Vama)

–

Expanding industrial energy and utility use (Jetstream, Vactor)

–

International waterblasting market share (Jetstream)

–

Price-competitive product introductions in ambulance and other

safety markets (Safety and Security Systems Group) |

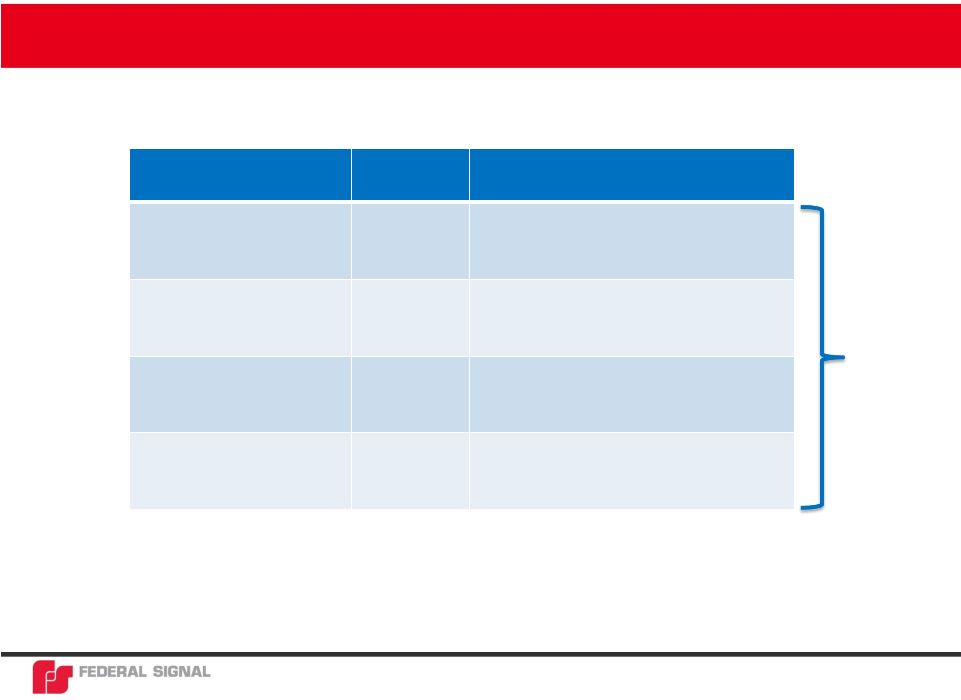

Business

Unit Industrial

Order Mix*

Success Factors in Increasing Industrial

Mix

U.S. Industrial Systems

63%

•

Extending Leadership in Public Warning

Systems in Commercial Markets

•

Building Global Distribution Capabilities

Global Jetstream

100%

•

Global Channel Development

•

New Product-Application Development

Bronto

23%

•

North American Distribution

•

Further Exploit Utility Markets

U.S. Vactor

50%

•

Continued Investment in Efficient Capacity

•

Leverage New Application Successes (e.g. ,

Hydro-excavation)

10

Industrial Business Growth Opportunities

* Industrial order mix includes fiscal years 2010 through 2012.

Success Factors

Complemented

by Targeted

Product Line

Acquisitions

Advancing security and well-being. |

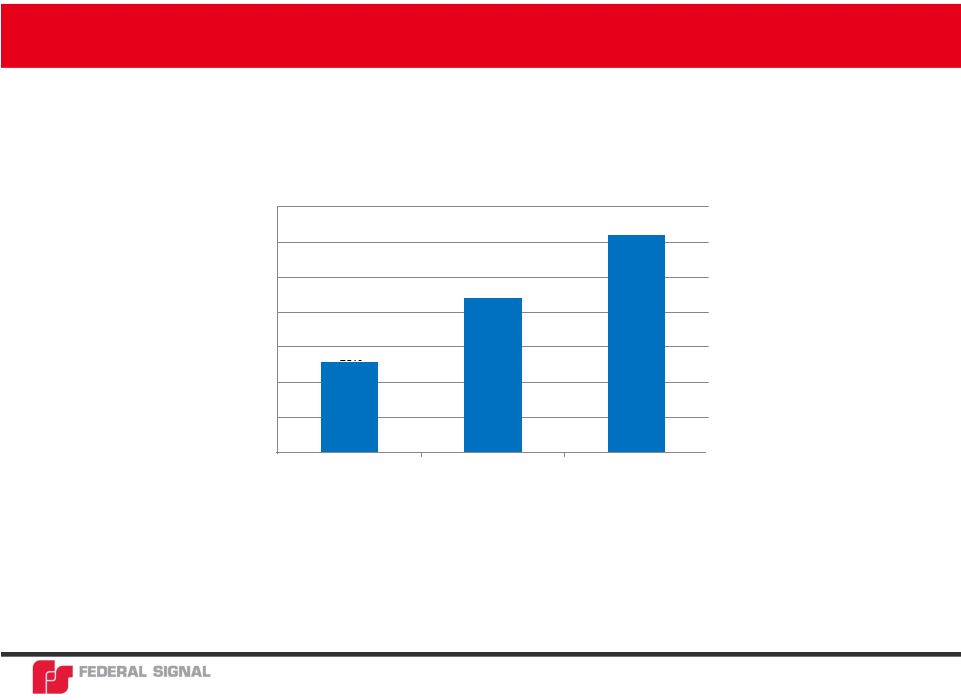

Advancing

security and well-being. Percentage of Orders from Industrial Customers*

*Lifts only, excluding service revenue. Data reflect revenue mix in Euros.

11

Execution on Building Industrial Customer Mix at Bronto

2010

2011

2012

13%

22%

31%

35

30

25

20

15

10

5

0 |

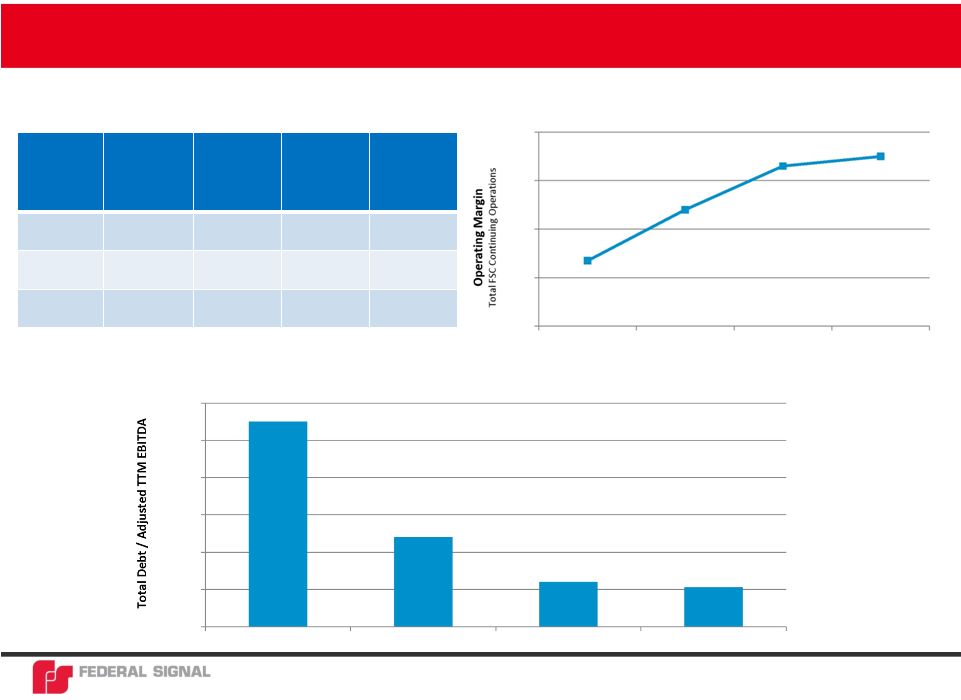

Advancing

security and well-being. Margin Expansion and Debt Reduction

12

Continued Progress on Operating Margin Targets *

Complemented by Declining Leverage

Business

Segment

FY 2011

Operating

Margin

FY 2012

Operating

Margin

1 Half

2013

Operating

Margin

Margin

Targets

ESG

6.8%

9.8%

11.9%

10% -

12%

SSG

9.7%

12.0%

7.9%

14% -

16%

Bronto

6.0%

6.6%

6.1%

10% -

12%

* Operating margin excludes the impact of restructuring charges in all periods.

st

8.0%

6.0%

4.0%

2.0%

0.0%

2010

2011

2012

1st Half 2013

2.7%

4.8%

6.6%

7.0%

2010

2011

2012

6/30/2013

12.0

10.0

8.0

6.0

4.0

2.0

0.0

11.0

4.8

2.4

2.1 |

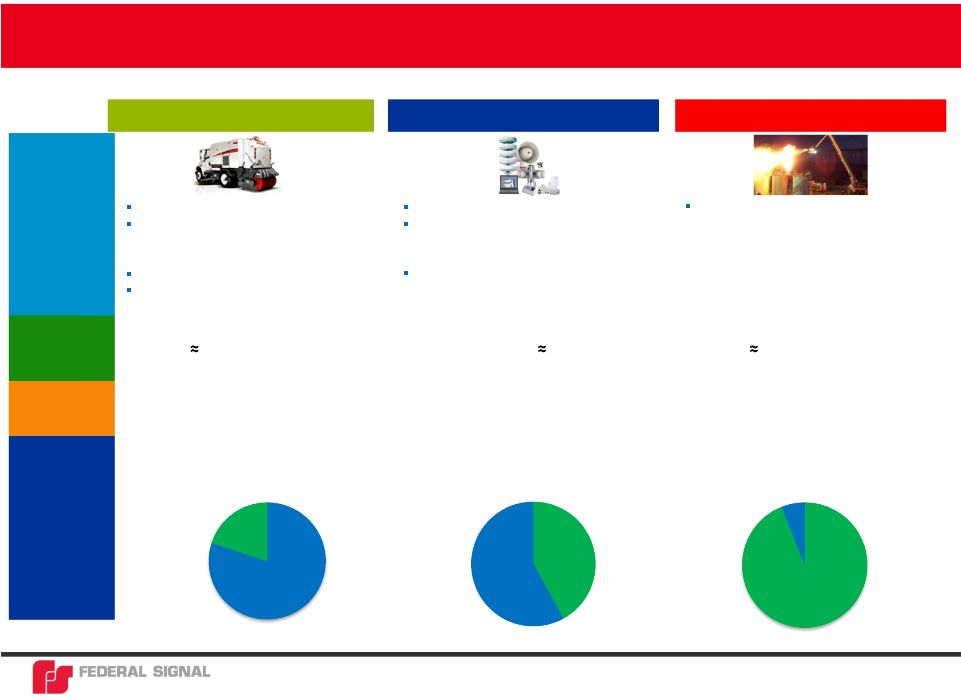

Advancing

security and well-being. 13

Federal Signal Segments

Environmental Systems (ESG)

Elgin street sweepers

Vactor truck-mounted sewer cleaners,

hydro-excavators, and industrial vacuum

trucks

Jetstream waterblasters

FS Depot and FS Solutions –

parts and

service deliveries and rental centers

$448MM (54% of sales)

$240MM (29% of sales)

$137MM (17% of sales)

Fire Rescue (Bronto)

Aerial lift access platforms for fire rescue

and wind turbine maintenance, utilities

and other industrial applications

Safety and Security (SSG)

Vehicle lights and sirens (U.S. and Vama)

Indoor and outdoor mass warning and

notification systems (Industrial Systems

and Alerting & Notification Systems)

Victor mining and electrical safety

equipment

U.S.

6%

Non-U.S.

94%

Non-U.S.

20%

U.S.

80%

30-50% U.S.

Range, avg. 30% U.S.

50% Globally

Non-U.S.

42%

U.S.

58%

Products

Representative

Market Share

June 2013,

TTM

Revenue

Geographic

Mix |

14

Diversified Product Mix

Advancing security and well-being. |

Advancing

security and well-being. Hydro-Excavation

Hydro-excavating through ice

with hot water

15 |

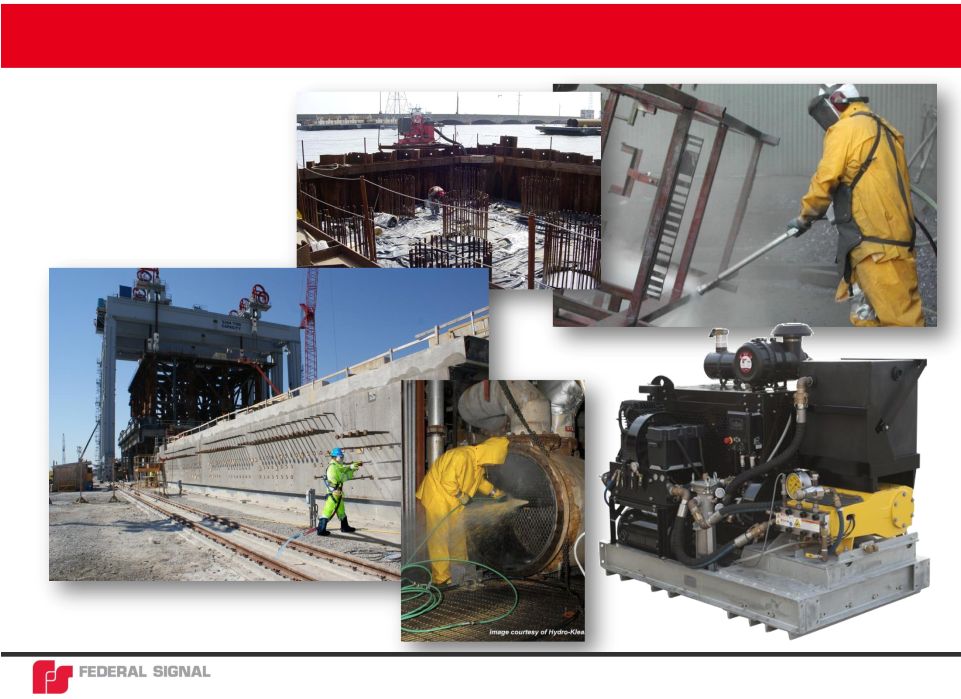

Waterblasting

Hydro-demolition,

hydro-cleaning and

high pressure cleaning

16

Advancing security and well-being. |

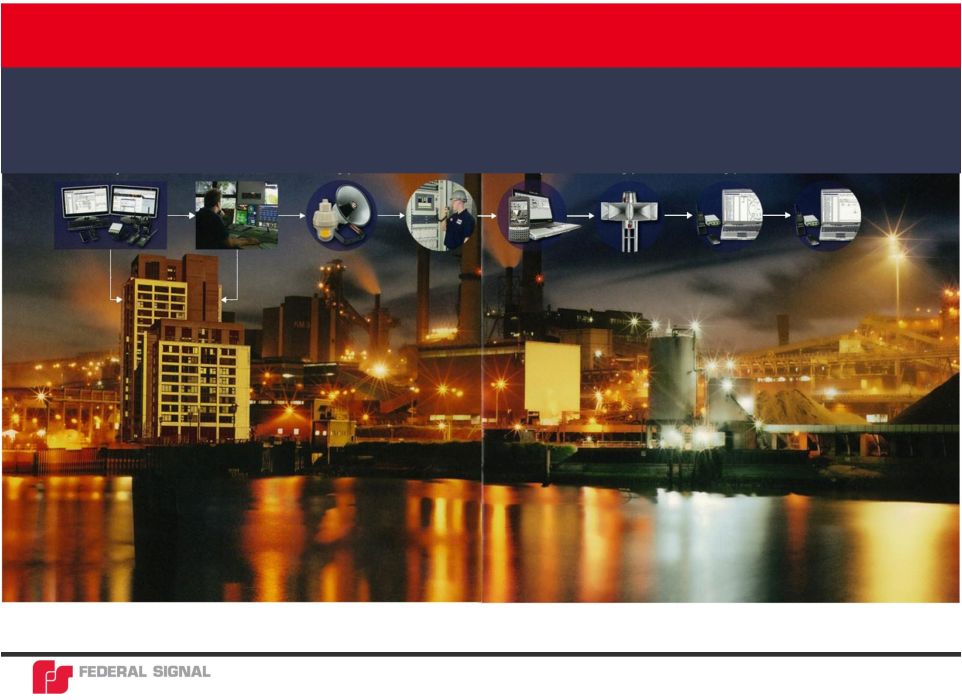

Advancing

security and well-being. Industrial Systems

Integrated Communications

17

SmartMsg

Enabled Systems

ICS Integrated

Command

Solutions

Indoor Warning

Systems

Public

Address/General

Alarm

Public Safety

Software Systems

Outdoor

Warning Systems

Interoperable

Communications

Citizen Alerting

Systems |

Advancing

security and well-being. Consolidated Historical Financial Performance*

18

* Consolidated financial results reflect only continuing operations of the Company.

($ in millions)

2010

2011

2012

June 2013

TTM

Revenue

$ 633.1

$ 688.7

$ 803.2

$ 825.1

% Growth

—

8.8%

16.6%

2.7%

COGS

482.2

533.3

613.4

631.2

Gross Profit

$ 150.9

$ 155.4

$ 189.8

$ 193.9

% Margin

23.8%

22.6%

23.6%

23.5%

Operating Expenses

138.5

122.2

138.3

138.2

Operating Income

$ 12.4

$ 33.2

$ 51.5

$ 55.7

% Margin

2.0%

4.8%

6.4%

6.8%

Interest Expense

10.2

16.4

21.4

17.1

Other Expense

1.2

0.2

4.2

10.9

Pretax Income

$ 1.0

$ 16.6

$ 25.9

$ 27.7 |

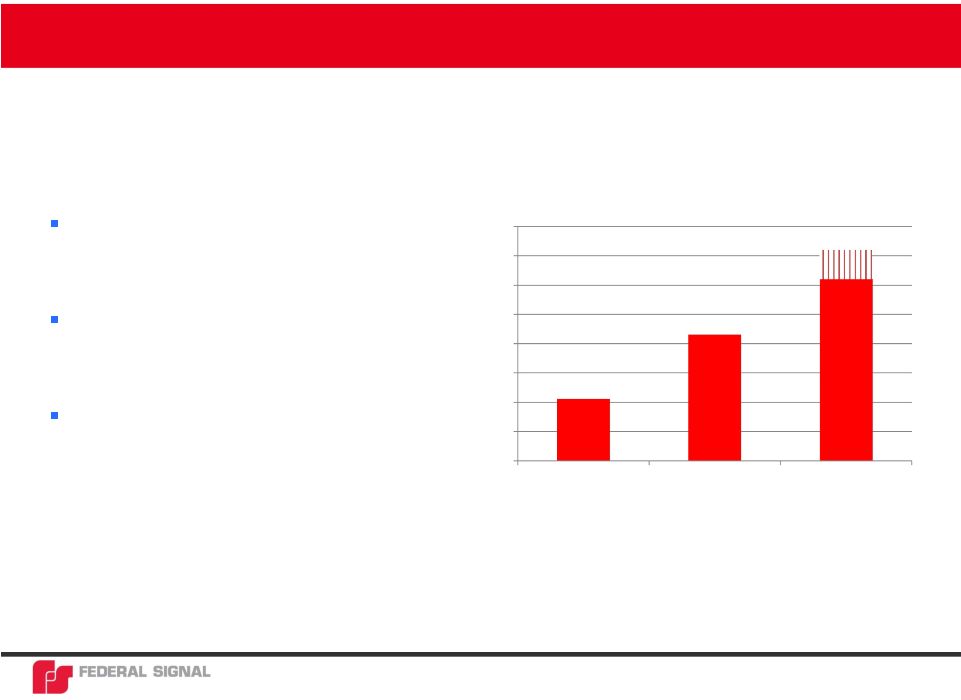

Advancing

security and well-being. 2013 and Beyond Overview

19

Areas of Focus

Progress toward margin targets

at Bronto and SSG

Accelerate growth in industrial

markets

Deliver increased value to

shareholders

Adjusted EPS* and Outlook

* Adjusted EPS excludes the effects of debt settlement charges,

restructuring charges, and the Q2 2013 tax valuation allowance release

($102 million); and reflects only the continuing operations of the Company.

$ per share

0.80

0.70

0.60

0.50

0.40

0.30

0.20

0.10

0.00

YR 2011

YR 2012

YR 2013 Outlook

0.21

0.43

0.62 –

0.72 |

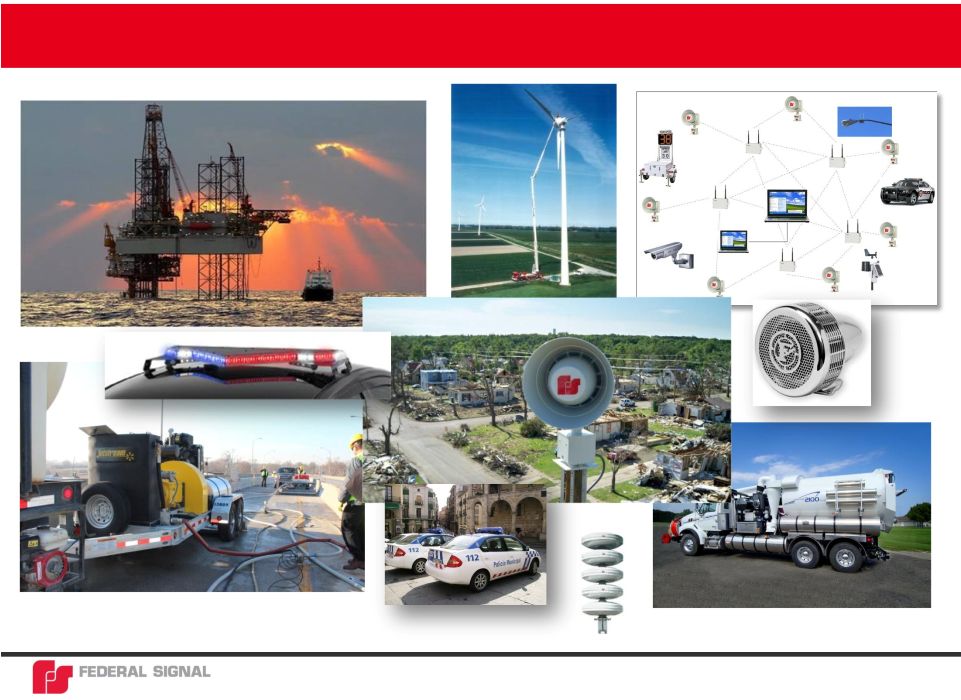

Building Equity

in Our Brands 20

Advancing security and well-being. |