| Consolidated Balance Sheets |

|

|

|

|

| (unaudited) |

|

|

|

|

| |

|

March 31, |

|

September 30, |

| ASSETS |

|

2013 |

|

2012 |

| Real Estate Investments: |

|

|

|

|

| Land |

|

$ 92,470,414 |

|

$ 88,559,914 |

| Buildings and Improvements |

|

499,445,482 |

|

457,557,443 |

| Total Real Estate Investments |

|

591,915,896 |

|

546,117,357 |

| Accumulated Depreciation |

|

(84,620,330) |

|

(78,230,873) |

| Net Real Estate Investments |

|

507,295,566 |

|

467,886,484 |

| |

|

|

|

|

| Real Estate Held for Sale |

|

- |

|

1,080,940 |

| Cash and Cash Equivalents |

|

20,130,455 |

|

24,650,858 |

| Securities Available for Sale at Fair Value |

|

52,264,390 |

|

61,685,173 |

| Tenant and Other Receivables |

|

3,068,710 |

|

1,116,825 |

| Deferred Rent Receivable |

|

2,937,695 |

|

2,214,501 |

| Loans Receivable, net |

|

76,695 |

|

87,916 |

| Prepaid Expenses |

|

3,448,316 |

|

1,428,454 |

| Financing Costs, net of Accumulated Amortization of |

|

|

|

|

| $2,747,413 and $2,546,806, respectively |

|

3,568,398 |

|

3,213,762 |

| Lease Costs, net of Accumulated Amortization of |

|

|

|

|

| $1,213,305 and $1,156,699, respectively |

|

2,046,158 |

|

1,518,780 |

| Intangible Assets, net of Accumulated Amortization of |

|

|

|

|

| $7,530,104 and $6,731,014, respectively |

|

7,485,936 |

|

7,635,026 |

| Other Assets |

|

2,450,801 |

|

1,988,983 |

| TOTAL ASSETS |

|

$ 604,773,120 |

|

$ 574,507,702 |

| |

|

|

|

|

| LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| Liabilities: |

|

|

|

|

| Mortgage Notes Payable |

|

$ 251,352,627 |

|

$ 237,943,911 |

| Subordinated Convertible Debentures |

|

-0- |

|

8,615,000 |

| Loans Payable |

|

17,200,000 |

|

5,200,000 |

| Accounts Payable and Accrued Expenses |

|

3,590,366 |

|

3,881,769 |

| Other Liabilities |

|

4,730,004 |

|

3,179,883 |

| Total Liabilities |

|

276,872,997 |

|

258,820,563 |

| |

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

| |

|

|

|

|

| Shareholders' Equity: |

|

|

|

|

| Series A - 7.625% Cumulative Redeemable Preferred Stock, |

|

|

|

|

| $0.01 Par Value Per Share: 2,139,750 Shares Authorized, Issued and |

|

|

|

|

| Outstanding as of March 31, 2013 and September 30, 2012 |

|

53,493,750 |

|

53,493,750 |

| Series B - 7.875% Cumulative Redeemable Preferred Stock, |

|

|

|

|

| $0.01 Par Value Per Share: 2,300,000 Shares Authorized, Issued and |

|

|

|

|

| Outstanding as of March 31, 2013 and September 30, 2012 |

|

57,500,000 |

|

57,500,000 |

| Common Stock – $0.01 Par Value Per Share: 67,700,000 Shares Authorized |

|

|

|

|

| as of March 31, 2013 and 42,205,458 and 40,696,692 Shares Issued and |

|

|

|

|

| Outstanding as of March 31, 2013 and September 30, 2012, respectively |

|

422,055 |

|

406,967 |

| Excess Stock – $0.01 Par Value per share: 5,000,000 Shares |

|

|

|

|

| Authorized; No Shares Issued or Outstanding |

|

- |

|

- |

| Additional Paid-In Capital |

|

210,561,738 |

|

198,902,485 |

| Accumulated Other Comprehensive Income |

|

5,922,580 |

|

5,383,937 |

| Undistributed Income |

|

- |

|

- |

| Total Shareholders' Equity |

|

327,900,123 |

|

315,687,139 |

| TOTAL LIABILITIES & SHAREHOLDERS' EQUITY |

|

$ 604,773,120 |

|

$ 574,507,702 |

| |

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 3 of 19

|

Consolidated Statements of Operations |

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

|

| |

3/31/2013 |

|

3/31/2012 |

|

3/31/2013 |

|

3/31/2012 |

|

| INCOME: |

|

|

|

|

|

|

|

|

| Rental Revenue |

$11,738,407 |

|

$10,691,955 |

|

$23,047,661 |

|

$21,349,581 |

|

| Reimbursement Revenue |

1,567,802 |

|

1,875,848 |

|

3,086,038 |

|

3,455,688 |

|

| Lease Termination Income |

-0- |

|

3,222,283 |

|

690,730 |

|

3,222,283 |

|

| TOTAL INCOME |

13,306,209 |

|

15,790,086 |

|

26,824,429 |

|

28,027,552 |

|

| |

|

|

|

|

|

|

|

|

| EXPENSES: |

|

|

|

|

|

|

|

|

| Real Estate Taxes |

1,117,948 |

|

1,675,693 |

|

2,281,462 |

|

3,100,296 |

|

| Operating Expenses |

967,176 |

|

605,502 |

|

1,493,800 |

|

1,270,329 |

|

| General & Administrative Expense |

944,352 |

|

926,267 |

|

2,239,408 |

|

1,941,500 |

|

| Acquisition Costs |

-0- |

|

261,382 |

|

385,862 |

|

565,724 |

|

| Depreciation |

3,268,393 |

|

2,810,470 |

|

6,389,457 |

|

5,576,986 |

|

| Amortization of Lease Costs and Intangible Assets |

477,852 |

|

413,123 |

|

970,716 |

|

801,518 |

|

| TOTAL EXPENSES |

6,775,721 |

|

6,692,437 |

|

13,760,705 |

|

13,256,353 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

| Interest and Dividend Income |

1,004,964 |

|

892,506 |

|

2,128,025 |

|

1,841,832 |

|

| Gain on Securities Transactions, net |

3,802,704 |

|

2,209,257 |

|

5,913,472 |

|

4,997,715 |

|

| Interest Expense |

(3,842,634) |

|

(3,779,879) |

|

(7,718,306) |

|

(7,633,597) |

|

| Amortization of Financing Costs |

(152,095) |

|

(115,259) |

|

(332,885) |

|

(355,321) |

|

| TOTAL OTHER INCOME (EXPENSE) |

812,939 |

|

(793,375) |

|

(9,694) |

|

(1,149,371) |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| INCOME FROM CONTINUING OPERATIONS |

7,343,427 |

|

8,304,274 |

|

13,054,030 |

|

13,621,828 |

|

| |

|

|

|

|

|

|

|

|

| INCOME (LOSS) FROM DISCONTINUED OPERATIONS |

300,484 |

|

(44,242) |

|

296,458 |

|

4,227 |

|

| |

|

|

|

|

|

|

|

|

| NET INCOME |

7,643,911 |

|

8,260,032 |

|

13,350,488 |

|

13,626,055 |

|

| |

|

|

|

|

|

|

|

|

| Less: Preferred Dividend |

2,151,758 |

|

1,019,805 |

|

4,303,516 |

|

2,039,610 |

|

| |

|

|

|

|

|

|

|

|

| NET INCOME ATTRIBUTABLE TO |

|

|

|

|

|

|

|

|

| COMMON SHAREHOLDERS |

$5,492,153 |

|

$7,240,227 |

|

$9,046,972 |

|

$11,586,445 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 4 of 19

|

FFO, Core FFO, AFFO, NOI and EBIDTA Reconciliations |

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

3/31/2013 |

|

3/31/2012 |

|

3/31/2013 |

|

3/31/2012 |

| Revenues |

|

|

|

|

|

|

|

| |

Rental Revenue |

$11,738,407 |

|

$10,691,955 |

|

$23,047,661 |

|

$21,349,581 |

| |

Reimbursement Revenue |

1,567,802 |

|

1,875,848 |

|

3,086,038 |

|

3,455,688 |

| |

Total Revenue |

13,306,209 |

|

12,567,803 |

|

26,133,699 |

|

24,805,269 |

| |

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

| |

Real Estate Taxes |

1,117,948 |

|

1,675,693 |

|

2,281,462 |

|

3,100,296 |

| |

Operating Expenses |

967,176 |

|

605,502 |

|

1,493,800 |

|

1,270,329 |

| |

Total Expenses |

2,085,124 |

|

2,281,195 |

|

3,775,262 |

|

4,370,625 |

| |

|

|

|

|

|

|

|

|

| Net Operating Income - NOI |

11,221,085 |

|

10,286,608 |

|

22,358,437 |

|

20,434,644 |

| |

|

|

|

|

|

|

|

|

| |

Lease Termination Income |

- |

|

3,222,283 |

|

690,730 |

|

3,222,283 |

| |

Interest and Dividend Income |

1,004,964 |

|

892,506 |

|

2,128,025 |

|

1,841,832 |

| |

Net Operating Income (Loss) from Discontinued Operations |

(45,310) |

|

(24,595) |

|

(36,493) |

|

51,234 |

| |

General & Administrative Expense |

(944,352) |

|

(926,267) |

|

(2,239,408) |

|

(1,941,500) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| EBITDA |

11,236,387 |

|

13,450,535 |

|

22,901,291 |

|

23,608,493 |

| |

|

|

|

|

|

|

|

|

| |

Interest Expense |

(3,842,634) |

|

(3,779,879) |

|

(7,718,306) |

|

(7,633,597) |

| |

Gain on Securities Transactions, net |

3,802,704 |

|

2,209,257 |

|

5,913,472 |

|

4,997,715 |

| |

Acquisition Costs |

- |

|

(261,382) |

|

(385,862) |

|

(565,724) |

| |

Preferred Dividend |

(2,151,758) |

|

(1,019,805) |

|

(4,303,516) |

|

(2,039,610) |

| |

Other Amortization |

(245,244) |

|

(206,463) |

|

(534,195) |

|

(517,028) |

| |

|

|

|

|

|

|

|

|

| Funds From Operations - FFO |

8,799,455 |

|

10,392,263 |

|

15,872,884 |

|

17,850,249 |

| |

|

|

|

|

|

|

|

|

| |

Depreciation Expense (including discontinued operations) |

(3,268,393) |

|

(2,830,117) |

|

(6,402,300) |

|

(5,615,773) |

| |

Income (Loss) on Sale of Investment Property |

345,794 |

|

- |

|

345,794 |

|

(8,220) |

| |

Amortization of In-Place Lease Intangible Assets |

(384,703) |

|

(321,919) |

|

(769,406) |

|

(639,811) |

| |

|

|

|

|

|

|

|

|

| Net Income Attributable to Common Shareholders |

5,492,153 |

|

7,240,227 |

|

9,046,972 |

|

11,586,445 |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Funds From Operations - FFO |

8,799,455 |

|

10,392,263 |

|

15,872,884 |

|

17,850,249 |

| |

|

|

|

|

|

|

|

|

| |

Acquisition Costs |

- |

|

261,382 |

|

385,862 |

|

565,724 |

| |

|

|

|

|

|

|

|

|

| Core Funds From Operations - Core FFO |

8,799,455 |

|

10,653,645 |

|

16,258,746 |

|

18,415,973 |

| |

|

|

|

|

|

|

|

|

| |

Gain on Securities Transactions, net |

(3,802,704) |

|

(2,209,257) |

|

(5,913,472) |

|

(4,997,715) |

| |

Stock Compensation Expense |

81,562 |

|

62,373 |

|

161,089 |

|

126,696 |

| |

Other Amortization |

245,244 |

|

206,463 |

|

534,195 |

|

517,028 |

| |

Straight-lined Rents |

(575,202) |

|

(69,437) |

|

(723,195) |

|

(98,462) |

| |

Recurring Capital Expenditures |

(140,164) |

|

(97,132) |

|

(176,804) |

|

(258,520) |

| |

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations - AFFO |

4,608,191 |

|

8,546,655 |

|

10,140,559 |

|

13,705,000 |

| |

|

|

|

|

|

|

|

|

| EBITDA |

11,236,387 |

|

13,450,535 |

|

22,901,291 |

|

23,608,493 |

| |

|

|

|

|

|

|

|

|

| |

Interest Expense |

(3,842,634) |

|

(3,779,879) |

|

(7,718,306) |

|

(7,633,597) |

| |

Preferred Dividend |

(2,151,758) |

|

(1,019,805) |

|

(4,303,516) |

|

(2,039,610) |

| |

Stock Compensation Expense |

81,562 |

|

62,373 |

|

161,089 |

|

126,696 |

| |

Straight-lined Rents |

(575,202) |

|

(69,437) |

|

(723,195) |

|

(98,462) |

| |

Recurring Capital Expenditures |

(140,164) |

|

(97,132) |

|

(176,804) |

|

(258,520) |

| |

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations - AFFO |

$4,608,191 |

|

$8,546,655 |

|

$10,140,559 |

|

$13,705,000 |

| |

|

|

|

|

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 5 of 19

|

Financial Highlights |

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

3/31/2013 |

|

3/31/2012 |

|

3/31/2013 |

|

3/31/2012 |

| |

|

|

|

|

|

|

|

|

| Weighted Average Shares Outstanding |

|

|

|

|

|

|

|

| |

Basic |

41,770,762 |

|

39,883,133 |

|

41,331,860 |

|

38,631,103 |

| |

Diluted |

41,989,449 |

|

40,043,673 |

|

41,545,266 |

|

38,749,864 |

| |

|

|

|

|

|

|

|

|

| Net Operating Income - NOI |

$11,221,085 |

|

$10,286,608 |

|

$22,358,437 |

|

$20,434,644 |

| |

|

|

|

|

|

|

|

|

| |

Basic |

$0.27 |

|

$0.26 |

|

$0.54 |

|

$0.53 |

| |

Diluted |

0.27 |

|

0.26 |

|

0.54 |

|

0.53 |

|

Net Income Attributable to Common Shareholders |

$5,492,153 |

|

$7,240,227 |

|

$9,046,972 |

|

$11,586,445 |

| |

|

|

|

|

|

|

|

|

| |

Basic |

$0.13 |

|

$0.18 |

|

$0.22 |

|

$0.30 |

| |

Diluted |

0.13 |

|

0.18 |

|

0.22 |

|

0.30 |

| |

|

|

|

|

|

|

|

|

| Funds From Operations - FFO |

$8,799,455 |

|

$10,392,263 |

|

$15,872,884 |

|

$17,850,249 |

| |

|

|

|

|

|

|

|

|

| |

Basic |

$0.21 |

|

$0.26 |

|

$0.38 |

|

$0.46 |

| |

Diluted |

0.21 |

|

0.26 |

|

0.38 |

|

0.46 |

| |

|

|

|

|

|

|

|

|

| Core Funds From Operations - Core FFO |

$8,799,455 |

|

$10,653,645 |

|

$16,258,746 |

|

$18,415,973 |

| |

|

|

|

|

|

|

|

|

| |

Basic |

$0.21 |

|

$0.27 |

|

$0.39 |

|

$0.48 |

| |

Diluted |

0.21 |

|

0.27 |

|

0.39 |

|

0.48 |

| |

|

|

|

|

|

|

|

|

| Core FFO Excluding Gains on Securities Transactions, net |

$4,996,751 |

|

$8,444,388 |

|

$10,345,274 |

|

$13,418,258 |

| |

|

|

|

|

|

|

|

|

| |

Basic |

$0.12 |

|

$0.21 |

|

$0.25 |

|

$0.35 |

| |

Diluted |

0.12 |

|

0.21 |

|

0.25 |

|

0.35 |

| |

|

|

|

|

|

|

|

|

| Adjusted Funds From Operations - AFFO |

$4,608,191 |

|

$8,546,655 |

|

$10,140,559 |

|

$13,705,000 |

| |

|

|

|

|

|

|

|

|

| |

Basic |

$0.11 |

|

$0.21 |

|

$0.25 |

|

$0.35 |

| |

Diluted |

0.11 |

|

0.21 |

|

0.24 |

|

0.35 |

| |

|

|

|

|

|

|

|

| AFFO Excluding Lease Termination Income, net |

$4,608,191 |

|

$5,324,372 |

|

$9,449,829 |

|

$10,482,717 |

| |

|

|

|

|

|

|

|

|

| |

Basic |

$0.11 |

|

$0.13 |

|

$0.23 |

|

$0.27 |

| |

Diluted |

0.11 |

|

0.13 |

|

0.23 |

|

0.27 |

| |

|

|

|

|

|

|

|

|

| Dividends Declared per Common Share |

$0.15 |

|

$0.15 |

|

$0.30 |

|

$0.30 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 6 of 19

| Consolidated Statements of Cash Flows |

|

|

|

|

| (unaudited) |

|

|

|

|

| |

|

Six Months Ended |

| |

|

3/31/2013 |

|

3/31/2012 |

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

| Net Income |

|

$13,350,488 |

|

$13,626,055 |

| Noncash Items Included in Net Income: |

|

|

|

|

| Depreciation |

|

6,402,300 |

|

5,615,773 |

| Amortization |

|

1,310,852 |

|

1,156,839 |

| Stock Compensation Expense |

|

161,089 |

|

126,696 |

| (Gain) on Securities Transactions, net |

|

(5,913,472) |

|

(4,997,715) |

| (Gain) Loss on Sale of Investment Property |

|

(345,794) |

|

8,220 |

| Changes In: |

|

|

|

|

| Tenant, Deferred Rent and Other Receivables |

|

(2,626,339) |

|

(406,291) |

| Prepaid Expenses |

|

(2,019,862) |

|

(717,706) |

| Other Assets and Lease Costs |

|

71,457 |

|

(174,042) |

| Accounts Payable, Accrued Expenses and Other Liabilities |

|

1,298,984 |

|

1,682,424 |

| NET CASH PROVIDED BY OPERATING ACTIVITIES |

|

11,689,703 |

|

15,920,253 |

| |

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

| Purchase of Real Estate and Intangible Assets, net of deposits |

|

(42,363,385) |

|

(50,810,600) |

| Capital and Land Site Improvements |

|

(3,741,423) |

|

(1,672,864) |

| Proceeds on Sale of Investment Property, net |

|

1,413,891 |

|

2,553,507 |

| Deposits on Acquisition of Real Estate |

|

(1,800,000) |

|

(1,000,000) |

| Proceeds from Sale of Securities Available for Sale |

|

25,178,027 |

|

19,248,938 |

| Purchase of Securities Available for Sale |

|

(9,305,129) |

|

(11,826,052) |

| Collections on Loans Receivable |

|

11,221 |

|

68,069 |

| NET CASH USED IN INVESTING ACTIVITIES |

|

(30,606,798) |

|

(43,439,002) |

| |

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

| Net Proceeds from (Repayments to) Loans Payable |

|

12,000,000 |

|

(8,360,950) |

| Repurchase of Subordinated Convertible Debentures |

|

(5,115,000) |

|

(125,000) |

| Proceeds from Mortgage Notes Payable |

|

35,000,000 |

|

49,233,000 |

| Principal Payments on Mortgage Notes Payable |

|

(21,591,284) |

|

(22,007,314) |

| Financing Costs Paid on Debt |

|

(519,521) |

|

(1,302,805) |

| Repayment of Employee Loan |

|

-0- |

|

688,724 |

| Net Distributions to Noncontrolling Interests |

|

(40,266) |

|

(40,267) |

| Proceeds from the Exercise of Stock Options |

|

-0- |

|

771,593 |

| Proceeds from Registered Direct Placement of Common Stock, |

|

|

|

|

| net of Offering Costs |

|

-0- |

|

16,189,700 |

| Proceeds from Issuance of Common Stock in the DRIP, net of Reinvestments |

|

8,160,817 |

|

10,074,648 |

| Preferred Dividends Paid |

|

(4,303,516) |

|

(2,039,610) |

| Common Dividends Paid, net of Reinvestments |

|

(9,194,538) |

|

(10,383,521) |

| NET CASH PROVIDED BY FINANCING ACTIVITIES |

|

14,396,692 |

|

32,698,198 |

| |

|

|

|

|

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS |

|

(4,520,403) |

|

5,179,449 |

| CASH AND CASH EQUIVALENTS - BEGINNING OF PERIOD |

|

24,650,858 |

|

6,376,808 |

| CASH AND CASH EQUIVALENTS - END OF PERIOD |

|

$20,130,455 |

|

$11,556,257 |

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 7 of 19

|

Capital Structure and Leverage Ratios |

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

| |

|

As of 3/31/2013 |

|

As of 3/31/2012 |

|

As of 9/30/2012 |

| Mortgage Notes Payable |

|

$251,352,627 |

|

$233,639,856 |

|

$237,943,911 |

| Loans Payable |

|

17,200,000 |

|

13,700,000 |

|

5,200,000 |

| Subordinated Convertible Debentures |

|

- |

|

8,790,000 |

|

8,615,000 |

| |

Total Debt |

|

268,552,627 |

|

256,129,856 |

|

251,758,911 |

| |

|

|

|

|

|

|

|

| Series A - 7.625% Cumulative Redeemable Preferred Stock |

|

53,493,750 |

|

53,493,750 |

|

53,493,750 |

| Series B - 7.875% Cumulative Redeemable Preferred Stock |

|

57,500,000 |

|

- |

|

57,500,000 |

| |

Total Preferred Stock |

|

110,993,750 |

|

53,493,750 |

|

110,993,750 |

| |

|

|

|

|

|

|

|

| Common Stock, Paid-in-Capital & Other |

|

216,906,373 |

|

212,339,117 |

|

204,693,389 |

| |

Total Shareholders' Equity |

|

327,900,123 |

|

265,832,867 |

|

315,687,139 |

| |

Total Book Capitalization |

|

596,452,750 |

|

521,962,723 |

|

567,446,050 |

| |

Accumulated Depreciation |

|

84,620,330 |

|

73,493,533 |

|

78,230,873 |

| |

Total Undepreciated Book Capitalization |

|

$681,073,080 |

|

$595,456,256 |

|

$645,676,923 |

| Shares Outstanding |

|

42,205,458 |

|

40,222,375 |

|

40,696,692 |

| Market Price Per Share |

|

$11.15 |

|

$9.74 |

|

$11.19 |

| Equity Market Capitalization |

|

$470,590,857 |

|

$391,765,933 |

|

$455,395,983 |

| Total Debt |

|

268,552,627 |

|

256,129,856 |

|

251,758,911 |

| Total Preferred Stock |

|

110,993,750 |

|

53,493,750 |

|

110,993,750 |

| |

Total Market Capitalization |

|

$850,137,234 |

|

$701,389,539 |

|

$818,148,644 |

| Total Debt |

|

$268,552,627 |

|

$256,129,856 |

|

$251,758,911 |

| less: Cash and Cash Equivalents |

|

20,130,455 |

|

11,556,257 |

|

24,650,858 |

| |

Net Debt |

|

$248,422,172 |

|

$244,573,599 |

|

$227,108,053 |

| Net Debt / Undepreciated Book Capitalization |

|

36.5% |

|

41.1% |

|

35.2% |

| Net Debt / Total Market Capitalization |

|

29.3% |

|

34.9% |

|

27.8% |

| Net Debt + Preferred / Total Market Capitalization |

|

42.3% |

|

42.5% |

|

41.3% |

| |

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Fiscal Year Ended |

| |

|

|

3/31/2013 |

|

3/31/2012 |

|

9/30/2012 |

| Net Income |

|

$7,643,911 |

|

$8,260,032 |

|

$18,684,495 |

| plus: Depreciation & Amortization (includes Discontinued Operations) |

3,898,340 |

|

3,358,499 |

|

13,910,385 |

| plus: Interest Expense |

|

3,842,634 |

|

3,779,879 |

|

15,352,499 |

| plus: Acquisition Costs |

|

- |

|

261,382 |

|

667,799 |

| less: Gain On Securities Transactions, net |

|

(3,802,704) |

|

(2,209,257) |

|

(6,044,065) |

| less: (Loss) on Sale of Investment Property |

|

(345,794) |

|

- |

|

- |

| |

EBITDA |

|

$11,236,387 |

|

$13,450,535 |

|

$42,571,113 |

| Interest Expense |

|

$3,842,634 |

|

$3,779,879 |

|

$15,352,499 |

| Preferred Dividends Paid |

|

2,151,758 |

|

1,019,805 |

|

5,135,782 |

| |

Total Fixed Charges |

|

$5,994,392 |

|

$4,799,684 |

|

$20,488,281 |

| Interest Coverage |

|

2.9 x |

|

3.6 x |

|

2.8 x |

| Fixed Charge Coverage |

|

1.9 x |

|

2.8 x |

|

2.1 x |

| Total Debt |

|

$268,552,627 |

|

$256,129,856 |

|

$251,758,911 |

| Annualized EBITDA |

|

44,945,548 |

|

53,802,140 |

|

42,571,113 |

| Total Debt / EBITDA |

|

6.0 x |

|

4.8 x |

|

5.9 x |

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 8 of 19

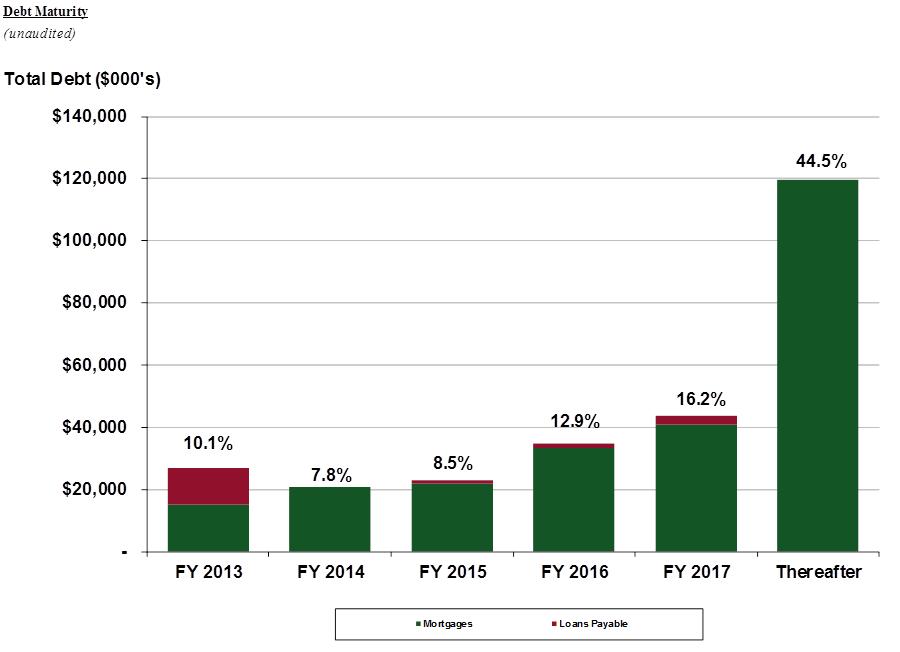

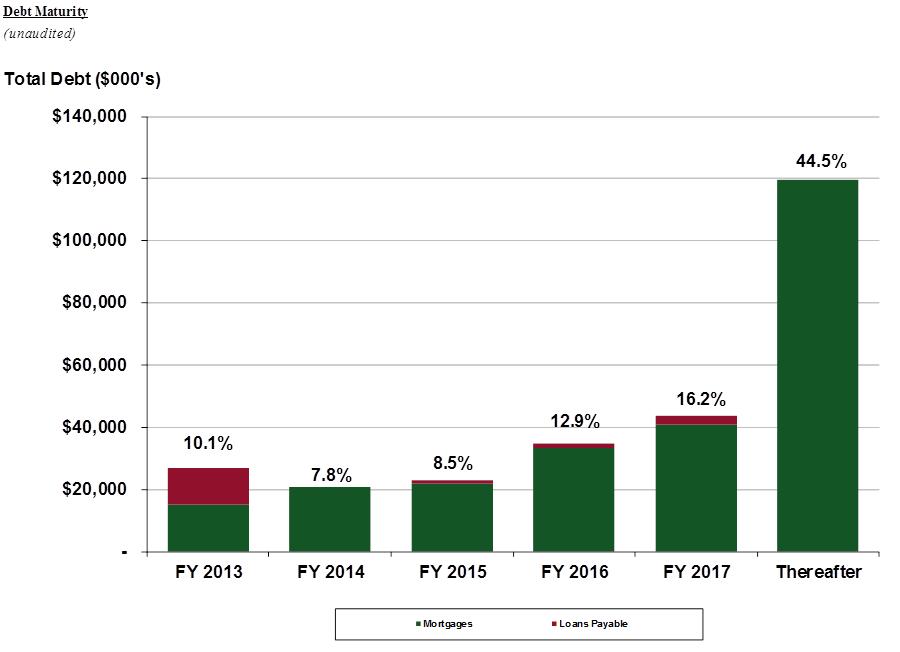

| |

|

|

Loans |

|

% of |

| FY Year |

|

Mortgages |

Payable (1) |

Total |

Total |

| |

|

|

|

|

|

| 2013 |

|

15,016,820 |

12,000,000 |

27,016,820 |

10.1% |

| 2014 |

|

20,818,049 |

- |

20,818,049 |

7.8% |

| 2015 |

|

21,835,789 |

1,012,039 |

22,847,828 |

8.5% |

| 2016 |

|

33,400,263 |

1,270,162 |

34,670,425 |

12.9% |

| 2017 |

|

40,721,489 |

2,917,799 |

43,639,288 |

16.2% |

| Thereafter |

|

119,560,217 |

- |

119,560,217 |

44.5% |

| |

|

|

|

|

|

| Total as of 3/31/2013 |

|

$251,352,627 |

$17,200,000 |

$268,552,627 |

100.0% |

| |

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 9 of 19

| Property Table by Tenant |

|

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

Occupied |

|

|

|

|

|

|

|

|

| |

|

Property |

Square |

Square |

% of Total |

Annual |

% of Total |

Rent Per |

|

Undepreciated |

|

Mortgage |

| Tenant |

|

Count |

Footage |

Footage |

Sq. Ft. |

Rent |

Ann. Rent |

Sq. Ft. Occup. |

|

Cost |

|

Balance |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| FedEx Ground |

|

22 |

2,358,295 |

2,358,295 |

25.7% |

$17,765,000 |

37.5% |

$7.53 |

|

$215,046,507 |

|

$92,136,205 |

| FedEx Express |

|

14 |

973,413 |

973,413 |

10.6% |

5,451,000 |

11.5% |

5.60 |

|

70,346,990 |

|

25,905,216 |

| FedEx Supply Chain Services |

|

1 |

449,900 |

449,900 |

4.9% |

1,305,000 |

2.8% |

2.90 |

|

14,600,000 |

|

9,154,332 |

| Total FedEx |

|

37 |

3,781,608 |

3,781,608 |

41.3% |

24,521,000 |

51.7% |

6.48 |

|

299,993,497 |

|

127,195,753 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Milwauke Tool |

|

1 |

615,305 |

615,305 |

6.7% |

1,923,000 |

4.1% |

3.13 |

|

27,368,816 |

|

17,018,351 |

| Woodstream |

|

1 |

388,671 |

256,000 |

2.8% |

896,000 |

1.9% |

3.50 |

|

13,116,870 |

|

2,646,926 |

| CBOCS Distribution, Inc. |

|

1 |

381,240 |

381,240 |

4.2% |

1,381,000 |

2.9% |

3.62 |

|

14,215,126 |

|

8,287,882 |

| Best Buy Warehousing Logistics, Inc. |

|

1 |

368,060 |

368,060 |

4.0% |

1,595,000 |

3.4% |

4.33 |

|

19,600,000 |

|

12,167,250 |

| Coca Cola / Western Container |

|

2 |

323,358 |

323,358 |

3.5% |

1,566,000 |

3.3% |

4.84 |

|

18,839,339 |

|

9,881,137 |

| Norton McNaughton of Squire, Inc. |

|

1 |

306,000 |

306,000 |

3.3% |

1,389,000 |

2.9% |

4.54 |

|

12,972,474 |

|

6,674,881 |

| Various |

|

2 |

265,480 |

230,605 |

2.5% |

907,000 |

1.9% |

3.93 |

|

4,407,744 |

|

- |

| Carrier Sales |

|

2 |

244,317 |

244,317 |

2.7% |

1,853,000 |

3.9% |

7.58 |

|

22,451,041 |

|

11,606,376 |

| Anda Pharmaceuticals, Inc |

|

1 |

234,660 |

234,660 |

2.6% |

1,182,000 |

2.5% |

5.04 |

|

14,550,000 |

|

10,571,407 |

| Caterpillar Logistics Services, Inc. |

|

1 |

218,120 |

218,120 |

2.4% |

1,169,000 |

2.5% |

5.36 |

|

14,868,857 |

|

8,036,374 |

| Anheuser-Busch, Inc. |

|

1 |

184,800 |

184,800 |

2.0% |

778,000 |

1.6% |

4.21 |

|

12,386,675 |

|

3,321,353 |

| Carlisle Tire & Wheel Company |

|

1 |

179,280 |

179,280 |

2.0% |

728,000 |

1.5% |

4.06 |

|

7,025,401 |

|

1,988,419 |

| Home Depot USA, Inc. |

|

1 |

171,200 |

171,200 |

1.9% |

889,000 |

1.9% |

5.19 |

|

11,298,367 |

|

- |

| Kellogg Company |

|

3 |

170,279 |

170,279 |

1.9% |

1,061,000 |

2.2% |

6.23 |

|

11,834,916 |

|

3,472,522 |

| Maidenform, Inc. |

|

1 |

148,000 |

148,000 |

1.6% |

444,000 |

0.9% |

3.00 |

|

4,870,749 |

|

3,354,210 |

| H.E.P. Direct |

|

1 |

106,507 |

106,507 |

1.2% |

288,000 |

0.6% |

2.70 |

|

6,913,986 |

|

- |

| Pittsburgh Glass Works |

|

1 |

102,135 |

102,135 |

1.1% |

427,000 |

0.9% |

4.18 |

|

3,900,602 |

|

- |

| National Oilwell |

|

1 |

91,295 |

91,295 |

1.0% |

733,000 |

1.5% |

8.03 |

|

8,080,828 |

|

4,435,044 |

| Joseph T. Ryerson |

|

1 |

89,052 |

89,052 |

1.0% |

506,000 |

1.1% |

5.68 |

|

6,867,596 |

|

1,941,705 |

| DHL |

|

1 |

83,000 |

83,000 |

0.9% |

639,000 |

1.3% |

7.70 |

|

6,815,697 |

|

3,493,991 |

| Sherwin-Williams Company |

|

2 |

78,887 |

78,887 |

0.9% |

631,000 |

1.3% |

8.00 |

|

7,103,762 |

|

1,912,857 |

| RGH Enterprises Inc. |

|

1 |

75,000 |

75,000 |

0.8% |

579,000 |

1.2% |

7.72 |

|

5,525,600 |

|

4,115,250 |

| Tampa Bay Grand Prix |

|

1 |

68,385 |

68,385 |

0.7% |

262,000 |

0.6% |

3.83 |

|

5,616,874 |

|

2,476,121 |

| Macy’s East, Inc. |

|

1 |

59,400 |

59,400 |

0.6% |

230,000 |

0.5% |

3.87 |

|

4,838,592 |

|

2,380,519 |

| Siemens |

|

1 |

51,130 |

51,130 |

0.6% |

456,000 |

1.0% |

8.92 |

|

4,416,000 |

|

2,930,259 |

| Keystone Automotive |

|

1 |

36,270 |

36,270 |

0.4% |

136,000 |

0.3% |

3.75 |

|

2,161,895 |

|

- |

| Graybar Electric Company |

|

1 |

26,340 |

26,340 |

0.3% |

109,000 |

0.2% |

4.14 |

|

1,850,794 |

|

- |

| Tenant Total as of 3/31/2013 |

|

70 |

8,847,779 |

8,680,233 |

94.7% |

$47,278,000 |

99.7% |

$5.45 |

|

$573,892,098 |

|

$249,908,587 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Vacant |

|

3 |

317,625 |

- |

5.3% |

119,000 (A) |

0.3% |

0.53 |

|

17,991,447 |

|

1,444,040 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total as of 3/31/2013 |

|

73 |

9,165,404 |

8,680,233 |

100.0% |

$47,397,000 |

100.0% |

$5.46 |

|

$591,883,545 (B) |

|

$251,352,627 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (A) | Includes rental revenue from properties during Fiscal 2013 prior to becoming vacant. |

| (B) | Does not include $32,351 of vacant land and corporate office leasehold improvements not associated

with a specific tenant. |

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 10 of 19

|

Property Table by State |

|

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Property |

Square |

Occupied Square |

% of Total |

Annual |

% of Total |

Rent Per |

|

Undepreciated |

|

Mortgage |

| State |

|

Count |

Footage |

Footage |

Sq. Ft. |

Rent |

Ann. Rent |

Sq. Ft. Occup. |

|

Cost |

|

Balance |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Mississippi |

|

4 |

912,305 |

912,305 |

10.0% |

$3,354,000 |

7.1% |

$3.68 |

|

$45,247,611 |

|

$27,589,757 |

| Tennessee |

|

3 |

891,777 |

891,777 |

9.7% |

2,998,000 |

6.3% |

3.36 |

|

33,614,166 |

|

19,720,680 |

| Florida |

|

9 |

784,677 |

784,677 |

8.6% |

5,081,000 |

10.7% |

6.48 |

|

67,116,257 |

|

33,201,414 |

| Illinois |

|

7 |

720,439 |

720,439 |

7.9% |

4,705,000 |

9.9% |

6.53 |

|

61,161,692 |

|

11,761,158 |

| Ohio |

|

5 |

684,762 |

684,762 |

7.5% |

3,629,000 |

7.7% |

5.30 |

|

43,906,299 |

|

25,365,907 |

| Missouri |

|

4 |

654,073 |

423,202 |

7.1% |

1,673,000 |

3.5% |

3.95 |

|

29,110,344 |

|

5,344,226 |

| Texas |

|

6 |

629,895 |

629,895 |

6.9% |

4,659,000 |

9.8% |

7.40 |

|

54,757,073 |

|

32,030,004 |

| South Carolina |

|

3 |

510,560 |

510,560 |

5.6% |

3,088,000 |

6.5% |

6.05 |

|

33,413,400 |

|

12,305,944 |

| Michigan |

|

3 |

437,417 |

437,417 |

4.8% |

2,847,000 |

6.0% |

6.51 |

|

37,365,647 |

|

22,347,582 |

| North Carolina |

|

3 |

414,507 |

254,507 |

4.5% |

779,000 |

1.6% |

3.06 |

|

17,274,557 |

|

4,798,251 |

| Georgia |

|

3 |

307,662 |

307,662 |

3.4% |

1,767,000 |

3.7% |

5.74 |

|

22,124,663 |

|

10,528,469 |

| Virginia |

|

4 |

303,863 |

303,863 |

3.3% |

1,815,000 |

3.8% |

5.97 |

|

23,588,938 |

|

5,321,616 |

| Arizona |

|

1 |

283,358 |

283,358 |

3.1% |

1,234,000 |

2.6% |

4.35 |

|

15,159,496 |

|

7,781,031 |

| New York |

|

3 |

230,381 |

230,381 |

2.5% |

1,898,000 |

4.0% |

8.24 |

|

20,148,376 |

|

5,411,422 |

| Kansas |

|

2 |

219,280 |

219,280 |

2.4% |

1,060,000 |

2.2% |

4.83 |

|

10,705,244 |

|

4,088,527 |

| Pennsylvania |

|

1 |

201,342 |

201,342 |

2.2% |

595,000 |

1.3% |

2.96 |

|

3,031,531 |

|

- |

| Maryland |

|

1 |

144,523 |

144,523 |

1.6% |

1,426,000 |

3.0% |

9.87 |

|

14,386,784 |

|

7,268,589 |

| Wisconsin |

|

1 |

139,564 |

139,564 |

1.5% |

901,000 |

1.9% |

6.46 |

|

9,373,672 |

|

1,368,371 |

| Colorado |

|

2 |

138,235 |

138,235 |

1.5% |

1,208,000 |

2.5% |

8.74 |

|

13,549,167 |

|

4,234,814 |

| New Jersey |

|

2 |

123,538 |

88,663 |

1.3% |

542,000 |

1.1% |

6.11 |

|

6,214,805 |

|

2,380,519 |

| Oklahoma |

|

1 |

119,912 |

119,912 |

1.3% |

706,000 |

1.5% |

5.89 |

|

9,437,733 |

|

5,933,699 |

| Nebraska |

|

1 |

89,115 |

89,115 |

1.0% |

454,000 |

1.0% |

5.09 |

|

5,732,599 |

|

360,063 |

| Alabama |

|

1 |

73,712 |

73,712 |

0.8% |

412,000 |

0.9% |

5.59 |

|

4,748,646 |

|

1,435,364 |

| Minnesota |

|

1 |

59,425 |

- |

0.6% |

72,000 |

0.2% |

- |

|

5,157,126 |

|

- |

| Connecticut |

|

1 |

54,812 |

54,812 |

0.6% |

358,000 |

0.8% |

6.53 |

|

3,395,824 |

|

775,220 |

| Iowa |

|

1 |

36,270 |

36,270 |

0.4% |

136,000 |

0.3% |

3.75 |

|

2,161,895 |

|

- |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total as of 3/31/2013 |

|

73 |

9,165,404 |

8,680,233 |

100.0% |

$47,397,000 |

100.0% |

$5.46 |

|

$591,883,545 |

|

$251,352,627 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 11 of 19

| Lease Expirations |

|

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Property |

Square |

% of Total |

Annual |

% of Total |

Rent Per |

Lease Exp. |

|

Undepreciated |

|

Mortgage |

| Fiscal Year |

|

Count |

Footage |

Sq. Ft. |

Rent |

Ann. Rent |

Sq. Ft. Occup. |

Term |

|

Cost |

|

Balance |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 2014 |

|

5 |

348,612 |

3.8% |

1,525,000 |

3.2% |

4.37 |

0.9 Yrs |

|

18,273,882 |

|

6,509,951 |

| 2015 |

|

7 |

836,256 |

9.1% |

4,300,000 |

9.1% |

5.14 |

2.1 Yrs |

|

47,485,773 |

|

13,867,646 |

| 2016 |

|

2 |

244,800 |

2.7% |

1,082,000 |

2.3% |

4.42 |

3.2 Yrs |

|

17,097,717 |

|

4,774,514 |

| 2017 |

|

15 |

1,974,950 |

21.5% |

11,287,000 |

23.8% |

6.13 |

4.1 Yrs |

|

145,796,266 |

|

57,732,558 |

| 2018 |

|

11 |

1,005,328 |

11.0% |

6,350,000 |

13.4% |

6.32 |

5.1 Yrs |

|

76,680,756 |

|

28,805,569 |

| 2019 |

|

8 |

1,196,114 |

13.1% |

7,345,000 |

15.5% |

6.14 |

6.1 Yrs |

|

86,252,433 |

|

38,468,373 |

| 2020 |

|

1 |

68,385 |

0.7% |

262,000 |

0.6% |

3.83 |

7.5 Yrs |

|

5,616,874 |

|

2,476,121 |

| 2021 |

|

4 |

271,768 |

3.0% |

1,752,000 |

3.7% |

6.45 |

8.4 Yrs |

|

20,341,956 |

|

12,189,050 |

| 2022 |

|

8 |

1,237,238 |

13.5% |

7,058,000 |

14.9% |

5.70 |

9.0 Yrs |

|

84,375,807 |

|

53,703,710 |

| 2023 |

|

4 |

862,106 |

9.4% |

3,105,000 |

6.6% |

3.60 |

10.1 Yrs |

|

42,075,165 |

|

20,906,291 |

| 2024 |

|

3 |

536,742 |

5.9% |

2,305,000 |

4.9% |

4.29 |

11.1 Yrs |

|

25,487,725 |

|

10,474,804 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Various |

|

2 |

265,480 |

2.9% |

907,000 |

1.9% |

3.93 |

- |

|

4,407,744 |

|

- |

| Vacant |

|

3 |

317,625 |

3.5% |

119,000 |

0.3% |

- |

- |

|

17,991,447 |

|

1,444,040 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total as of 3/31/2013 |

|

73 |

9,165,404 |

100.0% |

$47,397,000 |

100.0% |

$5.46 |

6.1 Yrs |

|

$591,883,545 |

|

$251,352,627 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 12 of 19

| Property Table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Fiscal Year |

|

Square |

Annual |

Rent Per |

Lease Exp. |

|

Undepreciated |

|

Mortgage |

|

| No |

Tenant |

City |

State |

|

Acquisition |

Occup. |

Footage |

Rent |

Sq. Ft. Occup. |

Term |

|

Cost |

|

Balance |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

Milwauke Tool |

Olive Branch |

MS |

|

2013 |

100.0% |

615,305 |

$1,923,000 |

$3.13 |

10.1 Yrs |

|

$27,368,816 |

|

$17,018,351 |

|

| 2 |

FedEx Supply Chain Services, Inc. |

Memphis |

TN |

|

2010 |

100.0% |

449,900 |

1,305,000 |

2.90 |

6.2 Yrs |

|

14,600,000 |

|

9,154,332 |

|

| 3 |

Woodstream |

St. Joseph |

MO |

|

2001 |

65.9% |

388,671 |

896,000 |

3.50 |

4.5 Yrs |

|

13,116,870 |

|

2,646,926 |

|

| 4 |

CBOCS Distribution, Inc. |

Lebanon |

TN |

|

2011 |

100.0% |

381,240 |

1,381,000 |

3.62 |

11.3 Yrs |

|

14,215,126 |

|

8,287,882 |

|

| 5 |

Best Buy Warehousing Logistics, Inc. |

Streetsboro |

OH |

|

2012 |

100.0% |

368,060 |

1,595,000 |

4.33 |

8.8 Yrs |

|

19,600,000 |

|

12,167,250 |

|

| 6 |

Norton McNaughton of Squire, Inc. |

Hanahan |

SC |

|

2005 |

100.0% |

306,000 |

1,389,000 |

4.54 |

2.1 Yrs |

|

12,972,474 |

|

6,674,881 |

|

| 7 |

Various |

Monaca |

PA |

|

1997 |

100.0% |

201,342 |

595,000 |

2.96 |

na |

|

3,031,531 |

|

- |

|

| 8 |

Western Container Corp |

Tolleson |

AZ |

|

2003 |

100.0% |

283,358 |

1,234,000 |

4.35 |

4.1 Yrs |

|

15,159,496 |

|

7,781,031 |

|

| 9 |

Anda Pharmaceuticals, Inc |

Olive Branch |

MS |

|

2012 |

100.0% |

234,660 |

1,182,000 |

5.04 |

9.2 Yrs |

|

14,550,000 |

|

10,571,407 |

|

| 10 |

Caterpillar Logistics Services, Inc. |

Griffin |

GA |

|

2006 |

100.0% |

218,120 |

1,169,000 |

5.36 |

3.7 Yrs |

|

14,868,857 |

|

8,036,374 |

|

| 11 |

FedEx Ground Package System, Inc. |

Orion |

MI |

|

2007 |

100.0% |

193,479 |

1,285,000 |

6.64 |

4.3 Yrs |

|

19,182,035 |

|

10,245,219 |

|

| 12 |

Anheuser-Busch, Inc. |

Granite City |

IL |

|

2001 |

100.0% |

184,800 |

778,000 |

4.21 |

3.2 Yrs |

|

12,386,675 |

|

3,321,353 |

|

| 13 |

Carrier Sales |

Dallas |

TX |

|

2010 |

100.0% |

184,317 |

1,549,000 |

8.40 |

5.8 Yrs |

|

17,740,000 |

|

10,153,215 |

|

| 14 |

Carlisle Tire & Wheel Company |

Edwardsville |

KS |

|

2003 |

100.0% |

179,280 |

728,000 |

4.06 |

5.2 Yrs |

|

7,025,401 |

|

1,988,419 |

|

| 15 |

Fedex Ground Package System. Inc |

Livonia |

MI |

|

2013 |

100.0% |

172,005 |

1,192,000 |

6.93 |

9.0 Yrs |

|

13,700,000 |

|

9,376,990 |

|

| 16 |

Home Depot USA, Inc. |

Montgomery |

IL |

|

2007 |

100.0% |

171,200 |

889,000 |

5.19 |

2.2 Yrs |

|

11,298,367 |

|

- |

|

| 17 |

FedEx Ground Package System, Inc. |

Tampa |

FL |

|

2004 |

100.0% |

170,779 |

1,412,000 |

8.27 |

5.8 Yrs |

|

17,723,825 |

|

8,845,677 |

|

| 18 |

Vacant |

Monroe |

NC |

|

2001 |

- |

160,000 |

47,000 |

na |

- |

|

5,489,822 |

|

1,444,041 |

|

| 19 |

Maidenform, Inc. |

Fayetteville |

NC |

|

1997 |

100.0% |

148,000 |

444,000 |

3.00 |

0.8 Yrs |

|

4,870,749 |

|

3,354,210 |

|

| 20 |

FedEx Ground Package System, Inc. |

Beltsville |

MD |

|

2001 |

100.0% |

144,523 |

1,426,000 |

9.87 |

5.3 Yrs |

|

14,386,784 |

|

7,268,589 |

|

| 21 |

FedEx Ground Package System, Inc. |

Cudahy |

WI |

|

2001 |

100.0% |

139,564 |

901,000 |

6.46 |

4.3 Yrs |

|

9,373,672 |

|

1,368,371 |

|

| 22 |

FedEx Ground Package System, Inc. |

Wheeling |

IL |

|

2007 |

100.0% |

123,000 |

1,386,000 |

11.27 |

4.2 Yrs |

|

18,537,652 |

|

4,585,244 |

|

| 23 |

FedEx Ground Package System, Inc. |

Oklahoma City |

OK |

|

2012 |

100.0% |

119,912 |

706,000 |

5.89 |

9.0 Yrs |

|

9,437,733 |

|

5,933,699 |

|

| 24 |

FedEx Ground Package System, Inc. |

Edinburg |

TX |

|

2011 |

100.0% |

113,582 |

598,000 |

5.26 |

8.4 Yrs |

|

7,414,000 |

|

4,437,390 |

|

| 25 |

FedEx Corporation |

Richmond |

VA |

|

2007 |

100.0% |

112,799 |

543,000 |

4.81 |

10.1 Yrs |

|

7,718,163 |

|

- |

|

| 26 |

FedEx Ground Package System, Inc. |

Ft. Mill |

SC |

|

2010 |

100.0% |

112,784 |

1,024,000 |

9.08 |

6.5 Yrs |

|

12,834,256 |

|

3,666,346 |

|

| 27 |

FedEx Corporation |

Orlando |

FL |

|

2008 |

100.0% |

110,638 |

666,000 |

6.02 |

4.7 Yrs |

|

8,492,904 |

|

5,080,426 |

|

| 28 |

H.E.P. Direct |

Winston-Salem |

NC |

|

2002 |

100.0% |

106,507 |

288,000 |

2.70 |

4.8 Yrs |

|

6,913,986 |

|

- |

|

| 29 |

FedEx Ground Package System, Inc. |

Cheektowaga |

NY |

|

2007 |

100.0% |

104,981 |

966,000 |

9.20 |

6.4 Yrs |

|

10,932,057 |

|

1,296,172 |

|

| 30 |

FedEx Ground Package System, Inc. |

West Chester Twp |

OH |

|

2000 |

100.0% |

103,818 |

518,000 |

4.99 |

10.4 Yrs |

|

5,061,253 |

|

2,824,987 |

|

| 31 |

Fedex Ground Package System. Inc |

Waco |

TX |

|

2012 |

100.0% |

102,594 |

659,000 |

6.42 |

9.2 Yrs |

|

8,733,000 |

|

5,668,706 |

|

| 32 |

Pittsburgh Glass Works |

O' Fallon |

MO |

|

1994 |

100.0% |

102,135 |

427,000 |

4.18 |

2.2 Yrs |

|

3,900,602 |

|

- |

|

| 33 |

Vacant |

Liberty |

MO |

|

1998 |

- |

98,200 |

- |

na |

- |

|

7,344,498 |

|

- |

|

| 34 |

FedEx Corporation |

Jacksonville |

FL |

|

1999 |

100.0% |

95,883 |

524,000 |

5.46 |

6.2 Yrs |

|

6,155,500 |

|

2,422,371 |

|

| 35 |

FedEx Corporation |

Tampa |

FL |

|

2006 |

100.0% |

95,662 |

603,000 |

6.30 |

4.5 Yrs |

|

7,565,717 |

|

4,658,580 |

|

| 36 |

FedEx Ground Package System, Inc. |

El Paso |

TX |

|

2007 |

100.0% |

91,854 |

668,000 |

7.27 |

2.5 Yrs |

|

8,024,745 |

|

4,409,469 |

|

| 37 |

FedEx Ground Package System, Inc. |

Hanahan |

SC |

|

2005 |

100.0% |

91,776 |

675,000 |

7.35 |

5.3 Yrs |

|

7,606,670 |

|

1,964,717 |

|

| 38 |

National Oilwell |

Houston |

TX |

|

2010 |

100.0% |

91,295 |

733,000 |

8.03 |

9.5 Yrs |

|

8,080,828 |

|

4,435,044 |

|

| 39 |

FedEx Corporation |

Omaha |

NE |

|

1999 |

100.0% |

89,115 |

454,000 |

5.09 |

10.6 Yrs |

|

5,732,599 |

|

360,063 |

|

| 40 |

FedEx Ground Package System, Inc. |

Cocoa |

FL |

|

2008 |

100.0% |

89,101 |

739,000 |

8.29 |

3.6 Yrs |

|

10,521,455 |

|

6,037,408 |

|

| 41 |

Joseph T. Ryerson |

Elgin |

IL |

|

2002 |

100.0% |

89,052 |

506,000 |

5.68 |

3.8 Yrs |

|

6,867,596 |

|

1,941,705 |

|

| 42 |

FedEx Ground Package System, Inc. |

Ft. Myers |

FL |

|

2003 |

100.0% |

87,500 |

416,000 |

4.75 |

1.6 Yrs |

|

4,977,449 |

|

- |

|

| 43 |

DHL |

Roanoke |

VA |

|

2007 |

100.0% |

83,000 |

639,000 |

7.70 |

3.7 Yrs |

|

6,815,697 |

|

3,493,991 |

|

| 44 |

FedEx Corporation |

Bedford Heights |

OH |

|

2007 |

100.0% |

82,269 |

415,000 |

5.04 |

5.4 Yrs |

|

6,620,313 |

|

3,261,689 |

|

| 45 |

FedEx Ground Package System, Inc. |

Richfield |

OH |

|

2006 |

100.0% |

79,485 |

645,000 |

8.11 |

3.6 Yrs |

|

8,208,733 |

|

4,181,723 |

|

| 46 |

RGH Enterprises Inc. |

Halfmoon |

NY |

|

2012 |

100.0% |

75,000 |

579,000 |

7.72 |

8.7 Yrs |

|

5,525,600 |

|

4,115,250 |

|

| 47 |

FedEx Ground Package System, Inc. |

Huntsville |

AL |

|

2005 |

100.0% |

73,712 |

412,000 |

5.59 |

9.4 Yrs |

|

4,748,646 |

|

1,435,364 |

|

| 48 |

FedEx Corporation |

Schaumburg |

IL |

|

1997 |

100.0% |

73,500 |

515,000 |

7.01 |

4.0 Yrs |

|

4,967,639 |

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 13 of 19

| Property Table |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Fiscal Year |

|

Square |

Annual |

Rent Per |

Lease Exp. |

|

Undepreciated |

|

Mortgage |

|

| No |

Tenant |

City |

State |

|

Acquisition |

Occup. |

Footage |

Rent |

Sq. Ft. Occup. |

Term |

|

Cost |

|

Balance |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 49 |

FedEx Corporation |

Romulus |

MI |

|

1998 |

100.0% |

71,933 |

$370,000 |

$5.14 |

8.2 Yrs |

|

$4,483,613 |

|

$2,725,373 |

|

| 50 |

FedEx Ground Package System, Inc. |

Denver |

CO |

|

2005 |

100.0% |

69,865 |

564,000 |

8.07 |

5.3 Yrs |

|

6,354,051 |

|

2,017,357 |

|

| 51 |

Tampa Bay Grand Prix |

Tampa |

FL |

|

2007 |

100.0% |

68,385 |

262,000 |

3.83 |

7.5 Yrs |

|

5,616,874 |

|

2,476,121 |

|

| 52 |

FedEx Ground Package System, Inc. |

Colorado Springs |

CO |

|

2006 |

100.0% |

68,370 |

644,000 |

9.42 |

5.5 Yrs |

|

7,195,115 |

|

2,217,457 |

|

| 53 |

Sherwin-Williams Company |

Rockford |

IL |

|

2011 |

100.0% |

66,387 |

470,000 |

7.08 |

10.8 Yrs |

|

5,540,000 |

|

1,826,860 |

|

| 54 |

Kellogg Sales Company |

Kansas City |

MO |

|

2007 |

100.0% |

65,067 |

350,000 |

5.38 |

2.3 Yrs |

|

4,748,374 |

|

2,697,299 |

|

| 55 |

Various |

Somerset |

NJ |

|

1970 |

45.6% |

64,138 |

312,000 |

10.66 |

na |

|

1,376,213 |

|

- |

|

| 56 |

FedEx Corporation |

Chattanooga |

TN |

|

2007 |

100.0% |

60,637 |

312,000 |

5.15 |

4.6 Yrs |

|

4,799,040 |

|

2,278,466 |

|

| 57 |

Carrier Sales |

Richmond |

VA |

|

2001 |

100.0% |

60,000 |

304,000 |

5.07 |

3.2 Yrs |

|

4,711,041 |

|

1,453,161 |

|

| 58 |

Vacant |

White Bear Lake |

MN |

|

2007 |

- |

59,425 |

72,000 |

na |

- |

|

5,157,126 |

|

- |

|

| 59 |

Macy’s East, Inc. |

Carlstadt |

NJ |

|

2007 |

100.0% |

59,400 |

230,000 |

3.87 |

1.0 Yrs |

|

4,838,592 |

|

2,380,519 |

|

| 60 |

FedEx Ground Package System, Inc. |

Augusta |

GA |

|

2005 |

100.0% |

59,358 |

477,000 |

8.04 |

5.3 Yrs |

|

5,328,874 |

|

1,429,142 |

|

| 61 |

Keebler Company |

Newington |

CT |

|

2001 |

100.0% |

54,812 |

358,000 |

6.53 |

0.9 Yrs |

|

3,395,824 |

|

775,220 |

|

| 62 |

Siemens |

Lebanon |

OH |

|

2012 |

100.0% |

51,130 |

456,000 |

8.92 |

6.1 Yrs |

|

4,416,000 |

|

2,930,259 |

|

| 63 |

Keebler Company |

Orangeburg |

NY |

|

1993 |

100.0% |

50,400 |

353,000 |

7.00 |

0.9 Yrs |

|

3,690,718 |

|

- |

|

| 64 |

FedEx Corporation |

Charlottesville |

VA |

|

1999 |

100.0% |

48,064 |

329,000 |

6.85 |

4.4 Yrs |

|

4,344,037 |

|

374,464 |

|

| 65 |

FedEx Ground Package System, Inc. |

Corpus Christi |

TX |

|

2012 |

100.0% |

46,253 |

452,000 |

9.77 |

8.4 Yrs |

|

4,764,500 |

|

2,926,180 |

|

| 66 |

Coca Cola Enterprises, Inc. |

Topeka |

KS |

|

2009 |

100.0% |

40,000 |

332,000 |

8.30 |

8.5 Yrs |

|

3,679,843 |

|

2,100,108 |

|

| 67 |

Keystone Automotive |

Urbandale |

IA |

|

1994 |

100.0% |

36,270 |

136,000 |

3.75 |

4.0 Yrs |

|

2,161,895 |

|

- |

|

| 68 |

FedEx Corporation |

Richland |

MS |

|

1994 |

100.0% |

36,000 |

140,000 |

3.89 |

1.0 Yrs |

|

1,478,000 |

|

- |

|

| 69 |

FedEx Corporation |

Punta Gorda |

FL |

|

2007 |

100.0% |

34,624 |

304,000 |

8.78 |

4.3 Yrs |

|

4,104,915 |

|

2,381,522 |

|

| 70 |

FedEx Corporation |

Lakeland |

FL |

|

2007 |

100.0% |

32,105 |

155,000 |

4.83 |

4.7 Yrs |

|

1,957,618 |

|

1,299,308 |

|

| 71 |

FedEx Corporation |

Augusta |

GA |

|

2007 |

100.0% |

30,184 |

121,000 |

4.01 |

9.7 Yrs |

|

1,926,932 |

|

1,062,954 |

|

| 72 |

Graybar Electric Company |

Jackson |

MS |

|

1993 |

100.0% |

26,340 |

109,000 |

4.14 |

6.3 Yrs |

|

1,850,794 |

|

- |

|

| 73 |

Sherwin-Williams Company |

Burr Ridge |

IL |

|

1997 |

100.0% |

12,500 |

161,000 |

12.88 |

1.6 Yrs |

|

1,563,765 |

|

85,995 |

|

| |

Total as of 3/31/2013 |

|

|

|

|

94.7% |

9,165,404 |

$47,397,000 |

$5.46 |

6.1 Yrs |

|

$591,883,545 |

|

$251,352,627 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 14 of 19

| Definitions |

|

| |

|

|

|

|

|

|

|

|

|

|

| Investors and analysts following the real estate industry utilize funds from operations ("FFO"), Core adjusted funds from operations ("Core FFO"), net operating income ("NOI"), earnings before interest, taxes, depreciation and amortization ("EBITDA") and adjusted funds from operations ("AFFO"), variously defined, as supplemental performance measures. While the Company believes net income available to common stockholders, as defined by accounting principles generally accepted in the United States of America (US GAAP), is the most appropriate measure, it considers NOI, EBITDA, FFO, Core FFO and AFFO, given their wide use by and relevance to investors and analysts, appropriate supplemental performance measures. FFO, reflecting the assumption that real estate asset values rise or fall with market conditions, principally adjusts for the effects of US GAAP depreciation and amortization of real estate assets. Core FFO reflects the same assumptions as FFO except that is also adjusts for the effects of acquisition costs. NOI provides a measure of rental operations, and does not factor in depreciation and amortization and non-property specific expenses such as general and administrative expenses. EBITDA provides a tool to further evaluate the ability to incur and service debt and to fund dividends and other cash needs. AFFO provides a tool to further evaluate the ability to fund dividends. In addition, NOI, EBITDA, FFO, Core FFO and AFFO are commonly used in various ratios, pricing multiples and yields and returns and valuation of calculations used to measure financial position, performance and value. |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

| As used herein, the Company calculates FFO, as defined by The National Association of Real Estate Investment Trusts (NAREIT), to be equal to net income (loss) applicable to common shareholders, as defined by US GAAP, excluding extraordinary items as defined under US GAAP, gains or losses from sales of previously depreciated real estate assets, impairment charges related to depreciable real estate assets, plus certain non-cash items such as real estate asset depreciation and amortization. FFO includes gains and losses realized on securities investments. |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

| Core FFO is calculated as FFO plus acquisition costs. |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| NOI is calculated as recurring revenues of the Company, minus property expenses such as real estate taxes, repairs and maintenance, property management, utilities, insurance and other expenses. NOI excludes realized gains (losses) on securities transactions. |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

| EBITDA is calculated as NOI less general and administrative expenses and less NOI from discontinued operations plus interest and dividend income. EBITDA excludes realized gains (losses) on securities transactions and interest expense. |

|

| |

| |

|

|

|

|

|

|

|

|

|

|

| AFFO is calculated as EBITDA minus US GAAP interest expense, minus preferred stock dividends, minus recurring capital expenditures and straight-line rents plus stock option expense. AFFO excludes realized gains (losses) on securities transactions. |

|

| |

NOI, EBITDA, FFO, Core FFO and AFFO do not represent cash generated from operating activities in accordance with US GAAP and are not necessarily indicative of cash available to fund cash needs, including the repayment of principal on debt and payment of dividends and distributions. NOI, EBITDA, FFO Core FFO and

AFFO should not be considered as substitutes for net income applicable to common shareholders (calculated in accordance with US GAAP) as a measure of results of operations or cash flows (calculated in accordance with US GAAP) as a measure of liquidity. NOI, EBITDA, FFO, Core FFO and AFFO as currently calculated by the Company may not be comparable to similarly titled, but variously calculated, measures of other REITs. |

|

| |

| |

| |

| |

Second Quarter FY 2013 Supplemental

of Monmouth Real Estate Investment Corp. Page 15 of 19

FOR IMMEDIATE RELEASE May 8, 2013

Contact: Susan

Jordan

732-577-9996

MONMOUTH REAL ESTATE INVESTMENT

CORPORATION

REPORTS 2nd QUARTER 2013 FINANCIAL

RESULTS FOR THE PERIOD ENDED MARCH 31, 2013

FREEHOLD, NJ,

May 8, 2013........ Monmouth Real Estate Investment Corporation (NYSE/MNR) reported Core Funds from Operations (Core FFO) for the

three months ended March 31, 2013 of $8,799,000 or $0.21 per diluted share versus $10,654,000 or $0.27 per diluted share for the

three months ended March 31, 2012. Core FFO for the prior year period included $3,222,000 or $0.08 per share in non-recurring lease

termination fees. Excluding the effect of these fees, Core FFO for the three months ended March 31, 2012 was $7,432,000 or $0.19

per diluted share.

A summary of significant financial information

for the three and six months ended March 31, 2013 and 2012 is as follows:

| |

|

Three Months Ended

March 31, |

| |

|

2013 |

|

2012 |

| Rental Revenue |

$ |

11,738,000 |

$ |

10,692,000 |

| Reimbursement Revenue |

$ |

1,568,000 |

$ |

1,876,000 |

| Lease Termination Income |

$ |

-0- |

$ |

3,222,000 |

| Total Expenses |

$ |

6,776,000 |

$ |

6,692,000 |

| Interest and Dividend Income |

$ |

1,005,000 |

$ |

893,000 |

| Gain on Securities Transactions, net |

$ |

3,803,000 |

$ |

2,209,000 |

|

Income from Continuing Operations

Income (Loss) from Discontinued Operations |

$

$ |

7,343,000

300,000 |

$

$ |

8,304,000

(44,000) |

| Net Income Attributable to Common Shareholders |

$ |

5,492,000 |

$ |

7,240,000 |

|

Net Income Attributable to Common Shareholders

Per Common Share |

$ |

0.13 |

$ |

0.18 |