Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Sonora Resources Corp. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - Sonora Resources Corp. | sure_ex311.htm |

| EX-32.1 - CERTIFICATION - Sonora Resources Corp. | sure_ex321.htm |

| EX-31.2 - CERTIFICATION - Sonora Resources Corp. | sure_ex312.htm |

| EX-32.2 - CERTIFICATION - Sonora Resources Corp. | sure_ex322.htm |

| EX-21.1 - SUBSIDIARIES - Sonora Resources Corp. | sure_ex211.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

þ ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (FEE REQUIRED)

For the fiscal year ended November 30, 2013

o TRANSACTION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 (NO FEE REQUIRED)

For the transaction period from ________to ________

Commission File No. 000-54268

SONORA RESOURCES CORP.

(Exact Name of Issuer as specified in its charter)

|

Nevada

|

27-1269503

|

|

(State or other jurisdiction of

|

(IRS Employer File Number)

|

|

incorporation)

|

|

|

Cerro del Padre #11, Rinconada de

|

|

|

los Pirules, Guadalupe, Zacatecas

|

|

|

Mexico 98619

|

98619 |

|

(Address of principal executive

|

(zip code)

|

|

offices)

|

1-877-513-7873

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Exchange Act:

|

Common

|

OTCQB

|

|

(Title of each class)

|

(Name of each exchange on which

|

|

registered)

|

Securities registered pursuant to Section 12 (g) of the Exchange Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.o Yes þ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. þ Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes o No

Indicate by check mark if disclosure of delinquent filers in response to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company þ

|

|

(Do not check if a

|

|

|

smaller reporting

|

|

|

company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes þ No

As of May 31, 2013 (the last business day of our most recently completed second fiscal quarter), based upon the last reported trade on that date, the aggregate market value of the voting and non-voting common equity held by non-affiliates (for this purpose, all outstanding and issued common stock minus stock held by the officers, directors and known holders of 10% or more of the Company’s common stock) was $4,408,727.

As of February 21, 2014, the Company had 92,855,861 shares of common stock issued and outstanding.

TABLE OF CONTENTS

|

Page

|

|

|

PART 1

|

|

|

ITEM 1.Description of Business

|

3 |

|

ITEM 1A. Risk Factors

|

5 |

|

ITEM 1B Unresolved Staff Comments

|

14 |

|

ITEM 2.Properties

|

14 |

|

ITEM 3.Legal Proceedings

|

14 |

|

ITEM 4.Mine Safety Disclosure

|

14 |

|

PART II

|

|

|

ITEM 5. Market for Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

15 |

|

ITEM 6.Selected Financial Data

|

18 |

|

ITEM 7.Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

18 |

|

ITEM 7A. Quantitative and Qualitative Disclosures About Market Risk

|

24 |

|

ITEM 8.Financial Statements and Supplementary Data

|

24 |

|

ITEM 9.Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

24 |

|

ITEM 9A. Controls and Procedures

|

25 |

|

ITEM 9B. Other Information

|

|

|

PART III

|

|

|

ITEM 10. Directors, Executive Officers and Corporate Governance

|

26 |

|

ITEM 11. Executive Compensation

|

28 |

|

ITEM 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

34 |

|

ITEM 13. Certain Relationships and Related Transactions, and Director Independence

|

35 |

|

ITEM 14. Principal Accounting Fees and Services

|

35 |

|

PART IV

|

|

|

ITEM 15. Exhibits, Financial Statement Schedules

|

37 |

|

SIGNATURES

|

39 |

2

PART I

FORWARD-LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this report, should be considered carefully in evaluating us and our prospects. This report (including without limitation the following factors that may affect operating results) contains forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933, as ("Securities Act") and Section 21E of the Securities Exchange Act of 1934, as ("Exchange Act") regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, development of new products, enhancements or technologies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed below and in "Management's Discussion and Analysis of Financial Condition and Results of Operations" as well as those discussed elsewhere in this report. Readers are urged not to place undue reliance on these forward-looking statements which speak only as of the date of this report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report.

As used in this Form 10-K, “we,” “us,” and “our” refer to Sonora Resources Corp. and its wholly-owned subsidiary, Finder Plata S.A. de C.V., a company organized under the laws of Mexico, which are also sometimes collectively referred to as the “Company” or “Sonora Resources” unless otherwise noted.

ITEM 1. DESCRIPTION OF BUSINESS

THE COMPANY AND OUR BUSINESS

Plan of Operation

Sonora Resources Corp. (the "Company" or "Sonora Resources") was incorporated under the laws of the State of Nevada on December 3, 2007. We are a mining exploration company focused on the acquisition and development of prospective silver and gold opportunities in Mexico. On July 12, 2011, we established a 100% owned subsidiary, Finder Plata S.A. de C.V. ("Finder Plata") for the development of our exploration business in Mexico.

The worldwide silver market has experienced a strong decline in the prices during 2013. As a result, we made the decision in September 2013 to focus on the Los Amoles Property in 2014 and the Jalisco Properties in 2015, each as further described below. As of November 30, 2013, we had cash of $19,000 and working capital deficit of $167,000 as compared to cash of $293,000 and a working capital of $347,000 as of November 30, 2012. This decrease in our working capital is primarily due to operating losses. We have incurred operating losses since inception, and this is likely to continue. We expect to cancel the Mining Option Agreement for the Ayones Property and have cancelled the Mining Option Agreement for the Corazon Property. We recorded an impairment expense of $445,000 related to the Ayones and Corazon Properties as of November 30, 2013. The Joint Venture and Benefits Agreement in Liz, Mexico expired on December 15, 2013.

We require funds to enable us to address our minimum current and ongoing expenses. Presently, we do not generate any revenue and expect to incur significant operating and capital expenses. Management projects that we may require an additional approximately $133,000 to fund our operating expenditures for the next twelve month period for the exploration of the Los Amoles Property. The exploration of the Jalisco Properties is scheduled for 2015.

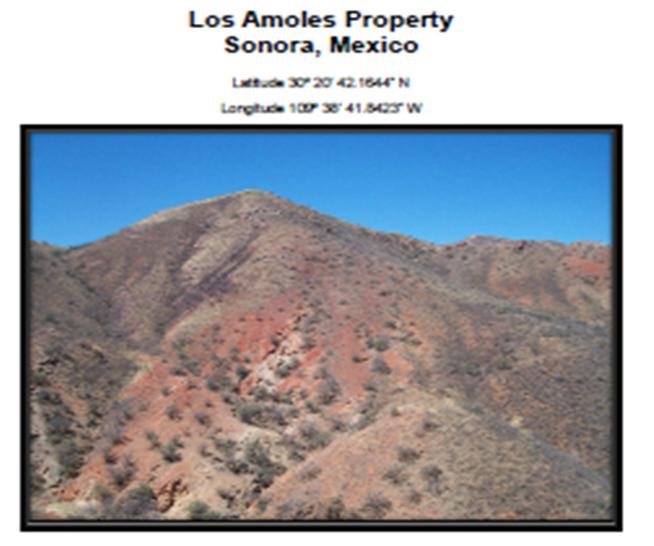

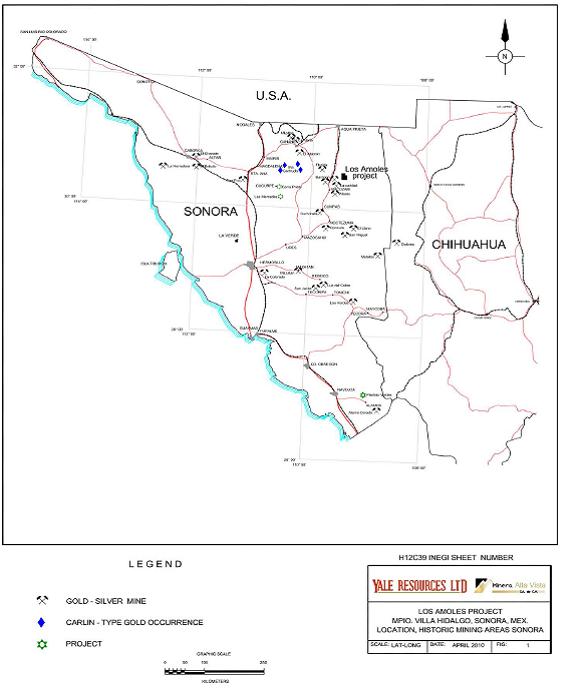

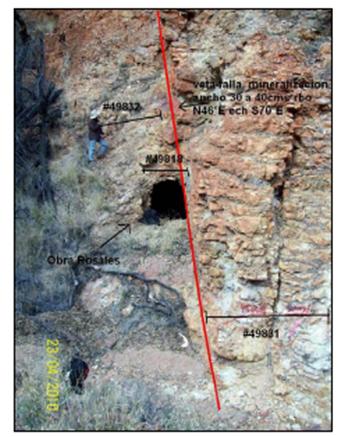

On March 15, 2013, we closed the Asset Purchase Agreement with Yale Resources Ltd to purchase all of the rights, title and interest in and to the Los Amoles 2 and Los Amoles 3 Fracc.1 properties, consisting of 2,166 hectares located in the State of Sonora Mexico (the “Los Amoles Property”). We purchased the Los Amoles Property from Yale by issuing 1,000,000 of restricted SURE common shares and paying $200,000 in cash. We have commenced an underground work program at the Los Amoles Property and completed a geologic report to define the potential vein structure and outcroppings and prepare for a planned drilling program in 2014.

3

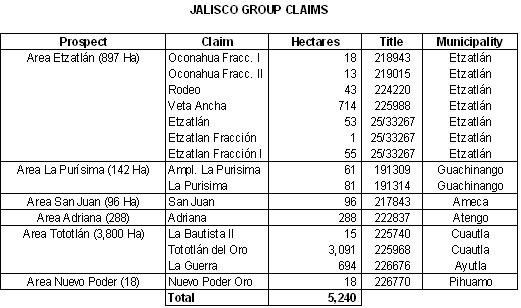

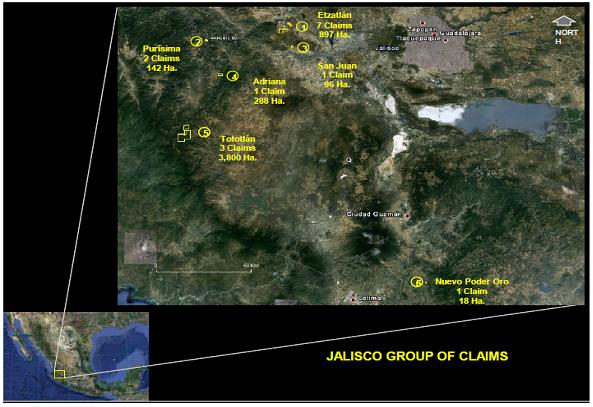

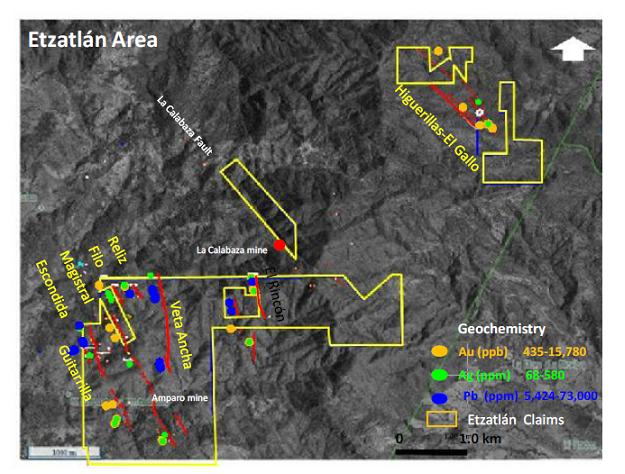

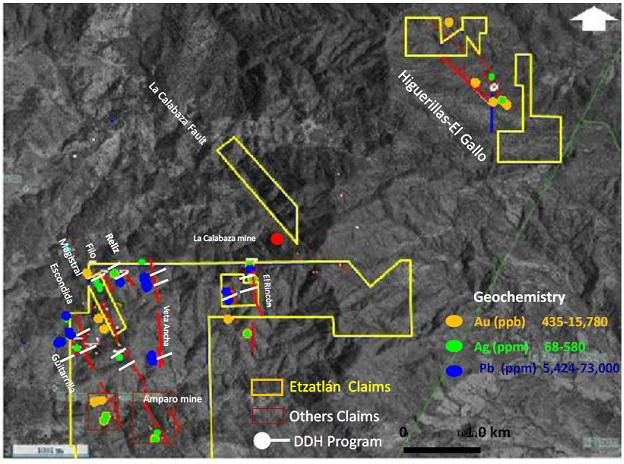

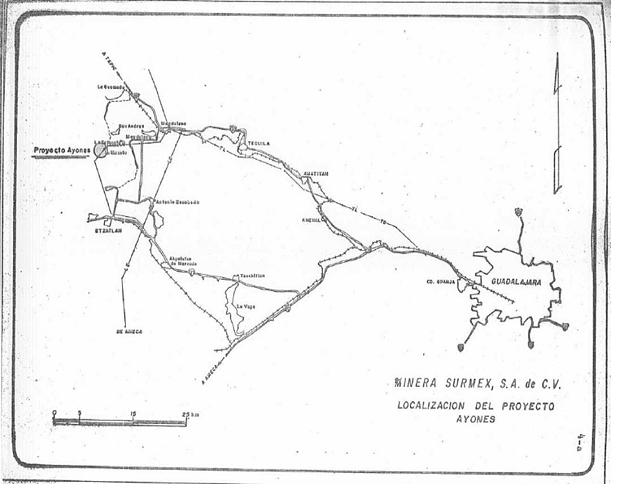

We also have an Mining Option Agreement with First Majestic Silver Corp., an existing shareholder and creditor of the Company for the Jalisco Group of Properties (“Jalisco Properties”). The Jalisco Properties consist of mining claims totaling 5,240 hectares located in Jalisco. As of February 21, 2014, we have has not spent any funds on the properties. We are required to spend $3,000,000 by April 15, 2014 to earn 50% interest in the Jalisco Properties and an additional $2,000,000 to earn an additional 20% interest by April 15, 2016 on exploration expenses. An additional 20% interest in and to the Jalisco Properties can be earned by completing a bankable feasibility study no later than the seventh anniversary of the Agreement. We expect to amend the Mining Option Agreement with First Majestic and delay our required expenditures.

Our principal executive office is located at Cerro del Padre # 11 Rinconada de los Pirules, Guadalupe, Zacatecas Mexico, 98619. Our US mailing address is PO Box 12616, Seattle, WA 98111 and our telephone number is 1-877-513-7873.

We are currently in the exploration stage as defined in ASC 915 "Accounting and Reporting for Development Stage Enterprises" and have minimal operations.

We have incurred a cumulative net loss since inception on December 3, 2007 to November 30, 2013 of $3,027,000 and have no source of operating revenue. While our management believes that the we will be successful in its planned operating activities under our business plan and capital raising activities, there can be no assurance that it will be successful in the mining development and exploration business or the raising of sufficient capital such that it will generate adequate revenues to earn a profit or sustain its operations. These and other factors raise doubt about the Company’s ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments or classifications that may result from the possible inability of the Company to continue as a going concern.

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplates our continuation as a going concern. We have not established a source of revenues sufficient to cover its operating costs, and as such, have incurred an operating loss since inception. Further, as of November 30, 2013, we have a working capital deficit of $167,000. These and other factors raise doubt about our ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments or classifications that may result from the possible inability of the Company to continue as a going concern.

Corporate Information

We were incorporated in the State of Nevada on December 3, 2007. Our principal executive office is located at Cerro del Padre # 11 Rinconada de los Pirules, Guadalupe, Zacatecas Mexico, 98619. Our US mailing address is PO Box 12616, Seattle, WA 98111 and our telephone number is 1-877-513-7873. Our principal website address is located at www.sonoraresources.com. The information on our website is not incorporated as a part of this Form 10-K.

The Company’s Common Stock

Our common stock currently trades on the Over the Counter Bulletin Board (“OTCQB”) under the symbol “SURE.”

Key Market Priorities

Our primary key market priority will be to explore our Los Amoles and Jalisco Properties in order to determine whether they possess commercially exploitable quantities of gold, silver, and other metals. We cannot guarantee that the Los Amoles or Jalisco Properties will be successful or that any project that we embark upon will be successful. Our goal is to build our Company into a successful mineral exploration and development company.

Primary Market Risks

We are exposed to various risks related to our need for additional financing, the volatility of the price of silver, our reserve estimates, operating as a going concern, unique difficulties and uncertainties in mining exploration ventures, and a volatile market price for our common stock. These risks and uncertainties are discussed in more detail below in this item.

Employees

As of November 30, 2013, we had two part-time employees. The Chief Executive Officer is based out of Guadalupe, Zacatecas Mexico. The Chief Financial Officer is based out of Seattle, WA and Atlanta, GA.

Website Access to United States Securities and Exchange Commission Reports

We file annual and quarterly reports, proxy statements and other information with the Securities and Exchange Commission ("SEC"). You may read and copy any document we file at the SEC's Public Reference Room at 100 F Street, N.E., Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. The SEC maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information concerning filers. We also maintain a web site at http://www.sonoraresources.com that provides additional information about our Company and links to documents we file with the SEC. The Company's charters for the Compensation Committee and the Code of Conduct & Ethics are also available on our website. The Company does not have an Auditing or Nominations Committee at this time. The information on our website is not part of this Form 10-K.

4

ITEM 1A. RISK FACTORS

An investment in our Common Stock involves a high degree of risk. You should carefully consider the following risk factors and other information in this prospectus before deciding to invest in shares of the Company’s Common Stock. The most significant risks and uncertainties known and identified by our management are described below; however, they are not the only risks that we face. If any of the following risks actually occurs, our business, financial condition, liquidity, results of operations and prospects for growth could be materially adversely affected, the trading price of our Common Stock could decline, and you may lose all or part of your investment. You should acquire shares of our Common Stock only if you can afford to lose your entire investment. We make various statements in this section that constitute “forward-looking statements”. See “Forward-Looking Statements” beginning on page 5 of this report.

Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, we may have to cease our exploration activities, lose our properties, divest the company and investors could lose their entire investment.

There is no assurance that we will operate profitably or generate positive cash flow in the future. We will require additional financing in order to proceed with our exploration program of the Los Amoles and Jalisco Properties. We will also require additional financing for the fees we must pay to maintain our mining option agreements and to pay the fees and expenses necessary to become and operate as a public company. We will also need more funds if the costs of the exploration of our existing projects are greater than we have anticipated. We will also require additional financing to sustain our business operations if we are not successful in earning revenues. We may not be able to obtain financing on commercially reasonable terms or terms that are acceptable to us when it is required. Our future is dependent upon our ability to obtain financing. If we do not obtain such financing, our business could fail or we could divest the company and investors could lose their entire investment.

We have a limited operating history on which to base an evaluation of our business and prospects.

We have been in the business of exploring mineral resource properties since November 2010. We have never had any revenues from our mining operations. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties, and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. We have no way to evaluate the likelihood of whether our mineral properties contain any mineral reserves or, if they do, that we will be able to build or operate a mine successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties. We therefore expect to continue to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from mining operations and any dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties, and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

The fact that we have not earned any operating revenues since our incorporation raises substantial doubt about our ability to continue to explore our mineral properties as a going concern.

We have not generated any revenue from operations since our incorporation, and we anticipate that we will continue to incur operating expenses without revenues unless and until we are able to identify a mineral resource in a commercially exploitable quantity on one or more of our mineral properties and we build and operate a mine. At November 30, 2013, we had working capital deficit of $167,000 and a net loss of $3,027,000 since inception. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering sufficient reserves, we will require significant additional funds in order to place our properties into commercial production. Should the results of our planned exploration require us to increase our current operating budget, we may have to raise additional funds to meet our currently budgeted operating requirements for the next 12 months. As we cannot assure a lender that we will be able to successfully explore and develop our mineral properties, we will probably find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity and debt securities, but there can be no assurance that we will continue to be able to do so. If we cannot raise the money that we need to continue exploration of our mineral properties, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail. These circumstances led our independent registered public accounting firm, in their report dated February 21, 2014 relative to our audited financial statements for the year ended November 30, 2013, to comment about our Company’s ability to continue as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that the Company will continue to operate indefinitely and not go out of business and liquidate its assets. These conditions raise substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event our Company cannot continue in existence. We continue to experience net operating losses.

Our management and First Majestic have substantial influence over our company.

As of November 30, 2013, Juan Miguel Ríos Gutiérrez, our CEO, either directly or indirectly, owns or controls 4.6 million shares or approximately 4.9% as of the filing date of our issued and outstanding common stock including stock option grants totaling 625,000 shares that Mr. Gutiérrez has the right to acquire in sixty days.

5

First Majestic owns or controls 13.8 million shares as of the filing date or approximately 14.8% of our issued and outstanding common stock as of the filing date of our issued and outstanding common stock. In addition, First Majestic is a major creditor of the Company, which gives First Majestic additional influence and control over the Company.

Mr. Gutiérrez and First Majestic, in combination with other large shareholders, could cause a change of control of our board of directors, approve or disapprove any matter requiring stockholder approval, cause, delay or prevent a change in control or sale of the Company, which in turn could adversely affect the market price of our common stock.

Economic and political developments in Mexico may adversely affect our business.

All of our operations and assets are located in Mexico. As a result, our financial condition, results of operations and business may be affected by and are subject to the general condition of the Mexican economy, the devaluation of the Mexican peso as compared to the U.S. Dollar, Mexican inflation, interest rates, regulation, taxation, social instability and other political, social and economic developments in or affecting Mexico, including changes in the laws and policies that govern foreign investment, as well as changes in United States laws and regulations relating to foreign trade and investment, over which we have no control. There can be no assurance as to the future effect of any such changes on our results of operations, financial condition, or cash flows.

Fluctuations in foreign currency rates, in particular the Mexican peso, may materially affect our results of operations.

The Company carries on its primary business activity outside of the United States. Accordingly, it is subject to the risks associated with fluctuation of the rate of exchange of other foreign currencies, in particular the Mexican peso, the currency in which much of the Company's costs are paid, and the United States dollar, the currency for calculating the Company's sales of gold and silver based on the world's commodity markets. Such currency fluctuations may materially affect the Company's financial position and results of operations.

All of our assets, our sole director and our Chief Executive Officer are outside the United States, with the result that it may be difficult for investors to enforce within the United States any judgments obtained against us or our directors and officers.

All of our assets are located outside the United States. In addition, our sole director and Chief Executive Officer is a national and resident of a country other than the United States, and all or a substantial portion of his assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against us or our director and officers, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, investors may be effectively prevented from pursuing remedies under United States federal and state securities laws against us or our directors and officers.

We are subject to corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We must comply with corporate governance requirements under the Sarbanes-Oxley Act of 2002 and the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010, as well as additional rules and regulations currently in place and that may be subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. We are required to include management’s report on internal controls as part of our annual report pursuant to Section 404 of the Sarbanes-Oxley Act. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404 of the Sarbanes-Oxley Act. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial.

Our management has concluded that our disclosure controls and procedures were not effective due to the presence of the following material weaknesses in internal control over financial reporting:

We do not have an audit committee. An audit committee would improve oversight in the establishment and monitoring of required internal controls and procedures.

Management anticipates that such disclosure controls and procedures will not be effective until the material weaknesses are remediated. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

6

Our business is dependent on key executives and the loss of any of our key executives could adversely affect our business, future operations and financial condition.

We are dependent on the services of key executives, including our officers, Mark Scott and Juan Miguel Ríos Gutiérrez, and our sole director Juan Miguel Ríos Gutiérrez. Mr. Gutierrez has many years of experience and an extensive background in the mining industry in general. We may not be able to replace that experience and knowledge with other individuals. We do not have “Key-Man” life insurance policies on our key executives. Both executives work the hours required to support the Company, which has been negatively impacted as worldwide silver market has experienced a strong decline in the prices during 2013. The loss of our key executives or our inability to attract and retain additional highly skilled employees may adversely affect our business, future operations, and financial condition.

We have limited insurance.

We have limited director and officer insurance and commercial insurance policies. Any significant insurance claims would have a material adverse effect on our business, financial condition and results of operations.

Risks Associated with Mining

Our Mining Operation Agreements are critical to our operations and are subject to cancellation and additional payments.

We have an Mining Option Agreement with First Majestic Silver Corp., an existing shareholder and creditor of the Company for the Jalisco Properties. As of February 21, 2014, we have has not spent any funds on the properties. We are required to spend $3,000,000 by April 15, 2014 to earn 50% interest in the Jalisco Properties and an additional $2,000,000 to earn an additional 20% interest by April 15, 2016 on exploration expenses. An additional 20% interest in and to the Jalisco Properties can be earned by completing a bankable feasibility study no later than the seventh anniversary of the Agreement. We expect to amend the Mining Option Agreement with First Majestic and delay our required expenditures.

We expect to cancel the Mining Option Agreement for the Ayones Property. We did not pay the $175,000 due February 10, 2013 and August 10, 2013 payment of $175,000 to IMMSA Grupo México under the August 10, 2011 Mining Option Agreement.

The failure to operate in accordance with the mining option agreements could result in the agreements being terminated or require additional payments.

Our business is extremely dependent on gold, silver, commodity prices, and currency exchange rates over which we have no control.

Our operations will be significantly affected by changes in the market price of gold, silver and other commodities since the evaluation of whether a mineral deposit is commercially viable is heavily dependent upon the market price of gold, silver and other commodities. The price of commodities also affects the value of exploration projects we own or may wish to acquire. These prices of commodities fluctuate on a daily basis and are affected by numerous factors beyond our control. The supply and demand for gold, silver and other commodities, the level of interest rates, the rate of inflation, investment decisions by large holders of these commodities, including governmental reserves, and stability of exchange rates can all cause significant fluctuations in prices. Such external economic factors are in turn influenced by changes in international investment patterns and monetary systems and political developments. The prices of commodities have fluctuated widely and future serious price declines could have a material adverse effect on our financial position or results of operations.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications, and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineable mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims. If this happens, our business will likely fail. All of our mineral properties to which we have rights are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of these properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

7

Because of the speculative nature of exploration of mineral properties, we may never discover a commercially exploitable quantity of minerals, our business may fail and investors may lose their entire investment.

We plan to conduct mineral exploration on certain mineral properties. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that additional exploration on these properties will establish that commercially exploitable reserves of minerals exist on these properties. Additional potential problems that may prevent us from discovering any reserves of minerals on these properties include, but are not limited to, unanticipated problems relating to exploration, environmental permitting difficulties and delays, and additional costs and expenses that may exceed current estimates. If we are unable to establish the presence of commercially exploitable reserves of minerals on these properties, our ability to fund future exploration activities will be impeded, we will not be able to operate profitably, and investors may lose all of their investment in our Company.

The nature of mineral exploration activities involves a high degree of risk and the possibility of uninsured losses that could materially and adversely affect our operations.

Exploration for minerals is highly speculative and involves greater risk than many other businesses. Many exploration programs do not result in the discovery of mineralization and any mineralization discovered may not be of sufficient quantity or quality to be profitably mined. Few properties that are explored are ultimately advanced to the stage of producing mines. Our current exploration efforts are, and any future exploration, development or mining operations we may elect to conduct will be, subject to all of the operating hazards and risks normally incident to exploring for and developing mineral properties, such as, but not limited to:

|

●

|

economically insufficient mineralized material;

|

|

●

|

fluctuations in production costs that may make mining uneconomical;

|

|

●

|

labor disputes;

|

|

●

|

unanticipated variations in grade and other geologic problems;

|

|

●

|

environmental hazards;

|

|

●

|

water conditions;

|

|

●

|

difficult surface or underground conditions;

|

|

●

|

industrial accidents;

|

|

●

|

metallurgical and other processing problems;

|

|

●

|

mechanical and equipment performance problems;

|

|

●

|

failure of pit walls or dams;

|

|

●

|

unusual or unexpected rock formations;

|

|

●

|

personal injury, fire, flooding, cave-ins, and landslides; and

|

|

●

|

decrease in revenues due to lower mineral prices.

|

Any of these risks can materially and adversely affect, among other things, the exploration of properties, production quantities and rates, costs and expenditures, and production commencement dates. We currently have no insurance to guard against any of these risks. If we determine that capitalized costs associated with any of our mineral interests are not likely to be recovered, we would incur a write-down of our investment in these interests. All of these factors may result in losses in relation to amounts spent which are not recoverable.

The potential profitability of mineral ventures depends in part upon factors beyond the control of our Company, and even if we discover and exploit mineral deposits, we may never become commercially viable and we may be forced to cease operations.

The commercial feasibility of mineral properties is dependent upon many factors beyond our control, including the existence and size of mineral deposits in the properties we explore, the proximity and capacity of processing equipment, market fluctuations of prices, taxes, royalties, land tenure, allowable production, and environmental regulation. These factors cannot be accurately predicted and any one or a combination of these factors may result in our Company not receiving an adequate return on invested capital. These factors may have material and negative effects on our financial performance and our ability to continue operations.

8

Mineralized material is based on interpretation and assumptions and may yield less mineral production under actual conditions than is currently estimated.

Unless otherwise indicated, mineralized material presented in our filings with securities regulatory authorities, including the SEC, press releases, and other public statements that may be made from time to time are based upon estimates made by our consultants. When making determinations about whether to advance any of our projects to development, we must rely upon such estimated calculations as to the mineralized material on our properties. Until mineralized material is actually mined and processed, it must be considered an estimate only. These estimates are imprecise and depend on geological interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. We cannot assure you that these mineralized material estimates will be accurate or that this mineralized material can be mined or processed profitably. Any material changes in estimates of mineralized material will affect the economic viability of placing a property into production and such property's return on capital. There can be no assurance that minerals recovered in small scale tests will be recovered at production scale. The mineralized material estimates have been determined and valued based on assumed future prices, cut-off grades, and operating costs that may prove inaccurate. Extended declines in market prices for gold and silver may render portions of our mineralized material uneconomic and adversely affect the commercial viability of one or more of our properties and could have a material adverse effect on our results of operations or financial condition.

The construction of mines is subject to all of the risks inherent in construction.

These risks include potential delays, cost overruns, shortages of material or labor, construction defects, and injuries to persons and property. While we anticipate taking all measures which we deem reasonable and prudent in connection with the construction, there is no assurance that the risks described above will not cause delays or cost overruns in connection with such construction. Any delay would postpone our anticipated receipt of revenue and adversely affect our operations. Cost overruns would likely require that we obtain additional capital in order to commence production. Any of these occurrences may adversely affect our ability to generate revenues and the price of our stock.

An adequate supply of water may not be available to undertake mining and production at our properties.

The amount of water that we are entitled to use from wells must be determined by the appropriate regulatory authorities. A determination of these rights is dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing a property to a point where it can commence commercial production of silver, gold or other precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at our properties.

Exploration and exploitation activities are subject to comprehensive regulation which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our Company.

Exploration and exploitation activities are subject to federal, state, and local, and in some cases, foreign laws, regulations, and policies, including laws regulating the removal of natural resources from the ground and the discharge of materials into the environment. Exploration and exploitation activities are also subject to federal, state, and local, and in some cases, foreign laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment.

Various permits from government bodies are required for drilling operations to be conducted, and no assurance can be given that such permits will be received. Environmental and other legal standards imposed by federal, state, or local authorities may be changed and any such changes may prevent us from conducting planned activities or increase our costs of doing so, which would have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages which we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Any laws, regulations, or policies of any government body or regulatory agency may be changed, applied, or interpreted in a manner which will alter and negatively affect our ability to carry on our business.

As we face intense competition in the mineral exploration industry, we will have to compete with our competitors for financing and for qualified managerial and technical employees.

Our mineral properties are in Mexico and our competition there includes large, established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may have to compete for financing and we may be unable to acquire financing on terms we consider acceptable. We may also have to compete with the other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or qualified employees, our exploration programs may be slowed down or suspended, which may cause us to cease operations as a Company.

9

Government regulation may adversely affect our business and planned operations.

Mineral exploration and development activities are subject to various Mexican laws governing prospecting, development, taxes, labor standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people, and other matters. We cannot assure you that new rules and regulations will not be enacted or that existing rules and regulations will not be applied in a manner which could limit or curtail our exploration or development of our properties.

The Company's mining, exploration and development projects could be adversely affected by amendments to such laws and regulations, by future laws and regulations, by more stringent enforcement of current laws and regulations, by changes in policies of México and the United States affecting foreign trade, investment, mining and repatriation of financial assets, by shifts in political attitudes in México and by exchange controls and currency fluctuations. The effect, if any, of these factors cannot be accurately predicted. Further, there can be no assurance that the Company will be able to obtain or maintain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects.

Our operating costs could be adversely affected by inflationary pressures especially to labor, equipment, and fuel costs.

The global economy is currently experiencing a period of high commodity prices and as a result, the mining industry is attempting to increase production at new and existing projects, while also seeking to discover, explore and develop new projects. This has caused significant upward price pressures in the costs of mineral exploration companies, especially in the areas of skilled labor and drilling equipment, both of which are in tight supply and whose costs are increasing. Continued upward price pressures in our exploration costs may have an adverse impact to our business.

We may not have sufficient funding for exploration which may impair our profitability and growth.

The capital required for exploration of mineral properties is substantial. From time to time, we will need to raise additional cash, or enter into joint venture arrangements, in order to fund the exploration activities required to determine whether mineral deposits on our projects are commercially viable. New financing or acceptable joint venture partners may or may not be available on a basis that is acceptable to us. Inability to obtain new financing or joint venture partners on acceptable terms may prohibit us from continued exploration of such mineral properties. Without successful sale or future development of our mineral properties through joint venture, we will not be able to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position and results of operations.

We have no reported mineral reserves and if we are unsuccessful in identifying mineral reserves in the future, we may not be able to realize any profit from our property interests.

We are an exploration stage company and have no reported mineral reserves. Any mineral reserves will only come from extensive additional exploration, engineering, and evaluation of existing or future mineral properties. The lack of reserves on our mineral properties could prohibit us from sale or joint venture of our mineral properties. If we are unable to sell or joint venture for development our mineral properties, we will not be able to realize any profit from our interests in such mineral properties, which could materially adversely affect our financial position or results of operations. Additionally, if we or partners to whom we may joint venture our mineral properties are unable to develop reserves on our mineral properties, we may be unable to realize any profit from our interests in such properties, which could have a material adverse effect on our financial position or results of operations.

Severe weather or violent storms could materially affect our operations due to damage or delays caused by such weather.

Our exploration activities are subject to normal seasonal weather conditions that often hamper and may temporarily prevent exploration activities. There is a risk that unexpectedly harsh weather or violent storms could affect areas where we conduct exploration activities. Delays or damage caused by severe weather could materially affect our operations or our financial position.

Estimates of mineralized materials are subject to geologic uncertainty and inherent sample variability.

Although the estimated resources at our existing properties will be delineated with appropriately spaced drilling, there is inherent variability between duplicate samples taken adjacent to each other and between sampling points that cannot be reasonably eliminated. There also may be unknown geologic details that have not been identified or correctly appreciated at the proposed level of delineation. This results in uncertainties that cannot be reasonably eliminated from the estimation process. Some of the resulting variances can have a positive effect and others can have a negative effect on mining and processing operations. Acceptance of these uncertainties is part of any mining operation.

10

If we establish the existence of a mineral resource on any of our properties in a commercially exploitable quantity, we will require additional capital in order to explore and develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our Company.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our Company.

If our costs of exploration are greater than anticipated, then we may not be able to complete the exploration program for our properties without additional financing, of which there is no assurance that we would be able to obtain.

We expect to proceed with the initial stages of exploration on our Los Amoles Property in 2014 and the properties in Jalisco, Mexico in 2015. Our exploration program outlines a budget for completion of the program. However, there is no assurance that our actual costs will not exceed the budgeted costs. Factors that could cause actual costs to exceed budgeted costs include increased prices due to competition for personnel and supplies during the exploration season, unanticipated problems in completing the exploration program and delays experienced in completing the exploration program. Increases in exploration costs could result in our not being able to carry out our exploration program without additional financing. There is no assurance that we would be able to obtain additional financing in this event.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

We have not commenced the initial stage of exploration of our mineral property, and thus have no way to evaluate the likelihood that we will be successful in establishing commercially exploitable reserves of gold, silver or other valuable minerals on our Los Amoles Property or properties in Jalisco, Mexico. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of gold, silver or other valuable minerals in our mineral property. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

As we undertake exploration of our mineral property, we will be subject to compliance with government regulation that may increase the anticipated time and cost of our exploration program, which could increase our expenses.

We will be subject to the mining laws and regulations in Mexico as we carry out our exploration program. We will be required to pay mining taxes to the Mexican government. We will be required to prove our compliance with relevant Mexican environmental and workplace safety laws, regulations and standards by submitting receipts showing the purchase of equipment used for workplace safety or the prevention of pollution or the undertaking of environmental remediation projects before we are able to obtain drilling permits. If our exploration activities lead us to make a decision to go into mining production, before we initiate a major drilling program, we will have to obtain an environmental impact statement authorization. This could potentially take more than 10 months to obtain and could potentially be refused. New regulations, if any, could increase our time and costs of doing business and prevent us from carrying out our exploration program. These factors could prevent us from becoming profitable.

11

Because our executive officers and directors have other business interests, they may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail.

Juan Miguel Ríos Gutiérrez, our Chief Executive Officer and sole director of our Company, and Mark Scott, our Chief Financial Officer, each devote approximately less than full time on providing management services to us. If the demands on our executive officers and sole director from their other obligations increase, they may no longer be able to devote sufficient time to the management of our business. This could negatively impact our business development.

Because we have limited staff, we need to utilize outside parties in our business operations, which could cause our business to fail.

Our President & CEO Juan Miguel Ríos Gutiérrez holds an MBA in P.Eng., Mining and Metallurgical. He has worked for twenty years in management and on projects at Peñoles, the largest mining operation in Mexico.

Because of our limited staff, we rely on outside parties in our business operations. This could negatively impact our business development.

The Company does not have a full time Chief Financial Officer and the Company’s Chief Financial Officer has commitments to other companies.

The Company’s Chief Financial Officer, Mark Scott, also serves as the Chief Financial Officer of two other companies. At this time, the Company does not require a full-time Chief Financial Officer but as the Company’s operations increase, it will consider retaining a full-time CFO.

Mr. Scott serves as the Chief Financial Officer of Visualant, Inc. as well as a consulting CFO for U.S. Rare Earths, Inc. The latter company does not require any specific time commitment from Mr. Scott, and his work for this company is sporadic and on an as-needed basis. All companies are aware of Mr. Scott’s employment by the Company and these other companies do not rely on Mr. Scott to identify or secure funding sources for their operations. If, however, the needs of the Company or any of the other two companies should change in the future requiring Mr. Scott to devote more time and/or requiring him to assist with identifying or securing funding sources, it could create material conflicts regarding the decisions he must make in allocating his time and the funding sources he might identify among the companies who employ him, which could have a material adverse effect on our business.

12

GLOSSARY OF TECHNICAL TERMS

“Base Metal” means a classification of metals usually considered to be of low value and higher chemical activity when compared with the precious metals (gold, silver, platinum, etc.). This nonspecific term generally refers to the high-volume, low-value metals copper, lead, tin, and zinc.

“Claim” means a mining interest giving its holder the right to prospect, explore for and exploit minerals within a defined area.

“Diamond Core” means a rotary type of rock drill that cuts a core of rock and is recovered in long cylindrical sections, two centimeters or more in diameter.

“Deposit” means an informal term for an accumulation of mineral ores.

“Exploration Stage” means a prospect that is not yet in either the development or production stage

“Feasibility Study” means an engineering study designed to define the technical, economic, and legal viability of a mining project with a high degree of reliability.

“Grade” means the metal content of ore, usually expressed in troy ounces per ton (2,000 pounds) or in grams per ton or metric tons which contain 2,204.6 pounds or 1,000 kilograms.

“Mineralization” means the concentration of metals within a body of rock.

“Mining” means the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized.

“Underground” means a mine working or excavation closed to the surface.

“Ore” means material containing minerals that can be economically extracted.

“Precious Metals” means any of several relatively scarce and valuable metals, such as gold, silver, and the platinum-group metals.

“Probable Reserves” means reserves for which quantity and grade and/or quality are computed from information similar to that used for Proven Reserves, but the sites for inspection, sampling and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for Proven Reserves, is high enough to assume continuity between points of observation.

“Proven Reserves” means reserves for which quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of the reserves are well-established.

“Production Stage” means a project that is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product.

“Reclamation” means the process of returning land to another use after mining is completed.

“Recovery” means that portion of the metal contained in the ore that is successfully extracted by processing, expressed as a percentage.

“Reserves” means that part of a mineral deposit that could be economically and legally extracted or produced at the time of reserve determination.

“Sampling” means selecting a fractional, but representative, pare of a mineral deposit for analysis.

“Vein” means a fissure, faults or crack in the rock filled by minerals that have traveled upward from some deep source.

13

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

Other than our mining claims, leases, and other real property interests specifically related to mining, we do not own real estate nor have plans to acquire any real estate.

ITEM 3. LEGAL PROCEEDINGS

There are no pending legal proceedings against us that are expected to have a material adverse effect on our cash flows, financial condition or results of operations.

ITEM 4. MINE SAFETY DISCLOSURE

Not applicable.

14

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is $.001 par value, 500,000,000 shares authorized and as of February 21, 2014, we had 92,855,861 issued and outstanding, held by 17 shareholders of record. The number of stockholders, including beneficial owners holding shares through nominee names is approximately 400. Each share of Common Stock entitles its holder to one vote on each matter submitted to the shareholders for a vote, and no cumulative voting for directors is permitted. Stockholders do not have any preemptive rights to acquire additional securities issued by the Company. As of February 21, 2014, we had 1,000,000 shares of common stock reserved for issuance upon exercise of outstanding warrants.

Nevada Agency and Transfer Company is the transfer agent and registrar for our Common Stock.

Stock Incentive Plan

On December 21, 2010, the Company adopted its 2010 Stock Option Plan pursuant to which it may grant stock options to acquire up to a total of 8,500,000 shares of its common stock. The Board of Directors currently acts as the plan administrator of this plan. On January 21, 2011, 1,400,000 options were granted pursuant to the plan.

On September 25, 2013, the Company filed Form S-8/A Post Effective Amendment 1 related to the 2010 Stock Option Plan.

Change in Control Provisions

Our articles of incorporation provide for a maximum of nine directors. There is no provision for classification or staggered terms for the members of the Board of Directors.

Our articles of incorporation also provide that except to the extent the provisions of Nevada General Corporation Law require a greater voting requirement, any action, including the amendment of the Company’s articles or bylaws, the approval of a plan of merger or share exchange, the sale, lease, exchange or other disposition of all or substantially all of the Company’s property other than in the usual and regular course of business, shall be authorized if approved by a simple majority of stockholders, and if a separate voting group is required or entitled to vote thereon, by a simple majority of all the votes entitled to be cast by that voting group.

Our bylaws provide that only the Chief Executive Officer or a majority of the Board of Directors may call a special meeting. The bylaws do not permit the stockholders of the Company to call a special meeting of the stockholders for any purpose.

Amendment of Bylaws

Our Board of Directors has the authority to amend our bylaws; however, the stockholders, under the provisions of our articles of incorporation as well as our bylaws, have the concurrent power to amend the bylaws.

Market Price of and Dividends on Common Equity and Related Stockholder Matters

Our common stock currently trades on the Over the Counter Bulletin Board (“OTCQB”) under the symbol “SURE.” The following table sets forth the range of the high and low sale prices of the common stock for the periods indicated:

|

Quarter Ended

|

High

|

Low

|

||||||

|

February 28, 2013

|

$ | 0.20 | $ | 0.05 | ||||

|

May 31, 2013

|

$ | 0.18 | $ | 0.05 | ||||

|

August 31, 2013

|

$ | 0.08 | $ | 0.04 | ||||

|

November 30, 2013

|

$ | 0.05 | $ | 0.02 | ||||

|

February 28, 2012

|

$ | 0.48 | $ | 0.24 | ||||

|

May 31, 2012

|

$ | 0.30 | $ | 0.16 | ||||

|

August 31, 2012

|

$ | 0.22 | $ | 0.13 | ||||

|

November 30, 2012

|

$ | 0.16 | $ | 0.05 | ||||

15

Dividend Policy

We have never paid any cash dividends and intend, for the foreseeable future, to retain any future earnings for the development of our business. Our future dividend policy will be determined by the board of directors on the basis of various factors, including our results of operations, financial condition, capital requirements and investment opportunities.

RECENT SALES OF UNREGISTERED SECURITIES

During the three months ended November 30, 2013, there were no sales of unregistered equity securities.

Performance Graph

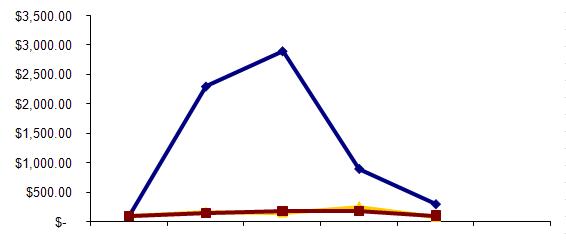

Comparison of Cumulative Total Return

Among Sonora Resources Corp, Global X Silver Miners ETF and iShares Silver Trust ETF

11/30/09 11/30/10 11/30/11 11/30/12 11/30/13

Sonora Resources Corp Sonora Resources Corp |

Global X Silver Miners ETF Global X Silver Miners ETF |

iShares Silver Trust ETF iShares Silver Trust ETF |

|

11/30/2009

|

11/30/2010

|

11/30/2011

|

11/30/2012

|

11/30/2013 | |||||||||||||||

|

Sonora Resources Corp

|

$ | 100.00 | $ | 2,300.00 | $ | 2,900.00 | $ | 900.00 | $ | 300.00 | |||||||||

|

Global X Silver Miners ETF

|

$ | 100.00 | $ | 163.38 | $ | 158.86 | $ | 255.98 | $ | 79.74 | |||||||||

|

iShares Silver Trust ETF

|

$ | 100.00 | $ | 151.18 | $ | 176.31 | $ | 178.29 $ | $ | 106.01 | |||||||||

The above assumes that $100 was invested in the common stock and each index on November 30, 2009. Although the company has not declared a dividend on its common stock, the total return for each index assumes the reinvestment of dividends. Stockholder returns over the periods presented should not be considered indicative of future returns. The foregoing table shall not be deemed incorporated by reference by any general statement incorporating by reference the Form 10-K into any filing under the Securities Act or the Exchange Act, except to the extent the company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the acts.

16

EQUITY COMPENSATION PLAN INFORMATION

The following table provides information as of November 30, 2013 related to the equity compensation plan in effect at that time.

|

(a)

|

(b)

|

(c)

|

|

|

Number of securities

|

|||

|

remaining available

|

|||

|

Number of securities

|

Weighted-average

|

for future issuance

|

|

|

to be issued upon

|

exercise price of

|

under equity compensation

|

|

|

exercise of outstanding

|

outstanding options,

|

plan (excluding securities

|

|

|

Plan Category

|

options, warrants and rights

|

warrants and rights

|

reflected in column (a))

|

|

Equity compensation plan

|

|||

|

approved by shareholders

|

|||

|

Equity compensation plans

|

|||

|

not approved by shareholders

|

1,400,000

|

0.200

|

7,100,000

|

|

Total

|

1,400,000

|

0.200

|

7,100,000

|

17

ITEM 6. SELECTED FINANCIAL DATA

In the following table, we provide you with our selected consolidated historical financial and other data. We have prepared the consolidated selected financial information using our consolidated financial statements for the years ended November 30, 2013 and 2012. When you read this selected consolidated historical financial and other data, it is important that you read along with it the historical financial statements and related notes in our consolidated financial statements included in this report, as well as Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

Years Ended,

|

||||||||||||||||||||

|

November 30, 2013

|

November 30, 2012

|

November 30, 2011

|

November 30, 2010

|

November 30, 2009

|

||||||||||||||||

|

STATEMENT OF OPERATIONS DATA:

|

||||||||||||||||||||

|

Revenue

|

$ | - | $ | - | $ | - | $ | - | $ | 11,254 | ||||||||||

|

Net loss

|

(830,255 | ) | (934,943 | ) | (1,153,748 | ) | (80,849 | ) | (17,866 | ) | ||||||||||

|

Net loss applicable to Sonora Resources Corp. common shareholders

|

(830,255 | ) | (934,943 | ) | (1,153,748 | ) | (80,849 | ) | (17,866 | ) | ||||||||||

|

Net loss per share

|

(0.01 | ) | (0.01 | ) | (0.01 | ) | - | - | ||||||||||||

|

BALANCE SHEET DATA:

|

||||||||||||||||||||

|

Total assets

|

4,155,731 | 4,536,250 | 3,965,749 | 300,750 | 2,130 | |||||||||||||||

|

Stockholders' equity (deficit)

|

3,871,421 | 4,490,075 | 3,520,593 | 297,011 | (21,629 | ) | ||||||||||||||

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements and Associated Risks.

This report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for future operations. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. Examples of forward-looking statements made in this report include statements about:

|

●

|

our future exploration programs and results;

|

|

●

|

our expectations regarding the impact of various accounting policies;

|

|

●

|

our future capital expenditures; and

|

|

●

|

our future investments in and acquisitions of mineral resource properties.

|

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including:

|

●

|

risks and uncertainties relating to the interpretation of sampling results, the geology, grade and continuity of mineral deposits;

|

|

●

|

risks and uncertainties that results of initial sampling and mapping will not be consistent with our expectations;

|

|

●

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in production;

|

|

●

|

the potential for delays in exploration activities; risks related to the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses;

|

18

|

●

|

risks related to commodity price fluctuations;

|

|

●

|

the uncertainty of profitability based upon our limited history;

|

|

●

|

risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned exploration project;

|

|

●

|

risks related to environmental regulation and liability;

|

|

●

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post- closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

●

|

risks related to tax assessments;

|

|

●

|

political and regulatory risks associated with mining development and exploration; and

|

|

●

|

the risks in the section entitled “Risk Factors”.

|

Any of these risks could cause our Company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements contained in this quarterly report.

While these forward-looking statements and any assumptions upon which they are based are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

Plan of Operation

We were incorporated under the laws of the State of Nevada on December 3, 2007. We are a mining exploration company focused on the acquisition and development of prospective silver and gold opportunities in Mexico. On July 12, 2011, we established a 100% owned subsidiary, Finder Plata S.A. de C.V. ("Finder Plata") for the development of our exploration business in Mexico.

The worldwide silver market has experienced a strong decline in the prices during 2013. As a result, we made the decision in September 2013 to focus on the Los Amoles Property in 2014 and the Jalisco Properties in 2015, each as further described below. As of November 30, 2013, we had cash of $19,000 and working capital deficit of $167,000 as compared to cash of $293,000 and a working capital of $347,000 as of November 30, 2012. This decrease in our working capital is primarily due to operating losses. We have incurred operating losses since inception, and this is likely to continue. We expect to cancel the Mining Option Agreement for the Ayones Property and have cancelled the Mining Option Agreement for the Corazon Property. We recorded an impairment expense of $445,000 related to the Ayones and Corazon Properties as of November 30, 2013. The Joint Venture and Benefits Agreement in Liz, Mexico expired on December 15, 2013.

19

We require funds to enable us to address our minimum current and ongoing expenses. Presently, we do not generate any revenue and expect to incur significant operating and capital expenses. Management projects that we may require an additional approximately $133,000 to fund our operating expenditures for the next twelve month period for the exploration of the Los Amoles Property. The exploration of the Jalisco Properties is scheduled for 2015.

On March 15, 2013, we closed the Asset Purchase Agreement with Yale Resources to purchase all of the rights, title and interest in and to the Los Amoles 2 and Los Amoles 3 Fracc.1 properties, consisting of 2,166 hectares located in the State of Sonora Mexico (the “Los Amoles Property”). We purchased the Los Amoles Property from Yale by issuing 1,000,000 of restricted SURE common shares and paying $200,000 in cash. We have commenced an underground work program at the Los Amoles Property and completed a geologic report to define the potential vein structure and outcroppings and prepare for a planned drilling program in 2014.

We also have an Mining Option Agreement with First Majestic, an existing shareholder and creditor of the Company for the Jalisco Properties. The Jalisco Properties consist of mining claims totaling 5,240 hectares located in Jalisco. As of February 21, 2014, we have has not spent any funds on the properties. We are required to spend $3,000,000 by April 15, 2014 to earn 50% interest in the Jalisco Properties and an additional $2,000,000 to earn an additional 20% interest by April 15, 2016 on exploration expenses. An additional 20% interest in and to the Jalisco Properties can be earned by completing a bankable feasibility study no later than the seventh anniversary of the Agreement. We expect to amend the Mining Option Agreement with First Majestic and delay our required expenditures.

Our principal executive office is located at Cerro del Padre # 11 Rinconada de los Pirules, Guadalupe, Zacatecas Mexico, 98619. Our US mailing address is PO Box 12616, Seattle, WA 98111 and our telephone number is 1-877-513-7873.

We are currently in the exploration stage as defined in ASC 915 "Accounting and Reporting for Development Stage Enterprises" and have minimal operations.