Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IMAX CORP | d549649d8k.htm |

| EX-3.2 - EX-3.2 - IMAX CORP | d549649dex32.htm |

| EX-10.3 - EX-10.3 - IMAX CORP | d549649dex103.htm |

| EX-10.1 - EX-10.1 - IMAX CORP | d549649dex101.htm |

| EX-10.2 - EX-10.2 - IMAX CORP | d549649dex102.htm |

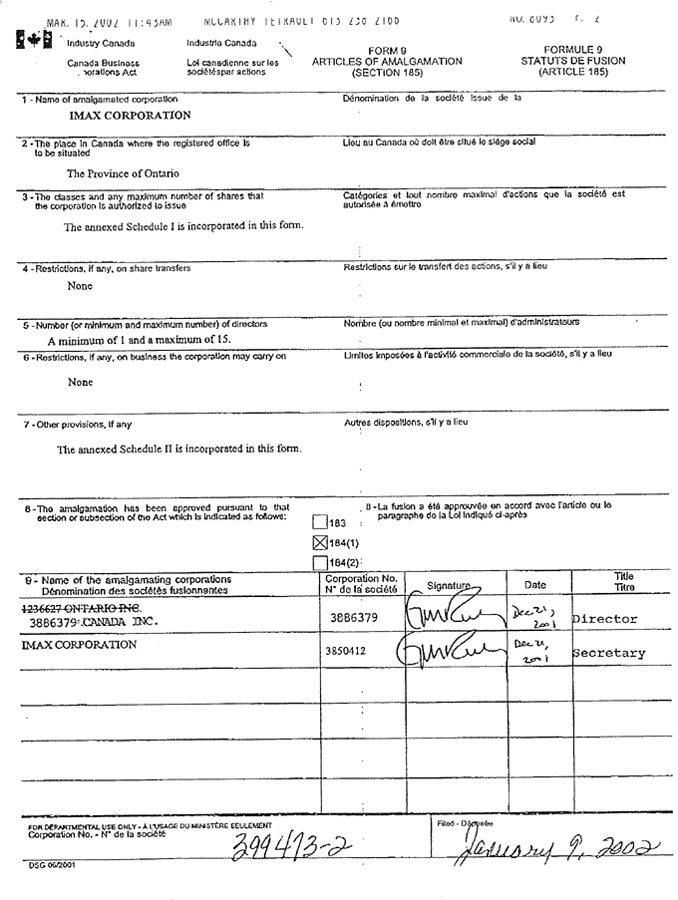

IMAX CORPORATION

EXHIBIT 3.1

Articles of Amalgamation

|

|

Industrie Canada |

| Certificate of Amalgamation |

Certificat de fusion | |

| Canada Business Corporations Act |

Loi canadienne sur les sociétés par actions | |

|

IMAX CORPORATION

|

399473-2 | |

|

|

| |

| Name of corporation-Dénomination de la société | Corporation number-Numéro de la société | |

| I hereby certify that the above-named corporation resulted from an amalgamation, under section 185 of the Canada Business Corporations Act, of the corporations set out in the attached articles of amalgamation. | Je certifie que la société susmentionnée est issue d’une fusion, en vertu de l’article 185 de la Loi canadienne sur les sociétés par actions, des sociétés dont les dénominations apparaissent dans les statuts de fusion ci-joints. | |

|

January 1, 2002 / le 1 janvier 2002 | |

| Director - Directeur | Date of Amalgamation - Date de fusion | |

Industry Canada Canada Business . watlons Act Industrie Canada \ Lo) canadienne sue les sodetespar acHons FORM 9 ARTICLES OF AMALGAMATION (SECTION 185} FORMULE 9 STATUTS DE FUSION (ARTICLE 185) 1 - Name of amalgamated corporation IMAX CORPORATION Denomination do la soclete Issue de la 2 -The place In Canada where the registered office Is to be situated The Province of Ontario Lieu au Canada od dolt Stre sltuS le sldga sodal 3 -The classes and any maximum number of shares that Categories et lout nombre maximal d’actfons que la sodet6 est the corporation Is authorized lo issue autods6a a 6mettre The annexed Schedule I is incorporated in this form. 4 - Restrictions, if any, on share transfers Restrictions sue te transfer! des actions, s’il y a lieu None 5 -Number (or minimum and maximum number) of directors Nombre (ou nombre minimal et maximal) d’adrnlnlstrateura A minimum of 1 and a maximum of 15. 6 -Restrictions, If any, on business the corporation may carry on Urnltes knpos6es 61’activ1t6 commerciale de la soc!6t6, sll y a lieu None 7 - Other provisions. If any Autres dispositions, sll y a lieu The annexed Schedule II is incorporated in this form. 8-The amalgamation has been approved pursuant to that eectjon or subsection of the Act which Is Indicated as fcflows: 5 -La fusion a 616 approuvee en accord avec Particle ou le D paragraphs <Je la Lol Indlqu6 cf-apfes 183 ; [X] 184(1) niw(2): 9 - Name of the amalgamating corporations Denomination des soctetes fuslonnarrtes 3886379’JCANftDA. INC. IMAX CORPORATION Corporation No. N” de la soci6t6 3886379 3850412 director Signature—, Date Trtle Tiire Secretary FOR DCPAKTMEKT/U. USE ONLY - A. LTJSAGE DU MINISTERS SEUUEMENT Corporation No. - N’ de la soctete

SCHEDULE I

The Corporation is authorized to issue an unlimited number of Common Shares, an unlimited number of Class C Shares, issuable in two series, and an unlimited number of Special Shares, issuable in series. Schedule I-A attached hereto sets forth the rights, privileges, restrictions and conditions of such shares.

McCarthy Tétrault TDO-CORP #6828586 / v. 1

SCHEDULE I-A

1. Definitions

For the purposes of this Schedule I-A:

“Class C Issue Price” means Cdn. $100;

“Class C Shares” means the 7%, cumulative, redeemable, preferred, non-voting shares of the Corporation with the rights, privileges, restrictions and conditions set forth herein;

“Common Shares” means the common shares of the Corporation with the rights, privileges, restrictions and conditions set forth herein;

“Consolidated Interest Coverage Ratio” will have the meaning specified in the Indenture to be dated as of the Issue Date between the Trustee named therein and the Corporation;

“Initial Public Offering” means an initial public offering of Common Shares in the United States of America and/or Canada pursuant to the securities laws of the United States of America or any province of Canada;

“Issue Date” means the date of closing of the acquisition of Imax Corporation by WGIM Acquisition Corporation;

“Net Proceeds” means the amount received by the Corporation in cash, after the payment of all costs, expenses (including, without limitation, filing fees and legal fees and disbursements) and commissions related thereto, from an Initial Public Offering and from any subsequent public offering or other public distribution of Common Shares by the Corporation pursuant to a prospectus filed with the Securities and Exchange Commission in the United States of America or Canada; and

“Special Shares” means the special shares of the Corporation with the rights, privileges, restrictions and conditions set forth herein.

2. Common Shares

The rights, privileges, restrictions and conditions attaching to the Common Shares are as follows:

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| (a) | Payment of Dividends: The holders of the Common Shares shall be entitled to receive dividends if, as and when declared by the board of directors of the Corporation out of the assets of the Corporation properly applicable to the payment of dividends in such amounts and payable in such manner as the board of directors may from time to time determine. Subject to the rights of the holders of any other class of shares of the Corporation entitled to receive dividends in priority to or ratably with the holders of the Common Shares, the board of directors may in their sole discretion declare dividends on the Common Shares to the exclusion of any other class of shares of the Corporation. |

| (b) | Participation upon Liquidation, Dissolution or Winding-Up: In the event of the liquidation, dissolution or winding-up of the Corporation or other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs, the holders of the Common Shares shall, subject to the rights of the holders of any other class of shares of the Corporation entitled to receive the assets of the Corporation upon such a distribution in priority to or ratably with the holders of the Common Shares, be entitled to participate ratably in any distribution of the assets of the Corporation. |

| (c) | Voting Rights: The holders of the Common Shares shall be entitled to receive notice of and to attend all annual and special meetings of the shareholders of the Corporation and to one vote in respect of each common share held at all such meetings. |

3. Class C Shares

I. The rights, privileges, restrictions and conditions attaching to the Class C Shares as a class are as follows:

| (a) | Dividends and Other Distributions: |

| (i) | The holders of the Class C Shares, subject to the rights of the holders of any class of shares entitled to receive dividends and any other distributions in priority to the holders of Class C Shares, but in priority to the holders of the Common Shares and all other shares ranking junior to the Class C Shares in respect of the payment of dividends, shall be entitled to receive and the Corporation shall, subject to the terms hereof, pay thereon, as and when declared by the board of directors of the Corporation out of the assets of the Corporation properly applicable to the payment of dividends, fixed preferential cumulative cash dividends at the rate of 7% per annum (or such higher rate as may apply pursuant to clause 3.I.(a)(iii) hereof) on the Class C Issue Price (the “Class C Cumulative Dividends”) for each such share. Class C Cumulative Dividends shall be payable as provided in clause 3.I.(a)(ii) hereof and shall accrue and be cumulative from the Issue Date. |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| (ii) | No Class C Cumulative Dividends shall be declared or paid prior to the third anniversary date of the Issue Date. Thereafter, on each subsequent anniversary date of the Issue Date, then |

| (A) | provided that the Corporation has not, prior to such third or subsequent anniversary date, received Net Proceeds equal to or greater than Cdn. $35,000,000, there shall be declared and paid in cash Class C Cumulative Dividends, if both before and, on a pro forma basis, after giving effect to the payment of such Class C Cumulative Dividends, the Consolidated Interest Coverage Ratio of the Corporation does not exceed 2.25 to 1; and |

| (B) | if the Corporation has received Net Proceeds equal to or greater than Cdn. $35,000,000 prior to such third or a subsequent anniversary date of the Issue Date, one-half of the Class C Cumulative Dividends as have accrued prior to such third or subsequent anniversary date immediately preceding receipt of such Net Proceeds shall be paid in cash on each of the first and second anniversary dates of the Issue Date after such third or subsequent anniversary date, unless the aggregate amount of such payments to be paid in cash on such date would exceed Cdn. $2,000,000 in either such year, in which case one-third of such accrued Class C Cumulative Dividends shall be declared and paid in cash on each of the first, second and third anniversary dates of the Issue Date after such third or subsequent anniversary date. |

| (iii) | If, on any anniversary date of the Issue Date after the third such anniversary date, the Class C Cumulative Dividends to be paid on such date are not paid in full in cash and such dividends were required to have been paid in full in cash pursuant to clause 3.I.(a)(ii), above, the rate at which Class C Cumulative Dividends shall accrue and be payable after such anniversary date as provided in clause 3.I.(a)(i) shall increase by 1% per annum, to a maximum dividend rate of 10% per annum, until such time as all Class C Cumulative Dividends have been paid in cash as provided herein, whereupon the dividend rate will revert to 7% per annum. |

| (iv) | If, on any date on which Class C Cumulative Dividends are to be paid, the dividend payable on such date is not paid in full on all the Class C Shares then issued and outstanding, such dividend, or the unpaid part thereof, shall be paid at a subsequent date or dates in priority to dividends on the Common Shares and any other shares ranking junior to the Class C Shares in respect of the payment of dividends. |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| (v) | Payment of dividends shall be made by cheque negotiable without charge at any branch of the Corporation’s bankers for the time being in Canada. The mailing of such cheques to holders of Class C Shares shall satisfy and discharge all liability of the Corporation for such dividends to the extent of the sums represented thereby (plus any tax required to be deducted or withheld therefrom) unless such cheques are not paid on due presentation. A dividend which is represented by a cheque which has not been presented for payment within 6 years after it was issued or that otherwise remains unclaimed for a period of 6 years from the date on which the cheque was mailed shall be forfeited to the Corporation. |

| (vi) | Subject to the terms hereof, the holders of Class C Shares shall not be entitled to any dividends or other distributions other than or in excess of the preferential cumulative cash dividends hereinbefore provided. |

| (b) | Dividends Preferential: Except with the consent in writing of the holders of all the Class C Shares outstanding, no dividend or other distribution shall be declared and made or set apart for payment on the Common Shares or upon any other shares of the Corporation ranking junior to or on a parity with the Class C Shares as to dividends or upon liquidation, nor shall any Common Shares nor any other such shares of the Corporation ranking junior to or on a parity with the Class C Shares as to dividends or upon liquidation, be redeemed, purchased or otherwise acquired for any consideration (or any moneys be paid to or made available for a sinking fund of the redemption of any such shares) by the Corporation (except by conversion into or exchange for stock of the Corporation ranking junior to the Class C Shares as to dividends and as to liquidation) unless and until the accrued Class C Cumulative Dividends on all of the Class C Shares outstanding have been declared and paid. |

| (c) | Participation upon Liquidation, Dissolution or Winding-Up: In the event of the liquidation, dissolution or winding-up of the Corporation or other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs, whether voluntary or involuntary, the holders of the Class C Shares shall be entitled to receive from the property and assets of the Corporation an amount equal to the aggregate Class C Redemption Amount (as hereinafter defined) of all Class C Shares held by them respectively before any distribution of any part of the property or assets of the Corporation to the holders of Common Shares or shares of any other class ranking junior to the Class C Shares in respect of such distribution. After payment to the holders of the Class C Shares of the Class C Redemption Amount, such holders shall not be entitled to share in any further distribution of the assets of the Corporation. |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| (d) | Redemption by Corporation: The Corporation may at any time redeem the whole, or from time to time or times redeem any part of the then outstanding Class C Shares (any of the foregoing being an “Optional Redemption”) and, on the date that is eight and one-half years after the Issue Date, shall redeem the whole of the then outstanding Class C Shares (such redemption on the date that is eight and one-half years after the Issue Date being a “Mandatory Redemption”) on payment for each Class C Share to be redeemed of the Class C Issue Price, plus all unpaid Class C Cumulative Dividends which shall have accrued thereon and which shall be treated as accruing to, but not including, the date of such redemption, the whole constituting and being herein referred to as the “Class C Redemption Amount”. Provided that if the Corporation is not permitted, at the date set for the Mandatory Redemption, by virtue of applicable law, to redeem all of the Class C Shares then to be redeemed, it shall redeem, pro rata, such number of Class C Shares then called for redemption as it may then redeem. The Corporation may at any time undertake the Optional Redemption. If there is an Optional Redemption, and less than all the Class C Shares are to be redeemed, the Class C Shares to be redeemed in such Optional Redemption shall be a pro rata portion of the Class C Shares held by each holder on the date of such Optional Redemption. |

| (e) | Notice of Redemption: In respect of the redemption of Class C Shares pursuant to the provisions of clause 3.I.(d) hereof, the Corporation shall, at least 21 days (or, if all of the holders of the Class C Shares consent, such shorter period to which they may consent) before the date specified for redemption, mail (or, with the consent of any particular holder, otherwise deliver) to each person who, at the date of mailing (or delivery, as the case may be) is a holder of Class C Shares to be redeemed a notice in writing of the intention of the Corporation to redeem such Class C Shares. Such notice shall (subject to the consent of any particular holder referred to above) be mailed by letter, postage prepaid, addressed to each such holder at his address as it appears on the records of the Corporation or, in the event of the address of any such holder not so appearing, then to the last known address of such holder; provided, however, that accidental failure to give any such notice to one or more of such holders shall not affect the validity of such redemption; but if such failure is discovered, notice as aforesaid shall be given forthwith to such holder or holders and shall have the same force and effect as if given in due time, provided that such notice shall not extend the date specified for such redemption. Such notice shall set out the number of Class C Shares held by the person to whom it is addressed which are to be redeemed; the aggregate Class C Redemption Amount to which such holder is entitled; the date on which redemption is to take place; and the place or places in Canada at which the holders of Class C Shares may present and surrender the certificates representing such shares for redemption. |

| (f) | Payment of Class C Redemption Amount: On the date so specified for redemption, the Corporation shall pay or cause to be paid to or to the order of the holders of the Class C Shares to be redeemed the Class C Redemption Amount thereof on presentation and surrender at the registered office of the Corporation or any other place designated in such notice of the certificates representing the Class C Shares called for redemption. Such payment shall be made by cheque payable at par at any branch of the |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| Corporation’s bankers in Canada. From and after the date specified for redemption in any such notice the holders of the Class C Shares called for redemption shall cease to be entitled to dividends and shall not be entitled to exercise any of the rights of holders of Class C Shares in respect thereof unless payment of the Class C Redemption Amount is not made upon presentation of certificates in accordance with the foregoing provisions, in which case the rights of the holders of the said Class C Shares shall remain unaffected. The Corporation shall have the right at any time after the mailing (or delivery, as the case may be) of notice of its intention to redeem any Class C Shares to deposit the Class C Redemption Amount of the shares so called for redemption to a special account in any chartered bank or in any trust company in Canada, named in such notice, to be paid without interest to or to the order of the respective holders of such Class C Shares called for redemption upon presentation and surrender to such bank or trust company of the certificates representing the same, and upon such deposit being made, the rights of the holders thereof after such deposit or such redemption date, whichever is the earlier, shall be limited to receiving without interest their proportionate part of the total Class C Redemption Amount so deposited against presentation and surrender of the said certificates held by them respectively, and any interest allowed on such deposit shall belong to the Corporation. |

| (g) | Voting Rights: Except as otherwise provided by law, the holders of the Class C Shares shall not, as such, be entitled to receive notice of or to attend any meeting of shareholders of the Corporation and shall not be entitled to vote at any such meeting. Without limiting the generality of the foregoing, the holders of the Class C Shares shall not be entitled to vote separately as a class on any proposal to amend the Articles of the Corporation to: |

| (i) | increase or decrease any maximum number of authorized Class C Shares, or increase any maximum number of authorized shares of a class having rights or privileges equal or superior to the Class C Shares; or |

| (ii) | effect an exchange, reclassification or cancellation of all or part of the Class C Shares; or |

| (iii) | create a new class of shares equal or superior to the Class C Shares. |

| (h) | Series: The Class C Shares are issuable in two series, with an unlimited number of Class C Shares, Series 1, constituting the first series and an unlimited number of Class C Shares, Series 2, constituting the second series. Class C Shares, Series 2 shall only be issued as a result of the conversion of Class C Shares, Series 1 into Class C Shares, Series 2. Immediately prior to any such conversion, the directors shall by resolution fix (i) the number of Class C Shares, Series 2 to be issued as such number as shall equal the number of Class C Shares, Series 1 which are to be converted into Class C Shares, Series 2; and (ii) the number of votes which each Class C Share, Series 2 shall |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| have attached to it, which number shall be such number as the directors shall by resolution, in their discretion, determine, to a maximum number of votes for all of the Class C Shares, Series 2 to be issued upon the conversion of the Class C Shares, Series 1, which shall not exceed, in the aggregate, 35% of the votes attached to all voting shares of the Corporation which will be outstanding immediately following such conversion. |

II. Class C Shares, Series 1

In addition to the rights, privileges, restrictions and conditions attaching to the Class C Shares as a class, the Class C Shares, Series 1 shall have the following rights, privileges, restrictions and conditions:

| (a) | Mandatory Conversion: |

| (i) | Mandatory Conversion: All, but not less than all, of the Class Shares, Series 1 of the Corporation may, on such date as may be determined by the directors of the Corporation by resolution in their sole discretion, be converted into the same number of Class C Shares, Series 2 as are outstanding on the date set for conversion on the basis of one Class C Share, Series 2 for each Class C Share, Series 1. |

| (ii) | Directors to Fix Number, Votes: Prior to giving the notice of conversion provided for in clause 3.II.(a)(iii), the directors shall by resolution have fixed (i) the number of Class C Shares, Series 2 to be issued as set forth in clause 3.I.(h); and (ii) the number of votes which each Class C Share, Series 2 shall have attached to it, as set forth in clause 3.I.(h). |

| (iii) | Notice of Conversion: In respect of the conversion of Class C Shares, Series 1 pursuant to the provisions of clause 3.II.(a)(i) hereof, the Corporation shall at least 21 days before the date specified for conversion mail or deliver to each person who at the date of mailing (or delivery, as the case may be) is a holder of Class C Shares, Series 1 to be converted a notice in writing of the intention of the Corporation to convert such Class C Shares, Series 1 into Class C Shares, Series 2. Such conversion shall take place on such date as is specified in the said notice, which date shall not be less than 21 days following the date of said notice. Effective on such date, the holder of the Class C Shares, Series 1 being converted shall be deemed to have become, and shall be registered as, the holder of the Class C Shares, Series 2 resulting from the conversion and shall cease to be registered as a holder of the Class C Shares, Series 1 converted. The Corporation shall specify in such notice the date on which the conversion is to occur, the number of Class C Shares, Series 1 held by the person to whom it is addressed to be converted, the number of Class C Shares, |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| Series 2 to be issued upon such conversion, the date upon which the conversion will occur and that the holder of Class C Shares, Series 1 shall have become the registered holder of the Class C Shares, Series 2 resulting from the conversion on such date. Such notice shall be mailed by letter, postage prepaid, addressed to each such holder at his address as it appears on the records of the Corporation or in the event of the address of any such holder not so appearing then to the last known address of such holder; provided, however, that accidental failure to give any such notice to one or more of such holders shall not affect the validity of such conversion; but if such failure is discovered, notice as aforesaid shall be given forthwith to such holder or holders and shall have the same force and effect as if given in due time, provided that such notice shall not extend the date specified for such conversion. |

III. Class C Shares, Series 2

In addition to the rights, privileges, restrictions and conditions attaching to the Class C Shares as a class, the Class C Shares, Series 2 shall have the following rights, privileges, restrictions and conditions:

| (a) | Voting Rights: The holders of the Class C Shares, Series 2 shall be entitled to receive notice of and to attend all annual and special meeting of the shareholders of the Corporation and to such number of votes for each Class C Share, Series 2, held by them as shall have been fixed by the directors by resolution prior to the issue of Class C Shares, Series 2, as set forth in clause 3.I.(h). |

4. Special Shares

The rights, privileges, restrictions and conditions attaching to the Special Shares are as follows:

| (a) | Series: The Special Shares may at any time or from time to time be issued in one or more series. The board of directors of the Corporation may from time to time before the issue thereof fix the number of shares in, and determine the designation, rights, privileges, restrictions and conditions attaching to the shares of, each series of Special Shares. |

| (b) | Priority: The Special Shares shall be entitled to priority over the Class C Shares and the Common Shares and all other shares ranking junior to the Special Shares with respect to the payment of dividends and the distribution of assets of the Corporation in the event of any liquidation, dissolution or winding-up of the Corporation or other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs. |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

| (c) | Voting Rights: Except as otherwise provided by law, the holders of the Special Shares shall not, as such, be entitled to receive notice of or to attend any meeting of the shareholders of the Corporation and shall not be entitled to vote at any such meeting. Without limiting the generality of the foregoing, the holders of the Special Shares shall not be entitled to vote separately as a class on any proposal to amend the Articles of the Corporation to: |

| (i) | increase or decrease any maximum number of authorized Special Shares, or increase any maximum number of authorized shares of a class having rights or privileges equal or superior to the Special Shares; or |

| (ii) | effect an exchange, reclassification or cancellation of all or part of the Special Shares; or |

| (iii) | create a new class of shares equal or superior to the Special Shares. |

McCarthy Tétrault TDO-CORP #6828586 / v. 1

SCHEDULE II

| 1. | The number of directors of the Corporation at any time shall be such number within the minimum and maximum number of directors set forth in the articles of the Corporation as is determined from time to time by resolution of the directors in light of the Corporation’s contractual obligations in effect from time to time. |

| 2. | Subject to the Act and Corporation’s contractual obligations then in effect, the directors may fill any vacancies among the directors, whether arising due to an increase in the number of directors within the minimum and maximum number of directors set forth in the articles of the Corporation or otherwise. |

| 3. | The directors shall be divided into three classes, with one-third of the directors to be elected for a term of one year, one-third for a term of two years and one-third for a term of three years, so that the term of office of one-third of the directors shall expire each year. At each election of directors after the effective date hereof to elect directors whose terms have expired, directors shall be elected for a term of three years. In any election or appointment of a director to fill a vacancy created by any director ceasing to hold office, the election or appointment shall be for the unexpired term of the director who has ceased to hold office. If the number of directors is changed, any increase or decrease shall be apportioned among the classes of directors in such a manner as will maintain or attain, to the extent possible, an equal number of directors in each class of directors. If such equality is not possible, the increase or decrease shall be apportioned among the classes of directors in such a manner that the difference in the number of directors in any two classes shall not exceed one. |

| 4. | If at any time or from time to time any single shareholder, together with each “affiliate” “controlled” by that shareholder (as such terms are defined in Rule 12b-2 under the Securities and Exchange Act of 1934 (United States) (the “Exchange Act”) or any group of which they are members, “beneficially owns” (as such term is defined pursuant to Section 13(d) of the Exchange Act) not less than twelve and one-half per cent (12.5%) of the common shares issued and outstanding at that time, then for as long as that condition continues, in order for any resolution of the directors on any of the following matters to be approved by the directors, such resolution must be approved by a seventy-five per cent (75%) majority of the directors then in office; |

McCarthy Tétrault TDO-CORP #6828589 / v. 1

| a. | Hiring or terminating the employment of the chief executive officer or any co-chief executive officer of the Corporation; |

| b. | Issuing any shares of capital stock for a purchase price, or incurring indebtedness, in an amount of US$25 million or more; |

| c. | Disposing of any material single asset, or all or substantially all of the assets of the Corporation or approving the sale or merger of the Corporation; |

| d. | Acquiring a substantial interest in any other entity or entering into any major strategic alliance; and |

| e. | Entering into or changing the terms of any agreement or transaction with Wasserstein Perella Partners, L.P., Wasserstein Perella Offshore Partners, L.P., WPPN Inc., Richard L. Gelfond or Bradley J. Wechsler (other than agreements in the ordinary course of business, such as employment agreements). |

McCarthy Tétrault TDO-CORP #6828589 / v. 1

- 2 -

|

Industry Canada | Industrie Canada |

| Certificate of Amendment |

Certificat de modification | |

| Canada Business Corporations Act |

Loi canadienne sur les sociétés par actions | |

| IMAX CORPORATION

|

399473-2

| |||

| Name of corporation-Dénomination de la société | Corporation number-Numéro de la société | |||

| I hereby certify that the articles of the above-named corporation were amended:

|

Je certifie que les statuts de la société susmentionnée ont été modifiés: | |||

| a) under section 13 of the Canada Business Corporations Act in accordance with the attached notice; |

¨ |

a) en vertu de 1’article 13 de la Loi canadienne sur les sociétés par actions, conformément à 1’avis ci-joint; | ||

| b) under section 27 of the Canada Business Corporations Act as set out in the attached articles of amendment designating a series of shares; |

¨ |

b) en vertu de 1’article 27 de la Loi canadienne sur les sociétés par actions, tel qu’il est indiqué dans les clauses modificatrices ci-jointes désignant une série d’actions; | ||

| c) under section 179 of the Canada Business Corporations Act as set out in the attached articles of amendment; |

þ |

c) en vertu de 1’article 179 de la Loi canadienne sur les sociétés par actions, tel qu’il est indiqué dans les clauses modificatrices ci-jointes; | ||

| d) under section 191 of the Canada Business Corporations Act as set out in the attached articles of reorganization; |

¨ |

d) en vertu de 1’article 191 de la Loi canadienne sur les sociétés par actions, tel qu’il est indiqué dans les clauses de réorganisation ci-jointes; | ||

|

Director - Directeur |

June 25, 2004 / le 25 juin 2004 Date of Amendment - Date de modification |

|

|

Industry Canada | Industrie Canada | ELECTRONIC TRANSACTION REPORT | RAPPORT DE LA TRANSACTION ÉLECTRONIQUE | ||||

| Canada Business Corporations Act |

Loi canadienne sur les sociétés par actions |

ARTICLES OF AMENDMENT (SECTIONS 27 OR 177) | CLAUSES MODIFICATRICES (ARTICLES 27 OU 177) |

| Processing Type - Mode de traitement: E-Commerce/Commerce-É | ||

| 1. Name of Corporation - Dénomination de la société | 2. Corporation No. - N° de la société | |

| IMAX CORPORATION |

399473-2 | |

| 3. | The articles of the above-named corporation are amended as follows: |

| Les statuts de la société mentionnée ci-dessus sont modifiés de la facon suivante: |

That the Certificate and Articles of Amalgamation dated January 1, 2002 of the Corporation be amended by deleting Schedule I including I-A of Article 3 and Schedule II of Article 7 thereof and replacing those schedules with the following Schedule I including I-A and Schedule II:

SCHEDULE I

The Corporation is authorized to issue an unlimited number of Common Shares and an unlimited number of Special Shares, issuable in series. Schedule I-A sets forth the rights, privileges, restrictions and conditions of such shares.

SCHEDULE I-A

1. Common Shares

The rights, privileges, restrictions and conditions attaching to the Common Shares are as follows:

(a) Payment of Dividends: The holders of the Common Shares shall be entitled to receive dividends if, as and when declared by the Board of Directors of the Corporation out of the assets of the Corporation properly applicable to the payment of dividends in such amounts and payable in such manner as the Board of Directors may from time to time determine. Subject to the rights of the holders of any other class of shares of the Corporation entitled to receive dividends in priority to or ratably with the holders of the Common Shares, the Board of Directors may in their sole discretion declare dividends on the Common Shares to the exclusion of any other class of shares of the Corporation.

(b) Participation upon Liquidation, Dissolution or Winding-Up: In the event of the liquidation, dissolution or winding-up of the Corporation or other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs, the holders of the Common Shares shall, subject to the rights of the holders of any other class of shares of the Corporation entitled to receive the assets of the Corporation upon such a distribution in priority to or ratably with the holders of the Common Shares, be entitled to participate ratably in any distribution of the assets of the Corporation.

(c) Voting Rights: The holders of the Common Shares shall be entitled to receive notice of and to attend all annual and special meetings of the shareholders of the Corporation and to one vote in respect of each Common Share held at all such meetings.

2. Special Shares

The rights, privileges, restrictions and conditions attaching to the Special Shares are as follows:

(a) Series: The Special Shares may at any time or from time to time be issued in one or more series. The Board of Directors of the Corporation may from time to time before the issue thereof fix the number of shares in, and determine the designation, rights, privileges, restrictions and conditions attaching to the shares of, each series of Special Shares.

(b) Priority: The Special Shares shall be entitled to priority over the Common Shares and all other shares ranking junior to the Special Shares with respect to the payment of dividends and the distribution of assets of the Corporation in the event of any liquidation, dissolution or winding-up of the Corporation or other distribution of assets of the Corporation among its shareholders for the purpose of winding-up its affairs.

(c) Voting Rights: Except as otherwise provided by law, the holders of the Special Shares shall not, as such, be entitled to receive notice of or to attend any meeting of the shareholders of the Corporation and shall not be entitled to vote at any such meeting. Without limiting the generality of the foregoing, the holders of the Special Shares shall not be entitled to vote separately as a class on any proposal to amend the Articles of the Corporation to:

(i) increase or decrease any maximum number of authorized Special Shares, or increase any maximum number of authorized shares of a class having rights or privileges equal or superior to the Special Shares; or

(ii) effect an exchange, reclassification or cancellation of all or part of the Special Shares; or

(iii) create a new class of shares equal or superior to the Special Shares.

SCHEDULE II

1. The number of directors of the Corporation at any time shall be such number within the minimum and maximum number of directors set forth in the articles of the Corporation as is determined from time to time by resolution of the directors in light of the Corporation’s contractual obligations in effect from time to time.

2. Subject to the Canada Business Corporations Act and the Corporation’s contractual obligations then in effect, the directors may fill any vacancies among the directors, whether arising due to an increase in the number of directors within the minimum and maximum number of directors set forth in the articles of the Corporation or otherwise.

3. The directors shall be divided into three classes and for a term of three years. In any election or appointment of a director to fill a vacancy created by any director ceasing to hold office, the election or appointment shall be for the unexpired term of the director who has ceased to hold office. If the number of directors is changed, any increase or decrease shall be apportioned among the classes of directors in such a manner as will maintain or attain, to the extent possible, an equal number of directors in each class of directors. If such equality is not possible, the increase or decrease shall be apportioned among the classes of directors in such a manner that the difference in the number of directors in any two classes shall not exceed one.

4. Meetings of shareholders may be held in New York, New York; Los Angeles, California; Chicago, Illinois; Houston, Texas; Philadelphia, Pennsylvania; San Diego, California; Dallas, Texas; Phoenix, Arizona; Detroit, Michigan; San Antonio, Texas and Washington, DC; or in any place in Canada that the directors from time to time determine.

| Date | Name - Nom | Signature | Capacity of - en qualité | |||

| 2004-06-25 | G. MARY RUBY | AUTHORIZED OFFICER |

Page 2 of 2

|

|

Industry Canada |

Industrie Canada |

| Certificate of Amendment | Certificat de modification | |

| Canada Business Corporations Act | Loi canadienne sur les sociétés par actions |

IMAX CORPORATION

Corporate name / Dénomination sociale

399473-2

Corporation number / Numéro de société

| I HEREBY CERTIFY that the articles of the above-named corporation are amended under section 178 of the Canada Business Corporations Act as set out in the attached articles of amendment. | JE CERTIFIE que les statuts de la société susmentionnée sont modifiés aux termes de 1’article 178 de la Loi canadienne sur les sociétés par actions, tel qu’il est indiqué dans les clauses modificatrices ci-jointes. |

Marcie Girouard

Director / Directeur

2013-06-11

Date of Amendment (YYYY-MM-DD)

Date de modification (AAAA-MM-JJ)

|

Industry Canada |

Industrie Canada |

Form 4 Articles of Amendment Canada Business Corporations Act (CBCA)(s.27 or 177) |

Formulaire 4 Clauses modificatrices Loi canadienne sur les sociétés par actions (LCSA) (art. 27 ou 177) |

| 1 | Corporate name |

Dénomination sociale

IMAX CORPORATION

| 2 | Corporation number |

Numéro de la société

399473-2

| 3 | The articles are amended as follows |

Les statuts sont modifiés de la façon suivante

The corporation amends the other provisions as follows:

Les autres dispositions sont modifiées comme suit:

See attached schedule / Voir l’annexe ci-jointe

| 4 | Declaration: I certify that I am a director or an officer of the corporation. |

Déclaration : J’atteste que je suis un administrateur ou un dirigeant de la société.

| Original signed by / Original signé par G. Mary Ruby | ||

| G. Mary Ruby 905-403-6404 |

Misrepresentation constitutes an offence and, on summary conviction, a person is liable to a fine not exceeding $5000 or to imprisonment for a term not exceeding six months or both (subsection 250 (l) of the CBCA).

Faire une fausse déclaration constitue une infraction et son auteur, sur déclaration de culpabilité par procédure sommaire, est passible d’une amende maximale de 5 000 $ et d’un emprisonnement maximal de six mois, ou l’une de ces peines (paragraphe 250(1) de la LCSA).

You are providing information required by the CBCA. Note that both the CBCA and the Privacy Act allow this information to be disclosed to the public. It will be stored in personal information bank number IC/PPU-049.

Vous fournissez des renseignements exigés par la LCSA. II est à noter que la LCSA et la Loi sur les renseignements personnels permettent que de tels renseignements soient divulgués au public. Its seront stockés dans la banque de renseignements personnels numéro IC/PPU-049.

|

IC 3069 (2008/04) |

Schedule / Annexe

Other Provisions / Autres dispositions

That the Certificate and Articles of Amendment dated June 25, 2004 of the Corporation be amended by deleting Schedule II and substituting Schedule II with the following Schedule II:

SCHEDULE II

1. The number of directors of the Corporation at any time shall be such number within the minimum and maximum number of directors set forth in the articles of the Corporation as is determined from time to time by resolution of the directors in light of the Corporation’s contractual obligations in effect from time to time.

2. Subject to the Canada Business Corporations Act and the Corporation’s contractual obligations then in effect, the directors may fill any vacancies among the directors, whether arising due to an increase in the number of directors within the minimum and maximum number of directors set forth in the articles of the Corporation or otherwise.

3. Directors elected at a meeting of shareholders will hold offices until the next annual meeting of shareholders or until their successors are elected or appointed.

4. Meetings of shareholders may be held in New York, New York; Los Angeles, California; Santa Monica, California; San Diego, California; Chicago, Illinois; Houston, Texas; San Antonio, Texas; Dallas, Texas; Philadelphia, Pennsylvania; Phoenix, Arizona; Detroit, Michigan; and Washington, DC; or in any place in Canada that the directors from time to time determine.

Industry Canada

Industry Canada