Attached files

| file | filename |

|---|---|

| EX-10.1 - EX-10.1 - WireCo WorldGroup Inc. | d316293dex101.htm |

| EX-31.2 - EX-31.2 - WireCo WorldGroup Inc. | d316293dex312.htm |

| EX-31.1 - EX-31.1 - WireCo WorldGroup Inc. | d316293dex311.htm |

| EX-32.1 - EX-32.1 - WireCo WorldGroup Inc. | d316293dex321.htm |

| EX-32.2 - EX-32.2 - WireCo WorldGroup Inc. | d316293dex322.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 333-174896

WireCo WorldGroup Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 27-0061302 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

12200 NW Ambassador Drive

Kansas City, MO 64163

(816) 270-4700

(address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ¨ NO x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ¨ NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | Smaller reporting company | ¨ | |||||

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). YES ¨ NO x

There is no market for the Registrant’s equity. As of March 15, 2012, the Company had 2,011,411 shares of common stock outstanding, all of which was held by affiliates.

DOCUMENTS INCORPORATED BY REFERENCE

None

Table of Contents

WireCo WorldGroup Inc.

Annual Report

For the year ended December 31, 2011

2

Table of Contents

Cautionary Information Regarding Forward-Looking Statements

The Securities and Exchange Commission (“SEC”) encourages companies to disclose forward-looking information so that investors can better understand a company’s future prospects and make informed investment decisions. This report contains such “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements relate to future events or our future financial performance with respect to our financial condition, results of operations, business plans and strategies, operating efficiencies or synergies, competitive positions, growth opportunities for existing products, plans and objectives of management, capital expenditures and other matters. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from those expressed or implied by any forward-looking statements. Such statements include, in particular, statements about our plans, strategies and prospects under the headings “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. In some cases, forward-looking statements are identified by terminology such as “may,” “will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “pro forma,” “seek” or “continue” or the negative of those terms or other comparable terminology. These statements are only predictions and such expectations may prove to be incorrect. Such differences could be caused by a number of factors or combination of factors including, but not limited to, the factors identified below and those discussed in Item 1A, Risk Factors, of this annual report. Readers are strongly encouraged to consider these factors and the following factors when evaluating any forward-looking statements concerning the Company:

| • | the general political, economic and competitive conditions in markets and countries where we have operations, including, inflation or deflation and changes in tax rates; |

| • | foreign currency exchange fluctuations; |

| • | our failure to meet quality standards; |

| • | our ability to successfully execute and integrate acquisitions; |

| • | changes in our operating strategy or development plans; |

| • | our ability to attract, hire and retain qualified personnel, including our ability to maintain our highly skilled executives, sales and engineering staff; |

| • | changes in the availability or cost of raw materials, energy and labor; |

| • | our ability to develop and maintain competitive advantages; |

| • | risks associated with our manufacturing activities; |

| • | labor disturbances, including any resulting from the suspension or termination of our collective bargaining agreements; |

| • | the impact of environmental and safety issues and changes in environmental and safety laws and regulations; |

| • | changes in the cost and availability of transportation; |

| • | our reliance on distributors; |

| • | additional tax liabilities we may incur; |

| • | the impact of trade regulations; |

| • | availability of credit, both to us and our customers; |

| • | the competitive environment in the wire rope, synthetic rope, electromechanical cable and specialty wire industries, both in the U.S. and abroad; |

| • | the substantial doubt of the China joint venture’s ability to continue operating; |

| • | our significant indebtedness; |

| • | interest rate fluctuations and changes in capital market conditions; and |

| • | our ability to implement and maintain sufficient internal controls. |

3

Table of Contents

Any forward-looking statements that we make in this annual report speak only as of the date of such statement, and we undertake no obligation to update such statements. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed as such, and should only be viewed as historical data.

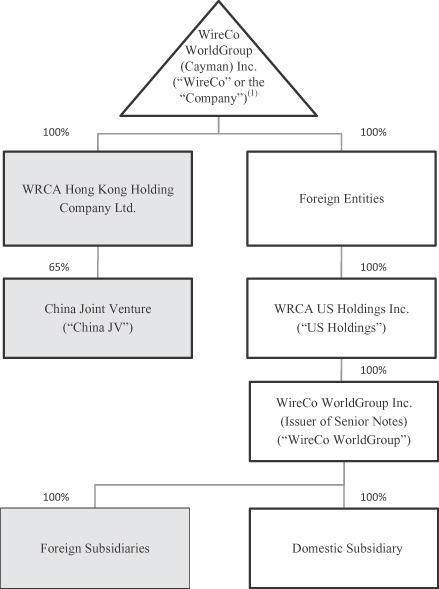

Our Organization

The diagram below illustrates our current corporate structure, including the Issuer of the 9.5% Senior Notes due 2017 (“Senior Notes”) and the Guarantors. The boxes of non-Guarantors are shaded. The percentages indicate our voting interest in each entity.

| (1) | This entity is 83.7% beneficially owned by Paine & Partners Fund III and 11.2% beneficially owned by our executive officers and directors with the remaining 5.1% held by other members of management. In addition, certain current and former members of management beneficially own 4.8% of the non-voting common stock of U.S. Holdings. WireCo directly or indirectly owns 100% of the voting common stock of WireCo WorldGroup and all of the subsidiaries guaranteeing the Senior Notes. |

4

Table of Contents

| Item 1. | Business |

Introduction

As permitted by the rules and regulations of the SEC, references herein to “WireCo,” the “Company,” “we,” “us” and “our” refer to WireCo WorldGroup (Cayman) Inc. and its consolidated subsidiaries unless otherwise noted. The financial statements and related footnotes included in Item 6, Item 7 and Item 8 of Part II of this annual report on Form 10-K are those of WireCo WorldGroup (Cayman) Inc., the indirect parent of WireCo WorldGroup Inc. (“WireCo WorldGroup”), and contain certain footnote disclosures regarding the financial information of WireCo WorldGroup (Cayman) Inc. and certain of its wholly-owned subsidiaries that guarantee, subject to customary release provisions, substantially all of the outstanding indebtedness of WireCo WorldGroup.

COMPANY OVERVIEW

WireCo WorldGroup (Cayman) Inc. is an exempted company incorporated under the laws of the Cayman Islands. We believe we are the largest global manufacturer of high-performance wire rope and one of the leading worldwide manufacturers of synthetic rope, electromechanical cable (“EMC”), fabricated products and specialty wire. Our highly engineered and specialized products have a reputation for quality, performance and safety, and are marketed under well-known brands such as Union®, Camesa®, MacWhyte®, CASAR®, Wireline Works™, U.S. Reel™, Phillystran®, Oliveira™, Drumet® and Union International. Our proprietary technical and manufacturing expertise utilizes advanced metallurgical and material technologies to develop highly engineered and specialized ropes which are “mission-critical” operating components used in heavy lifting, pulling, supporting and suspension applications, where functionality and safety are the top priority. We maintain a comprehensive product portfolio across the diverse end markets we serve, including crane, oil and gas, mining, fishing, marine, structures and general industrial.

Our global manufacturing footprint, with 13 facilities, is supplemented by a global network of company-owned distribution facilities and independent distributors. Our China joint venture (“China JV”) provides additional manufacturing capacity in Wuhan, China. We currently have global capacity to annually produce approximately 408,000 tons of wire and approximately 230,000 tons of wire rope. We are vertically integrated and manufacture the majority of the wire we use in our wire ropes. Controlling our wire supply is a significant advantage in terms of quality, manufacturing flexibility, inventory control and cost reduction. Our global presence enables us to provide fast delivery and short lead times to customers, ensuring product availability and high quality customer service and technical support. For financial information about our operations in geographic areas, refer to Note 17—“Segment Reporting” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report. For the year ended December 31, 2011, we recorded net sales of $604.9 million, Acquisition Adjusted EBITDA of $129.6 million including pro forma EBITDA for our most recent acquisition, operating income of $57.0 million and a net loss of $50.7 million. The net loss in 2011 was driven by the loss on our investment in and advances to the China JV, additional interest expense and unrealized foreign currency exchange losses attributed primarily to intercompany loans. For a reconciliation of (i) net loss to Acquisition Adjusted EBITDA and (ii) cash flows from operating activities to Acquisition Adjusted EBITDA, refer to Item 6, Selected Financial Data, of this annual report.

5

Table of Contents

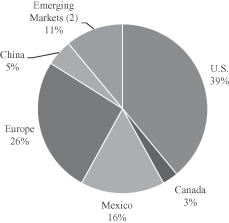

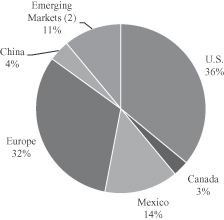

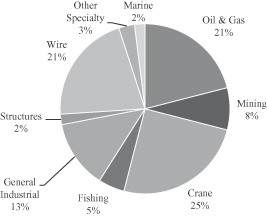

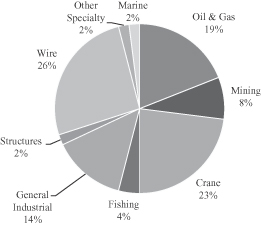

The charts below provide a breakdown of our 2011 actual and pro forma sales(1) by customer location and end market:

| 2011 Actual Sales by Customer Location | 2011 Pro forma Sales(1) by Customer Location | |

|

| |

| 2011 Actual Sales by End Market | 2011 Pro forma Sales(1) by End Market | |

|

| |

| (1) | 2011 pro forma sales reflect the July 18, 2011 acquisition of Drumet Liny i Druty spółka z ograniczoną odpowiedzialnością (“Drumet”) as if it closed on January 1, 2011. See Note 3 “Acquisitions” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report for additional information on the Drumet acquisition. |

| (2) | Emerging markets primarily include Africa, Australia, Central America, Commonwealth of Independent States (“CIS”), India, the Middle East, the Pacific Rim and South America. |

OUR HISTORY

On June 30, 2003, Wire Rope Corporation of America purchased our predecessor’s assets out of bankruptcy. After restructuring our operations, we began to expand globally. On June 17, 2005, we acquired Aceros Camesa, S.A. de C.V. (“Aceros Camesa”), which provided us with low cost manufacturing, increased capacity, a source of high quality, low cost wire for our wire ropes throughout North America, expanded geographic coverage, product diversification and access to additional customers in the industries we serve. On June 12, 2006, we entered into a 50-year equity joint venture agreement with WISCO Wuhan Jiangbei Iron and Steel Ltd. (f/k/a Jiangbei Steel Processing and Logistics Co., Ltd.), a steel producer based in Hubei, China, and wholly owned subsidiary of Wuhan Iron and Steel Company, establishing WISCO WireCo Wire Rope Co., Ltd. (f/k/a WISCO WRCA Co. Ltd.) (“China JV”) in Wuhan, China, primarily for the purpose of manufacturing, marketing and sale of specialty wire and wire ropes.

6

Table of Contents

In 2007, we purchased three companies. On February 26, 2007, we purchased all of the outstanding shares of Wireline Works Partnership (“Wireline Works”), a Calgary, Canada-based manufacturer of EMC for the oil & gas market. On August 24, 2007, we purchased all of the outstanding shares of CASAR Drahtseilwerk Saar GmbH (“CASAR”), a manufacturer of high performance wire rope for the crane and mining end markets, located in Kirkel, Germany. The CASAR acquisition provided a premium brand, new customers and our first manufacturing footprint in Europe. On November 16, 2007, we purchased all of the outstanding shares of U.S. Reel, Inc. (“U.S. Reel”), a leading U.S. wooden reels supplier located in Carrolton, Missouri. In 2007, Wire Rope Corporation of America changed its name to WireCo WorldGroup Inc. to align its identity with our global operations. Since 2008, we have completed one acquisition each year.

Phillystran Acquisition. On December 31, 2009, we purchased all of the outstanding shares of Phillystran Inc. (“Phillystran”) based in Montgomeryville, Pennsylvania. Phillystran is a leading manufacturer of high performance synthetic rope products. With this acquisition, we expanded into the global high tech synthetic rope market.

Oliveira Acquisition. On November 16, 2010, we purchased all of the outstanding shares of Luís Oliveira Sá, SGPS, S.A. (“Oliveira”), a Portugal-based steel and synthetic rope manufacturer with facilities in Portugal and the Netherlands. Oliveira is a leading manufacturer of high performance synthetic ropes targeted at the offshore oil and gas, marine, agricultural and general industrial markets and wire ropes for the fishing and crane markets. In combination with the Phillystran acquisition described above, we now market technologically advanced synthetic ropes on a global scale. In addition to diversifying our product offerings, we were able to access new customers, expand our end markets and broaden our geographic coverage, primarily in Europe.

Drumet Acquisition. On July 18, 2011, we purchased all of the outstanding shares of Drumet, a leading producer of steel wire ropes and a large producer of specialty wire and staple band located in Włocławek, Poland. Drumet’s wire capacity supplies most of our internal wire requirements in Europe, which allows us to manufacture the highest quality wire for our wire ropes, provide shorter lead times, reduce our inventory, provide greater manufacturing flexibility and offer significant cost savings. In addition, Drumet expands our sales presence in Eastern Europe with new customer relationships, introduces a new brand to the Company’s existing portfolio and offers a high-quality, low-cost labor base. Furthermore, we expect to continue penetrating existing markets by cross-selling our broad portfolio of branded products.

OUR STRATEGY

Expand Global Penetration and Brand Distinction to Drive Organic Growth. We intend to capitalize on our technological leadership, market position, engineering capabilities and industry expertise to target growth opportunities in both emerging geographic markets and attractive industry segments within large established markets. We believe substantial growth opportunities exist internationally. Accordingly, we have invested significantly in expanding our international sales force, implemented a comprehensive global sales and brand management strategy and established a global manufacturing and service structure to increase our presence in these key growth markets. Industry teams have been established to provide product expertise and outstanding customer service for the crane, oil and gas, mining, fishing and structures end markets. We intend to leverage our strong existing relationships with large multinational firms to expand into new markets and grow our business within existing markets.

Drive Growth Through Continued Product Innovation. We plan to build on our history of innovation and technological expertise to bring to market new highly engineered products. We have over 50 engineers and metallurgists who in their respective capacities contribute to our product development efforts. For more information on products currently in development, refer to the Product Development section within Our Business Activities.

7

Table of Contents

Create One Customer Experience. We will develop business processes and systems to support a consistent customer experience across all brands and markets. The four key elements to the “One WireCo” customer experience include:

| 1. | Product quality and performance; |

| 2. | On time delivery; |

| 3. | Creative solutions to customer applications delivered by engineers, industry specialists and customer service representatives; and |

| 4. | Standing behind everything we do. |

Our global sales team has the technical training to offer customers products from our broad portfolio of brands in order to best meet their performance requirements. Our global manufacturing and distribution footprint, complemented by our vertically integrated production of wire for our wire ropes, provides the highest level of quality assurance with the shortest amount of lead time possible for our customers. We believe providing customers with the same high quality service and products across all of our brands and locations will enhance our customer relationships and growth potential.

Optimize our Global Assets through Supply Chain Management. Our supply chain process is centrally managed to provide cost reduction opportunities within our global operations through strategic sourcing relationships for key raw materials used to manufacture our products. Where cost effective, we utilize internally produced wire that is consumed in the production process to displace externally sourced materials, and we leverage our global transportation through carriers with regional expertise. We are also implementing production planning scheduling tools and processes to optimize the manufacturing of our products to serve our customers’ needs, asset utilization, inventory management and overall costs.

Diversify through Strategic Acquisitions. We have a strong track record of identifying, executing and successfully integrating acquisitions. Since 2007, we have successfully integrated five acquisitions (Wireline Works, CASAR, U.S. Reel, Phillystran and Oliveira) and we are in the process of integrating Drumet, which we acquired in July 2011. These acquisitions have been critical to creating new growth opportunities, have enhanced our leadership position and have served to diversify our end market penetration. We plan to continue pursuing acquisitions and strategic alliances that further expand and complement our product portfolio, improve our competitive positioning in growth markets and present opportunities for significant cost synergies. We will evaluate each potential acquisition by strategic and financial metrics and prioritize maintaining liquidity.

SEGMENT REPORTING

We report the manufacturing, marketing, selling and distribution of wire and synthetic ropes, EMC, specialty wire and related products as one global enterprise. We have five operating segments that reflect geographic regions including the United States, Mexico, Germany, Portugal and Poland. The production processes across each of these operating segments exhibit a high degree of similarity involving stranding wire or synthetic fiber and closing the resulting strand into wire or synthetic rope. We have established a global sales force organized by geography and supported by end-market directors and an international operations group, which parallels the global sales structure with one member of management responsible for North American operations and another member of management responsible for European operations. Additionally, the global supply chain management functions of logistics, purchasing and planning are headquartered at the corporate office. In order to align employee interests with our global objectives, one of our primary employee incentive plans is based upon our consolidated results. Financial information reported at the consolidated level is used by corporate management in evaluating overall financial and operational performance, market strategies and decisions to allocate capital resources. Based upon all of these factors, we have concluded that we have one reportable segment. For information regarding net sales, net income (loss) and assets, refer to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data.

8

Table of Contents

OUR INDUSTRY

Overview

Our industry consists of highly engineered wire ropes, synthetic ropes, EMC and specialty wire. Wire ropes serve a variety of end markets such as crane, oil and gas, mining, general industrial, fishing, marine and structures, which require customized products capable of withstanding extremely heavy loads and harsh operating environments with specific quality, durability, weight, functionality and performance capabilities. Given the intensity of wire rope usage in heavy lifting, pulling, supporting and suspension applications and their consumable nature, wire ropes are subject to strict inspection and removal criteria, necessitating frequent replacement. As a result, the aftermarket represents a significant portion of highly engineered wire rope sales.

The following provides a detailed description about uses of our products by some of our end markets and the growth drivers impacting respective key industry end markets:

Cranes

Wire ropes are a critical component of infrastructure applications and are used by cranes and other heavy machinery employed in commercial construction for repair and maintenance of buildings, manufacturing facilities, bridges, material handling at port and railway facilities and other infrastructure assets. Growth in this market is predominantly driven by global macroeconomic and demographic trends, including economic activity, population growth, urbanization and aging infrastructure throughout the world. Infrastructure demand for wire ropes is also impacted by commercial trade and transportation activity as wire ropes are used by container cranes at ports and rail yards.

Having reached a trough in mid-2009, the crane market is expected to rebound in line with broader construction and infrastructure trends. According to the Association of Equipment Manufacturers, the global construction machinery industry is predicted to grow approximately 11% in 2012, 10% in 2013 and 8% in 2014. The resulting increase in construction activity is expected to increase demand for wire rope, as new cranes coming online will require high-tech wire rope products to operate, while existing cranes will require frequent replacements from the normal wear-and-tear associated with heavy industrial processes.

The wire rope industry is expected to benefit from two key macroeconomic trends: a growing demand for emerging market infrastructure and an increasing emphasis on clean-tech, alternative and traditional energy.

| • | Infrastructure projects are expected to increase in emerging market economies driven by a rapidly growing population, continued urbanization and strong gross domestic product growth. For example, China continues to invest heavily in infrastructure projects and recently announced plans to build 42,000 kilometers of new rail track by 2020. This construction will require significant crane usage, and thus offers a substantial opportunity for technically advanced wire rope products. In India, demand for infrastructure is amplified by significant infrastructure shortages throughout the country. Per the Economic Times, India’s heavily utilized ports, congested roads, chronic power and water shortages and aging railways, has prompted investment of nearly $480 billion in the five-year plan ending in 2012, more than doubling their investment of $216 billion during the previous plan. The next plan envisions investment of $1 trillion. |

| • | The growing popularity of construction associated with green and alternative energy sources is another positive sign for the crane industry. The United Kingdom’s intentions to source a quarter of its electric requirements from off-shore wind farms by 2020 will require new turbines to support 32 gigawatts of generating capacity over the span of the next decade. This represents a vast potential for the original equipment manufacturers (“OEM”) and replacement crane market, as it involves huge cranes mounted on semi-submersible barges. The market for nuclear power plant construction also presents a significant expansion opportunity for cranes: China plans to bring the nuclear sector’s share of China’s power-generating capacity to 4% from less than 2%. The U.S. is also expected to increase its share of electricity derived from nuclear energy, which is currently 20%, with four to six new reactors coming |

9

Table of Contents

| on line by 2020, according to the World Nuclear Association. Each nuclear power construction site requires the use of approximately three to six jumbo crawler cranes for a number of years, and will therefore potentially require frequent and high volume wire rope replacements to maintain smooth crane operations. |

Oil and Gas

Wire and synthetic ropes are used throughout the oil and gas industry from exploration to production. Wire rope and synthetic rope demand will benefit from several key trends in the oil and gas market:

| • | Growth in active rig count driven by increasing global energy demand; |

| • | Increasing average well depth requiring larger ropes with specific weight and strength characteristics; and |

| • | Greater need for real-time data transmission to optimize drilling efficiency. |

The increased global demand for oil and gas drives increased production, workover, completion and drilling activity, as observed in the rising active global rig count. According to Baker Hughes, the worldwide active rig count increased from 3,227 as of December 2010 to 3,612 as of December 2011, an increase of 12%. Oil and gas activity varies by geography based on local drilling and production economics. The U.S. active rig count increased from 1,711 rigs as of December 2010 to 2,003 rigs as of December 2011, an increase of 17%.

According to the U.S. Energy Information Administration, the average depth of a crude oil exploratory well has increased from 6,950 feet to 7,778 feet. Demand for synthetic rope is increasing as offshore drilling and production activity continues to expand into deeper water depths where steel ropes are prohibitively heavy to use. Wire ropes cannot be used for mooring applications beyond approximately 6,500 feet, whereas synthetic ropes can be used up to approximately 32,800 feet. Synthetic ropes are also used for seismic streamer applications in offshore exploration.

As production and drilling activity shifts to harder-to-access reserves, the need for real-time information becomes increasingly important to optimize production. EMC provides the strength member and signal conductor for insertion and removal of the geophysical tools used for data-logging and perforation of the well. Demand for EMC is estimated to grow in line with the broader oil and gas industry, while supply remains limited given the unique technological expertise required to produce this product.

Mining

Wire ropes are used for various operating applications, primarily in surface and deep shaft mining for minerals, base and precious metals. The mining industry is marked by long-term growth trends and historically stable production. As a result, the aftermarket for parts and servicing of mining equipment tends to be relatively stable. The high fixed costs and lower variable costs associated with operating a mine help contribute to a decreased likelihood of shutdown once a mine is opened. In addition, mines typically operate 24 hours per day, seven days per week due to the high costs associated with any downtime. Due to the severe wear-and-tear that wire ropes endure in surface mining operations, wire ropes typically need to be replaced every two to nine months according to strict safety guidelines.

Mining activity has been increasing despite fluctuations in commodity pricing. The global natural resource market is benefiting from heightened demand driven by the urbanization of emerging markets such as China. According to the China Electricity Council, China’s coal demand is expected to be 4.3 billion tons by 2015. The exploration and production of mined commodity metals such as copper and iron ore is expected to increase in the near future. According to the International Copper Study Group, worldwide mine production of copper was 16.8 million metric tons in 2011 and is projected to increase to 17.9 million metric tons in 2012.

10

Table of Contents

General Industrial

General industrial encompasses industrial applications that use general purpose wire rope or specialty wire in various end markets, including construction, transportation, defense, automotive, agriculture and logging. These end markets tend to be directly correlated to general economic activity and output given the breadth of applications included. According to the International Monetary Fund, global output is expected to grow 3.3% in 2012 and 3.9% in 2013, with growth in emerging and developing countries, such as Russia, China, India and Brazil at 5.4% in 2012 and 5.9% in 2013. The global outlook was slightly revised downward compared to last year due primarily to the euro area economy. Growth in emerging and developing economies slowed more than forecast, possibly due to a greater-than-expected effect of macroeconomic policy tightening or weaker underlying growth.

OUR PRODUCTS

Our position as one of the global leaders in each of the end markets we serve is derived from our ability to provide a comprehensive and technically advanced product portfolio of wire rope, synthetic rope, EMC, fabricated products and specialty wire. Our products have limited life cycles as a result of operating wear-and-tear. Below is detail of the various products we offer:

Wire Rope

We produce both highly engineered specialty products and general purpose wire rope suitable for a variety of uses. Our wire rope products are sold under CASAR, MacWhyte, Union, Camesa, Oliveira and Drumet brand names and range from small specialty ropes of 1/16 of an inch in diameter to large mining ropes of up to five inches in diameter. Several applications of wire rope products are listed below by end market:

| End Market |

Uses | |

| Oil and Gas | Drill lines Sand lines Tubing lines | |

| Crane | Construction (tower, mobile) Harbor (ship-to-shore, dockside) Marine (deck, offshore) Industrial (overhead and special cranes) | |

| General Industrial | Slings Barrier cable | |

| Mining | Surface mining ropes (drag lines, shovels) Underground ropes (shaft ropes, balance ropes) | |

| Marine | Mooring lines Towing lines | |

| Structures | Bridges | |

| Fishing | Bottom trawlers Tuna fishing | |

| Other Specialty | Logging Aircraft | |

11

Table of Contents

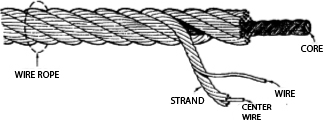

Wire ropes are designed and engineered to meet specific end use requirements and customer specifications, such as bright or galvanized rope, or rope that is impregnated with various synthetic materials. Production begins by helically stranding, or laying, steel wire together around a center wire to form strands. During the stranding process, protective lubricants are applied to the strands before they are spooled and taken to the closing department where they are finished into wire rope. Closing machines helically arrange, or close, the strands of wire around an independent wire rope or fiber core to form wire rope.

We are a provider of both highly engineered and standardized rope products. We market our wire rope products using the Union, MacWhyte and CASAR brand names as highly engineered products that, although more expensive than most competitors’ wire rope, provide customers with better value due to their quality, performance and the aftermarket service we provide. Our standardized products are sold under the Camesa, Oliveira and Drumet brand names. We have targeted markets both domestically and internationally and determined specific customers and products to be used to penetrate these markets. Our product development efforts will continue to identify critical applications where new or enhanced products can add value for the end user. Our product development process incorporates our extensive field expertise, rope design experience, manufacturing knowledge, state-of-the-art metallurgy and plastic extrusion capabilities to develop products that set the standard for performance in key industries. Net sales of wire rope were approximately 59%, 61% and 65% of our consolidated net sales for the years ended December 31, 2011, 2010 and 2009, respectively.

Synthetic Rope

We manufacture and sell synthetic rope products under the Phillystran and Oliveira brand names. Synthetic ropes are high tenacity fiber ropes, strands, braids and strength members made from fibers such as Kevlar®, Dyneema®, Twaron® and Technora®, and are used in a broad range of marine, fishing, industrial and government/military rope applications. Synthetic ropes are primarily used in applications that require specific operating strength, buoyancy, corrosion resistance or weight tolerance characteristics beyond wire rope. These include mooring lines, fishing ropes, life and winch lines, structural and support lines, boat rigging, power cables and broadcast tower guy cables. We have pioneered the development of new products which combine the use of steel wire ropes with high-strength synthetic components that improves the strength to weight ratio in the finished product.

We specialize in producing jacketed synthetic ropes as well as braided, twisted, and parallel ropes and strength members. Jacketed ropes have a protective outer jacket that increases the synthetic fibers’ resistance to harsh and abrasive conditions. All synthetic ropes are tested for tensile strength, elongation, modulus, stress relaxation, creep, tension, and bending life in both wet and dry conditions to ensure a high quality. Many of the products supplied by Phillystran and Oliveira are designed to specific customer requirements. Net sales of synthetic rope represented approximately 6% and 5% of our consolidated net sales for the years ended December 31, 2011 and 2010, respectively.

EMC

We believe that we are the leading non-captive global manufacturer of EMC. Our EMC product, marketed under the Camesa and Wireline Works brand names, is an electrical signal conducting cable that is armor-plated with high-carbon steel wire or highly engineered steel alloys to protect the signal conductors inside. Our EMC

12

Table of Contents

product is used in the oil and gas exploration industry and provides a link to the surface from underground drilling holes. The cable not only transmits data but also acts as a strength member for the insertion and removal of the geophysical tools used for logging and perforating the wells. We produce EMC to customer specifications in single conductor and multiconductor varieties, and the production process consists of stranding together purchased copper wires that are then jacketed with a polypropylene plastic. The jacketed copper strands are then stranded together, covered with an adhesive tape and wrapped by two layers of high-carbon steel wire to form the finished product.

We service our EMC customers through a network of distributors worldwide. We believe the Camesa brand of EMC has a very strong brand image for quality and reliability in this market. We sell EMC primarily to oil and gas companies operating in Mexico, the U.S. and Canada, but have strong distribution relationships in China, the Middle East and Europe. As part of our customer service strategy, we routinely produce EMC to customer specifications and inventory standardized product around the globe. Net sales of EMC represented approximately 7%, 9% and 7% of our consolidated net sales for the years ended December 31, 2011, 2010 and 2009, respectively.

Fabricated products

We also manufacture fabricated products with wire rope. These fabricated products are wire ropes with a wide variety of fittings attached at the ends, ranging from hooks, studs or sockets to highly specialized fittings produced to customer specifications. We are a leading supplier of bridge cable in North America with an increasing presence in South America and Europe. Our products include bridge rope, spiral strand, locked coil and custom assemblies sold into suspension and bridge applications. These products are custom designed and often have longer lead times compared to our other products. Sold under the WireCo and MacWhyte brand names, we supplied the cable hangers for America’s latest two large bridge projects: the San Francisco Bay Bridge and the Manhattan Bridge. We are currently supplying the lift cables for the Bordeaux Bridge in France.

We are a leading manufacturer of engineered OEM fabricated products, supplying the crane, automotive, amusement ride, mining, industrial, petroleum and military markets. These products are custom made to exacting standards and requirements. Our product line spans a wide range of specialty assemblies including parachute cables on NASA’s latest space capsule, the Orion, to jet-catching arrestor cables on aircraft carriers.

Net sales of fabricated products represented approximately 6% of our consolidated net sales for each of the years ended December 31, 2011, 2010 and 2009.

Specialty Wire

We are a leading producer of specialty wire used for infrastructure applications and general industrial end markets. Our high-quality wire products, such as spring wire, PC strand, tire bead, hard drawn wire, steel wire band and guy strands are manufactured for a wide variety of uses in a broad range of industries. For example, our wire products are used in furniture, mattress springs, screens, augers, car and truck tires, construction, air conditioning, fencing and tensioning applications. Our PC strand serves as a strengthening member in concrete used in bridges, road projects and commercial construction. Steel wire band is used to manufacture staples for various industries and guy strand is used in the telecommunications industry. We also manufacture high-carbon steel wire for use in the production of our own wire ropes and EMC products. Steel wire is produced by reducing the diameter of high-carbon steel rod into smaller diameter wires. The production process begins by submerging the high-carbon steel rod coils in various chemical baths to clean it of scale and rust, and to ensure it is lubricated and chemically ready for the production process. The high-carbon steel rod is then drawn, or pulled, through carboloy dies, which transforms it into wire of various diameters and tensile strengths.

We manufacture specialty wire products in the U.S., Mexico and Poland and primarily sell it throughout North America, South America and Europe. We service our customers through wire distributors and direct sales to manufacturers and end users globally. In order to quickly fill customer orders and effectively sell specialty

13

Table of Contents

steel wire through customary spot contracts, we usually maintain short production lead times and carry small inventories of various types of high volume wires. We only maintain inventory for long-term accounts with consistent purchasing behavior. We plan to grow our specialty wire sales globally with our high quality and cost competitive specialty wire products produced in Mexico and Poland. Our net sales of specialty wire were approximately 21%, 20% and 22% of our consolidated net sales for the years ended December 31, 2011, 2010 and 2009, respectively.

OUR BUSINESS ACTIVITIES

Manufacturing

We operate 13 manufacturing facilities located in North America and Europe. Within the U.S., we have five facilities located in Missouri in the cities of St. Joseph, Sedalia, Chillicothe, Kirksville and Carrollton and manufacturing facilities in Rosenberg, Texas and Montgomeryville, Pennsylvania. We have two facilities in Mexico in the cities of Vallejo and Cuautitlan. Within Europe, we have a facility in Kirkel, Germany, two facilities in Portugal in the cities of Maia and Paredes and one facility in Włocławek, Poland. Our China JV also operates a facility in Wuhan, China.

Sales, Marketing and Distribution

During 2010, a new global sales structure was developed. This new structure focuses on expanding our international sales force and streamlining our product and end market management with a comprehensive global sales strategy. Our global sales force is directed by two senior members of the management team. We have a cross-functional sales force consisting of regional sales managers who are supported by global end-market directors. Our team of global end-market directors is responsible for the marketing efforts and business development activities for key end markets. Our industry technical experts help our customers understand the optimal rope for their specific applications in order to maximize performance, enhance safety and decrease costs. Each global end-market director works with assigned product engineers and production planners. This structure is designed to provide the highest level of service to our customers. The regional sales managers maintain primary sales responsibility for sales in a geographic region of the world. We continued to expand our sales coverage in emerging markets by adding regional managers. During 2010, we added sales coverage in Canada, Europe, CIS, Africa, Australia, the Pacific Rim and the Middle East. The sales of our products are driven by a technical understanding of the applications. The evolution of our sales force has contributed to our growth.

We provide technical and educational materials to distributors and customers and often dispatch engineering personnel to visit end user operations. Our team of more than 50 engineers and metallurgists is an important resource for end-users, assisting in installations and explaining operating parameters and machinery limitations to our customers’ operators and facility managers. Our engineering staff works closely with our customers and our manufacturing facilities to design and produce the best products that fulfill their specific needs. We complement these sales efforts with a comprehensive internet presence that provides information on our products and technical support capabilities in multiple languages. We also participate in trade shows targeted at our key markets to expand our brand identity. An international business director and our customer service team coordinate the efforts of all parties to assure a rapid response to customers around the world.

Customers

Our key customers include distributors, OEMs and end users of our products in the various industries we serve. We benefit from a broad customer base and have a strong incumbency position, as evidenced by the fact that, on average, our top 20 customers have been conducting business with us for over 20 years. Due to our diversified customer base, our top ten customers only accounted for approximately 23% and 26% of our net sales in 2011 and 2010, respectively, and our largest customer accounted for less than 6% of net sales in 2011 and 2010.

14

Table of Contents

Raw Materials and Suppliers

The main raw materials that we use to manufacture our products are high-carbon steel rod and synthetic fibers. We purchase high-carbon steel rod from a number of U.S., Mexican and other foreign suppliers. We purchase standard fibers, such as polypropylene, polyethylene, polyester and polyamide (nylon), and high tenacity synthetic fibers, such as Dyneema®, from a number of suppliers located in the U.S., Europe, China, Japan, Brazil and other foreign countries. These raw materials are purchased at regular intervals, usually on a monthly basis, depending on pricing and market conditions.

Product Development

Our product engineering department includes both R&D engineers and technical service engineers who are located in the corporate office as well as around the world. Our product development effort also includes members of sales, finance, quality assurance and manufacturing operations. The product engineering team also has responsibility for product training and evaluating performance of all our products at customer locations as well as other quality assurance activities.

We have over 50 engineers and metallurgists who in their respective capacities contribute to our product development efforts. We believe our research and development initiatives have enhanced our reputation as a product innovator in the industries that we serve. Demand for the products developed in previous years continues to increase as our customers recognize the added value to their business. Within the last two years, we have introduced an average of nine new products per year to the diverse industries that we serve. These new products have been added to our already extensive and highly engineered product portfolio. We plan to build on our history of innovation and technological expertise to bring to market new highly engineered products. We have plans in 2012 to introduce eight new products.

Based on our review of related costs, we estimate our annual cost of research and development to be less than $2.0 million.

TRADEMARKS

We rely on patents, trademarks, trade secrets and other intellectual property laws and strategies to protect our proprietary rights. We have a significant number of trademarks covering our company names and material brands. These trademarks include WireCo® WorldGroup, Union®, Camesa®, MacWhyte®, CASAR®, Wireline Works™, U.S. Reel™, Phillystran®, Oliveira™ and Drumet®. In addition, we have trademarks registered in the U.S. and some foreign countries to protect our specific “marker strand” designs, which, consistent with market practice, designate our wire rope products as well as various product trade names. We have also trademarked our orange plastic coating used to enhance the performance of our wire rope product lines.

COMPETITION

We produce and sell a wide range of products and compete with other U.S. and international manufacturers of similar products. Our main competitors in the wire rope sector include Bridon International Ltd., Usha Martin Ltd. and KISWIRE Co., Ltd. Our major competitors in the synthetic rope sector include Cortland Cable Co., Bexco Ropes B.V., Samson Rope Technologies, Royal Lankhorst Euronete Group, Lupatech S.A., CSL and Offshore & Trawl Supply AS (“OTS”). In the EMC sector, we compete with Rochester Corporation and other vertically integrated companies which produce EMC solely for internal use. Our main competitors in the specialty wire sector include KISWIRE Co. Ltd., N.V. Bekaert S.A., Leggett & Platt Wire Group, Davis Wire Corporation, Deacero, S.A. de C.V. and various other manufacturers, both domestic and international.

In spite of this highly competitive environment, we have established market leading positions in the end markets we serve under our distinguished brands. We generally compete on the basis of product performance, price and sales and technical service support. We do not currently face significant competition from alternative technologies, such as hydraulic mechanisms.

15

Table of Contents

Competitive Strengths

Global Leadership Position. We maintain leadership positions across our end markets. In the crane market, our CASAR brand is recognized around the world as a leader in high-performance crane ropes used in a wide range of heavy lifting applications, including tower cranes, mobile cranes and port cranes. This position provides us with a strong and growing presence in North America, Europe and Asia, the three major centers for crane manufacturing and utilization in the world. We are a leading supplier to the oil and gas and mining end markets under the Union brand. Our Camesa brand EMC product is recognized globally as a premier product offering. We are a premium provider of synthetic ropes sold under the Phillystran and Oliveira brands. We attribute our leadership position to our engineering capabilities and technical expertise underpinned by a heritage of over 75 years of innovation, quality, industry experience and superior customer service. We also differentiate ourselves through our comprehensive portfolio of over 4,000 highly engineered rope designs.

Global Manufacturing Footprint Combined with Local Distribution. We focus on maintaining an efficient global supply chain and a variable, low-cost operating model. We have 13 manufacturing facilities in North America and Europe. Our China JV also operates a facility in Wuhan, China. These facilities are strategically located to provide fast delivery and short lead times to ensure product availability and high quality customer service from our well-trained sales and engineering teams. We leverage our low cost facilities to provide wire and other components to other facilities globally for use in the assembly of more highly engineered products. As we enter new global markets, our manufacturing capabilities allow us to match manufacturing requirements to customer demand.

Advanced Technical and Manufacturing Expertise. Our team of over 50 engineers and metallurgists continues to enhance our current product offering portfolio as well as develop new product innovations that extend our leading technical expertise and enable us to deliver application-specific products to our customers. Our experienced manufacturing team of plant managers and engineers has extensive industry experience, allowing us to leverage a talented and knowledgeable workforce to deliver high performance products to our customers. Our culture of innovation has led to the frequent introduction of new products and extension of product lines to meet the changing needs of our customers.

Diversity of End Markets, Customers and Geographies. We offer a broad range of leading brand name products to over 5,800 customers across a diverse range of end markets. We believe our overall business diversity helps to mitigate the impact of a downturn in any one product, end market or geographic area. We also have a global customer base generating approximately 61% and 52% of net sales in 2011 and 2010, respectively, to customers outside the U.S. We expect that percentage to increase as we expand our overseas market presence and further integrate recently acquired manufacturing facilities.

Poised to Benefit from End Markets with Attractive Fundamentals. Our leading market positions, global manufacturing and distribution footprint and technical capabilities position us to benefit from strong industry fundamentals in the major end markets we serve. Global infrastructure spending is expected to total more than $41 trillion through 2030, driven by the urbanization of emerging markets such as China, India and Brazil, as well as stimulus projects aimed at refurbishing infrastructure in developed markets. Drilling and production activity is expanding into new and harsher environments that will require more technologically advanced rope, longer drill lines and more frequent replacement cycles, each of which is expected to increase demand for wire rope. Furthermore, global mining activity is also expected to strengthen as long term demand for coal, copper and other minerals increase in line with the increased need for natural resources and energy.

Recurring Sales and Profitability. Our highly engineered and specialized ropes are mission critical equipment components in our customers’ operations. Although they represent a comparatively small cost of the larger projects in which they are used, our customers view our products as key operating expenses in the broader context of limiting exposure to operational disruption and downtime, and, as a result, are willing to pay for high quality ropes. Moreover, the consumable nature of our products and their rigid replacement cycles result in a recurring revenue base. Our sales are complemented by our flexible cost structure and our focus on maintaining

16

Table of Contents

and enhancing our profitability. For example, from 2007 to 2011, we increased gross profit from 20% to 26%. We have also demonstrated an ability to deliver favorable financial results throughout economic cycles by reacting quickly and closely managing our cost position by head count reduction, production optimization and distribution rationalization.

Experienced and Proven Management Team. We are led by an experienced management team that has over 300 cumulative years of direct industry experience and averages 22 years of experience. Management holds a meaningful equity interest and their compensation is tied directly to our financial performance. The team has a proven track record of product development, expanding the customer base, improving operating efficiencies and entering new markets. Consistent with our strategy of further diversifying and strengthening our product platform, management has a successful track record of pursuing and integrating complementary and strategic acquisitions.

REGULATION

Safety

Our facilities and operations are subject to, among other laws and regulations, comprehensive occupational health and safety laws and regulations. Numerous national and local government agencies in a number of countries regulate our manufacturing operations to protect the health of workers, prevent workplace injuries and illnesses and save lives. The Occupational Safety and Health Administration (“OSHA”) is the primary regulator in the United States. The Secretariat of Labor and Social Welfare (“STPS”) issues the regulations on health and safety in the workplace in Mexico. The European Agency for Safety and Health at Work (“EU-OSHA”) is the regulator in Germany, Portugal and Poland. The State Administration on Work Safety (“SAWS”) is the agency of the Government of the People’s Republic of China responsible for the regulation of risks to occupational safety and health in China. Our facilities are subject to investigation by these regulators without advance notice. Our regulators have not identified any material deficiencies or situations that could have a material impact on our operations.

Environmental Matters

Our business operations and facilities are subject to a number of laws and regulations, which govern the discharge of pollutants and hazardous substances into the air and water, the handling, storage, use and disposal of such materials and remediation of contaminated sites. The Environmental Protection Agency (“EPA”) is the primary regulator in the United States. Mexico’s environment ministry is The Secretariat of Environment and Natural Resources. Within Europe, the Federal Ministry of the Environment, Nature Conservation and Nuclear Safety is the regulator in Germany, the Ministry for Environment and Spatial Planning is the regulator in Portugal and the Ministry of the Environment is the regulator in Poland. The People’s Republic of China formed the Ministry of Environmental Protection to oversee regulations in China to protect human health and the environment. Operations at our facilities include transforming steel rods and wire into wire rope or cable, which can produce wastewater, spent acid and excess petroleum waste and transforming polyethylene and polypropylene into fiber strand and fiber rope, which produce no waste. We also store certain petroleum products and hazardous substances that we use in our operations. Due to the nature of these activities, our facilities are subject to investigation by regulators who regularly inspect our facilities. Our regulators have not identified any material deficiencies or situations that could have a material impact on our operations.

Quality Certifications

We hold numerous quality certifications for the products we manufacture. All of our rope and wire fabrication facilities throughout North America and Europe, including our China JV in Asia, are ISO 9001 certified. ISO 9001 is an international standard certification granted by the International Organization for Standardization (“ISO”) that confirms a supplier can consistently provide goods and services that meet client needs and expectations and comply with applicable regulations. Certain of our facilities in the U.S. and Mexico and the facility operated by our China JV provide product into the petroleum industry are also certified to

17

Table of Contents

“API 9A”. This API certification is granted by the American Petroleum Institute (“API”) and relates to quality and performance standards for oilfield products. Our API certifications assure our customers that we have a quality control system and that our products are approved in accordance with API performance standards. Because of the high risk environment inherent in our customers’ industries, many insurance providers require petroleum companies to only purchase products that are produced from a supplier certified by API and carries the API logo. Our goal is to have our three European plants API certified by the end of 2012. The Qualified Products List (“QPL”) 83420 certification, granted by the Defense Logistics Agency of the U.S. government, provides us with the ability to produce and supply aircraft control cables for various aircraft manufacturers, including Boeing, Raytheon, Cessna and the U.S. government. We also hold a certification to AS9100, which relates specifically to the aircraft industry. We believe we are the only manufacturer that holds all four such certifications.

We hold Center for Engineering (“CFE”) certifications for products produced at our facilities in Mexico. CFE certifications are granted by the Mexican federal government and authorize an industrial manufacturer to supply industrial products. Specific customers also certify us as qualified and approved suppliers. We are certified by many of the largest manufacturers in the world, including PEMEX, Boeing, Cessna, Goodrich, Caterpillar, Grove and Oshkosh Truck.

We are certified by Lloyd’s Register Quality Assurance, Inc. for the products produced at our St. Joseph and Sedalia locations in Missouri. The Lloyd’s Register Group is an independent risk-management organization providing risk assessment and mitigation services and management systems certification. We are certified by Germanischer Lloyd SE for the products produced at our German and Portuguese facilities. Germanischer Lloyd is a technical supervisory organization that conducts safety surveys to mitigate risks and assurance of technical compliance for the shipping and oil and gas industries.

EMPLOYEES AND LABOR RELATIONS

We have nearly 3,000 employees, not including the China JV, of which approximately 65% are covered by collective bargaining agreements. The current agreements have expiration dates as follows:

| Location |

Collective Bargaining Unit |

Expiration | ||

| St. Joseph, Missouri | United Steelworkers of America Local 5783 | June 30, 2013 | ||

| St. Joseph, Missouri | International Brotherhood of Electric Workers Local 545 | December 31, 2014 | ||

| Chillicothe, Missouri | United Steelworkers of America Local 990-1 | February 28, 2014 | ||

| Vallejo, Mexico | Sindicato Progresista de Trabajadores de la Industria Metálica, del Plástico, del Vidrio, Similares y Conexos de la República Mexicana | October 31, 2012 | ||

| Cuautitlan, Mexico | Indicato de Trabajdores de la Industria Metálica y Metal-Mecánica de la Industria y Maquila de Cables de Acero, Alambres, Compra-Venta de Materiales, Maquinaria y Refacciones, Maquinados, Soldadura, Arrendamiento de Equipo, Similares y Conexos del Estado de México | December 31, 2012 | ||

| Kirkel, Germany | Industriegewerkschaft Metall | May 31, 2013 | ||

| Maia and Paredes, Portugal | Federação dos Sindicatos dos Trabalhadores Texteis, Lanifícios, Vesturário, Calçado e Peles de Portugal (“FESETE”) | February 28, 2011(1) | ||

| Włocławek, Poland | Trade Union of Metal Workers in DRUMET, the Independent and Self-Governing Trade Union Solidarność in DRUMET and Technicians and Engineers Trade Union | December 31, 2014 |

| (1) | The collective bargaining agreement for the year 2012 has not been formally approved at our Portuguese facility; the previous agreement issued on February 28, 2011 continues to remain effective. |

18

Table of Contents

FINANCIAL INFORMATION ABOUT GEOGRAPHIC AREAS

WireCo’s foreign operations are primarily conducted in Mexico, Germany, Portugal and Poland, where we have manufacturing facilities. Refer to Note 17—“Segment Reporting” to our consolidated financial statements included in Item 8, Financial Statements and Supplementary Data, of this annual report for financial information about WireCo’s foreign and domestic operations.

AVAILABLE INFORMATION

Effective February 7, 2012, we became an SEC registrant and will file annual reports, quarterly reports and other documents with the SEC subsequent to that date. Interested parties may also read and copy any of our filings at the SEC’s Public Reference Room at 100 F Street N.E., Room 1580, Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet website that contains reports and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Our financial information, including annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and if applicable, amendments to those reports filed or furnished pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”), is available, free of charge by making a request within the investors tab on our website, www.wirecoworldgroup.com.

19

Table of Contents

| Item 1A. | Risk Factors |

Our financial condition, results of operations and cash flows are subject to various risks, many of which are not exclusively within our control and may cause actual performance to differ materially from historical or projected future performance. The risks described below could materially and adversely affect our business, financial condition, results of operations or cash flows. These risks are not the only risks that we face and our business operations could also be affected by additional factors that are not presently known to us or that we currently consider to be immaterial to our operations. See “Forward-Looking Statements” on page 3 of this annual report for cautionary statements regarding forward-looking statements.

Risks Relating to our Business

Demand for our products depends on the health of the global economy.

Demand for our products depends on the level of activity in the industries that we serve. The oil and gas, mining, infrastructure and general industrial end markets are cyclical in nature. The general condition of the economy in our markets and a variety of other factors beyond our control affect demand for our products. Historically, downturns in general economic conditions have resulted in diminished product demand, excess manufacturing capacity and lower average selling prices. In addition, cyclicality in particular industries we serve may affect our results of operations. For example, our sales to the oil and gas end market are subject to variability due to fluctuations in oil and gas supply and demand, exploration discoveries and weather-related factors. Our sales to the mining end market are subject to similar fluctuations related to the price for the commodity that is mined, which is driven by global demographic, political and economic circumstances. Our sales to the infrastructure end market are also dependent on regional economic conditions and overall demand for commercial buildings, bridges and roads.

The ongoing European debt crisis continues to have a negative impact on the European economy. A prolonged downturn could have the following impacts, among others:

| • | disrupt the current U.S. recovery and weaken global trade; |

| • | hamper key emerging markets such as China and India and result in another global recession with reduced demand and lower prices for the products we produce; |

| • | disruption of the Euro currency system and/or changes in currency regimes; |

| • | disruption of the payment and settlement system; |

| • | severe inflation due to currency depreciation; |

| • | the failure of banks or financial systems or the reduced ability of banks to lend due to higher funding costs; and |

| • | devaluation of assets. |

Economic downturns in national or international economies in general or in the industries we serve in particular could have a material adverse effect on our sales, results of operations, cash flows and access to capital.

An increasing portion of our business depends on operations and sales outside North America in areas that are subject to increased political and economic risks.

We operate and sell our products in regions outside of North America, which are exposed to political and economic risks. Therefore, our international operations may be subject to additional risks, including:

| • | economic, social and political instability; |

| • | exchange controls and currency restrictions; |

| • | currency fluctuations and devaluations; |

20

Table of Contents

| • | high levels of inflation and high domestic interest rates; |

| • | tariffs and other trade regulations; |

| • | risks related to local governmental and other regulatory regimes; |

| • | difficulties in repatriating earnings; |

| • | changes in local economic conditions; |

| • | exposure to possible expropriation or other government actions; |

| • | hostility from local populations; |

| • | diminished ability to legally enforce our contractual rights in non-U.S. countries; |

| • | ineffective intellectual property protection; |

| • | possible terrorist attacks; |

| • | difficulties in receivables collection; and |

| • | dependence on foreign personnel. |

Our international operations expose us to varying political and business risks and challenges. For example, we are faced with potential difficulties in staffing and managing local operations and have to design solutions to manage credit risks of local customers and distributors. In addition, certain jurisdictions in which we operate may be politically unstable. We also operate in jurisdictions in which our status as a Cayman company may expose us to increased risk of terrorist attacks, or to greater impact from the national and global military, diplomatic and financial response to any future attacks or other threats.

Some of our operations are located in jurisdictions that have historically experienced high levels of inflation and high domestic interest rates. The operating results and cash flows of our subsidiaries located in such jurisdictions could be adversely affected due to lower demand or lower growth in demand for our products if they experience high levels of inflation. In addition, because the U.S. dollar is our functional currency, our results of operations and financial condition could be adversely affected if inflation in such jurisdictions increases without a corresponding devaluation of the local currency.

Some of our operations are located in regions with particular exposure to storms, floods, riots, fires, sabotage, terrorism, civil commotion or civil unrest, interference by civil or military authorities, acts of war (declared or undeclared) or armed hostilities or other national or international calamity, or failure of energy sources. Production efficiency prevents us from relocating such operations and, as a result any of the aforementioned occurrences, could materially adversely affect our business.

Our reported financial condition and results of operations are subject to exchange rate fluctuations, which will make it more difficult to predict our financial results.

Our financial condition and results of operations are reported in multiple currencies, which currently include the Mexican peso, the euro, the Polish złoty and the Chinese renminbi, and are then translated into U.S. dollars at the applicable exchange rate for inclusion in our consolidated financial statements. As a result, appreciation of the U.S. dollar against the Mexican peso, euro, Polish złoty and Chinese renminbi will have a negative impact on our reported revenues and operating profit while depreciation of the U.S. dollar against such currencies will have a positive effect on reported revenues and operating profit. We do not expect to use derivative financial instruments to mitigate this translation effect.

If we do not maintain the quality of our products, our customers may choose to purchase from other suppliers and our sales would be harmed.

Our products are used in applications by our customers where quality and performance are critical. If we are unable to maintain the high standards, including various quality certifications, expected by our customers, or our

21

Table of Contents

competitors are able to produce higher quality products, our sales may be harmed by the loss of existing customers and our ability to attract new customers. Should this occur, we may also need to increase our investments in manufacturing processes, which could increase our expenses, reduce our margins and adversely affect our cash flows. A failure to maintain certification in any one plant will not affect the certification process in our other plants.

We could face product liability claims relating to products we manufacture that could increase our costs.

Our products are often used in conjunction with heavy machinery or in construction. Accordingly, we have potential exposure to product liability claims in the event that the use of any of our products results in personal injury, property damage or a failure of our products cause a work stoppage, including situations resulting from misuse of our products. Any such claims may be significant. Therefore, product liability claims against us could have a negative reputational impact, particularly if the failure of a product is highly publicized.

Furthermore, manufacturing defects may not be discovered for some time after new products are introduced. In the event that any of our products prove to be defective, among other things, we may be responsible for damages related to any defective products and we may be required to recall or redesign such products. Any insurance we maintain may not continue to be available on terms acceptable to us or such coverage may not be adequate for liabilities actually incurred. As a result, products liability claims could have a material and adverse effect on our business, financial condition and results of operations.

We may pursue and execute acquisitions, which could adversely affect our business.

We have made, and may in the future make, acquisitions of or significant investments in businesses with complementary products, services and/or technologies. We cannot provide assurance that we will be able to consummate any such transactions or that any future acquisitions will be consummated at acceptable prices and terms. Acquisitions involve numerous risks, including, but not limited to:

| • | difficulties in integrating the operations, technologies, products and personnel of acquired companies; |

| • | lack of synergies or the inability to realize expected synergies and cost savings; |

| • | revenue and expense levels of acquired entities differing from those anticipated at the time of the acquisitions; |

| • | difficulties in managing geographically dispersed operations; |

| • | the potential loss of key employees, customers and strategic partners of acquired companies; |

| • | claims by terminated employees, shareholders of acquired companies or other third parties related to the transaction; |

| • | the issuance of dilutive securities, assumption or incurrence of additional debt obligations or expenses, or use of substantial portions of our cash to fund our acquisition; |

| • | diversion of management’s attention from normal daily operations of the business; and |

| • | the impairment of acquired intangible assets as a result of technological advancements or worse-than-expected performance of acquired companies. |

We may become responsible for unexpected liabilities that we failed or were unable to discover in the course of performing due diligence in connection with historical acquisitions and any future acquisitions. We cannot provide assurance that any indemnification rights we have obtained, or will obtain in the future, will be enforceable, collectible or sufficient in amount, scope or duration to fully offset the possible liabilities associated with the business or property acquired. Any of these liabilities, individually or in the aggregate, could have a material adverse effect on our business, financial condition and results of operations.

22

Table of Contents

Acquisitions are inherently risky, and we cannot provide any assurance that our previous or future acquisitions will be successful. The inability to effectively manage the risks associated with previous or future acquisitions could materially and adversely affect our business, financial condition or results of operations.

We cannot provide assurance that we will achieve the synergies identified in this report or that we will achieve synergies and cost savings in connection with future acquisitions. In addition, many of the businesses that we have acquired and will acquire have financial statements that have been prepared by the management of such companies, which may be presented or audited in a different manner than our financial statements or may have not been independently reviewed or audited. We cannot provide assurance that the financial statements of companies we have acquired or will acquire would not be materially different if such statements were prepared or audited on a basis consistent with our financial statements, or that we would not discover adjustments that need to be made to such financial statements following the acquisitions. Finally, we cannot provide assurance that we will continue to acquire businesses at valuations consistent with our prior acquisitions or that we will complete acquisitions at all.

We depend heavily on our senior management, and we may be unable to replace key executives if needed.

Our future success depends, in significant part, upon the continued services and leadership skills of our management personnel. Our senior management team has extensive manufacturing, finance and engineering experience, and we believe that the depth of our management team is instrumental to our continued success. The loss of the services of one or more of our senior management personnel for any reason, including resignation or retirement, could adversely affect our business, financial condition and results of operations. We cannot provide assurance that we will be able to retain and maintain existing senior management personnel or attract additional qualified personnel when needed.

We face volatility in the prices for, and availability of, raw materials and energy used in our business, which could adversely impact our competitive position and results of operations.