Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Wendy's Co | d533109d8k.htm |

©

2013 Oldemark LLC

First Quarter 2013

First Quarter 2013

Earnings Conference Call

Earnings Conference Call

May 8, 2013

May 8, 2013

Exhibit 99.1 |

©

2013 Oldemark LLC

JOHN BARKER

JOHN BARKER

Chief Communications

Chief Communications

Officer

Officer

2 |

Today’s Agenda

Today’s Agenda

CEO Overview

Emil Brolick

Financial Update

Steve Hare

Q&A

3 |

4

Forward-Looking Statements and Non-GAAP Financial Measures

Forward-Looking Statements and Non-GAAP Financial Measures

This presentation, and certain information that management may discuss in connection with

this presentation, contains certain statements that are not historical

facts, including information concerning possible or assumed future results of our

operations. Those statements constitute “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995 (The “Reform Act”). For

all forward-looking statements, we claim the protection of the safe harbor for

forward-looking statements contained in the Reform Act.

Many important factors could affect our future results and could cause those results to

differ materially from those expressed in or implied by our forward-looking

statements. Such factors, all of which are difficult or impossible to predict

accurately, and many of which are beyond our control, include but are not limited to those identified under

the caption “Forward-Looking Statements” in our news release issued on May

8, 2013 and in the “Special Note Regarding Forward-Looking Statements and

Projections” and “Risk Factors” sections of our most recent Form 10-K /

Form 10-Qs.

In addition, this presentation and certain information management may

discuss in connection with this presentation reference non-GAAP financial

measures, such as adjusted earnings before interest, taxes, depreciation and

amortization, or adjusted EBITDA, and adjusted earnings per share. Adjusted EBITDA and

adjusted earnings per share exclude certain expenses, net of certain benefits.

Reconciliations of non-GAAP financial measures to the most directly comparable

GAAP financial measures are provided in the Appendix to this presentation, and are included in

our news release issued on May 8, 2013 and posted on www.aboutwendys.com.

|

©

2013 Oldemark LLC

EMIL BROLICK

EMIL BROLICK

President & CEO

President & CEO

5 |

Adjusted

EBITDA* $77.3 mil

vs.

$63.9 mil

Adjusted EPS*

$0.03

vs.

$0.01

Company-Operated

1.0%

vs. 0.8%

SSS

6

Q1 2013 Highlights

Q1 2013 Highlights

2013

2012

*See reconciliation of Adjusted EBITDA and Adjusted EPS in the appendix.

|

©

2013 Oldemark LLC

Adjusted EBITDA

Adjusted EBITDA

$350 to $360 million

$350 to $360 million

Reaffirm

Reaffirm

Adjusted EPS

Adjusted EPS

$0.20 to $0.22

$0.20 to $0.22

Raising

Raising

2013 OUTLOOK:

2013 OUTLOOK:

7 |

Expect

2012 Expect 2012

Initiatives to

Initiatives to

Contribute to

Contribute to

Solid 2013

Solid 2013

8 |

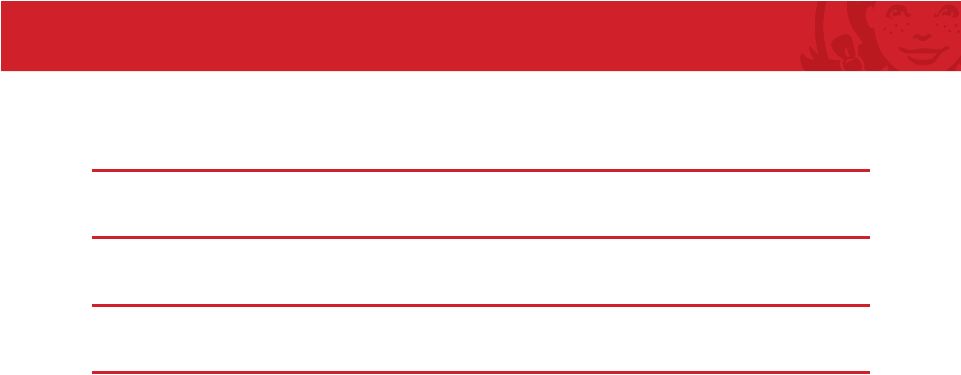

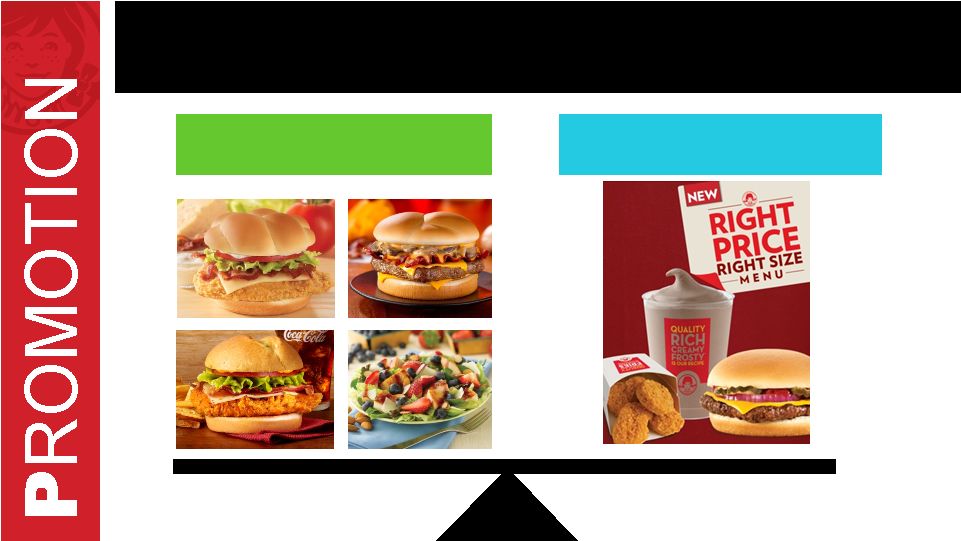

Right

Price Right Size Menu Development Right Price Right Size Menu Development

9 |

Image

Activation Beginning to Support SSS Image Activation Beginning to Support SSS

and Accelerate Re-imaging

and Accelerate Re-imaging

Opened 48 Tier I Reimages

Completed Tier II & III

Design Work

10 |

Reduction in Number of Restaurants

Reduction in Number of Restaurants

Serving Breakfast

Serving Breakfast

Negative Impact on SSS

Positive Impact on EBITDA

11 |

Ongoing

Cost Reduction Ongoing Cost Reduction

G&A Management & Efficiencies

Reduction in Beverage Costs

Packaging Optimization

RFPs with Purchasing Co-op

12 |

HIGH

LOW

FUNCTIONAL

EMOTIONAL

BRAND VISION…

BRAND VISION…

13

COMPETITOR

A

COMPETITOR

B

NEW QSRs |

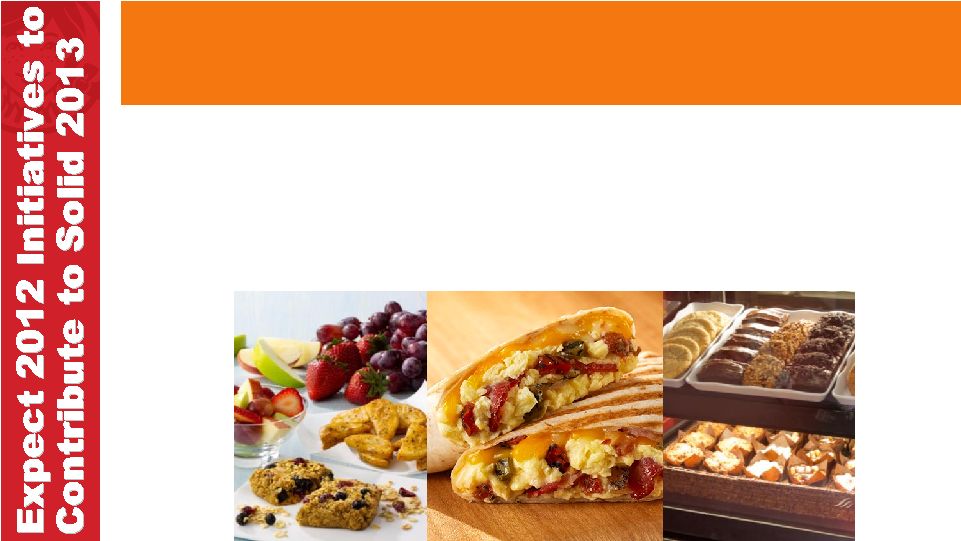

PRICE

PRICE

New QSR Quality at QSR Price

New QSR Quality at QSR Price

PRODUCT

PRODUCT

Play a different game …

Play a different game …

Superior

Superior

perceived quality, competitive price

perceived quality, competitive price

PEOPLE

PEOPLE

5-Star Performers

5-Star Performers

PERFORMANCE

PERFORMANCE

Keeping the brand promise

Keeping the brand promise

PROMOTION

PROMOTION

Strategically driven, tactically brilliant

Strategically driven, tactically brilliant

PLACE

PLACE

The complete brand experience

The complete brand experience

14

Enabling Profitable Growth

Enabling Profitable Growth

THE RECIPE TO WIN

THE RECIPE TO WIN |

NEW QSR

QUALITY AT QSR PRICE 15 |

PLAYING A

DIFFERENT

GAME

16 |

PREMIUM

PRICE / VALUE

BUILD BIG BRAND, DRIVE TRAFFIC

17 |

2013 Tier II

2013 Tier II

Columbus, OH

Columbus, OH

2013 Tier III

2013 Tier III

Salt Lake City

Salt Lake City

18 |

19

Tier III

Tier III

Interior

Interior |

20

Core Organic

Growth

Strategies

Shareholder

Value-Enhancing

Initiatives |

Todd

Penegor to Become Chief Financial Officer

September 1, 2013

CFO Steve Hare to Retire

from Wendy’s

21 |

©

2013 Oldemark LLC

STEVE HARE

STEVE HARE

Chief Financial Officer

Chief Financial Officer

22 |

23

Wendy’s Q1 2013 Highlights

Wendy’s Q1 2013 Highlights

Company

Restaurant Margin +100bps

Q1 2013 12.8%

Q1 2012 11.8%

Company

Restaurant Margin +100bps

Q1 2013 12.8%

Q1 2012 11.8%

February

March (local)

January

Q1 2013 North America

Same-Store Sales

1-Year

2-Year

Company-Operated 1.0%

1.8%

Franchise

0.6% 1.3% |

24

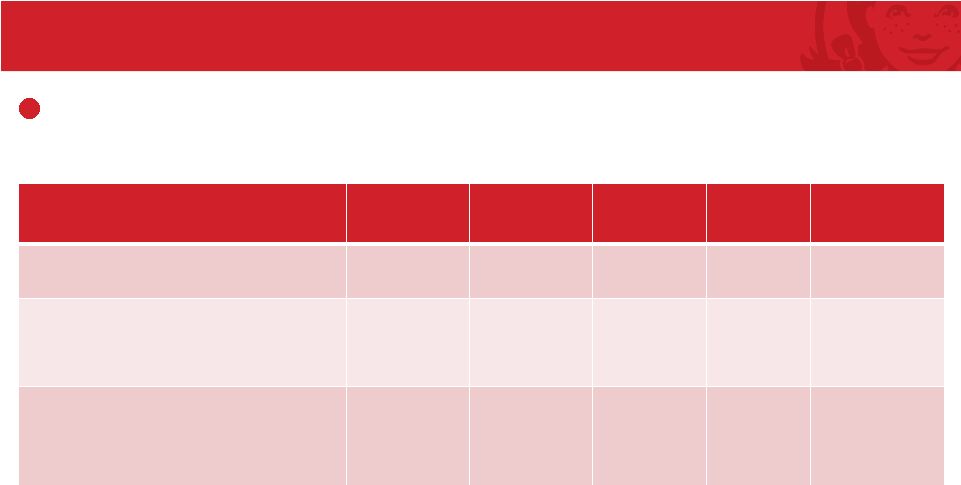

Q1 2013 Financial Summary

Q1 2013 Financial Summary

Q1

2013

Q1

2012

$

Change

%

Change

Sales

530.7

$

519.9

$

10.8

$

2.1%

Franchise revenues

73.0

73.3

(0.3)

-0.4%

Total revenues

603.7

$

593.2

$

10.5

$

1.8%

Adjusted EBITDA*

77.3

$

63.9

$

13.4

$

21.0%

Adjusted EPS*

0.03

$

0.01

$

0.02

$

200.0%

($ in millions except per share amounts)

(Unaudited)

*See reconciliation of Adjusted EBITDA and Adjusted EPS in the appendix.

|

Adjusted

Income and Special Items Adjusted Income and Special Items

25

*See reconciliation of Adjusted Income and Adjusted EPS in the appendix.

(In Thousands Except Per Share Amounts)

(Unaudited)

Per share

Per share

Adjusted income and adjusted earnings per share*

13,101

$

0.03

$

3,347

$

0.01

$

(Less) plus:

Depreciation of assets that will be replaced as part of the Image Activation initiative

(9,068)

(0.02)

-

-

Facilities relocation costs and other transactions

(1,900)

(0.00)

(3,808)

(0.01)

Impairment of long-lived assets

-

-

(2,783)

(0.01)

Gain on sale of investment, net

-

-

17,978

0.05

Total adjustments

(10,968)

(0.02)

11,387

0.03

Net income

2,133

0.01

14,734

0.04

Net income attributable to noncontrolling interests

-

-

(2,384)

(0.01)

Net income and earnings per share attributable to The Wendy's Company

2,133

$

0.01

$

12,350

$

0.03

$

First Quarter

2013

2012 |

26

2013 Image Activation Depreciation

2013 Image Activation Depreciation

Assets replaced are depreciated from the beginning of the year

until closure for construction

Q1

Q2

Q3

Q4

2013

# of reopenings

3

24

44

29

100

# of restaurants

depreciated

100

73

29

-

100

% of IA depreciation

adjustment

~65%

~25%

~10%

0%

$20M to

$25M |

27

Q1 2013 Cash Flow Highlights

Q1 2013 Cash Flow Highlights

($ in millions)

(unaudited)

Cash flow from operations

32.6

$

Capital expenditures

40.0

Beginning cash balance

453.4

$

Change in cash

(24.7)

Ending cash balance

428.7

$

Q1 2013 |

28

Selected Balance Sheet Highlights

Selected Balance Sheet Highlights

($ in millions)

(unaudited)

Cash

429

$

Senior Debt

1,419

$

Capital Leases and Other Debt

37

Total Debt

1,456

$

TTM Adjusted EBITDA*

347

$

Total Debt / TTM Adjusted EBITDA*

4.2x

Net Debt / TTM Adjusted EBITDA*

3.0x

March 31, 2013

*See reconciliation of Adjusted EBITDA in the appendix. |

29

•Refinancing

of $350M of the $1,119M senior secured Term Loan B into

a new senior secured Term Loan A

•Repricing of

the remaining Term Loan B balance of approximately $769M by reducing

the interest rate margin and floor •Extension of the maturity of the $200M revolving credit facility

by one year

2013 Debt Refinancing Expected to Save

2013 Debt Refinancing Expected to Save

~$20 million in Annualized Interest Expense

~$20 million in Annualized Interest Expense

$50M

$50M

Annualized Net Interest Expense Savings

Annualized Net Interest Expense Savings

vs. 2011 from 2012 and 2013 Refinancings

vs. 2011 from 2012 and 2013 Refinancings |

Image

Activation Results* Image Activation Results*

Year 1 average sales

lift exceeded 25%

Sales sustaining at

~20% vs. pre-remodel

volumes

2011

10 concept reimages

Average sales lift

exceeding 25%

since re-opening

Sales sustaining at

~18% vs. pre-remodel

volumes

2012

48 Tier I reimages

* Results exclude 2 non-comparable restaurants in 2011 and 5 non-comparable

restaurants in 2012. 30 |

Image

Activation Designs Expanding Image Activation Designs Expanding

Franchise Restaurant

San Antonio, TX

International

Restaurants

714 Third Ave

June 2013

New Build

650 Broadway

June 2013

Reimage

85 Nassau St

July 2013

Reimage

Elmsford

August 2013

Reimage

NY

Openings

31 |

Image

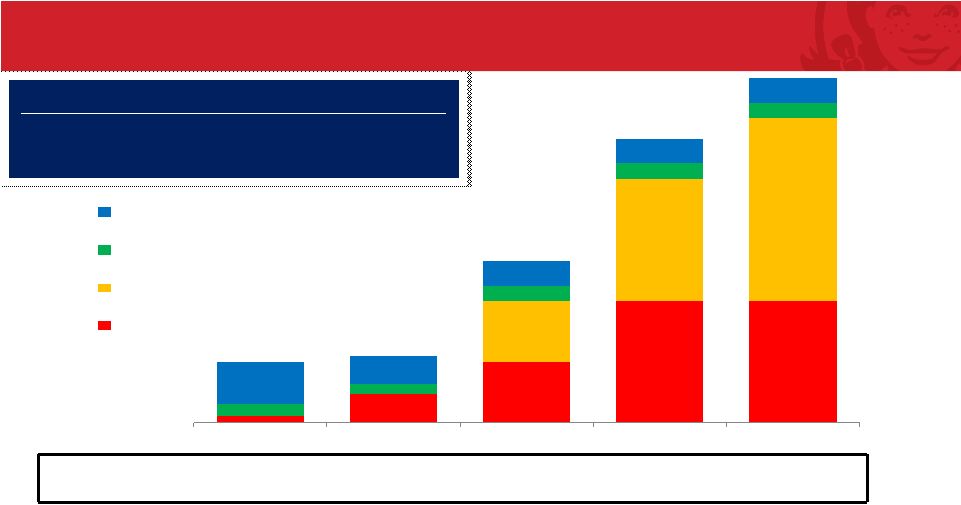

Activation Multi-Year Growth Plan Image Activation Multi-Year Growth

Plan 32

10

48

100

200

200

100

200

300

20

16

25

25

25

69

45

40

40

40

2011

2012

2013

2014

2015

Fr. New

Co. New

Fr. Reimage

Co. Reimage

Cumulative

IA Restaurants

10

76

301

766

1,331

Image Activation Progress by Year-End 2015:

•50% of Company

restaurants •1 out

of 5 restaurants in the Wendy’s System

Note: New Company restaurants were Image Activation building design beginning

in 2012; 2 of 45 new Franchise restaurants were Image Activation in

2012. Estimates based on Company’s current outlook. |

Strong Free

Cash Flow & Balance Sheet Strong Free Cash Flow & Balance Sheet

33

Accelerating Investment in

Image Activation:

Expect $440 to $500 million 2013 to 2015*

RETURN CAPITAL TO SHAREHOLDERS

RETURN CAPITAL TO SHAREHOLDERS

* Estimates based on

Company’s current outlook.

$100 million share repurchase program

authorized through 12/29/13

Current dividend yield of 2.7%

(based on share price as of 5/3/13)

CORE GROWTH PRIORITY

CORE GROWTH PRIORITY |

2013 and

Long-Term Earnings Outlook 2013 and Long-Term Earnings Outlook

Adjusted EBITDA:

$350 to $360 million,

5% to 8% increase vs. 2012

Adjusted EPS:

$0.20 to $0.22,

18% to 29% increase vs.

2012

Average annual

Adjusted EBITDA and

Adjusted EPS

growth rates in

high-single-digit to low-

double-digit range

2013

Long-Term

Estimates based on Company’s current outlook.

34 |

©

2013 Oldemark LLC

JOHN BARKER

JOHN BARKER

Chief Communications

Chief Communications

Officer

Officer

35 |

2013

Events May 23:

Annual Stockholder Meeting

June:

Begin Image Activation Market Visits with Investors

Aug. 7:

Second Quarter Earnings Release & Conference Call

36

Investor Relations Calendar

Investor Relations Calendar |

Q&A

Q&A

37 |

Appendix

Appendix

38 |

Reconciliation of Adjusted EBITDA to Net Income

Attributable to The Wendy's Company

(In Thousands)

(Unaudited)

2013

2012

Adjusted EBITDA

77,299

$

63,881

$

Less:

Depreciation and amortization

(51,797)

(32,311)

Impairment of long-lived assets

-

(4,511)

Facilities relocation costs and other transactions

(3,038)

(6,143)

Operating profit

22,464

20,916

Interest expense

(20,964)

(28,235)

Other expense, net and investment income, net

(2,271)

28,931

(Loss) income before income taxes and noncontrolling interests

(771)

21,612

Benefit from (provision for) income taxes

2,904

(6,878)

Net income

2,133

14,734

Net income attributable to noncontrolling interests

-

(2,384)

Net income attributable to The Wendy's Company

2,133

$

12,350

$

First Quarter

39 |

40

Reconciliation of Adjusted Income and Adjusted Earnings Per Share to

Net Income and Earnings Per Share Attributable to The Wendy's Company

(In Thousands Except Per Share Amounts)

(Unaudited)

Per share

Per share

Adjusted income and adjusted earnings per share

13,101

$

0.03

$

3,347

$

0.01

$

(Less) plus:

Depreciation of assets that will be replaced as part of the Image Activation initiative

(9,068)

(0.02)

-

-

Facilities relocation costs and other transactions

(1,900)

(0.00)

(3,808)

(0.01)

Impairment of long-lived assets

-

-

(2,783)

(0.01)

Gain on sale of investment, net

-

-

17,978

0.05

Total adjustments

(10,968)

(0.02)

11,387

0.03

Net income

2,133

0.01

14,734

0.04

Net income attributable to noncontrolling interests

-

-

(2,384)

(0.01)

Net income and earnings per share attributable to The Wendy's Company

2,133

$

0.01

$

12,350

$

0.03

$

First Quarter

2013

2012 |