Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WireCo WorldGroup Inc. | a8-k_debtxslides.htm |

Lender Presentation June 2013

2 Disclaimer This presentation does not constitute an offer to make any investment or a solicitation of offers to make any investment. Any offers to make an investment or solicitation of offers to make an investment will be made only pursuant to definitive agreements and other documents that may be subsequently provided to you, and you are advised to read any such agreements and documents carefully and in their entirety when they become available because they will contain important information relating to any investment opportunity. You are not entitled to rely upon any advice or opinions contained in this presentation with respect to the tax, financial and/or legal structuring of the transactions described herein. Accordingly, in evaluating the investment, you should obtain and rely upon the advice of your own independent tax, financial and legal advisors. Some statements and information set forth in this communication contain forward-looking statements that are subject to change, including, without limitation, future estimates or projections for WireCo and Lankhorst. These forward-looking statements are subject to risks and uncertainties that could cause actual events or actual future results to differ materially from the expectations set forth in the forward-looking statements. Neither WireCo nor any of its affiliates have any responsibility to update any of the information provided in this presentation. It is understood and acknowledged that any person’s access to, and use of, any of the attached materials constitutes their overall acceptance of the following: (1) none of WireCo nor any other party involved in the preparation of the attached materials makes any representation, warranty or claim that the materials and information contained therein is current or accurate; (2) by virtue of access to these materials, no one shall be entitled to claim detrimental reliance on any information provided or expressed; (3) no person should rely on statements or representations made within these materials nor should any person rely on the statements or representations made by any other source based on these materials; and (4) neither WireCo nor any other party involved in the preparation of the attached materials shall have any duty or liability to any person in connection with the attached materials. EBITDA Definition Reported EBITDA and Acquisition EBITDA as used in this presentation are consistent with our definitions of Adjusted EBITDA and Acquisition Adjusted EBITDA, respectively, as presented in our annual reports filed on Form 10-K and our quarterly reports filed on Form 10-Q. 6/24/2013 3:02 PM 2

3 Attendees Name Position Stephan Kessel Director, Board of Directors Brian Block CFO and Senior Vice President Kevin Lawi Vice President, Goldman, Sachs & Co.

Agenda Transaction Overview Kevin Lawi Company Overview Stephan Kessel / Brian Block Financial Update Brian Block Amendment Overview Kevin Lawi Q&A 4

Transaction Overview

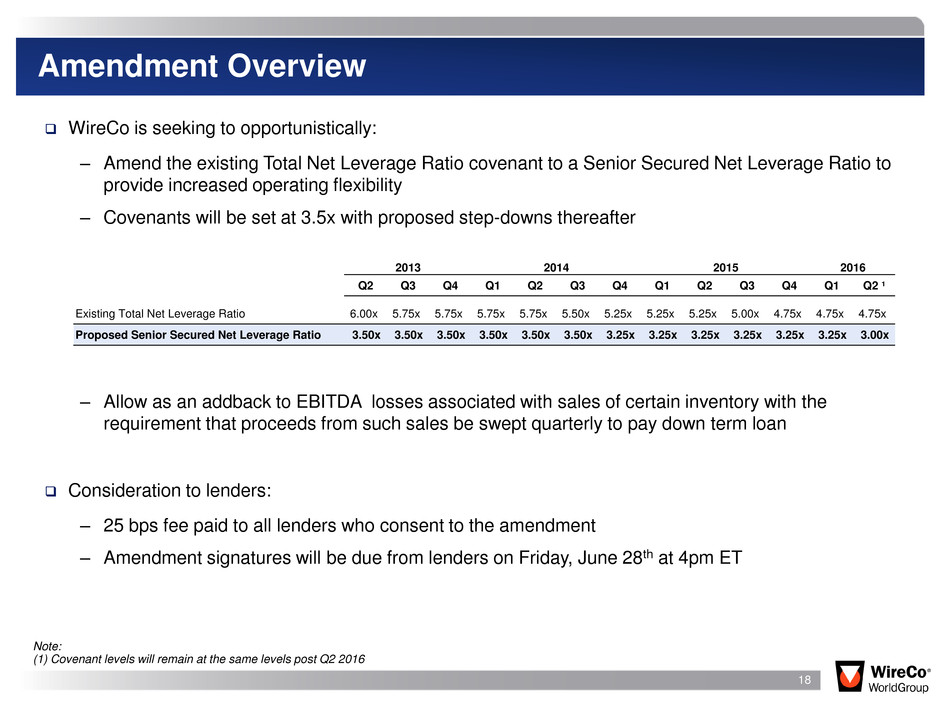

WireCo WorldGroup (“WireCo” or the “Company”) is one of the world’s largest manufacturers of steel and synthetic lifting products – WireCo serves a diverse range of end markets, geographies and customers with multiple product offerings, including high-performance ropes, engineered products, specialty steel wire and synthetic yarns – WireCo completed the acquisition of Lankhorst for approximately $230mm in July 2012 The Company has continued to demonstrate consistent financial performance – Revenue and Adjusted EBITDA for LTM 3/31/2013 were $865.9mm and $143.6mm, respectively – Margins have strengthened through cost management and synergy execution – Secured Leverage and Net Leverage per covenants, as of March 31, 2013 were 2.5x and 5.6x, respectively The Company is seeking to opportunistically: – Amend the existing Total Net Leverage Ratio covenant to a Senior Secured Net Leverage Ratio – In light of Q3 and Q4 2012 softness and a desire to provide new leadership with the room to maneuver and maximize value for all stakeholders, this amendment would provide the company with expanded EBITDA cushions in subsequent quarters – 25 bps will be paid to all lenders who consent to the amendment Amendment signatures will be due from lenders on Friday, June 28th at 4pm ET 6 Transaction Summary

Current Capitalization (USD in Millions) 7 CCR: B2 / B Current x LTM Adj. Cov. EBITDA LIBOR Floor Coupon Maturity Ratings Cash and Equivalents $ 36.3 Revolver ($145 million) 48.7 0.3x L+475 15-Feb-17 Ba2 / B+ Term Loan 333.3 2.5x 1.25% L+475 15-Feb-17 Ba2 / B+ Total Bank Debt $ 382.0 2.5x Drumet assumed Polish Debt 16.3 2.6x 31-Dec-14 9.50% Senior Notes 425.0 5.3x 9.50% 15-May-17 B3 / B 11.75% Senior Notes 82.5 5.8x 11.75% 15-May-17 Other 0.8 5.8x Total Debt $ 906.6 5.8x Net Debt $ 870.3 5.6x LTM 31-Mar-13 Adj. EBITDA ¹ $ 143.6 nrealized Synergies 11.7 LTM 31-Mar-13 Adj. Covenant EBITDA ² $ 155.3 Notes: Per Notes indenture, Secured Leverage is permitted, subject to cap of 3.0x on a gross debt basis; a general basket of $20mm is permitted for certain additional secured indebtedness (1) Pro forma for Lankhorst pre-acquisition EBITDA (2) Adjusted EBITDA per Credit Agreement to allow for unrealized synergies from the Lankhorst acquisition

Company Overview

9 Management Update Effective July 7, 2013, Mr. Christopher L. Ayers will become President and Chief Executive Officer of WireCo Proven track record in achieving operational excellence, strong financial performance and executive leadership Prior to this appointment, Mr. Ayers served as Executive Vice President – President of Global Primary Products at Alcoa, a $10.5 billion division with 39 global facilities and 20,000 employees Mr. Ayers joined Alcoa in February 2010 as Vice President and Chief Operations Officer of Alcoa Cast, Forged and Extruded Products He was promoted to Chief Operations Officer of Global Primary Products in August 2010 He was again promoted to President of Global Primary Products in May 2011 where he served until May 2013 Prior to Alcoa, Mr. Ayers held executive positions at PCC Forgings and Wyman Gordon Forgings Mr. Ayers holds an MBA from the University of Connecticut and Master’s and Bachelor’s degrees in Aerospace engineering from Georgia Institute of Technology

Leading Global Producer with Broad Product Offering… Steel (50% of Sales) Large diameter, highly engineered rope and electrical signal transmission cable used in mining, oil and gas, and infrastructure end markets Wire: engineered specialty wire products used in general industrial end markets Highly engineered, made-to- order synthetic ropes and technical products that have strength characteristics of steel but weigh significantly less Synthetic (21% of Sales) Highly engineered plastic molding from recycled materials used in a variety of industrial, structural and oil and gas applications Rope (71% of Sales) Specialty Wire and Yarns (19% of Sales) Yarns: selection of specialty synthetic yarns used in a variety of end market applications Engineered Products (10% of Sales) 10 Headquartered in the United States, with 24 manufacturing operations in 10 countries and over 4,400 employees “Mission-critical” products where performance, quality and safety are key buying decision ~87% of sales serving replacement market; products are consumable with 6 – 24 month useful life Proprietary technology and manufacturing expertise supported by staff of over 75 engineers, R&D specialists and metallurgists WireCo is a leading global manufacturer of wire rope, synthetic rope, electromechanical (“EM”) cable and specialty wire

…Providing Solutions Across Diverse End Markets 11 Rope Solutions By End Market Application (71% of Total Sales) Oil & Gas (25% of Sales) Crane (22% of Sales) Fishing (18% of Sales) Marine (9% of Sales) Mining (8% of Sales) Structures / FAB (5% of Sales) General Purpose (14% of Sales)

50,000 40,000 185,000 76,000 71,000 30,000 26,000 4,000 89,000 Capacity: 296,000 Tons Global Manufacturing Footprint North America Asia Europe United States (7) People: 892 Germany (2) People: 374 Manufacturing Facilities Global Manufacturing Capacity Capacity: 358,000 Tons India (1) (JV) People: 60 France (1) People: 65 Greece (1) (JV) People: 58 South America Brazil (1) People: 45 Rope and Plastics by Location Wire Rope and Plastics by Type Capacity: 296,000 Tons Mexico (2) People: 566 Poland (1) People: 631 Netherlands (2) People: 317 Portugal (6) People: 1,183 Eastern Europe Southern Europe Mexico Brazil U.S. Northern Europe Plastics Synthetic Yarn 13,000 EMC 5,000 Nets 3,000 Steel 163,000 120,000 75,000 Mexico Poland U.S. 12

13 4,400 employees, 24 manufacturing facilities, 22 distribution centers, 18 sales offices and 175 sales personnel servicing customers in 122 different countries Providing a True Global Service The world is our worksite Headquarters Manufacturing Sales Office Distribution

Financial Update & Key Initiatives

2011 2012 2013 Q4 Q1 Q2 Q3 Q4 Q1 Sales 219.3 230.8 229.2 204.8 209.4 222.4 EBITDA 38.4 37.9 39.4 33.7 32.9 37.6 EBITDA Margin 17.5% 16.4% 17.2% 16.5% 15.7% 16.9% Quarterly Trend Q-o-Q % Change Sales N/A 5.2% (0.7%) (10.6%) 2.2% 6.2% EBITDA N/A (1.4%) 4.0% (14.4%) (2.5%) 14.3% Quarterly Financial Performance & Key Initiatives (USD in Millions) 15 Upgraded and streamlined management structure over last 6 months Renewed focus on engineering and technical talent Rationalizing distribution network and inventory levels to reduce cost and working capital Reorganization of synthetic and steel plants in Portugal complete; significant efficiency gains over for 2013 and 2014 Integration of Lankhorst sales force complete stronger regional management and industry expertise Margin improvement initiatives implemented Cost and Margin Enhancement Several Key Initiatives in place to accelerate EBITDA & Cash Generation despite slow economic climate Q1 Recovery and Stable Outlook Q3 and Q4 of 2012 performance was tough due to difficult economic conditions and complex initial integration activities; benefit seen in Q1 with upside to be realized remainder of year Last 3 quarters of 2013 expect stabilizing end market performance, and implementation of several key initiatives to run WireCo more efficiently, in turn generating additional cash flow and EBITDA growth in a slower market SG&A cutback of excess overhead / redundant processes Operating Spend Reduction Cash Generation Projects – Reducing excess inventory, selling unused property, higher ROI thresholds for CapEx projects 1 2 3 Note: (1) Pro forma for Lankhorst acquisition (1) (1) (1) (1)

Financial Overview Note: All figures shown are pro forma for Phillystran, Oliveira, Drumet and Lankhorst acquisitions. (1) LTM Q1 2013 & FY 2012 Adjusted EBITDA per Company filings; does not include unrealized synergies from Lankhorst acquisition Financial Performance (FYE December 31) 2010 2011 2012 LTM Q1 2013 Sales $780 $891 $874 $866 % Growth 23.5% 14.1% (1.8%) N/A EBITDA(1) $133 $153 $144 $144 Margin 17.0% 17.2% 16.5% 16.6% % Growth 21.0% 15.3% (5.9%) N/A CapEx $24 $45 $45 $49 Financial Performance (FYE December 31) (USD in Millions) 16

Amendment Overview

Amendment Overview 18 WireCo is seeking to opportunistically: – Amend the existing Total Net Leverage Ratio covenant to a Senior Secured Net Leverage Ratio to provide increased operating flexibility – Covenants will be set at 3.5x with proposed step-downs thereafter Consideration to lenders: – 25 bps fee paid to all lenders who consent to the amendment – Amendment signatures will be due from lenders on Friday, June 28th at 4pm ET Note: (1) Covenant levels will remain at the same levels post Q2 2016 2013 2014 2015 2016 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 ¹ Existing Total Net Leverage Ratio 6.00x 5.75x 5.75x 5.75x 5.75x 5.50x 5.25x 5.25x 5.25x 5.00x 4.75x 4.75x 4.75x Proposed Senior Secured Net Leverage Ratio 3.50x 3.50x 3.50x 3.50x 3.50x 3.50x 3.25x 3.25x 3.25x 3.25x 3.25x 3.25x 3.00x – Allow as an addback to EBITDA losses associated with sales of certain inventory with the requirement that proceeds from such sales be swept quarterly to pay down term loan

Transaction Timeline Date Event June 24, 2013 • Launch Transaction via Lender Conference Call June 28, 2013 • Amendment Signatures due at 4:00pm ET • Transaction Close 19 Key Date June S M T W T F S 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

Contact Information Contacts E-mail Phone Goldman, Sachs & Co. Kevin Lawi kevin.lawi@gs.com (212) 902-2684 Melissa McQueen melissa.mcqueen@gs.com (212) 902-3227 Anwer Gheddai anwer.gheddai@gs.com (212) 902-3846 Deutsche Bank Will Wiltshire william.wiltshire@db.com (212) 250-8662 Chris Blum christopher.blum@db.com (212) 250-7902 Ryan Corning ryan-m.corning@db.com (212) 250-8303 Latham & Watkins Greg Robins greg.robins@lw.com (213) 891-8850 Kenneth Askin kenneth.askin@lw.com (213) 891-8507 20

Q&A