Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SmartStop Self Storage, Inc. | d540533d8k.htm |

First Quarter

Update May 21, 2013

Strategic Storage Trust, Inc.

Exhibit 99.1 |

Disclaimers

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements

contained

in

this

material,

other

than

historical

facts,

may

be

considered

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933,

as

amended

(the

“Securities

Act”)

and

Section

21E

of

the

Securities

Exchange

Act

of

1934,

as

amended

(the

“Exchange

Act”).

We

intend

for

all

such

forward

looking

statements

to

be

covered

by

the

applicable

safe

harbor

provisions

for

forward-looking

statements

contained

in

Section

27A

of

the

Securities

Act

and

Section

21E

of

the

Exchange

Act,

as

applicable.

Such

statements

include,

in

particular,

statements

about

our

plans,

strategies,

and

prospects

and

are

subject

to

certain

risks

and

uncertainties,

including

known

and

unknown

risks,

which

could

cause

actual

results

to

differ

materially

from

those

projected

or

anticipated.

Therefore,

such

statements

are

not

intended

to

be

a

guarantee

of

our

performance

in

future

periods.

Such

forward-looking

statements

can

generally

be

identified

by

our

use

of

forward-looking

terminology

such

as

“may,”

“will,”

“expect,”

“intend,”

“anticipate,”

“estimate,”

“believe,”

“continue,”

or

other

similar

words.

Readers

are

cautioned

not

to

place

undue

reliance

on

these

forward-looking

statements,

which

speak

only

as

of

the

date

this

report

is

filed

with

the

Securities

and

Exchange

Commission.

We

cannot

guarantee

the

accuracy

of

any

such

forward

looking

statements

contained

in

this

material,

and we do not intend to publicly update or revise any forward-looking statements, whether

as a result of new information, future events, or otherwise. Any

such

forward-looking

statements

are

subject

to

risks,

uncertainties,

and

other

factors

and

are

based

on

a

number

of

assumptions

involving

judgments

with

respect

to,

among

other

things,

future

economic,

competitive,

and

market

conditions,

all

of

which

are

difficult

or

impossible

to

predict

accurately.

To

the

extent

that

our

assumptions

differ

from

actual

results,

our

ability

to

meet

such

forward-looking

statements,

including

our

ability

to

generate

positive

cash

flow

from

operations

and

provide

distributions

to

stockholders,

and

our

ability

to

find

suitable

investment

properties,

may

be

significantly

hindered.

All

forward-looking

statements

should

be

read

in

light

of

the

risks

identified

in

our

prospectus

and

supplements.

Risk Factors

2

•

See our Form 10-K, Form 10-K/A, and recent Form 10-Q for specific risks associated

with an investment in Strategic Storage Trust, Inc. •

As of March 31, 2013, our accumulated deficit was approximately $64.1 million, and our

operations will not be profitable in 2013. •

No public market currently exists for shares of our common stock

and we may not list our shares on a national securities exchange before three to five years

after completion of this offering, if at all. It may be difficult to sell your shares.

If you sell your shares, it will likely be at a substantial discount.

•

We have paid distributions from sources other than our cash flows from operations, including

from the net proceeds from our initial public offering. We are not prohibited from

undertaking such activities by our charter, bylaws or investment

policies, and we may use an unlimited amount from any source to

pay our distributions. Until we generate

operating cash flows sufficient to pay distributions to you, we may pay distributions from the

net proceeds of this offering or from borrowings in anticipation of future cash flows.

We also may be required to sell assets or issue new securities for cash in order to pay

distributions. Any such actions could reduce the amount of capital we ultimately invest in

assets and negatively impact the amount of income available for future distributions.

•

We have no employees and must depend on our advisor to select investments and conduct our

operations, and there is no guarantee that our advisor will devote adequate time or

resources to us. •

Our board of directors may change any of our investment objectives, including our focus on

self storage facilities. •

We will pay substantial fees and expenses to our advisor, its affiliates and participating

broker-dealers, which will reduce cash available for investment and distribution.

•

There are substantial conflicts of interest among us and our sponsor, advisor, property

manager and dealer manager. •

We may fail to remain qualified as a REIT, which could adversely

affect our operations and our ability to make distributions.

•

We may incur substantial debt, which could hinder our ability to

pay distributions to our stockholders or could decrease the value of your investment.

•

Future distribution declarations are at the sole discretion of our board of directors and are

not guaranteed. Since our inception, our cumulative distributions have exceeded

cumulative GAAP earnings. We cannot assure you that we will achieve any of our investment

objectives. •

We encourage you to review our SEC filings at www.sec.gov.

Disclaimer and Risk Factors |

Strategic

Storage Trust, Inc. About Us

3

•

First and only publicly registered non-traded REIT

focused on self storage

•

Sponsor was ranked 7th in Mini-Storage Messenger’s

Top Operators List in 2012

•

As of 3/31/13, SSTI wholly owned 110 properties in

17 states and Ontario, Canada with approximately

70,000 units and approximately 9.2 million rentable

square feet |

Investment

Philosophy Stabilized Properties

•

70% occupancy

•

More predictable income

Lease-Up Properties

•

Occupancy below 70%

•

Greater opportunity for growth

Stabilized + Lease-Up Properties

=

Income + Growth

=

Stockholder Value

4 |

Agenda

•

Performance Highlights

•

Portfolio Update

•

Self Storage Operations –

Why it Works

•

Vision

5 |

Performance

Highlights Cash Flow from Operations

•

$2 Million for Three Months Ended 3/31/2012

•

$4 Million for Three Months Ended 3/31/2013

103%

IPA Modified Funds from Operations

•

$1.1 Million for Three Months Ended 3/31/2012

•

$4.6 Million for Three Months Ended 3/31/2013

315%

6 |

Performance

Highlights IPA Modified Funds From Operations

•

10% increase in Q1 2013 vs. Q4 2012

•

74% increase in Q1 2013 vs. Q3 2012

•

373% increase in Q1 2013 vs. Q2 2012

•

315% increase in Q1 2013 vs. Q1 2012

7 |

Performance

Highlights Same Store Performance

•

First Quarter 2013 vs. 2012

•

Revenues

9.0%

•

Net Operating Income

19.0%

2013

2012

•

Property Operating Expenses as a

Percentage of Revenue

39.9%

45%

•

Number of Facilities

90

90

•

Occupancy

81%

73%

8 |

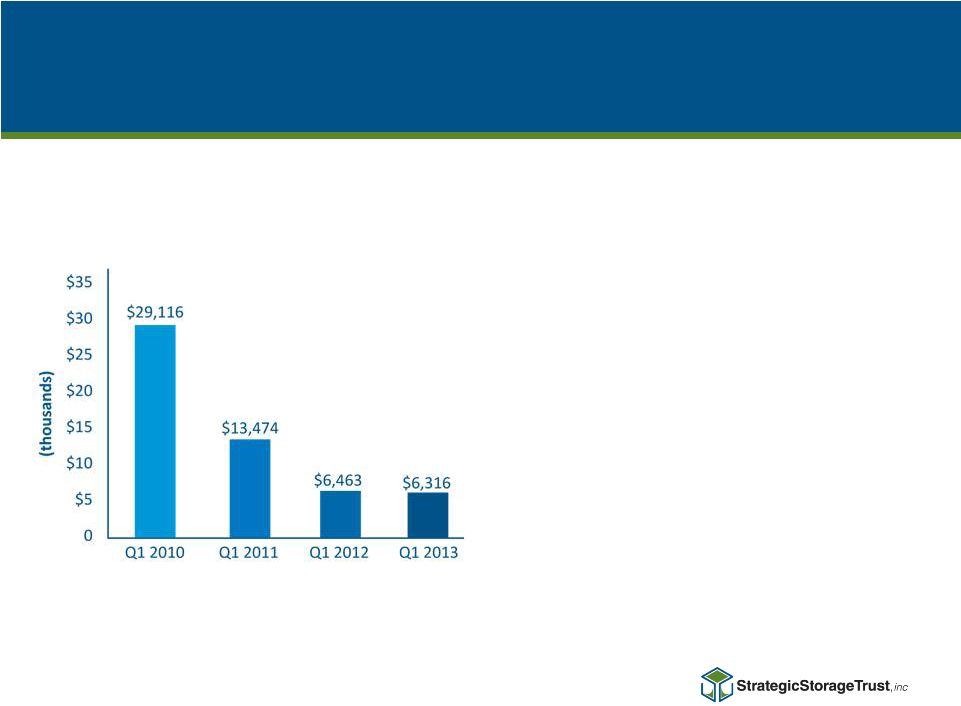

Performance

Highlights G&A Per Property

Q1

2010

$29,116

Q1

2011

$13,474

(53.7% decrease)

Q1

2012

$6,463

(52.0% decrease)

Q1

2013

$6,316

(2.3% decrease)

G&A Per Property by Quarter

9 |

Agenda

•

Performance Highlights

•

Portfolio Update

•

Self Storage Operations –

Why it Works

•

Vision

10 |

Portfolio

Update Wholly-Owned Properties by Year

11 |

Portfolio

Update 12

Rentable Square Feet

by State (as of 3/31/13)

•

110 properties

•

17 states, 1 province

•

70,190 units

•

9.2 million SF |

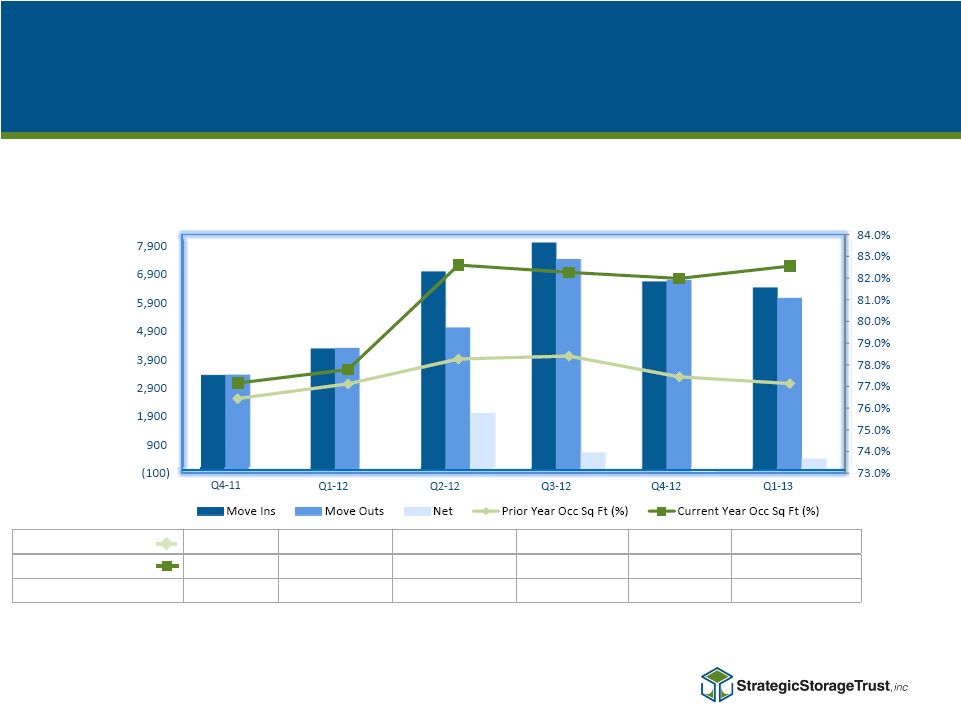

Portfolio

Update Prior Year Occ Sq Ft (%)

76.4%

76.1%

78.3%

78.4%

77.4%

73.3%

Current Year Occ Sq Ft (%)

77.2%

77.1%

82.6%

82.3%

82.0%

81.6%

No. of Properties

41

45

60

71

76

89

13

* Note: Highest occupancy achieved in 2011 was 79.3% on 7/31/11.

Does not include Canadian properties, but does include consolidated joint venture, SF

property. Same Store Occupancy

Q4 -

2011 -

Q1 -

2013 |

Portfolio

Update Occ Sq Ft(%)

51.00%

61.00%

67.10%

69.00%

74.60%

Q1-12

Q2-12

Q3-12

Q4-12

Q1-13

14 |

Portfolio

Update No. of Properties

8

8

10

16

16

16

16

16

16

Occ Sq Ft (%)

60.90%

63.00%

65.80%

72.60%

73.80%

75.10%

75.80%

77.40%

78.90%

15

Note: At acquisition, the occupancy for the properties in this portfolio was 71.3% for

combined 16 stores |

Agenda

•

Performance Highlights

•

Portfolio Update

•

Self Storage Operations –

Why it Works

•

Vision

16 |

Self Storage

Operations – Why it Works

Self Storage Is An Operating Business

Increasing Revenues

Decreasing Expenses

Increasing Occupancy

=

Increasing Net Operating Income

17

Because We Can |

Increasing

Revenues -

Existing customers

-

Street (asking) rates

-

Merchandise sales

-

Truck rentals

Self Storage Operations –

Why it Works

18

•

Increasing rates based on dynamic pricing

•

Convenience fees

•

Tenant insurance

•

Ancillary sales |

Self Storage

Operations – Why it Works

Decreasing Expenses

19

•

Largest Components

•

Economies of Scale

•

National Pricing Power |

Self Storage

Operations – Why it Works

Discounts

Promotions

Revenues

Occupancy =

Pricing Power

20 |

Self Storage

Operations – Why it Works

Why it Works

And We Are Just Now Getting to Busy Season!

21

•

167,000 Unit Code Permutations for Price

Changes

•

Asking Rents Higher Than in Place Leases

•

Move Outs Lead to Higher Revenues |

Self Storage

Operations – Why it Works

Time

Technology Driven Marketing

22

•

Properties Maturing

•

Key People in Place

•

Training Initiatives

•

Economies of Scale

•

Pay Per Click Specific to Time of Day

•

Relevant Search Engine Optimization

•

Reservation Marketing –

Sense of Urgency |

Self Storage

Operations – Why it Works

Technology Size Advantage

-

Over 15,000 price changes in 2012

-

Sense of urgency

-

Improved conversion

23

•

Reservation system

•

Real time analytics dashboard

•

Logic based operating system for dynamic unit pricing

•

Reservation management |

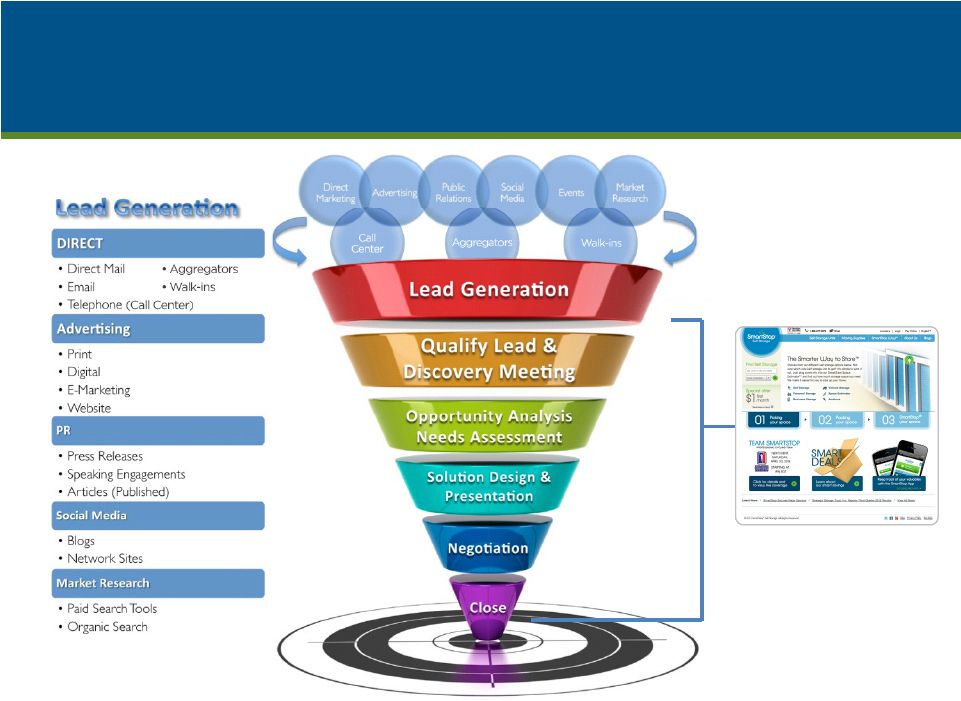

Marketing

- It’s All About Reservations!

24 |

Website

25 |

Website

26 |

Agenda

•

Performance Highlights

•

Portfolio Update

•

Self Storage Operations –

Why it Works

•

Vision

27 |

Strategic

Vision $2.16

(Billion)

$4.93

(Billion)

$2.29

(Billion)

$28.69

(Billion)

PUBLICLY TRADED SELF STORAGE REITS

Market Cap

(1)

PUBLIC NON-TRADED SELF STORAGE REIT

(1)

Bloomberg 5/20/2013

28 |

Questions?

29 |

Recap

Property Performance

•

Strategy is Working

Financials

•

Double Digit Same Store NOI Increase

Portfolio Update

•

Buying for Income AND Growth

Vision

•

We Are on Path

30 |

May 21,

2013 Strategic Storage Trust, Inc.

First Quarter Update |