Attached files

| file | filename |

|---|---|

| EX-21.1 - Sonora Resources Corp. | sure_ex211.htm |

| EX-31.2 - CERTIFICATION - Sonora Resources Corp. | sure_ex312.htm |

| EX-31.1 - CERTIFICATION - Sonora Resources Corp. | sure_ex311.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Sonora Resources Corp. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Sonora Resources Corp. | sure_ex321.htm |

| EX-32.2 - CERTIFICATION - Sonora Resources Corp. | sure_ex322.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K /A

Amendment 1

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the fiscal year ended November 30, 2012

o TRANSACTION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

For the transaction period from ________to ________

Commission File No. 000-54268

SONORA RESOURCES CORP.

(Exact Name of Issuer as specified in its charter)

|

Nevada

|

27-1269503

|

|

|

(State or other jurisdiction of incorporation)

|

(IRS Employer File Number)

|

|

|

Cerro del Padre #11, Rinconada de

|

||

|

los Pirules, Guadalupe, Zacatecas

|

||

|

Mexico 98619

|

98619 | |

|

(Address of principal executive offices)

|

(zip code)

|

1-877-513-7873

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Exchange Act:

|

Common

|

OTCBB

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12 (g) of the Exchange Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o |

Accelerated filer

|

o |

|

Non-accelerated filer

|

o |

Smaller reporting company

|

þ |

|

(Do not check if a smaller reporting company)

|

|||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

As of May 31, 2012 (the last business day of our most recently completed second fiscal quarter), based upon the last reported trade on that date, the aggregate market value of the voting and non-voting common equity held by non-affiliates (for this purpose, all outstanding and issued common stock minus stock held by the officers, directors and known holders of 10% or more of the Company’s common stock) was $16,202,947.

As of February 7, 2013, the Company had 91,855,861 shares of common stock issued and outstanding.

EXPLANATORY NOTE

We are filing this Amendment No. 1 on Form 10-K/A to our Annual Report on Form 10-K for the year ended November 30, 2012 (the “Form 10-K”), which was originally filed with the Securities and Exchange Commission on February 7, 2013, for the purpose of expanding our disclosures concerning our mining option agreements, our exploration and production status and other disclosures.

No other changes have been made to the Form 10-K. This Amendment does not reflect events that have occurred after the February 7, 2013 filing date of the Form 10-K, or modify or update the disclosures presented therein, except to reflect the amendment described above.

SONORA RESOURCES CORP.

TABLE OF CONTENTS

| Page | |||||

| PART 1 | |||||

| ITEM 1. |

Description of Business

|

4 | |||

| ITEM 1A. |

Risk Factors

|

6 | |||

| ITEM 1B. |

Unresolved Staff Comments

|

16 | |||

| ITEM 2. |

Properties

|

16 | |||

| ITEM 3. |

Legal Proceedings

|

16 | |||

| ITEM 4. |

Mine Safety Disclosure

|

16 | |||

| PART II | |||||

| ITEM 5. |

Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

17 | |||

| ITEM 6. |

Selected Financial Data

|

19 | |||

| ITEM 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

20 | |||

| ITEM 7A. |

Quantitative and Qualitative Disclosures About Market Risk

|

25 | |||

| ITEM 8. |

Financial Statements and Supplementary Data

|

25 | |||

| ITEM 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

25 | |||

| ITEM 9A. |

Controls and Procedures

|

25 | |||

| ITEM 9B. |

Other Information

|

26 | |||

| PART III | |||||

| ITEM 10. |

Directors, Executive Officers and Corporate Governance

|

27 | |||

| ITEM 11. |

Executive Compensation

|

30 | |||

| ITEM 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

35 | |||

| ITEM 13. |

Certain Relationships and Related Transactions, and Director Independence

|

36 | |||

| ITEM 14. |

Principal Accounting Fees and Services

|

37 | |||

| PART IV | |||||

| ITEM 15. |

Exhibits, Financial Statement Schedules

|

40 | |||

|

SIGNATURES

|

42 | ||||

2

PART I

FORWARD-LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this report, should be considered carefully in evaluating us and our prospects. This report (including without limitation the following factors that may affect operating results) contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as amended ("Securities Act") and Section 21E of the Securities Exchange Act of 1934, as amended ("Exchange Act") regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, development of new products, enhancements or technologies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed below and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements which speak only as of the date of this report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report.

As used in this Form 10-K, “we,” “us,” and “our” refer to Sonora Resources Corp. and its wholly-owned subsidiary, Finder Plata S.A. de C.V., a company organized under the laws of Mexico, which are also sometimes collectively referred to as the “Company” or “Sonora Resources” unless otherwise noted.

3

ITEM 1. DESCRIPTION OF BUSINESS

THE COMPANY AND OUR BUSINESS

Plan of Operation

Sonora Resources Corp. (formerly Nature's Call Brands, Inc.) (the "Company" or "Sonora Resources" ) was incorporated under the laws of the State of Nevada on December 3, 2007 with a business plan to sell and distribute water treatment systems for residential and commercial use. In September of 2010, the business of the Company was changed to the acquisition, exploration and development of mineral resources, with emphasis on gold and silver. Efforts in the area of water treatment were then abandoned.

We are a mining exploration company focused on the acquisition and exploration of prospective silver opportunities in Mexico. Our goal is to build our Company into a successful mineral exploration and development company. During 2013, we intend to produce silver and gold at our Corazon and Liz properties discussed below.

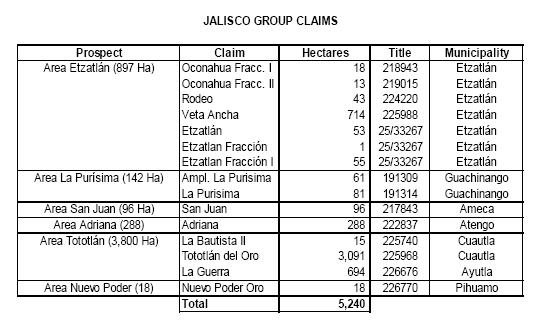

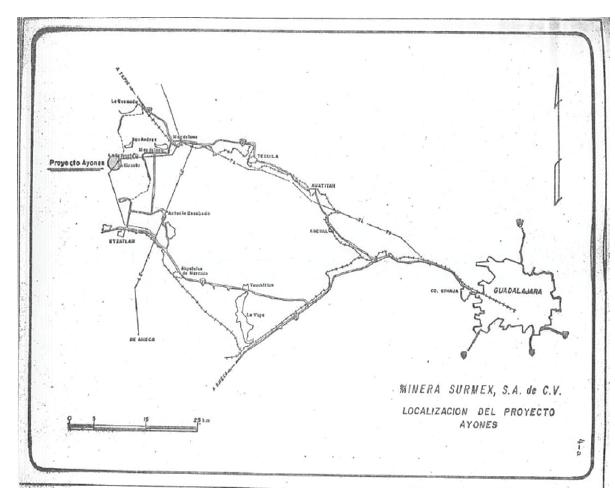

We have mining option agreements in (i) the Los Amoles Property consisting of 1,630 hectares located in Sonora; (ii) the Jalisco Group of Properties, consisting of mining claims totaling 5,240 hectares located in Jalisco; and (iii) the Ayones Group of Properties consisting of numerous mining claims totaling 48 hectares in Jalisco. We have commenced an underground work program at the Los Amoles property and completed a geologic report to define the potential vein structure and outcroppings and prepare for a planned drilling program later in 2013.

Also, we have five mining concessions on 721 hectares surrounding the Ayones Group of Properties, called the Corazon Property. We have a letter of intent with the Liz Property located in Ayutla, Jalisco State, Mexico. Sonora Resources is based in Guadalupe, Zacatecas, Mexico. We have concluded phase one field work at the Corazon property and we intend to produce silver and gold at our Corazon and Liz properties in 2013.

We are currently in the development stage as defined in ASC 915 "Accounting and Reporting for Development Stage Enterprises" and have minimal operations.

We have incurred a cumulative net loss since inception on December 3, 2007 to November 30, 2012 of $2,197,000 and have no source of operating revenue. While our management believes that we will be successful in our planned operating activities under our business plan and capital raising activities, there can be no assurance that we will be successful in the mining development and exploration business or the raising of sufficient capital such that we will generate adequate revenues to earn a profit or sustain its operations.

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplates our continuation as a going concern. We have not established a source of revenues sufficient to cover its operating costs, and as such, have incurred an operating loss since inception. Further, as of November 30, 2012, we have working capital of $347,000. These and other factors raise doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments or classifications that may result from the possible inability of the Company to continue as a going concern.

On July 12, 2011, we established a 100% owned subsidiary, Finder Plata S.A. de C.V. ("Finder Plata") for the development of our exploration business in Mexico.

4

Corporate Information

We were incorporated in the State of Nevada on December 3, 2007. Our principal executive office is located at Cerro del Padre # 11 Rinconada de los Pirules, Guadalupe, Zacatecas Mexico, 98619. Our US mailing address is PO Box 12616, Seattle, WA 98111 and our telephone number is 1-877-513-7873. The Company’s principal website address is located at www.sonoraresources.com. The information on our website is not incorporated as a part of this Form 10-K.

The Company’s Common Stock

Our common stock currently trades on the Over the Counter Bulletin Board (“OTCBB”) under the symbol “SURE.”

Key Market Priorities

Our primary key market priority will be to explore our Los Amoles, Jalisco, Ayones, Corazon and Liz, Mexico properties in order to determine whether they possess commercially exploitable quantities of gold, silver, and other metals. We cannot guarantee that the Los Amoles, Jalisco, Ayones, Corazon and Liz, Mexico properties will be successful or that any project that we embark upon will be successful. Our goal is to build our Company into a successful mineral exploration and development company.

Primary Market Risks

We are exposed to various risks related to the volatility of the price of silver, our reserve estimates, operating as a going concern, unique difficulties and uncertainties in mining exploration ventures, our need for additional financing, and a volatile market price for our common stock. These risks and uncertainties are discussed in more detail below in this item.

Employees

As of November 30, 2012, we had two part-time employees. The Chief Executive Officer is based out of Guadalupe, Zacatecas Mexico. The Chief Financial Officer is based out of Seattle, WA and Atlanta, GA.

Website Access to United States Securities and Exchange Commission Reports

We file annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission ("SEC"). You may read and copy any document we file at the SEC's Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information concerning filers. We also maintain a web site at http://www.sonoraresources.com that provides additional information about our Company and links to documents we file with the SEC. The Company's charters for the Compensation Committee and the Code of Conduct & Ethics are also available on our website. The Company does not have an Auditing or Nominations Committee at this time. The information on our website is not part of this Form 10-K.

5

An investment in our Common Stock involves a high degree of risk. You should carefully consider the following risk factors and other information in this prospectus before deciding to invest in shares of the Company’s Common Stock. The most significant risks and uncertainties known and identified by our management are described below; however, they are not the only risks that we face. If any of the following risks actually occurs, our business, financial condition, liquidity, results of operations and prospects for growth could be materially adversely affected, the trading price of our Common Stock could decline, and you may lose all or part of your investment. You should acquire shares of our Common Stock only if you can afford to lose your entire investment. We make various statements in this section that constitute “forward-looking statements”. See “Forward-Looking Statements” beginning on page 4 of this report.

We have a limited operating history on which to base an evaluation of our business and prospects.

We have been in the business of exploring mineral resource properties since November 2010. As a result, we have never had any revenues from our mining operations. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties, and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. We have no way to evaluate the likelihood of whether our mineral properties contain any mineral reserves or, if they do, that we will be able to build or operate a mine successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties. We therefore expect to continue to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from mining operations and any dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties, and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

The fact that we have not earned any operating revenues since our incorporation raises substantial doubt about our ability to continue to explore our mineral properties as a going concern.

We have not generated any revenue from operations since our incorporation, and we anticipate that we will continue to incur operating expenses without revenues unless and until we are able to identify a mineral resource in a commercially exploitable quantity on one or more of our mineral properties and we build and operate a mine. At November 30, 2012, we had working capital of $347,000. We incurred a net loss of $935,000 for the fiscal year ended November 30, 2012 and a net loss of $2,197,000 since inception. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering reserves of commercial tonnage and grade, we will require significant additional funds in order to place our properties into commercial production. Should the results of our planned exploration require us to increase our current operating budget, we may have to raise additional funds to meet our currently budgeted operating requirements for the next 12 months. As we cannot assure a lender that we will be able to successfully explore and develop our mineral properties, we will probably find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity and debt securities, but there can be no assurance that we will continue to be able to do so. If we cannot raise the money that we need to continue exploration of our mineral properties, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail. These circumstances led our independent registered public accounting firm, in their report dated February 7, 2013 relative to our audited financial statements for the year ended November 30, 2012, to comment about our Company’s ability to continue as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the Company will continue to operate indefinitely and not go out of business and liquidate its assets. These conditions raise substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event our Company cannot continue in existence. We continue to experience net operating losses.

6

Economic and political developments in Mexico may adversely affect our business.

All of our operations and assets are located in Mexico. As a result, our financial condition, results of operations and business may be affected by and are subject to the general condition of the Mexican economy, the devaluation of the Mexican peso as compared to the U.S. Dollar, Mexican inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Mexico, including changes in the laws and policies that govern foreign investment, as well as changes in United States laws and regulations relating to foreign trade and investment, over which we have no control. There can be no assurance as to the future effect of any such changes on our results of operations, financial condition, or cash flows.

Fluctuations in foreign currency rates, in particular the Mexican peso, may materially affect our results of operations.

The Company carries on its primary business activity outside of the United States. Accordingly, it is subject to the risks associated with fluctuation of the rate of exchange of other foreign currencies, in particular the Mexican peso, the currency in which much of the Company's costs are paid, and the United States dollar, the currency for calculating the Company's sales of gold and silver based on the world's commodity markets. Such currency fluctuations may materially affect the Company's financial position and results of operations.

All of our assets, our sole director and our Chief Executive Officer are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or our directors and officers.

All of our assets are located outside the United States. In addition, our sole director and Chief Executive Officer is a national and resident of a country other than the United States, and all or a substantial portion of his assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against us or our director and officers, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under United States federal and state securities laws against us or our directors and officers.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our exploration activities and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed beyond the first few months of our exploration program. We will also require additional financing for the fees we must pay to maintain our status in relation to the rights to our properties and to pay the fees and expenses necessary to become and operate as a public company. We will also need more funds if the costs of the exploration of our existing projects are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail and investors could lose their entire investment.

7

We are subject to corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We must comply with corporate governance requirements under the Sarbanes-Oxley Act of 2002 and the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010, as well as additional rules and regulations currently in place and that may be subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. We are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial.

Our management has concluded that our disclosure controls and procedures were not effective due to the presence of the following material weaknesses in internal control over financial reporting:

We do not have an audit committee. An audit committee would improve oversight in the establishment and monitoring of required internal controls and procedures.

Management anticipates that such disclosure controls and procedures will not be effective until the material weaknesses are remediated. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

Our business is dependent on key executives and the loss of any of our key executives could adversely affect our business, future operations and financial condition.

We are dependent on the services of key executives, including our officers, Mark Scott and Juan Miguel Ríos Gutiérrez, and our sole director Juan Miguel Ríos Gutiérrez. Mr. Gutierrez has many years of experience and an extensive background in the mining industry in general. We may not be able to replace that experience and knowledge with other individuals. We do not have “Key-Man” life insurance policies on our key executives. The loss of our key executives or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations, and financial condition.

We have limited insurance.

We have limited director and officer insurance and commercial insurance policies. Any significant insurance claims would have a material adverse effect on our business, financial condition and results of operations.

8

Risks Associated with Mining

Our Mining Operation Agreements are critical to our operations and are subject to cancellation.

We are a mining exploration company focused on the acquisition and development of prospective silver opportunities in Mexico. We have mining option agreements in (i) the Los Amoles Property consisting of 1,630 hectares located in Sonora; (ii) the Jalisco Group of Properties, consisting of mining claims totaling 5,240 hectares located in Jalisco; (iii) the Ayones Group of Properties consisting of numerous mining claims totaling 48 hectares in Jalisco; and (iv) the five mining concessions on 721 hectares surrounding the Ayones Group of Properties, called the Corazon Property. We have a letter of intent with the Liz Property located in Ayutla, Jalisco State, Mexico. Sonora Resources is based in Guadalupe, Zacatecas, Mexico.

The failure to operate in accordance with the mining option agreements could result in the agreements being terminated. See Note 3 to the Consolidated Financial Statements for a discussion of these critical agreements.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineable mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims. If this happens, our business will likely fail. All of our mineral properties to which we have rights are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of these properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

Because of the speculative nature of exploration of mineral properties, we may never discover a commercially exploitable quantity of minerals, our business may fail and investors may lose their entire investment.

We plan to conduct mineral exploration on certain mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on these properties will establish that commercially exploitable reserves of minerals exist on these properties. Additional potential problems that may prevent us from discovering any reserves of minerals on these properties include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays, and additional costs and expenses that may exceed current estimates. If we are unable to establish the presence of commercially exploitable reserves of minerals on these properties, our ability to fund future exploration activities will be impeded, we will not be able to operate profitably, and investors may lose all of their investment in our Company.

9

The nature of mineral exploration activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations.

Exploration for minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to the stage of producing mines. Our current exploration efforts are, and any future exploration, development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

|

●

|

economically insufficient mineralized material;

|

|

●

|

fluctuations in production costs that may make mining uneconomical;

|

|

●

|

labor disputes;

|

|

●

|

unanticipated variations in grade and other geologic problems;

|

|

●

|

environmental hazards;

|

|

●

|

water conditions;

|

|

●

|

difficult surface or underground conditions;

|

|

●

|

industrial accidents;

|

|

●

|

metallurgical and other processing problems;

|

|

●

|

mechanical and equipment performance problems;

|

|

●

|

failure of pit walls or dams;

|

|

●

|

unusual or unexpected rock formations;

|

|

●

|

personal injury, fire, flooding, cave-ins, and landslides; and

|

|

●

|

decrease in revenues due to lower mineral prices.

|

Any of these risks can materially and adversely affect, among other things, the exploration and development of properties, production quantities and rates, costs and expenditures, and production commencement dates. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

The potential profitability of mineral ventures depends in part upon factors beyond the control of our Company, and even if we discover and exploit mineral deposits, we may never become commercially viable and we may be forced to cease operations.

The commercial feasibility of mineral properties is dependent upon many factors beyond our control, including the existence and size of mineral deposits in the properties we explore, the proximity and capacity of processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production, and environmental regulation. These factors cannot be accurately predicted and any one or a combination of these factors may result in our Company not receiving an adequate return on invested capital. These factors may have material and negative effects on our financial performance and our ability to continue operations.

10

Mineralized material is based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralized material presented in our filings with securities regulatory authorities, including the SEC, press releases, and other public statements that may be made from time to time are based upon estimates made by our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property's return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered at production scale. The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades, and operating costs that may prove inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

The construction of mines is subject to all of the risks inherent in construction.

These risks include potential delays, cost overruns, shortages of material or labor, construction defects, and injuries to persons and property. While we anticipate taking all measures which we deem reasonable and prudent in connection with the construction, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such construction. Any delay would postpone our anticipated receipt of revenue and adversely affect our operations. Cost overruns would likely require that we obtain additional capital in order to commence production. Any of these occurrences may adversely affect our ability to generate revenues and the price of our stock.

An adequate supply of water may not be available to undertake mining and production at our properties.

The amount of water that we are entitled to use from wells must be determined by the appropriate regulatory authorities. A determination of these rights is dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing a property to a point where it can commence commercial production of silver, gold or other precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at our properties.

Exploration and exploitation activities are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our Company.

Exploration and exploitation activities are subject to federal, state, and local, and in some cases, foreign laws, regulations, and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Exploration and exploitation activities are also subject to federal, state, and local, and in some cases, foreign laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment.

Various permits from government bodies are required for drilling operations to be conducted, and no assurance can be given that such permits will be received. Environmental and other legal standards imposed by federal, state, or local authorities may be changed and any such changes may prevent us from conducting planned activities or increase our costs of doing so, which would have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Any laws, regulations, or policies of any government body or regulatory agency may be changed, applied, or interpreted in a manner which will alter and negatively affect our ability to carry on our business.

11

As we face intense competition in the mineral exploration industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

Our mineral properties are in Mexico and our competition there includes large, established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may have to compete for financing and we may be unable to acquire financing on terms we consider acceptable. We may also have to compete with the other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or qualified employees, our exploration programs may be slowed down or suspended, which may cause us to cease operations as a Company.

Government regulation may adversely affect our business and planned operations.

Mineral exploration and development activities are subject to various Mexican laws governing prospecting, development, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people, and other matters. We cannot assure you that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail our exploration or development of our properties.

The Company's mining, exploration and development projects could be adversely affected by amendments to such laws and regulations, by future laws and regulations, by more stringent enforcement of current laws and regulations, by changes in policies of México and the United States affecting foreign trade, investment, mining and repatriation of financial assets, by shifts in political attitudes in México and by exchange controls and currency fluctuations. The effect, if any, of these factors cannot be accurately predicted. Further, there can be no assurance that the Company will be able to obtain or maintain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects.

Our operating costs could be adversely affected by inflationary pressures especially to labor, equipment, and fuel costs.

The global economy is currently experiencing a period of high commodity prices and as a result, the mining industry is attempting to increase production at new and existing projects, while also seeking to discover, explore and develop new projects. This has caused significant upward price pressures in the costs of mineral exploration companies, especially in the areas of skilled labor and drilling equipment, both of which are in tight supply and whose costs are increasing. Continued upward price pressures in our exploration costs may have an adverse impact to our business.

We may not have sufficient funding for exploration which may impair our profitability and growth.

The capital required for exploration of mineral properties is substantial. From time to time, we will need to raise additional cash, or enter into joint venture arrangements, in order to fund the exploration activities required to determine whether mineral deposits on our projects are commercially viable. New financing or acceptable joint venture partners may or may not be available on a basis that is acceptable to us. Inability to obtain new financing or joint venture partners on acceptable terms may prohibit us from continued exploration of such mineral properties. Without successful sale or future development of our mineral properties through joint venture, we will not be able to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position and results of operations.

We have no reported mineral reserves and if we are unsuccessful in identifying mineral reserves in the future, we may not be able to realize any profit from our property interests.

We are an exploration stage company and have no reported mineral reserves. Any mineral reserves will only come from extensive additional exploration, engineering, and evaluation of existing or future mineral properties. The lack of reserves on our mineral properties could prohibit us from sale or joint venture of our mineral properties. If we are unable to sell or joint venture for development our mineral properties, we will not be able to realize any profit from our interests in such mineral properties, which could materially adversely affect our financial position or results of operations. Additionally, if we or partners to whom we may joint venture our mineral properties are unable to develop reserves on our mineral properties, we may be unable to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position or results of operations.

12

Severe weather or violent storms could materially affect our operations due to damage or delays caused by such weather.

Our exploration activities are subject to normal seasonal weather conditions that often hamper and may temporarily prevent exploration activities. There is a risk that unexpectedly harsh weather or violent storms could affect areas where we conduct exploration activities. Delays or damage caused by severe weather could materially affect our operations or our financial position.

Our business is extremely dependent on gold, silver, commodity prices, and currency exchange rates over which we have no control.

Our operations will be significantly affected by changes in the market price of gold, silver and other commodities since the evaluation of whether a mineral deposit is commercially viable is heavily dependent upon the market price of gold, silver and other commodities. The price of commodities also affects the value of exploration projects we own or may wish to acquire. These prices of commodities fluctuate on a daily basis and are affected by numerous factors beyond our control. The supply and demand for gold, silver and other commodities, the level of interest rates, the rate of inflation, investment decisions by large holders of these commodities, including governmental reserves, and stability of exchange rates can all cause significant fluctuations in prices. Such external economic factors are in turn influenced by changes in international investment patterns and monetary systems and political developments. The prices of commodities have fluctuated widely and future serious price declines could have a material adverse effect on our financial position or results of operations.

Estimates of mineralized materials are subject to geologic uncertainty and inherent sample variability.

Although the estimated resources at our existing properties will be delineated with appropriately spaced drilling, there is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There also may be unknown geologic details that have not been identified or correctly appreciated at the proposed level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining and processing operations. Acceptance of these uncertainties is part of any mining operation.

We engage in our operations through a venture that we do not control. We may not be able to materially affect the cost or success of that venture.

Pursuant to our option agreement with Yale Resources, the exploration and development work on our Los Amoles Property is expected to be performed by Minera Alta Vista S.A. de C.V., the Mexican subsidiary of the optionor, Yale Resources. As the operator, Yale Resources makes most of the decisions about the exploration and development of this project. We cannot assure you that Yale Resources or its subsidiaries, affiliates, agents or management will make decisions concerning this project that are reasonable, profitable or in our best interest.

If we establish the existence of a mineral resource on any of our properties in a commercially exploitable quantity, we will require additional capital in order to explore and develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our Company.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our Company.

13

If our costs of exploration are greater than anticipated, then we may not be able to complete the exploration program for our properties without additional financing, of which there is no assurance that we would be able to obtain.

We are proceeding with the initial stages of exploration on our Los Amoles Property and properties in Jalisco, Mexico. Our exploration program outlines a budget for completion of the program. However, there is no assurance that our actual costs will not exceed the budgeted costs. Factors that could cause actual costs to exceed budgeted costs include increased prices due to competition for personnel and supplies during the exploration season, unanticipated problems in completing the exploration program and delays experienced in completing the exploration program. Increases in exploration costs could result in our not being able to carry out our exploration program without additional financing. There is no assurance that we would be able to obtain additional financing in this event.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

We have not commenced the initial stage of exploration of our mineral property, and thus have no way to evaluate the likelihood that we will be successful in establishing commercially exploitable reserves of gold, silver or other valuable minerals on our Los Amoles Property or properties in Jalisco, Mexico. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold, silver or other valuable minerals in our mineral property. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

As we undertake exploration of our mineral property, we will be subject to compliance with government regulation that may increase the anticipated time and cost of our exploration program, which could increase our expenses.

We will be subject to the mining laws and regulations in Mexico as we carry out our exploration program. We will be required to pay mining taxes to the Mexican government. We will be required to prove our compliance with relevant Mexican environmental and workplace safety laws, regulations and standards by submitting receipts showing the purchase of equipment used for workplace safety or the prevention of pollution or the undertaking of environmental remediation projects before we are able to obtain drilling permits. If our exploration activities lead us to make a decision to go into mining production, before we initiate a major drilling program, we will have to obtain an environmental impact statement authorization. This could potentially take more than 10 months to obtain and could potentially be refused. New regulations, if any, could increase our time and costs of doing business and prevent us from carrying out our exploration program. These factors could prevent us from becoming profitable.

Because our executive officers and directors have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Juan Miguel Ríos Gutiérrez, our Chief Executive Officer and sole director of our Company, and Mark Scott, our Chief Financial Officer, each devote approximately 40% of their working time on providing management services to us. If the demands on our executive officers and sole director from their other obligations increase, they may no longer be able to devote sufficient time to the management of our business. This could negatively impact our business development.

Because we have limited staff, we need to utilize outside parties in our business operations, which could cause our business to fail.

Our President & CEO Juan Miguel Ríos Gutiérrez holds an MBA in P.Eng., Mining and Metallurgical. He has worked for twenty years in management and on projects at Peñoles, the largest mining operation in Mexico. Mr. Juan Miguel Ríos Gutiérrez was the fourth employee at First Majestic Silver Corp. (“First Majestic” or FMSC”) and helped build that company from a junior mining exploration company on the TSXV and NYSE to a major global silver producer. Mr. Gutierrez held the General Manager position at four of the FMSC mining units in Mexico.

Because of limited staff, we rely on outside parties in our business operations. This could negatively impact our business development.

14

Risks Related to Our Common Stock

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

Our articles of incorporation authorize the issuance of up to 500,000,000 shares of common stock with a par value of $0.001 per share. Our Board of Directors may choose to issue some or all of such shares to acquire one or more companies or properties and to fund our overhead and general operating requirements. The issuance of any such shares may reduce the book value per share and may contribute to a reduction in the market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will reduce the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in a change of control of our corporation.

Our common stock is illiquid and the price of our common stock may be negatively impacted by factors which are unrelated to our operations.

Although our common stock is currently quoted on the OTC Bulletin Board, relatively few of our shares have been purchased or sold on that market. Even when a more active market is established, trading through the OTC Bulletin Board is frequently thin and highly volatile. There is no assurance that a sufficient market will develop in our stock, in which case it could be difficult for shareholders to sell their stock. The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of our competitors, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

We do not intend to pay cash dividends on any investment in the shares of stock of our Company.

We have never paid any cash dividends and currently do not intend to pay any cash dividends for the foreseeable future. Because we do not intend to declare cash dividends, any gain on an investment in our Company will need to come through an increase in the stock's price. This may never happen and investors may lose all of their investment in our Company.

Our stock is categorized as a penny stock. Trading of our stock may be restricted by the SEC's penny stock regulations which may limit a shareholder's ability to buy and sell our stock.

Our stock is categorized as a penny stock. The SEC has adopted Rule 15g-9 which generally defines "penny stock" to be any equity security that has a market price (as defined) less than US$ 5.00 per share or an exercise price of less than US$ 5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer's account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer's confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

15

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

Other than our mining claims, leases, and other real property interests specifically related to mining, we do not own real estate nor have plans to acquire any real estate.

ITEM 3. LEGAL PROCEEDINGS

There are no pending legal proceedings against us that are expected to have a material adverse effect on our cash flows, financial condition or results of operations.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

16

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock currently trades on the Over the Counter Bulletin Board (“OTCBB”) under the symbol “SURE.” The following table sets forth the range of the high and low sale prices of the common stock for the periods indicated:

|

Quarter Ended

|

High

|

Low

|

||||||

|

February 28, 2012

|

$ | 0.48 | $ | 0.24 | ||||

|

May 31, 2012

|

$ | 0.30 | $ | 0.16 | ||||

|

August 31, 2012

|

$ | 0.22 | $ | 0.13 | ||||

|

November 30, 2012

|

$ | 0.16 | $ | 0.05 | ||||

|

February 28, 2011

|

$ | 0.29 | $ | 0.10 | ||||

|

May 31, 2011

|

$ | 0.67 | $ | 0.18 | ||||

|

August 31, 2011

|

$ | 0.76 | $ | 0.38 | ||||

|

November 30, 2011

|

$ | 0.61 | $ | 0.22 | ||||

|

February 28, 2010

|

$ | - | $ | - | ||||

|

May 31, 2010

|

$ | - | $ | - | ||||

|

August 31, 2010

|

$ | - | $ | - | ||||

|

November 30, 2010

|

$ | 0.32 | $ | 0.16 | ||||

As of February 6, 2013, the closing price of the Company's common stock was $0.19 per share. As of February 7, 2013, there were 91,855,861 shares of common stock outstanding held by approximately 17 stockholders of record. The number of stockholders, including the beneficial owners' shares through nominee names, is approximately 400.

DIVIDEND POLICY

We have never paid any cash dividends and intend, for the foreseeable future, to retain any future earnings for the development of our business. Our future dividend policy will be determined by the board of directors on the basis of various factors, including our results of operations, financial condition, capital requirements and investment opportunities.

RECENT SALES OF UNREGISTERED SECURITIES

During the three months ended November 30, 2012, there were the following sales of unregistered equity securities.

On November 16, 2012, we issued 200,000 shares to Yale Resources pursuant to an Option Agreement at the market value of $0.08 per share for a total value of $16,000. The shares do not have registration rights.

Unless otherwise indicated, all of the above private placements of Company securities were conducted under the exemption from registration as provided under Section 4(2) of the Securities Act of 1933. All of the shares issued were issued in private placements not involving a public offering, are considered to be “restricted stock” as defined in Rule 144 promulgated under the Securities Act of 1933 and stock certificates issued with respect thereto bear legends to that effect.

17

|

Performance Graph

|

|

Comparison of Cumulative Total Return

|

|

Among Sonora Resources Corp, Global X Silver Miners ETF and iShares Silver Trust ETF

|

|

11/30/2009

|

11/30/2010

|

11/30/2011

|

11/30/2012

|

|||||||||||||

|

Sonora Resources Corp

|

$ | 100.00 | $ | 2,300.00 | $ | 2,900.00 | $ | 900.00 | ||||||||

|

Global X Silver Miners ETF

|

$ | 100.00 | $ | 163.38 | $ | 158.86 | $ | 255.98 | ||||||||

|

iShares Silver Trust ETF

|

$ | 100.00 | $ | 151.18 | $ | 176.31 | $ | 178.29 | ||||||||

The above assumes that $100 was invested in the common stock and each index on November 30, 2009. Although the company has not declared a dividend on its common stock, the total return for each index assumes the reinvestment of dividends. Stockholder returns over the periods presented should not be considered indicative of future returns. The foregoing table shall not be deemed incorporated by reference by any general statement incorporating by reference the Form 10-K into any filing under the Securities Act or the Exchange Act, except to the extent the company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the acts.

18

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of November 30, 2012 related to the equity compensation plan in effect at that time.

|

(a)

|

(b)

|

(c)

|

||||||||||

|

Plan Category

|

Number of securities

to be issued uponoptions, warrants

and rights

|

Weighted-average

exercise price of |

Number of securities

remaining available(excluding securities

reflected in column (a)) |

|||||||||

|

Equity compensation plan approved by shareholders

|

||||||||||||

|

Equity compensation plans not approved by shareholders

|

1,400,000 | 0.200 | 7,100,000 | |||||||||

|

Total

|

1,400,000 | 0.200 | 7,100,000 | |||||||||

ITEM 6. SELECTED FINANCIAL DATA

In the following table, we provide you with our selected consolidated historical financial and other data. We have prepared the consolidated selected financial information using our consolidated financial statements for the years ended November 30, 2012 and 2011. When you read this selected consolidated historical financial and other data, it is important that you read along with it the historical financial statements and related notes in our consolidated financial statements included in this report, as well as Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

Year Ended,

|

||||||||||||||||

|

November 30, 2012

|

November 30, 2011

|

November 30, 2010

|

November 30, 2009

|

|||||||||||||

|

STATEMENT OF OPERATIONS DATA:

|

||||||||||||||||

|

Revenue

|

$ | - | $ | - | $ | - | $ | 11,254 | ||||||||

|

Net loss

|

(934,943 | ) | (1,153,748 | ) | (80,849 | ) | (17,866 | ) | ||||||||

|

Net loss applicable to Sonora Resources Corp. common shareholders

|

(934,943 | ) | (1,153,748 | ) | (80,849 | ) | (17,866 | ) | ||||||||

|

Net loss per share

|

(0.01 | ) | (0.01 | ) | - | - | ||||||||||

|

BALANCE SHEET DATA:

|

||||||||||||||||

|

Total assets

|

4,536,250 | 3,965,749 | 300,750 | 2,130 | ||||||||||||

|

Stockholders' equity (deficit)

|

4,490,075 | 3,520,593 | 297,011 | (21,629 | ) | |||||||||||

19

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements and Associated Risks.

This report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for future operations. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. Examples of forward-looking statements made in this report include statements about:

|

●

|

our future exploration programs and results;

|

|

●

|

our expectations regarding the impact of various accounting policies;

|

|

●

|

our future capital expenditures; and

|

|

●

|

our future investments in and acquisitions of mineral resource properties.

|

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including:

|

●

|

risks and uncertainties relating to the interpretation of sampling results, the geology, grade and continuity of mineral deposits;

|

|

●

|

risks and uncertainties that results of initial sampling and mapping will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration activities; risks related to the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses;

|

|

●

|

risks related to commodity price fluctuations;

|

|

●

|

the uncertainty of profitability based upon our limited history;

|

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration project;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post- closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments;

|

|

●

|

political and regulatory risks associated with mining development and exploration; and

|

|

●

|

the risks in the section entitled “Risk Factors”.

|

Any of these risks could cause our Company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements contained in this quarterly report.

While these forward-looking statements and any assumptions upon which they are based are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

20

Plan of Operation

We are a mining exploration company focused on the acquisition and exploration of prospective silver opportunities in Mexico. Our goal is to build our Company into a successful mineral exploration and development company. During 2013, we intend to produce silver and gold at our Corazon and Liz properties discussed below.

We have mining option agreements in (i) the Los Amoles Property consisting of 1,630 hectares located in Sonora; (ii) the Jalisco Group of Properties, consisting of mining claims totaling 5,240 hectares located in Jalisco; and (iii) the Ayones Group of Properties consisting of numerous mining claims totaling 48 hectares in Jalisco. We have commenced an underground work program at the Los Amoles property and completed a geologic report to define the potential vein structure and outcroppings and prepare for a planned drilling program later in 2013.

Also, we have five mining concessions on 721 hectares surrounding the Ayones Group of Properties, called the Corazon Property. We have a letter of intent with the Liz Property located in Ayutla, Jalisco State, Mexico. Sonora Resources is based in Guadalupe, Zacatecas, Mexico. We have concluded phase one field work at the Corazon property and we intend to produce silver and gold at our Corazon and Liz properties in 2013.

We are currently in the development stage as defined in ASC 915 "Accounting and Reporting for Development Stage Enterprises" and have minimal operations.

We have incurred a cumulative net loss since inception on December 3, 2007 to November 30, 2012 of $2,197,000 and have no source of operating revenue. While our management believes that we will be successful in our planned operating activities under our business plan and capital raising activities, there can be no assurance that we will be successful in the mining development and exploration business or the raising of sufficient capital such that we will generate adequate revenues to earn a profit or sustain its operations.

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplates our continuation as a going concern. We have not established a source of revenues sufficient to cover its operating costs, and as such, have incurred an operating loss since inception. Further, as of November 30, 2012, we have working capital of $347,000. These and other factors raise doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments or classifications that may result from the possible inability of the Company to continue as a going concern.

On July 12, 2011, we established a 100% owned subsidiary, Finder Plata S.A. de C.V. ("Finder Plata") for the development of our exploration business in Mexico.

Results of Operations

The following table presents certain consolidated statement of operations information and presentation of that data as a percentage of change from period-to-period.

(dollars in thousands)

For the year ended November 30, 2012 compared to the year ended November 30, 2011

|

Year Ended November 30,

|

||||||||||||||||

|

2012

|

2011

|

$ Variance

|

% Variance

|

|||||||||||||

|

Revenue

|

$ | - | $ | - | $ | - | ||||||||||

| Cost of sales | - | - | - | |||||||||||||

|

Gross profit

|

- | - | - | |||||||||||||

|

General and administrative expenses

|

277 | 558 | (281 | ) | 50.4 | % | ||||||||||

|

Exploration expenses

|

520 | 185 | 335 | -100.0 | % | |||||||||||

|

Operating loss

|

(797 | ) | (743 | ) | (54 | ) | -7.3 | % | ||||||||

|

Other income (expense):

|

||||||||||||||||

|

Interest expense

|

(138 | ) | (412 | ) | 274 | 66.5 | % | |||||||||

|

Foreign exchange gain

|

- | 1 | (1 | ) | -100.0 | % | ||||||||||

|

Total other expense

|

(138 | ) | (411 | ) | 273 | 66.4 | % | |||||||||

| Net loss | (935 | ) | (1,154 | ) | 219 | 19.0 | % | |||||||||

21

We have not generated any revenues during the year ended November 30, 2012 and 2011.

We acquired mining option agreements with the Los Amoles, Jalisco, Ayones, and Corazon Mexico properties in order to determine whether they possess commercially exploitable quantities of gold, silver, and other metals.

General and administrative expenses for the year ended November 30, 2012 decreased $281,000 to $277,000 as compared to $558,000 for the year ended November 30, 2011.

Exploration expenses for the year ended November 30, 2012 increased $335,000 to $520,000 as compared to $185,000 for the year ended November 30, 2011.

Net loss for the year ended November 30, 2012 was $935,000 as compared to a net loss of $1,154,000 for the year ended November 30, 2011.

Liquidity and Capital Resources

As of November 30, 2012, we had cash of $293,000 and working capital of $347,000. This increase in our working capital is primarily due to the issuance of common stock and convertible debentures for exploration expenses related to Los Amoles and Corazon properties and common stock issued for private placement for cash. We have incurred operating losses since inception, and this is likely to continue until we mine the Corazon property. We expect to finance our plan through investors, First Majestic and cash flow from the Corazon and Liz properties discussed below.

We require funds to enable us to address our minimum current and ongoing expenses. Presently, we do not generate any revenue and expect to incur significant operating and capital expenses. Management projects that we may require an additional $4,584,250 to fund our operating expenditures for the next twelve month period for the Los Amoles, Jalisco, Ayones and Corazon, Mexico properties. Details are as follows:

|

Expenditures

|

Amount

|

|||

|

Mining exploration expenses

|

$ | 4,296,250 | ||

| General and administration expenses | 288,000 | |||

|

Total

|