Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OCLARO, INC. | d534373d8k.htm |

Exhibit 99.1

| Q3 FY 2013 Investor Call Alain Couder Chairman and CEO May 7, 2013 Jerry Turin Chief Financial Officer |

| Safe Harbor Statement This presentation, in association with Oclaro's third quarter fiscal year 2013 financial results conference call, contains statements about management's future expectations, plans or prospects of Oclaro and its business, and together with the assumptions underlying these statements, constitute forward-looking statements for the purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements concerning (i) financial targets and expectations, and progress toward our target business model, including financial guidance for the fiscal quarter ending June 29, 2013 regarding revenue, non-GAAP gross margin and Adjusted EBITDA, (ii) expectations related to the integration of Opnext into Oclaro following the closing of the merger on July 23, 2012, and (iii) our market position, economic conditions, product development and future operating prospects. Such statements can be identified by the fact that they do not relate strictly to historical or current facts and may contain words such as "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," "will," "should," "outlook," "could," "target," "model" and other words and terms of similar meaning in connection with any discussion of future operations or financial performance. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including (i) the future performance of Oclaro and its ability to effectively integrate the operations of acquired companies following the closing of acquisitions and mergers, including its merger with Opnext, (ii) the potential inability to realize the expected and ongoing benefits and synergies of acquisitions and mergers, (iii) the impact to our operations, revenues and financial condition attributable to the flooding in Thailand, (iv) the impact of continued uncertainty in world financial markets and any resulting reduction in demand for our products, (v) our ability to meet or exceed our gross margin expectations, (vi) the effects of fluctuating product mix on our results, (vii) our ability to timely develop and commercialize new products, (viii) our ability to reduce costs and operating expenses, (ix) our ability to respond to evolving technologies and customer requirements and demands, (x) our dependence on a limited number of customers for a significant percentage of our revenues, (xi) our ability to maintain strong relationships with certain customers, (xii) our ability to effectively compete with companies that have greater name recognition, broader customer relationships and substantially greater financial, technical and marketing resources than we do, (xiii) our ability to effectively and efficiently transition to an outsourced back-end assembly and test model, (xiv) our ability to timely capitalize on any increases in market demand, (xv) increased costs related to downsizing and compliance with regulatory requirements in connection with such downsizing, (xvi) competition and pricing pressure, (xvii) the potential lack of availability of credit or opportunity for equity based financing, (xviii) the risks associated with our international operations, (xix) the outcome of tax audits or similar proceedings, (xx) the outcome of pending litigation against the company, (xxi) our ability to maintain or increase our cash reserves and obtain financing on terms acceptable to us or at all, and (xxii) other factors described in Oclaro's most recent annual report on Form 10-K, quarterly report on Form 10-Q and other documents we periodically file with the SEC. The forward-looking statements included in this announcement represent Oclaro's view as of the date of this announcement. Oclaro anticipates that subsequent events and developments may cause Oclaro's views and expectations to change. Oclaro specifically disclaims any intention or obligation to update any forward-looking statements as a result of developments occurring after the date of this announcement. |

| $ millions FQ3-12 MAR-12 FQ4-12 JUN-12 FQ1-13 SEP-12 FQ2-13 DEC-12 FQ3-13 MAR-13 Total Revenues $88.7 $104.4 $148.8 $159.5 $141.6 Gross Profit (non-GAAP)1 14.1 21.9 20.2 25.0 14.2 Gross Margin % 16% 21% 14% 16% 10% R&D (non-GAAP) 1 14.7 16.9 25.4 25.2 24.8 SG&A (non-GAAP) 1 14.0 14.8 23.5 21.9 21.7 Non-GAAP Operating Loss $ (14.6) $ (9.9) $ (28.7) $ (22.1) $ (32.3) Adjusted EBITDA $ (9.9) $ (5.0) $ (20.6) $ (13.2) $ (24.0) Financial Results (1) See tabular reconciliation to comparable GAAP numbers on pages 14 to 16. |

| Q2 FY2013 Financial Summary (CHART) (CHART) (CHART) |

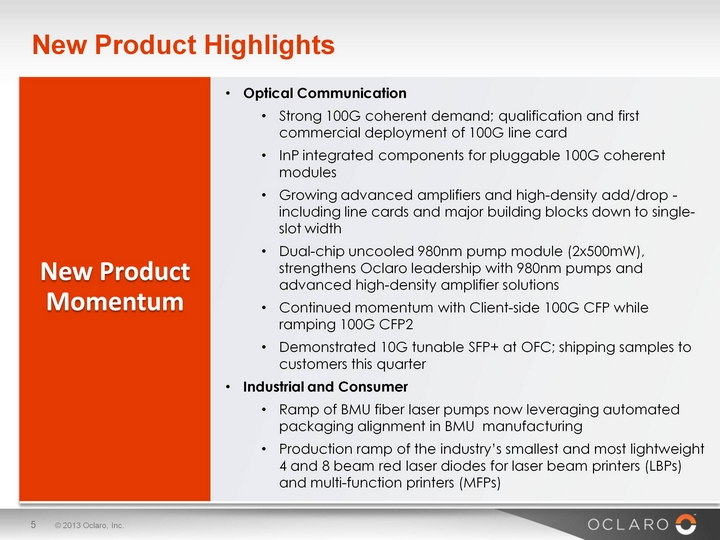

| New Product Highlights New Product Momentum Optical Communication Strong 100G coherent demand; qualification and first commercial deployment of 100G line card InP integrated components for pluggable 100G coherent modules Growing advanced amplifiers and high-density add/drop - including line cards and major building blocks down to single-slot width Dual-chip uncooled 980nm pump module (2x500mW), strengthens Oclaro leadership with 980nm pumps and advanced high-density amplifier solutions Continued momentum with Client-side 100G CFP while ramping 100G CFP2 Demonstrated 10G tunable SFP+ at OFC; shipping samples to customers this quarter Industrial and Consumer Ramp of BMU fiber laser pumps now leveraging automated packaging alignment in BMU manufacturing Production ramp of the industry's smallest and most lightweight 4 and 8 beam red laser diodes for laser beam printers (LBPs) and multi-function printers (MFPs) |

| Revenue by Product Group (Pro Forma) Includes 10 Gb/s, 40 Gb/s and 100 Gb/s transponders and transceivers.Includes lasers, modulators, laser pumps, receivers and integrated lasers and modulators.Includes amplifiers, micro-optics, dispersion compensation management, WSS modules, subsystems, ROADM line cards and thin film filters.Includes high power laser and VCSEL products. $ millions FQ3-12 MAR-12 FQ4-12 JUN-12 FQ1-13 SEP-12 FQ2-13 DEC-12 FQ3-13 MAR-12 40G and 100G Transmission Modules1 $ 50.8 $ 42.0 $ 32.7 $ 38.2 $ 37.6 10G and Lower Transmission Modules 1 38.8 47.6 45.5 47.8 42.3 Transmission Components 2 24.3 28.5 27.3 22.2 22.3 Amplification, Filtering & Optical Routing 3 23.3 36.4 34.8 31.2 20.8 Industrial & Consumer 4 20.0 21.9 19.8 20.1 18.6 Total Revenues $ 157.2 $ 176.5 $ 160.2 $ 159.5 $ 141.6 |

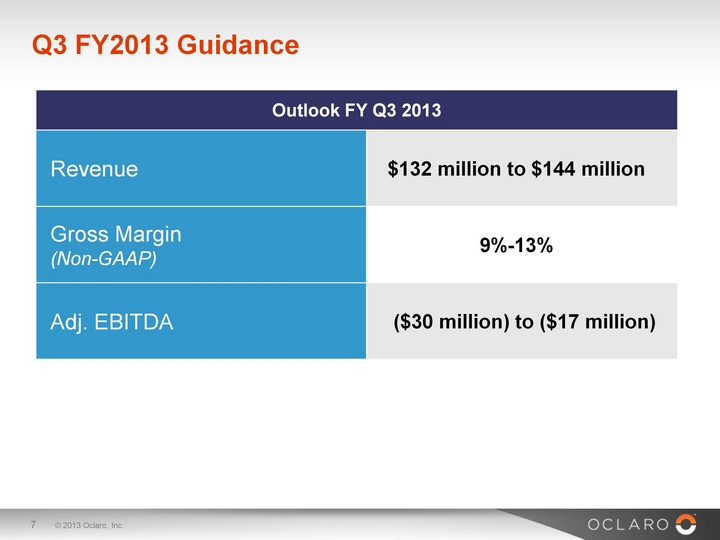

| Outlook FY Q3 2013 Outlook FY Q3 2013 Revenue $132 million to $144 million Gross Margin (Non-GAAP) 9%-13% Adj. EBITDA ($30 million) to ($17 million) Q3 FY2013 Guidance |

| TRENDED FINANCIAL SLIDES |

| Non-GAAP Financial Measures Oclaro provides certain supplemental non-GAAP financial measures to its investors as a complement to the most comparable GAAP measures. The GAAP measure most directly comparable to non-GAAP gross margin rate is gross margin rate. The GAAP measure most directly comparable to non-GAAP operating income/loss is operating income/loss. The GAAP measure most directly comparable to non-GAAP net income/loss and Adjusted EBITDA is net income/loss. An explanation and reconciliation of each of these non-GAAP financial measures to GAAP information is set forth below.Oclaro believes that providing these non-GAAP measures to its investors, in addition to corresponding income statement measures, provides investors the benefit of viewing Oclaro's performance using the same financial metrics that the management team uses in making many key decisions and evaluating how Oclaro's "core operating performance" and its results of operations may look in the future. Oclaro defines "core operating performance" as its on-going performance in the ordinary course of its operations. Items that are non-recurring or do not involve cash expenditures, such as impairment charges, income taxes, restructuring and severance programs, costs relating to specific major projects, such as acquisitions, gain on bargain purchase, non-cash compensation related to stock and options, purchase accounting adjustments related to the fair market value of acquired inventories, costs to outsource our back-end manufacturing activities and certain expenses related to flooding in Thailand are not included in Oclaro's view of "core operating performance." Management does not believe these items are reflective of Oclaro's ongoing core operations and accordingly excludes those items from non-GAAP gross margin rate, non-GAAP operating income/loss, non-GAAP net income/loss and Adjusted EBITDA. Additionally, each non-GAAP measure has historically been presented by Oclaro as a complement to its most comparable GAAP measure, and Oclaro believes that the continuation of this practice increases the consistency and comparability of Oclaro's earnings releases. Non-GAAP financial measures are not in accordance with, or an alternative for, generally accepted accounting principles in the United States of America. Non-GAAP measures should not be considered in isolation from or as a substitute for financial information presented in accordance with generally accepted accounting principles, and may be different from non-GAAP measures used by other companies. |

| Non-GAAP Financial Measures Non-GAAP Gross Margin Rate Non-GAAP gross margin rate is calculated as gross margin rate as determined in accordance with GAAP (gross profit as a percentage of revenues) excluding non-cash compensation related to stock and options, purchase accounting adjustments related to the fair market value of acquired inventories and costs to outsource our back-end manufacturing activities. Oclaro evaluates its performance using non-GAAP gross margin rate to assess Oclaro's historical and prospective operating financial performance, as well as its operating performance relative to its competitors. Non-GAAP Operating Income/Loss Non-GAAP operating income/loss is calculated as operating income/loss as determined in accordance with GAAP excluding the impact of amortization of intangible assets, restructuring, acquisition and related costs, non-cash compensation related to stock and options granted to employees and directors, certain other one-time charges and credits and excluding any flood related impairment of fixed assets and inventory and related income (expenses) specifically identified in the non-GAAP reconciliation schedules set forth below. Oclaro evaluates its performance using, among other things, non-GAAP operating income/loss in evaluating Oclaro's historical and prospective operating financial performance, as well as its operating performance relative to its competitors. Non-GAAP Net Income/Loss Non-GAAP net income/loss is calculated as net income/loss excluding the impact of restructuring, acquisition and related costs, gain on bargain purchase, Thailand flood-related expenses, non-cash compensation related to stock and options granted to employees and directors, net foreign currency translation gains/losses, the impact of amortization of intangible assets and certain other one-time charges and credits specifically identified in the non-GAAP reconciliation schedules set forth below. Oclaro uses non-GAAP net income/loss in evaluating Oclaro's historical and prospective operating financial performance, as well as its operating performance relative to its competitors. Adjusted EBITDA Adjusted EBITDA is calculated as net income/loss excluding the impact of income taxes, net interest income/expense, depreciation and amortization, net foreign currency translation gains/losses, as well as restructuring, acquisition and related costs, non-cash compensation related to stock and options, gain on bargain purchase and certain other one-time charges and credits, including flood related impairment of fixed assets and inventory and related income (expenses), specifically identified in the non-GAAP reconciliation schedules set forth below. Oclaro uses Adjusted EBITDA in evaluating Oclaro's historical and prospective cash usage, as well as its cash usage relative to its competitors. Specifically, management uses this non-GAAP measure to further understand and analyze the cash used in/generated from Oclaro's core operations. Oclaro believes that by excluding these non-cash and non-recurring charges, more accurate expectations of its future cash needs can be assessed in addition to providing a better understanding of the actual cash used in or generated from core operations for the periods presented. Oclaro further believes that providing this information allows Oclaro's investors greater transparency and a better understanding of Oclaro's core cash position. |

| Income Statement (Unaudited) |

| Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures |

| Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures |

| Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures |

| Condensed Consolidated Balance Sheets |

| THANK YOU. |